The Race to Zero Emissions in MINT Economies: Can Economic Growth, Renewable Energy and Disintegrated Trade Be the Path to Carbon Neutrality?

Abstract

:1. Introduction

2. Literature Review

2.1. Synopsis of Studies between Environmental Quality and Financial Development, and Renewable Energy

2.2. Synopsis of Studies between Environmental Quality and Exports and Imports

3. Data and Methodology

3.1. Data

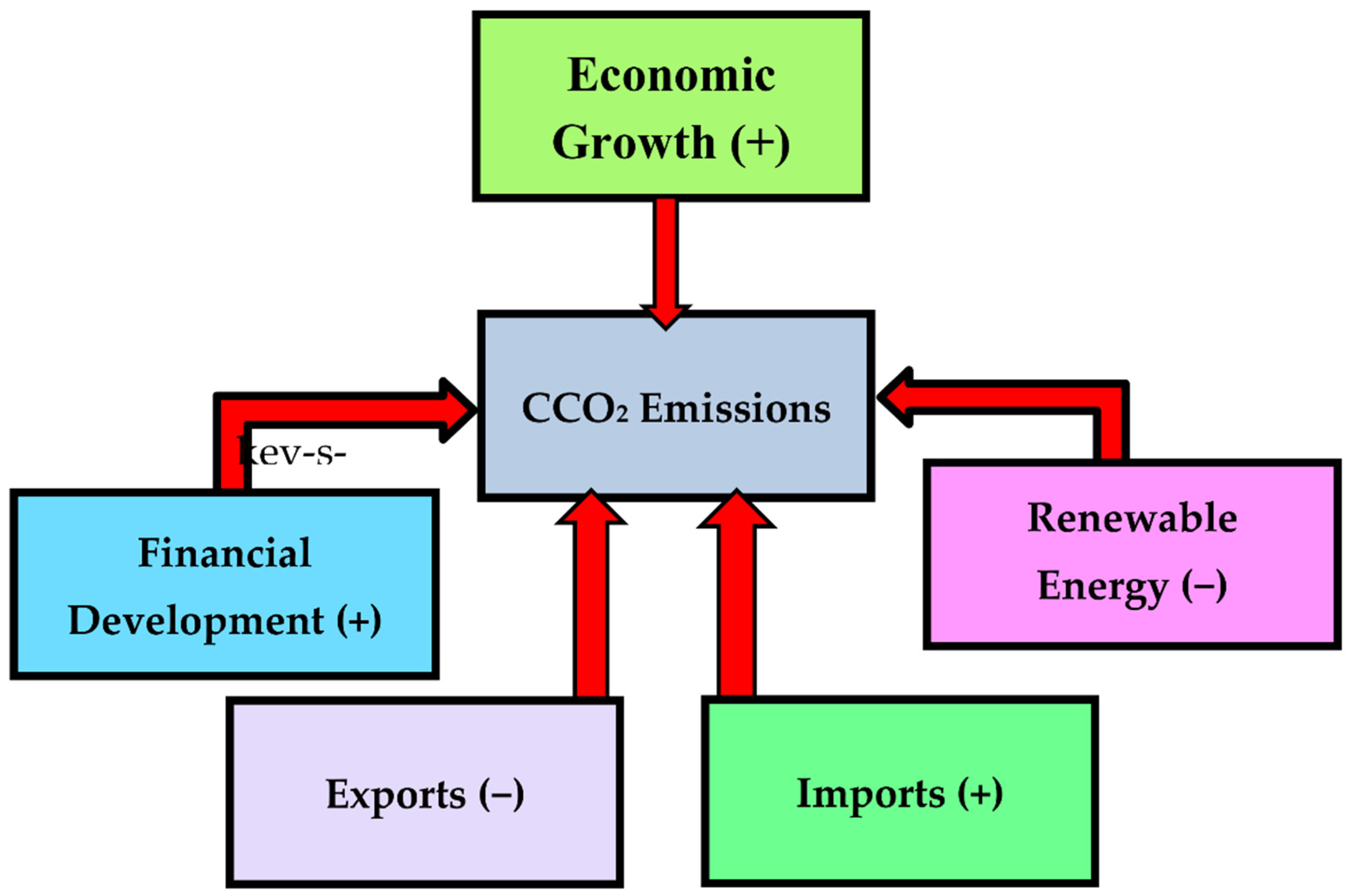

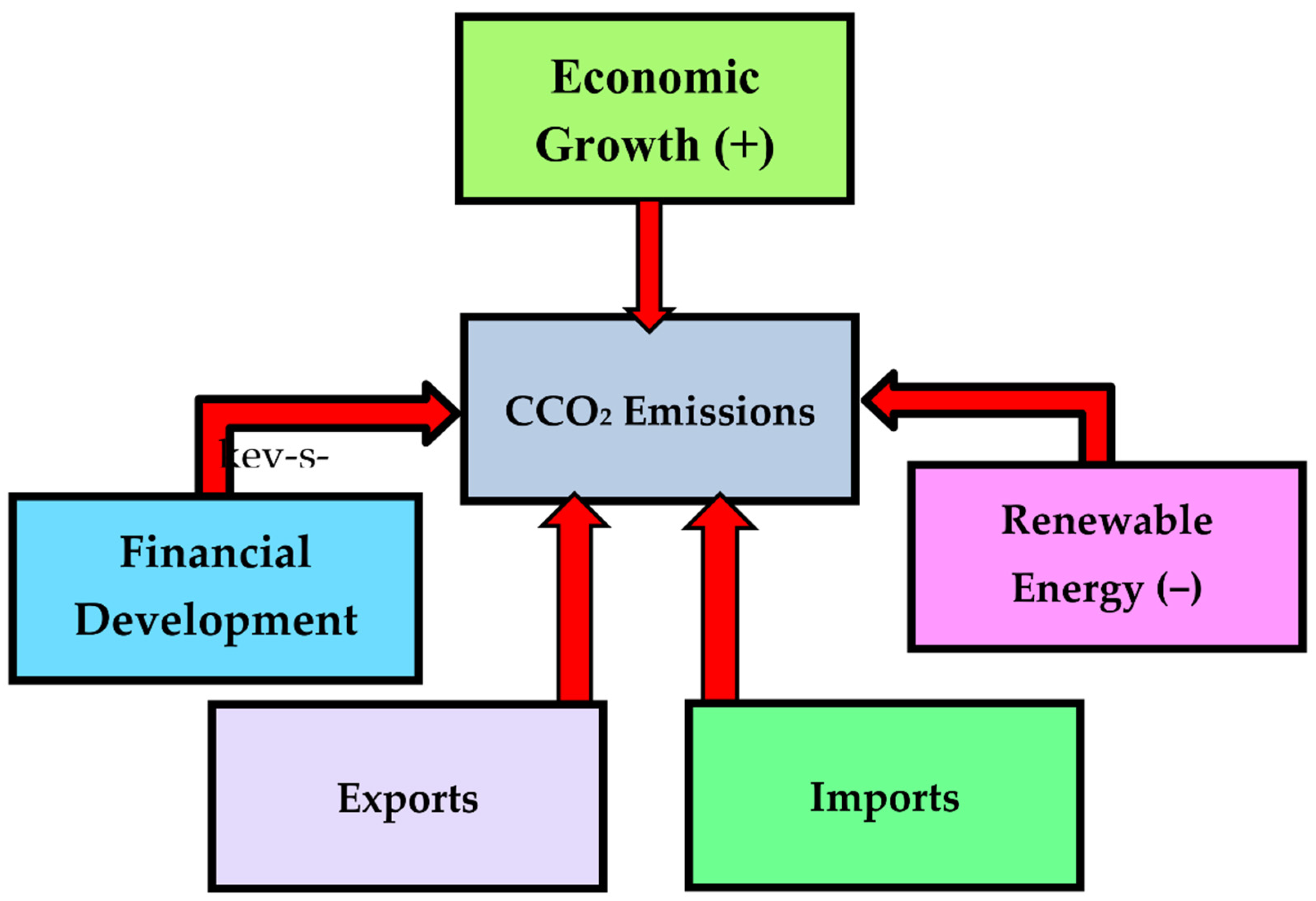

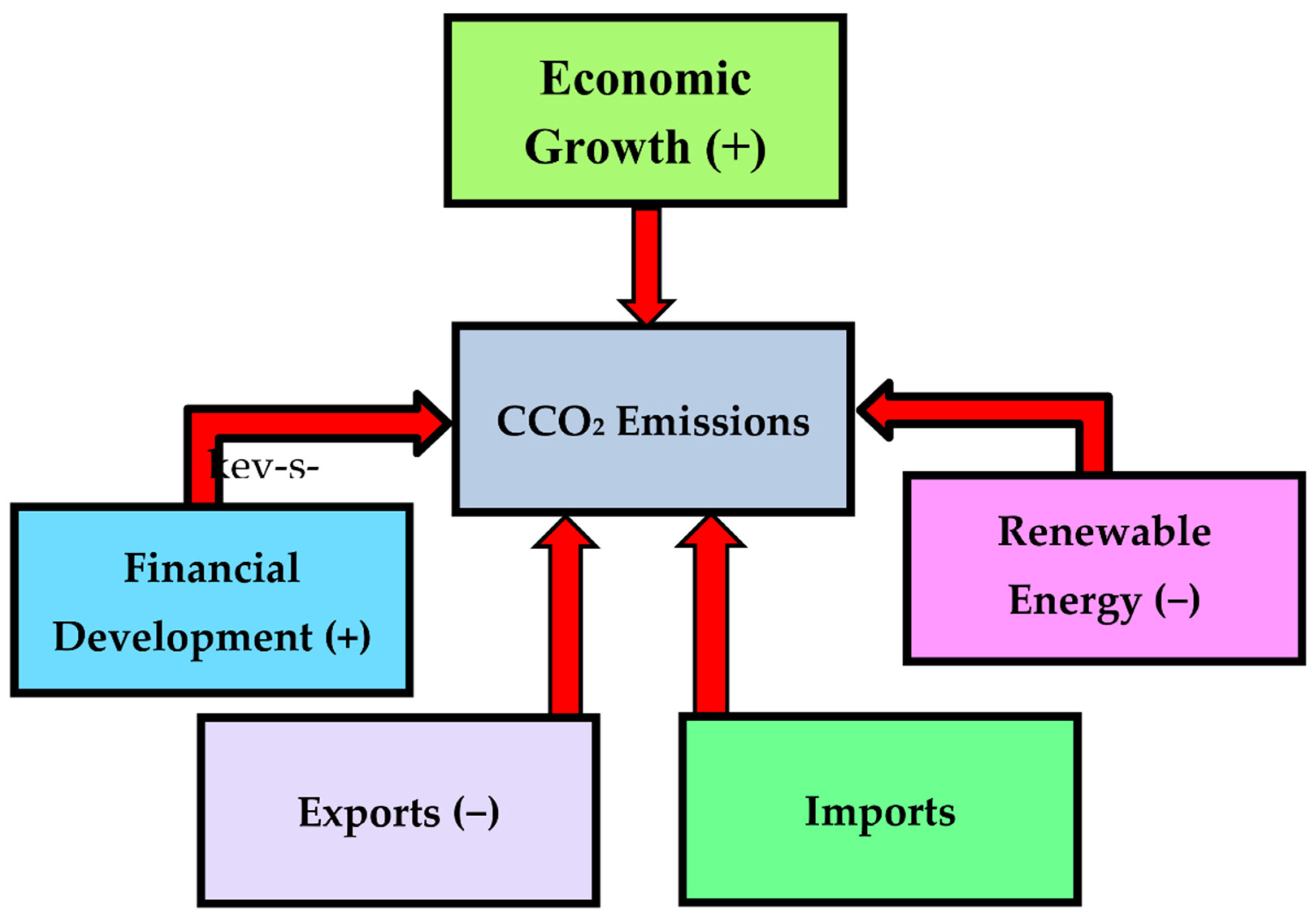

3.2. Theoretical Framework

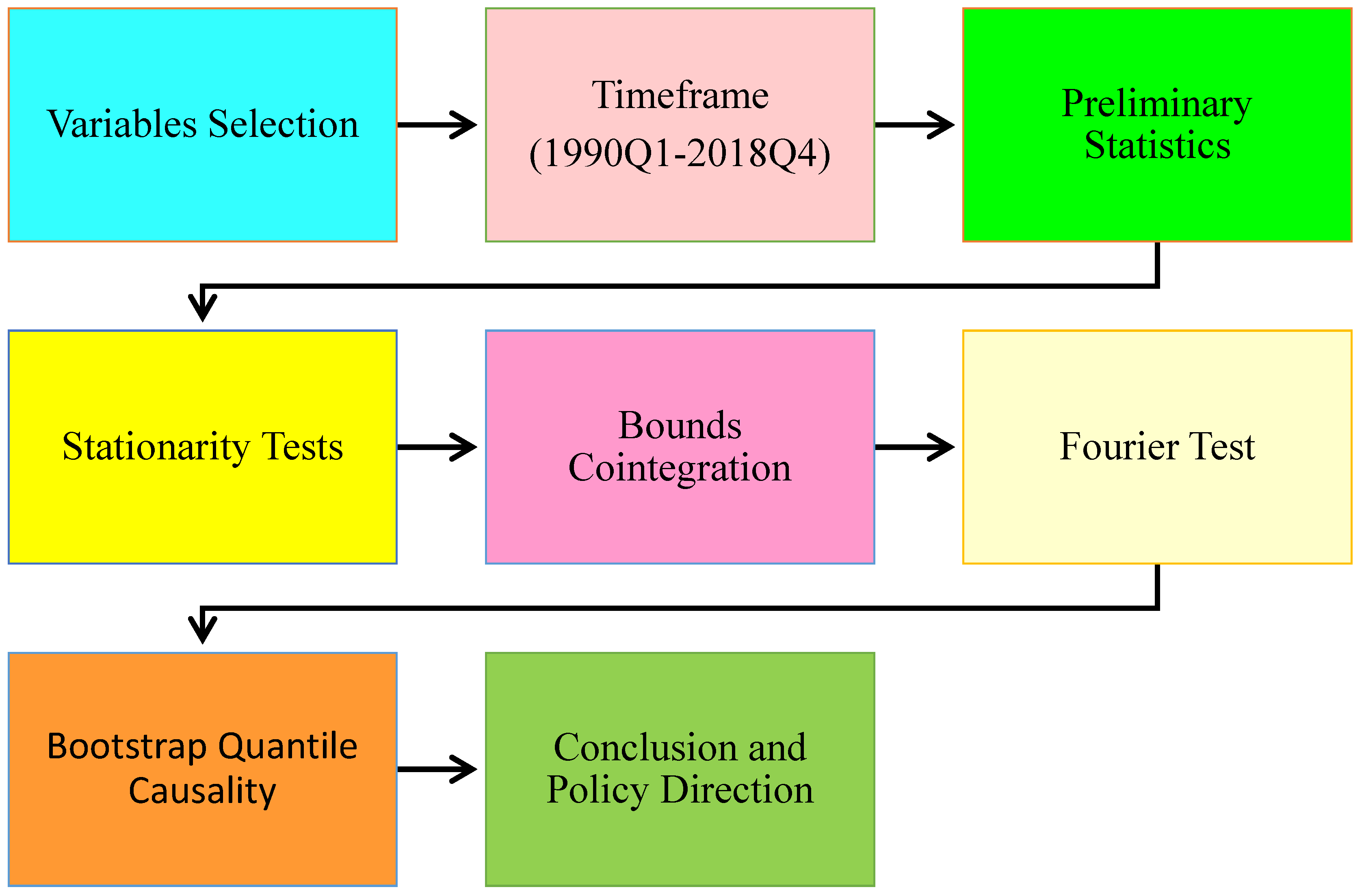

3.3. Methodology

4. Empirical Results

4.1. Stationarity Test Results

4.2. Cointegration

4.3. Fourier Test Results

4.4. Fourier Quantile Causality Results

5. Conclusions and Policy Ramifications

5.1. Conclusions

5.2. Policy Ramifications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ozturk, I.; Acaravci, A. Energy consumption, CO2 emissions, economic growth, and foreign trade relationship in Cyprus and Malta. Energy Sources Part B Econ. Plan. Policy 2016, 11, 321–327. [Google Scholar] [CrossRef]

- Shahbaz, M.; Loganathan, N.; Muzaffar, A.T.; Ahmed, K.; Ali Jabran, M. How urbanization affects CO2 emissions in Malaysia? The application of STIRPAT model. Renew. Sustain. Energy Rev. 2016, 57, 83–93. [Google Scholar] [CrossRef] [Green Version]

- Samour, A.; Moyo, D.; Tursoy, T. Renewable energy, banking sector development, and carbon dioxide emissions nexus: A path toward sustainable development in South Africa. Renew. Energy 2022, 193, 1032–1040. [Google Scholar] [CrossRef]

- Balcilar, M.; Ozdemir, Z.A.; Tunçsiper, B.; Ozdemir, H.; Shahbaz, M. On the nexus among carbon dioxide emissions, energy consumption and economic growth in G-7 countries: New insights from the historical decomposition approach. Environ. Dev. Sustain. 2020, 22, 8097–8134. [Google Scholar] [CrossRef]

- Grossman, G.M.; Krueger, A.B. Economic Growth and the Environment. Q. J. Econ. 1995, 110, 353–377. [Google Scholar] [CrossRef] [Green Version]

- Ahmed, Z.; Udemba, E.N.; Adebayo, T.S.; Kirikkaleli, D. Determinants of consumption-based carbon emissions in Chile: An application of non-linear ARDL. Environ. Sci. Pollut. Res. 2021, 28, 43908–43922. [Google Scholar] [CrossRef]

- Ding, Q.; Khattak, S.I.; Ahmad, M. Towards sustainable production and consumption: Assessing the impact of energy productivity and eco-innovation on consumption-based carbon dioxide emissions (CCO2) in G-7 nations. Sustain. Prod. Consum. 2021, 27, 254–268. [Google Scholar] [CrossRef]

- Ibrahim, R.L.; Adebayo, T.S.; Awosusi, A.A.; Ajide, K.B.; Adewuyi, A.O.; Bolarinwa, F.O. Investigating the asymmetric effects of renewable energy-carbon neutrality nexus: Can technological innovation, trade openness, and transport services deliver the target for Germany? Energy Environ. 2022; preprint. [Google Scholar] [CrossRef]

- Kartal, M.T. Production-based disaggregated analysis of energy consumption and CO2 emission nexus: Evidence from the USA by novel dynamic ARDL simulation approach. Environ. Sci. Pollut. Res. 2022; preprint. [Google Scholar] [CrossRef]

- Kartal, M.T.; Kılıç Depren, S.; Ayhan, F.; Depren, Ö. Impact of renewable and fossil fuel energy consumption on environmental degradation: Evidence from USA by nonlinear approaches. Int. J. Sustain. Dev. World Ecol. 2022, 29, 738–755. [Google Scholar] [CrossRef]

- Awosusi, A.A.; Adebayo, T.S.; Altuntaş, M.; Agyekum, E.B.; Zawbaa, H.M.; Kamel, S. The dynamic impact of biomass and natural resources on ecological footprint in BRICS economies: A quantile regression evidence. Energy Rep. 2022, 8, 1979–1994. [Google Scholar] [CrossRef]

- Destek, M.A.; Sarkodie, S.A. Investigation of environmental Kuznets curve for ecological footprint: The role of energy and financial development. Sci. Total Environ. 2019, 650, 2483–2489. [Google Scholar] [CrossRef]

- Gyamfi, B.A.; Bekun, F.V.; Adebayo, T.S.; Rjoub, H.; Agboola, M.O.; Agyekum, E.B. Another look at the nexus between economic growth trajectory and emission within the context of developing country: Fresh insights from a nonparametric causality-in-quantiles test. Environ. Dev. Sustain. 2022; preprint. [Google Scholar] [CrossRef]

- Alola, A.A.; Adebayo, T.S. Are green resource productivity and environmental technologies the face of environmental sustainability in the Nordic region? Sustain. Dev. 2022, 2, 1–13. [Google Scholar] [CrossRef]

- Abbasi, K.R.; Hussain, K.; Haddad, A.M.; Salman, A.; Ozturk, I. The role of Financial Development and Technological Innovation towards Sustainable Development in Pakistan: Fresh insights from consumption and territory-based emissions. Technol. Forecast. Soc. Chang. 2022, 176, 121444. [Google Scholar] [CrossRef]

- Wu, L.; Adebayo, T.S.; Yue, X.-G.; Umut, A. The role of renewable energy consumption and financial development in environmental sustainability: Implications for the Nordic Countries. Int. J. Sustain. Dev. World Ecol. 2022; in press. [Google Scholar] [CrossRef]

- Al-mulali, U.; Tang, C.F.; Ozturk, I. Does financial development reduce environmental degradation? Evidence from a panel study of 129 countries. Environ. Sci. Pollut. Res. 2015, 22, 14891–14900. [Google Scholar] [CrossRef]

- Charfeddine, L.; Kahia, M. Impact of renewable energy consumption and financial development on CO2 emissions and economic growth in the MENA region: A panel vector autoregressive (PVAR) analysis. Renew. Energy 2019, 139, 198–213. [Google Scholar] [CrossRef]

- Ibrahiem, D.M. Do technological innovations and financial development improve environmental quality in Egypt? Environ. Sci. Pollut. Res. 2020, 27, 10869–10881. [Google Scholar] [CrossRef]

- O’Neill, J. Who you calling a BRIC. Bloomberg View 2013, 12, 63–79. [Google Scholar]

- Morgan, J.A.; Luca, J.; Wright, G.B.; Dispert, H. Mint Goes International: Innovation to Become Major Focus. In Proceedings of the International Conference on Engineering and Computer Education, Online, 27 July 2014; Volume 6. [Google Scholar]

- Samour, A.; Baskaya, M.M.; Tursoy, T. The Impact of Financial Development and FDI on Renewable Energy in the UAE: A Path towards Sustainable Development. Sustainability 2022, 14, 1208. [Google Scholar] [CrossRef]

- Altuntaş, M.; Awosusi, A.A.; Adebayo, T.S.; Kirikkaleli, D. Role of technological innovation and globalization in BRICS economies: Policy towards environmental sustainability. Int. J. Sustain. Dev. World Ecol. 2022, 29, 593–610. [Google Scholar] [CrossRef]

- Caglar, A.E.; Zafar, M.W.; Bekun, F.V.; Mert, M. Determinants of CO2 emissions in the BRICS economies: The role of partnerships investment in energy and economic complexity. Sustain. Energy Technol. Assess. 2022, 51, 101907. [Google Scholar] [CrossRef]

- Shahbaz, M.; Hye, Q.M.A.; Tiwari, A.K.; Leitão, N.C. Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew. Sustain. Energy Rev. 2013, 25, 109–121. [Google Scholar] [CrossRef] [Green Version]

- Khan, Z.; Ali, S.; Umar, M.; Kirikkaleli, D.; Jiao, Z. Consumption-based carbon emissions and International trade in G7 countries: The role of Environmental innovation and Renewable energy. Sci. Total Environ. 2020, 730, 138945. [Google Scholar] [CrossRef]

- Cheng, K.; Hsueh, H.-P.; Ranjbar, O.; Wang, M.-C.; Chang, T. Urbanization, coal consumption and CO2 emissions nexus in China using bootstrap Fourier Granger causality test in quantiles. Lett. Spat. Resour. Sci. 2021, 14, 31–49. [Google Scholar] [CrossRef]

- Fareed, Z.; Pata, U.K. Renewable, non-renewable energy consumption and income in top ten renewable energy-consuming countries: Advanced Fourier based panel data approaches. Renew. Energy 2022, 194, 805–821. [Google Scholar] [CrossRef]

- Qin, L.; Hou, Y.; Miao, X.; Zhang, X.; Rahim, S.; Kirikkaleli, D. Revisiting financial development and renewable energy electricity role in attaining China’s carbon neutrality target. J. Environ. Manag. 2021, 297, 113335. [Google Scholar] [CrossRef]

- Anwar, A.; Sinha, A.; Sharif, A.; Siddique, M.; Irshad, S.; Anwar, W.; Malik, S. The nexus between urbanization, renewable energy consumption, financial development, and CO2 emissions: Evidence from selected Asian countries. Environ. Dev. Sustain. 2022, 24, 6556–6576. [Google Scholar] [CrossRef]

- Khan, A.; Chenggang, Y.; Hussain, J.; Kui, Z. Impact of technological innovation, financial development and foreign direct investment on renewable energy, non-renewable energy and the environment in belt & Road Initiative countries. Renew. Energy 2021, 171, 479–491. [Google Scholar] [CrossRef]

- Kirikkaleli, D.; Adebayo, T.S. Do renewable energy consumption and financial development matter for environmental sustainability? New global evidence. Sustain. Dev. 2021, 29, 583–594. [Google Scholar] [CrossRef]

- Usman, M.; Balsalobre-Lorente, D. Environmental concern in the era of industrialization: Can financial development, renewable energy and natural resources alleviate some load? Energy Policy 2022, 162, 112780. [Google Scholar] [CrossRef]

- Ramzan, M.; Raza, S.A.; Usman, M.; Sharma, G.D.; Iqbal, H.A. Environmental cost of non-renewable energy and economic progress: Do ICT and financial development mitigate some burden? J. Clean. Prod. 2022, 333, 130066. [Google Scholar] [CrossRef]

- Mahmood, H. The spatial analyses of consumption-based CO2 emissions, exports, imports, and FDI nexus in GCC countries. Environ. Sci. Pollut. Res. 2022, 29, 48301–48311. [Google Scholar] [CrossRef]

- Hasanov, F.J.; Liddle, B.; Mikayilov, J.I. The impact of international trade on CO2 emissions in oil exporting countries: Territory vs consumption emissions accounting. Energy Econ. 2018, 74, 343–350. [Google Scholar] [CrossRef]

- Dumitrescu, E.-I.; Hurlin, C. Testing for Granger non-causality in heterogeneous panels. Econ. Model. 2012, 29, 1450–1460. [Google Scholar] [CrossRef] [Green Version]

- Hasanov, F.J.; Khan, Z.; Hussain, M.; Tufail, M. Theoretical Framework for the Carbon Emissions Effects of Technological Progress and Renewable Energy Consumption. Sustain. Dev. 2021, 29, 810–822. [Google Scholar] [CrossRef]

- Ojekemi, O.S.; Rjoub, H.; Awosusi, A.A.; Agyekum, E.B. Toward a sustainable environment and economic growth in BRICS economies: Do innovation and globalization matter? Environ. Sci. Pollut. Res. 2022, 29, 57740–57757. [Google Scholar] [CrossRef]

- Fareed, Z.; Rehman, M.A.; Adebayo, T.S.; Wang, Y.; Ahmad, M.; Shahzad, F. Financial inclusion and the environmental deterioration in Eurozone: The moderating role of innovation activity. Technol. Soc. 2022, 69, 101961. [Google Scholar] [CrossRef]

- Sharif, A.; Saqib, N.; Dong, K.; Khan, S.A.R. Nexus between green technology innovation, green financing, and CO2 emissions in the G7 countries: The moderating role of social globalisation. Sustain. Dev. 2022, 4, 12–24. [Google Scholar] [CrossRef]

- Hassan, T.; Song, H.; Kirikkaleli, D. International trade and consumption-based carbon emissions: Evaluating the role of composite risk for RCEP economies. Environ. Sci. Pollut. Res. 2022, 29, 3417–3437. [Google Scholar] [CrossRef] [PubMed]

- Fernández-Amador, O.; Francois, J.F.; Oberdabernig, D.A.; Tomberger, P. Carbon Dioxide Emissions and Economic Growth: An Assessment Based on Production and Consumption Emission Inventories. Ecol. Econ. 2017, 135, 269–279. [Google Scholar] [CrossRef]

- Khan, Z.; Ali, M.; Jinyu, L.; Shahbaz, M.; Siqun, Y. Consumption-based carbon emissions and trade nexus: Evidence from nine oil exporting countries. Energy Econ. 2020, 89, 104806. [Google Scholar] [CrossRef]

- Knight, K.W.; Schor, J.B. Economic Growth and Climate Change: A Cross-National Analysis of Territorial and Consumption-Based Carbon Emissions in High-Income Countries. Sustainability 2014, 6, 3722. [Google Scholar] [CrossRef] [Green Version]

- Antonelli, C.; Gehringer, A. Technological change, rent and income inequalities: A Schumpeterian approach. Technol. Forecast. Soc. Change 2017, 115, 85–98. [Google Scholar] [CrossRef] [Green Version]

- Chikezie Ekwueme, D.; Lasisi, T.T.; Eluwole, K.K. Environmental sustainability in Asian countries: Understanding the criticality of economic growth, industrialization, tourism import, and energy use. Energy Environ. 2022. preprint. [Google Scholar] [CrossRef]

- Alam, M.M.; Murad, M.W. The impacts of economic growth, trade openness and technological progress on renewable energy use in organization for economic co-operation and development countries. Renew. Energy 2020, 145, 382–390. [Google Scholar] [CrossRef]

- Ali, Q.; Yaseen, M.R.; Anwar, S.; Makhdum, M.S.A.; Khan, M.T.I. The impact of tourism, renewable energy, and economic growth on ecological footprint and natural resources: A panel data analysis. Resour. Policy 2021, 74, 102365. [Google Scholar] [CrossRef]

- Acheampong, A.O.; Adams, S.; Boateng, E. Do globalization and renewable energy contribute to carbon emissions mitigation in Sub-Saharan Africa? Sci. Total Environ. 2019, 677, 436–446. [Google Scholar] [CrossRef]

- Alola, A.A.; Bekun, F.V.; Sarkodie, S.A. Dynamic impact of trade policy, economic growth, fertility rate, renewable and non-renewable energy consumption on ecological footprint in Europe. Sci. Total Environ. 2019, 685, 702–709. [Google Scholar] [CrossRef]

- Abbasi, F.; Riaz, K. CO2 emissions and financial development in an emerging economy: An augmented VAR approach. Energy Policy 2016, 90, 102–114. [Google Scholar] [CrossRef]

- You, W.-H.; Zhu, H.-M.; Yu, K.; Peng, C. Democracy, Financial Openness, and Global Carbon Dioxide Emissions: Heterogeneity Across Existing Emission Levels. World Dev. 2015, 66, 189–207. [Google Scholar] [CrossRef] [Green Version]

- Sadorsky, P. The impact of financial development on energy consumption in emerging economies. Energy Policy 2010, 38, 2528–2535. [Google Scholar] [CrossRef]

- Granger, C.W.J. Investigating Causal Relations by Econometric Models and Cross-spectral Methods. Econometrica 1969, 37, 424–438. [Google Scholar] [CrossRef]

- Enders, W.; Jones, P. Grain prices, oil prices, and multiple smooth breaks in a VAR. Stud. Nonlinear Dyn. Econ. 2016, 20, 399–419. [Google Scholar] [CrossRef]

- Toda, H.Y.; Yamamoto, T. Statistical inference in vector autoregressions with possibly integrated processes. J. Econ. 1995, 66, 225–250. [Google Scholar] [CrossRef]

- Nazlioglu, S.; Gormus, N.A.; Soytas, U. Oil prices and real estate investment trusts (REITs): Gradual-shift causality and volatility transmission analysis. Energy Econ. 2016, 60, 168–175. [Google Scholar] [CrossRef]

- Gallant, A.R. On the bias in flexible functional forms and an essentially unbiased form: The fourier flexible form. J. Econ. 1981, 15, 211–245. [Google Scholar] [CrossRef]

- He, X.; Adebayo, T.S.; Kirikkaleli, D.; Umar, M. Consumption-based carbon emissions in Mexico: An analysis using the dual adjustment approach. Sustain. Prod. Consum. 2021, 27, 947–957. [Google Scholar] [CrossRef]

- Salazar-Núñez, H.F.; Venegas-Martínez, F.; Lozano-Díez, J.A. Assessing the interdependence among renewable and non-renewable energies, economic growth, and CO2 emissions in Mexico. Environ. Dev. Sustain. 2021, 24, 12850–12866. [Google Scholar] [CrossRef]

- Pan, B.; Adebayo, T.S.; Ibrahim, R.L.; Al-Faryan, M.A.S. Does nuclear energy consumption mitigate carbon emissions in leading countries by nuclear power consumption? Evidence from quantile causality approach. Energy Environ. 2022, in press. [Google Scholar] [CrossRef]

- Acheampong, A.O. Economic growth, CO2 emissions and energy consumption: What causes what and where? Energy Econ. 2018, 74, 677–692. [Google Scholar] [CrossRef]

- Zhang, L.; Li, Z.; Kirikkaleli, D.; Adebayo, T.S.; Adeshola, I.; Akinsola, G.D. Modeling CO2 emissions in Malaysia: An application of Maki cointegration and wavelet coherence tests. Environ. Sci. Pollut. Res. 2021, 28, 26030–26044. [Google Scholar] [CrossRef] [PubMed]

- Adebayo, T.S. Environmental consequences of fossil fuel in Spain amidst renewable energy consumption: A new insights from the wavelet-based Granger causality approach. Int. J. Sustain. Dev. World Ecol. 2022, 29, 579–592. [Google Scholar] [CrossRef]

- Magazzino, C.; Mutascu, M.; Mele, M.; Sarkodie, S.A. Energy consumption and economic growth in Italy: A wavelet analysis. Energy Rep. 2021, 7, 1520–1528. [Google Scholar] [CrossRef]

- Bekun, F.V.; Emir, F.; Sarkodie, S.A. Another look at the relationship between energy consumption, carbon dioxide emissions, and economic growth in South Africa. Sci. Total Environ. 2019, 655, 759–765. [Google Scholar] [CrossRef]

- Shahbaz, M.; Nasir, M.A.; Roubaud, D. Environmental degradation in France: The effects of FDI, financial development, and energy innovations. Energy Econ. 2018, 74, 843–857. [Google Scholar] [CrossRef] [Green Version]

- Adewale Alola, A.; Ozturk, I.; Bekun, F.V. Is clean energy prosperity and technological innovation rapidly mitigating sustainable energy-development deficit in selected sub-Saharan Africa? A myth or reality. Energy Policy 2021, 158, 112520. [Google Scholar] [CrossRef]

- World Bank. World Developmental Indicator. 2022. Available online: https://data.worldbank.org/country/china (accessed on 7 August 2022).

- Abbasi, K.R.; Shahbaz, M.; Jiao, Z.; Tufail, M. How energy consumption, industrial growth, urbanization, and CO2 emissions affect economic growth in Pakistan? A novel dynamic ARDL simulations approach. Energy 2021, 221, 119793. [Google Scholar] [CrossRef]

- Cetin, M.; Demir, H.; Saygin, S. Financial Development, Technological Innovation and Income Inequality: Time Series Evidence from Turkey. Soc. Indic. Res. 2021, 156, 47–69. [Google Scholar] [CrossRef]

- Kirikkaleli, D.; Adebayo, T.S.; Khan, Z.; Ali, S. Does globalization matter for ecological footprint in Turkey? Evidence from dual adjustment approach. Environ. Sci. Pollut. Res. 2021, 28, 14009–14017. [Google Scholar] [CrossRef]

- Pata, U.K. Renewable energy consumption, urbanization, financial development, income and CO2 emissions in Turkey: Testing EKC hypothesis with structural breaks. J. Clean. Prod. 2018, 187, 770–779. [Google Scholar] [CrossRef]

- Ahmad, M.; Jiang, P.; Murshed, M.; Shehzad, K.; Akram, R.; Cui, L.; Khan, Z. Modelling the dynamic linkages between eco-innovation, urbanization, economic growth and ecological footprints for G7 countries: Does financial globalization matter? Sustain. Cities Soc. 2021, 70, 102881. [Google Scholar] [CrossRef]

| Mexico | ||||||

| CCO2 | FD | REC | GDP | IMP | EXP | |

| Mean | 448.20 | 0.3344 | 10.949 | 8747.9 | 28.249 | 26.666 |

| Median | 469.80 | 0.3282 | 10.228 | 8820.9 | 27.674 | 26.142 |

| Maximum | 547.74 | 0.4008 | 15.187 | 9954.3 | 41.454 | 39.410 |

| Minimum | 312.54 | 0.2521 | 8.9487 | 7343.5 | 15.156 | 11.459 |

| Std. Dev. | 71.262 | 0.0468 | 1.6589 | 735.07 | 6.6390 | 7.0045 |

| Skewness | −0.4887 | −0.1151 | 0.5316 | −0.2295 | 0.1749 | −0.1450 |

| Kurtosis | 1.8650 | 1.5927 | 1.8958 | 2.0920 | 2.4342 | 2.6829 |

| Jarque–Bera | 11.218 | 10.167 | 11.748 | 5.1754 | 2.2127 | 0.9236 |

| Probability | 0.0036 | 0.0061 | 0.0028 | 0.0751 | 0.3307 | 0.6301 |

| Indonesia | ||||||

| Mean | 357.44 | 0.3122 | 2423.7 | 25.676 | 40.485 | 28.481 |

| Median | 317.97 | 0.3075 | 2159.1 | 25.309 | 41.515 | 26.742 |

| Maximum | 693.81 | 0.4001 | 3931.9 | 44.226 | 58.833 | 54.776 |

| Minimum | 132.54 | 0.2383 | 1462.1 | 16.601 | 18.943 | 16.979 |

| Std. Dev. | 159.57 | 0.0415 | 691.89 | 4.6656 | 10.914 | 7.1238 |

| Skewness | 0.4235 | −0.0019 | 0.6322 | 1.5145 | −0.1826 | 1.4132 |

| Kurtosis | 1.8527 | 2.0246 | 2.1623 | 7.7038 | 2.1152 | 5.8497 |

| Jarque–Bera | 10.169 | 4.7569 | 11.501 | 156.50 | 4.5811 | 80.553 |

| Probability | 0.0061 | 0.0926 | 0.0031 | 0.0000 | 0.1012 | 0.0000 |

| Nigeria | ||||||

| CCO2 | FD | GDP | IMP | REC | EXP | |

| Mean | 76.929 | 0.1898 | 1969.8 | 15.379 | 85.064 | 21.893 |

| Median | 80.407 | 0.1893 | 1916.9 | 14.378 | 85.168 | 22.052 |

| Maximum | 131.12 | 0.2739 | 2705.1 | 23.428 | 88.842 | 37.157 |

| Minimum | 33.529 | 0.1167 | 1411.3 | 8.595 | 80.541 | 8.8927 |

| Std. Dev. | 33.004 | 0.0352 | 470.43 | 3.9310 | 2.2691 | 6.4406 |

| Skewness | 0.1886 | −0.0619 | 0.1982 | 0.4743 | −0.2275 | 0.0526 |

| Kurtosis | 1.6725 | 2.6520 | 1.4011 | 2.1677 | 1.9715 | 2.6046 |

| Jarque–Bera | 9.5224 | 0.6819 | 13.568 | 7.9636 | 6.3246 | 0.8368 |

| Probability | 0.0085 | 0.7110 | 0.0011 | 0.0186 | 0.0423 | 0.6580 |

| Turkey | ||||||

| Mean | 306.00 | 0.4006 | 7941.7 | 24.680 | 17.005 | 22.299 |

| Median | 288.51 | 0.4053 | 7475.6 | 25.105 | 16.010 | 22.840 |

| Maximum | 445.09 | 0.5311 | 12022. | 31.515 | 24.712 | 32.760 |

| Minimum | 206.13 | 0.1920 | 5286.7 | 16.568 | 11.208 | 12.629 |

| Std. Dev. | 82.533 | 0.1010 | 2179.5 | 4.2417 | 4.4882 | 4.4437 |

| Skewness | 0.2293 | −0.4415 | 0.5619 | −0.2954 | 0.4453 | −0.1846 |

| Kurtosis | 1.4464 | 2.0872 | 1.9781 | 2.1182 | 1.7070 | 3.5362 |

| Jarque–Bera | 13.120 | 8.0644 | 11.536 | 5.6326 | 12.325 | 2.1200 |

| Probability | 0.0014 | 0.0177 | 0.0031 | 0.0598 | 0.0021 | 0.3464 |

| Mexico | Indonesia | Nigeria | Turkiye | |||||

|---|---|---|---|---|---|---|---|---|

| ADF | ||||||||

| Variables | T-stat. | Lag | T-stat. | Lag | T-stat. | Lag | T-stat. | Lag |

| LnCCO2 | −5.583 * | 8 | −3.748 *** | 8 | −3.249 *** | 8 | −3.995 ** | 5 |

| LnGDP | −3.454 *** | 7 | −3.497 ** | 5 | −3.350 ** | 7 | −3.683 *** | 8 |

| LnREC | −3.692 ** | 11 | −3.401 *** | 8 | −4.385 * | 9 | −3.275 *** | 8 |

| LnFD | −6.855 * | 4 | −3.612 *** | 8 | −3.224 *** | 8 | −4.639 * | 5 |

| LnEXP | −4.714 * | 7 | −6.840 * | 7 | −3.669 ** | 12 | −3.683 ** | 8 |

| LnIMP | −10.783 * | 9 | −4.396 * | 8 | −3.616 ** | 12 | −3.976 ** | 8 |

| ERS | ||||||||

| LnCCO2 | −5.747 * | 6 | −3.154 ** | 12 | −3.273 *** | 8 | −3.153 *** | 4 |

| LnGDP | −4.452 * | 10 | −3.396 *** | 5 | −3.284 ** | 6 | −3.691 * | 8 |

| LnREC | −2.858 *** | 8 | −2.770 *** | 12 | −3.190 ** | 8 | −2.858 ** | 7 |

| LnFD | −4.139 * | 4 | −2.832 *** | 8 | −2.877 *** | 8 | −2.919 *** | 4 |

| LnEXP | −2.975 *** | 5 | −6.846 * | 7 | −3.089 *** | 12 | −3.691 ** | 8 |

| LnIMP | −2.926 *** | 12 | −4.124 * | 8 | −2.935 ** | 12 | −3.330 ** | 8 |

| Countries | Models | F-Statistics | Lag Selection | Cointegration |

|---|---|---|---|---|

| Mexico | LnCCO2 = f(LnGDP, LnIMP, LnEXP, LnREC, LnFD) | 8.937 * | 1, 2, 1, 1, 0, 0 | Yes |

| Indonesia | LnCCO2 = f(LnGDP, LnIMP, LnEXP, LnREC, LnFD) | 5.971 * | 1, 1, 1, 0, 2, 1 | Yes |

| Nigeria | LnCCO2 = f(LnGDP, LnIMP, LnEXP, LnREC, LnFD) | 5.836 * | 1, 0, 0, 2, 2, 1 | Yes |

| Turkey | LnCCO2 = f(LnGDP, LnIMP, LnEXP, LnREC, LnFD) | 7.530 * | 1, 2, 1, 1, 0, 0 | Yes |

| Models | Mexico | Indonesia | Nigeria | Turkey |

|---|---|---|---|---|

| Optimum Frequency | 0.8 | 2.2 | 0.8 | 2.0 |

| Optimum Lag | 6 | 6 | 6 | 6 |

| F-statistics for Fourier expansion | 12.968 * | 14.858 * | 8.474 * | 10.968 * |

| 10% CV | 10.211 | 12.032 | 6.184 | 7.211 |

| 5% CV | 10.882 | 12.772 | 6.846 | 8.204 |

| 1% CV | 11.317 | 13.460 | 7.503 | 8.995 |

| H0: LnGDP↛LnCCO2 | ||||

| quantile | Wald stat. | 10% CV | 5% CV | 1% CV |

| 0.1 | 31.978 | 63.388 | 67.092 | 81.577 |

| 0.3 | 26.653 | 51.287 | 52.845 | 61.023 |

| 0.5 | 25.818 | 51.568 | 56.829 | 67.076 |

| 0.7 | 17.751 | 64.849 | 73.141 | 101.56 |

| 0.9 | 87.062*** (+) | 82.583 | 87.108 | 117.63 |

| H0: LnREC↛LnCCO2 | ||||

| 0.1 | 9.0119 | 16.482 | 18.31736 | 23.171 |

| 0.3 | 29.125* (−) | 13.597 | 15.20117 | 21.076 |

| 0.5 | 15.323** (−) | 11.576 | 14.42830 | 15.608 |

| 0.7 | 4.7447 | 14.835 | 16.14676 | 21.377 |

| 0.9 | 1.9978 | 27.162 | 28.40824 | 34.811 |

| H0: LnEXP↛LnCCO2 | ||||

| 0.1 | 8.3898 | 28.373 | 32.80566 | 55.1 |

| 0.3 | 7.6605 | 25.010 | 32.53499 | 36.648 |

| 0.5 | 19.1422*** (−) | 18.639 | 22.62982 | 24.484 |

| 0.7 | 28.5644*** (−) | 27.881 | 33.61882 | 41.403 |

| 0.9 | 11.895 | 32.187 | 34.80926 | 46.525 |

| H0: LnIMP↛LnCCO2 | ||||

| 0.1 | 13.146 | 20.018 | 21.44194 | 26.673 |

| 0.3 | 9.0842 *** (+) | 8.7170 | 10.36571 | 15.382 |

| 0.5 | 9.8575*** (+) | 7.5424 | 9.569465 | 10.425 |

| 0.7 | 4.0832 | 8.2339 | 9.546957 | 14.768 |

| 0.9 | 13.324 | 15.074 | 17.28618 | 26.622 |

| H0: LnFD↛LnCCO2 | ||||

| 0.1 | 12.64739 | 24.178 | 29.077 | 38.807 |

| 0.3 | 13.80425*** (+) | 12.672 | 13.942 | 19.690 |

| 0.5 | 6.280467 | 9.9456 | 13.971 | 16.627 |

| 0.7 | 2.005601 | 12.055 | 13.820 | 17.593 |

| 0.9 | 2.778037 | 17.914 | 18.573 | 23.587 |

| H0: LnGDP↛LnCCO2 | ||||

| quantile | Wald stat. | 10% CV | 5% CV | 1% CV |

| 0.1 | 155.016*** (+) | 152.07 | 169.6371 | 182.03 |

| 0.3 | 54.3869 | 115.58 | 150.2648 | 163.12 |

| 0.5 | 53.3321 | 104.68 | 112.4484 | 136.03 |

| 0.7 | 64.3851 | 142.37 | 159.7852 | 170.04 |

| 0.9 | 76.1747 | 222.61 | 241.0449 | 316.92 |

| H0: LnREC↛LnCCO2 | ||||

| 0.1 | 46.606** (−) | 41.780 | 46.295 | 113.77 |

| 0.3 | 29.447*** (−) | 28.860 | 31.215 | 43.643 |

| 0.5 | 9.5617 | 22.751 | 25.283 | 50.833 |

| 0.7 | 4.6260 | 26.136 | 29.177 | 64.730 |

| 0.9 | 12.265 | 39.507 | 51.031 | 75.474 |

| H0: LnEXP↛LnCCO2 | ||||

| 0.1 | 8.7534 | 173.89 | 182.84 | 218.72 |

| 0.3 | 4.7759 | 149.94 | 163.65 | 183.70 |

| 0.5 | 4.8257 | 136.53 | 157.20 | 167.85 |

| 0.7 | 2.0517 | 146.86 | 166.26 | 205.21 |

| 0.9 | 6.7543 | 175.68 | 206.35 | 253.02 |

| H0: LnIMP↛LnCCO2 | ||||

| 0.1 | 8.5628 | 177.87 | 187.94 | 211.6 |

| 0.3 | 1.9128 | 74.241 | 100.72 | 148.80 |

| 0.5 | 5.5059 | 37.284 | 38.902 | 72.992 |

| 0.7 | 1.9302 | 32.128 | 46.606 | 51.729 |

| 0.9 | 5.085 | 47.377 | 58.787 | 72.820 |

| H0: LnFD↛LnCCO2 | ||||

| 0.1 | 102.967* (+) | 56.141 | 67.663 | 97.104 |

| 0.3 | 40.66** (+) | 25.050 | 27.437 | 42.239 |

| 0.5 | 9.0807 | 14.700 | 19.357 | 35.294 |

| 0.7 | 7.4778 | 19.663 | 25.182 | 30.660 |

| 0.9 | 36.756 | 45.243 | 50.380 | 73.003 |

| H0: LnGDP↛LnCCO2 | ||||

| quantile | Wald stat. | 10% CV | 5% CV | 1% CV |

| 0.1 | 27.220 | 43.719 | 49.391 | 57.726 |

| 0.3 | 45.567** (+) | 32.852 | 37.150 | 47.866 |

| 0.5 | 32.972*** (+) | 31.719 | 33.170 | 46.260 |

| 0.7 | 48.859*** (+) | 35.334 | 41.658 | 51.812 |

| 0.9 | 15.253 | 42.8749 | 43.440 | 50.842 |

| H0: LnREC↛LnCCO2 | ||||

| 0.1 | 19.316*** (−) | 18.620 | 20.738 | 26.566 |

| 0.3 | 17.158*** (−) | 15.859 | 22.644 | 24.593 |

| 0.5 | 8.8579 | 17.022 | 20.349 | 33.701 |

| 0.7 | 10.757 | 25.134 | 30.30 | 61.526 |

| 0.9 | 14.192 | 38.486 | 45.18 | 59.555 |

| H0: LnEXP↛LnCCO2 | ||||

| 0.1 | 24.551 | 31.168 | 33.907 | 56.850 |

| 0.3 | 12.032 | 17.394 | 21.465 | 29.676 |

| 0.5 | 5.7322 | 12.492 | 13.865 | 16.700 |

| 0.7 | 4.7990 | 11.424 | 14.101 | 17.905 |

| 0.9 | 29.685*** (−) | 24.913 | 29.192 | 33.831 |

| H0: LnIMP↛LnCCO2 | ||||

| 0.1 | 2.4349 | 11.527 | 13.534 | 23.828 |

| 0.3 | 3.5846 | 7.1759 | 8.6019 | 9.5594 |

| 0.5 | 3.5608 | 6.0437 | 8.5011 | 11.572 |

| 0.7 | 5.5401 | 7.2298 | 9.7265 | 10.753 |

| 0.9 | 4.3756 | 18.724 | 19.768 | 28.575 |

| H0: LnFD↛LnCCO2 | ||||

| 0.1 | 10.564 | 24.939 | 30.925 | 32.743 |

| 0.3 | 5.6160 | 15.779 | 22.195 | 35.045 |

| 0.5 | 19.540** (+) | 11.978 | 15.302 | 21.349 |

| 0.7 | 13.008 | 16.530 | 20.794 | 22.502 |

| 0.9 | 19.834 | 27.332 | 29.549 | 45.254 |

| H0: LnGDP↛LnCCO2 | ||||

| quantile | Wald stat. | 10% CV | 5% CV | 1% CV |

| 0.1 | 36.428 | 66.243 | 80.359 | 86.919 |

| 0.3 | 28.057 | 49.487 | 60.666 | 63.138 |

| 0.5 | 18.002 | 40.485 | 46.294 | 56.863 |

| 0.7 | 44.586*** (+) | 44.487 | 49.658 | 53.456 |

| 0.9 | 18.721 | 47.58500 | 57.543 | 73.676 |

| H0: LnREC↛LnCCO2 | ||||

| 0.1 | 10.197 | 39.429 | 53.859 | 67.185 |

| 0.3 | 5.2158 | 25.054 | 27.767 | 33.596 |

| 0.5 | 31.358* (−) | 19.444 | 20.862 | 30.186 |

| 0.7 | 25.154** (−) | 20.586 | 24.542 | 36.920 |

| 0.9 | 5.9246 | 38.479 | 42.183 | 54.410 |

| H0: LnEXP↛LnCCO2 | ||||

| 0.1 | 5.2356 | 41.212 | 46.597 | 60.857 |

| 0.3 | 72.227** (−) | 34.444 | 36.143 | 47.222 |

| 0.5 | 30.658*** (−) | 30.024 | 31.161 | 50.435 |

| 0.7 | 43.076** (−) | 32.715 | 36.800 | 43.846 |

| 0.9 | 125.51 | 43.520 | 46.856 | 73.936 |

| H0: LnIMP↛LnCCO2 | ||||

| 0.1 | 6.6256 | 26.208 | 45.458 | 93.274 |

| 0.3 | 12.670 | 17.397 | 17.999 | 40.338 |

| 0.5 | 24.698* (+) | 16.254 | 20.574 | 21.229 |

| 0.7 | 14.644 | 19.519 | 25.487 | 31.232 |

| 0.9 | 22.369 | 36.157 | 44.813 | 80.656 |

| H0: LnFD↛LnCCO2 | ||||

| 0.1 | 19.485 | 23.438 | 25.57 | 34.017 |

| 0.3 | 4.3859 | 14.253 | 18.2903 | 22.908 |

| 0.5 | 10.468 | 13.323 | 15.213 | 18.944 |

| 0.7 | 10.041 | 16.003 | 16.681 | 19.989 |

| 0.9 | 8.4628 | 27.354 | 34.427 | 47.014 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Adebayo, T.S.; Ağa, M. The Race to Zero Emissions in MINT Economies: Can Economic Growth, Renewable Energy and Disintegrated Trade Be the Path to Carbon Neutrality? Sustainability 2022, 14, 14178. https://doi.org/10.3390/su142114178

Adebayo TS, Ağa M. The Race to Zero Emissions in MINT Economies: Can Economic Growth, Renewable Energy and Disintegrated Trade Be the Path to Carbon Neutrality? Sustainability. 2022; 14(21):14178. https://doi.org/10.3390/su142114178

Chicago/Turabian StyleAdebayo, Tomiwa Sunday, and Mehmet Ağa. 2022. "The Race to Zero Emissions in MINT Economies: Can Economic Growth, Renewable Energy and Disintegrated Trade Be the Path to Carbon Neutrality?" Sustainability 14, no. 21: 14178. https://doi.org/10.3390/su142114178

APA StyleAdebayo, T. S., & Ağa, M. (2022). The Race to Zero Emissions in MINT Economies: Can Economic Growth, Renewable Energy and Disintegrated Trade Be the Path to Carbon Neutrality? Sustainability, 14(21), 14178. https://doi.org/10.3390/su142114178