Cohesion of Agricultural Crowdfunding Risk Prevention under Sustainable Development Based on Gray–Rough Set and FAHP-TOPSIS

Abstract

:1. Introduction

2. Literature Review

2.1. Agriculture and Agricultural Crowdfunding under Sustainable Development

2.2. Risk Prevention in Agricultural Crowdfunding

2.3. Evaluation of Risk Prevention Cohesion

3. Methods

3.1. GCA-RS

- 1.

- Create the scoring matrix X

- 2.

- Construct the association matrix E

- 3.

- F-statistic to determine the optimal threshold

- 4.

- Rough Set Indicator Simplification

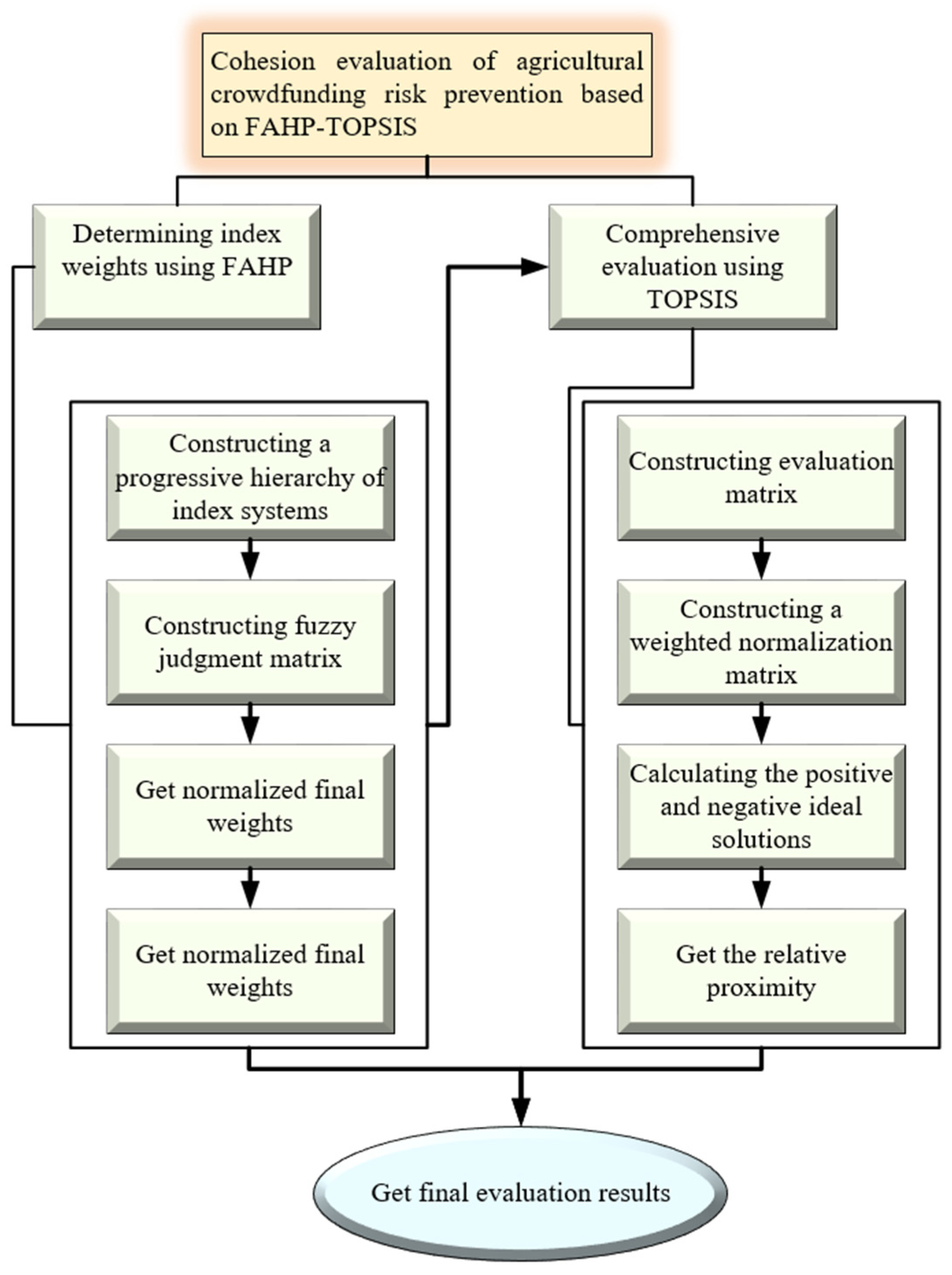

3.2. FAHP-TOPSIS

- FAHP not only has the advantages of quantitative and objective AHP, but also has the inclusiveness of FCE (Fuzzy Comprehensive Evaluation Method). It is more objective compared with FUCOM, SWARA, etc., and can handle the problem of attribute weighting without correlation compared with BWM. Therefore, FAHP is more applicable.

- TOPSIS can accurately reflect the gap between evaluation programs. It is more conducive to managers’ decision making compared to VIKOR. Based on the fact that the indicators constructed in this paper are not independent of each other, TOPSIS is more suitable than MABAC for this paper. MAIRCA is used more for disaster risk assessment. Therefore, TOPSIS has better applicability.

- 5.

- Construct the integrated triangular fuzzy judgment matrix for each layer

- 6.

- Calculate the total weight

- 7.

- Build TOPSIS matrix

- 8.

- Calculate the relative proximity of each evaluation object

4. The Construction of a Cohesive Evaluation Index System for Agricultural Crowdfunding Risk Prevention Based on GCA-RS

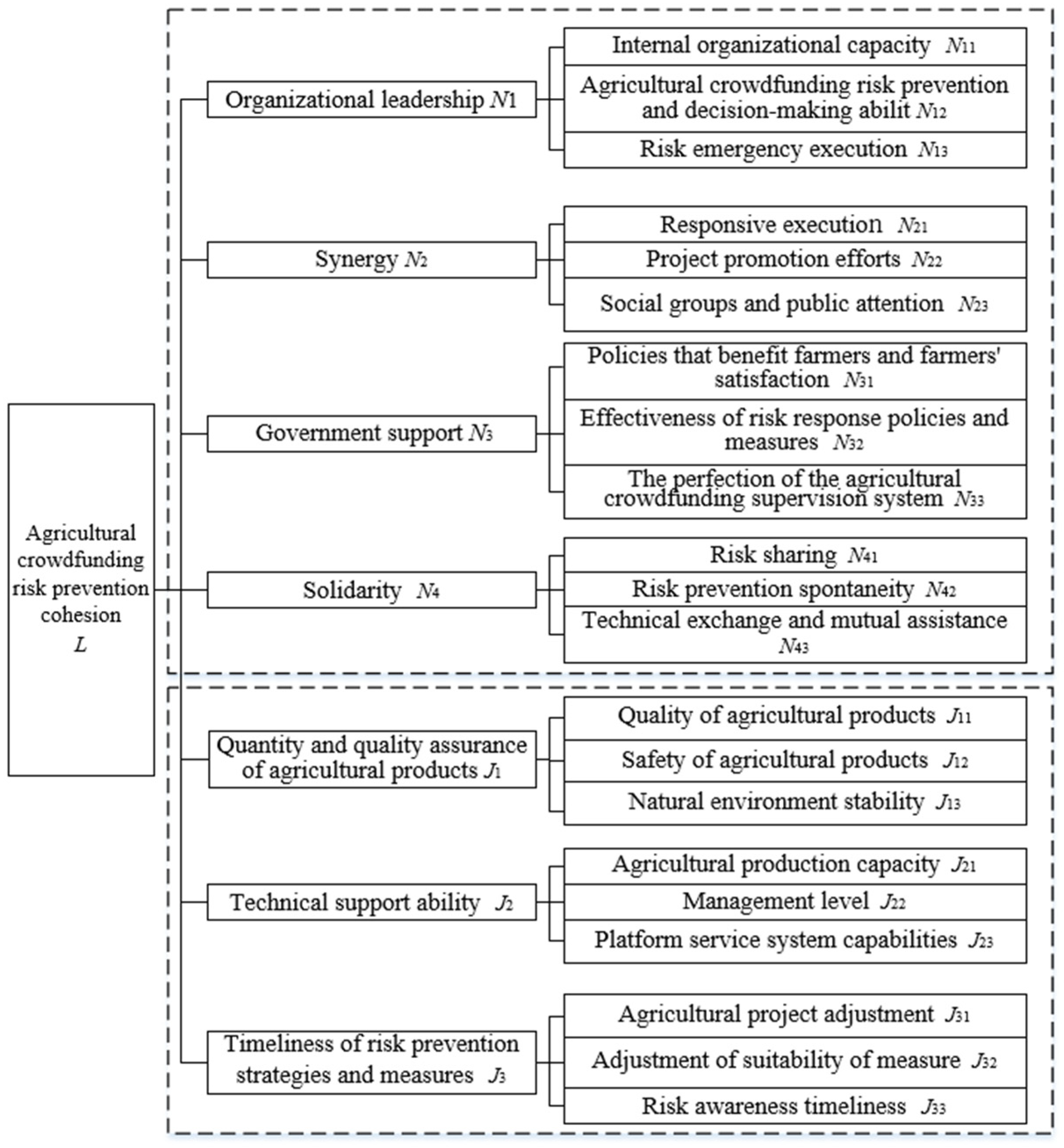

4.1. Define Risk Prevention Cohesion in Agricultural Crowdfunding

4.2. Pre-Selected Indicators of Agricultural Crowdfunding Risk Prevention Cohesion

4.3. Determination of Cohesion Evaluation Index System Based on GCA-RS

- 9.

- Score Matrix X

- 10.

- Correlation matrix E

- 11.

- Best Threshold

- 12.

- Rough set index reduction

5. Cohesion Evaluation of Agricultural Crowdfunding Risk Prevention and Comparative Analysis of Models

5.1. Cohesion Evaluation of Agricultural Crowdfunding Risk Prevention Based on FAHP-TOPSIS

- 13.

- Comprehensive triangular fuzzy judgment matrix and

- 14.

- Total Weight

- 15.

- TOPSIS Matrix Z

- 16.

- The relative proximity of each evaluation object

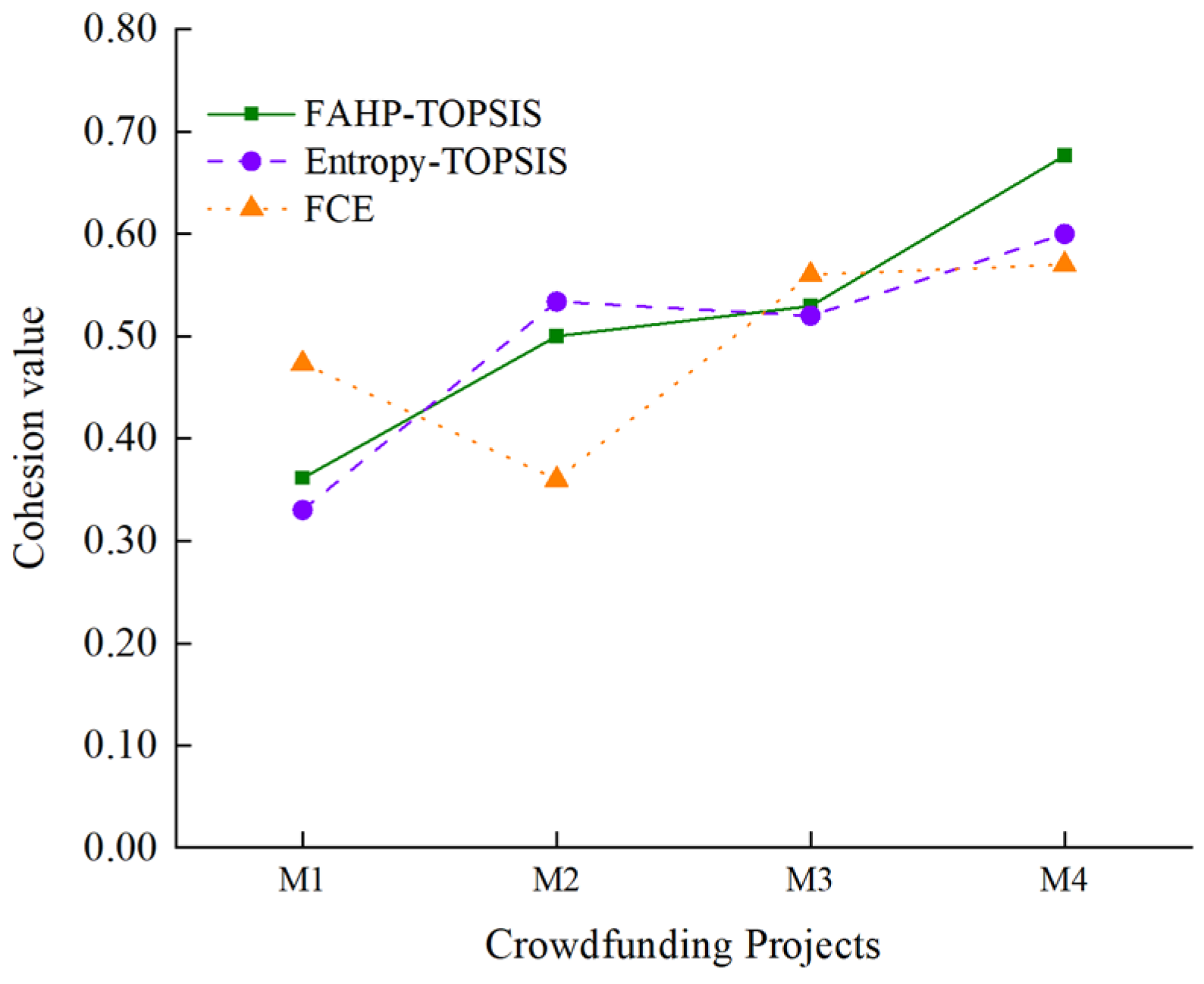

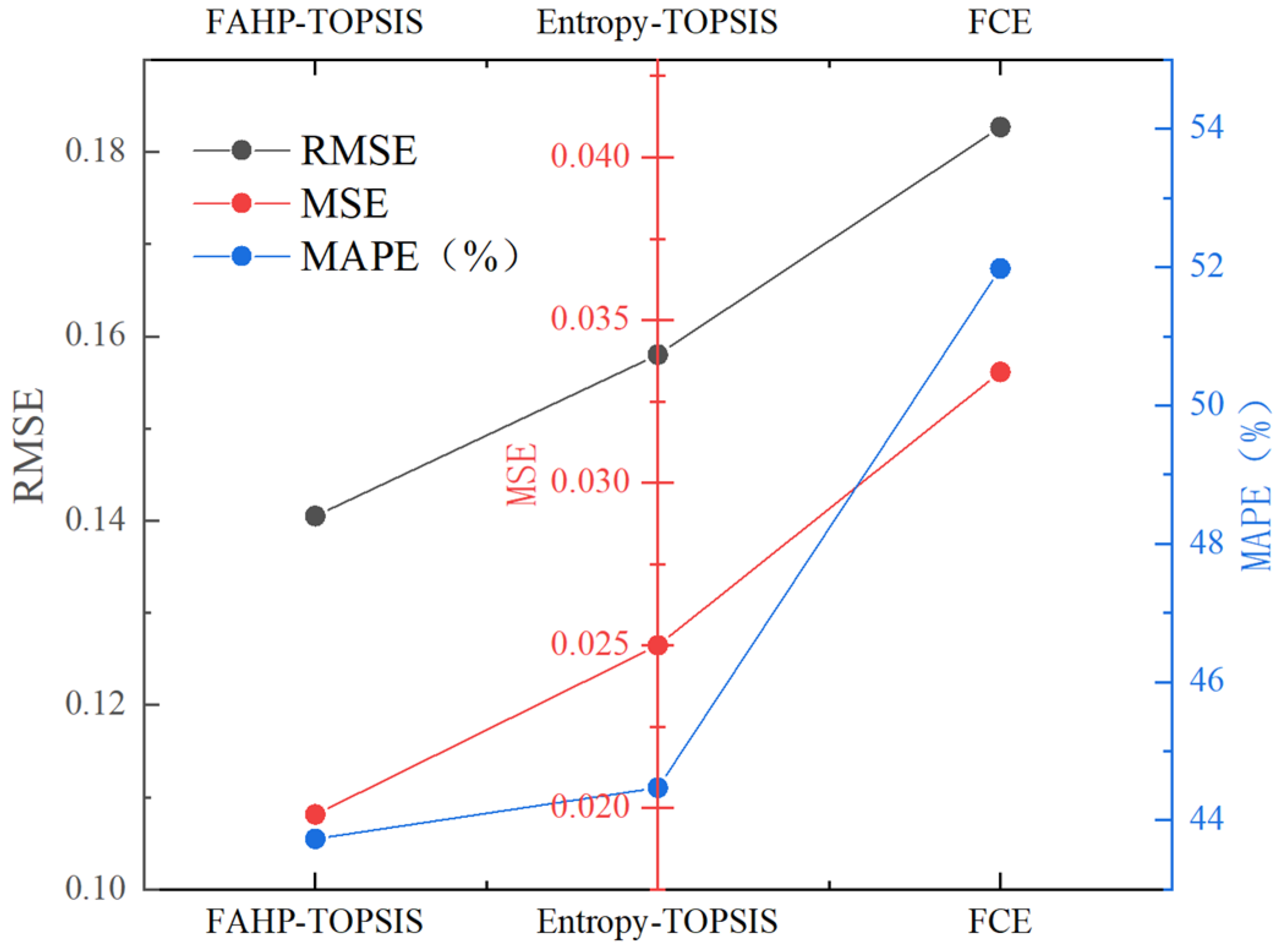

5.2. Comparative Analysis of Model Evaluation Results

6. Analysis of Influencing Factors of Agricultural Crowdfunding Risk Prevention Cohesion

6.1. Analysis of Influencing Factors of Concentration

6.2. Analysis of Factors Affecting Aggregation

7. Conclusions and Discussion

- Strengthen coordination and cooperation capacity and solidify the working basis of consensus building. First, it is clear that the goal of improving internal organizational capabilities is to enhance risk prevention and decision-making capacity. Improve the quality inspection and certification system for agricultural products, credit evaluation systems, and other related systems to improve the success rate of risk prevention. The department should increase the publicity and promotion of agricultural crowdfunding projects, improve the public’s understanding and participation in agricultural crowdfunding, and effectively use agricultural crowdfunding to provide agricultural financing and marketing services for farmers and agricultural enterprises. Finally, agricultural insurance can be taken out to provide protection against capital losses caused by natural disasters and market risks. For example, in 2018, the Internet agricultural insurance platform “Yimi Agricultural Insurance” was launched, which has greatly promoted the development of agricultural crowdfunding.

- Promulgate relevant support policies, improve relevant laws and regulations, and provide institutional guarantees. In recent years, the government has been regulating rural financial operations, including agricultural crowdfunding. It is also necessary to strengthen the supervision of crowdfunding platforms. On the one hand, the government continues to improve the agricultural crowdfunding policy support system, improve the agricultural crowdfunding supervision system, clarify the supervisory body and division of labor, strengthen the review, improve the access conditions, reduce the legal risks of the agricultural crowdfunding industry, and enhance the overall quality of agricultural crowdfunding; on the other hand, the government establishes a fund supervision system to enhance the trust of the three parties and improve the information sharing of the platform to create a good investment and financing environment for the initiators and investors of agricultural crowdfunding projects.

- Integrate existing resources, develop special advantageous industries, and promote technological innovation. First, the promoters should continuously innovate management methods, develop characteristic advantageous industries, and improve operational efficiency. In addition, crowdfunding platforms should accelerate the development of system service informatization and intelligence, such as the introduction of blockchain technology. Cultivate new industries and models of modern agricultural crowdfunding, and absorb professional talent to provide support for the development of agricultural crowdfunding-related technologies.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Qiao, Y.F. The realization logic and construction path of agricultural crowdfunding to promote green development. South. Financ. 2020, 8, 71–80. [Google Scholar]

- Opinions of the Central Committee of the Communist Party of China and the State Council on Establishing and Improving the Institutional Mechanism and Policy System for Urban-Rural Integrated Development. Available online: http://env.people.com.cn/n1/2021/0602/c1010-32120414.html (accessed on 2 June 2021).

- Wo, F.F. The current situation and promotion path of agricultural crowdfunding development under the background of “Internet+”. Henan Agric. 2021, 14, 4–5. [Google Scholar]

- Yuan, Y. The concept, types and characteristics of crowdfunding in China. Hebei J. 2016, 2, 133–137. [Google Scholar]

- Yuan, Y.X. Thinking about fresh food e-commerce business model innovation in the epidemic period. Coop. Econ. Technol. 2022, 7, 102–103. [Google Scholar]

- Lăzăroiu, G.; Andronie, M.; Uţă, C.; Hurloiu, I. Trust Management in Organic Agriculture: Sustainable Consumption Behavior, Environmentally Conscious Purchase Intention, and Healthy Food Choices. Front. Public Health 2019, 7, 340. [Google Scholar] [CrossRef] [PubMed]

- Wang, A.Q. Opportunities and challenges of agricultural crowdfunding in the context of “Internet+”—Take “everyone’s seed” network as an example. E-commerce 2015, 9, 42–43,79. [Google Scholar]

- Shi, Y.J.; Qiu, F.; Kuai, Q.M. Focus on agricultural crowdfunding: Effects, dilemmas and promotion strategies. Rural. Financ. Res. 2017, 5, 68–72. [Google Scholar]

- Sun, Y.; Gou, T.L. Analysis of the successful project demonstration factors of Internet agricultural crowdfunding—Take the agricultural crowdfunding platform of “everyone’s seed” as an example. J. Beijing Agric. Coll. 2017, 4, 89–92. [Google Scholar]

- Song, S.M. Research on the dilemma and development path of agricultural crowdfunding in China. Agric. Econ. 2019, 12, 97–98. [Google Scholar]

- Yang, S.; Zhang, J.H. Current situation and development path of agricultural crowdfunding in China. Agric. Outlook 2018, 11, 29–34. [Google Scholar]

- Liao, X.; Juan, G.G.; Liao, C.H. Agricultural crowdfunding financing: The current development and future in China and the United States. Foreign Econ. Trade Pract. 2015, 10, 23–26. [Google Scholar]

- Zhao, S.J. Strategies and methods of sustainable development of agricultural economy. Agric. Mach. Use Maint. 2022, 7, 82–84. [Google Scholar]

- Lv, H.J. Sustainable development of agricultural economy in the new economic environment and suggestions. Shanxi Agric. Econ. 2021, 13, 45–46. [Google Scholar]

- Wang, Y. Analysis of agricultural economic development problems and countermeasures under the perspective of sustainable development. Shanxi Agric. Econ. 2021, 18, 60–61. [Google Scholar]

- Li, H.; Zhang, G.P. Analysis of the development of agricultural crowdfunding in China in the context of rural revitalization. Chin. Foreign Enterp. Cult. 2020, 9, 47–48. [Google Scholar]

- Liu, J.; Yuan, R.F.; Yang, W.J. Deflation and alienation of functions: A true picture of the development of agricultural crowdfunding in China. Hubei Agric. Sci. 2019, 5, 108–113. [Google Scholar]

- Cui, Y.W.; Guo, L.F.; Dai, H.; Ma, J.Q. Research on the construction of agricultural crowdfunding risk prevention mechanism from the perspective of “Internet +”. North. Hortic. 2019, 2, 186–190. [Google Scholar]

- Ji, X.D.; Xue, Y.; Xue, C.Y. Risk factors analysis of equity agricultural crowdfunding from the perspective of investors—Based on AHP-DEMATEL model. Mod. Manag. 2020, 40, 105–109. [Google Scholar]

- He, L.; Li, H. Agricultural crowdfunding risk prevention and case studies: A case study of Beijing. Sci. Innov. 2018, 6, 59–65. [Google Scholar]

- Zhou, Y.Y.; Shi, H.Y. Research on the risks and countermeasures of agricultural crowdfunding in my country. Reform. Strategy 2017, 9, 108–110,118. [Google Scholar]

- Zhang, Y.; Hou, Q.L. “Blockchain + agricultural crowdfunding”: Innovation, risk and legal regulation. J. Huazhong Agric. Univ. (Soc. Sci. Ed.) 2021, 2, 1–9. [Google Scholar]

- Gao, H.; Jv, R. Analysis on the status and development countermeasure of China’s agricultural crowdfunding platform. E-Commer. Lett. 2020, 9, 79–87. [Google Scholar] [CrossRef]

- Shi, P.J.; Wang, M.; Hu, X.B.; Ye, T. A cohesive model of social-ecosystem comprehensive risk prevention. Acta Geogr. Sin. 2014, 69, 863–876. [Google Scholar]

- Wang, X. Cohesion—A “new way of thinking” for the exploration of integrated disaster risk prevention. China Disaster Reduct. 2020, 21, 32–33. [Google Scholar]

- Wang, J.A.; Shang, Y.R.; Wu, Y.Y.; Zhou, H.J. Integrated risk prevention for regional agricultural drought: From vulnerability, resilience, adaptation to cohesion. J. Hebei Norm. Univ. (Nat. Sci. Ed.) 2021, 4, 400–409. [Google Scholar]

- Jiang, Y.; Wu, Y.Y.; Guo, H.; Zhang, G.M.; Wang, J.A. Research on cohesion of integrated risk prevention in agricultural drought. J. Hebei Norm. Univ. (Nat. Sci. Ed.) 2021, 4, 410–417. [Google Scholar]

- Wu, Y.Y.; Jiang, Y.; Guo, H.; Wang, J.A. A quantitative study on the consensus of multiple subjects for comprehensive risk prevention in agricultural drought—A case study of Dingcheng District, Hunan. J. Geogr. 2021, 7, 1778–1791. [Google Scholar]

- Hu, X.B.; Shi, P.J.; Wang, M.; Ye, T.; Leeson, M.S. Cohesion—A new property to describe and measure the resistance of social-ecological systems to disturbance. China Sci. Inf. Sci. 2014, 11, 1467–1481. [Google Scholar]

- Wu, Y.Y.; Guo, H.; Wang, Y.; Wang, J.A. Progress and prospects of cohesive research on integrated disaster risk prevention. Disaster Sci. 2018, 4, 217–222. [Google Scholar]

- Yang, D.G.; Zhou, Z.T.; Song, Y.Y.; Zhang, G.W.; Yang, G.L. Research on national cohesion evaluation of major countries in the world. Bull. Chin. Acad. Sci. 2016, 31, 1215–1223. [Google Scholar]

- Yang, J.; Liu, S.S.; Wang, Z.Q.; Wang, J.; Li, H.J. Research on the evaluation index of college campus network based on network cultural cohesion. J. Southwest Univ. (Soc. Sci. Ed.) 2016, 42, 47–54. [Google Scholar]

- Xie, J.J.; Liu, C.P. Fuzzy Mathematical Methods and Applications; Huazhong University of Science and Technology Press: Wuhan, China, 2005. [Google Scholar]

- Zdzisław, P. Rough sets and intelligent data analysis. Inf. Sci. 2002, 147, 1–12. [Google Scholar]

- Du, J.H. Research on evaluation index screening method based on grey rough sets. J. North Univ. China (Nat. Sci. Ed.) 2012, 33, 559–562. [Google Scholar]

- Xue, F.; Hu, P.; Li, Q.Q. Construction of high-speed railway operation statistical index system based on grey-rough sets. Syst. Eng. 2021, 39, 115–125. [Google Scholar]

- Lu, Y.F.; Li, L.L.; Zhang, Z. Index screening method based on grey rough sets. Fire Control. Command. Control 2018, 43, 37–42. [Google Scholar]

- Zhang, J.; Yan, Z.H.; Liang, H.X. Construction and empirical analysis of social entrepreneurship performance evaluation system based on FAHP. Sci. Technol. Manag. Res. 2013, 290, 254–258. [Google Scholar]

- Riaz, M.; Farid, H.M.A. Picture fuzzy aggregation approach with application to third-party logistic provider selection process. Rep. Mech. Eng. 2022, 1, 318–327. [Google Scholar] [CrossRef]

- He, X.Y. Research on credit evaluation model of scientific and technological project evaluation experts based on TOPSIS. Sci. Technol. Manag. Res. 2020, 445, 32–38. [Google Scholar]

- Petrovic, I.; Kankaras, M. A hybridized IT2FS-DEMATEL-AHP-TOPSIS multicriteria decision making approach: Case study of selection and evaluation of criteria for determination of air traffic control radar position. Decis. Mak. Appl. Manag. Eng. 2020, 3, 146–164. [Google Scholar] [CrossRef]

- Duan, J.L. Evaluation of service-oriented enterprise suppliers based on FAHP-TOPSIS. J. Chongqing Technol. Bus. Univ. (Nat. Sci. Ed.) 2020, 37, 52–58. [Google Scholar]

- Pamučar, D.; Stević, Ž.; Sremac, S. A new model for determining weight coefficients of criteria in MCDM models: Full consistency method (FUCOM). Symmetry 2018, 10, 393. [Google Scholar] [CrossRef] [Green Version]

- Ayyildiz, E.; Yildiz, A.; Taskin Gumus, A.; Ozkan, C. An integrated methodology using extended swara and dea for the performance analysis of wastewater treatment plants: Turkey case. Environ. Manag. 2021, 67, 449–467. [Google Scholar] [CrossRef] [PubMed]

- Rezaei, J. Best-worst multi-criteria decision-making method. Omega 2015, 53, 49–57. [Google Scholar] [CrossRef]

- Dong, H.; Li, F.Y. Sustainable supplier selection based on R-DEMATEL-MABAC method. J. Zhejiang Univ. Technol. 2022, 4, 393–400. [Google Scholar]

- Liu, S.Q.; Yu, J.X.; Chen, H.C.; Han, F.; Wu, S.B.; Fan, H.Z. Methodology for fire and explosion risk assessment of FPSO. Ship Eng. 2021, 6, 135–142. [Google Scholar]

- Wu, S.S.; Tian, S.C.; Yuan, M.; Ma, R.S.; Lin, H.Y. Research on intelligent evaluation of coal mines based on subjective and objective assignment VIKOR method. Min. Res. Dev. 2021, 4, 165–169. [Google Scholar]

- Whewell, W. The Philosophy of the Inductive Sciences; Johnson Reprint Corp.: New York, NY, USA, 1847. [Google Scholar]

- Feng, J.T. Risk control and prevention of agricultural crowdfunding. Banker 2016, 7, 99–101. [Google Scholar]

- Huang, X.L.; Zhang, X.L.; Liu, F.X. Discussion on the advantages, risks and development countermeasures of agricultural crowdfunding. Fujian J. Agric. Sci. 2015, 30, 914–918. [Google Scholar]

- Nie, L.; Yu, Z.H. Research on legal risk prevention of agricultural crowdfunding. J. Changchun Norm. Univ. 2017, 36, 44–47. [Google Scholar]

- Sagar, P.; Gupta, P.; Tanwar, R. A novel prediction algorithm for multivariate data sets. Decis. Mak. Appl. Manag. Eng. 2021, 4, 225–240. [Google Scholar] [CrossRef]

- Wen, M.W. Define organizational leadership development. Forum Leadersh. Sci. 2013, 3, 29–31. [Google Scholar]

| Approaches to Empowerment | Advantages | Limitations |

|---|---|---|

| FAHP | Optimize assessment results by transforming incomplete information into fuzzy concepts | Ignores secondary factors |

| FUCOM [43] | Simple and efficient quantitative processing using the simplified pairwise comparison principle | Highly subjective |

| SWARA [44] | No pairwise comparisons are required. Weights are simple to determine and easier to implement | Empowerment according to the subjective judgment of decision makers, which is highly subjective |

| BWM [45] | Consistent results can be obtained with less information | Deals with attribute weights where there is no association between attributes |

| Approaches to MCDM | Advantages | Limitations |

|---|---|---|

| TOPSIS | More in line with the actual situation | Difficulty in determining indicator weights |

| MABAC [46] | Easy to calculate and stable results | Addresses issues related to independent metrics only |

| MAIRCA [47] | Each alternative has the same priority and is more objective | More uses in natural disaster risk assessment such as fire and flooding |

| VIKOR [48] | A compromise with priorities can be obtained | More than one best solution is not conducive to decision making |

| First-Level Indicator | Secondary Indicators | Third-Level Indicators | Indicator Screening |

|---|---|---|---|

| Agricultural crowdfunding risk prevention cohesion | Organizational leadership | Internal organizational capacity , Agricultural crowdfunding risk prevention and decision-making ability , Ability to obtain information , Risk emergency execution | Reduce |

| Synergy | Responsive execution , Work efficiency , Project promotion efforts , Social groups and public attention | Reduce | |

| Government support | Policies that benefit farmers and farmers’ satisfaction , Effectiveness of risk response policies and measures , The perfection of the agricultural crowdfunding supervision system | Reserve | |

| Solidarity | Risk sharing , Risk prevention spontaneity , Technical exchange and mutual assistance , Risk prevention consensus | Reduce | |

| Quantity and quality assurance of agricultural products | Quality of agricultural products , Natural environment stability , Safety of agricultural products , Agricultural production efficiency | Reduce | |

| Technical support ability | Agricultural production capacity , Management level , Platform service system capabilities , Agronomic techniques | Reduce | |

| Timeliness of risk prevention strategies and measures | Agricultural project adjustment , Adjustment of suitability of measures , Risk awareness timeliness | Reserve |

| Number of Categories | 2 | 3 | 4 |

| value | 0.7542 | 0.7740 | 0.7747 |

| F value | 9.2560 | 12.3328 | 27.0344 |

| 5.9874 | 5.7861 | 6.5914 | |

| 0.3531 | 0.5308 | 0.7562 | |

| Number of Categories | 5 | 6 | 7 |

| value | 0.7866 | 0.7877 | 0.8041 |

| F value | 34.5080 | 29.9184 | 41.1352 |

| 9.1172 | 19.2964 | 233.986 | |

| 0.7358 | 0.3550 | — |

| Indicator Situation | Best Classification |

|---|---|

| All indicators | |

| Third-Level Indicators | Triangular Fuzzy Judgment Matrix |

|---|---|

| Criterion Layer | Criterion Layer Weights | Criterion Layer Weight Ranking | Factor Layer | Factor Layer Weights | Total Weight | Factor Layer Total Weight Ranking | |

|---|---|---|---|---|---|---|---|

| Concentration N | 0.198 | 2 | 0.425 | 0.084 | 3 | ||

| 0.500 | 0.099 | 2 | |||||

| 0.075 | 0.015 | 10 | |||||

| 0.207 | 1 | 0.553 | 0.114 | 1 | |||

| 0.403 | 0.083 | 4 | |||||

| 0.044 | 0.009 | 11 | |||||

| 0.110 | 3 | 0.417 | 0.046 | 5 | |||

| 0.254 | 0.028 | 8 | |||||

| 0.329 | 0.036 | 7 | |||||

| 0.076 | 4 | 0.343 | 0.026 | 9 | |||

| 0.571 | 0.043 | 6 | |||||

| 0.086 | 0.007 | 12 | |||||

| Aggregation J | 0.198 | 1 | 0.075 | 0.015 | 8 | ||

| 0.680 | 0.135 | 1 | |||||

| 0.245 | 0.049 | 4 | |||||

| 0.050 | 3 | 0.521 | 0.026 | 6 | |||

| 0.406 | 0.020 | 7 | |||||

| 0.073 | 0.004 | 9 | |||||

| 0.161 | 2 | 0.360 | 0.058 | 3 | |||

| 0.216 | 0.035 | 5 | |||||

| 0.424 | 0.068 | 2 | |||||

| Crowdfunding Projects | Target Amount (RMB) | Expected Duration (d) | Completion Time (d) | Amount Raised (RMB) | Number of Participants (per) |

|---|---|---|---|---|---|

| M1 | 150,000 | 30 | 180 | 566,670 | 1364 |

| M2 | 100,000 | 30 | 19 | 121,810 | 3850 |

| M3 | 100,000 | 30 | 27 | 682,986 | 4501 |

| M4 | 800,000 | 30 | 17 | 836,000 | 6445 |

| Crowdfunding Project | Ranking | |||

|---|---|---|---|---|

| 0.0191 | 0.0108 | 0.3612 | 4 | |

| 0.0153 | 0.0153 | 0.5000 | 3 | |

| 0.0128 | 0.0144 | 0.5294 | 2 | |

| 0.0107 | 0.0224 | 0.6767 | 1 |

| FAHP-TOPSIS | Entropy-TOPSIS | FCE | |

|---|---|---|---|

| M1 | 0.3612 | 0.3300 | 0.4734 |

| M2 | 0.5000 | 0.5337 | 0.3600 |

| M3 | 0.5294 | 0.5200 | 0.5600 |

| M4 | 0.6767 | 0.6000 | 0.5700 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xue, Y.; Li, Y. Cohesion of Agricultural Crowdfunding Risk Prevention under Sustainable Development Based on Gray–Rough Set and FAHP-TOPSIS. Sustainability 2022, 14, 12709. https://doi.org/10.3390/su141912709

Xue Y, Li Y. Cohesion of Agricultural Crowdfunding Risk Prevention under Sustainable Development Based on Gray–Rough Set and FAHP-TOPSIS. Sustainability. 2022; 14(19):12709. https://doi.org/10.3390/su141912709

Chicago/Turabian StyleXue, Ye, and Ying Li. 2022. "Cohesion of Agricultural Crowdfunding Risk Prevention under Sustainable Development Based on Gray–Rough Set and FAHP-TOPSIS" Sustainability 14, no. 19: 12709. https://doi.org/10.3390/su141912709