Assessing the Performance of Vietnam’s Banks in the Era of Free Trade Agreements

Abstract

:1. Introduction

2. Study Context

2.1. An Overview of the Vietnam’s Financial System and Signed FTAs

2.2. An Overview of the EVFTA

3. Literature Review

4. Methodology

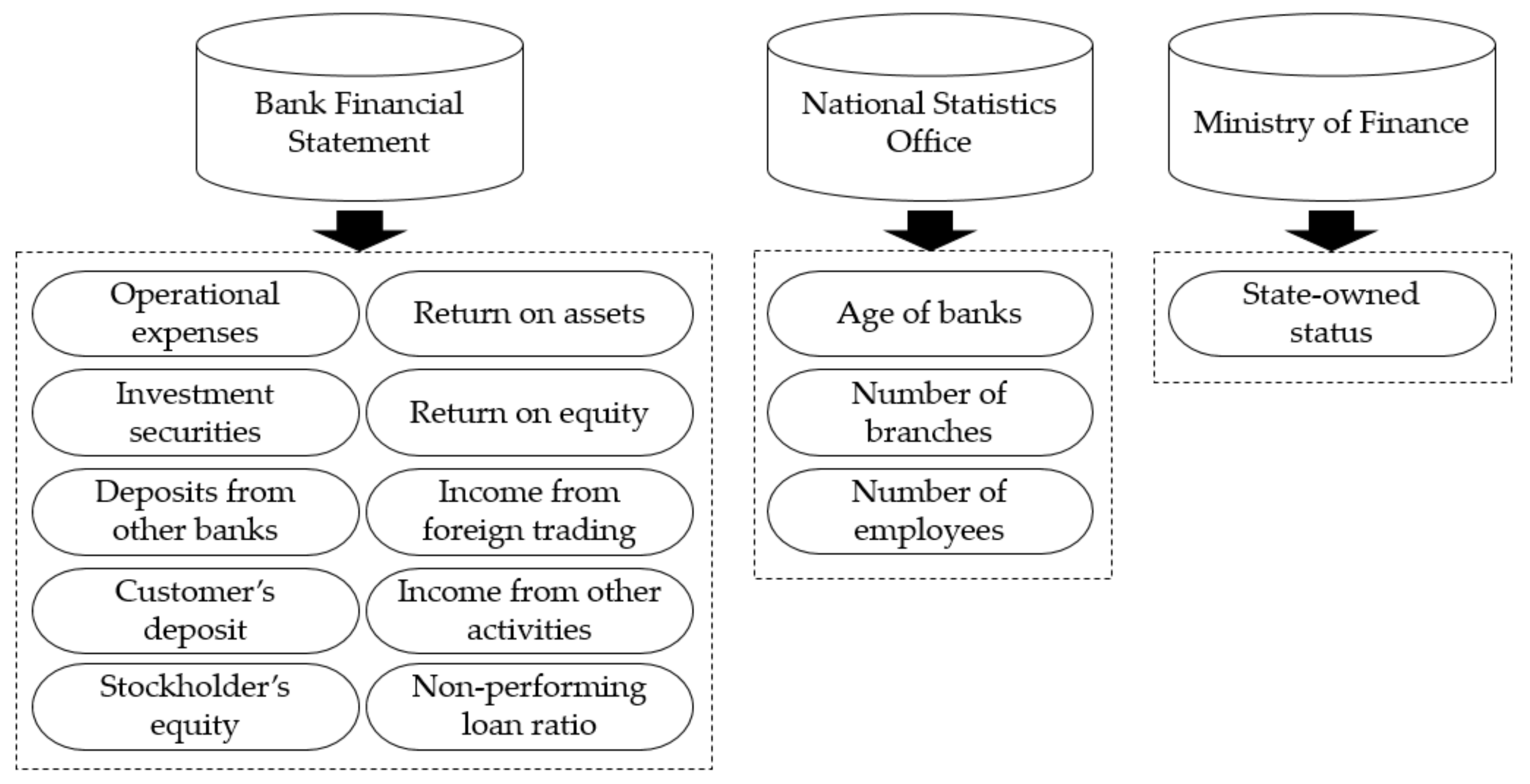

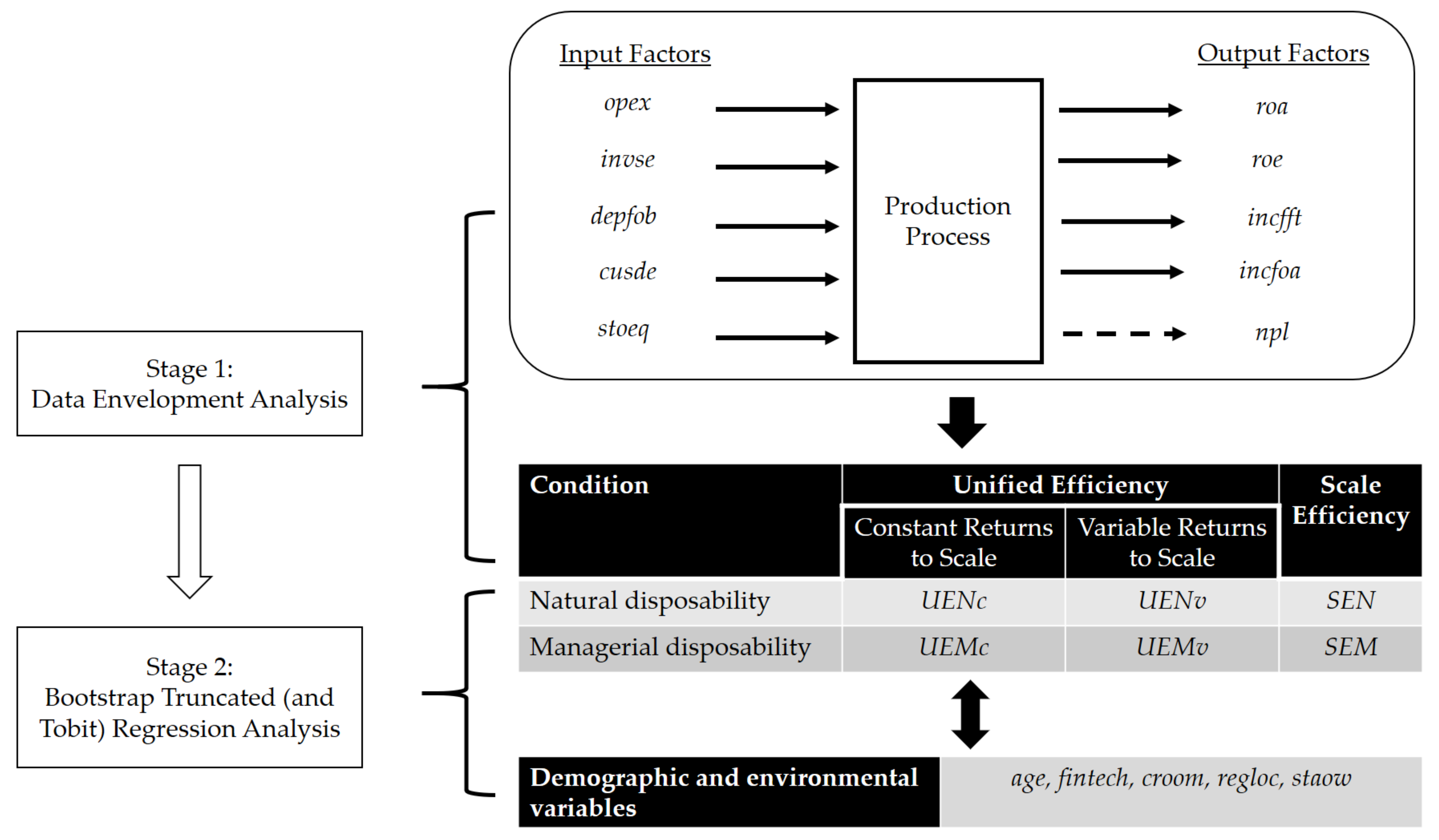

4.1. Data

4.2. Variables and Proxies

- Operating expenses (opex) are all expenses that a business is obliged to incur to smooth the operational structure, including staff payroll, rent premium, and insurance fee. It reflects the financial health of a company and is subject to minimization.

- Investment securities (invse) are bonds and shares that are purchased as a proxy for future investments; the profit will be extracted from dividends on an accumulated basis.

- Deposits from other banks (depfob) are often defined as “interbank deposit,” meaning an arrangement of both sides where one bank possesses an account in another. The corresponding bank will hold the due to account from the holding bank; transactions will include deposits and loans as normal.

- Customer’s deposit (cusde) refers to a client’s money that is placed into banks for safekeeping and is categorized as saving or checking accounts. Customers are eligible to withdraw or deposit additional amounts to their balance, whereas it performs as a liability to financial institutions.

- Stockholder’s equity (stoeq) is the remaining assets for shareholders after all liabilities have been processed; it includes paid-in capital, treasury stocks, or retained earnings. It is expected that this equity remains positive, which indicates the bank’s sustainability in financial health and capability to cover debts.

- Return on assets (roa) measures the profit that a company receives from its assets after the operation. Investors are interested in this ratio because it is an indicator of a firm’s operational efficiency (5% is marked as good and over 20% is marked as excellent). Return on equity (roe) measures the profits generated from stockholder’s equity; this ratio is often used in conjunction with the retention ratio to measure a firm’s growth rate.

- Income from foreign trading (incfft) refers to the bank’s profitability in trading currencies, as for now, the Forex market is a large electronic network with enormous trading volume.

- Income from other activities (incfoa) includes profits from the sale of investments or treasury income and also covers the charge and fees from electronic banking services or maintenance.

- Non-performing loan ratio (npl) measures the level of default risk and outstanding loans; there is a threshold established by Basel III to standardize the acceptable NPL to smooth the bank’s operation and avoid substantial loss.

- Financial technology (fintech) indicates whether a bank makes Fintech innovations. While there are two broad categories of Fintech—digital payment and digital financing services—this study focuses on the latter rather than the former, since the former has been already developed domestically even prior to the EVFTA (e.g., cooperation between Techcombank and Fintech Fastacash, and between Vietcombank and M_Service) whereas the latter is still at the embryonic stage. The latter includes customer-centric services such as robo-advisor for investment, (re)financing service, or P2P lending, which tend to require more advanced and large-scale technologies that can be brought in by the EVFTA.

- Credit room (croom) indicates whether a bank increases its credit room. This study defines credit room from angles of not only real estate, but also foreign credit room or foreign ownership limits (FOL), which are more related to the EVFTA’s effects. Considering the importance of foreign investment, a bank’s ability to vie for foreign equity or to raise FOL can influence its competitive advantage by increasing the inflow of investment and decreasing the risk of a merger.

- Regional location (regloc) indicates whether the headquarters of a bank are located in Northern or Southern Vietnam. While a few large banks have a national presence, a majority of banks in our list are small and medium-sized banks that are slated to primarily serve customers in geographical proximity. The operation of Nam A, a bank headquartered in Southern Vietnam, for example, is concentrated in the Southern region; it has 86 branches in the South out of a total of 98 branches. In this study, we assume that the business environment for a bank may vary between two regions due to their different contexts.

- State-owned status (staow) indicates whether the bank has over 50% equity from the state.

4.3. Two-Stage Analytic Framework

5. Results

6. Discussion

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

Appendix A. Data Envelopment Analysis with Undesirable Output

Appendix B. Bootstrap Truncated Regression Analysis

- Retrieve UENc and UEMc from the first stage and generate a truncated regression to get coefficients of β and the estimates of σ.

- Repeat the following steps 2,000 times to compute bootstrap estimates of and . For i = 1, …, m < n observations, draw εi from the N(0, ) with left truncated at 1 − zi. Again, for each i = 1, …, m, compute = zi + εi. Use the maximum likelihood method to estimate the truncated regression of on zi, yielding estimates and .

- Use the bootstrapped values and the original estimates and to construct estimated confidence intervals for each element of β and σ.

Appendix C. Results of Regression Analyses on Scale Efficiency Measures

| Var | Tobit | Bootstrap Truncated | Difference (2b − 1b) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Model 1a | Model 1b | Model 2a | Model 2b | ||||||

| opex | −0.0030 | (−0.28) | 0.0084 | (0.80) | −0.0030 | (−0.28) | 0.0084 | (0.80) | 0.0000 |

| invse | −0.1592 ** | (−2.39) | −0.1089 | (−1.72) | −0.1592 ** | (−2.41) | −0.1089 * | (−1.72) | 0.0000 |

| depfob | −0.0280 | (−0.67) | −0.0105 | (−0.26) | −0.0280 | (−0.69) | −0.0105 | (−0.25) | 0.0000 |

| cusde | −0.1514 * | (−1.73) | −0.2197 ** | (−2.61) | −0.1514 * | (−1.70) | −0.2197 *** | (−2.68) | 0.0000 |

| stoeq | 0.1952 * | (1.89) | 0.1818 | (1.68) | 0.1952 * | (1.84) | 0.1818 * | (1.67) | 0.0000 |

| roa | −0.1812 | (−1.54) | −0.1821 | (−1.57) | −0.1812 | (−1.50) | −0.1821 | (−1.58) | 0.0000 |

| roe | 0.1873 * | (1.77) | 0.1891 * | (1.88) | 0.1873 * | (1.75) | 0.1891 * | (1.89) | 0.0000 |

| incfft | 0.0504 * | (2.00) | 0.0251 | (0.78) | 0.0504 ** | (2.01) | 0.0251 | (0.77) | 0.0000 |

| incfoa | 0.0575 | (1.55) | 0.0361 | (0.94) | 0.0575 | (1.54) | 0.0361 | (0.93) | 0.0000 |

| npl | −0.0259 | (−0.62) | −0.0586 | (−1.17) | −0.0259 | (−0.60) | −0.0586 | (−1.15) | 0.0000 |

| age | 0.1085 | (0.96) | 0.1085 | (0.94) | 0.0000 | ||||

| regloc | 0.0371 | (1.07) | 0.0371 | (1.05) | 0.0000 | ||||

| croom | 0.0292 | (0.90) | 0.0292 | (0.88) | 0.0000 | ||||

| fintech | −0.0600 | (−1.45) | −0.0600 | (−1.45) | 0.0000 | ||||

| staow | 0.0986 * | (1.78) | 0.0986 * | (1.80) | 0.0000 | ||||

| AIC | 392.173 | 392.070 | 392.173 | 392.070 | |||||

| BIC | 409.381 | 416.448 | 409.381 | 416.448 | |||||

| Var | Tobit | Bootstrap Truncated | Difference (2b − 1b) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Model 1a | Model 1b | Model 2a | Model 2b | ||||||

| opex | −0.0025 | (−0.22) | −0.0029 | (−0.24) | −0.0025 | (−0.22) | −0.0029 | (−0.24) | 0.0000 |

| invse | −0.0549 | (−0.78) | −0.0435 | (−0.60) | −0.0549 | (−0.76) | −0.0435 | (−0.61) | 0.0000 |

| depfob | −0.0682 | (−1.54) | −0.0574 | (−1.24) | −0.0682 | (−1.55) | −0.0574 | (−1.24) | 0.0000 |

| cusde | −0.1449 | (−1.56) | −0.1852 * | (−1.92) | −0.1449 | (−1.55) | −0.1852 * | (−1.88) | 0.0000 |

| stoeq | 0.0897 | (0.82) | 0.0942 | (0.76) | 0.0897 | (0.81) | 0.0942 | (0.76) | 0.0000 |

| roa | −0.0772 | (−0.62) | −0.0656 | (−0.49) | −0.0772 | (−0.61) | −0.0656 | (−0.49) | 0.0000 |

| roe | 0.1428 | (1.27) | 0.1321 | (1.15) | 0.1428 | (1.26) | 0.1321 | (1.14) | 0.0000 |

| incfft | 0.0495 * | (1.85) | 0.0559 | (1.52) | 0.0495 * | (1.90) | 0.0559 | (1.56) | 0.0000 |

| incfoa | 0.0602 | (1.52) | 0.0525 | (1.19) | 0.0602 | (1.53) | 0.0525 | (1.22) | 0.0000 |

| npl | 0.0444 | (1.00) | 0.0526 | (0.92) | 0.0444 | (1.00) | 0.0526 | (0.91) | 0.0000 |

| age | −0.0361 | (−0.28) | −0.0361 | (−0.29) | 0.0000 | ||||

| regloc | 0.0387 | (0.97) | 0.0387 | (0.99) | 0.0000 | ||||

| croom | −0.0069 | (−0.18) | −0.0069 | (−0.18) | 0.0000 | ||||

| fintech | −0.0535 | (−1.13) | −0.0535 | (−1.13) | 0.0000 | ||||

| staow | 0.0593 | (0.93) | 0.0593 | (0.95) | 0.0000 | ||||

| AIC | 395.902 | 400.504 | 395.902 | 400.504 | |||||

| BIC | 413.110 | 424.881 | 413.110 | 424.881 | |||||

References

- De Carvalho Ferreira, M.C.R.; Sobreiro, V.A.; Kimura, H.; de Moraes Barboza, F.L. A systematic review of literature about finance and sustainability. J. Sustain. Financ. Investig. 2016, 6, 112–147. [Google Scholar] [CrossRef]

- Ntarmah, A.H.; Kong, Y.; Gyan, M.K. Banking system stability and economic sustainability: A panel data analysis of the effect of banking system stability on sustainability of some selected developing countries. Quant. Financ. Econ. 2019, 3, 709–738. [Google Scholar] [CrossRef]

- Dutta, M. Vietnam: Marketization and internationalization of its economy. J. Asian Econ. 1995, 6, 311–326. [Google Scholar] [CrossRef]

- Yoo, J.-G. An Economic Effect Analysis of ASEAN FTA on FDI Flows into the ASEAN Countries. J. Distrib. Sci. 2016, 14, 39–49. [Google Scholar]

- Narayan, P.K.; Narayan, S. Modelling the impact of oil prices on Vietnam’s stock prices. Appl. Energy 2010, 87, 356–361. [Google Scholar] [CrossRef]

- Kikuchi, T.; Yanagida, K.; Vo, H. The effects of Mega-Regional Trade Agreements on Vietnam. J. Asian Econ. 2018, 55, 4–19. [Google Scholar] [CrossRef]

- Tien, N.H.; Vu, N.T.; Dung, H.T.; Duc, L. Determinants of real estate bubble in Vietnam. Int. J. Res. Financ. Manag. 2019, 2, 75–80. [Google Scholar]

- Huy, D.T.N.; Nhan, V.K.; Bich, N.T.N.; Hong, N.T.P.; Chung, N.T.; Huy, P.Q. Impacts of Internal and External Macroeconomic Factors on Firm Stock Price in an Expansion Econometric model—A Case in Vietnam Real Estate Industry. In Data Science for Financial Econometrics; Springer: Berlin/Heidelberg, Germany, 2021; pp. 189–205. [Google Scholar]

- Vu, H.T. Assessing potential impacts of the EVFTA on Vietnam’s pharmaceutical imports from the EU: An application of SMART analysis. SpringerPlus 2016, 5, 1–22. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Le, C.; Šević, A.; Tzeremes, P.G.; Ngo, T. Bank efficiency in Vietnam: Do scale expansion strategies and non-performing loans matter? Int. J. Financ. Econ. 2020, 1–22. [Google Scholar] [CrossRef]

- Huu, N.D. Challenges in Intellectual Property Policy in Vietnam Participating in the EU-Vietnam Free Trade Agreement (EVFTA). Rev. GEINTEC 2021, 11, 595–609. [Google Scholar] [CrossRef]

- Fforde, A.J. Luck, policy or something else entirely? Vietnam’s economic performance in 2009 and prospects for 2010. J. Curr. Southeast Asian Aff. 2009, 28, 71–94. [Google Scholar] [CrossRef] [Green Version]

- Thanassoulis, E. Data envelopment analysis and its use in banking. Compos. Interfaces 1999, 29, 1–13. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Goto, M. Environmental Assessment on Energy and Sustainability by Data Envelopment Analysis; John Wiley & Sons: Hoboken, NJ, USA, 2018. [Google Scholar]

- Simar, L.; Wilson, P.W. Estimation and inference in two-stage, semi-parametric models of production processes. J. Econom. 2007, 136, 31–64. [Google Scholar] [CrossRef]

- Packard, L.A.T.; Thurman, S.S. A Model Design for Vietnam as an Open Economy in Transition. ASEAN Econ. Bull. 1996, 13, 241–261. [Google Scholar] [CrossRef]

- Anwar, S.; Nguyen, L.P. Channels of monetary policy transmission in Vietnam. J. Policy Model. 2018, 40, 709–729. [Google Scholar] [CrossRef]

- Nguyen, T.N.; Steward, C. Vietnamese banking system between 1999 and 2009: A structural model approach. J. Financ. Regul. Compliance 2013, 21, 268–283. [Google Scholar] [CrossRef] [Green Version]

- Manyin, M.E. The Vietnam-US Bilateral Trade Agreement; U.S. Congressional Research Service: Washington, DC, USA, 2001.

- Barai, M.K.; Le, T.A.L.; Nguyen, N.H. Vietnam: Achievements and challenges for emerging as a FTA hub. Transnatl. Corp. Rev. 2017, 9, 51–65. [Google Scholar] [CrossRef]

- Kawai, M.; Wignaraja, G. Asian FTAs: Trends, prospects and challenges. J. Asian Econ. 2011, 22, 1–22. [Google Scholar] [CrossRef]

- Le, G.; Bui, H. Vietnamese Exporters in the Midst of Rules of Origin Under FTAs. Glob. Trade Cust. J. 2020, 15, 164–167. [Google Scholar]

- Cheng, M.; Geng, H.; Zhang, J. Chinese commercial banks: Benefits from foreign strategic investors? Pac. Basin Finance J. 2016, 40, 147–172. [Google Scholar] [CrossRef]

- Phan, D.H.B.; Narayan, P.K.; Rahman, R.E.; Hutabarat, A.R. Do financial technology firms influence bank performance? Pac. Basin Financ. J. 2020, 62, 101210. [Google Scholar] [CrossRef]

- Jun, J.; Yeo, E. Entry of FinTech firms and competition in the retail payments market. Asia-Pac. J. Financ. Stud. 2016, 45, 159–184. [Google Scholar] [CrossRef]

- Anagnostopoulos, L. Fintech and regtech: Impact on regulators and banks. J. Econ. Bus. 2018, 100, 7–25. [Google Scholar] [CrossRef]

- Büthe, T.; Miller, H.V. The politics of foreign direct investment into developing countries: Increasing FDI through international trade agreements? Am. J. Pol. Sci. 2008, 52, 741–762. [Google Scholar] [CrossRef]

- Maudos, J.; Pastor, J.M.; Perez, F.; Quesada, J. Cost and profit efficiency in European banks. J. Int. Financ. Mark. Inst. Money 2002, 12, 33–58. [Google Scholar] [CrossRef]

- Van Dinh, U.L.; Le, P. Measuring the Impacts of Internet Banking to Bank Performance: Evidence from Vietnam. J. Internet Bank. Commerce 2015, 20, 1–14. [Google Scholar]

- Dang, V. The effects of loan growth on bank performance: Evidence from Vietnam. Manag. Sci. Lett. 2019, 9, 899–910. [Google Scholar] [CrossRef]

- Le, T.T.D. Determinants of Retail Banking Efficiency: A Case of Vietcombank Branches in the Mekong-Delta Region. J. Asian Financ. Econ. Bus. 2020, 7, 439–451. [Google Scholar] [CrossRef]

- Nguyen, T.P.T.; Roca, E.; Sharma, P. How efficient is the banking system of Asia’s next economic dragon? Evidence from rolling DEA windows. Appl. Econ. Lett. 2014, 46, 2665–2684. [Google Scholar] [CrossRef]

- Stewart, C.; Matousek, R.; Nguyen, T.N. Efficiency in the Vietnamese banking system: A DEA double bootstrap approach. Res. Int. Bus. Financ. 2016, 36, 96–111. [Google Scholar] [CrossRef] [Green Version]

- Vu, H.T.; Turnell, S. Cost efficiency of the banking sector in Vietnam: A Bayesian stochastic frontier approach with regularity constraints. Asian Econ. J. 2010, 24, 115–139. [Google Scholar] [CrossRef]

- Le, P.T.; Harvie, C.; Arjomandi, A.; Borthwick, J. Financial liberalization, bank ownership type and performance in a transition economy: The case of Vietnam. Pac. Basin. Financ. J. 2019, 57, 101182. [Google Scholar] [CrossRef]

- Wu, D.D.; Yang, Z.; Liang, L. Efficiency analysis of cross-region bank branches using fuzzy data envelopment analysis. Appl. Math. Comput. 2006, 181, 271–281. [Google Scholar] [CrossRef]

- Shyu, J.; Lieu, P.T.; Chang, W. How the environment determines banking efficiency: A comparison of banking firms in Taiwan, Hong Kong, and Mainland China. Int. Trans. Oper. Res. 2015, 22, 757–770. [Google Scholar] [CrossRef]

- Wijesiri, M.; Martinez-Campillo, A.; Wanke, P. Is there a trade-off between social and financial performance of public commercial banks in India? A multi-activity DEA model with shared inputs and undesirable outputs. Rev. Manag. Sci. 2019, 13, 417–442. [Google Scholar] [CrossRef]

- Minh, D.N.; Dat, P.M. European-Vietnam Free Trade Agreement (EVFTA) impacts on imports: A case study. J. Secur. Sustain. Issues 2020, 9, 56–68. [Google Scholar]

- Guild, J. Fintech and the Future of Finance. Asian J. Public Aff. 2017, 10, 12–17. [Google Scholar] [CrossRef]

- Chen, X.; You, X.; Chang, V. FinTech and commercial banks’ performance in China: A leap forward or survival of the fittest? Technol. Forecast. Soc. Chang. 2021, 166, 120645. [Google Scholar] [CrossRef]

- Preston, H.H. Branch banking with special reference to California conditions. J. Polit. Econ. 1922, 30, 494–517. [Google Scholar] [CrossRef] [Green Version]

- Boone, C.; Özcan, S. Ideological purity vs. hybridization trade-off: When do Islamic banks hire managers from conventional banking? Organ. Sci. 2016, 27, 1380–1396. [Google Scholar] [CrossRef]

- Deng, S.; Elyasiani, E. Geographic diversification, bank holding company value, and risk. J. Money Credit. Bank. 2008, 40, 1217–1238. [Google Scholar] [CrossRef]

- Eckardt, H.M.P. Branch Banking among the State Banks. Ann. Am. Acad. Pol. Soc. Sci. 1910, 36, 148–161. [Google Scholar] [CrossRef]

- Zhao, S.X.; Zhang, L.; Wang, D.T. Determining factors of the development of a national financial center: The case of China. Geoforum 2004, 35, 577–592. [Google Scholar] [CrossRef] [Green Version]

- Berger, A.N.; DeYoung, R. The effects of geographic expansion on bank efficiency. J. Financ. Serv. Res. 2001, 19, 163–184. [Google Scholar] [CrossRef]

- Ptak, S.A. Geographical Analysis of Commercial Lending by US Banks: A Study of Knowledge-Intensive Business Services. Ph.D. Thesis, State University of New York at Buffalo, Buffalo, NY, USA, January 2016. [Google Scholar]

- Jiménez, G.; Salas, V.; Saurina, J. Organizational distance and use of collateral for business loans. J. Bank. Financ. 2009, 33, 234–243. [Google Scholar] [CrossRef] [Green Version]

- Belkhir, M.; Grira, J.; Hassan, M.K.; Soumaré, I. Islamic banks and political risk: International evidence. Q. Rev. Econ. Financ. 2019, 74, 39–55. [Google Scholar] [CrossRef]

- Athari, S.A. Domestic political risk, global economic policy uncertainty, and banks’ profitability: Evidence from Ukrainian banks. Post-Communist Econ. 2021, 33, 458–483. [Google Scholar] [CrossRef]

- Lisle-Williams, M. Beyond the market: The survival of family capitalism in the English merchant banks. Br. J. Sociol. 1984, 35, 241–271. [Google Scholar] [CrossRef]

- Glynos, J.; Speed, E. Varieties of co-production in public services: Time banks in a UK health policy context. Crit. Policy Stud. 2012, 6, 402–433. [Google Scholar] [CrossRef]

- Ba, T.L. Determinants of credit risk management in Vietnam. J. Financ. Monet. Mark. 2018, 6, 25. [Google Scholar]

- Alodayni, S. Oil prices, credit risks in banking systems, and macro-financial linkages across GCC oil exporters. Int. J. Financ. Stud. 2016, 4, 23. [Google Scholar] [CrossRef] [Green Version]

- Anwar, S.; Nguyen, L.P. Financial development and economic growth in Vietnam. J. Econ. Financ. 2011, 35, 348–360. [Google Scholar] [CrossRef]

- Malesky, E.J.; Taussig, M. Where is credit due? Legal institutions, connections, and the efficiency of bank lending in Vietnam. J. Law Econ. Organ. 2009, 25, 535–578. [Google Scholar] [CrossRef]

- Ha, N.M.; Le, N.D.; Kien, P.T. The impact of urbanization on income inequality: A study in Vietnam. J. Risk Financ. 2019, 12, 146. [Google Scholar] [CrossRef] [Green Version]

- Smith, D.W.; Scarpaci, J.L. Urbanization in transitional societies: An overview of Vietnam and Hanoi. Urban Geogr. 2000, 21, 745–757. [Google Scholar] [CrossRef]

- Thu, T.T.; Perera, R. Consequences of the two-price system for land in the land and housing market in Ho Chi Minh City, Vietnam. Habitat Int. 2011, 35, 30–39. [Google Scholar]

- Quigley, J.M. Real estate and the Asian crisis. J. Hous. Econ. 2001, 10, 129–161. [Google Scholar] [CrossRef] [Green Version]

- Nguyen, M.; Skully, M.; Perera, S. Bank market power and revenue diversification: Evidence from selected ASEAN countries. J. Asian Econ. 2012, 23, 688–700. [Google Scholar] [CrossRef]

- Leightner, J.E.; Lovell, C.K. The impact of financial liberalization on the performance of Thai banks. J. Econ. Bus. 1998, 50, 115–131. [Google Scholar] [CrossRef]

- Sufian, F. Determinants of bank efficiency during unstable macroeconomic environment: Empirical evidence from Malaysia. Res. Int. Bus. Financ. 2009, 23, 54–77. [Google Scholar] [CrossRef]

- Salim, R.; Arjomandi, A.; Seufert, J.H. Does corporate governance affect Australian banks’ performance? J. Int. Financ. Mark. Inst. Money 2016, 43, 113–125. [Google Scholar] [CrossRef] [Green Version]

- Minh, N.K.; Long, G.T.; Hung, N.V. Efficiency and super-efficiency of commercial banks in Vietnam: Performances and determinants. Asia-Pac. J. Oper. Res. 2013, 30, 1250047. [Google Scholar] [CrossRef] [Green Version]

- Drake, L.; Hall, M.J.; Simper, R. The impact of macroeconomic and regulatory factors on bank efficiency: A non-parametric analysis of Hong Kong’s banking system. J. Bank. Financ. 2006, 30, 1443–1466. [Google Scholar] [CrossRef] [Green Version]

- Sueyoshi, T.; Ryu, Y. Performance Assessment of the Semiconductor Industry: Measured by DEA Environmental Assessment. Energies 2020, 13, 5998. [Google Scholar] [CrossRef]

- Berger, A.N.; Humphrey, D.B. Efficiency of financial institutions: International survey and directions for future research. Eur. J. Oper. Res. 1997, 98, 175–212. [Google Scholar] [CrossRef] [Green Version]

- Ho, T.H.; Nguyen, D.T.; Ngo, T.; Le, T.D. Efficiency in Vietnamese banking: A meta-regression analysis approach. Int. J. Financ. Stud. 2021, 9, 41. [Google Scholar] [CrossRef]

- Halkos, G.; Petrou, K.N. Treating undesirable outputs in DEA: A critical review. Econ. Anal. Policy 2019, 62, 97–104. [Google Scholar] [CrossRef]

- Dyson, R.G.; Allen, R.; Camanho, A.S.; Podinovski, V.V.; Sarrico, C.S.; Shale, E.A. Pitfalls and protocols in DEA. Eur. J. Oper. Res. 2001, 132, 245–259. [Google Scholar] [CrossRef]

- Keeton, W.R. Does faster loan growth lead to higher loan losses? Fed. Reserve Bank Kansas City Econ. Rev. 1999, 84, 57–75. [Google Scholar]

- The State Bank of Vietnam Prescribing Lending Transactions of Credit Institutions and/or Foreign Bank Branches with Customers. 2016. Available online: https://english.luatvietnam.vn/circular-no-39-2016-tt-nhnn-dated-december-30-2016-of-the-state-bank-of-vietnam-prescribing-lending-transactions-of-credit-institutions-and-or-forei-112177-Doc1.html (accessed on 1 October 2021).

- Chiorazzo, V.; Milani, C.; Salvini, F. Income Diversification and Bank Performance: Evidence from Italian Banks. J. Financ. Serv. Res. 2008, 33, 181–203. [Google Scholar] [CrossRef]

- Berger, A.N.; Hasan, I.; Zhou, M. The effects of focus versus diversification on bank performance: Evidence from Chinese banks. J. Bank. Financ. 2010, 34, 1417–1435. [Google Scholar] [CrossRef] [Green Version]

- Phuong, N.N.D.; Luan, L.T.; Dong, V.V. Examining Customers’ Continuance Intentions towards E-wallet Usage: The Emergence of Mobile Payment Acceptance in Vietnam. J. Asian Financ. Econ. Bus. 2020, 7, 505–516. [Google Scholar] [CrossRef]

- Phan, T.N.; Ho, T.V.; Le-Hoang, P.V. Factors Affecting the Behavioral Intention and Behavior of Using E-Wallets of Youth in Vietnam. J. Asian Financ. Econ. Bus. 2020, 7, 295–302. [Google Scholar] [CrossRef]

- Long, N.D.; Ogunlana, S.; Quang, T.; Lam, K.C. Large construction projects in developing countries: A case study from Vietnam. Int. J. Proj. Manag. 2004, 22, 553–561. [Google Scholar] [CrossRef]

- Nong, D.; Wang, C.; Al-Amin, A.Q. A critical review of energy resources, policies and scientific studies towards a cleaner and more sustainable economy in Vietnam. Renew. Sust. Energ. Rev. 2020, 134, 110117. [Google Scholar] [CrossRef]

- Williams, J.; Nguyen, N. Financial liberalization, crisis, and restructuring: A comparative study of bank performance and bank governance in South East Asia. J. Bank. Financ. 2005, 29, 2119–2154. [Google Scholar] [CrossRef]

- Shen, C.H.; Hasan, I.; Lin, C.Y. The government’s role in government-owned banks. J. Financ. Serv. Res 2014, 45, 307–340. [Google Scholar] [CrossRef] [Green Version]

- Kharisma, D.B. Urgency of financial technology (Fintech) laws in Indonesia. Int. J. Law Manag. 2021, 63, 320–331. [Google Scholar] [CrossRef]

- Magnuson, W. Regulating Fintech. Vanderbilt Law Rev. 2018, 71, 1167. [Google Scholar]

- Vietnam: America Lost, Capitalism Won. The Economist, 30 April 2005, 950. Available online: https://www.economist.com/asia/2005/04/28/america-lost-capitalism-won (accessed on 1 November 2021).

- Masina, P.P.; Cerimele, M. Patterns of industrialisation and the state of industrial labour in post-WTO-accession Vietnam. Eur. J. East. Asian Stud. 2018, 17, 289–323. [Google Scholar] [CrossRef]

- Nguyen, T.T.; Van Dijk, M.A. Corruption, growth, and governance: Private vs. state-owned firms in Vietnam. J. Bank. Financ. 2012, 36, 2935–2948. [Google Scholar] [CrossRef]

- Phan, H.T.; Hoang, T.N.; Dinh, L.V.; Hoang, D.N. The Determinants of Listed Commercial Banks’ Profitability in Vietnam. J. Asian Financ. Econ. Bus. 2020, 7, 219–229. [Google Scholar] [CrossRef]

- Bentick, B.L.; Lewis, M.K. Real Estate Speculation as a Source of Banking and Currency Instability: Some Different Lessons from the Asian Crisis. Econ. Labour Relat. Rev. 2004, 14, 256–275. [Google Scholar] [CrossRef]

| FTAs | Validated Year | Members |

|---|---|---|

| AFTA | 1993 | ASEAN |

| ACFTA | 2003 | ASEAN, China |

| AKFTA | 2007 | ASEAN, South Korea |

| AJCEP | 2008 | ASEAN, Japan |

| VJEPA | 2009 | Vietnam, Japan |

| AIFTA | 2010 | ASEAN, India |

| AANZFTA | 2010 | ASEAN, Australia, New Zealand |

| VCFTA | 2014 | Vietnam, Chile |

| VKFTA | 2015 | Vietnam, South Korea |

| VN-EAEU FTA | 2016 | Vietnam, Russia, Belarus, Kazakhstan, etc. |

| CPTPP | 2019 | Vietnam, Canada, Mexico, Peru, Chile, Japan, etc. |

| AHKFTA | 2019 | ASEAN, Hong Kong, China |

| EVFTA | 2020 | Vietnam, EU |

| Ref. | Country | Summary | Inputs | Outputs |

|---|---|---|---|---|

| [31] | Vietnam | This study shed light on factors affecting the retail banking efficiency of Vietcombank branches in the Mekong Delta region by combining DEA with Tobit regression. | Number of employees; labor costs; non-interest expense; total operating expenses in providing service | Total retail loans; total retail mobilized funds; total net interest income for retail banking; ton-interest income |

| [32] | Vietnam, ASEAN | This paper analyzed the level and trends of the cost and profit efficiency of the Vietnamese banking sector over the period of 1995–2011, based on SFA and DEA, taking into account the Asian and Global Financial crises. | Deposits; assets; number of employees; per unit interest costs; other operating costs; personnel expenses | Net loans and other earning assets; per unit interest income; noninterest operating income |

| [33] | Vietnam | This study analyzed bank efficiency in Vietnam from 1999 to 2009, using a double-bootstrap DEA method to measure the difference in operating efficiency between large and medium-sized banks; state-owned banks and non-state-owned banks. | Staff, purchased funds, customer deposits | Customer loans, other loans, securities |

| [34] | Vietnam | This paper investigated the cost efficiency of the Vietnamese banking industry based on the SFA and DEA approach, and described the differences in cost efficiency between different groups of banks, categorized by the level of ownership. | Personnel expenses/number of employees; other non-interest expenses/fixed assets; interest expenses/total borrowed funds | Customer loans, other earning assets. actual value of off-balance-sheet items |

| [35] | Vietnam | This paper evaluated the impact of financial liberalization on the banking ecosystem in Vietnam, using the double-bootstrap DEA method; it also compared the performance of state-owned banks and private banks in different business scenarios. | Labor expenditure, fixed assets and deposits | Loans and non-traditional assets |

| [36] | China | This paper assessed the performance of bank branches from different regions by applying fuzzy DEA. | Personal equipment; occupancy; other expenses | Mortgage; non-term per loans; standby letter of credit |

| [37] | Greater China | This study explored the true managerial efficiency of the banking firms in Taiwan, Hong Kong, and Mainland China by using three-stage DEA. | Deposits; fixed assets; number of employees | Loans; long-term investment; noninterest incomes |

| [38] | India | This paper measured the social and financial efficiency of a sample of 26 Indian public banks over the period of 2011–2014 by using multi-activity DEA. | Labor; assets; deposits | Loan to priority sectors; number of female accounts; NPLs to priority sectors; etc. |

| Var | Definition | Obs | Mean | Max | Min | STDEV |

|---|---|---|---|---|---|---|

| opex | Operating expenses | 31 | 9416447 | 125167367 | 486328 | 22298800 |

| invse | Investment securities | 31 | 42177337 | 167529689 | 679704 | 43824632 |

| depfob | Deposits from other banks | 31 | 29976328 | 109483059 | 1900003 | 26105901 |

| cusde | Customer’s deposit | 31 | 254752226 | 1269373071 | 15667758 | 333594208 |

| stoeq | Stockholder’s equity | 31 | 23355487 | 80882982 | 3561206 | 24465923 |

| roa | Return on assets | 31 | 0.010 | 0.027 | 0.0003 | 0.007 |

| roe | Return on equity | 31 | 0.121 | 0.243 | 0.010 | 0.075 |

| incfft | Income from foreign trading | 31 | 386605 | 3378274 | 3189 | 691529 |

| incfoa | Income from other activities | 31 | 1494871 | 11685423 | 25219 | 2406745 |

| npl | Non-performing loan (NPL) ratio | 31 | 1.74 | 3.50 | 0.42 | 0.75 |

| age | Age of bank | 31 | 27 | 64 | 8 | 12 |

| fintech | Whether a bank makes Fintech innovations | 31 | 0.645 | 1 | 0 | 0.486 |

| croom | Whether a bank increases its credit room | 31 | 0.387 | 1 | 0 | 0.425 |

| regloc | Regional location: whether the headquarter is in Northern or Southern Vietnam | 31 | 0.645 | 1 | 0 | 0.486 |

| staow | State-owned status: whether the bank has over 50% equity from the state | 31 | 0.226 | 1 | 0 | 0.425 |

| Banks | UEN | UEM | ||||

|---|---|---|---|---|---|---|

| CRS | VRS | SEN | CDS | VDS | SEM | |

| ABB | 1.000 | 1.000 | 1.000 | 0.829 | 0.960 | 0.864 |

| ACB | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| AGR | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| BAB | 1.000 | 1.000 | 1.000 | 0.764 | 1.000 | 0.764 |

| BID | 0.367 | 0.414 | 0.886 | 0.178 | 0.296 | 0.603 |

| BVB | 0.858 | 1.000 | 0.858 | 0.726 | 1.000 | 0.726 |

| CTG | 0.367 | 0.365 | 1.007 | 0.193 | 0.270 | 0.714 |

| HSB | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| EIB | 1.000 | 1.000 | 1.000 | 0.449 | 0.460 | 0.977 |

| HDB | 0.798 | 0.811 | 0.985 | 0.671 | 0.781 | 0.859 |

| KLB | 1.000 | 1.000 | 1.000 | 0.721 | 1.000 | 0.721 |

| LPB | 0.586 | 0.670 | 0.876 | 0.457 | 0.494 | 0.926 |

| MBB | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| MSB | 0.548 | 0.557 | 0.983 | 0.455 | 0.486 | 0.936 |

| NAB | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| NVB | 0.600 | 0.794 | 0.755 | 0.574 | 0.795 | 0.722 |

| OCB | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| PGB | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| PVC | 0.493 | 0.547 | 0.901 | 0.407 | 0.508 | 0.801 |

| SCB | 0.559 | 1.000 | 0.559 | 0.560 | 1.000 | 0.560 |

| SGB | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| SHB | 0.572 | 0.572 | 0.999 | 0.231 | 0.235 | 0.982 |

| SSB | 1.000 | 1.000 | 1.000 | 0.993 | 1.000 | 0.993 |

| STB | 1.000 | 1.000 | 1.000 | 0.310 | 0.325 | 0.954 |

| TCB | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| TPB | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| VAB | 1.000 | 1.000 | 1.000 | 0.768 | 1.000 | 0.768 |

| VBB | 0.869 | 1.000 | 0.869 | 0.868 | 1.000 | 0.868 |

| VCB | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| VIB | 0.733 | 1.000 | 0.733 | 0.714 | 1.000 | 0.714 |

| VPB | 0.448 | 0.684 | 0.655 | 0.389 | 0.537 | 0.726 |

| Average | 0.832 | 0.884 | 0.938 | 0.718 | 0.811 | 0.877 |

| Var | Tobit | Bootstrap Truncated | Difference (2b − 1b) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Model 1a | Model 1b | Model 2a | Model 2b | ||||||

| opex | −0.0299 | (−1.57) | −0.0288 | (−1.32) | −0.0297 | (−1.60) | −0.0279 | (−1.27) | 0.0009 |

| invse | −0.1988 | (−1.66) | −0.2114 | (−1.61) | −0.1811 | (−1.44) | −0.1889 | (−1.40) | 0.0225 |

| depfob | 0.0431 | (0.57) | 0.0119 | (0.14) | 0.0407 | (0.53) | 0.0015 | (0.02) | −0.0104 |

| cusde | −0.0323 | (−0.21) | −0.0690 | (−0.40) | −0.0463 | (−0.29) | −0.0916 | (−0.53) | −0.0226 |

| stoeq | −0.4385 ** | (−2.36) | −0.3421 | (−1.53) | −0.4630 ** | (−2.36) | −0.3597 | (−1.58) | −0.0175 |

| roa | 0.3834 * | (1.81) | 0.3015 | (1.25) | 0.3888 * | (1.79) | 0.2882 * | (1.20) | −0.0132 |

| roe | −0.1995 | (−1.05) | −0.1161 | (−0.56) | −0.2034 | (−1.05) | −0.1035 | (−0.50) | 0.0126 |

| incfft | 0.1705 *** | (3.76) | 0.1721 ** | (2.58) | 0.1742 *** | (3.71) | 0.1773 *** | (2.57) | −0.0090 |

| incfoa | 0.2186 *** | (3.27) | 0.2378 *** | (2.97) | 0.2292 *** | (3.30) | 0.2597 *** | (3.07) | −0.0060 |

| npl | −0.2428 *** | (−3.21) | −0.2284 ** | (−2.20) | −0.2447 *** | (−3.17) | −0.2297 ** | (−2.14) | −0.0110 |

| age | −0.0885 | (−0.38) | −0.0965 | (−0.40) | −0.0080 | ||||

| regloc | −0.0350 | (−0.48) | −0.0493 | (−0.65) | −0.0143 | ||||

| croom | −0.0085 | (−0.13) | −0.0068 | (−0.10) | 0.0017 | ||||

| fintech | −0.0692 | (−0.81) | −0.0733 | (−0.84) | −0.0040 | ||||

| staow | 0.0604 | (0.52) | 0.0509 | (0.44) | −0.0095 | ||||

| AIC | 428.588 | 437.320 | 428.003 | 436.498 | |||||

| BIC | 445.796 | 461.698 | 445.211 | 460.876 | |||||

| Var | Tobit | Bootstrap Truncated | Difference (2b − 1b) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Model 1a | Model 1b | Model 2a | Model 2b | ||||||

| opex | −0.0278 ** | (−2.22) | −0.0325 ** | (−2.49) | −0.0278 ** | (−2.23) | −0.0325 ** | (−2.49) | 0.0000 |

| invse | −0.0571 | (−0.73) | −0.1152 | (−1.47) | −0.0570 | (−0.72) | −0.1151 | (−1.42) | 0.0001 |

| depfob | −0.1414 *** | (−2.86) | −0.1806 *** | (−3.61) | −0.1414 *** | (−2.83) | −0.1806 *** | (−3.67) | −0.0001 |

| cusde | 0.0316 | (0.31) | −0.0759 | (−0.73) | 0.0315 | (0.31) | −0.0761 | (−0.75) | −0.0001 |

| stoeq | −0.1748 | (−1.43) | 0.0193 | (0.14) | −0.1749 | (−1.45) | 0.0192 | (0.14) | −0.0001 |

| roa | 0.2988 ** | (2.15) | 0.1095 | (0.76) | 0.2988 ** | (2.22) | 0.1094 | (0.78) | −0.0001 |

| roe | −0.1682 | (−1.35) | −0.0378 | (−0.31) | −0.1682 | (−1.39) | −0.0378 | (−0.31) | 0.0001 |

| incfft | 0.0827 ** | (2.78) | 0.1398 *** | (3.52) | 0.0827 *** | (2.77) | 0.1398 *** | (3.45) | 0.0000 |

| incfoa | 0.0506 | (1.15) | 0.1221 ** | (2.56) | 0.0507 | (1.14) | 0.1222 ** | (2.55) | 0.0001 |

| npl | −0.1258 ** | (−2.54) | −0.0492 | (−0.80) | −0.1258 ** | (−2.48) | −0.0492 | (−0.81) | 0.0000 |

| age | −0.2737 * | (−1.97) | −0.2737 ** | (−1.97) | 0.0000 | ||||

| regloc | −0.0777 * | (−1.81) | −0.0778 * | (−1.82) | −0.0001 | ||||

| croom | 0.0425 | (1.06) | 0.0425 | (1.07) | 0.0000 | ||||

| fintech | −0.1130 ** | (−2.22) | −0.1130 ** | (−2.23) | 0.0000 | ||||

| staow | −0.0930 | (−1.36) | −0.0931 | (−1.33) | −0.0001 | ||||

| AIC | 402.482 | 405.151 | 402.480 | 405.147 | |||||

| BIC | 419.690 | 429.529 | 419.688 | 429.525 | |||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nguyen, H.; Ryu, Y. Assessing the Performance of Vietnam’s Banks in the Era of Free Trade Agreements. Sustainability 2022, 14, 1014. https://doi.org/10.3390/su14021014

Nguyen H, Ryu Y. Assessing the Performance of Vietnam’s Banks in the Era of Free Trade Agreements. Sustainability. 2022; 14(2):1014. https://doi.org/10.3390/su14021014

Chicago/Turabian StyleNguyen, Hoang, and Youngbok Ryu. 2022. "Assessing the Performance of Vietnam’s Banks in the Era of Free Trade Agreements" Sustainability 14, no. 2: 1014. https://doi.org/10.3390/su14021014

APA StyleNguyen, H., & Ryu, Y. (2022). Assessing the Performance of Vietnam’s Banks in the Era of Free Trade Agreements. Sustainability, 14(2), 1014. https://doi.org/10.3390/su14021014