What’s Happening with the Patent Box Regimes? A Systematic Review

Abstract

:1. Introduction

2. Conceptual Framework

3. Methodology

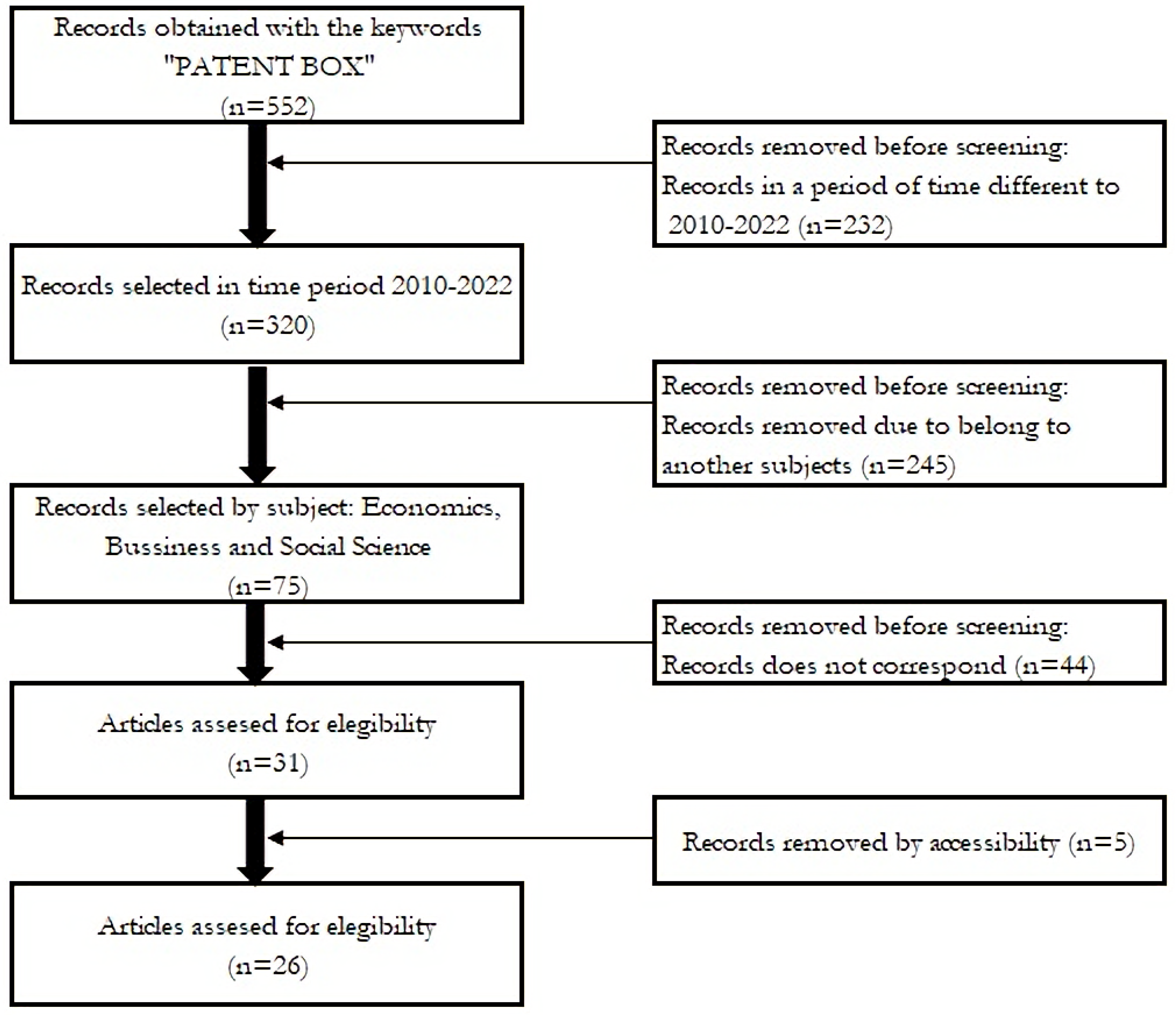

3.1. Scientific Research Selection

3.1.1. Search Strategy and Information Sources

3.1.2. Inclusion and Exclusion Criteria

3.2. Scientific Production Analysis

3.3. Bibliometric Analysis

3.4. Current Regimes in Patent Box Countries

4. Results

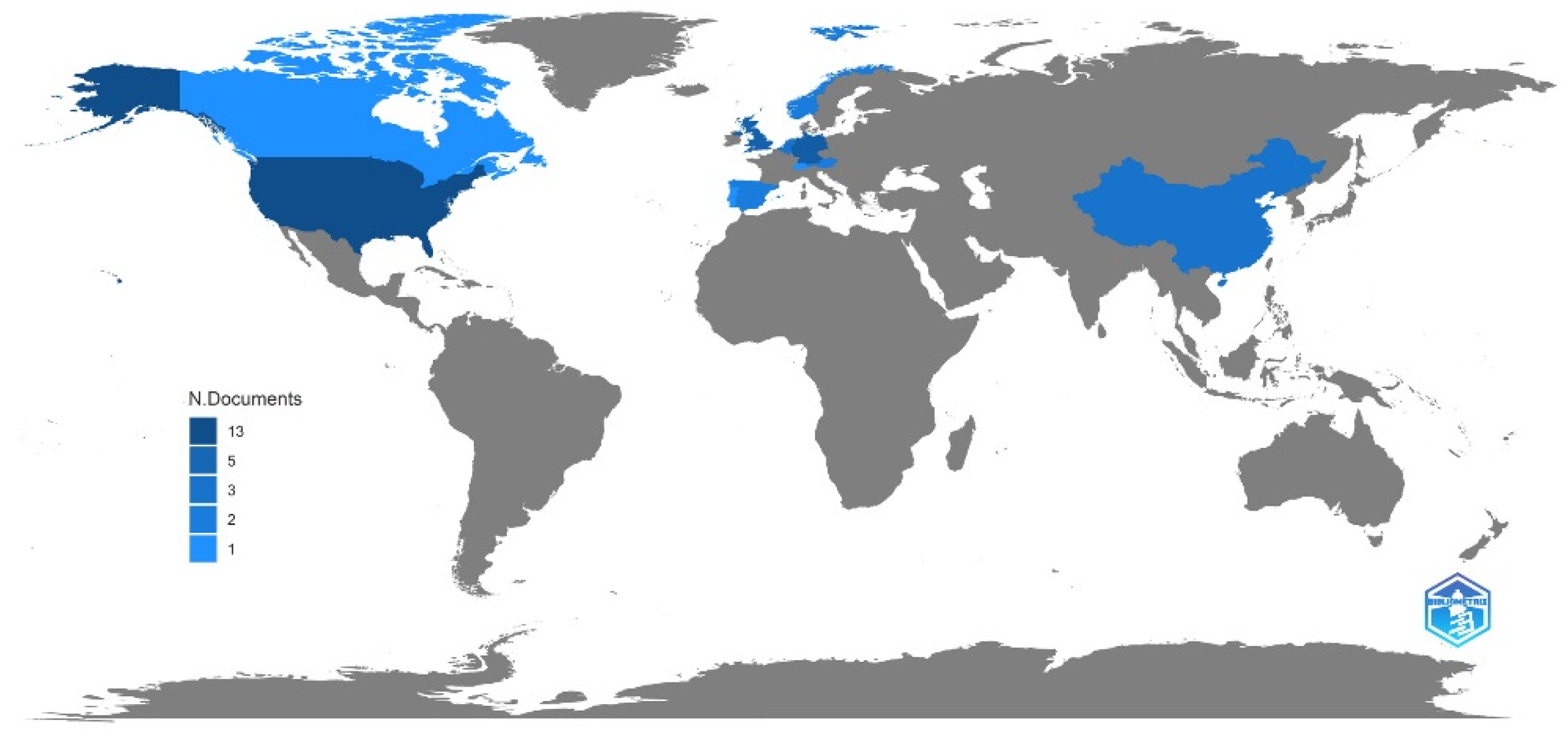

4.1. Sample Characteristics

4.2. Patent Box: A Complete Review

4.3. Current Patent Box Regimes in the World

5. Discussion

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Review of Papers, Methods, and Findings

| No | Title | Authors | Year | Outcome | Type | Objective | Method | Country |

|---|---|---|---|---|---|---|---|---|

| 1 | Should there be lower taxes on patent income? | Gaessler F., Hall B.H., Harhoff D. | 2021 | (−) Patents move across jurisdictions | Quantitative | Impact of PB on international Patent Transfers | Random-effects Poisson model | Various (51) |

| 2 | Thinking outside the box: The cross-border effect of tax cuts on R&D | Schwab T., Todtenhaupt M. | 2021 | (+) patent output in other countries | Quantitative | Effects of PB on the R&D in other countries | Using Diff in Diff, Instrumental Variables, and event study methods | Various (9) |

| 3 | The Impact of IP Box Regimes on the M&A Market | Bradley S., Robinson L., Ruf M. | 2021 | (+) On M&A Activity | Quantitative | Effects of the Nexus Approach on M&A transactions | Using Diff in Diff, triple differences, and event study methods | Various (24) |

| 4 | Tax Accounting Research on Corporate Investment: A Discussion of The Impact of IP Box Regimes on the M& A Market by Bradley, Ruf, and Robinson (2021) | Lester R. | 2021 | NA | Qualitative | Discussion about findings of PB on M&A transactions | Descriptive and qualitative | Various (24) |

| 5 | State stimulation of innovation activities in Switzerland and Russia | Belozyorov S., Zabolotskaya V. | 2021 | NA | Qualitative | Explore the system of State Financing of Research and Development (R&D) of small- and medium-sized enterprises (SME) in Switzerland | Descriptive and qualitative | Switzerland |

| 6 | The impact of R&D tax incentive programs on the performance of innovative companies | Makeeva E., Murashkina I., Mikhaleva I. | 2019 | (+) company performance | Quantitative | Explore the influence of corporate taxation on the performance of innovative companies under various research and development (R&D) tax incentive programs. | Blundell–Bond equation | Various (13) |

| 7 | Patent boxes and the erosion of trust in trade and governance | Diaz E.B. | 2019 | NA | Qualitative | Discuss the BEPS reform and its implications on trust and governance | Descriptive and qualitative | Nonspecific |

| 8 | Impact of the Intellectual Property Tax Regime on FDI in R&D Activities at the City Level | Falk M., Peng F. | 2018 | (+) FDI inflows in R&D and related activities | Quantitative | Determine the impact of the introduction of the patent box/IP regime on foreign direct investment (FDI) inflows in R&D and related activities | Diff in Diff Model | Various (80) |

| 9 | Patent boxes design, patents location, and local R&D | Alstadsæter A., Barrios S., Nicodeme G., Skonieczna A.M., Vezzani A. | 2018 | (+) Attract Patents | Quantitative | Find determinants of the geographical distribution of patent applications in countries. | The structural model proposed by Griffith et al.(2014) was estimated with a negative binomial model. | Various (39) |

| 10 | The Portuguese intellectual property box: issues in designing investment incentives | Martins A. | 2018 | (−) Not competitive and raised complexities | Qualitative | Discuss the competitiveness of Intellectual Property Box, effects on tax avoidance, and accounting complexities | Descriptive and qualitative | Portugal |

| 11 | Evaluating the innovation box tax policy instrument in the Netherlands, 2007-13 | Mohnen P., Vankan A., Verspagen B. | 2017 | (+) on R&D investment | Quantitative | Effect of the Innovation Box policy on local R&D investment of the firm | Diff in Diff Model | Netherlands |

| 12 | R&D tax incentives and the emergence and trade of ideas | Bösenberg S., Egger P.H. | 2017 | (−) Filling patents | Quantitative | Effects of tax incentives in R&D on the filing and trading of patents | Fixed-country-effects Poisson model for patent filing and a random-country-pair-effects Poisson model for patent trading | Various (106) |

| 13 | The Luxembourg effect: Patent boxes and the limits of international cooperation | Faulhaber L.V. | 2017 | NA | Qualitative | Discuss the Nexus approach’s effect on EU Members’ regulations | Descriptive and qualitative | Luxembourg |

| 14 | Do patent boxes still make sense under the OECD-BEPS nexus approach? | Englisch J. | 2017 | NA | Qualitative | Examine the effectiveness of a patent box regime that adheres to the nexus approach in attracting or stimulating additional R&D investments | Descriptive and qualitative | Germany |

| 15 | Patent boxes: research incentive or tax loophole? | Klodt H., Lang S. | 2016 | (−) Shift profits to low-tax countries | Quantitative | Impact of the introduction of patent boxes on R&D expenditures and patent applications. | Descriptive | Various (15) |

| 16 | A patent/innovation box as a tax incentive for domestic research and development | Gravelle J.G. | 2016 | NA | Quantitative | Effects of a patent box on encouraging research and development in the United States | Descriptive equations | US |

| 17 | Corporate patents, R&D success, and tax avoidance | Gao L., Yang L.L., Zhang J.H. | 2016 | NA | Quantitative | Examine whether R&D success (expenditures and patent activity) concerning patent output is associated with the level of tax reduction. | Panel Data Regress with firm fixed effects | US |

| 18 | Why are researchers paid bonuses? On technology spillovers and market rivalry | d’Andria D. | 2016 | (+) Increase the capital investment on R&D (−) Overinvestment under certain conditions | Quantitative | Analyze the R&D tax incentives’ effects on the innovation process and market rivalry | Theoretical Model | Nonspecific |

| 19 | Innovation boxes: BEPS and beyond | Merrill P. | 2016 | NA | Qualitative | Explains the IP box concept, outlines recent US IP box proposals with a focus on the Boustany–Neal discussion draft, and explains changes adopted in 2015 to the OECD standards. | Descriptive and qualitative | US |

| 20 | Economic impacts of intellectual property-conditioned government incentives | Prud’homme D., Song H. | 2016 | NA | Qualitative | Relations between tax incentives and Patent activity | Descriptive and qualitative | Nonspecific |

| 21 | Intellectual property box regimes: effective tax rates and tax policy considerations | Evers L., Miller H., Spengel C. | 2015 | (+) Increase incentives for investment by reducing the EATR | Quantitative | Estimate the cost of capital and the effective average tax rate under Patent Box conditions | Descriptive with effective average tax rates (EATR) | Various (12) |

| 22 | Cross-Country Evidence On The Preliminary Effects Of Patent Box Regimes On Patent Activity And Ownership | Bradley S., Dauchy E., Robinson L. | 2015 | (+) Patent Applications | Quantitative | Effects of Patent Box on extent and location of innovation and patent ownership. | Panel Data regressions including year and country fixed effects. | Various (70) |

| 23 | Corporate Tax Changes under the UK Coalition Government (2010-15) | Miller H., Pope T. | 2015 | NA | Qualitative | Review the policy changes of the UK government. Patent Box between them. | Descriptive and qualitative | UK |

| 24 | Taxation and incentives to innovate: a principal-agent approach | d’Andria D. | 2014 | (+) Aggregate innovation | Quantitative | Effects of different tax schemes on innovation in a pure knowledge economy | Principal-Agent Model | Nonspecific |

| 25 | Ownership of intellectual property and corporate taxation | Griffith R., Miller H., O’Connell M. | 2014 | (+) Share of new patents | Quantitative | Effects of the corporate income taxes in the location of patents. | The choice model estimated with mixed logit random model | Various (15) |

| 26 | Technological innovation, international competition, and the challenges of international income taxation | Graetz M.J., Doud R. | 2013 | NA | Qualitative | Describe the R&D tax incentives and offer recommendations | Descriptive and qualitative | US |

References

- Makeeva, E.; Murashkina, I.; Mikhaleva, I. The impact of R&D tax incentive programs on the performance of innovative companies. Foresight 2019, 21, 545–562. [Google Scholar]

- Bradley, S.; Dauchy, E.; Robinson, L. Cross-Country Evidence on The Preliminary Effects of Patent Box Regimes on Patent Activity and Ownership. 2015. Available online: http://ssrn.com/abstract=2681433 (accessed on 1 August 2021).

- Jose, M.; Sharma, R. Effectiveness of fiscal incentives for innovation: Evidence from meta-regression analysis. J. Public Aff. 2021, 21. [Google Scholar] [CrossRef]

- Bösenberg, S.; Egger, P.H. R&D tax incentives and the emergence and trade of ideas. Econ. Policy 2017, 32, 39–80. Available online: https://www.scopus.com/inward/record.uri?eid=2-s2.0-85019663485&doi=10.1093%2fepolic%2feiw017&partnerID=40&md5=0099df5ae2738c90104effb6091537b3 (accessed on 1 August 2021).

- Mohnen, P.; Vankan, A. Verspagen B. Evaluating the innovation box tax policy instrument in the Netherlands, 2007–2013. Oxf. Rev. Econ. Policy 2017, 33, 141–156. [Google Scholar] [CrossRef]

- Alstadsaeter, A.; Barrios, S.; Nicodeme, G.; Skonieczna, A.M.; Vezzani, A.; Alstadsaeter, A. Patent Boxes Design, Patents Location, and Local R&D. 2018. Available online: https://academic.oup.com/economicpolicy/article/33/93/131/4833998 (accessed on 1 August 2021).

- Evers, L.; Miller, H.; Spengel, C. Intellectual property box regimes: Effective tax rates and tax policy considerations. Int. Tax Public Financ. 2015, 22, 502–530. [Google Scholar] [CrossRef]

- PWC. The UK Patent Box regime; PWC: London, UK, 2021; Available online: https://thesuite.pwc.com/media/11830/patent-box-overview-june-2021.pdf (accessed on 1 August 2021).

- HMRC. Patent Box Relief Statistics; United Kingdom: GOV.UK. 2021. Available online: shorturl.at/rVWY5 (accessed on 1 August 2021).

- García-Quevedo, J. Do Public Subsidies Complement Business R&D? A Meta-Analysis of the Econometric Evidence. Kyklos 2004, 57, 87–102. Available online: https://onlinelibrary.wiley.com/doi/full/10.1111/j.0023-5962.2004.00244.x (accessed on 1 August 2021).

- Hall, B.; van Reenen, J. How effective are fiscal incentives for R&D? A review of the evidence. Res. Policy 2000, 29, 449–469. [Google Scholar]

- Pöschel, C.; Heckemeyer, J.; Hundsdoerfer, J.; Matthaei, E. Quantitative Research in Taxation-Discussion Papers Incentive Effects of R&D Tax Incentives: A Meta-Analysis Focusing on R&D Tax Policy Designs. Arqus Discussion Paper. 2020, pp. 1–32. Available online: www.arqus.info (accessed on 1 August 2021).

- Blandinières, F.; Steinbrenner, D. How Does the Evolution of R&D Tax Incentives Schemes Impact Their Effectiveness? Evidence From a Meta-Analysis; ZEW Discussion Papers No. 21-020; Leibniz-Zentrum für Europäische Wirtschaftsforschung: Mannheim, Germany, 2021. [Google Scholar]

- Bornemann, T.; Laplante, S.K.; Osswald, B.; Eberhartinger, E.; Lang, M.; Sausgruber, R. The Effect of Intellectual Property Boxes on Innovative Activity & Effective Tax Rates; WU International Taxation Research Paper Series: Vienna, Austria, 2018. [Google Scholar]

- Falk, M.; Peng, F. Impact of the Intellectual Property Tax Regime on FDI in R&D Activities at the City Level. Rev. Policy Res. 2018, 35, 733–749. [Google Scholar]

- Bradley, S.; Robinson, L.; Ruf, M. The Impact of IP Box Regimes on the M&A Market. J. Account. Econ. 2021, 72, 101448. [Google Scholar]

- Tax Justice Network. Haven Indicator 7: Patent Boxes. 2021. Available online: https://cthi.taxjustice.net/cthi2021/HI-7.pdf (accessed on 1 August 2022).

- PWC. PwC WWTS-Corporate Taxes 2018-19. 2018. Available online: shorturl.at/cFG46 (accessed on 1 November 2021).

- EY. Worldwide R&D Incentives Reference Guide. 2021. Available online: https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/tax/tax-guides/2021/ey-worldwide-r-and-d-incentives-guide.pdf?download (accessed on 1 November 2021).

- Page, M.J.; McKenzie, J.E.; Bossuyt, P.M.; Boutron, I.; Hoffmann, T.C.; Mulrow, C.D.; Shamseer, L.; Tetzlaff, J.M.; Akl, E.A.; Brennan, S.E.; et al. The PRISMA 2020 Statement: An Updated Guideline for Reporting Systematic Reviews. BMJ 2021, 372. Available online: https://www.bmj.com/content/372/bmj.n71 (accessed on 1 August 2021).

- Gravelle, J.G. A Patent/Innovation Box as a Tax Incentive for Domestic Research and Development; Federal Tax Incentives for Research and Development: Policies, Issues, Effectiveness; Nova Science Publishers, Inc.: Hauppauge, NY, USA, 2016; pp. 47–68. Available online: https://www.scopus.com/inward/record.uri?eid=2-s2.0-85016633398&partnerID=40&md5=2fb9b2e328a8c7fe1f9af90f7686a115 (accessed on 1 August 2021).

- Gao, L.; Yang, L.L.; Zhang, J.H. Corporate patents, R&D success, and tax avoidance. Rev. Quant. Financ. Account. 2016, 47, 1063–1096. [Google Scholar]

- Merrill, P. Innovation boxes: BEPS and beyond. Natl. Tax J. 2016, 69, 847–862. Available online: https://www.scopus.com/inward/record.uri?eid=2-s2.0-85027726790&doi=10.17310%2fntj.2016.4.06&partnerID=40&md5=efbe7dcf9a9c020dec854b021ba8f064 (accessed on 1 August 2021). [CrossRef]

- Diaz, E.B. Patent boxes and the erosion of trust in trade and in governance. Int. J. Public Law Policy 2019, 6, 270–304. [Google Scholar] [CrossRef]

- Lester, R. Tax Accounting Research on Corporate Investment: A Discussion of The Impact of IP Box Regimes on the M& A Market by Bradley, Ruf, and Robinson. J. Account. Econ. 2021. Available online: https://linkinghub.elsevier.com/retrieve/pii/S0165410121000665 (accessed on 1 August 2021).

- Gaessler, F.; Hall, B.H.; Harhoff, D. Should there be lower taxes on patent income? Res. Policy 2021, 50. [Google Scholar] [CrossRef]

- Faulhaber, L.V. The Luxembourg effect: Patent boxes and the limits of international cooperation. Minn. Law Rev. 2017, 101, 1641–1702. Available online: https://www.scopus.com/inward/record.uri?eid=2-s2.0-85018757295&partnerID=40&md5=71856e5c251062d0cb9b20863050e7d6 (accessed on 1 August 2021). [CrossRef]

- OECD. Countering Harmful Tax Practices More Effectively, Taking into Account Transparency and Substance, Action 5-2015 Final Report. OECD; 2015. (OECD/G20 Base Erosion and Profit Shifting Project). Available online: https://www.oecd-ilibrary.org/taxation/countering-harmful-tax-practices-more-effectively-taking-into-account-transparency-and-substance-action-5-2015-final-report_9789264241190-en (accessed on 1 August 2021).

- Petrin, T. A Literature Review on the Impact and Effectiveness of Government Support for R&D and Innovation; ISIGrowth: Pisa, Italy, 2018. [Google Scholar]

- Czarnitzki, D.; Delanote, J.; Czarnitzki, D.; Delanote, J. Incorporating Innovation Subsidies in the CDM Framework: Empirical Evidence from Belgium. 2016. Available online: https://EconPapers.repec.org/RePEc:zbw:zewdip:16045 (accessed on 1 August 2021).

- Guo, D.; Guo, Y.; Jiang, K. Government-subsidized R&D and firm innovation: Evidence from China. Res. Policy 2016, 45, 1129–1144. [Google Scholar]

- Bronzini, R.; Piselli, P. The impact of R&D subsidies on firm innovation. Res. Policy 2016, 45, 442–457. [Google Scholar]

- Hong, J.; Feng, B.; Wu, Y.; Wang, L. Do government grants promote innovation efficiency in China’s high-tech industries? Technovation 2016, 57–58, 4–13. [Google Scholar] [CrossRef]

- Herrera, L.; Sánchez-González, G. Firm Size and Innovation Policy. pp. 137–155. Available online: https://journals.sagepub.com/doi/10.1177/0266242611405553 (accessed on 1 August 2021).

- Aria, M.; Cuccurullo, C. bibliometrix: An R-tool for comprehensive science mapping analysis. J. Informetr. 2017, 11, 959–975. [Google Scholar] [CrossRef]

- Bunn, D.; Asen, E.; Enache, C. Foundation TX. Digital Taxation around the World. 2020. Available online: https://files.taxfoundation.org/20200527192056/Digital-Taxation-Around-the-World.pdf (accessed on 1 November 2021).

- OECD. Intellectual Property Regimes. Corporate Tax Statistics. 2020. Available online: http://qdd.oecd.org/data/IP_Regimes (accessed on 1 August 2021).

- Martins, A. The Portuguese intellectual property box: Issues in designing investment incentives. J. Int. Trade Law Policy 2018, 17, 86–102. [Google Scholar] [CrossRef]

- Miller, H.; Pope, T. Corporate Tax Changes under the UK Coalition Government (2010-15). Fisc. Stud. 2015, 36, 327–347. Available online: https://www.scopus.com/inward/record.uri?eid=2-s2.0-84941618239&doi=10.1111%2fj.1475-5890.2015.12054&partnerID=40&md5=02308f95cba10b0d76767adb9f55fd27 (accessed on 1 August 2021). [CrossRef]

- Englisch, J. Do patent boxes still make sense under the OECD-BEPS nexus approach? [Steuer- und wirtschaftspolitische bedeutung von patentboxen im POST-BEPS-zeitalter]. Wirtschaftsdienst 2017, 97, 577–583. Available online: https://www.scopus.com/inward/record.uri?eid=2-s2.0-85027728173&doi=10.1007%2fs10273-017-2179-1&partnerID=40&md5=d44fce66e5249b9f75e4b274562ef84c (accessed on 1 August 2021). [CrossRef]

- Belozyorov, S.; Zabolotskaya, V. State stimulation of innovation activities in switzerland and russia. Sovrem. Evropa 2021, 101, 108–120. [Google Scholar] [CrossRef]

- Graetz, M.J.; Doud, R. Technological innovation, international competition, and the challenges of international income taxation. Columbia Law Rev. 2013, 113, 347–446. Available online: https://www.scopus.com/inward/record.uri?eid=2-s2.0-84878377455&partnerID=40&md5=9710092216a29585fb9f54d337f3d85b (accessed on 1 August 2021).

- Griffith, R.; Miller, H.; O’Connell, M. Ownership of intellectual property and corporate taxation. J. Public Econ. 2014, 112, 12–23. [Google Scholar] [CrossRef]

- D’andria, D. Why are researchers paid bonuses? On technology spillovers and market rivalry. Res. Policy 2016, 45, 2105–2112. [Google Scholar] [CrossRef]

- Klodt, H.; Lang, S. Patent boxes: Research incentive or tax loophole? List. Forum Fur Wirtsch. Und Finanzpolit. 2016, 41, 349–365. [Google Scholar] [CrossRef]

- Schwab, T.; Todtenhaupt, M. Thinking outside the box: The cross-border effect of tax cuts on R&D. J. Public Econ. 2021, 1, 204. [Google Scholar]

- D’andria, D.; Schiller, F.; Jena, U. Taxation and Incentives to Innovate: A Principal-Agent Approach. Jena Economic Research Papers. 2014. Available online: www.uni-jena.dewww.econ.mpg.de (accessed on 1 August 2021).

- Cunningham, K. Intellectual Property in Bermuda. 2004. Available online: www.beesmont.bm (accessed on 1 August 2021).

- Lööf, H.; Heshmati, A. The Impact of Public Funding on Private R&D Investment: New Evidence from a Firm Level Innovation Study. Available online: https://EconPapers.repec.org/RePEc:hhs:cesisp:0006 (accessed on 1 March 2005).

- Acemoglu, D.; Akcigit, U.; Alp, H.; Bloom, N.; Kerr, W.R. Innovation, Reallocation and Growth. Am. Econ. Rev. 2013, 108, 3050–3091. [Google Scholar]

- Czarnitzki, D.; Hanel, P.; Rosa, J.M. Evaluating the impact of R&D tax credits on innovation: A microeconometric study on Canadian firms. Res. Policy 2011, 40, 217–229. [Google Scholar]

- Cappelen, Å.; Raknerud, A.; Rybalka, M. The effects of R&D tax credits on patenting and innovations. Res. Policy 2012, 41, 334–345. [Google Scholar]

- Colombo, M.G.; Grilli, L.; Murtinu, S. R&D subsidies and the performance of high-tech start-ups. Econ. Lett. 2011, 112, 11297–11299. [Google Scholar]

| Description | Results |

|---|---|

| Timespan | 2013–2021 |

| Sources (Journals, Books, etc.) | 21 |

| Documents | 26 |

| Average years from publication | 4.73 |

| Average citations per document | 11.08 |

| References | 1239 |

| Document Types | |

| Article | 21 |

| Book | 1 |

| Book chapter | 1 |

| Review | 3 |

| Authors | |

| Authors | 49 |

| Authors of single-authored documents | 8 |

| Co-Authors per Doc | 2.08 |

| No | Country | Year Implemented | Qualified PI Assets | Patent Box Rate | Corporate Income Tax | ||

|---|---|---|---|---|---|---|---|

| Patent | Software | Others * | |||||

| 1 | Andorra | 2010 | ✓ | ✓ | 2% | 10% | |

| 2 | Belgium | 2008 | ✓ | ✓ | 3.75% | 25% | |

| 3 | China ** | 2008 | ✓ | 15% | 25% | ||

| 4 | Curacao | 2018 | ✓ | ✓ | ✓ | 0% | 22% |

| 5 | Cyprus | 2012 | ✓ | ✓ | 2.5% | 12.5% | |

| 6 | France | 2000 | ✓ | ✓ | ✓ | 10% | 28.4% |

| 7 | Hungary | 2003 | ✓ | ✓ | 0% for qualifying IP and 4.5% in royalties’ income | 9% | |

| 8 | India | 2016 | ✓ | 10.3% to 11.85% | 30.91% to 35.45% | ||

| 9 | Ireland | 1973 | ✓ | ✓ | ✓ | 6.25% | 12.5% |

| 10 | Israel | 2017 | ✓ | ✓ | ✓ | 5%, 7.5%, 8%, 16% | 23% |

| 11 | Italy | 2015 | ✓ | ✓ | 13.91% | 27.81% | |

| 12 | Lithuania | 2018 | ✓ | ✓ | 5% | 15% | |

| 13 | Luxemburg | 2008 | ✓ | ✓ | 4.99% | 24.94% | |

| 14 | Malta | 2010 | ✓ | ✓ | ✓ | 1.75% minimum (referred to as a deduction of 95% of net income) | 35% |

| 15 | Netherlands | 2007 | ✓ | ✓ | ✓ | 9% | 25% |

| 16 | Poland | 2019 | ✓ | ✓ | 5% | 19% | |

| 17 | Portugal | 2014 | ✓ | 10.5% | 21% | ||

| 18 | San Marino | ✓ | ✓ | 0% or 8.5% | 17% | ||

| 19 | Slovakia | 2018 | ✓ | ✓ | 10.5% | 21% | |

| 20 | Spain (Federal) | 2008 | ✓ | ✓ | 10% | 25% | |

| 21 | Spain (Basque Country) | 2008 | ✓ | ✓ | 7.8% | 25% | |

| 22 | Spain (Navarre) | 2008 | ✓ | ✓ | 8.4% | 25% | |

| 23 | Singapore | 2018 | ✓ | ✓ | 5% or 10% | 17% | |

| 24 | Switzerland | 2020 | ✓ | Tax base reduction of up to 90% on patent income | 11.9–21.6% (canton level) | ||

| 25 | Turkey | 2015 | ✓ | ✓ | 12.5% | 25% | |

| 26 | United Kingdom | 2013 | ✓ | 10% | 19% | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Silva-Gámez, A.I.; Méndez-Prado, S.M.; Arauz, A. What’s Happening with the Patent Box Regimes? A Systematic Review. Sustainability 2022, 14, 11423. https://doi.org/10.3390/su141811423

Silva-Gámez AI, Méndez-Prado SM, Arauz A. What’s Happening with the Patent Box Regimes? A Systematic Review. Sustainability. 2022; 14(18):11423. https://doi.org/10.3390/su141811423

Chicago/Turabian StyleSilva-Gámez, Alexander Israel, Silvia Mariela Méndez-Prado, and Andrés Arauz. 2022. "What’s Happening with the Patent Box Regimes? A Systematic Review" Sustainability 14, no. 18: 11423. https://doi.org/10.3390/su141811423