Effects of Subsidy Cancellations on Investment Strategies of Local Governments and New Energy Vehicle Manufacturers: A Study Based on Differential Game

Abstract

:1. Introduction

2. Problem Description and Differential Game Model

2.1. Problem Description

2.2. Model Assumptions

2.3. Game Model Construction

3. Solution to Differential Game Model

3.1. Decentralized Game Mode

3.2. Centralized Decision-Making Mode

4. Comparison of Results of Two Scenarios

5. Numerical Simulation and Parameter Sensitivity Analysis

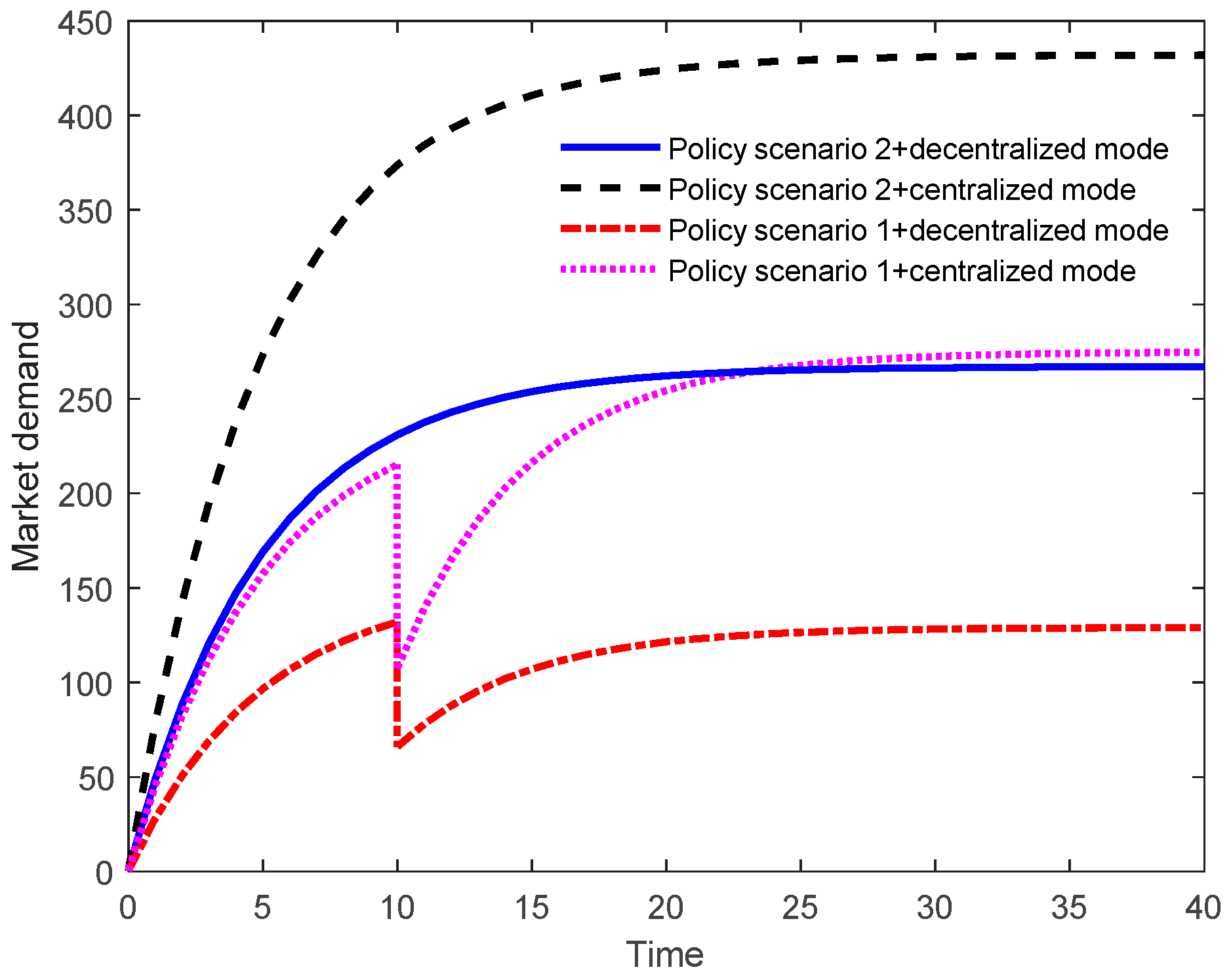

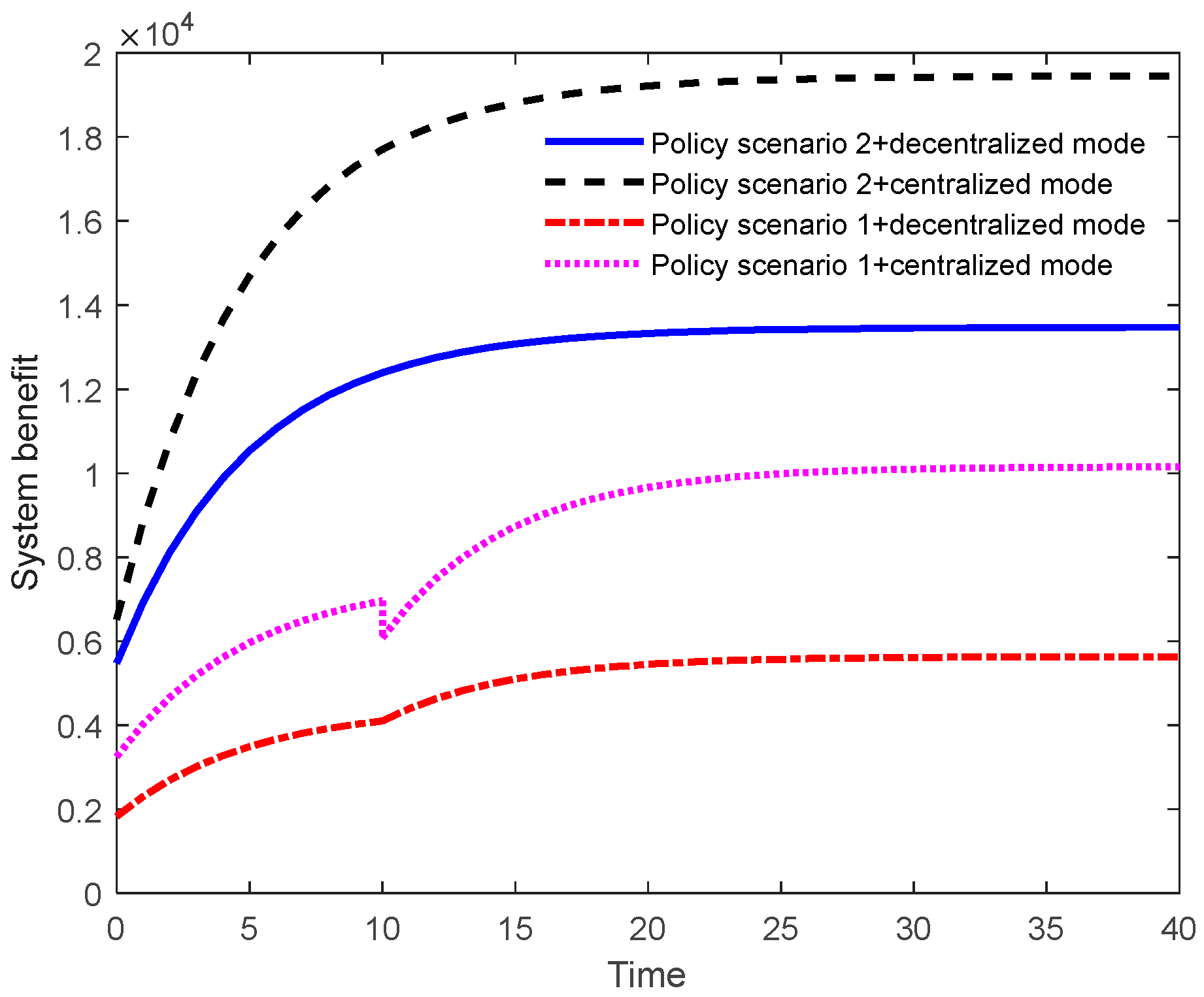

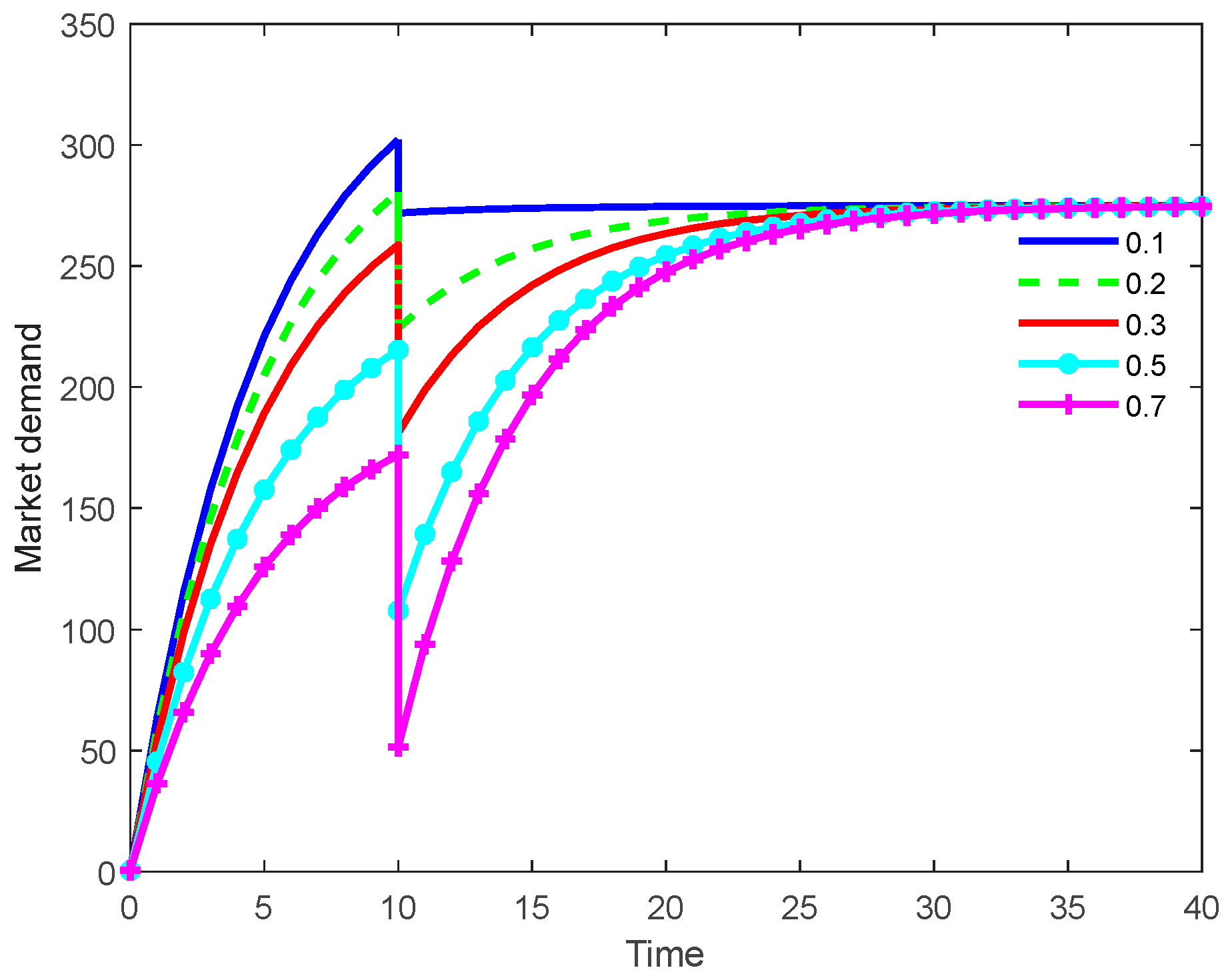

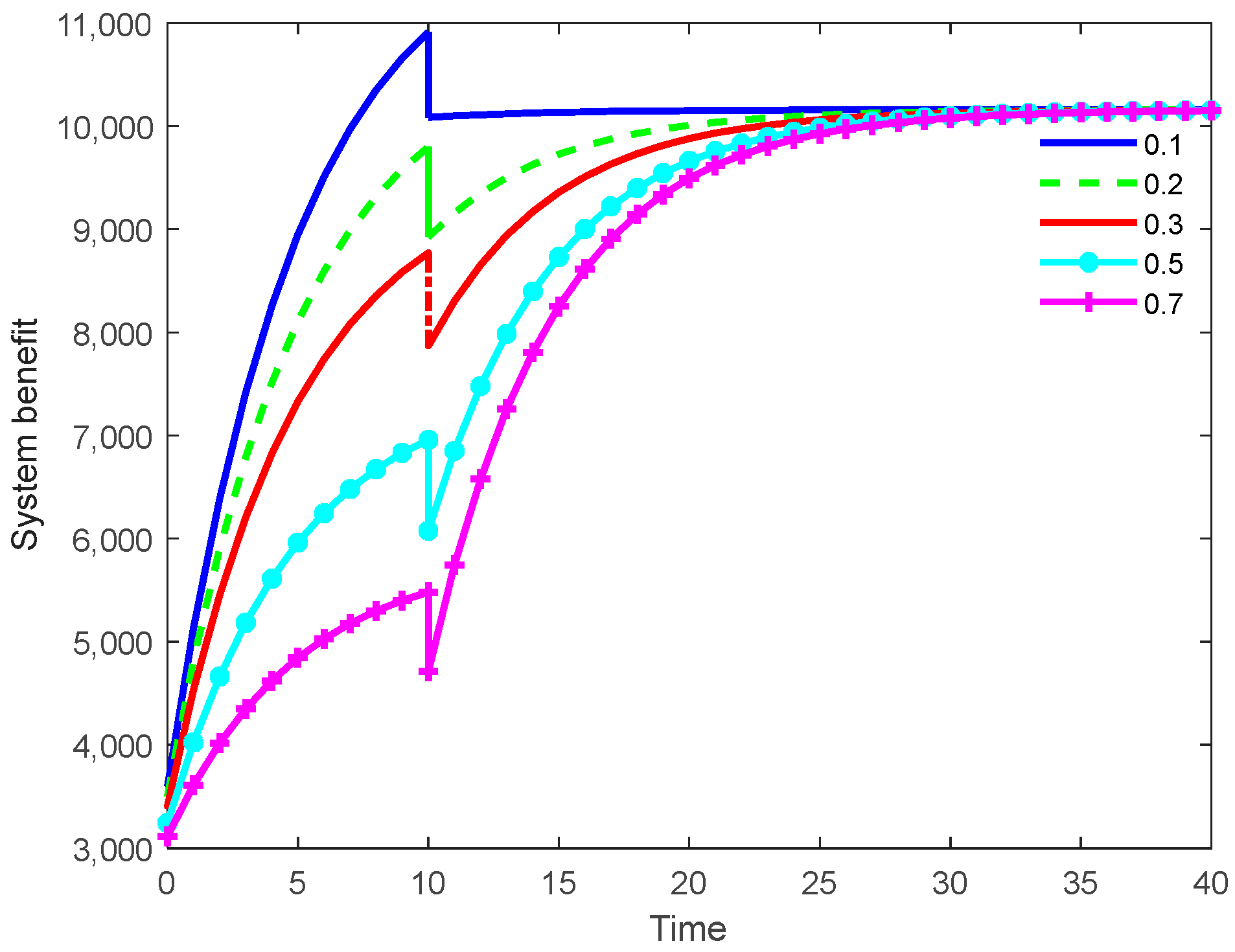

5.1. Market Demand and System Benefits

5.2. Parameter Sensitivity Analysis

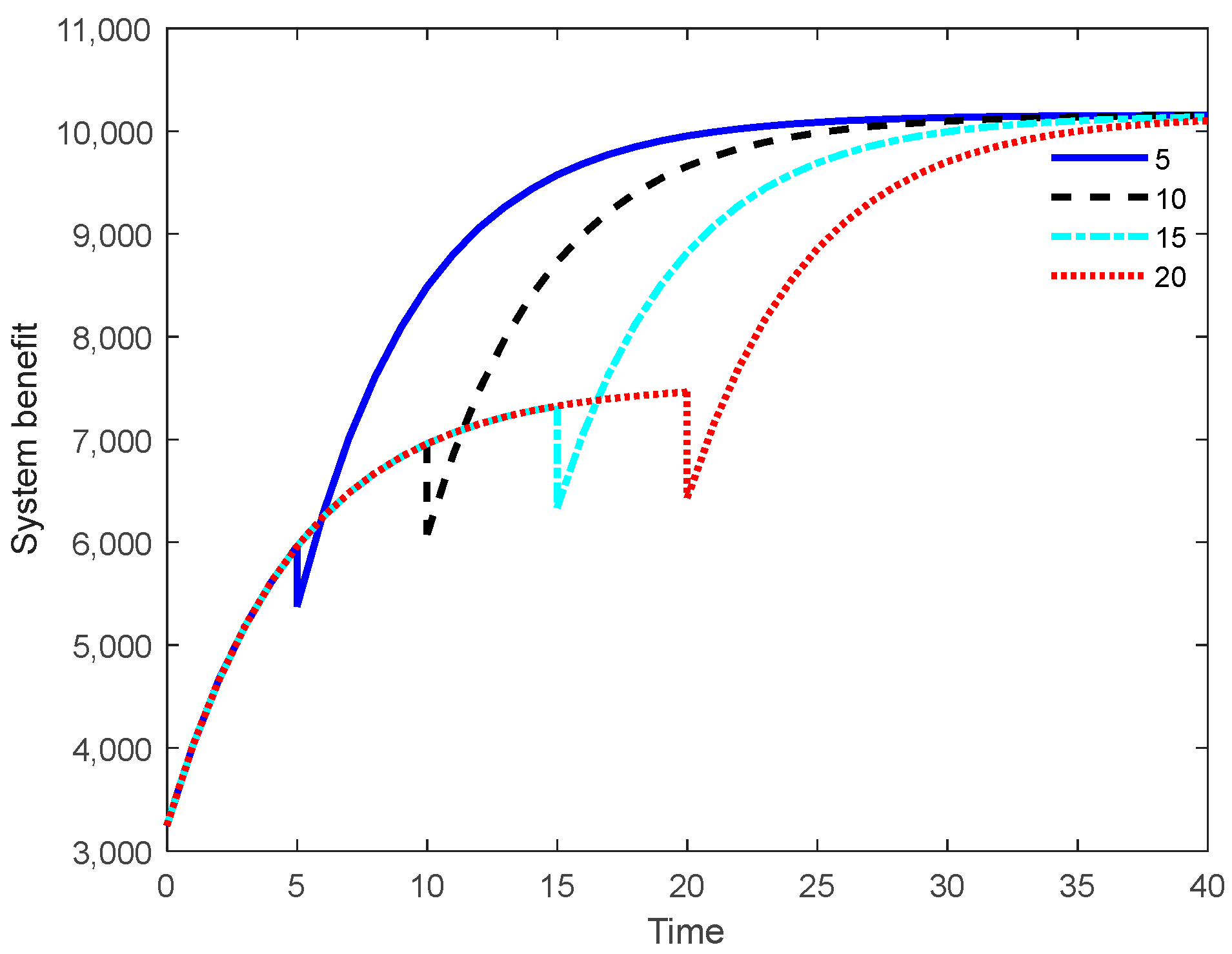

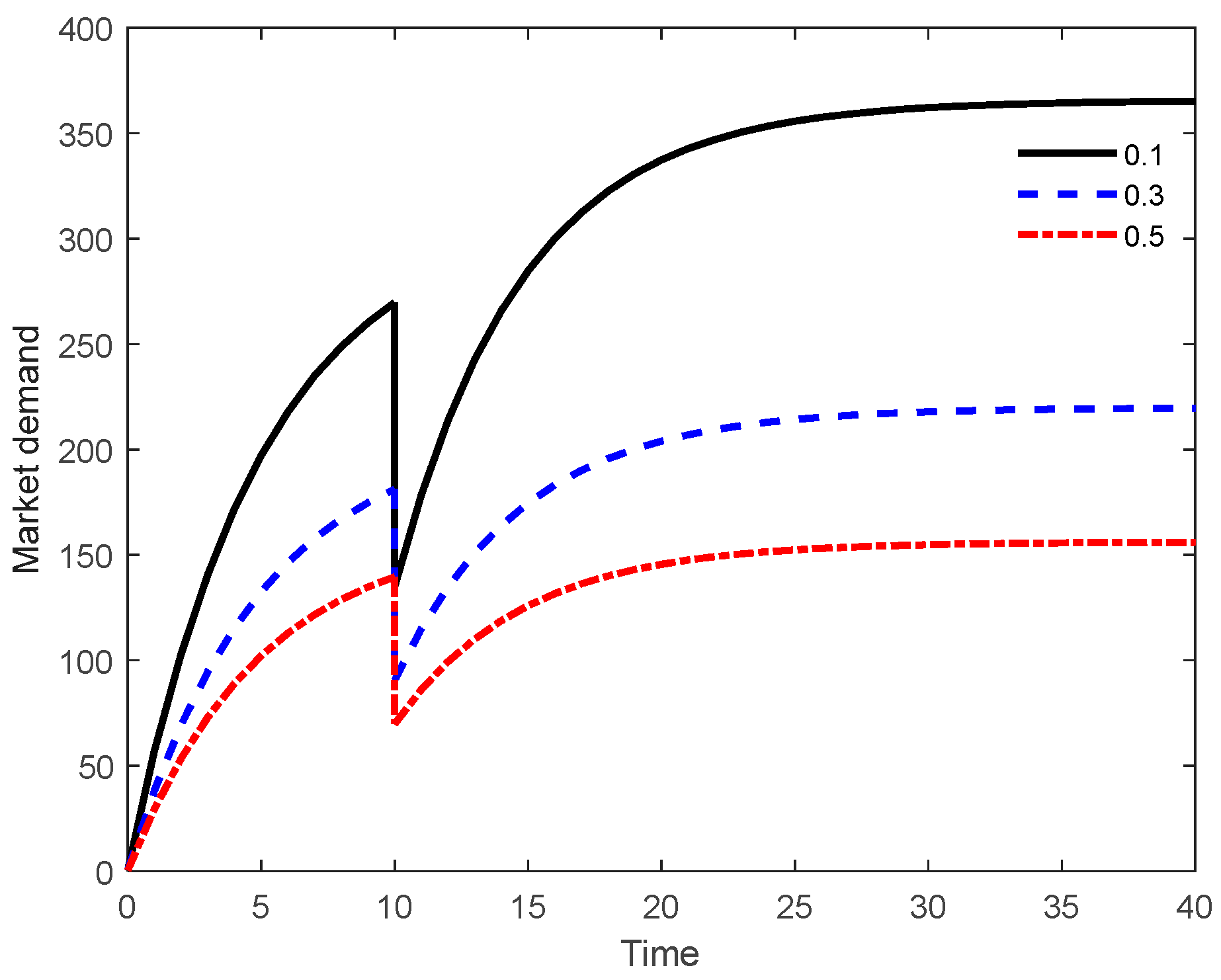

5.2.1. Effects on Market Demand and System Benefits

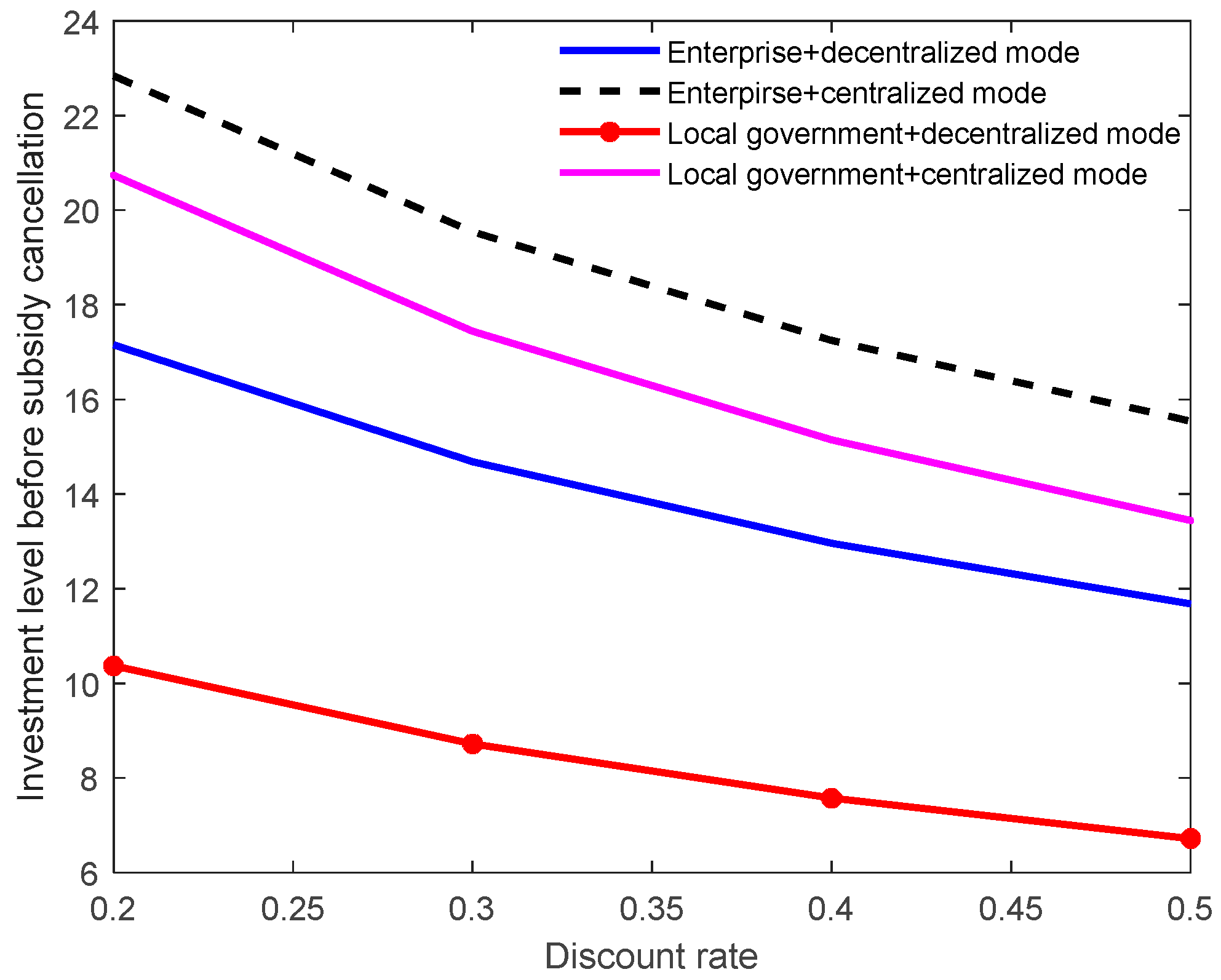

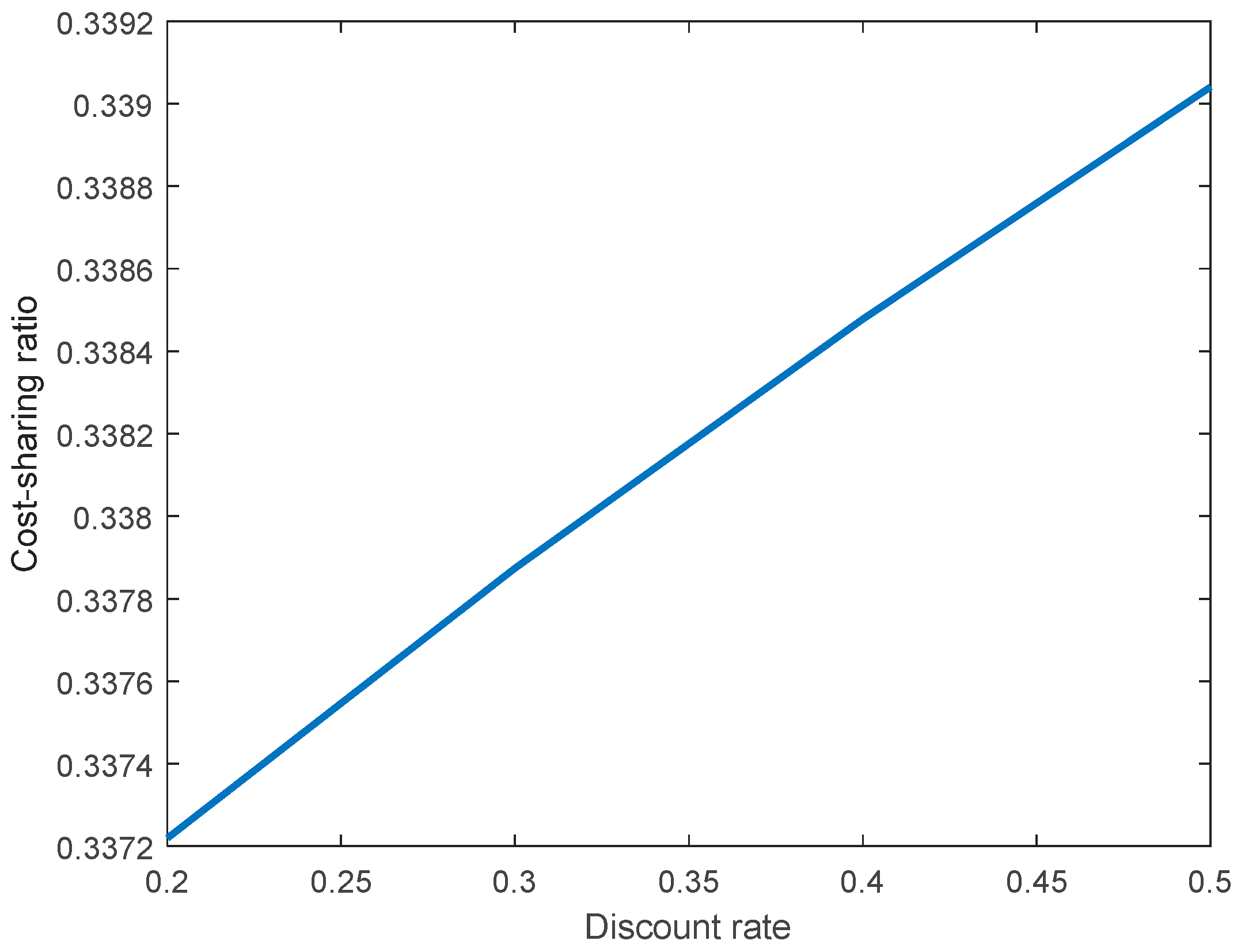

5.2.2. Effects on Optimal Strategies

6. Conclusions

- (1)

- In anticipation of the subsidy cancellation, both parties should formulate investment strategies for the stages before and after the cancellation, rather than for an infinite time horizon. In both modes, the investments, market demand, and system benefits are lower than they were before the cancellation. In order to face the fluctuations in market demand that would be caused by the cancellation, both parties should appropriately reduce their investments beforehand, then increase them afterward in order to maximize their benefits over both stages and promote the market demand, which could rebound due to the growing investments in the second stage. However, the market demand would be lower than it was before the cancellation.

- (2)

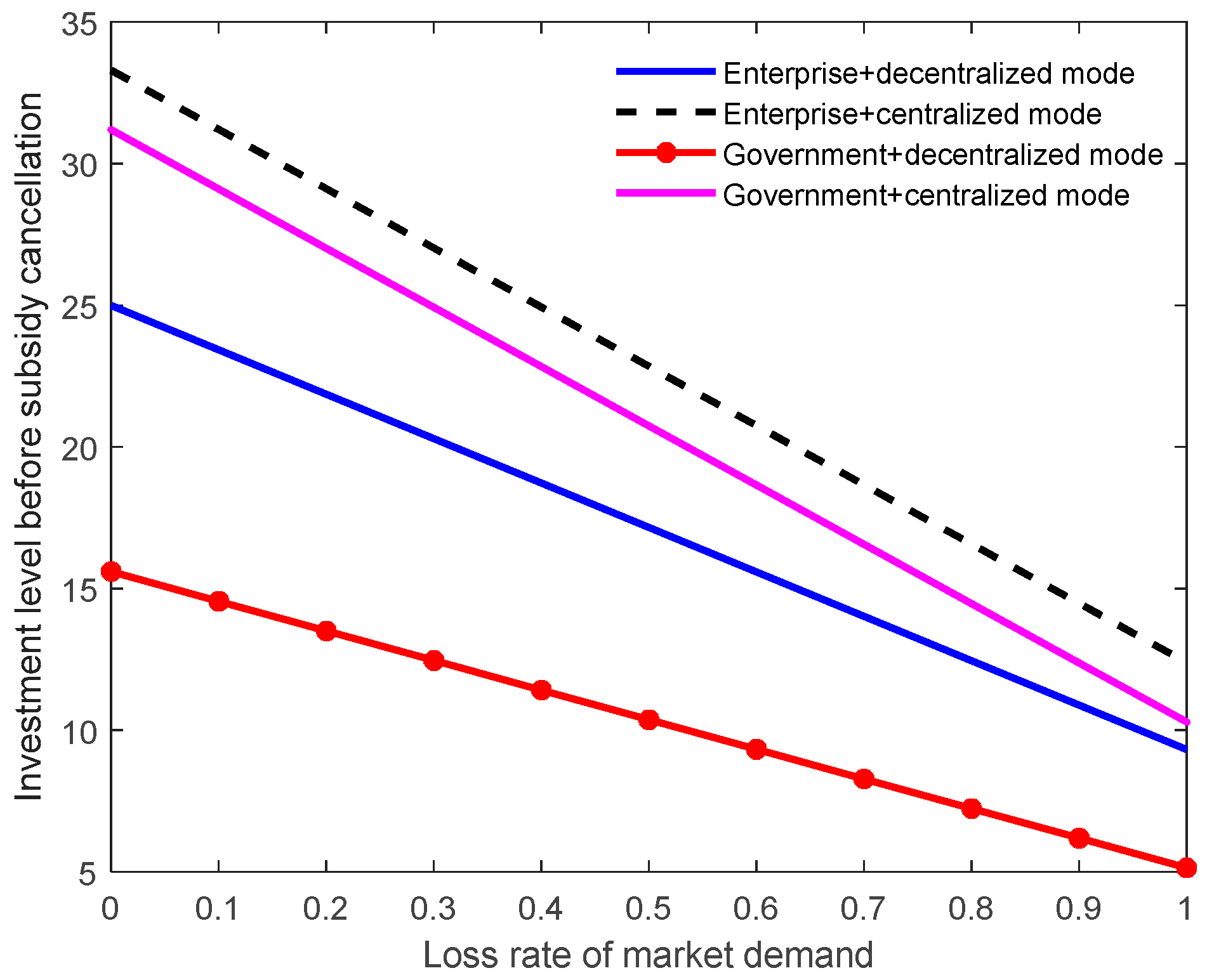

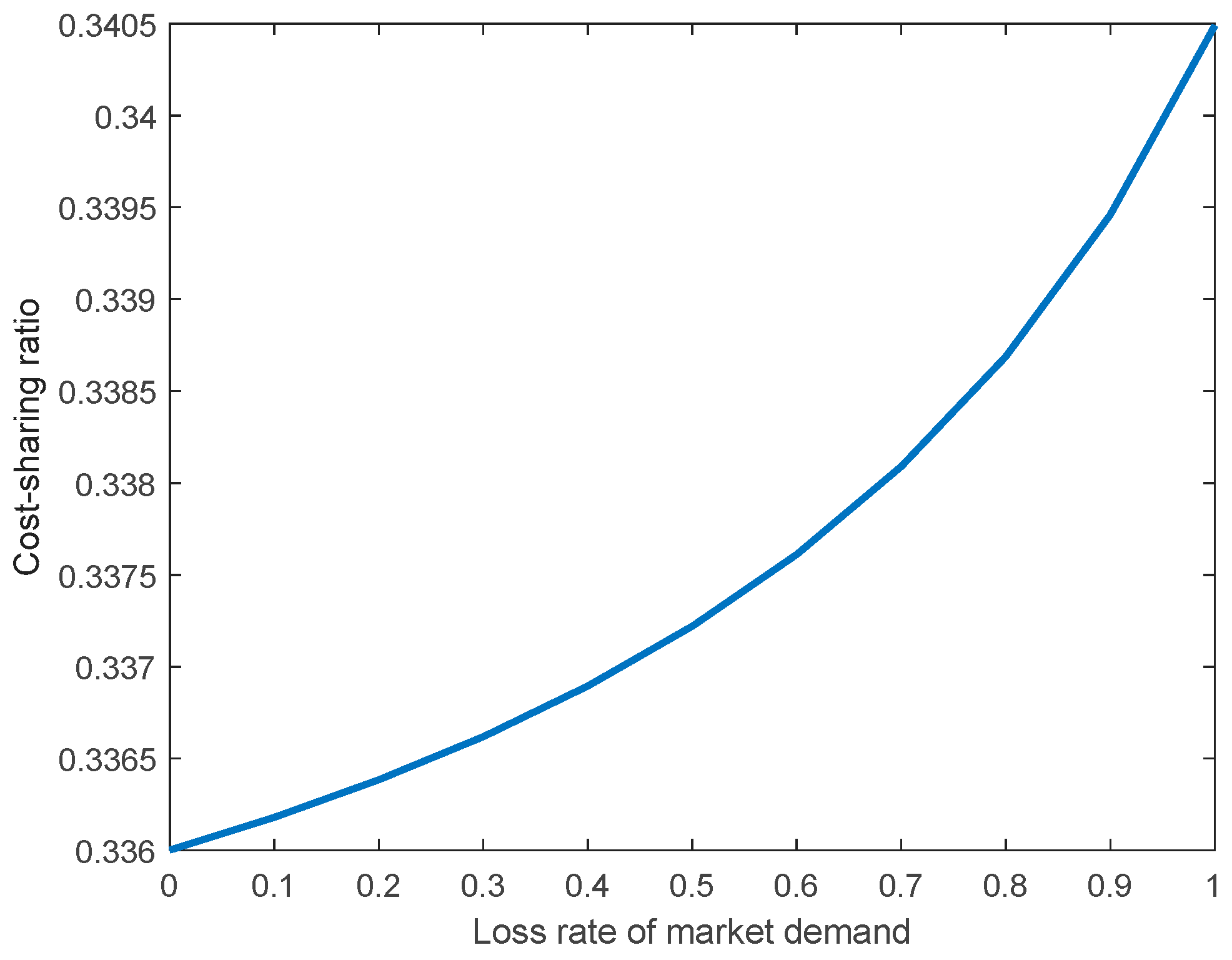

- The parameter sensitivity analysis implied that the occurrences of the subsidy cancellation would not affect the investment levels of either party before and after the cancellation, but would affect the loss of market demand and system benefits at about the time of the cancellation, as well as until the market demand and system benefits stabilize. The earlier the cancellation occurs, the sooner the market demand and system benefits could stabilize so that fewer benefits would be lost. The results also showed that higher discount rates lowered the market demand and system benefits. The loss rate of the market demand does not affect its level or the system benefits. As the discount rate increases, the investments of both parties nonlinearly diminish in the first stage, but the government’s cost-sharing ratio rises linearly. With the increasing loss rate of the market demand, the investment levels of both parties show linear downward trends, whereas the government’s cost-sharing ratio is a nonlinear upward parabolic curve.

- (3)

- A comparison of the results of both scenarios showed that whether the subsidy was canceled or not, the optimal investments, market demand, and benefits of both the local government and enterprises in the centralized game mode were superior to those in the decentralized game mode. Hence, the centralized mode can improve the investment levels and market demand of both parties while increasing the system’s benefits and achieving Pareto optimality.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Hao, H.; Ou, X.; Du, J.; Wang, H.; Ouyang, M. China’s Electric Vehicle Subsidy Scheme: Rationale and Impacts. Energy Policy 2014, 73, 722–732. [Google Scholar] [CrossRef]

- Zhang, X.; Liang, Y.; Yu, E.; Rao, R.; Xie, J. Review of Electric Vehicle Policies in China: Content summary and Effect Analysis. Renew. Sustain. Energy Rev. 2017, 70, 698–714. [Google Scholar] [CrossRef]

- Sheldon, T.L.; Dua, R. Effectiveness of China’s plug-in electric vehicle subsidy. Energy Econ. 2020, 88, 104773. [Google Scholar] [CrossRef]

- Available online: https://mp.weixin.qq.com/s/vXmIU_xExiGnKwNzmI_zAQ (accessed on 13 January 2022).

- Liu, Z.; Deng, Z.; He, G.; Wang, H.; Zhang, X.; Lin, J.; Qi, Y.; Liang, X. Challenges and Opportunities for Carbon Neutrality in China. Nat. Rev. Earth Environ. 2022, 3, 141–155. [Google Scholar] [CrossRef]

- Zhang, S.; Chen, W. Assessing the Energy Transition in China Towards Carbon Neutrality with a Probabilistic Framework. Nat. Commun. 2022, 13, 87. [Google Scholar] [CrossRef] [PubMed]

- Measures for Parallel Management of Average Fuel Consumption and New Energy Vehicle Credits of Passenger Vehicle Enterprises; Ministry of Industry and Information Technology: Beijing, China, 2017.

- Zhu, Q.; Wang, Y.; Tian, Y. Analysis of an Evolutionary Game between Local Governments and Manufacturing enterprises under Carbon Reduction Policies Based on System Dynamics. Oper. Res. Manag. Sci. 2014, 23, 71–82. [Google Scholar]

- Jiang, C.; Zhang, Y.; Li, W.; Wu, C. Evolutionary Game Study between Government Subsidy and R&D Activities of New Energy Vehicle Enterprises. Oper. Res. Manag. Sci. 2020, 29, 22–28. [Google Scholar]

- Ji, S.; Zhao, D.; Luo, R. Evolutionary Game Analysis on Local Governments and Manufacturers’ Behavioral Strategies: Impact of Phasing out Subsidies for New Energy Vehicles. Energy 2019, 189, 116064. [Google Scholar] [CrossRef]

- Chen, W.; Hu, Z. Using Evolutionary Game Theory to Study Governments and Manufacturers’ Behavioral Strategies under Various Carbon Taxes and Subsidies. J. Clean. Prod. 2018, 201, 123–141. [Google Scholar] [CrossRef]

- Tang, X.; Wu, J.; Feng, B.; Wei, X.; Mao, X.; Shao, W. Research on “Subsidy Defraud” of New Energy Vehicles Enterprises Based on Signal Game. Open J. Bus. Manag. 2019, 7, 1803–1814. [Google Scholar] [CrossRef]

- Pham, H. Continuous-time Stochastic Control and Optimization with Financial Applications; Springer: Berlin/Heidelberg, Germany, 2007. [Google Scholar]

- Rubel, O.; Naik, P.; Srinivasan, S. Optimal Advertising When Envisioning a Product-Harm Crisis. Mark. Sci. 2011, 30, 1048–1065. [Google Scholar] [CrossRef]

- Wang, W.; Ma, D.; Hu, J. Optimal Dynamic Advertising Strategies with Presence of Probable Product-Harm Crisis. Chin. J. Manag. Sci. 2022, 30, 204–215. [Google Scholar]

- Wang, W.; Hu, J. Dynamic Quality and Marketing Decisions with Envision of Brand Crisis in a Dual-channel Supply Chain. J. Syst. Manag. 2022, 31, 413–427. [Google Scholar]

- Hu, J.; Liu, Y.; Ma, D. Research on Food Supply Chain Dynamic Strategy Formulation and Coordination under the Prediction of Food Safety Crisis. Chin. J. Manag. Sci. 2021. [Google Scholar] [CrossRef]

- Mukherjee, A.; Chauhan, S.S. The Impact of Product Recall on Advertising Decisions and Firm Profit While Envisioning Crisis or Being Hazard Myopic. Eur. J. Oper. Res. 2021, 288, 953–970. [Google Scholar] [CrossRef]

- Rubel, O. Profiting from Product-harm Crises in Competitive Markets. Eur. J. Oper. Res. 2018, 265, 219–227. [Google Scholar] [CrossRef]

- Lu, L.; Navas, J. Advertising and Quality Improving Strategies in a Supply Chain When Facing Potential Crises. Eur. J. Oper. Res. 2020, 288, 839–851. [Google Scholar] [CrossRef]

- Sakamoto, H. Dynamic Resource Management under the Risk of Regime Shifts. J. Environ. Econ. Manag. 2014, 68, 1–19. [Google Scholar] [CrossRef]

- Kamien, M.I.; Schwartz, N.L. Dynamic Optimization: The Calculus of Variations and Optimal Control in Economics & Management; North Holland, Inc.: Amsterdam, The Netherlands, 1998. [Google Scholar]

- Bertsekas, D.P. Dynamic Programming and Optimal Control, 4th ed.; Athena Scientific: Massachusetts, MA, USA, 2017. [Google Scholar]

| Parameter | Value | Parameter | Value | Parameter | Value | Parameter | Value |

|---|---|---|---|---|---|---|---|

| 0.2 | 0.5 | 0.5 | 0.2 | ||||

| 1.1 | 1.2 | 1.1 | 1.0 | ||||

| 1.0 | 5.0 | 6.0 | 0.5 | ||||

| 0.6 | 6.0 | 5.0 | 6.0 | ||||

| 1.0 | 1.1 | 1.1 | 1.0 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, F.; Wang, L.; Xie, S. Effects of Subsidy Cancellations on Investment Strategies of Local Governments and New Energy Vehicle Manufacturers: A Study Based on Differential Game. Sustainability 2022, 14, 12324. https://doi.org/10.3390/su141912324

Liu F, Wang L, Xie S. Effects of Subsidy Cancellations on Investment Strategies of Local Governments and New Energy Vehicle Manufacturers: A Study Based on Differential Game. Sustainability. 2022; 14(19):12324. https://doi.org/10.3390/su141912324

Chicago/Turabian StyleLiu, Fangfang, Leyan Wang, and Shaobo Xie. 2022. "Effects of Subsidy Cancellations on Investment Strategies of Local Governments and New Energy Vehicle Manufacturers: A Study Based on Differential Game" Sustainability 14, no. 19: 12324. https://doi.org/10.3390/su141912324