A Study of the Influencing Factors on the Carbon Emission Trading Price in China Based on the Improved Gray Relational Analysis Model

Abstract

:1. Introduction

2. Literature Review

- (1)

- Compared with the existing literature, a vertical dimension is added. In the horizontal and vertical dimensions, we explore the differences in the correlation degree between the carbon trading price and factors under regional differences and time variations, and then we analyze the influence of each factor more comprehensively so as to improve the pricing mechanism of carbon trading prices and accomplish the “double carbon” goal.

- (2)

- In this paper, the entire sample of China is covered, covering all pilot carbon trading markets. This reflects the impact of market regional differences on the correlation degree more comprehensively compared with the existing literature and provides a reference for the development of China’s carbon trading market.

- (3)

- Based on the traditional gray relational analysis model, we replace the series spacing with the series variance spacing in order to reflect the price fluctuation more obviously. At the same time, the coefficient of variation method is introduced to improve the gray relational analysis method. Compared with the existing literature, the precision of the calculation of the correlation results is improved.

3. Analysis and Selection of Influencing Factors on Carbon Trading Price

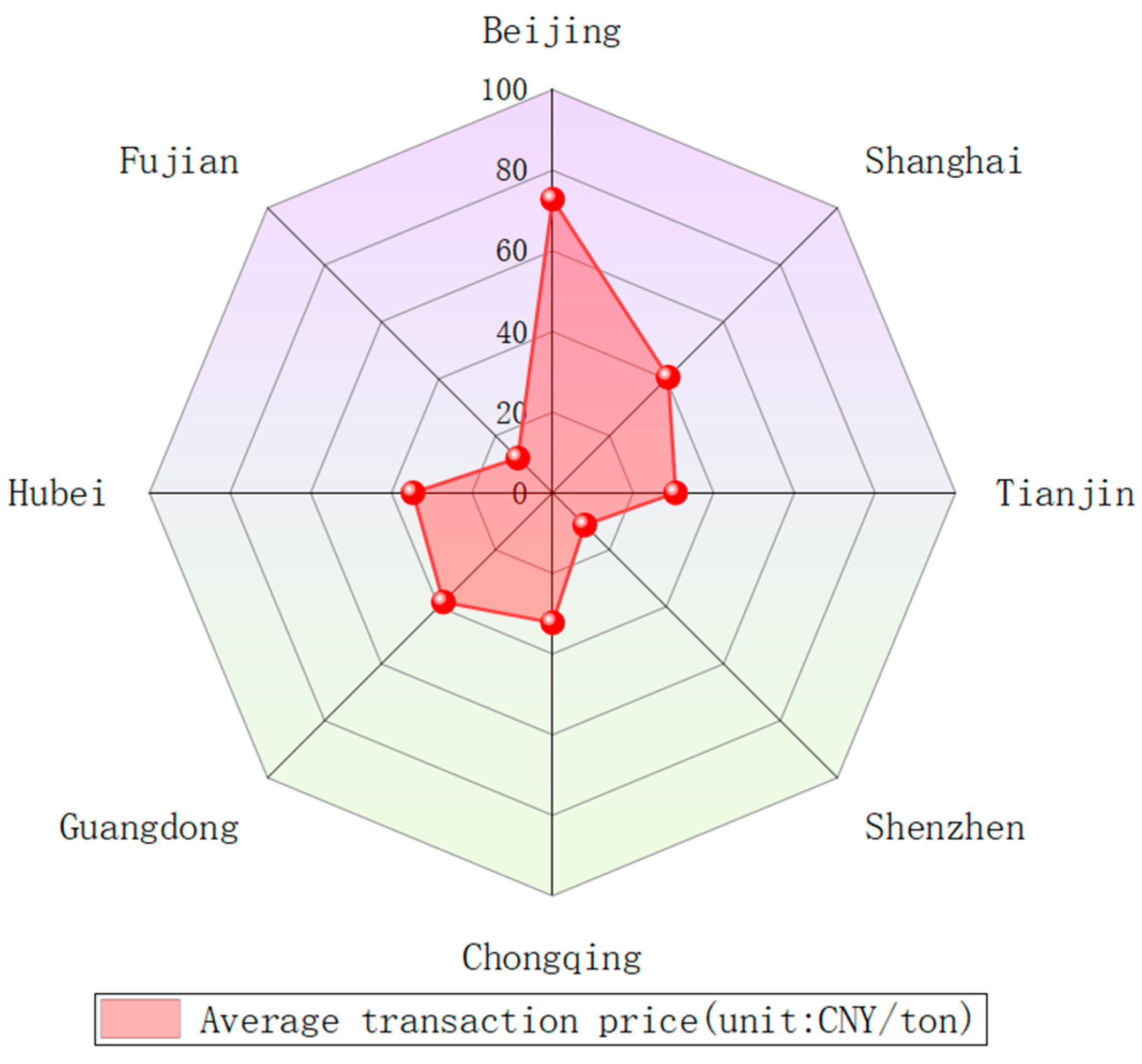

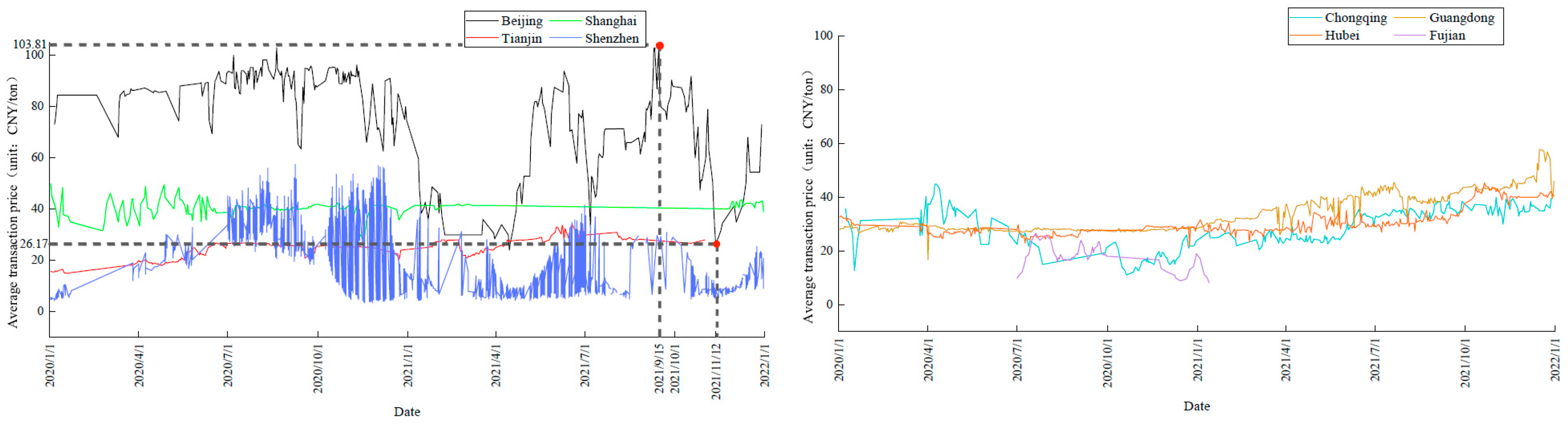

3.1. Current Situation Analysis of Prices

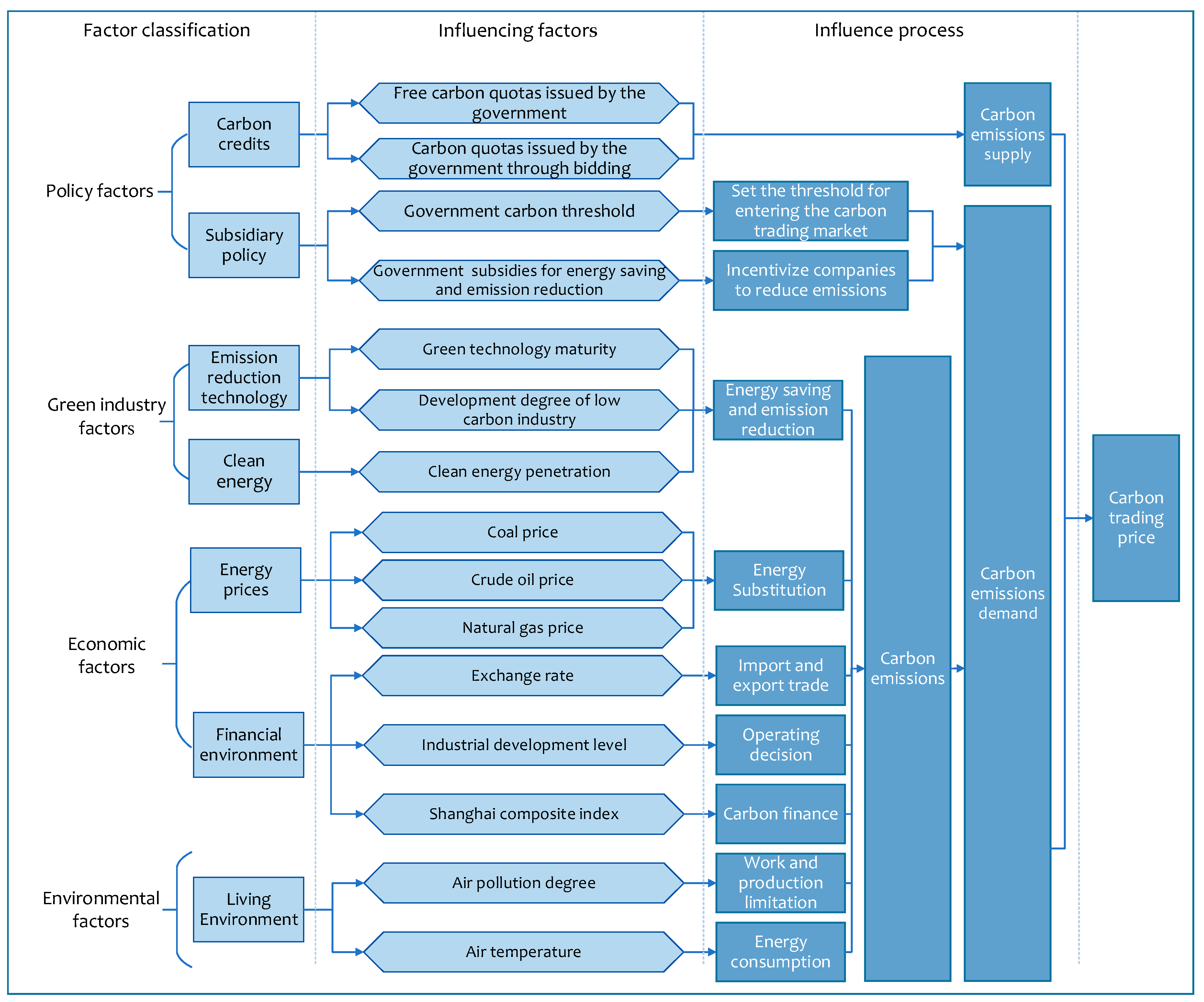

3.2. Selection and Mechanism Analysis of the Influencing Factors on the Carbon Trading Price

3.2.1. Selection of the Influencing Factors on the Price

3.2.2. Mechanism Analysis of the Influencing Factors on the Price

- Policy Factors

- 2.

- Green Industry Factors

- 3.

- Economic Factors

- 4.

- Environmental Factors

3.2.3. Data

3.3. Systematic Cluster Analysis of the Influencing Factors on the Carbon Trading Price

3.3.1. Systematic Cluster Analysis

3.3.2. Cluster Results Analysis

4. Improved Gray Relational Analysis Model

4.1. Gray Relational Analysis Model

4.2. Improvement of the Gray Relational Analysis Model

4.2.1. The Traditional Gray Relational Model

- Determine the Parent Sequence and Characteristic Sequence

- 2.

- Dimensionless Treatment

- 3.

- Calculate the Correlation Coefficient

- 4.

- Calculate the Correlation Degree

4.2.2. Improved Gray Relational Model

- Calculate the Coefficient of Variation

- 2.

- Terming Weight

4.2.3. Add the Positive and Negative Correlations

5. Empirical Analysis and Results

5.1. Spatial Dimension

5.1.1. Correlation Results of the Spatial Dimension

5.1.2. Analysis of Results

- Overall Analysis

- Industrial Development Level

- Development Degree of the Low-Carbon Industry

- Air Pollution Degree

- Green Technology Maturity

- 2.

- Regional Analysis

- Crude Oil Price

- Clean Energy Penetration

- Air Temperature

- Coal Price

- Free Carbon Quotas Issued by the Government

5.2. Temporal Dimension

5.2.1. Correlation Results of the Temporal Dimension

5.2.2. Analysis of Results

- Overall Analysis

- 2.

- Regional Analysis

- Policy Factors

- Green Industry Factors

- Economic Factors

- Environmental Factors

6. Conclusions and Recommendations

6.1. Conclusions

- From the perspective of the spatial dimension, on the whole, the correlation between the industrial development level and carbon trading price in the economic factors was the most significant, followed by the development degree of the low-carbon industry in the green industry factors, air pollution degree in the environmental factors and finally green technology maturity in the green industry factors. In addition, due to the different levels of economic development, energy consumption and construction of the carbon trading market in different regions, the correlation degree ranking of factors in different regions was different from the overall ranking. For example, the correlation degree between the crude oil price and local carbon trading price in Beijing, Tianjin, Shenzhen, Chongqing, Guangdong and Hubei was high. The clean energy penetration in Shanghai and Tianjin was highly correlated with the local carbon trading price. Shanghai had the highest correlation degree between the coal price and local carbon trading price.

- From the perspective of the temporal dimension, with the development and improvement of the carbon trading market, the correlation degree between various factors and the carbon trading price showed a downward trend as a whole, and the fluctuation of the correlation degree of individual factors was different from the overall trend. It can be seen that the carbon trading market gradually matured, and the carbon trading price gradually became stable. The change of a certain factor will not lead to a sharp fluctuation in the carbon trading price. This reduces the risk of loss of enterprises due to sharp fluctuations in the carbon trading price and can effectively promote enterprises to conduct carbon trading, increase the trading volume and make the carbon trading mechanism play a better role in emissions reduction. This is a good sign for the realization of the “double carbon” goal in the future.

6.2. Recommendations

- Promote new industrialization, and control the number of carbon quotas.

- 2.

- Encourage the development of low-carbon industries and promote the sharing of green technologies.

- 3.

- Steadily improve the ecological environment and prevent the rebound of air pollution.

- 4.

- Increase the number of allocation quotas through bidding, and appropriately increase the cost of carbon emissions.

6.3. Limitations and Future Research

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Zeng, S.; Li, F.; Weng, Z.; Zhong, Z. A study on the emission reduction effect of carbon market—Empirical evidence from pilot carbon trading regions in China. China Environ. Sci. 2022, 15, 1000–6923. [Google Scholar]

- Tang, B.-J.; Ji, C.-J.; Hu, Y.-J.; Tan, J.-X.; Wang, X.-Y. Optimal carbon allowance price in China’s carbon emission trading system: Perspective from the multi-sectoral marginal abatement cost. J. Clean. Prod. 2020, 253, 119945. [Google Scholar] [CrossRef]

- Oberndorfer, U. EU emission allowances and the stock market: Evidence from the electricity industry. Ecol. Econ. 2009, 68, 1116–1126. [Google Scholar] [CrossRef] [Green Version]

- Mo, J.-L.; Zhu, L.; Fan, Y. The impact of the EU ETS on the corporate value of European electricity corporations. Energy 2012, 45, 3–11. [Google Scholar] [CrossRef]

- Tian, Y.; Akimov, A.; Roca, E.; Wong, V. Does the carbon market help or hurt the stock price of electricity companies? Further evidence from the European context. J. Clean. Prod. 2016, 112, 1619–1626. [Google Scholar] [CrossRef] [Green Version]

- Li, Y.; Nie, D.; Li, B.; Li, X. The Spillover Effect between Carbon Emission Trading (CET) Price and Power Company Stock Price in China. Sustainability 2020, 12, 6573. [Google Scholar] [CrossRef]

- Reboredo, J.C. Modeling EU allowances and oil market interdependence. Implications for portfolio management. Energy Econ. 2013, 36, 471–480. [Google Scholar] [CrossRef]

- Kanamura, T. Role of carbon swap trading and energy prices in price correlations and volatilities between carbon markets. Energy Econ. 2016, 54, 204–212. [Google Scholar] [CrossRef]

- Li, X.; Ma, J.; Chen, Z.; Zheng, H. Linkage Analysis among China’s Seven Emissions Trading Scheme Pilots. Sustainability 2018, 10, 3389. [Google Scholar] [CrossRef] [Green Version]

- Zhao, L.; Wen, F.; Wang, X. Interaction among China carbon emission trading markets: Nonlinear Granger causality and time-varying effect. Energy Econ. 2020, 91, 104901. [Google Scholar] [CrossRef]

- Chen, H.; Liu, Z.; Zhang, Y.; Wu, Y. The linkages of carbon spot-futures: Evidence from EU-ETS in the third phase. Sustainability 2020, 12, 2517. [Google Scholar] [CrossRef] [Green Version]

- Byun, S.J.; Cho, H. Forecasting carbon futures volatility using GARCH models with energy volatilities. Energy Econ. 2013, 40, 207–221. [Google Scholar] [CrossRef]

- Tan, X.; Sirichand, K.; Vivian, A.; Wang, X. How connected is the carbon market to energy and financial markets? A systematic analysis of spillovers and dynamics. Energy Econ. 2020, 90, 104870. [Google Scholar] [CrossRef]

- Lyu, J.; Cao, M.; Wu, K.; Li, H. Price volatility in the carbon market in China. J. Clean. Prod. 2020, 255, 120171. [Google Scholar] [CrossRef]

- Zhu, B.; Ye, S.; Wang, P.; He, K.; Zhang, T.; Wei, Y.-M. A novel multiscale nonlinear ensemble leaning paradigm for carbon price forecasting. Energy Econ. 2018, 70, 143–157. [Google Scholar] [CrossRef]

- Sun, W.; Huang, C. A carbon price prediction model based on secondary decomposition algorithm and optimized back propagation neural network. J. Clean. Prod. 2020, 243, 118671. [Google Scholar] [CrossRef]

- Zhou, J.; Wang, Q. Forecasting carbon price with secondary decomposition algorithm and optimized extreme learning machine. Sustainability 2021, 13, 8413. [Google Scholar] [CrossRef]

- Hao, Y.; Tian, C. A hybrid framework for carbon trading price forecasting: The role of multiple influence factor. J. Clean. Prod. 2020, 262, 120378. [Google Scholar] [CrossRef]

- Zhao, L.-T.; Miao, J.; Qu, S.; Chen, X.-H. A multi-factor integrated model for carbon price forecasting: Market interaction promoting carbon emission reduction. Sci. Total Environ. 2021, 796, 149110. [Google Scholar] [CrossRef]

- Zhang, L.; Luo, Q.; Guo, X.; Umar, M. Medium-term and long-term volatility forecasts for EUA futures with country-specific economic policy uncertainty indices. Resour. Policy 2022, 77, 102644. [Google Scholar] [CrossRef]

- Alberola, E.; Chevallier, J.; Chèze, B.T. Price drivers and structural breaks in European carbon prices 2005–2007. Energy 2008, 36, 787–797. [Google Scholar] [CrossRef]

- Marimoutou, V.; Soury, M. Energy markets and CO2 emissions: Analysis by stochastic copula autoregressive model. Energy 2015, 88, 417–429. [Google Scholar] [CrossRef]

- Wang, L.; Yin, K.; Cao, Y.; Li, X. A new grey relational analysis model based on the characteristic of inscribed core (IC-GRA) and its application on seven-pilot carbon trading markets of China. Int. J. Environ. Res. Public Health 2019, 16, 99. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Yu, J.; Mallory, M.L. Exchange rate effect on carbon credit price via energy markets. J. Int. Money Financ. 2014, 47, 145–161. [Google Scholar] [CrossRef]

- Zhou, K.; Li, Y. Influencing factors and fluctuation characteristics of China’s carbon emission trading price. Phys. A Stat. Mech. Its Appl. 2019, 524, 459–474. [Google Scholar] [CrossRef]

- Li, X.; Li, Z.; Su, C.-W.; Umar, M.; Shao, X. Exploring the asymmetric impact of economic policy uncertainty on China’s carbon emissions trading market price: Do different types of uncertainty matter? Technol. Forecast. Soc. Chang. 2022, 178, 121601. [Google Scholar] [CrossRef]

- Chu, W.; Chai, S.; Chen, X.; Du, M. Does the Impact of Carbon Price Determinants Change with the Different Quantiles of Carbon Prices? Evidence from China ETS Pilots. Sustainability 2020, 12, 5581. [Google Scholar] [CrossRef]

- Wang, Z.-J.; Zhao, L.-T. The impact of the global stock and energy market on EU ETS: A structural equation modelling approach. J. Clean. Prod. 2021, 289, 125140. [Google Scholar] [CrossRef]

- Ji, C.-J.; Hu, Y.-J.; Tang, B.-J.; Qu, S. Price drivers in the carbon emissions trading scheme: Evidence from Chinese emissions trading scheme pilots. J. Clean. Prod. 2021, 278, 123469. [Google Scholar] [CrossRef]

- Xu, J.; Tan, X.; He, G.; Liu, Y. Disentangling the drivers of carbon prices in China’s ETS pilots—An EEMD approach. Technol. Forecast. Soc. Chang. 2019, 139, 1–9. [Google Scholar] [CrossRef]

- Chang, K.; Ge, F.; Zhang, C.; Wang, W. The dynamic linkage effect between energy and emissions allowances price for regional emissions trading scheme pilots in China. Renew. Sustain. Energy Rev. 2018, 98, 415–425. [Google Scholar] [CrossRef]

- Zhu, B.; Ye, S.; Han, D.; Wang, P.; He, K.; Wei, Y.-M.; Xie, R. A multiscale analysis for carbon price drivers. Energy Econ. 2019, 78, 202–216. [Google Scholar] [CrossRef]

- Jiang, C.; Wu, Y.-F.; Li, X.-L.; Li, X. Time-frequency connectedness between coal market prices, new energy stock prices and CO2 emissions trading prices in China. Sustainability 2020, 12, 2823. [Google Scholar] [CrossRef] [Green Version]

- Wu, Z.; Zhang, W.; Zeng, X. Exploring the short-term and long-term linkages between carbon price and influence factors considering COVID-19 impact. Environ. Sci. Pollut. Res. 2022, 1–17. [Google Scholar] [CrossRef] [PubMed]

- Mansanet-Bataller, M.; Pardo, A.; Valor, E. CO2 prices, energy and weather. Energy J. 2007, 28, 73–92. [Google Scholar] [CrossRef]

- Li, Y.; Song, J. Research on the Application of GA-ELM Model in Carbon Trading Price—An Example of Beijing. Pol. J. Environ. Stud. 2022, 31, 149–161. [Google Scholar] [CrossRef]

- Wen, F.; Zhao, H.; Zhao, L.; Yin, H. What drive carbon price dynamics in China? Int. Rev. Financ. Anal. 2022, 79, 101999. [Google Scholar] [CrossRef]

- Zhu, B.; Tang, J.; Wang, P.; Zhang, L. Exploring the drivers of carbon market risk: A meta regression analysis. J. Clean. Prod. 2022, 352, 131538. [Google Scholar] [CrossRef]

- Zeqiraj, V.; Sohag, K.; Soytas, U. Stock market development and low-carbon economy: The role of innovation and renewable energy. Energy Econ. 2020, 91, 104908. [Google Scholar] [CrossRef]

| Factor Classification | Variable | Influencing Factor | Measurement Index | Data Sources |

|---|---|---|---|---|

| Policy factors | Free carbon quotas issued by the government | Number of free carbon quotas issued by the government | Official website of regional ecological environment bureaus | |

| Carbon quotas issued by the government through bidding | Number of carbon quotas issued by the government through bidding | |||

| Government carbon threshold | Carbon dioxide emission threshold for enterprises included in carbon trading | |||

| Government subsidies for energy saving and emission reduction | The amount of subsidies allocated by the government to locals for energy saving and emission reduction | China Ministry of Finance official website | ||

| Green industry factors | Green technology maturity | Number of green patents authorized | CSMAR | |

| Development degree of low-carbon industries | China’s Low-Carbon Index fund unit net worth | China carbon trading website | ||

| Clean energy penetration | Proportion of clean energy consumption in total energy consumption | Official websites of regional statistical bureaus | ||

| Economic factors | Coal price | Bohai-Rim Steam-Coal Price Index | Wind | |

| Crude oil price | Brent crude oil price | |||

| Natural gas price | IPE UK gas price | |||

| Exchange rate | USDCNY | |||

| Industrial development level | Shanghai Industrial Index | |||

| Shanghai composite index | Shanghai Composite Index | |||

| Environmental factors | Air pollution degree | AQI | Wind, official website of regional ecological environment bureaus | |

| Air temperature | Air temperature | Wind, China Meteorological Administration Network |

| Factor Classification | Variable | Influencing Factors |

|---|---|---|

| Policy factors | Free carbon quotas issued by the government | |

| Carbon quotas issued by the government through bidding | ||

| Government carbon threshold | ||

| Green industry factors | Green technology maturity | |

| Development degree of low-carbon industry | ||

| Clean energy penetration | ||

| Economic factors | Coal price | |

| Crude oil price | ||

| Industrial development index | ||

| Environmental factors | Air pollution degree | |

| Air temperature |

| Variable | Beijing | Shanghai | Tianjin | Shenzhen | Chongqing | Guangdong | Hubei | Fujian |

|---|---|---|---|---|---|---|---|---|

| −0.810 | −0.814 | 0.769 | 0.742 | 0.718 | 0.866 | −0.673 | 0.799 | |

| / | 0.706 | 0.628 | / | −0.720 | 0.623 | 0.523 | / | |

| 0.729 (/) | 0.809 (/) | 0.736 (/) | 0.680 (/) | 0.711 (/) | 0.846 (/) | 0.609 (/) | 0.725 (/) | |

| 0.862 | 0.726 | 0.786 | −0.740 | 0.754 | 0.923 | 0.669 | −0.802 | |

| 0.818 | −0.851 | 0.790 | 0.755 | 0.749 | 0.896 | −0.729 | 0.773 | |

| 0.783 | 0.847 | 0.808 | 0.729 | 0.724 | 0.878 | 0.630 | 0.743 | |

| −0.781 | −0.872 | −0.775 | 0.708 | −0.727 | −0.871 | −0.653 | 0.756 | |

| −0.818 | −0.746 | −0.807 | −0.764 | −0.757 | −0.908 | 0.688 | 0.757 | |

| −0.839 | −0.866 | −0.776 | 0.773 | −0.756 | −0.904 | −0.759 | 0.791 | |

| −0.813 | −0.813 | −0.744 | −0.795 | −0.747 | −0.915 | 0.724 | 0.766 | |

| 0.510 | 0.545 | 0.546 | 0.722 | −0.810 | 0.915 | 0.586 | 0.755 |

| Region | Top Four in Correlation Degree Ranking |

|---|---|

| Beijing | |

| Shanghai | |

| Tianjin | |

| Shenzhen | |

| Chongqing | |

| Guangdong | |

| Hubei | |

| Fujian |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Song, X.; Zhang, W.; Ge, Z.; Huang, S.; Huang, Y.; Xiong, S. A Study of the Influencing Factors on the Carbon Emission Trading Price in China Based on the Improved Gray Relational Analysis Model. Sustainability 2022, 14, 8002. https://doi.org/10.3390/su14138002

Song X, Zhang W, Ge Z, Huang S, Huang Y, Xiong S. A Study of the Influencing Factors on the Carbon Emission Trading Price in China Based on the Improved Gray Relational Analysis Model. Sustainability. 2022; 14(13):8002. https://doi.org/10.3390/su14138002

Chicago/Turabian StyleSong, Xiaohua, Wen Zhang, Zeqi Ge, Siqi Huang, Yamin Huang, and Sijia Xiong. 2022. "A Study of the Influencing Factors on the Carbon Emission Trading Price in China Based on the Improved Gray Relational Analysis Model" Sustainability 14, no. 13: 8002. https://doi.org/10.3390/su14138002

APA StyleSong, X., Zhang, W., Ge, Z., Huang, S., Huang, Y., & Xiong, S. (2022). A Study of the Influencing Factors on the Carbon Emission Trading Price in China Based on the Improved Gray Relational Analysis Model. Sustainability, 14(13), 8002. https://doi.org/10.3390/su14138002