Can ESG Ratings Stimulate Corporate Green Innovation? Evidence from China

Abstract

:1. Introduction

2. Literature Review and Hypothesis Development

2.1. Literature Review

2.2. Hypothesis Development

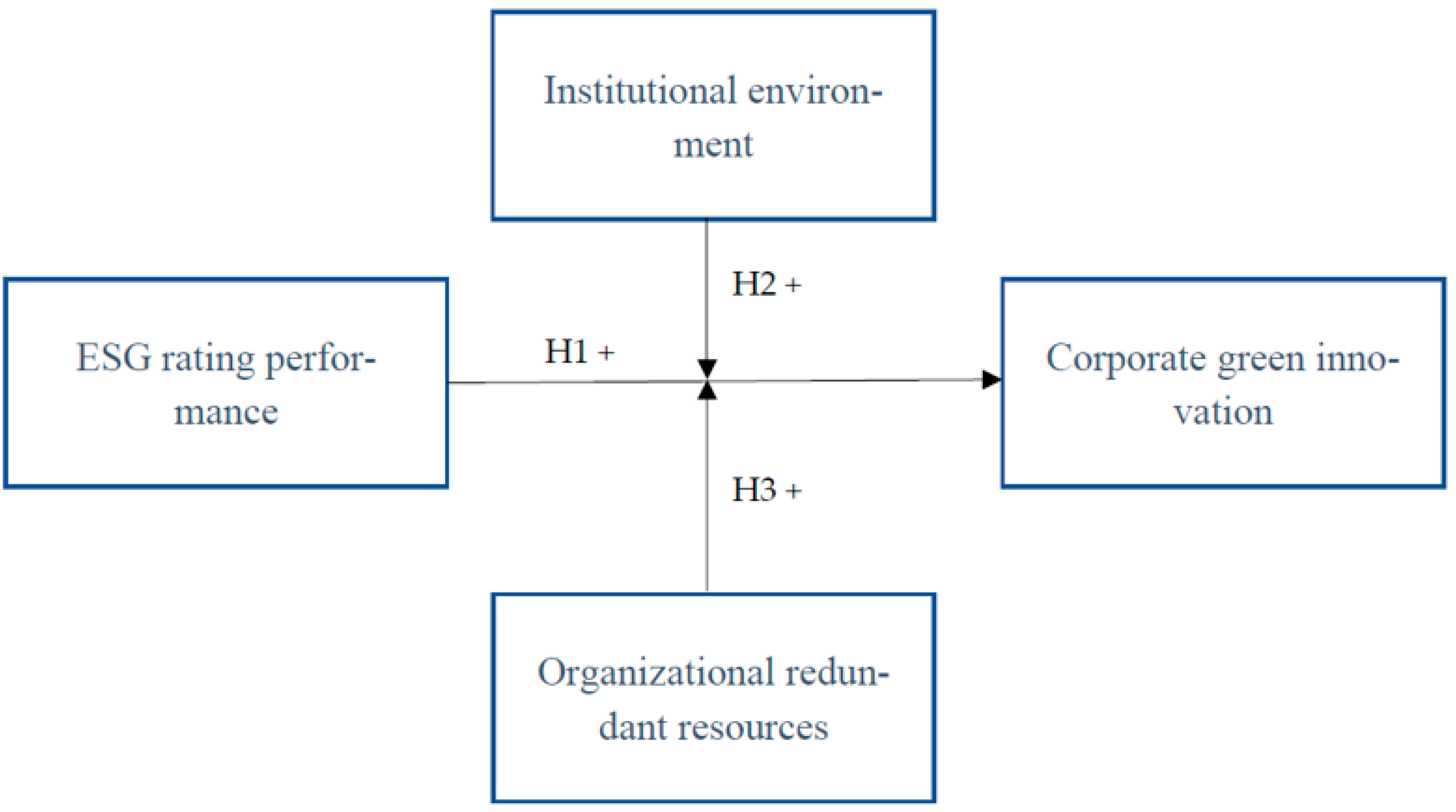

2.2.1. ESG and Corporate Green Innovation

2.2.2. Moderation Effect of Institutional Environment

2.2.3. Moderation Effect of Redundant Organizational Resources

3. Data and Methodology

3.1. Data and Samples

3.2. Variables Definition

3.2.1. Dependent Variable

3.2.2. Independent Variable

3.2.3. Moderation Variables

3.2.4. Control Variables

3.3. Models Establishment

4. Empirical Findings

4.1. Descriptive Statistics and Correlation Analysis

4.2. Multiple Regression Analysis

4.2.1. The Effect of ESG Ratings on Corporate Green Innovation

4.2.2. The Moderating Effect of Institutional Environment and Redundant Organizational Resources

4.3. Robustness Test

4.3.1. The Change of the Measurement Method of Corporate Green Innovation

4.3.2. The Change of the Measurement Method of Standard Errors

5. Conclusions and Discussion

5.1. Conclusions

5.2. Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Friedman, M. The social responsibility of business is to increase its profits. In Corporate Ethics and Corporate Governance; Springer: Berlin/Heidelberg, Germany, 2007; pp. 173–178. [Google Scholar]

- Hambrick, D.C.; Wowak, A.J. CEO sociopolitical activism: A stakeholder alignment model. Acad. Manag. Rev. 2021, 46, 33–59. [Google Scholar] [CrossRef]

- Nguyen, P.A.; Kecskes, A.; Mansi, S. Does corporate social responsibility create shareholder value? The importance of long-term investors. J. Bank. Financ. 2020, 112, 1–65. [Google Scholar] [CrossRef]

- Michelson, G.; Wailes, N.; Van Der Laan, S.; Frost, G. Ethical investment processes and outcomes. J. Bus. Ethics 2004, 52, 1–10. [Google Scholar] [CrossRef]

- Nekhili, M.; Boukadhaba, A.; Nagati, H.; Chtioui, T. ESG performance and market value: The moderating role of employee board representation. Int. J. Hum. Resour. Manag. 2021, 32, 3061–3087. [Google Scholar] [CrossRef]

- Cappucci, M. The ESG integration paradox. J. Appl. Corp. Financ. 2018, 30, 22–28. [Google Scholar] [CrossRef]

- Buallay, A. Is sustainability reporting (ESG) associated with performance? Evidence from the European banking sector. Manag. Environ. Qual. Int. J. 2019, 30, 98–115. [Google Scholar] [CrossRef]

- Humphrey, J.E.; Lee, D.D.; Shen, Y. The independent effects of environmental, social and governance initiatives on the performance of UK firms. Aust. J. Manag. 2012, 37, 135–151. [Google Scholar] [CrossRef]

- Ben Hmiden, O.; Rjiba, H.; Saadi, S. Competition through environmental CSR engagement and cost of equity capital. Financ. Res. Lett. 2022, 47, 102773. [Google Scholar] [CrossRef]

- Goss, A.; Roberts, G.S. The impact of corporate social responsibility on the cost of bank loans. J. Bank. Financ. 2011, 35, 1794–1810. [Google Scholar] [CrossRef]

- Ng, T.-H.; Lye, C.-T.; Chan, K.-H.; Lim, Y.-Z.; Lim, Y.-S. Sustainability in Asia: The roles of financial development in environmental, social and governance (ESG) performance. Soc. Indic. Res. 2020, 150, 17–44. [Google Scholar] [CrossRef]

- Albuquerque, R.; Koskinen, Y.; Zhang, C. Corporate social responsibility and firm risk: Theory and empirical evidence. Manag. Sci. 2019, 65, 4451–4469. [Google Scholar] [CrossRef]

- Lin, Y.; Fu, X.; Fu, X. Varieties in state capitalism and corporate innovation: Evidence from an emerging economy. J. Corp. Financ. 2021, 67, 101919. [Google Scholar] [CrossRef]

- Broadstock, D.C.; Chan, K.L.; Cheng, L.T.W.; Wang, X.W. The role of ESG performance during times of financial crisis: Evidence from COVID-19 in China. Financ. Res. Lett. 2021, 38, 101716. [Google Scholar] [CrossRef] [PubMed]

- Garvey, G.T.; Kazdin, J.; Nash, J.; LaFond, R.; Safa, H. A Pitfall in Ethical Investing: ESG Disclosures Reveal Vulnerabilities, Not Virtues. Not Virtues, 19 September 2016.

- Avetisyan, E.; Hockerts, K. The consolidation of the ESG rating industry as an enactment of institutional retrogression. Bus. Strat. Environ. 2017, 26, 316–330. [Google Scholar] [CrossRef]

- Entine, J. The myth of social investing: A critique of its practice and consequences for corporate social performance research. Organ. Environ. 2003, 16, 352–368. [Google Scholar] [CrossRef]

- Atan, R.; Razali, F.A.; Said, J.; Zainun, S. Environmental, social and governance (ESG) disclosure and its effect on firm’s performance: A comparative study. Int. J. Econ. Manag. 2016, 10, 355–375. [Google Scholar]

- Friede, G.; Busch, T.; Bassen, A. ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. Sustain. Financ. Investig. 2015, 5, 210–233. [Google Scholar] [CrossRef]

- Feng, J.; Goodell, J.W.; Shen, D. ESG rating and stock price crash risk: Evidence from China. Financ. Res. Lett. 2022, 46, 102476. [Google Scholar] [CrossRef]

- Eliwa, Y.; Aboud, A.; Saleh, A. ESG practices and the cost of debt: Evidence from EU countries. Crit. Perspect. Account. 2021, 79, 102097. [Google Scholar] [CrossRef]

- Jang, G.-Y.; Kang, H.-G.; Lee, J.-Y.; Bae, K. ESG scores and the credit market. Sustainability 2020, 12, 3456. [Google Scholar] [CrossRef]

- Zhang, F.; Qin, X.; Liu, L. The interaction effect between ESG and green innovation and its impact on firm value from the perspective of information disclosure. Sustainability 2020, 12, 1866. [Google Scholar] [CrossRef] [Green Version]

- Montiel, I.; Cuervo-Cazurra, A.; Park, J.; Antolín-López, R.; Husted, B.W. Implementing the United Nations’ sustainable development goals in international business. J. Int. Bus. Stud. 2021, 52, 999–1030. [Google Scholar] [CrossRef] [PubMed]

- Xu, L.; Fan, M.; Yang, L.; Shao, S. Heterogeneous green innovations and carbon emission performance: Evidence at China’s city level. Energy Econ. 2021, 99, 105269. [Google Scholar] [CrossRef]

- Huang, H.; Wang, F.; Song, M.; Balezentis, T.; Streimikiene, D. Green innovations for sustainable development of China: Analysis based on the nested spatial panel models. Technol. Soc. 2021, 65, 101593. [Google Scholar] [CrossRef]

- Lin, W.L.; Ho, J.A.; Sambasivan, M.; Yip, N.; Mohamed, A.B. Influence of green innovation strategy on brand value: The role of marketing capability and R&D intensity. Technol. Forecast. Soc. Chang. 2021, 171, 120946. [Google Scholar]

- Javeed, S.A.; Teh, B.H.; Ong, T.S.; Chong, L.L.; Abd Rahim, M.F.B.; Latief, R. How Does Green Innovation Strategy Influence Corporate Financing? Corporate Social Responsibility and Gender Diversity Play a Moderating Role. Int. J. Environ. Res. Public Health 2022, 19, 8724. [Google Scholar] [CrossRef]

- Aguilera-Caracuel, J.; Ortiz-de-Mandojana, N. Green innovation and financial performance: An institutional approach. Organ. Environ. 2013, 26, 365–385. [Google Scholar] [CrossRef]

- Yuan, B.; Cao, X. Do corporate social responsibility practices contribute to green innovation? The mediating role of green dynamic capability. Technol. Soc. 2022, 68, 101868. [Google Scholar] [CrossRef]

- Chu, Z.; Wang, L.; Lai, F. Customer pressure and green innovations at third party logistics providers in China: The moderation effect of organizational culture. Int. J. Logist. Manag. 2018, 30, 57–75. [Google Scholar] [CrossRef]

- Shahzad, M.; Qu, Y.; Zafar, A.U.; Appolloni, A. Does the interaction between the knowledge management process and sustainable development practices boost corporate green innovation? Bus. Strat. Environ. 2021, 30, 4206–4222. [Google Scholar] [CrossRef]

- Zhou, M.; Govindan, K.; Xie, X.; Yan, L. How to drive green innovation in China’s mining enterprises? Under the perspective of environmental legitimacy and green absorptive capacity. Resour. Policy 2021, 72, 102038. [Google Scholar] [CrossRef]

- Xia, L.; Gao, S.; Wei, J.; Ding, Q. Government subsidy and corporate green innovation-Does board governance play a role? Energy Policy 2022, 161, 112720. [Google Scholar] [CrossRef]

- Fang, Z.; Kong, X.; Sensoy, A.; Cui, X.; Cheng, F. Government’s awareness of environmental protection and corporate green innovation: A natural experiment from the new environmental protection law in China. Econ. Anal. Policy 2021, 70, 294–312. [Google Scholar] [CrossRef]

- Xiang, X.; Liu, C.; Yang, M. Who is financing corporate green innovation? Int. Rev. Econ. Financ. 2022, 78, 321–337. [Google Scholar] [CrossRef]

- Jiang, L.; Bai, Y. Strategic or substantive innovation?-The impact of institutional investors’ site visits on green innovation evidence from China. Technol. Soc. 2022, 68, 101904. [Google Scholar] [CrossRef]

- Tan, X.; Yan, Y.; Dong, Y. Peer effect in green credit induced green innovation: An empirical study from China’s Green Credit Guidelines. Resour. Policy 2022, 76, 102619. [Google Scholar] [CrossRef]

- Gillan, S.L.; Koch, A.; Starks, L.T. Firms and social responsibility: A review of ESG and CSR research in corporate finance. J. Corp. Financ. 2021, 66, 101889. [Google Scholar] [CrossRef]

- Bofinger, Y.; Heyden, K.J.; Rock, B. Corporate social responsibility and market efficiency: Evidence from ESG and misvaluation measures. J. Bank. Financ. 2022, 134, 106322. [Google Scholar] [CrossRef]

- Nekhili, M.; Boukadhaba, A.; Nagati, H. The ESG–financial performance relationship: Does the type of employee board representation matter? Corp. Gov. Int. Rev. 2021, 29, 134–161. [Google Scholar] [CrossRef]

- Chen, Z.; Xie, G. ESG disclosure and financial performance: Moderating role of ESG investors. Int. Rev. Financ. Anal. 2022, 83, 102291. [Google Scholar] [CrossRef]

- Tang, H. The Effect of ESG Performance on Corporate Innovation in China: The Mediating Role of Financial Constraints and Agency Cost. Sustainability 2022, 14, 3769. [Google Scholar] [CrossRef]

- Zhou, G.; Liu, L.; Luo, S. Sustainable development, ESG performance and company market value: Mediating effect of financial performance. Bus. Strategy Environ. 2022. [Google Scholar] [CrossRef]

- Barko, T.; Cremers, M.; Renneboog, L. Shareholder engagement on environmental, social, and governance performance. J. Bus. Ethics 2021, 180, 1–36. [Google Scholar] [CrossRef]

- Wong, J.B.; Zhang, Q. Stock market reactions to adverse ESG disclosure via media channels. Br. Account. Rev. 2022, 54, 101045. [Google Scholar] [CrossRef]

- Zhang, Q.; Loh, L.; Wu, W. How do environmental, social and governance initiatives affect innovative performance for corporate sustainability? Sustainability 2020, 12, 3380. [Google Scholar] [CrossRef]

- Flammer, C. Does product market competition foster corporate social responsibility? Evidence from trade liberalization. Strateg. Manag. J. 2015, 36, 1469–1485. [Google Scholar] [CrossRef]

- Li, T.-T.; Wang, K.; Sueyoshi, T.; Wang, D.D. ESG: Research progress and future prospects. Sustainability 2021, 13, 11663. [Google Scholar] [CrossRef]

- Wang, H.M.D. Corporate social performance and financial-based brand equity. J. Prod. Brand Manag. 2010, 19, 335–345. [Google Scholar] [CrossRef]

- Cohen, S.; Kadach, I.; Ormazabal, G.; Reichelstein, S. Executive Compensation Tied to ESG Performance: International Evidence; Finance Working Paper; European Corporate Governance Institute: Brussels, Belgium, 2022. [Google Scholar]

- Schuler, D.A.; Cording, M. A corporate social performance–corporate financial performance behavioral model for consumers. Acad. Manag. Rev. 2006, 31, 540–558. [Google Scholar] [CrossRef]

- Drempetic, S.; Klein, C.; Zwergel, B. The influence of firm size on the ESG score: Corporate sustainability ratings under review. J. Bus. Ethics 2020, 167, 333–360. [Google Scholar] [CrossRef]

- Dorobantu, S.; Kaul, A.; Zelner, B. Nonmarket strategy research through the lens of new institutional economics: An integrative review and future directions. Strateg. Manag. J. 2017, 38, 114–140. [Google Scholar] [CrossRef]

- Ciszewska-Mlinarič, M.; Trąpczyński, P. Foreign market adaptation and performance: The role of institutional distance and organizational capabilities. Sustainability 2019, 11, 1793. [Google Scholar] [CrossRef] [Green Version]

- Pfeffer, J.; Salancik, G.R. The External Control of Organizations: A Resource Dependence Perspective; Stanford University Press: New York, NY, USA, 2003. [Google Scholar]

- Rathert, N. Strategies of legitimation: MNEs and the adoption of CSR in response to host-country institutions. J. Int. Bus. Stud. 2016, 47, 858–879. [Google Scholar] [CrossRef]

- Matthiesen, M.L.; Salzmann, A.J. Corporate social responsibility and firms’ cost of equity: How does culture matter? Cross. Cult. Strateg. Manag. 2017, 24, 105–124. [Google Scholar] [CrossRef]

- Colwell, S.R.; Joshi, A.W. Corporate ecological responsiveness: Antecedent effects of institutional pressure and top management commitment and their impact on organizational performance. Bus. Strateg. Environ. 2013, 22, 73–91. [Google Scholar] [CrossRef]

- Chu, Z.; Xu, J.; Lai, F.; Collins, B.J. Institutional theory and environmental pressures: The moderating effect of market uncertainty on innovation and firm performance. IEEE Trans. Eng. Manag. 2018, 65, 392–403. [Google Scholar] [CrossRef]

- DiMaggio, P.J.; Powell, W.W. The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. Am. Soc. Rev. 1983, 48, 147–160. [Google Scholar] [CrossRef]

- Abrahamson, E.; Rosenkopf, L. Institutional and competitive bandwagons: Using mathematical modeling as a tool to explore innovation diffusion. Acad. Manag. Rev. 1993, 18, 487–517. [Google Scholar] [CrossRef]

- Zhu, Q.; Geng, Y. Drivers and barriers of extended supply chain practices for energy saving and emission reduction among Chinese manufacturers. J. Clean. Prod. 2013, 40, 6–12. [Google Scholar] [CrossRef]

- Zhang, Y.; Wei, Y.; Zhou, G. Promoting firms’ energy-saving behavior: The role of institutional pressures, top management support and financial slack. Energy Policy 2018, 115, 230–238. [Google Scholar] [CrossRef]

- Yang, H.; Lee, M.; Park, S. The impact of institutional pressures on green supply chain management and firm performance: Top management roles and social capital. Sustainability 2017, 9, 764. [Google Scholar]

- Rahdari, A.; Sheehy, B.; Khan, H.Z.; Braendle, U.; Rexhepi, G.; Sepasi, S. Exploring global retailers’ corporate social responsibility performance. Heliyon 2020, 6, E04644. [Google Scholar] [CrossRef] [PubMed]

- Tan, Y.; Zhu, Z. The effect of ESG rating events on corporate green innovation in China: The mediating role of financial constraints and managers’ environmental awareness. Technol. Soc. 2022, 68, 101906. [Google Scholar] [CrossRef]

- Bourgeois, L.J., III. On the measurement of organizational slack. Acad. Manag. Rev. 1981, 6, 29–39. [Google Scholar] [CrossRef]

- Yun, L.; Yao, X.; Zhu, W.; Zhang, Z. Evaluating the Effect of Redundant Resources on Corporate Entrepreneurial Performance. Sustainability 2022, 14, 7101. [Google Scholar] [CrossRef]

- Gruber, M. Exploring the origins of organizational paths: Empirical evidence from newly founded firms. J. Manag. 2010, 36, 1143–1167. [Google Scholar] [CrossRef]

- Hoskisson, R.E.; Chirico, F.; Zyung, J.; Gambeta, E. Managerial risk taking: A multitheoretical review and future research agenda. J. Manag. 2017, 43, 137–169. [Google Scholar] [CrossRef]

- Audia, P.G.; Greve, H.R. Less likely to fail: Low performance, firm size, and factory expansion in the shipbuilding industry. Manag. Sci. 2006, 52, 83–94. [Google Scholar] [CrossRef]

- Ko, Y.J.; O’Neill, H.; Xie, X. Strategic intent as a contingency of the relationship between external knowledge and firm innovation. Technovation 2021, 104, 102260. [Google Scholar] [CrossRef]

- Brockman, P.; Unlu, E. Dividend policy, creditor rights, and the agency costs of debt. J. Financ. Econ. 2009, 92, 276–299. [Google Scholar] [CrossRef]

- Kim, C.; Bettis, R.A. Cash is surprisingly valuable as a strategic asset. Strateg. Manag. J. 2014, 35, 2053–2063. [Google Scholar] [CrossRef]

- Driscoll, J.C.; Kraay, A.C. Consistent covariance matrix estimation with spatially dependent panel data. Rev. Econ. Stat. 1998, 80, 549–560. [Google Scholar] [CrossRef]

- Chouaibi, S.; Chouaibi, J.; Rossi, M. ESG and corporate financial performance: The mediating role of green innovation: UK common law versus Germany civil law. Eur. Med. J. Bus. 2021, 17, 46–71. [Google Scholar] [CrossRef]

- Cohen, L.; Gurun, U.G.; Nguyen, Q.H. The ESG-Innovation Disconnect: Evidence from Green Patenting; National Bureau of Economic Research: Cambridge, MA, USA, 2020. [Google Scholar]

| Author | Journal Titles | Drivers of GI | Outcomes of GI | Moderating Variables | Mediating Variables |

|---|---|---|---|---|---|

| Research literature on the outcomes of green innovation (GI) | |||||

| Xu et al. (2021) [25] | Energy Economics | carbon emission performance | energy consumption structure effect, industrial structure effect, urbanization effect, and foreign direct investment (FDI) effect | ||

| Huang et al. (2021) [26] | Technology in Society | sustainable development | marketization, local government competition | ||

| Lin et al. (2021) [27] | Technological Forecasting and Social Change | brand value | marketing capability and R&D intensity | ||

| Javeed et al. (2022) [28] | International Journal of Environmental Research and Public Health | Corporate Financing | Corporate Social Responsibility and Gender Diversity | ||

| Aguilera-Caracuel and Ortiz-de-Mandojana (2013) [29] | Organization and Environment | Financial performance | national institutional conditions | ||

| Research literature on influencing factors of green innovation (GI) | |||||

| Yuan and Cao (2022) [30] | Technology in Society | corporate social responsibility practices | green dynamic capability | ||

| Chu et al. (2018) [31] | The International Journal of Logistics Management | Customer pressure | organizational culture | ||

| Shahzad et al. (2021) [32] | Business Strategy and the Environment | knowledge management process | sustainable development practices | ||

| Zhou et al. (2021) [33] | Resources Policy | environmental legitimacy | green absorptive capacity | Senior management cognition and green strategic orientation | |

| Xia et al. (2022) [34] | Energy Policy | Government subsidy | board diversity and independent directors | ||

| Fang et al. (2021) [35] | Economic Analysis and Policy | Government’s awareness of environmental protection | information disclosure | ||

| Xiang et al. (2022) [36] | International Review of Economics and Finance | Internal and external financing | debt financing and equity financing. | ||

| Jiang and Bai (2022) [37] | Technology in Society | institutional investors’ site visits | Firm size | CEO duality or low-competitive market environment. | |

| Tan et al. (2022) [38] | Resources Policy | green credit policy | financing constraint or the fiercer the industrial competition and degree of marketization | ||

| Research on the outcomes of ESG | |||||

| Author | Journal | Outcomes of ESG | Moderating Variables | Mediating Variables | |

| Gillan et al. (2021) [39] | Journal of Corporate Finance | Corporate Social Responsibility | Institutional investor ownership | ||

| Bofinger et al. (2022) [40] | Journal of Banking and Finance | Market efficiency | market sentiment toward sustainability | ||

| Nekhili et al. (2021) [41] | Corporate Governance: An International Review | financial performance | employee board representation | ||

| Chen and Xie (2022) [42] | International Review of Financial Analysis | financial performance | ESG investors | ||

| Tang (2022) [43] | Sustainability | corporate Innovation | Financial Constraints and Agency Cost | ||

| Zhou, Liu, and Luo (2022) [44] | Business Strategy and the Environment | company market value | financial performance | ||

| Variables | Description | |

|---|---|---|

| Dependent Variable | Green innovation. | We applied the natural logarithm of the sum of the total number of applications of green innovation patents and utility patents plus 1 to measure corporate green innovation (GRInno). We classified the application of green innovation patents as exploratory green innovation (GRInva) and the application of utility patents as exploitative green innovation (GRUma). |

| Independent Variable | ESG rating | All listed companies were rated by the China Securities ESG rating score |

| Moderation Variables | Institutional Environment | the degree of marketization is often used as its proxy variable |

| Redundant Organizational Resources | The cash ratio was adopted to determine the redundant organizational resources given their importance in firms′ green innovation, in reference to the research of Kim and Bettis (2014). Specifically, cash ratio = (Cash + marketable securities)/current liabilities) | |

| Control Variables | Size | The natural logarithm of the total assets |

| Age | The number of years that the firm has been established. | |

| Top1 | Percentage of shares held by the largest shareholder | |

| ROA | Net profit divided by average total assets | |

| Lev | The total liabilities divided by the total assets | |

| Board | The natural logarithm of the number of directors on the board | |

| Inde | The number of independent directors divided by the total number of all directors. | |

| Dualiy | Whether the chairman and the general manager are the same people |

| Variables | Mean | SD | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. GRInno | 0.445 | 0.852 | 1 | |||||||||||||

| 2. GRInva | 0.301 | 0.678 | 0.928 *** | 1 | ||||||||||||

| 3. GRUma | 0.269 | 0.619 | 0.881 *** | 0.694 *** | 1 | |||||||||||

| 4. ESG | 4.070 | 1.054 | 0.159 *** | 0.155 *** | 0.131 *** | 1 | ||||||||||

| 5. InEnv | 8.150 | 1.934 | 0.105 *** | 0.101 *** | 0.085 *** | 0.070 *** | 1 | |||||||||

| 6. OrRes | 0.968 | 1.698 | −0.066 *** | −0.055 *** | −0.075 *** | 0.074 *** | −0.013 ** | 1 | ||||||||

| 7. Size | 22.025 | 1.246 | 0.237 *** | 0.246 *** | 0.218 *** | 0.151 *** | 0.001 | −0.287 *** | 1 | |||||||

| 8. Age | 2.792 | 0.355 | −0.016 ** | 0.005 | −0.026 *** | −0.065 *** | 0.113 *** | −0.196 *** | 0.175 *** | 1 | ||||||

| 9. Top1 | 0.369 | 0.149 | 0.018 *** | 0.007 | 0.036 *** | 0.104 *** | 0.021 *** | 0.066 *** | 0.119 *** | −0.170 *** | 1 | |||||

| 10. Roa | 0.039 | 0.061 | 0.041 *** | 0.043 *** | 0.025 *** | 0.230 *** | 0.054 *** | 0.205 *** | −0.011 * | −0.107 *** | 0.175 *** | 1 | ||||

| 11. Lev | 0.415 | 0.206 | 0.093 *** | 0.088 *** | 0.105 *** | −0.110 *** | −0.115 *** | −0.544 *** | 0.489 *** | 0.176 *** | −0.043 *** | −0.377 *** | 1 | |||

| 12. Board | 2.251 | 0.177 | 0.049 *** | 0.053 *** | 0.045 *** | 0.029 *** | −0.142 *** | −0.075 *** | 0.269 *** | 0.020 *** | −0.013 ** | 0.013 ** | 0.166 *** | 1 | ||

| 13. Inde | 0.374 | 0.053 | 0.009 | 0.010 | 0.010 * | 0.071 *** | 0.043 *** | 0.012 ** | 0.003 | −0.017 *** | 0.054 *** | −0.019 *** | −0.017 *** | −0.516 *** | 1 | |

| 14. Dualiy | 0.274 | 0.446 | 0.006 | 0.003 | 0.001 | −0.009 | 0.147 *** | 0.103 *** | −0.187 *** | −0.083 *** | −0.00700 | 0.045 *** | −0.158 *** | −0.185 *** | 0.114 *** | 1 |

| (1) | (2) | (3) | |

|---|---|---|---|

| GRInno | GRInva | GRUma | |

| ESG | 0.019 *** | 0.017 *** | 0.011 *** |

| (3.789) | (4.247) | (2.968) | |

| Size | 0.046 *** | 0.043 *** | 0.026 *** |

| (4.405) | (4.968) | (3.158) | |

| Age | 0.118 * | 0.116 ** | 0.055 |

| (1.806) | (2.153) | (1.071) | |

| Top1 | −0.075 | −0.012 | −0.070 |

| (−1.199) | (−0.237) | (−1.438) | |

| Roa | 0.519 *** | 0.306 *** | 0.380 *** |

| (5.679) | (4.063) | (5.338) | |

| Lev | 0.121 *** | 0.101 *** | 0.068 ** |

| (2.938) | (2.988) | (2.139) | |

| Board | 0.015 | 0.016 | −0.018 |

| (0.327) | (0.406) | (−0.490) | |

| Inde | −0.069 | −0.037 | −0.070 |

| (−0.540) | (−0.350) | (−0.701) | |

| Dualiy | 0.002 | −0.005 | 0.002 |

| (0.160) | (−0.430) | (0.176) | |

| Constant | −1.000 *** | −1.081 *** | −0.433 * |

| (−3.247) | (−4.262) | (−1.804) | |

| Industry FE | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| N | 21,616 | 21,616 | 21,616 |

| Adj.R2 | 0.692 | 0.673 | 0.643 |

| (1) | (2) | (3) | |

|---|---|---|---|

| GRInno | GRInno | GRInno | |

| ESG | 0.019 *** | 0.018 *** | 0.019 *** |

| (3.939) | (3.647) | (3.799) | |

| InEnv | −0.004 | −0.004 | |

| (−0.360) | (−0.390) | ||

| ESG × InEnv | 0.009 *** | 0.009 *** | |

| (3.819) | (3.790) | ||

| OrRes | 0.001 | 0.001 | |

| (0.449) | (0.461) | ||

| ESG × OrRes | 0.067 ** | 0.066 ** | |

| (2.140) | (2.092) | ||

| Size | 0.046*** | 0.045 *** | 0.046 *** |

| (4.447) | (4.337) | (4.380) | |

| Age | 0.113 * | 0.116 * | 0.112 * |

| (1.732) | (1.765) | (1.695) | |

| Top1 | −0.079 | −0.075 | −0.079 |

| (−1.265) | (−1.198) | (−1.264) | |

| Roa | 0.520 *** | 0.518 *** | 0.519 *** |

| (5.690) | (5.667) | (5.679) | |

| Lev | 0.118 *** | 0.129 *** | 0.126 *** |

| (2.881) | (2.923) | (2.875) | |

| Board | 0.014 | 0.017 | 0.015 |

| (0.289) | (0.365) | (0.327) | |

| Inde | −0.058 | −0.069 | −0.058 |

| (−0.452) | (−0.537) | (−0.450) | |

| Dualiy | 0.002 | 0.002 | 0.002 |

| (0.122) | (0.157) | (0.119) | |

| Constant | −1.261 *** | −1.265 *** | −1.248 *** |

| (−3.004) | (−2.993) | (−2.958) | |

| Industry FE | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| N | 21,616 | 21,616 | 21,616 |

| Adj.R2 | 0.692 | 0.692 | 0.692 |

| (1) | (2) | (3) | (4) | |

| GRInva | GRUma | GRInva | GRUma | |

| ESG | 0.018 *** | 0.012 *** | 0.017 *** | 0.011 *** |

| (4.421) | (3.097) | (4.118) | (2.796) | |

| InEnv | 0.002 | −0.002 | ||

| (0.189) | (−0.191) | |||

| ESG × InEnv | 0.009 *** | 0.006 *** | ||

| (4.315) | (3.248) | |||

| OrRes | 0.004 | 0.002 | ||

| (1.491) | (0.666) | |||

| ESG × OrRes | 0.065 *** | 0.064 *** | ||

| (2.653) | (2.605) | |||

| Size | 0.043 *** | 0.026 *** | 0.042 *** | 0.025 *** |

| (5.009) | (3.192) | (4.887) | (3.073) | |

| Age | 0.111 ** | 0.051 | 0.123 ** | 0.054 |

| (2.068) | (1.007) | (2.272) | (1.045) | |

| Top1 | −0.016 | −0.073 | −0.015 | −0.070 |

| (−0.305) | (−1.493) | (−0.286) | (−1.442) | |

| Roa | 0.306 *** | 0.381 *** | 0.308 *** | 0.380 *** |

| (4.071) | (5.346) | (4.096) | (5.328) | |

| Lev | 0.098 *** | 0.067 ** | 0.121 *** | 0.078 ** |

| (2.907) | (2.087) | (3.336) | (2.260) | |

| Board | 0.014 | −0.019 | 0.017 | −0.016 |

| (0.367) | (−0.522) | (0.436) | (−0.442) | |

| Inde | −0.026 | −0.063 | −0.034 | −0.070 |

| (−0.244) | (−0.625) | (−0.319) | (−0.695) | |

| Dualiy | −0.005 | 0.001 | −0.005 | 0.002 |

| (−0.478) | (0.143) | (−0.480) | (0.168) | |

| Constant | −1.004 *** | −0.383 | −1.027 *** | −0.376 |

| (−3.953) | (−1.593) | (−4.029) | (−1.559) | |

| Industry FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| N | 21616 | 21616 | 21616 | 21616 |

| Adj.R2 | 0.674 | 0.644 | 0.673 | 0.644 |

| (1) | (2) | (3) | |

|---|---|---|---|

| GRInno | GRInno | GRInno | |

| ESG | 0.019 *** | 0.018 *** | 0.019 *** |

| (3.279) | (3.078) | (3.173) | |

| InEnv | −0.004 | −0.004 | |

| (−0.254) | (−0.275) | ||

| ESG × InEnv | 0.009 *** | 0.009 *** | |

| (3.341) | (3.321) | ||

| OrRes | (0.421) | (0.433) | |

| 0.067 * | 0.066 * | ||

| ESG × OrRes | (1.909) | (1.879) | |

| (0.421) | (0.433) | ||

| Size | 0.046 *** | 0.045 *** | 0.046 *** |

| (2.928) | (2.862) | (2.893) | |

| Age | 0.113 | 0.116 | 0.112 |

| (1.062) | (1.078) | (1.037) | |

| Top1 | −0.079 | −0.075 | −0.079 |

| (−0.877) | (−0.830) | (−0.877) | |

| Roa | 0.520 *** | 0.518 *** | 0.519 *** |

| (5.053) | (5.031) | (5.040) | |

| Lev | 0.118 ** | 0.129 ** | 0.126 ** |

| (2.325) | (2.374) | (2.339) | |

| Board | 0.014 | 0.017 | 0.015 |

| (0.223) | (0.282) | (0.253) | |

| Inde | −0.058 | −0.069 | −0.058 |

| (−0.347) | (−0.412) | (−0.345) | |

| Dualiy | 0.002 | 0.002 | 0.002 |

| (0.102) | (0.130) | (0.099) | |

| Constant | −1.007 ** | −1.000 ** | −0.998 ** |

| (−2.110) | (−2.078) | (−2.079) | |

| Industry FE | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| N | 21616 | 21616 | 21616 |

| Adj.R2 | 0.043 | 0.042 | 0.043 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, H.; Lyu, C. Can ESG Ratings Stimulate Corporate Green Innovation? Evidence from China. Sustainability 2022, 14, 12516. https://doi.org/10.3390/su141912516

Liu H, Lyu C. Can ESG Ratings Stimulate Corporate Green Innovation? Evidence from China. Sustainability. 2022; 14(19):12516. https://doi.org/10.3390/su141912516

Chicago/Turabian StyleLiu, Heying, and Chan Lyu. 2022. "Can ESG Ratings Stimulate Corporate Green Innovation? Evidence from China" Sustainability 14, no. 19: 12516. https://doi.org/10.3390/su141912516