Abstract

Strategic emerging industries are gradually becoming the main driving force promoting the development of the national economy. As one of the strategic emerging industries, the New Generation of Information Technology Companies (NGITCs) play a crucial role in accelerating the integration of information and industrialization and in promoting the information processing of the whole society, with the support of various policy tools, such as government subsidy policy. Based on the panel data on the Chinese A-Stock Market (Shanghai and Shenzhen Stock Markets) from 2011 to 2020, this article empirically studies the correlations between the government subsidies, innovation input, and innovation output of the NGITCs. In the first step, we check the immediate effect and delayed effect of the government subsidies on the innovation output of the NGITCs and further test whether the ownership and geographical locations of the NGITCs have moderating effects between the government subsidies and innovation output of the NGITCs. In the second step, we investigate the government subsidies’ immediate impact and the delayed effect on the innovation input of the NGITCs. In the third step, we examine the innovation input’s immediate effect and the delayed effect on the innovation output of the NGITCs. In the last step, we analyze the mediating role of innovation input between government subsidies and the innovation output of the NGITCs. Our findings indicate that government subsidies positively promote the innovation output of the NGITCs and have a two-year-delayed effect. However, the government subsidies can most significantly increase the innovation output of the non-state-owned enterprises and those in the coastal areas. The government subsidies enhance the innovation input and have a three-year positive delayed effect. Innovation input positively impacts innovation output and also has a two-year-delayed effect. Our results also show that innovation input presents a partial mediating effect between government subsidies and the innovation output of the NGITCs.

1. Introduction

Innovation has become a critical driving force for China’s economic transformation and development in the new era. Since China is a developing country, the Chinese government put forward the “Innovation-Driven Development Strategy” in order to enhance the national independent innovation capacity. However, technological innovation relies on R&D (research and development) activities, and R&D activities are mainly carried out by companies, depending on their primary role in technological innovation [1,2]. Thus, the Chinese government, using some policy tools, including subsidy policy and tax policy, is mainly focusing on fostering and supporting the New Generation of Information Technology Companies (NGITCs) because NGITCs represent one of the critical emerging industries in China. Improving the innovation efficiency of the NGITCs is vital for developing the national economy and implementing the “Innovation-Driven Development Strategy.” During the “13th Five-Year Plan” period, the NGITCs were placed in a more prominent economic and social development position to encourage the vigorous building of a new modern industrial system and promote sustained and healthy economic and social development. In 2020, the growth rate of the added value of the NGITCs was 9.5%—higher than all the other strategic emerging industries. In addition, according to the “China Statistical Yearbook 2021 and 2011”, the ratio of the expenditure on R&D to GDP increased from 1.7% to 2.4% from 2010 to 2020. The government funds grew from 169.63 billion yuan to 482.52 billion yuan. Therefore, the evidence above illustrates that the Chinese government is profoundly implementing the “Innovation-Driven Development Strategy” and further improving innovation capabilities and efficiency. In order to promote development and enhance the technological innovation abilities of the NGITCs, like other developed countries, the Chinese government is using public policy tools, such as subsidy and tax policy. However, the question is why the government subsidizes the firms. What is the justification for this?

The justification for public support is market failure. On the one hand, innovation activities supply public goods, so it is relatively challenging to motivate enterprises and individual investors to allocate sufficient resources for innovation activities that depend on the market without public support. In addition, innovation activities have positive externalities and spillover effects that would not be considered when a firm is planning to make its R&D investments. Due to the positive spillover, private R&D investment cannot reach a socially optimal level. Public support aims to improve the R&D investment level [3,4,5,6]. On the other hand, information asymmetry is another market failure that lowers an enterprise’s ability to obtain financing on the market [7]. Furthermore, R&D investments are riskier than real asset investments, so internal funds are superior to external financing, but small or young companies may face financing restrictions for R&D activities [8,9]. Therefore, government subsidies aim to provide enterprises with sufficient funds to implement innovation investments. The Chinese government is also applying government subsidies to the NGITCs for the same reasons as those listed above. Although the government has provided subsidies to the NGITCs, the main concern is whether the government has effectively corrected market failures and improved the innovation ability of the NGITCs through government subsidies. What are the relationships between the government subsidies, innovation input, and innovation output of the NGITCs? If the government subsidies impact the innovation input and output of the NGITCs, is it an immediate or delayed effect? What is the case for the innovation input of the NGITCs? What roles do the ownership and geographical locations of the enterprises play in the subsidization and innovation output of the NGITCs?

While there is substantial evidence about the correlation between government subsidies, enterprises’ innovation inputs, and their innovation outputs, most prior studies have analyzed the relationship between government subsidies and innovation input [10,11,12,13,14]. Some recent studies have focused on the impact of government subsidies on innovation output [15,16,17,18]. However, a limited number of surveys have investigated the relationships between government subsidies, innovation input, and innovation output from one dimension [19]. Most importantly, despite the importance of the NGITCs, only a few researchers have focused on this field.

Thus, in order to make up for the present research gap and answer the questions above, in this study, we investigate whether the mechanisms behind government subsidies influence the innovation activities of the NGITCs: the relationships among the government subsidies, innovation input, and innovation output of the NGITCs. In the first step, we assess the immediate and delayed effect of government subsidies on the innovation output of the NGITCs. In addition, we further explore whether the ownership and geographical locations of the NGITCs have moderating effects on the government subsidies and innovation output. Then, we investigate the immediate and lagging impacts of government subsidies on the innovation input of the NGITCs. Next, the relationship between the innovation input and output is checked, considering the innovation input’s delayed effect. Finally, we examine whether the innovation input mediates between government subsidies (both current government subsidies and one-year-old government subsidies) and innovation output.

The essential contributions of this article are as follows: first, we chose the NGITCs as our research object. Although in China, as one of the strategic emerging industries, NGITCs are mainly supported by the government due to their relatively large innovation potential, few studies have paid attention to the NGITCs as the research object, so we mainly focused on the NGITCs. In addition, while most of the existing research works have focused on the impact of government subsidies on enterprise innovation input or output, we comprehensively consider the relationships among the government subsidies, innovation input, and innovation output of the NGITCs. In this way, we can better evaluate the government subsidy policy’s effect. In addition, in this paper, considering the long-term character of innovation activities, we also test the three-phase delayed effects of government subsidies and innovation input on the innovation input and output of the NGITCs, respectively. Although the existing studies have also studied the delayed effects of government subsidies and innovation input, most researchers have only tested one phase of the delayed effect, which may not accurately show the cumulative effect of the government subsidies and innovation input. Furthermore, we test the mediating effect of the innovation input between the government subsidies and the innovation output of the NGITCs so that we can clearly understand the proportion of government subsidies that can affect the innovation output of NGITCs through the innovation input of NGITCs. Finally, we examine the moderating effects of the ownership and geographical locations of NGITCs on the impact of government subsidies on the innovation output of the NGITCs. Although some existing studies have examined the impacts of enterprises’ ownership and geographical locations on the effect of government subsidies on enterprise innovation input, the ultimate goal of government subsidies is to enhance enterprises’ innovation output, so examining the moderating effects of the ownership and geographical locations of enterprises between the government subsidies and innovation output may better reflect the different incentive mechanisms of the government subsidies.

2. Literature Review and Hypotheses’ Development

2.1. Effects of Government Subsidies on the Innovation Output

According to the innovation theory, government subsidies impact innovation output through the firm’s R&D investment. The justification of enforcing subsidy policy is that the government wants to reduce the firm’s R&D costs by subsidies, which is essential for increasing R&D activities and innovation output [20]. In the existing literature, fewer surveys were carried out on the impact of government subsidies on innovation output compared to the investigations on the relationship between government subsidies and innovation input. The findings of investigations on the relationship between government subsidies and innovation output are also different. For instance, Hussinger [15] tested the impact of government subsidies for German manufacturing on per capita R&D expenditure and new product sales. Doh et al. [21] studied the relationships between the Korean government’s technical development assistance program and regional SME patent acquisition and new design registration. Howell [22] studied the impact of government subsidies on innovation output using the relevant data of the small enterprise innovation funding program (SBIR) established by the U.S. Department of Energy. The studies above have drawn almost the same conclusion: that government subsidies have a positive incentive impact on enterprises’ innovation outputs. However, some other studies have found a negative relationship between government subsidies and innovation output. For example, Zemplinerová et al. [23] investigated a large Czech enterprise’s sample dataset. They found that large companies were inefficient in transforming innovation input into output, and government subsidies negatively impacted innovation output. By studying China’s high-tech industry, Hong et al. [24] also found a negative impact of government subsidies on innovation output.

Some authors reported the mixed effects of public support on innovation output. For example, Radicic et al. [25] studied the impacts of national and international programs on the innovation behavior of European small and medium-sized enterprises in 2015. They reported that the programs had a positive effect on the tendency to apply for patents but had no impact on innovation sales. Yang et al. [26] empirically investigated the effects of financial subsidies on the innovation input and innovation output of China’s strategic emerging industry enterprises using data from 2010 to 2015. The results of their study indicated that financial subsidies were conducive to the innovation output of enterprises. However, the incentive effect was not significant in state-owned enterprises. The above literature review indicates that government subsidies affect enterprise innovation output differently. However, the characteristics of the NGITCs, such as high scientific and technological content, excellent market potential, strong driving capacity, and critical trends in future scientific and technological development, determine the special status of the NGITCs in China’s technological innovation. Therefore, the Chinese government focuses on supporting the NGITCs with policy tools such as government subsidies in order to improve their innovation output. The NGITCs may use the government subsidies more effectively than other industries. In addition, the characteristics of the NGITCs also reveal that engaging in innovation activities in this sector is more complex than in other industries. Thus, this takes some work: from receiving the subsidies to investing them in innovation activities and authorizing patents. Therefore, it is difficult to assume that the current government subsidies immediately impact the current patent authorization. Thus, based on the theories and prior studies, we propose the following hypothesis:

Hypothesis 1 (H1).

Government subsidies can increase the innovation output of the NGITCs and present a certain delayed effect.

The ownership of the enterprise fundamentally determines its resource allocation and governance structure, so it profoundly affects the technological innovation behavior and innovation output. For example, enterprises whose ownership is controlled by the CEO have higher innovation efficiency than those with decentralized ownership [27]. Institutional ownership has a significant positive impact on technological innovation [28]. Enterprises belonging to foreign-funded groups are more innovative than their domestic counterparts [29]. Corporate capital with clear property rights can promote innovation, whereas collective capital with vague property rights can hinder innovation [30]. The difference in property rights is the main reason for the differences in technological innovation capabilities among state-owned enterprises, private enterprises, and mixed-ownership enterprises. Foreign-invested enterprises rely on technology transfer from their parent companies, which is the main reason for their low innovation investment but brings the advantage of new products [31]; however, Li et al. [32] found that the property right structure is not the critical factor affecting the innovation performances of enterprises. In China, state-owned enterprises are usually controlled and operated by the government. The natural connection with the government gives them apparent advantages based on resources. The government may in a timely fashion give subsidies and tax incentives when state-owned enterprises face difficulties, meaning that state-owned enterprises have fewer financing problems than non-state-owned enterprises. Therefore, after receiving government subsidies, state-owned enterprises may replace the original R&D investments with government subsidies. However, non-state-owned enterprises are generally small, young, and have no special relationship with the government, so they have serious financing problems regarding innovation investment. Non-state-owned enterprises regard government subsidies as an effective supplement to financial shortages. Hence, they may pour subsidies into innovation activities to reduce the costs of enterprise innovation and mitigate risks, thus improving innovation output more effectively. Therefore, Hypothesis H1a is proposed:

Hypothesis 1a (H1a).

Government subsidies can more greatly promote the innovation output of the non-state-owned enterprises than that of the state-owned enterprises.

The geographical location of an enterprise affects its innovation output [33]. For example, enterprises in economically developed regions are more competitive than those in other, less developed regions. The economy is more open, the degree of marketization is higher, and the management level is higher. Internal governance is more scientific and better, so resources can be used more effectively to improve the innovation output efficiency of enterprises [34]. However, the Chinese government’s incentive policies for innovation in coastal areas began earlier and are much stronger than in inland areas. In addition, coastal areas’ development levels and marketization degrees are higher than those of inland areas, meaning that the NGITCs in coastal areas have higher competitive pressure than those inland. In this highly competitive market environment, the NGITCs can exist and develop better only through scientific and technological innovation. Thus, after receiving subsidies, the NGITCs in coastal areas may use government subsidies more effectively and promote innovation output. Therefore, Hypothesis H1b is proposed:

Hypothesis 1b (H1b).

Government subsidies more strongly promote the innovation output of enterprises in the coastal areas than that of enterprises in the inland areas.

2.2. Effects of Government Subsidies on the Innovation Input

Given the notion that government support can increase an enterprises’ tendency to invest more in innovation activity through private R&D investment [7], it is relatively common in the research field to assess the impact of government support on private R&D. The results of surveys are heterogeneous, displaying the crowding-in effect, crowding-out effect, and mixed effect of government support on the private R&D in various countries and industries. The crowding-in effect—an economic theory—is that the increasing of government spending creates favorable conditions for private investment; thus, more private investments are poured into innovation activities. On the contrary, the crowding-out effect is that the increasing of government expenditure decreases private investment. Some existing empirical studies have focused on the possible crowding-in effect of government subsidies on private R&D expenditure. For example, Almus et al. [35] empirically studied the impact of government subsidies on the scientific and technological innovation of enterprises in eastern Germany from 1995 to 1997 by using the PSM method. González et al. [14] analyzed the data of 2214 manufacturing enterprises in Spain. Hewitt-Dundaset et al. [36] examined the impact of government funding on enterprise innovation using data from Ireland and Northern Ireland from 1994 to 2002. Qiang et al. [37] used the financial data of all listed companies in the Shanghai and Shenzhen A-share market from 2012 to 2017 to empirically test the impact of government subsidies on enterprise R&D investment under different degrees of marketization. The results of the studies listed above confirmed the positive relationship between the government subsidies and firms’ private R&D investment, indicating the crowding-in effect of the government support on the innovation input.

In contrast, some other researchers investigated the crowding-out effect of government support. For instance, Wallsten [12] applied the data of the American SBIR database and examined the effect of the financial subsidies on the R&D investment of small and medium-sized enterprises. Busom [38] demonstrated the impact of Spanish R&D subsidies on enterprise R&D investment in 1988. The surveys listed above found a negative relationship between the government subsidies and private R&D. In more recent studies, Catozze et al. [13] used Italian company data to analyze the impact of government subsidies on enterprise innovation empirically. Zhang et al. [39], taking China’s listed companies in Shanghai and Shenzhen’s A-share strategic emerging industries from 2016 to 2017 as the sample, discussed the impacts of government subsidies and financing constraints on firm R&D investment. These studies also resulted in findings in line with the previous surveys, indicating that the government subsidies have a crowding-out effect on private R&D of the companies.

Furthermore, few studies examined the mixed effect of both crowding-in and crowding-out effects. For example, Lach [40] found the different impacts of Israeli government subsidies on manufacturing enterprises in the 1990s on private R&D. According to the firm size, the result of his survey was different; that is, the public subsidies had a negative effect on the R&D investment of large firms, though there was a positive effect on the R&D investment of small firms. Based on his findings, he suggested that the government had to direct the small firms to subsidize. Görg et al. [41] empirically analyzed the effect of R&D subsidies on enterprise R&D investment in the Irish manufacturing industry from 1999 to 2002 using DID and PSM methods. According to the number of government subsidies, the results of his paper were different; the small number of subsidies increased enterprise R&D investment, whereas a large number of subsidies may have led to the crowding-out effect. A more recent analysis conducted by Qing et al. [42] studied the relationship between government subsidies and enterprise innovation based on China’s industrial enterprise data from 1998 to 2007. Their survey found a significant “inverted U-shaped” relationship between government subsidies and enterprise innovation. Government subsidies encouraged enterprises to choose innovation and improve their innovation output and innovation performance. However, when the government subsidies reached a certain level, they would inhibit this impact on enterprise innovation.

In addition, most researchers have recognized that policy has a time lag, and the effect of government subsidies theoretically also has a certain time lag. For example, Francesco et al. [43] found that government science and technology funds had a delayed effect on enterprise performance, which was about 3–4 years. Ying et al. [44] indicated that government subsidies positively impacted R&D capital investment and R&D personnel investment of enterprises. At the same time, the impact also had a certain lag effect. Although there are various research results on the impact of government subsidies on enterprise innovation investment, the Chinese government’s purpose for supporting the NGITCs is clear; that is, through subsidy policy, the government hopes to effectively make up for the market failures and enhance the innovation input of the NGITCs. Therefore, we propose the following hypothesis:

Hypothesis 2 (H2).

Government subsidies can increase the innovation input of the NGITCs and present a certain delayed effect.

2.3. Innovation Input and Innovation Output

The level of R&D investment is an essential factor that affects the independent innovation ability of enterprises [45]. The R&D investment includes the capital investment and staffing that the enterprise carries out according to its research and development propensity and innovation purpose, which decides its innovation performance and competitiveness. Enterprise innovation performance is reflected in the number of patents and new product sales [46,47]. Most researchers support the positive correlation between innovation input and output, considering that innovation output depends on innovation input. For example, the research of [48] indicated a significant positive impact between scientific researchers, R&D investment, and the number of patents. Grilliches [49] revealed that firm R&D capital, as the direct investment of enterprises in R&D activities, was beneficial to increasing enterprise innovation output, especially for some specific industries, such as high-tech enterprises. Enterprises’ R&D investment significantly promoted enterprises’ innovation output and improved their innovation performance. Fan [50] took China’s telecommunication industry as the research object, and the results of her investigation illustrated that technological innovation input had a significant effect on enterprise innovation performance.

However, some other articles indicated a nonlinear or negative relationship between R&D investment and innovation output. Wang et al. [51] used the survey data of 279 China’s enterprises to investigate the correlation between innovation input and output. The results proved that with the increase in R&D intensity, innovation output decreased, and some enterprises improperly invested. Using the data of the CVC portfolios of 40 telecom equipment companies, Wadhwa et al. [52] found that the impact of innovation input on innovation output had an “inverted U shape”. In the most recent study, Zhou et al. [53] took China’s small and medium-sized board enterprises from 2010 to 2017 as the research sample and found an “inverted U-shaped” relationship between R&D input and enterprise innovation output.

In addition, as an essential industry representing future development trends, NGITCs also have a relatively positive interior intention toward innovation investment. In addition, R&D activities have a cumulative time effect. Most innovation activities take a long time from project approval to R&D investment and to new product development and production. This makes it challenging to produce immediate effects in the short term; that is, the effect of the innovation input on the innovation of output of the NGITCs may lag for a certain period. Therefore, combined with the analysis above, we propose the following hypothesis:

Hypothesis 3 (H3).

The innovation input can promote the innovation output of the NGITCs and have a certain delayed effect.

2.4. Government Subsidies, Innovation Input, and Innovation Output

According to the existing literature, relevant researchers have supposed that government subsidies impact innovation performance in two ways [54]. One is the direct effect; that is, government subsidies directly affect the R&D activities of enterprises by supplementing the innovation resources required by enterprises to promote technological innovation performance. Generally, such subsidies will be targeted for R&D activities. The other is the meditating effect; that is, the incentive effect of government subsidies on innovation performance is achieved through innovation input. The main reason is that the government subsidies account for a small proportion of the R&D investment of enterprises, making it challenging for these to have a significant role. Hence, it is necessary to measure the effect through the mediating function of R&D investment. In the research field, studies have also tested the mediating effect. Investigating China’s aerospace manufacturing industry, Hong [55] asserted that government subsidies and enterprise R&D investment jointly improved the innovation efficiency of the industry. The research results of Dong et al. [56] proved that enterprise R&D investment presented the full mediating effect between government grants and enterprise innovation output, and government grants indirectly promoted enterprise innovation output. Most of the time, whether government subsidies crowd in or crowd out the enterprise R&D investment, private R&D and enterprise innovation performance are positively correlated. Theoretically, subsidized firms tend to invest in more R&D activities to improve technological innovation performance. Consequently, government subsidies may have an indirect incentive effect on enterprise innovation output. Applying the microdata of listed AI companies from 2015 to 2017, Sun et al. [57] analyzed the impact of government subsidies on their innovation output. The results revealed that government R&D subsidies promoted the innovation output of listed AI companies. Simultaneously, there was a significant positive correlation between government subsidies and the innovation investment of AI companies; more significantly, enterprise innovation input played a mediating role between government subsidies and innovation output. About 31.32% of the impact of government subsidies on enterprise innovation output was mediated through enterprise innovation input.

The ultimate goal of government subsidies is to enhance technological innovation output. The government hopes that companies will use the subsidies for their innovation activities. However, the subsidized firms will likely utilize part or all of the subsidies for enterprise innovation input. The innovation input further promotes enterprise innovation output. Thus, the innovation input may be a bridge between the subsidies and innovation output. In addition, in the NGITCs, the competition is relatively fierce; engaging in innovation activities sometimes requires high technical content and is relatively risky. Thus, the Chinese government mainly cultivates and supports the NGITCs with incentive policy tools, such as subsidies. Thus, NGITCs have a better propensity to invest in innovation and increase their innovation output to ensure their existence and better development in such competitive situations. Therefore, this paper puts forward the following hypothesis:

Hypothesis 4 (H4).

The innovation input of the NGITCs presents a mediating effect between government subsidies and innovation output.

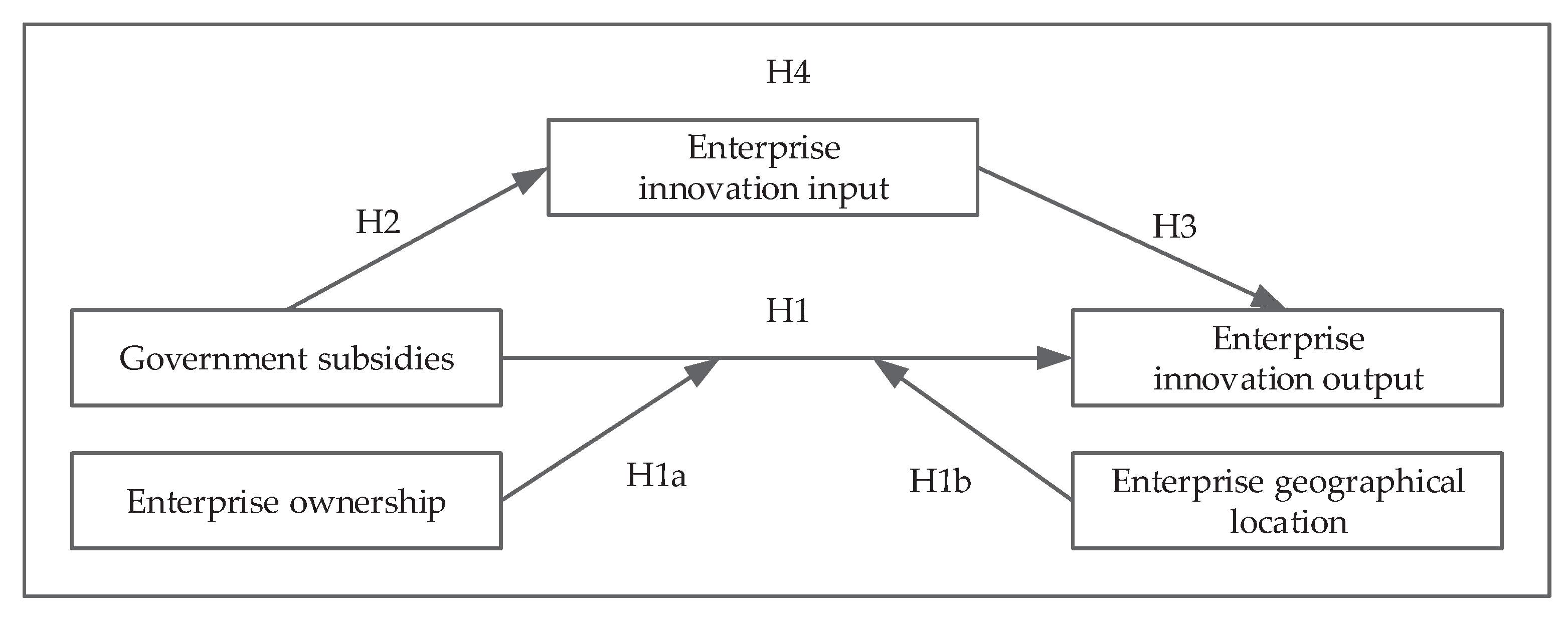

The conceptual framework and hypotheses of this paper are shown in Figure 1 below.

Figure 1.

Conceptual framework and hypotheses.

3. Research Design

3.1. Data Sources

In this paper, we used the data of the NGITCs listed on the Chinese A-Stock Market from 2011 to 2020 as the research object. The data on patent applications and the number of authorized patents came from the China National Intellectual Property Administration Website and the Pat Snap Global Patent Search Database. Other relevant data came from the China Stock Market Account Research (CSMAR) and Wind Databases. According to “The Classification of Strategic Emerging Industries 2018”, five industries belonging to the NGITCs were selected, including the next-generation information network industry, the electronic core industry, emerging software and new information technology services, Internet and cloud computing, big data services, and artificial intelligence. After eliminating the observations for which all the necessary information was unavailable, the sample included 2210 observations from 221 NGITCs.

3.2. Variables

3.2.1. Dependent Variable

Innovation performance is the efficiency of an enterprise’s innovation activities and their contribution to economic growth. New products and patents are commonly employed to measure innovation performance in research. The sales revenue of new products reflects the value created in manufacturing. The number of patents displays enterprises’ inventive or innovative performance in creating new technologies, processes, and products. Based on the previous literature [20,58], we employed the number of authorized patents as a proxy for innovation output because the sales revenue data of new products was not listed on annual financial reports.

3.2.2. Independent Variable

Government subsidies were the primary analytical variable. Government subsidies mainly include direct subsidies and tax incentives [20]. This research focuses on direct subsidies, including government research funds, government loans, government discounts, and government guarantees to enterprises. In this study, we applied the total amount of direct government subsidies of firms received from the government annually as a proxy indicator for government funding.

3.2.3. Mediating Variable

The primary purpose of this research was to examine whether government subsidies can increase the innovation performance of the NGITCs through the mediating effect of the innovation input; the amount of funds spent on innovation activities is also a fundamental input indicator to measure innovation efficiency. Thus, according to previous research [40,59], we used the total amount of firms’ R&D expenditure as the mediating variable.

3.2.4. Moderating Variables

In this paper, according to the ownership situations and geographical locations of the companies, we divided ownership into two types (state-owned and non-state-owned) and geographical location into two types (coastal area and inland area).

3.2.5. Control Variables

Based on the existing literature [60,61], we applied a series of variables affecting enterprise innovation, including the company’s age, intangible assets, R&D expenditure intensity, asset–liability ratio, and corporate profitability.

The summary and definitions of all the variables above are shown in Table 1 below.

Table 1.

Description of the research variables.

According to the research hypotheses and variables, the corresponding models are as follows:

Model (1) examined the impact of government subsidies on the innovation output of the NGITCs and the delayed effect of government subsidies.

Model (2) examined the moderating effect of the ownership of the enterprises between the government subsidies and innovation output of the NGITCs.

Model (3) examined the moderating effect of the geographical location of the enterprises between the government subsidies and innovation output of the NGITCs.

Model (4) investigated the impact of government subsidies on the innovation input of the NGITCs and the delayed effect of government subsidies.

Model (5) examined the relationship between the innovation input and innovation output of the NGITCs and the delayed effect of the innovation input of the NGITCs.

Model (6) testd whether the innovation input of the NGITCs presents a mediating effect between government subsidies and innovation output.

4. Empirical Analysis

4.1. Descriptive Statistics

Table 2 reflects the relevant data of 221 NGITCs from 2011 to 2020, with 2210 observations. The maximum number of authorized patents was 7.83, and the minimum value was 0, reflecting the difference in the innovation outputs of different NGITCs. For R&D investment, the maximum value was 22.57, and the minimum value was 14.69. The maximum value of government subsidies was 21.56, and the minimum value was 10.96, indicating that the distribution of government subsidies for the NGITCs is uneven. However, the difference is small. The standard deviation is slight, proving that the NGITCs actively invest in innovation activities. In addition, the mean value of enterprise age was 16.90, and the standard deviation was 5.70, which means the span of enterprise age is relatively large. Other control variables show that the maximum and minimum values are significantly different, so the operating efficiency and financial policies of the NGITCs are different.

Table 2.

Descriptive statistics.

4.2. Multicollinearity Test

Pseudo-regression results when there is multicollinearity among explanatory variables, resulting in biased estimates. Therefore, a variance inflation factor (VIF) was used to test for collinearity among the explanatory variables. The core idea of this method is to compare the variance ratio when there is multicollinearity among the explanatory variables to the variance and when there is no multicollinearity. The larger the ratio, the more serious the collinearity. When 0 < VIF < 10, there is no multicollinearity among the explanatory variables. The multicollinearity test results are shown in Table 3. From the test results in Table 3, it can be seen that the VIF between the explanatory variables is less than 10, indicating that there is no collinearity problem among the explanatory variables, and regression analysis can be performed.

Table 3.

Multicollinearity test.

4.3. Multiple Regression Analysis

Before performing regression analysis, the Hausman test was used to judge whether the model was a fixed or a random-effects model. The results of the Hausman test show that the p-value is 0, so the fixed-effects model is chosen.

4.3.1. Government Subsidies and the Innovation Output of the NGITCs

Table 4 shows the regression results of the government subsidies and innovation output of the NGITCs. In Model (1),the coefficient of government subsidies was 0.135, which was significant at the level of 0.01, which means that government subsidies significantly impact the innovation output of the NGITCs; that is, the government subsidies can increase companies’ innovation output [21,22]. Furthermore, considering that innovation is a long-term activity and it takes a certain period from receiving subsidies to patent application and then to patent authorization, we also tested whether the government subsidies have a delayed effect and checked the three-year-delayed effect. Models (2)–(4) calculated the delayed effect of government subsidies. The coefficients of government subsidies in Models (2) and (3) were, respectively, 0.161 and 0.126, which were significant at the level of 0.01, signifying that government subsidies have a delayed effect on the innovation output of the NGITCs. The delayed effect of government subsidies lasts for two years. Thus, H1 is supported; most importantly, the order of the coefficients government subsidies is 0.161 > 0.135 > 0.126, which indicates that the government subsidies have the greatest impact on the current innovation output of the NGITCs one year after their provision. Model (4) is insignificant, which suggests that there is no delayed effect of the government subsidies on the innovation output of the NGITCs.

Table 4.

Regression analysis of government subsidies and innovation output of the NGITCs.

The ownership of the enterprise has a moderating role in the impact of government subsidies on the innovation output of the NGITCs. Model (5) displays the moderating effect of the ownership of the NGITCs on the direct impact of the government subsidies on the innovation output of the NGITCs. The regression result of the interaction between ownership and government subsidies was −0.147, which was significant at the level of 0.05; this means that ownership has a significantly negative moderating effect on the direct impact of government subsidies on the innovation output, demonstrating that the direct incentive effect of government subsidies on the innovation output of non-state-owned enterprises is stronger than that on state-owned enterprises. Thus, H1a is supported. The reason may be that the state-owned firms obtain government subsidies and external innovation resources more easily because of their uniqueness. The financing constraints and competitive pressure of state-owned enterprises are small, and there is no greater pressure or motivation to improve their innovation output. While private enterprises face more fierce market competition, they have more willingness to use the obtained government subsidies for innovation, drive long-term development, and form their own foothold by relying on innovation to counter market competition. At the same time, non-state-owned enterprises have the advantages of organized management and high efficiency of strategy implementation, so government subsidies play an obvious role in promoting their innovation output.

Model (6) revealed the moderating effect of the geographical location of the NGITC on the direct impact of government subsidies on the company’s innovation output. The regression result of the interaction between geographical location and government subsidies was 0.149, which was significant at the level of 0.05, which means that the geographical location of the NGITC has a positive moderating effect on the direct impact of government subsidies on innovation output. The direct positive influence of government subsidies on the innovation output of the NGITCs in coastal areas is more robust than that on enterprises in inland areas. Thus, H1b is supported. The reason may be that enterprises in coastal areas have a higher degree of openness to the outside world and receive the early benefits of the market economy. Indeed, the marketization level in coastal areas is higher, which leads to a higher grade of market-oriented management ability and investment skills than the firms in inland areas. Therefore, enterprises in coastal areas can better use government subsidies to enhance their innovation output.

4.3.2. Government Subsidies and the Innovation Input of the NGITCs

The results in Table 5 show the regression analysis of government subsidies’ immediate and delayed effects on the innovation input of the NGITCs. The regression result of Model (1) shows that government subsidies have a significant positive impact on the innovation input of the NGITCs ( = 0.174, p < 0.01), In other words, government subsidies can promote the innovation investment of the NGITCs. In addition, the delayed effect of the government subsidies was also checked. Models (2)–(4) revealed the delayed effect of government subsidies on the innovation input of the NGITCs. The results show that government subsidies have a positive lagging impact on the innovation input of the NGITCs ( = 0.131, p < 0.01, = 0.077, p < 0.01, = 0.038, p < 0.05), indicating that H2 is supported. The delayed effect decreased gradually from the first lag phase. However, the current government subsidies are most effective on the current enterprise innovation investment, meaning that subsidized firms may utilize most of the subsidies to enhance the firm’s innovation input in the years they receive them.

Table 5.

Regression analysis of government subsidies and innovation input of the NGITCs.

4.3.3. Innovation Input and Innovation Output of the NGITCs

Table 6 reflects the relationship between the innovation input and output of the NGITCs. The regression result of Model (1) shows that innovation input has a significant positive impact on the innovation output of the NGITCs ( = 0.335, p < 0.01), indicating that an increase in innovation input of the NGITCs boosts the current innovation output of the companies; that is, the innovation input of the NGITCs can promote innovation output. In addition, Models (2)–(4) show a delayed effect of enterprise innovation input on innovation output. In the first and second lag phases, the innovation input still had a significant promoting effect on the innovation output of the NGITCs. Nevertheless, the influence coefficient was weakened ( = 0.350, p < 0.01, = 0.219, p < 0.01). In the first lag phase, the enterprise innovation input maintained the greatest impact on enterprise innovation output (0.350 > 0.335 > 0.219), which may have been because it takes a certain amount of time to progress from the innovation input to patent application and then to patent authorization. Thus, H3 is supported. Model (4) shows that the impact of innovation input on the innovation output in the third lag phase is insignificant.

Table 6.

Regression analysis of innovation input and innovation output of the NGITCs.

4.3.4. Government Subsidies, Innovation Input, and Innovation Output of NGITCs

Table 7 shows the mediating effect of the innovation input between the government subsidies and innovation output both in the current period and in the first lag phase. Due to the precondition of testing the mediating effect, we also completed the three steps of the mediation effect test. The regression results of Models (1)–(3) in Table 7 correspond to checking the current mediating effect. The regression result of Model (1) shows that the government subsidies have a significant positive impact on the innovation output of the NGITCs ( = 0.135, p < 0.01), which is the total effect of the government subsidies on the innovation output. The regression coefficient of the government subsidies in Model (2) was 0.174, p < 0.01, meaning that government subsidies have a significant positive impact on the innovation input of the NGITCs. In Model (3), both government subsidies and innovation inputs positively affected the innovation output of the NGITCs. Both passed the significance test at the levels of 0.01 and 0.05, indicating that innovation input presents a partial mediating effect between the government subsidies and innovation output of the NGITCs. Thus, H4 is supported. Part of the government subsidies impacts innovation output through the innovation input of the NGITCs. The proportion of the mediating effect of the innovation input of the NGITCs is 0.174 × 0.288/0.135 ≈ 0.37—approximately 37%.

Table 7.

Regression analysis of mediating effect of the innovation input between the government subsidies and innovation output of the NGITCs.

In addition, to better test the mediating effect of innovation input between government subsidies and innovation output, we also considered the mediating effect of the current innovation input between one lag period of government subsidies and the current innovation output. The results are shown for Models (4)–(6) in Table 7. Model (4) showed the impact of the one-lag-period government subsidies on the innovation output of the current period ( = 0.161, p < 0.01). Model (5)showed the impact of the one-lag-period government subsidies on the innovation input in the current period ( = 0.131, p < 0.01). Model (6)showed the impact of the one-lag-period government subsidies and current innovation input on the innovation output in the current period ( = 0.120, p < 0.01, = 0.314, p < 0.01). These results surpassed the significance threshold of 0.01, illustrating that the innovation input in the current period has a partial mediating effect between one lag period of government subsidies and the innovation output in the current period. The mediating effect is 0.131 × 0.314/0.161 ≈ 0.26—approximately 26%.

4.4. Robustness Test

In order to prove that the results of this paper are robust, we replaced the dependent variable (the number of authorized patents) with the number of patent applications. We performed a regression analysis considering the current and the one-lag-phase government subsidies. The results are shown in Table 8. It can be seen in Models (1) and (2) that government subsidies are positively correlated with both the innovation output ( = 0.147, p < 0.01) and innovation input of the NGITCs ( = 0.174, p < 0.01). Furthermore, Model (3)shows that current government subsidies ( = 0.082, p < 0.05) and innovation input ( = 0.373, p < 0.01) are positively correlated with innovation output. Once again, these results indicate that the innovation input of the NGITCs mediates between government subsidies and innovation output, supporting the results of Models (1)–(3) in Table 7. In addition, we also considered the delayed effect of the government subsidies and checked the relationships between one lag phase of government subsidies and the current innovation output and the current innovation input of the NGITCs. The results are demonstrated in Models (4)–(6) in Table 8. The one lag phase of government subsidies positively affect the current innovation output ( = 0.080, p < 0.05) and innovation input of the NGITCs ( = 0.131, p < 0.01), as shown in Models (4) and (5). In Model (6), we tested the effects of the one lag phase of government subsidies and current innovation input on the innovation output. Although the coefficient of the one-lag-phase government subsidies is insignificant, the current innovation input positively enhances the current innovation output ( = 0.446, p < 0.05), meaning that the current innovation input has a full mediating effect between the current innovation output and one lag phase of government subsidies. The cause of the full mediating effect may be illustrated by the fact that at the stage of the patent application, the NGITCs utilize most of the government subsidies to enhance the innovation input which is being invested in applying for more patents, and so this was the reason for the full mediating effect when we employed the number of patent applications to measure the innovation output. However, when we applied the number of authorized patents to measure the innovation output, the innovation input presented a partial mediating effect, which may illustrate that in the process from patent application to patent authorization, part of the applied patent cannot be authorized, explaining that part of the mediation of government subsidies and innovation input is invalid.

Table 8.

Regression analysis of the robustness test.

5. Discussion

5.1. Research Discussion

Using the panel data of 221 NGITCs on the Chinese A-Share Market from 2011 to 2020 as our research sample, we established study models according to relevant theories and existing papers to examine the relationships between government subsidy policy and the innovation input and innovation output of the NGITCs. In the first step, we checked the immediate effect and delayed effect of the government subsidies on the innovation output of the NGITCs and further tested whether the ownership and geographical locations of the NGITCs have moderating effects between the government subsidies and innovation output of the NGITCs. In the second step, we investigated the government subsidies’ immediate impact and delayed effect on the innovation input of the NGITCs. In the third step, we examined the innovation input’s immediate impact and delayed effect on the innovation output of the NGITCs. In the last step, we analyzed the mediating role of innovation input between government subsidies and the innovation output of the NGITCs. The findings of this essay are as follows.

In the first step, we found that government subsidies had a positive incentive effect on the innovation output of the NGITCs, meaning that the government subsidy policy can effectively stimulate the NGITCs to produce more patents. This result further confirms the findings of Hyytinen et al. [9] and Guo et al. [62], who stated that government grants can effectively make up for market failure and enhance the innovation activities of the companies. In addition, Liu et al. [63] found that the R&D subsidies have a delayed effect on the innovation performance of new energy companies; similarly to their findings, our findings show that government subsidies have a time-delayed effect on the innovation output of the NGITCs—specifically, the government subsidies’ effect lags by two years, but in the first lag year, the government subsidies are most effective on the innovation output of the NGITCs. Thus, our study can fill up the research space in the NGITCs.

From the perspective of the ownership and geographical locations of the NGITCs, our findings show that the ownership and geographical locations of the NGITCs have a moderating role between the government subsidies and innovation output of the NGITCs; precisely, the direct incentive effect of government subsidies on the innovation output of non-state-owned and coastal-area NGITCs is stronger than on the state-owned and inland areas NGITCs. Although the conclusions of Liu et al. [64] and Zhou et al. [65] that a firm’s ownership and geographical location moderate between the R&D subsidies and the firm’s R&D capital investment are similar to our findings, unlike them, we found that ownership and geographical location have moderating effects between government subsidies and innovation output (instead of innovation input). We think that the ultimate goal of the subsidies is to boost innovation performance, so the innovation output better represents the firm innovation performance.

In the second step, our findings showed that the government subsidies positively enhance the innovation input of the NGITCs, indicating that when the government increases the subsidies, the NGITCs will increase their investment in innovation activities. This result displays that the government subsidies present a crowding-in effect on the innovation input of the NGITCs, lining up with the findings of Xu et al. [66] and Wu et al. [67]; that is, the government subsidies effectively deal with the market’s flaws, tackle the companies’ financing constraints, and effectively enhance the R&D investment of companies. However, our results also show that government subsidies have a certain delayed effect on the innovation input of the NGITCs. The effects of the government subsidies last three years, but the current government subsidies affecting the current innovation input are the most influential. The phenomenon may arise because the NGITCs have financial difficulties in carrying out innovation activities, so after receiving the subsidies, the NGITCs use the government subsidies promptly as the innovation input in the current year.

In the third step, our results indicated that the innovation input of the NGITCs has a positive enhancing impact on the innovation output of the NGITCs, demonstrating that when the NGITCs invest in innovation activities, their innovation output will be increased accordingly. The surveys of Leun et al. [68] support this result; that is, the innovation input carried by the enterprise is essential to achieving more output, and the private R&D input of the companies has a positive incentive effect on innovation output. Meanwhile, our results also indicate that the effect of the innovation input lasts three years, and the investment in the second year is most effective on the innovation output. We consider the reason that enterprises need a certain amount of time from innovation input to output to be because of the complexity and time-consuming features of the innovation activities in the NGITCs.

In the last step, we analyzed the mediating role of innovation input between government subsidies and the innovation output of NGITCs. In this step, our results showed that the innovation input of the NGITCs mediates between government subsidies and innovation output. In the existing literature, researchers have presented different findings about the mediating effect of innovation input. For example, using the Chinese small and medium-sized listed enterprises as the research sample, Zhuan et al. [69] found that corporate R&D investment partially mediates the relationship between government subsidies and corporate performance. On the contrary, exploring industrial enterprises above the designated size, Zou et al. [70] found that enterprise R&D investment has a full mediating effect on the relationship between government R&D subsidies and enterprise innovation output. Similarly to the previous studies, our results show that the innovation input of the NGITCs has a partial or complete mediating effect on the relationship between government subsidies and innovation output. Specifically, the innovation input of the NGITCs has a partial mediating effect on the impacts of current and one-lag-phase government subsidies on the patent authorizations of the NGITCs. When we used the number of patent applications as the proxy of innovation output, the result was different; that is, the innovation input of the NGITCs had a full mediating effect on the relationship between one lag phase of government subsidies and innovation output. Thus, the mediating effect of the innovation input is conditional. This phenomenon demonstrates that after receiving the government subsidies, the NGITCs may use all of the subsidies as innovation input, so after one year, the government subsidies fully affect the patent application through the innovation input of NGITCs. However, although government subsidies, through innovation input, fully impact the number of patent applications, some of the patents may not be authorized, meaning that only some of the subsidies can cause an improvement in the number of authorized patents.

5.2. Research Implications

5.2.1. Theoretical Implications

This study theoretically reconfirmed that government subsidies are an effective policy tool for solving market failure, as government subsidies can effectively correct market failure and enhance the innovation input and output of NGITCs. In addition, our findings indicate that analyzing the relationships among the subsidies, innovation input, and output from a different perspective is beneficial to understanding the mechanisms behind them better because we have found that government subsidies and innovation input have a delayed effect, which directly affects the decision making of the investors and policymakers. Thus, this paper can act as practical proof to estimate the efficiency of both R&D investment and subsidies. Meanwhile, using the moderating effect, we found that the ownership and the geographical locations of the NGITCs have a moderating role between the government subsidies and innovation output. Unlike the other studies, the moderating effect is between the subsidies and innovation output instead of the innovation input, which helps us to more accurately estimate the efficiency of the subsidies according to the different ownership types and locations. More interestingly, we found conditional results when we estimated the mediating role of innovation input between the subsidies and innovation output. For example, the mediating effect of the innovation input is different according to the number of patent applications and the number of patent authorizations, which theoretically indicates that the number of patent applications may sometimes not be the best proxy variable for innovation output. Finally, we used data from the NGITCs as our research sample, so our study can fill up the research space in this field and enrich the empirical evidence about the relationships among government subsidies, innovation input, and innovation output.

5.2.2. Policy Implications

In this paper, in addition to the theoretical implications, we put forward some practical policy implications based on the empirical results and research theories. The results of this paper effectively revealed the efficacy of the government subsidies and innovation input of the NGITCs. According to this, the implications can provide a practical blueprint for managers, investors, and the government to make more effective investment decisions and adjust public policy tools in a timely manner. The policy implications are as follows.

Firstly, to improve the independent innovation ability of the NGITCs, the Chinese government should continue to increase subsidies, because the subsidies effectively increase both the innovation input and the innovations of the NGITCs, especially for the non-state-owned NGITCs and the NGITCs in the coastal areas. At the same time, the Chinese government should continue to reform and supervise state-owned NGITCs and the NGITCs in inland areas to improve the efficiency of subsidy usage and enhance innovation ability. Secondly, to promote the coordinated development of the NGITCs, the Chinese government should formulate relevant supporting policies targeting different ownership types and locations. For example, the subsidy policy for the state-owned and inland area NGITCs is not as effective as for the non-state-owned and coastal-area NGITCs; thus, the Chinese government can make some relative policies, including tax policy and personnel policy, combined with the subsidy policy, directed at the state-owned and inland-area NGITCs. Thirdly, the NGITCs should continue to make more R&D investments for their innovation activities, which will be beneficial to the innovation ability of the NGITCs because the innovation input of the NGITCs can effectively improve their innovation output, meaning that the inner innovation input of the NGITCs can bring more innovation output and boost the development of the NGITCs. Finally, both the Chinese government and the NGITCs should consider the time span of government subsidies and innovation input when making adjustments for investment decisions or formulating relevant policies because subsidies and innovation input have time-delayed effects on the innovation output of NGITCs.

5.3. Limitations and Suggestions for Future Research

Although we have presented some new findings in this paper, owing to drawbacks in the availability of data and the choice of data proxy variables, this study still has some research limitations and certain deficiencies that need to be gradually improved in future research. Firstly, due to the limitations of the research data, we have only studied the listed companies that received government subsidies. However, the NGITCs are not only listed firms, so the results of this paper may not avoid some biased conclusions. In the future, researchers could apply appropriate methods, including interviews and questionnaires, to make up for this limitation and more accurately estimate the relationships between government subsidies and the innovation input and innovation output of the NGITCs. Secondly, government subsidies can be divided into direct and indirect subsidies, but because of limitations in data availability, we chose only direct subsidies as the independent variable. This paper’s results might have been more comprehensive if we had used both. In addition, the R&D investment of companies includes R&D capital investment and R&D human investment. Due to the flaws in the database, we only used the total R&D capital investment as a proxy of innovation input; if we had applied both R&D capital investment and R&D human investment, the innovation input of NGITCs could have been reflected more completely. In the future, studies can focus on the total government subsidies (direct and indirect subsidies) and total R&D investment (R&D capital and R&D human investment) so that the research results can be made more reliable. Finally, we also suggest that apart from government subsidy policy, other incentives, such as personnel policy and tax policy, may impact the innovation performance of the NGITCs, so investigators can further consider those incentive policies in future research.

6. Conclusions

Firstly, government subsidies are an effective policy tool to improve the innovation output of the NGITCs, meaning that the more subsidies the NGITCs receive, the more patents they produce. However, government subsidies are more effective at promoting the innovation output of the non-state-owned NGITCs and the NGITCs in the coastal areas compared to state-owned and inland areas’ NGITCs. In addition, government subsidies have a two-year-delayed effect, and in the first lag year, the subsidies have the greatest effect on the innovation output of the NGITCs. Secondly, government subsidies are a practical policy incentive that can efficiently enhance the innovation input of the NGITCs, meaning that the more subsidies the NGITCs obtain, the more R&D capital the NGITCs invest in innovation activities. In addition, the government subsidies have a three-year-delayed effect, but the current subsidies are most effective on the current innovation input of the NGITCs. Thirdly, the innovation input of the NGITCs helps to promote the innovation output, meaning that the more R&D capital investment from the NGITCs is dedicated to the innovation activities, the more patents the NGITCs can obtain. Moreover, the innovation output of the NGITCs also has a two-year-delayed effect. The government subsidies in the first lag period are most effective for the innovation output of the NGITCs. Finally, the innovation input of the NGITCs has a partial mediating effect between government subsidies and innovation output, meaning that part of the government subsidies increases the patent production of the NGITCs through the R&D investment of the NGITCs.

Author Contributions

Conceptualization, Y.S. and H.W.; methodology, Y.S.; software, Y.S.; formal analysis, Y.S. and H.W.; writing—original draft preparation, Y.S.; writing—review and editing, Y.S. and H.W. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by The National Social Science Fundation of China (NSFC) under the Grant No. 18BJY035.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data about the patent applications and the number of authorized patents came from the China National Intellectual Property Administration Website and the Pat Snap Global Patent Search Database. Other relevant data came from the China Stock Market Account Research (CSMAR) and Wind Databases.

Acknowledgments

We are grateful for the reviewers for their valuable comments and efforts.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Schumpeter, J.; Backhaus, U. The theory of economic development. In Joseph Alois Schumpeter; Springer: Berlin/Heidelberg, Germany, 2003; pp. 61–116. [Google Scholar]

- Krugman, P. The narrow moving band, the Dutch disease, and the competitive consequences of Mrs. Thatcher: Notes on trade in the presence of dynamic scale economies. J. Dev. Econ. 1987, 27, 41–55. [Google Scholar] [CrossRef]

- Arrow, K.J. The economic implications of learning by doing. In Readings in the Theory of Growth; Springer: Berlin/Heidelberg, Germany, 1971; pp. 131–149. [Google Scholar]

- Nelson, R.R. The simple economics of basic scientific research. J. Political Econ. 1959, 67, 297–306. [Google Scholar]

- Aerts, K.; Schmidt, T. Two for the price of one?: Additionality effects of R&D subsidies: A comparison between Flanders and Germany. Res. Policy 2008, 37, 806–822. [Google Scholar]

- Meuleman, M.; De Maeseneire, W. Do R&D subsidies affect SMEs’ access to external financing? Res. Policy 2012, 41, 580–591. [Google Scholar]

- Hall, B.H.; Lerner, J. The financing of R&D and innovation. Handbook of the Economics of Innovation. North Holl. 2010, 1, 609–639. [Google Scholar]

- Czarnitzki, D.; Licht, G. Additionality of public R&D grants in a transition economy: The case of Eastern Germany. Econ. Transit. 2006, 14, 101–131. [Google Scholar]

- Hyytinen, A.; Toivanen, O. Do financial constraints hold back innovation and growth?: Evidence on the role of public policy. Res. Policy 2005, 34, 1385–1403. [Google Scholar]

- Bloch, C.; Graversen, E.K. Additionality of public R&D funding for business R&D–A dynamic panel data analysis. World Rev. Sci. Technol. Sustain. Dev. 2012, 9, 204–220. [Google Scholar]

- Hud, M.; Hussinger, K. The impact of R&D subsidies during the crisis. Res. Policy 2015, 44, 1844–1855. [Google Scholar]

- Wallsten, S.J. The effects of government-industry R&D programs on private R&D: The case of the Small Business Innovation Research program. RAND J. Econ. 2000, 31, 82–100. [Google Scholar]

- Catozzella, A.; Vivarelli, M. The possible adverse impact of innovation subsidies: Some evidence from Italy. Int. Entrep. Manag. J. 2016, 12, 351–368. [Google Scholar] [CrossRef]

- González, X.; Pazó, C. Do public subsidies stimulate private R&D spending? Res. Policy 2008, 37, 371–389. [Google Scholar]

- Hussinger, K. R&D and subsidies at the firm level: An application of parametric and semiparametric two-step selection models. J. Appl. Econom. 2008, 23, 729–747. [Google Scholar]

- Hall, B.H.; Maffioli, A. Evaluating the impact of technology development funds in emerging economies: Evidence from Latin America. Eur. J. Dev. Res. 2008, 20, 172–198. [Google Scholar] [CrossRef]

- Xu, X.; Cui, X.; Chen, X.; Zhou, Y. Impact of government subsidies on the innovation performance of the photovoltaic industry: Based on the moderating effect of carbon trading prices. Energy Policy 2022, 170, 113216. [Google Scholar] [CrossRef]

- Afcha, S.; Lucena, A. R&D subsidies and firm innovation: Does human capital matter? In Industry and Innovation; Taylor & Francis: Abingdon, UK, 2022; pp. 1–31. [Google Scholar]

- Czarnitzki, D.; Hussinger, K. The Link between R&D Subsidies, R&D Spending and Technological Performance; ZEW-Centre for European Economic Research Discussion Paper. 2004. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=575362 (accessed on 4 September 2022).

- Le, T.; Jaffe, A.B. The impact of R&D subsidy on innovation: Evidence from New Zealand firms. Econ. Innov. New Technol. 2017, 26, 429–452. [Google Scholar]

- Doh, S.; Kim, B. Government support for SME innovations in the regional industries: The case of government financial support program in South Korea. Res. Policy 2014, 43, 1557–1569. [Google Scholar] [CrossRef]

- Howell, S.T. Financing innovation: Evidence from R&D grants. Am. Econ. Rev. 2017, 107, 1136–1164. [Google Scholar]

- Zemplinerová, A.; Hromádková, E. Determinants of firm’s innovation. Prague Econ. Pap. 2012, 21, 487–503. [Google Scholar] [CrossRef]

- Hong, J.; Feng, B.; Wu, Y.; Wang, L. Do government grants promote innovation efficiency in China’s high-tech industries? Technovation 2016, 57, 4–13. [Google Scholar] [CrossRef]

- Radicic, D.; Pugh, G. Input and output additionality of R&D programmes in European SMEs. In Proceedings of the European Conference on Innovation and Entrepreneurship. Academic Conferences International Limited, Reading, UK, 25 February 2015; p. 567. [Google Scholar]

- Yanglin, C.; Deyin, C.; Changquan, Z. Study on the Incentive Effect of Fiscal Subsidies for Strategic Emerging Industry in China. Collect. Essays Financ. Econ. 2019, 246, 33–41. [Google Scholar]

- Zúñiga-Vicente, J.Á.; Alonso-Borrego, C.; Forcadell, F.J.; Galán, J.I. Assessing the effect of public subsidies on firm R&D investment: A survey. J. Econ. Surv. 2014, 28, 36–67. [Google Scholar]

- Aghion, P.; Van Reenen, J.; Zingales, L. Innovation and institutional ownership. Am. Econ. Rev. 2013, 103, 277–304. [Google Scholar] [CrossRef]

- Tether, B.S. Who co-operates for innovation, and why: An empirical analysis. Res. Policy 2002, 31, 947–967. [Google Scholar] [CrossRef]

- Wu, Y. Determinants of innovation – An Empirical Study Based on China’s manufacturing industry. World Econ. Pap. 2008, 2, 46–58. [Google Scholar]

- Wu, Y. Investigation on technological innovation ability of enterprises with different ownership. In Indus. Econ. Res. 2014, 2, 53–64. [Google Scholar] [CrossRef]

- Li, J.; Wang, X. An empirical study on industrial characteristics and technological innovation performance – panel data analysis of Guangdong industrial industry based on Data Envelopment Analysis. Soc. Work Manag. 2011, 11, 18–22. [Google Scholar]

- Wu, M.; Wang, X.; Chen, X.; Cao, Y. The threshold effect of R&D investment on regional economic performance in China considering environmental regulation. Technol. Anal. Strateg. Manag. 2020, 32, 851–868. [Google Scholar]

- Min, S.; Kim, J.; Sawng, Y.W. The effect of innovation network size and public R&D investment on regional innovation efficiency. Technol. Forecast. Soc. Chang. 2020, 155, 119998. [Google Scholar]

- Almus, M.; Czarnitzki, D. The effects of public R&D subsidies on firms’ innovation activities: The case of Eastern Germany. J. Bus. Econ. Stat. 2003, 21, 226–236. [Google Scholar]

- Hewitt-Dundas, N.; Roper, S. Output additionality of public support for innovation: Evidence for Irish manufacturing plants. Eur. Plan. Stud. 2010, 18, 107–122. [Google Scholar] [CrossRef]

- Liu, Q.; Zhao, Y.; Lenggui, W. The influence of government subsidy behavior and marketization degree on Enterprise R&D investment. Res. Financ. Account. 2021, 1, 64–72. [Google Scholar]

- Busom, I. An empirical evaluation of the effects of R&D subsidies. Econ. Innov. New Technol. 2000, 9, 111–148. [Google Scholar]

- Zhang, B.; Tian, Q.; Sun, Z. Influence of government subsidy and financing constraint on R&D investment. Friends Account. 2020, 5, 29–33. [Google Scholar]

- Lach, S. Do R&D subsidies stimulate or displace private R&D? Evidence from Israel. J. Ind. Econ. 2002, 50, 369–390. [Google Scholar]

- Görg, H.; Strobl, E. The effect of R&D subsidies on private R&D. Economica 2007, 74, 215–234. [Google Scholar]

- Qing, Z.; Yanling, W.; Wei, Y. An empirical study of the impact of digital level on innovation performance—A study based on the panel data of 73 counties (districts, cities) of Zhejiang Province. Sci. Res. Manag. 2020, 41, 120–129. [Google Scholar]

- Bogliacino, F.; Pianta, M. Innovation and employment: A reinvestigation using revised Pavitt classes. Res. Policy 2010, 39, 799–809. [Google Scholar] [CrossRef]

- Zhao, Y.; Zhang, L.; Chen, B. Research on the Influence of Government Subsidies and R&D Investment on Innovation Performance of GEM Technology based Enterprises. In Productivity Research; Henan University: Kaifeng, China, 2021; pp. 60–66. [Google Scholar]

- Grossman, G.M.; Helpman, E. Endogenous innovation in the theory of growth. J. Econ. Perspect. 1994, 8, 23–44. [Google Scholar] [CrossRef]

- Petrin, T. A Literature Review on the Impact and Effectiveness of Government Support for R&D and Innovation; ISIGrowth. 2018, Volume 5. Available online: http://www.isigrowth.eu/wp-content/uploads/2018/02/working_paper_2018_05.pdf (accessed on 4 September 2022).

- Cunningham, P.; Gök, A.; Laredo, P. The impact of direct support to R & D and innovation in firms. In Handbook of Innovation Policy Impact; Edward Elgar Publishing: Cheltenham, UK, 2016; pp. 54–107. [Google Scholar]

- Schmookler, J. Economic sources of inventive activity. J. Econ. Hist. 1962, 22, 1–20. [Google Scholar] [CrossRef]

- Grilliches, Z. Patent Statistics as Economic Indicators: A Survey Part I. In NBER Working Paper; National Bureau of Economic Research: Cambridge, MA, USA, 1990; Volume 3301. [Google Scholar]

- Fan, P. Catching up through developing innovation capability: Evidence from China’s telecom-equipment industry. Technovation 2006, 26, 359–368. [Google Scholar] [CrossRef]

- Wang, F.; Chen, J.; Wang, Y.; Lutao, N.; Vanhaverbeke, W. The effect of R&D novelty and openness decision on firms’ catch-up performance: Empirical evidence from China. Technovation 2014, 34, 21–30. [Google Scholar]

- Wadhwa, A.; Phelps, C.; Kotha, S. Corporate venture capital portfolios and firm innovation. J. Bus. Ventur. 2016, 31, 95–112. [Google Scholar] [CrossRef]

- Zhou, Y.; Feigeng, F.; Cheh, H.; Wu, G. Can R&D investment really improve enterprise innovation performance- Evidence from generalized propensity score matching. Financ. Account. Mon. 2019, 20, 149–160. [Google Scholar] [CrossRef]

- Thomson, R.; Jensen, P. The effects of government subsidies on business R&D employment: Evidence from OECD countries. Natl. Tax J. 2013, 66, 281–309. [Google Scholar]

- Song, H. Government R&D Grants, Private R&D Funding and Industrial Innovation Efficiency. Ph.D. Thesis, University of Science and Technology of China, Hefei, China, 2015. [Google Scholar]

- Dong, Q.; Wang, W.; Xie, Z. The influence of R&D input impact on the region’s innovation performance: A mediating perspective. Sci. Technol. Prog. Policy 2016, 33, 41–48. [Google Scholar]

- Sun, Y.; Zhou, M.; Dou, G. Research on the Impact of Government Subsidies on the Innovation Output of AI Listed Companies—Mediation Effect Based on Innovation Input. Sci. Technol. Dev. 2020, 16, 735–745. [Google Scholar]

- Czarnitzki, D.; Hussinger, K. Input and output additionality of R&D subsidies. Appl. Econ. 2018, 50, 1324–1341. [Google Scholar]

- Bronzini, R.; Piselli, P. The impact of R&D subsidies on firm innovation. Res. Policy 2016, 45, 442–457. [Google Scholar]

- Hall, B.; Van Reenen, J. How effective are fiscal incentives for R&D? A review of the evidence. Res. Policy 2000, 29, 449–469. [Google Scholar]

- Rosenbloom, R.S.; Christensen, C.M. Technological discontinuties, organizational capabilities, and strategic commitments. Ind. Corp. Chang. 1994, 3, 655–685. [Google Scholar] [CrossRef]

- Guo, D.; Guo, Y.; Jiang, K. Government-subsidized R&D and firm innovation: Evidence from China. Res. Policy 2016, 45, 1129–1144. [Google Scholar]

- Liu, M.; Du, M.; Liu, X. Government Subsidy and Performance of New Energy Enterprises: From the Perspective of Heterogeneity and Time Lag. Sci. Res. Manag. 2022, 43, 17–26. [Google Scholar] [CrossRef]

- Liu, M.; Liu, L.; Xu, S.; Du, M.; Liu, X.; Zhang, Y. The influences of government subsidies on performance of new energy firms: A firm heterogeneity perspective. Sustainability 2019, 11, 4518. [Google Scholar] [CrossRef]

- Zhou, K.Z.; Gao, G.Y.; Zhao, H. State ownership and firm innovation in China: An integrated view of institutional and efficiency logics. Adm. Sci. Q. 2017, 62, 375–404. [Google Scholar] [CrossRef]

- Xu, J.; Wang, X.; Liu, F. Government subsidies, R&D investment and innovation performance: Analysis from pharmaceutical sector in China. Technol. Anal. Strateg. Manag. 2021, 33, 535–553. [Google Scholar]

- Wu, W.S.; Zhao, K. Government R&D subsidies and enterprise R&D activities: Theory and evidence. Econ. Res.-Ekon. Istraživanja 2022, 35, 391–408. [Google Scholar]

- Leung, T.Y.; Sharma, P. Differences in the impact of R&D intensity and R&D internationalization on firm performance—Mediating role of innovation performance. J. Bus. Res. 2021, 131, 81–91. [Google Scholar]

- Zhuang, W.; Li, F.; Li, A. Research on the Influence of government subsidies on firm performance—Based on the mediating effect of firm R&D investment. Commun. Financ. Account. 2018, 30, 53–57. [Google Scholar] [CrossRef]

- Zou, Y.; Zhen, Y.; Li, B. Research on the Impact of Government R&D Subsidy on Enterprise Innovation Output. J. Shanxi Univ. Financ. Econ. 2019, 1, 17–26. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).