Financial Development, Heterogeneous Technological Progress, and Carbon Emissions: An Empirical Analysis Based on Provincial Panel Data in China

Abstract

:1. Introduction

2. Literature Review

3. Methodology and Data

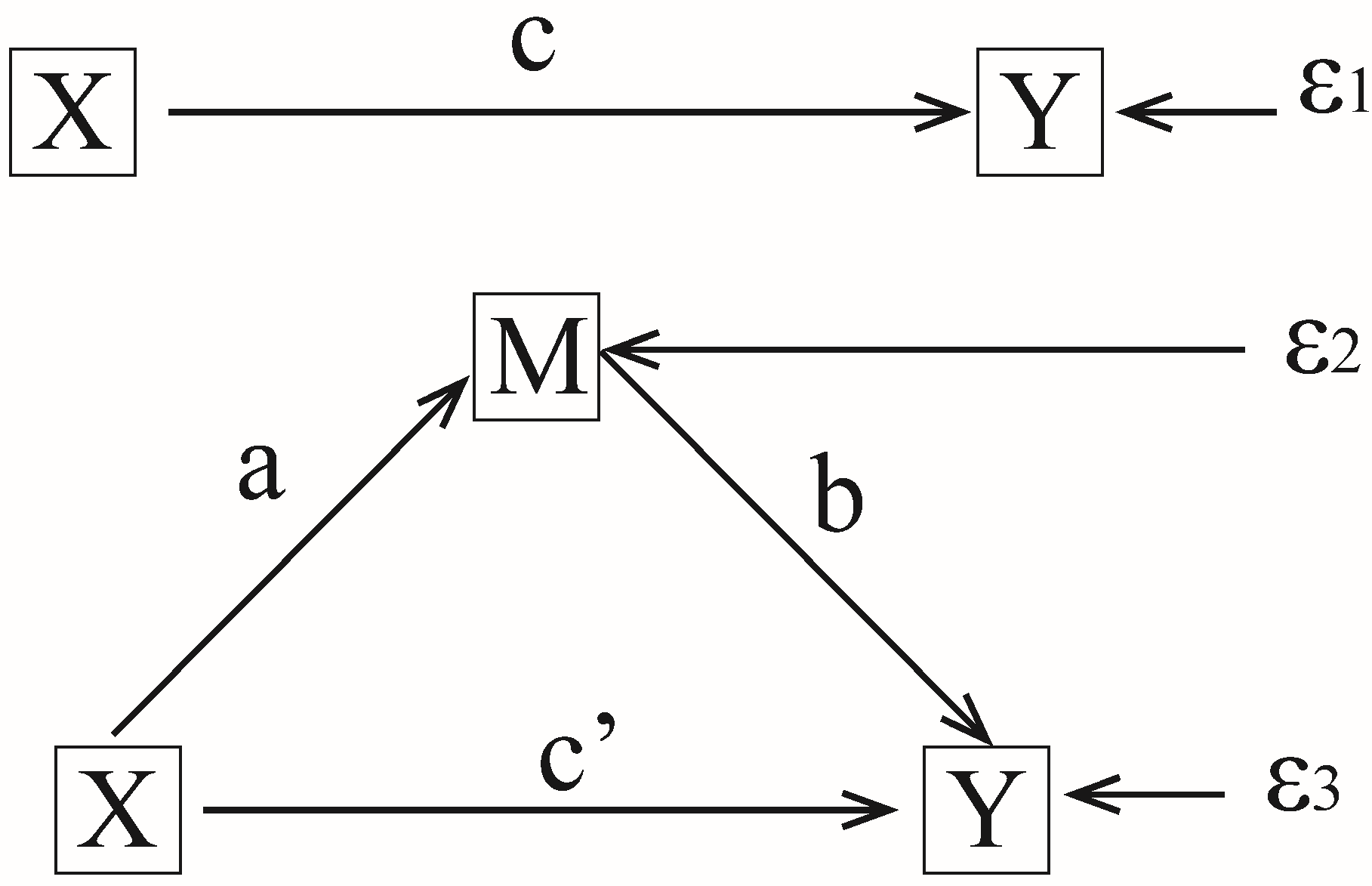

3.1. Introduction to theIntermediary Variable Method

3.2. Empirical Model

3.3. Data Sources

3.4. Variable Selection

- (1)

- Explained variables

- (2)

- Explanatory variables

- (3)

- Indicators of heterogeneous technological progress

- (4)

- Control variables

3.5. Descriptive Statistics and Correlation Analysis

4. Empirical Results and Discussion

4.1. Principal Effect Test

4.2. Mediating Effect Test

4.3. Subsample Mediation Effect Test

5. Conclusions and Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Jin, J.; Zhao, R.; Yang, Y.; Chuan, M. Endogenous Study on Economic Development, Environmental Investment, and Green Development Based on the Panel Data Analysis of 11 Provinces in the Yangtze River Economic Belt. J. Coast. Res. 2019, 98, 426–432. [Google Scholar] [CrossRef]

- Sun, L.-L.; Cui, H.-J.; Ge, Q.-S. Will China achieve its 2060 carbon neutral commitment from the provincial perspective? Adv. Clim. Chang. Res. 2022, 13, 169–178. [Google Scholar] [CrossRef]

- Wu, Y.; Zhou, Y.; Liu, Y.; Liu, J. A Race Between Economic Growth and Carbon Emissions: How Will the CO2 Emission Reach the Peak in Transportation Industry? Front. Energy Res. 2022, 9, 778757. [Google Scholar] [CrossRef]

- Chen, J.; Xu, C.; Gao, M.; Li, D. Carbon peak and its mitigation implications for China in the post-pandemic era. Sci. Rep. 2022, 12, 3473. [Google Scholar] [CrossRef] [PubMed]

- Kliman, A.; Williams, S.D. Why ‘financialisation’ hasn’t depressed US productive investment. Camb. J. Econ. 2014, 39, 67–92. [Google Scholar] [CrossRef]

- Du, J.; Li, C.; Wang, Y. A comparative study of shadow banking activities of non-financial firms in transition economies. China Econ. Rev. 2017, 46, S35–S49. [Google Scholar] [CrossRef]

- Rjoub, H.; Odugbesan, J.A.; Adebayo, T.S.; Wong, W.-K. Sustainability of the Moderating Role of Financial Development in the Determinants of Environmental Degradation: Evidence from Turkey. Sustainability 2021, 13, 1844. [Google Scholar] [CrossRef]

- Jiang, C.; Ma, X. The Impact of Financial Development on Carbon Emissions: A Global Perspective. Sustainability 2019, 11, 5241. [Google Scholar] [CrossRef] [Green Version]

- Grossman, G.M.; Krueger, A.B. Environmental Impacts of a North American Free Trade Agreement. Natl. Bureau Econom. Res. Work. Paper 1992, 8, 223–250. [Google Scholar] [CrossRef]

- Neagu, O. The Link between Economic Complexity and Carbon Emissions in the European Union Countries: A Model Based on the Environmental Kuznets Curve (EKC) Approach. Sustainability 2019, 11, 4753. [Google Scholar] [CrossRef]

- Wang, Z.Q.; Sun, G. Empirical analysis of the relationships between the financial development scale, Structure, efficiency and economic growth of China. Manag. World 2003, 13–20. [Google Scholar] [CrossRef]

- Fan, X.J. Financial System and Economic Growth: Evidence from China. J. Financ. Res. 2006, 40, 57–66. [Google Scholar]

- Levine, R. Financial development and economic growth: Views and agenda. J. Econom. Lit. 1997, 35, 688–726. [Google Scholar]

- Zhang, Y.-J. The impact of financial development on carbon emissions: An empirical analysis in China. Energy Policy 2011, 39, 2197–2203. [Google Scholar] [CrossRef]

- Shoaib, H.M.; Rafique, M.Z.; Nadeem, A.M.; Huang, S. Impact of financial development on CO2 emissions: A comparative analysis of developing countries (D8) and developed countries (G8). Environ. Sci. Pollut. Res. 2020, 27, 12461–12475. [Google Scholar] [CrossRef]

- Mahalik, M.K.; Babu, M.S.; Loganathan, N.; Shahbaz, M. Does financial development intensify energy consumption in Saudi Arabia? Renew. Sustain. Energy Rev. 2017, 75, 1022–1034. [Google Scholar] [CrossRef] [Green Version]

- Bashir, M.F.; Ma, B.; Shahbaz, M.; Jiao, Z. The nexus between environmental tax and carbon emissions with the roles of environmental technology and financial development. PLoS ONE 2020, 15, e0242412. [Google Scholar] [CrossRef]

- Sadorsky, P. The impact of financial development on energy consumption in emerging economies. Energy Policy 2010, 38, 2528–2535. [Google Scholar] [CrossRef]

- Tamazian, A.; Chousa, J.P.; Vadlamannati, K.C. Does higher economic and financial development lead to environmental degradation: Evidence from BRIC countries. Energy Policy 2009, 37, 246–253. [Google Scholar] [CrossRef]

- Shahbaz, M.; Tiwari, A.; Nasir, M. The effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy 2013, 61, 1452–1459. [Google Scholar] [CrossRef] [Green Version]

- Xu, G.Y.; Song, D.Y. An empirical study of the environmental kuznetscurve for China’s carbonemissions:based on provincial panel data. China Ind. Econom. 2010, 9, 37–47. [Google Scholar] [CrossRef]

- Hu, J.Y.; Wang, M.Q. China’s financial development and carbon dioxide emission: A study based on provincial panel data from 1998–2015. Shan Dong Soc. Sci. 2018, 63, 118–124. [Google Scholar] [CrossRef]

- Sun, C.W.; Liu, X.Y.; Lin, J. Measurement and convergence of total factor productivity in China under carbon intensity constraint. J. Financ. Res. 2010, 17–33. [Google Scholar]

- Li, D.S.; Xu, H.F.; Zhang, S.Y. Financial Development, Technological Innovation and Carbon Emission efficiency: Theoretical and empirical studies. Inq. Econom. Issues 2018, 169–174. [Google Scholar]

- Zhao, J.; Liu, C.Y.; Li, T. The Influence of Financial Development on Carbon Emission: ‘Promotion’ or ‘Inhibition’?—A Mediating Effect Model Based on Technological Progress Heterogeneity. J. Xinjiang Univ. Philos. Soc. Sci. 2020, 48, 1–10. [Google Scholar] [CrossRef]

- Acemoglu, D.; Aghion, P.; Bursztyn, L.; Hemous, D. The Environment and Directed Technical Change. Am. Econ. Rev. 2012, 102, 131–166. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Jiang, T.; Li, S.; Yu, Y.; Peng, Y. Energy-related carbon emissions and structural emissions reduction of China’s construction industry: The perspective of input–output analysis. Environ. Sci. Pollut. Res. 2022, 29, 39515–39527. [Google Scholar] [CrossRef]

- Yang, G.; Zha, D.; Zhang, C.; Chen, Q. Does environment-biased technological progress reduce CO2 emissions in APEC economies? Evidence from fossil and clean energy consumption. Environ. Sci. Pollut. Res. 2020, 27, 20984–20999. [Google Scholar] [CrossRef]

- Gu, W.; Zhao, X.; Yan, X.; Wang, C.; Li, Q. Energy technological progress, energy consumption, and CO2 emissions: Empirical evidence from China. J. Clean. Prod. 2019, 236, 117666. [Google Scholar] [CrossRef]

- Zhang, B.B.; Zhu, J.; Quan, X.Y. A theoretical and empirical analysis of technical progress and CO2 emission intensity. Sci. Res. Manag. 2017, 38, 42–48. [Google Scholar] [CrossRef]

- Zhu, Q.; Peng, X.Z.; Lu, Z.M.; Yu, J. Analysis model and empirical study of impacts from population an consumption on carbon emissions. China Popul. Resourc. Environ. 2010, 98–102. [Google Scholar]

- Wei, W.X.; Yang, F. Impact of technology advance on carbon dioxide emission in China. Stat. Res. 2010, 36–44. [Google Scholar] [CrossRef]

- Li, S.S.; Niu, L. An analysis of the impact of technology advance on carbon dioxide emission in China-based on the static and dynamic panel data models. Res. Econom. Manag. 2014, 19–26. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Newell, R.G.; Stavins, R.N. Environmental Policy and Technological Change. Environ. Resour. Econ. 2002, 22, 41–70. [Google Scholar] [CrossRef]

- Lu, W.B.; Qiu, T.T.; Du, L. A study on influence factors of carbon emissions under different economic growth stages in China. Econom. Res. J. 2013, 48, 106–118. [Google Scholar]

- Liu, X.; Bae, J. Urbanization and industrialization impact of CO2 emissions in China. J. Clean. Prod. 2018, 172, 178–186. [Google Scholar] [CrossRef]

- Chen, Y.; Lee, C.-C. Does technological innovation reduce CO2 emissions?Cross-country evidence. J. Clean. Prod. 2020, 263, 121550. [Google Scholar] [CrossRef]

- Wang, B.; Sun, Y.; Wang, Z. Agglomeration effect of CO2 emissions and emissions reduction effect of technology: A spatial econometric perspective based on China’s province-level data. J. Clean. Prod. 2018, 204, 96–106. [Google Scholar] [CrossRef]

- Ma, D.L.; Yang, G.M. Financial development, technological progress and low carbon economic growth efficiency in China: An empirical research of spatial panel data model. J. Chongqing Univ. Soc. Sci. Ed. 2018, 24, 13–28. [Google Scholar]

- Chen, L.; Hu, W.T. Synergistic Effects of financial development, technological progress and carbon emissions: Based on VAR analysis of carbon emissions in 30 Provinces of China from 2005 to 2017. Study Explor. 2020, 117–124. [Google Scholar]

- Xie, Z.; Wu, R.; Wang, S. How technological progress affects the carbon emission efficiency? Evidence from national panel quantile regression. J. Clean. Prod. 2021, 307, 127133. [Google Scholar] [CrossRef]

- Liu, W.; Liu, Y.; Lin, B. Empirical analysis on energy rebound effect from the perspective of technological progress—a case study of China’s transport sector. J. Clean. Prod. 2018, 205, 1082–1093. [Google Scholar] [CrossRef]

- Kang, Z.-Y.; Li, K.; Qu, J. The path of technological progress for China’s low-carbon development: Evidence from three urban agglomerations. J. Clean. Prod. 2018, 178, 644–654. [Google Scholar] [CrossRef]

- Zhou, X.; Song, M.; Cui, L. Driving force for China’s economic development under Industry 4.0 and circular economy: Technological innovation or structural change? J. Clean. Prod. 2020, 271, 122680. [Google Scholar] [CrossRef]

- Zhang, Y.-J.; Peng, Y.-L.; Ma, C.-Q.; Shen, B. Can environmental innovation facilitate carbon emissions reduction? Evidence from China. Energy Policy 2017, 100, 18–28. [Google Scholar] [CrossRef]

- Yan, C.L.; Li, T.; Lan, W. Financial development, innovation and carbon emission. J. Financ. Res. 2016, 14–29. [Google Scholar]

- MacKinnon, D.P.; Lockwood, C.M.; Hoffman, J.M.; West, S.G.; Sheets, V. A comparison of methods to test mediation and other intervening variable effects. Psychol. Methods 2002, 7, 83–104. [Google Scholar] [CrossRef]

- Wen, Z.L.; Zhang, L.; Hou, J.T.; Liu, H.Y. Testing and application of the mediating effects. Acta Psychol. Sin. 2004, 36, 614–620. [Google Scholar]

- Shan, H.J. Reestimating the capital stock of China: 1952–2006. J. Quant. Tech. Econom. 2008, 17–31. [Google Scholar]

- Zhang, W.B.; Li, G.P. Analysis on carbon emission Reduction effect of heterogeneous technological progress. Sci. Sci. Manag. S. T. 2015, 36, 55–60. [Google Scholar]

| Energy Name | Coal | Coke | Coke Oven Gas | Blast Furnace Gas | Converter Gas | Other Gas | Crude Oil |

|---|---|---|---|---|---|---|---|

| (kj/kg) | 20,908 | 28,435 | 17,981 | 3855 | 8585 | 18,273.6 | 41,816 |

| (Kg/TJ) | 95,977 | 105,996 | 44,367 | 259,600 | 181,867 | 44,367 | 73,333 |

| Energy name | Gasoline | Kerosene | Diesel oil | Fuel oil | Liquefied petroleum gas (LPG) | Natural gas | Liquefied natural gas |

| (kj/kg) | 43,070 | 43,070 | 42,652 | 41,816 | 50,179 | 38,931 | 44,200 |

| (Kg/TJ) | 70,033 | 71,500 | 74,067 | 77,367 | 63,067 | 56,100 | 64,167 |

| Variable | CI | FD | Tech | ET | IE | KE | TFDI |

|---|---|---|---|---|---|---|---|

| CI | 1.000 | ||||||

| FD | −0.273 *** | 1.000 | |||||

| Tech | −0.655 *** | 0.237 *** | 1.000 | ||||

| ET | 0.592 *** | −0.332 *** | −0.247 *** | 1.000 | |||

| IE | 0.848 *** | −0.233 *** | −0.741 *** | 0.200 *** | 1.000 | ||

| KE | −0.310 *** | −0.044 | 0.345 *** | −0.171 *** | −0.276 *** | 1.000 | |

| TFDI | −0.304 *** | 0.120 ** | 0.273 *** | 0.018 | −0.411 *** | 0.324 *** | 1.000 |

| Open | −0.361 *** | 0.520 *** | 0.440 *** | −0.215 *** | −0.399 *** | 0.441 *** | 0.505 *** |

| Hc | −0.361 *** | 0.620 *** | 0.502 *** | −0.092 * | −0.528 *** | 0.013 | 0.429 *** |

| Infr | −0.105 ** | −0.450 *** | 0.339 *** | −0.018 | −0.134 *** | 0.113 *** | −0.315 *** |

| Stru | 0.273 *** | −0.670 *** | −0.065 | 0.206 *** | 0.262 *** | 0.045 | −0.025 |

| Urb | −0.414 *** | 0.631 *** | 0.545 *** | −0.171 *** | −0.524 *** | 0.075 | 0.561 *** |

| MEAN | 2.454 | 2.928 | 9.397 | 2.357 | 1.115 | 0.543 | 0.022 |

| SD | 1.668 | 1.092 | 1.590 | 0.580 | 0.633 | 0.118 | 0.017 |

| Variable | Open | Hc | Infr | Stru | Urb | ||

| Open | 1.000 | ||||||

| Hc | 0.564 *** | 1.000 | |||||

| Infr | −0.382 *** | −0.325 *** | 1.000 | ||||

| Stru | −0.252 *** | −0.415 *** | 0.259 *** | 1.000 | |||

| Urb | 0.737 *** | 0.875 *** | −0.445 *** | −0.326 *** | 1.000 | ||

| MEAN | 0.367 | 8.841 | 14.131 | 0.458 | 54.088 | ||

| SD | 0.311 | 0.986 | 7.494 | 0.083 | 13.596 |

| Variable | Nationwide (1) | Eastern Region (2) | Middle Region (3) | Western Region (4) |

|---|---|---|---|---|

| L.FD | 0.321** | −0.849 ** | 2.156 ** | 0.217 * |

| (2.53) | (−2.02) | (2.31) | (1.66) | |

| L.FD2 | −0.048 *** | −0.041 * | −0.450 ** | 0.005 |

| (−3.59) | (−1.81) | (−2.57) | (0.05) | |

| Constant | 6.405 ** | 14.73 *** | 7.651 *** | 12.186 *** |

| (2.43) | (7.71) | (3.99) | (9.57) | |

| Control variables | Yes | Yes | Yes | Yes |

| Individual fixed effect | Yes | Yes | Yes | Yes |

| Year fixed effect | Yes | Yes | Yes | Yes |

| R-squared | 0.731 | 0.596 | 0.601 | 0.750 |

| Number of obs | 360 | 132 | 96 | 132 |

| Variable | Tech | CI1 | ET | CI2 | IE | CI3 | KE | CI4 | TFDI | CI5 |

|---|---|---|---|---|---|---|---|---|---|---|

| (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | (13) | (14) | |

| L.FD | 0.258 *** | 0.292 ** | −0.320 *** | 0.070 | −0.107 *** | 0.319 * | 0.013 * | 0.267 ** | 0.011 * | 0.280 * |

| (5.11) | (2.32) | (−4.34) | (0.21) | (−3.13) | (1.68) | (1.67) | (2.49) | (1.68) | (1.66) | |

| L.FD2 | −0.048 * | −0.001 | −0.045 | −0.042 | −0.045 | |||||

| (−1.67) | (−0.01) | (−1.06) | (−0.79) | (−1.03) | ||||||

| Tech | 0.271 * | |||||||||

| (1.91) | ||||||||||

| ET | 0.742 *** | |||||||||

| (6.96) | ||||||||||

| IE | 0.812 ** | |||||||||

| (2.29) | ||||||||||

| KE | −0.189 * | |||||||||

| (−1.65) | ||||||||||

| TFDI | −3.696 * | |||||||||

| (−1.66) | ||||||||||

| Constant | −0.325 | 6.136 ** | 3.950 *** | 6.008 ** | 5.830 *** | 4.226 * | 0.636 *** | 7.202 *** | 0.025 | 7.123 *** |

| (−0.73) | (2.57) | (6.04) | (2.57) | (19.13) | (1.66) | (7.67) | (2.87) | (1.64) | (2.89) | |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Individual fixed effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year fixed effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| R-squared | 0.897 | 0.733 | 0.134 | 0.774 | 0.733 | 0.756 | 0.555 | 0.728 | 0.117 | 0.731 |

| Number of obs | 360 | 360 | 360 | 360 | 360 | 360 | 360 | 360 | 360 | 360 |

| Variable | Tech | CI1 | ET | CI2 | IE | CI3 | KE | CI4 | TFDI | CI5 |

|---|---|---|---|---|---|---|---|---|---|---|

| (15) | (16) | (17) | (18) | (19) | (20) | (21) | (22) | (23) | (24) | |

| L.FD | 0.233 *** | −0.739 * | −0.642 *** | −0.252 ** | −0.040 * | −0.797 ** | 0.006 * | −0.786 * | 0.013 * | −0.802 ** |

| (3.48) | (−1.75) | (−4.86) | (−2.19) | (−1.68) | (−2.05) | (1.66) | (−1.81) | (1.71) | (−2.14) | |

| L.FD2 | 0.037 | −0.012 | −0.045 | 0.033 | 0.049 | |||||

| (0.88) | (−0.59) | (−1.15) | (0.74) | (1.14) | ||||||

| Tech | −0.434 ** | |||||||||

| (−2.26) | ||||||||||

| ET | 0.861 *** | |||||||||

| (18.68) | ||||||||||

| IE | 2.112 *** | |||||||||

| (4.46) | ||||||||||

| KE | 0.633 * | |||||||||

| (1.76) | ||||||||||

| TFDI | −4.509 * | |||||||||

| (−1.66) | ||||||||||

| Constant | −0.467 | 13.478 *** | 10.043 *** | 8.075 *** | 3.666 *** | 8.476 *** | 0.688 *** | 14.019 *** | 0.062 | 15.104 *** |

| (−0.49) | (7.19) | (5.30) | (4.37) | (10.74) | (3.65) | (4.19) | (6.76) | (1.38) | (8.16) | |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Individual fixed effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year fixed effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| R-squared | 0.891 | 0.609 | 0.334 | 0.707 | 0.836 | 0.640 | 0.575 | 0.593 | 0.368 | 0.731 |

| Number of obs | 132 | 132 | 132 | 132 | 132 | 132 | 132 | 132 | 132 | 132 |

| Variable | Tech | CI1 | ET | CI2 | IE | CI3 | KE | CI4 | TFDI | CI5 |

|---|---|---|---|---|---|---|---|---|---|---|

| (25) | (26) | (27) | (28) | (29) | (30) | (31) | (32) | (33) | (34) | |

| L.FD | 0.415 * | 0.317 *** | 0.314 ** | 0.601 | −0.118 * | 1.403 ** | 0.024 ** | 2.066 *** | 0.002 * | 1.639 * |

| (1.96) | (3.20) | (2.09) | (0.82) | (−1.69) | (2.25) | (2.13) | (2.72) | (1.71) | (1.70) | |

| L.FD2 | −0.615 *** | −0.237 * | −0.235 ** | −0.497 *** | −0.330 * | |||||

| (−3.38) | (−1.76) | (−1.99) | (−3.04) | (−1.79) | ||||||

| Tech | −4.90 ** | |||||||||

| (−2.50) | ||||||||||

| ET | 1.619 *** | |||||||||

| (7.91) | ||||||||||

| IE | 2.551 *** | |||||||||

| (10.24) | ||||||||||

| KE | 3.239 *** | |||||||||

| (3.68) | ||||||||||

| TFDI | 34.875 * | |||||||||

| (1.82) | ||||||||||

| Constant | −2.407 ** | 9.349 *** | 0.424 | 9.493 *** | 5.397 *** | −1.237 | 0.606 *** | 6.175 *** | −0.010 | 10.354 *** |

| (−2.51) | (5.01) | (0.62) | (7.21) | (11.04) | (−0.68) | (4.14) | (3.63) | (−1.01) | (6.19) | |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Individual fixed effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year fixed effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| R-squared | 0.893 | 0.575 | 0.223 | 0.744 | 0.799 | 0.774 | 0.749 | 0.669 | 0.444 | 0.586 |

| Number of obs | 96 | 96 | 96 | 96 | 96 | 96 | 96 | 96 | 96 | 96 |

| Variable | Tech | CI1 | ET | CI2 | IE | CI3 | KE | CI4 | TFDI | CI5 |

|---|---|---|---|---|---|---|---|---|---|---|

| (35) | (36) | (37) | (38) | (39) | (40) | (41) | (42) | (43) | (44) | |

| L.FD | 0.198 ** | 0.089 * | 0.031 * | 0.191 * | −0.118 | −0.089 | 0.046 *** | 0.047 * | 0.001 | 0.123 |

| (2.58) | (1.73) | (1.71) | (1.65) | (−1.09) | (−0.14) | (2.98) | (1.89) | (0.05) | (0.18) | |

| L.FD2 | −0.005 | 0.089 | −0.022 | 0.062 | −0.016 | |||||

| (−0.05) | (1.07) | (0.24) | (0.68) | (−0.16) | ||||||

| Tech | −0.211 * | |||||||||

| (−1.66) | ||||||||||

| ET | 0.852 *** | |||||||||

| (6.52) | ||||||||||

| IE | 0.525 *** | |||||||||

| (2.68) | ||||||||||

| KE | 3.712 *** | |||||||||

| (3.96) | ||||||||||

| TFDI | 10.264 | |||||||||

| (0.99) | ||||||||||

| Constant | 1.328 ** | 12.271 *** | 2.214 *** | 11.355 *** | 5.397 *** | 8.148 *** | 0.803 *** | 14.318 *** | −0.008 | 12.268 *** |

| (2.41) | (10.35) | (3.06) | (9.32) | (11.04) | (4.92) | (7.24) | (11.46) | (−0.75) | (10.49) | |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Individual fixed effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year fixed effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| R-squared | 0.935 | 0.751 | 0.102 | 0.759 | 0.799 | 0.771 | 0.649 | 0.777 | 0.308 | 0.752 |

| Number of obs | 132 | 132 | 132 | 132 | 132 | 132 | 132 | 132 | 132 | 132 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, R.; Du, J.; Wei, L. Financial Development, Heterogeneous Technological Progress, and Carbon Emissions: An Empirical Analysis Based on Provincial Panel Data in China. Sustainability 2022, 14, 12761. https://doi.org/10.3390/su141912761

Liu R, Du J, Wei L. Financial Development, Heterogeneous Technological Progress, and Carbon Emissions: An Empirical Analysis Based on Provincial Panel Data in China. Sustainability. 2022; 14(19):12761. https://doi.org/10.3390/su141912761

Chicago/Turabian StyleLiu, Renzhong, Jingxiu Du, and Liuyan Wei. 2022. "Financial Development, Heterogeneous Technological Progress, and Carbon Emissions: An Empirical Analysis Based on Provincial Panel Data in China" Sustainability 14, no. 19: 12761. https://doi.org/10.3390/su141912761