Abstract

Crowd-shipping platforms have the potential to serve as flexible and low-cost logistics solutions for small and medium-sized enterprises (SMEs), which tend to have proportionally higher logistics costs than large companies. By increasing visibility and access to underutilized vehicle capacity, crowd-shipping platforms can offer lower rates than traditional delivery services. Leveraging excess capacity on premeditated delivery trips can also improve logistics efficiency and reduce emissions. However, high platform fees, insufficient carriers, and difficulty finding suitable platforms are common barriers to widespread adoption. This research evaluates the degree to which existing commercial crowd-shipping platforms can provide suitable transportation solutions for SMEs. A systematic search yielded 400 platforms, which were evaluated for SME suitability by requesting quotes for delivery service from each platform, based on typical shipping requirements of two agriculture-based SMEs in Texas. The responses and quotes that were received, as well as feedback from the case study SMEs, indicate that most existing platforms are unlikely to meet the needs of SME shippers. The results suggest ways in which crowd-shipping platform managers could take advantage of this market opportunity by tailoring the services and features of their platforms to better meet the expectations of SMEs.

1. Introduction and Motivation

Small and medium-sized enterprises (SMEs) play an important role in achieving the seventeen Sustainable Development Goals (SDGs) identified by the United Nations. SMEs comprise the backbone of national economies and the global supply chains of large companies [1]. In emerging markets, 4 out of 5 new positions in the formal sector (about 90 percent of total employment) were created by SMEs, which has significantly reduced the number of people living below the poverty line (SDG 1) [1,2]. Similarly, in developed countries such as the U.S., SMEs have accounted for 65.1% of net new job creation since 2000 [3]. SMEs also tend to spend more of the money they make from a local area within that area, demonstrating their potential to regenerate economically disadvantaged localities (SDG 10) [1].

Despite their contributions to economic and social sustainability, SMEs must improve their environmental performance, particularly with respect to energy efficiency [4]. While individual small businesses may have low environmental footprints, their combined impact can exceed that of large businesses. SMEs are responsible for 64% of pollution in Europe and account for 60% of carbon dioxide and 70% of all industrial pollution globally [5]. Therefore, there is an urgent need for SMEs to adopt innovative and sustainable solutions to better promote other SDGs, for example, SDG 11 (sustainable cities and communities) and SDG 13 (climate action).

One key area where SMEs face many challenges and lack efficiency is logistics, and especially with transportation [6]. While many large online retailers have sufficient resources to maintain in-house transportation capacity, SMEs lack the necessary economies of scale to implement efficient delivery networks. Therefore, they often outsource transportation to delivery companies; however, standard parcel delivery services are relatively slow, and expedited services are expensive [7]. Large companies can also take advantage of economies of scale to negotiate lower freight prices, and they can buy materials in bulk to enable cost-efficient full-truckload (FTL) shipments, as well as receiving preferential treatment from the government in the form of tax breaks and better freight discounts [8,9]. SMEs cannot access these advantages, and as a result, they tend to have proportionally higher logistics costs than large companies, representing 12% of their annual sales revenues (compared with 5% for large companies) [8], with transportation cost comprising nearly half of total logistics costs [10].

In addition, SMEs that have traditionally operated as brick-and-mortar retailers are now struggling to compete against large e-commerce companies that offer convenient online ordering and home delivery [11]. The COVID-19 pandemic accelerated this trend: from 2020 to 2021, e-commerce purchases grew by 33% to $792 billion, representing 14% of all retail sales [12]. Customers now expect same-day deliveries to their doorstep at low cost, and SMEs must increase their logistics capacity to offer this level of service. As a result, during the COVID-19 pandemic, 87% of SMEs reported maintaining or increasing their logistics budget [13].

The increased availability of sophisticated, easy to use, and low-cost crowd-shipping platforms could help SMEs access the scale of larger firms [14]. As part of the sharing economy, crowd-shipping platforms act as automated digital intermediaries, connecting those with items to ship (i.e., senders) directly with independent carriers who are offering transportation services on an ad hoc basis. Such platforms are widely used for restaurant food delivery (e.g., DoorDash) and increasingly for both last-mile and long-haul freight. They facilitate matchmaking, transactions, and secure online payment processing [15]. The main appeal of crowd-shipping platforms is their ability to offer lower rates than traditional less-than-truckload (LTL) brokerages or courier services, as well as providing the convenience of automated transportation scheduling via a smartphone app [16]. The carrier crowd may include full-time commercial drivers, part-time free-lancers, and commuters looking to offset their trip costs. The crowd serves as a large, pooled resource that increases the probability that a sender can quickly and easily find an available carrier to provide same-day service and convenient delivery times [17]. Furthermore, having visibility and access to these carriers’ underutilized vehicle capacity and free time without requiring the services of a middleman can make crowd-shipping a cost-effective option for senders. Competition among a large crowd of carriers can also make same-day deliveries financially viable [18].

On the other hand, the use of crowd-shipping platforms by brick-and-mortar retailers may be unprofitable if the platforms charge high service fees [19]. Moreover, if a platform has insufficient carriers, the limited availability of physical assets and logistics capabilities will yield inconsistent service and participant dissatisfaction [20]. This can be an issue for crowd-shipping platforms, because senders compete for carrier capacity not only with each other, but also with carriers’ outside interests, since carriers manage their own schedules and work as long or as little as they wish [21]. In fact, unreliable service has caused many sharing economy-based platforms to fail during the start-up phase [22]. For example, during an eleven-month study of 57 crowd-shipping platforms, 30 had failed, experienced decline, or were acquired by the end of the study [23]. This suggests that, while crowd-shipping platforms might be cost-effective, SME senders might not be able to rely on them for consistent service quality. Indeed, senders often report concerns regarding liability and quality of service, and the importance of a rating system to review possible carriers [24]. Furthermore, it may be difficult for SMEs to find a platform that will meet their specific shipping requirements. Many platforms only offer their services in a specific geographic region or for a specific industry (e.g., restaurants) [18,25], and many of them are start-up SMEs themselves and therefore do not have a wide marketing reach [24]. Even when using large and established crowd-shipping platforms, finding suitable carriers can be challenging, since this relies on the platform’s search algorithms [26].

This raises the question: to what degree can crowd-shipping platforms fulfill the transportation needs of SME senders? Research on crowd-shipping platforms is still sparse [27], and most of it focuses on last-mile peer-to-peer deliveries in urban areas and/or courier services for intra-urban deliveries. There is limited empirical research on the ability of crowd-shipping platforms to meet SMEs senders’ transportation requirements, and while many SME senders require long-haul LTL freight services, research on “freight apps” that provide this type of service is also limited. To address these gaps, this paper describes a case study approach to frame a structured evaluation of the suitability of existing crowd-shipping platforms (including last-mile and long-haul freight) for two small agriculture-based enterprises (agri-SMEs) in Texas that distribute their products regionally. First, a systematic search for existing online transportation platforms was performed, and the resulting platforms were screened to retain only those that allows senders to connect directly with independent carriers (i.e., crowd-shipping platforms). Next, the transportation requirements of the two case study agri-SMEs were elicited via interviews. Based on these requirements, quotes were requested from the shortlisted platforms to determine the degree to whicfh their services would meet the agri-SMEs’ requirements. Finally, the three platforms that best met each agri-SME’s requirements were identified, and the agri-SMEs were asked to request quotes from those platforms based on their delivery requirements and then provide feedback. The results of this research are summarized, and the implications of these results for SMEs are discussed.

2. Background: The Sharing Economy and Crowd-Shipping

Crowd-shipping platforms, in which people providing delivery services are matched with people who need to ship items via an electronic marketplace, are part of the sharing economy. The sharing economy consists of for-profit companies that use software platforms and apps, as well as crowdsourced ratings and reputational data, to coordinate exchanges between parties [28]. The software platform acts as a middleman/broker for these exchanges. The idea is that individual crowd members have financial, intellectual, and material assets and resources that can be redistributed, shared, and reused to perform services rapidly and inexpensively for mutual economic advantage of all participants [23,29]. Well-known examples of sharing economy-based platforms include Uber and Airbnb, which use their platforms to directly connect individuals or businesses offering to share their services and/or resources with individuals who have demand for these services/resources. By contrast, businesses like Zipcar, a car sharing company, are not considered part of the sharing economy because they acquire and manage the shared resource (i.e., the cars), making their operations very similar to conventional businesses [28].

Research on the sharing economy indicates that users participate for a variety of reasons. Platforms offer service providers economic opportunity, allowing them to earn money in ways that were not previously safely or easily available [30]. Convenience and immediacy are two other key advantages of sharing economy-based platforms, with information and communication technology (ICT) making information (e.g., demand, available capacity) more visible to participants [20]. Another advantage is scale: a large pool of participants and high transaction volumes increase the likelihood that providers’ resources and availability and consumers’ demands will be satisfactorily matched [31].

For consumers, however, the primary advantage of using sharing economy-based platforms is the provision of services that are lower cost than market alternatives. This is achievable because the service providers’ costs are lower than conventional businesses’ (e.g., Uber vs. taxi), and the platforms’ fees are also lower than traditional agencies’ (e.g., concierge services) [30]. Platforms can charge lower fees by eliminating the need for centralized intermediaries and directly connecting service providers with consumers. This allows for the reallocation of wealth away from middlemen and toward providers and consumers [32]. Removing brokers (i.e., disintermediation) is facilitated by digital trust building, in which platforms reduce users’ risk of working with anonymous participants through ratings and platform reputation. By being connected to a large and well-known platform’s brand, small-scale providers can take advantage of the trust built up previously by many other users over time [33].

As part of the sharing economy, crowd-shipping platforms thus have the potential to be convenient and cost-effective for senders by connecting them directly to independent carriers. Crowd-shipping (or crowd logistics) has been defined as “an information connectivity enabled marketplace concept that matches supply and demand for logistics services with an undefined and external crowd that has free capacity with regard to time and/or space, participates on a voluntary basis and is compensated accordingly” [29]. With crowd-shipping, this free capacity takes the form of idle or underutilized vehicles owned by members of the carrier crowd, which can be used to perform delivery services. The carrier crowd may include private individuals, independent contractors, or platform employees but often consists of casual carriers using personal vehicles that may not be fully dedicated to logistics activities. By leveraging the crowd’s excess resource capacity, senders gain temporary access to asset ownership benefits at a reduced cost and receive service that is faster and more efficient, effective, and reliable than conventional delivery and courier companies [21]. Thus, crowd-shipping promotes load consolidation, which can reduce the number of vehicles on the road, thereby reducing congestion and greenhouse gas emissions [34]. From a social sustainability aspect, crowd-shipping gives carriers the freedom to provide service any time they want and for as long as they want, giving them access to flexible earnings.

Crowd-shipping platforms that connect senders and carriers tend to be set up for one of two general purposes: last-mile delivery to homes and businesses, and long-haul LTL freight. Existing crowd-shipping services are primarily used for local business-to-consumer deliveries [35] and are popular for same-day or next-day deliveries (e.g., DoorDash). With a large pool of available carriers in urban areas, the likelihood of finding a carrier to make a delivery is high [17]. However, there are also online delivery platforms for long-haul freight (i.e., “freight apps” or “digital freight brokers”), which typically provide spot-market less-than-truckload (LTL) transportation services. These platforms tend to work with professional carriers to improve the utilization and fuel efficiency of commercial vehicles (e.g., by filling empty backhauls) [36]. They connect senders, recipients, and carriers via load matching algorithms that efficiently allocate senders’ delivery requests to carriers, based on their locations, equipment, and qualifications. Once the sender and carrier are matched, the platform may also provide other useful services, such as route planning, real-time shipment tracking and proof of delivery, billing and payment processing, and insurance to replace or repair items damaged in transit [20,23]. The availability of smartphones has enabled the creation of such platforms to directly connect senders and carriers, without the need for a human broker/intermediary, allowing them to charge lower fees for these services and operate more efficiently than traditional freight brokers [20]. Although many traditional freight brokers have begun offering apps that facilitate communication and digital document storage, digital freight platforms are differentiated by their focus on full-service, fully automated platforms that minimize or eliminate third-party interaction [37,38,39].

3. Research Gap and Contribution

Research on crowd-shipping platforms has been primarily document-based, i.e., examining the platforms’ websites and mobile apps, as well as relevant online media coverage (e.g., [23]). Some of these studies have sought to gain a broader understanding of how/why platforms succeed or fail; for example, [40] used information from platform websites to develop a framework for classifying platforms according to their business models, with an aim to determine keys to success. In addition to collecting data from platform websites, [17] interviewed platform managers and executives to examine the practices and business models that tend to yield success. However, acquiring the kinds of detailed data on a platform’s performance that a sender would need to evaluate its strengths and shortcomings, such as platform responsiveness and quotes for service, is difficult via document-based approaches alone. Furthermore, it is easy for a platform to claim on its website that it offers specific services, but it is difficult to verify such claims without actually using the app.

In addition, while behavioral studies have been performed to assess carriers’ willingness to participate in crowd-shipping work [41,42,43], there is very little empirical research that studies crowd-shipping platforms from a sender’s point of view. A study conducted by [44] suggests that senders’ participation is primarily influenced by delivery cost, shipment duration, control over delivery conditions, driver training, and past experiences, and the significance of each of these attributes varies based on shipment distance. However, the degree to which existing crowd-shipping platforms meet these needs has not been rigorously explored.

This research seeks to build on and extend the existing document-based research on crowd-shipping platforms to determine the degree to which they can provide suitable and scale-appropriate delivery solutions for SME senders. The focus of this work is on platforms that leverage independent carriers’ underutilized vehicle capacity to provide value. To accomplish this, a systematic search was performed to find existing commercial crowd-shipping platforms that directly connect senders and carriers. The resulting platforms were then evaluated for suitability by using the platform apps to request quotes for service, based on typical shipping requirements of the two case study agri-SMEs. To the best of our knowledge, this is the first study in which crowd-shipping platforms are evaluated from a sender’s perspective via this type of experiential approach. Findings from this study were synthesized with respect to platforms’ responsiveness and their ability to meet senders’ shipping and pricing requirements.

4. Case Study Description

To examine the potential of crowd-shipping platforms to provide cost-effective last-mile and long-haul transportation for SMEs, a case study focusing on two agri-SMEs in Texas was used. The two agri-SMEs were selected based on their shipping requirements: one requiring last-mile home deliveries and the other seeking long-haul transport. Each of these SMEs is part of a regional food supply chain (RFSC), in which food producers and consumers are co-located within the same geographic region. RFSC market channels are often direct-to-consumer (e.g., in-person and online farmers’ markets) but may also be intermediated by a distributor and/or retailer. RFSCs provide many economic, environmental, and social benefits to the communities in which they are embedded, including fresh and healthy food for consumers, as well as livable incomes for small and mid-sized producers (which account for 96% of U.S. farms) and support for rural economies [45,46].

As with many SMEs, logistics is a challenge for the agri-SMEs within RFSCs. Many of them perform their own deliveries using personal vehicles, but as their businesses grow and they increase their sales volumes and the size of their distribution regions, they typically must outsource transportation. Finding services that meet their needs is challenging, because they are shipping small volumes of products that require special handling (e.g., temperature control) from rural locations to urban buyers. Traditional parcel service is expensive, particularly for shipping perishable food items, and freight hauling services are typically designed for large-scale operations (e.g., shipping full truckloads). The two agri-SMEs (hereafter referred as SME1 and SME2) in this case study exemplify these challenges.

SME1 is located in Lucas, Texas, northeast of the city of Dallas. The SME produces microgreens and serves as a food hub (i.e., regional aggregator and distributor) for 60 other small-scale farmers in the North Texas region. This SME distributes products to 35 Dallas-area restaurants and offers home delivery service to 65 local customers using two refrigerated vans. Although the two vans, driven by SME1 employees, have sufficient capacity to make the current weekly restaurant deliveries, the demand for home delivery service has recently grown rapidly, and their delivery capacity is reaching its limit. Instead of investing in additional logistics infrastructure, SME1 has experimented with outsourcing home deliveries using crowd-based online delivery platforms. While they were able to find a service that charged an affordable fee (i.e., less than double their current delivery cost), a test run with the service indicated that the delivery drivers were unprofessional and lacked experience in handling perishable food. The service was also unable to return SME1’s reusable insulated tote bags and struggled to deliver products within specified time windows.

SME2 is in Weslaco, Texas, a city in the Rio Grande Valley. They produce a wide variety of fresh vegetables for local consumers, as well as selling wholesale to customers in Houston, Austin, and San Antonio, which are more than 200 miles away. One of these customers, a grocery chain, backhauls its orders from the Rio Grande Valley to its San Antonio and Austin distribution centers. SME2 has also been able to work with a local shipping company to send products to a food hub in Houston. Shipments to customers in Austin are more challenging: orders are typically small (1–2 pallets), so SME2 uses an LTL broker to arrange transportation. The broker often gives SME2 very short notice on pickup times, forcing them to scramble at the last minute to harvest and pack products for the customer’s order before the truck arrives. SME2 has sufficient production capacity to expand to new markets in Dallas and San Antonio, but they have been unable to find a carrier willing to deliver single pallet loads.

The two agri-SMEs are focused on different market channels—SME1 on home delivery (last-mile deliveries) and SME2 on wholesale (long-haul freight)—but both have struggled to find cost-effective transportation services that offer highly flexible scheduling and are responsive to shippers with small volumes. Faced with these challenges, they both expressed willingness to experiment with using crowd-shipping platforms. The idea was that these platforms might offer more affordable and flexible transportation services by connecting the agri-SMEs to a large crowd of independent carriers with underutilized vehicle capacity. Furthermore, such platforms can provide a measure of driver accountability through online ratings, and the capabilities of individual drivers offering service (e.g., temperature control) can be clearly specified. However, it was unclear whether such platforms would be capable of fulfilling the SMEs’ unique transportation requirements, particularly temperature control.

5. Methodology

To evaluate the potential of crowd-shipping platforms for the two case study SMEs, a study was conducted to review the features and attributes of existing platforms. The study was conducted in three stages. First, a systematic search for available crowd-shipping platforms was performed. The resulting list of platforms was then screened to remove unsuitable platforms (e.g., no longer operational, did not actually provide transportation services). The remaining shortlisted platforms were then used to request quotes for shipping services that reflected the requirements of the case study SMEs, and the outcomes of these requests were summarized and evaluated.

5.1. Preliminary Search for Crowd-Shipping Platforms

The search for existing crowd-shipping platforms included peer-reviewed journal articles from scholarly databases, as well as relevant logistics trade publications found online. To the best of our knowledge, the paper by [23] is the first peer-reviewed journal article to perform a comprehensive exploration of existing crowd-logistics applications, providing a review of 57 crowd-logistics-based mobile applications and web-based platforms. Forward citation of this article revealed three more recent articles reviewing crowd-logistics-based applications. [47] developed a design tool for crowd-logistics platform developers and applied this tool to 69 crowd-logistics applications. [24] reviewed 45 crowd-shipping-based platforms from the perspectives of supply, demand, and operations management. [40] proposed a framework for classifying different crowd-shipping platform features and applied the framework to 105 platforms to determine best practices for crowd-shipping organizations.

In addition to the peer-reviewed literature, platforms were found via an online search of relevant logistics and transportation trade publications. Multiple keywords were used to perform the search, including “crowd logistics,” “crowd-shipping”, “transportation applications,” and “transportation platforms”. This search yielded three sources. Culterra Capital, an advisory firm focused on tech-driven innovation in food systems, published a list of organizations that provide supply chain technology solutions for the food industry [48]. Of the 449 total organizations on their list, 63 were identified as providing transportation-related services. CB Insight, an organization that analyzes online platforms, identified 129 companies offering logistics-supporting technologies, including 31 transportation platforms [49]. Logistics IQ, a research and advisory organization that focuses on the supply chain and logistics sector, published their list of “Top 500” logistics companies, which included 28 transportation-focused platforms [50].

A summary of the number of crowd-shipping platforms identified from each source is given in Table 1, with 276 derived from scholarly articles and 122 from online publications. An additional two platforms were identified through conversations with the case study SMEs, for a total of 400 platforms.

Table 1.

Sources of online transportation platforms.

5.2. Shortlisting Process

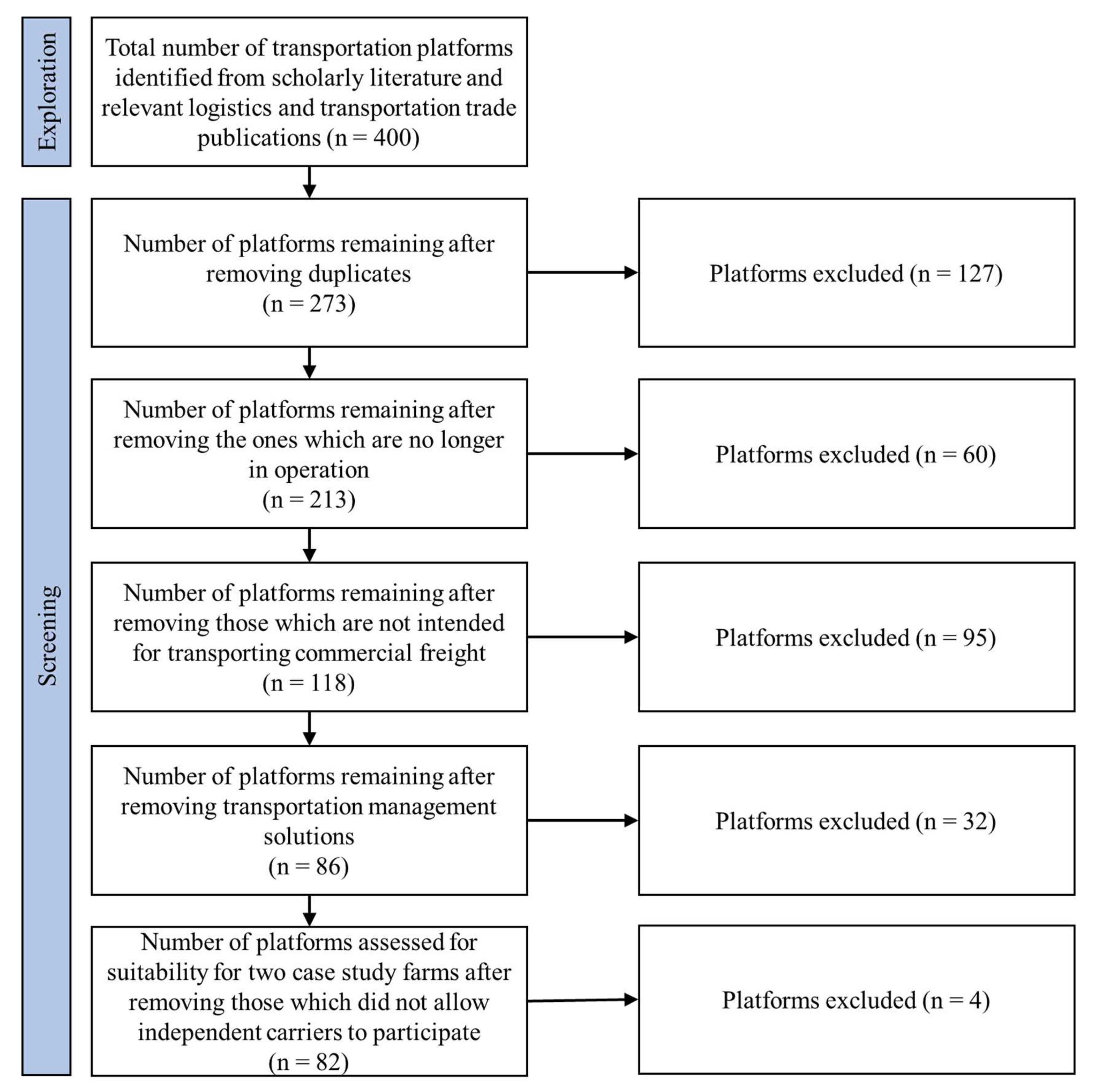

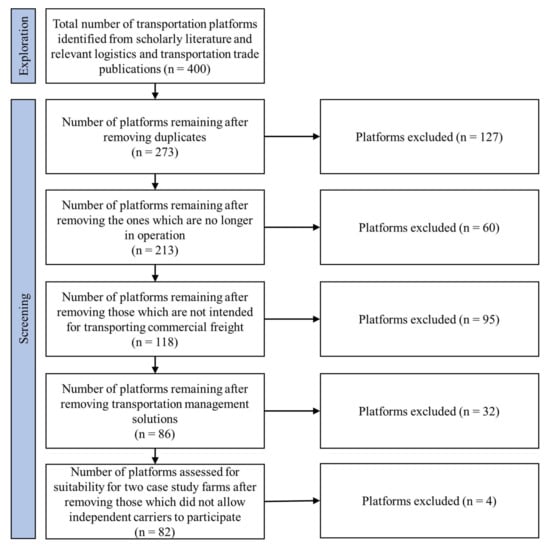

The master list of 400 transportation platforms was evaluated via an iterative process to find platforms that would meet the requirements of the case study SMEs. In the first round of review, 127 platforms were removed from the list because they were repeated instances across multiple sources. Sixty platforms that were no longer operating were then identified and removed from the list. Ninety-five platforms were further removed which were not intended for transporting commercial freight but rather focused on services such as ridesharing, restaurant and grocery delivery, moving services, and services connecting people who are looking for items with travelers who can acquire those items, among others.

The remaining 118 platforms were evaluated to determine whether their services were intended to leverage the underutilized vehicle capacity of independent carriers, i.e., whether they fell within the purview of crowd-shipping. Such platforms seemed to have the greatest potential of being sufficiently affordable and flexible to meet the needs of the case study SMEs. Thirty-two platforms were determined to be Transportation Management Software (TMS) solutions, which are platforms that offer a suite of services that help senders aggregate and manage shipments across multiple carriers. Although they allow senders to search for and connect with carriers, TMS platforms do not serve as intermediaries for brokering shipments; therefore, they were excluded from further evaluation. The 86 remaining platforms were then classified based on whether independent carriers could participate. Four platforms were identified as operating their own fleets and disallowing independent carriers outside their organization from participating (e.g., UPS and FedEx); these platforms were removed from the list. In some cases, the platform organization operates its own fleet but also allows independent carriers to offer their services via the platform. These platforms, as well as platforms working strictly with independent carriers, comprised the remaining 82 platforms. The iterative approach taken to shortlist the platforms to those most relevant to this study is summarized in Figure 1.

Figure 1.

Flowchart depicting the shortlisting process.

5.3. Request for Quotes Process

The shortlisting process described above was based on the information available on platform websites. However, assessing the suitability of the 82 shortlisted crowd-shipping platforms for the two case study SMEs would require case-based testing. As a first step, quotes were requested from all 82 shortlisted platforms for both home deliveries and wholesale shipments, based on typical requirements for SME1 (home deliveries/last mile delivery) and SME2 (wholesale/long-haul freight), which are summarized in Table 2 below. Platform feasibility was then evaluated based on the degree to which the resulting quote provided by the platform could satisfy the requirements.

Table 2.

Shipment requirements for the two case study SMEs.

Online quote request forms were completed for each platform based on the shipment requirements in Table 2, specifying a lead time of three days. The same delivery day was requested for all platforms. For home delivery quote requests, if a platform offered multiple delivery stops on a single route, then a quote for five deliveries was requested, with each drop-off location chosen as a separate address within a 30-mile radius. If a given platform did not offer multiple delivery stops, then a quote was requested for a single package delivered to a single home address. For wholesale shipments, if a platform did not explicitly offer temperature control, the quote was requested anyway, with failure to meet this specific requirement noted.

Thirty-seven platforms were operational only outside the U.S., and twenty-four of the U.S.-based platforms did not offer service in Texas. However, these platforms were included in the quote evaluation process, since their responses could still potentially provide useful information about the degree to which existing crowd-shipping platforms can serve agri-SMEs. For these platforms, addresses within their area of operation were generated and assigned as origin and destination points based on the distances stated in the shipping requirements (i.e., 30 miles for home deliveries and 120 miles for wholesale shipments).

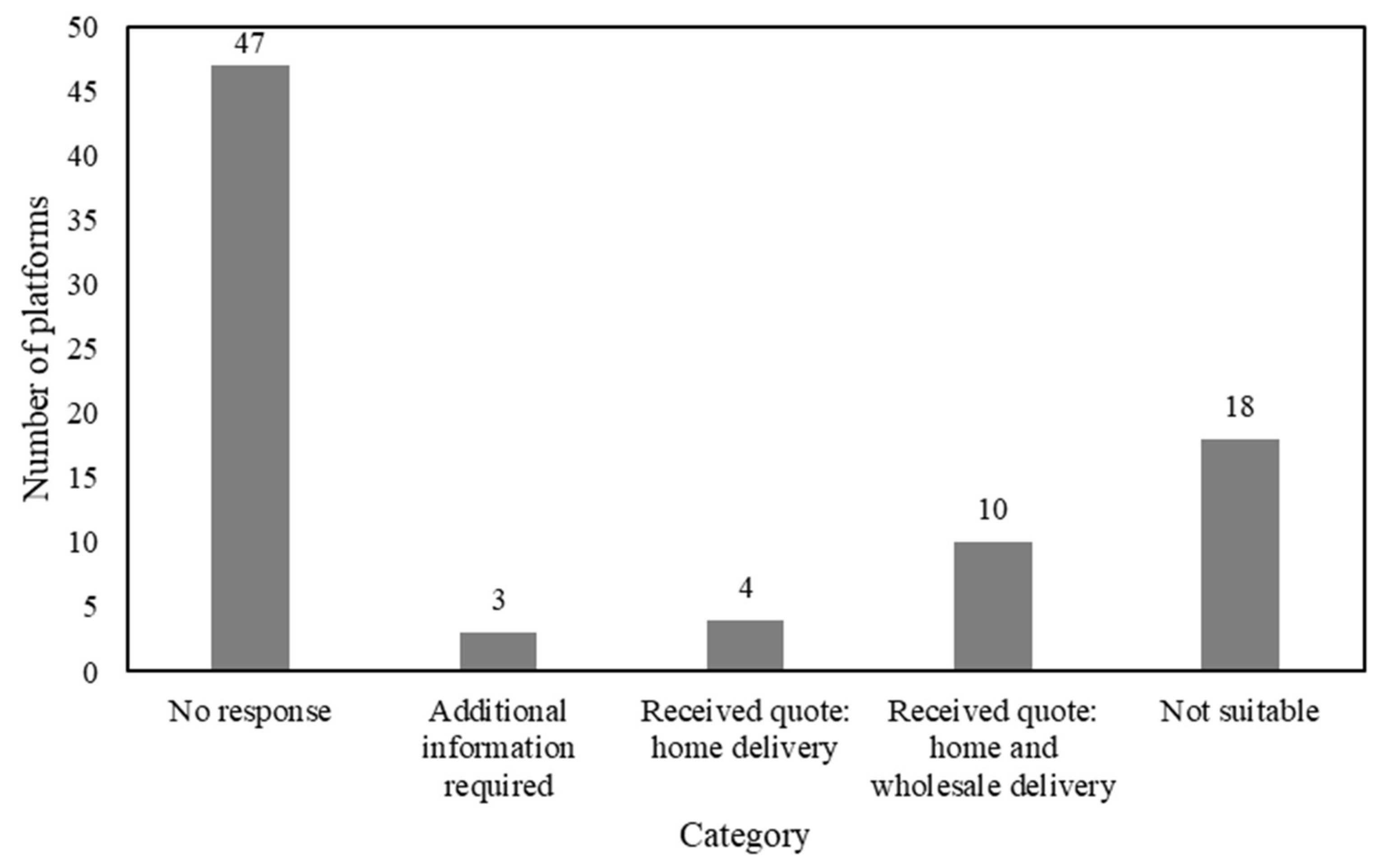

Each platform’s response to these initial quote requests was then assigned to one of the categories described in Table 3. Home delivery quotes were received from total of 13 platforms, while wholesale delivery quotes were received from 10 platforms. Five platforms required a follow-up call and seven required additional information to be able to provide a quote. Forty-five platforms, including all 37 operating outside the U.S., did not respond to the initial quote request. Twelve platforms were categorized as “not suitable”, as they did not meet the shipping requirements of the case study SMEs.

Table 3.

Categories of platform responses for delivery quotes.

Next, follow-up emails were sent to the 37 platforms that were not operating in the U.S., with a repeated request for quotes. None responded, and no further attempts were made to contact them. Follow-up emails were also sent to the eight U.S.-based platforms in the “no response” category. Four of them did not respond, one requested additional information (required payment authorization before quoting), and the responses received from the remaining three platforms indicated that they were not suitable for the case study SMEs shipments because they offered only full-truckload services or would not accept fresh produce.

The seven platforms that required additional information were then contacted via email. These platforms were seeking detailed shipment specifications, scheduling for a specific date, account registration, or payment enrollment. Only one of these platforms provided a quote for home delivery shipments; four did not respond, and the remaining two required further information. Of the two platforms that still required further information, one required an actual booking to be scheduled in order to receive the quote, and the other provided service in only some areas of the Twin Cities and wanted specific information about the shipping destination to be able to provide a quote.

The five platforms that required a call were first contacted via email to schedule a call and establish a point of contact. One of these platforms never responded. Phone conversations with personnel from the other four platforms revealed that two platforms provided only full-truckload service (therefore, categorized as “not suitable”), one platform was operating primarily in Canada and did not provide a quote after a follow-up (categorized as “no response”), and one platform could not guarantee temperature-controlled conditions at loading and unloading sites to ensure that high quality of perishable items was maintained (categorized as “not suitable”). This step completed the quotes request process.

6. Results

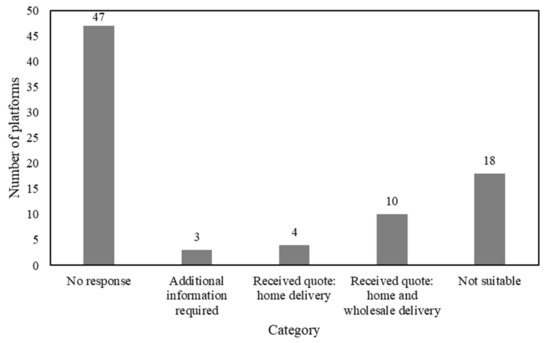

The final categorization of all 82 shortlisted crowd-shipping platforms is given in Figure 2. In the end, fourteen platforms provided quotes for home deliveries with only four of these offering multiple delivery stops, an essential delivery requirement for SME1.

Figure 2.

Final categorization of 82 platforms after multiple rounds of requesting quotes.

Of the ten quotes received for wholesale shipments, none explicitly offered the option to require refrigerated vehicles, although three platforms allowed senders to note/request refrigeration while in transit (with no guarantee that the request would be granted). Table 4 gives the names of the platforms that provided quotes and the corresponding lowest quoted prices for delivering to a single home address, five delivery stops (for the four platforms that provided multi-stop quotes), and wholesale shipments, respectively.

Table 4.

Platforms and the corresponding quotes received for home delivery and wholesale shipments.

To further evaluate the suitability of the crowd-shipping platforms with respect to the transportation needs of the two case study SMEs, SME1 and SME2 were each asked to request quotes from three platforms that had been identified as being most likely to meet their delivery requirements and then provide feedback. If a particular platform did not offer delivery service in their region of operation, they were asked to use the same addresses that had been used to generate quotes, as described above.

Feedback was taken from SME1 on three of the four apps that had provided quotes for multiple delivery stops for home delivery (Roadie, PigeonShip, and GoShare). The quotes from all three of these platforms were significantly higher than the amount that SME1 was willing to pay for home deliveries: for five delivery stops, Roadie, PigeonShip, and GoShare quoted $95.00, $46.32, and $139.70, respectively, while SME1 expected to pay $30.00 for five deliveries, based on previous experience with outsourcing deliveries. Furthermore, none of these platforms provided the option to add more than five delivery stops, while SME1 typically required as many as 120 home deliveries to be made on delivery days. Therefore, none of the three platforms was deemed suitable for use by SME1.

Feedback was sought from SME2 on the three platforms that allowed temperature control to be requested when requesting a quote for long-haul shipments (i.e., GoShare, CH Robinson, and Kuebix). SME2 was able to get quotes from GoShare and Kuebix, but CH Robinson did not provide a quote, responding that they did not offer LTL shipping for temperature sensitive items. GoShare’s pricing was 41% more than SME2’s current typical LTL shipment cost ($126.91 for a pallet versus $90), and the Kuebix quote was nearly eight times the expected rate ($750.00 versus $90). However, SME2 did express willingness to try using these three platforms if they could get quotes that guaranteed temperature control at rates that were comparable to their existing LTL service.

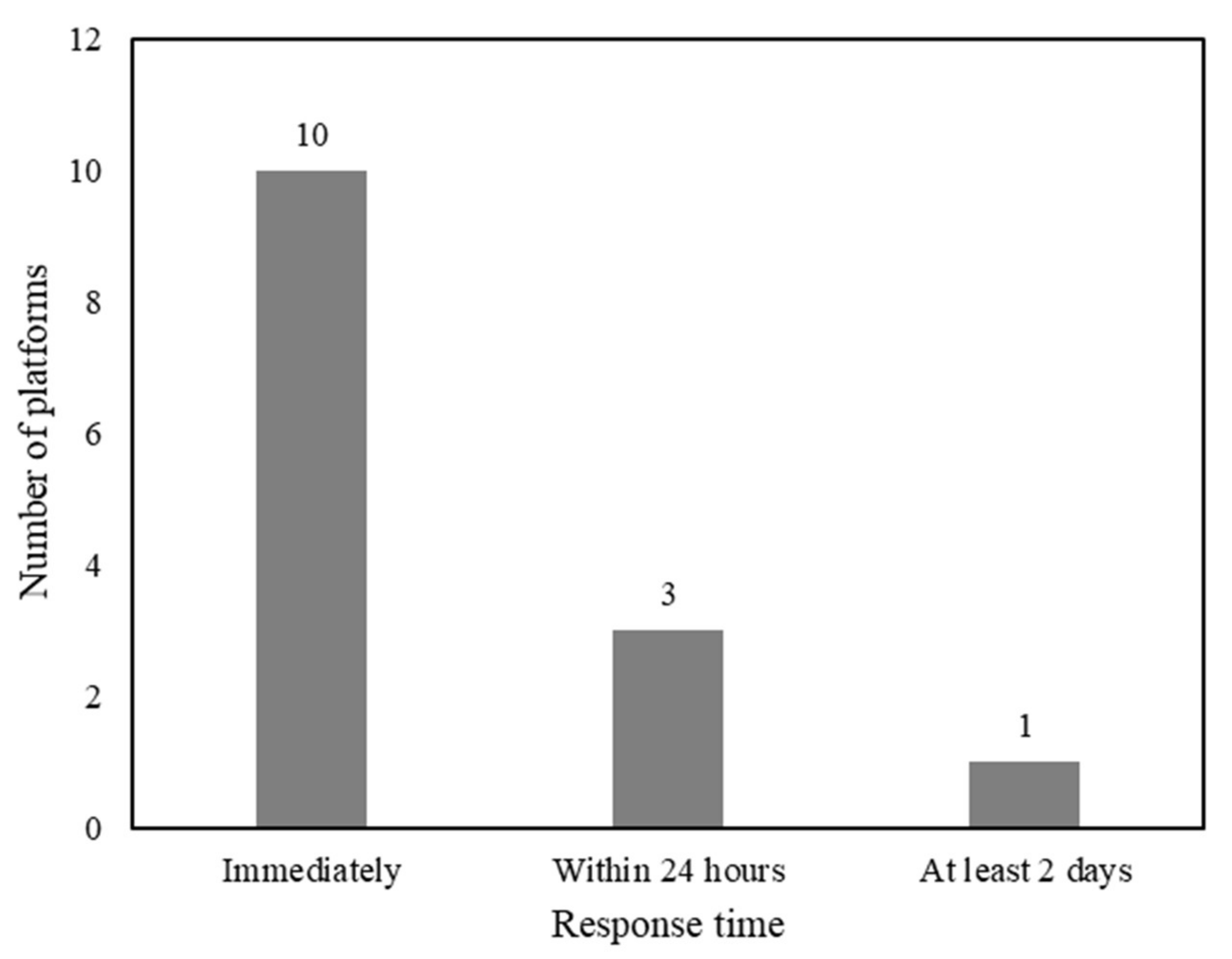

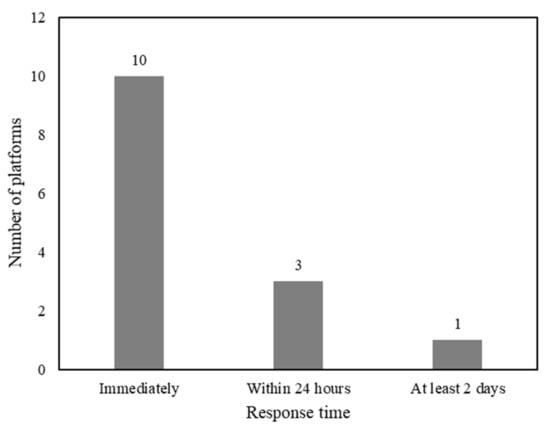

The responsiveness of each platform was also tracked. SME2 had experienced challenges with booking LTL shipments with enough lead time to complete harvesting and packing activities. Therefore, a platform’s response time is important in evaluating its suitability for agri-SMEs. As Figure 3 shows, the majority offered an instant quote via an online form. SME2 appreciated the quick responses they received from all three platforms, especially because responsiveness had been an ongoing problem for them with their current LTL broker.

Figure 3.

Platform response time.

Each platform also offered some specific features that SME2 liked. GoShare’s platform allows senders to request a specific pick-up time and a particular type of delivery vehicle for their shipment, as well as providing an option to request assistance with loading and unloading. CH Robinson’s platform allows senders to specify a temperature control range, which is critical for shipping perishable food products, because different products have different temperature requirements during transit (e.g., frozen versus refrigerated). Similarly, Kuebix’s platform allows senders to enter special instructions at the time of booking a shipment. However, none of the platforms met all of SME2’s requirements, and the business owner expressed doubts about crowd-shipping as a suitable avenue for outsourcing deliveries. The business owner commented: “I think small scale farmers have different needs that a general transportation app may not address…the ability to ship smaller loads, collaborate with other farmers to save costs, faster communication”.

7. Discussion

The results of the study described in this paper were disappointing, suggesting that existing crowd-shipping platforms are entirely unsuitable for meeting the delivery requirements of the two agri-SMEs. Only 14 of the 82 shortlisted platforms provided quotes for home delivery and/or wholesale shipment. None of these 14 platforms provided home delivery quotes that met SME1’s expectations for rates (i.e., they were too expensive). While SME2 acknowledged the potential of crowd-shipping, the business owner observed that none of the existing platforms reviewed in this study offered services that were comparable to her existing LTL brokerage service.

Although the results of this specific case study cannot be generalized to all SMEs, they do point to some areas of concern that would likely be common to many small businesses trying to make a series of home deliveries or sending a pallet-load of products to distant customers:

Lack of response: Of the 82 platforms that were issued quote requests, 47 did not respond. Most of these platforms (37) were not based in the U.S.; therefore, their lack of response is likely due to carriers’ unwillingness to provide a quote to an international sender, even for a shipment occurring within the country of the platform—possibly they did not view the request as legitimate, or there may have been concerns about follow-up communication (especially language barriers) or payment. It is not clear why the remaining ten platforms did not respond. This could be attributed to an insufficient number of carriers available to address the service request, or a lack of carriers with vehicles capable of servicing temperature-controlled LTL shipments. It is also possible that these platforms were no longer in business. Regardless of the reasons, it is concerning that such a high percentage (22.2%) of the crowd-shipping platforms operating in the U.S. did not offer any response at all to a request for a quote.

FTL requirement: 7 of the 82 shortlisted platforms responded that their carriers only transported full truckloads, so no quotes were provided. Furthermore, when SME2 requested a quote from C.H. Robinson, they were told explicitly that the platform would not accept requests for LTL shipments requiring temperature control. This could also be a reason that some of the “no response” platforms did not provide a quote—their carriers may have only been interested in transporting full truckloads. This result was somewhat surprising—the websites of the 82 platforms that were issued quote requests had been carefully screened to ensure that they met the requirements of the study, i.e., the platform directly connected independent senders and carriers with the objective of making use of underutilized carrier capacity (i.e., carriers looking to fill their vehicles). Even so, when the platforms were actually used to request quotes, it became clear that these seven platforms were not focused on underutilized capacity for package or LTL shipments. Thus, a large percentage (21.9%) of the platforms that were thought to be suitable platforms did not meet the needs of SMEs seeking to ship packages or LTL pallet-loads. This also indicates that evaluating the capabilities of a crowd-shipping platform based on its website alone (i.e., without actually using their services) can be misleading.

Lack of platform automation: Out of the 37 platforms that provided some kind of response to a quote request, initially 5 required a discovery call and 7 required additional information via email before providing a quote. This indicates that these platforms were not directly connecting senders to carriers without a human intermediary (broker). Again, this was an unexpected result, since the platforms had been shortlisted to include only those that connected independent senders directly with carriers. This finding suggests that, while a platform’s website might suggest that the service is fully automated, there may actually be a broker behind the scenes who is matching senders with a curated set of carriers, i.e., the “platform” is actually just an online version of a traditional LTL brokerage. This result also suggests that it is possible that the other platforms that provided quotes may have relied on a human intermediary who controlled the set of carriers/quotes that were presented to the sender.

Inadequate service capabilities: For SME2, temperature control was a necessary feature—their products are all perishable foods, which is of particular concern in a hot climate. While not all SMEs will require temperature control, it was notable that none of the ten platforms that provided quotes for wholesale shipments explicitly offered the option to request refrigerated vehicles. Reliable and responsive crowd-shipping service (i.e., the ability to get a timely and suitable quote) requires a sufficiently large pool of carriers, and it is likely that there are a limited number of LTL carriers available on any given platform with temperature-controlled vehicles. This suggests that SMEs shipping perishable items will likely be unable to rely on crowd-shipping as a reliable regular delivery service provider. Furthermore, only four of the fourteen platforms providing home delivery quotes were able to quote a multi-stop “milk run” delivery, per SME1’s requirement. Requiring each delivery stop to be quoted as a separate job is likely to be impractical for many SMEs, in terms of pricing (since the rate per delivery should be less for a milk run) and additional complication in requesting and receiving quotes for multiple jobs.

Rates are not competitive: Beyond inadequate service functionality and poor responsiveness, the most problematic issue encountered with the existing crowd-shipping platforms was their quoted rates, which were generally much higher than expected. Few of the ten wholesale delivery quotes met SME2’s expectation ($90.00 for a single pallet), and none of the fourteen home delivery quotes (even those that offered multiple stops) met SME1’s pricing requirement of $6.00 per delivery. PigeonShip came the closest, with a 5-stop quote at $46.32, but this is still $9.27 per delivery, and the platform did not permit more than five stops to be included in the quote request. SME1’s expectations for pricing might have been too rigorous; although they had paid $6.00 per delivery stop with a previous attempt at using a delivery service, they reported that the quality of service was completely inadequate. However, with the exception of the five-stop PigeonShip quote, none of the home delivery quotes was even close to meeting the pricing requirement, with single-stop quotes ranging from around 2.5 to 100 times the expected rate. Since cost-effectiveness is the most important potential advantage of crowd-shipping over traditional delivery services, this finding is particularly disappointing. For platforms that allow independent carriers to bid on a job (rather than automatically generating a price via an algorithm), it is possible that extending the three-day lead time for quotes would have allowed time for more competitive quotes to arrive. However, longer lead times would be infeasible for the case study businesses, which schedule shipments according to harvest dates. In addition, longer wait times for quotes increase the amount of time that the customer waits for a delivery.

In summary, the results of this study indicate that existing crowd-shipping platforms are unlikely to meet the needs of the two case study SMEs. The quotes received from some platforms for long-haul shipments (i.e., from Roadie, Taskrabbit, and C.H. Robinson) were encouraging—these platforms were responsive to the quote requests, and their rates were reasonable—but they were unable to guarantee temperature control in transit, making their services unsuitable for SME2. However, these platforms could potentially be suitable for an SME with shipments that do not require refrigeration. It is also possible that platforms quoting a somewhat-higher-than-expected rate (i.e., PigeonShip and GoShare) could be suitable for SMEs as a backup option to complement their regular LTL service provider, or for making expedited shipments.

Even without the refrigeration requirement, though, the response rate for last-mile delivery quotes was underwhelming. The 14 platforms that provided quotes offered rates that were much higher than expected, particularly given the three-day delivery lead-time that was requested. Furthermore, only PigeonShip, Roadie, GoShare, and Dolly were willing to quote multi-stop deliveries, indicating that most existing crowd-shipping platforms are not set up to ship items from a single origin to multiple local destinations on the same day using the same carrier (i.e., via a milk run). As a result, crowd-shipping services proved to be unsuitable for SME1. Not all SMEs require multi-stop last-mile deliveries, and returning reusable packaging (i.e., SME1’s insulated totes) after deliveries have been completed is not a typical requirement. An SME that is periodically shipping packages to local destinations might be able to take advantage of crowd-shipping, particularly if same-day deliveries are needed. Ten of the reviewed platforms did provide immediate quotes, suggesting that they leverage platform automation for high responsiveness. Nonetheless, if the primary motivation for using a crowd-shipping platform is low-cost last-mile service, this study indicates that existing platforms do not meet this expectation.

Thus, the results of this study suggest that existing crowd-shipping platforms in the U.S. may not be capable of serving as a cost-effective and flexible outbound transportation option for SMEs at the present time. However, these results do point to a significant opportunity for the development of new platforms and improvement of existing platforms. To attract the business of SMEs, four key strategies emerged from this study:

Increased user base: Growing a large pool of carriers with a wide variety of vehicles/capabilities to serve the platform is highly likely to improve responsiveness to service requests (through increased capacity) and reduce cost (through increased competition), although growing a platform is not easy and is not entirely under the platform’s control [52].

Targeted services: The lack of available services for shipments requiring temperature control suggests that there may be sufficient demand for crowd-shipping platforms to focus on niche industries/markets with specific shipping requirements (e.g., fresh produce distribution), and/or focus on the specific needs of SMEs. This is exemplified by the success of restaurant delivery platforms (e.g., DoorDash), which target their services to a very specific type of sender.

Improved outreach: Platforms would benefit from better advertising to target SMEs (as well as other types of customers). More than half of the platforms discovered in the preliminary search (276 of 400) were found via papers published in the scholarly journals, which may not be easily accessible for industry practitioners. Platforms should also provide clearer details on the kinds of services that they actually offer. For example, based on the information provided on its website, it was often very difficult to discern whether a platform offered long-haul LTL shipping, last-mile package deliveries, or both.

Digital matchmaking: Many of the platforms reviewed in this study required senders to either schedule a “discovery call” with a human intermediary or provide additional information before quotes became available. To improve responsiveness, crowd-shipping platforms should be developed that directly connect senders with potential carriers, thereby removing the human middleman entirely, and potentially taking advantage of automated algorithm-based matchmaking.

8. Conclusions

This study extends the existing document-based research on crowd-shipping platforms by taking an experiential approach to evaluate platforms suitability for SMEs. Existing platforms were used to collect and analyze data and information relevant to two SME senders’ requirements and to assess the scope for potential service improvements to better meet the needs of SMEs. SMEs need better and affordable transportation options, especially considering recent increased demand for home delivery. Crowd-shipping, where underutilized vehicle capacity of independent carriers can be leveraged to provide cost-effective deliveries, seems to have significant potential to address SME transportation challenges. However, the results of the case studies described in this paper suggest that crowd-shipping platforms may need to offer more responsive, flexible, and cost-effective services in order to meet the needs of SME shippers.

The case study approach used in this research limits the results from being generalized to all SME senders. Furthermore, the only feedback received from the carriers/platforms was quoted rates for each job—the carriers themselves were not interviewed to gain a better understanding of why there were few bids, or why the quoted rates were unreasonably high. Because this study focused on two agri-SMEs in Texas, it is likely that their specific locations and/or their delivery requirements (i.e., temperature control, multiple stops) made the jobs outside the scope of what most carriers are willing to do. Another possible reason for receiving a low response rate was the lead time: all quote requests specified a three-day lead time for delivery; responsiveness and quoted rates might have been more competitive if platforms/carriers were given more time. An additional limitation of the study was the timeframe in which it was carried out. While carrier availability and rates are likely to change from day to day, in this study quotes were only requested 1–2 times from each platform, which provides a snapshot of platform responses/quotes, rather than a complete picture of the service responsiveness, their price offerings and/or reliability over time. Finally, it is difficult to evaluate service and draw firm conclusions about the capabilities of a crowd-shipping platform based on a quote request alone, without actually accepting any bids and going through the actual pickup and delivery process.

Some of these limitations are currently being addressed as part of ongoing research projects. Focus groups have been conducted with agri-SMEs in Texas to determine their transportation challenges and to assess their views on whether a crowd-shipping platform would help them to outsource their deliveries reliably and affordably. Many respondents liked the concept but believed that the platform would need to be tailored to the specific needs of small-scale agribusiness. To gain a better understanding of how/whether a crowd-shipping platform could be designed to meet these needs, a basic crowd-shipping platform is currently being developed specifically for agri-SMEs, which will be piloted with potential users across Texas. Additionally, individuals who have served as carriers for an existing farm-to-table home delivery service will be interviewed to gain an understanding of what motivates them to participate in the platform and what discourages bids/job acceptance. It is hoped that these behavioral studies, coupled with experiential research on platform usage, will provide a better understanding of how to design, launch, and manage crowd-shipping platforms that help agri-SMEs to overcome their logistics challenges, become more sustainable in their operations, and compete successfully.

Author Contributions

Conceptualization, A.M., A.A.M. and C.C.K.; Methodology, A.M., A.A.M., C.C.K. and N.S.; Formal Analysis, A.M., A.A.M. and N.S.; Writing—Original Draft Preparation, A.M., A.A.M. and C.C.K.; Writing—Review and Editing, C.C.K.and K.J.R.; Visualization, A.M. and A.A.M.; Supervision, C.C.K.; Project Administration, C.C.K.; Funding Acquisition, C.C.K. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by the Southern Sustainable Agriculture Research and Education Program of the United States Department of Agriculture [project number LS19-312].

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data sharing is not applicable to this article as no new data were created or analyzed in this study.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Sobir, R. Micro-, Small and Medium-Sized Enterprises (MSMEs) and Their Role in Achieving the Sustainable Development Goals. 2022. Available online: https://www.google.com.hk/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&ved=2ahUKEwivspa3zev6AhXgplYBHVJNBNgQFnoECBIQAQ&url=https%3A%2F%2Fsustainabledevelopment.un.org%2Fcontent%2Fdocuments%2F26073MSMEs_and_SDGs.pdf&usg=AOvVaw3wEEKbgSzFbtcSFYkNNwXe (accessed on 18 September 2022).

- Teodorina, L. SMEs and SDGs: Challenges and Opportunities. Available online: https://oecd-development-matters.org/2019/04/23/smes-and-sdgs-challenges-and-opportunities/ (accessed on 15 September 2022).

- U.S. SBA Frequently Asked Questions about Small Business. 2020. Available online: https://cdn.advocacy.sba.gov/wp-content/uploads/2020/11/05122043/Small-Business-FAQ-2020.pdf (accessed on 18 September 2022).

- Dey, P.K.; Malesios, C.; Chowdhury, S.; Saha, K.; Budhwar, P.; De, D. Adoption of Circular Economy Practices in Small and Medium-Sized Enterprises: Evidence from Europe. Int. J. Prod. Econ. 2022, 248, 108496. [Google Scholar] [CrossRef]

- Kasiri, N.; Movassaghi, H.; Lamoureux, S. Sustainability Engagement or Not? US SMEs Approach. J. Small Bus. Strategy 2020, 30, 16–32. [Google Scholar]

- Islam, A.K.M.H.; Sarker, M.R.; Hossain, M.I.; Ali, K.; Noor, K.M.A. Challenges of Small- and Medium-Sized Enterprises (SMEs) in Business Growth: A Case of Footwear Industry. J. Oper. Strateg. Plan. 2021, 4, 119–143. [Google Scholar] [CrossRef]

- Schreieck, M.; Pflügler, C.; Dehner, C.; Vaidya, S.; Bönisch, S.; Wiesche, M.; Krcmar, H. A Concept of Crowdsourced Delivery for Small Local Shops. Informatik. 2016. Available online: https://www.google.com.hk/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&ved=2ahUKEwjfqN6Kzev6AhXVh1YBHQeaDuIQFnoECAoQAQ&url=https%3A%2F%2Fcs.emis.de%2FLNI%2FProceedings%2FProceedings259%2F375.pdf&usg=AOvVaw3tWm8fI4ygdnmnsD2VcrCl (accessed on 18 September 2022).

- Establish. Logistics Cost and Service 2020. 2021. Available online: https://www.google.com.hk/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&ved=2ahUKEwjwiMnVzuv6AhVQY94KHeZFD24QFnoECBMQAQ&url=https%3A%2F%2Fwww.establishinc.com%2Fs%2FLogistics-Cost-and-Service-2020-Updated.pdf&usg=AOvVaw0edXKVNtz4IUr7vd2SlpfT (accessed on 18 September 2022).

- Holter, A.R.; Grant, D.B.; Ritchie, J.; Shaw, N. A Framework for Purchasing Transport Services in Small and Medium Size Enterprises. Int. J. Phys. Distrib. Logist. Manag. 2008, 38, 21–38. [Google Scholar] [CrossRef]

- Schaefer, T.; Holcomb, M.; Manrodt, K.B. Will New Tools Fix Our Old Problems. 2018. Available online: https://scg-lm.s3.amazonaws.com/pdfs/2018_lm_annual_trends_transportation_091218d.pdf (accessed on 18 September 2022).

- Cargo Heads Up: Engaging with Small Business Will Never Be the Same Again|B2B Marketing. Available online: https://www.b2bmarketing.net/en/partner-downloads/heads-engaging-small-business-will-never-be-same-again (accessed on 9 August 2022).

- Kearney State of Logistics. Available online: https://www.kearney.com/transportation-travel/2020-state-of-logistics-report (accessed on 9 August 2022).

- Church, D. Top Shipping & Logistics Challenges for Small Businesses|Phase 5. Available online: https://www.phase-5.com/insights/top-logistics-challenges-cited-by-small-businesses-in-2021-phase-5 (accessed on 9 August 2022).

- Mandviwalla, M.; Flanagan, R. Small Business Digital Transformation in the Context of the Pandemic. Eur. J. Inf. Syst. 2021, 30, 359–375. [Google Scholar]

- Hawlitschek, F.; Notheisen, B.; Teubner, T. The Limits of Trust-Free Systems: A Literature Review on Blockchain Technology and Trust in the Sharing Economy. Electron. Commer. Res. Appl. 2018, 29, 50–63. [Google Scholar] [CrossRef]

- Dolan, S. Crowdsourced Delivery Explained: Making Same Day Shipping Cheaper through Local Couriers. Available online: https://www.businessinsider.in/crowdsourced-delivery-explained-making-same-day-shipping-cheaper-through-local-couriers/articleshow/69899105.cms (accessed on 18 September 2022).

- Frehe, V.; Mehmann, J.; Teuteberg, F. Understanding and Assessing Crowd Logistics Business Models–Using Everyday People for Last Mile Delivery. J. Bus. Ind. Mark. 2017, 32, 75–97. [Google Scholar] [CrossRef]

- Rougès, J.-F.; Montreuil, B. Crowdsourcing Delivery: New Interconnected Business Models to Reinvent Delivery. In Proceedings of the 1st International Physical Internet Conference, Quebec City, Canada, 28–30 May 2014; Volume 1, pp. 1–19. [Google Scholar]

- He, B.; Mirchandani, P.; Shen, Q.; Yang, G. How Should Local Brick-and-Mortar Retailers Offer Delivery Service in a Pandemic World? Self-Building Vs. O2O Platform. Transp. Res. Part E Logist. Transp. Rev. 2021, 154, 102457. [Google Scholar]

- Standing, C.; Standing, S.; Biermann, S. The Implications of the Sharing Economy for Transport. Transp. Rev. 2019, 39, 226–242. [Google Scholar]

- Castillo, V.E.; Bell, J.E.; Rose, W.J.; Rodrigues, A.M. Crowdsourcing Last Mile Delivery: Strategic Implications and Future Research Directions. J. Bus. Logist. 2018, 39, 7–25. [Google Scholar]

- Evans, D.S.; Schmalensee, R. Failure to Launch: Critical Mass in Platform Businesses. Rev. Netw. Econ. 2010, 9. Available online: https://dspace.mit.edu/bitstream/handle/1721.1/76685/Schmalensee_Failure%20to%20launch.pdf?sequence=1&isAllowed=y (accessed on 18 September 2022). [CrossRef]

- Carbone, V.; Rouquet, A.; Roussat, C. The Rise of Crowd Logistics: A New Way to Co-Create Logistics Value. J. Bus. Logist. 2017, 38, 238–252. [Google Scholar] [CrossRef]

- Le, T.V.; Stathopoulos, A.; Van Woensel, T.; Ukkusuri, S.V. Supply, Demand, Operations, and Management of Crowd-Shipping Services: A Review and Empirical Evidence. Transp. Res. Part C: Emerg. Technol. 2019, 103, 83–103. [Google Scholar] [CrossRef]

- Ermagun, A.; Stathopoulos, A. Crowd-Shipping Delivery Performance from Bidding to Delivering. Res. Transp. Bus. Manag. 2021, 41, 100614. [Google Scholar] [CrossRef]

- Göldi, A. A Blind Spot for the Dark Side: The Monopolies We Didn’t See Coming. Electron. Mark. 2020, 30, 55–56. [Google Scholar] [CrossRef]

- Carbone, V.; Rouquet, A.; Roussat, C. Guest Editorial. Int. J. Phys. Distrib. Logist. Manag. 2021, 51, 449–459. [Google Scholar] [CrossRef]

- Schor, J.B. Does the Sharing Economy Increase Inequality within the Eighty Percent? Findings from a Qualitative Study of Platform Providers. Camb. J. Reg. Econ. Soc. 2017, 10, 263–279. [Google Scholar]

- Buldeo Rai, H.; Verlinde, S.; Merckx, J.; Macharis, C. Crowd Logistics: An Opportunity for More Sustainable Urban Freight Transport? Eur. Transp. Res. Rev. 2017, 9, 1–13. [Google Scholar] [CrossRef]

- Schor, J. Debating the Sharing Economy. J. Self-Gov. Manag. Econ. 2016, 4, 7–22. [Google Scholar]

- Wirtz, J.; So, K.K.F.; Mody, M.A.; Liu, S.Q.; Chun, H.H. Platforms in the Peer-to-Peer Sharing Economy. J. Serv. Manag. 2019, 30, 452–483. [Google Scholar] [CrossRef]

- Berti, G.; Mulligan, C.; Yap, H. DiGital Food Hubs as Disruptive Business Models Based on Coopetition and “Shared Value” for Sustainability in the Agri-Food Sector. In Global Opportunities for Entrepreneurial Growth: Coopetition and Knowledge Dynamics within and across Firms; Emerald Publishing Limited: Bingley, UK, 2017; Available online: https://www.emerald.com/insight/content/doi/10.1108/978-1-78714-501-620171023/full/html (accessed on 18 September 2022).

- Sundararajan, A. The Sharing Economy: The End of Employment and the Rise of Crowd-Based Capitalism; The MIT Press: Cambridge, MA, USA, 2016; ISBN 978-0-262-03457-9. [Google Scholar]

- Sivikhina, A. The Impact of Sustainability on Performance of Finnish and Swedish Crowd-Shipping Companies. 2021. Available online: https://www.theseus.fi/handle/10024/497419b (accessed on 18 September 2022).

- Sampaio, A.; Savelsbergh, M.; Veelenturf, L.; Van Woensel, T. Crowd-Based City Logistics. In Sustainable Transportation and Smart Logistics; Elsevier: Amsterdam, The Netherlands, 2019; pp. 381–400. [Google Scholar]

- Dehoney, C. Commentary: What Is a Digital Broker?—FreightWaves. Available online: https://www.freightwaves.com/news/commentary-what-is-a-digital-broker (accessed on 9 August 2022).

- Armstrong & Associated, Inc. DIGITAL FREIGHT MATCHING: Capturing Technology-Based Efficiencies in the Trucking Industry; Armstrong & Associated, Inc.: Milwaukee, WI, USA, 2018. [Google Scholar]

- Baron, R.; Zintel, M.; Zieris, M.; Mikulla, D. Digital Platforms in Freight Transportation: A True Industry Disruptor? 2017. Available online: https://www.adlittle.com/en/insights/viewpoints/digital-platforms-freight-transportation (accessed on 18 September 2022).

- Wadewitz, T.; Johnson, A.; Triano, M.U.S. Truck Brokerage: Will CHRW Get “Uber-Ed”? UBS Evidence Lab Analysis + Industry Contacts Suggest They Will Not. 2018. Available online: https://inmotionglobal.com/assets/Press%20Releases/UBS%20Report%20-%20CHRW,%20Uber%20Freight%20and%20the%20state%20of%20logistics%20digitization.%20June%202018..pdf (accessed on 18 September 2022).

- Ciobotaru, G.; Chankov, S. Towards a Taxonomy of Crowdsourced Delivery Business Models. Int. J. Phys. Distrib. Logist. Manag. 2021, 51, 460–485. [Google Scholar] [CrossRef]

- Devari, A.; Nikolaev, A.G.; He, Q. Crowdsourcing the Last Mile Delivery of Online Orders by Exploiting the Social Networks of Retail Store Customers. Transp. Res. Part E Logist. Transp. Rev. 2017, 105, 105–122. [Google Scholar] [CrossRef]

- Le, T.V.; Ukkusuri, S.V. Modeling the Willingness to Work as Crowd-Shippers and Travel Time Tolerance in Emerging Logistics Services. Travel Behav. Soc. 2019, 15, 123–132. [Google Scholar] [CrossRef]

- Miller, J.; Nie, Y.; Stathopoulos, A. Crowdsourced Urban Package Delivery: Modeling Traveler Willingness to Work as Crowdshippers. Transp. Res. Rec. 2017, 2610, 67–75. [Google Scholar] [CrossRef]

- Punel, A.; Stathopoulos, A. Modeling the Acceptability of Crowdsourced Goods Deliveries: Role of Context and Experience Effects. Transp. Res. Part E Logist. Transp. Rev. 2017, 105, 18–38. [Google Scholar] [CrossRef]

- MacDonald, J.M.; Hoppe, R.A. USDA ERS—Large Family Farms Continue to Dominate U.S. Agricultural Production. Available online: https://www.ers.usda.gov/amber-waves/2017/march/large-family-farms-continue-to-dominate-us-agricultural-production/ (accessed on 15 September 2022).

- Mittal, A.; Krejci, C.C.; Craven, T.J. Logistics Best Practices for Regional Food Systems: A Review. Sustainability 2018, 10, 168. [Google Scholar] [CrossRef]

- Rześny-Cieplińska, J.; Szmelter-Jarosz, A. Assessment of the Crowd Logistics Solutions—The Stakeholders’ Analysis Approach. Sustainability 2019, 11, 5361. [Google Scholar] [CrossRef]

- Day, S.; Rosenheim, B. Delivering the Goods: Food Supply Chain Tech Market Map & Predictions for 2021. Available online: https://agfundernews.com/delivering-the-goods-food-supply-chain-tech-market-map-predictions-for-2021 (accessed on 11 August 2022).

- CBINSIGHTS From Tracking Food To Last-Mile Delivery, 125+ Startups Disrupting The Supply Chain & Logistics Industry. Available online: https://www.cbinsights.com/research/digitizing-supply-chain-logistics-market-map/ (accessed on 11 August 2022).

- Logistics IQ Next Generation Supply Chain Market—More than $100B Opportunity. Available online: https://www.thelogisticsiq.com/research/next-gen-supply-chain-market/ (accessed on 11 August 2022).

- CAF Worldwide What Is Freight Class & How Do You Determine Yours? Available online: https://www.cafworldwide.com/blog/what-is-freight-class-and-how-do-you-determine-yours (accessed on 11 August 2022).

- Mittal, A.; Gibson, N.O.; Krejci, C.C.; Marusak, A.A. Crowd-Shipping for Urban Food Rescue Logistics. Int. J. Phys. Distrib. Logist. Manag. 2021, 51, 486–507. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).