Investigating e-Retailers’ Intentions to Adopt Cryptocurrency Considering the Mediation of Technostress and Technology Involvement

Abstract

:1. Introduction

- RQ1: How can the technological characteristics of cryptocurrencies help explain e-retailers’ attitudes toward them?

- RQ2: How can e-retailers’ attitudes define their intentions to adopt and accept cryptocurrency as a mode of payments and transactions?

- RQ3: How can regulatory force affect e-retailers’ choices to adopt and accept cryptocurrency as a mode of payments and transactions?

2. Literature

2.1. Empirical Background

2.2. Theoretical Background

3. Hypotheses Development

3.1. Stimuli

3.2. Organism and Response

3.3. Moderating Role of the Regulatory Environment

4. Methods

4.1. Instrument Development

4.2. Data Collection

5. Analysis

5.1. Common-Method-Bias Testing

5.2. Measurement Model Testing

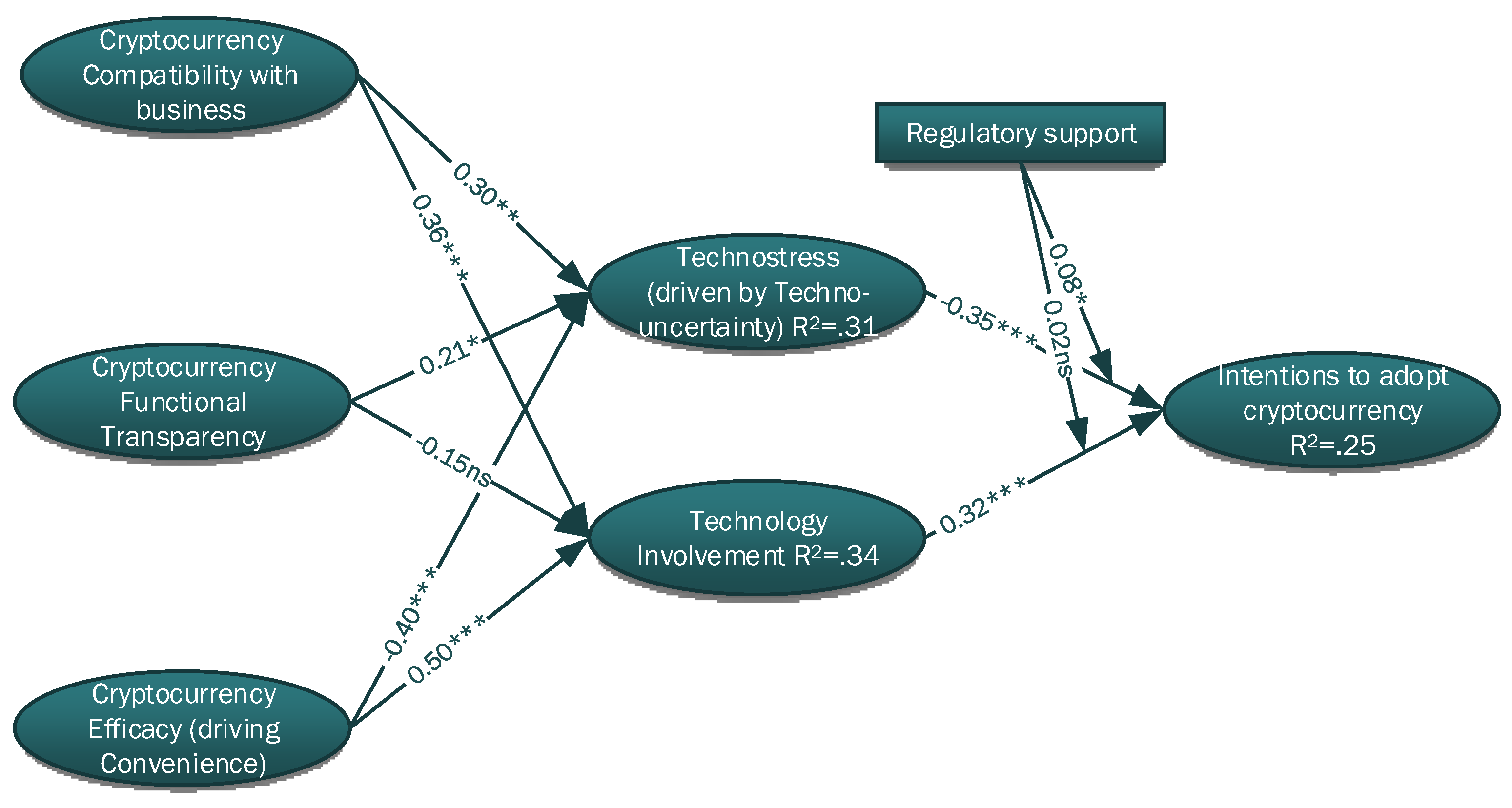

5.3. Structural Model Testing

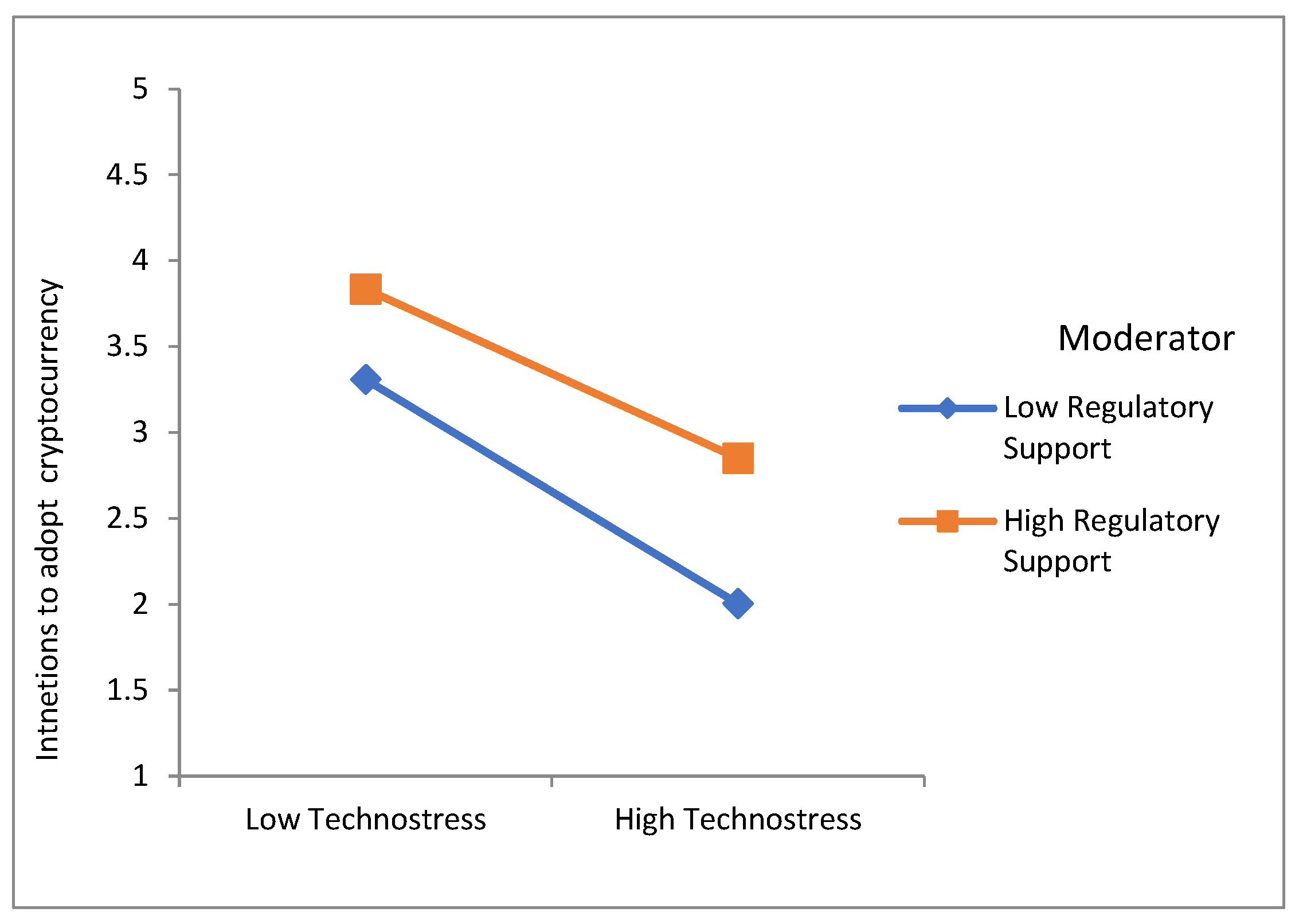

5.4. Moderation Testing

6. Discussion

6.1. Implications

6.2. Future Studies

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Leong, K. FinTech (Financial Technology): What is It and How to Use Technologies to Create Business Value in Fintech Way? Int. J. Innov. Manag. Technol. 2018, 9, 74–78. [Google Scholar] [CrossRef]

- Park, J.; Park, S.; Kim, K.; Lee, D. CORUS: Blockchain-based trustworthy evaluation system for efficacy of healthcare remedies. In Proceedings of the 2018 IEEE International Conference on Cloud Computing Technology and Science (CloudCom), Nicosia, Cyprus, 10–13 December 2018; pp. 181–184. [Google Scholar]

- Rupeika-Apoga, R.; Thalassinos, E.I. Ideas for a regulatory definition of FinTech. Int. J. Econ. Bus. Adm. 2020, 8, 136–154. [Google Scholar] [CrossRef] [Green Version]

- Yao, M.; Di, H.; Zheng, X.; Xu, X. Impact of payment technology innovations on the traditional financial industry: A focus on China. Technol. Forecast. Soc. Chang. 2018, 135, 199–207. [Google Scholar] [CrossRef]

- Coffie, C.P.K.; Hongjiang, Z.; Mensah, I.A.; Kiconco, R.; Simon, A.E.O. Determinants of FinTech payment services diffusion by SMEs in Sub-Saharan Africa: Evidence from Ghana. Inf. Technol. Dev. 2020, 27, 539–560. [Google Scholar] [CrossRef]

- Solarz, M.; Swacha-Lech, M. Determinants of the adoption of innovative fintech services by millennials. E + M Ekon. Manag. 2021, 24, 149–166. [Google Scholar] [CrossRef]

- Polasik, M.; Piotrowska, A.I.; Wisniewski, T.P.; Kotkowski, R.; Lightfoot, G. Price Fluctuations and the Use of Bitcoin: An Empirical Inquiry. Int. J. Electron. Commer. 2015, 20, 9–49. [Google Scholar] [CrossRef] [Green Version]

- Kijkasiwat, P. Opportunities and Challenges for Fintech Startups: The Case Study of Thailand. ABAC J. 2021, 41, 41–60. [Google Scholar]

- Vasenska, I.; Dimitrov, P.; Koyundzhiyska-Davidkova, B.; Krastev, V.; Durana, P.; Poulaki, I. Financial Transactions Using FINTECH during the COVID-19 Crisis in Bulgaria. Risks 2021, 9, 48. [Google Scholar] [CrossRef]

- Jiang, S.; Li, Y.; Lu, Q.; Hong, Y.; Guan, D.; Xiong, Y.; Wang, S. Policy assessments for the carbon emission flows and sustainability of Bitcoin blockchain operation in China. Nat. Commun. 2021, 12, 1–10. [Google Scholar] [CrossRef]

- Qin, M.; Su, C.-W.; Tao, R. BitCoin: A new basket for eggs? Econ. Model. 2020, 94, 896–907. [Google Scholar] [CrossRef]

- Papantoniou, C. Esri Which Countries Use Cryptocurrency Most? 2021, p. 1. Available online: https://www.esri.com/about/newsroom/publications/wherenext/cryptocurrency-use-by-geography/ (accessed on 1 May 2021).

- Mariana, S. Cryptocurrency–definition, functions, advantages and risks. Підприємництво і торгівля 2021, 30, 5–10. [Google Scholar]

- Molling, G.; Klein, A.; Hoppen, N.; Dalla, R.R. Cryptocurrency: A Mine of Controversies. J. Inf. Syst. Technol. Manag. 2020, 17, 1–15. [Google Scholar] [CrossRef]

- Zook, M.A.; Blankenship, J. New spaces of disruption? The failures of Bitcoin and the rhetorical power of algorithmic governance. Geoforum 2018, 96, 248–255. [Google Scholar] [CrossRef]

- De Haro-Olmo, F.J.; Varela-Vaca, Á.J.; Álvarez-Bermejo, J.A. Blockchain from the perspective of privacy and anonymisation: A systematic literature review. Sensors 2020, 20, 7171. [Google Scholar] [CrossRef]

- Albayatia, H.; Kim, S.K.; Rho, J.J. Accepting financial transactions using blockchain technology and cryptocurrency: A customer perspective approach. Technol. Soc. 2020, 62, 101320. [Google Scholar] [CrossRef]

- Wani, T.A.; Ali, S.W. Innovation Diffusion Theory Review & Scope in the Study of Adoption of Smartphones in India. J. Gen. Manag. Res. 2015, 3, 101–118. [Google Scholar]

- Cheema, M.A.; Faff, R.W.; Szulczuk, K. The 2008 Global Financial Crisis and COVID-19 Pandemic: How Safe are the Safe Haven Assets? COVID Econ. Vetted Real-Time Pap. 2020, 1, 88–115. [Google Scholar] [CrossRef]

- Wunsche, A. Technological Disruption of Capital Markets and Reporting? An Introduction to Blockchain; CPA Chartered Professional Accountants Canada: Toronto, ON, Canada, 2016; pp. 1–27. [Google Scholar]

- Arias-Oliva, M.; Pelegrín-Borondo, J.; Matías-Clavero, G. Variables Influencing Cryptocurrency Use: A Technology Acceptance Model in Spain. Front. Psychol. 2019, 10, 475. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Johng, H.; Kim, D.; Hill, T.; Chung, L. Using blockchain to enhance the trustworthiness of business processes: A goal-oriented approach. In Proceedings of the 2018 IEEE International Conference on Services Computing (SCC), San Francisco, CA, USA, 2–7 July 2018; pp. 249–252. [Google Scholar] [CrossRef]

- Hove, L.; Van Karimov, F.P. The role of risk in e-retailers’ adoption of payment methods: Evidence for transition economies. Electron. Commer. Res. 2016, 16, 27–72. [Google Scholar] [CrossRef]

- Grüschow, R.M.; Kemper, J.; Brettel, M. How do different payment methods deliver cost and credit efficiency in electronic commerce? Electron. Commer. Res. Appl. 2016, 18, 27–36. [Google Scholar] [CrossRef]

- Hung, J.-C.; Liu, H.-C.; Yang, J.J. Trading activity and price discovery in Bitcoin futures markets. J. Empir. Finance 2021, 62, 107–120. [Google Scholar] [CrossRef]

- Rogers, E.M. Diffusion of Innovation, 4th ed.; The Free Press: New York, NY, USA, 1995. [Google Scholar]

- Fishbein, M.; Ajzen, I. Belief, Attitude, Intention, and Behavior: An Introduction to Theory and Research; Addison-Wesley Pub: Boston, MA, USA, 1975; ISBN 9780201020892. [Google Scholar]

- Rodd, M.G.; Miskin, A.; Tomlinson, J. Knowledge management in a multimedia environment: Some key research issues. In Proceedings of the 2002 Student Conference on Research and Development, Shah Alam, Malaysia, 17 July 2002; pp. 1–7. [Google Scholar] [CrossRef]

- Venkatesh, V.; Morris, M.G.; Davis, G.B.; Davis, F.D.; Hall, M.; Davis, G.B.; Davis, F.D.; Walton, S.M. User a cceptance of information technology: Toward a unified view. MIS Q. 2003, 27, 425–478. [Google Scholar] [CrossRef] [Green Version]

- Venkatesh, V.; Thong, J.Y.L.; Xu, X. Consumer Acceptance and Use of Information Technology: Extending the Unified Theory. MIS Q. 2012, 36, 157–178. [Google Scholar] [CrossRef] [Green Version]

- Zhai, X.; Dong, Y.; Wang, S.; Wang, L.; Yuan, J. Exploring eye-tracking analyses of EFL learners’ cognitive processing of reduced relative clause. Clust. Comput. 2019, 22, 14181–14192. [Google Scholar] [CrossRef]

- Zhai, X.; Fang, Q.; Dong, Y.; Wei, Z.; Yuan, J.; Cacciolatti, L.; Yang, Y. The effects of biofeedback-based stimulated recall on self-regulated online learning: A gender and cognitive taxonomy perspective. J. Comput. Assist. Learn. 2018, 34, 775–786. [Google Scholar] [CrossRef]

- Kim, M. A Psychological Approach to Bitcoin Usage Behavior in the Era of COVID-19: Focusing on the Role of Attitudes toward Money. J. Retail. Consum. Serv. 2021, 62, 102606. [Google Scholar] [CrossRef]

- Gazali, H.M.; Ismail, C.M.H.B.C.; Amboala, T. Exploring the intention to invest in cryptocurrency: The case of bitcoin. In Proceedings of the 2018 International Conference on Information and Communication Technology for the Muslim World (ICT4M), Kuala Lumpur, Malaysia, 23–25 July 2018; pp. 64–68. [Google Scholar]

- Nadeem, M.A.; Liu, Z.; Pitafi, A.H.; Younis, A.; Xu, Y. Investigating the Adoption Factors of Cryptocurrencies—A Case of Bitcoin: Empirical Evidence From China. SAGE Open 2021, 11, 2158244021998704. [Google Scholar] [CrossRef]

- Mehrabian, A.; Russell, J.A. An Approach to Environmental Psychology; M.I.T. Press: Cambridge, MA, USA, 1974; pp. 62–65. [Google Scholar]

- Song, S.; Yao, X.; Wen, N. What motivates Chinese consumers to avoid information about the COVID-19 pandemic?: The perspective of the stimulus-organism-response model. Inf. Process. Manag. 2021, 58, 102407. [Google Scholar] [CrossRef]

- Peng, C.; Kim, Y.G. Application of the Stimuli-Organism-Response (S-O-R) Framework to Online Shopping Behavior. J. Internet Commer. 2014, 13, 159–176. [Google Scholar] [CrossRef]

- Jacoby, J. Stimulus-organism-response reconsidered: An evolutionary step in modeling (consumer) behavior. J. Consum. Psychol. 2002, 12, 51–57. [Google Scholar] [CrossRef]

- Vieira, V.A. Stimuli-organism-response framework: A meta-analytic review in the store environment. J. Bus. Res. 2013, 66, 1420–1426. [Google Scholar] [CrossRef]

- Flavián, C.; Ibáñez-Sánchez, S.; Orús, C. Integrating virtual reality devices into the body: Effects of technological embodiment on customer engagement and behavioral intentions toward the destination. J. Travel Tour. Mark. 2019, 36, 847–863. [Google Scholar] [CrossRef]

- Ye, Q.; Anwar, M.A.; Zhou, R.; Asmi, F. Short stay, long impact: Ecological footprints of sojourners. Environ. Sci. Pollut. Res. 2020, 17, 11797–11808. [Google Scholar] [CrossRef] [PubMed]

- Guo, J.; Liu, Z.; Liu, Y. Key success factors for the launch of government social media platform: Identifying the formation mechanism of continuance intention. Comput. Hum. Behav. 2016, 55, 750–763. [Google Scholar] [CrossRef]

- Kim, M.J.; Lee, C.; Jung, T. Exploring Consumer Behavior in Virtual Reality Tourism Using an Extended Stimulus-Organism-Response Model. J. Travel Res. 2018, 59, 69–89. [Google Scholar] [CrossRef] [Green Version]

- Pandita, S.; Mishra, H.G.; Chib, S. Psychological impact of COVID-19 crises on students through the lens of Stimulus-Organism-Response (SOR) model. Child. Youth Serv. Rev. 2021, 120, 105783. [Google Scholar] [CrossRef] [PubMed]

- Gatautis, R.; Vitkauskaite, E.; Gadeikiene, A.; Piligrimiene, Z. Gamification as a Mean of Driving Online Consumer Behaviour: SOR Model Perspective. Inz. Ekon. Econ. 2016, 27, 90–97. [Google Scholar] [CrossRef] [Green Version]

- Bagozzi, R.P. The Legacy of the Technology Acceptance Model and a Proposal for a Paradigm Shift. J. Assoc. Inf. Syst. 2007, 8, 244–254. [Google Scholar] [CrossRef]

- Delfabbro, P.; King, D.L.; Williams, J. The psychology of cryptocurrency trading: Risk and protective factors. J. Behav. Addict. 2021, 10, 201–207. [Google Scholar] [CrossRef] [PubMed]

- Berger, J.L.; Girardet, C.; Vaudroz, C.; Crahay, M. Teaching Experience, Teachers’ Beliefs, and Self-Reported Classroom Management Practices: A Coherent Network. SAGE Open 2018, 8, 2158244017754119. [Google Scholar] [CrossRef] [Green Version]

- Ullah, N.; Al-Rahmi, W.M.; Alzahrani, A.I.; Alfarraj, O.; Alblehai, F.M. Blockchain technology adoption in smart learning environments. Sustainability 2021, 13, 1801. [Google Scholar] [CrossRef]

- Plouffe, C.R.; Hulland, J.S.; Vandenbosch, M. Research Report: Richness Versus Parsimony in Modeling Technology Adoption Decisions–Understanding Merchant Adoption of a Smart Card-Based Payment System. Inf. Syst. Res. 2001, 12, 208–222. [Google Scholar] [CrossRef]

- Ayedh, A.; Echchabi, A.; Battour, M.; Omar, M. Malaysian Muslim investors’ behaviour towards the blockchain-based Bitcoin cryptocurrency market. J. Islam. Mark. 2020, 12, 690–704. [Google Scholar] [CrossRef]

- Sun, Y.; Bhattacherjee, A.; Ma, Q. Extending technology usage to work settings: The role of perceived work compatibility in ERP implementation. Inf. Manag. 2009, 46, 351–356. [Google Scholar] [CrossRef]

- Sander, F.; Semeijn, J.; Mahr, D.; Mahr, D. The acceptance of blockchain technology in meat traceability and transparency. Br. Food J. 2018, 120, 2066–2079. [Google Scholar] [CrossRef] [Green Version]

- Calvão, F.; Archer, M. Digital extraction: Blockchain traceability in mineral supply chains. Polit. Geogr. 2021, 87, 102381. [Google Scholar] [CrossRef]

- Lin, J.; Shen, Z.; Miao, C. Using blockchain technology to build trust in sharing LoRaWAN IoT. In Proceedings of the 2nd International Conference on Crowd Science and Engineering, Beijing, China, 6–9 July 2017; pp. 38–43. [Google Scholar]

- Pardo, M.Á.; Jiménez, E.; Pérez-Villarreal, B. Misdescription incidents in seafood sector. Food Control. 2016, 62, 277–283. [Google Scholar] [CrossRef]

- Ross, O.; Jensen, J.; Asheim, T. Assets under Tokenization. SSRN Electron. J. 2019, 1–9. [Google Scholar] [CrossRef]

- Grover, P.; Kar, A.K.; Janssen, M.; Ilavarasan, P.V. Perceived usefulness, ease of use and user acceptance of blockchain technology for digital transactions–insights from user-generated content on Twitter. Enterp. Inf. Syst. 2019, 13, 771–800. [Google Scholar] [CrossRef]

- Chiappetta, M. The Technostress: Definition, symptoms and risk prevention. Senses Sci. 2017, 4, 358–361. [Google Scholar] [CrossRef]

- John, S.P. The integration of information technology in higher education: A study of faculty’s attitude towards IT adoption in the teaching process. Contaduria y Adm. 2015, 60, 230–252. [Google Scholar] [CrossRef] [Green Version]

- Tarafdar, M.; Tu, Q.; Ragu-Nathan, T. Impact of technostress on end-user satisfaction and performance. J. Manag. Inf. Syst. 2010, 27, 303–334. [Google Scholar] [CrossRef]

- Beames, J.R.; Johnston, L.; O’Dea, B.; Torok, M.; Christensen, H.; Boydell, K.M.; Werner-Seidler, A. Factors that help and hinder the implementation of digital depression prevention programs: School-based cross-sectional study. J. Med. Internet Res. 2021, 23, e26223. [Google Scholar] [CrossRef] [PubMed]

- Tams, S.; Thatcher, J.B.; Grover, V. Concentration, competence, confidence, and capture: An experimental study of age, interruption-based technostress, and task performance. J. Assoc. Inf. Syst. 2018, 19, 857–908. [Google Scholar] [CrossRef]

- Chou, H.L.; Chou, C. A multigroup analysis of factors underlying teachers’ technostress and their continuance intention toward online teaching. Comput. Educ. 2021, 175, 104335. [Google Scholar] [CrossRef]

- Salazar-Concha, C.; Ficapal-Cusí, P.; Boada-Grau, J.; Camacho, L.J. Analyzing the evolution of technostress: A science mapping approach. Heliyon 2021, 7, e06726. [Google Scholar] [CrossRef] [PubMed]

- Stadin, M.; Nordin, M.; Broström, A.; Magnusson Hanson, L.L.; Westerlund, H.; Fransson, E.I. Technostress operationalised as information and communication technology (ICT) demands among managers and other occupational groups–Results from the Swedish Longitudinal Occupational Survey of Health (SLOSH). Comput. Human Behav. 2021, 114, 106486. [Google Scholar] [CrossRef]

- Fuglseth, A.M.; Sørebø, Ø. The effects of technostress within the context of employee use of ICT. Comput. Human Behav. 2014, 40, 161–170. [Google Scholar] [CrossRef]

- Li, L.; Wang, X. Technostress inhibitors and creators and their impacts on university teachers’ work performance in higher education. Cogn. Technol. Work 2021, 23, 315–330. [Google Scholar] [CrossRef]

- Atabek, O. Associations between Emotional States, Self-Efficacy For and Attitude Towards Using Educational Technology. Int. J. Progress. Educ. 2020, 16, 175–194. [Google Scholar] [CrossRef]

- Tarafdar, M.; Tu, Q.; Ragu-Nathan, B.S.; Ragu-Nathan, T.S. The impact of technostress on role stress and productivity. J. Manag. Inf. Syst. 2007, 24, 301–328. [Google Scholar] [CrossRef]

- Rogers, T.; Kowal, J. Selection of glass, anodic bonding conditions and material compatibility for silicon-glass capacitive sensors. Sens. Actuators A Phys. 1995, 46, 113–120. [Google Scholar] [CrossRef]

- Altawallbeh, M.; Soon, F.; Thiam, W.; Alshourah, S. Mediating role of attitude, subjective norm and perceived behavioural control in the relationships between their respective salient beliefs and behavioural intention to adopt e-learning among instructors in Jordanian universities. J. Educ. Pract. 2015, 6, 152–160. [Google Scholar]

- Ko, T.; Lee, J.; Ryu, D. Blockchain Technology and Manufacturing Industry: Real-Time Transparency and Cost Savings. Sustainability 2018, 10, 4274. [Google Scholar] [CrossRef] [Green Version]

- Tezel, A.; Papadonikolaki, E.; Yitmen, I.; Hilletofth, P. Preparing construction supply chains for blockchain technology: An investigation of its potential and future directions. Front. Eng. Manag. 2020, 7, 547–563. [Google Scholar] [CrossRef]

- DuPree, Y. Determinants of Intention to Use New Technology: An Investigation of Students in Higher Education. Ph.D. Thesis, Nova Southeastern University, Fort Lauderale, FL, USA, 2015. [Google Scholar]

- Makarov, I.; Schoar, A. Trading and arbitrage in cryptocurrency markets. J. Financ. Econ. 2020, 135, 293–319. [Google Scholar] [CrossRef] [Green Version]

- Chakravaram, V.; Ratnakaram, S.; Agasha, E. Cryptocurrency: Threat or Opportunity; Springer: Singapore, 2020; ISBN 9789811579615. [Google Scholar]

- Bolotaeva, O.S.; Stepanova, A.A.; Alekseeva, S.S. The Legal Nature of Cryptocurrency. In IOP Conference Series: Earth and Environmental Science; IOP Publishing: Bristol, UK, 2019; Volume 272, p. 032166. [Google Scholar] [CrossRef]

- Nolasco Braaten, C.; Vaughn, M.S. Convenience Theory of Cryptocurrency Crime: A Content Analysis of U.S. Federal Court Decisions. Deviant Behav. 2021, 42, 958–978. [Google Scholar] [CrossRef]

- Daniel, W.W.; Cross, C.L. Biostatistics: A Foundation for Analysis in the Health Sciences, 11th ed.; John Wiley & Sons Inc.: New York, NY, USA, 2018. [Google Scholar]

- Ragu-Nathan, T.S.; Monideepa, T.; Ragu-Nathan, B.S.; Tu, Q. The Consequences of Technostress for End Users in Organizations: Conceptual Development and Empirical Validation. Inf. Syst. Res. 2008, 19, 417–433. [Google Scholar] [CrossRef] [Green Version]

- Zhu, Y.; Kanjanamekanant, K. No trespassing: Exploring privacy boundaries in personalized advertisement and its effects on ad attitude and purchase intentions on social media. Inf. Manag. 2021, 58, 103314. [Google Scholar] [CrossRef]

- Fazal-e-hasan, S.M.; Amrollahi, A.; Mortimer, G.; Adapa, S. Computers in Human Behavior A multi-method approach to examining consumer intentions to use smart retail technology. Comput. Hum. Behav. 2021, 117, 106622. [Google Scholar] [CrossRef]

- Urban, B.; Kujinga, L. The institutional environment and social entrepreneurship intentions. Int. J. Entrep. Behav. Res. 2017, 23, 638–655. [Google Scholar] [CrossRef]

- Venkatesh, V.; Thong, J.Y.; Chan, F.K.; Hu, P.J. Managing Citizens Uncertainty in E-Government Services: The Mediating and Moderating Roles of Transparency and Trust. Inf. Syst. Res. 2016, 27, 87–111. [Google Scholar] [CrossRef] [Green Version]

- Dutta, D.K.; Gwebu, K.L.; Wang, J. Personal innovativeness in technology, related knowledge and experience, and entrepreneurial intentions in emerging technology industries: A process of causation or effectuation? Int. Entrep. Manag. J. 2015, 11, 529–555. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis, 7th ed.; Pearson Education: Upper Saddle River, NJ, USA, 2014. [Google Scholar]

- Harman, H.H. Modern Factor Analysis; University of Chicago Press: Chicago, IL, USA, 1976; ISBN 0226316521. [Google Scholar]

- Elliot, A.C.; Woodward, W.A. IBM SPSS by Example: A Practical Guide to Statistical Data Analysis, 2nd ed.; SAGE Publication: London, UK, 2016. [Google Scholar]

- Hu, L.T.; Bentler, P.M. Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Struct. Equ. Model. 1999, 6, 1–55. [Google Scholar] [CrossRef]

- Hooper, D.; Mullen, J.; Hooper, D.; Coughlan, J.; Mullen, M.R. Structural Equation Modelling: Guidelines for Determining Model Fit. Electron. J. Bus. Res. Methods 2008, 6, 53–60. [Google Scholar]

- Keren, F.; Siddiquei, A.N.; Anwar, M.A.; Asmi, F.; Ye, Q. What Explains Natives and Sojourners Preventive Health Behavior in a Pandemic: Role of Media and Scientific Self-Efficacy. Front. Psychol. 2021, 12, 2446. [Google Scholar] [CrossRef]

- Zhai, X.; Asmi, F.; Zhou, R.; Ahmad, I.; Anwar, M.A.; Saneinia, S.; Li, M. Investigating the Mediation and Moderation Effect of Students Addiction to Virtual Reality Games: A Perspective of Structural Equation Modeling. Discret. Dyn. Nat. Soc. 2020. [Google Scholar] [CrossRef]

- Pallant, J. SPSS Survival Manual: A Step by Step Guide to Data Analysis Using IBM SPSS, 6th ed.; McGraw-Hill Education: Berkshire, UK, 2016; ISBN 9780335261543. [Google Scholar]

- Antonius, R. Interpreting Quantitative Data with SPSS, 1st ed.; SAGE Publications: London, UK, 2003. [Google Scholar]

- Fornell, C.; Larcker, D. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Henseler, J. ADANCO 2.0.1: User Manual; Composite Modeling GmbH & Co. KG: Kleve, Germany, 2017. [Google Scholar]

- Jonker, N. What drives the adoption of crypto-payments by online retailers? Electron. Commer. Res. Appl. 2019, 35, 100848. [Google Scholar] [CrossRef]

- Asmi, F.; Anwar, M.A.; Zhou, R.; Nawaz, M.A.; Tahir, F. Predicting functional transparency and privacy concerns as future challenge for diffusion of IoT and blockchain. In Proceedings of the 3rd International Conference on Big Data and Internet of Things, Melbourn, Australia, 22–24 August 2019; pp. 99–104. [Google Scholar] [CrossRef]

- Turja, T.; Aaltonen, I.; Taipale, S.; Oksanen, A. Information & Management Robot acceptance model for care (RAM-care): A principled approach to the intention to use care robots. Inf. Manag. 2020, 57, 103220. [Google Scholar] [CrossRef]

- Brooks, S.; Califf, C. Social media-induced technostress: Its impact on the job performance of it professionals and the moderating role of job characteristics. Comput. Net. 2017, 114, 143–153. [Google Scholar] [CrossRef]

- Pietrych, L.; Sandubete, J.E.; Escot, L. Solving the chaos model-data paradox in the cryptocurrency market. Commun. Nonlinear Sci. Numer. Simul. 2021, 102, 105901. [Google Scholar] [CrossRef]

- Tarafdar, M.; Pullins, E.B.; Ragu-Nathan, T.S. Technostress: Negative effect on performance and possible mitigations. Inf. Syst. J. 2015, 25, 103–132. [Google Scholar] [CrossRef] [Green Version]

- Lee, S.J.; Jin, S.H.; Choi, B.J. The influence of technostress and antismart on continuous use of smartphones. Lect. Notes Eng. Comput. Sci. 2012, 1, 303–308. [Google Scholar]

- Boyer-Davis, S. Technostress: An antecedent of job turnover intention in the accounting profession. J. Bus. Account. 2019, 12, 49–63. [Google Scholar]

- Arthur, M. The uncertainty of cryptocurrency regulation: Achieving effective regulation without stifling law enforcement and innovation. Ethos Off. Publ. Law Soc. Aust. Cap. Territ. 2021, 1, 26–30. [Google Scholar]

| Region | Reform Reporting Date | Effect on |

|---|---|---|

| United States—Internal Revenue Service (IRS) | February 2020 | Customers, businesses, governments |

| Canada—Bitcoin exchange-traded fund (ETF) | February 2021 | Investment industry, money services firms |

| United Kingdom—Financial Conduct Authority (FCA) | 1 April 2013 | Taxation, governments |

| Japan—Payment Services Act (PSA) | May 2021 | Governments, businesses |

| Australia—AML/CTF 2006)—Under Section 5, crypto became legal | 2017 | customers, properties, taxation |

| Demographics | Detail | Percentage | Frequency |

|---|---|---|---|

| Representing e-entity as | Executive | 34 | 16.11 |

| Non-executive | 63 | 29.86 | |

| Manager | 87 | 41.23 | |

| Others | 27 | 12.80 | |

| Experience (in years) | Less than 2 years | 52 | 24.64 |

| 2–3 years | 84 | 39.82 | |

| 3–5 years | 44 | 20.85 | |

| More than 5 years | 31 | 14.69 | |

| E-entity (nature) | Non-specialized | 77 | 36.49 |

| Clothing | 08 | 03.79 | |

| Furniture and appliances | 46 | 21.80 | |

| Hardware and other | 80 | 37.92 | |

| E-entity (coverage area) | East Asia (i.e., China, North Korea, South Korea, and Japan | 45 | 21.33 |

| North Asia (i.e., Russia) | 03 | 01.42 | |

| South Asia (i.e., India, Bangladesh, and Pakistan) | 87 | 41.23 | |

| Southeast Asia (i.e., Singapore, the Philippines, and Thailand) | 49 | 23.22 | |

| Oceana (i.e., Australia and New Zealand) | 27 | 12.80 | |

| Others (i.e., Melanesia, Polynesia, and Micronesia region) | - | - |

| Study Measures and Source | Measurement Items | Mean | SD | CFA Loadings | SEM Loading |

|---|---|---|---|---|---|

| Technostress (driven by techno-uncertainty) [82] | There are always new developments in the CC as technologies that I can use in my business setting. | 3.24 | 0.81 | 0.87 | 0.87 |

| There are constant changes in the CC as technologies that I can use in my business setting. | 0.83 | 0.82 | |||

| There are frequent updates/developments in the CC as technologies that I can use in my business setting. | 0.87 | 0.87 | |||

| Intentions to adopt cryptocurrency [83] | I am willing to adopt CC in my business setting as the mode of payment. | 3.36 | 1.02 | 0.96 | 0.96 |

| I am intending to become involved in CC to include it in my business setting as a mode of payment. | 0.87 | 0.87 | |||

| I will make an effort to become involved and practice including CC in my business setting as a mode of payment. | 0.77 | 0.77 | |||

| Cryptocurrency compatibility with business [84] | Using CC fits my business setting | 3.82 | 0.99 | 0.83 | 0.84 |

| Using CC fits well with the way consumers shop in my e-store/e-business | 0.88 | 0.80 | |||

| Using CC is completely compatible with my e-store/e-business needs | 0.87 | 0.86 | |||

| Cryptocurrency functional transparency [86] | I can easily understand the functionality of CC as a mode for transaction purpose | 3.44 | 1.01 | 0.85 | 0.84 |

| I was familiar with CC as a mode for transaction purposes. | 0.80 | 0.80 | |||

| I am clear about CC as a mode for transaction purposes. | 0.79 | 0.80 | |||

| Regulatory support [85] | I think the government has a friendly attitude toward commercial entities that adopt CC in their business settings. | 3.89 | 0.72 | 0.77 | 0.77 |

| Government has a lenient attitude toward commercial entities who adopt CC in their business settings. | 0.79 | 0.83 | |||

| Government has a supportive attitude toward commercial entities who adopt CC in their business settings. | 0.74 | 0.79 | |||

| Cryptocurrency efficacy (driving convenience) [84] | Using CC will allow my business to complete payment processes quickly. | 3.66 | 0.78 | 0.77 | 0.76 |

| Using CC requires little effort to complete payment processes. | 0.79 | 0.78 | |||

| Using CC seems to be a fast way for payment processes. | 0.74 | 0.75 | |||

| Technology involvement [87] | If I heard about new technology, I would look for ways to experiment with it. | 4.24 | 0.76 | 0.65 | 0.64 |

| Among my peers, I am usually the first to try out new technologies. | 0.61 | 0.60 | |||

| I like to experiment with new technologies. | 0.76 | 0.73 |

| CR | AVE | MSV | MaxR(H) | TI | IAC | CC | CF | RS | CE | TS | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TI | 0.89 | 0.73 | 0.22 | 0.89 | 0.86 | ||||||

| IAC | 0.90 | 0.76 | 0.32 | 0.94 | 0.34 | 0.87 | |||||

| CC | 0.90 | 0.74 | 0.37 | 0.90 | 0.27 | −0.13 | 0.86 | ||||

| CF | 0.85 | 0.66 | 0.37 | 0.86 | 0.15 | 0.07 | 0.61 | 0.81 | |||

| RS | 0.84 | 0.64 | 0.61 | 0.85 | 0.47 | 0.54 | 0.10 | 0.16 | 0.80 | ||

| CE | 0.81 | 0.59 | 0.61 | 0.81 | 0.41 | 0.57 | 0.01 | 0.18 | 0.78 | 0.77 | |

| TS | 0.70 | 0.52 | 0.16 | 0.70 | −0.15 | −0.32 | 0.40 | 0.33 | −0.22 | −0.27 | 0.64 |

| TI | IAC | CC | CF | RS | CE | TS | |

|---|---|---|---|---|---|---|---|

| TI | |||||||

| IAC | 0.37 | ||||||

| CC | 0.28 | 0.12 | |||||

| CF | 0.16 | 0.07 | 0.62 | ||||

| RS | 0.48 | 0.53 | 0.10 | 0.16 | |||

| CE | 0.42 | 0.58 | 0.02 | 0.18 | 0.79 | ||

| TS | 0.13 | 0.33 | 0.39 | 0.33 | 0.21 | 0.26 |

| Factors | Variance Explained | |||

|---|---|---|---|---|

| Detail | TS | TI | IAC | |

| Experience | Less than 2 years | 09% | 41.6% | 25.5% |

| 2–3 years | 62.8% | 30.6% | 18.2% | |

| More than 3 years | 31.1% | 33.6% | 46.9% | |

| Designation | Executives/Non-executives | 36.4% | 33.2% | 56.2% |

| Managers/Others | 34.0% | 31.2% | 14.3% | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wu, R.; Ishfaq, K.; Hussain, S.; Asmi, F.; Siddiquei, A.N.; Anwar, M.A. Investigating e-Retailers’ Intentions to Adopt Cryptocurrency Considering the Mediation of Technostress and Technology Involvement. Sustainability 2022, 14, 641. https://doi.org/10.3390/su14020641

Wu R, Ishfaq K, Hussain S, Asmi F, Siddiquei AN, Anwar MA. Investigating e-Retailers’ Intentions to Adopt Cryptocurrency Considering the Mediation of Technostress and Technology Involvement. Sustainability. 2022; 14(2):641. https://doi.org/10.3390/su14020641

Chicago/Turabian StyleWu, Runhan, Kamran Ishfaq, Siraj Hussain, Fahad Asmi, Ahmad Nabeel Siddiquei, and Muhammad Azfar Anwar. 2022. "Investigating e-Retailers’ Intentions to Adopt Cryptocurrency Considering the Mediation of Technostress and Technology Involvement" Sustainability 14, no. 2: 641. https://doi.org/10.3390/su14020641

APA StyleWu, R., Ishfaq, K., Hussain, S., Asmi, F., Siddiquei, A. N., & Anwar, M. A. (2022). Investigating e-Retailers’ Intentions to Adopt Cryptocurrency Considering the Mediation of Technostress and Technology Involvement. Sustainability, 14(2), 641. https://doi.org/10.3390/su14020641