Assessment of Sand and Glass Industry in Saudi Arabia

Abstract

:1. Background

1.1. Glass in the Middle East

1.2. Glass in Saudi Arabia

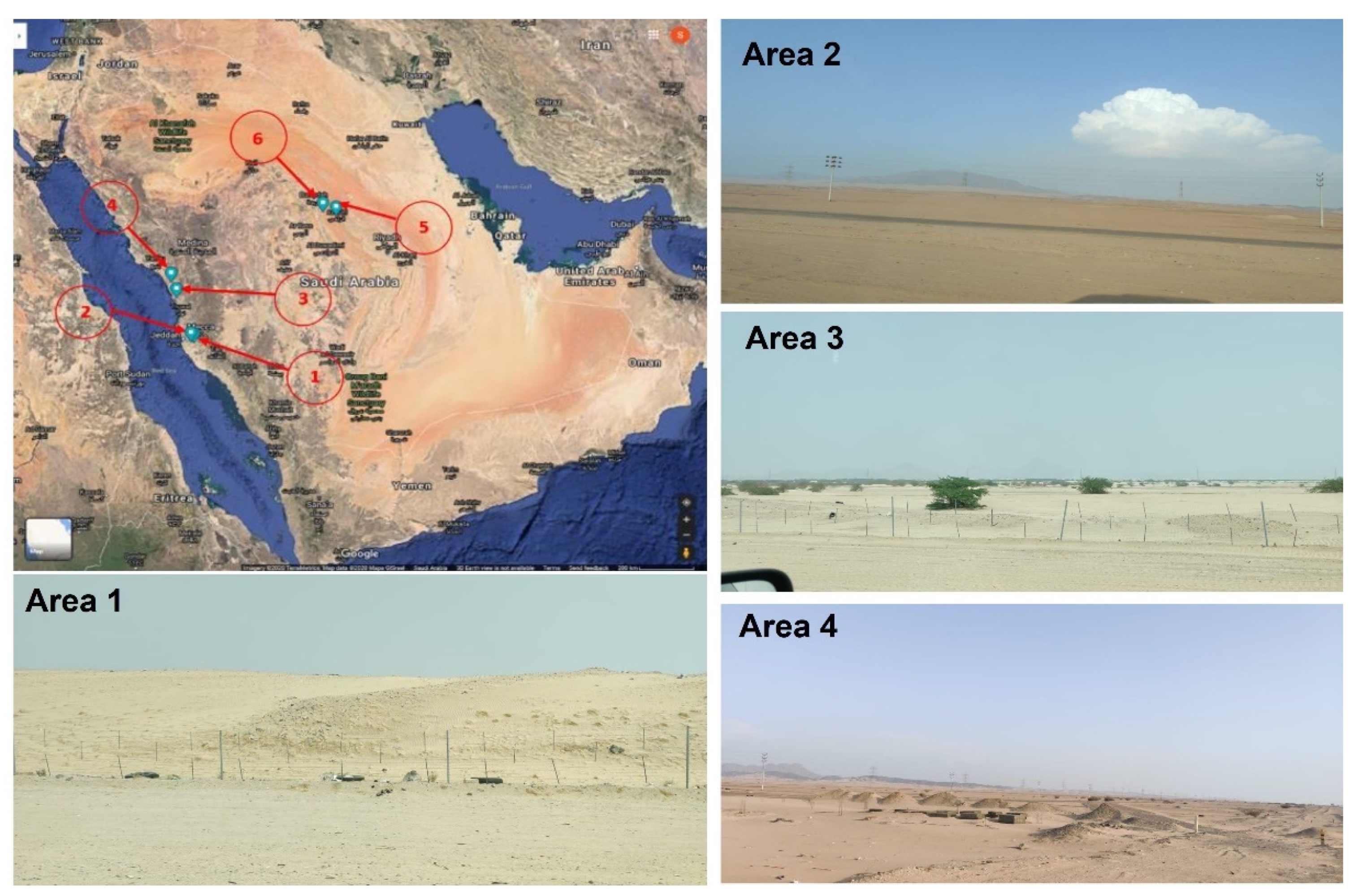

1.3. Sand Geography in Saudi Arabia

2. Methodology

3. Results and Discussion

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Al-Wali’I, A.B.N. Seas of Sand in the Kingdom of Saudi Arabia. King Abdulaziz Circ. Press 1999, 25, 223–238. [Google Scholar]

- El-Badry, A.; Al-Juhani, A.; Ibrahim, E.-K.; Al-Zubiany, S. Distribution of Sand Flies in El-Nekheil Province, in Al-Madinah Al-Munawwarah Region, Western of Saudi Arabia. Parasitol. Res. 2008, 103, 151. [Google Scholar] [CrossRef] [PubMed]

- McCloy, J.S. Frontiers in Natural and Un-Natural Glasses: An Interdisciplinary Dialogue and Review. J. Non-Cryst. Solids 2019, 4, 100035. [Google Scholar] [CrossRef]

- Martin Jensen Meyland; Jens Henrik Nielsen; Cenk Kocer Tensile Behaviour of Soda-Lime-Silica Glass and the Significance of Load Duration—A Literature Review. J. Build. Eng. 2021, 44, 102966. [CrossRef]

- Katarzyna Pasiut; Janusz Partyka; Magdalena Lesniak; Piotr Jelen; Zbigniew Olejniczak Raw Glass-Ceramics Glazes from SiO2–Al2O3–CaO–MgO–Na2O–K2O System Modified by ZrO2 Addition—Changes of Structure, Microstructure and Surface Properties. Open Ceram. 2021, 8, 100188. [CrossRef]

- Ponce-Peña, P.; González-Lozano, M.A.; Escobedo-Bretado, M.A.; Núñez-Ramírez, D.M.; Rodríguez-Pulido, A.; Jurado, Z.V.Q.; Poisot, M.; Sulbarán-Rangel, B. Crystallization of Glasses Containing K2O, PbO, BaO, Al2O3, B2O3, and TiO2. Crystals 2022, 12, 574. [Google Scholar] [CrossRef]

- Deng, L.; Yao, B.; Lu, W.; Zhang, M.; Li, H.; Chen, H.; Zhao, M.; Du, Y.; Zhang, M.; Ma, Y.; et al. Effect of SiO2/Al2O3 Ratio on the Crystallization and Heavy Metal Immobilization of Glass Ceramics Derived from Stainless Steel Slag. J. Non-Cryst. Solids 2022, 593, 121770. [Google Scholar] [CrossRef]

- Deng, L.; Fu, Z.; Mingxing, Z.; Li, H.; Yao, B.; He, J.; Chen, H.; Ma, Y. Crystallization, structure, and properties of TiO2-ZrO2 co-doped MgO-B2O3-Al2O3-SiO2 glass-ceramics. J. Non-Cryst. Solids 2022, 575, 121217. [Google Scholar] [CrossRef]

- González, M.A.; Gorokhovsky, A.; Escalante, J.I.; Ponce, P.; Escobedo, M.A. Crystallization and properties of glass-ceramics of the K2O-BaO-B2O3 -Al2O3 -TiO2 System. Mater. Sci. Forum 2013, 755, 125–132. [Google Scholar] [CrossRef]

- Shankar, J.; Deshpande, V. Effect of MgO addition on the properties of PbO–TiO2–B2O3 glass and glass–ceramics. Ceram. Int. 2013, 39, S15–S18. [Google Scholar] [CrossRef]

- Sharafudeen, R.; Al-Hashim, J.M.; Al-Harbi, M.O.; Al-Ajwad, A.I.; Al-Waheed, A.A. Preparation and Characterization of Precipitated Silica Using Sodium Silicate Prepared from Saudi Arabian Desert Sand. Silicon 2017, 9, 917–922. [Google Scholar] [CrossRef]

- Cable, M. The Advance of Glass Technology in the Nineteenth Century. Glass Technol. Eur. J. Glass Sci. Technol. Part A 2020, 61, 115–126. [Google Scholar] [CrossRef]

- Selin, H. (Ed.) Encyclopaedia of the History of Science, Technology, and Medicine in Non-Western Cultures; Springer: Berlin/Heidelberg, Germany, 2008; ISBN 978-1-4020-4559-2. [Google Scholar]

- Khater, G.A. The Use of Saudi Slag for the Production of Glass-Ceramic Materials. Ceram. Int. 2002, 28, 59–67. [Google Scholar] [CrossRef]

- Arabian United Float Glass Company. Available online: http://aufgc.com/home/ (accessed on 11 March 2020).

- Trieb, F.; Schillings, C.; Pregger, T.; O’Sullivan, M. Solar Electricity Imports from the Middle East and North Africa to Europe. Energy Policy 2012, 42, 341–353. [Google Scholar] [CrossRef]

- Glass Market Intelligence Report; Report 1—2013, Part of I spy publishing Industry Survey; Market Intelligence and Forecasts Series; I Spy Publishing Limited—Albert House: London, UK, 2013.

- Middle East and North Africa (MENA) Region, Assessment of the Local Manufacturing Potential for Concentrated Solar Power (CSP) Projects; The World Bank Report; January 2011. Available online: http://www.esmap.org/sites/esmap.org/files/DocumentLibrary/ESMAP-MENA_CSP-ReadMoreLink.pdf (accessed on 27 June 2022).

- Saudi Arabia Industrial Ambitions, Business Week; The McGraw-Hill Companies, Inc.: New York, NY, USA, 2007.

- Glasses as Engineering Materials: A Review—ScienceDirect. Available online: https://www-sciencedirect-com.sdl.idm.oclc.org/science/article/pii/S0261306910006837 (accessed on 6 June 2022).

- Abu Safiah, M.O.; Hamzawy, E.M.A. Nanometre Pyroxenic Glass-Ceramics Prepared by Crystallization of Saudi Basalt Glass. Ceram. Int. 2019, 45, 4482–4486. [Google Scholar] [CrossRef]

- Meftah, N.; Mahboub, M.S. Spectroscopic Characterizations of Sand Dunes Minerals of El-Oued (Northeast Algerian Sahara) by FTIR, XRF and XRD Analyses. Silicon 2020, 12, 147–153. [Google Scholar] [CrossRef]

- General Authority for Statistics. Available online: https://www.stats.gov.sa/en (accessed on 6 June 2022).

- Benaafi, M.; Abdullatif, O. Sedimentological, Mineralogical, and Geochemical Characterization of Sand Dunes in Saudi Arabia. Arab. J. Geosci. 2015, 8, 11073–11092. [Google Scholar] [CrossRef]

- Al-Refeai, T.; Al-Ghamdy, D. Geological and Geotechnical Aspects of Saudi Arabia. Geotech. Geol. Eng. 1994, 12, 253–276. [Google Scholar] [CrossRef]

- Al-Shuhail, A.A.; Alsaleh, M.H.; Sanuade, O.A. Analysis of Time-Depth Data in Sand Dunes from the Empty Quarter Desert of Southeastern Saudi Arabia. Arab. J. Sci. Eng. 2018, 43, 3769–3774. [Google Scholar] [CrossRef]

- Park, J.B.; Bronzino, J.D. (Eds.) Biomaterials: Principles and Applications; CRC Press: Boca Raton, FL, USA, 2002; ISBN 978-0-429-11819-7. [Google Scholar]

- Feng, Y.; Zhang, T.; Yang, R. A Work Approach to Determine Vickers Indentation Fracture Toughness. J. Am. Ceram. Soc. 2011, 94, 332–335. [Google Scholar] [CrossRef]

| Ref | Glass Goods | Countries | Quantity, Tons | Price, Thousand SR |

|---|---|---|---|---|

| 1 | Other glass tubes | China, USA, Belgium | 2180 | 20,111 |

| 2 | Other Drawn or blown glass | United Arab Emirates, Italy, Turkey | 2697 | 15,136 |

| 3 | NON-Wired float glass with reflecting layer | United Arab, India, China | 15,969 | 28,423 |

| 4 | colored non wired float glass | United Arab Emirates, Thailand, China, USA, Belgium | 36,665 | 64,926 |

| 5 | other non-wired float glass | United Arab Emirates, China, Germany, Poland | 10,959 | 23,094 |

| 6 | tempered safety glass for transportation | China, USA | 3273 | 18,160 |

| 7 | other tempered safety glass | United Arab Emirates, China, USA, Poland | 1861 | 46,717 |

| 8 | laminated safety glass for transportation | China, Japan, Egypt, USA, Peru | 6901 | 40,641 |

| 9 | other laminated safety glass | United Arab Emirates, China, Japan, Germany, Italy | 1334 | 29,594 |

| 10 | multiple-walled insulating units of glass | Bahrain, United Arab Emirates, China, Italy, Turkey | 7649 | 52,771 |

| 11 | rear-view mirrors for vehicles | China, Taiwan, South Korea, USA | 1022 | 25,131 |

| 12 | unframed glass mirrors | URE, China, Turkey | 3524 | 19,374 |

| 13 | framed glass mirrors | India, Malaysia, China USA, Italy | 9343 | 70,294 |

| 14 | other bottles and beakers of glass | Kuwait, Oman, URE, India, China, Indonesia, Egypt, USA, Germany, France, Italy | 41,493 | 172,845 |

| 15 | tableware or kitchenware of glass-ceramics | URE, India, China, USA, France, Turkey, Poland | 18,798 | 125,603 |

| 16 | other drinking glasses with leg | China, Italy | 1027 | 10,374 |

| 17 | other drinking glasses other than of glass ceramic | Jordan, China, France, Italy, Turkey | 7399 | 40,838 |

| 18 | other glassware of a kind used for table (other than drinking | UAE, India, China, UK, France, Italy, Turkey | 7395 | 65,503 |

| 19 | others glassware | UAE, China, Taiwan, France | 2553 | 29,366 |

| 20 | glass cubes and other glass small wares | UAE, India, China, Tunisia, Italy, Spain | 3872 | 27,843 |

| 21 | other glass paving blocks and the like; leaded light | China, Canada, Belgium, Italy, Spain | 21,107 | 1750 |

| 22 | other lab glassware | China, USA, Germany | 263 | 11,135 |

| 23 | mats of glass fibers | China, USA, UK | 15,164 | 2112 |

| 24 | other articles of glass fibers | Bahrain, UAE, India, China, Egypt, USA, Germany, Turkey | 37,573 | 2263 |

| 25 | other articles of glass | India, China, USA, Switzerland, Germany | 20,971 | 851 |

| Total | 280,992 | 937,886 | ||

| No. | Region | SiO2 | Al2O3 | Fe2O3 | CaO | Na2O | K2O |

|---|---|---|---|---|---|---|---|

| 1 | Madinah | 76.21 | 10.52 | 2.32 | 2.26 | 3.11 | 1.13 |

| 2 | Jeddah | 93.51 | 2.61 | 0.72 | 0.21 | 0.19 | 0.01 |

| 3 | Ar Rayis | 97.02 | 1.62 | 0.62 | 0.18 | 0.12 | 0.11 |

| 4 | Rabigh | 75.07 | 11.20 | 4.53 | 3.42 | 2.51 | 1.54 |

| 5 | Al Majma’ah | 95.62 | 1.42 | 0.79 | 0.32 | 0.22 | 0.09 |

| 6 | Unayzah | 94.51 | 1.25 | 0.72 | 0.65 | 0.37 | 0.55 |

| Sample No. | Catalyst Type | Purity, % | Particle size | Wt.% |

|---|---|---|---|---|

| 1 | Plain glass without any crystallization catalyst addition | |||

| 2 | VC | 99.00 | <100 nm | 3 |

| 3 | WC | 99.95 | 30 nm | 3 |

| 4 | TiC | 99.90 | 30 nm | 3 |

| 5 | Y2O3 | 99.90 | 40 nm | 3 |

| Sample No. | Hardness Kg/mm2 (Standard Deviation) |

|---|---|

| Plain glass | 312 (6.63) |

| 2 (VC) | 417 (13.40) |

| 3 (WC) | 640 (12.82) |

| 4 (TiC) | 710 (24.18) |

| 5 (Y2O3) | 687 (17.58) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mahmoud, E.R.I.; Shaharoun, A.M.; Aljabri, A.; Almohamadi, H.; Farhan, M. Assessment of Sand and Glass Industry in Saudi Arabia. Sustainability 2022, 14, 12904. https://doi.org/10.3390/su141912904

Mahmoud ERI, Shaharoun AM, Aljabri A, Almohamadi H, Farhan M. Assessment of Sand and Glass Industry in Saudi Arabia. Sustainability. 2022; 14(19):12904. https://doi.org/10.3390/su141912904

Chicago/Turabian StyleMahmoud, Essam R. I., Awaluddin Mohamed Shaharoun, Abdulrahman Aljabri, Hamad Almohamadi, and Mohammed Farhan. 2022. "Assessment of Sand and Glass Industry in Saudi Arabia" Sustainability 14, no. 19: 12904. https://doi.org/10.3390/su141912904

APA StyleMahmoud, E. R. I., Shaharoun, A. M., Aljabri, A., Almohamadi, H., & Farhan, M. (2022). Assessment of Sand and Glass Industry in Saudi Arabia. Sustainability, 14(19), 12904. https://doi.org/10.3390/su141912904