Environmental Taxation Assessment on Clean Technologies Reducing Carbon Emissions Cost-Effectively

Abstract

1. Introduction

2. Literature Review and Theoretical Analysis of Research

2.1. The Role of Environmental Taxation in the Development of Clean Technologies

2.2. Environmental Taxes in Green Finance for Clean Technology Development

2.3. Encouraging Green Innovation through Taxation

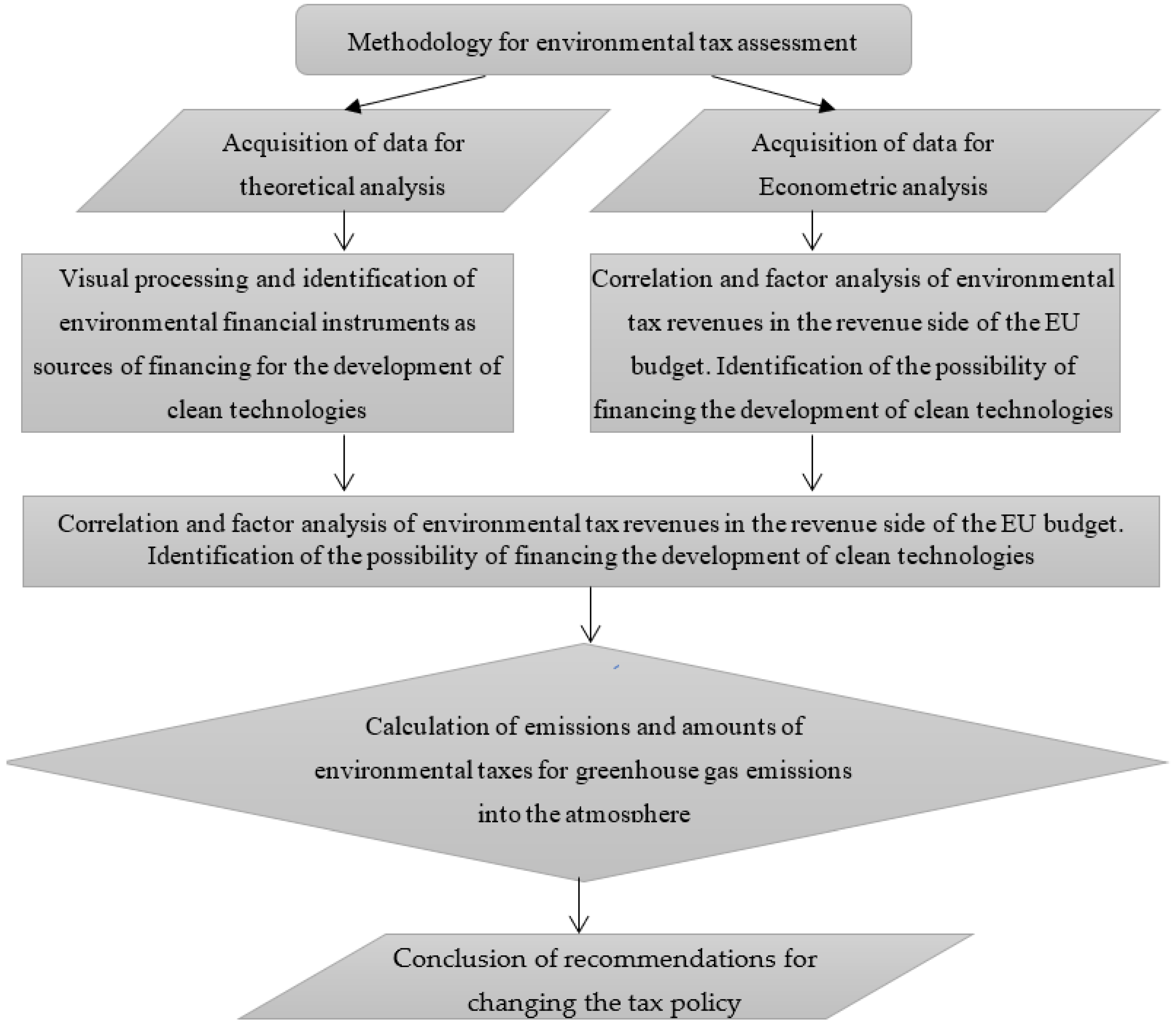

3. Methodology of Analysis and Environmental Tax Assessment of Clean Technologies That Reduce Carbon Emissions at the Lowest Cost

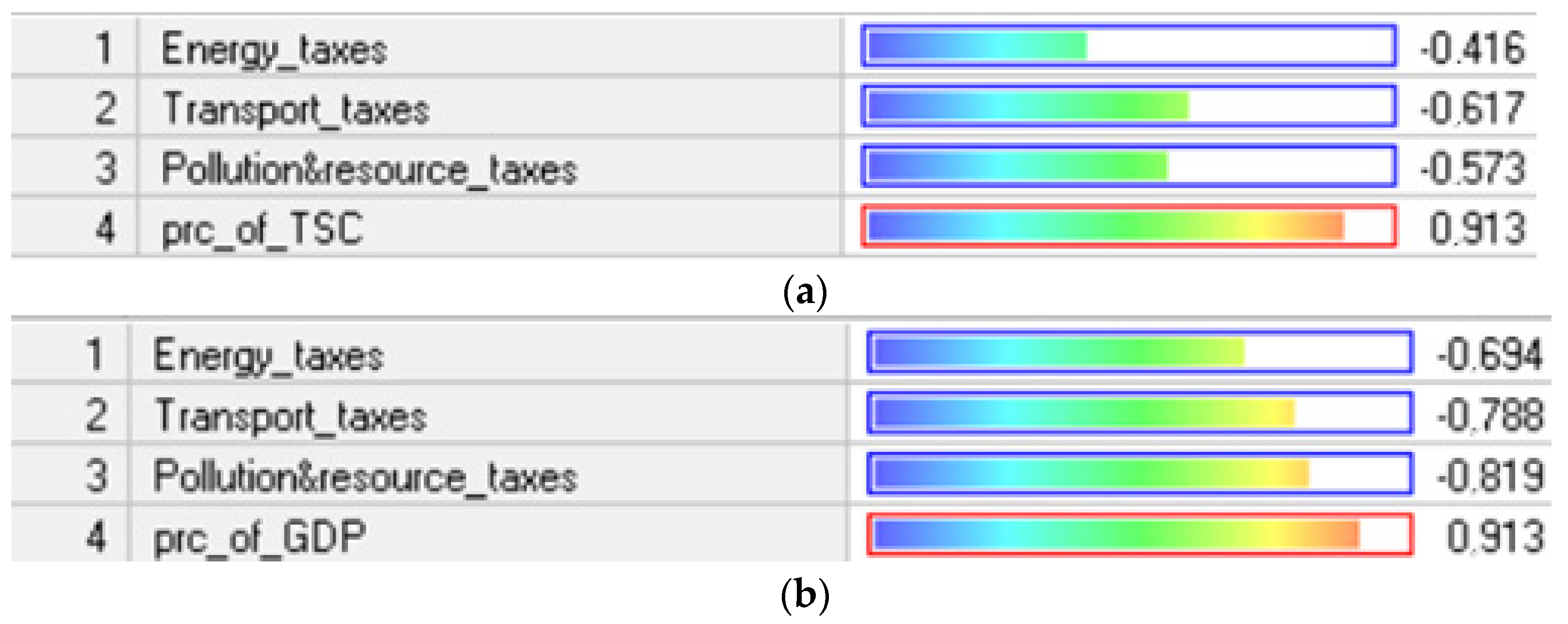

3.1. An Econometric Data Analysis

3.2. Methodology for Calculating Greenhouse Gas Emissions (Price Adjustment)

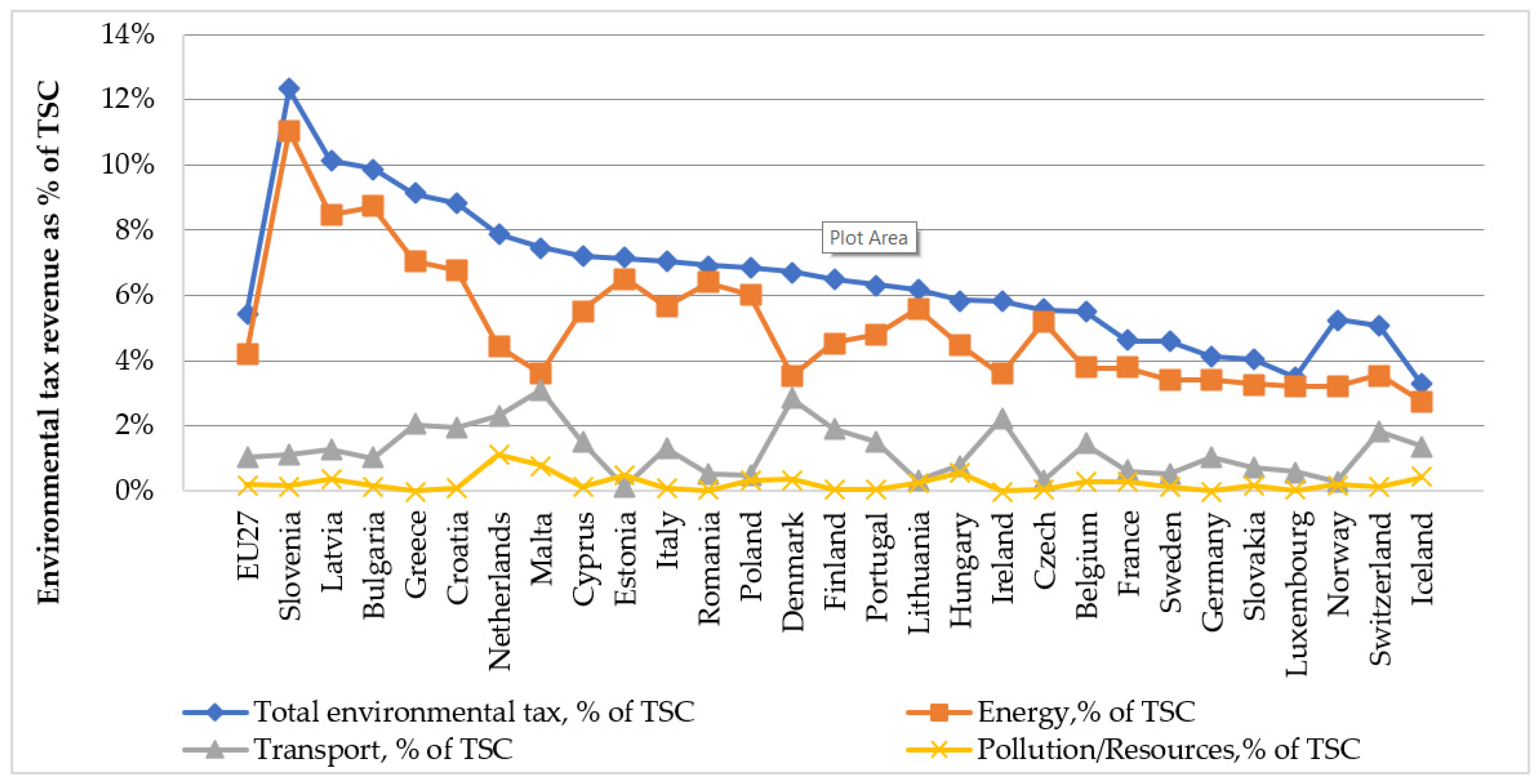

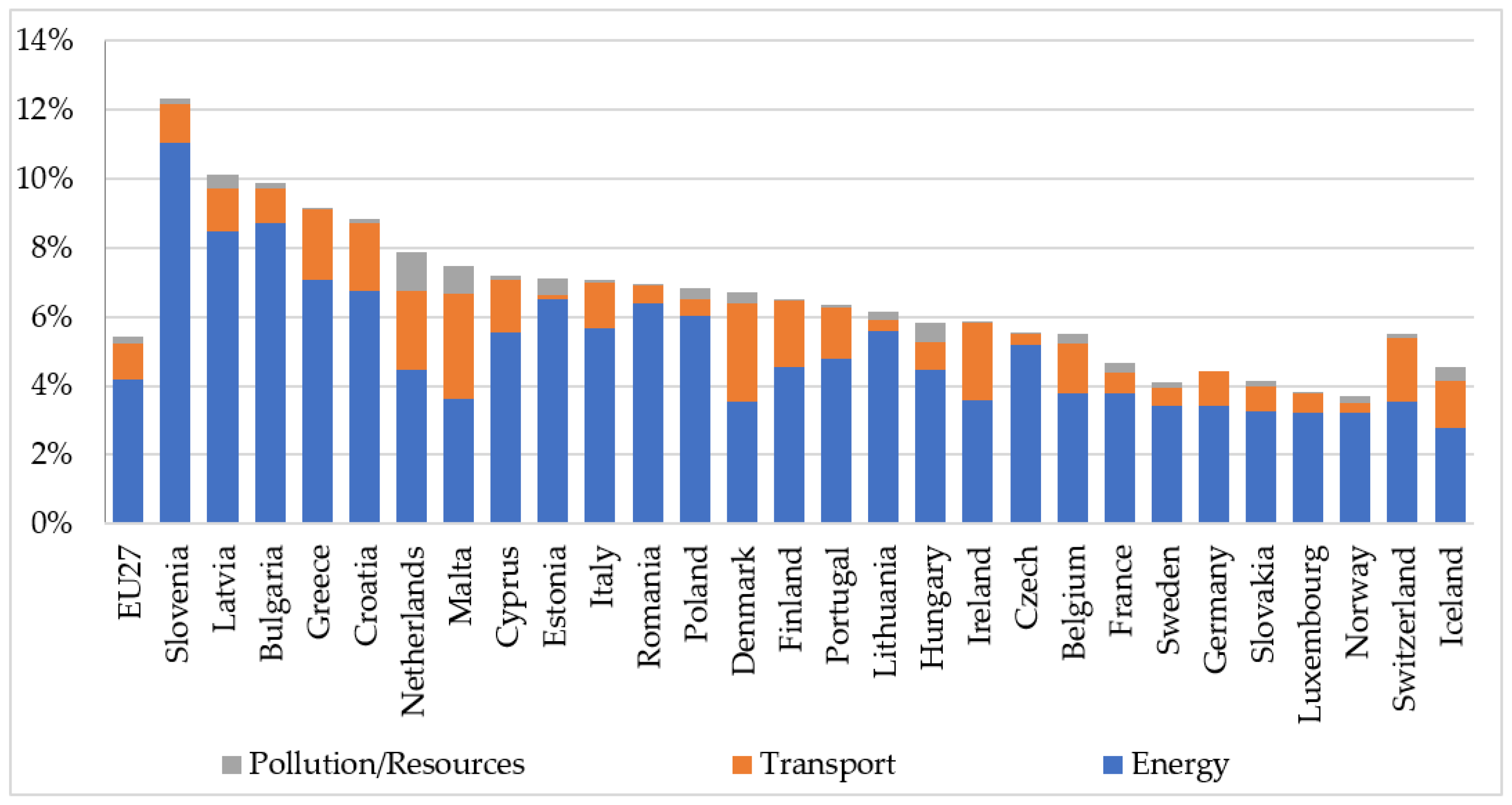

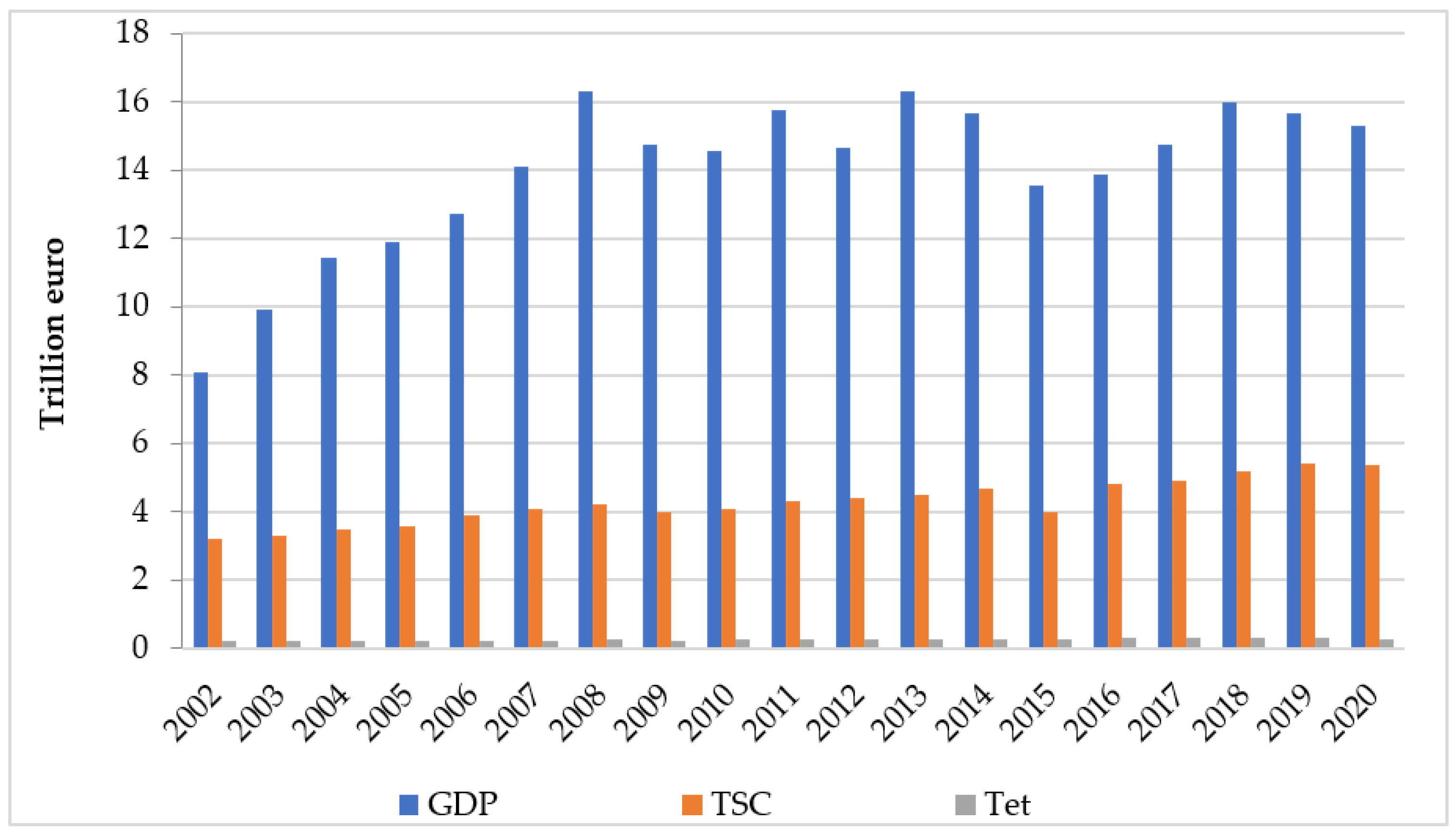

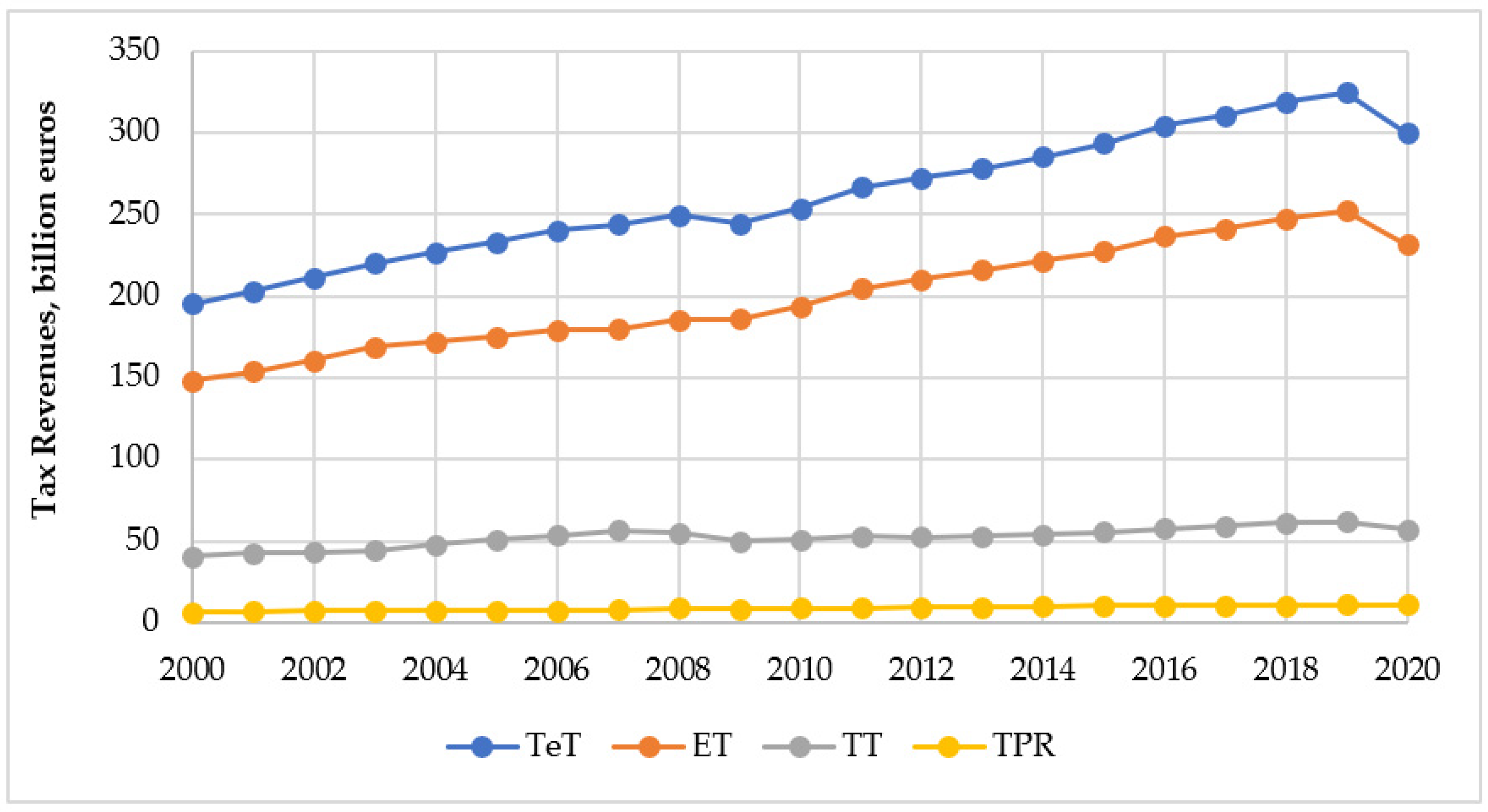

4. Result

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Gwangndi, M.I.; Muhammad, Y.A.; Tagi, S.M. The Impact of Environmental Degradation on Human Health and Its Relevance to the Right to Health Under International Law. Eur. Sci. J. 2016, 12, 485. [Google Scholar] [CrossRef]

- Adaptation Fund: Portfolio—Programmes. Funding and Financing Solution for Infrastucture. Funding and Financing Green and Circular Economy Solutions. 2021. Available online: https://www.adapta-tion-fund.org/projects (accessed on 18 March 2022).

- Useful Information. Info Session 3: New European Bauhaus Funding Opportunities. 2022. Available online: https://new-european-bauhaus.europa.eu/get-involved/funding-opportu-nities_en (accessed on 18 March 2022).

- Francisco, J. Environmental taxation in the European Union: Are there common trends? Econ. Anal. Policy 2022, 73, 670–682. [Google Scholar]

- Goulder, L.H.; Mathai, K. Optimal CO2 Abatement in the Presence of Induced Technological Change. J. Environ. Econ. Manag. 2000, 39, 1–38. [Google Scholar] [CrossRef]

- Hart, R. The timing of taxes on CO2 emissions when technological change is endogenous. J. Environ. Econ. Manag. 2008, 55, 194–212. [Google Scholar] [CrossRef]

- Voskolupov, V.; Balanovska, T.; Havrysh, O.; Gogulya, O.; Drahnieva, N. Marketing Management as a Tool for Preventing Crisis of Agricultural Enterprises. Financ. Credit. Act. Probl. Theory Pract. 2021, 5, 410–417. [Google Scholar] [CrossRef]

- Olczak, P.; Żelazna, A.; Matuszewska, D.; Olek, M. The “My Electricity” Program as One of the Ways to Reduce CO2 Emissions in Poland. Energies 2021, 14, 7679. [Google Scholar] [CrossRef]

- Gerlagh, R.; Kverndokk, S.; Rosendahl, K.E. Optimal Timing of Climate Change Policy: Interaction Between Carbon Taxes and Innovation Externalities. Environ. Resour. Econ. 2009, 43, 369–390. [Google Scholar] [CrossRef]

- Goulder, L.H.; Schein, A.R. Carbon Taxes Versus Cap and Trade: A Critical Review. Clim. Chang. Econ. 2013, 4, 135001. [Google Scholar] [CrossRef]

- Quadrelli, R.; Peterson, S. The energy-climate challenge: Recent trends in CO2 emissions from fuel combustion. Energy Policy 2007, 35, 5938–5952. [Google Scholar] [CrossRef]

- Rubio, S.J.; Escriche, L. Strategic pigouvian taxation, stock externalities and polluting non-renewable resources. J. Public Econ. 2001, 79, 297–313. [Google Scholar] [CrossRef]

- Schou, P. When Environmental Policy is Superfluous: Growth and Polluting Resources. Scand. J. Econ. 2002, 104, 605–620. [Google Scholar] [CrossRef]

- Sinclair, P. High does nothing and rising is worse: Carbon taxes should keep declining to cut harmful emissions. Manch. Sch. 1992, 60, 41–52. [Google Scholar] [CrossRef]

- Schou, P. Polluting Non-Renewable Resources and Growth. Environ. Resour. Econ. 2000, 16, 211–227. [Google Scholar] [CrossRef]

- Sinn, H.-W. Taxation, growth, and resource extraction. A general equilibrium approach. Eur. Econ. Rev. 1982, 19, 357–386. [Google Scholar] [CrossRef]

- Sinn, H.-W. Public policies against global warming: A supply side approach. Int. Tax Public Financ. 2008, 15, 360–394. [Google Scholar] [CrossRef]

- Ulph, A.; Ulph, D. The Optimal Time Path of a Carbon Tax. Oxf. Econ. Pap. 1994, 46, 857–868. [Google Scholar] [CrossRef]

- Samsin, I.; Kovalko, N.; Kovalenko, A.; Zabzaliuk, D.; Kurando, K. Legal Aspects of Identity Transactions Involving Entities with Foreign Elements: ICT Technologies and Issues of the Tax Burden. Stud. Appl. Econ. 2021, 39, 4865. [Google Scholar] [CrossRef]

- Tong, J.; Yue, T.; Xue, J. Carbon taxes and a guidance-oriented green finance approach in China: Path to carbon peak. J. Clean. Prod. 2022, 367, 133050. [Google Scholar] [CrossRef]

- Turski, I.; Mashika, H.; Tkachenko, T.; Khmara, M.; Komarnitskyi, I.; Oliinyk, M. Medical Tourism: Analysis of the State of International Tourism and Prospects for Domestic Development. Univers. J. Public Health 2021, 9, 27–34. [Google Scholar] [CrossRef]

- Koval, L.; Turski, I.; Kolomiiets, O.; Komarnitskyi, I.; Chaika, T. New Opportunities for Restaurant Business Development Based on Computer Modeling of Consumer Preferences. Stud. Appl. Econ. 2021, 39, 4714. [Google Scholar] [CrossRef]

- Bovsh, L.; Hopkalo, L.; Levytska, I.; Komarnitskyi, I.; Rasulova, A. Simulation of Behavior of Hotel and Restaurant Business Staff in the Conditions of COVID-19 Viral Pandemic. J. Environ. Manag. Tour. 2021, 12, 186–195. [Google Scholar] [CrossRef]

- Dankeieva, O.; Solomianiuk, N.; Strashynska, L.; Fiedotova, N.; Soloviova, Y.; Koval, V. Application of Cognitive Modelling for Operation Improvement of Retail Chain Management System. TEM J. 2021, 10, 358–367. [Google Scholar] [CrossRef]

- Koval, L.; Tserklevych, V.; Popovich, O.; Bukhta, S.; Hurman, O.; Komarnitskyi, I. Gender Targeting of Restaurants’ Visitors-Representatives of Generation Z. Int. J. Manag. 2020, 11, 155–162. [Google Scholar]

- Danko, Y.I.; Medvid, V.Y.; Koblianska, I.I.; Kornietskyy, O.V.; Reznik, N.P. Territorial government reform in Ukraine: Problem aspects of strategic management. Int. J. Sci. Technol. Res. 2020, 9, 1376–1382. [Google Scholar]

- Balanovska, T.; Gogulya, O.; Dramaretska, K.; Voskolupov, V.; Holik, V. Using marketing management to ensure competitiveness of agricultural enterprises. Agric. Resour. Econ. Int. Sci. E-J. 2021, 7, 142–161. [Google Scholar] [CrossRef]

- Oklander, M.; Chukurna, O.; Oklander, T.; Yashkina, O. Methodical Approach to Calculating Information Value in Pricing Policy in Supply Chains. Stud. Appl. Econ. 2020, 38, 4009. [Google Scholar] [CrossRef]

- Halkiv, L.; Karyy, O.; Kulyniak, I.; Ohinok, S. Modeling and Forecasting of Innovative, Scientific and Technical Activity Indicators Under Unstable Economic Situation in the Country: Case of Ukraine. In International Conference on Data Stream Mining and Processing; Communications in Computer and Information Science; Springer: Cham, Switzerland, 2020; Volume 1158, pp. 79–97. [Google Scholar] [CrossRef]

- Mirzoieva, T.; Heraimovych, V.; Loshakova, Y.; Tripak, M.; Humeniuk, I. Optimization of the sown areas structure as a tool for the development of medicinal crop production on the basis of sustainability and regenerative agriculture. E3S Web Conf. 2021, 244, 03027. [Google Scholar] [CrossRef]

- Bohach, L.; Heraimovych, V.; Humeniuk, I.; Nahornyi, V.; Gerasymenko, N. Formation of optimal field crop structure on leased lands of agricultural enterprises. J. Adv. Res. Law Econ. 2019, 10, 1868–1876. [Google Scholar]

- Prokopenko, O.; Chechel, A.; Sotnyk, I.; Omelyanenko, V.; Kurbatova, T.; Nych, T. Improving state support schemes for the sustainable development of renewable energy in Ukraine. Polityka Energetyczna 2021, 24, 85–100. [Google Scholar] [CrossRef]

- Hrechyn, B.; Krykavskyy, Y.; Binda, J. The Development of a Model of Economic and Ecological Evaluation of Wooden Biomass Supply Chains. Energies 2021, 14, 8574. [Google Scholar] [CrossRef]

- Maslov, A.; Spasiv, N.; Bezzubko, B.; Lazebnyk, I.; Nych, T.; Ternova, L. Spatial optimization of regional social infrastructure facilities. Int. J. Innov. Technol. Explor. Eng. 2019, 9, 929–3932. [Google Scholar] [CrossRef]

- Semigina, T. Frustrations or moving forward? Ukrainian social work within the ‘hybrid war’ context. Eur. J. Soc. Work. 2019, 22, 446–457. [Google Scholar] [CrossRef]

- Koval, V.; Laktionova, O.; Atstāja, D.; Grasis, J.; Lomachynska, I.; Shchur, R. Green Financial Instruments of Cleaner Production Technologies. Sustainability 2022, 14, 10536. [Google Scholar] [CrossRef]

- Bashkirova, N.N.; Lessovaia, S.N. Sustainable Natural Resources Use: Financial and Tax Issues. IOP Conf. Ser. Earth Environ. Sci. 2022, 988, 022012. [Google Scholar] [CrossRef]

- Huo, W.; Ullah, M.R.; Zulfiqar, M.; Parveen, S.; Kibria, U. Financial Development, Trade Openness, and Foreign Direct Investment: A Battle Between the Measures of Environmental Sustainability. Front. Environ. Sci. 2022, 10, 77. [Google Scholar] [CrossRef]

- Cai, Y.-J.; Choi, T.-M.; Feng, L.; Li, Y. Producer’s choice of design-for-environment under environmental taxation. Eur. J. Oper. Res. 2022, 297, 532–544. [Google Scholar] [CrossRef]

- Dragone, D.; Lambertini, L.; Palestini, A. Emission taxation, green innovations and inverted-U aggregate R&D efforts in a linear state differential game. Res. Econ. 2022, 76, 62–68. [Google Scholar] [CrossRef]

- Huang, L.; Zhen, L.; Wang, J.; Zhang, X. Blockchain implementation for circular supply chain management: Evaluating critical success factors. Ind. Mark. Manag. 2022, 102, 451–464. [Google Scholar] [CrossRef]

- Ouchida, Y.; Goto, D. Strategic non-use of the government’s precommitment ability for emissions taxation: Environmental R&D formation in a Cournot duopoly. Aust. Econ. Pap. 2022, 61, 181–206. [Google Scholar] [CrossRef]

- Vidal-Meliá, L.; Arguedas, C.; Camacho-Cuena, E.; Zofío, J.L. An Experimental Analysis of the Effects of Imperfect Compliance on Technology Adoption. Environ. Resour. Econ. 2022, 81, 425–451. [Google Scholar] [CrossRef]

- Xie, P.; Jamaani, F. Does Green Innovation, Energy Productivity and Environmental Taxes Limit Carbon Emissions in Developed economies: Implications for Sustainable development. Struct. Chang. Econ. Dyn. 2022, 63, 66–78. [Google Scholar] [CrossRef]

- Niu, B.; Zhang, N.; Xu, H.; Chen, L.; Ji, P. Inviting MNFs’ green offshoring: Is it an effective way to coordinate economic and environmental sustainability? Int. J. Prod. Econ. 2022, 254, 108605. [Google Scholar] [CrossRef]

- Wan, Q.; Miao, X.; Afshan, S. Dynamic effects of natural resource abundance, green financing, and government environmental concerns toward the sustainable environment in China. Resour. Policy 2022, 79, 102954. [Google Scholar] [CrossRef]

- Chen, S. The inequality impacts of the carbon tax in China. Humanit. Soc. Sci. Commun. 2022, 9, 277. [Google Scholar] [CrossRef]

- Bae, J.H. Impacts of income inequality on CO2 emission under different climate change mitigation policies. Korean Econ. Rev. 2018, 34, 187–211. [Google Scholar]

- Zhang, Z.; Hu, G.; Mu, X.; Kong, L. From low carbon to carbon neutrality: A bibliometric analysis of the status, evolution and development trend. J. Environ. Manag. 2022, 322, 116087. [Google Scholar] [CrossRef]

- Zhen, L.; Huang, L.; Wang, W. Green and sustainable closed-loop supply chain network design under uncertainty. J. Clean. Prod. 2019, 227, 1195–1209. [Google Scholar] [CrossRef]

- Huang, L.; Zhen, L.; Yin, L. Waste material recycling and exchanging decisions for industrial symbiosis network optimization. J. Clean. Prod. 2020, 276, 124073. [Google Scholar] [CrossRef]

- Li, S.; Jia, N.; Chen, Z.; Du, H.; Zhang, Z.; Bian, B. Multi-objective optimization of environmental tax for mitigating air pollution and greenhouse gas. J. Manag. Sci. Eng. 2022, 7, 473–488. [Google Scholar] [CrossRef]

- Alola, A.A.; Nwulu, N. Do energy-pollution-resource-transport taxes yield double dividend for Nordic economies? Energy 2022, 254, 124275. [Google Scholar] [CrossRef]

- Tchorzewska, K.; Garcia-Quevedo, J.; Martinez-Ros, E. The heterogeneous effects of environmental taxation on green technologies. Res. Policy 2022, 51, 104541. [Google Scholar] [CrossRef]

- Sikder, M.; Wang, C.; Yao, X.; Huai, X.; Wu, L.; KwameYeboah, F.; Wood, J.; Zhao, Y.; Dou, X. The integrated impact of GDP growth, industrialization, energy use, and urbanization on CO2 emissions in developing countries: Evidence from the panel ARDL approach. Sci. Total Environ. 2022, 837, 155795. [Google Scholar] [CrossRef] [PubMed]

- Capital misallocation, technological innovation, and green development efficiency: Empirical analysis based on China provincial panel data. Environ. Sci. Pollut. Res. 2022, 29, 65535–65548. [CrossRef]

- Yijun, Z. Tax rebates, technological innovation and sustainable development: Evidence from Chinese micro-level data. Technol. Forecast. Soc. Change 2022, 176, 121481. [Google Scholar]

- Establishing Green Finance System to Support the Circular Economy. Available online: https://www.eria.org/uploads/media/ERIA-Books-2018-Industry4.0-Circular_-Economy.pdf (accessed on 18 March 2022).

- Eurostat Database. 2018. Available online: https://ec.europa.eu/eurostat/data/database (accessed on 10 June 2022).

- Koval, V.; Mikhno, I.; Udovychenko, I.; Gordiichuk, Y.; Kalina, I. Sustainable Natural Resource Management to Ensure Strategic Environmental Development. TEM J. 2021, 10, 1022–1030. [Google Scholar] [CrossRef]

- European Commission. A European Green Deal. 2019. Available online: https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal_en (accessed on 18 March 2022).

- European Commission 2021. Revision of the Energy Taxation Directive (ETD): Questions and Answers. Available online: https://ec.europa.eu/commission/presscorner/detail/en/qanda_21_3662 (accessed on 18 March 2022).

- United Nation Climate Change. The Paris Agreement—Publication. Available online: https://unfccc.int/documents/184656/2022 (accessed on 18 November 2021).

- European Commission. New European Bauhaus. 2022. Available online: https://europa.eu/new-european-bauhaus/index_en (accessed on 18 March 2022).

- Bollerslev, T.; Russell, J.; Watson, M. Volatility and Time Series Econometrics: Essays in Honor of Robert Engle; OUP Oxford: Oxford, UK, 2010. [Google Scholar]

- Philanthropova, V.A.; Sham, P.I. On Atmospheric Air Pollution by Ferrous Metallurgy Enterprises. Bull. Azov State Tech. Univ. 2001, 11, 1–4. [Google Scholar]

- Tax Code of Ukraine. 2021. Available online: https://www.wto.org/english/thewto_e/acc_e/ukr_e/wtaccukr88_leg_3.pdf (accessed on 18 March 2022).

- Cader, J.; Olczak, P.; Koneczna, R. Regional dependencies of interest in the “My Electricity” photovoltaic subsidy program in Poland. Polityka Energetyczna—Energy Policy J. 2021, 24, 97–116. [Google Scholar] [CrossRef]

- Cader, J.; Koneczna, R.; Olczak, P. The Impact of Economic, Energy, and Environmental Factors on the Development of the Hydrogen Economy. Energies 2021, 14, 4811. [Google Scholar] [CrossRef]

| Million Euro | Share of Total Environmental Taxes, % | Share of GDP, % | Share of Total Environmental Taxes, % | Share of (Specific Type of) Environmental Tax Revenue (by Tax Payer), % | |||

|---|---|---|---|---|---|---|---|

| 2020 | 2019 | ||||||

| Corporations | Households | Non-residents | |||||

| Total environmental taxes | 299,885 | 100.0 | 2.24 | 5.42 | 47.7 | 48.0 | 3.4 |

| Energy taxes | 232,411 | 77.2 | 1.74 | 4.19 | 51.4 | 43.3 | 4.2 |

| Transport taxes | 56,838 | 19.1 | 0.42 | 1.03 | 32.3 | 65.4 | 0.5 |

| Taxes on pollution/ resources | 10,636 | 3.7 | 0.08 | 0.20 | 42.4 | 56.5 | 1.1 |

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | |

|---|---|---|---|---|---|---|

| GDP | 8,540,077.0 | 8,768,884.8 | 9,168,960.0 | 9,561,846.3 | 10,113,606.0 | 10,740,038.1 |

| TSC | 3,289,484.6 | 3,377,960.3 | 3,509,263.4 | 3,685,837.8 | 3,931,673.1 | 4,187,016.4 |

| TET | 217,623.33 | 226,683.65 | 235,467.66 | 242,508.35 | 249,795.39 | 254,040.43 |

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | |

| GDP | 11,085,484.4 | 4,027,279.9 | 4,163,941.6 | 4,344,072.5 | 4,478,704.2 | 4,581,440.4 |

| TSC | 4,261,044.3 | 4,027,279.9 | 4,163,941.6 | 4,344,072.5 | 4,478,704.2 | 4,581,440.4 |

| TET | 255,000.63 | 249,489.6 | 259,603.6 | 272,357.19 | 278,482.61 | 284,174.26 |

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

| GDP | 4,696,565.0 | 4,852,744.3 | 4,998,941.2 | 5220,149.9 | 5,420507.0 | 5,595,531.4 |

| TSC | 4,696,565.0 | 4,027,279.9 | 4,852,744.3 | 4,998,941.2 | 5,220,149.9 | 5,420,507.0 |

| TET | 290,979.85 | 249,489.6 | 299,066.49 | 310,173.35 | 316,635.62 | 324,958.63 |

| Countries | pp Change in the Share of TSC | pp Change in the Share of GDP | Countries | pp Change in the Share of TSC | pp Change in the Share of GDP |

|---|---|---|---|---|---|

| EU-27 | −0.33 | −0.12 | |||

| Estonia | −2.37 | −0.76 | France | −0.32 | −0.13 |

| Slovenia | −1.45 | −0.52 | Bulgaria | −0.31 | −0.06 |

| Romania | −1.00 | −0.24 | Spain | −0.30 | −0.01 |

| Luxembourg | −0.77 | −0.35 | Belgium | −0.25 | −0.09 |

| Netherlands | −0.66 | −0.23 | Denmark | −0.21 | −0.09 |

| Italy | −0.59 | −0.21 | Cyprus | −0.17 | −0.04 |

| Malta | −0.59 | −0.19 | Slovakia | −0.15 | −0.01 |

| Portugal | −0.55 | −0.15 | Finland | −0.14 | −0.07 |

| Poland | −0.49 | −0.13 | Germany | −0.13 | −0.05 |

| Ireland | −0.38 | −0.20 | Czechia | −0.12 | −0.03 |

| Croatia | −0.34 | −0.17 | Greece | −0.12 | −0.10 |

| Austria | −0.34 | −0.17 | Sweden | −0.02 | −0.01 |

| Hungary | −0.34 | −0.13 | Lithuania | −0.01 | 0.03 |

| Norway | 0.27 | 0.33 | Latvia | 0.24 | 0.16 |

| Iceland | 0.12 | −0.01 | Switzerland | 0.32 | −0.01 |

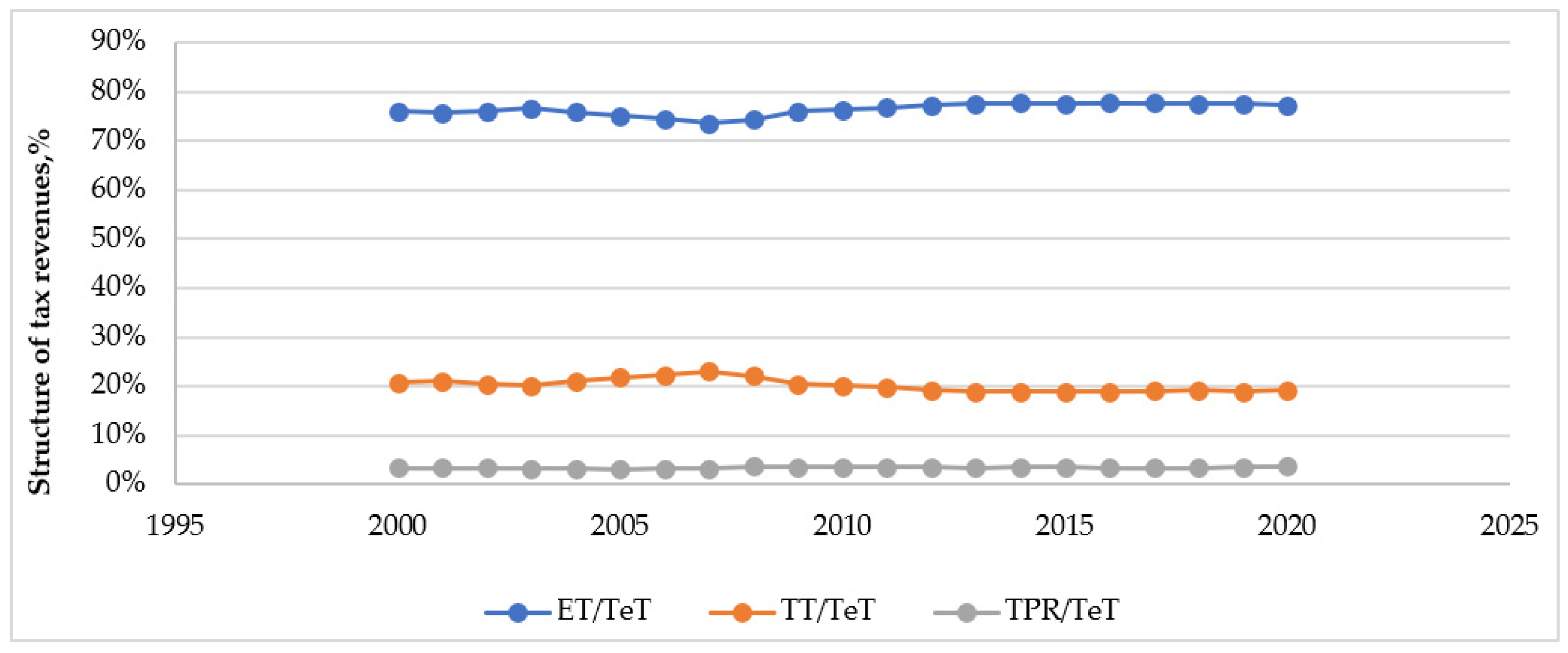

| Year | ET/TET | TT/TET | TPR/TET | Year | ET/TET | TT/TET | TPR/TET |

|---|---|---|---|---|---|---|---|

| 2000 | 76.0 | 20.7 | 3.3 | 2011 | 76.8 | 19.8 | 3,4 |

| 2001 | 75.7 | 21.0 | 3.3 | 2012 | 77.2 | 19.3 | 3,5 |

| 2002 | 76.1 | 20.5 | 3.4 | 2013 | 77.7 | 18.9 | 3,4 |

| 2003 | 76.7 | 20.1 | 3.2 | 2014 | 77.7 | 18.8 | 3,5 |

| 2004 | 75.9 | 21.0 | 3.2 | 2015 | 77.5 | 19.0 | 3,5 |

| 2005 | 75.1 | 21.8 | 3.1 | 2016 | 77.8 | 18.9 | 3,4 |

| 2006 | 74.5 | 22.3 | 3.2 | 2017 | 77.7 | 19.0 | 3,3 |

| 2007 | 73.6 | 23.1 | 3.3 | 2018 | 77.5 | 19.1 | 3,3 |

| 2008 | 74.3 | 22.1 | 3.6 | 2019 | 77.6 | 19.0 | 3,4 |

| 2009 | 76.1 | 20.4 | 3.5 | 2020 | 77.2 | 19.1 | 3,7 |

| 2010 | 76.4 | 20.1 | 3.4 | 2021 | 77.3 | 19.1 | 3.7 |

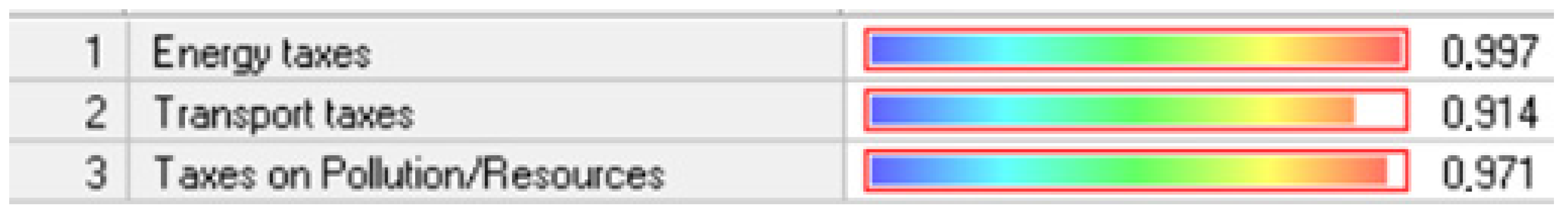

| Refinement of the number of selected factors in accordance with the desired proportion of the variance reproduced by them (right column), Significance threshold—46, 88 | Main Components | Eigenvalues | Contribution to the Result | Total Contribution |

| Meaning 1 | 2.813 | 93.7540 % | 93.7540% | |

| Meaning 2 | 0.157 | 5.2352 % | ||

| Meaning 3 | 0.030 | 1.01 % | ||

| Final factors (Varimax method) Significance threshold 0.30 | Variables | Factor | ||

| Energy taxes | 0.9822 | |||

| Transport taxes | 0.9451 | |||

| Taxes on Pollution/Resources | 0.9770 | |||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Koval, V.; Laktionova, O.; Udovychenko, I.; Olczak, P.; Palii, S.; Prystupa, L. Environmental Taxation Assessment on Clean Technologies Reducing Carbon Emissions Cost-Effectively. Sustainability 2022, 14, 14044. https://doi.org/10.3390/su142114044

Koval V, Laktionova O, Udovychenko I, Olczak P, Palii S, Prystupa L. Environmental Taxation Assessment on Clean Technologies Reducing Carbon Emissions Cost-Effectively. Sustainability. 2022; 14(21):14044. https://doi.org/10.3390/su142114044

Chicago/Turabian StyleKoval, Viktor, Olga Laktionova, Iryna Udovychenko, Piotr Olczak, Svitlana Palii, and Liudmyla Prystupa. 2022. "Environmental Taxation Assessment on Clean Technologies Reducing Carbon Emissions Cost-Effectively" Sustainability 14, no. 21: 14044. https://doi.org/10.3390/su142114044

APA StyleKoval, V., Laktionova, O., Udovychenko, I., Olczak, P., Palii, S., & Prystupa, L. (2022). Environmental Taxation Assessment on Clean Technologies Reducing Carbon Emissions Cost-Effectively. Sustainability, 14(21), 14044. https://doi.org/10.3390/su142114044