1. Introduction

Irrigated agriculture is key for human development as it is responsible for more than 40% of the world’s total food production (Aquastat, F. A. O. (2020). FAO’s Global Information System on water and agriculture). Ensuring a sustainable model for irrigation is particularly relevant considering that, in order to meet the increased demand for calories from developing countries, it must expand by 70% approximately by 2050 [

1]. In this regard, water and energy consumption represent the most relevant sustainability issues related to irrigated agriculture. Thus, water consumption for irrigation accounts for around 70% of all freshwater withdrawals, causing stress on existing natural resources. Irrigation also relies on pumping power to transport water from wells, rivers, and reservoirs to the crops, a process that requires intense energy consumption. Furthermore, a sustainable water model for irrigation will need additional pumping power to expand precision agriculture techniques and desalinization. Such techniques require pressurization, which is costly in terms of energy. Thus, relevant sustainability issues arise from the existing energy model of irrigation which relies on fossil fuels and is a major producer of greenhouse gas (GHG) emissions. As an example, in the European Union irrigation consumes more than 24 TWh, which causes GHG emissions of more than 4 million tons of CO

2 [

2]. Therefore, in order to achieve a sustainable model for irrigated agriculture, the most relevant issue that must be addressed is the availability of an energy model capable of delivering large amounts of energy from clean sources and at an affordable cost. Such an energy model is technically possible due to the availability of specifically designed irrigation green energy technologies based on photovoltaic irrigation systems (PVI).

PVI consists of the integration of a photovoltaic system into an irrigation infrastructure in order to reduce or avoid the need of using conventional energy sources to transport and pressurize water [

3,

4]. Due to the specific requirements of irrigation infrastructures and practices, PVI requires the use of highly specialized technical solutions, as well as operation and maintenance practices. Therefore, upgrading a new or existing irrigated infrastructure to PVI requires high upfront investment and long payback times, thus limiting its suitability for those farmers with access to long-term, low-cost sources of finance. This factor is the most important barrier to PVI dissemination and, consequently, to the decarbonization of irrigated agriculture.

In order to overcome the aforementioned barrier, tailored financial instruments (FI) and business models with the capacity to attract affordable capital to PVI projects are needed. In this regard, business models based on power purchase agreements (PPA) have proven their capacity to facilitate investments in clean technologies in many contexts [

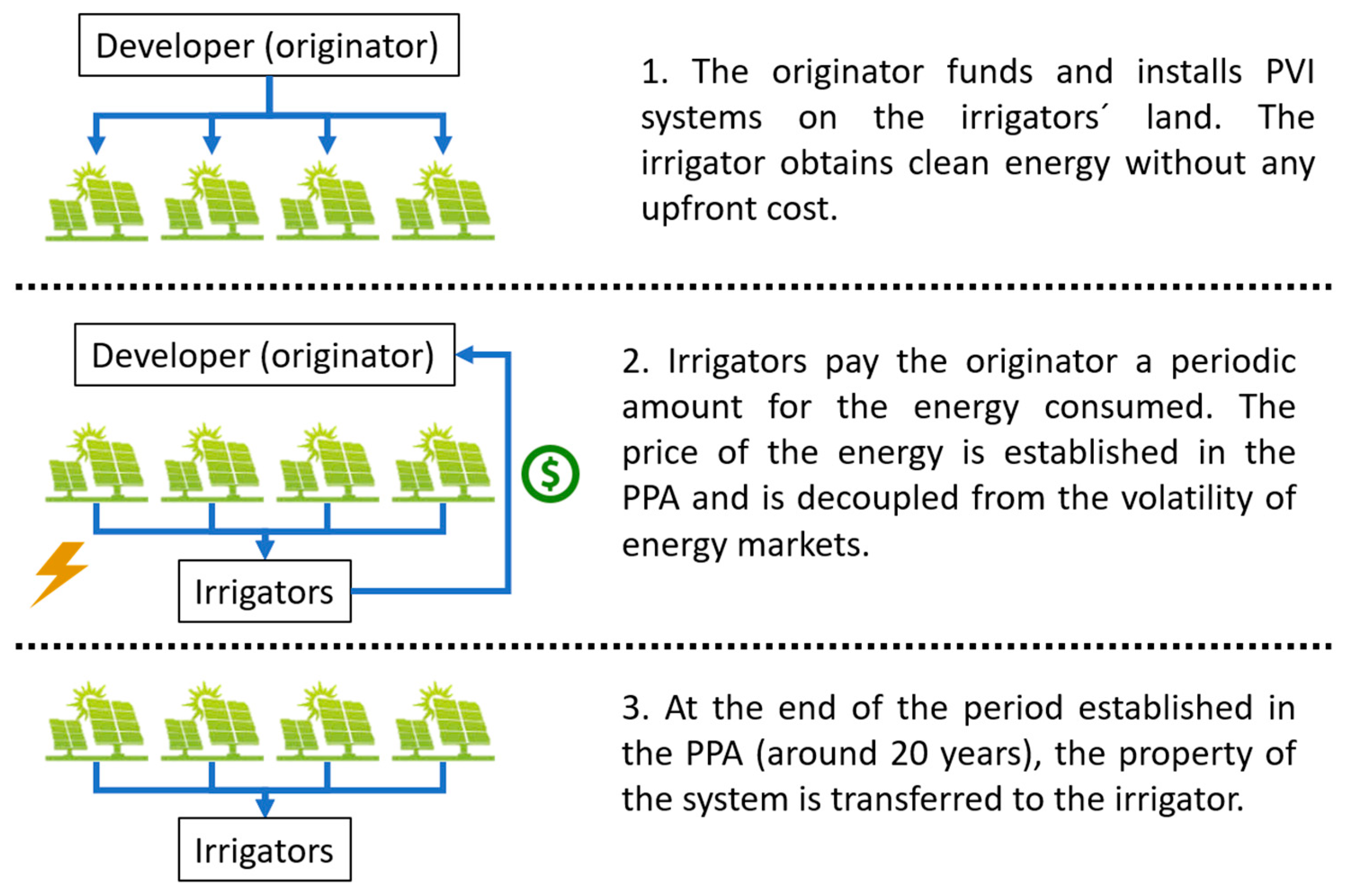

5]. PPAs provide long-term guarantees for investors and consumers of clean energy, a prerequisite to making projects investable and facilitating access to affordable finance. A PPA consists of a bilateral agreement between an energy consumer (such as an irrigator) and a specialized provider of clean energy, such as an energy services company (ESCO, see

Figure 1). A PPA typically establishes the price of the energy for the consumer, the amount of energy to be delivered to the consumer, and the term of the agreement between the parties. Once these details are agreed upon, the provider executes the required investment and carries out the necessary activities to operate and maintain the systems in optimal conditions. Then, the consumer pays a periodic bill for the energy and receives a guarantee of service from the provider during the life of the PPA. For the PPA model to be viable, it is required that competitive energy prices can be offered to consumers, equal to or lower than the price of incumbent alternatives. In this regard, the capacity of the PPA provider to offer such competitive prices to potential consumers depends on accessing long-term affordable funds to pay for the necessary upfront investments.

Among the different options available for PPA providers to access finance for renewable energy-based projects, green bond issuance is increasingly popular. Green bonds are fixed-income FIs, which offer investors a pre-established cash flow over a future period of time [

6]. This cash flow normally consists of periodic payments (coupons) plus the repayment of the initial investment (face or principal value) at the end of the life of the bond (maturity date). Green bonds differ from traditional bonds because the proceeds of the issuance are used to fund investments in green technologies, such as renewable energy systems. Green bonds’ issuers can use cash-producer green assets, such as PPAs, as guarantees (collateral) for the bonds by carrying out a securitization process.

Securitization involves different stages and tasks including bundling a sufficient number of assets into a dedicated pool, assessing its value, creating securities based on the pool, and selling and servicing the related bond issuance, as presented in

Figure 2. Securitization allows for transforming illiquid assets (PPAs) into liquid ones (green bonds), increasing the attractiveness for investors and facilitating the issuer’s access to capital markets, a key factor in obtaining affordable finance [

7]. Nevertheless, securitization is also expensive as it requires the involvement of specialized services and financial intermediaries to bundle the assets used as collateral and to produce and monetize the resulting securities. Furthermore, securitization fixed costs are high (around EUR 2 M per issuance) meaning that it is only suited to large pools of assets so the stranded costs can be sufficiently diluted. As a result, the use of securitization as a financial tool to fund the decarbonization of irrigated agriculture can be hampered by its costs and the distributed nature of the PVI systems.

In this regard, the application of decentralized finance (DeFi) concepts to PVI-PPA securitization has the potential to reduce its cost [

8], becoming a viable alternative to fund PVI projects. DeFi solutions use blockchain (BC) technology in order to “decentralize” a number of financial processes. Therefore, fewer or no financial intermediaries are needed to originate, settle, and execute secure and transparent financial transactions. BC uses cryptographic techniques and self-executed programs (smart contracts) to store information and execute transactions without the need for any centralized party or authority such as a bank or an auditor to record and validate the process. Instead, a network of computers uses distributed ledgers and consensus algorithms to carry out the related tasks, ensuring the veracity and integrity of records and transactions. As a result, a BC-based green bond should be able to resemble the capacity of a traditional green bond in order to intermediate between investors and projects with the advantage that fewer or no financial intermediators would be needed. This would lead to significant reductions in the cost of capital of the PVI projects, resulting in more competitive prices of clean energy for irrigators, a requirement for the decarbonization of irrigated agriculture. Thus, both PVI and BC are disruptive innovations that can have a significant impact on the sustainability of farming if suitable implementations are produced, tested, and put into practice. The main objective of this article is to explore and provide a framework for the application of DeFi concepts and instruments suited to support the decarbonization of irrigated agriculture. In this regard, an innovative methodological approach to the design of DeFi FIs has been applied, focused on maximizing its impact on the reduction of the cost of clean energy in terms of leveled cost of energy. Thus, although the proposed FI is aimed at the specific case of PVI, the methodological approach can be applied generally to the design of DeFi FIs backed by any class of cash-producing green energy assets. In order to achieve this objective, a comprehensive review of the existing literature and experiences in the field of BC-based FIs has been carried out. Then, the implementation of fully decentralized securitization designed to fund PVI projects has been developed on the BC platform Hyperledger Fabric. As a result, it has been possible to identify both the potential of the concept and the challenges and risks that a real implementation may present, especially with respect to an equivalent centralized securitization. Thus, this article contains a number of relevant and original contributions to the design and implementation of decentralized FIs to support the sustainability of farming, including:

A review of the existing literature regarding the application of BC technology to the securitization of assets, as well as the most relevant projects based on such a concept.

An innovative application of BC technology aimed at supporting the decarbonization of agriculture by reducing the cost of clean energy for irrigators.

A functional implementation of a fully decentralized securitization backed by PVI-PPA.

A discussion of the opportunities and challenges of using BC-based financial solutions to fund investments in the agricultural sector and an estimation of its impact on the cost of energy for irrigators.

After this introduction, the most relevant initiatives and research related to the use of BC in the context of green securitization are reviewed in

Section 2. In

Section 3, the description of a fully decentralized securitization process backed by PVI projects is presented. The multiple concepts, parties, and processes involved in the transaction are presented, as well as the details of their execution in a fully decentralized BC framework. Based on the functionality of such implementation,

Section 4 analyzes the opportunities and challenges that a decentralized securitization of PVI-PPA would present in contrast with a traditional, centralized one. In this regard, an estimation of the impact on the cost of clean energy for irrigators by introducing decentralized FIs is carried out. Finally,

Section 5 presents the conclusions, the limitations of the proposed model, and potential lines for future research on DeFi applications for sustainability. The source code is available on Github (

https://github.com/oliverRuas/ppaSecuritization.git), accessed on 27 June 2022.

2. Related Literature and Projects

Over the last few years, the potential of distributed ledgers and BC technology to disrupt key functions of the economic and social framework has been explored and analyzed by a fast-growing community of developers, entrepreneurs, and academics. In the fields of economics and finance, the focus has mainly been on developing “decentralized” financial frameworks suited to delivering financial transactions in a more efficient manner [

9]. Such proposals apply BC technology to reduce or even to eliminating the need for “centralized” institutions acting as trusted intermediaries or depositaries [

10]. In general, the available literature focuses on the potential systemic impacts of BC on the existing financial framework as a whole [

11,

12]. Therefore, fewer contributions are available regarding how BC technology can be applied in order to improve existing practices with the ultimate objective of better addressing specific needs of society, such as decarbonization in farming.

In this regard, Peters and Panayi [

13] focus on systemic impacts, by analyzing, from a broad perspective, how the banking and insurance systems can benefit from BC technology. They highlight three potential key applications of BC: (1) facilitating linked bank accounts to execute governments’ receipts and payments, (2) allowing for the automatic update of accounting books, and (3) the execution of trading, clearing, and settlement processes. The result would be the decentralization of the management of such tasks, a reduction in transaction costs, improved double-entry ledgers, and a reduction in execution times. On the other hand, they point to the lack of reversibility of BC transactions as one concerning feature. A number of authors have studied the potential application of BC to execute some of the basic tasks of financial institutions, including settlement, custody, and clearing processes [

14,

15,

16]. The results indicate that BC can improve such processes at several levels, including increased confidentiality during the validation process and allowing the triggering of asset servicing by events instead of by orders. Nevertheless, several drawbacks of DeFi have also been pointed out, including a lack of track record of core technology and a lack of suitable regulation and standards [

15,

16].

The aforementioned concepts have been applied to carrying out a number of pilot implementations in different environments [

17]. In this regard, the Bank of Canada carried out Project Jasper [

18] to demonstrate that settlement and equity payments can be executed within a private distributed network. For this purpose, a network has been developed where nodes were traditional parties such as brokers, notaries, and lenders among others. Then, cash tokens were introduced to represent holders’ claims against a bank account while equity tokens acted as a claim against an equity wallet. Importantly, such tokens are not registered on any bank account or on a stock register. Instead, once created they are withdrawn and transferred to a pool where transactions are automatically validated, executed, and registered. Based on these results, Project Ubin has been established by the Monetary Authority of Singapore to explore the use of BC for the clearing and settlement of payments and securities. It involves the production of a digital cash representation of the Singapore dollar, which is a claim against the central bank to be employed by financial institutions in intrabank debt settlements.

Beyond the improvements that BC could bring to the operation of existing financial processes and institutions, emerging lines of work have explored the potential of the technology to directly eliminate the need for the intervention of intermediaries to execute transactions. Such an approach can deliver gains in efficiency, especially to replace existing practices that require the intervention of many different parties and complex and costly tasks [

8]. In this regard, a decentralized securitization should deliver the same results as a centralized one, including transforming illiquid assets into liquid ones and facilitating access to a broader investment base, but at a lower cost and with an increased level of transparency and thus, enhancing SMEs’ project funding.

In order to validate such a hypothesis, Sindle and Santhana [

19] explored the concept of DeFi securitization through an assessment of BC in its lifecycle. In the origination stage, they noted that on-chain data storage could reduce information loss risk as well as enhance transparency since a payment commitment is attached to the on-chain data. In relation to the structuring phase, they indicate that the process can be streamlined as access to information regarding underlying assets and payments is facilitated by BC. Furthermore, they asserted that the costs, errors, and analysis time of external credit assessment would be significantly reduced. Regarding bonds’ servicing and trading, BC would allow investors to verify the behavior of the underlying assets and to check whether there is a delay or not in payments. They also depicted some challenges that BC is currently facing, such as sensitive data management, allowing legitimate human intervention, compliance with regulatory aspects, and interoperability with traditional financial infrastructure.

Cohen [

8] identified similar potential benefits of applying BC to securitizations. They showed how a consensus algorithm can securely validate transactions and therefore eliminate the need for an intermediary. Additionally, distributed databases can reduce duplicative information efforts while smart contracts allow for the automatic execution of business agreements whenever programmed conditions are met. Taking these features into account, the authors conclude that BC can reduce securitization costs and counterparty risks, streamline transactions, and allow real-time analysis, which would increase transparency on rating scores. Thus, while BC may introduce some disruptive improvements in securitization, the issue of off-chain data dependence should be properly addressed in order to make DeFi issuances attractive to mainstream investors.

A comparative analysis between “traditional” securitization and one based on the digital representation of assets (tokenization) has been carried out by Wandmacher and Wegmann [

20] through a review of the existing literature. They concluded that tokenization would allow more investors to participate and would diminish the cost of transactions as fewer intermediaries are needed. Furthermore, they analyzed how investors could exchange these digital assets depending on the decentralization of the structure.

The use of BC to support the deployment of PVI by facilitating collective projects has been explored by a team led by Enescu [

21]. Their proposed model organizes irrigators into cooperatives to buy energy from utility companies and sell surplus energy from members’ systems. In order to organize the associations themselves and to settle energy production and consumption balances among the members, a smart contract and a decentralized ledger were designed.

The concept of DeFi securitization has been tested in a number of pilot projects involving some of the most relevant asset classes. For example, in 2021 the first decentralized residential mortgage-backed securitization was carried out by the American residential lender Redwood Trust [

22]. It consisted of the issuance of tokens with an initial notional balance of USD 449 M, mimicking a centralized transaction with the same collateral. Soon after, Bank Frick of Liechtenstein carried out the first securitization in which all the components of the transaction were processed over BC (

https://www.bankfrick.li/en/services/blockchain-banking), accessed on 27 June 2022. The issuance was structured in three tranches and it was based on the Ethereum platform. In the US, a group of more than fifty financial institutions partnered to set up Provenance, in order to produce and adopt BC-based financial innovations [

23]. The aim was to offer potential token issuers an environment to carry out their transactions. Preliminary results of the project indicate that decentralized securitization can save up to 117 basis points (bps) over a traditional one, a significant figure considering that the outstanding value of securitizations exceeds USD 3 trillion. Provenance developed a fully functional securitization on BC which delivered many of the benefits theorized by researchers. Alongside this, they also estimated the savings that BC could provide over a traditional securitization in each of the four stages of the process: origination, servicing, financing, and issuing.

A number of initiatives have been established with the particular aim of using BC to facilitate bond issuance. In this regard, in 2018 the World Bank issued a BC global bond based on a network composed of four nodes, two of which are directly owned by the World Bank and the other two by the Commonwealth Bank in Australia (

https://www.worldbank.org/en/news/press-release/2018/08/23/world-bank-prices-first-global-blockchain-bond-raising-a110-million), accessed on 27 June 2022. A similar bond implementation on BC was conducted by Nivaura, resulting in the so-called control bond (

https://www.nivaura.com/media/automation-and-blockchain-in-securities-issuances/), accessed on 27 June 2022, which works in the following way: at the moment of buying a control bond, the purchaser’s bank account is locked by the amount corresponding to its price. Next, this amount is tokenized and transferred to the bond issuer. On the coupon date, the same process is applied to the bond issuer: the bond owner receives tokenized cash and can redeem it in his/her bank account. Along with this hybrid of decentralized and traditional bonds, Nivaura has also developed an experimental bond denominated in ether (the Ethereum native cryptocurrency), that allows investors to both buy the security and receive coupons in such cryptocurrency. Additionally, based on Ethereum is the implementation carried out in 2019 by the French bank Société General, which consists of issuing bonds as tokenized securities in order to provide faster transferability, settlement, and transparency (

https://www.societegenerale.com/en/news/press-release/first-structured-product-public-blockchain), accessed on 27 June 2022. In order to pay for the coupons, security tokens were created on a public BC and the associated payout has been carried out using an on-chain representation of the euro, thus demonstrating the feasibility of BC in interbank settlements. Finally, in 2021 the bank issued a structured product as a security token on the Tezos public BC, completing the securitization cycle.

In relation to the specific case of “green” decentralized securitizations, the first issuance partially based on BC has been carried out by the Spanish bank BBVA in 2019 (

https://www.bbva.com/en/sustainability/bbva-issues-the-first-blockchain-supported-structured-green-bond-for-mapfre/), accessed on 27 June 2022. A similar pilot project was introduced in 2021 by the Bank for International Settlements in order to expand the investor base in green assets as well as to facilitate the tracking of their green impact. In this case, two prototypes of DeFi green bonds are being tested. This will allow for the assessment of two alternative network configurations (public versus permissioned).

As presented here, the existing literature and accumulated experience, summarized in

Table 1, indicate the potential of BC technology to improve existing financial transactions in general as well as securitization in particular. Based on such results and other recent developments, a decentralized securitization tailored to fund the decarbonization of irrigated agriculture is proposed in

Section 3.

3. A Decentralized Financial Instrument for PVI Projects

The implementation of a decentralized securitization tailored to PVI has been carried out in Hyperledger Fabric version 2.2, a permissioned BC designed for developing enterprise solutions. Fabric has been selected because it provides a modular and customizable architecture and allows for the use of smart contracts written in general-purpose programming languages. Furthermore, Fabric does not implement a native cryptocurrency and, importantly, does not rely on energy-intensive consensus mechanisms. In order to facilitate communication between the participants in the network and the BC, Fabric SDK has been used. Every node of the network (peers and orderers) runs on a docker container while a smart contract is installed in each peer. The chosen endorsement policy is the majority and only the participation of law-abiding actors is considered. The implementation has been deployed on an Ubuntu 20.04 system and executed on a web application developed using [

24] as methodological reference.

3.1. Network Design

In order to store the information and execute the deal, the network was designed as depicted in

Figure 3. This network includes five nodes corresponding to the necessary stakeholders in the deal (the organizations), namely: irrigators, originators, SPV, rating agencies, and investors. The model requires fewer stakeholders than a traditional securitization to be executed, a feature that should allow for a reduced cost of capital, ultimately leading to cheaper clean energy for irrigators.

Each organization is composed of two certificate authorities (hereinafter CA), one is responsible for delivering the clients’ digital identities and the other one produces the certificates to let peers and orderers communicate in a secure way, therefore using transport layer security; one peer and one orderer. This latter will set up the so-called ordering service. Consensus is achieved by means of a Raft protocol, which is crash fault tolerant and can overcome two orderer failures in this network. For simplicity, every party shares the same channel and no private data gathering has been considered.

At the initial stage, each organization has to register its clients with its CA, so that a public and private key pair can be generated, the former being inside the X.509 certificate. The implementation allows for the inclusion of personal data, such as email addresses, and assigns each user a specific identifier. Then, clients can enroll in the network with a password generated by the CA, which allows them to execute transactions (in this section, “transaction” refers to a function that updates or has access to the BC.).

Figure 4 and

Figure 5 show the decentralized securitization process and the related code, respectively. The entire process is carried out on-chain following a sequence that is initiated by an irrigator interested in PVI. This irrigator requests a PPA offer from a provider who will act as the originator. In response to this request, the originator produces and presents a detailed PVI-PPA offer to be evaluated by the irrigator. If the irrigator agrees with the terms, a smart contract version of the PPA is produced and the originator introduces the PPA identifier within a pool of projects. At a certain point, if the PPA meets the established criteria, the SPV and originator can agree to the transaction of the assets. At that point, the originator transfers the agreed PPA payment rights to the SPV and the SPV pays the originator a certain amount of cash tokens in exchange. At that time, the PPA is bundled into a pool of PPAs. As a result, the PPA will directly transfer the tokenized cash paid by the irrigator to the SPV. As in any securitization, the objective is to produce a predictable cash flow that can be used to create a PVI-PPA-backed ABS.

In order to assess the risks of the resulting FI, a rating agency will analyze the relevant data which will be unequivocally recorded on the BC. Based on that assessment, a credit rating will be produced and a coherent value will be calculated for the tokenized securities. By purchasing the tokenized securities, investors will have access to a periodic coupon payment established in normal currency, although paid in tokenized cash at the exchange rate of the payment date. On the maturity date, investors will receive a principal payment consisting of a proportional part of the pool’s available funds. After issuance, this tokenized security will be traded in a secondary market organized around a decentralized order book. As in the equivalent traditional transaction, the underlying assets (the PVI-PPA) will be unaffected by the changes in the ownership of the related cash flows involved in the securitization. Thus, the irrigator will continue to obtain maintenance and other services from the originator and will pay his/her bills periodically as agreed in the PPA. Then, such payments will be directed to a specific client ID depending on who is the owner at each moment, either the originator or the SPV.

The described transaction has been integrated into a BC network through a smart contract developed in node.js. The smart contract is split into four classes, one containing common functions and the other three corresponding to three business scenarios associated with specific stages of the securitization and the organizations which take part in each of them. Thus, the business scenarios included in the smart contract are origination, issuance, and secondary market. Then, due to its flexibility to support complex queries, a CouchDB was chosen to record the relevant information as data states (see

Figure 5). These data can be stored following two alternative data models: “Unspent Transaction Output” (UTXO) or “Account-Based”, as presented in

Table 2. UTXO represents a state that is created at the start of a transaction and destroyed before initiating the next transaction. The ownership of UTXO data is reflected by the public key contained in the state. Hyperledger Fabric implements an example of this model (

https://hyperledger-fabric.readthedocs.io/en/release-2.2/#a-blockchain-platform-for-the-enterprise.). On the other hand, the account-based model creates a state that is not destroyed when it is modified. In this regard, the use of UTXO is more suited to support transactions where the priority is to avoid double spending while account-based is more suitable for those cases where high traceability and flexible data management of the information about the assets is particularly necessary.

In order to simplify the model, we have considered that all the cash has already been tokenized on-chain (following the UTXO model) at the beginning. In a real scenario, cash should be tokenized at the time when any transaction involving payments in normal currency takes place; for example, each time the irrigator has to pay a bill, an exchange mechanism should be included. Users wishing to interact in the network must be registered by their organization’s CA and this membership will provide access control. Moreover, it is expected that organizations with few users (originator, rating agency, SPV) will not use the web application.

The application includes a secondary market for the tokenized bonds, which is operated by the same network used to carry out the securitization. Thus, an investor client can submit an ask order proposal into the system in order to sell his/her bonds (dotted square). Such a proposal is then verified by a majority of the peers (three of the five green hexagons in

Figure 3). Once verified, the proposal is sent to the ordering service. Next, the lead orderer will package this transaction into a block, deliver it to the rest of the orderers, add this new block to the BC and deliver this data to peers who will update their own copy of the ledger.

3.2. Origination and Servicing

The first business scenario of the smart contract deals with origination and servicing and it is shown in

Figure 6. As in every business scenario, several prior verifications must be assessed before its initiation, including identity role, empty arguments, and membership (hereinafter referred to as

beforeTransaction verifications). These

beforeTransaction verifications will be triggered every time a transaction is invoked and allow for splitting the PPA-smart contract into the aforementioned three classes.

The entire process starts when an irrigator client submits a request for subscribing to a PVI-PPA (see step 1 of

Figure 4). Next, a client of the Originator company can query this PPA request and produce a PPA contract tailored to the needs of the irrigator, which will be submitted on the BC (step 2) with all the necessary attributes of a traditional PPA. Following this, in step 3, the irrigator client queries his/her bespoke PPA to inform whether or not it will be “signed” (if it is the case, the PPA changes a boolean attribute to True). The smart contract verifies that: the PPA has not been signed before, the PPA customer matches a client’s digital identity and the PPA has been rightfully produced by the originator. If the irrigator accepts the offered contractual terms (step 4), in step 5, the originator client will include this PPA ID into a pool which, if accepted and purchased, entitles the owner to receive cash flows from the previously tokenized PPA. The related function will verify the integrity of all the information stored since step 1, including that the PPA ID exists, that the PPA owner matches the originator client’s digital identity, and that the PPA has been already signed and has not yet been introduced within the pool. This pool will be destroyed and created every time a PPA ID is appended and not necessarily every PPA will be gathered into a pool. These functions belong to the so-called origination on-chain.

At this stage, the smart-contract PPA has been created, so servicing functions must be carried out as part of the business scenario. Once an irrigator client has signed his/her PPA and clean energy supply is available, a long commercial relationship is established between her and the originator or whoever the SPV determines. On one side, the customer can request maintenance services, which will be mirrored in the PPA (step 6). The PPA will register the energy consumption (), which is billed by the originator client in step 7, and the corresponding amount which the irrigator must pay. The irrigator client must pay that electricity bill (which is an update in the PPA state) employing that tokenized cash already on-chain (step 8). In order to verify that the bills are paid in due term, the originator client updates the PPA state with the latest electricity bill (time data uses a built-in function that indicates the client timestamp of a transaction). Then, a function queries if the last bill has been paid along with identity checks. If the irrigator client does not pay that electricity bill, the originator client will update PPAs pointing out which PPAs are in default. If the irrigator client pays the bill, the cash token will be delivered to the PPA owner, who is either the originator client or the SPV (if the PPA has been already transferred to a pool). If the PPA is already pooled, a function embedded in the payment process is executed. This function will allocate a portion of the tokenized receipts of the PPA to pay for coupons and a portion to pay the principal. This latter cash token will be labeled as . During the payment process, cash tokens are evaluated in order to not allow clients to use tokens not owned by them and to avoid transactions involving more value than is actually owned. Along with these checks, the elapsed time between bill deliverance and payment commitment is evaluated.

3.3. Pooling, Structuring, and Issuing

The second business scenario deals with asset bundling into a pool, structuring the securitization, and issuing securities (see

Figure 7). Here, the aforementioned

beforeTransaction verifications ensure that only the originator, the SPV, and the rating agency clients interact within this scenario. As in a centralized securitization, the originator sells the PPA to an SPV in order to recover the investment. Once the SPV pays the originator for the PPA-PVI, tokenized cash flows produced from the PPA are relocated to the new owner (steps 1.1, 1.2, 1.3, and 1.4). This process begins with a function that includes the price that the SPV is willing to pay and the size that the pool must achieve to initiate the securitization. The originator queries this request from the SPV and submits another request with the price at which he/she is willing to sell and the pool ID. This latter request will also be queried by the SPV and will “sign” (again, the sign means changing a boolean attribute) a request which includes both. This request is verified in order to not allow already signed ones to sign again and to ensure that the cash token provided has enough funds to overcome this transaction and is not locked. Now, the originator queries this last request and “signs” it, thus verifying that the pool size and the cash token amounts match each other. This mutual transference is achieved by means of a Delivery v. Payment process and can be initiated by any party. This process either results in both assets (the PPA and the cash tokens) swapping ownership or in the ownership remaining unchanged. At a certain time, the pool will be large enough for the securitization to take place. In order to produce high-quality securities, a rating agency will assess the pool of PPAs (step 2) by observing the recorded information in the BC and the quality of the implementation. By taking into account the results of this independent assessment, the SPV client will decide if the securitization is viable. If the SPV decides to go ahead, a bond issuance under the UTXO model (step 3) will be carried out, which will be offered to investors in a primary market. At issuance, SPV establishes the characteristics of the bond, including the assets backing it and the parameters to calculate the coupon and principal payments, as well as their equivalence in cash tokens.

3.4. Secondary Market and Securities Servicing

The last business scenario deals with the secondary market, which is represented in

Figure 8. In this scenario, the so-called

beforeTransaction verifications will allow only the SPV and investor clients to participate. In this regard, the SPV will also act as the underwriter of the issuance, selling the securities directly to investors. For this purpose, the SPV will submit sell requests (ask orders) at the issuance price that will be included in an order book state (step 1). Every investor will be able to query the order book to check the price as well as the underlying pool of PPAs to assess the quality of the collateral. The order book included in this model works as an order-driven market, where matching is achieved at the same time a bid or ask order is submitted. Investors in the bond tokens can also query the value of the cash tokens available in the SPV to pay the principal at any time, so they could make an accurate assessment of the value of the securities, for example by determining whether they are under or over collateralized. The decentralized market mechanism included in the transaction can perform the essential functions of a centralized market with the advantage that no intermediaries are needed. For example, if at first instance matching is not achieved, the order’s underlying assets will be labeled as

. Thus, the application ensures that a unique ID cannot introduce several orders at the same time with the aim of executing only the most advantageous (step 2). Additionally, whenever a bond is not labeled as

CanBeUsed: False, its owner will receive cash tokens on the coupon date (step 3). This is guaranteed because several verifications are carried out: the amount, the ownership, and match checking.

The three business scenarios that make up the implementation have been tested by carrying out unit tests covering 82.95% of the lines of code of the smart contract. The results of the unit tests indicate that each of the business scenarios works as expected and ensures the legitimacy of the operations at any time.

4. Discussion

The decentralized securitization of PVI-PPA presented in the previous section has a number of advantages in terms of cost, transparency, and ease of access to investors over traditional centralized securitizations. Nevertheless, replacing the processes and stakeholders involved in a traditional securitization with self-validated ledgers and contracts presents its own challenges that must be carefully addressed before considering a practical implementation. In this section, such aspects are presented and discussed by considering each stage of the securitization process.

Origination. PVI-PPA origination involves the necessary tasks that developers and irrigators must undertake to commit to a new project and to design and build the system. Both in the proposed model and in a centralized securitization, origination requires the use of equivalent protocols and procedures to assess and validate the viability of PVI projects and the creditworthiness of clients. Thus, at this stage, both approaches are equivalent in terms of efficiency and cost. Note that the decentralized model presented here records the relevant information regarding the characteristics of the irrigators and the commercial practice of the originator. This increases the transparency of the collateral for investors and facilitates the activity of rating agencies. However, the decentralized model requires irrigators to pay their bills in tokenized cash. This means that normal cash has to be transformed into tokenized cash at some point, a process that is likely to have a cost in terms of fees and volatility.

Aggregation. The second phase of the securitization process consists of bundling the assets created by originators into pools of sufficient size. Aggregation is normally carried out by a specialized fund that purchases the assets from originators in order to transfer them to an SPV. In a traditional securitization, the process of bundling many individual assets into a suitable pool is particularly costly and inefficient, as it involves tasks and actions which are intense in capital and work. In this regard, it is necessary to individually assess each of the assets in order to ensure their suitability to be used as collateral for the bonds. In the case of a pool composed of PVI-PPA, factors such as the details of the contracts, the performance of the systems, and the creditworthiness of the irrigators should be assessed by specialized staff on the basis of the information available. Aggregation allows for the diversification of non-systemic risks but also introduces a level of agency risk for investors, as the individual characteristics of the assets included in the pool cannot be tracked or validated afterward. In this regard, the decentralized model presents advantages in terms of cost and transparency. It is cheaper because the validation of the PPAs to be included in the pool is carried out automatically and unequivocally, based on the information recorded in the BC and the quality parameters decided by the SPV. It is more transparent because all the relevant information regarding the origination and performance of the PPAs used as collateral is available to investors and other stakeholders, with the certainty that it has not been manipulated at any point. Nevertheless, the proposed implementation also has some challenges. First, the smart contracts containing the PPA-PVI cannot be easily changed after origination, so any ill design or flaw detected at the aggregation step may be difficult to fix. Secondly, no single party has access to the tokenized cash available in the SPV. This ensures that the SPV is bankruptcy remote to the issuer and that the cash is distributed as initially planned. Nevertheless, it also means that any unplanned need for cash, any malfunction due to technical problems, or even a cyberattack can be hard (or impossible) to remedy. As a result, the design and implementation of the details of the smart contracts and BC applications must be carefully checked to ensure their robustness and resilience.

Issuance/rating. In order to obtain liquidity and to pay for the expenses of the securitization, the aggregator must create and sell tradable securities backed by the pool of assets. The resulting financial instruments are bonds, which entitle their holders to obtain a specific cash flow at certain times in the future. The value of such bonds, which determines the cost of capital of the underlying assets, depends on the promised cash flow payments, the general level of interest rates, and the probability of default of the issuer. This last element is normally assessed by independent rating agencies on the basis of the creditworthiness of the issuer and/or on the quality of the collateral backing the bonds. The riskier the issuer, the less valuable the issuance.

In the case of the decentralized model proposed here, bonds take the form of tokens. Each token entitles its holder to obtain a specific amount of tokenized cash at a given time. The issuance is executed in a decentralized order book where the SPV places ask orders at the issuance price. The issuance price reflects the appropriate valuation of the future tokenized cash flows attached to the tokens. As the process that channels cash from PPAs to the tokens is decentralized, the ability of the bond tokens to pay depends exclusively on the irrigators paying their bills. In this regard, the issuer of the tokens has no control over the payments to investors. The result is that the decentralized token is fully bankruptcy remote from the issuer, a key feature that is much more complex and costly to achieve in traditional securitizations. Another advantage of the proposed model is that the credit rating evaluation can be simplified, as all the relevant information including energy consumption, payments, and credit events is unequivocally recorded in the BC itself. Nevertheless, the decentralized transaction requires the exchange of normal cash flows produced by the underlying assets into tokenized cash and the exchange of tokenized cash into normal cash to fund the underlying assets. Such processes introduce exchange risk and difficult valuations, so a dedicated risk assessment and valuation methodology would be necessary for decentralized securitizations, thus resulting in specific credit enhancement measures.

Underwriting/secondary market. Traditional securitizations usually rely on an underwriter, normally an investment bank that purchases the issuance with the aim of reselling it to other investors. Underwriters can also act as market makers, providing a secondary market for the securities. By providing access to the securities to investors and by ensuring investor liquidity for the securities, underwriters perform a valuable intermediation between investors and projects. Nevertheless, underwriters charge substantial fees to issuers, negatively affecting the cost of capital of projects, especially if the volume of the issuance is relatively small.

In this regard, the proposed decentralized model does not require underwriting, as the tokenized securities are sold directly by the SPV to investors, once the pre-established conditions are met. At that point, the issuance is marketed in a decentralized order book that also allows for a secondary market. Thus, PVI-PPA token investors can place buy/sell orders in the order book that automatically matches supply and demand and produces quotations indicating a market price for the securities. Transactions are validated by the network and recorded in the BC without deposit or brokerage costs. The removal of underwriters will have a relevant impact on reducing the cost of securitization of PVI-PPA and, consequently, on the price of the energy for irrigators. Nevertheless, the decentralized market that replaces underwriters can lack sufficient depth to guarantee adequate functionality. In that case, a certain level of centralization would have to be included in the implementation, for example by adding a market maker who guarantees a certain level of value and liquidity for the tokens in the secondary market.

Investors. By securitizing their assets, PVI promoters would have access to wholesale capital markets instead of relying on a small number of specialized funds. The decentralized model would also attract crypto investors, which is a market segment that presents a high growth rate. PVI-PPA bond tokens will provide such investors with a number of features that may suit their portfolios, combining exposure to cryptos and to cash flow producing green assets. The return for such investors will consist of two sources of income: (1) periodic coupons nominated in euros and paid in the equivalent in cash tokens at the exchange rate on the payment day and (2) a principal paid in cash tokens at maturity, representing the accumulated value of the cash flow which has been tokenized over the life of the bond. By setting the proportion of cash flow originated in the PPA allocated to each of these sources, the issuer of the token can fine-tune the risk–return profile of the instrument, the exposure to crypto markets, and/or create several tranches with different seniorities.

In contrast with the limited information available to investors in centralized bonds, investors in the bond tokens have direct and real-time information on key issues both at the asset level (such as energy yield, delinquency rates, or systems failure) and at the SPV level (such as available funds and transactions) with the certainty that it has not been altered or lost by the originator, or the asset manager. This is possible because all the information is self-validated by the network and recorded in the BC, without the need for any party to centralize the process.

Regardless of these advantages, decentralization also introduces a number of risks for investors. Firstly, the principal of the bond tokens is a crypto money box that is filled periodically with cash tokens of a pre-established amount of conventional cash from the PVI-PPA. Thus, the value at any given time of such a money box will be affected by the volatility of the exchange rate of the cash tokens and the normal cash. This introduces exchange risk which is not present in centralized securitizations, where the currency of the inflows and outflows is the same. Secondly, in the proposed implementation, no market maker is available and prices are entirely determined by an automated order book. This means that the liquidation of the bond tokens can be difficult or costly if there is not enough demand. In order to mitigate these risks, the introduction of a market maker that guarantees a certain level of liquidity and price can be considered.

Trustee. In order to mitigate the information asymmetry that exists between bond issuers and investors, it is common to appoint (and pay) an independent party, a trustee, to oversee the issuer on behalf of investors. Trustees track the cash flows from the underlying assets to the SPV in order to identify any incoherence with the cash flows from the SPV to investors. The proposed model does not need a trustee, as the cash flows are managed by a smart contract and recorded in the BC.

Servicer. Securitization requires a responsible party to manage the collection of the cash flows from the underlying assets to the SPV and from the SPV to the bondholders. The proposed decentralized securitization does not require a servicer as the smart contract manages the cash flows at all levels and the BC records the balance of each participant. Therefore, decentralization avoids costs related to payment servicing.

Credit enhancement. In order to increase the value of the issuance, it is common to include features aimed at reducing riskiness for investors. Such credit enhancement measures can include overcollateralization, first loss facilities, and tranching, among others. A decentralized securitization can include equivalent credit enhancements, for example, by issuing tokens with different seniority. In order to mitigate risks that are specific to this decentralized securitization, tailored credit enhancement measures can be designed and implemented.

Table 3 below summarizes the benefits and risks that a decentralized securitization will present compared to a traditional one. Also, a number of mitigation measures are suggested in order improve the decentralized transaction.

As it has never been implemented before in real conditions, the actual impact of the use of a decentralized securitization on the cost of clean energy for irrigators is difficult to assess. Nevertheless, a reduction in 117 bps of the resulting cost of capital for the underlying assets has been reported [

23]. The detailed assessment of the reported cost reduction is shown in

Table 4.

Thus, assuming that the rest of the factors affecting the energy cost of PVI remain unaffected, the resulting reduction in the cost of energy can be estimated. In this regard, the most commonly used metric to estimate the cost of energy at the system level is the leveled cost of energy (LCOE). In order to establish the LCOE in monetary units per energy unit, for each period of expected operation, one must divide the cost of constructing and operating an electricity generating plant by the expected total energy production. The resulting future costs of energy production are then “discounted” using a discount rate that reflects the cost of capital of the project, as is defined in Equation (1).

where:

- -

CAPEXt represents the capital expenditure spent in year t to design, build, and put the energy production system into operation,

- -

OPEXt is the costs paid to operate and maintain the system in year t,

- -

EnGent is the energy yield of the system during year t,

- -

WACC is the weighted average cost of capital of the project,

- -

n is the expected lifespan of the system in years.

In the case of a 125kWp PVI system based in Spain, the costs and yields presented in

Table 5 can be considered [

25]. The resulting LCOE is 120.9 USD/MWh, which is a proxy of the price of the energy that an irrigator demanding a PPA would be offered in the market. This is a business scenario where funding is exclusively obtained in the form of equity, so that any form of leverage, including securitization, will likely reduce the cost of capital and, hence, the cost of energy.

In order to produce an estimation of the impact in PVI’s LCOE of securitization, we can consider that a typical transaction with a 25% of overcollaterization should result in issuing bonds with a 4% annual yield. This consideration would allow for a reduction in the cost of capital for the projects from 9.64% to 5.18%, resulting in an LCOE of USD 102.2. Furthermore, as the model here proposed is decentralized, the cost of debt can be expected to be reduced by an additional 117 bps, thus resulting in an estimated yield for the bond tokens of 2.8% annual yield, and in a cost of capital for the projects of 4.22%. In such a scenario, the market price (LCOE) for a PVI-PPA would be 98.4 USD/MWh, which represents a reduction of more than 22% in comparison with the scenario without the DeFi instrument. We would like to emphasize that such a reduction can likely be achieved only by using a decentralized securitization, as traditional transactions are not well suited to pools of relatively small size compared to the ones that can be produced with PVI-PPA in a given period of time.

5. Conclusions

The sustainability of irrigated agriculture is a key point to address important societal challenges including climate change, human development, and sustainable growth. As PVI technology allows for steep reductions in water consumption and GHG emissions in most of the existing irrigated farms, it can play an important role to achieve such a goal. Nevertheless, PVI’s market uptake depends on the capacity of the promoters of PVI projects to attract large amounts of affordable long-term finance. In this article, we have explored the suitability of BC technology to produce more efficient and cheaper financial instruments tailored to PVI projects and to a variety of investors. In order to identify the benefits and risks of the concept, a fully decentralized securitization has been designed and implemented in the BC platform Fabric. The different stakeholders interact with each other by exchanging cash and bond tokens according to a smart contract. Transactions are validated following a consensus algorithm and are unequivocally recorded in the BC. The resulting application can execute the tasks and processes of a traditional securitization without the need for financial intermediaries or trustees. Furthermore, investors in the resulting financial instruments benefit from a higher level of transparency in relevant information, such as the performance of the underlying assets and the financial situation of the SPV. These features would lead to reductions in the cost of capital of PVI projects, thus allowing for estimated reductions of more than 20% in the cost of clean energy for irrigators, without affecting the quality or the profitability of the projects. This cost reduction would significantly increase the competitiveness of PVI over existing fossil fuel-based alternatives, accelerating the transition of the energy model of irrigated agriculture.

The results show the potential of combining distributed renewable energy assets and DeFi solutions in order to produce high-quality and cost-efficient financial instruments. In this regard, the relative simplicity and high predictability of PPAs make them particularly well suited to be embedded in a smart contract and to serve as collateral for bond tokens. Furthermore, a decentralized secondary market for such tokens can be created and operated, providing liquidity to investors without significant costs.

Nevertheless, despite the significant potential of the approach, the BC implementation also showed a number of risks that should be addressed. In this regard, converting cash flows of traditional money produced by the PPAs into tokenized cash involves a cost in terms of fees and introduces additional risks associated with the volatility of the exchange rate. Furthermore, any ill design in the implementation of the smart contracts can be difficult or impossible to repair once the transaction has started, thus adding a specific type of operational risk to decentralized financial instruments that should be dealt with. As a result, in order to realize the potential of BC to support the decarbonization of irrigated agriculture, further developments, and pilot implementations are required, including specific risk assessment methodologies and credit enhancement measures. Future research is also encouraged to assess the suitability of applying the proposed methodology to green assets classes other than PPA-PVI, including energy performance contracts and renewable energy-themed real estate investment trusts. Finally, the integration of green certificates and PPA into a single smart contract can also be explored in order to increase its value and, consequently, reduce the cost of green energy.