The Trade Effect of Trust: Evidence from Agricultural Trade between China and Its Partners

Abstract

:1. Introduction

2. Hypothesis Development

3. Empirical Design

3.1. Model Construction and Data Sources

- Dependent Variable

- Core Explanatory Variable

- Control Variables

3.2. Sample Selection

3.3. Methodology

3.4. Descriptive Statistics

4. Results and Discussion

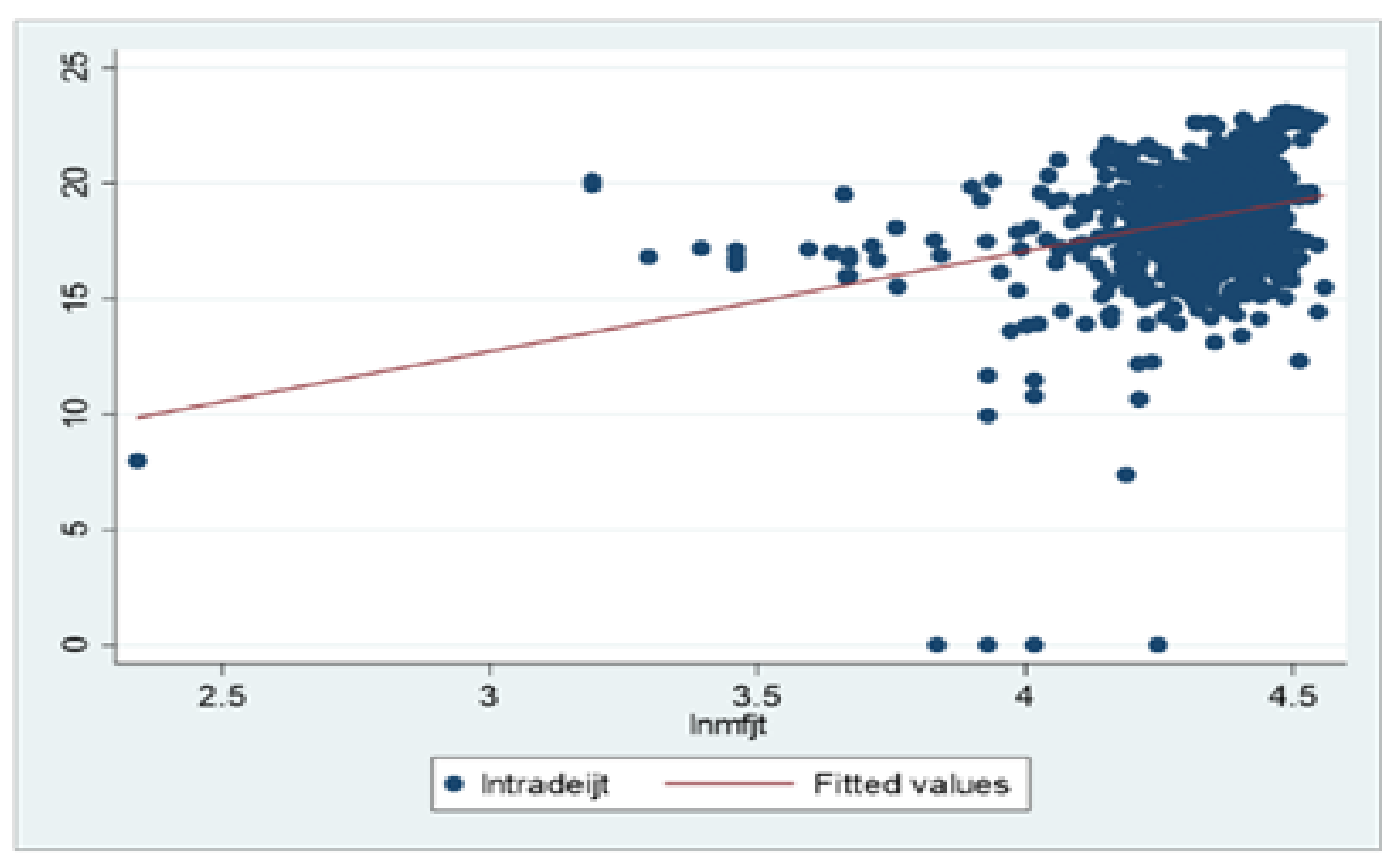

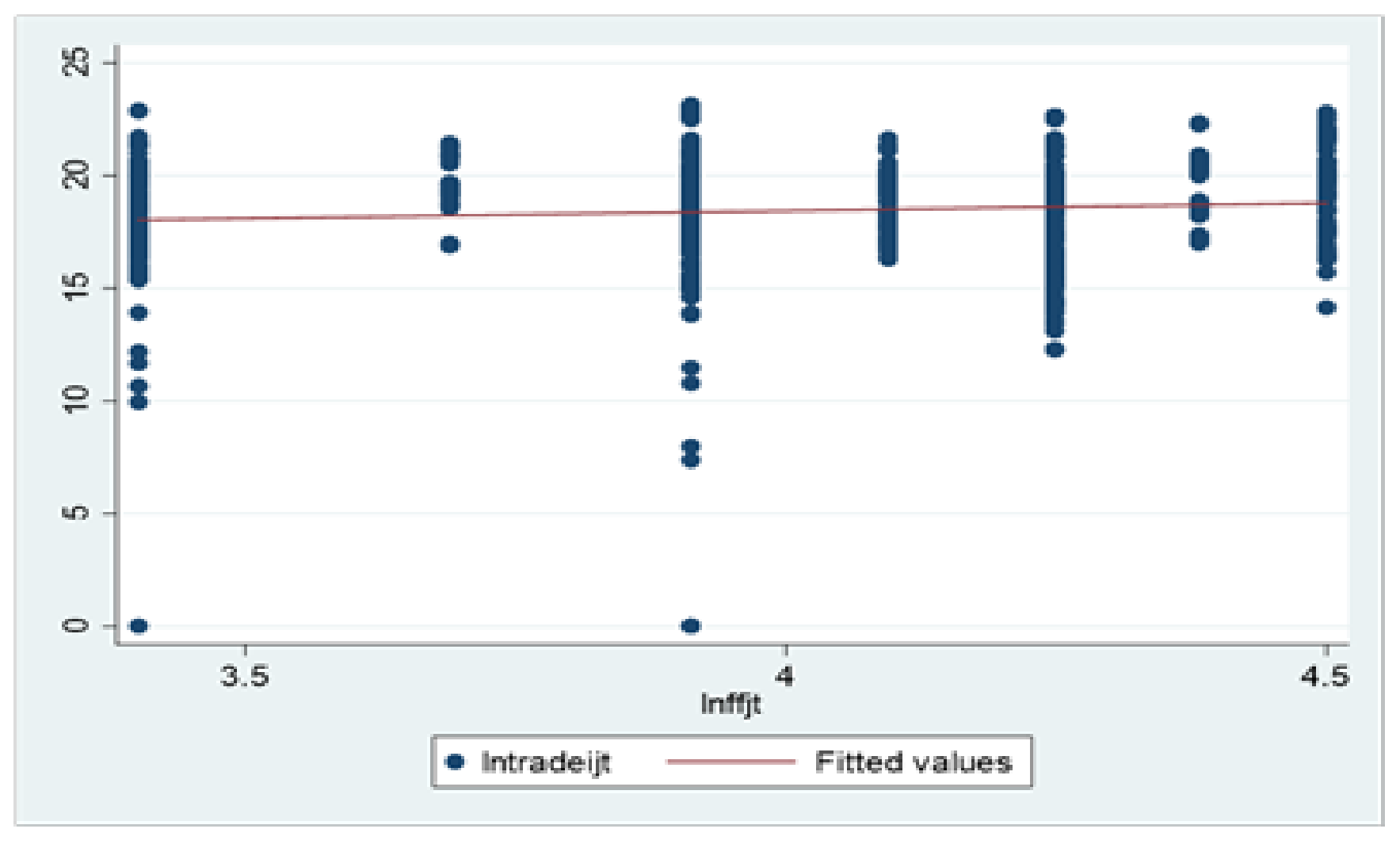

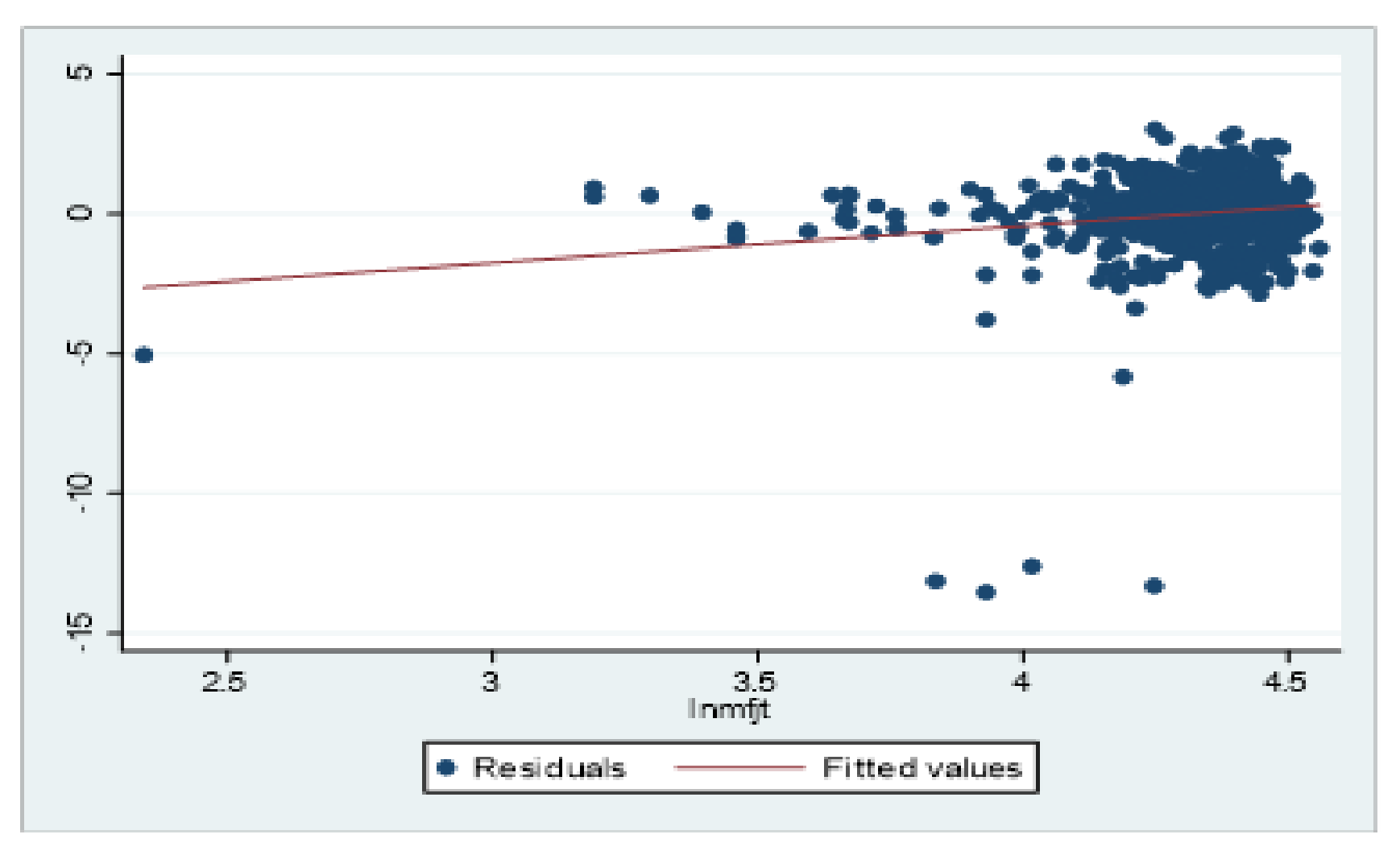

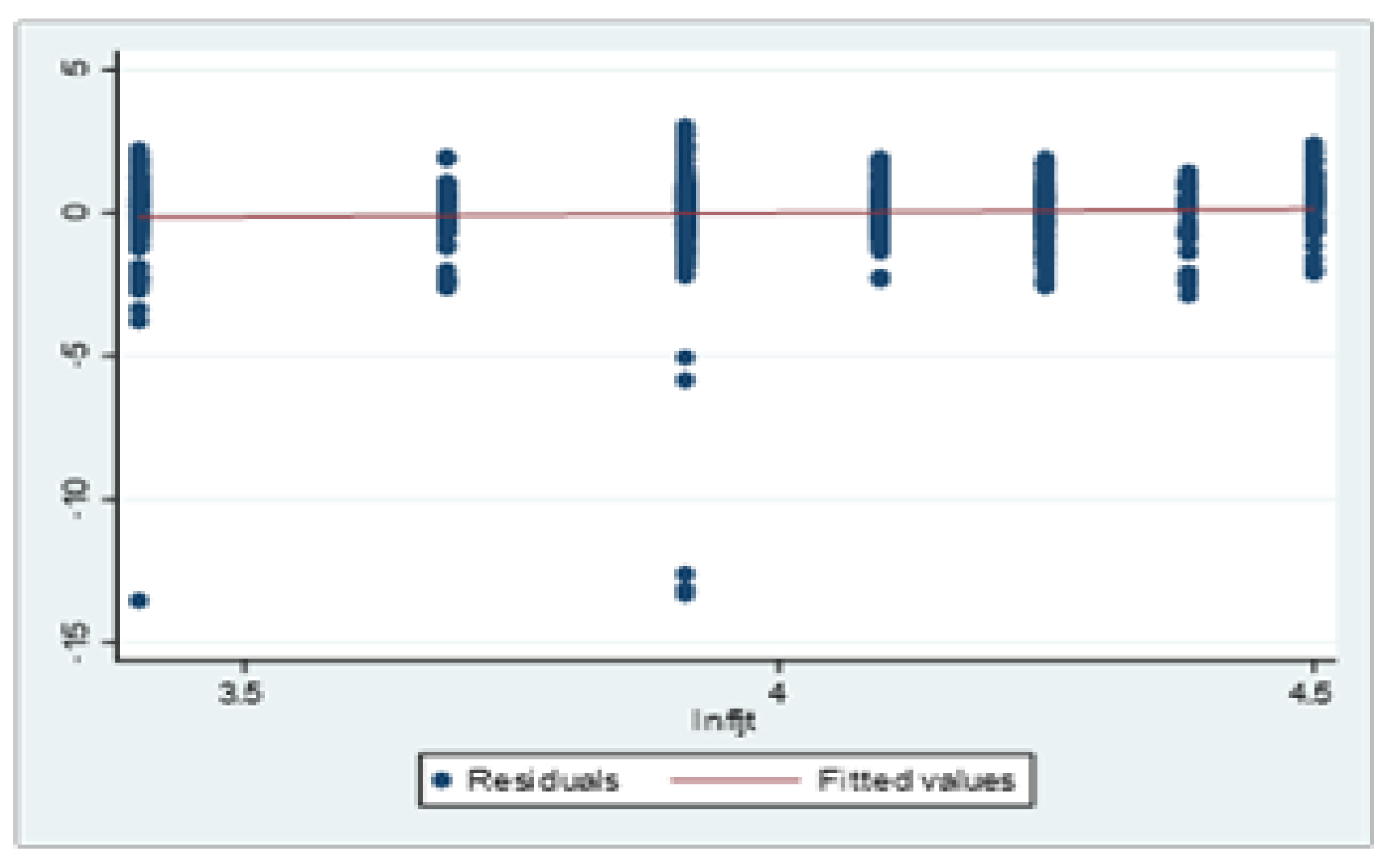

4.1. Preliminary Observation

4.2. Benchmark Regression

4.3. Two Stage Least Squares Test Based on Instrumental Variable

4.4. Heterogeneity Test

- Quartile Regression Test

- Quartile Regression Test Based on the Control Function Method

5. Conclusions and Insights

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Dearmon, J.; Grier, K. Trust and Development. J. Econ. Behav. Organ. 2009, 2, 210–220. [Google Scholar] [CrossRef]

- Xie, F.; Zhang, B.; Zhang, W. Trust, Innovate, Grow. Available online: https://ssrn.com/abstract=2803220 (accessed on 13 November 2021).

- Kondo, J.; Li, D.; Papanikolaou, D. Trust, Collaboration, and Economic Growth. Manag. Sci. 2021, 3, 1825–1850. [Google Scholar] [CrossRef]

- Lü, C.; Chen, H.; Santos, L. Social Trust, Incomplete Contracts and Long-term Growth. Econ. Res. J. 2019, 3, 4–20. [Google Scholar]

- Arrow, K.J. Gifts and Exchanges. Philos. Public Aff. 1972, 4, 343–362. [Google Scholar]

- Zak, P.J.; Knack, S. Trust and Growth. Econ. J. 2001, 470, 295–321. [Google Scholar] [CrossRef]

- Butter, F.; Mosch, R. Trade, Trust and Transaction Costs; Tinbergen Institute Working Paper: Amsterdam, The Netherlands, 2003. [Google Scholar]

- Spilker, G.; Schaffer, L.; Bernauer, T. Does Social Capital Increase Public Support for Economic Globalization? Eur. J. Polit. Res. 2012, 6, 756–784. [Google Scholar] [CrossRef] [Green Version]

- Kaltenthaler, K.; Miller, W.J. Social Psychology and Public Support for Trade Liberalization. Int. Stud. Q. 2013, 57, 784–790. [Google Scholar] [CrossRef] [Green Version]

- Nupia, O. Trust and Trade. Available online: https://ssrn.com/abstract=1485835 (accessed on 13 November 2021).

- Yu, S.; Beugelsdijk, S.; de Haan, J. Trade, trust and the rule of law. Eur. J. Polit. Econ. 2015, 37, 102–115. [Google Scholar] [CrossRef]

- Roy, D.; Munasib, A.; Chen, X. Social trust and international trade: The interplay between social trust and formal finance. Rev. World Econ. 2014, 150, 693–714. [Google Scholar] [CrossRef]

- Zhao, J.; Chi, J. Trust, Formal Institution and China’s Foreign Trade Development—Evidence from 65 Countries. China Soft Sci. 2014, 1, 43–53. [Google Scholar]

- Wang, C.; Li, Z.; Zhong, T. Social Trust, Rule of Law, and Economic Exchange: Evidence from China and Its Major Trading Partners. Emerg. Mark. Financ. Trade 2019, 55, 3134–3150. [Google Scholar] [CrossRef]

- Xing, W.; Zhou, L.-A. Bilateral trust and trade: Evidence from China. World Econ. 2018, 41, 1918–1940. [Google Scholar] [CrossRef]

- Wang, Y.; Sheng, D. Social Trust and Export Comparative Advantage: An Empirical Investigation Based on IVTSLS and PSM Method. J. Int. Trade 2010, 10, 64–71. [Google Scholar]

- Cingano, F.; Pinotti, P. Trust, Firm Organization, and the Pattern of Comparative Advantage. J. Int. Econ. 2016, 100, 1–13. [Google Scholar] [CrossRef]

- Ndubuisi, G.O. Contractual Frictions and the Patterns of Trade: The Role of Generalized Trust. J. Int. Trade Econ. Dev. 2020, 7, 775–796. [Google Scholar] [CrossRef] [Green Version]

- Guiso, L.; Sapienza, P.; Zingales, L. Cultural Biases in Economic Exchange. Q. J. Econ. 2009, 3, 1095–1131. [Google Scholar] [CrossRef] [Green Version]

- Rauch, J.E. Networks versus markets in international trade. J. Int. Econ. 1999, 48, 7–35. [Google Scholar] [CrossRef] [Green Version]

- Hirsch, F. Social Limits to Growth; Harvard University Press: Cambridge, MA, USA, 1976. [Google Scholar]

- Fang, H.; Zhao, T. Does Cultural Difference Influence Agricultural Product Trade—A Research Based on the Countries along the Belt and Road. Int. Econ. Trade Res. 2018, 9, 64–78. [Google Scholar]

- Dasgupta, P.S. Trust as a Commodity. In Trust: Making and Breaking Cooperative Relations; Gambetta, D., Ed.; Basil Blackwell: Oxford, UK, 2000; pp. 49–72. [Google Scholar]

- Anderson, J.E. The Gravity Model. Annu. Rev. Econ. 2011, 1, 133–160. [Google Scholar] [CrossRef] [Green Version]

- Sheng, B.; Liao, M. Trade Flow and Export Potential in China: A Study of Gravity Model. J. World Econ. 2004, 2, 3–12. [Google Scholar]

- Bjørnskov, C. Determinants of generalized trust: A cross-country comparison. Public Choice 2007, 130, 1–21. [Google Scholar] [CrossRef]

- Linder, S.B. An Essay on Trade and Transformation; Almqvist & Wiksell: Stockholm, Sweden, 1961. [Google Scholar]

- Head, K.; Mayer, T. Illusory Border Effects: Distance Mismeasurement Inflates Estimates of Home Bias in Trade. In CEPII Working Papers 2002-01; CEPII Research Center: Paris, France, 2002. [Google Scholar]

- Mayer, T.; Zignago, S. Notes on CEPII’s Distances Measures: The GeoDist Database. In CEPII Working Papers 2011-25; CEPII Research Center: Paris, France, 2011. [Google Scholar]

- La Porta, R.; Florencio, L.; Shleifer, A.; Vishny, R. The Quality of Government; NBER Working Paper No. 6727; National Bureau of Economic Research: Cambridge, MA, USA, 1998. [Google Scholar]

- Zhu, S.; Duan, F.; Shao, X.; Zhong, T. Informal Institutions, Generalized Morality and Quality of Export Products. J. World Econ. 2019, 8, 121–145. [Google Scholar]

- Chen, Q. Advanced Econometrics and Stata Applications, 2nd ed.; Higher Education Press: Beijing, China, 2014. [Google Scholar]

- Rose, A.K. Do We Really Know That the WTO Increases Trade? Am. Econ. Rev. 2004, 94, 98–114. Available online: https://www.aeaweb.org/articles?id=10.1257/000282804322970724 (accessed on 13 November 2021). [CrossRef] [Green Version]

- Rose, A.K. Do We Really Know That the WTO Increases Trade? Reply. Am. Econ. Rev. 2007, 97, 2019–2025. [Google Scholar] [CrossRef]

- Dutt, P. The WTO is not passé. Eur. Econ. Rev. 2020, 128, 103507. [Google Scholar] [CrossRef]

- Subramanian, A.; Wei, S.J. The WTO promotes trade strongly, but unevenly. J. Int. Econ. 2007, 1, 151–175. [Google Scholar] [CrossRef] [Green Version]

- Knack, S.; Keefer, P. Does Social Capital Have an Economic Payoff? A Cross-Country Investigation. Q. J. Econ. 1997, 112, 1251–1288. [Google Scholar] [CrossRef]

- Alesina, A.; Devleeschauwer, A.; Easterly, W.; Kurlat, S.; Wacziarg, R. Fractionalization; NBER Working Paper No. 9411; National Bureau of Economic Research: Cambridge, MA, USA, 2002. [Google Scholar]

- Delhey, J.; Newton, K. Predicting Cross-National Levels of Social Trust: Global Pattern or Nordic Exceptionalism? Eur. Sociol. Rev. 2005, 21, 311–327. [Google Scholar] [CrossRef]

- Stock, J.; Yogo, M. Testing for Weak Instruments in Linear IV Regression. In Andrews DWK Identification and Inference for Econometric Models; Cambridge University Press: New York, NY, USA, 2005; pp. 80–108. [Google Scholar]

- Baum, C.F.; Schaffer, M.E.; Stillman, S. Enhanced Routines for Instrumental Variables/GMM Estimation and Testing. Stata J. 2007, 4, 465–506. [Google Scholar] [CrossRef]

- Koenker, R.; Bassett, G. Regression Quartiles. Econometrica 1978, 1, 33–50. [Google Scholar] [CrossRef]

- Machado, J.; Santos Silva, J. Glejser’s Test Revisited. J. Econom. 2000, 1, 189–202. [Google Scholar] [CrossRef]

- Ma, L.; Koenker, R. Quartile Regression Methods for Recursive Structural Equation Models. J. Econom. 2006, 2, 471–506. [Google Scholar] [CrossRef] [Green Version]

- Lee, S. Endogeneity in Quartile Regression Models: A Control Function Approach. J. Econom. 2007, 2, 1131–1158. [Google Scholar] [CrossRef] [Green Version]

- Kim, T.H.; Muller, C. Two-Stage Quartile Regression When the First Stage is Based on Quartile Regression. Econom. J. 2004, 1, 218–231. [Google Scholar] [CrossRef]

- Rauch, J.; Watson, J. Starting Small in an Unfamiliar Environment. Int. J. Ind. Organ. 2003, 21, 1021–1042. [Google Scholar] [CrossRef] [Green Version]

| Variable | Mean | S.D. | Min | Max | Observables |

|---|---|---|---|---|---|

| lntradeijt | 18.4544 | 2.5230 | 0.0250 | 23.1418 | 810 |

| lngdpit | 28.9740 | 0.49915 | 28.2032 | 29.7505 | 810 |

| lngdpjt | 26.4594 | 1.6915 | 22.0232 | 30.4194 | 810 |

| lnedijt | 1.1798 | 1.3019 | −1.7561 | 3.7801 | 810 |

| lndistwij | 8.8674 | 0.6335 | 7.0632 | 9.8580 | 810 |

| abslnlatitudeij | 0.5709 | 0.7113 | 0.0281 | 3.3533 | 810 |

| lnargjt | 1.4181 | 1.3340 | −3.4014 | 3.6100 | 810 |

| lnrerijt | 0.5619 | 2.6768 | −2.7336 | 8.0164 | 810 |

| adjacent | 0.2222 | 0.4160 | 0 | 1 | 810 |

| WTO | 0.7222 | 0.4482 | 0 | 1 | 810 |

| crisis | 0.1111 | 0.3145 | 0 | 1 | 810 |

| lntrustjt | 3.0973 | 0.6250 | 1.0296 | 4.1912 | 639 |

| lntfjt | 4.2827 | 0.2258 | 2.5802 | 4.5539 | 810 |

| lnmfjt | 4.3215 | 0.1816 | 2.3418 | 4.5581 | 810 |

| lnffjt | 4.0198 | 0.3385 | 3.4012 | 4.4998 | 810 |

| Variable | lntrustjt | lntfjt | lnmfjt | lnffjt |

|---|---|---|---|---|

| lntradeijt | 0.2414 | 0.1671 | 0.3412 | 0.1181 |

| Residuals (e) | 0.0703 | 0.0738 | 0.1989 | 0.0951 |

| Variable | Model (1) | Model (2) | Model (3) | Model (4) |

|---|---|---|---|---|

| lngdpit | 1.1884 *** (0.1423) | 1.0838 *** (0.1971) | 1.0078 *** (0.1894) | 0.9898 *** (0.1886) |

| lngdpjt | 0.9342 *** (0.0663) | 0.9464 *** (0.0572) | 0.9589 *** (0.0565) | 0.9662 *** (0.0590) |

| lnedijt | −0.3284 *** (0.0805) | −0.3792 *** (0.1000) | −0.4547 *** (0.0981) | −0.4788 *** (0.0992) |

| lndistwij | −0.7640 *** (0.1308) | −0.7315 *** (0.1215) | −0.7678 *** (0.1252) | −0.7537 *** (0.1299) |

| abslnlatitudeij | 0.3259 *** (0.0693) | 0.3232 *** (0.0682) | 0.3045 *** (0.0634) | 0.3102 *** (0.0633) |

| lnargjt | −0.3880 *** (0.0735) | −0.3906 *** (0.0716) | −0.3234 *** (0.0682) | −0.3126 *** (0.0644) |

| lnrerijt | −0.0931 *** (0.0316) | −0.0953 *** (0.0320) | −0.1021 *** (0.0308) | −0.1007 *** (0.0313) |

| adjacent | 0.7370 *** (0.2040) | 0.7962 *** (0.1952) | 0.7308 *** (0.2058) | 0.7740 *** (0.2155) |

| WTO | 0.1015 (0.1687) | 0.1173 (0.1570) | −0.0275 (0.1557) | −0.0167 (0.1588) |

| crisis | −0.2334 (0.2848) | −0.2312 (0.2869) | −0.0979 (0.2769) | −0.1065 (0.2799) |

| lntrustjt | 0.2196 ** (0.0874) | 0.2408 ** (0.0967) | 0.2013 ** (0.0973) | 0.2068 ** (0.0971) |

| lntfjt | 0.3383 (0.5214) | 0.5397 (0.4981) | 0.5033 (0.5084) | |

| lnmfjt | 1.6792 *** (0.4739) | 1.6223 *** (0.4789) | ||

| lnffjt | 0.2387 (0.2468) | |||

| constant | −34.0367 *** (4.5292) | −33.0867 *** (5.0006) | −38.7786 *** (5.4111) | −39.1557 *** (5.4856) |

| F Test | 88.75 {0.0000} | 97.58 {0.0000} | 95.57 {0.0000} | 87.65 {0.0000} |

| adj-R2 | 0.6819 | 0.6818 | 0.6928 | 0.6928 |

| Obsvations | 639 | 639 | 639 | 639 |

| Variable | Model (1) | Model (2) | Model (3) | Model (4) |

|---|---|---|---|---|

| lngdpit | 1.2678 *** (0.1862) | 0.8772 *** (0.2297) | 0.8464 *** (0.2093) | 0.8357 *** (0.2053) |

| lngdpjt | 0.8687 *** (0.0844) | 0.9205 *** (0.0659) | 0.9354 *** (0.0651) | 0.9480 *** (0.0668) |

| lnedijt | −0.5175 *** (0.1146) | −0.6813 *** (0.1607) | −0.6960 *** (0.1479) | −0.7080 *** (0.1461) |

| lndisij | −0.3212 (0.2660) | −0.2529 (0.2769) | −0.3623 (0.2722) | −0.3799 (0.2637) |

| abslnlatitudeij | 0.6335 *** (0.1758) | 0.5887 *** (0.1586) | 0.5292 *** (0.1566) | 0.5164 *** (0.1528) |

| lnargjt | −0.3009 *** (0.1034) | −0.3206 *** (0.0923) | −0.2749 *** (0.0840) | −0.2639 *** (0.0808) |

| lnrerijt | −0.1480 *** (0.0478) | −0.1500 *** (0.0484) | −0.1467 *** (0.0467) | −0.1405 *** (0.0468) |

| adjacent | 1.0338 *** (0.2791) | 1.2158 *** (0.3179) | 1.0914 *** (0.3186) | 1.1200 *** (0.3200) |

| WTO | 0.1066 (0.1817) | 0.1637 (0.1662) | 0.0329 (0.1637) | 0.0429 (0.1642) |

| crisis | −0.1424 (0.2952) | −0.1447 (0.2936) | −0.0456 (0.2797) | −0.0630 (0.2820) |

| lntrustjt | 1.6631 ** (0.7366) | 1.5765 ** (0.6798) | 1.3239 ** (0.6721) | 1.2268 * (0.6508) |

| lntfjt | 1.2342 * (0.6832) | 1.2585 ** (0.6389) | 1.1387 * (0.6358) | |

| lnmfjt | 1.4275 ** (0.5724) | 1.3690 ** (0.5688) | ||

| lnffjt | 0.3442 (0.2510) | |||

| constant | −43.1144 *** (7.2393) | −38.6174 *** (6.3717) | −42.5492 *** (6.3961) | −42.7396 *** (6.3382) |

| Unidentifiable test Kleibergen−Paap rk LM χ2 (1) | 15.993 {0.0001} | 18.697 {0.0000} | 16.971 {0.0000} | 17.823 {0.0000} |

| Weak identification test Kleibergen−Paap rk Wald F | 17.113 [8.96] {0.0000} | 19.691 [8.96] {0.0000} | 17.863 [8.96] {0.0000} | 18.880 [8.96] {0.0000} |

| Endogenous Test χ2 (1) | 5.422 {0.0199} | 5.038 {0.0248} | 3.456 {0.0630} | 2.956 {0.0856} |

| F test | 78.20 {0.0000} | 77.00 {0.0000} | 75.41 {0.0000} | 69.85 {0.0000} |

| Centered R2 | 0.6043 | 0.6197 | 0.6512 | 0.6601 |

| Obsvations | 639 | 639 | 639 | 639 |

| Variable | QR_10 | QR_25 | QR_50 | QR_75 | QR_90 |

|---|---|---|---|---|---|

| lngdpit | 1.0809 *** (0.2709) | 0.4186 (0.2998) | 0.6567 *** (0.1460) | 0.8160 *** (0.1843) | 1.0357 *** (0.1869) |

| lngdpjt | 1.1385 *** (0.1195) | 0.9785 *** (0.0840) | 0.9125 *** (0.0276) | 0.8294 *** (0.0314) | 0.7351 *** (0.0336) |

| lnedijt | −0.4369 ** (0.2037) | −0.8250 *** (0.1519) | −0.6834 *** (0.0911) | −0.4317 *** (0.0866) | −0.2508 *** (0.0941) |

| lndistwij | −0.9294 *** (0.3088) | −0.7665 *** (0.1368) | −0.7520 *** (0.1168) | −0.9598 *** (0.1786) | −0.9384 *** (0.0945) |

| abslnlatitudeij | 0.1928 (0.1971) | 0.2730 (0.2960) | 0.3929 *** (0.0532) | 0.2080 *** (0.0566) | 0.1232 *** (0.0437) |

| lnargjt | −0.3294 ** (0.1354) | −0.3307 (0.3433) | −0.2000 *** (0.0399) | −0.1657 *** (0.0439) | −0.0973 ** (0.0431) |

| lnrerijt | −0.0343 (0.0677) | −0.1765 *** (0.0456) | −0.1681 *** (0.0214) | −0.1134 *** (0.0268) | −0.0680 *** (0.0195) |

| adjacent | −1.1502 (0.8467) | 0.7081 ** (0.3478) | 1.0689 *** (0.1683) | 0.9804 *** (0.2555) | 0.9522 *** (0.1473) |

| WTO | −0.3158 * (0.1761) | −0.2403 (0.1933) | −0.1561 (0.1187) | −0.0979 (0.1240) | −0.0899 (0.1135) |

| crisis | 0.0804 (0.2263) | 0.2839 * (0.1452) | 0.0604 (0.1006) | 0.0781 (0.1333) | 0.0008 (0.0919) |

| lntrustjt | 0.2404 ** (0.1204) | 0.5534 *** (0.1541) | 0.3976 *** (0.0735) | 0.2417 *** (0.0869) | 0.2314 *** (0.0780) |

| lntfjt | 0.5677 (0.4678) | 2.5852 *** (0.4616) | 1.7819 *** (0.3002) | 0.2230 (0.8705) | −0.7210 (0.5524) |

| lnmfjt | 1.9683 *** (0.4738) | 0.9845 * (0.5306) | 1.4937 *** (0.2883) | 1.0189 ** (0.5114) | 0.8246 *** (0.2123) |

| lnffjt | −0.2928 (0.2521) | −0.3093 (0.2888) | 0.3785 ** (0.1608) | 0.4081 ** (0.1840) | 0.6556 *** (0.1758) |

| constant | −45.2370 *** (8.9660) | −27.7626 ** (12.3018) | −33.8551 *** (3.3122) | −25.1554 *** (4.4073) | −25.1178 *** (3.1075) |

| R2 | 0.6418 | 0.6643 | 0.6851 | 0.6772 | 0.6574 |

| Heteroscedasticity test χ2 (1) | 95.755 {0.000} | 87.516 {0.000} | 99.138 {0.000} | 116.414 {0.000} | 136.794 {0.000} |

| Obsvations | 639 | 639 | 639 | 639 | 639 |

| Variable | QR_10 | QR_25 | QR_50 | QR_75 | QR_90 |

|---|---|---|---|---|---|

| lngdpit | 0.0547 (0.3022) | 0.5406 (0.2799) | 0.6301 *** (0.1460) | −0.1392 (0.3995) | 0.4912 (0.8790) |

| lngdpjt | 1.1513 *** (0.0581) | 0.9210 *** (0.0531) | 0.8443 *** (0.0463) | 0.9036 *** (0.0447) | 0.7420 *** (0.0363) |

| lnedijt | −1.8743 *** (0.3233) | −1.0260 *** (0.1335) | −0.7282 *** (0.0937) | −1.2301 *** (0.3137) | −0.8291 (0.9635) |

| lndistwij | 0.2750 (0.2617) | −0.3781 ** (0.1832) | −0.4278 ** (0.2039) | −0.1742 (0.2572) | 0.2582 (1.8743) |

| abslnlatitudeij | 2.1654 *** (0.2784) | 0.6514 *** (0.1457) | 0.6331 *** (0.1055) | 0.1681 *** (0.0548) | 0.1481 ** (0.0643) |

| lnargjt | 0.4104 *** (0.1265) | −0.0492 (0.1253) | −0.1002 * (0.0583) | −0.4918 *** (0.1144) | −0.4346 (0.5476) |

| lnrerijt | −0.0852 (0.0529) | −0.1775 *** (0.0487) | −0.1868 *** (0.0211) | −0.1492 *** (0.0286) | −0.0845 *** (0.0321) |

| adjacent | 0.1214 (0.4969) | 0.9168 * (0.4862) | 1.5070 *** (0.2747) | 0.9177 *** (0.2348) | 1.3349 ** (0.5219) |

| WTO | −0.0547 (0.1259) | 0.1386 (0.1761) | −0.0762 (0.1231) | 0.1348 (0.1442) | −0.0718 (0.1054) |

| crisis | 0.4833 *** (0.1696) | 0.2341 * (0.1344) | 0.0740 (0.1117) | 0.1458 (0.1180) | 0.0738 (0.1800) |

| lntrustjt | 5.2744 *** (0.8039) | 2.5486 *** (0.4009) | 1.2636 *** (0.3601) | 2.1909 *** (0.6997) | 1.8136 (2.6155) |

| lntfjt | 3.5358 *** (0.5927) | 3.0098 *** (0.5999) | 2.2658 *** (0.3807) | 1.1761 (0.8526) | −0.2569 (0.9062) |

| lnmfjt | −1.1608 ** (0.5886) | 0.8959 ** (0.4531) | 1.3333 *** (0.3000) | 0.3042 (0.4629) | 0.4876 (0.5882) |

| lnffjt | 0.0760 (0.1947) | 0.4144 (0.2889) | 0.4741 *** (0.1749) | 0.4050 ** (0.1791) | 0.6985 *** (0.1822) |

| constant | −40.3823 *** (8.1944) | −43.7732 *** (7.5385) | −38.9687 *** (3.8140) | −12.9113 ** (6.2431) | −25.6468 *** (3.3305) |

| R2 | 0.6464 | 0.6717 | 0.6849 | 0.6738 | 0.6596 |

| Heteroscedasticity test χ2 (2) | 86.491 {0.000} | 87.084 {0.000} | 96.153 {0.000} | 108.093 {0.000} | 136.724 {0.000} |

| Obsvations | 639 | 639 | 639 | 639 | 639 |

| Variable | QR_10 | QR_25 | QR_50 | QR_75 | QR_90 |

|---|---|---|---|---|---|

| lngdpit | 1.0218 *** (0.2759) | 0.5665 ** (0.2686) | 0.7739 *** (0.1511) | −0.0633 (0.3469) | 0.6727 (0.5145) |

| lngdpjt | 1.1141 *** (0.1400) | 0.9457 *** (0.0586) | 0.8901 *** (0.0576) | 0.9160 *** (0.0432) | 0.7641 *** (0.0449) |

| lnedijt | −1.1314 * (0.6085) | −1.0115 *** (0.1422) | −0.6013 *** (0.1135) | −1.1621 *** (0.2862) | −0.6703 (0.6110) |

| lndistwij | 0.2294 (0.8485) | −0.3929 ** (0.1859) | −0.5710 ** (0.2278) | −0.2436 (0.2776) | −0.2240 (1.0463) |

| abslnlatitudeij | 2.2395 (1.3939) | 0.7847 *** (0.1728) | 0.5818 *** (0.1374) | 0.2510 *** (0.0570) | 0.1447 *** (0.0528) |

| lnargjt | 0.9474 (0.8689) | 0.0228 (0.1336) | 0.0501 (0.1951) | −0.3833 *** (0.1191) | −0.2543 (0.2833) |

| lnrerijt | −0.0561 (0.0851) | −0.1834 *** (0.0430) | −0.1820 *** (0.0227) | −0.1369 *** (0.0329) | −0.0655 *** (0.0232) |

| adjacent | −0.1081 (1.1179) | 0.6227 (0.4166) | 1.1875 *** (0.3392) | 0.5584 * (0.3107) | 0.7995 *** (0.2128) |

| WTO | −0.1142 (0.2266) | 0.1512 (0.1839) | −0.2243 (0.1396) | 0.1280 (0.1471) | −0.0521 (0.1147) |

| crisis | 0.6152 (0.4305) | 0.1773 (0.1779) | 0.1047 (0.1047) | 0.0880 (0.1254) | 0.0928 (0.1977) |

| lntrustjt | 4.8539 (3.4648) | 2.5085 *** (0.4686) | 1.0033 *** (0.3798) | 2.1380 *** (0.6897) | 1.3333 (1.5624) |

| lntfjt | 2.1592 (1.4397) | 2.8113 *** (0.5757) | 2.1309 *** (0.3787) | 1.1352 (0.8086) | −0.4723 (0.6278) |

| lnmfjt | −0.4734 (1.7404) | 1.0818 ** (0.5049) | 1.7922 *** (0.4017) | 0.4973 (0.5532) | 0.6819 (0.4815) |

| lnffjt | −0.0341 (0.2063) | 0.4324 (0.3153) | 0.2587 (0.1884) | 0.3880 * (0.2041) | 0.8148 *** (0.2712) |

| constant | −64.4094 *** (11.5513) | −45.1088 *** (7.7872) | −43.0240 *** (5.9121) | −15.4403 *** (5.9541) | −26.1923 *** (3.6755) |

| R2 | 0.6435 | 0.6651 | 0.6763 | 0.6665 | 0.6501 |

| Heteroscedasticity test χ2 (2) | 93.609 {0.000} | 91.507 {0.000} | 92.135 {0.000} | 111.952 {0.000} | 158.617 {0.000} |

| Obsvations | 627 | 627 | 627 | 627 | 627 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, H.; Qi, C. The Trade Effect of Trust: Evidence from Agricultural Trade between China and Its Partners. Sustainability 2022, 14, 729. https://doi.org/10.3390/su14020729

Chen H, Qi C. The Trade Effect of Trust: Evidence from Agricultural Trade between China and Its Partners. Sustainability. 2022; 14(2):729. https://doi.org/10.3390/su14020729

Chicago/Turabian StyleChen, Heping, and Chunjie Qi. 2022. "The Trade Effect of Trust: Evidence from Agricultural Trade between China and Its Partners" Sustainability 14, no. 2: 729. https://doi.org/10.3390/su14020729