Changes in Share Prices of Macrosector Companies on the Warsaw Stock Exchange as a Reaction to the COVID-19 Pandemic

Abstract

:1. Introduction

2. Literature Review

3. Materials and Methods

3.1. Data

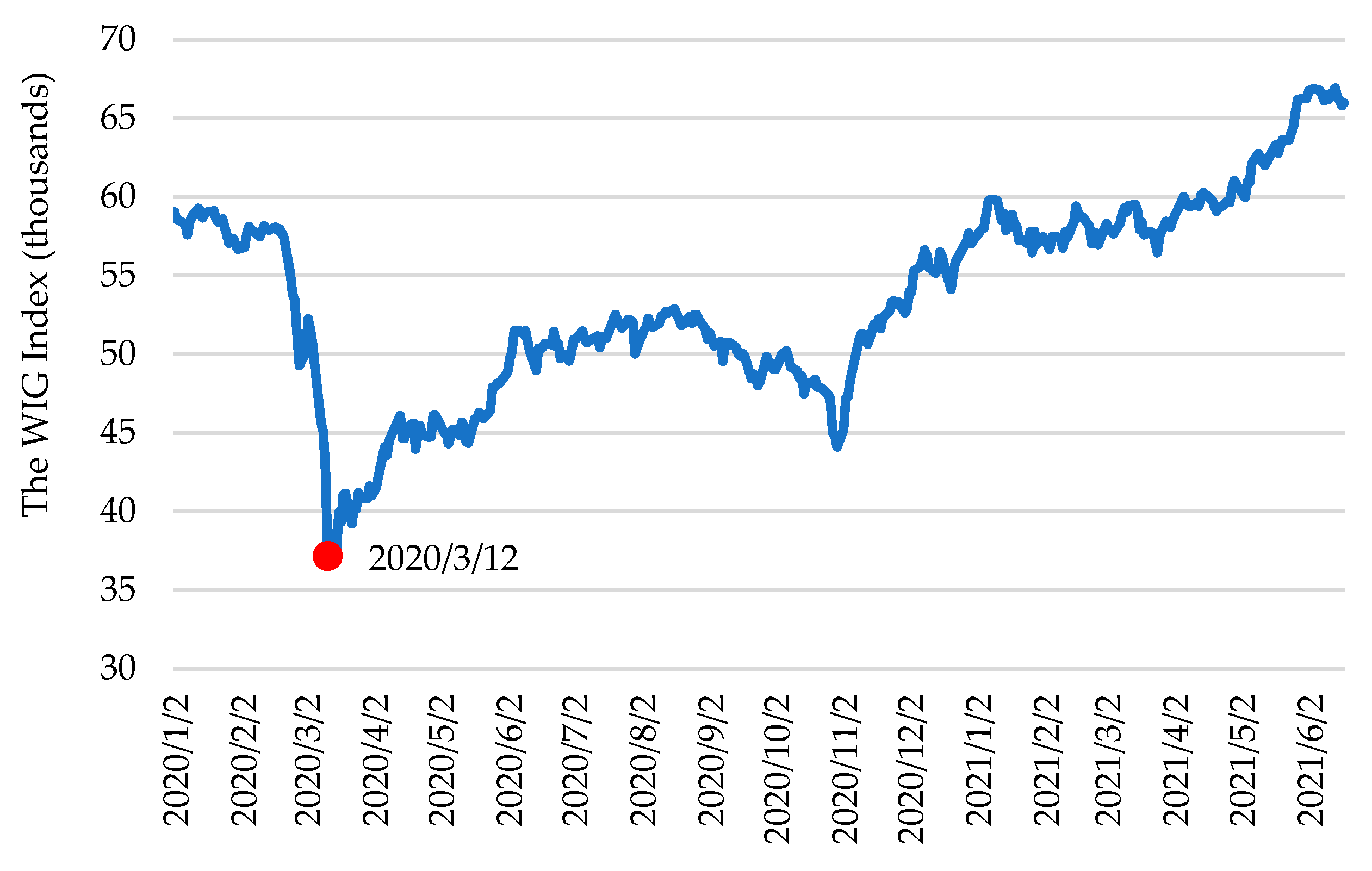

- Time of decline: observation period Q1 2020, random variable T-time from the moment of reaching the maximum to the moment of decline by 37.3% (analogous to the decline of WIG). Companies that did not reach the decline in Q1 2020 were considered censored observations.

- Time of increase: observation period Q2–Q4 2020, random variable T-time from the minimum achieved in 2020 to the moment of recovery (level of the maximum from the beginning of 2020). Companies that did not achieve this increase by the end of 2020 were assumed to be censored observations.

3.2. Methodology

- T—duration,

- F(t)—cumulative distribution function of random variable T.

- ti—the point in time when at least one event occurs, ,

- di—number of events in time ti,

- ni—number of units observed in time ti, ,

- zi—number of censored observations in time ti.

- —vector of independent variables,

- —baseline hazard,

- —model coefficients,

- t—observation period.

- —conditional probability of the occurrence of an event,

- —vector of independent variables,

- —model coefficients.

4. Results

5. Discussion

6. Conclusions

- differences in survival functions for individual macrosectors were not significant for the decline in share prices but were significant at the time of recovery,

- the Finance macrosector was in the most difficult situation (longer duration of share price increases after the crisis factor receded).

- relative hazard (intensity) of price decline—no differences between macrosectors,

- the lowest relative hazard (intensity) of price increases was in the Finance macrosector.

- risk of decline in prices at a particular time of crisis—no differences between macrosectors,

- lowest relative chance of price increases in the post-crisis period was for the Finance macrosector.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Islam, M.M.; Jannat, A.; Al Rafi, D.A.; Aruga, K. Potential Economic Impacts of the COVID-19 Pandemic on South Asian Economies: A Review. World 2020, 1, 283–299. [Google Scholar] [CrossRef]

- Lee, C.-T.; Hu, J.-L.; Kung, M.-H. Economic Resilience in the Early Stage of the COVID-19 Pandemic: An Across-Economy Comparison. Sustainability 2022, 14, 4609. [Google Scholar] [CrossRef]

- Begum, H.; Alam, A.S.A.F.; Leal Filho, W.; Awang, A.H.; Ghani, A.B.A. The COVID-19 Pandemic: Are There Any Impacts on Sustainability? Sustainability 2021, 13, 11956. [Google Scholar] [CrossRef]

- The Sustainable Development Goals Report 2021. Available online: https://unstats.un.org/sdgs/report/2021/ (accessed on 3 June 2022).

- Ahmed, F.; Syed, A.A.; Kamal, M.A.; de las Nieves López-García, M.; Ramos-Requena, J.P.; Gupta, S. Assessing the Impact of COVID-19 Pandemic on the Stock and Commodity Markets Performance and Sustainability: A Comparative Analysis of South Asian Countries. Sustainability 2021, 13, 5669. [Google Scholar] [CrossRef]

- Liu, N.; Xu, Z.; Skare, M. The research on COVID-19 and economy from 2019 to 2020: Analysis from the perspective of bibliometrics. Oeconomia Copernic. 2021, 12, 217–268. [Google Scholar] [CrossRef]

- Hassan, S.M.; Riveros Gavilanes, J.M. First to React Is the Last to Forgive: Evidence from the Stock Market Impact of COVID 19. J. Risk Financ. Manag. 2021, 14, 26. [Google Scholar] [CrossRef]

- Dias, R.; Teixeira, N.; Machova, V.; Pardal, P.; Horak, J.; Vochozka, M. Random walks and market efficiency tests: Evidence on US, Chinese and European capital markets within the context of the global COVID-19 pandemic. Oeconomia Copernic. 2020, 11, 585–608. [Google Scholar] [CrossRef]

- Roszkowska, P.; Prorokowski, Ł. Model of Financial Crisis Contagion: A Survey-based Simulation by Means of the Modified Kaplan-Meier Survival Plots. Folia Oeconomica Stetin. 2014, 13, 22–55. [Google Scholar] [CrossRef]

- Zaremba, A.; Kizys, R.; Tzouvanas, P.; Aharon, D.Y.; Demir, E. The quest for multidimensional financial immunity to the COVID-19 pandemic: Evidence from international stock markets. J. Int. Financ. Mark. Inst. Money 2021, 71, 101284. [Google Scholar] [CrossRef]

- Aharon, D.Y.; Siev, S. COVID-19, government interventions and emerging capital markets performance. Res. Int. Bus. Financ. 2021, 58, 101492. [Google Scholar] [CrossRef]

- Markowicz, I.; Rudawska, I. Struggling with COVID-19—A Framework for Assessing Health System Performance. Sustainability 2021, 13, 11146. [Google Scholar] [CrossRef]

- Smith, R.D.; Keogh-Brown, M.R.; Barnett, T.; Tait, J. The economy-wide impact of pandemic influenza on the UK: A computable general equilibrium modelling experiment. BMJ-Br. Med. J. 2009, 339, b4571. [Google Scholar] [CrossRef] [PubMed]

- Arriola, K.; Kowalski, P.; van Tongeren, F. The impact of COVID-19 on the directions and structure of international trade. OECD Trade Policy Pap. 2021, 252. [Google Scholar] [CrossRef]

- Jones, L.; Palumbo, D.; Brown, D. Coronavirus: How the Pandemic Has Changed the World Economy. BBC News. 24 January 2021. Available online: https://www.bbc.com/news/business-51706225 (accessed on 1 June 2022).

- Spiegel, M.; Tookes, H. Business restrictions and COVID-19 fatalities. Rev. Financ. Stud. 2021, 34, 5266–5308. [Google Scholar] [CrossRef]

- Waliszewski, K.; Warchlewska, A. Comparative analysis of Poland and selected countries in terms of household financial behaviour during the COVID-19 pandemic. Equilibrium. Q. J. Econ. Econ. Policy 2021, 16, 577–615. [Google Scholar] [CrossRef]

- Goldstein, I.; Koijen, R.S.J.; Mueller, H.M. COVID-19 and Its Impact on Financial Markets and the Real Economy. Rev. Financ. Stud. 2021, 34, 5135–5148. [Google Scholar] [CrossRef]

- Svabova, L.; Tesarova, E.N.; Durica, M.; Strakova, L. Evaluation of the impacts of the COVID-19 pandemic on the development of the unemployment rate in Slovakia: Counterfactual before-after comparison. Equilibrium. Q. J. Econ. Econ. Policy 2021, 16, 261–284. [Google Scholar] [CrossRef]

- Laborde, D.; Martin, W.; Swinnen, J.; Vos, R. COVID-19 Risks to Global Food Security. Science 2020, 369, 500–502. [Google Scholar] [CrossRef]

- Hossain, M. The effect of the COVID-19 on sharing economy activities. J. Clean. Prod. 2021, 280, 124782. [Google Scholar] [CrossRef]

- Barlow, J.; Vodenska, I. Socio-Economic Impact of the COVID-19 Pandemic in the U.S. Entropy 2021, 23, 673. [Google Scholar] [CrossRef]

- Dmytrów, K.; Landmesser, J.; Bieszk-Stolorz, B. The Connections between COVID-19 and the Energy Commodities Prices: Evidence through the Dynamic Time Warping Method. Energies 2021, 14, 4024. [Google Scholar] [CrossRef]

- Drzymała, A.J.; Korzeniewska, E. Impact of the Self-Consumption of Electricity on the Profitability of the Investment into a Photovoltaic Installation: The Case of a Company in Poland. Eur. Res. Stud. J. 2022, 25, 316–332. [Google Scholar]

- Bertram, C.; Luderer, G.; Creutzig, F.; Bauer, N.; Ueckerdt, F.; Malik, A.; Edenhofer, O. COVID-19-induced low power demand and market forces starkly reduce CO2 emissions. Nat. Clim. Change 2021, 11, 193–196. [Google Scholar] [CrossRef]

- Whitehouse Associates. BP Statistical Review of World Energy, 71st ed.; Whitehouse Associates: London, UK, 2022. [Google Scholar]

- Msomi, T.S.; Olarewaju, O.M.; Ngcobo, X. Sustaining South African small and medium-sized enterprises through monetary access and Literacy in the COVID-19 ERA. Folia Oeconomica Stetin. 2021, 21, 57–75. [Google Scholar] [CrossRef]

- Fatih, C. What can SVAR models tell us about the impact of Public Expenditure Shocks on macroeconomic variables in Algeria? A Slight Hint to the COVID-19 Pandemic. Folia Oeconomica Stetin. 2021, 21, 21–37. [Google Scholar] [CrossRef]

- Sunstein, C.R.; Zeckhauser, R. Overreaction to Fearsome Risks, Public Law and Legal Theory Working Paper. 2008. Available online: https://chicagounbound.uchicago.edu/public_law_and_legal_theory/219/ (accessed on 25 May 2022).

- Martofel, A. Analysis of Governmental and International Responses to The SARS-CoV-2 Pandemic. Almanach 2020, 15, 48–53. [Google Scholar]

- Kahneman, D. Thinking, Fast and Slow; Farrar, Straus and Giroux: New York, NY, USA, 2011. [Google Scholar]

- Farooq, U.; Nasir, A.; Bilal; Bashir, M.F. The COVID-19 pandemic and stock market performance of transportation and travel services firms: A cross-country study. Econ. Res.-Ekon. Istraz. 2022. [Google Scholar] [CrossRef]

- Bora, D.; Basistha, D. The outbreak of COVID-19 pandemic and its impact on stock market volatility: Evidence from a worst-affected economy. J. Public Aff. 2021, 21, e2623. [Google Scholar] [CrossRef]

- Bieszk-Stolorz, B.; Markowicz, I. Decline in Share Prices of Energy and Fuel Companies on the Warsaw Stock Exchange as a Reaction to the COVID-19 Pandemic. Energies 2021, 14, 5412. [Google Scholar] [CrossRef]

- Susu, S. The impact of the COVID-19 pandemic on the financial performance and price of the shares of the energy and fuel companies listed on the main segment of the Bucharest Stock Exchange. USV Ann. Econ. Public Adm. 2021, 21, 27–36. [Google Scholar]

- Haddad, V.; Moreira, A.; Muir, T. When selling becomes viral: Disruptions in debt markets in the COVID-19 crisis and the Fed’s response. Rev. Financ. Stud. 2021, 34, 5309–5351. [Google Scholar] [CrossRef]

- Ramelli, S.; Wagner, A.F. Feverish Stock Price Reactions to COVID-19. Rev. Corp. Financ. Stud. 2020, 9, 622–655. [Google Scholar] [CrossRef]

- Albaity, M.; Mallek, R.S.; Mustafa, H. Bank Stock Return Reactions to the COVID-19 Pandemic: The Role of Investor Sentiment in MENA Countries. Risks 2022, 10, 43. [Google Scholar] [CrossRef]

- Lyócsa, Š.; Baumöhl, E.; Výrost, E.; Molnár, P. Fear of the coronavirus and the stock markets. Financ. Res. Lett. 2020, 36, 101735. [Google Scholar] [CrossRef] [PubMed]

- Pardal, P.; Dias, R.; Šuleř, P.; Teixeira, N.; Krulický, T. Integration in Central European capital markets in the context of the global COVID-19 pandemic. Equilibrium. Q. J. Econ. Econ. Policy 2020, 15, 627–650. [Google Scholar] [CrossRef]

- Chatjuthamard, P.; Jindahra, P.; Sarajoti, P.; Treepongkaruna, S. The effect of COVID-19 on the global stock market. Account. Finance 2021, 61, 4923–4953. [Google Scholar] [CrossRef]

- Available online: https://www.gpw.pl/pub/GPW/STATIC/files/29.12.16_kom4.pdf (accessed on 26 May 2022).

- Available online: https://prnews.pl/gpw-oglasza-nowa-klasyfikacje-sektorowa-emitentow-361758 (accessed on 29 May 2022).

- Available online: https://www.gpw.pl/biblioteka-gpw-lista?gpwlc_id=10 (accessed on 25 May 2022).

- Foryś, I. The Cox Proportional Hazards Model in the Analysis of Property Transactions. Folia Oeconomica Stetin. 2010, 8, 71–81. [Google Scholar] [CrossRef]

- Markowicz, I. Duration Analysis of Firms—Cohort Tables and Hazard Function. Int. J. Bus. Soc. Res. 2015, 5, 36–47. [Google Scholar] [CrossRef]

- Urbańczyk, D.M. Competing Risks Models for an Enterprises Duration on the Market. Folia Oeconomica Stetin. 2020, 20, 456–473. [Google Scholar] [CrossRef]

- Bieszk-Stolorz, B.; Dmytrów, K. Evaluation of Changes on World Stock Exchanges in Connection with the SARS-CoV-2 Pandemic. Survival Analysis Methods. Risks 2021, 9, 121. [Google Scholar] [CrossRef]

- Markowicz, I.; Baran, P. Duration of Trade Relationships of Polish Enterprises on the Intra-Community Market: The Case of Vehicles and Automotive Parts Trade. Sustainability 2022, 14, 3599. [Google Scholar] [CrossRef]

- Kleinbaum, D.G.; Klein, M. Survival Analysis. A Self-Learning Text, 3rd ed.; Springer: New York, NY, USA, 2012. [Google Scholar] [CrossRef]

- Kaplan, E.L.; Meier, P. Nonparametric estimation from incomplete observations. J. Am. Stat. Assoc. 1958, 53, 457–481. [Google Scholar] [CrossRef]

- Klein, J.; Moeschberger, M. Survival Analysis. Techniques for Censored and Truncated Data; Springer: New York, NY, USA, 1997. [Google Scholar]

- Suciu, G.P.; Lemeshow, S.; Moeschberger, M. Statistical Tests of the Equality of Survival Curves: Reconsidering the Option. In Advances in Survival Analysis; Balakrishnan, N., Rao, C.R., Eds.; Elsevier: Amsterdam, The Netherlands, 2003; pp. 251–262. [Google Scholar] [CrossRef]

- Karadeniz, P.G.; Ercan, I. Examining Tests for Comparing Survival Curves with Right Censored Data. Stat. Transit. 2017, 18, 311–328. [Google Scholar] [CrossRef]

- Lee, E.T.; Desu, M.M.; Gehan, E.A. A Monte Carlo Study of the Power of Some Two sample Tests. Biometrika 1975, 62, 425–432. [Google Scholar] [CrossRef]

- Bland, J.M.; Altman, D.G. The logrank test. BMJ-Br. Med. J. 2004, 328, 1073. [Google Scholar] [CrossRef]

- Cox, D.R. Regression Models and Life-Tables. J. R. Stat. Soc. Series B Stat. Methodol. 1972, 34, 187–220. [Google Scholar] [CrossRef]

- Kleinbaum, D.G.; Klein, M. Logistic Regression. A Self-Learning Text, 3rd ed.; Springer: New York, NY, USA, 2010. [Google Scholar] [CrossRef]

- Bieszk-Stolorz, B.; Markowicz, I. The Influence of Variable Coding on the Interpretation of the Cox Proportional Hazards Model Parameters. In Proceedings of the 37th International Business Information Management Association (IBIMA), Cordoba, Spain, 1–2 April 2021; pp. 3329–3339. [Google Scholar]

- Bieszk-Stolorz, B.; Markowicz, I. The Assessment of the Situation of Listed Companies in Macrosectors in a Bear Market— Duration Analysis Models. In Proceedings of the Applications of Mathematics and Statistics in Economics. International Scientific Conference, Szklarska Poręba, Poland, 30 August–3 September 2017; Wroclaw University of Economics and Business: Wroclaw, Poland, 2017; pp. 17–26. [Google Scholar] [CrossRef]

- Bieszk-Stolorz, B.; Markowicz, I. Application of models of survival analysis in the assessment of the situation of macrosectors of listed companies. Optimum. Econ. Stud. 2018, 1, 3–15. [Google Scholar] [CrossRef]

- Kartal, M.T.; Depren, S.K.; Depren, Ö. How Main Stock Exchange Indices React to COVID-19 Pandemic: Daily Evidence from East Asian Countries. Glob. Econ. Rev. 2021, 50, 54–71. [Google Scholar] [CrossRef]

- Hatmanu, M.; Cautisanu, C. The Impact of COVID-19 Pandemic on Stock Market: Evidence from Romania. Int. J. Environ. Res. Public Health 2021, 18, 9315. [Google Scholar] [CrossRef]

- Devi, S.; Warasniasih, N.M.S.; Masdiantini, P.R.; Musmini, L.S. The Impact of COVID-19 Pandemic on the Financial Performance of Firms on the Indonesia Stock Exchange. J. Econ. Bus. Account. Ventur. 2020, 23, 226–242. [Google Scholar] [CrossRef]

- Ganie, I.R.; Wani, T.A.; Yadav, M.P. Impact of COVID-19 Outbreak on the Stock Market: An Evidence from Select Economies. Bus. Perspect. Res. 2022, 22785337211073635. [Google Scholar] [CrossRef]

- Honko, S.; Remlein, M.; Rowinska-Kral, M.; Swietla, K. Effects of COVID-19 in the Financial Statements of Selected Companies Listed in Warsaw Stock Exchange. Eur. Res. Stud. J. 2020, 23, 854–871. [Google Scholar] [CrossRef]

- Bernardelli, M.; Korzeb, Z.; Niedziółka, P. The banking sector as the absorber of the COVID-19 crisis? economic consequences: Perception of WSE investors. Oeconomia Copernic. 2021, 12, 335–374. [Google Scholar] [CrossRef]

- Ҫolak, G.; Öztekin, Ö. The Impact of COVID-19 Pandemic on Bank Lending Around the World. J. Bank. Financ. 2021, 133, 106207. [Google Scholar] [CrossRef]

- Özlem Dursun-de Neef, H.; Schandlbauer, A. COVID-19 and Lending Responses of European banks. J. Bank. Financ. 2021, 133, 106236. [Google Scholar] [CrossRef]

- Roy, S. Economic impact of COVID-19 Pandemic. Tech. Rep. 2020. Available online: https://www.researchgate.net/publication/343222400_ECONOMIC_IMPACT_OF_COVID-19_PANDEMIC (accessed on 30 May 2022).

- Izzeldin, M.; Muradoğlu, Y.G.; Pappas, V.; Sivaprasad, S. The Impact of COVID-19 on G7 Stock Markets Volatility: Evidence from a ST-HAR Model. Int. Rev. Financ. Anal. 2021, 74, 101671. [Google Scholar] [CrossRef]

- Kwan, S.H.; Merterns, M.T. Market Assessment of COVID-19. FRBDF Econ. Lett. 2020, 14, 1–5. Available online: https://www.frbsf.org/economic-research/files/el2020-14.pdf (accessed on 28 May 2022).

- Huayu, S.; Fu, M.; Pan, H.; Yu, Z.; Chen, Y. The impact of the COVID-19 pandemic on firm performance. Emerg. Mark. Financ. Trade 2020, 56, 2213–2230. [Google Scholar] [CrossRef]

- Gębski, Ł. The Impact of the Crisis Triggered by the COVID-19 Pandemic and the Actions of Regulators on the Consumer Finance Market in Poland and Other European Union Countries. Risks 2021, 9, 102. [Google Scholar] [CrossRef]

- Deloitte, COVID-19 CEE Banking Sector Impact Survey. First Symptoms of the Coronavirus Outbreak. 2020. Available online: https://www2.deloitte.com/cz/en/pages/covid-19/articles/covid-19-cee-banking-sector-impact-survey.html (accessed on 31 July 2022).

- Wójcik, D.; Ioannou, S. COVID-19 and finance: Market developments so far and potential impacts on the financial sector and centres. J. Econ. Hum. Geogr. 2020, 111, 387–400. [Google Scholar] [CrossRef]

- Feyen, E.; Gispert, T.A.; Kliatskova, T.; Mare, D.S. Financial Sector Policy Response to COVID-19 in Emerging Markets and Developing Economies. J. Bank. Financ. 2021, 133, 106184. [Google Scholar] [CrossRef] [PubMed]

- Resti, A. Did the pandemic lead to structural changes in the banking sector? In In-Depth Analysis, Requested by the ECON Committee; European Union: Maastricht, The Netherlands, 2021. [Google Scholar]

- Nisani, D.; Qadan, M.; Shelef, A. Risk and Uncertainty at the Outbreak of the COVID-19 Pandemic. Sustainability 2022, 14, 8527. [Google Scholar] [CrossRef]

- Bartik, A.W.; Bertrand, M.; Cullen, A. The impact of COVID-19 on small business outcomes and expectations. Econ. Sci. 2020, 117, 17656–17666. [Google Scholar] [CrossRef] [PubMed]

| Observations | Industry | Finance | Services | Total |

|---|---|---|---|---|

| Share price decline | ||||

| Completed | 98 | 40 | 84 | 222 |

| Censored | 83 | 32 | 72 | 187 |

| Share price increase | ||||

| Completed | 122 | 30 | 103 | 255 |

| Censored | 59 | 42 | 53 | 154 |

| Groups | Significance Level | |

|---|---|---|

| Gehan Test | Log-Rank Test | |

| Share price decline | ||

| Industry–Finance–Services | p = 0.4320 | |

| Industry–Finance | p = 0.5731 | p = 0.5731 |

| Industry–Services | p = 0.9237 | p = 0.9237 |

| Services–Finance | p = 0.5675 | p = 0.5675 |

| Share price increase | ||

| Industry–Finance–Services | p = 0.0049 | |

| Industry–Finance | p = 0.0004 | p = 0.0004 |

| Industry–Services | p = 0.6248 | p = 0.6248 |

| Services–Finance | p = 0.0014 | p = 0.0014 |

| Macrosector | Variable |

|---|---|

| Industry | X1 |

| Finance | X2 |

| Services | X3 |

| Specification | Parameter’s Estimate | Chi-Square | p | HR |

|---|---|---|---|---|

| Share price decline | ||||

| Industry | 0.0273 | 0.0864 | 0.7688 | 1.0277 |

| Finance | −0.0694 | 0.3545 | 0.5516 | 0.9330 |

| Services | 0.0421 | 0.1921 | 0.6612 | 1.0430 |

| Share price increase | ||||

| Industry | 0.2532 | 7.5826 | 0.0059 | 1.2881 |

| Finance | −0.4428 | 11.6275 | 0.0007 | 0.6422 |

| Services | 0.1895 | 4.0016 | 0.0455 | 1.2086 |

| Specification | Parameter’s Estimate | Wald’s Statistic | p | OR |

|---|---|---|---|---|

| Share price decline | ||||

| Intercept | 0.1811 | 2.8314 | 0.0924 | |

| Industry | −0.0150 | 0.0119 | 0.9133 | 0.9851 |

| Finance | 0.0420 | 0.0582 | 0.8094 | 1.0429 |

| Services | −0.0270 | 0.0361 | 0.8493 | 0.9734 |

| Share price increase | ||||

| Intercept | 0.3515 | 10.0289 | 0.0015 | |

| Industry | 0.3750 | 6.7934 | 0.0092 | 1.4550 |

| Finance | −0.6880 | 15.0890 | 0.0001 | 0.5026 |

| Services | 0.3130 | 4.4836 | 0.0342 | 1.3675 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bieszk-Stolorz, B.; Markowicz, I. Changes in Share Prices of Macrosector Companies on the Warsaw Stock Exchange as a Reaction to the COVID-19 Pandemic. Sustainability 2022, 14, 10252. https://doi.org/10.3390/su141610252

Bieszk-Stolorz B, Markowicz I. Changes in Share Prices of Macrosector Companies on the Warsaw Stock Exchange as a Reaction to the COVID-19 Pandemic. Sustainability. 2022; 14(16):10252. https://doi.org/10.3390/su141610252

Chicago/Turabian StyleBieszk-Stolorz, Beata, and Iwona Markowicz. 2022. "Changes in Share Prices of Macrosector Companies on the Warsaw Stock Exchange as a Reaction to the COVID-19 Pandemic" Sustainability 14, no. 16: 10252. https://doi.org/10.3390/su141610252