Prediction of Supply Chain Financial Credit Risk Based on PCA-GA-SVM Model

Abstract

1. Introduction

2. Literature Review

2.1. Concept and Role of SCF

2.2. Innovation of SCF Mode

2.3. Credit Risk Prediction of SCF

2.3.1. Credit Risk Prediction System

2.3.2. Credit Risk Prediction Model

2.4. Literature Summary

3. Establishment of Model

3.1. Feature Extraction Using Principal Component Analysis

- Step 1 Standardize the original data.

- Step 2 KMO and Bartlett tests were conducted.

- Step 3 The eigenvalues and eigenvectors of the correlation coefficient matrix are calculated from the standardized matrix.

- Step 4 Calculate the principal component contribution rate and cumulative variance contribution rate.

- Step 5 The principal component factor load matrix is obtained, and the principal component is explained in practical sense.

3.2. Optimize SVM Using GA

3.2.1. Genetic Algorithm

3.2.2. Support Vector Machine

| Algorithm 1. Pseudocode for GA-SVM |

| Input: Initialize: set Binary encoding of while do if then Crossover operation according to crossover probabilities get generation end if if then Mutation operation according to crossover probabilities get new generation end if get and from Compute fitness = average(10-Fold-CV()) Select operation according to generation and fitness get new end while Decoding get and from Output: |

- Step 1 The value ranges of the given parameters and are . Set the maximum evolution algebra to .

- Step 2 and are encoded as gene sequences with binary 01, and the initial population with population size is created. Set the precision as , according to the formula to calculate the binary encoding length of each parameter. is the interval length and is the coding length

- Step 3 Decode the chromosomes of individuals in the initial population to obtain pair of and real number pairs. Then each pair of and is brought into the SVM model, and ten-fold cross is used for training. After training, the average accuracy of ten-fold cross validation is calculated, and the average accuracy is taken as the fitness value of each individual.

- Step 4 Judge whether the termination conditions are met. If not, go to the next step; If the conditions are met, enter Step 6.

- Step 5 Natural selection, crossover and mutation operations are carried out for contemporary surviving populations. Among them, natural selection is carried out through roulette. Two-point crossover operator is used for crossover, with probability of , and basic bit mutation operator is used for mutation, with probability of . After generation of offspring population, return to Step 3.

- Step 6 The optimal gene sequence obtained by decoding. First, convert the binary results of and into decimal numbers . Then, through the formula and to calculate the natural number results of and .

- Step 7 Input the optimal parameters and into the SVM model for training and output the prediction results.

3.3. PCA-GA-SVM Prediction Model

- Interpreted Variable

- Explanatory Variable

- Step 1 The principal component analysis is used to reduce the original data into several factors.

- Step 2 The optimal parameters obtained by genetic algorithm are input into SVM model.

- Step 3 Several factors obtained through principal component analysis are input into the GA-SVM model.

- Step 4 Train the model and output the classification prediction results.

4. Empirical Analysis

4.1. Establishment of Credit Risk Prediction System

- Internal Factors of Financing Enterprises

- Influencing Factors of Core Enterprises

- Status of Supply Chain

- Characteristics of Pledge

4.2. Data Acquisition and Processing

4.3. Dimension Reduction by PCA

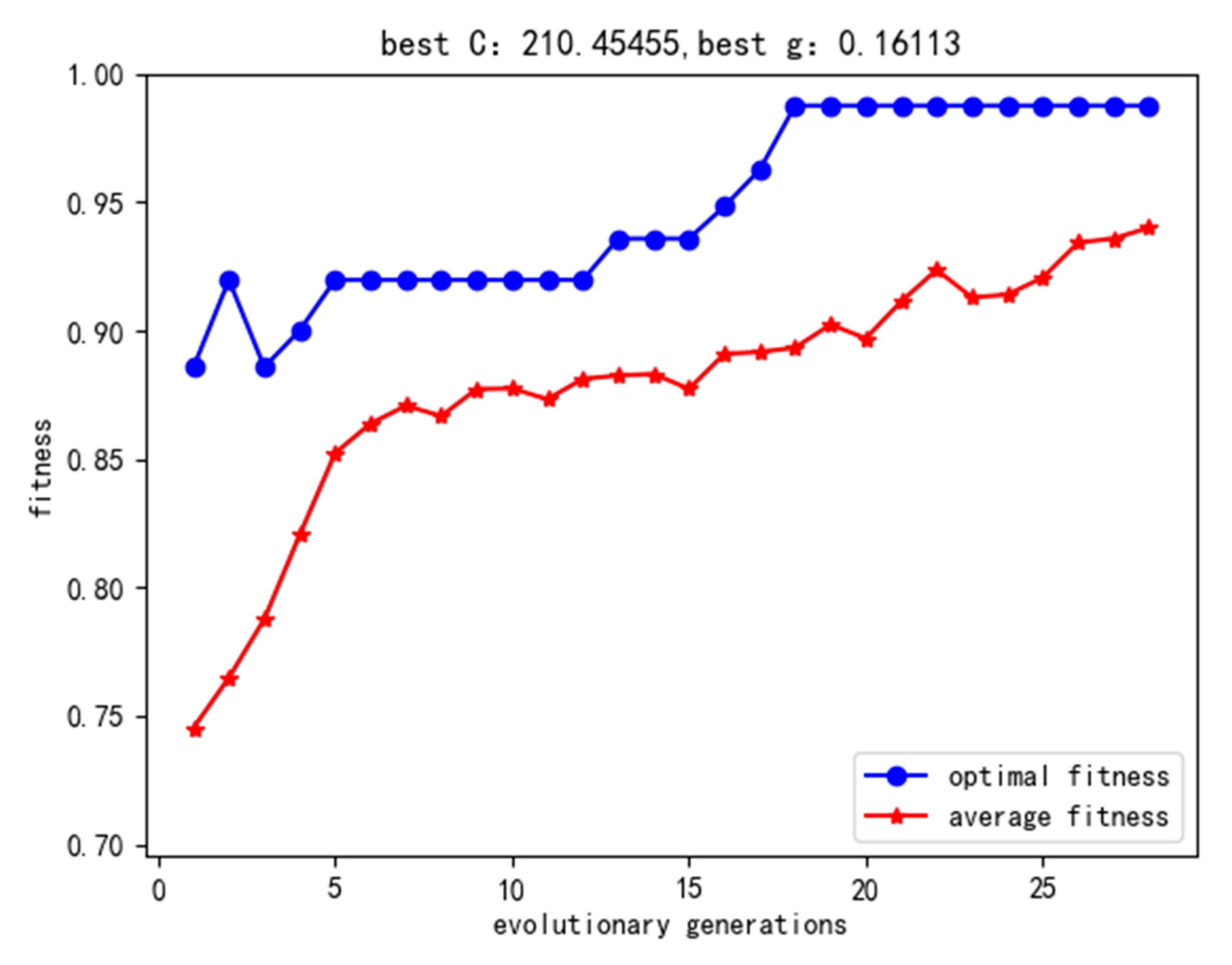

4.4. Model Solution

- Kernel function parameter , penalty parameter ;

- Accuracy . According to the calculation , the binary length of is 25 and the binary length of is 20;

- Population size , maximum evolutionary algebra , crossover probability , mutation probability .

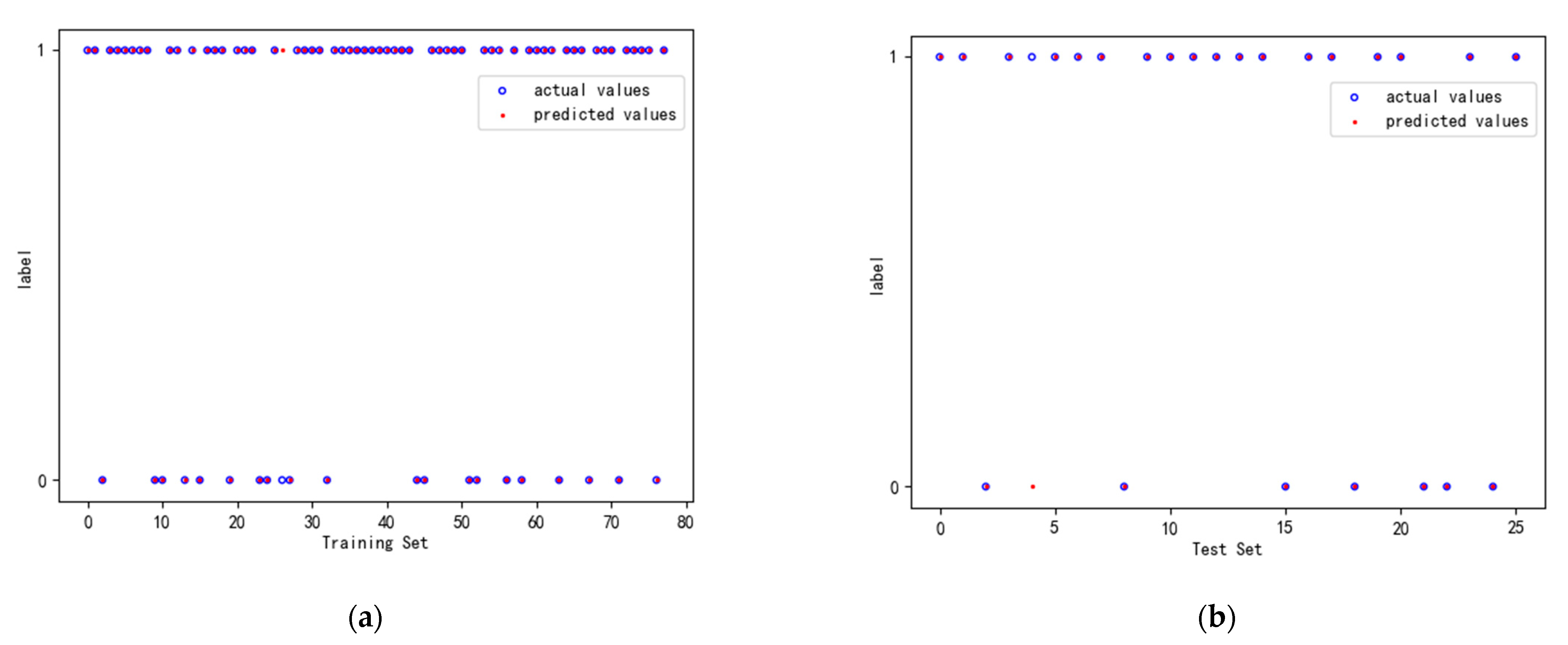

4.5. Result Analysis

- By comparing the performance of the SVM model and the GA-SVM model, it can be seen that the SVM model does not find appropriate parameters, resulting in its poor performance. It is necessary to optimize its parameters. Therefore, it is necessary to improve the performance of the SVM model through optimization methods. The accuracy of the GA-SVM model is 26.92% higher than that of the original SVM model, which indicates that the penalty parameters and kernel parameters of SVM have a great impact on the accuracy of the results, and the performance of the SVM model using the optimal parameters has been greatly improved.

- By comparing the performance of the GA-SVM model and the PCA-GA-SVM model, it can be seen that the accuracy of the PCA-GA-SVM model is 7.69% higher than that of the GA-SVM model, indicating that the addition of principal component analysis not only reduces the input of the model but also improves the classification and prediction ability of the model. It shows that PCA has outstanding advantages in feature selection and strong data mining ability, and the selected principal components can broadly represent the influence of initial explanatory variables on the interpreted variables.

- In statistics, the two types of classification error rates are usually used to test the effectiveness of credit risk models. The first type of error is the sample proportion of actual default but predicted default, and the second type of error is the sample proportion of actual default but predicted default. In real life, the interest generated by enterprise loans is often less than the loss from the default of enterprise loans. The Type I error causes commercial banks to reduce potential financing customers, while the Type II error causes commercial banks and core enterprises to suffer serious losses due to the default of financing enterprises. Therefore, people tend to pay more attention to the Type II error. Reducing the Type II error is more important than reducing Type I error. It can be seen from the figure that the Type II error of each model is lower than the Type I error, which indicates that all models established in this paper have certain recognition ability for financing enterprises with credit risk, which can reduce the risk of commercial banks issuing loans to enterprises with credit risk due to recognition errors. Finally, the PCA-GA-SVM model reduces the Type I error to 3.84%, and the Type II error to 0, with good performance.

5. Conclusions and Suggestions

- The financing mode of accounts receivable is the most typical mode of SCF, and the most commonly used mode in automobile supply chain is also the financing mode of accounts receivable. Therefore, this paper chooses the accounts receivable financing model for research. The pledge in the SCF accounts receivable mode is generally accounts receivable, and the SMEs handle financing from the commercial bank with the unmatured accounts receivable. Accounts receivable and recovery ability affect the normal capital operation and debt paying ability of enterprises. This paper takes the characteristics of pledge (accounts receivable) as the first-level indicator of the prediction system and establishes a prediction system that is more consistent with the specific model.

- The PCA-GA-SVM model established in this paper has very good performance ability in identifying risk enterprises and reducing miscalculation. Principal component analysis can reduce the dimension of data while retaining the information of original data to the maximum extent; the genetic algorithm has strong robustness. Using the genetic algorithm to optimize the kernel function of support vector machine can not only overcome the randomness of artificial selection of parameters but also find the optimal solution under stable conditions, improve the accuracy of the model and reduce the error rate. Therefore, the PCA-GA-SVM model can provide a theoretical reference for commercial banks when granting credit and provide a more scientific and reasonable credit risk prediction.

- SCF mode is in the supply chain system, which is different from the traditional financing mode. We should not only pay attention to the situation of financing enterprises but also to the core enterprises, supply chain operation and the transaction assets. Therefore, we should consider the above four aspects at the same time and build a credit risk index system combining qualitative and quantitative information. At the same time, different financing modes and industries have their own characteristics. A specific credit risk prediction system should be established according to the different characteristics of the model and industry to improve the accuracy of the prediction.

- In the prediction model, the traditional method driven by model is essentially based on probability distribution and attaches great importance to inference, while the fundamental of machine learning driven by data is to minimize the prediction error. The purpose of traditional modeling methods is to obtain the probability distribution of data, while the purpose of machine learning is the prediction accuracy. Although the credit risk prediction of SCF is a two classifications model, if the probability of performance or default can be predicted, it can help financing institutions make more accurate decisions. Therefore, this paper asserts that the prediction model that tries to combine the traditional methods with machine learning can be the next research direction.

- In terms of application scenarios, blockchain technology has the advantages of maintaining smooth information, ensuring information security and strengthening risk control in innovative supply chain finance. Therefore, the application of blockchain technology in the field of supply chain finance can effectively solve the problem that the supply chain financial data information is not smooth and transparent, thus ensuring data security and improving the supply chain financial risk prevention and control capability. In future research, we can strengthen the research on “Supply Chain Finance + Blockchain”.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Fiedler, A. An agent-based negotiation protocol for supply chain finance. Comput. Ind. Eng. 2022, 168, 108136. [Google Scholar] [CrossRef]

- Li, J.; Wang, Y.J.; Feng, G.Z.; Wang, S.Y.; Song, Y.G. Supply chain finance review: Current situation and future trend. Syst. Eng. Theory Pract. 2020, 40, 1977–1995. [Google Scholar]

- Dong, J. Credit Risk Assessment of Middle and Small-Sized Enterprises and Its Method-Based on the Analysis of Accounts Receivable Financing Model. Jianghan Trib. 2022, 3, 22–28. [Google Scholar]

- Vangen Digital Technology. Analysis of the Current Situation of China’s Supply Chain Finance Industry. Available online: https://m.sohu.com/a/583705132_121438954?_trans_=010004_pcwzy (accessed on 9 September 2022).

- Xie, X.; Yang, Y.; Gu, J.; Zhou, Z. Research on the contagion effect of associated credit risk in supply chain based on dual-channel financing mechanism. Environ. Res. 2020, 184, 109356. [Google Scholar] [CrossRef] [PubMed]

- Xie, X.; Hu, X.; Xu, K.; Wang, J.; Shi, X.; Zhang, F. Prediction of associated credit risk in supply chain based on trade credit risk contagion. Procedia Comput. Sci. 2022, 199, 946–953. [Google Scholar] [CrossRef]

- CBRC. Notice of the CBRC on Printing and Distributing the Administrative Measures for Joint Credit Granting of Banking Financial Institutions (for Trial Implementation). Available online: http://www.gov.cn/gongbao/content/2018/content_5326377.htm (accessed on 22 May 2018).

- Wang, Y.; Shen, J.; Pan, J.; Chen, T. A Credit Risk Contagion Intensity Model of Supply Chain Enterprises under Different Credit Modes. Sustainability 2022, 14, 13518. [Google Scholar] [CrossRef]

- Liu, S.Q. Summary and Discussion on the Current Situation and Progre25ss of Supply Chain Finance Research—Based on Citespace Knowledge Graph Analysis. Jiangsu Commer. Forum 2022, 6, 93–96. [Google Scholar] [CrossRef]

- Hofmann, E. Supply chain finance: Some conceptual insights. Beiträge Beschaff. Logist. 2005, 16, 203–214. [Google Scholar]

- Read, C.; Scheuermann, H.-D. The CFO as Business Integrator; John Wiley & Sons: Hoboken, NJ, USA, 2003. [Google Scholar]

- Pfohl, H.-C.; Gomm, M. Supply chain finance: Optimizing financial flows in supply chains. Logist. Res. 2009, 1, 149–161. [Google Scholar] [CrossRef]

- Wuttke, D.A.; Blome, C.; Foerstl, K.; Henke, M. Managing the innovation adoption of supply chain finance—Empirical evidence from six European case studies. J. Bus. Logist. 2013, 34, 148–166. [Google Scholar] [CrossRef]

- Jiang, W.; Yao, W.T. Implementation of Property Law and Supply Chain Finance: Empirical Evidence from Pledge Financing of Accounts Receivable. Econ. Res. J. 2016, 51, 141–154. [Google Scholar]

- Gelsomino, L.M.; de Boer, R.; Steeman, M.; Perego, A. An optimisation strategy for concurrent Supply Chain Finance schemes. J. Purch. Supply Manag. 2019, 25, 185–196. [Google Scholar] [CrossRef]

- Lam, H.K.S.; Zhan, Y.; Zhang, M.; Wang, Y.; Lyons, A. The effect of supply chain finance initiatives on the market value of service providers. Int. J. Prod. Econ. 2019, 216, 227–238. [Google Scholar] [CrossRef]

- Jia, F.; Blome, C.; Sun, H.; Yang, Y.; Zhi, B. Towards an integrated conceptual framework of supply chain finance: An information processing perspective. Int. J. Prod. Econ. 2020, 219, 18–30. [Google Scholar] [CrossRef]

- Huang, C.; Chan, F.T.S.; Chung, S.H. Recent contributions to supply chain finance: Towards a theoretical and practical research agenda. Int. J. Prod. Res. 2022, 60, 493–516. [Google Scholar] [CrossRef]

- Natanelov, V.; Cao, S.; Foth, M.; Dulleck, U. Blockchain smart contracts for supply chain finance: Mapping the innovation potential in Australia-China beef supply chains. J. Ind. Inf. Integr. 2022, 30, 100389. [Google Scholar] [CrossRef]

- Yang, S.H. Research On Supply Chain Financing Service from the Business Model of Commercial Banks. Logist. Technol. 2005, 10, 179–182. [Google Scholar]

- Hu, Y.F.; Huang, S.Q. Supply Chain Finance: Background, Innovation and Concept Definition. Res. Financ. Econ. Issues 2009, 8, 76–82. [Google Scholar]

- Camerinelli, E. Supply chain finance. J. Paym. Strategy Syst. 2009, 3, 114–128. [Google Scholar]

- Zhao, X.; Yeung, K.; Huang, Q.; Song, X. Improving the predictability of business failure of supply chain finance clients by using external big dataset. Ind. Manag. Data Syst. 2015, 115, 1683–1703. [Google Scholar] [CrossRef]

- Atkinson, W. Supply chain finance: The next big opportunity. Supply Chain Manag. Rev. 2008, 12, 57–60. [Google Scholar]

- Grosse-Ruyken, P.T.; Wagner, S.M.; Jönke, R. What is the right cash conversion cycle for your supply chain? Int. J. Serv. Oper. Manag. 2011, 10, 13–29. [Google Scholar] [CrossRef]

- Xu, X.; Chen, X.; Jia, F.; Brown, S.; Gong, Y.; Xu, Y. Supply chain finance: A systematic literature review and bibliometric analysis. Int. J. Prod. Econ. 2018, 204, 160–173. [Google Scholar] [CrossRef]

- Chen, T.; Wang, D. Combined application of blockchain technology in fractional calculus model of supply chain financial system. Chaos Solitons Fractals 2020, 131, 109461. [Google Scholar] [CrossRef]

- Zhou, L.; Chen, M.; Lee, H. Supply Chain Finance: A Research Review and Prospects Based on a Systematic Literature Analysis from a Financial Ecology Perspective. Sustainability 2022, 14, 14452. [Google Scholar] [CrossRef]

- Tang, Y.X. Research on the Influence of Supply Chain Finance on Financing Constraints of SMEs. Master’s Thesis, Shandong University, Jinan, China, 2020. [Google Scholar]

- He, S. Research on the Influence of Supply Chain Finance on SME Financing. Master’s Thesis, Heilongjiang University, Harbin, China, 2020. [Google Scholar]

- Bao, C. On the Mitigating Effect of Supply Chain Finance on SMEs’ Financing. East China Econ. Manag. 2020, 34, 91–98. [Google Scholar] [CrossRef]

- Ling, R.Z.; Pan, A.L.; Li, B. Can Supply Chain Finance Improve the Innovation Level of Enterprises? J. Financ. Econ. 2021, 47, 64–78. [Google Scholar] [CrossRef]

- Fu, W.Q.; Bai, S.Z. Effect of Supply Chain Finance on Easing Financing Constraint of Small and Medium-sized Agricultural Enterprises. J. Northwest AF Univ. (Soc. Sci. Ed.) 2021, 21, 140–151. [Google Scholar] [CrossRef]

- Ren, X.Z. Research on Internet Supply Chain Finance Empowering China’s Commercial Circulation Industry Development Effect. J. Commer. Econ. 2020, 19, 159–162. [Google Scholar]

- Yu, J.; Zhuang, X.T. Research into Incentive Strategy of Third-party B2B Platform Based on Risk Aversion of Banks. Oper. Res. Manag. Sci. 2020, 29, 186–195. [Google Scholar]

- Xu, P.; Wang, Q.; Liu, Y.Q. Does Reciprocal Preference Affect Incentive Contract Based on Online Agricultural Supply Chain. Theory Pract. Financ. Econ. 2022, 43, 9–16. [Google Scholar] [CrossRef]

- Du, M.; Chen, Q.; Xiao, J.; Yang, H.; Ma, X. Supply Chain Finance Innovation Using Blockchain. IEEE Trans. Eng. Manag. 2020, 67, 1045–1058. [Google Scholar] [CrossRef]

- Ning, L.; Yuan, Y. How blockchain impacts the supply chain finance platform business model reconfiguration. Int. J. Logist. Res. Appl. 2021, 1–21. [Google Scholar] [CrossRef]

- Zheng, K.; Zheng, L.J.; Gauthier, J.; Zhou, L.; Xu, Y.; Behl, A.; Zhang, J.Z. Blockchain technology for enterprise credit information sharing in supply chain finance. J. Innov. Knowl. 2022, 7, 100256. [Google Scholar] [CrossRef]

- Meng, X. Risk Assessment and Analysis in Supply Chain Finance Based on Blockchain Technology. J. Sens. 2022, 2022, 1985803. [Google Scholar] [CrossRef]

- Han, J.W.; Han, M.X. Research on Supply Chain Finance Innovation Based on Blockchain Technology. Qilu J. 2022, 67, 131–141. [Google Scholar]

- Chen, C.B.; Sheng, X. Research on the Construction of Credit Risk Prediction System in Supply Chain Finance. J. Fujian Norm. Univ. (Philos. Soc. Sci. Ed.) 2013, 2, 79–86. [Google Scholar]

- Aust, G.; Buscher, U. Vertical cooperative advertising and pricing decisions in a manufacturer–retailer supply chain: A game-theoretic approach. Eur. J. Oper. Res. 2012, 223, 473–482. [Google Scholar] [CrossRef]

- Kuang, H.B.; Du, H.; Feng, H.Y. Construction of the Credit Risk Indicator Prediction System of Small and Medium-sized Enterprises under Supply Chain Finance. Sci. Res. Manag. 2020, 41, 209–219. [Google Scholar] [CrossRef]

- Zheng, Y.; Zhang, K.X. Research on the Risk Management of the Supply Chain Finance—From the Perspective of SME Financing. J. Financ. Dev. Res. 2020, 10, 45–51. [Google Scholar] [CrossRef]

- Zhao, T.T. Credit Risk Rvaluation Index System Based on Sustainable Supply Chain Finance. Logist. Eng. Manag. 2021, 43, 62–64, 70. [Google Scholar]

- Zhu, X.Y.; Zhao, T.T. Establishment of Supply Chain Financial Credit Risk Prediction Index System Based on KMV Model. Logist. Eng. Manag. 2022, 44, 48–51. [Google Scholar]

- Chen, X.Z.; Tao, L.H. Credit Risk Assessment of SME Supply Chain Finance Based on MLP Neural Network. J. Hunan Univ. Sci. Technol. (Nat. Sci. Ed.) 2021, 36, 91–99. [Google Scholar] [CrossRef]

- Xiong, X.; Ma, J.; Zhao, W.J.; Wang, X.Y.; Zhang, J. Credit Risk Analysis of Supply Chain Finance. Nankai Bus. Rev. 2009, 12, 92–98, 106. [Google Scholar]

- Fu, W.Q. Research on Credit Risk Warning and Prevention of Small and Medium-sized Agricultural Enterprises from the Perspective of Supply Chain Finance. Guizhou Soc. Sci. 2020, 4, 158–168. [Google Scholar] [CrossRef]

- Tian, K.; Zhuang, X.T.; Zhao, W.T. Credit Risk Prediction of SMEs Under the Mode of Supply Chain Finance—Analysis Based on Sample Data of Automobile Manufacturing Industry. J. Ind. Technol. Econ. 2021, 40, 15–20. [Google Scholar]

- Mou, W.; Wong, W.-K.; McAleer, M. Financial Credit Risk Prediction Based on Core Enterprise Supply Chains. Sustainability 2018, 10, 3699. [Google Scholar] [CrossRef]

- Zhou, Q.; Xie, X.M.; Zhang, Z. Analysis on Credit Risk Measurement and Control of Small and Micro tech Enterprises in Supply Chain Finance—Based on Immune Theory. Enterp. Econ. 2019, 8, 146–154. [Google Scholar] [CrossRef]

- Liu, Y.; Zhang, L.J.; Han, Y.N.; Pang, L.Y.; Wang, S. Financial Credit Risk Prediction Model of Supply Chain Finance Based on Particle Swarm Cooperative Optimization Algorithm. J. Jilin Univ. (Sci. Ed.) 2018, 56, 119–125. [Google Scholar] [CrossRef]

- Liu, Y.M.; Liu, L.; Ren, G.Q. Financing Risk Prediction of China’s Listed Company Based on GA-SVR Model. J. Beijing Inst. Technol. (Soc. Sci. Ed.) 2019, 21, 73–81. [Google Scholar] [CrossRef]

- Zhang, H.; Shi, Y.; Yang, X.; Zhou, R. A firefly algorithm modified support vector machine for the credit risk assessment of supply chain finance. Res. Int. Bus. Financ. 2021, 58, 101482. [Google Scholar] [CrossRef]

- Qian, W.Y.; Zhang, H.N. Research on Supply Chain Financial Credit Risk Prediction Based on Adaboos-DPSO-SVM Model. J. Ind. Technol. Econ. 2022, 41, 72–79. [Google Scholar]

- Zhu, Y.; Zhou, L.; Xie, C.; Wang, G.-J.; Nguyen, T.V. Forecasting SMEs’ credit risk in supply chain finance with an enhanced hybrid ensemble machine learning approach. Int. J. Prod. Econ. 2019, 211, 22–33. [Google Scholar] [CrossRef]

- Liu, Y.; Huang, L. Supply chain finance credit risk assessment using support vector machine–based ensemble improved with noise elimination. Int. J. Distrib. Sens. Netw. 2020, 16, 1550147720903631. [Google Scholar] [CrossRef]

- Gu, T.X.; Q, M.L.; Ye, C.M. Credit Prediction of Supply Chain Finance Based on BO-XGBoost and Ensemble Learning Method. J. Univ. Shanghai Sci. Technol. 2022, 1–8. [Google Scholar] [CrossRef]

- Liu, J.; Liu, S.; Li, J.; Li, J. Financial credit risk assessment of online supply chain in construction industry with a hybrid model chain. Int. J. Intell. Syst. 2022, 37, 8790–8813. [Google Scholar] [CrossRef]

- Cai, X.; Qian, Y.; Bai, Q.; Liu, W. Exploration on the financing risks of enterprise supply chain using Back Propagation neural network. J. Comput. Appl. Math. 2020, 367, 112457. [Google Scholar] [CrossRef]

- Huang, F.; Gao, G.J. Research on Risk Measurement of P2P Platform in Rural Supply Chain Financial Business—Based on PNN Model. Rural Financ. Res. 2017, 3, 61–65. [Google Scholar] [CrossRef]

- Sang, B. Application of genetic algorithm and BP neural network in supply chain finance under information sharing. J. Comput. Appl. Math. 2021, 384, 113170. [Google Scholar] [CrossRef]

- Zhang, W.; Yan, S.; Li, J.; Tian, X.; Yoshida, T. Credit risk prediction of SMEs in supply chain finance by fusing demographic and behavioral data. Transp. Res. Part E Logist. Transp. Rev. 2022, 158, 102611. [Google Scholar] [CrossRef]

- Gu, T.; Liu, Q. Credit Prediction of Supply Chain Finance for High Dimensional and Unbalanced Data. Appl. Res. Comput. 2022, 1–8. [Google Scholar] [CrossRef]

- Liu, J.; Zhang, S.; Fan, H. A two-stage hybrid credit risk prediction model based on XGBoost and graph-based deep neural network. Expert Syst. Appl. 2022, 195, 116624. [Google Scholar] [CrossRef]

- Yao, G.; Hu, X.; Wang, G. A novel ensemble feature selection method by integrating multiple ranking information combined with an SVM ensemble model for enterprise credit risk prediction in the supply chain. Expert Syst. Appl. 2022, 200, 117002. [Google Scholar] [CrossRef]

- Wu, J.M.; Zhao, R. The Construction of SME Credit Prediction System in Supply Chain Financing Mode—Also on the Application of Three dimensional Credit Prediction Index System. Mod. Manag. Sci. 2017, 6, 12–14. [Google Scholar]

- Xia, L.M.; Zong, H.H.; Meng, L. The Construction of Assessment Index System of SME Credit Risks-Based on the Perspective of Supply Chain Finance. Financ. Forum 2011, 16, 73–79. [Google Scholar] [CrossRef]

- Li, J.; Nie, Y. Analysis of the Factors Inducing Supply Chain Financial Risk and Their Mechanisms—Based on the Rooting Theory. Financ. Account. Mon. 2021, 16, 146–151. [Google Scholar] [CrossRef]

- Zhou, L.; Qiu, X.; Zhu, Y.; Mao, X.F. An Empirical Study on Credit Risk Assessment in Supply Chain Finance Based on Big Data—Taking the Vehicle Manufacturing Industry as an Example. J. Financ. Dev. Res. 2022, 5, 64–70. [Google Scholar] [CrossRef]

- Chen, X.X.; He, S. Research on Financial Risk Measurement of Supply Chain of Commercial Banks—Based on the Perspective of Financial Technology. J. Southwest Minzu Univ. (Humanit. Soc. Sci.) 2022, 43, 123–128. [Google Scholar]

- Yi, J.H.; Guo, F. Selection and Application of Enterprise Credit Risk Prediction Index System from the Perspective of Supply Chain Finance. J. Univ. Jinan(Soc. Sci. Ed.) 2021, 31, 103–112, 159–160. [Google Scholar]

- Hu, H.Q.; Zhang, L.; Zhang, D.H.; Chen, L. Research on Finance Credit Risk Assessment of Supply Chain Based on SVM. Soft Sci. 2011, 25, 26–30, 36. [Google Scholar]

| First Level Indexes | Second Level Indexes | Third Level Indicators | Equation |

|---|---|---|---|

| Internal factors of financing enterprise | Basic conditions of financing enterprise | Enterprise scale | X1, Main business income of the enterprise |

| Operating years | X2, Operating time of the enterprise from the beginning of registration | ||

| Background of shareholders | X3, Ownership structure and equity stability of the enterprise | ||

| Stability of management | x4, Stability of enterprise management | ||

| Credit rating | X5, Credit rating of an enterprise in a bank | ||

| Credit history | X6, Default status of enterprises | ||

| Financial indicators of financing enterprise | Current ratio | X7, Current assets/current liabilities | |

| Asset liability ratio | X8, Total liabilities/total assets | ||

| Net interest rate of assets | X9, Net profit/average total assets | ||

| Operating profit margin | X10, Operating profit/total business income | ||

| Growth rate of total assets | X11, Operating income/total assets | ||

| Growth rate of operating revenue | X12, Growth of operating revenue/total operating revenue of last year | ||

| Influencing factors of core enterprises | Basic conditions of core enterprises | Operating years | X13, Operating time of the enterprise from registration |

| Credit rating | X14, Credit rating of enterprises in banks | ||

| Credit history | X15, Default status of enterprises | ||

| Related risks | X16, External guarantee of enterprises | ||

| Financial indicators of core enterprises | Current ratio | X17, Current assets/current liabilities | |

| Cash ratio | X18, Cash/current liabilities | ||

| Asset liability ratio | X19, Total liabilities/total assets | ||

| Net interest rate of assets | X20, Net profit/average total assets | ||

| Status of supply chain | Supply chain relationship | Collaborative processing capability | X21, Cooperation degree of the supply chain of financing enterprises |

| Informatization level | X22, Information acquisition ability of the supply chain of financing enterprises | ||

| Characteristics of pledge | Characteristics of accounts receivable | Accounts receivable turnover | X23, Main business income/average balance of accounts receivable |

| Bad debt provision | X24, Bad debt provision/accounts receivable of financing enterprises at the end of the period | ||

| Quality of accounts receivable | X25, Recovery ability and stability of accounts receivable |

| Training Sample | Test Sample | Total | |

|---|---|---|---|

| Actual performance (The value is 0) | 39 | 15 | 54 |

| Actual default (The value is 1) | 39 | 11 | 50 |

| Total | 78 | 26 | 104 |

| KMO Sampling Suitability Quantity | 0.764 | |

|---|---|---|

| Bartlett sphericity test | Approximate chi square | 1084.621 |

| Free degree | 300 | |

| Significance | 0.000 |

| Component | Initial Characteristic Value | Extract The Sum of Squares of The Load | Sum of Squares of Rotating Loads | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Total | Percent Variance | Cumulative % | Total | Percent Variance | Cumulative % | Total | Percent Variance | Cumulative % | |

| 1 | 3.691 | 14.763 | 14.763 | 3.691 | 14.763 | 14.763 | 2.502 | 10.009 | 10.009 |

| 2 | 2.775 | 11.099 | 25.863 | 2.775 | 11.099 | 25.863 | 2.486 | 9.943 | 19.952 |

| 3 | 2.374 | 9.496 | 35.359 | 2.374 | 9.496 | 35.359 | 2.166 | 8.664 | 28.616 |

| 4 | 2.100 | 8.399 | 43.759 | 2.100 | 8.399 | 43.759 | 2.130 | 8.519 | 37.135 |

| 5 | 1.701 | 6.805 | 50.563 | 1.701 | 6.805 | 50.563 | 2.108 | 8.432 | 45.567 |

| 6 | 1.618 | 6.471 | 57.034 | 1.618 | 6.471 | 57.034 | 2.038 | 8.153 | 53.720 |

| 7 | 1.404 | 5.615 | 62.649 | 1.404 | 5.615 | 62.649 | 1.619 | 6.477 | 60.196 |

| 8 | 1.107 | 4.428 | 67.077 | 1.107 | 4.428 | 67.077 | 1.421 | 5.682 | 65.879 |

| 9 | 1.037 | 4.148 | 71.225 | 1.037 | 4.148 | 71.225 | 1.337 | 5.346 | 71.225 |

| 10 | 0.970 | 3.878 | 75.103 | ||||||

| 11 | 0.859 | 3.437 | 78.540 | ||||||

| 12 | 0.784 | 3.135 | 81.675 | ||||||

| 13 | 0.730 | 2.920 | 84.595 | ||||||

| 14 | 0.634 | 2.536 | 87.130 | ||||||

| 15 | 0.625 | 2.500 | 89.631 | ||||||

| 16 | 0.467 | 1.869 | 91.500 | ||||||

| 17 | 0.449 | 1.794 | 93.294 | ||||||

| 18 | 0.370 | 1.482 | 94.776 | ||||||

| 19 | 0.317 | 1.269 | 96.046 | ||||||

| 20 | 0.260 | 1.038 | 97.084 | ||||||

| 21 | 0.239 | 0.955 | 98.039 | ||||||

| 22 | 0.205 | 0.819 | 98.858 | ||||||

| 23 | 0.134 | 0.536 | 99.393 | ||||||

| 24 | 0.096 | 0.385 | 99.778 | ||||||

| 25 | 0.055 | 0.222 | 100.000 | ||||||

| Index | Component | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | |

| X1 | −0.126 | 0.117 | 0.118 | 0.193 | −0.161 | 0.207 | 0.306 | 0.730 | 0.176 |

| X2 | −0.047 | 0.103 | 0.079 | −0.066 | −0.015 | 0.043 | −0.074 | 0.832 | 0.112 |

| X3 | 0.023 | 0.243 | −0.017 | 0.272 | 0.062 | −0.040 | 0.164 | 0.594 | −0.318 |

| X4 | −0.203 | 0.474 | −0.047 | 0.010 | 0.004 | −0.048 | −0.034 | 0.159 | −0.091 |

| X5 | 0.237 | −0.604 | 0.019 | −0.046 | −0.093 | 0.179 | 0.103 | −0.074 | 0.132 |

| X6 | −0.012 | 0.582 | −0.397 | −0.068 | 0.065 | −0.025 | −0.136 | 0.099 | 0.089 |

| X7 | 0.022 | 0.051 | 0.020 | −0.868 | −0.028 | −0.065 | −0.131 | 0.024 | 0.094 |

| X8 | −0.109 | −0.128 | 0.041 | 0.858 | 0.040 | 0.068 | 0.074 | 0.064 | 0.090 |

| X9 | 0.027 | 0.680 | 0.365 | −0.410 | −0.151 | 0.200 | 0.074 | −0.027 | 0.071 |

| X10 | 0.042 | 0.826 | 0.109 | −0.095 | −0.134 | 0.168 | −0.024 | −0.033 | 0.103 |

| X11 | 0.035 | 0.151 | 0.756 | 0.122 | −0.121 | 0.164 | −0.124 | 0.053 | −0.028 |

| X12 | −0.065 | −0.220 | 0.820 | −0.130 | 0.060 | 0.059 | 0.088 | 0.050 | −0.040 |

| X13 | 0.196 | −0.057 | −0.184 | −0.079 | 0.113 | 0.138 | 0.832 | 0.087 | 0.062 |

| X14 | 0.059 | 0.080 | −0.174 | 0.053 | 0.842 | −0.073 | 0.008 | −0.121 | 0.028 |

| X15 | 0.119 | −0.098 | 0.112 | 0.187 | 0.092 | 0.020 | 0.713 | 0.005 | −0.123 |

| X16 | −0.099 | 0.098 | −0.075 | −0.044 | −0.790 | −0.051 | 0.013 | −0.149 | −0.044 |

| X17 | −0.189 | −0.027 | 0.016 | −0.005 | 0.706 | 0.025 | 0.490 | −0.048 | 0.058 |

| X18 | 0.431 | −0.155 | −0.270 | 0.043 | 0.098 | −0.085 | 0.662 | 0.015 | 0.191 |

| X19 | 0.842 | −0.097 | −0.027 | −0.024 | 0.108 | 0.012 | 0.289 | −0.033 | 0.043 |

| X20 | 0.853 | −0.136 | 0.059 | −0.019 | −0.164 | 0.018 | 0.172 | 0.097 | 0.228 |

| X21 | −0.187 | −0.025 | 0.151 | −0.012 | −0.131 | 0.782 | −0.040 | 0.179 | 0.101 |

| X22 | 0.258 | −0.186 | −0.358 | 0.278 | 0.253 | 0.317 | −0.282 | −0.072 | 0.116 |

| X23 | −0.108 | 0.164 | 0.321 | 0.298 | 0.042 | −0.155 | −0.157 | −0.332 | 0.834 |

| X24 | 0.075 | 0.007 | 0.039 | 0.075 | 0.082 | 0.918 | 0.018 | −0.073 | −0.036 |

| X25 | −0.083 | 0.309 | 0.424 | 0.296 | 0.109 | 0.485 | 0.054 | −0.317 | 0.096 |

| Accuracy Rate | Type I Error | Type II Error | |||

|---|---|---|---|---|---|

| Training Set | TEST SET | Training Set | Test Set | Training Set | Test Set |

| 98.72% | 96.15% | 2.38% | 3.84% | 2.78% | 0 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, M.; Fu, Y. Prediction of Supply Chain Financial Credit Risk Based on PCA-GA-SVM Model. Sustainability 2022, 14, 16376. https://doi.org/10.3390/su142416376

Li M, Fu Y. Prediction of Supply Chain Financial Credit Risk Based on PCA-GA-SVM Model. Sustainability. 2022; 14(24):16376. https://doi.org/10.3390/su142416376

Chicago/Turabian StyleLi, Meiyan, and Yingjun Fu. 2022. "Prediction of Supply Chain Financial Credit Risk Based on PCA-GA-SVM Model" Sustainability 14, no. 24: 16376. https://doi.org/10.3390/su142416376

APA StyleLi, M., & Fu, Y. (2022). Prediction of Supply Chain Financial Credit Risk Based on PCA-GA-SVM Model. Sustainability, 14(24), 16376. https://doi.org/10.3390/su142416376