Exploring Innovation Ecosystem of Incumbents in the Face of Technological Discontinuities: Automobile Firms

Abstract

:1. Introduction

2. Theoretical Background

2.1. Innovation Ecosystem

2.2. Technological Discontinuities and Incumbents

2.3. Dynamic Capability View

3. Conceptual Framework

3.1. Conceptualizing the Innovation Ecosystem

3.1.1. Collaboration and Networking

3.1.2. Opportunity Sensing

3.1.3. Entrepreneurial Orientation

3.1.4. Knowledge Management

3.1.5. Strategic Flexibility

3.2. Research Framework

4. Research Method

5. Case Analysis

5.1. Case Description

5.2. Research Results

5.2.1. Evidence from the Case—Ecosystem Actors

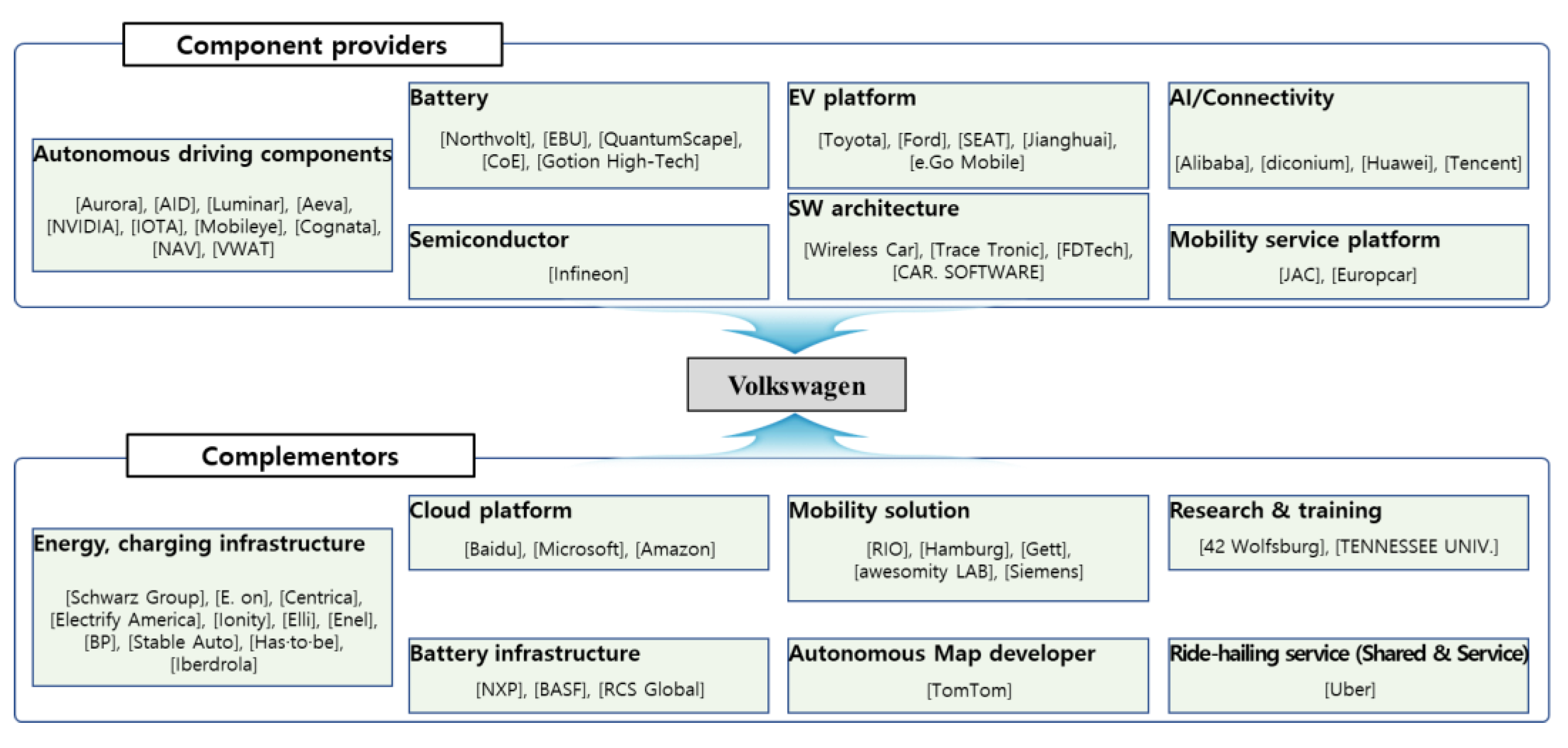

Case of VW

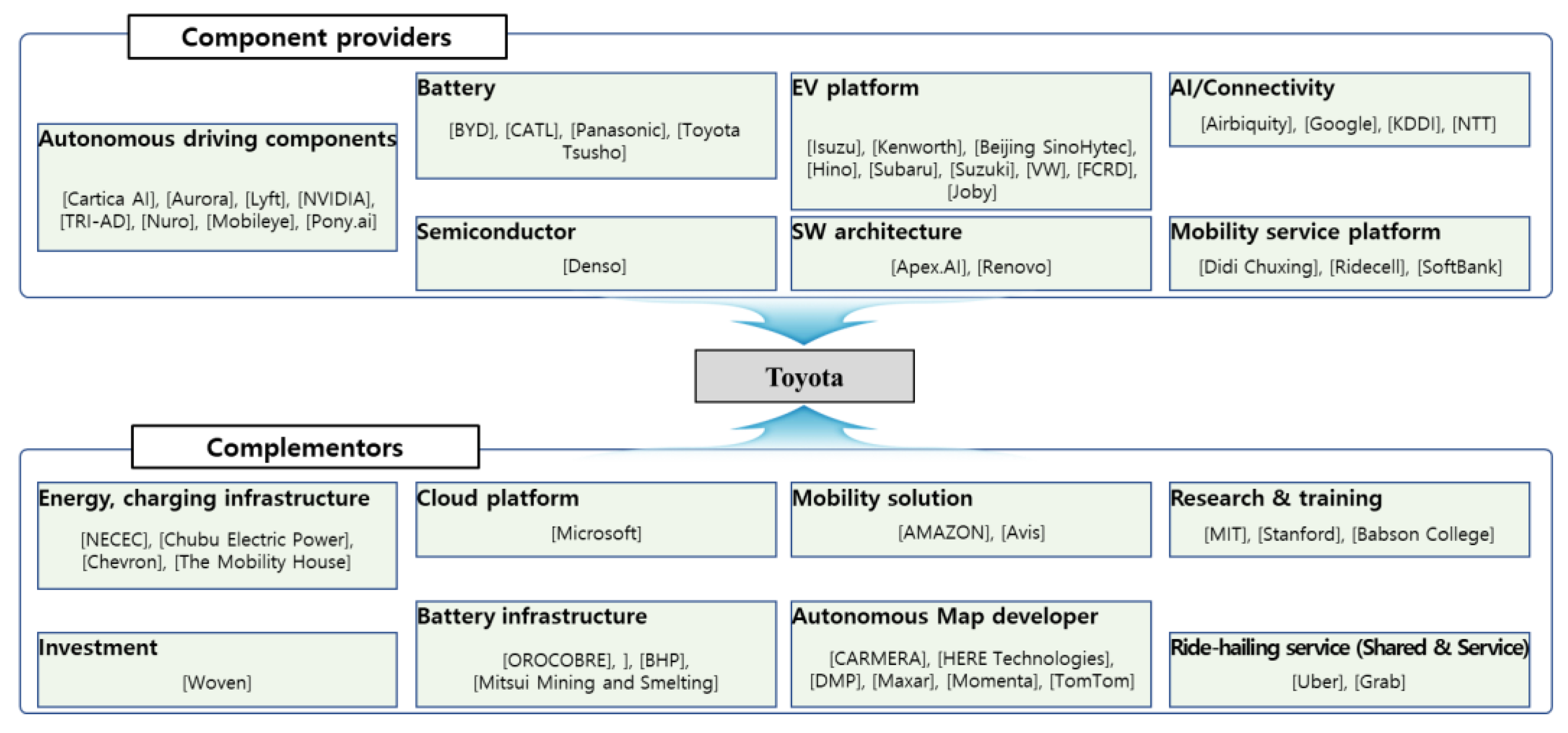

Case of Toyota

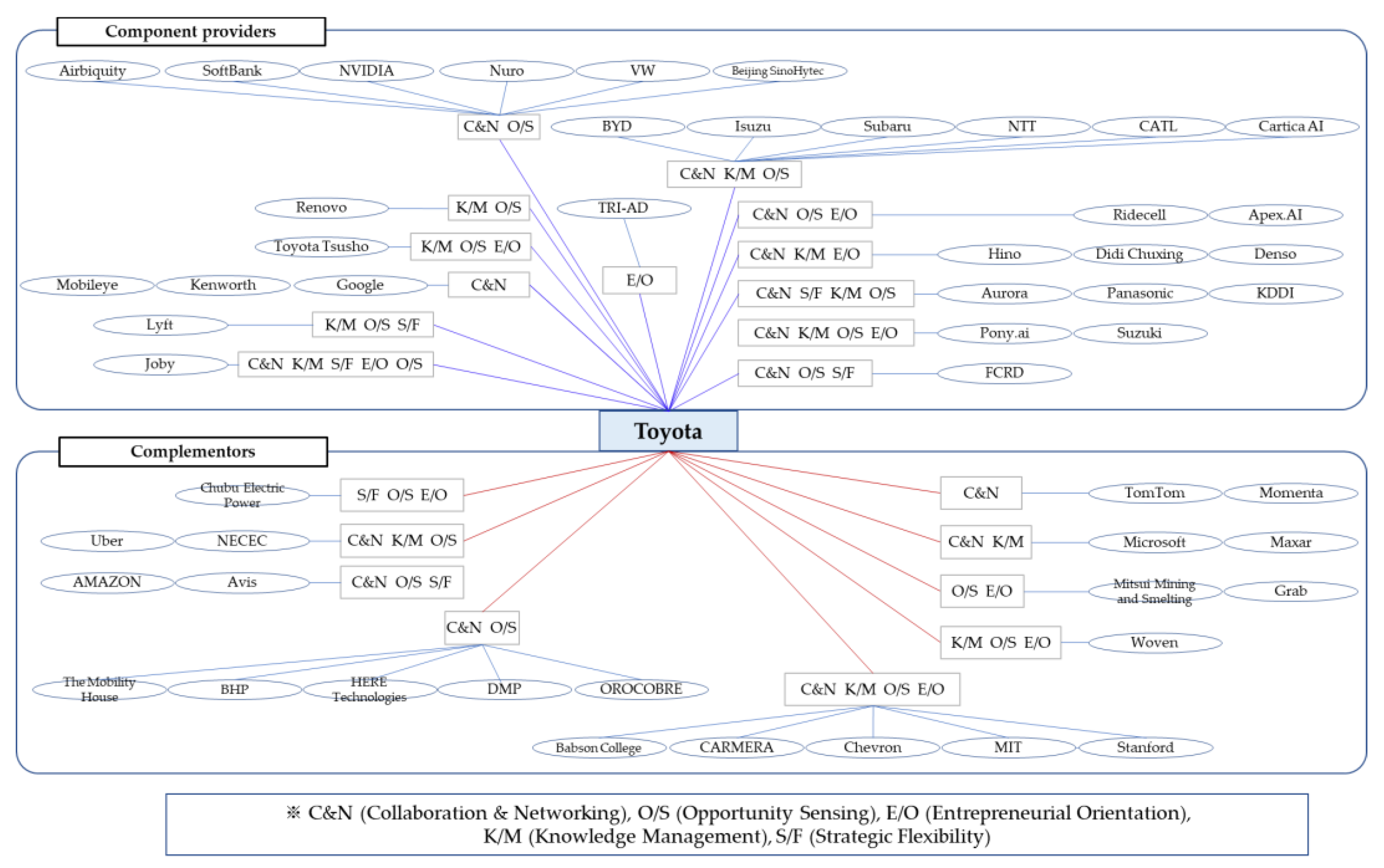

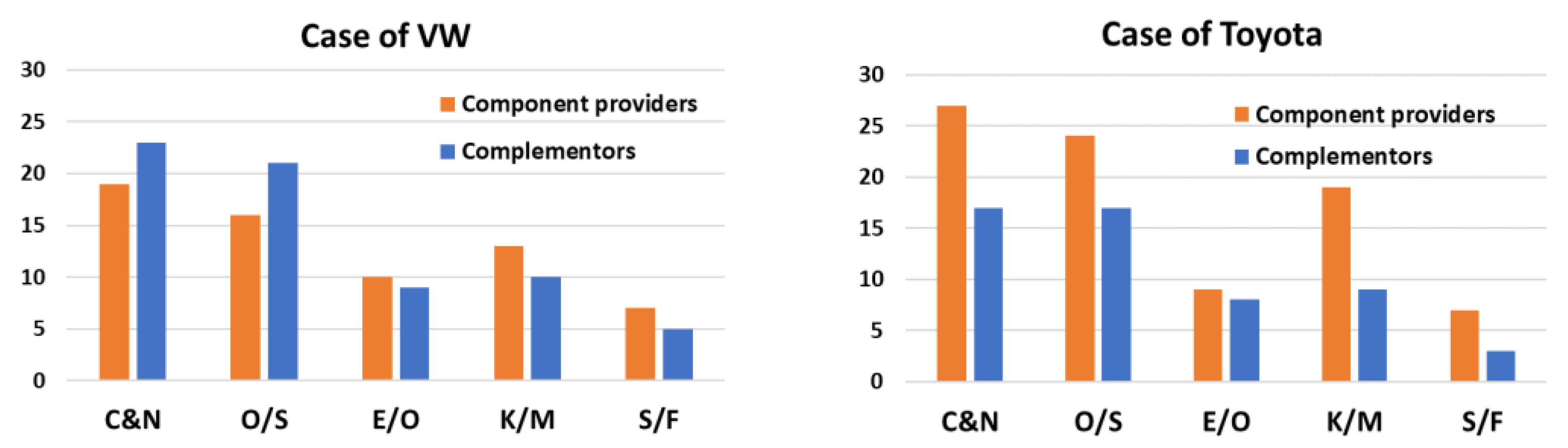

5.2.2. Evidence from the Case—Activities

Case of VW

Case of Toyoda

5.2.3. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Date | Actors | Title of Articles | Source |

| 160524 | VW, Gett | Volkswagen Group announces a strategic partnership with on-demand mobility provider Gett | Volkswagen (2016) |

| 160911 | VW, Tencent | VW’s Audi steps up collaboration with Chinese tech groups | Reuters (2016) |

| 171103 | VW, Ionity | Launch of Pan-European High-Power Charging Network IONITY | Porsche (2017) |

| 180104 | VW, Aurora | Volkswagen Group and leading self-driving technology company, Aurora Innovation, announce strategic partnership | Volkswagen (2018) |

| 180107 | VW, NVIDIA | Volkswagen and NVIDIA to Infuse AI into Future Vehicle Lineup | Nvidia (2018) |

| 180626 | VW, Cognata | Audi partners with Israel’s autonomous vehicle simulation startup Cognata | Reuters (2018) |

| 180627 | VW, awesomity LAB | Milestone in Africa: Volkswagen launches local assembly and Car sharing in Rwanda | Volkswagen (2018) |

| 180702 | VW, Continental (NAV) | Continental, NVIDIA, Volkswagen Join Hands, Forms Networking for Autonomous Vehicles (NAV) Alliance | News18 (2018) |

| 180710 | VW, Huawei | Audi and Huawei sign memorandum of understanding for strategic cooperation | Finchannel (2018) |

| 180904 | VW, FDTech | VW Acquires Stake in Autonomous Driving Specialist FDTech | Tu-auto (2018) |

| 181101 | VW, Mobileye | VW and Mobileye are partnering on autonomous taxis | Businessinsider (2018) |

| 181102 | VW, Baidu | VW taps Baidu’s Apollo platform to develop self-driving cars in China | Reuters (2018) |

| 181123 | VW, diconium | Volkswagen invests in digital specialist diconium | Volkswagen (2018) |

| 181218 | VW, Luminar | VW’s Robo-Cars Get a Boost from Luminar’s Lidar | Wired (2018) |

| 181219 | VW, Wireless Car | Volkswagen to take over telematics specialist WirelessCar from Volvo | Volkswagen (2018) |

| 181227 | VW, AID | Audi’s AID subsidiary leads self-driving car development at | Motorauthority (2018) |

| 190227 | VW, Microsoft | Volkswagen to work with Microsoft on cloud-based Automated Driving Platform | Europe. autonews (2019) |

| 190305 | VW, e.Go Mobile | VW signs EV startup as the first partner for MEB electric platform | Autonews (2019) |

| 190312 | VW, TomTom | TomTom expands HD Map portfolio and completes deals with VW and FCA | Traffictechnologytoday (2019) |

| 190321 | VW, European Battery Union | Volkswagen forms European Battery Union with Northvolt | Volkswagen (2019) |

| 190327 | VW, Amazon | Volkswagen and Amazon Web Services to develop Industrial Cloud | Volkswagen (2019) |

| 190514 | VW, Infineon | Volkswagen partners with Infineon for electric vehicle | Roboticsandautomationnews (2019) |

| 190527 | VW, SEAT | Volkswagen strengthens activities in China with the market entry of SEAT and Smart City Project | Volkswagen (2019) |

| 190606 | VW, Elli | Volkswagen plans 36,000 charging points for electric cars throughout Europe | Volkswagen (2019) |

| 190611 | VW, Alibaba | Alibaba A. I. Labs Partners with Audi, Renault and Honda for Intelligent In-car Experience | Businesswire (2019) |

| 190619 | VW, Schwarz Group | Volkswagen and Schwarz Group to be strategic e-partners | Volkswagen (2019) |

| 190712 | VW, Ford | Ford-VW alliance expands to include autonomous and electric vehicles | Theverge (2019) |

| 190731 | VW, has·to·be cooperate | Volkswagen and software expert has·to·be cooperate for expansion of charging infrastructure | Volkswagen (2019) |

| 190801 | VW, Stable Auto | VW wants to test robotic EV chargers for self-driving cars | Theverge (2019) |

| 190923 | VW, CoE | Volkswagen Group starts battery cell development and production in Salzgitter | Volkswagen (2019) |

| 191002 | VW, RIO | RIO digitizes Volkswagen Group Logistics | Volkswagen (2019) |

| 191028 | VWAT | Volkswagen plans to make autonomous driving market-ready | Volkswagen (2019) |

| 191029 | VW, Siemens | First for Africa: Volkswagen and Siemens launch joint electric mobility pilot project in Rwanda | Volkswagen (2019) |

| 191121 | VW, Car.Software | Volkswagen strengthens new software organization | Volkswagen (2019) |

| 191207 | VW, IOTA | IOTA and VW to Build Autonomous System Cars | Medium (2019) |

| 191212 | VW, Aeva | Aeva snags VW investment with smaller, longer-range lidar | Techcrunch (2019) |

| 191216 | VW, Hamburg | Volkswagen’s Weshare launches new e-car sharing service in Hamburg | Erticonetwork (2019) |

| 200117 | VW, Tennessee Univ. | Volkswagen and University of Tennessee announce innovation hub collaboration | Volkswagen (2020) |

| 200304 | VW, Centrica | Centrica and Volkswagen announce EV enablement partnership | Centrica (2020) |

| 200403 | VW, E. on | E.ON and Volkswagen to make fast charging possible | Eon (2020) |

| 200528 | VW, Jianghuai | VW in final talks to seal big EV deals in China, report says | Europe. autonews (2020) |

| 200529 | VW, JAC | VW to take over the majority stake in JAC joint venture | Electrive (2020) |

| 200529 | VW, Guoxuan | Volkswagen intensifies e-mobility activities in China | Volkswagen (2020) |

| 200610 | VW, FORD | Ford and Volkswagen sign agreements for joint projects on commercial veheicle, EVs, autonomous driving | Ford (2020) |

| 200616 | VW, QuantumScape | Volkswagen increases stake in QuantumScape | Volkswagen (2020) |

| 200625 | VW, Siemens | Siemens provides its expertise to Volkswagen to develop digitized electric car production | Roboticsandautomationnews (2020) |

| 200910 | VW, RCS Global | VW partners with RCS on battery supply | Miningmagazine (2020) |

| 200921 | VW, Electrify America | Electrify America and Volkswagen of America Announce Agreement Providing Unlimited Charging Plan for Owners of the All-New 2021 VW ID.4 Electric SUV | Automotiveworld (2020) |

| 201002 | VW, Uber | Volkswagen partners with Uber to provide sustainable public transportation | Yahoo (2020) |

| 201020 | VW, NXP | Volkswagen Adopts NXP Battery Management Solutions for its MEB Electrical Vehicle Platform | Nxp (2020) |

| 201028 | VW, Toyota | VW’s Traton, Toyota’s Hino Agree Electric Truck Venture | Barrons (2020) |

| 210315 | VW, BP | Volkswagen Group and bp to join forces to expand ultra-fast electric vehicle charging across Europe | Bp (2021) |

| 210316 | VW, Northvolt | VW strengthens ties with Northvolt to expand battery capacity in Europe | Automotivelogistics (2021) |

| 210316 | VW, Enel | Iberdrola, Enel and bp form E-mobility power alliance with Volkswagen | Smart-energy (2021) |

| 210317 | VW, Iberdrola | Volkswagen, Iberdrola, Enel, BP to install EV recharging stations and battery plants in Europe | Pv-magazine (2021) |

| 210510 | VW, 42 Wolfsburg | Volkswagen: A boost for the digital age—Programming school “42 Wolfsburg” starts operations | Volkswagen (2021) |

| 210608 | VW, BASF | Volkswagen Group, BASF, Daimler AG and Fairphone start a partnership for sustainable Lithium mining in Chile | Volkswagen (2021) |

| 210729 | VW, Europcar | Volkswagen makes $3.4 billion Europcar bet on mobility services | Reuters (2021) |

| 210730 | VW, Trace Tronic | Volkswagen and TraceTronic establish neocx—a joint venture for automated software integration | Volkswagen (2021) |

| 160406 | Toyota, Microsoft | Toyota expands Microsoft partnership in connected vehicle services | Reuters (2016) |

| 160602 | Toyota, KDDI | Agreement on New Business and Capital Alliance between Toyota Motor Corporation and KDDI Corporation | Toyota (2016) |

| 170328 | Toyota, NTT | Toyota and NTT to collaborate on connected car tech, including AI | Techcrunch (2017) |

| 180313 | Toyota, Avis | Toyota Connected North America Partners with Avis Budget Group to Enhance Customer Rental Experience | Toyota (2018) |

| 180828 | Toyota, Uber | Toyota and Uber Extend Collaboration to Automated Vehicle Technologies | Toyota (2018) |

| 181004 | Toyota, SoftBank | Toyota and SoftBank partner to develop self-driving car services | Venturebeat (2018) |

| 181218 | Toyota, Grab | Toyota develops “Total-care Service” Designed for Ride-hailing Companies | Toyota (2018) |

| 190228 | Toyota, CARMERA | TRI-AD and CARMERA team up to build high definition maps for automated vehicles using camera data | Toyota (2019) |

| 190311 | Toyota, Airbiquity | Toyota invests in $15M round for Airbiquity, a 22-year-old connected car startup in Seattle | Qeekwire (2019) |

| 190318 | Toyota, NVIDIA | NVIDIA and Toyota Research Institute-Advanced Development Partner to Create Safer Autonomous Transportation | Nvidianews (2019) |

| 190320 | Toyota, Suzuki | Toyota and Suzuki charge up a partnership for electric cars | Reuters (2019) |

| 190423 | Toyota, Kenworth | The Kenworth T680 with Integrated Toyota Hydrogen Fuel Cell Technology Starts at Port of Los Angeles | Bulktransporter (2019) |

| 190510 | Toyota, Babson College | Babson College and the Toyota Mobility Foundation Team Up to Accelerate the Future of Mobility-Partnership will leverage Toyota Mobility Foundation’s know-how and Babson’s entrepreneurial management expertise to develop mobility models aimed at solving real-world problems | Toyota (2019) |

| 190624 | Toyota, OROCOBRE | Toyota Tsusho to wait on EV market before Upping Lithium investment | Reuters (2019) |

| 190710 | Toyota, Denso | Toyota, Denso Form Venture To Create Advanced Chips For Self-Driving And Connected Cars | Forbes (2019) |

| 190717 | Toyota, CATL | CATL and Toyota Form Comprehensive Partnership for New Energy Vehicle Batteries | Toyota (2019) |

| 190725 | Toyota, Didi Chuxing | Toyota Expands Collaboration in Mobility as a Service (MaaS) with Didi Chuxing, a Leading Ride-hailing Platform | Toyota (2019) |

| 190903 | Toyota, Cartica AI | Israel’s Cortica teams with Toyota, BMW in autonomous AI car tech. | Reuters (2019) |

| 190927 | Toyota, Subaru | Toyota and Subaru Agree on New Business and Capital Alliance | Toyota (2020) |

| 200115 | Toyota, Joby | Toyota and Joby Aviation are Flying to New Heights Together | Toyota (2020) |

| 200204 | Toyota, PANASONIC | Toyota and Panasonic decide to establish a joint venture specialising in automotive prismatic batteries | Counterpointresearch (2020) |

| 200226 | Toyota, Pony.ai | Toyota leads fundraising for Chinese self-driving startup Pony.ai | Asia.nikkei (2020) |

| 200310 | TRI-AD | TRI-AD enables the successful creation of HD maps for automated driving on surface roads | Toyota (2020) |

| 200310 | Toyota, HERE Technologies | TRI-AD Enables Successful Creation of HD Maps for Automated | Toyota (2020) |

| 200310 | Toyota, TomTom | TomTom Partners with Toyota Research And DENSO to Demonstrate High-Speed HD Map-Building | Autofutures.tv (2021) |

| 200312 | Toyota, Maxar | Toyota hones in on maps for AVs | Autonews (2020) |

| 200317 | Toyota, DMP | TRI-AD and DMP kick off HD Map update PoC from April 2020 | Toyota (2020) |

| 200318 | Toyota, Momenta | Toyota partners with China’s Momenta on high definition maps for autonomous cars | Reuters (2020) |

| 200402 | Toyota, BYD | BYD, Toyota Launch BYD Toyota EV technology Joint Venture to Conduct Battery Electric Vehicle R&D | Toyota (2020) |

| 200403 | Toyota, Chubu Electric Power | Toyota Green Energy Established to Conduct Renewable Energy Power Generation Business | Toyota (2020) |

| 200605 | Toyota, Beijing SinoHytec | Six Companies Establish R&D Joint Venture for Commercial Vehicle Fuel Cell Systems for the Creation of a Hydrogen-based Society in China | Toyota (2020) |

| 200609 | Toyota, FCRD | Toyota partners with 5 Chinese firms on fuel cells | Motorauthority (2020) |

| 200619 | Toyota, MIT, Stanford | MIT and Toyota partner to advance autonomous driving research | Toyota (2020) |

| 200817 | Toyota, AMAZON | Toyota and Amazon Web Services Collaborate on Toyota’s Mobility Services Platform | Toyota (2020) |

| 200910 | Toyota, Woven Capital | Toyota Research Institute—Advanced Development to Form Woven Capital, an $800 Million Global Investment Fund | Toyota (2020) |

| 201006 | Toyota, Hino | Toyota and Hino to Jointly Develop Class 8 Fuel Cell Electric Truck for North America | Toyota (2020) |

| 201028 | Toyota, VW | VW’s Traton and Toyota’s Hino to develop electric trucks together | Autonews (2020) |

| 201210 | Toyota, Mitsui Mining and Smelting | Toyota’s game-changing solid-state battery en route for 2021 debut | Asia.nikkei (2020) |

| 210210 | Toyota, Aurora | Toyota Enters into a Strategic Partnership with Silicon Valley Startup Aurora on Autonomous Driving Technology | Futurecar (2020) |

| 210324 | Toyota, Isuzu | Toyota and Isuzu to take a stake in each other to co-develop new vehicles | Toyota (2021) |

| 210414 | Toyota, Apex.AI | Toyota partners with Apex.AI to develop an autonomous platform | Electrek (2021) |

| 210421 | Toyota, Chevron | Chevron, Toyota Pursue Strategic Alliance on Hydrogen | Chevron (2021) |

| 210427 | Toyota, LyfT | Lyft sells autonomous car division to Toyota subsidiary Woven Planet in $550 m deal | Zdnet (2021) |

| 210518 | Toyota, Mobileye | ZF and Mobileye Safety Technology Chosen by Toyota | Autofutures.tv (2021) |

| 210518 | Toyota, The Mobility House | Toyota and The Mobility House extend long-standing partnership | Mobilityhouse (2021) |

| 210525 | Toyota, Nuro | Woven Capital Makes Its First Investment, Backing Nuro | Toyota (2021) |

| 210527 | Toyota, NECEC | Toyota Joins NECEC’s Strategic Partner Network | Necec (2021) |

| 210617 | Toyota, Ridecell | Woven Capital Invests in Ridecell to Accelerate Global Growth in IoT-driven Automation for Mobility and Fleet Businesses | Toyota (2021) |

| 210722 | Toyota, | Toyota launches Google-powered voice assistant and interactive car manual named Joya | Voicebot.ai (2021) |

| 210928 | Toyota, Renovo | Toyota buys software firm Renovo to accelerate self-driving tech development | Reuters (2021) |

| 211004 | Toyota, BHP | BHP to supply nickel to Toyota-Panasonic battery venture | Reuters (2021) |

| 211018 | Toyota Tsusho | Toyota Charges into Electrified Future in the U.S. with 10-year, $3.4 billion Investment | Toyota (2021) |

References

- Jiang, S.; Hu, Y.; Wang, Z. Core firm based view on the mechanism of constructing an enterprise innovation ecosystem: A case study of Haier group. Sustainability 2019, 11, 3108. [Google Scholar] [CrossRef] [Green Version]

- Adner, R. Match your innovation strategy to your innovation ecosystem. Harv. Bus. Rev. 2006, 84, 98. [Google Scholar] [PubMed]

- Granstrand, O.; Holgersson, M. Innovation ecosystems: A conceptual review and a new definition. Technovation 2020, 90, 102098. [Google Scholar] [CrossRef]

- Tsujimoto, M.; Kajikawa, Y.; Tomita, J.; Matsumoto, Y. A review of the ecosystem concept—Towards coherent ecosystem design. Technol. Forecast. Soc. Change 2018, 136, 49–58. [Google Scholar] [CrossRef]

- Schroth, F.; Häußermann, J.J. Collaboration strategies in innovation ecosystems: An empirical study of the German microelectronics and photonics industries. Technol. Innov. Manag. Rev. 2018, 8, 4–12. [Google Scholar] [CrossRef]

- Cantner, U.; Cunningham, J.A.; Lehmann, E.E.; Menter, M. Entrepreneurial ecosystems: A dynamic lifecycle model. Small Bus. Econ. 2021, 57, 407–423. [Google Scholar] [CrossRef] [Green Version]

- Ozalp, H.; Cennamo, C.; Gawer, A. Disruption in platform-based ecosystems. J. Manag. Stud. 2018, 55, 1203–1241. [Google Scholar] [CrossRef]

- Adner, R.; Kapoor, R. Innovation ecosystems and the pace of substitution: Re-examining technology S-curves. Strateg. Manag. J. 2016, 37, 625–648. [Google Scholar] [CrossRef] [Green Version]

- Lütjen, H.; Schultz, C.; Tietze, F.; Urmetzer, F. Managing ecosystems for service innovation: A dynamic capability view. J. Bus. Res. 2019, 104, 506–519. [Google Scholar] [CrossRef]

- Adner, R. Ecosystem as structure: An actionable construct for strategy. J. Manag. 2017, 43, 39–58. [Google Scholar] [CrossRef]

- Walrave, B.; Talmar, M.; Podoynitsyna, K.S.; Romme, A.G.L.; Verbong, G.P. A multi-level perspective on innovation ecosystems for path-breaking innovation. Technol. Forecast. Soc. Change 2018, 136, 103–113. [Google Scholar] [CrossRef] [Green Version]

- Koch-Ørvad, N.; Thuesen, C.; Koch, C.; Berker, T. Transforming ecosystems: Facilitating sustainable innovations through the lineage of exploratory projects. Proj. Manag. J. 2019, 50, 602–616. [Google Scholar] [CrossRef]

- Bessant, J.; Von Stamm, B.; Moeslein, K.M.; Neyer, A.K. Backing outsiders: Selection strategies for discontinuous innovation. RD Manag. 2010, 40, 345–356. [Google Scholar] [CrossRef]

- Dattée, B.; Alexy, O.; Autio, E. Maneuvering in poor visibility: How firms play the ecosystem game when uncertainty is high. Acad. Manag. J. 2018, 61, 466–498. [Google Scholar] [CrossRef] [Green Version]

- de Vasconcelos Gomes, L.A.; Facin, A.L.F.; Salerno, M.S.; Ikenami, R.K. Unpacking the innovation ecosystem construct: Evolution, gaps and trends. Technol. Forecast. Soc. Change 2018, 136, 30–48. [Google Scholar] [CrossRef]

- Adner, R.; Kapoor, R. Value creation in innovation ecosystems: How the structure of technological interdependence affects firm performance in new technology generations. Strateg. Manag. J. 2010, 31, 306–333. [Google Scholar] [CrossRef]

- Priem, R.L.; Butler, J.E.; Li, S. Toward reimagining strategy research: Retrospection and prospection on the 2011 AMR decade award article. Acad. Manag. Rev. 2013, 38, 471–489. [Google Scholar] [CrossRef]

- Ritala, P.; Agouridas, V.; Assimakopoulos, D.; Gies, O. Value creation and capture mechanisms in innovation ecosystems: A comparative case study. Int. J. Technol. Manag. 2013, 63, 244–267. [Google Scholar] [CrossRef]

- Su, Y.-S.; Zheng, Z.-X.; Chen, J. A multi-platform collaboration innovation ecosystem: The case of China. Manag. Decis. 2018, 56, 125–142. [Google Scholar] [CrossRef]

- Moore, J.F. Predators and prey: A new ecology of competition. Harv. Bus. Rev. 1993, 71, 75–86. [Google Scholar]

- Oh, D.-S.; Phillips, F.; Park, S.; Lee, E. Innovation ecosystems: A critical examination. Technovation 2016, 54, 1–6. [Google Scholar] [CrossRef]

- Yin, D.; Ming, X.; Zhang, X. Sustainable and smart product innovation ecosystem: An integrative status review and future perspectives. J. Clean. Prod. 2020, 274, 123005. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Martin, J.A. Dynamic capabilities: What are they? Strateg. Manag. J. 2000, 21, 1105–1121. [Google Scholar] [CrossRef]

- Helfat, C.E.; Finkelstein, S.; Mitchell, W.; Peteraf, M.; Singh, H.; Teece, D.; Winter, S.G. Dynamic Capabilities: Understanding Strategic Change in Organizations; John Wiley & Sons: Hoboken, NJ, USA, 2009. [Google Scholar]

- Jacobides, M.; Cennamo, C.; Gawer, A. Toward a Theory of Ecosystems. Strateg. Manag. J. 2017, 39, 2255–2276. [Google Scholar] [CrossRef] [Green Version]

- Lusch, R.F.; Vargo, S.L. Service-Dominant Logic: Premises, Perspectives, Possibilities; Cambridge University Press: Cambridge, UK, 2014. [Google Scholar]

- Teece, D.J. Profiting from innovation in the digital economy: Standards, complementary assets, and business models in the wireless world. Res. Policy 2017, 47, 1367–1387. [Google Scholar] [CrossRef]

- Xu, G.; Wu, Y.; Minshall, T.; Zhou, Y. Exploring innovation ecosystems across science, technology, and business: A case of 3D printing in China. Technol. Forecast. Soc. Change 2018, 136, 208–221. [Google Scholar] [CrossRef]

- Autio, E.; Thomas, L. Innovation Ecosystems: Implications for Innovation Management? In The Oxford Handbook of Innovation Management; Oxford University Press: Oxford, UK, 2014. [Google Scholar]

- Kwak, K.; Kim, W.; Park, K. Complementary multiplatforms in the growing innovation ecosystem: Evidence from 3D printing technology. Technol. Forecast. Soc. Change 2018, 136, 192–207. [Google Scholar] [CrossRef]

- Mei, L.; Zhang, T.; Chen, J. Exploring the effects of inter-firm linkages on SMEs’ open innovation from an ecosystem perspective: An empirical study of Chinese manufacturing SMEs. Technol. Forecast. Soc. Change 2019, 144, 118–128. [Google Scholar] [CrossRef]

- Afuah, A. How much do your co-opetitors’ capabilities matter in the face of technological change? Strateg. Manag. J. 2000, 21, 397–404. [Google Scholar] [CrossRef]

- Dyer, J.H.; Singh, H. The relational view: Cooperative strategy and sources of interorganizational competitive advantage. Acad. Manag. Rev. 1998, 23, 660–679. [Google Scholar] [CrossRef] [Green Version]

- Iansiti, M.; Levien, R. The Keystone Advantage: What the New Dynamics of Business Ecosystems Mean for Strategy, Innovation, and Sustainability; Harvard Business Press: Boston, MA, USA, 2004. [Google Scholar]

- Oksanen, K.; Hautamäki, A. Sustainable innovation: A competitive advantage for innovation ecosystems. Technol. Innov. Manag. Rev. 2015, 5, 24–30. [Google Scholar] [CrossRef]

- Estrin, S.; Baghdasaryan, D.; Meyer, K.E. The impact of institutional and human resource distance on international entry strategies. J. Manag. Stud. 2009, 46, 1171–1196. [Google Scholar] [CrossRef] [Green Version]

- Frenkel, A.; Maital, S. Mapping National Innovation Ecosystems: Foundations for Policy Consensus; Edward Elgar Publishing: Cheltenham, UK, 2014. [Google Scholar]

- Aarikka-Stenroos, L.; Lehtimäki, T. Commercializing a radical innovation: Probing the way to the market. Ind. Mark. Manag. 2014, 43, 1372–1384. [Google Scholar] [CrossRef]

- McNally, R.C.; Cavusgil, E.; Calantone, R.J. Product innovativeness dimensions and their relationships with product advantage, product financial performance, and project protocol. J. Prod. Innov. Manag. 2010, 27, 991–1006. [Google Scholar] [CrossRef] [Green Version]

- Schilling, M.A.; Shankar, R. Strategic Management of Technological Innovation; McGraw-Hill Education: New York, NY, USA, 2019. [Google Scholar]

- Anderson, P.; Tushman, M.L. Technological discontinuities and dominant designs: A cyclical model of technological change. Adm. Sci. Q. 1990, 604–633. [Google Scholar] [CrossRef] [Green Version]

- Coviello, N.E.; Joseph, R.M. Creating major innovations with customers: Insights from small and young technology firms. J. Mark. 2012, 76, 87–104. [Google Scholar] [CrossRef] [Green Version]

- O’Connor, G.C.; Rice, M.P. A comprehensive model of uncertainty associated with radical innovation. J. Prod. Innov. Manag. 2013, 30, 2–18. [Google Scholar] [CrossRef]

- Aarikka-Stenroos, L.; Sandberg, B.; Lehtimäki, T. Networks for the commercialization of innovations: A review of how divergent network actors contribute. Ind. Mark. Manag. 2014, 43, 365–381. [Google Scholar] [CrossRef]

- Woodside, A.G. Theory of rejecting superior, new technologies. J. Bus. Ind. Mark. 1996, 11, 25–43. [Google Scholar] [CrossRef] [Green Version]

- Lettl, C. User involvement competence for radical innovation. J. Eng. Technol. Manag. 2007, 24, 53–75. [Google Scholar] [CrossRef]

- Adner, R.; Kapoor, R. Right tech, wrong time. Harv. Bus. Rev. 2016, 94, 60–67. [Google Scholar] [CrossRef]

- Ferràs-Hernández, X.; Tarrats-Pons, E.; Arimany-Serrat, N. Disruption in the automotive industry: A Cambrian moment. Bus. Horiz. 2017, 60, 855–863. [Google Scholar] [CrossRef]

- Paek, B.; Kim, J.; Park, J.; Lee, H. Outsourcing strategies of established firms and sustainable competitiveness: Medical device firms. Sustainability 2019, 11, 4550. [Google Scholar] [CrossRef] [Green Version]

- Teece, D.J. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef] [Green Version]

- Linder, M.; Williander, M. Circular business model innovation: Inherent uncertainties. Bus. Strategy Environ. 2017, 26, 182–196. [Google Scholar] [CrossRef]

- Zollo, M.; Winter, S.G. Deliberate learning and the evolution of dynamic capabilities. Organ. Sci. 2002, 13, 339–351. [Google Scholar] [CrossRef] [Green Version]

- Winter, S.G. Understanding dynamic capabilities. Strateg. Manag. J. 2003, 24, 991–995. [Google Scholar] [CrossRef] [Green Version]

- Paek, B.; Lee, H. Strategic entrepreneurship and competitive advantage of established firms: Evidence from the digital TV industry. Int. Entrep. Manag. J. 2018, 14, 883–925. [Google Scholar] [CrossRef]

- Pellicelli, M. Gaining flexibility and innovation through offshore outsourcing. Sustainability 2018, 10, 1672. [Google Scholar] [CrossRef] [Green Version]

- Song, L.; Jing, L. Strategic orientation and performance of new ventures: Empirical studies based on entrepreneurial activities in China. Int. Entrep. Manag. J. 2017, 13, 989–1012. [Google Scholar] [CrossRef]

- Griffith, D.A.; Harvey, M.G. A resource perspective of global dynamic capabilities. J. Int. Bus. Stud. 2001, 32, 597–606. [Google Scholar] [CrossRef]

- Butler, B.; Soontiens, W. Offshoring of higher education services in strategic nets: A dynamic capabilities perspective. J. World Bus. 2015, 50, 477–490. [Google Scholar] [CrossRef]

- Helfat, C.E.; Raubitschek, R.S. Dynamic and integrative capabilities for profiting from innovation in digital platform-based ecosystems. Res. Policy 2018, 47, 1391–1399. [Google Scholar] [CrossRef]

- Helfat, C.E.; Campo-Rembado, M.A. Integrative capabilities, vertical integration, and innovation over successive technology lifecycles. Organ. Sci. 2016, 27, 249–264. [Google Scholar] [CrossRef]

- Gawer, A.; Cusumano, M.A. Industry platforms and ecosystem innovation. J. Prod. Innov. Manag. 2014, 31, 417–433. [Google Scholar] [CrossRef] [Green Version]

- Roundy, P.T.; Fayard, D. Dynamic capabilities and entrepreneurial ecosystems: The micro-foundations of regional entrepreneurship. J. Entrep. 2019, 28, 94–120. [Google Scholar] [CrossRef]

- Eriksson, T. Processes, antecedents and outcomes of dynamic capabilities. Scand. J. Manag. 2014, 30, 65–82. [Google Scholar] [CrossRef]

- O’Connor, G.C.; Paulson, A.S.; DeMartino, R. Organisational approaches to building a radical innovation dynamic capability. Int. J. Technol. Manag. 2008, 44, 179–204. [Google Scholar] [CrossRef]

- Yung, I.-S.; Lai, M.-H. Dynamic capabilities in new product development: The case of Asus in motherboard production. Total Qual. Manag. Bus. Excell. 2012, 23, 1125–1134. [Google Scholar] [CrossRef]

- Lin, Y.; Wu, L.-Y. Exploring the role of dynamic capabilities in firm performance under the resource-based view framework. J. Bus. Res. 2014, 67, 407–413. [Google Scholar] [CrossRef]

- Lavie, D. Alliance portfolios and firm performance: A study of value creation and appropriation in the US software industry. Strateg. Manag. J. 2007, 28, 1187–1212. [Google Scholar] [CrossRef]

- Weerawardena, J.; Mort, G.S.; Liesch, P.W.; Knight, G. Conceptualizing accelerated internationalization in the born global firm: A dynamic capabilities perspective. J. World Bus. 2007, 42, 294–306. [Google Scholar] [CrossRef]

- Aldrich, H.; Zimmer, C.; Jones, T. Small business still speaks with the same voice: A replication of ‘the voice of small business and the politics of survival’. Sociol. Rev. 1986, 34, 335–356. [Google Scholar] [CrossRef]

- Nerkar, A.; Paruchuri, S. Evolution of R&D capabilities: The role of knowledge networks within a firm. Manag. Sci. 2005, 51, 771–785. [Google Scholar]

- Selnes, F.; Sallis, J. Promoting relationship learning. J. Mark. 2003, 67, 80–95. [Google Scholar] [CrossRef]

- Ritter, T.; Wilkinson, I.F.; Johnston, W.J. Managing in complex business networks. Ind. Mark. Manag. 2004, 33, 175–183. [Google Scholar] [CrossRef]

- Walter, A.; Auer, M.; Ritter, T. The impact of network capabilities and entrepreneurial orientation on university spin-off performance. J. Bus. Ventur. 2006, 21, 541–567. [Google Scholar] [CrossRef]

- Li, D.-Y.; Liu, J. Dynamic capabilities, environmental dynamism, and competitive advantage: Evidence from China. J. Bus. Res. 2014, 67, 2793–2799. [Google Scholar] [CrossRef]

- Nicholls-Nixon, C.L.; Woo, C.Y. Technology sourcing and output of established firms in a regime of encompassing technological change. Strateg. Manag. J. 2003, 24, 651–666. [Google Scholar] [CrossRef]

- Roy, K.; Khokhle, P.W. Integrating resource-based and rational contingency views: Understanding the design of dynamic capabilities of organizations. Vikalpa 2011, 36, 67–76. [Google Scholar] [CrossRef] [Green Version]

- Sanchez, R.; Heene, A. Reinventing strategic management: New theory and practice for competence-based competition. Eur. Manag. J. 1997, 15, 303–317. [Google Scholar] [CrossRef]

- Lumpkin, G.T.; Dess, G.G. Clarifying the entrepreneurial orientation construct and linking it to performance. Acad. Manag. Rev. 1996, 21, 135–172. [Google Scholar] [CrossRef]

- Rauch, A.; Wiklund, J.; Lumpkin, G.T.; Frese, M. Entrepreneurial orientation and business performance: An assessment of past research and suggestions for the future. Entrep. Theory Pract. 2009, 33, 761–787. [Google Scholar] [CrossRef]

- Nambisan, S.; Baron, R.A. Entrepreneurship in innovation ecosystems: Entrepreneurs’ self–regulatory processes and their implications for new venture success. Entrep. Theory Pract. 2013, 37, 1071–1097. [Google Scholar] [CrossRef]

- Shang, S.S.; Lin, S.F.; Wu, Y.L. Service innovation through dynamic knowledge management. Ind. Manag. Data Syst. 2009, 109, 322–337. [Google Scholar] [CrossRef]

- Zhan, W.; Chen, R.R. Dynamic capability and IJV performance: The effect of exploitation and exploration capabilities. Asia Pac. J. Manag. 2013, 30, 601–632. [Google Scholar] [CrossRef]

- Fernández-Mesa, A.; Alegre-Vidal, J.; Chiva-Gómez, R.; Gutiérrez-Gracia, A. Design management capability and product innovation in SMEs. Manag. Decis. 2013, 51, 547–565. [Google Scholar] [CrossRef]

- Hobday, M.; Davies, A.; Prencipe, A. Systems integration: A core capability of the modern corporation. Ind. Corp. Change 2005, 14, 1109–1143. [Google Scholar] [CrossRef]

- Jantunen, A.; Ellonen, H.-K.; Johansson, A. Beyond appearances–do dynamic capabilities of innovative firms actually differ? Eur. Manag. J. 2012, 30, 141–155. [Google Scholar] [CrossRef]

- Christensen, C.; Raynor, M. The Innovator’s Solution: Creating and Sustaining Successful Growth; Harvard Business Review Press: Brighton, MA, USA, 2013. [Google Scholar]

- Steiber, A.; Alänge, S. A corporate system for continuous innovation: The case of Google Inc. Eur. J. Innov. Manag. 2013, 16, 243–264. [Google Scholar] [CrossRef]

- Swafford, P.M.; Ghosh, S.; Murthy, N. The antecedents of supply chain agility of a firm: Scale development and model testing. J. Oper. Manag. 2006, 24, 170–188. [Google Scholar] [CrossRef]

- Stalk, G., Jr.; Hout, T.M. Competing against time. Res.-Technol. Manag. 1990, 33, 19–24. [Google Scholar] [CrossRef]

- Wang, P. An integrative framework for understanding the innovation ecosystem. In Proceedings of the Conference on Advancing the Study of Innovation and Globalisation in Organizations, Nuremberg, Germany, 28–30 May 2009; pp. 301–314. [Google Scholar]

- Pagani, M. Digital business strategy and value creation: Framing the dynamic cycle of control points. Mis Q. 2013, 37, 617–632. [Google Scholar] [CrossRef]

- Brandenburger, A.M.; Nalebuff, B.J. Co-Opetition; Currency: Redfern, Australia, 2011. [Google Scholar]

- Yin, R. Case Study Research and Applications: Design and Methods; SAGE Publications Inc.: Thousand Oaks, CA, USA, 2018. [Google Scholar]

- Perkins, G.; Murmann, J.P. What does the success of Tesla mean for the future dynamics in the global automobile sector? Manag. Organ. Rev. 2018, 14, 471–480. [Google Scholar] [CrossRef] [Green Version]

- Schulze, A.; Paul MacDuffie, J.; Täube, F.A. Introduction: Knowledge generation and innovation diffusion in the global automotive industry—change and stability during turbulent times. Ind. Corp. Change 2015, 24, 603–611. [Google Scholar] [CrossRef] [Green Version]

- Jacobides, M.G.; MacDuffie, J.P.; Tae, C.J. Agency, structure, and the dominance of OEMs: Change and stability in the automotive sector. Strateg. Manag. J. 2016, 37, 1942–1967. [Google Scholar] [CrossRef]

- Jacobides, M.G.; MacDuffie, J.P. How to drive value your way. Harv. Bus. Rev. 2013, 91, 92–100. [Google Scholar]

- Delhi, S.I.-N. Automotive revolution & perspective towards 2030. Auto Tech Rev. 2016, 4, 20–25. [Google Scholar]

- Teece, D.J. Tesla and the reshaping of the auto industry. Manag. Organ. Rev. 2018, 14, 501–512. [Google Scholar] [CrossRef] [Green Version]

- Teece, D.J. China and the reshaping of the auto industry: A dynamic capabilities perspective. Manag. Organ. Rev. 2019, 15, 177–199. [Google Scholar] [CrossRef] [Green Version]

- Attias, D.; Mira-Bonnardel, S. Extending the scope of partnerships in the automotive industry between competition and cooperation. In The Automobile Revolution; Springer: Berlin/Heidelberg, Germany, 2017; pp. 69–85. [Google Scholar]

- Casals, L.C.; Martinez-Laserna, E.; García, B.A.; Nieto, N. Sustainability analysis of the electric vehicle use in Europe for CO2 emissions reduction. J. Clean. Prod. 2016, 127, 425–437. [Google Scholar] [CrossRef]

- Günther, H.-O.; Kannegiesser, M.; Autenrieb, N. The role of electric vehicles for supply chain sustainability in the automotive industry. J. Clean. Prod. 2015, 90, 220–233. [Google Scholar] [CrossRef]

- Wu, Z.; Wang, M.; Zheng, J.; Sun, X.; Zhao, M.; Wang, X. Life cycle greenhouse gas emission reduction potential of battery electric vehicle. J. Clean. Prod. 2018, 190, 462–470. [Google Scholar] [CrossRef]

- Attias, D. The automobile world in a state of change. In The Automobile Revolution; Springer: Berlin/Heidelberg, Germany, 2017; pp. 7–19. [Google Scholar]

- Christensen, C.M.; Bower, J.L. Customer power, strategic investment, and the failure of leading firms. Strateg. Manag. J. 1996, 17, 197–218. [Google Scholar] [CrossRef]

- Henderson, R.M.; Clark, K.B. Architectural innovation: The reconfiguration of existing product technologies and the failure of established firms. Adm. Sci. Q. 1990, 35, 9–30. [Google Scholar] [CrossRef] [Green Version]

- Lavie, D. Capability reconfiguration: An analysis of incumbent responses to technological change. Acad. Manag. Rev. 2006, 31, 153–174. [Google Scholar] [CrossRef]

- Tushman, M.L.; Anderson, P. Technological discontinuities and organizational environments. Adm. Sci. Q. 1986, 31, 439–465. [Google Scholar] [CrossRef] [Green Version]

- Cozzolino, A.; Rothaermel, F.T. Discontinuities, competition, and cooperation: Coopetitive dynamics between incumbents and entrants. Strateg. Manag. J. 2018, 39, 3053–3085. [Google Scholar] [CrossRef]

- Batrancea, L.; Pop, M.C.; Rathnaswamy, M.M.; Batrancea, I.; Rus, M.-I. An Empirical Investigation on the Transition Process toward a Green Economy. Sustainability 2021, 13, 13151. [Google Scholar] [CrossRef]

- Burlea-Schiopoiu, A.; Bălan, D. The short memory life span of consumer: A premise for corporate socially irresponsible behavior. In Proceedings of the 31st International Business Information Management Association Conference (IBIMA), Milan, Italy, 25–26 April 2018; pp. 1274–1286. [Google Scholar]

- Burlea-Schiopoiu, A.; Balan, D.A. Modelling the impact of corporate reputation on customers’ behaviour. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 1142–1156. [Google Scholar] [CrossRef]

- Bollinger, S.R. Creativity and forms of managerial control in innovation processes: Tools, viewpoints and practices. Eur. J. Innov. Manag. 2019, 23, 214–229. [Google Scholar] [CrossRef]

- Cohendet, P.; Harvey, J.-F.; Simon, L. Managing creativity in the firm: The fuzzy front end of innovation and dynamic capabilities. In The Economics of Creativity; Routledge: Abingdon-on-Thames, UK, 2013; pp. 155–174. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, J.; Paek, B.; Lee, H. Exploring Innovation Ecosystem of Incumbents in the Face of Technological Discontinuities: Automobile Firms. Sustainability 2022, 14, 1606. https://doi.org/10.3390/su14031606

Kim J, Paek B, Lee H. Exploring Innovation Ecosystem of Incumbents in the Face of Technological Discontinuities: Automobile Firms. Sustainability. 2022; 14(3):1606. https://doi.org/10.3390/su14031606

Chicago/Turabian StyleKim, Joohyun, Byungjoo Paek, and Heesang Lee. 2022. "Exploring Innovation Ecosystem of Incumbents in the Face of Technological Discontinuities: Automobile Firms" Sustainability 14, no. 3: 1606. https://doi.org/10.3390/su14031606

APA StyleKim, J., Paek, B., & Lee, H. (2022). Exploring Innovation Ecosystem of Incumbents in the Face of Technological Discontinuities: Automobile Firms. Sustainability, 14(3), 1606. https://doi.org/10.3390/su14031606