An Empirical Framework to Sustain Value Generation with Project Risk Management: A Case Study in the IT Consulting Sector

Abstract

:1. Introduction

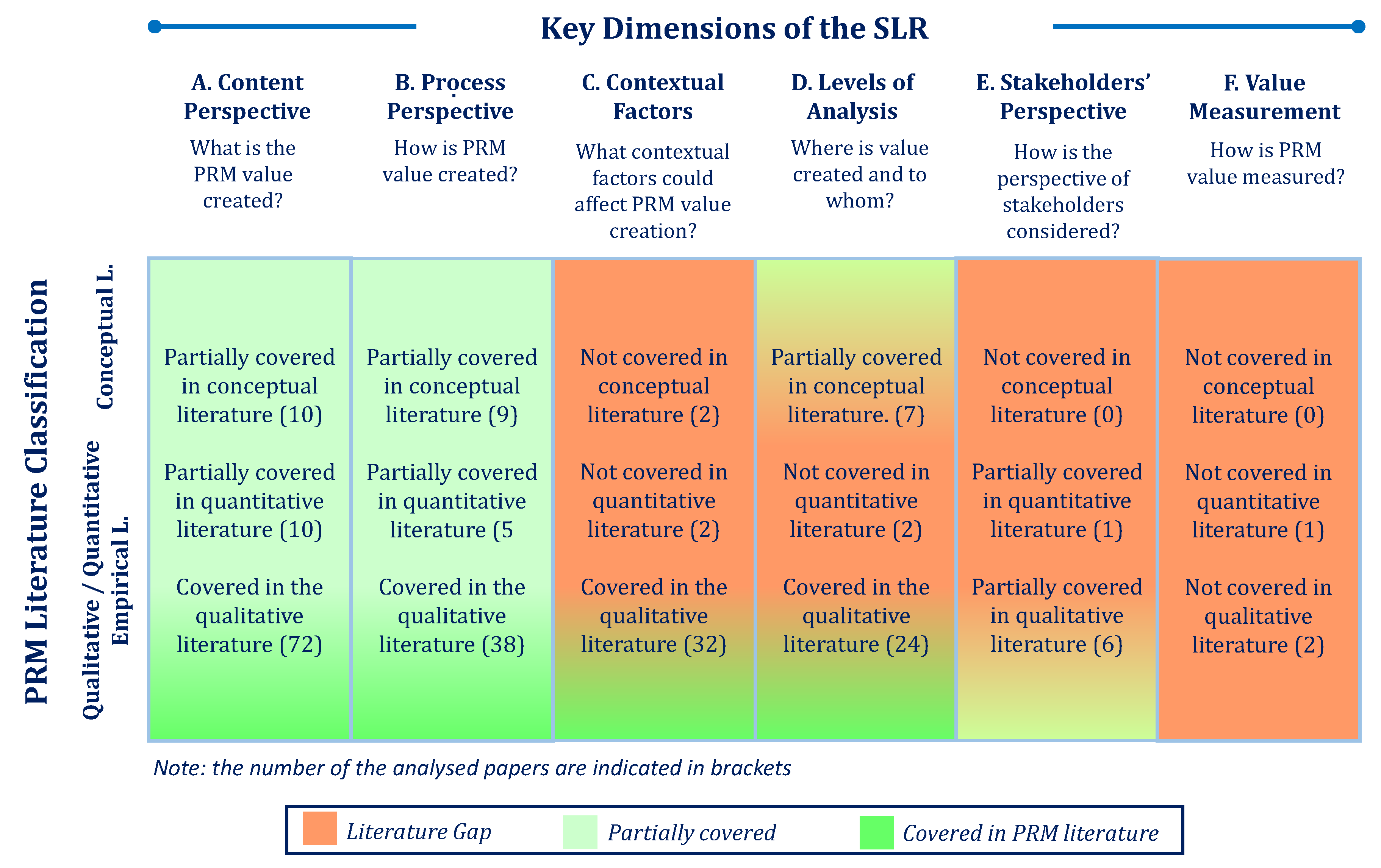

2. Main Concepts and Literature Review

- PRM value: It is defined as the total value generated through PRM for a stakeholder or a group of stakeholders and includes both PRM economic value and PRM intangible benefit;

- PRM value generation: It is the process of value generation through PRM. The generation of PRM value depends on the relative amount of value that is subjectively realised by a target user, who is the focus of value generation. The generation of PRM value is context-specific and depends on the level of analysis, whether an individual, an organisation or a society [15,24].

- Context in which PRM has been implemented includes the contextual factors and considers the stakeholders’ perspectives;

- PRM value generated considers the type of value generated through PRM (content perspective) and the measure of the value generated (value measurement), while considering the recipients of value generation (stakeholders’ perspective) and the level of analysis (individual, organisational, societal levels).

3. Objectives and Methodology

- RQ1a: What economic value and intangible (not monetary) benefits are generated through PRM for stakeholders?

- RQ1b: How can the economic value and the intangible benefit generated through PRM be measured?

- RQ2: How do contextual factors impact PRM value generation?

- RQ3: How can PRM be improved to increase the value generated?

3.1. Empirical Framework

- Context in which PRM has been implemented, including the characteristics of the company, the project, the project stakeholders, and the respondents;

- PRM value generated for stakeholders, both in terms of actual/potential PRM economic value and PRM intangible benefit.

3.2. Case Selection

- A project developed by a project-oriented company operating in a business sector where the project management practices are particularly relevant (e.g., consulting sector);

- A project where PRM has been implemented;

- A project that involves both internal and external stakeholders (e.g., performed for a customer company);

- A project finished for at least 6 months, to consider the PRM value generated during the whole project life cycle;

- Availability and knowledge of the Project Manager and at least another project stakeholder.

3.3. Data Collection and Analysis

4. Findings

4.1. Context

4.1.1. Respondents’ Value System

4.1.2. Project Complexity

4.1.3. Stakeholders Analysis

4.2. PRM Implementation

4.3. PRM Value Generation

4.3.1. PRM Economic Value

4.3.2. Additional PRM Intangible Benefit

5. Discussion

- Adopting a multilevel approach in the analysis of the value generated through PRM, considering that economic value can slip from one level of analysis to another;

- Carefully evaluating which stakeholders have to be involved in PRM, considering this aspect influences the generation of both PRM economic value and PRM intangible benefit;

- Mapping all relevant stakeholders at the beginning of the PRM process and defining appropriate strategies to manage the different stakeholder groups. In fact, stakeholders are of primary relevance in the generation of PRM value and could be sources of project risk (particularly ‘sleeping giants’);

- Analysing the value system of the respondents, considering that the value system influences the perceived level of PRM intangible benefit.

6. Conclusions

7. Patents

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Questionnaire

- Company profile: business sector, company type, number of employees, type of organisation, type of products/services, annual turnover [47];

- Project stakeholders’ profiles: stakeholder groups, stakeholders’ roles in the company and or external organisations, stakeholders’ roles in the project, stakeholders’ level of interest in the project as measured by the extent to which they will be active or passive (7-point Likert-type scale), stakeholders’ attitude to the project as measured by the extent to which they will support or resist (7-point Likert-type scale), stakeholders’ power or ability to influence the project (7-point Likert-type scale), derived from their positional or resource power in the company or external organisations, or from their credibility as a leader or expert [46];

- Respondent value system: Respondents were asked diverse sets of closed questions to collect their subjective interest in different types of benefits that could potentially be generated from PRM at different levels (7-point Likert-type scale), based on [48] and extended to all project stakeholders.

- 5.

- 6.

- Project risks: quantitative and qualitative information has been collected on the project risks identified and/or encountered during the project, including risk type, risk sources, risk responses, project stakeholders involved, risk evaluation in terms of probability and impact before and after the implementation of the risk responses;

- 7.

- PRM cost: total cost of PRM implementation, including internal and external resources engaged, training courses, tools, and other investments in PRM [49].

- 8.

- PRM actual economic benefits: quantitative and qualitative information has been collected to evaluate (1) project risk reduction, defined as the difference between the initial evaluation of project risks (in terms of probability and impact), and the evaluation of the same risks after the implementation of risk responses [40,41], and (2) the impact of opportunities generated by positive risks through PRM;

- 9.

- PRM potential economic benefits: quantitative and qualitative information has been collected to evaluate potential project risk reduction considering the risks that have been could be managed in a more effective way during the project;

- 10.

- PRM Intangible Value: respondents were asked diverse sets of closed questions about their perceptions of the benefits actually obtained through PRM during the project (7-point Likert-type scale).

Appendix B. Value Measurement Indexes

- (S): number of project stakeholders;

- (j): jth project stakeholder, where j = (1, …, S);

- (i): ith project risks, where i = (1, …, N);

- (rij): risk reduction of the ith project risks for the jth project stakeholder;

- (oij): economic opportunities for the jth project stakeholder generated through the management of the ith project risk;

- (cij): cost paid by the jth project stakeholder to manage the ith project risks.

- (S): number of project stakeholders;

- (j): jth project stakeholder, where j = (1, …, S);

- (i) = ith intangible benefit obtained through PRM;

- (wij) is the relative importance (weight) of the ith intangible benefit to the jth project stakeholder.

- (wij) have been determined on the basis of the project stakeholder value system, where

- (uij) is the perceived utility of the ith intangible benefit obtained through PRM to the jth project stakeholder (7-point Likert type scale).

References

- ISO 31000; Risk Management. International Organization for Standardization: Geneva, Switzerland, 2018. Available online: http://www.iso.org.2018 (accessed on 1 January 2020).

- Radner, R.; Shepp, L. Risk vs. profit potential: A model for corporate strategy. J. Econ. Dyn. Control 1996, 20, 1373–1393. [Google Scholar] [CrossRef]

- Fernando, Y.; Walters, T.; Ismail, M.N.; Seo, Y.W.; Kaimasu, M. Managing project success using project risk and green supply chain management: A survey of automotive industry. Int. J. Manag. Proj. Bus. 2018, 11, 332–365. [Google Scholar] [CrossRef]

- COSO. Enterprise Risk Management—Integrated Framework; Committee of Sponsoring Organizations of the Treadway Commission (COSO): New York, NY, USA, 2017. [Google Scholar]

- de Pooter, M. Don’t Manage Risk, Manage Value. Internal Auditor. June 2019. Available online: https://iiafiji.org (accessed on 1 January 2020).

- Maylor, H.; Brady, T.; Cooke-Davies, T.; Hodgson, D. From projectification to programmification. Int. J. Proj. Manag. 2006, 24, 663–674. [Google Scholar] [CrossRef]

- PMI. A Guide to the Project Management Body of Knowledge (PMBOK Guide), 3rd ed.; PMI: Chuo, Tokyo, 2004. [Google Scholar]

- Shimizu, T.; Park, Y.W.; Hong, P. Project managers for risk management: Case for Japan. Benchmarking 2012, 19, 532–547. [Google Scholar] [CrossRef]

- Badri, A. The challenge of integrating ohs into industrial project risk management: Proposal of a methodological approach to guide future research (case of mining projects in Quebec, Canada). Minerals 2015, 5, 314–334. [Google Scholar] [CrossRef]

- Raz, T.; Michael, E. Use and benefits of tools for project risk management. Int. J. Proj. Manag. 2001, 19, 9–17. [Google Scholar] [CrossRef]

- Borge, D. The Book of Risk; John Wiley & Sons: Hoboken, NJ, USA, 2002. [Google Scholar]

- PMI. A Guide to the Project Management Body of Knowledge (PMBOK Guide), 5th ed.; PMI: Chuo, Tokyo, 2013. [Google Scholar]

- Willumsen, P.; Oehmen, J.; Stingl, V.; Geraldi, J. Value creation through project risk management. Int. J. Proj. Manag. 2019, 37, 731–749. [Google Scholar] [CrossRef]

- Winter, M.; Smith, C.; Morris, P.; Cicmil, S. Directions for future research in project management: The main findings of a UK government-funded research network. Int. J. Proj. Manag. 2006, 24, 638–649. [Google Scholar] [CrossRef]

- Lepak, D.P.; Smith, K.G.; Taylor, M.S. Value creation and value capture: A multilevel perspective. Acad. Manag. Rev. 2007, 32, 180–194. [Google Scholar] [CrossRef]

- Elkington, P.; Smallman, C. Managing project risks: A case study from the utilities sector. Int. J. Proj. Manag. 2002, 7863, 49–57. [Google Scholar] [CrossRef]

- Cagliano, A.C.; Grimaldi, S.; Rafele, C. Choosing project risk management techniques. A theoretical framework. J. Risk Res. 2015, 18, 232–248. [Google Scholar] [CrossRef]

- Andersen, E.S. Do project managers have different perspectives on project management? Int. J. Proj. Manag. 2016, 34, 58–65. [Google Scholar] [CrossRef]

- Andersen, E.S. Value creation using the mission breakdown structure. Int. J. Proj. Manag. 2014, 32, 885–892. [Google Scholar] [CrossRef]

- Turner, R.; Ledwith, A.; Kelly, J. Project management in small to medium-sized enterprises: Matching processes to the nature of the firm. Int. J. Proj. Manag. 2010, 28, 744–755. [Google Scholar] [CrossRef]

- Turner, R.; Ledwith, A. Project management in small to medium-sized enterprises: Fitting the practices to the needs of the firm to deliver benefit. J. Small Bus. Manag. 2018, 56, 475–493. [Google Scholar] [CrossRef]

- Sanchez, H.; Robert, B.; Bourgault, M.; Pellerin, R. Risk management applied to projects, programs, and portfolios. Int. J. Manag. Proj. Bus. 2009, 2, 14–35. [Google Scholar] [CrossRef]

- Serra, C.E.M.; Kunc, M. Benefits Realisation Management and its influence on project success and on the execution of business strategies. Int. J. Proj. Manag. 2015, 33, 53–66. [Google Scholar] [CrossRef]

- Laursen, M.; Svejvig, P. Taking stock of project value creation: A structured literature review with future directions for research and practice. Int. J. Proj. Manag. 2016, 34, 736–747. [Google Scholar] [CrossRef]

- European Standard 12973; Value Management. European Standard LLC.: New York, NY, USA, 2000. Available online: https://www.en-standard.eu (accessed on 1 January 2020).

- Morris, P. Reconstructing Project Management; Wiley Blackwell: Chichester, UK, 2013. [Google Scholar]

- Quartermain, M. Value Engineering. In Project Management Pathways; Association for Project Management, Ed.; Association for Project Management: Buckinghamshire, UK, 2002. [Google Scholar]

- Scholz, R.W.; Tietje, O. Embedded Case Study Methods: Integrating Quantitative and Qualitative Knowledge; SAGE Publications: Thousand Oaks, CA, USA, 2002. [Google Scholar]

- Macpherson, A.; Holt, R. Knowledge, Learning and Small Firm Growth: A Systematic Review of the Evidence. Res. Policy 2007, 36, 172–192. [Google Scholar] [CrossRef]

- Tranfield, D.; Denyer, D.; Smart, P. Towards a Methodology for Developing Evidence-Informed Management Knowledge by Means of Systematic Review. Br. J. Manag. 2003, 14, 207–222. [Google Scholar] [CrossRef]

- Cavacini, A. What is the Best Database for Computer Science Journal Articles? Scientometrics 2015, 102, 2059–2071. [Google Scholar] [CrossRef]

- Guz, A.N.; Rushchitsky, J.J. Scopus: A System for the Evaluation of Scientific Journal. Int. Appl. Mech. 2009, 45, 351–362. [Google Scholar] [CrossRef]

- Yeo, K.T.; Ren, Y.T. Risk Management Capability Maturity Model for Complex Product Systems (CoPS) Projects. Syst. Eng. 2009, 12, 275–294. [Google Scholar] [CrossRef]

- Artto, K.; Ahola, T.; Vartiainen, V. From the front end of projects to the back end of operations: Managing projects for value creation throughout the system lifecycle. Int. J. Proj. Manag. 2016, 34, 258–270. [Google Scholar] [CrossRef]

- Chen, Y.S.; Chuang, H.M.; Sangaiah, A.K.; Lin, C.K.; Huang, W.B. A study for project risk management using an advanced MCDM-based DEMATEL-ANP approach. J. Ambient Intell. Humaniz. Comput. 2019, 10, 2669–2681. [Google Scholar] [CrossRef]

- Pargar, F.; Kujala, J.; Aaltonen, K.; Ruutu, S. Value creation dynamics in a project alliance. Int. J. Proj. Manag. 2019, 37, 716–730. [Google Scholar] [CrossRef]

- PMI. A Guide to the Project Management Body of Knowledge (PMBOK Guide), 6th ed.; PMI: Chuo, Tokyo, 2017. [Google Scholar]

- Yin, R.K. Discovering the Future of the Case Study. Method in Evaluation Research. Eval. Pract. 1994, 15, 283–290. [Google Scholar] [CrossRef]

- Voss, C.; Tsikriktsis, N.; Frohlich, M. Case Research in Operations Management. Int. J. Oper. Prod. Manag. 2002, 22, 195–219. [Google Scholar] [CrossRef]

- Ahmadi-Javid, A.; Fateminia, S.H.; Gemünden, H.G. A Method for Risk Response Planning in Project Portfolio Management. Proj. Manag. J. 2020, 51, 77–95. [Google Scholar] [CrossRef]

- Serpell, A.F.; Ferrada, X.; Rubio, L. Measuring the performance of project risk management: A preliminary model. Organ. Technol. Manag. Constr. Int. J. 2019, 11, 1984–1991. [Google Scholar] [CrossRef] [Green Version]

- Keeney, R.L.; Raiffa, H. Decisions with Multiple Objectives—Preferences and Value Tradeoffs; Cambridge University Press: Cambridge, UK, 1993. [Google Scholar]

- Qazi, A.; Quigley, J.; Dickson, A.; Kirytopoulos, K.A. Project Complexity and Risk Management (ProCRiM): Towards modelling project complexity driven risk paths in construction projects. Int. J. Proj. Manag. 2016, 34, 1183–1198. [Google Scholar] [CrossRef]

- Crispim, J.; Silva, L.H.; Rego, N. Project risk management practices: The organizational maturity influence. Int. J. Manag. Proj. Bus. 2019, 12, 187–210. [Google Scholar] [CrossRef]

- Josey, C.W.; England, K. Utilizing a project profile matrix to determine project management requirements. In Proceedings of the PMI® Global Congress, Orlando, FL, USA, 10–13 October 2009; Project Management Institute: Newtown Square, PA, USA, 2009. [Google Scholar]

- Murray-Webster, R.; Simon, P. Making Sense of Stakeholder Mapping. PM World Today 2006, 3, 5. Available online: http://skat.ihmc.us/rid=1JGD4CJZ4-F9CF0Y-1KM6/SEMINAL (accessed on 1 January 2020).

- EU Recommendation 2003/361, Global Industry Classification St. 1999. Available online: https://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:L:2003:124:0036:0041:en:PDF (accessed on 1 January 2020).

- Surlan, N.; Cekic, Z.; Torbica, Z. Use of value management workshops and critical success factors in introducing local experience on the international construction projects. J. Civ. Eng. Manag. 2016, 22, 1021–1031. [Google Scholar] [CrossRef]

- de Araújo, F.L.P.; Marcelino-Sadaba, S.; Verbano, C. Successful implementation of project risk management in small and medium enterprises: A cross-case analysis. Int. J. Manag. Proj. Bus. 2021, 14, 1023–1045. [Google Scholar]

| Project Type & Objectives | Project Size & Risk | Interviews | ||||||

|---|---|---|---|---|---|---|---|---|

| Project Type | Project Objectives | Project Budget (euro) | Team Size (persons) | Project Duration (months) | Project Losses (losses/budget) | Respondents Role | Respondents Seniority (years) | Interviews (number, duration) |

| External | Improving the cost estimation process | 70,000.00 | 5 | 8 | Low (1.4%) | Project Manager | 2–5 | 2 (160 min) |

| CEO | 5–10 | 1 (45 min) | ||||||

| Risk Types | Initial Impact Evaluation | Impact Evaluation (after PRM) | Actual Impact on Alpha | Actual Impact on the Client Company | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Probability (%) | Potential Impact (euro) | Impact Evaluation (euro) | Probability (%) | Potential Impact (euro) | Impact Evaluation (euro) | Negative Impact (Losses) | Positive Impact (Opportun.) | Negative Impact (Losses) | Positive Impact (Opportun.) | |

| Strategic Risk | 70% | 10,000.00 | 7000.00 | 10% | 10,000.00 | 1000.00 | - | 10,000.00 | 10,000.00 | - |

| Operative Risk | 70% | 5000.00 | 3500.00 | 0% | 5000.00 | - | 1000.00 | - | - | - |

| Technical Risk | 10% | 70,000.00 | 7000.00 | 0% | 70,000.00 | - | - | - | - | - |

| Total | 17,500.00 | 1000.00 | 1000.00 | 10,000.00 | 10,000.00 | - | ||||

| % on Project Budget | 25.0% | 1.4% | 1.4% | 14.3% | 14.3% | |||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Testorelli, R.; Verbano, C. An Empirical Framework to Sustain Value Generation with Project Risk Management: A Case Study in the IT Consulting Sector. Sustainability 2022, 14, 12117. https://doi.org/10.3390/su141912117

Testorelli R, Verbano C. An Empirical Framework to Sustain Value Generation with Project Risk Management: A Case Study in the IT Consulting Sector. Sustainability. 2022; 14(19):12117. https://doi.org/10.3390/su141912117

Chicago/Turabian StyleTestorelli, Raffaele, and Chiara Verbano. 2022. "An Empirical Framework to Sustain Value Generation with Project Risk Management: A Case Study in the IT Consulting Sector" Sustainability 14, no. 19: 12117. https://doi.org/10.3390/su141912117

APA StyleTestorelli, R., & Verbano, C. (2022). An Empirical Framework to Sustain Value Generation with Project Risk Management: A Case Study in the IT Consulting Sector. Sustainability, 14(19), 12117. https://doi.org/10.3390/su141912117