What Motivates Local Governments to Be Efficient? Evidence from Philippine Cities

Abstract

:1. Introduction

2. Literature Review and Hypotheses

2.1. The Efficiency of Local Government Services Delivery

2.2. Local Government Efficiency, the Philippines, and Other Developing Countries

2.3. Determinants of Local Governments’ Public Service Efficiency

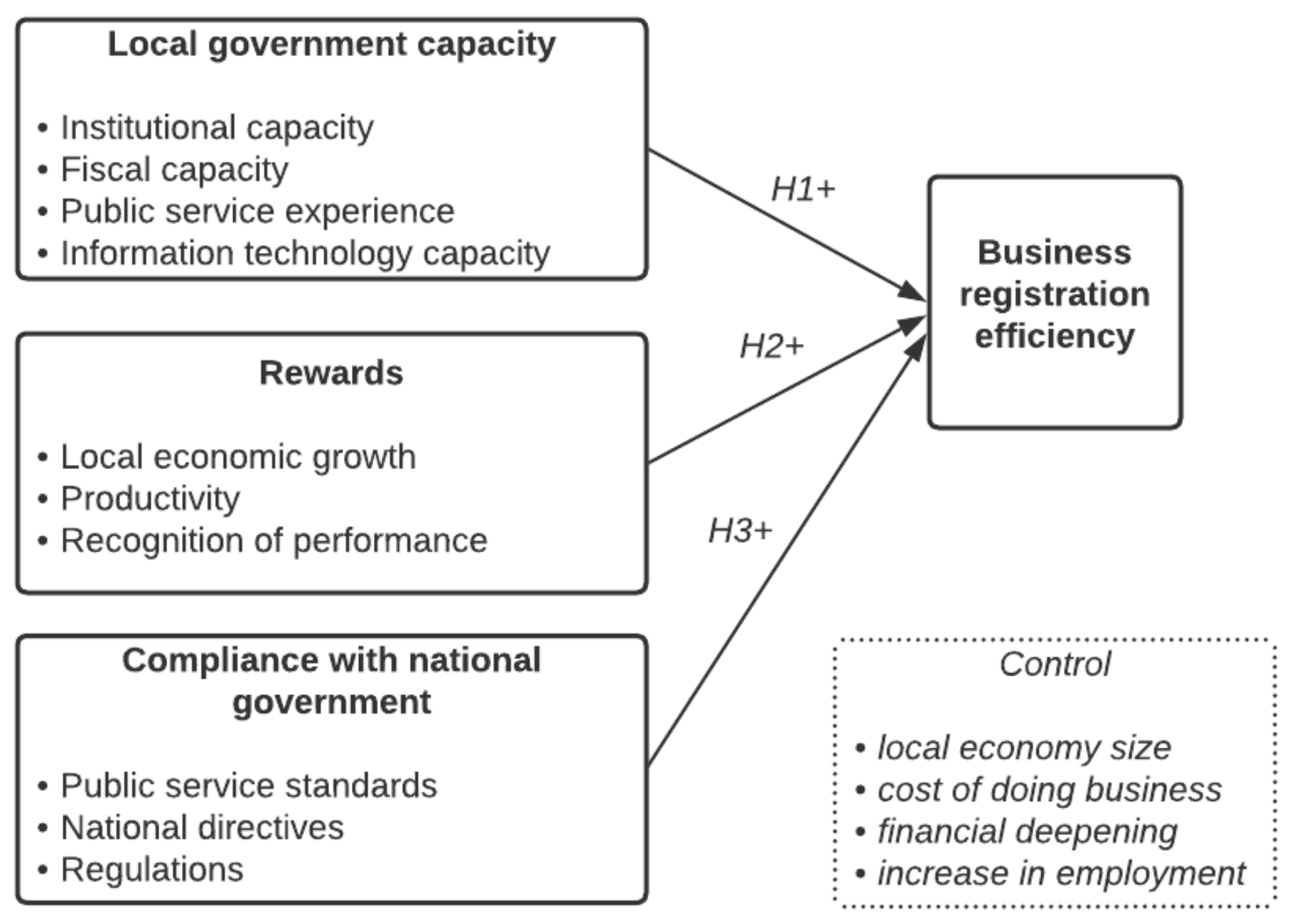

2.4. Local Government Capacity and Efficiency

2.5. Rewards and Efficiency

2.6. Compliance with the National Government and Efficiency

3. Methods and Data

4. Results and Discussion

4.1. Descriptive Statistics

4.2. Panel Regression Results

5. Conclusions

5.1. Summary

5.2. Policy Implications

5.3. Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Highly Urbanized Cities (N = 33) | Component Cities (N = 108) |

|---|---|

| Angeles, Bacolod, Baguio, Butuan, Cagayan De Oro, Caloocan, Cebu, Davao, General Santos, Iligan, Iloilo, Lapu Lapu, Las Pinas, Lucena, Makati, Malabon, Mandaluyong, Mandaue, Manila, Marikina, Muntinlupa, Navotas, Olongapo, Paranaque, Pasay, Pasig, Puerto Princesa, Quezon, San Juan, Tacloban, Taguig, Valenzuela, Zamboanga | Alaminos, Antipolo, Bacoor, Bago, Bais, Balanga, Batac, Batangas, Bayawan, Baybay, Bayugan, Binan, Bislig, Bogo, Cabadbaran, Cabanatuan, Cabuyao, Cadiz, Calamba, Calapan, Calbayog, Candon, Canlaon, Carcar, Catbalogan, Cauayan, Cavite, Cotabato, Dagupan, Danao, Dapitan, Dasmarinas, Digos, Dipolog, Dumaguete, El Salvador, Escalante, Gapan, General Trias, Gingoog, Guihulngan, Himamaylan, Igacos, Ilagan, Imus, Iriga, Isabela, Kabankalan, Kidapawan, Koronadal, La Carlota, Laoag, Legazpi, Ligao, Lipa, Maasin, Mabalacat, Malaybalay, Malolos, Masbate, Mati, Meycauayan, Naga (Camarines Sur), Naga (Cebu), Ormoc, Oroquieta, Ozamiz, Pagadian, Palayan, Panabo, Passi, Roxas, Sagay, San Carlos (Negros Occidental), San Carlos (Pangasinan), San Fernando, San Jose, San Jose Del Monte, San Pablo, San Pedro, Santa Rosa, Santiago, Science City of Munoz, Silay, Sipalay, Sorsogon, Surigao, Tabaco, Tabuk, Tacurong, Tagaytay, Tagbilaran, Tagum, Talisay, Tanauan, Tandag, Tangub, Tanjay, Tarlac, Tayabas, Toledo, Trece Martires, Tuguegarao, Urdaneta, Valencia, Victorias, Vigan |

References

- Milán-García, J.; Rueda-López, N.; De Pablo-Valenciano, J. Local government efficiency: Reviewing determinants and setting new trends. Int. Trans. Oper. Res. 2022, 29, 2871–2898. [Google Scholar] [CrossRef]

- Van Dooren, W.; Bouckaert, G.; Halligan, J. Performance Management in the Public Sector; Routledge: Abingdon-on-Thames, UK, 2015. [Google Scholar]

- Andrews, M.; Shah, A. Assessing local government performance in developing countries. In Measuring Government Performance in the Delivery of Public Services; The World Bank: Washington, DC, USA, 2003. [Google Scholar]

- Teng-Calleja, M.; Hechanova, M.R.M.; Alampay, R.B.A.; Canoy, N.A.; Franco, E.P.; Alampay, E.A. Transformation in Philippine local government. Local Gov. Stud. 2017, 43, 64–88. [Google Scholar] [CrossRef]

- Ishii, R.; Hossain, F.; Rees, C.J. Participation in decentralized local governance: Two contrasting cases from the Philippines. Public Organ. Rev. 2007, 7, 359–373. [Google Scholar] [CrossRef]

- Tiebout, C.M. A pure theory of local expenditures. J. Political Econ. 1956, 64, 416–424. [Google Scholar] [CrossRef]

- Oates, W.E. Fiscal Federalism; Harcourt Brace Jovanovich: New York, NY, USA, 1972; Volume 35. [Google Scholar]

- Besley, T.; Case, A. Does electoral accountability affect economic policy choices? Evidence from gubernatorial term limits. Q. J. Econ. 1995, 110, 769–798. [Google Scholar] [CrossRef]

- Balaguer-Coll, M.T.; Prior, D.; Tortosa-Ausina, E. Decentralization and efficiency of local government. Ann. Reg. Sci. 2010, 45, 571–601. [Google Scholar] [CrossRef]

- Setyaningrum, D.; Martani, D. Determinants of local government performance in Indonesia. In Proceedings of the 6th International Accounting Conference (IAC 2017), Yogyakarta, Indonesia, 27–29 August 2017; pp. 7–12. [Google Scholar]

- Kalb, A. Public Sector Efficiency: Applications to Local Governments in Germany; Springer Science & Business Media: Berlin, Germany, 2010. [Google Scholar]

- Borgonovi, E.; Anessi-Pessina, E.; Bianchi, C. Outcome-Based Performance Management in the Public Sector; Springer International Publishing AG: Cham, Switzerland, 2018; Volume 2. [Google Scholar]

- Hood, C. The “new public management” in the 1980s: Variations on a theme. Account. Organ. Soc. 1995, 20, 93–109. [Google Scholar] [CrossRef]

- Osborne, D.; Gaebler, T. Reinventing Government: How the Entrepreneurial Spirit is Transforming the Public Sector; Addison-Wesley Publishing Company: Reading, MA, US, 1992. [Google Scholar]

- Greve, C.; Hodge, G. A transformative perspective on public–private partnerships. In The Ashgate Research Companion to New Public Management, 1st ed.; Christensen, T., Laegreid, P., Eds.; Ashgate Publishing Limited: Farnham, UK, 2011; pp. 265–277. [Google Scholar]

- Da Cruz, N.F.; Marques, R.C. Mixed companies and local governance: No man can serve two masters. Public Adm. 2012, 90, 737–758. [Google Scholar] [CrossRef] [Green Version]

- Pérez-López, G.; Prior, D.; Zafra-Gómez, J.L. Rethinking new public management delivery forms and efficiency: Long-term effects in Spanish local government. J. Public Adm. Res. Theory 2015, 25, 1157–1183. [Google Scholar] [CrossRef]

- Farrell, M.J. The measurement of productive efficiency. J. R. Stat. Soc. Ser. A (General) 1957, 120, 253–281. [Google Scholar] [CrossRef]

- Knapp, M. Searching for efficiency in long-term care: De-institutionalisation and privatisation. Br. J. Soc. Work 1987, 18, 149–171. [Google Scholar]

- Lovell, C.K. Production frontiers and productive efficiency. Meas. Product. Effic. Tech. Appl. 1993, 3, 67. [Google Scholar]

- Zhang, H.; Eimicke, W.B. In the Pursuit of the Balance between Efficiency and Responsiveness: A Case Study on the Innovation of the administrative Service Organization in Chinese Local Government. Public Organ. Rev. 2022, 1–16. [Google Scholar] [CrossRef]

- Atienza, M.E.L. Local governments and devolution in the Philippines. In Philippine Politics and Governance: An Introduction; Philippines University Press: Quezon City, Philippines, 2006; pp. 415–440. [Google Scholar]

- Canare, T.A. Decentralization, Local Government Fiscal Independence, and Poverty: Evidence from Philippine Provinces. Southeast Asian J. Econ. 2020, 8, 77–108. [Google Scholar]

- Arcenas, A.L.; Magno, C.D.; IV, R.J.A.B. Natural Resource Management and Federalism in the Philippines: Much Ado About Nothing? Public Policy 2017, 16–17, 15–27. [Google Scholar]

- Agba, M.S.; Akwara, A.F.; Idu, A. Local government and social service delivery in Nigeria: A content analysis. Acad. J. Interdiscip. Stud. 2013, 2, 455. [Google Scholar] [CrossRef]

- Mahabir, J. Quantifying inefficient expenditure in local government: A free disposable hull analysis of a sample of South African municipalities. South Afr. J. Econ. 2014, 82, 493–517. [Google Scholar] [CrossRef]

- Ricart-Huguet, J.; Sellars, E. The Politics of Decentralization Level: Local and Regional Devolution as Substitutes. SSRN 2021, 3885174. [Google Scholar] [CrossRef]

- Pacheco, F.; Sanchez, R.; Villena, M.G. Estimating local government efficiency using a panel data parametric approach: The case of Chilean municipalities. Appl. Econ. 2021, 53, 292–314. [Google Scholar] [CrossRef]

- Rambe, R.A. Implication of Regional Split in Local Government Efficiency: Evidence From North Sumatra, Indonesia. J. Ekon. Dan Studi Pembang. 2020, 12, 159–175. [Google Scholar]

- Rambe, R.A.; Wibowo, K.; Febriani, R.E.; Septriani, S. Assessing Local Government Efficiency: Evidence from Sumatra, Indonesia. Appl. Econ. J. 2020, 27, 20–44. [Google Scholar]

- Narbón-Perpiñá, I.; De Witte, K. Local governments’ efficiency: A systematic literature review—part II. Int. Trans. Oper. Res. 2018, 25, 1107–1136. [Google Scholar] [CrossRef] [Green Version]

- Benito, B.; Faura, U.; Guillamón, M.-D.; Ríos, A.-M. The efficiency of public services in small municipalities: The case of drinking water supply. Cities 2019, 93, 95–103. [Google Scholar] [CrossRef]

- Hong, S. What are the areas of competence for central and local governments? Accountability mechanisms in multi-level governance. J. Public Adm. Res. Theory 2017, 27, 120–134. [Google Scholar] [CrossRef]

- Benito, B.; Guillamón, M.-D.; Martínez-Córdoba, P.-J. Determinants of efficiency improvement in the Spanish public lighting sector. Util. Policy 2020, 64, 101026. [Google Scholar] [CrossRef]

- Da Cruz, N.F.; Marques, R.C. Revisiting the determinants of local government performance. Omega 2014, 44, 91–103. [Google Scholar] [CrossRef]

- Stastna, L.; Gregor, M. Local government efficiency: Evidence from the Czech municipalities. SSRN 2011, 1–65. [Google Scholar] [CrossRef] [Green Version]

- Šťastná, L.; Gregor, M. Public sector efficiency in transition and beyond: Evidence from Czech local governments. Appl. Econ. 2015, 47, 680–699. [Google Scholar] [CrossRef]

- Moore, A.; Nolan, J.; Segal, G.F. Putting out the trash: Measuring municipal service efficiency in US cities. Urban Aff. Rev. 2005, 41, 237–259. [Google Scholar] [CrossRef]

- Rogers Everett, M. Diffusion of Innovations; Free Press: New York, NJ, USA, 1995; Volume 12. [Google Scholar]

- Berry, F.S. Innovation in public management: The adoption of strategic planning. Public Adm. Rev. 1994, 54, 322–330. [Google Scholar] [CrossRef]

- Borge, L.-E.; Falch, T.; Tovmo, P. Public sector efficiency: The roles of political and budgetary institutions, fiscal capacity, and democratic participation. Public Choice 2008, 136, 475–495. [Google Scholar] [CrossRef]

- Lamothe, S.; Lamothe, M.; Feiock, R.C. Examining local government service delivery arrangements over time. Urban Aff. Rev. 2008, 44, 27–56. [Google Scholar] [CrossRef]

- Moon, M.J.; Norris, D.F. Does managerial orientation matter? The adoption of reinventing government and e-government at the municipal level. Inf. Syst. J. 2005, 15, 43–60. [Google Scholar] [CrossRef]

- Bruns, C.; Himmler, O. Newspaper Circulation and Local Government Efficiency*. Scand. J. Econ. 2011, 113, 470–492. [Google Scholar] [CrossRef]

- Kalb, A.; Geys, B.; Heinemann, F. Value for money? German local government efficiency in a comparative perspective. Appl. Econ. 2012, 44, 201–218. [Google Scholar] [CrossRef] [Green Version]

- Bingham, R.D.; McNaught, T.P. The Adoption of Innovation by Local Government; Lexington Books: Lanham, MD, USA, 1976. [Google Scholar]

- Monkam, N.F. Local municipality productive efficiency and its determinants in South Africa. Dev. South. Afr. 2014, 31, 275–298. [Google Scholar] [CrossRef] [Green Version]

- Bosch, N.; Espasa, M.; Mora, T. Citizen control and the efficiency of local public services. Environ. Plan. C Gov. Policy 2012, 30, 248–266. [Google Scholar] [CrossRef]

- Geys, B.; Moesen, W. Exploring Sources of Local Government Technical Inefficiency: Evidence from Flemish Municipalities. Public Financ. Manag. 2009, 9, 1–22. [Google Scholar]

- Sung, N. Information technology, efficiency and productivity: Evidence from Korean local governments. Appl. Econ. 2007, 39, 1691–1703. [Google Scholar] [CrossRef]

- Ashworth, J.; Geys, B.; Heyndels, B.; Wille, F. Competition in the political arena and local government performance. Appl. Econ. 2014, 46, 2264–2276. [Google Scholar] [CrossRef] [Green Version]

- Rainey, H.G.; Steinbauer, P. Galloping elephants: Developing elements of a theory of effective government organizations. J. Public Adm. Res. Theory 1999, 9, 1–32. [Google Scholar] [CrossRef]

- Benito, B.; Bastida, F.; García, J.A. Explaining differences in efficiency: An application to Spanish municipalities. Appl. Econ. 2010, 42, 515–528. [Google Scholar] [CrossRef] [Green Version]

- Kwon, M.; Jang, H.S. Motivations behind using performance measurement: City-wide vs. selective users. Local Gov. Stud. 2011, 37, 601–620. [Google Scholar] [CrossRef]

- Baldridge, J.V.; Burnham, R.A. Organizational innovation: Individual, organizational, and environmental impacts. Adm. Sci. Q. 1975, 20, 165–176. [Google Scholar] [CrossRef]

- Piña, G.; Avellaneda, C.N. Local Government Effectiveness: Assessing the Role of Administrative Capacity; School of Public and Environmental Affairs, University of Indiana: Bloomington, IN, USA, 2017; Available online: https://ostromworkshop.indiana.edu/pdf/seriespapers/2017spr-colloq/avellaneda-paper (accessed on 23 June 2022).

- Andrews, R.; Entwistle, T. Public–private partnerships, management capacity and public service efficiency. Policy Politics 2015, 43, 273–290. [Google Scholar] [CrossRef]

- Baird, K.; Schoch, H.; Chen, Q.J. Performance management system effectiveness in Australian local government. Pac. Account. Rev. 2012, 24, 161–185. [Google Scholar] [CrossRef]

- Swiss, J.E. A framework for assessing incentives in results-based management. Public Adm. Rev. 2005, 65, 592–602. [Google Scholar] [CrossRef]

- Levine, C.H. Managing Fiscal Stress: The Crisis in the Public Sector; Chatham House Publishers: Chatham, NJ, USA, 1980. [Google Scholar]

- Ho, A. Perceptions of performance measurement and the practice of performance reporting by small cities. State Local Gov. Rev. 2003, 35, 161–173. [Google Scholar] [CrossRef]

- De Bruijn, H. Managing Performance in the Public Sector; Routledge: Abingdon-on-Thames, UK, 2003. [Google Scholar]

- Kroll, A. Drivers of performance information use: Systematic literature review and directions for future research. Public Perform. Manag. Rev. 2015, 38, 459–486. [Google Scholar] [CrossRef]

- Moynihan, D.P. The promises and paradoxes of performance-based bureaucracy. In The Oxford Handbook of American Bureaucracy; Oxford University Press: Oxford, UK, 2010. [Google Scholar]

- Silkman, R.; Young, D.R. X-efficiency and state formula grants. Natl. Tax J. 1982, 35, 383–397. [Google Scholar] [CrossRef]

- Burby, R.J.; May, P.J.; Paterson, R.C. Improving compliance with regulations: Choices and outcomes for local government. J. Am. Plan. Assoc. 1998, 64, 324–334. [Google Scholar] [CrossRef]

- Andersson, K. What motivates municipal governments? Uncovering the institutional incentives for municipal governance of forest resources in Bolivia. J. Environ. Dev. 2003, 12, 5–27. [Google Scholar] [CrossRef]

- Gibson, C.C.; Lehoucq, F.E. The local politics of decentralized environmental policy in Guatemala. J. Environ. Dev. 2003, 12, 28–49. [Google Scholar] [CrossRef] [Green Version]

- Andersson, K. An Institutional Assessment of Two Cornerstones of Bolivia’s Decentralized Forestry Regime: Municipal Governments and Indigenous Territories; Food and Agriculture Organization of the United Nations: Rome, Italy, 2001. [Google Scholar]

- Plaček, M.; Ochrana, F.; Půček, M.J.; Nemec, J. Fiscal Decentralization Reforms: The Impact on the Efficiency of Local Governments in Central and Eastern Europe; Springer Nature: Cham, Switzerland, 2020; Volume 19. [Google Scholar]

- Gerrish, E.; Spreen, T.L. Does benchmarking encourage improvement or convergence? Evaluating North Carolina’s fiscal benchmarking tool. J. Public Adm. Res. Theory 2017, 27, 596–614. [Google Scholar] [CrossRef]

- Bayani, K.G.; Dawey, M.; Pajimola, A.H. Validation of Streamlining Business Permits and Licensing System of Region 1. In Proceedings of the World Conference for Public Administration Daegu, Daegu, Korea, 25–27 June 2014; pp. 23–25. [Google Scholar]

- Penetrante, M.O.T.; Castigador, D.C.; De los Santos, L.O.; Duerme, R.L.; Somosierra, J.H.; Diamante, L.J. Streamlining workshops in business permits and licensing system of the cities of Puerto Princesa, Tagbilaran and Zamboanga. Patubas 2017, 16, 77–103. [Google Scholar]

- Tortor, R.N.; Dolosa, R.E.; Labay, B.J.S.; Hernandez, J.T. An Online Workflow Management System for Streamlining the Processing of Business Permits in A Local Government Unit. In Proceedings of the 5th International Conference on E-business and Mobile Commerce, Taichung, Taiwan, 22–24 May 2019; pp. 64–68. [Google Scholar]

- Hood, C. A public management for all seasons? Public Adm. 1991, 69, 3–19. [Google Scholar] [CrossRef]

- Rodríguez-Pose, A.; Tijmstra, S.A.; Bwire, A. Fiscal decentralisation, efficiency, and growth. Environ. Plan. A 2009, 41, 2041–2062. [Google Scholar] [CrossRef]

- Plaček, M.; Špaček, D.; Ochrana, F.; Křápek, M.; Dvořáková, P. Does excellence matter? National quality awards and performance of Czech municipalities. JEEMS J. East Eur. Manag. Stud. 2019, 24, 589–613. [Google Scholar] [CrossRef]

- Basílio, M.; Pires, C.; Borralho, C.; dos Reis, J.P. Local government efficiency: Is there anything new after Troika’s intervention in Portugal? Eurasian Econ. Rev. 2020, 10, 309–332. [Google Scholar] [CrossRef]

- Reiter, R.; Klenk, T. The manifold meanings of ‘post-New Public Management’–a systematic literature review. Int. Rev. Adm. Sci. 2019, 85, 11–27. [Google Scholar] [CrossRef]

- Manning, N. The legacy of the New Public Management in developing countries. Int. Rev. Adm. Sci. 2001, 67, 297–312. [Google Scholar] [CrossRef] [Green Version]

- Styrin, E.; Mossberger, K.; Zhulin, A. Government as a platform: Intergovernmental participation for public services in the Russian Federation. Gov. Inf. Q. 2022, 39, 101627. [Google Scholar] [CrossRef]

| Variables | Obs. | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| Business registration efficiency | 423 | 1.952 | 0.369 | 0 | 2.499 |

| Institutional capacity | 423 | 2.367 | 0.470 | 0 | 2.5 |

| Fiscal capacity | 423 | 0.626 | 0.537 | 0 | 2.485 |

| Public service experience | 423 | 0.525 | 0.480 | 0 | 2.5 |

| Information technology capacity | 423 | 0.598 | 0.335 | 0 | 2.0 |

| Local economic growth | 423 | 0.242 | 0.335 | 0 | 2.5 |

| Productivity | 423 | 0.247 | 0.423 | 0 | 2.5 |

| Recognition of performance | 423 | 0.425 | 0.333 | 0 | 2.125 |

| Compliance with public service standards | 423 | 1.968 | 0.381 | 0.668 | 2.494 |

| Compliance with national directives | 423 | 2.172 | 0.479 | 0 | 2.5 |

| Compliance with regulations | 423 | 0.384 | 0.344 | 0 | 2.030 |

| Local economy size | 423 | 0.174 | 0.344 | 0 | 2.5 |

| Cost of doing business | 423 | 1.797 | 0.279 | 0.010 | 2.326 |

| Financial deepening | 423 | 0.626 | 0.509 | 0 | 2.5 |

| Increase in employment | 423 | 0.279 | 0.438 | 0 | 2.5 |

| Variables | Business Registration Efficiency | ||

|---|---|---|---|

| (1) **** | (2) | ||

| Local government capacity | Institutional capacity | 0.083 (0.036) ** | 0.074 (0.043) * |

| Fiscal capacity | 0.019 (0.030) | 0.023 (0.034) | |

| Public service experience | 0.095 (0.043) ** | 0.103 (0.058) * | |

| Information technology capacity | 0.195 (0.062) *** | 0.148 (0.086) * | |

| Rewards | Local economic growth | –0.103 (0.052) ** | –0.056 (0.061) |

| Productivity | –0.005 (0.042) | 0.014 (0.045) | |

| Recognition of performance | 0.041 (0.052) | 0.031 (0.061) | |

| Compliance with national government | Compliance with public service standards | 0.106 (0.046) ** | 0.088 (0.057) |

| Compliance with national directives | –0.022 (0.038) | –0.037 (0.048) | |

| Compliance with regulations | –0.093 (0.084) | –0.243 (0.133) * | |

| Control variables | Local economy size | –0.013 (0.081) | –0.089 (0.123) |

| Cost of doing business | –0.017 (0.067) | –0.098 (0.087) | |

| Financial deepening | –0.006 (0.046) | 0.001 (0.067) | |

| Increase in employment | –0.036 (0.050) | –0.014 (0.058) | |

| R2 | 0.108 | 0.052 | |

| Variables | Business Registration Efficiency | ||

|---|---|---|---|

| (1) **** | (2) | ||

| Local government capacity | Institutional capacity | 0.052 (0.076) | 0.013 (0.086) |

| Fiscal capacity | –0.116 (0.086) | –0.120 (0.096) | |

| Public service experience | 0.047 (0.127) | –0.019 (0.187) | |

| Information technology capacity | 0.160 (0.169) | 0.277 (0.235) | |

| Rewards | Local economic growth | –0.041 (0.095) | –0.105 (0.107) |

| Productivity | 0.091 (0.083) | 0.072 (0.092) | |

| Recognition of performance | 0.231 (0.105) ** | 0.154 (0.121) | |

| Compliance with national government | Compliance with public service standards | 0.211 (0.136) | 0.177 (0.159) |

| Compliance with national directives | −0.093 (0.083) | −0.026 (0.104) | |

| Compliance with regulations | 0.120 (0.266) | −0.314 (0.393) | |

| Control variables | Local economy size | −0.028 (0.168) | −0.055 (0.312) |

| Cost of doing business | −0.296 (0.206) | −0.253 (0.266) | |

| Financial deepening | −0.097 (0.180) | 0.023 (0.246) | |

| Increase in employment | 0.001 (0.093) | 0.035 (0.108) | |

| R2 | 0.205 | 0.196 | |

| Variables | Business Registration Efficiency | ||

|---|---|---|---|

| (1) **** | (2) | ||

| Local government capacity | Institutional capacity | 0.105 (0.041) ** | 0.077 (0.054) |

| Fiscal capacity | 0.041 (0.032) | 0.047 (0.038) | |

| Public service experience | 0.111 (0.045) ** | 0.123 (0.064) * | |

| Information technology capacity | 0.151 (0.064) ** | 0.128 (0.094) | |

| Rewards | Local economic growth | –0.016 (0.083) | –0.033 (0.098) |

| Productivity | –0.036 (0.050) | –0.029 (0.055) | |

| Recognition of performance | –0.010 (0.062) | –0.030 (0.074) | |

| Compliance with national government | Compliance with public service standards | 0.060 (0.046) | 0.073 (0.063) |

| Compliance with national directives | 0.021 (0.041) | –0.039 (0.059) | |

| Compliance with regulations | –0.067 (0.086) | –0.130 (0.159) | |

| Control variables | Local economy size | –0.060 (0.099) | –0.099 (0.153) |

| Cost of doing business | –0.013 (0.070) | –0.087 (0.095) | |

| Financial deepening | –0.026 (0.045) | –0.026 (0.072) | |

| Increase in employment | –0.029 (0.064) | –0.039 (0.086) | |

| R2 | 0.104 | 0.096 | |

| H# | Hypothesized Relationship with Business Registration Efficiency | Table 2 Overall Cities (N = 423) | Table 3 Highly Urbanized Cities (N = 99) | Table 4 Component Cities (N = 324) |

|---|---|---|---|---|

| 1a | Institutional capacity (+) | Accepted | Not accepted | Accepted |

| 1b | Fiscal capacity (+) | Not accepted | Not accepted | Not accepted |

| 1c | Public service experience (+) | Accepted | Not accepted | Accepted |

| 1d | Information technology capacity (+) | Accepted | Not accepted | Accepted |

| 2a | Local economic growth (+) | Not accepted | Not accepted | Not accepted |

| 2b | Productivity (+) | Not accepted | Not accepted | Not accepted |

| 2c | Recognition of performance (+) | Not accepted | Accepted | Not accepted |

| 3a | Compliance with public service standards (+) | Accepted | Not accepted | Not accepted |

| 3b | Compliance with national directives (+) | Not accepted | Not accepted | Not accepted |

| 3c | Compliance with regulations (+) | Not accepted | Not accepted | Not accepted |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Distor, C.B.; Khaltar, O. What Motivates Local Governments to Be Efficient? Evidence from Philippine Cities. Sustainability 2022, 14, 9426. https://doi.org/10.3390/su14159426

Distor CB, Khaltar O. What Motivates Local Governments to Be Efficient? Evidence from Philippine Cities. Sustainability. 2022; 14(15):9426. https://doi.org/10.3390/su14159426

Chicago/Turabian StyleDistor, Charmaine B., and Odkhuu Khaltar. 2022. "What Motivates Local Governments to Be Efficient? Evidence from Philippine Cities" Sustainability 14, no. 15: 9426. https://doi.org/10.3390/su14159426

APA StyleDistor, C. B., & Khaltar, O. (2022). What Motivates Local Governments to Be Efficient? Evidence from Philippine Cities. Sustainability, 14(15), 9426. https://doi.org/10.3390/su14159426