State-Level Urban Agglomeration and Enterprise Innovation: A Quasi-Natural Experiment

Abstract

:1. Introduction

2. Literature Review

2.1. Urban Agglomeration

2.2. Determinants of Enterprise Innovation

2.2.1. Internal Factors

2.2.2. External Factors

3. Research Design

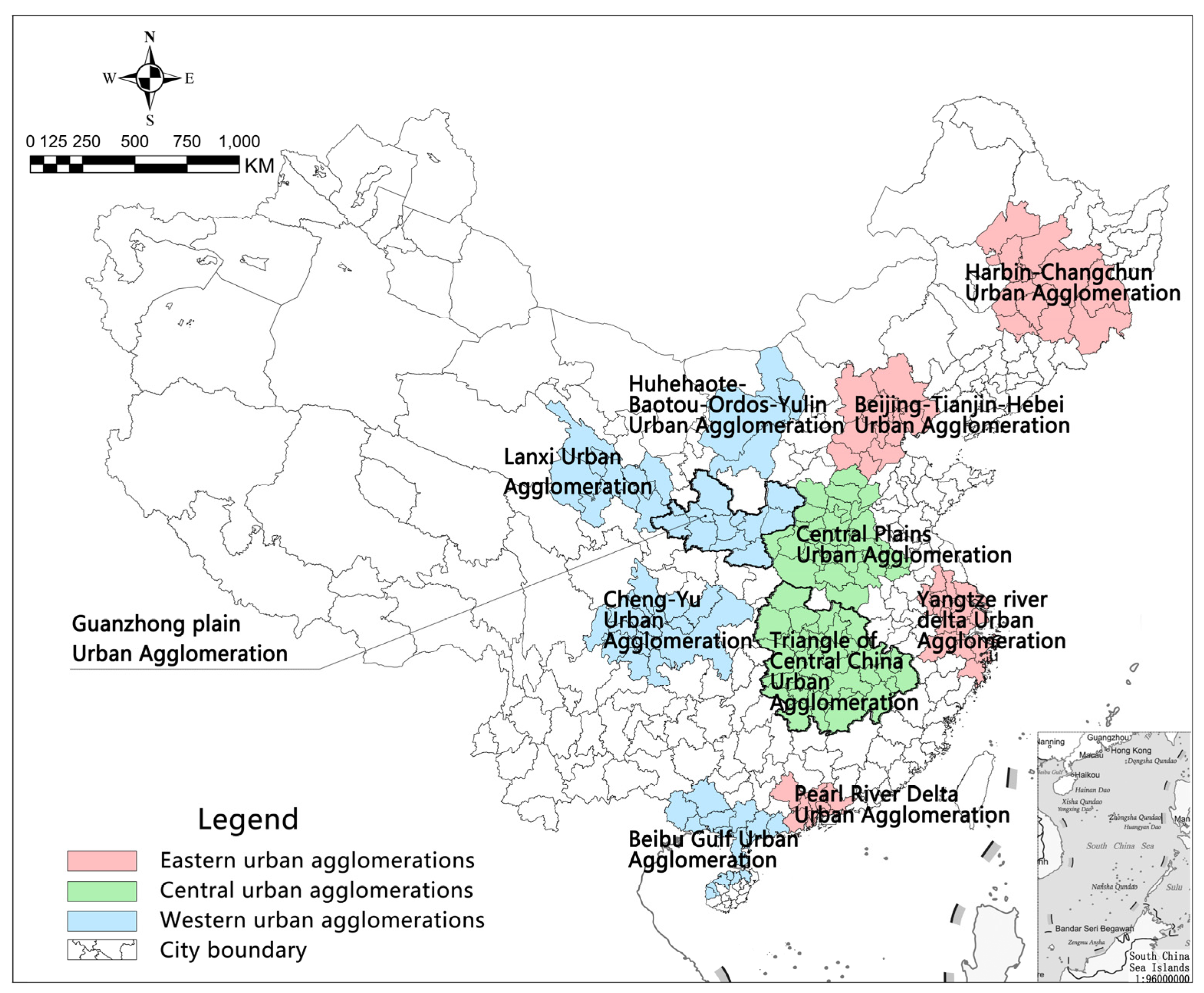

3.1. State-Level Urban Agglomerations

3.2. Identification Strategy

4. Data Source and Variable Definition

5. Results and Discussion

5.1. Policy Effect Estimation

5.2. Validity Tests

5.2.1. Parallel Trend Tests

5.2.2. Placebo Tests

6. Regional Heterogeneity

7. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Zhang, Q.F.; Mou, S.B. Research on innovation and development strategy of China’s five urban agglomerations under the new development pattern. Reg. Econ. Rev. 2021, 2, 97–105. [Google Scholar]

- Zhai, S.Y.; Gu, P.; An, Y. Under cluster and enterprise innovation: Correlation effect and path analysis. Sci. Sci. Manag. S. T 2019, 40, 31–42. [Google Scholar]

- Obeng-Odoom, F. Spatial political economy: The case of metropolitan industrial policy. Rev. Evol. Political Econ. 2022, 1–27. [Google Scholar] [CrossRef]

- Phelps, N.A.; Ozawa, T. Contrasts in agglomeration: Proto-industrial, industrial and post-industrial forms compared. Prog. Hum. Geogr. 2003, 27, 583–604. [Google Scholar] [CrossRef]

- Alonso-Villar, O. Urban agglomeration: Knowledge spillovers and product diversity. Ann. Reg. Sci. 2002, 36, 551–573. [Google Scholar] [CrossRef]

- Musterd, S.; Bontje, M.; Ostendorf, W. The changing role of old and new urban centers: The case of Amsterdam region. Urban Geogr. 2006, 27, 360–387. [Google Scholar] [CrossRef]

- Lang, R.; Knox, P.K. The new metropolis: Rethinking megalopolis. Reg. Stud. 2009, 43, 789–802. [Google Scholar] [CrossRef]

- Lagarias, A. Urban sprawl simulation linking macro-scale processes to micro-dynamics through cellular automata, an application in Thessaloniki, Greece. Appl. Geogr. 2012, 34, 146–160. [Google Scholar] [CrossRef]

- Marull, J.; Galletto, V.; Domene, E.; Trullen, J. Emerging megaregions: A new spatial scale to explore urban sustainability. Land Use Policy 2013, 34, 353–366. [Google Scholar] [CrossRef]

- Wang, K.Y.; Deng, Y.; Sun, D.W.; Song, T. Evolution and spatial patterns of spheres of urban influence in China. Chin. Geogr. Sci. 2014, 24, 126–136. [Google Scholar] [CrossRef] [Green Version]

- Florida, R.; Gulden, T.; Mellander, C. The rise of the mega-region. Camb. J. Reg. Econ. Soc. 2008, 1, 469–476. [Google Scholar] [CrossRef]

- De Goei, B.; Burger, M.J.; Van Oort, F.G.; Kitson, M. Functional polycentrism and urban network development in the Greater South East, United Kingdom: Evidence from commuting patterns, 1981–2001. Reg. Stud. 2010, 44, 1149–1170. [Google Scholar] [CrossRef]

- Huang, X.L.; Li, G.P.; Liu, J.G. The impact of spatial structure on economic efficiency of Beijing-Tianjin-Hebei megalopolis in China. Complexity 2020, 18, 6038270. [Google Scholar] [CrossRef]

- Meijers, E.J.; Burger, M.J. Stretching the concept of “Borrowed Size”. Urban Stud. 2017, 54, 269–291. [Google Scholar] [CrossRef]

- Zhang, X.C.; Guo, Q.E.; Cheung, D.M.W.; Zhang, T.Y. Evaluating the institutional performance of the Pearl River Delta integration policy through intercity cooperation network analysis. Cities 2018, 81, 131–144. [Google Scholar] [CrossRef]

- Liu, Y.L.; Zhang, X.H.; Pan, X.Y.; Ma, X.X.; Tang, M.Y. The spatial integration and coordinated industrial development of urban agglomerations in Yangtze River Economic Belt, China. Cities 2020, 104, 102801. [Google Scholar] [CrossRef]

- Li, Z.; Jiang, W.G.; Wang, W.J.; Chen, Z.; Ling, Z.Y.; Lv, J.X. Ecological risk assessment of the wetlands in Beijing-Tianjin-Hebei urban agglomeration. Ecol. Indic. 2020, 117, 106677. [Google Scholar] [CrossRef]

- Chen, M.X.; Guo, S.S.; Hu, M.G.; Zhang, X.P. The spatiotemporal evolution of population exposure to PM2.5 within the Beijing-Tianjin-Hebei urban agglomeration, China. J. Clean. Prod. 2020, 265, 121708. [Google Scholar] [CrossRef]

- Tian, Z.Z.; Fang, D.L.; Chen, B. Three-scale input-output analysis for energy and water consumption in urban agglomeration. J. Clean. Prod. 2020, 268, 122148. [Google Scholar] [CrossRef]

- Ouyang, X.; Zhu, X. Spatio-temporal characteristics of urban land expansion in Chinese urban agglomerations. Acta Geogr. Sin. 2020, 75, 571–588. [Google Scholar]

- Lu, C.Y.; Xu, Y.T.; Lin, X.Q.; Zhong, L.X.; Su, Y. Study of spatio-temporal evolution of circum-Bohai urban agglomeration based on DMSP/OLS night-time light data. Remote Sens. Land Resour. 2019, 31, 218–226. [Google Scholar]

- Fang, C.L.; Mao, Q.Z.; Ni, P.F. Discussion on the scientific selection and development of China’s urban agglomerations. Acta Geogr. Sin. 2015, 70, 515–527. [Google Scholar]

- Xie, C.Y.; Hu, H.H.; Zhou, H.B. Principles and paths of the city-industry integration development against the background of a new kind of urbanization. J. Financ. Econ. 2016, 42, 72–82. [Google Scholar]

- Zeng, H.; Yan, C.H.; Huang, W.B.; Lin, Q.Y.; Yu, L.Y.; Qiu, G.Y. A case study on the relationship between urbanization level and water use efficiency in the Pearl River Delta urban agglomeration. Acta Sci. Nat. Univ. Pekin. 2020, 56, 561–570. [Google Scholar]

- Chen, L.T.; Li, J.L.; Ye, C.H.; Xu, L.Z. Research on the impact of industrial structure change on eco-efficiency in Yangtze River economic zone urban agglomeration: 2006–2014. J. Appl. Stat. Manag. 2020, 39, 206–222. [Google Scholar]

- Yu, J.W.; Zhao, D.L. The rise of urban cluster, economic performance and regional income disparity based on the metropolitan area of Jing-Jin-Ji, Yangtze River Delta and Pearl River Delta. J. Zhongnan Univ. Econ. Law 2010, 181, 15–20. [Google Scholar]

- Zhang, Y.; Liu, L.; Huang, S.J. Does regional integration promote the high-quality development of urban agglomeration economy: A quasi-natural experiment based on the Yangtze River Delta urban economic coordination commission. Stud. Sci. Sci. 2021, 39, 63–72. [Google Scholar]

- Zhang, X.L.; Li, P.X.; Li, L.X. Government cooperation, market integration and economic performance of city cluster: Evidence from the Yangtze River Delta urban economic coordination committee. China Econ. Q. 2017, 16, 1563–1582. [Google Scholar]

- Li, X.S.; Zhang, Y.D.; Sun, B.W. Does regional integration promote the efficiency of economic growth? An empirical analysis of Yangtze River Economic Belt. China Popul. Resour. Environ. 2017, 27, 10–19. [Google Scholar]

- Hirschey, M.; Skiba, H.; Wintoki, M.B. The size, concentration and evolution of corporate R&D spending in US firms from 1976 to 2010: Evidence and implications. J. Corp. Financ. 2012, 18, 496–518. [Google Scholar]

- Laforet, S. Organizational innovation outcomes in SMEs: Effects of age, size and sector. J. World Bus. 2013, 48, 490–502. [Google Scholar] [CrossRef]

- Soete, L.L.G. Firm size and incentive activity: The evidence reconsidered. Eur. Econ. Rev. 1979, 12, 319–324. [Google Scholar] [CrossRef]

- Lin, C.; Lin, P.; Song, F. Property rights protection and corporate R&D: Evidence from China. J. Dev. Econ. 2010, 93, 49–62. [Google Scholar]

- Hu, A.G.; Jefferson, G.H. A great wall of patents: What is behind China’s recent patent explosion? J. Dev. Econ. 2009, 90, 57–68. [Google Scholar] [CrossRef]

- Hou, Q.; Hu, M.; Yuan, Y. Corporate innovation and political connections in Chinese listed firms. Pac. Basin Financ. J. 2017, 46, 158–176. [Google Scholar] [CrossRef]

- Yuan, R.; Wen, W. Managerial foreign experience and corporate innovation. J. Corp. Financ. 2018, 48, 752–770. [Google Scholar] [CrossRef]

- Mazouz, K.; Zhao, Y. CEO incentives, takeover protection and corporate innovation. Br. J. Manag. 2019, 30, 494–515. [Google Scholar] [CrossRef] [Green Version]

- Li, P.Y. The impact of the top management teams’ knowledge and experience on strategic decisions and performance. J. Manag. Organ. 2017, 23, 504–523. [Google Scholar] [CrossRef]

- Chen, Y.; Podolski, E.J.; Veeraraghavan, M. Does managerial ability facilitate corporate innovative success? J. Empir. Financ. 2015, 34, 313–326. [Google Scholar] [CrossRef]

- Bereskin, F.L.; Cicero, D.C. CEO compensation contagion: Evidence from an exogenous shock. J. Financ. Econ. 2013, 107, 477–493. [Google Scholar] [CrossRef]

- Han, S.; Cui, W.J.; Chen, J.; Fu, Y. Female CEOs and corporate innovation behaviors—Research on the regulating effect of gender culture. Sustainability 2019, 11, 682. [Google Scholar] [CrossRef] [Green Version]

- Wan, W.; Zhou, F.; Liu, L.; Fang, L.; Chen, X. Ownership structure and R&D: The role of regional governance environment. Int. Rev. Econ. Financ. 2021, 72, 45–58. [Google Scholar]

- Michael, S.C.; Pearce, J.A. The need for innovation as a rationale for government involvement in entrepreneurship. Entrep. Reg. Dev. 2009, 21, 285–302. [Google Scholar] [CrossRef]

- Deng, K.; Ding, Z.; Xu, M. Population agglomeration and the effectiveness of enterprise subsidies: A Chinese analysis. Reg. Stud. 2020, 54, 1136–1148. [Google Scholar] [CrossRef]

- Bronzini, R.; Piselli, P. The impact of R&D subsidies on firm innovation. Res. Policy 2016, 45, 442–457. [Google Scholar]

- Wallsten, S.J. The effects of government-industry R&D programs on private R&D: The case of the small business innovation research program. RAND J. Econ. 2000, 31, 82–100. [Google Scholar]

- Shang, H.T.; Huang, X.S. A research on the performance of government innovation subsidies for pharmaceutical companies in China. Sci. Res. Manag. 2019, 40, 32–42. [Google Scholar]

- Jaklic, A.; Burger, A.; Rojec, M. The quest for more efficient R&D subsidies. East. Eur. Econ. 2013, 51, 5–25. [Google Scholar]

- Crespi, G.; Giuliodori, D.; Giuliodori, R.; Rodriguez, A. The effectiveness of tax incentives for R&D+i in developing countries: The case of Argentina. Res. Policy 2016, 45, 2023–2035. [Google Scholar]

- Tassey, G. Tax incentives for innovation: Time to restructure the R&E tax credit. J. Technol. Transf. 2007, 32, 605–615. [Google Scholar]

- Zheng, T.T.; Wang, H.; Gan, S.D. Tax incentives and innovation quality improvement: Based on the perspective of quantity growth and structural optimization. Mod. Financ. Econ.-J. Tianjin Univ. Financ. Econ. 2020, 360, 29–40. [Google Scholar]

- Atanassov, J.; Liu, X.D. Can corporate income tax cuts stimulate innovation? J. Financ. Quant. Anal. 2020, 55, 1415–1465. [Google Scholar] [CrossRef] [Green Version]

- Pertuze, J.A.; Reyes, T.; Vassolo, R.S.; Olivares, N. Political uncertainty and innovation: The relative effects of national leaders’ education levels and regime systems on firm-level patent applications. Res. Policy 2019, 48, 103808. [Google Scholar] [CrossRef]

- Bhattacharya, U.; Hsu, P.H.; Tian, X.; Xu, Y. What affects innovation more: Policy or policy uncertainty? J. Financ. Quant. Anal. 2017, 52, 1869–1901. [Google Scholar] [CrossRef] [Green Version]

- Amore, M.D.; Schneider, C.; Alminas, Z. Credit supply and corporate innovation. J. Financ. Econ. 2013, 109, 835–855. [Google Scholar] [CrossRef]

- Hsu, P.H.; Xuan, T.; Yan, X. Financial development and innovation: Cross-country evidence. J. Financ. Econ. 2014, 112, 116–135. [Google Scholar] [CrossRef] [Green Version]

- Maskus, K.E.; Milani, S.; Neumann, R. The impact of patent protection and financial development on industrial R&D. Res. Policy 2019, 48, 355–370. [Google Scholar]

- Mnnasoo, K.; Merikull, J. Credit constraints and R&D over the boom and bust: Firm-level evidence from central and eastern Europe. Econ. Syst. 2020, 44, 100747. [Google Scholar]

- Roper, S.; Du, J.; Love, J.H. Modelling the innovation value chain. Res. Policy 2008, 37, 961–977. [Google Scholar] [CrossRef] [Green Version]

- Hoynes, H.W.; Schanzenbach, D.W.; Douglas, A. Long-run impacts of childhood access to the safety net. Am. Econ. Rev. 2016, 106, 903–934. [Google Scholar] [CrossRef] [Green Version]

- Becker, S.O.; Ichino, A. Estimation of average treatment effects based on propensity scores. Stata J. 2002, 2, 358–377. [Google Scholar] [CrossRef] [Green Version]

- Jia, Z.J.; Wen, S.Y.; Zhu, R.Q. Carbon emission trading and total factor carbon efficiency: Evidence from China’s pilot carbon trading. J. Xiamen Univ. 2022, 270, 21–34. [Google Scholar]

- Li, P.; Lu, Y.; Wang, J. Does flattening government improve economic performance? Evidence from China. J. Dev. Econ. 2016, 123, 18–37. [Google Scholar] [CrossRef]

- Topalova, P. Factor immobility and regional impacts of trade liberalization: Evidence on poverty from India. Am. Econ. J. Appl. Econ. 2010, 2, 1–41. [Google Scholar] [CrossRef] [Green Version]

- Tan, J.; Zhang, J.H. Special economic zones and firm productivity—Empirical evidence from Chinese listed companies. Econ. Perspect. 2019, 1, 43–59. [Google Scholar]

- Keele, L.J.; Titiunik, R. Geographic boundaries as regression discontinuities. Political Anal. 2015, 23, 127–155. [Google Scholar] [CrossRef]

- Pan, H.Z.; Yang, T.R.; Jin, Y.; Dall’Erba, S.; Hewings, G. Understanding heterogeneous spatial production externalities as a missing link between land-use planning and urban economic futures. Reg. Stud. 2021, 55, 90–100. [Google Scholar] [CrossRef]

- Yang, T.R.; Jin, Y.; Yan, L.X.; Pei, P. Aspirations and realities of polycentric development: Insights from multisource data into the emerging urban form of Shanghai. Environ. Plan. B Urban Anal. City Sci. 2019, 46, 1264–1280. [Google Scholar] [CrossRef]

| No | Name | Scope | Government Document | Year |

|---|---|---|---|---|

| 1 | Yangtze river delta Urban Agglomeration | Shanghai, Nanjing, Suzhou, Wuxi, Changzhou, Zhenjiang, Yangzhou, Taizhou, Nantong, Hangzhou, Ningbo, Huzhou, Jiaxing, Shaoxing, Zhoushan and Taizhou. | “Regional Planning of the Yangtze River Delta Region” | 2010 |

| 2 | Pearl River Delta Urban Agglomeration | Guangzhou, Shenzhen, Zhuhai, Foshan, Jiangmen, Dongguan, Zhongshan, Huizhou, Huidong, Boluo, Zhaoqing, Gaoyao and Sihui. | “Planning for Coordinated Development of Urban Agglomerations in Pearl River Delta” | 2004 |

| 3 | Beijing-Tianjin-Hebei Urban Agglomeration | Beijing, Tianjin, Baoding, Langfang, Tangshan, Qinhuangdao, Cangzhou, Zhangjiakou, Chengde, Shijiazhuang, Handan, Xingtai and Hengshui | “Regional Planning of Beijing-Tianjin-Hebei Metropolitan Area” | 2011 |

| 4 | Harbin-Changchun Urban Agglomeration | Harbin, Daqing, Qiqihar, Suihua and Mudanjiang in Heilongjiang Province, Changchun, Jilin, Siping, Liaoyuan, Songyuan and Yanbian Korean Autonomous Prefecture in Jilin Province. | “Development Plan of Harbin-Changchun Urban Agglomeration” | 2016 |

| 5 | Triangle of Central China Urban Agglomeration | Wuhan, Huangshi, Ezhou, Huanggang, Xiaogan, Xianning, Xiantao, Qianjiang, Tianmen, Xiangyang, Yichang, Jingzhou and Jingmen in Hubei, Changsha, Zhuzhou, Xiangtan, Yueyang, Yiyang, Changde, Hengyang and Loudi in Hunan, Nanchang, Jiujiang and Jingdezhen in Jiangxi. | “Development Plan of Urban Agglomeration in the Middle Reaches of the Yangtze River” | 2015 |

| 6 | Beibu Gulf Urban Agglomeration | Nanning, Beihai, Qinzhou, Fangchenggang, Yulin and Chongzuo in Guangxi Zhuang Autonomous Region, Zhanjiang, Maoming and Yangjiang in Guangdong Province, Haikou, Danzhou, Dongfang, Chengmai, Lingao and Changjiang counties in Hainan Province | “Beibu Gulf Urban Agglomeration Development Plan” | 2017 |

| 7 | Huhehaote-Baotou-Ordos-Yulin Urban Agglomeration | Hohhot, Baotou and Erdos in Inner Mongolia Autonomous Region and Yulin in Shaanxi Province. | “Huhehaote-Baotou-Ordos-Yulin Urban Agglomeration Development Plan” | 2018 |

| 8 | Central Plains Urban Agglomeration | Zhengzhou, Luoyang, Kaifeng, Xinxiang, Jiaozuo, Xuchang, Pingdingshan, Luohe, Jiyuan, Hebi, Shangqiu, Zhoukou, Jincheng and Bozhou. | “Central Plains Urban Agglomeration Development Plan” | 2016 |

| 9 | Cheng-Yu Urban Agglomeration | Chongqiong, Chengdu, Zigong, Luzhou, Deyang, Mianyang, Suining, Neijiang, Leshan, Nanchong, Meishan, Yibin, Guang’an, Dazhou (except Wanyuan City), Ya’an (except tianquan county and Baoxing County) and Ziyang in Sichuan Province. | “Cheng-Yu Urban Agglomeration Development Plan” | 2016 |

| 10 | Guanzhong plain Urban Agglomeration | Xi’an, Baoji, Xianyang, Tongchuan and Weinan in Shaanxi Province, Shangzhou District, Luonan County, Danfeng County and Zhashui County in yangling district and Shangluo City, Yuncheng City (except Pinglu County and Yuanqu County) in Shanxi Province, Yaodu District, houma city, Xiangfen County, huozhou city, Quwo County, Yicheng County, Hongdong County and Fushan County in Linfen City and Tianshui City in Gansu Province. | “Guanzhong plain Urban Agglomeration Development Plan” | 2017 |

| 11 | Lanxi Urban Agglomeration | Lanzhou, Gansu Province, Baiyin District, Pingchuan District, Jingyuan, Jingtai, Dingxi, anding district, Longxi, Weiyuan, Lintao, Linxia Hui Autonomous Prefecture, Dongxiang Autonomous County, Yongjing, Jishishan Bao’an Dongxiang Salar Autonomous County, Xining, Haidong, Haibei Tibetan Autonomous Prefecture, Hainan Tibetan Autonomous Prefecture, Gonghe, Guide. | “Lanzhou-Xining Urban Agglomeration Development Plan” | 2018 |

| Type | Name | Symbol | Definition |

|---|---|---|---|

| Outcome variable | R&D investment | RD | Natural logarithm of enterprise R&D investment amount plus 1 |

| Innovation output | Innovation | Natural logarithm of total patent application plus 1 | |

| Policy treatment variable | Establishment of state-level urban agglomeration | Urban | Dummy variable. If the enterprise within state-level urban agglomeration, urban = 1; otherwise, 0 |

| Control variable | Enterprise income | lnsale | Natural logarithm of enterprise operating income plus 1 |

| Enterprise age | age | Current year minus enterprise establishment year | |

| Profitability | roa | (Total profit)/(Average total assets) | |

| Fixed assets ratio | fix | (Fixed assets)/(Total assets) | |

| Staff size | lnstaff | Natural logarithm of number of employees | |

| R&D background of executives | funbackyn | Dummy variable. If executives have R&D background, funbackyn = 1, otherwise 0 | |

| State-owned enterprise | SOE | Dummy variable. If state-owned enterprise, SOE = 1, otherwise 0 | |

| Enterprise management | exe | Natural logarithm of number of directors and supervisors in enterprises | |

| Enterprise growth | rev | (Growth of operating income)/(Total operating income of the previous year) | |

| Quick ratio | qui | (Current assets)/(Current liabilities) | |

| Ownership concentration A | eq1 | Shareholding ratio of the largest shareholder of enterprise | |

| Ownership concentration B | eq5 | Sum of the shareholding ratios of the top five major shareholders | |

| Current assets ratio | cur | (Current assets)/(Owner’s equity) | |

| Enterprise scale | size | Natural logarithm of enterprise total assets | |

| Grouping variable | Eastern region | area_e | Dummy variable. If the location of the enterprise belongs to the eastern region, area_e = 1, otherwise 0 |

| Central region | area_m | Dummy variable. If the location of the enterprise belongs to the central region, area_m = 1, otherwise 0 | |

| Western region | area_w | Dummy variable. If the location of the enterprise belongs to the central region, area_w = 1, otherwise 0 |

| Variable | Mean | Median | Standard Deviation | Min | Max | Obs. |

|---|---|---|---|---|---|---|

| RD | 17.7900 | 17.9400 | 1.8980 | 0 | 25.0300 | 8296 |

| Innovation | 3.6060 | 3.8070 | 2.2720 | 0 | 11.2100 | 4952 |

| Urban | 0.6112 | 1 | 0.4875 | 0 | 1 | 9377 |

| lnsale | 22.0100 | 21.8800 | 1.4930 | 16.3500 | 28.7200 | 9326 |

| age | 14.2900 | 15 | 5.8370 | 0 | 29 | 9377 |

| roa | 0.0003 | 0.0003 | 0.0009 | −0.0391 | 0.0113 | 9377 |

| fix | 0.0025 | 0.0022 | 0.0017 | 2.06 × 10-6 | 0.0095 | 9377 |

| lnstaff | 8.1920 | 8.1410 | 1.2320 | 3.1350 | 13.2100 | 9373 |

| funbackyn | 0.6134 | 1 | 0.4870 | 0 | 1 | 9377 |

| SOE | 0.2129 | 0 | 0.4094 | 0 | 1 | 9377 |

| exe | 17.5700 | 17 | 4.0620 | 3 | 40 | 7572 |

| rev | 0.0163 | 0.0010 | 0.5916 | −0.0268 | 45 | 9353 |

| qui | 0.0139 | 0.0097 | 0.0192 | 0.0004 | 0.5214 | 9332 |

| eq1 | 35.1200 | 33.3400 | 14.9000 | 2.1970 | 89.0900 | 9377 |

| eq5 | 47.0800 | 46.3700 | 15.3500 | 2.6720 | 98.2900 | 9377 |

| cur | 0.0054 | 0.0055 | 0.0020 | 0 | 0.0099 | 9350 |

| size | 22.5600 | 22.4000 | 1.4310 | 19.0800 | 31.0400 | 9377 |

| area_e | 0.6281 | 1 | 0.4833 | 0 | 1 | 9377 |

| area_m | 0.2105 | 0 | 0.4077 | 0 | 1 | 9377 |

| area_w | 0.1614 | 0 | 0.3679 | 0 | 1 | 9377 |

| Variable | Before/After | Mean | Standardized Deviation (%) | t Statistics | |

|---|---|---|---|---|---|

| Treated | Control | ||||

| exe | Before | 17.4130 | 17.8410 | −10.9 | −3.91 *** |

| After | 17.3970 | 17.3020 | 2.4 | 1.33 | |

| fix | Before | 0.0023 | 0.0029 | −31 | −11.46 *** |

| After | 0.0023 | 0.0023 | −1.4 | −0.77 | |

| rev | Before | 0.0181 | 0.0228 | −0.7 | −0.25 |

| After | 0.0181 | 0.0273 | −1.3 | −0.66 | |

| eq5 | Before | 46.4100 | 46.7850 | −2.5 | −0.89 |

| After | 46.3820 | 46.5970 | −1.4 | −0.75 | |

| qui | Before | 0.0142 | 0.0132 | 5.7 | 1.99 ** |

| After | 0.0142 | 0.0139 | 1.6 | 0.81 | |

| age | Before | 16.0050 | 15.4430 | 11.6 | 4.13 *** |

| After | 16.0150 | 16.1010 | −1.8 | −0.93 | |

| eq1 | Before | 34.4980 | 35.5750 | −7.2 | −2.62 *** |

| After | 34.4560 | 34.7490 | −1.9 | −1.05 | |

| cur | Before | 0.0055 | 0.0050 | 21.6 | 7.81 *** |

| After | 0.0055 | 0.0054 | 4.8 | 2.53 ** | |

| lnsale | Before | 22.1260 | 22.1880 | −4.3 | −1.54 |

| After | 22.1230 | 22.1130 | 0.7 | 0.38 | |

| lnstaff | Before | 8.2183 | 8.3672 | −12.9 | −4.53 *** |

| After | 8.2145 | 8.2074 | 0.6 | 0.32 | |

| size | Before | 22.6920 | 22.7460 | −4.1 | −1.45 |

| After | 22.6890 | 22.7110 | −1.7 | −0.91 | |

| R&D Investment | Innovation Output | |||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Urban | 0.2132 *** | 0.2145 *** | 0.2286 *** | 0.5796 *** | 0.5910 *** | 0.5805 *** |

| (3.14) | (3.20) | (3.52) | (3.66) | (3.74) | (3.60) | |

| lnsale | 0.8217 *** | 0.8290 *** | 0.6955 *** | 0.4691 *** | 0.4834 *** | 0.4342 *** |

| (20.54) | (20.24) | (14.73) | (4.28) | (4.45) | (3.19) | |

| roa | −27.5088 * | −20.6942 | −68.0485 | −65.5941 | ||

| (−1.73) | (−1.22) | (−1.47) | (−1.39) | |||

| fix | 12.2551 | −0.4945 | 44.6284 | 40.6335 | ||

| (0.43) | (−0.02) | (0.78) | (0.70) | |||

| SOE | 0.0298 | −0.2164 | ||||

| (0.63) | (−1.59) | |||||

| lnstaff | 0.2512 *** | 0.0974 | ||||

| (4.12) | (0.59) | |||||

| funbackyn | −0.0567 | −0.0897 | ||||

| (−1.41) | (−0.99) | |||||

| Constant | −0.4276 | −0.6120 | 0.3204 | −8.3555 *** | −8.7704 *** | −8.3741 *** |

| (−0.49) | (−0.67) | (0.35) | (−3.48) | (−3.68) | (−3.45) | |

| Obs. | 7289 | 7289 | 7289 | 3321 | 3321 | 3321 |

| Goodness of fit | 0.8390 | 0.8391 | 0.8407 | 0.5249 | 0.5257 | 0.5264 |

| R&D Investment | Innovation Output | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Pseudo-policy-year | 2008 | 2009 | 2008 | 2009 |

| Urban | 0.0927 | 0.0717 | 0.1010 | −0.0823 |

| (1.13) | (1.35) | (0.79) | (−0.52) | |

| Control | yes | yes | yes | yes |

| Obs. | 435 | 587 | 773 | 889 |

| Goodness of fit | 0.7655 | 0.8445 | 0.5598 | 0.5898 |

| R&D Investment | Innovation Output | |||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Eastern region | Central region | Western region | Eastern region | Central region | Western region | |

| Urban | 0.3722 | 0.2103 *** | 0.1979 | −0.2596 | 0.5753 *** | 0.8073 *** |

| (1.46) | (3.51) | (1.45) | (−0.47) | (2.82) | (2.85) | |

| Control | yes | yes | yes | yes | yes | yes |

| Obs. | 4473 | 1608 | 1208 | 2115 | 689 | 517 |

| Goodness of fit | 0.8395 | 0.8857 | 0.7919 | 0.5412 | 0.4059 | 0.5813 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhao, K.; Huang, H.; Wu, W. State-Level Urban Agglomeration and Enterprise Innovation: A Quasi-Natural Experiment. Sustainability 2022, 14, 9170. https://doi.org/10.3390/su14159170

Zhao K, Huang H, Wu W. State-Level Urban Agglomeration and Enterprise Innovation: A Quasi-Natural Experiment. Sustainability. 2022; 14(15):9170. https://doi.org/10.3390/su14159170

Chicago/Turabian StyleZhao, Kai, Huahua Huang, and Wanshu Wu. 2022. "State-Level Urban Agglomeration and Enterprise Innovation: A Quasi-Natural Experiment" Sustainability 14, no. 15: 9170. https://doi.org/10.3390/su14159170

APA StyleZhao, K., Huang, H., & Wu, W. (2022). State-Level Urban Agglomeration and Enterprise Innovation: A Quasi-Natural Experiment. Sustainability, 14(15), 9170. https://doi.org/10.3390/su14159170