Industry 4.0 as an Opportunity and Challenge for the Furniture Industry—A Case Study

Abstract

:1. Introduction

2. Theoretical Background

2.1. Smart Factories and Industry 4.0

2.2. Integration of Industry 4.0 into Smart Factories

2.3. The Basic Building Blocks of Industry 4.0

3. Methodology

4. Results

4.1. Case Study—Complete Integration of Industry 4.0 into the Furniture Industry Based on the 7S Model

4.1.1. Structure

- Pre-production department: sales, design, development, accounting, construction, and warehouse;

- Production department: engine room (material cutting, banding, and CNC), other engine room, paint shop, pressing shop, and handicraft workshop;

- After production department: shipping, assembly, and logistics.

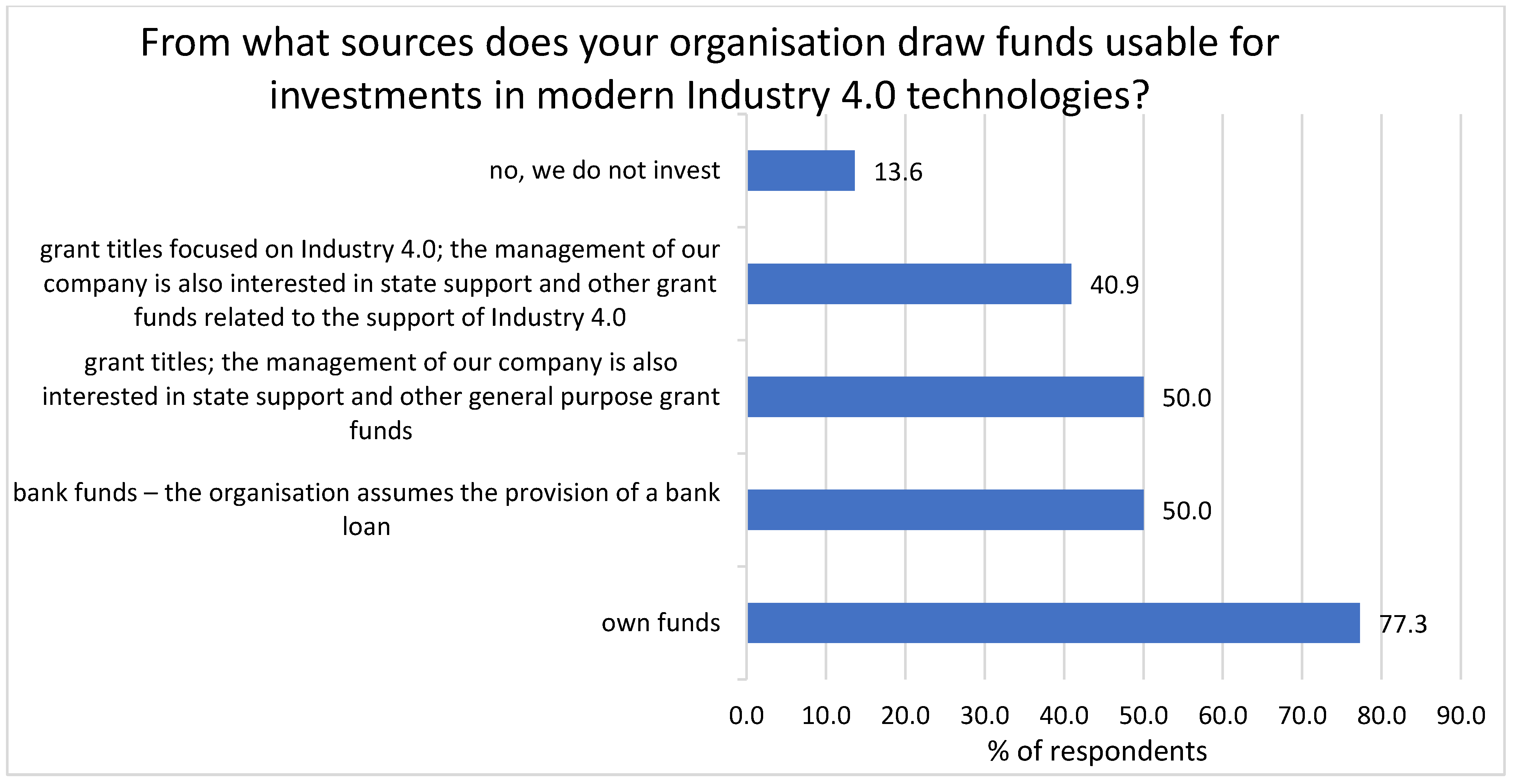

4.1.2. Strategy

4.1.3. Systems

4.1.4. Management Style

4.1.5. Collaborators

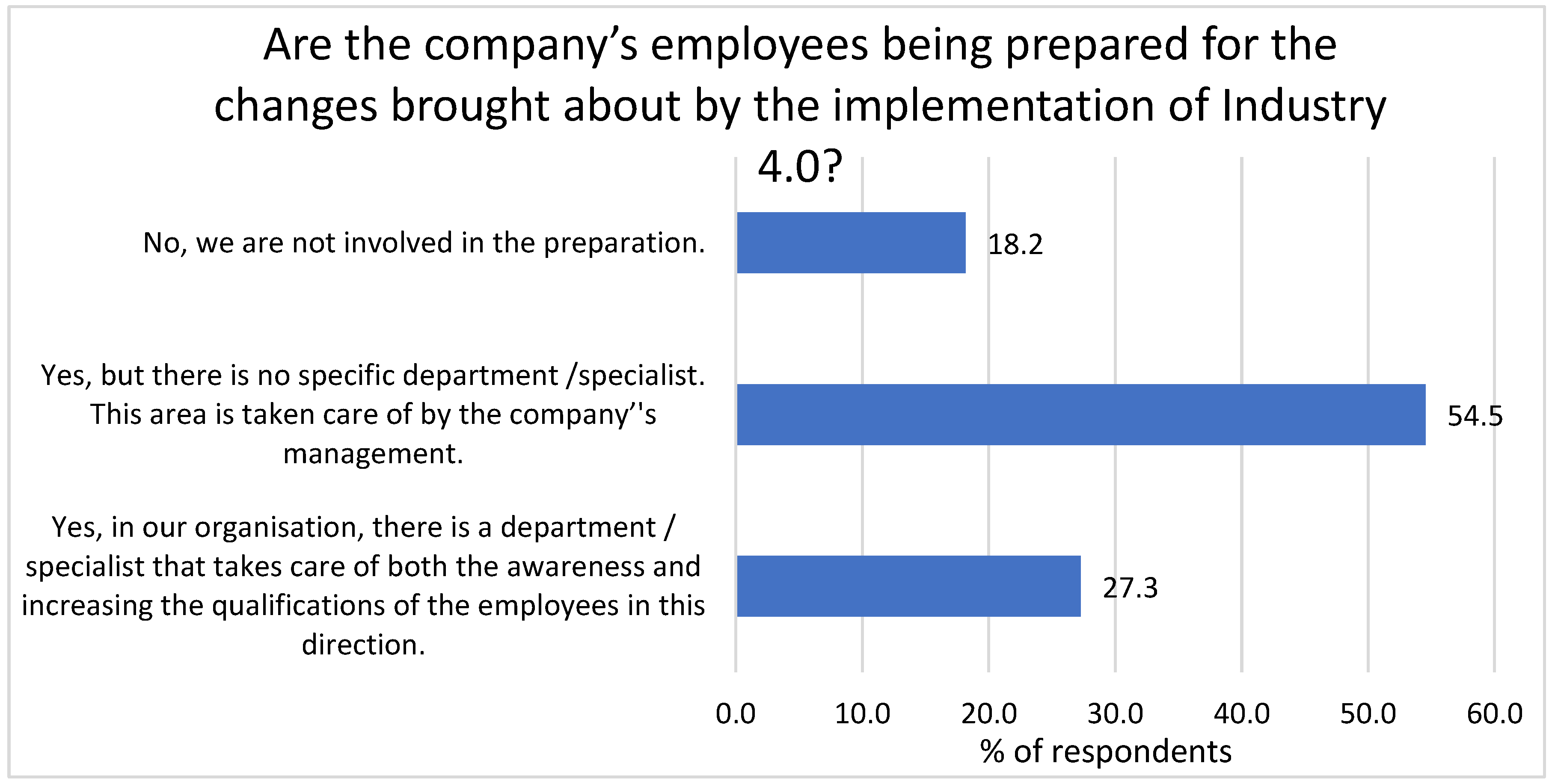

4.1.6. Competences and Skills

4.1.7. Shared Values

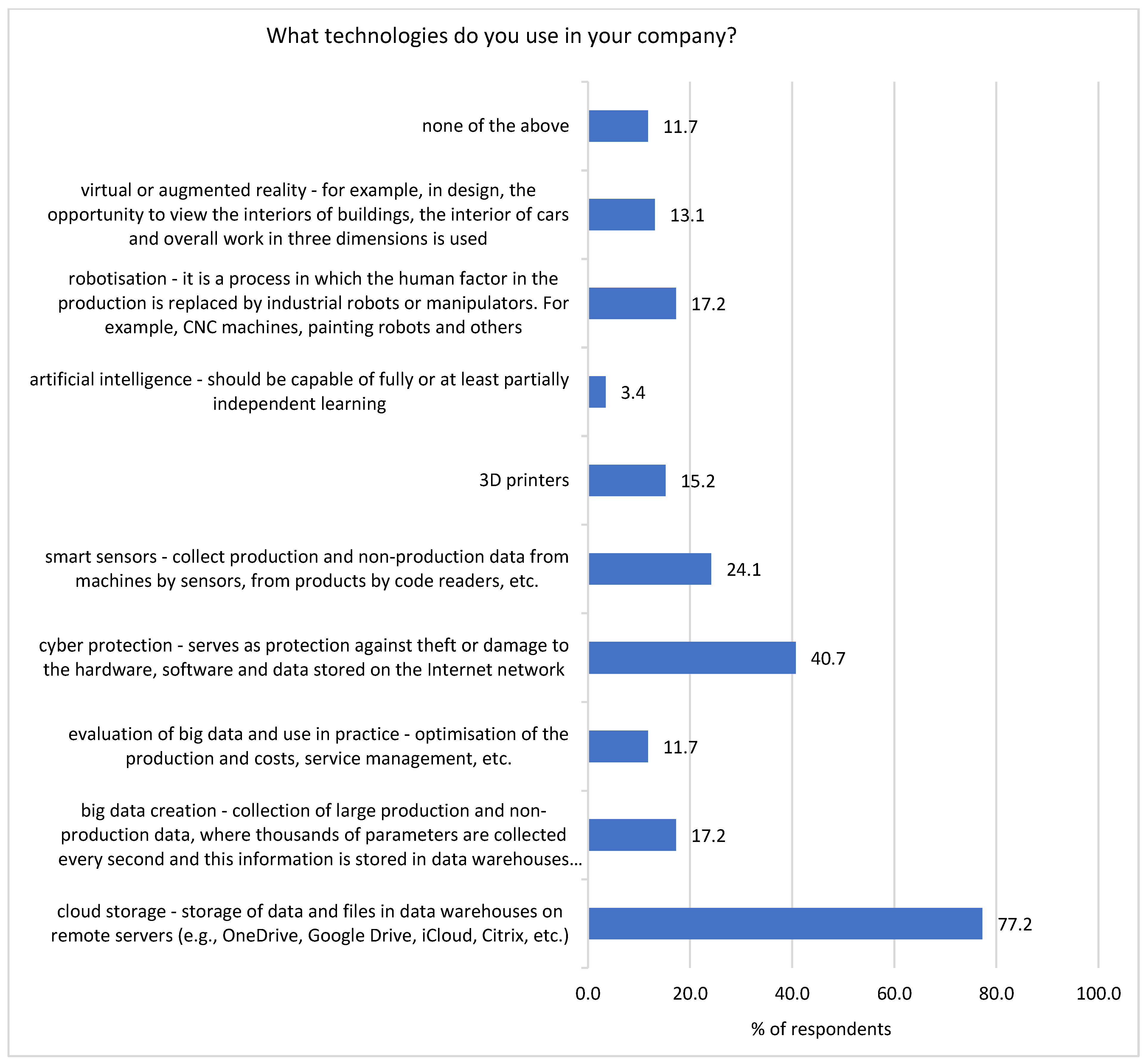

4.2. Technological Components of Industry 4. 0—Intelligent Factory

Main Building Blocks of Industry 4.0

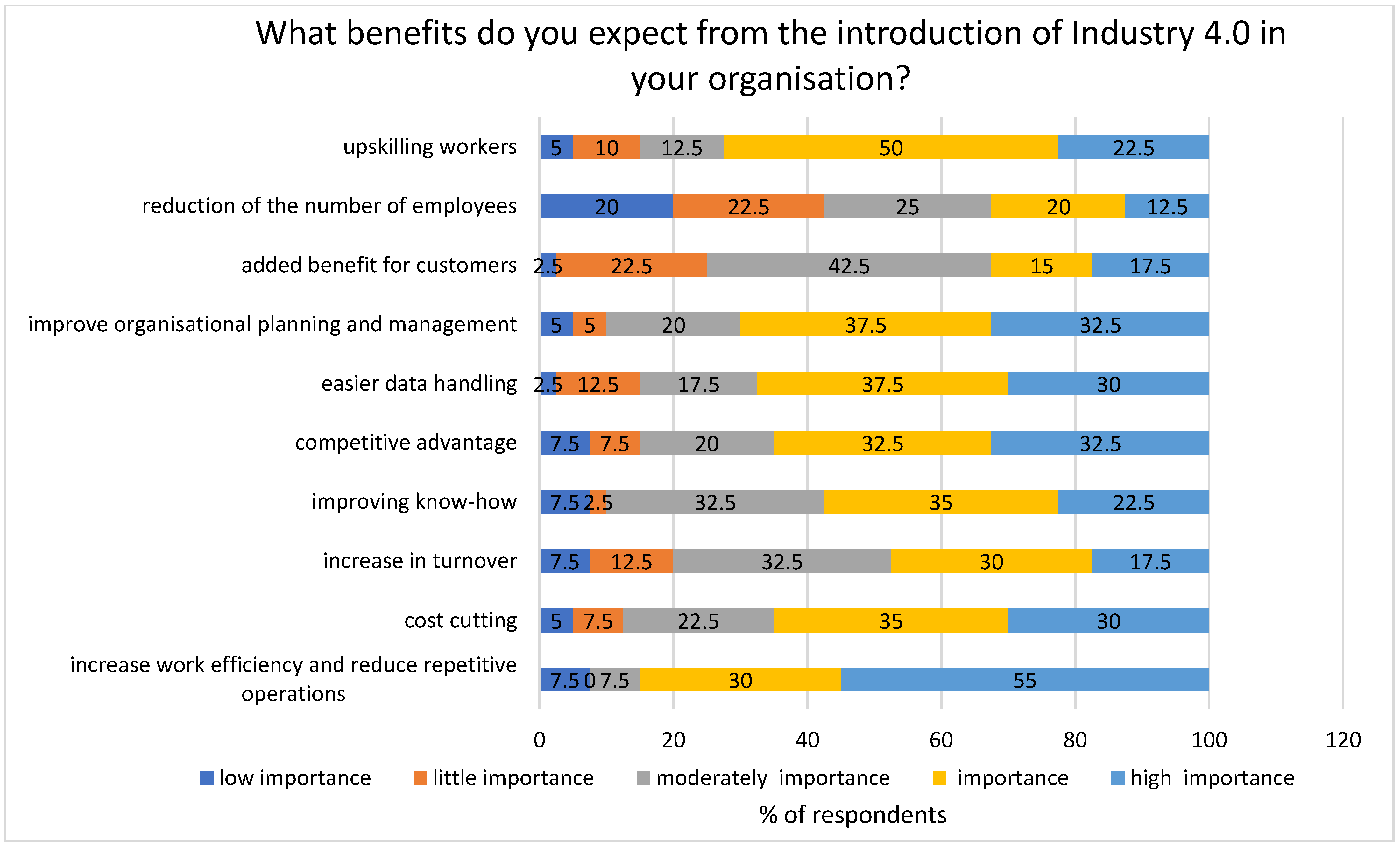

5. Discussion

Industry 4.0 vs. Industry 5.0 (from Digital Production to a Digital Society)

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| CPS | cyber–physical systems |

| HCPS | Human–Cyber–Physical System |

| EC | European Commission |

| AI | artificial intelligence |

| MES | manufacturing execution system |

| ERP | enterprise resource planning |

| ICT | information and communications technology |

| IoT | Internet of Things |

| IoS | The Internet of Services |

| RFID | Radio Frequency Identification |

| CM | Cloud manufacturing |

| CC | Cloud computing (CC) |

References

- Posada, J.; Toro, C.; Barandiaran, I.; Oyarzun, D.; Stricker, D.; de Amicis, R.; Pinto, E.B.; Eisert, P.; Dollner, J.; Vallarino, I. Visual Computing as a Key Enabling Technology for Industrie 4.0 and Industrial Internet. IEEE Comput. Graph. Appl. 2015, 35, 26–40. [Google Scholar] [CrossRef]

- Azman, N.A.; Ahmad, N. Technological capability in industry 4.0: A literature review for small and medium manufacturers challenges. J. Crit. Rev. 2020, 7, 1429–1438. [Google Scholar] [CrossRef]

- Sivathanu, B.; Pillai, R. Smart HR 4.0 – how industry 4.0 is disrupting HR. Hum. Resour. Manag. Int. Dig. 2018, 26, 7–11. [Google Scholar] [CrossRef]

- Vrchota, J.; Řehoř, P.; Maříková, M.; Pech, M. Critical Success Factors of the Project Management in Relation to Industry 4.0 for Sustainability of Projects. Sustainability 2020, 13, 281. [Google Scholar] [CrossRef]

- Wang, L.; He, J.; Xu, S. The Application of Industry 4.0 in Customized Furniture Manufacturing Industry. MATEC Web Conf. 2017, 100, 03022. [Google Scholar] [CrossRef] [Green Version]

- Mařík, V. Průmysl 4.0: Výzva pro Českou Republiku; Management Press: Praha, Czech Republic, 2016; pp. 27–35. ISBN 978-80-7261-440-0. [Google Scholar]

- Sharma, A.K.; Bhandari, R.; Pinca-Bretotean, C.; Sharma, C.; Dhakad, S.K.; Mathur, A. A study of trends and industrial prospects of Industry 4.0. Mater. Today Proc. 2021, in press. [Google Scholar] [CrossRef]

- Brozzi, R.; Forti, D.; Rauch, E.; Matt, D.T. The Advantages of Industry 4.0 Applications for Sustainability: Results from a Sample of Manufacturing Companies. Sustainability 2020, 12, 3647. [Google Scholar] [CrossRef]

- Müller, J.M.; Kiel, D.; Voigt, K.-I. What Drives the Implementation of Industry 4.0? The Role of Opportunities and Challenges in the Context of Sustainability. Sustainability 2018, 10, 247. [Google Scholar] [CrossRef] [Green Version]

- Saniuk, S.; Grabowska, S.; Straka, M. Identification of Social and Economic Expectations: Contextual Reasons for the Transformation Process of Industry 4.0 into the Industry 5.0 Concept. Sustainability 2022, 14, 1391. [Google Scholar] [CrossRef]

- Xu, X.; Lu, Y.; Vogel-Heuser, B.; Wang, L. Industry 4.0 and Industry 5.0—Inception, conception and perception. J. Manuf. Syst. 2021, 61, 530–535. [Google Scholar] [CrossRef]

- Polat, L.; Erkollar, A. Industry 4.0 vs. Society 5.0. In Digital Conversion on the Way to Industry 4.0. ISPR 2020; Durakbasa, N.M., Gençyılmaz, M.G., Eds.; Lecture Notes in Mechanical Engineering; Springer: Cham, Switzerland; pp. 333–345. [CrossRef]

- Gereffi, G. Shifting Governance Structures in Global Commodity Chains, With Special Reference to the Internet. Am. Behav. Sci. 2001, 44, 1616–1637. [Google Scholar] [CrossRef] [Green Version]

- Zhu, J.; Niu, J. Green material characteristics applied to office desk furniture. BioResources 2022, 17. [Google Scholar] [CrossRef]

- Silvius, G.; Ismayilova, A.; Sales-Vivó, V.; Costi, M. Exploring Barriers for Circularity in the EU Furniture Industry. Sustainability 2021, 13, 11072. [Google Scholar] [CrossRef]

- Renda, A.; Zavatta, R.; Tracogna, A.; Tomasell, A.R.; Busse, M.; Wieczorkiewicz, J.; Mustilli, F.; Simonelli, F.; Luchetta, G.; Pelkmans, J.; et al. The EU Furniture Market Situation and a Possible Furniture Products Initiative. Available online: https://www.ceps.eu/ceps-publications/eu-furniture-market-situation-and-possible-furniture-products-initiative/ (accessed on 2 August 2022).

- Forrest, A.; Holton, M.; Ballinger, A.; Whittaker, D. Bureau Circular Economy Opportunities in the Furniture Sector; Eunomia Research & Consulting Ltd: Brussels, Belgium, 2017; pp. 3–5. Available online: https://www.eunomia.co.uk/reports-tools/circular-economy-opportunities-in-the-furniture-sector/ (accessed on 2 August 2022).

- Statista • Top Exporters of Furniture Globally | Statista. Available online: https://www.statista.com/statistics/1053231/furniture-leading-exporters-worldwide/ (accessed on 2 August 2022).

- Research and Markets European Furniture Manufacturers Report 2022: Profiles of 1600 Leading Furniture Manufacturers in Europe. Available online: https://www.prnewswire.com/news-releases/european-furniture-manufacturers-report-2022-profiles-of-1600-leading-furniture-manufacturers-in-europe-301551963.html (accessed on 2 August 2022).

- Bianco, I.; Thiébat, F.; Carbonaro, C.; Pagliolico, S.; Blengini, G.A.; Comino, E. Life Cycle Assessment (LCA)-based tools for the eco-design of wooden furniture. J. Clean. Prod. 2021, 324, 129249. [Google Scholar] [CrossRef]

- Ding, J.; Wang, M.; Zeng, X.; Qu, W.; Vassiliadis, V.S. Mass personalization strategy under Industrial Internet of Things: A case study on furniture production. Adv. Eng. Informatics 2021, 50. [Google Scholar] [CrossRef]

- Oliveira, O.; Gamboa, D.; Fernandes, P. An Information System for the Furniture Industry to Optimize the Cutting Process and the Waste Generated. Procedia Comput. Sci. 2016, 100, 711–716. [Google Scholar] [CrossRef] [Green Version]

- Jácome, N.R.; Medina-Tovar, F.; Rodríguez-Herás, J.; Vásquez-Peñaloza, L.; Gómez-Charris, Y. Model for the development of innovation as a dynamic capability for an organization in the furniture industry. Procedia Comput. Sci. 2022, 198, 542–547. [Google Scholar] [CrossRef]

- Demirarslan, D. Standardization of Furniture DESIGN and Production in Turkey. In Proceedings of the 12th International Conference-Standardization, Prototypes and Quality: A Means of Balkan Countries’ Collaboration, Kocaeli Univ, Izmit, Turkey, 22–24 October 2015; Erdogan, N., Ed.; 2015; pp. 355–360. Available online: https://www-webofscience-com.infozdroje.czu.cz/wos/woscc/full-record/WOS:000380591200042 (accessed on 2 August 2022).

- Grzegorzewska, E.; Sedliačiková, M.; Kalafús, J. A comparison of the importance of the furniture manufacturing in eu countries using cluster analysis and hellwig's method. Acta Fac. Xylol. Zvolen 2021, 63, 151–164. [Google Scholar] [CrossRef]

- Long, G.J.; Lin, B.H.; Cai, H.X.; Nong, G.Z. Developing an Artificial Intelligence (AI) Management System to Improve Product Quality and Production Efficiency in Furniture Manufacture. Procedia Comput. Sci. 2020, 166, 486–490. [Google Scholar] [CrossRef]

- Lukiewska, K.; Brelik, A. A Model for Measuring the International Competitiveness of Furniture Industry in the European Union Countries. Eur. Res. Stud. J. 2021, XXIV, 334–350. [Google Scholar] [CrossRef]

- Epede, M.B.; Wang, D. Competitiveness and upgrading in global value chains: A multiple-country analysis of the wooden furniture industry. For. Policy Econ. 2022, 140, 102737. [Google Scholar] [CrossRef]

- Sellitto, M.A.; Camfield, C.G.; Buzuku, S. Green innovation and competitive advantages in a furniture industrial cluster: A survey and structural model. Sustain. Prod. Consum. 2020, 23, 94–104. [Google Scholar] [CrossRef]

- European Commission; Directorate-General for Research and Innovation; Breque, M.; De Nul, L.; Petridis, A. Industry 5.0: Towards a Sustainable, Human-centric and Resilient European Industry; Publications Office of the Europen Union: Luxemburg, 2021; pp. 3–7. [Google Scholar] [CrossRef]

- Crnjac, M.; Veža, I.; Banduka, N. From Concept to the Introduction of Industry 4.0. Int. J. Ind. Eng. Manag. 2017, 8, 21–30. [Google Scholar]

- Wiśniewska-Sałek, A. Sustainable Development in Accordance With the Concept of Industry 4.0 on the Example of the Furniture Industry. MATEC Web Conf. 2018, 183, 04005. [Google Scholar] [CrossRef]

- Mabkhot, M.M.; Al-Ahmari, A.M.; Salah, B.; Alkhalefah, H. Requirements of the Smart Factory System: A Survey and Perspective. Machines 2018, 6, 23. [Google Scholar] [CrossRef] [Green Version]

- Pinzone, M.; Fantini, P.; Perini, S.; Garavaglia, S.; Taisch, M.; Miragliotta, G. Jobs and Skills in Industry 4.0: An Exploratory Research. In Collaboration in a Hyperconnected World; Springer: Cham, Switzerland, 2017; Volume 513, pp. 282–288. [Google Scholar]

- Zhu, J.; Wang, X. Research on enabling technologies and development path of intelligent manufacturing of wooden furniture. J. For. Eng. 2021, 6, 177–183. [Google Scholar]

- Shehadeh, M.A.; Schroeder, S.; Richert, A.; Jeschke, S. Hybrid teams of industry 4.0: A work place considering robots as key players. In Proceedings of the 2017 IEEE International Conference on Systems, Man, and Cybernetics (SMC), Banff, AB, Canada, 5 October 2017; pp. 1208–1213. [Google Scholar]

- Benešová, A.; Tupa, J. Requirements for Education and Qualification of People in Industry 4.0. Procedia Manuf. 2017, 11, 2195–2202. [Google Scholar] [CrossRef]

- Romero-Gazquez, J.L.; Canavate-Cruzado, G.; Bueno-Delgado, M.-V. IN4WOOD: A Successful European Training Action of Industry 4.0 for Academia and Business. IEEE Trans. Educ. 2021, 65, 200–209. [Google Scholar] [CrossRef]

- Păltan, R.D.; Biriș, C.; Rădulescu, L.A.M. Industrial processes efficiency and lower energy consumption initiatives through advanced retrofitting in the wood industry. IOP Conf. Series Mater. Sci. Eng. 2019, 564, 012096. [Google Scholar] [CrossRef]

- Brettel, M.; Friederichsen, N.; Keller, M.; Rosenberg, M. How Virtualization, Decentralization and Network Building Change the Manufacturing Landscape: An Industry 4.0 Perspective. Int. J. Inf. Commun. 2014, 8, 37–44. [Google Scholar] [CrossRef]

- Veile, J.W.; Kiel, D.; Müller, J.M.; Voigt, K.-I. Lessons learned from Industry 4.0 implementation in the German manufacturing industry. J. Manuf. Technol. Manag. 2019, 31, 977–997. [Google Scholar] [CrossRef] [Green Version]

- Strandhagen, J.W.; Alfnes, E.; Strandhagen, J.O.; Vallandingham, L.R. The fit of Industry 4.0 applications in manufacturing logistics: A multiple case study. Adv. Manuf. 2017, 5, 344–358. [Google Scholar] [CrossRef] [Green Version]

- Wang, S.; Wan, J.; Li, D.; Zhang, C. Implementing Smart Factory of Industrie 4.0: An Outlook. Int. J. Distrib. Sens. Netw. 2016, 12, 3159805. [Google Scholar] [CrossRef] [Green Version]

- Stock, T.; Seliger, G. Opportunities of Sustainable Manufacturing in Industry 4.0. Procedia CIRP 2016, 40, 536–541. [Google Scholar] [CrossRef] [Green Version]

- Huxtable, J.; Schaefer, D. On Servitization of the Manufacturing Industry in the UK. Procedia CIRP 2016, 52, 46–51. [Google Scholar] [CrossRef] [Green Version]

- Wang, B.; Zheng, P.; Yin, Y.; Shih, A.; Wang, L. Toward human-centric smart manufacturing: A human-cyber-physical systems (HCPS) perspective. J. Manuf. Syst. 2022, 63, 471–490. [Google Scholar] [CrossRef]

- Dumbill, E. Making Sense of Big Data. Big Data 2013, 1, 1–2. [Google Scholar] [CrossRef] [Green Version]

- de Oliveira, V.F.; Pessoa, M.A.D.O.; Junqueira, F.; Miyagi, P.E. SQL and NoSQL Databases in the Context of Industry 4.0. Machines 2021, 10, 20. [Google Scholar] [CrossRef]

- Xu, X. From cloud computing to cloud manufacturing. Robot. Comput. Manuf. 2012, 28, 75–86. [Google Scholar] [CrossRef]

- Sun, C.-C.; Hahn, A.; Liu, C.-C. Cyber security of a power grid: State-of-the-art. Int. J. Electr. Power Energy Syst. 2018, 99, 45–56. [Google Scholar] [CrossRef]

- Jackson, K. Building a secure computer system: Morris Gasser 0-442-23022-2 Van Nostrand Reinhold at International Thomson Publishing Services Ltd, North Way, Andover, Hants SP10 5BE. £26–95. Comput. Fraud Secur. Bull. 1989, 11, 18–19. [Google Scholar] [CrossRef]

- Baines, T.; Lightfoot, H.; Benedettini, O.; Whitney, D.; Kay, J.M. The adoption of servitization strategies by UK-based manufacturers. Proc. Inst. Mech. Eng. Part B J. Eng. Manuf. 2009, 224, 815–829. [Google Scholar] [CrossRef] [Green Version]

- Neely, A. Exploring the financial consequences of the servitization of manufacturing. Oper. Manag. Res. 2008, 1, 103–118. [Google Scholar] [CrossRef] [Green Version]

- Peters, T.J.; Waterman, R.H. In Search of Excellence. Nurs. Adm. Q. 1984, 8, 85–86. [Google Scholar] [CrossRef]

- Durana, P.; Zauskova, A.; Vagner, L.; Zadnanova, S. Earnings Drivers of Slovak Manufacturers: Efficiency Assessment of Innovation Management. Appl. Sci. 2020, 10, 4251. [Google Scholar] [CrossRef]

- Bhullar, G.; Osborne, S.; Ariño, M.N.; Navarro, J.D.A.; Valencia, F.G. Vision System Experimentation in Furniture Industrial Environment. Futur. Internet 2021, 13, 189. [Google Scholar] [CrossRef]

- Velásquez, M.; Zabala, N.; Neira-Rodado, D.; Baldovino, T.O.; Mercado-Caruso, N. Design of lean-based strategies to improve the flow of materials in the value chain of a furniture company in Colombia. Procedia Comput. Sci. 2022, 203, 502–507. [Google Scholar] [CrossRef]

- Skobelev, P.O.; Borovik, S.Y. On the way from Industry 4.0 to Industry 5.0: From digital manufacturing to digital society. Ind. 4.0. 2017, 2, 307–311. [Google Scholar]

| Type | Basic Characteristic | Example |

|---|---|---|

| (1) Internet of Things (IoT) | A network infrastructure that provides data transmission and sensor collection. The data collected are mostly difficult to measure by human perception, and then sent over the network. | A computer network that exchanges information between computers and provides data transmission and communication, for example, through M2M, which transforms human–machine dialogue. Using various sensors, transducers and sensors, the data are measured and transmitted to the cyber environment via the Internet. The collected information is difficult to measure by man, such as smoke leakage, vibration, product defects, weight, roughness, temperature, movement and more. The obtained information is evaluated directly by a sensor, which is also capable of making simple decisions or send data to collection points (cloud storage). Based on specific events, various cameras, sensors can be used to monitor the service life and predict the maintenance of machines, which reduces service costs, increases product quality, increases machine safety and more. |

| (2) Internet of Services (IoS) | These are software solutions stored on networks and cloud storage, for example. It creates predefined operations or decisions based on the data flow or a certain programmed trigger impulse. | Their purpose is to compile reports, monitor the performance of individual departments, support the motivation and retraining of employees and more. Software operating on networks or repositories performs repetitive processes and evaluates any pre-programmed tasks. Furthermore, the SW can perform predefined control tasks on the basis of the evaluated data, it can also start or set other devices. Examples are software that controls a company’s safety systems, production-quality robots that control the production flow, machining speeds, and more. |

| (3) Intelligent factories | Comprehensive factory management to reduce errors and increase efficiency. | Autonomous information exchange and monitoring of business activities. For example, it is an Intelligent Ordering and Payment System through an intelligent platform. Thanks to information from the network, we can, for example, “immerse” ourselves inside machining centres and thus obtain data on a given date and time of the performed activity, where we can monitor the efficiency and think about innovations. It is comprehensive coverage of the production and non-production operations within a smart company. |

| (4) Human–Cyber–Physical Systems (HCPS) | Based on the use of cyber–physical systems to create self-organising structures. Teams are made up of human resources and software that creates organised units. | CPS refers to a system that consists of physical resources controlled by computer algorithms. Through CPS, Industry 4.0 increases the ability to communicate with machines, while managing the production and machine capabilities. In practice, information on all phases of furniture production, such as design, production, logistics, transport, machine maintenance and more, is linked through the CPS where it is not natively provided by the supplier. In practice, all the manufactured parts are marked with bar/QR codes, after the code is read by the sensor by any production device at the input and output, there is a reference to the records of all the data in the cloud storage. One can enter this process, for example, using the machine’s display, tablet or other display devices and modify the process itself depending on one’s own decision. A machine, program or machine learning together with a person can thus create a work team or organisational unit. |

| (5) Big Data | Huge amount of all company data, related to each material or intangible segment forming a product or production segment | The intelligent factory is characterised by its communication network, allowing detailed monitoring of all the processes using a variety of sensors ensuring large data collection and distribution, which are: inspection of machines and their operation, monitoring of service life, and the influence of the environment or materials in interaction with various tools and other production aspects. The data from the machine or production technology are sent in a raw or pre-processed state to cloud repositories. |

| (6) “Cloud manufacturing” (CM) Cloud computing (CC) | Cloud storage focused on network services, storage of large data in a raw or pre-processed state, current and predictive evaluations and comprehensive conclusions across the enterprise. Internal servers can also be used, backed up if possible. | In the cloud storage, the data are evaluated. The data obtained this way are aimed at more efficient management, planning and optimisation of production and evaluation of predictable situations across the entire plant. By collecting and evaluating data, the system can predict any failure or worn tool. The data provided can indicate, for example, increased temperatures or higher machine vibrations. These and other collected data make it possible to anticipate machine failures, and defective parts, or to point out the low efficiency of various segments of the company and thus create a more efficient and sustainable process. |

| (7) Cyber Security | Safety in the area of Personal Data Security | This is the security of data transmission and management in the communication network and across the services used. It is the direct and indirect protection of the companies and their cloud storage. Company data are centralised in the company in cloud storage outside the company or on its own backup servers. This service is offered by specialised companies, which provide special protection here. The data are encrypted and unreadable to the average user. By indirect protection, we reduce the leakage of sensitive and valuable information through user authorisations and processes to restrict document accessibility, censor sensitive information, and unauthorised physical copying outside the enterprise. |

| (8) Autonomy or artificial intelligence (AI) | Use of artificial intelligence to streamline production lines with the participation of human resources | More human resource opportunities for personal development and space for innovative thinking. For example, the application of newly designed strategies obtained through the evaluation of analysis and machine learning with the participation of human resources and their experience. Based on the collection of relevant data, these data are subjected to a statistical analysis, which serves to streamline production and previous order preparation. |

| (9) Servitisation, servification | Creating a direct interaction between the primary manufacturer and the customer | Vision of future furniture production aimed at the customer, by connecting Internet marketing together with smart automated production and order processing. The product will be manufactured after direct order by the customer. All this leads to more flexible production, with zero or minimal stock. For example, the design of parametric products will help increase the added value of processing, satisfy individual demand, and reduce the cost of activities associated with the preparation of production. An example is the possibility of creating user-friendly software, where the client designs his own specific furniture with the possibility of consulting corporate architects. The said furniture would then be automatically produced after the required deposit has been paid, without a significant entry of employees into production. The customer thus directly participates in the pre-production part, while the production itself takes place fully automatically. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Červený, L.; Sloup, R.; Červená, T.; Riedl, M.; Palátová, P. Industry 4.0 as an Opportunity and Challenge for the Furniture Industry—A Case Study. Sustainability 2022, 14, 13325. https://doi.org/10.3390/su142013325

Červený L, Sloup R, Červená T, Riedl M, Palátová P. Industry 4.0 as an Opportunity and Challenge for the Furniture Industry—A Case Study. Sustainability. 2022; 14(20):13325. https://doi.org/10.3390/su142013325

Chicago/Turabian StyleČervený, Luboš, Roman Sloup, Tereza Červená, Marcel Riedl, and Petra Palátová. 2022. "Industry 4.0 as an Opportunity and Challenge for the Furniture Industry—A Case Study" Sustainability 14, no. 20: 13325. https://doi.org/10.3390/su142013325

APA StyleČervený, L., Sloup, R., Červená, T., Riedl, M., & Palátová, P. (2022). Industry 4.0 as an Opportunity and Challenge for the Furniture Industry—A Case Study. Sustainability, 14(20), 13325. https://doi.org/10.3390/su142013325