Transition to a Hydrogen-Based Economy: Possibilities and Challenges

Abstract

:1. Introduction

2. The State of Hydrogen Demand and Supply

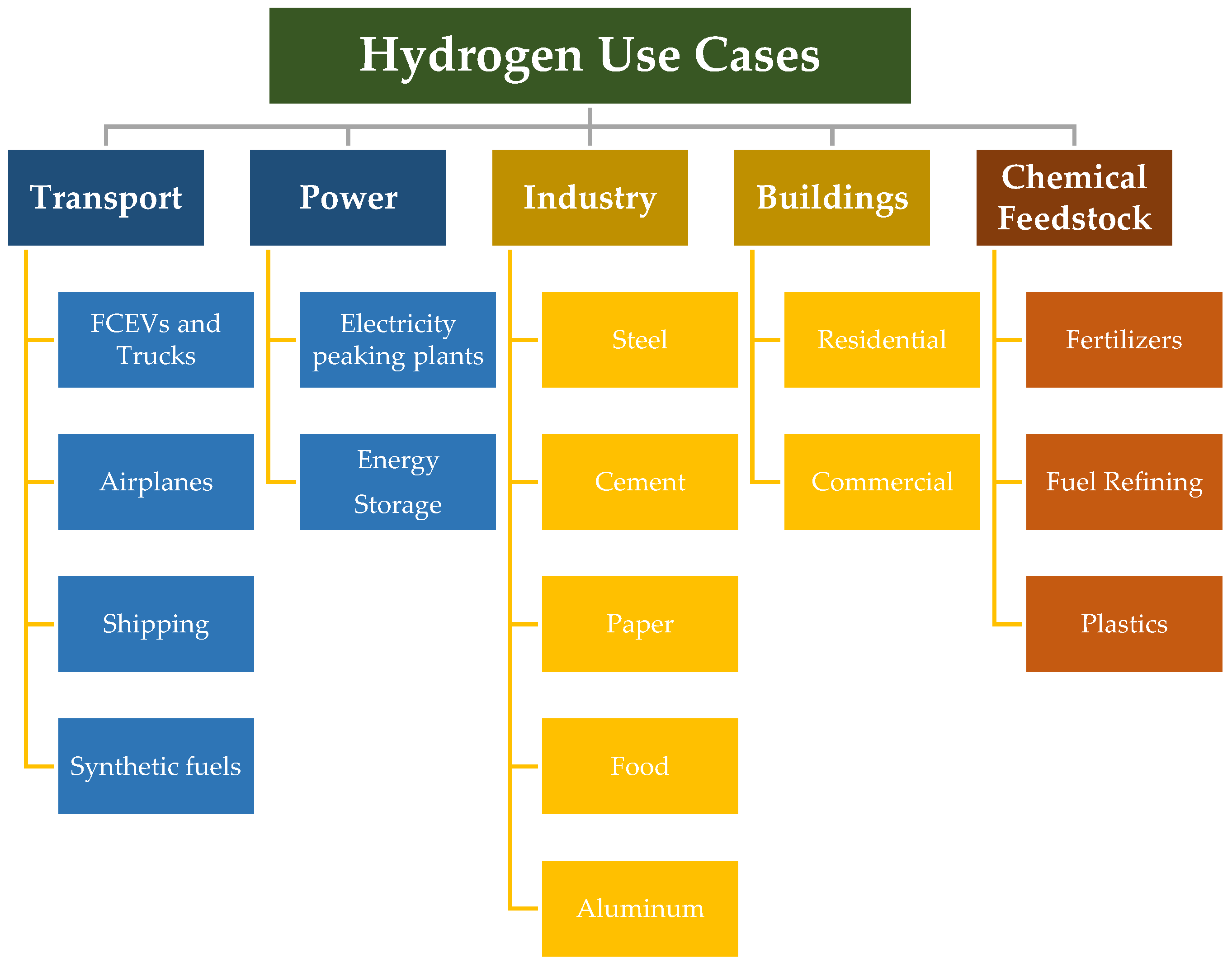

2.1. Hydrogen Applications

2.2. Hydrogen Demand

2.3. Hydrogen Supply

3. Production Technologies for Hydrogen

3.1. Overview of Production Technologies

3.2. Fossil-Fuel-Based Hydrogen Production

3.2.1. Steam Methane Reforming (SMR)

3.2.2. Partial Oxidation (POX)

3.2.3. Autothermal Reforming (ATR)

3.2.4. Coal Gasification

3.3. Renewable Processes for Hydrogen Production

3.3.1. Electrolysis

3.3.2. Microbial Processes

3.4. Cost of Production

3.5. Current Challenges for Green Hydrogen

- Limited knowledge of optimum design, thus limiting profitability and stability: Fulfilling market demand will make it necessary for organizations to augment and enhance the designs of their plants for green hydrogen generation. However, optimizing plant designs and end-to-end green hydrogen systems can be a complicated affair and extremely expensive due to the dearth of market data. When green hydrogen generation plants are built within existing industrial clusters, designing and scaling up become even more complicated because care has to be taken to minimize any adverse commercial impact of the transition to green hydrogen on existing operations during the transition phase [37].

- Elevated operational costs and inadequacy of dedicated workforce: The hydrogen economy will create many new employment opportunities, but a slow rate of technical learning and lack of necessary skill sets has led to the inadequacy of the specialized labor required to support the hydrogen economy. This will be a significant impediment to the development and maturity of the industry. In addition, storing and transporting a highly inflammable and explosive gas such as hydrogen requires substantial investments in specialized pipelines and carriers. Astronomical expenses and uncertainties accompanying the infrastructure adaptation and transfiguration for generation, distribution, and storage systems are among the key issues [38].

- Significant energy losses: Green hydrogen loses a substantial amount of energy throughout the supply chain. About 30–35% of the energy is lost during hydrogen production through the electrolysis process. Additionally, liquifying hydrogen or converting it to carriers such as ammonia causes a 13–25% energy loss. Furthermore, transporting hydrogen incurs another 10–12% loss [39]. Lastly, the application of hydrogen in fuel cells will give rise to an additional 40–50% energy loss. Unless these inefficiencies are addressed and improved, a substantial volume of renewable energy will be required to feed green hydrogen electrolyzers that are capable of competing with end-use electrification [37].

- Green hydrogen procurers and value: Monetizing green hydrogen is a crucial challenge due to the exigence of storage and distribution. Green hydrogen can be produced economically in places that receive copious amounts of sunlight, such as Spain, Portugal, Australia, and Tunisia, but the industrial procurers are usually not located in close proximity. This makes it essential to install a dedicated transportation infrastructure, thereby increasing costs and lead times. Moreover, green hydrogen valuation presupposes “Guarantee of Origin” certification and carbon credit convertibility. Both of these schemes are still in the developmental stage and are constantly subjected to intense debates [40].

3.6. Green vs. Blue Hydrogen

4. Regulatory Strategies to Accelerate the Hydrogen Revolution

4.1. Policy Framework for the Hydrogen Economy

4.2. State of Hydrogen-Focused Policies and Strategies

5. Conclusions

- Transitioning to a hydrogen-based economy requires overcoming the “locked-in” nature of existing energy systems. Despite the availability of environmentally superior technologies, carbon lock-in obstructs implementation and impedes the realization of maintainable energy systems [97]. Significant investments will be required to improve the infrastructure around transporting, storing, and distributing hydrogen. In the early stages of a hydrogen transition, the burden of these investments could be mitigated by mixing hydrogen with natural gas or by repurposing the existing natural gas infrastructure.

- Strong regulatory support is expected to spur the use of low-carbon hydrogen and result in many countries aiming to position themselves as production hubs. However, the definition of “low-carbon” needs to be standardized across countries in order to create a global market for hydrogen and enable the most efficient allocation of resources. This can be mitigated through international agreements and the development of robust MRV techniques.

- The relatively high cost of low-carbon hydrogen production is still a major challenge to its large-scale adoption. However, rapidly improving technology and the declining costs of electrolysis [98,99,100] together with increased amounts of government funding have led to the announcement of over 500 large-scale projects, of which 10% have reached the final investment decision (FID) stage [101].

- In the near term, the ambitious “green” hydrogen targets of various nations could lead to supply chain issues for electrolyzers. Furthermore, PEM electrolyzers require precious metals such as iridium and platinum, production rates of which can only support the manufacturing of 3.5–7 GW of electrolyzers annually [30]. This opens a significant opportunity to increase the electrolyzer manufacturing capacity and find substitutes for the precious metals used in electrolyzers.

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

References

- Lu, W.-C. Greenhouse Gas Emissions, Energy Consumption and Economic Growth: A Panel Cointegration Analysis for 16 Asian Countries. Int. J. Environ. Res. Public Health 2017, 14, 1436. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- US EPA. Greenhouse Gases. Available online: https://www.epa.gov/report-environment/greenhouse-gases (accessed on 25 October 2022).

- Lamb, W.F.; Wiedmann, T.; Pongratz, J.; Andrew, R.; Crippa, M.; Olivier, J.G.J.; Wiedenhofer, D.; Mattioli, G.; Khourdajie, A.A.; House, J.; et al. A Review of Trends and Drivers of Greenhouse Gas Emissions by Sector from 1990 to 2018. Environ. Res. Lett. 2021, 16, 073005. [Google Scholar] [CrossRef]

- Why Are Greenhouse Gases A Problem?|Inspire Clean Energy. Available online: https://www.inspirecleanenergy.com/blog/clean-energy-101/what-are-greenhouse-gases (accessed on 14 October 2022).

- Bridgeland, R.; Chapman, A.; McLellan, B.; Sofronis, P.; Fujii, Y. Challenges toward Achieving a Successful Hydrogen Economy in the US: Potential End-Use and Infrastructure Analysis to the Year 2100. Clean. Prod. Lett. 2022, 3, 100012. [Google Scholar] [CrossRef]

- Jawerth, N. What Is the Clean Energy Transition and How Does Nuclear Power Fit In? Available online: https://www.iaea.org/bulletin/what-is-the-clean-energy-transition-and-how-does-nuclear-power-fit-in (accessed on 16 October 2022).

- What Is Energy Transition? Available online: https://www.spglobal.com/en/research-insights/articles/what-is-energy-transition (accessed on 16 October 2022).

- McDowall, W. Exploring Possible Transition Pathways for Hydrogen Energy: A Hybrid Approach Using Socio-Technical Scenarios and Energy System Modelling. Futures 2014, 63, 1–14. [Google Scholar] [CrossRef] [Green Version]

- Shukla, S.; Samuel, A. Hydrogen: A Targeted Decarbonization Tool but Not a Panacea. Available online: https://www.nrdc.org/experts/shruti-shukla/hydrogen-targeted-decarbonization-tool-not-panacea (accessed on 16 October 2022).

- Yue, M.; Lambert, H.; Pahon, E.; Roche, R.; Jemei, S.; Hissel, D. Hydrogen Energy Systems: A Critical Review of Technologies, Applications, Trends and Challenges. Renew. Sustain. Energy Rev. 2021, 146, 111180. [Google Scholar] [CrossRef]

- Lindsey, T. Why Hydrogen May Be Renewable Energy’s Best Bet. Available online: https://www.industryweek.com/technology-and-iiot/emerging-technologies/article/21163897/is-hydrogen-the-answer-to-renewable-energys-shortcomings (accessed on 12 October 2022).

- Ren, X.; Dong, L.; Xu, D.; Hu, B. Challenges towards Hydrogen Economy in China. Int. J. Hydrog. Energy 2020, 45, 34326–34345. [Google Scholar] [CrossRef]

- Noussan, M.; Raimondi, P.P.; Scita, R.; Hafner, M. The Role of Green and Blue Hydrogen in the Energy Transition—A Technological and Geopolitical Perspective. Sustainability 2021, 13, 298. [Google Scholar] [CrossRef]

- Kane, M.K.; Gil, S. Green Hydrogen: A Key Investment for the Energy Transition. Available online: https://blogs.worldbank.org/ppps/green-hydrogen-key-investment-energy-transition (accessed on 25 October 2022).

- Harnessing Green Hydrogen. Available online: https://rmi.org/insight/harnessing-green-hydrogen/ (accessed on 25 October 2022).

- Brandon, N.P.; Kurban, Z. Clean Energy and the Hydrogen Economy. Philos. Trans. R. Soc. A Math. Phys. Eng. Sci. 2017, 375, 20160400. [Google Scholar] [CrossRef] [Green Version]

- Rosen, M.A.; Koohi-Fayegh, S. The Prospects for Hydrogen as an Energy Carrier: An Overview of Hydrogen Energy and Hydrogen Energy Systems. Energ. Ecol. Environ. 2016, 1, 10–29. [Google Scholar] [CrossRef] [Green Version]

- Ministry of Economy, Trade and Industry, Japan. Strategy for Developing Hydrogen and Fuel-Cell Technologies Formulated. Available online: https://www.meti.go.jp/english/press/2019/0918_001.html (accessed on 15 October 2022).

- Hart, D.; Howes, J.; Madden, B.; Boyd, E. Hydrogen and Fuel Cells: Opportunities for Growth, a Roadmap for the UK; E4tech and Element Energy Hydrogen and Fuel Cells: London, UK, 2016. [Google Scholar]

- IEA. Hydrogen. 2022. Available online: https://www.iea.org/reports/hydrogen (accessed on 26 October 2022).

- Satyapal, S. Hydrogen: A Clean, Flexible Energy Carrier. Available online: https://www.energy.gov/eere/articles/hydrogen-clean-flexible-energy-carrier (accessed on 16 October 2022).

- Marchant, N. Grey, Blue, Green—Why Are There So Many Colours of Hydrogen? Available online: https://www.weforum.org/agenda/2021/07/clean-energy-green-hydrogen/ (accessed on 25 October 2022).

- Kochanek, E. The Role of Hydrogen in the Visegrad Group Approach to Energy Transition. Energies 2022, 15, 7235. [Google Scholar] [CrossRef]

- IEA. Global Hydrogen Review 2022; International Energy Agency: Paris, France, 2022; p. 71. [Google Scholar]

- Ritchie, H.; Roser, M.; Rosado, P. CO2 and Greenhouse Gas Emissions. In Our World in Data; University of Oxford: Oxford, UK, 2020. [Google Scholar]

- Kalamaras, C.M.; Efstathiou, A.M. Hydrogen Production Technologies: Current State and Future Developments. Conf. Pap. Sci. 2013, 2013, 9. [Google Scholar] [CrossRef] [Green Version]

- National Academies of Sciences, Engineering, and Medicine Chapter 8: Hydrogen Production Technologies. In The Hydrogen Economy: Opportunities, Costs, Barriers, and R&D Needs; The National Academic Press: Washington, DC, USA, 2004; ISBN 0-309-53068-7.

- Hydrogen Production: Natural Gas Reforming. Available online: https://www.energy.gov/eere/fuelcells/hydrogen-production-natural-gas-reforming (accessed on 18 October 2022).

- L’Huby, T.; Gahlot, P.; Debarre, R. Hydrogen Applications and Business Models; Kearney Energy Transition Institute: Chicago, IL, USA, 2020. [Google Scholar]

- IRENA. Green Hydrogen Cost Reduction: Scaling up Electrolysers to Meet the 1.5 °C Climate Goal; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2020. [Google Scholar]

- Ritchie, H.; Roser, M. Water Use and Stress. In Our World in Data; University of Oxford: Oxford, UK, 2017. [Google Scholar]

- Beswick, R.R.; Oliveira, A.M.; Yan, Y. Does the Green Hydrogen Economy Have a Water Problem? ACS Energy Lett. 2021, 6, 3167–3169. [Google Scholar] [CrossRef]

- Bourbon, E.; Science, A. Clean Cities Alternative Fuel Price Report, July 2022; US Department of Energy: Washington, DC, USA, 2022. [Google Scholar]

- IEA. Global Average Levelised Cost of Hydrogen Production by Energy Source and Technology, 2019 and 2050. Available online: https://www.iea.org/data-and-statistics/charts/global-average-levelised-cost-of-hydrogen-production-by-energy-source-and-technology-2019-and-2050 (accessed on 26 October 2022).

- Cho, R. Why We Need Green Hydrogen|Columbia Climate School. Available online: https://news.climate.columbia.edu/2021/01/07/need-green-hydrogen/ (accessed on 10 October 2022).

- Searle, S.; Zhou, Y. Don’t Let the Industry Greenwash Green Hydrogen; International Council on Clean Transportation: San Francisco, CA, USA, 2021. [Google Scholar]

- Ouziel, S.; Avelar, L. 4 Technologies Driving the Green Hydrogen Revolution. Available online: https://www.weforum.org/agenda/2021/06/4-technologies-accelerating-green-hydrogen-revolution/ (accessed on 25 October 2022).

- Agnolucci, P.; McDowall, W. Designing Future Hydrogen Infrastructure: Insights from Analysis at Different Spatial Scales. Int. J. Hydrog. Energy 2013, 38, 5181–5191. [Google Scholar] [CrossRef]

- IRENA. Green Hydrogen—A Guide to Policy Making; IRENA: Abu Dhabi, United Arab Emirates, 2020. [Google Scholar]

- Dong, Z.Y.; Yang, J.; Yu, L.; Daiyan, R.; Amal, R. A Green Hydrogen Credit Framework for International Green Hydrogen Trading towards a Carbon Neutral Future. Int. J. Hydrogen Energy 2021, 47, 728–734. [Google Scholar] [CrossRef]

- Howarth, R.W.; Jacobson, M.Z. How Green Is Blue Hydrogen? Energy Sci. Eng. 2021, 9, 1676–1687. [Google Scholar] [CrossRef]

- Clifford, C. Hydrogen Power Is Gaining Momentum, but Critics Say It’s Neither Efficient nor Green Enough. Available online: https://www.cnbc.com/2022/01/06/what-is-green-hydrogen-vs-blue-hydrogen-and-why-it-matters.html (accessed on 25 October 2022).

- Ajanovic, A.; Sayer, M.; Haas, R. The Economics and the Environmental Benignity of Different Colors of Hydrogen. Int. J. Hydrog. Energy 2022, 47, 24136–24154. [Google Scholar] [CrossRef]

- Jacobo, J. Why Green Hydrogen Is the Renewable Energy Source to Watch in 2021. Available online: https://abcnews.go.com/Technology/green-hydrogen-renewable-energy-source-watch-2021/story?id=74128340 (accessed on 14 October 2022).

- Ochu, E.; Braverman, S.; Smith, G.; Friedmann, J. Columbia|SIPA Center on Global Energy Policy|Hydrogen Fact Sheet: Production of Low-Carbon Hydrogen. Available online: https://www.energypolicy.columbia.edu/research/article/hydrogen-fact-sheet-production-low-carbon-hydrogen (accessed on 25 October 2022).

- Cheng, W.; Lee, S. How Green Are the National Hydrogen Strategies? Sustainability 2022, 14, 1930. [Google Scholar] [CrossRef]

- Nnabuife, S.G.; Ugbeh-Johnson, J.; Okeke, N.E.; Ogbonnaya, C. Present and Projected Developments in Hydrogen Production: A Technological Review. Carbon Capture Sci. Technol. 2022, 3, 100042. [Google Scholar] [CrossRef]

- IRENA. Green Hydrogen the Potential Energy Transition Gamechanger. Available online: https://www.irena.org/news/articles/2020/Jan/Green-hydrogen-the-potential-energy-transition-gamechanger (accessed on 26 October 2022).

- Siemens Gamesa. Unlocking the Green Hydrogen Revolution. Available online: https://www.siemensgamesa.com/en-int/products-and-services/hybrid-and-storage/green-hydrogen/unlocking-the-green-hydrogen-revolution (accessed on 20 October 2022).

- Steitz, C. E.ON and Australia’s FFI to Explore Green Hydrogen Shipments to Europe. Reuters, 29 March 2022. [Google Scholar]

- ESMAP. Green Hydrogen in Developing Countries; World Bank: Washington, DC, USA, 2020. [Google Scholar]

- Equitymaster. Five Indian Companies Leading the Green Hydrogen Revolution. Available online: https://www.livemint.com/industry/energy/five-indian-companies-leading-the-green-hydrogen-revolution-11636369476063.html (accessed on 25 October 2022).

- IEA. Sustainable Recovery Policy Tracker—Fuels and Technology Innovation. 2022. Available online: https://www.iea.org/data-and-statistics/data-tools/sustainable-recovery-policy-tracker (accessed on 20 October 2022).

- COAG Energy Council. Australia’s National Hydrogen Strategy; Commonwealth of Australia: Canberra, Australia, 2019; p. 136. [Google Scholar]

- Hydrogen Strategy for Austria. Available online: https://www.bmk.gv.at/themen/energie/energieversorgung/wasserstoff/strategie.html (accessed on 26 October 2022).

- Belgium Council of Ministers. Federal Hydrogen Vision and Strategy. Available online: https://news.belgium.be/nl/federale-waterstofvisie-en-strategie (accessed on 25 October 2022).

- Ministry of Mines and Energy, Brazil Official Diary of the Union, Order of the President of the Republic. Available online: https://in.gov.br/en/web/dou/-/despacho-do-presidente-da-republica-419972141 (accessed on 18 October 2022).

- Council of Ministers of the Republic of Bulgaria National Recovery and Resilience Plan. Available online: https://nextgeneration.bg/14 (accessed on 22 October 2022).

- Natural Resources Canada The Hydrogen Strategy. Available online: https://www.nrcan.gc.ca/climate-change-adapting-impacts-and-reducing-emissions/canadas-green-future/the-hydrogen-strategy/23080 (accessed on 20 October 2022).

- Chile Ministry of Energy. National Green Hydrogen Strategy; Government of Chile: Santiago, Chile, 2020. [Google Scholar]

- Nakano, J. China Unveils Its First Long-Term Hydrogen Plan. Available online: https://www.csis.org/analysis/china-unveils-its-first-long-term-hydrogen-plan (accessed on 26 October 2022).

- Garcia-Navarro, J. The Colombian Hydrogen Strategy—What Are Its Targets? Available online: https://hydrogen-central.com/colombian-hydrogen-strategy-targets/ (accessed on 20 October 2022).

- Reuters. Denmark Takes First Steps towards Green Hydrogen Economy. Available online: https://news.abs-cbn.com/business/03/15/22/denmark-takes-first-steps-towards-green-hydrogen-economy (accessed on 25 October 2022).

- Egypt among Countries That Started Hydrogen Strategy. Available online: https://www.sis.gov.eg/Story/162235/Gov’t-Egypt-among-countries-that-started-hydrogen-strategy?lang=en-us (accessed on 25 October 2022).

- European Commission. REPowerEU: Affordable, Secure and Sustainable Energy for Europe. Available online: https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal/repowereu-affordable-secure-and-sustainable-energy-europe_en (accessed on 20 October 2022).

- European Council Fit for 55. Available online: https://www.consilium.europa.eu/en/policies/green-deal/fit-for-55-the-eu-plan-for-a-green-transition/ (accessed on 26 October 2022).

- European Commission. A Hydrogen Strategy for a Climate-Neutral Europe. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52020DC0301 (accessed on 25 October 2022).

- Fuel Cells and Hydrogen 2 Joint Undertaking (EU body or agency) Now known as. In Hydrogen Roadmap Europe: A Sustainable Pathway for the European Energy Transition; Publications Office of the European Union: Luxembourg, 2016; ISBN 978-92-9246-331-1.

- Laurikko, J.; Ihonen, J.; Kiviaho, J.; Himanen, O.; Weiss, R.; Saarinen, V.; Kärki, J.; Hurskainen, M. National Hydrogen Roadmap; Business Finland: Helsinki, Finland, 2020; p. 48. [Google Scholar]

- Ministry of Economy, Finance and Recovery, France. Recovery Plan; Ministry of Economy, Finance and Recovery, France: Bercy, France, 2020; p. 8. [Google Scholar]

- IEA. Package for the Future—Hydrogen Strategy. Available online: https://www.iea.org/policies/11561-package-for-the-future-hydrogen-strategy (accessed on 21 October 2022).

- Hungary’s National Hydrogen Strategy. Available online: https://cdn.kormany.hu/uploads/document/a/a2/a2b/a2b2b7ed5179b17694659b8f050ba9648e75a0bf.pdf (accessed on 26 October 2022).

- International Trade Administration. Italy Invests in Green Hydrogen. Available online: https://www.trade.gov/market-intelligence/italy-invests-green-hydrogen (accessed on 25 October 2022).

- Ministerial Council on Renewable Energy, Hydrogen and Related Issues. Basic Hydrogen Strategy; Ministry of Economy, Trade and Industry: Tokyo, Japan, 2017. [Google Scholar]

- HESC. Launch of the World’s First Hydrogen Carrier. Available online: https://www.hydrogenenergysupplychain.com/hydrogen-carrier-20191211 (accessed on 23 October 2022).

- Ministry of Energy, Mining and Environment. Feuille de Route—Hydrogene Verte; Ministry of Energy, Mining and Environment: Rabat, Morocco, 2021. [Google Scholar]

- Government of Netherlands. Government Strategy on Hydrogen. Available online: https://www.government.nl/documents/publications/2020/04/06/government-strategy-on-hydrogen (accessed on 23 October 2020).

- Ministry of Business, Innovation & Employment. A Roadmap for Hydrogen in New Zealand. Available online: https://www.mbie.govt.nz/building-and-energy/energy-and-natural-resources/energy-strategies-for-new-zealand/hydrogen-in-new-zealand/a-vision-for-hydrogen-in-new-zealand/roadmap-for-hydrogen-in-new-zealand/ (accessed on 23 October 2022).

- Sillett, K. Norway Plans to Double Hydrogen Funding in Revised 2021 Budget. Available online: https://www.icis.com/explore/resources/news/2021/05/12/10638931/norway-plans-to-double-hydrogen-funding-in-revised-2021-budget (accessed on 21 October 2022).

- H2 Peru. H2 Peru Publishes its Proposal for a Green Hydrogen Roadmap in Peru. Available online: https://h2.pe/noticias/h2-peru-publica-su-propuesta-de-hoja-de-ruta-de-hidrogeno-verde-en-el-peru/ (accessed on 25 October 2022).

- Ministry of Climate and Environment, Poland Public Consultations of the Draft “Polish Hydrogen Strategy” Are Now Underway. Available online: https://www.gov.pl/web/climate/public-consultations-of-the-draft-polish-hydrogen-strategy-are-now-underway (accessed on 20 October 2022).

- IEA. Hydrogen Strategy—Portugal. Available online: https://prod.iea.org/policies/12436-hydrogen-strategy (accessed on 26 October 2022).

- Ministry of European Investments and Projects National Recovery and Resilience Plan (PNRR). Available online: https://mfe.gov.ro/pnrr/ (accessed on 22 October 2022).

- World Energy Council. Working Paper|National Hydrogen Strategies. Available online: https://www.worldenergy.org/assets/downloads/Working_Paper_-_National_Hydrogen_Strategies_-_September_2021.pdf (accessed on 22 October 2022).

- HySA. Infrastructure|Hydrogen Power. Available online: https://hysainfrastructure.com/ (accessed on 25 October 2022).

- IEA. Korea Hydrogen Economy Roadmap 2040. Available online: https://www.iea.org/policies/6566-korea-hydrogen-economy-roadmap-2040 (accessed on 23 October 2022).

- International Trade Administration. Spain Renewable Hydrogen Roadmap. Available online: https://www.trade.gov/market-intelligence/spain-renewable-hydrogen-roadmap (accessed on 22 October 2022).

- UAE Announces Hydrogen Leadership Roadmap, Reinforcing Nation’s Commitment to Driving Economic Opportunity through Decisive Climate Action. Emirates News Agency—WAM, 4 November 2021.

- Department for Business, Energy & Industrial Strategy, UK. British Energy Security Strategy. Available online: https://www.gov.uk/government/publications/british-energy-security-strategy (accessed on 25 October 2022).

- Prime Minister’s Office, UK PM Outlines His. Ten Point Plan for a Green Industrial Revolution for 250,000 Jobs. Available online: https://www.gov.uk/government/news/pm-outlines-his-ten-point-plan-for-a-green-industrial-revolution-for-250000-jobs (accessed on 20 October 2022).

- Low Carbon Fuel Standard|California Air Resources Board. Available online: https://ww2.arb.ca.gov/our-work/programs/low-carbon-fuel-standard (accessed on 23 October 2022).

- Center for Climate and Energy Solutions. U.S. State Clean Vehicle Policies and Incentives. Available online: https://www.c2es.org/document/us-state-clean-vehicle-policies-and-incentives/ (accessed on 22 October 2022).

- US Department of Energy Hydrogen Shot. Available online: https://www.energy.gov/eere/fuelcells/hydrogen-shot (accessed on 25 October 2022).

- DOE Establishes Bipartisan Infrastructure Law’s $9.5 Billion Clean Hydrogen Initiatives. Available online: https://www.energy.gov/articles/doe-establishes-bipartisan-infrastructure-laws-95-billion-clean-hydrogen-initiatives (accessed on 24 October 2022).

- Electrolysers—Analysis. Available online: https://www.iea.org/reports/electrolysers (accessed on 18 November 2022).

- IRENA. World Energy Transitions Outlook 2022: 1.5 °C Pathway; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2022. [Google Scholar]

- Trencher, G.; Rinscheid, A.; Duygan, M.; Truong, N.; Asuka, J. Revisiting Carbon Lock-in in Energy Systems: Explaining the Perpetuation of Coal Power in Japan. Energy Res. Soc. Sci. 2020, 69, 101770. [Google Scholar] [CrossRef]

- Bristowe, G.; Smallbone, A. The Key Techno-Economic and Manufacturing Drivers for Reducing the Cost of Power-to-Gas and a Hydrogen-Enabled Energy System. Hydrogen 2021, 2, 273–300. [Google Scholar] [CrossRef]

- Miyagawa, T.; Goto, M. Hydrogen Production Cost Forecasts since the 1970s and Implications for Technological Development. Energies 2022, 15, 4375. [Google Scholar] [CrossRef]

- Schoots, K.; Ferioli, F.; Kramer, G.J.; van der Zwaan, B.C.C. Learning Curves for Hydrogen Production Technology: An Assessment of Observed Cost Reductions. Int. J. Hydrog. Energy 2008, 33, 2630–2645. [Google Scholar] [CrossRef]

- Hydrogen Council; McKinsey & Company. Hydrogen Insights 2022. Available online: https://hydrogencouncil.com/wp-content/uploads/2022/09/Hydrogen-Insights-2022-2.pdf (accessed on 18 November 2022).

- CLIMATE CH2AMPION. How Will Hydrogen Create Jobs? Available online: https://www.climatech2ampion.org/ (accessed on 18 November 2022).

- Bezdek, R.H. The Hydrogen Economy and Jobs of the Future. Renew. Energy Environ. Sustain. 2019, 4, 1. [Google Scholar] [CrossRef]

| Hydrogen Type | Production Technology | Source | Remarks |

|---|---|---|---|

| Black | Gasification | Bituminous coal | Most environmentally damaging with a high GHG footprint. Carbon dioxide and carbon monoxide generated during the process are not recaptured. |

| Brown | Lignite coal | ||

| Grey | Natural gas reforming | Natural gas | Most common. Medium GHG footprint. |

| Blue | Natural gas reforming or gasification with carbon capture (85–95%) | Methane, coal | Low GHG footprint |

| Turquoise | Pyrolysis | Methane | Solid byproduct |

| Green | Electrolysis | Renewable sources: solar, wind, hydroelectricity | Additionally called “Clean hydrogen”. Minimal GHG footprint. |

| Pink/ Purple | Nuclear energy | Minimal GHG footprint | |

| White | Occurs naturally in underground deposits and is exploited through drilling. | Minimal GHG footprint |

| Production Pathways | Energy Sources |

|---|---|

| Electrolysis | |

| Electrolysis of water | Solar, wind, nuclear, microbial |

| Photolytic splitting of water | Solar |

| Biological | |

| Fermentation | Biomass |

| Thermochemical | |

| Thermal splitting of water | Solar |

| Gasification | Biomass, oil, coal |

| Pyrolysis | Biomass, natural gas |

| Steam reforming | Natural gas |

| Plasma reforming | Natural gas |

| Partial oxidation | Natural gas, oil, coal |

| Alkaline Electrolysis | Proton-Exchange Membrane (PEM) | Solid Oxide Electrolysis Cell (SOEC) | |

|---|---|---|---|

| Description | Alkaline technology is used extensively in the chlorine industry; a strong base such as potassium hydroxide is generally used as the electrolyte due to its high conductivity. | PEM uses a ionically conductive solid polymer; hydrogen ions travel through the polymer membrane toward the cathode. PEM has a very short reponse time of less than 2 s. | SOEC is based on steam water electrolysis at high temperatures, thereby reducing need for electrical power. Heat is only needed to vaporize water and can be obtained from waste industrial heat. |

| Capital Costs(stack-only, >1 MW, USD/kWe) | 270; <100 expected | 400; <100 expected | >2000; <200 expected |

| Efficiency(%, LHV) | 52–69% | 60–77% | 74–81% excluding heat to vaporize water) |

| Typical Plant Size(tpd H2) | 60; 100 expected | 50–80; 100–120 expected | <20; 80 expected |

| Stack Lifetime(in thousands of hours) | 60; 100 expected | 50–80; 100–120 expected | <20; 80 expected |

| Operating Temperature (°C) | 60–80 | 50–80 | 650–1000 |

| Operating Pressure (bar) | 1–30 | 20–50 | 1 |

| Expected R&D Improvements | Scaling benefits to reduce costs; improvement in lifetime; improved heat exchangers. | Scaling benefits to reduce costs; improvement in material and component lifetimes. | Improvement in component lifetime by improving the resistance to high temperatures and improving the response to fluctuating energy inputs. |

| Pros and Cons | Most mature technology; has the lowest capital cost but also the lowest efficiency. | Highly efficient but more expensive than alakaline electrolysis. | High future potential but still in the developmental stage. |

| Production Source | LCOH-Low (USD/kg H2) | LCOH-High (USD/kg H2) | CAPEX (USD/kWe) | OPEX (% of CAPEX) | Efficiency | Capacity Factor | Fuel Price |

|---|---|---|---|---|---|---|---|

| 2019 | |||||||

| Natural gas | 0.7 | 1.6 | 910 | 4.7% | 76% | 95% | USD 1.5–6.6/MMbtu |

| Natural gas with carbon capture and sequestration (CCS) (95% capture) | 1.2 | 2.1 | 1580 | 3.0% | 69% | 95% | |

| Coal gasification | 1.9 | 2.5 | 2670 | 5.0% | 60% | 95% | USD 50–250/ton |

| Coal gasification with CCS (90% capture) | 2.1 | 2.6 | 2780 | 5.0% | 58% | 95% | |

| Electrolysis with dedicated renewables supply | 3.2 | 7.7 | 870 | 2.2% | 64% | 35% | USD 35/kWh |

| 2050 | |||||||

| Natural gas with CCS | 1.2 | 2.1 | 1280 | 3.0% | 69% | 95% | USD 1.8–7.4/MMBtu |

| Coal with CCS | 2.2 | 2.5 | 2780 | 5.0% | 58% | 95% | USD 30–65/ton |

| Electrolysis with dedicated supply of renewables | 1.3 | 3.3 | 270 | 1.5% | 74% | 45% | USD 20/kWh |

| Country | Year | Policy/Reference | Estimated Budgetary Support (USD Millions) | Policy Details/Targets |

|---|---|---|---|---|

| Australia | 2020 | National Hydrogen Strategy [53,54] | 450 | Federal and state Australian governments have pledged significant funding to support the growth of a competitive hydrogen industry with the goal of Australia becoming a major global player in the hydrogen industry by 2030. It includes both fossil-based hydrogen production with CCS as well as renewable electrolytic hydrogen. |

| Austria | 2021 | Austria Hydrogen Strategy [53,55] | 150 | Austria’s strategy aims to reach climate neutrality by 2040 and 100% renewable energy capacity in the electricity mix by 2030. One target is to reach 1 GW of electrolysis capacity by 2030 in order to produce 4 TWh of green hydrogen. |

| Belgium | 2021 | Hydrogen Vision and Strategy [53,56] | 450 | The four pillars of Belgium’s strategy are for Belgium to become an import and transit hub for Europe and a leader in hydrogen technology globally, to develop a hydrogen market with an open access hydrogen transport, and to encourage the sharing of knowledge and collaboration between industries and neighboring countries. |

| Brazil | 2022 | National Hydrogen Program (PNH2) [57] | The program does not set any hydrogen production goals or include a clear position on Brazil becoming an export market. | |

| Bulgaria | 2022 | National Recovery and Sustainability Plan [58] | 70 | The policy supports the development of green hydrogen and biogas pilot projects for use in the industrial, transport, electricity, and heat sectors. These funds are for equipment and machinery, not R&D projects, and are expected to be distributed between 2022 and 2026. |

| Canada | 2020 | Low-Carbon and Zero-Emissions Fuels Fund/Hydrogen Strategy for Canada [53,59] | 1100 | The strategy seeks to position the country as a global hydrogen leader as a key part of the path to net-zero emissions by 2050. The strategy aims to reduce GHG emissions to 45 million metric tons a year in 2030 and would create up to 350,000 new jobs by 2050, thereby building a USD 50 billion domestic hydrogen market. By 2050, the goal is to produce 20 million metric tons of H2 per year, have over 5 million FCEVs (up from 110 in 2020), and have 31% of Canada’s energy system demands met with hydrogen. |

| Chile | 2020 | National Hydrogen Strategy/Green H2 Incubator [53,60] | 50 | The strategy aims for Chile to produce the cheapest green hydrogen in the world (<1.5 USD/kg) and become the leader in green hydrogen exports and production with a 25 GW electrolyzer capacity by 2030. |

| China | 2021 | 14th Five-Year Plan—Medium and Long-Term Planning for the Development of Hydrogen Energy Industry [61] | Hydrogen was identified as one of the six industries for focused advancement in China’s 14th Five-Year Plan (FYP). China’s key targets include 50,000 FCEVs by 2025, 100,000 to 200,000 tons per year of green hydrogen production, and additional goals for building hydrogen storage and transportation infrastructure. | |

| Colombia | 2021 | Hydrogen Roadmap [62] | Colombia plans to have between 1 and 3 GW of electrolyzer capacity installed and 50,000 metric tons of blue hydrogen production by 2030. | |

| Denmark | 2022 | [63] | 185 | Denmark increased its electrolyzer capacity target to between 4 GW and 6 GW by 2030. These electrolyzers will generate green hydrogen using wind and solar energy. |

| Egypt | Under development | National Hydrogen Strategy [64] | Egypt aims to achieve 1.4 GW of hydrogen production by 2030. | |

| European Union | 2022 | REPower EU [65] | The policy, which aims for the EU to become independent of Russian fossil fuels, includes an acceleration of renewable hydrogen infrastructure development and use. REPower EU sets a target of 10 Mt of renewable hydrogen produced domestically and another 10 Mt imported. It also sets aside a dedicated amount to accelerate hydrogen research. | |

| European Union | 2021 | Fit for 55 Package [66] | EU has set a GHG emission reduction target of 55% by 2030 and net-zero emissions by 2050. The use of renewable hydrogen is a key piece and includes binding targets for the use of renewable fuels of non-biological origins (RFNBOs). A total of 50% of industrial hydrogen demand is to be met with RFNBOs by 2030. | |

| European Union | 2020 | EU Hydrogen Strategy [67] | EU’s hydrogen strategy aims to develop a Europe-wide hydrogen market supported by green hydrogen in the long term and reach 6 GW of electrolyzers by 2024 and 40 GW by 2030. By 2040, the goal is to produce10 million metric tons of renewable hydrogen within the EU. | |

| European Union | 2019 | Hydrogen Roadmap Europe [68] | The roadmap states that by 2050, hydrogen could provide up to a quarter of the total EU energy demand (up to ~2250 TWh of energy). In addition, by 2030 there could be 4.2 million light-duty FCEVs on the road and 45,000 fuel-cell trucks and buses. | |

| Finland | 2020 | National Hydrogen Roadmap [69] | 150 | The roadmap aims to develop large-scale green hydrogen production for domestic use by leveraging good onshore and offshore wind potential. |

| France | 2020 | Recovery and Resilience Plan [53,70] | 7000 | France’s COVID-19 recovery plan includes a goal of reaching 6.5 GW of electrolyzers by 2030. |

| Germany | 2020 | Package for the Future—Hydrogen Strategy [53,71] | 9000 | Germany’s strategy includes goals of 5 GW of electrolyzer capacity (14 TWh of green hydrogen production) by 2030 and an additional 5 GW by 2040. |

| Hungary | 2021 | National Hydrogen Strategy [72] | 2030 goals: Hungary targets an annual production of 36,000 tons of low-carbon/carbon-free hydrogen and the installation of 240 MW of electrolyzer capacity. The goal is to have ~25,000 tons; i.e., 15% of annual industrial hydrogen demand, produced by low-carbon methods and 4800 FCEVs to run on 10,000 tons of clean hydrogen. | |

| India | 2022 | Green Hydrogen Policy, part of the National Hydrogen Mission (under development) [15] | India targets the production of 5 Mt of green hydrogen by 2030 and to become a global green hydrogen production hub. | |

| Italy | 2021 | National Hydrogen Strategy [73] | 8000–13,000 | Italy aims for a 2% hydrogen penetration into the final energy mix by 2030 and 20% by 2050. It also includes the development of 5 GW of electrolyzer capacity by 2030 and a substantial investment from the government. |

| Japan | 2017 | Basic Hydrogen Strategy; Hydrogen Energy Supply Chain project [74,75] | Japan aims to become a hydrogen-based society with targets of 800,000 FCEVs, 1200 fuel-cell buses, and 10,000 fuel-cell forklifts by 2030. Japan also launched a joint R&D effort with Australia and launched the world’s first liquid-hydrogen-powered carrier ship. | |

| Morocco | 2021 | Feuille de Route Hydrogene Verte [76] | Morocco aims to develop into a hydrogen hub with estimates of domestic green hydrogen demand growing to 4 TWh by 2030 and 22 TWh by 2040. An additional 10 TWh of hydrogen could be exported by 2030; this number could increase to 46 TWh in 2040 and 115 TWh in 2050. | |

| Netherlands | 2020 | National Hydrogen Strategy [77] | The Netherlands’ strategy is to have 500 MW of electrolyzer capacity by 2025 and 3–4 GW by 2030, which would result in around 8 TWh of green hydrogen. An additional 12 TWh of hydrogen will be produced using SMRs with CCS to reach a total supply of 80 TWh by 2030. By 2050, 30% to 50% of the total energy mix is expected to be gaseous energy carriers, all of which could be hydrogen in a decarbonized society. | |

| New Zealand | Under Develop-ment | National Hydrogen Strategy [78] | NA | |

| Norway | 2020 | 2021 Budget/National Hydrogen Strategy [53,79] | 25 | Norway supports the use of electrolysis and methane reforming with carbon capture in order to produce low-carbon hydrogen. |

| Peru | Under Develop-ment | Green Hydrogen Roadmap [80] | The Peruvian Hydrogen Association (H2 Peru) proposed a green hydrogen roadmap that targets 1 GW of electrolyzer capacity by 2030 and 12 GW by 2050 to produce hydrogen for both domestic consumption and export. | |

| Poland | 2021 | National Hydrogen Strategy [81] | Poland’s strategy focuses on hydrogen use in the transport, industrial, and energy sectors. Some targets include the installation of 2 GW of electrolyzer capacity, 2000 fuel cell buses, and 32 hydrogen refueling stations by 2030. | |

| Portugal | 2020 | National Hydrogen Strategy [82] | 7000 | 2030 goals: Portugal aims for 5% of its final energy consumption to come from hydrogen along with 15% injection into natural gas networks, 50–100 hydrogen refueling stations, and 2 GW electrolyzers. |

| Romania | 2021 | National Recovery and Resilience Plan [83] | Romania expects to purchase 12 hydrogen-powered trains by 2024. By 2026, 90,000 consumers are expected to be connected to a natural gas distribution system with hydrogen-blending capabilities, and 1300 MW of lignite power plants are to be replaced with hydrogen-enabled natural gas CCGTs. | |

| Saudi Arabia | Under development | National Hydrogen Strategy [84] | NA | |

| South Africa | 2013 | Hydrogen South Africa (HySA) Infrastructure program [85] | South Africa aims to improve research and development in hydrogen production, storage, and delivery to support cost-competitive solutions. | |

| South Korea | 2019 | Hydrogen Economy Revitalization Roadmap [86] | South Korea’s roadmap aims to produce 6.2 million FCEVs, have 40,000 FCEV buses and 30,000 FCEV trucks on the road, and install 1200 fueling stations by 2040. The government is also aiming to produce 15 GW of fuel cells for power generation by 2040. | |

| Spain | 2020 | Hydrogen Roadmap [87] | Spain plans to reach a 300 to 600 MW electrolyzer capacity by 2024 and a 4 GW capacity by 2030 along with a goal of 150 hydrogen buses, 5000 light- and heavy-duty FCEVs, 2 hydrogen trains, and at least 100 hydrogen refueling stations by 2030. Additonally, around a quarter of the 500,000 metric tons of fossil-fuel-based hydrogen will be replaced with green hydrogen. | |

| United Arab Emirates | 2021 | Hydrogen Leadership Roadmap [88] | The UAE plans to use low-carbon hydrogen domestically to meet its net-zero ambitions and for excess production to help the country become a global hydrogen exporter. | |

| United Kingdom | 2022 | British Energy Security Strategy [89] | Britain will focus on achieving 10 GW of low-carbon hydrogen production capacity by 2030. Green hydrogen will constitute at least 5 GW of the 2030 capacity. The strategy also aims to design new hydrogen transport and storage infrastructure business models and set up a hydrogen certification scheme by 2025 to help achieve net-zero emissions by 2050. | |

| United Kingdom | 2020 | Ten-Point Plan for a Green Industrial Revolution [53,90] | 300 | The government will aid in the production of low-carbon hydrogen for use in industry, transport, power, and homes. |

| United States | 2022 | Inflation Reduction Act (IRA) [88] | Through the IRA, the USA aims to accelerate low-carbon hydrogen production through production tax credit incentives of up to USD 3/kg, an increased 45Q CO2 sequestration tax credit, and the extension of tax credits for solar and wind to lower the cost of renewable electricity. | |

| United States, California | 2011 | Low-Carbon Fuel Standard [91] | California’s low-carbon fuel standard (LCFS) is a technology-agnostic policy that has helped decarbonize the transportation sector and has promoted the production and distribution of low-carbon hydrogen in the transportation market. | |

| United States, Multiple States | 2021 | Zero-emission and low-emission vehicle standards [92] | California, Connecticut, Maine, Maryland, Massachusetts, New Jersey, New York, Oregon, Rhode Island, Vermont, and Washington have adoped goals of 100% zero-emission or low-emission in-state vehicle sales by 2035. | |

| United States | 2021 | Hydrogen Shot Program [93] | The program aims to reduce the cost of clean hydrogen to under USD 1 per kilogram over the next 10 years. | |

| United States | 2022 | Infrastructure and Jobs Act [53,94] | 9500 | The USA aims to accelerate the domestic production, deployment, and use of clean hydrogen through regional clean hydrogen hubs, a clean hydrogen electrolysis program, clean hydrogen manufacturing, and recycling programs. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Agarwal, R. Transition to a Hydrogen-Based Economy: Possibilities and Challenges. Sustainability 2022, 14, 15975. https://doi.org/10.3390/su142315975

Agarwal R. Transition to a Hydrogen-Based Economy: Possibilities and Challenges. Sustainability. 2022; 14(23):15975. https://doi.org/10.3390/su142315975

Chicago/Turabian StyleAgarwal, Rishabh. 2022. "Transition to a Hydrogen-Based Economy: Possibilities and Challenges" Sustainability 14, no. 23: 15975. https://doi.org/10.3390/su142315975