A Review on Renewable Energy Transition under China’s Carbon Neutrality Target

Abstract

:1. Introduction

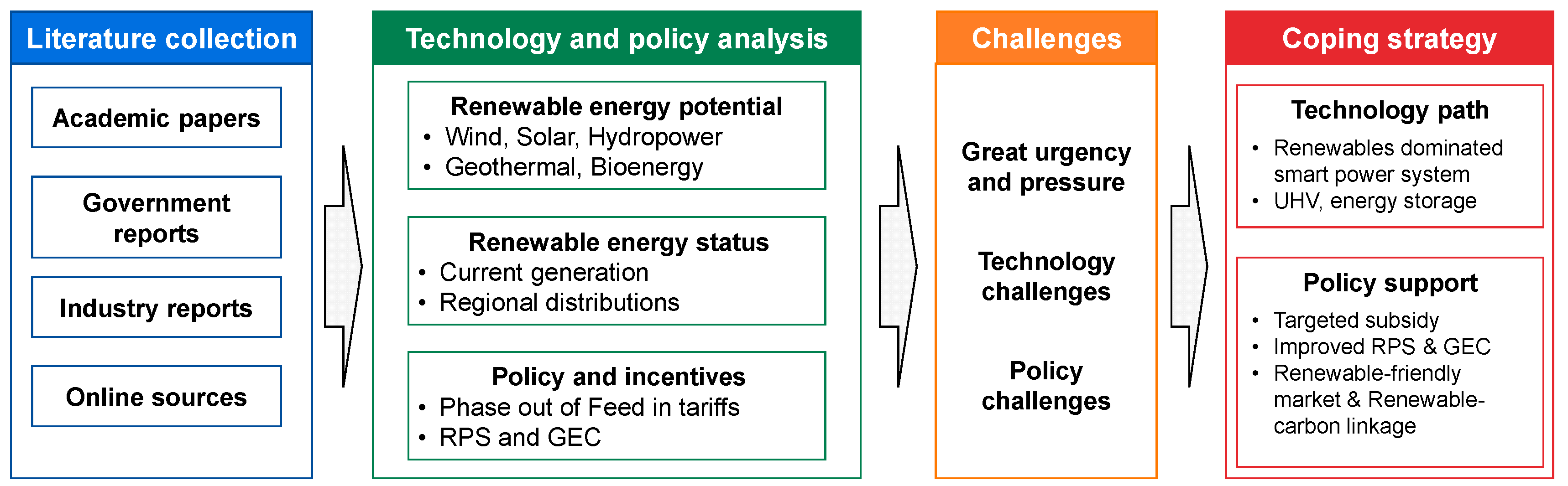

2. Methods

3. Renewable Energy Potential and Status Quo in China

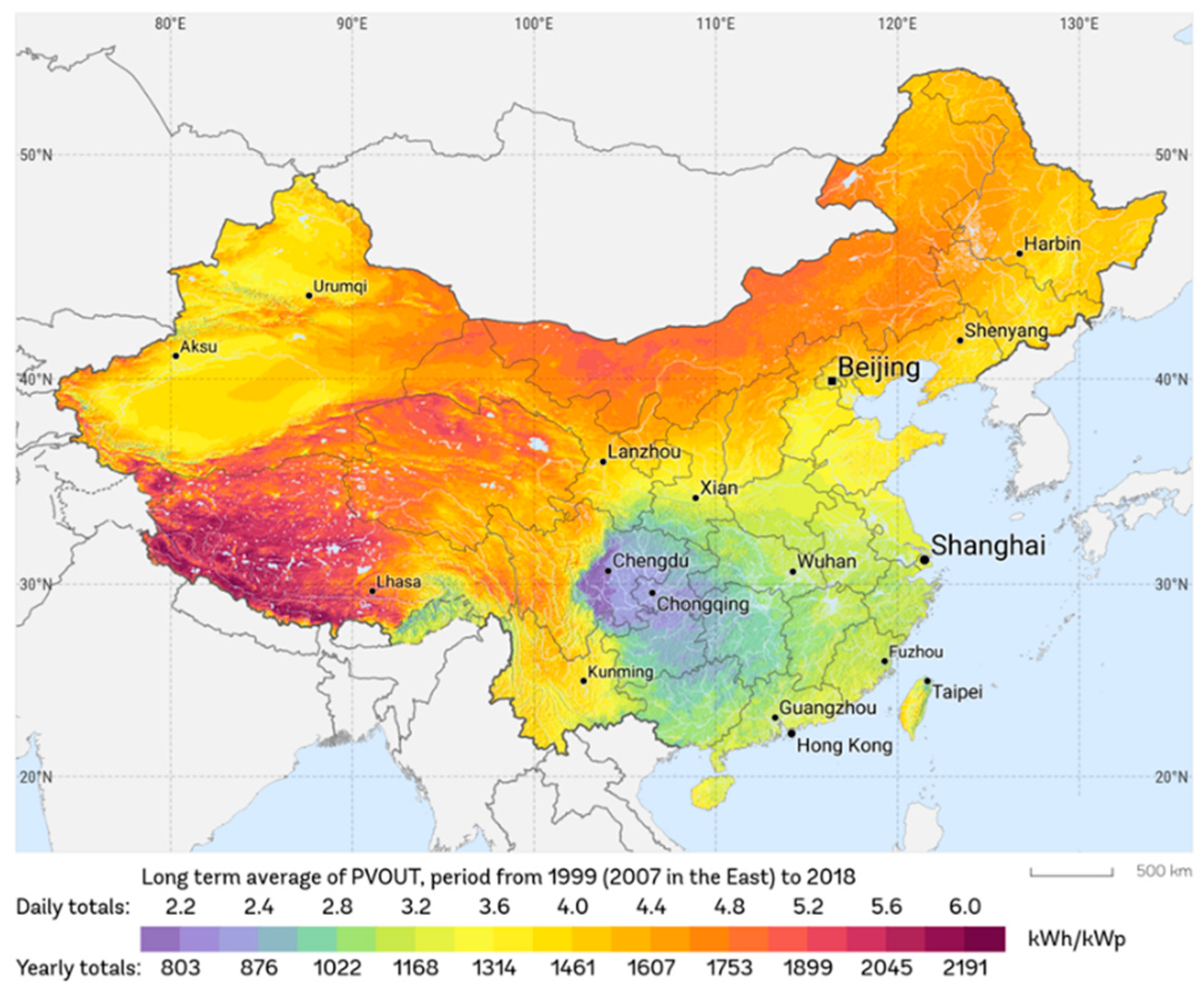

3.1. Renewable Energy Potential in China

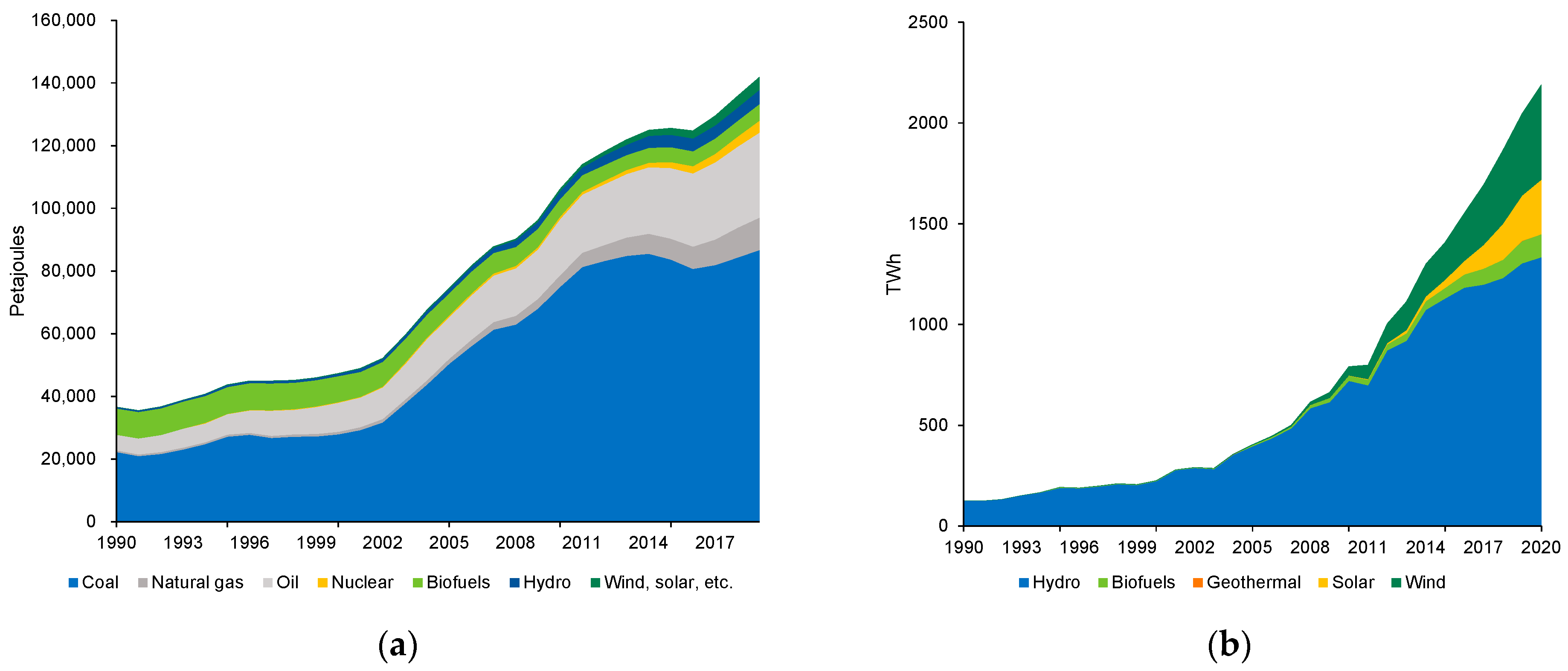

3.2. Renewable Energy Status Quo in China

- Hydropower generation remains the largest contributor to renewable energy in China, accounting for 54% in 2021. However, the share of hydropower is gradually declining as the cost advantage of wind and solar power becomes more prominent and the corresponding installed capacity surges.

- Wind power generation has shown a steady growth rate during 2010–2020, contributing 27% of renewable energy generation in 2021.

- Solar Photovoltaic power contributes 13% of renewable energy, with the highest compound annual growth rate of 81% among all renewables during 2010–2020.

- Biomass generation is still in its infancy compared to solar generation, accounting for only 5% of the total renewable generation. However, it is growing at a high rate, nearly doubling from 2016–2017 to 2020–2021.

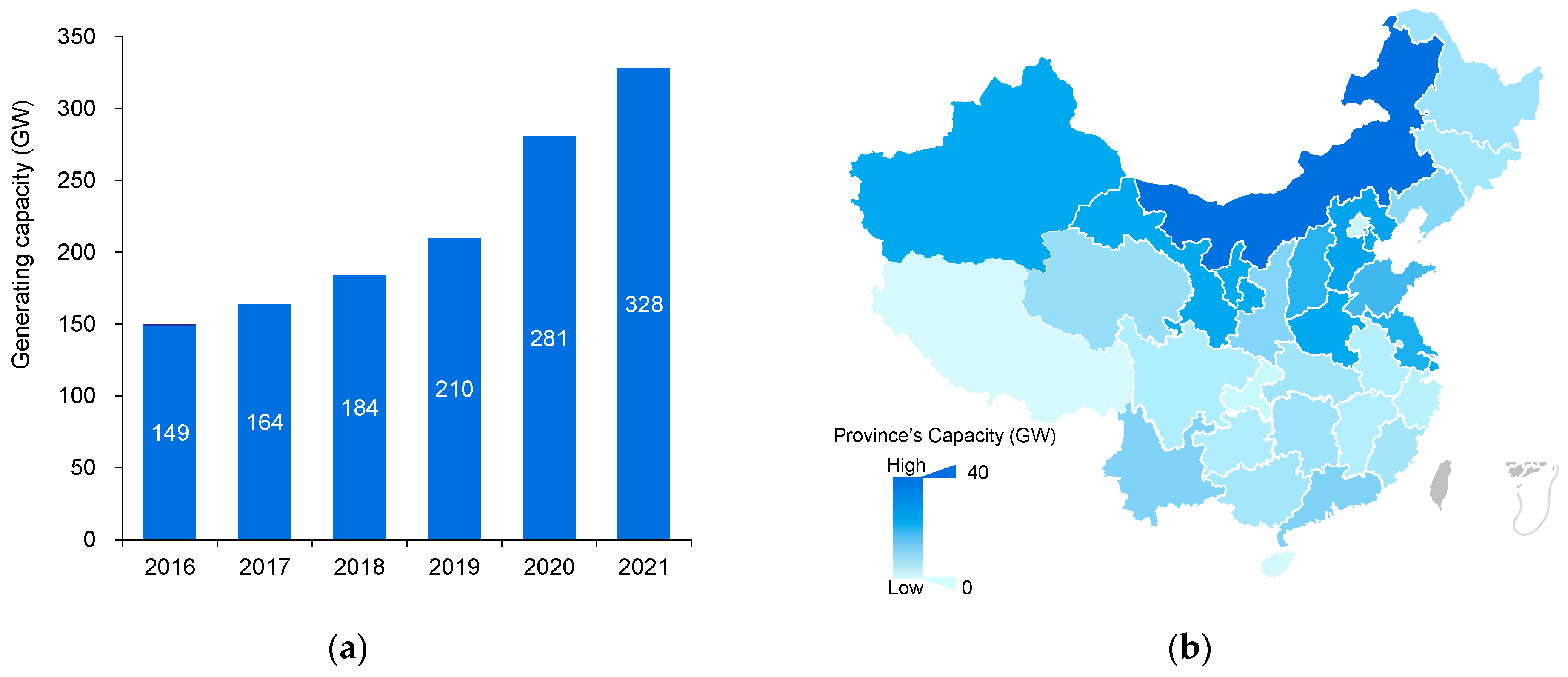

3.2.1. Wind Power

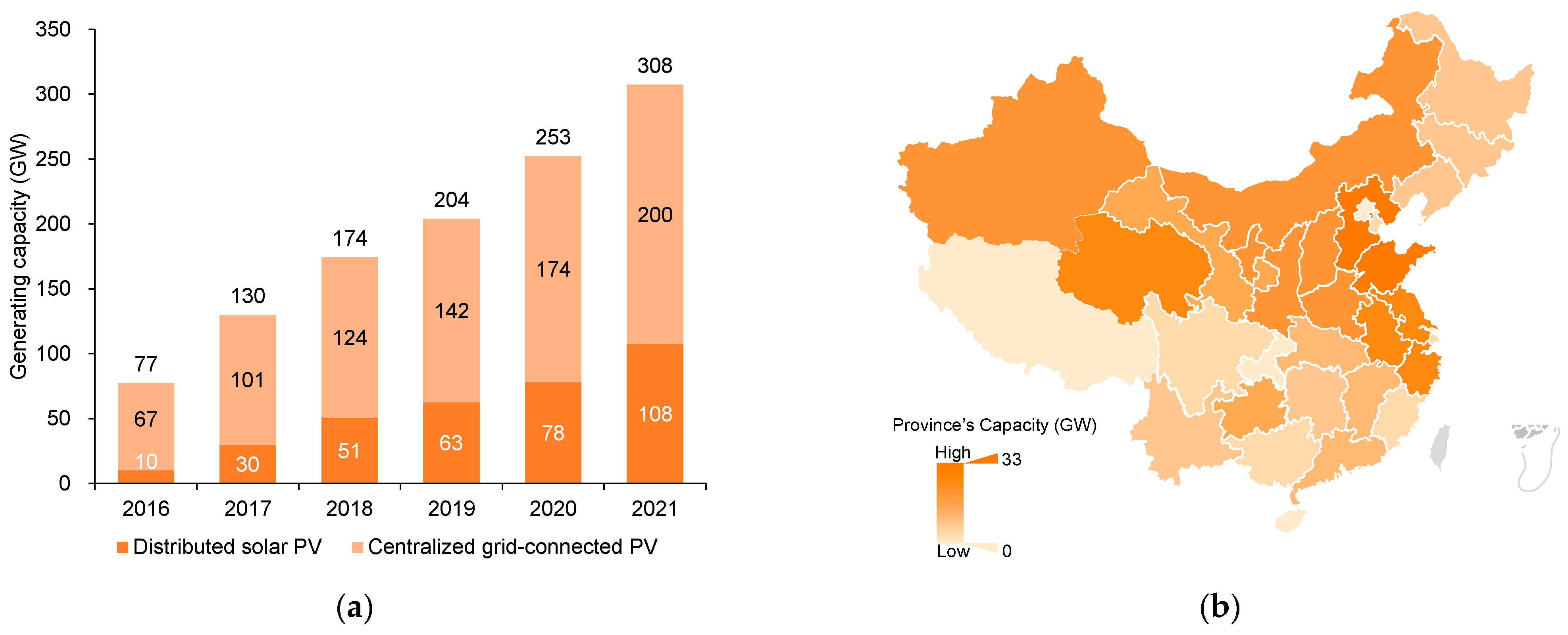

3.2.2. Solar Power

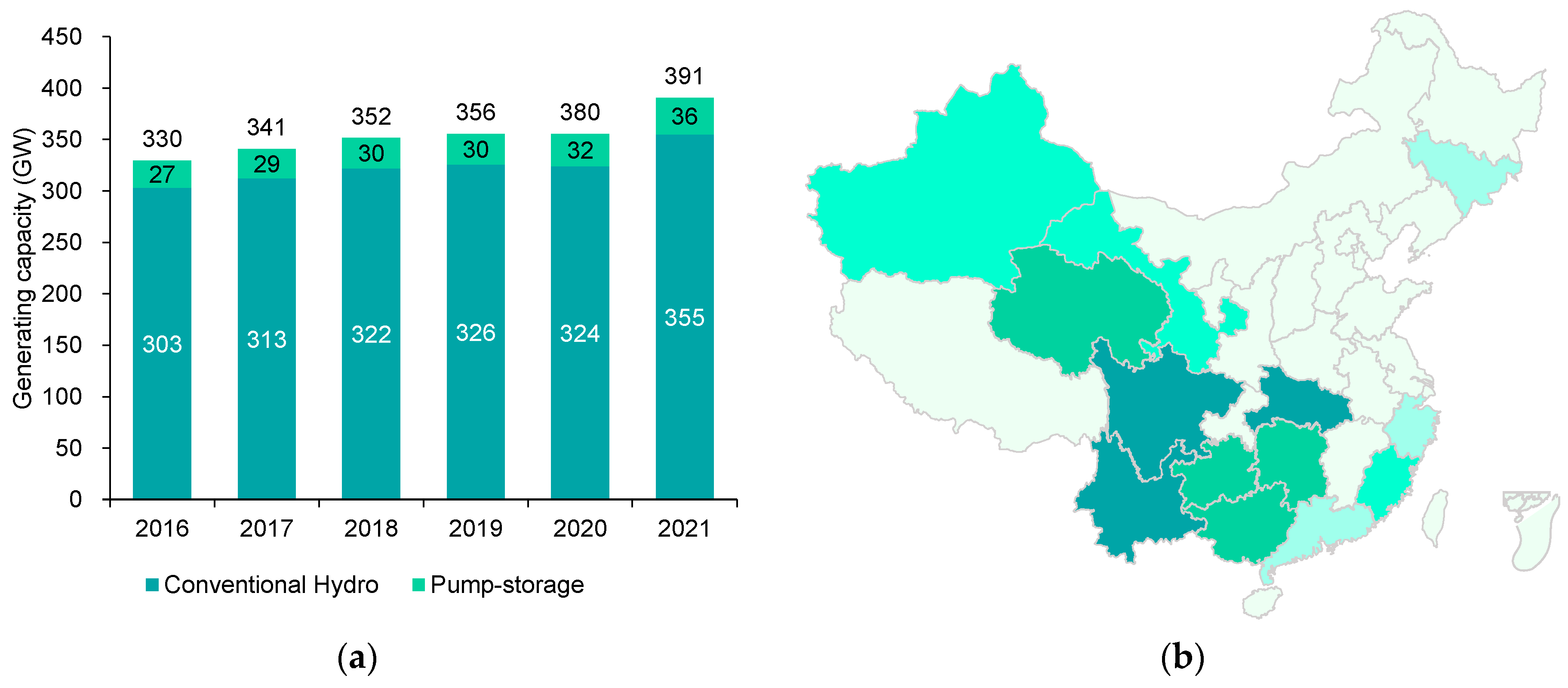

3.2.3. Hydropower

3.2.4. Others

4. Policy and Incentives

4.1. Feed-in Tariffs (FiTs)

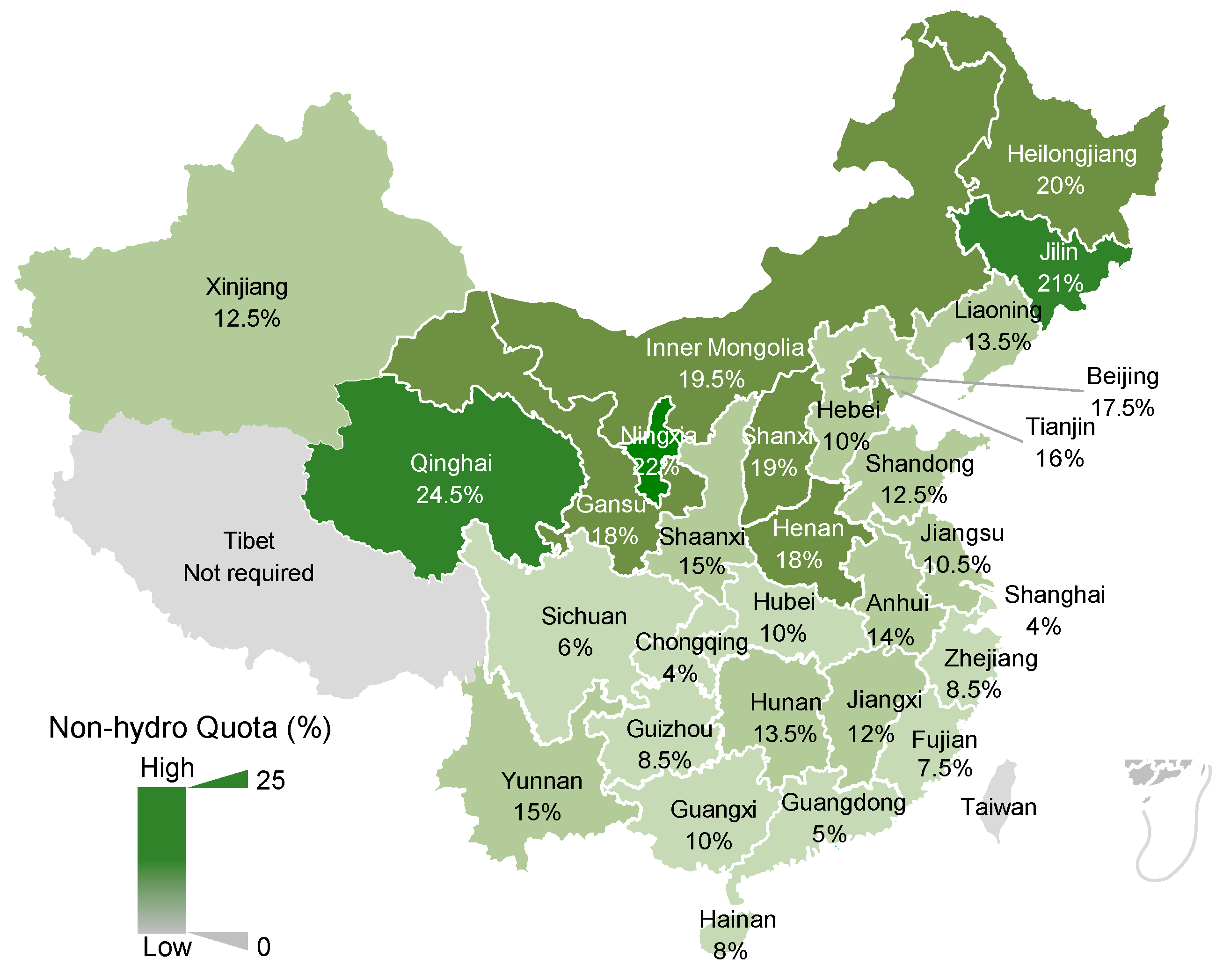

4.2. Renewable Portfolio Standards and Green Electricity Certificate

5. Challenges to Renewable Energy Transition under the Carbon Neutrality Target

5.1. Great Transition Urgency and Pressure

5.2. Consumption Challenges and Technology Flaws

5.3. Policy Challenges

6. Coping Strategy

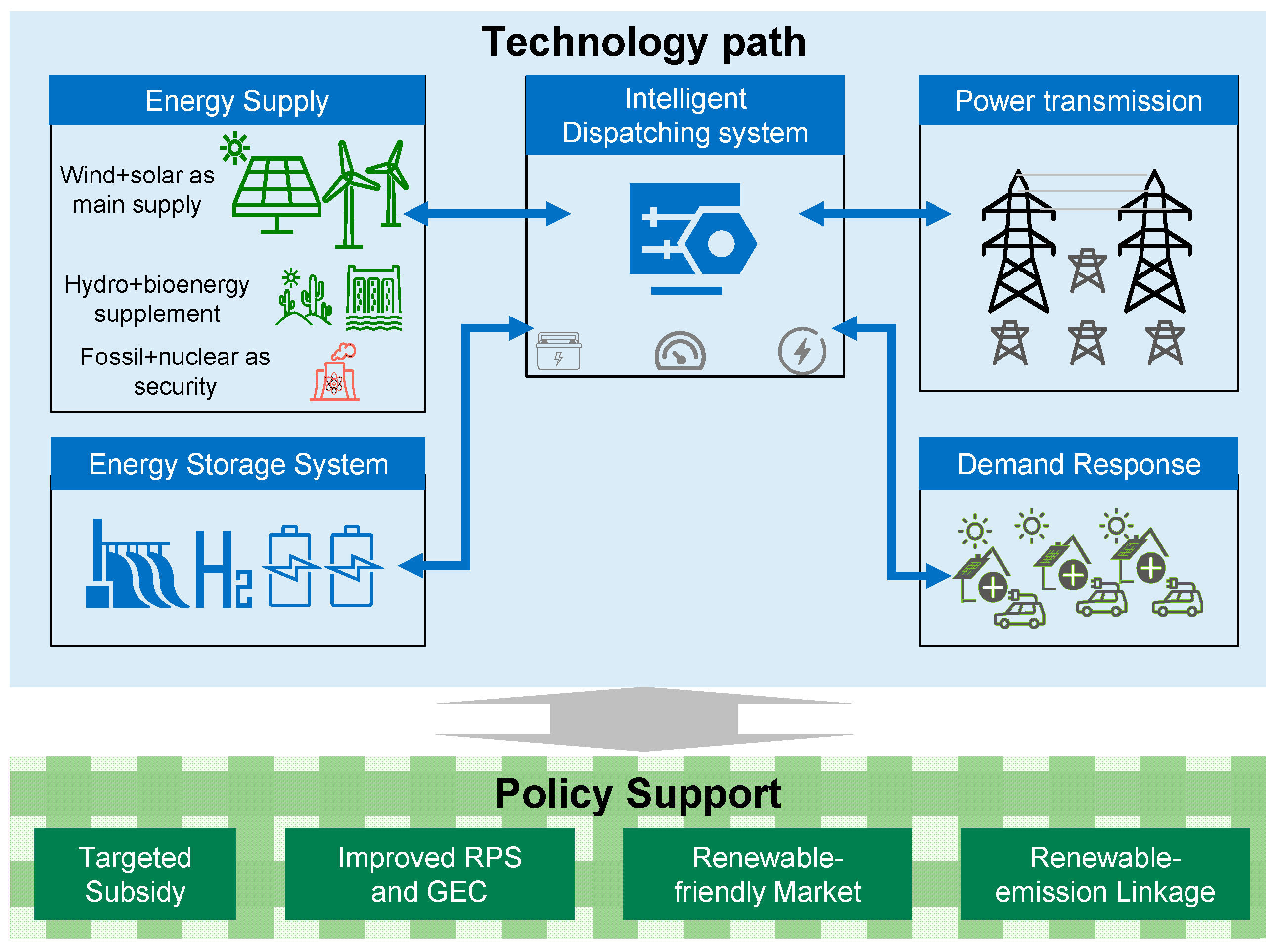

6.1. Technology Path

- Power supply: As shown in Figure 11, the renewable-dominated power system will form a paradigm of wind-solar-hydro-thermal-storage complementarity. Renewable energy especially wind and solar PV need to become the main power generation supply, while thermal power, nuclear power, and energy storage will play the role of security guarantee. This combination can ensure a high-quality power supply and increase the power reliability. For different forms of renewables, as resources such as land required for centralized renewables become more and more scarce, distributed renewable energy must play an increasingly important role. Centralized and distributed power present a simultaneous development.

- Power transmission: Ultra-high voltage (UHV) transmission needs to be the major contributor to China’s “West-to-East Power Transmission” due to the huge east–west imbalance [119,120]. The construction of UHV transmission network needs scientific and comprehensive planning. Before 2025, the construction of UHV delivery channels for renewables in Western China and UHV alternating current (AC) backbone networks in the east and west should be prioritized. Before 2035, the construction of two UHV AC synchronous power grids in the east and the west needs to be completed so the scale of west–east power transmission will be expanded. Renewable energy will dominate electricity transmission by 2025. Before 2050, China’s interconnected energy internet will be fully completed. The energy transmission efficiency between the east and the west will be significantly improved, bringing about a fundamental change in energy development. In addition to UHV transmission, the intelligent microgrid is an important tool to promote the consumption of distributed renewable energy. Microgrids can operate either connected to or off the larger grid, providing a more flexible form of renewable energy consumption. At present, the main problems of microgrids are the low yield and profitability. It is thus necessary to adopt incentives for microgrids to encourage them to participate in market transactions as independent auxiliary service providers.

- Intelligent dispatching system: To address problems caused by the high penetration of variable renewable energy, a more responsive and robust dispatching system must be established. Relying on advanced information technology, big data, the Internet of Things, 5G, artificial intelligence, etc., the new dispatching system can comprehensively cover all aspects of the power generation side, grid side, power consumption side, and energy storage side. It has the ability of high-speed, intelligent, and agile perception of the power grid system. Based on the external information and prediction of the power grid, the intelligent and precise self-control of the power grid can be realized through real-time system monitoring and advanced strategies. The dispatch center also has the function of accident prediction and protection, which can minimize the loss of system accidents. An intelligent dispatching system will serve as a core to realize the optimal adjustment of all parties with a quick response and strong robustness.

- Demand side: To promote the consumption of renewable energy, the regulation service of demand response (DR) should be fully utilized. Demand response is an effective way to control demand-side resources through information and communication technologies to provide regulation services for smart grids [121]. Through demand response, power consumption at the demand side is guided and changed so that the energy consumption is aligned as much as possible with the output of renewable energy. It can shift the peak load, causing the grid to be more reliable and efficient with lower costs. The implementation of DR is a complex system-level project that requires the cooperation of power grids, distributors, and users [122]. By establishing corresponding incentives or price agreements between retailers and users, users can change their consumption behavior, thereby providing regulation services. For the better application of demand response, cluster analysis based on big data and artificial intelligence should be conducted to accurately grasp the law between load change and user’s behavior. For areas with high load and abundant renewable energy, demand response pilot projects should be promoted. In addition, the combination of demand response and energy storage systems will exert synergistic effects to further optimize the energy consumption of smart grids. Among all energy users, the development of electric vehicles will produce the greatest contribution. Compared with other demand-side resources, electric vehicles promise a more flexible and cheaper demand response service [123]. China is the world’s largest electric vehicle market and is uniquely positioned for electric vehicle-grid interaction. It is predicted that China’s V2G implementation could reduce total power system costs by 2% by 2030 [124]. Through reasonable guidance and scientific market mechanisms, a win-win situation can be achieved for both EV owners and the grid side [125,126].

- Energy storage: As mentioned above, the difficulty of renewable energy consumption has become a major factor restricting its development. Renewable energy with high variability needs a powerful storage system to mitigate the curtailment. In the future, China should adopt efforts to develop flexible energy and realize the integration of different renewables and energy storage systems. There are three main types of renewable energy storage: (1) Mechanical energy storage, such as pumped storage. (2) Electrochemical storage, e.g., energy storage batteries. (3) Electro-fuels (e-fuels), which are hydrogen produced through renewable electricity and other electric fuels derived from hydrogen [127].

- a.

- Pumped storage can be divided into two stages. First, when the power generation power is greater than the load, the excess power is used to pump water into the upstream reservoir, and then generate electricity using the energy of water flowing downstream when the power generation power is less than the load. Pumped storage has many functions such as peak shaving, valley filling, frequency regulation, energy storage, and emergency standby. It is one of the most mature storages with great efficiency and promising large-scale development [128]. However, it has high requirements for site selection and construction. At present, 36 GW of pumped storage capacity has been put into production in China. The Chinese government proposes that by 2025, the total scale of the pumped storage capacity will be doubled compared with the 13th Five-Year Plan, reaching more than 62 GW [129]. By 2030, the total scale of pumped storage will be doubled compared with the 14th Five-year plan, reaching about 120 GW [130].

- b.

- Besides pumped storage, battery energy storage has attracted notable attention. It can absorb power through electrochemical reactions in a lithium-ion battery, sodium-sulfur battery, and others. Because of its geographical independence, it is widely used on the power supply side, grid, and user side. Its main features are low-power, short-period, and distributed energy storage [131,132]. In addition, the development of the vehicle-to-grid (V2G) causes electric vehicles to become major mobile battery storers in China in the future [125,133,134]. By 2060, the stock of light electric vehicles in China will reach 350 million units and their electrochemical energy storage capacity will be about 25 TWh [135].

- c.

- With the increasing variability of renewable energy generation, it is necessary to store a large amount of power over days, weeks, or even months [136]. Hydrogen has obvious advantages in large-scale, long-term energy storage scenarios and is considered the most desirable way. It stores renewable energy by electrolyzing hydrogen with renewable electricity. It can be transmitted through the form of compressed gas, liquefied, metal hydride storage, or hydrogen-based fuels over long distances. It is believed that large-scale energy storage using hydrogen is an order of magnitude cheaper than batteries. For China, hydrogen is a particularly important energy carrier because it can transmit energy from areas with ample renewable energy to areas with high power demand, which addresses the mismatch of the energy supply center and demand center.

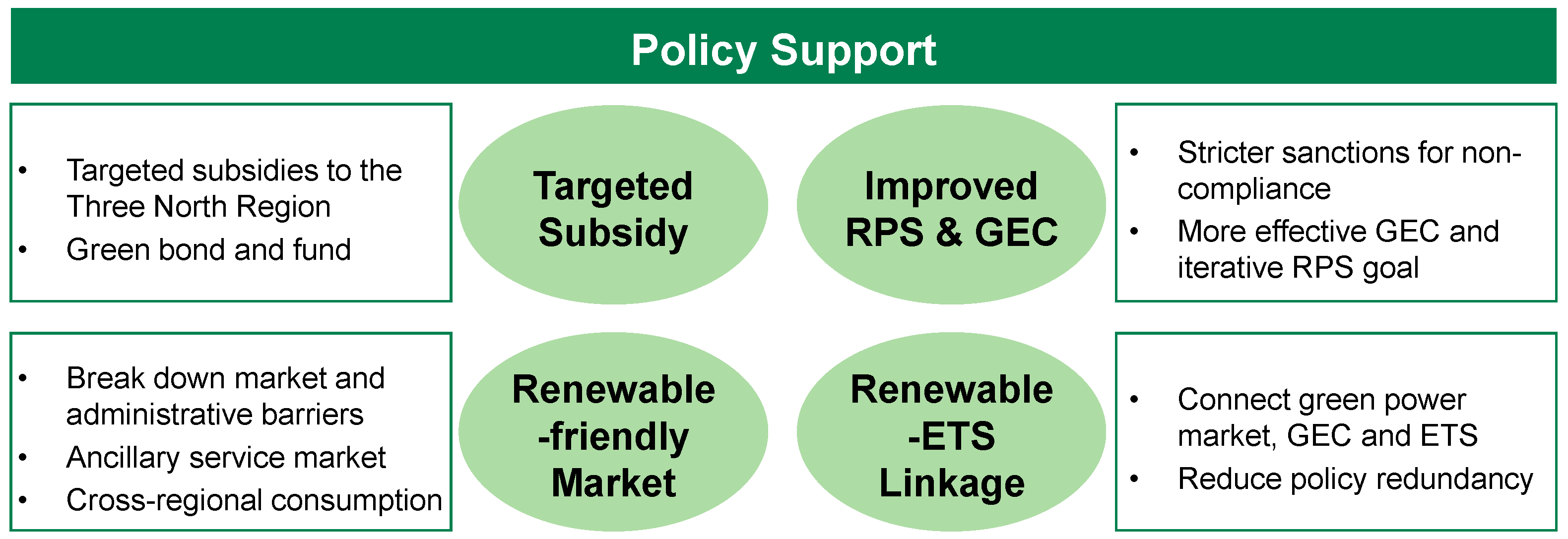

6.2. Policy Support

- Improve the current subsidy system to fully exploit Western China’s enormous renewable energy potential. Now, there is still a lot of renewable energy to be developed, particularly in Southwestern China. However, the cost and curtailment rate of renewable energy in the western region is still high and renewable energy power generation is still in its infancy due to poor infrastructure, lower local consumption, and difficulty in power transmission. As a result, Tibet is not included in RPS [137]. This sets up a vicious cycle whereby the absence of policy regulations causes renewable energy growth in these areas to lag even further. Facing the huge renewable energy development pressure brought by carbon neutrality, the great renewable energy resource endowment and lower land cost in the western region cause it to be necessary to develop renewable energy there. In the future, China should implement targeted incentives to encourage the growth of renewable energy in the west, including funding, developing infrastructure, and promoting the pilot project. Some market-based instruments, such as green credit and green bond pilots, should also be promoted. Since the capital investment in renewable energy projects is particularly high, the payback period is long, and the profitability is poor. The government’s support for the underdeveloped region is especially important.

- Enhance the RPS allocation system. First, a scientific and appropriate RPS system should be designed to focus on the development of various forms of renewable energy. Currently, RPS implementation is still in its infancy and the target is only separated into renewable energy generation and non-hydro renewable energy generation, which does not reflect the diversity of renewable energy. RPS targets should include precise targets for each type of renewable energy source. Within an implementation cycle, the RPS target should be constantly revised based on the actual completion of each province and each renewable energy source. To accommodate the rapid expansion of renewable energy, the verification cycle should be gradually shifted from annual to half-annual/monthly. RPS should also take into account the perspectives of local power grid firms and implement a feedback mechanism between power grid enterprises, province energy departments, and the National Energy Administration to thus accomplish a balanced and complete development. In addition, a sound quota obligation assessment mechanism and severe punishment measures should be implemented. Third-party regulators should be involved in monitoring transaction pricing, checking compliance with quota commitments, and penalizing infractions. Increasingly severe punishments should be established for provinces that do not achieve the RPS target. The green certificate market can only completely fulfill its role and have a certain impact on the electricity market under a robust RPS regulating mechanism and mandatory punishment.

- To effectively take advantage of the environmental benefit of renewable energy, the renewable energy market, and emission trading system should be linked. China currently has coexisting power, emission trading, and GEC markets. Demand for electricity, carbon emission quotas, and the RPS are all crucial factors that influence renewable consumption. Renewable energy, GEC, and other environmental rights products can play a certain role in promoting carbon emission reduction. It is essential to rationalize the pricing relationship between carbon emissions and renewable energy. Therefore, the carbon emissions reduced by the consumption of green electricity should be considered in the company’s carbon emissions accounting. The closer relationship between the emission trading system and the renewable energy market will enhance the company’s enthusiasm to consume green electricity. Moreover, the additional social cost brought about by the consumption of renewable energy should be shared with all stakeholders in the whole society through ETS, GEC, and RPS. In this way, energy consumers can be pushed to optimize their manner of energy consumption and lead the transformation of energy consumption. The GEC and RPS can also be paired with other financial tools such as green bonds. However, it should be highlighted that the overlap of different policy instruments should be avoided. To promote the growth of both the supply and demand sides of renewable energy, market and policy standards should be harmonized to minimize redundancy and imbalance.

- Build a renewable energy-friendly electricity market. The price mechanism maximizing the consumption of renewable energy should be adopted to increase the transactions of renewable energy in the electricity market. Market and administrative impediments should be eliminated to build a reasonable market mechanism. A level playing field for renewable energy should be provided. For renewable energy consumers, the long-term renewable power purchase agreement should be encouraged. In addition, the power market should be enhanced to incorporate auxiliary power services and represent the value of flexible regulating resources, such as peak shaving and energy storage. To increase cross-regional renewable energy consumption, the flexibility of the trading system should be optimized to encourage a larger share of power to participate in inter-provincial spot trading. Specific measures include expanding the share of market-oriented power trading and reducing non-market electricity, such as national power transmission plans. The transmission pricing should be modified to reduce the barrier effect of transmission cost on the inter-provincial consumption of renewable energy. A perfect market mechanism should be provided to maximize the consumption of renewable energy.

7. Conclusions

- (1)

- China’s renewable energy reserves are quite rich. Wind power and photovoltaic have the greatest potential for development. They are expected to overtake hydropower soon to become the major renewable energy. In terms of geographical distribution, most of China’s renewable energy sources show a huge imbalance. Western China, with rich renewable resources, is supposed to be the center of supply, yet Eastern China accounts for most of the energy consumption.

- (2)

- China’s renewable energy development has contributed significant achievements, with it having the world’s largest installed capacity and power generation. In the past, China’s policy incentives have led to the growth of renewable energy. However, most renewable energy projects in China are currently no longer subsidized. It is at a critical stage of transition from policy-driven development to market-driven development. RPS and GEC are replacing FiTs as the new policy mix to support renewable energy development.

- (3)

- In the context of carbon neutrality, China’s renewable energy development is facing serious challenges. First, the proposed goal of carbon neutrality poses a huge challenge to China’s energy transformation. It requires increasing installed renewable energy at a faster rate over the next 40 years. Second, there are issues with energy storage, the instability of industrial chain change, and the poor utilization rate. Third, the transition period from policy-led to market-led requires stronger policy support. The current competitiveness of renewable energy in the power market needs to be enhanced.

- (4)

- To achieve the energy transition required by the carbon neutrality target, China should establish a power system dominated by renewable energy and comprehensively assist the development and consumption of renewable energy in energy storage, smart grid, demand side, and dispatching. In terms of policy, we should improve the existing incentive and punishment system, refine the RPS and GEC mechanism, build a renewable energy-friendly market mechanism, link the renewable energy market and carbon emissions trading system.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Xia, P.; Yuan, B.; Lu, G.; Wang, Y.; Zhang, Y.; Zhang, L.; Shu, Y. Carbon Peak and Carbon Neutrality Path for China’s Power Industry. Chin. J. Eng. Sci. 2021, 23, 1–14. [Google Scholar] [CrossRef]

- IEA. An Energy Sector Roadmap to Carbon Neutrality in China; IEA: Paris, France, 2021. [Google Scholar]

- Jie, D.; Xu, X.; Guo, F. The future of coal supply in China based on non-fossil energy development and carbon price strategies. Energy 2021, 220, 119644. [Google Scholar] [CrossRef]

- Xu, S. The paradox of the energy revolution in China: A socio-technical transition perspective. Renew. Sustain. Energy Rev. 2021, 137, 110469. [Google Scholar] [CrossRef]

- Tong, Z.; Cheng, Z.; Tong, S. A review on the development of compressed air energy storage in China: Technical and economic challenges to commercialization. Renew. Sustain. Energy Rev. 2021, 135, 110178. [Google Scholar] [CrossRef]

- Fan, J.-L.; Wang, J.-X.; Hu, J.-W.; Yang, Y.; Wang, Y. Will China achieve its renewable portfolio standard targets? An analysis from the perspective of supply and demand. Renew. Sustain. Energy Rev. 2021, 138, 110510. [Google Scholar] [CrossRef]

- Winter, N. Renewables 2022 Global Status Report China Factsheet-Key Headlines; REN21: Paris, France, 2022. [Google Scholar]

- Ahmadi, A.; Khazaee, M.; Zahedi, R.; Faryadras, R. Assessment of renewable energy production capacity of Asian countries: A review. New Energy Exploit. Appl. 2022, 1, 25–41. [Google Scholar]

- National Development and Reform Commission. 14th Five-year Plan for Renewable Energy Development. Available online: https://www.ndrc.gov.cn/xxgk/zcfb/ghwb/202206/P020220602315308557623.pdf (accessed on 19 June 2022).

- Stern, N.; Xie, C. China’s new growth story: Linking the 14th Five-Year Plan with the 2060 carbon neutrality pledge. J. Chin. Econ. Bus. Stud. 2022, 20, 1–21. [Google Scholar] [CrossRef]

- Zhang, S.; Chen, W. Assessing the energy transition in China towards carbon neutrality with a probabilistic framework. Nat. Commun. 2022, 13, 87. [Google Scholar] [CrossRef]

- Zhang, S.; Chen, W. China’s Energy Transition Pathway in a Carbon Neutral Vision. Engineering 2022, 14, 64–76. [Google Scholar] [CrossRef]

- Liu, L.; Wang, Z.; Wang, Y.; Wang, J.; Chang, R.; He, G.; Tang, W.; Gao, Z.; Li, J.; Liu, C.; et al. Optimizing wind/solar combinations at finer scales to mitigate renewable energy variability in China. Renew. Sustain. Energy Rev. 2020, 132, 110151. [Google Scholar] [CrossRef]

- Yuan, X.; Zuo, J. Transition to low carbon energy policies in China—From the Five-Year Plan perspective. Energy Policy 2011, 39, 3855–3859. [Google Scholar] [CrossRef]

- He, Y.; Xu, Y.; Pang, Y.; Tian, H.; Wu, R. A regulatory policy to promote renewable energy consumption in China: Review and future evolutionary path. Renew. Energy 2016, 89, 695–705. [Google Scholar] [CrossRef]

- Liu, J. China’s renewable energy law and policy: A critical review. Renew. Sustain. Energy Rev. 2019, 99, 212–219. [Google Scholar] [CrossRef]

- The State Council of the People’s Republic of China. China’s Installed Renewable Power Generation Capacity Exceeds 1 Billion Kilowatts. Available online: http://www.gov.cn/xinwen/2021-11/29/content_5653908.htm (accessed on 17 April 2022).

- Zhang, D.; Wang, J.; Lin, Y.; Si, Y.; Huang, C.; Yang, J.; Huang, B.; Li, W. Present situation and future prospect of renewable energy in China. Renew. Sustain. Energy Rev. 2017, 76, 865–871. [Google Scholar] [CrossRef]

- Liu, W.; Lund, H.; Mathiesen, B.V.; Zhang, X. Potential of renewable energy systems in China. Appl. Energy 2011, 88, 518–525. [Google Scholar] [CrossRef] [Green Version]

- Li, X.-z.; Chen, Z.-j.; Fan, X.-c.; Cheng, Z.-j. Hydropower development situation and prospects in China. Renew. Sustain. Energy Rev. 2018, 82, 232–239. [Google Scholar] [CrossRef]

- Xu, X.; Yang, G.; Tan, Y.; Liu, J.; Zhang, S.; Bryan, B. Unravelling the effects of large-scale ecological programs on ecological rehabilitation of China’s Three Gorges Dam. J. Clean. Prod. 2020, 256, 120446. [Google Scholar] [CrossRef]

- Zhang, L.; Pang, M.; Bahaj, A.S.; Yang, Y.; Wang, C. Small hydropower development in China: Growing challenges and transition strategy. Renew. Sustain. Energy Rev. 2021, 137, 110653. [Google Scholar] [CrossRef]

- Liu, B.; Liao, S.; Cheng, C.; Chen, F.; Li, W. Hydropower curtailment in Yunnan Province, southwestern China: Constraint analysis and suggestions. Renew. Energy 2018, 121, 700–711. [Google Scholar] [CrossRef]

- Rocky Mountain Institute. China: 2050 a Fully Developed Rich Zero Carbon Economy; Rocky Mountain Institute-Energy Transition Commssion: Basalt, CO, USA, 2019. [Google Scholar]

- Liu, F.; Sun, F.; Liu, W.; Wang, T.; Wang, H.; Wang, X.; Lim, W.H. On wind speed pattern and energy potential in China. Appl. Energy 2019, 236, 867–876. [Google Scholar] [CrossRef]

- Bandoc, G.; Prăvălie, R.; Patriche, C.; Degeratu, M. Spatial assessment of wind power potential at global scale. A geographical approach. J. Clean. Prod. 2018, 200, 1065–1086. [Google Scholar] [CrossRef]

- Dai, J.; Yang, X.; Wen, L. Development of wind power industry in China: A comprehensive assessment. Renew. Sustain. Energy Rev. 2018, 97, 156–164. [Google Scholar] [CrossRef]

- Feng, Y.; Zhang, X.; Jia, Y.; Cui, N.; Hao, W.; Li, H.; Gong, D. High-resolution assessment of solar radiation and energy potential in China. Energy Convers. Manag. 2021, 240, 114265. [Google Scholar] [CrossRef]

- Qaisrani, M.A.; Wei, J.; Khan, L.A. Potential and transition of concentrated solar power: A case study of China. Sustain. Energy Technol. Assess. 2021, 44, 101052. [Google Scholar] [CrossRef]

- Energy Sector Management Assistance Program. Global Photovoltaic Power Potential by Country; World Bank: Washington, DC, USA, 2020. [Google Scholar]

- He, J.; Zhu, R.; Lin, B. Prospects, obstacles and solutions of biomass power industry in China. J. Clean. Prod. 2019, 237, 117783. [Google Scholar] [CrossRef]

- Ministry of Natural Resources, PRC. China Mineral Resources Report (2022); Geological Publishing House: Beijing, China, 2022.

- International Energy Agency. Key Energy Statistics. 2019. Available online: https://www.iea.org/countries/china (accessed on 15 June 2022).

- National Energy Administration. National Power Industry Statistics of China in 2021. Available online: http://www.nea.gov.cn/2022-01/26/c_1310441589.htm (accessed on 17 June 2022).

- Jiang, Z.; Liu, Z. Policies and exploitative and exploratory innovations of the wind power industry in China: The role of technological path dependence. Technol. Forecast. Soc. Chang. 2022, 177, 121519. [Google Scholar] [CrossRef]

- National Development and Reform Commission. Clean Energy Consumption Plan (2018–2020). Available online: https://www.ndrc.gov.cn/xxgk/zcfb/ghxwj/201812/W020190905495739358481.pdf (accessed on 23 June 2022).

- National Energy Administration. Online Press Conference in the Fourth Quarter of 2020. Available online: http://www.nea.gov.cn/2020-10/30/c_139478872.htm (accessed on 20 June 2022).

- National New Energy Consumption Monitoring and Warning Center. National New Energy Power Consumption Assessment and Analysis Report for the Fourth Quarter of 2021. Available online: https://www.escn.com.cn/news/show-1357810.html (accessed on 27 June 2022).

- Hsiao, C.Y.-L.; Sheng, N.; Fu, S.; Wei, X. Evaluation of contagious effects of China’s wind power industrial policies. Energy 2022, 238, 121760. [Google Scholar] [CrossRef]

- Zhuo, C.; Junhong, G.; Wei, L.; Fei, Z.; Chan, X.; Zhangrong, P. Changes in wind energy potential over China using a regional climate model ensemble. Renew. Sustain. Energy Rev. 2022, 159, 112219. [Google Scholar] [CrossRef]

- Song, S.; Lin, H.; Sherman, P.; Yang, X.; Nielsen, C.P.; Chen, X.; McElroy, M.B. Production of hydrogen from offshore wind in China and cost-competitive supply to Japan. Nat. Commun. 2021, 12, 6953. [Google Scholar] [CrossRef]

- Lei, Y.; Lu, X.; Shi, M.; Wang, L.; Lv, H.; Chen, S.; Hu, C.; Yu, Q.; da Silveira, S.D.H. SWOT analysis for the development of photovoltaic solar power in Africa in comparison with China. Environ. Impact Assess. Rev. 2019, 77, 122–127. [Google Scholar] [CrossRef]

- Chen, C.; Jiang, Y.; Ye, Z.; Yang, Y.; Hou, L.a. Sustainably integrating desalination with solar power to overcome future freshwater scarcity in China. Glob. Energy Interconnect. 2019, 2, 98–113. [Google Scholar] [CrossRef]

- Wu, X.; Li, C.; Shao, L.; Meng, J.; Zhang, L.; Chen, G. Is solar power renewable and carbon-neutral: Evidence from a pilot solar tower plant in China under a systems view. Renew. Sustain. Energy Rev. 2021, 138, 110655. [Google Scholar] [CrossRef]

- Wu, Y.; Zhang, B.; Wu, C.; Zhang, T.; Liu, F. Optimal site selection for parabolic trough concentrating solar power plant using extended PROMETHEE method: A case in China. Renew. Energy 2019, 143, 1910–1927. [Google Scholar] [CrossRef]

- Wang, Y.; He, J.; Chen, W. Distributed solar photovoltaic development potential and a roadmap at the city level in China. Renew. Sustain. Energy Rev. 2021, 141, 110772. [Google Scholar] [CrossRef]

- Yang, Y.; Campana, P.E.; Yan, J. Potential of unsubsidized distributed solar PV to replace coal-fired power plants, and profits classification in Chinese cities. Renew. Sustain. Energy Rev. 2020, 131, 109967. [Google Scholar] [CrossRef]

- Bin, D. Discussion on the development direction of hydropower in China. Clean Energy 2021, 5, 10–18. [Google Scholar] [CrossRef]

- Yuguda, T.K.; Imanche, S.A.; Ze, T.; Akintunde, T.Y.; Luka, B.S. Hydropower development, policy and partnership in the 21st century: A China-Nigeria outlook. Energy Environ. 2022, 22107, 9423. [Google Scholar] [CrossRef]

- Jiayu, B.; Xingang, W.; Chaoshan, X.; Zhiyong, Y.; Shoutao, T.; He, C. Development Status and Measures to Promote the Development of Renewable Energy in China. In Proceedings of the 2021 3rd Asia Energy and Electrical Engineering Symposium (AEEES), Chengdu, China, 26–29 March 2021; pp. 1102–1107. [Google Scholar]

- GEIDCO. Research Report of China’s Carbon Neutrality before 2060; Global Energy Interconnection Development and Cooperation Organization: Beijing, China, 2021. [Google Scholar]

- Zhu, J.; Hu, K.; Lu, X.; Huang, X.; Liu, K.; Wu, X. A review of geothermal energy resources, development, and applications in China: Current status and prospects. Energy 2015, 93, 466–483. [Google Scholar] [CrossRef]

- Hu, Y.; Cheng, H.; Tao, S. Opportunity and challenges in large-scale geothermal energy exploitation in China. Crit. Rev. Environ. Sci. Technol. 2021, 52, 1–22. [Google Scholar] [CrossRef]

- Zhong, C.; Xu, T.; Yuan, Y.; Feng, B.; Yu, H. The feasibility of clean power generation from a novel dual-vertical-well enhanced geothermal system (EGS): A case study in the Gonghe Basin, China. J. Clean. Prod. 2022, 344, 131109. [Google Scholar] [CrossRef]

- Nie, Y.; Li, J.; Wang, C.; Huang, G.; Fu, J.; Chang, S.; Li, H.; Ma, S.; Yu, L.; Cui, X. A fine-resolution estimation of the biomass resource potential across China from 2020 to 2100. Resour. Conserv. Recycl. 2022, 176, 105944. [Google Scholar] [CrossRef]

- Shen, L.; Liu, L.; Yao, Z.; Liu, G.; Lucas, M. Development potentials and policy options of biomass in China. Environ. Manag. 2010, 46, 539–554. [Google Scholar] [CrossRef] [PubMed]

- Chen, X.; Lin, B. Towards carbon neutrality by implementing carbon emissions trading scheme: Policy evaluation in China. Energy Policy 2021, 157, 112510. [Google Scholar] [CrossRef]

- Song, D.; Liu, Y.; Qin, T.; Gu, H.; Cao, Y.; Shi, H. Overview of the Policy Instruments for Renewable Energy Development in China. Energies 2022, 15, 6513. [Google Scholar] [CrossRef]

- Wu, J.; Fan, Y.; Timilsina, G.; Xia, Y.; Guo, R. Understanding the economic impact of interacting carbon pricing and renewable energy policy in China. Reg. Environ. Chang. 2020, 20, 1–11. [Google Scholar] [CrossRef]

- Cao, J.; Dai, H.; Li, S.; Guo, C.; Ho, M.; Cai, W.; He, J.; Huang, H.; Li, J.; Liu, Y. The general equilibrium impacts of carbon tax policy in China: A multi-model comparison. Energy Econ. 2021, 99, 105284. [Google Scholar] [CrossRef]

- Dong, Z.; Yu, X.; Chang, C.-T.; Zhou, D.; Sang, X. How does feed-in tariff and renewable portfolio standard evolve synergistically? An integrated approach of tripartite evolutionary game and system dynamics. Renew. Energy 2022, 186, 864–877. [Google Scholar] [CrossRef]

- Rigter, J.; Vidican, G. Cost and optimal feed-in tariff for small scale photovoltaic systems in China. Energy Policy 2010, 38, 6989–7000. [Google Scholar] [CrossRef]

- Lu, Y.; Khan, Z.A.; Alvarez-Alvarado, M.S.; Zhang, Y.; Huang, Z.; Imran, M. A critical review of sustainable energy policies for the promotion of renewable energy sources. Sustainability 2020, 12, 5078. [Google Scholar] [CrossRef]

- Zhang, L.; Chen, C.; Wang, Q.; Zhou, D. The impact of feed-in tariff reduction and renewable portfolio standard on the development of distributed photovoltaic generation in China. Energy 2021, 232, 120933. [Google Scholar] [CrossRef]

- Lo, K. A critical review of China’s rapidly developing renewable energy and energy efficiency policies. Renew. Sustain. Energy Rev. 2014, 29, 508–516. [Google Scholar] [CrossRef]

- Zhang, A.H.; Sirin, S.M.; Fan, C.; Bu, M. An analysis of the factors driving utility-scale solar PV investments in China: How effective was the feed-in tariff policy? Energy Policy 2022, 167, 113044. [Google Scholar] [CrossRef]

- Tu, Q.; Mo, J.; Betz, R.; Cui, L.; Fan, Y.; Liu, Y. Achieving grid parity of solar PV power in China-The role of Tradable Green Certificate. Energy Policy 2020, 144, 111681. [Google Scholar] [CrossRef]

- Xu, X.; Niu, D.; Xiao, B.; Guo, X.; Zhang, L.; Wang, K. Policy analysis for grid parity of wind power generation in China. Energy Policy 2020, 138, 111225. [Google Scholar] [CrossRef]

- Shahbaz, M.; Rizvi, S.K.A.; Dong, K.; Vo, X.V. Fiscal decentralization as new determinant of renewable energy demand in China: The role of income inequality and urbanization. Renew. Energy 2022, 187, 68–80. [Google Scholar] [CrossRef]

- Zhang, C.; Zhou, D.; Wang, Q.; Ding, H.; Zhao, S. Will fiscal decentralization stimulate renewable energy development? Evidence from China. Energy Policy 2022, 164, 112893. [Google Scholar] [CrossRef]

- Wei, Y.; Zou, Q.-P.; Lin, X. Evolution of price policy for offshore wind energy in China: Trilemma of capacity, price and subsidy. Renew. Sustain. Energy Rev. 2021, 136, 110366. [Google Scholar] [CrossRef]

- Ying, Z.; Xin-gang, Z.; Lei, X. Supply side incentive under the Renewable Portfolio Standards: A perspective of China. Renew. Energy 2022, 193, 505–518. [Google Scholar] [CrossRef]

- Muhammed, G.; Tekbiyik-Ersoy, N. Development of renewable energy in China, USA, and Brazil: A comparative study on renewable energy policies. Sustainability 2020, 12, 9136. [Google Scholar] [CrossRef]

- Lin, B.; Chen, Y. Impact of the Feed-in Tariff Policy on Renewable Innovation: Evidence from Wind Power Industry and Photovoltaic Power Industry in China. Energy J. 2023, 44, 2. [Google Scholar] [CrossRef]

- National Development and Reform Commission. Notice on the Renewable Electricity Consumption Quota and Related Matters in 2021. Available online: https://www.ndrc.gov.cn/xxgk/zcfb/tz/202105/t20210525_1280789.html?code=&state=123 (accessed on 23 September 2022).

- Rocky Mountain Institute. China Green Power Market Annual Report; Rocky Mountain Institute: Basalt, CO, USA, 2022. [Google Scholar]

- Fan, J.-L.; Wang, J.-X.; Hu, J.-W.; Wang, Y.; Zhang, X. Optimization of China’s provincial renewable energy installation plan for the 13th five-year plan based on renewable portfolio standards. Appl. Energy 2019, 254, 113757. [Google Scholar] [CrossRef]

- State Council of the People’s Republic of China. Carbon Peaking Action Plan before 2030. Available online: http://www.gov.cn/zhengce/content/2021-10/26/content_5644984.htm (accessed on 17 September 2022).

- Niu, Z.; Xiong, J.; Ding, X.; Wu, Y. Analysis of China’s Carbon Peak Achievement in 2025. Energies 2022, 15, 5041. [Google Scholar] [CrossRef]

- Zhang, X.; Huang, X.; Zhang, D. Research on the Pathway and Policies for China’s Energy and Economy Transformation toward Carbon Neutrality. J. Manag. World 2022, 38, 35–66. [Google Scholar]

- China National Petroleum Corporation. World and China Energy Outlook 2060; CNPC: Beijing, China, 2021. [Google Scholar]

- Shell. Achieving a Carbon-Neutral Energy System in China by 2060; Shell: Beijing, China, 2022. [Google Scholar]

- DNV. Energy Transition Outlook 2021 Great China Regional Forecast; Det Norske Veritas: Bærum, Norway, 2021. [Google Scholar]

- British Petroleum. Energy Outlook 2022. Available online: https://www.bp.com.cn/content/dam/bp/country-sites/zh_cn/china/home/reports/bp-energy-outlook/2022/energy-outlook-2022-edition-cn.pdf (accessed on 17 September 2022).

- Kang, Y.; Yang, Q.; Bartocci, P.; Wei, H.; Liu, S.S.; Wu, Z.; Zhou, H.; Yang, H.; Fantozzi, F.; Chen, H. Bioenergy in China: Evaluation of domestic biomass resources and the associated greenhouse gas mitigation potentials. Renew. Sustain. Energy Rev. 2020, 127, 109842. [Google Scholar] [CrossRef] [PubMed]

- Ibrahim, R.L. Post-COP26: Can energy consumption, resource dependence, and trade openness promote carbon neutrality? Homogeneous and heterogeneous analyses for G20 countries. Environ. Sci. Pollut. Res. 2022, 1–12. [Google Scholar] [CrossRef]

- Harjanne, A.; Korhonen, J.M. Abandoning the concept of renewable energy. Energy Policy 2019, 127, 330–340. [Google Scholar] [CrossRef] [Green Version]

- Zhang, Y.; Xu, Y.; Guo, H.; Zhang, X.; Guo, C.; Chen, H. A hybrid energy storage system with optimized operating strategy for mitigating wind power fluctuations. Renew. Energy 2018, 125, 121–132. [Google Scholar] [CrossRef]

- Li, J.; Chen, S.; Wu, Y.; Wang, Q.; Liu, X.; Qi, L.; Lu, X.; Gao, L. How to make better use of intermittent and variable energy? A review of wind and photovoltaic power consumption in China. Renew. Sustain. Energy Rev. 2021, 137, 110626. [Google Scholar] [CrossRef]

- Zhang, Y.; Xu, Y.; Zhou, X.; Guo, H.; Zhang, X.; Chen, H. Compressed air energy storage system with variable configuration for accommodating large-amplitude wind power fluctuation. Appl. Energy 2019, 239, 957–968. [Google Scholar] [CrossRef]

- National Energy Administration. In the First Half of the Year, the Newly Installed Capacity of Renewable Energy Power Generation Accounted for 80% of the National Total. Available online: http://www.gov.cn/xinwen/2022-08/06/content_5704430.htm (accessed on 27 September 2022).

- Zhang, R.; Shimada, K.; Ni, M.; Shen, G.Q.; Wong, J.K. Low or No subsidy? Proposing a regional power grid based wind power feed-in tariff benchmark price mechanism in China. Energy Policy 2020, 146, 111758. [Google Scholar] [CrossRef]

- Dong, F.; Shi, L. Regional differences study of renewable energy performance: A case of wind power in China. J. Clean. Prod. 2019, 233, 490–500. [Google Scholar] [CrossRef]

- Huang, T.; Wang, S.; Yang, Q.; Li, J. A GIS-based assessment of large-scale PV potential in China. Energy Procedia 2018, 152, 1079–1084. [Google Scholar] [CrossRef]

- Song, X.; Huang, Y.; Zhao, C.; Liu, Y.; Lu, Y.; Chang, Y.; Yang, J. An approach for estimating solar photovoltaic potential based on rooftop retrieval from remote sensing images. Energies 2018, 11, 3172. [Google Scholar]

- Amrouche, S.O.; Rekioua, D.; Rekioua, T.; Bacha, S. Overview of energy storage in renewable energy systems. Int. J. Hydrogen Energy 2016, 41, 20914–20927. [Google Scholar] [CrossRef]

- Wang, Y.W. Carbon peaking, carbon neutrality targets and China’s new energy revolution. Soc. Sci. Digest. 2022, 1, 5–7. [Google Scholar]

- Guo, X.; Zhang, J.; Tian, Q. Modeling the potential impact of future lithium recycling on lithium demand in China: A dynamic SFA approach. Renew. Sustain. Energy Rev. 2021, 137, 110461. [Google Scholar] [CrossRef]

- Sun, X.; Hao, H.; Zhao, F.; Liu, Z. The dynamic equilibrium mechanism of regional lithium flow for transportation electrification. Environ. Sci. Technol. 2018, 53, 743–751. [Google Scholar] [CrossRef]

- Zhang, H.; Nai, J.; Yu, L.; Lou, X.W.D. Metal-organic-framework-based materials as platforms for renewable energy and environmental applications. Joule 2017, 1, 77–107. [Google Scholar]

- Sibtain, M.; Li, X.; Bashir, H.; Azam, M.I. Hydropower exploitation for Pakistan’s sustainable development: A SWOT analysis considering current situation, challenges, and prospects. Energy Strategy Rev. 2021, 38, 100728. [Google Scholar] [CrossRef]

- Duan, K.; Caldwell, P.V.; Sun, G.; McNulty, S.G.; Zhang, Y.; Shuster, E.; Liu, B.; Bolstad, P.V. Understanding the role of regional water connectivity in mitigating climate change impacts on surface water supply stress in the United States. J. Hydrol. 2019, 570, 80–95. [Google Scholar] [CrossRef]

- Cheng, C.; Liu, B.; Chau, K.-W.; Li, G.; Liao, S. China’s small hydropower and its dispatching management. Renew. Sustain. Energy Rev. 2015, 42, 43–55. [Google Scholar] [CrossRef]

- Ugwu, C.O.; Ozor, P.A.; Mbohwa, C. Small hydropower as a source of clean and local energy in Nigeria: Prospects and challenges. Fuel Commun. 2022, 10, 100046. [Google Scholar] [CrossRef]

- Sun, L.; Niu, D.; Wang, K.; Xu, X. Sustainable development pathways of hydropower in China: Interdisciplinary qualitative analysis and scenario-based system dynamics quantitative modeling. J. Clean. Prod. 2021, 287, 125528. [Google Scholar] [CrossRef]

- Luo, G.-l.; Li, Y.-l.; Tang, W.-j.; Wei, X. Wind curtailment of China’s wind power operation: Evolution, causes and solutions. Renew. Sustain. Energy Rev. 2016, 53, 1190–1201. [Google Scholar] [CrossRef]

- Chen, X.; Kang, C.; O’Malley, M.; Xia, Q.; Bai, J.; Liu, C.; Sun, R.; Wang, W.; Li, H. Increasing the flexibility of combined heat and power for wind power integration in China: Modeling and implications. IEEE Trans. Power Syst. 2014, 30, 1848–1857. [Google Scholar] [CrossRef]

- Xia, F.; Lu, X.; Song, F. The role of feed-in tariff in the curtailment of wind power in China. Energy Econ. 2020, 86, 104661. [Google Scholar] [CrossRef]

- Jinnan, Y. Ministry of Finance: To Promote the Solution of Renewable Energy Generation Subsidies Funding Gap. China Energy Newsp. 2022, 321, 8. [Google Scholar]

- Zhang, G.; Zhu, Y.; Xie, T.; Zhang, K.; He, X. Wind Power Consumption Model Based on the Connection between Mid-and Long-Term Monthly Bidding Power Decomposition and Short-Term Wind-Thermal Power Joint Dispatch. Energies 2022, 15, 7201. [Google Scholar] [CrossRef]

- Yu, X.; Dong, Z.; Zhou, D.; Sang, X.; Chang, C.-T.; Huang, X. Integration of tradable green certificates trading and carbon emissions trading: How will Chinese power industry do? J. Clean. Prod. 2021, 279, 123485. [Google Scholar] [CrossRef]

- Yang, D.-x.; Jing, Y.-q.; Wang, C.; Nie, P.-y.; Sun, P. Analysis of renewable energy subsidy in China under uncertainty: Feed-in tariff vs. renewable portfolio standard. Energy Strategy Rev. 2021, 34, 100628. [Google Scholar] [CrossRef]

- Liu, S.; Bie, Z.; Lin, J.; Wang, X. Curtailment of renewable energy in Northwest China and market-based solutions. Energy Policy 2018, 123, 494–502. [Google Scholar] [CrossRef]

- Dong, F.; Shi, L.; Ding, X.; Li, Y.; Shi, Y. Study on China’s renewable energy policy reform and improved design of renewable portfolio standard. Energies 2019, 12, 2147. [Google Scholar] [CrossRef] [Green Version]

- Li, L.; Taeihagh, A. An in-depth analysis of the evolution of the policy mix for the sustainable energy transition in China from 1981 to 2020. Appl. Energy 2020, 263, 114611. [Google Scholar] [CrossRef]

- Cai, X.; Li, Z. Regional smart grid of island in China with multifold renewable energy. In Proceedings of the 2014 International Power Electronics Conference, Hiroshima, Japan, 18–21 May 2014; pp. 1842–1848. [Google Scholar]

- Yuan, J.; Shen, J.; Pan, L.; Zhao, C.; Kang, J. Smart grids in China. Renew. Sustain. Energy Rev. 2014, 37, 896–906. [Google Scholar] [CrossRef]

- Zame, K.K.; Brehm, C.A.; Nitica, A.T.; Richard, C.L.; Schweitzer, G.D., III. Smart grid and energy storage: Policy recommendations. Renew. Sustain. Energy Rev. 2018, 82, 1646–1654. [Google Scholar] [CrossRef]

- Wu, W.-P.; Wu, K.-X.; Zeng, W.-K.; Yang, P.-C. Optimization of long-distance and large-scale transmission of renewable hydrogen in China: Pipelines vs. UHV. Int. J. Hydrogen Energy 2022, 47, 24635–24650. [Google Scholar] [CrossRef]

- Shu, Y.; Chen, W. Research and application of UHV power transmission in China. High Volt. 2018, 3, 1–13. [Google Scholar] [CrossRef]

- Ding, Y.; Shao, C.; Yan, J.; Song, Y.; Zhang, C.; Guo, C. Economical flexibility options for integrating fluctuating wind energy in power systems: The case of China. Appl. Energy 2018, 228, 426–436. [Google Scholar] [CrossRef]

- Zhang, Z.; Peng, J.; Xu, Z.; Wang, X.; Meersmans, J. Ecosystem services supply and demand response to urbanization: A case study of the Pearl River Delta, China. Ecosyst. Serv. 2021, 49, 101274. [Google Scholar] [CrossRef]

- Chen, L.; Zhang, Y.; Figueiredo, A. Spatio-Temporal Model for Evaluating Demand Response Potential of Electric Vehicles in Power-Traffic Network. Energies 2019, 12, 1981. [Google Scholar] [CrossRef] [Green Version]

- Yao, X.; Fan, Y.; Zhao, F.; Ma, S.-C. Economic and climate benefits of vehicle-to-grid for low-carbon transitions of power systems: A case study of China’s 2030 renewable energy target. J. Clean. Prod. 2022, 330, 129833. [Google Scholar] [CrossRef]

- Cai, W.; Wu, X.; Zhou, M.; Liang, Y.; Wang, Y. Review and development of electric motor systems and electric powertrains for new energy vehicles. Automot. Innov. 2021, 4, 3–22. [Google Scholar] [CrossRef]

- Li, J.; He, H.; Wei, Z.; Zhang, X. Hierarchical sizing and power distribution strategy for hybrid energy storage system. Automot. Innov. 2021, 4, 440–447. [Google Scholar] [CrossRef]

- Zhao, H.; Wu, Q.; Hu, S.; Xu, H.; Rasmussen, C.N. Review of energy storage system for wind power integration support. Appl. Energy 2015, 137, 545–553. [Google Scholar] [CrossRef]

- Kong, Y.; Kong, Z.; Liu, Z.; Wei, C.; Zhang, J.; An, G. Pumped storage power stations in China: The past, the present, and the future. Renew. Sustain. Energy Rev. 2017, 71, 720–731. [Google Scholar] [CrossRef]

- Haisheng, C.; Hong, L.; Wentao, M.; Yujie, X.; Zhifeng, W.; Man, C.; Dongxu, H.; Xianfeng, L.; Xisheng, T.; Yongsheng, H. Research progress of energy storage technology in China in 2021. Energy Storage Sci. Technol. 2022, 11, 1052. [Google Scholar]

- Chen, H.; Xu, Y.; Liu, C.; He, F.; Hu, S. Storing energy in China—An overview. Storing Energy 2022, 2, 771–791. [Google Scholar]

- Pu, G.; Zhu, X.; Dai, J.; Chen, X. Understand technological innovation investment performance: Evolution of industry-university-research cooperation for technological innovation of lithium-ion storage battery in China. J. Energy Storage 2022, 46, 103607. [Google Scholar] [CrossRef]

- Huang, N.; Wang, W.; Cai, G.; Qi, J.; Jiang, Y. Economic analysis of household photovoltaic and reused-battery energy storage systems based on solar-load deep scenario generation under multi-tariff policies of China. J. Energy Storage 2021, 33, 102081. [Google Scholar] [CrossRef]

- Huang, H.; Meng, J.; Wang, Y.; Cai, L.; Peng, J.; Wu, J.; Xiao, Q.; Liu, T.; Teodorescu, R. An Enhanced Data-Driven Model for Lithium-Ion Battery State-of-Health Estimation with Optimized Features and Prior Knowledge. Automot. Innov. 2022, 5, 134–145. [Google Scholar] [CrossRef]

- Cao, R.; Cheng, H.; Jia, X.; Gao, X.; Zhang, Z.; Wang, M.; Li, S.; Zhang, C.; Ma, B.; Liu, X. Non-invasive Characteristic Curve Analysis of Lithium-ion Batteries Enabling Degradation Analysis and Data-Driven Model Construction: A Review. Automot. Innov. 2022, 5, 1–18. [Google Scholar] [CrossRef]

- Jian, L.; Zechun, H.; Banister, D.; Yongqiang, Z.; Zhongying, W. The future of energy storage shaped by electric vehicles: A perspective from China. Energy 2018, 154, 249–257. [Google Scholar] [CrossRef]

- Meng, X.; Gu, A.; Wu, X.; Zhou, L.; Zhou, J.; Liu, B.; Mao, Z. Status quo of China hydrogen strategy in the field of transportation and international comparisons. Int. J. Hydrogen Energy 2021, 46, 28887–28899. [Google Scholar] [CrossRef]

- Fang, D.; Zhao, C.; Kleit, A.N. The impact of the under enforcement of RPS in China: An evolutionary approach. Energy Policy 2019, 135, 111021. [Google Scholar] [CrossRef]

| Renewables | 2016–2017 (TWh) | 2017–2018 (TWh) | 2018–2019 (TWh) | 2019–2020 (TWh) | 2020–2021 (TWh) |

|---|---|---|---|---|---|

| Hydropower | 1184 | 1198 | 1232 | 1304 | 1335 |

| Wind | 237 | 297 | 366 | 406 | 471 |

| Solar PV | 67 | 118 | 177 | 224 | 270 |

| Bioenergy | 65 | 79 | 91 | 111 | 114 |

| Year | Policy |

|---|---|

| 2006 | Renewable Energy Law of China |

| 2007 | Medium- and Long-Term Development Plan for Renewable Energy |

| 2008 | 11th Five-Year Plan for Renewable Energy Development |

| 2009 | Feed-in-tariff Policy for Wind Power Generation |

| 2011 | Feed-in-tariff Pricing Policy for Photovoltaic Power Generation |

| 2015 | Special Fund for Renewable Energy Development |

| 2017 | Implementation of Renewable Energy Green Power Certificate Issuance |

| 2019 | Notice on the Renewable Electricity Consumption Quota Mechanism |

| 2021 | 14th Five-Year Plan for Renewable Energy Development |

| Renewables | 2016 (Benchmark) | 2017 (Benchmark) | 2018 (Benchmark) | 2019 (Guiding) | 2020 (Guiding) | |

|---|---|---|---|---|---|---|

| Solar PV | Centralized | 0.8–0.98 | 0.65–0.85 | 0.5–0.75 | 0.4–0.55 | 0.35–0.49 |

| Distributed | 0.42 | 0.42 | 0.32–0.37 | 0.1–0.18 | 0.05–0.08 | |

| Wind | On-shore | 0.47–0.6 | 0.47–0.6 | 0.4–0.57 | 0.34–0.52 | 0.29–0.47 |

| Off-shore | 0.85 | 0.85 | 0.85 | 0.8 | 0.75 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhao, F.; Bai, F.; Liu, X.; Liu, Z. A Review on Renewable Energy Transition under China’s Carbon Neutrality Target. Sustainability 2022, 14, 15006. https://doi.org/10.3390/su142215006

Zhao F, Bai F, Liu X, Liu Z. A Review on Renewable Energy Transition under China’s Carbon Neutrality Target. Sustainability. 2022; 14(22):15006. https://doi.org/10.3390/su142215006

Chicago/Turabian StyleZhao, Fuquan, Fanlong Bai, Xinglong Liu, and Zongwei Liu. 2022. "A Review on Renewable Energy Transition under China’s Carbon Neutrality Target" Sustainability 14, no. 22: 15006. https://doi.org/10.3390/su142215006