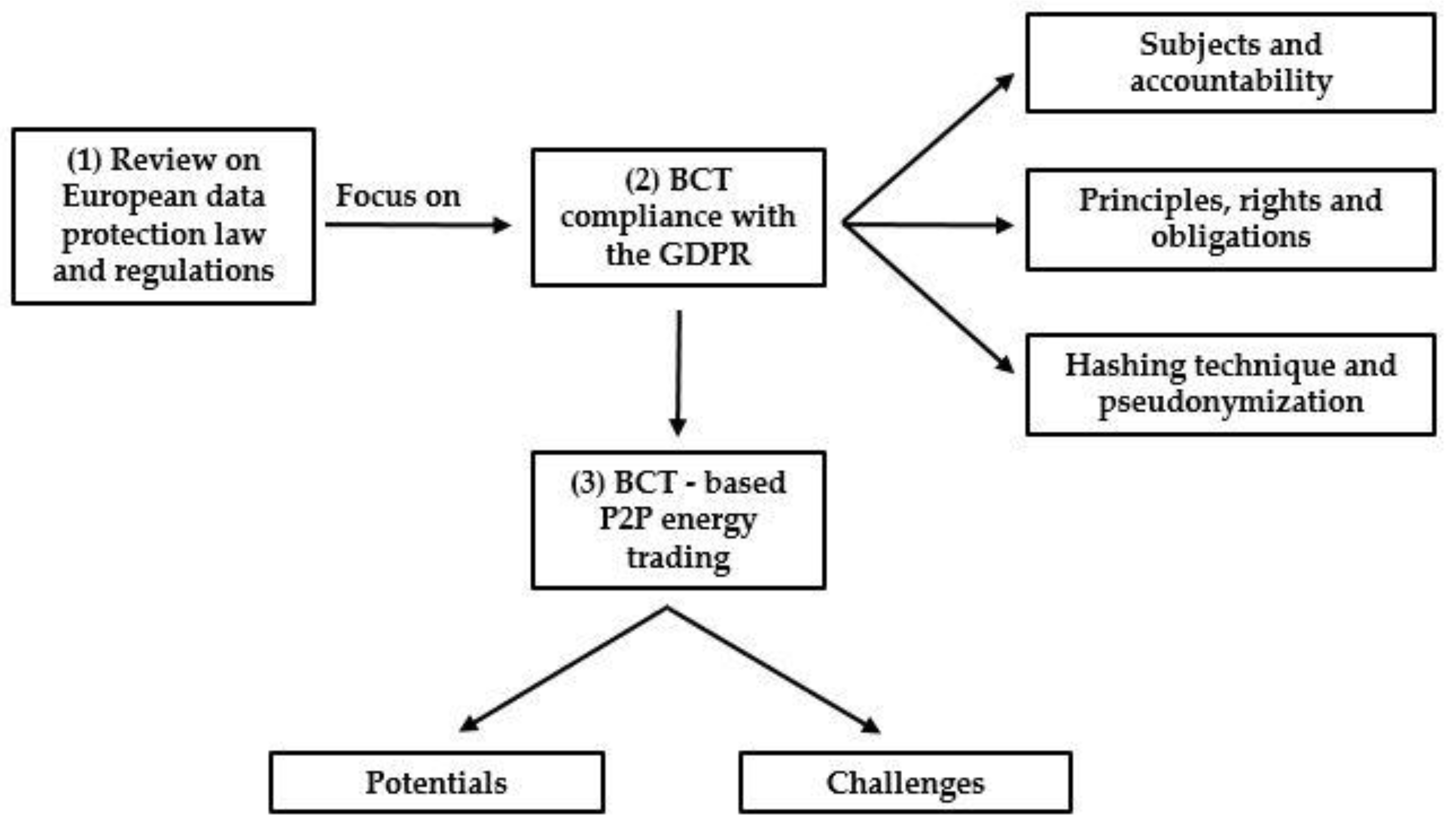

Blockchain, Data Protection and P2P Energy Trading: A Review on Legal and Economic Challenges

Abstract

:1. Introduction

2. The European Data Protection Law and BCT

2.1. Subjects and Accountability

2.2. Principles, Rights and Obligations

2.3. Hashing Technique and Pseudonymization

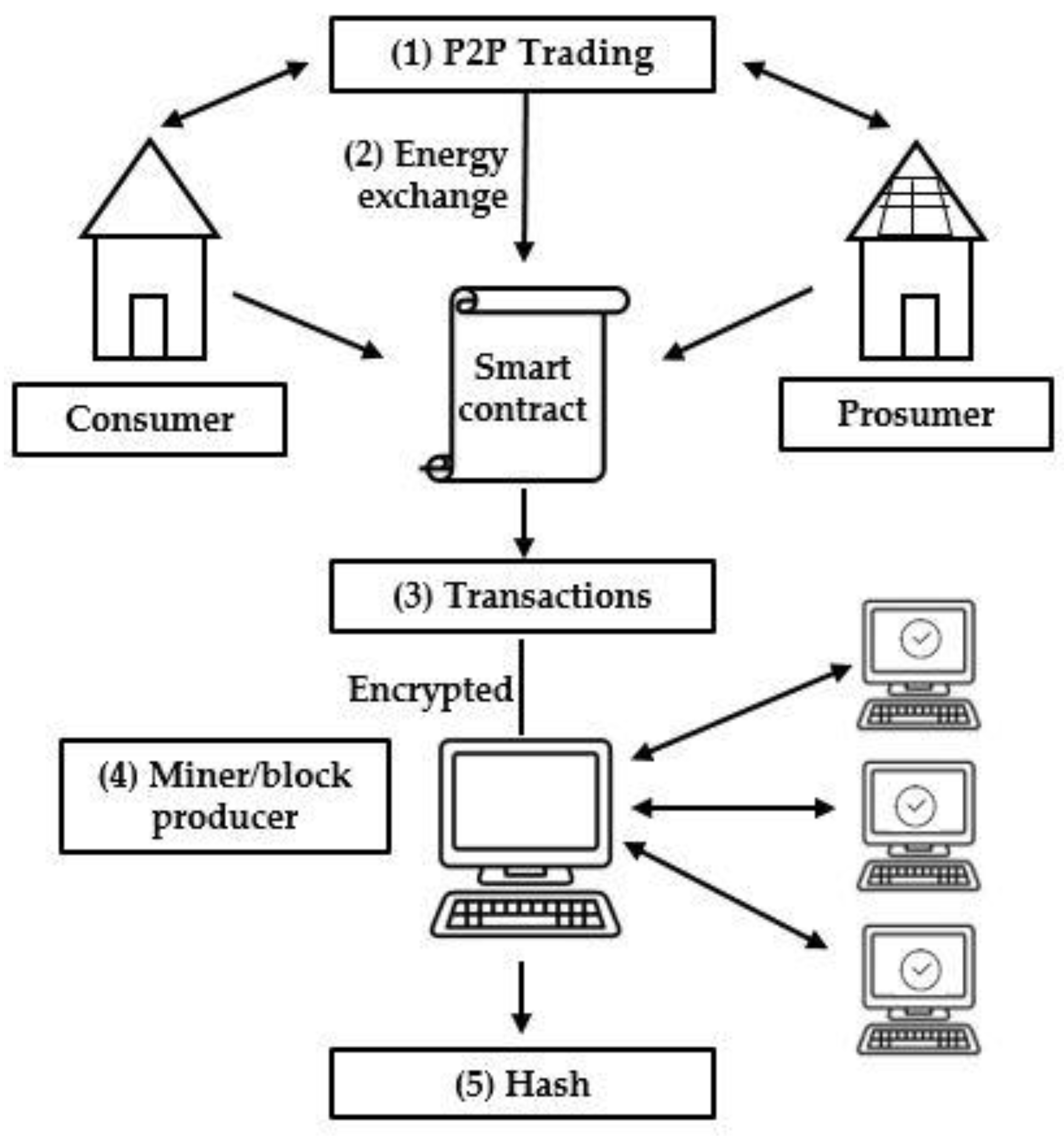

3. BCT-Based P2P Energy Trading

3.1. The Rise of Energy Communities and P2P Energy Trading

3.2. Potentials of BCT-Based P2P Energy Trading

3.3. Challenges of BCT-Based P2P Energy Trading

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Conflicts of Interest

References

- Pérez-Montalvo, E.; Zapata-Velásquez, M.-E.; Benítez-Vázquez, L.-M.; Cermeño-González, J.-M.; Alejandro-Miranda, J.; Martínez-Cabero, M.-A.; de la Puente-Gil, A. Model of monthly electricity consumption of healthcare buildings based on climatological variables using PCA and linear regression. Energy Rep. 2022, 8, 250–258. [Google Scholar] [CrossRef]

- Enerdata. Available online: https://d1owejb4br3l12.cloudfront.net/publications/executive-briefing/eu-evolution-households-energy-patterns.pdf (accessed on 2 December 2022).

- Eurostat. Available online: https://ec.europa.eu/eurostat/web/products-eurostat-news/-/ddn-20220617-1 (accessed on 2 December 2022).

- Deconinck, G.; Vankrunkelsven, F. Digitalised, decentralised power infrastructures challenge blockchains. Proc. Inst. Civ. Eng. Smart Infrastruct. Constr. 2020, 173, 29–40. [Google Scholar] [CrossRef]

- Shen, B.; Dong, C.; Minner, S. Combating copycats in the supply chain with permissioned blockchain technology. Prod. Oper. Manag. 2022, 31, 138–154. [Google Scholar] [CrossRef]

- Cho, J.; DeStefano, T.; Kim, H.; Kim, I.; Paik, J.H. What’s driving the diffusion of next-generation digital technologies? Technovation 2022, 119, 102477. [Google Scholar] [CrossRef]

- Organization for Economic Cooperation and Development (OECD). Available online: https://www.oecd-ilibrary.org/science-and-technology/oecd-digital-economy-outlook-2020_bb167041-en (accessed on 7 November 2022).

- Financial Times. Available online: https://www.ft.com/content/7d9874c0-a25d-11e5-8d70-42b68cfae6e4 (accessed on 7 November 2022).

- Joskow, P.L. Comparing the costs of intermittent and dispatchable electricity generating technologies. Am. Econ. Rev. 2011, 101, 238–241. [Google Scholar] [CrossRef] [Green Version]

- Yahaya, A.S.; Javaid, N.; Alzahrani, F.A.; Rehman, A.; Ullah, I.; Shahid, A.; Shafiq, M. Blockchain based sustainable local energy trading considering home energy management and demurrage mechanism. Sustainability 2020, 12, 3385. [Google Scholar] [CrossRef] [Green Version]

- Cory, K.; Schwabe, P. Wind Levelized Cost of Energy: A Comparison of Technical and Financing Input Variables; National Renewable Energy Lab. (NREL): Golden, CO, USA, 2009. [Google Scholar] [CrossRef] [Green Version]

- Tushar, W.; Saha, T.K.; Yuen, C.; Smith, D.; Poor, H.V. Peer-to-peer trading in electricity networks: An overview. IEEE Trans. Smart Grid 2020, 4, 3185–3200. [Google Scholar] [CrossRef] [Green Version]

- Abrell, J.; Rausch, S.; Streitberger, C. Buffering volatility: Storage investments and technology-specific renewable energy support. Energy Econ. 2019, 84, 104463. [Google Scholar] [CrossRef]

- Wongthongtham, P.; Marrable, D.; Abu-Salih, B.; Liu, X.; Morrison, G. Blockchain-enabled Peer-to-Peer energy trading. Comput. Electr. Eng. 2021, 94, 107299. [Google Scholar] [CrossRef]

- Yu, T.; Luo, F.; Pu, C.; Zhao, Z.; Ranzi, G. Dual-blockchain-based P2P energy trading system with an improved optimistic rollup mechanism. IET Smart Grid 2022, 5, 246–259. [Google Scholar] [CrossRef]

- Andoni, M.; Robu, V.; Flynn, D.; Abram, S.; Geach, D.; Jenkins, D.; McCallum, P.; Peacock, A. Blockchain technology in the energy sector: A systematic review of challenges and opportunities. Renew. Sustain. Energy Rev. 2019, 100, 143–174. [Google Scholar] [CrossRef]

- Wang, D.; Zhao, J.; Wang, Y. A survey on privacy protection of blockchain: The technology and application. IEEE Access 2020, 8, 108766–108781. [Google Scholar] [CrossRef]

- Rossetto, N.; Reif, V. Digitalization of the Electricity Infrastructure: A Key Enabler for the Decarbonization and Decentralization of the Power Sector; Florence School of Regulation; [Electricity]; European University Institute: Fiesole, Italy, 2021; Volume 47, Available online: https://cadmus.eui.eu/handle/1814/70736 (accessed on 2 December 2022).

- Doan, H.T.; Cho, J.; Kim, D. Peer-to-peer energy trading in smart grid through blockchain: A double auction-based game theoretic approach. IEEE Access 2021, 9, 49206–49218. [Google Scholar] [CrossRef]

- Zhou, Y.; Wu, J.; Long, C.; Ming, W. State-of-the-art analysis and perspectives for peer-to-peer energy trading. Engineering 2020, 6, 739–753. [Google Scholar] [CrossRef]

- Mazzola, L.; Denzler, A.; Christen, R. Towards a Peer-to-Peer Energy Market: An Overview. 2020. Available online: http://arxiv.org/abs/2003.07940 (accessed on 7 November 2022).

- Cali, U.; Cakir, O. Energy policy instruments for distributed ledger technology empowered peer-to-peer local energy markets. IEEE Access 2019, 7, 82888–82900. [Google Scholar] [CrossRef]

- Morstyn, T.; McCulloch, M.D. Peer-to-peer energy trading. In Analytics for the Sharing Economy: Mathematics, Engineering and Business Perspectives; Springer: Cham, Switzerland, 2020; pp. 279–300. [Google Scholar] [CrossRef]

- Sousa, T.; Soares, T.; Pinson, P.; Moret, F.; Baroche, T.; Sorin, E. Peer-to-peer and community-based markets: A comprehensive review. Renew. Sustain. Energy Rev. 2019, 104, 367–378. [Google Scholar] [CrossRef] [Green Version]

- Compagnucci, L.; Lepore, D.; Spigarelli, F.; Frontoni, E.; Baldi, M.; Di Berardino, L. Uncovering the potential of blockchain in the agri-food supply chain: An interdisciplinary case study. J. Eng. Technol. Manage. 2022, 65, 101700. [Google Scholar] [CrossRef]

- Nakamoto, S. Bitcoin: A Peer-to-Peer Electronic Cash System. 2020. Available online: https://bitcoin.org/bitcoin.pdf (accessed on 7 November 2022).

- Zhao, J.L.; Fan, S.; Yan, J. Overview of business innovations and research opportunities in blockchain and introduction to the special issue. Financ. Innov. 2016, 2, 2–7. [Google Scholar] [CrossRef]

- Gambino, A.; Bomprezzi, C. Blockchain e protezione dei dati personali. Il Dirit. Dell’Informazione e Dell’Informatica 2019, 35, 619–646. [Google Scholar]

- Islam, I.; Munim, K.M.; Oishwee, S.J.; Islam, A.K.M.N.; Islam, M.N. A critical review of concepts, benefits, and pitfalls of blockchain technology using concept map. IEEE Access 2020, 8, 68333–68341. [Google Scholar] [CrossRef]

- Fell, M.J.; Schneiders, A.; Shipworth, D. Consumer demand for blockchain-enabled Peer-to-Peer electricity trading in the United Kingdom: An online survey experiment. Energies 2019, 12, 3913. [Google Scholar] [CrossRef] [Green Version]

- De Almeida, L.; Cappelli, V.; Klausmann, N.; Van Soest, H. Peer-to-Peer Trading and Energy Community in the Electricity Market: Analysing the Literature on Law and Regulation and Looking Ahead to Future Challenges; Florence School of Regulation; [Electricity]; European University Institute: Fiesole, Italy, 2021; Volume 35, Available online: https://cadmus.eui.eu/handle/1814/70457 (accessed on 2 December 2022).

- van Soest, H. Peer-to-peer electricity trading: A review of the legal context. Compet. Regul. Netw. Ind. 2018, 19, 180–199. [Google Scholar] [CrossRef]

- Yang, Q.; Wang, H. Privacy-preserving transactive energy management for IoT-aided smart homes via blockchain. IEEE Internet Things J. 2021, 8, 11463–11475. [Google Scholar] [CrossRef]

- Siano, P.; de Marco, G.; Rolan, A.; Loia, V. A survey and evaluation of the potentials of distributed ledger technology for Peer-to-Peer transactive energy exchanges in local energy markets. IEEE Syst. J. 2019, 13, 3454–3466. [Google Scholar] [CrossRef]

- Wu, Y.; Wu, Y.; Cimen, H.; Vasquez, J.C.; Guerrero, J.P. P2P energy trading: Blockchain-enabled P2P energy society with multi-scale flexibility services. Energy Rep. 2022, 8, 3614–3628. [Google Scholar] [CrossRef]

- European Commission. Available online: https://ec.europa.eu/commission/presscorner/detail/en/IP_12_46 (accessed on 7 November 2022).

- Ibáñez, L.-D.; Kieron, O.; Simperl, E. On Blockchains and the General Data Protection Regulation. 2018. Available online: https://www.researchgate.net/publication/326913146_On_Blockchains_and_the_General_Data_Protection_Regulation (accessed on 7 November 2022).

- Daoui, S.; Fleinert-Jensen, T.; Lampiere, M. GDPR, Blockchain and the French Data Protection Authority: Many Answers but Some Remaining Questions. Stanf. J. Blockchain Law Policy 2019, 2, 240. [Google Scholar]

- Lyons, T.; Courcelas, L.; Timsit, K. Blockchain and the GDPR. Thematic Report. 2018. Available online: https://www.eublockchainforum.eu/sites/default/files/reports/20181016_report_gdpr.pdf (accessed on 7 November 2022).

- European Data Protection Supervisor. Available online: https://edps.europa.eu/data-protection/our-work/subjects/accountability_en (accessed on 7 November 2022).

- European Court of Justice. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A62012CJ0131 (accessed on 7 November 2022).

- European Court of Justice. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A62016CC0210 (accessed on 7 November 2022).

- European Court of Justice. Available online: https://eur-lex.europa.eu/legal-content/it/TXT/?uri=CELEX:62017CJ0040 (accessed on 7 November 2022).

- Fink, M. Blockchains and data protection in the European Union. Eur. Data Prot. Law Rev. 2018, 4, 17–35. [Google Scholar] [CrossRef] [Green Version]

- Commission Nationale de l’Informatique et des Libertés (CNIL). Available online: https://www.cnil.fr/sites/default/files/atoms/files/blockchain_en.pdf (accessed on 7 November 2022).

- European Parliament. Blockchain and the General Data Protection Regulation: Can Distributed Ledgers Be Squared with European Data Protection Law? 2019. Available online: https://www.europarl.europa.eu/RegData/etudes/STUD/2019/634445/EPRS_STU(2019)634445_EN.pdf (accessed on 7 November 2022).

- Xu, L.D.; Lu, Y.; Li, L. Embedding blockchain technology into IoT for security: A survey. IEEE Internet Things 2021, 8, 10452–10473. [Google Scholar] [CrossRef]

- Truong, N.B.; Sun, K.; Lee, G.M.; Guo, Y. GDPR-compliant personal data management: A blockchain-based solution. IEEE Trans. Inf. Secur. 2020, 15, 1746–1761. [Google Scholar] [CrossRef] [Green Version]

- Kadena, E.; Holicza, P. Security issues in the blockchain(ed) world. In Proceedings of the IEEE 18th International Symposium on Computational Intelligence and Informatics (CINT), Budapest, Hungary, 21–22 November 2019. [Google Scholar] [CrossRef]

- European Parliament. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52018IP0373 (accessed on 7 November 2022).

- Zemler, F.; Westner, M. Blockchain and GDPR: Application scenarios and compliance requirements. In Proceedings of the Portland International Conference on Management of Engineering and Technology (PICMET), Portland, OR, USA, 25–29 August 2019. [Google Scholar] [CrossRef]

- European Law Institute. Available online: https://www.europeanlawinstitute.eu/fileadmin/user_upload/p_eli/Publications/ELI_Principles_on_Blockchain_Technology__Smart_Contracts_and_Consumer_Protection.pdf (accessed on 7 November 2022).

- Finck, M.; Pallas, F. They who must not be identified—Distinguishing personal from non-personal data under the GDPR. Int. Data Priv. Law 2020, 10, 11–36. [Google Scholar] [CrossRef]

- Mourby, M.; Mackey, E.; Elliot, M.; Gowans, H.; Wallace, S.; Bell, J.; Smith, H.; Aidinlis, S.; Kaye, J. Are ‘pseudonymised’ data always personal data? Implications of the GDPR for administrative data research in the UK. Comput. Law Secur. Rep. 2018, 34, 222–233. [Google Scholar] [CrossRef]

- Martini, M.; Weinzierl, Q. Die Blockchain-Technologie und das Recht auf Vergessenwerden. Neue Z. Für Verwalt. 2017, 17, 1251–1256. [Google Scholar]

- Munjal, K.; Bhatia, R. A systematic review of homomorphic encryption and its contributions in healthcare industry. Complex Intell. Syst. 2022. [Google Scholar] [CrossRef] [PubMed]

- Feige, U.; Fiat, A.; Shamir, A. Zero-knowledge proofs of identity. J. Cryptol. 1988, 1, 77–94. [Google Scholar] [CrossRef]

- Giannopoulou, A. Putting data protection by design on the blockchain. Eur. Data Prot. Law Rev. 2021, 7, 388–399. [Google Scholar] [CrossRef]

- Curtis, S.K.; Lehner, M. Defining the sharing economy for sustainability. Sustainability 2019, 11, 567. [Google Scholar] [CrossRef] [Green Version]

- de Simón-Martín, M.; Bracco, S.; Piazza, G.; Pagnini, L.C.; González-Martínez, A.; Delfino, F. The role of energy communities in the energy framework. In Levelized Cost of Energy in Sustainable Energy Communities; Springer: Cham, Switzerland, 2022. [Google Scholar] [CrossRef]

- Cuenca, J.J.; Jamil, E.; Hayes, B. State of the art in energy communities and sharing economy concepts in the electricity sector. IEEE Trans. Ind. Appl. 2021, 57, 5737–5746. [Google Scholar] [CrossRef]

- De Almeinda, L.; Klausman, N. Peer-to-Peer, Energy Communities, Legal Definitions and Access to Markets. 2021. Available online: https://fsr.eui.eu/peer-to-peer-energy-communities-legal-definitions-and-access-to-markets/ (accessed on 7 November 2022).

- Lowitzsch, J.; Hoicka, C.E.; van Tulder, F.J. Renewable energy communities under the 2019 European Clean Energy Package—Governance model for the energy clusters of the future? Renew. Sustain. Energy Rev. 2020, 122, 109489. [Google Scholar] [CrossRef]

- Torabi Moghadam, S.; Di Nicoli, M.V.; Manzo, S.; Lombardi, P. Mainstreaming energy communities in the transition to a low-carbon future: A methodological approach. Energies 2020, 13, 1597. [Google Scholar] [CrossRef] [Green Version]

- Stephant, M.; Hassam-Ouari, K.; Abbes, D.; Labrunie, A.; Robyns, B. A survey on energy management and blockchain for collective self-consumption. In Proceedings of the 7th International Conference on Systems and Control (ICSC 2018), Valencia, Spain, 24–26 October 2018. [Google Scholar] [CrossRef]

- World Energy Council. Available online: https://www.worldenergy.org/assets/downloads/Full-White-paper_the-developing-role-of-blockchain.pdf (accessed on 7 November 2022).

- Esmat, A.; de Vos, M.; Ghiassi-Farrokhfal, Y.; Palensky, P.; Epema, D. A novel decentralized platform for peer-to-peer energy trading market with blockchain technology. Appl. Energy 2021, 282, 116123. [Google Scholar] [CrossRef]

- Thukral, M.K. Emergence of blockchain-technology application in peer-to-peer electrical-energy trading: A review. Clean Energy 2021, 5, 104–123. [Google Scholar] [CrossRef]

- Lei, N.; Masanet, E.; Koomey, J. Best practices for analyzing the direct energy use of blockchain technology systems: Review and policy recommendations. Energy Policy 2021, 156, 112422. [Google Scholar] [CrossRef]

- Council of European Energy Regulators. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32018L2001 (accessed on 7 November 2022).

- Greenspan, G. Avoiding the Pointless Blockchain Project. Available online: https://www.multichain.com/blog/2015/11/avoiding-pointless-blockchain-project/ (accessed on 2 December 2022).

- Baashar, Y.; Alkawsi, G.; Alkahtani, A.A.; Hashim, W.; Razali, R.A.; Tiong, S.K. Toward Blockchain Technology in the Energy Environment. Sustainability 2021, 13, 9008. [Google Scholar] [CrossRef]

- Malone, T.; Yates, J.; Benjamin, R. Electronic markets and electronic hierarchies. Commun. ACM 1987, 30, 484–497. [Google Scholar] [CrossRef] [Green Version]

- Wilkinson, S.; Hojckova, K.; Eon, C.; Morrison, G.M.; Sandén, B. Is peer-to-peer electricity trading empowering users? Evidence on motivations and roles in a prosumer business model trial in Australia. Energy Res. Soc. Sci. 2020, 66, 101500. [Google Scholar] [CrossRef]

- Catalini, C.; Gans, J.S. Some simple economics of the blockchain. Commun. ACM 2020, 63, 80–90. [Google Scholar] [CrossRef]

- Sun, R.; Garimella, A.; Han, W.; Chang, H.; Shaw, M.J. Transformation of the transaction cost and the agency cost in an organization and the applicability of blockchain—A case study of Peer-to-Peer insurance. Front. Blockchain 2020, 3, 24. [Google Scholar] [CrossRef]

- Peters, G.; Panayi, E. Understanding Modern Banking Ledgers through Blockchain Technologies: Future of Transaction Processing and Smart Contracts on the Internet of Money. 2015. Available online: https://ssrn.com/abstract=2692487 (accessed on 2 December 2022). [CrossRef] [Green Version]

- Abdella, J.; Shuaib, K. Peer to Peer distributed energy trading in smart grids: A survey. Energies 2018, 11, 1560. [Google Scholar] [CrossRef] [Green Version]

- International Renewable Energy Agency (IRENA). Available online: https://irena.org/-/media/Files/IRENA/Agency/Publication/2020/Jul/IRENA_Peer-to-peer_trading_2020.pd (accessed on 7 November 2022).

- Junlakarn, S.; Kokchang, P.; Audomvongseree, K. Drivers and challenges of peer-to-peer energy trading development in Thailand. Energies 2022, 15, 1229. [Google Scholar] [CrossRef]

- Scuri, S.; Tasheva, G.; Barros, L.; Nunes, N.J. An HCI perspective on distributed ledger technologies for Peer-to-Peer energy trading. In Proceedings of the 17th IFIP Conference on Human-Computer Interaction (INTERACT), Paphos, Cyprus, 2–6 September 2019. [Google Scholar] [CrossRef]

- Brisbois, M.C. Powershifts: A framework for assessing the growing impact of decentralized ownership of energy transitions on political decision-making. Energy Res. Soc. Sci. 2018, 50, 151–161. [Google Scholar] [CrossRef]

- Mollah, M.B.; Zhao, J.; Niyato, D.; Lam, K.-Y.; Zhang, X.; Ghias, A.M.Y.M.; Koh, L.H.; Yang, L. Blockchain for future smart grid: A comprehensive survey. IEEE Internet Things 2021, 8, 18–43. [Google Scholar] [CrossRef]

- Kwak, S.; Lee, J. Implementation of blockchain based P2P energy trading platform. In Proceedings of the 2021 International Conference on Information Networking (ICOIN), Jeju Island, Republic of Korea, 13–16 January 2021; pp. 5–7. [Google Scholar] [CrossRef]

- Kumari, A.; Gupta, R.; Tanwar, S.; Tyagi, S.; Kumar, N. When blockchain meets smart grid: Secure energy trading in demand response management. IEEE Netw. 2020, 34, 299–305. [Google Scholar] [CrossRef]

- Brilliantova, V.; Thurner, T.W. Blockchain and the future of energy. Technol. Soc. 2019, 57, 38–45. [Google Scholar] [CrossRef]

- Mannaro, K.; Pinna, A.; Marchesi, M. Crypto-trading: Blockchain-oriented energy market. In Proceedings of the 2017 AEIT International Annual Conference, Cagliari, Italy, 20–22 September 2017. [Google Scholar]

- Ahl, A.; Yarime, M.; Tanaka, K.; Sagawa, D. Review of blockchain-based distributed energy: Implications for institutional development. Renew. Sustain. Energy Rev. 2019, 107, 200–211. [Google Scholar] [CrossRef]

- Peter, V.; Paredes, J.; Rosado Rivial, M.; Soto Sepúlveda, E.; Hermosilla Astorga, D.A. Blockchain Meets Energy: Digital Solutions for a Decentralized and Decarbonized Sector; European University Institute: Fiesole, Italy, 2019; Available online: https://cadmus.eui.eu/handle/1814/63369 (accessed on 2 December 2022)Florence School of Regulation; Energy.

- Di Silvestre, M.L.; Gallo, P.; Guerrero, J.M.; Musca, R.; Riva Sanseverino, E.; Sciumè, G.; Vásquez, J.; Zizzo, G. Blockchain for power systems: Current trends and future applications. Renew. Sustain. Energy Rev. 2020, 119, 109585. [Google Scholar] [CrossRef]

- Dong, H.; Chengzhenghao, Z.; Jian, P.; Zheng, Y. Smart contract architecture for decentralized energy trading and management based on blockchains. Energy 2020, 199, 117417. [Google Scholar] [CrossRef]

- Monacchi, A.; Elmenreich, W. Assisted energy management in smart microgrids. J. Ambient Intell. Hum. Comput. 2016, 7, 901–913. [Google Scholar] [CrossRef] [Green Version]

- Kounelis, I.; Steri, G.; Giuliani, R.; Geneiatakis, D.; Neisse, R.; Nai Fovino, I. Fostering consumers’ energy market through smart contracts. In Proceedings of the International Conference in Energy and Sustainability in Small Developing Economies (ES2DE), Funchal, Portugal, 10–12 July 2017. [Google Scholar] [CrossRef]

- Kapassa, E.; Themistocleous, M.; Touloupos, M.; Quintanilla, J.R.; Papadaki, M. Blockchain in smart energy grids: A market analysis. In Proceedings of the 17th European, Mediterranean, and Middle Eastern Conference (EMCIS), Dubai, United Arab Emirates, 25–26 November 2020. [Google Scholar]

- Mylrea, M.; Gourisetti, S.N.G. Blockchain for smart grid resilience: Exchanging distributed energy at speed, scale and security. In Proceedings of the 2017 Resilience Week (RWS), Wilmington, DE, USA, 18–22 September 2017; pp. 18–23. [Google Scholar] [CrossRef]

- Nai Fovino, I.; Andreadou, N.; Geneiatakis, D.; Giuliani, R.; Kounelis, I.; Lucas, A.; Marinopoulos, A.; Martin, T.; Poursanidis, I.; Soupionis, I.; et al. Blockchain in the Energy Sector; Publications Office of the European Union: Luxembourg, 2021. [Google Scholar] [CrossRef]

- Borges, C.E.; Kapassa, E.; Touloupou, M.; Legarda Macón, J.; Casado-Mansilla, D. Blockchain application in P2P energy markets: Social and legal aspects. Connect. Sci. 2022, 34, 1066–1088. [Google Scholar] [CrossRef]

- Vieira, G.; Zhang, J. Peer-to-peer energy trading in a microgrid leveraged by smart contracts. Renew. Sustain. Energy Rev. 2021, 143, 110900. [Google Scholar] [CrossRef]

- Wang, Q.; Su, M. Integrating BCT into the energy sector—From theory of blockchain to research and application of energy blockchain. Comput. Sci. Rev. 2020, 37, 100275. [Google Scholar] [CrossRef]

- Huang, L.; Zhen, L.; Wang, J.; Zhang, X. Blockchain implementation for circular supply chain management: Evaluating critical success factors. Ind. Market. Manag. 2022, 102, 451–464. [Google Scholar] [CrossRef]

- Wang, H.; Chen, K.; Xu, D. A maturity model for blockchain adoption. Financ. Innov. 2016, 2, 12. [Google Scholar] [CrossRef] [Green Version]

- Yang, J.; Paudel, A.; Gooi, H.B.; Nguyen, H.D. A proof-of-stake public blockchain based pricing scheme for peer-to-peer energy trading. Appl. Energy 2021, 298, 117154. [Google Scholar] [CrossRef]

- Esposito, C.; de Santis, A.; Tortora, G.; Chang, H.; Choo, K.-K.R. Blockchain: A panacea for healthcare cloud-based data security and privacy? IEEE Cloud Comput. 2018, 5, 31–37. [Google Scholar] [CrossRef]

- Chod, J.; Trichakis, N.; Tsoukalas, G.; Aspegren, H.; Weber, M. On the financing benefits of supply chain transparency and blockchain adoption. Manag. Sci. 2020, 66, 4378–4396. [Google Scholar] [CrossRef]

- Khaqqi, K.N.; Sikorski, J.J.; Hadinoto, K.; Kraft, M. Incorporating seller/buyer reputation-based system in blockchain-enabled emission trading application. Appl. Energy 2018, 209, 8–19. [Google Scholar] [CrossRef]

- Javed, H.; Irfan, M.; Shehzad, M.; Abdul Muqeet, H.; Akhter, J.; Dagar, V.; Guerrero, J.M. Recent trends, challenges, and future aspects of p2p energy trading platforms in electrical-based networks considering blockchain technology: A roadmap toward environmental sustainability. Front. Energy Res. 2022, 10, 810395. [Google Scholar] [CrossRef]

- Parag, Y.; Sovacool, B.K. Electricity market design for the prosumer era. Nat. Energy 2016, 1, 16032. [Google Scholar] [CrossRef]

- Espe, E.; Potdar, V.; Chang, E. Prosumer communities and relationships in smart grids: A literature review, evolution and future directions. Energies 2018, 11, 2528. [Google Scholar] [CrossRef] [Green Version]

- Son, Y.-B.; Im, J.-H.; Kwon, H.-Y.; Jeon, S.-Y.; Lee, M.-K. Privacy-preserving Peer-to-Peer energy trading in blockchain-enabled smart grids using functional encryption. Energies 2020, 13, 1321. [Google Scholar] [CrossRef] [Green Version]

- Majeed, U.; Khan, L.U.; Yaqoob, I.; Ahsan Kazmi, S.M.; Salah, K.; Hong, C.S. Blockchain for IoT-based smart cities: Recent advances, requirements, and future challenges. J. Netw. Comput. Appl. 2021, 181, 103007. [Google Scholar] [CrossRef]

- Gai, K.; Wu, Y.; Zhu, L.; Qiu, M.; Shen, M. Privacy-preserving energy trading using consortium blockchain in smart grid. IEEE Trans. Ind. Inform. 2019, 15, 3548–3558. [Google Scholar] [CrossRef]

- German Energy Agency (DENA). Available online: https://www.dena.de/fileadmin/user_upload/dena-Studie_Blockchain_Integrierte_Energiewende_EN.pdf (accessed on 7 November 2022).

- Rui, Z.; Rui, X.; Ling, L. Security and privacy on blockchain. ACM Comput. Surv. 2019, 52, 1–34. [Google Scholar] [CrossRef] [Green Version]

- Mengelkamp, E.; Gärttner, J.; Rock, K.; Kessler, S.; Orsini, L.; Weinhardt, C. Designing microgrid energy markets: A case study: The Brooklyn Microgrid. Appl. Energy 2018, 210, 870–880. [Google Scholar] [CrossRef]

- Lang, M.; Müller, M. Blockchain and smart contracts in the energy industry: A European perspective. In Proceedings of the International Mining and Oil & Gas Law, Development, and Investment, Rio de Janeiro, Brazil, 10–12 April 2019; p. 17B-1. Available online: https://www.twobirds.com/-/media/pdfs/blockchain-and-smart-contracts-in-the-energy-industry--article.pdf (accessed on 7 November 2022).

- EU Blockchain Observatory & Forum. Available online: https://www.eublockchainforum.eu/sites/default/files/reports/EUBOF-Thematic_Report_Energy_Sector_0.pdf (accessed on 7 November 2022).

| Domains | Challenges | Proposed Solutions |

|---|---|---|

| Accountability |

|

|

|

| |

| Right to rectification |

|

|

| Right to erasure |

|

|

| Principle of purpose limitation |

|

|

| Principle of data minimization |

|

|

| Hashing technique and pseudonymization |

|

|

| Domains | Challenges | Proposed Solutions |

|---|---|---|

| Technological maturity |

|

|

| Disintermediation |

|

|

| Data protection |

|

|

| Social awareness and market players |

|

|

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chiarini, A.; Compagnucci, L. Blockchain, Data Protection and P2P Energy Trading: A Review on Legal and Economic Challenges. Sustainability 2022, 14, 16305. https://doi.org/10.3390/su142316305

Chiarini A, Compagnucci L. Blockchain, Data Protection and P2P Energy Trading: A Review on Legal and Economic Challenges. Sustainability. 2022; 14(23):16305. https://doi.org/10.3390/su142316305

Chicago/Turabian StyleChiarini, Alessandra, and Lorenzo Compagnucci. 2022. "Blockchain, Data Protection and P2P Energy Trading: A Review on Legal and Economic Challenges" Sustainability 14, no. 23: 16305. https://doi.org/10.3390/su142316305