1.1. Background

Innovation theory originated in the early 20

th century. Schumpeter put forward the concept of “innovation” and conducted representative pioneering research on innovation management in 1912. Since Hansen et al. (2007) proposed the “innovation value chain” based on knowledge transformation [

2], Roper et al. (2008; 2012) supplemented and improved the theory of the innovation value chain based on a comparison of manufacturing innovation activity in Ireland and Sweden, and proposed that the firm innovation value chain includes three progressive links [

3,

4]. The first link is knowledge acquisition, which obtains the necessary knowledge for innovation via various methods; the second link is knowledge transformation, which transforms knowledge into innovation achievements, including new product or process innovation; the third link is the use of knowledge, where companies utilize innovation achievements to improve product sales and profits. Some scholars divide the innovation process into three stages: knowledge innovation, R&D design innovation, and product innovation [

5,

6,

7]. Technological innovation in China has experienced four development processes: technology introduction and imitation, open market to attract investment, secondary innovation and integrated innovation, and independent innovation and collaborative innovation [

8]. Based on the innovation practice with Chinese characteristics, innovation theories such as closed independent innovation, open independent innovation, and sustainable enterprise innovation have gradually formed [

9].

With the trend of globalization, China has continuously acquired knowledge, carried out knowledge transformation, and improved innovative abilities through innovation introduction and self-innovation. However, the applications of innovation achievements are not satisfactory and do not create much economic value [

10]. How to obtain knowledge more efficiently through the introduction of innovation and independent innovation, form innovation output, and achieve the commercial transformation of innovation achievements, has become the focus of the current government, enterprises, and academia.

1.2. Literature Review

There are many studies on improving innovation efficiency in the literature. The research scope covers the relationship between independent and secondary innovation—the choice of innovation methods—and other influencing factors of innovation, etc. There are multiple paths for enterprises to pursue technological progress. They can choose independent innovation, technology introduction, or a combination of the two strategies. Which technological progress path an enterprise chooses, is related to its technical level [

10], and also to the applicability and effectiveness of the long-term development strategy and technological progress of the enterprise. Combined with the solid development background of the enterprise, relevant research has incorporated factors such as environmental constraints, trade status, resource endowments, equity incentives, digital economy, and self-created zone policies into the category of influencing factors for the choice of innovation methods and examine innovation capabilities under the influence of different factors [

11,

12,

13,

14,

15,

16]. In addition, the improvement of innovation ability will eventually be transformed into the sustainable economic output of enterprises. Therefore, much literature has also explored the relationship between innovation ability and economic output from different perspectives and levels, such as technology spillover effect and enterprise absorptive capacity [

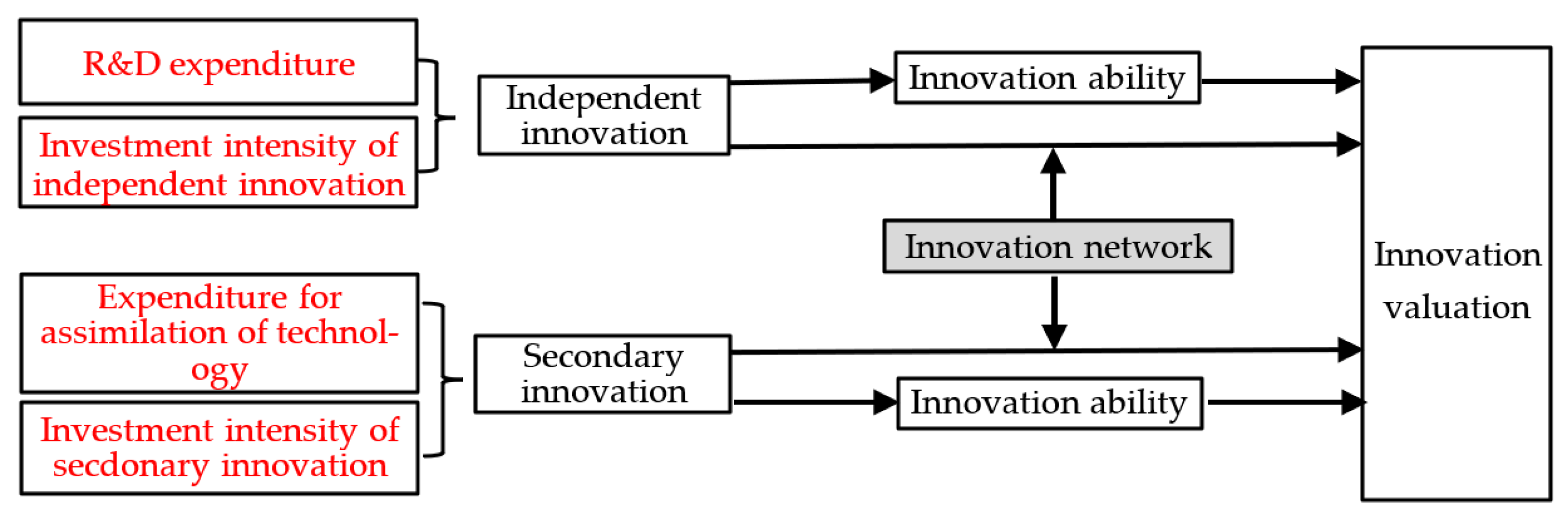

8]. The above analysis shows that the discussion of innovation performance requires two parts: the formation efficiency of innovation capability and the transformation efficiency of innovation achievements. This paper argues that innovation performance embodies the continuous action mechanism of innovation mode selection—innovation capability formation—innovation economic output. It is a two-stage achievement process from the start of innovation to the profit of innovation. Therefore, the research design of this paper intends to use innovation capability as a mediating cohesive variable to examine its mediating effect in the innovation value chain.

With the increasingly complex innovation environment, it is difficult for enterprises to survive and stand out in the fierce market competition by themselves. More and more enterprises are promoting collaborative innovation through cooperation [

17]. During this process, a market-led and government-led innovation network has gradually formed and broadly impacted corporate innovation [

15]. Freeman (1991) first proposed the concept of a scientific and technological innovation network, which is a network relationship based on orderly interaction between participating subjects [

18], an organizational collective formed for innovation. Min et al. (2020) defined the concept of enterprise innovation network, and pointed out that enterprise innovation network is a network formed in the process of enterprise innovation activities, that is, the process of technological innovation includes formal and informal cooperative relations with enterprises as the core [

19]. The innovation network is accompanied by the creation, flow, transfer, and spillover of knowledge [

20]. It is dynamic, open, complex, and focuses on collaborative innovation [

21]. The connection between multiple subjects is conducive to the accumulation of innovation resources, further forming network externalities [

8]. Moreover, joining the innovation network can stimulate enterprises to acquire, integrate and utilize essential innovation resources [

22]. The network structure governance and network relationship governance of the innovation network can solve the current constraints of innovation development to a certain extent, thereby improving the innovation performance of enterprises [

15]. Therefore, more and more enterprises formulate and spread technical standards by forming alliances, and obtaining innovation resources by means of network embedding, so as to improve their technological innovation performance [

23]. From the above analysis, it can be seen that the innovation network brings together innovation subjects such as enterprises, scientific research institutions, intermediaries, and financial institutions. The flow of knowledge between different subjects in the innovation network creates favorable conditions for enterprise innovation. However, the existing research has not revealed the influence of an innovation network on the links of the enterprise innovation value chain. This paper argues that a firm’s innovation value chain activities are affected by the innovation network in which it is embedded, especially in knowledge acquisition. Therefore, the research design of this paper intends to use the innovation network as an embedded moderator variable to examine its moderating effect in the innovation value chain.

In contrast, some scholars believe that independent innovation capability is crucial to acquire sustainable competitive advantages for an enterprise [

24]. Wu et al. (2012) constructed the double helix model of TC and TM for independent innovation, and found that both technology management and technological capabilities have a significant impact on the success of independent innovation [

25]. Perks et al. (2012) found that independent innovative behavior from network partners of enterprises can foster sharing and visualization of innovation advances [

26]. Therefore, independent innovation can also enhance the competitiveness of enterprises, and it is affected by the technology management and technological capabilities of enterprises.

The original definition of open innovation stressed that valuable ideas could originate from inside or outside the company and could go to market from inside or outside the company [

27]. The analysis of Obradović et al. (2021) showed that research into sustainability, commitment-based HR practices, and Industry 4.0 (I40) represent important research streams for the future of OI in manufacturing [

28]. Yun et al. (2020) proposed a cultural conceptual model of the dynamics of open innovation and found that culture can have different impacts on open innovation dynamics [

29]. Chesbrough et al. (2018) argued that open innovation requires collaboration among distributed but interdependent actors who rely on each other’s capabilities to create and capture value [

30]. Xia et al. (2020) found that when innovative talent input exceeds a specific value, the open innovation environment can alleviate the positive marginal effect of its decline [

8]. To sum up, open innovation requires cooperation among enterprises, is widely applied and effective in modern enterprise management, and is influenced by culture.