Monetary Policy, External Shocks and Economic Growth Dynamics in East Africa: An S-VAR Model

Abstract

:1. Introduction

Theoretical Framework (Monetary Transmission Mechanism)

2. Literature Review

3. Data and Methods

3.1. Definition of the Variables and Sources

3.2. Unit Root Test

3.3. Diagnostic Tests (Optimum Lag and Stability Tests)

3.4. Structural Vector Autoregressive (S-VAR) Model

3.5. Derivation of Variance Decomposition and Impulse Response Functions

3.6. Model Identification

4. Results and Discussion

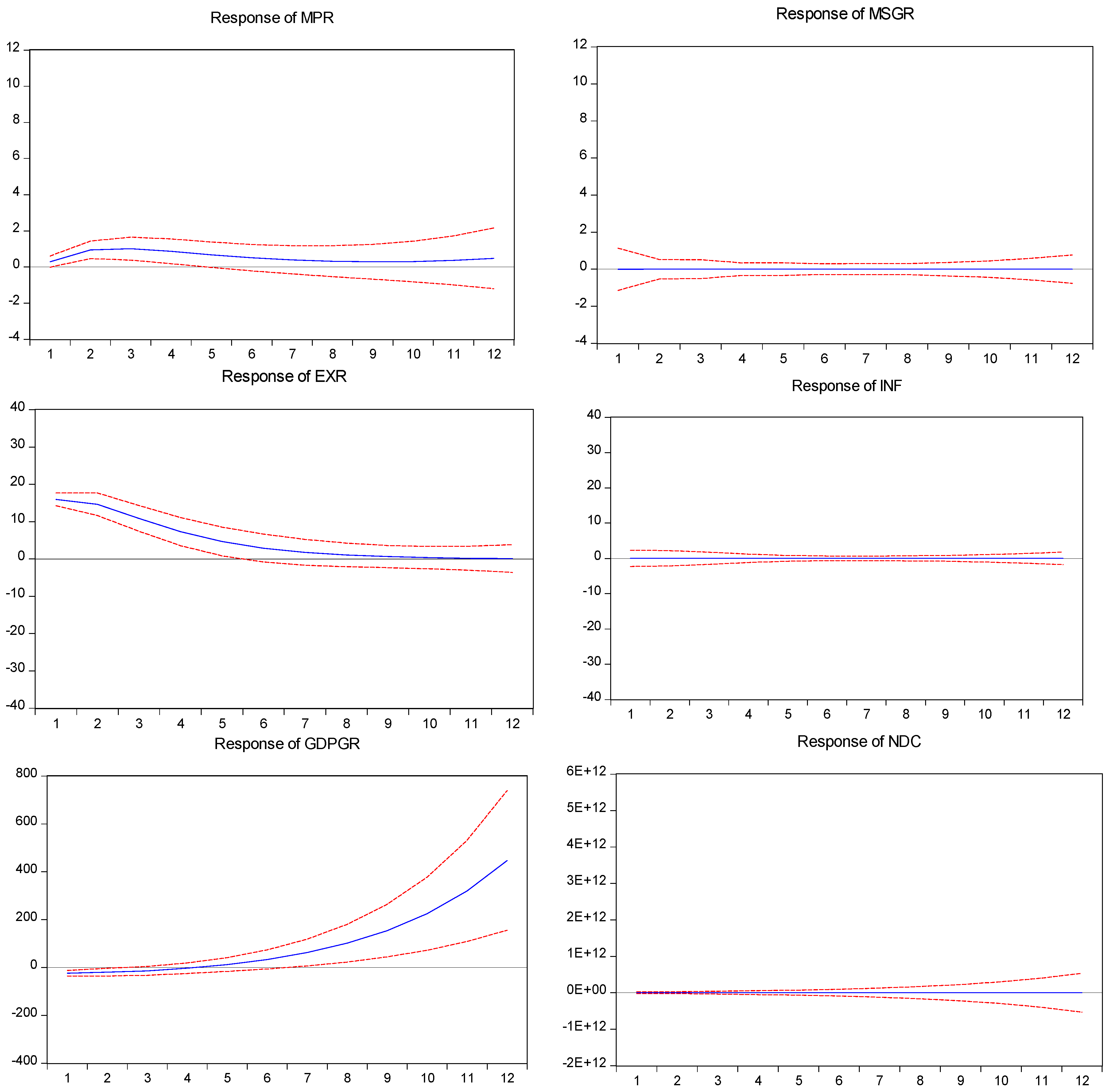

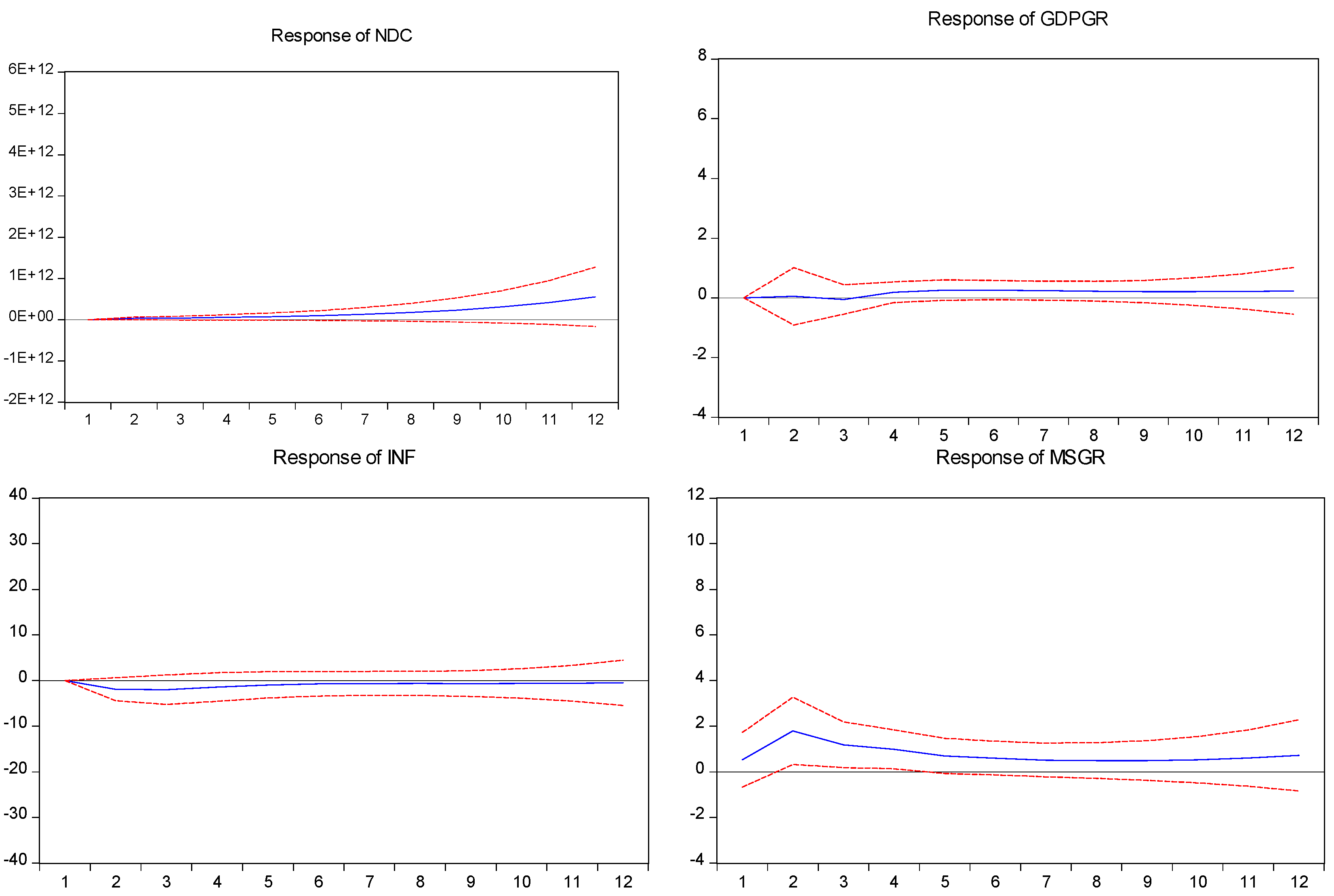

4.1. Impulse Response Analyses

4.2. Forecast Error Variance Decompositions Analysis

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- East Africa Economic Outlook. Macroeconomic Development and Prospects-Political Economy of Regional Integration; African Development Bank Group: Abidjan, Cote d’Ivoire, 2019. [Google Scholar]

- Dillon, B.M.; Barrett, C. Global Oil Prices and Local Food Prices: Evidence from East Africa. Am. J. Agric. Econ. 2015, 98, 154–171. [Google Scholar] [CrossRef]

- Ng’ang’a, W.I.; Chevallier, J.; Ndiritu, S. Investigating Fiscal and Monetary Policies Coordination and Public Debt in Kenya: Evidence from Regime-Switching and Self-Exciting Threshold Autoregressive Models; halshs-02156495; Kiel Institute for the World Economy (IfW Kiel): Kiel, Germany, 2019. [Google Scholar]

- Addison, T.; Ghoshray, A.; Stamatogiannis, M.P. Agricultural Commodity Price Shocks and Their Effect on Growth in Sub-Saharan Africa. J. Agric. Econ. 2015, 67, 47–61. [Google Scholar] [CrossRef] [Green Version]

- Chuku, C.; Simpasa, A.; Oduor, J. Macroeconomic Consequences of Commodity Price Fluctuations in African Economies. Afr. Dev. Rev. 2018, 30, 329–345. [Google Scholar] [CrossRef]

- Chileshe, P.M.; Chisha, K.; Ngulube, M. The effect of external shocks on macroeconomic performance and monetary. Int. J. Sustain. Econ. 2018, 10, 18–40. [Google Scholar]

- Cieślik, E. International Trade in East Africa: The Case of the Intergovernmental Authority on Development. J. Pan Afr. Stud. 2015, 8, 79–96. [Google Scholar]

- Afesorgbor, S.K. Regional Integration, Bilateral Diplomacy and African Trade: Evidence from the Gravity Model. Afr. Dev. Rev. 2019, 31, 492–505. [Google Scholar] [CrossRef]

- Umulisa, Y. Estimation of the East African Community’s trade benefits from promoting intra-regional trade. Afr. Dev. Rev. 2020, 32, 55–66. [Google Scholar] [CrossRef]

- Christensen, B.V. Challenges of Low Commodity Prices for Africa; Bank of International Settlement Papers No 87; Bank of International Settlement: Basel, Switzerland, 2016. [Google Scholar]

- African Development Bank Group. African Economic Outlook; African Development Bank Group: Abidjan, Côte d’Ivoire, 2018. [Google Scholar]

- Omolade, A.; Ngalawa, H.; Kutu, A. Crude oil price shocks and macroeconomic performance in Africa’s oil-producing countries. Cogent Econ. Financ. 2019, 7, 1607431. [Google Scholar] [CrossRef]

- Alenoghena, R.O. Oil Price Shocks and Macroeconomic Performance of the Nigerian Economy: A Structural VAR Approach. Facta Univ. Ser. Econ. Organ. 2020, 17, 299–316. [Google Scholar] [CrossRef]

- Bynoe, A.J. Monetary and Fiscal Influences on Economic Activities in African Countries; African Review of Money Finance and Banking, No. 1/2; Giordano Dell-Amore Foundation, 1994; pp. 97–107. Available online: http://www.jstor.org/stable/23027487 (accessed on 8 November 2021).

- Alavi, S.E.; Moshiri, S.; Sattarifar, M. An Analysis of the Efficiency of the Monetary and Fiscal Policies in Iran Economy Using IS–MP–AS Model. Procedia Econ. Financ. 2016, 36, 522–531. [Google Scholar] [CrossRef] [Green Version]

- Cavalcanti, M.A.; Vereda, L.; Doctors, R.D.B.; Lima, F.; Maynard, L. The macroeconomic effects of monetary policy shocks under fiscal rules constrained by public debt sustainability. Econ. Model. 2018, 71, 184–201. [Google Scholar] [CrossRef]

- Ismail, S.F.; Sek, S.K. Investigating the effects of fiscal and monetary policy on economic performance: Dynamic panel threshold regression analysis. In Proceedings of the AIP Conference, Penang, Malaysia, 10–12 December 2018; Volume 2184. [Google Scholar] [CrossRef]

- Büyükbaşaran, T.; Çebi, C.; Yılmaz, E. Interaction of monetary and fiscal policies in Turkey. Cent. Bank Rev. 2020, 20, 193–203. [Google Scholar] [CrossRef]

- Le, H.V.; Pfau, W.D. VAR Analysis of the Monetary Transmission Mechanism in Vietnam. Appl. Econom. Int. Dev. 2009, 9, 165–179. [Google Scholar]

- Can, U.; Bocuoglu, M.E.; Can, Z.G. How does the monetary transmission mechanism work? Evidence from Turkey. Borsa Istanb. Rev. 2020, 20, 375–382. [Google Scholar] [CrossRef]

- Nkalu, C.N. Empirical Analysis of Demand for Real Money Balances in Africa: Panel Evidence from Nigeria and Ghana. Afr. Asian Stud. 2020, 19, 363–376. [Google Scholar] [CrossRef]

- Arwatchanakarn, P. Monetary Policy Shocks and Macroeconomic Variables: Evidence from Thailand. In Computational Intelligence; ResearchGate, 2019; Available online: https://doi.org/10.1007/978-3-030-04263-9_16 (accessed on 5 March 2020).

- Ndubuisi, G.O. Interest Rate Channel of Monetary Policy Transmission Mechanisms: What Do We Know about It? 2015. Available online: https://doi.org/10.2139/ssrn.2623036 (accessed on 5 March 2021).

- Amusa, H.; Fadiran, D. The J-Curve Hypothesis: Evidence from Commodity Trade Between South Africa and the United States. Stud. Econ. Econ. 2019, 43, 39–62. [Google Scholar] [CrossRef]

- Mishkin, F.S. Symposium on the Monetary Transmission Mechanism. J. Econ. Perspect. 1995, 9, 3–10. [Google Scholar] [CrossRef] [Green Version]

- Njimanted, F.G.; Daniel Akume, D.; Mukete, E.M. The Impact of Key Monetary Variables on the Economic Growth of the CEMAC Zone. Expert J. Econ. 2016, 4, 54–67. [Google Scholar]

- Olamide, E.G.; Maredza, A. Regional Effects of Monetary Policy on Economic Growth of ECOWAS: An S-VAR Approach. J. Dev. Areas 2019, 53, 205–223. [Google Scholar] [CrossRef]

- Antwi, S.; Issah, M.; Patience, A.; Antwi, S. The effect of macroeconomic variables on exchange rate: Evidence from Ghana. Cogent Econ. Financ. 2020, 8, 1821483. [Google Scholar] [CrossRef]

- Hassan, A.S.; Meyer, D.F. Analysis of the Non-Linear Effect of Petrol Price Changes on Inflation in South Africa. Int. J. Soc. Sci. Hum. Stud. 2020, 12, 34–49. [Google Scholar]

- Schmitt-Grohé, S.; Uribe, M. How important are terms-of-trade shocks? Int. Econ. Rev. 2018, 59, 85–111. [Google Scholar] [CrossRef] [Green Version]

- Drechsel, T.; Tenreyro, S. Commodity booms and busts in emerging economies. J. Int. Econ. 2018, 112, 200–218. [Google Scholar] [CrossRef]

- Roch, F. The adjustment to commodity price shocks. J. Appl. Econ. 2019, 22, 437–467. [Google Scholar] [CrossRef]

- Gabriel, L.F.; Ribeiro, L.C.D.S. Economic growth and manufacturing: An analysis using Panel VAR and intersectoral linkages. Struct. Chang. Econ. Dyn. 2019, 49, 43–61. [Google Scholar] [CrossRef]

- Ezeaku, H.C.; Ibe, I.G.; Ugwuanyi, U.B.; Modebe, N.J.; Agbaeze, E.K. Monetary Policy Transmission and Industrial Sector Growth: Empirical Evidence from Nigeria. Sage Open 2018, 8, 2158244018769369. [Google Scholar] [CrossRef]

- Hoang, T.T.; Thi, V.A.N. The impact of macroeconomic factors on the inflation in Vietnam. Manag. Sci. Lett. 2020, 10, 333–342. [Google Scholar] [CrossRef]

- Ciora, Z. Monetary Policy, Inflation and the Causal Relation between the Inflation Rate and Some of the Macroeconomic Variables. Procedia Econ. Financ. 2014, 16, 391–401. [Google Scholar] [CrossRef] [Green Version]

- Hatmanu, M.; Cautisanu, C.; Ifrim, M. The Impact of Interest Rate, Exchange Rate and European Business Climate on Economic Growth in Romania: An ARDL Approach with Structural Breaks. Sustainability 2020, 12, 2798. [Google Scholar] [CrossRef] [Green Version]

- Iddrisu, S.; Harvey, S.K.; Amidu, M. The Impact of Monetary Policy on Stock Market Performance: Evidence from Twelve African Countries. Res. Int. Bus. Financ. 2017, 42, 1372–1382. [Google Scholar] [CrossRef]

- Akosah, N.K.; Alagidede, I.P.; Schaling, E. Testing for asymmetry in monetary policy rule for small-open developing economies: Multiscale Bayesian quantile evidence from Ghana. J. Econ. Asymmetries 2020, 22, e00182. [Google Scholar] [CrossRef]

- Asongu, S. New empirics of monetary policy dynamics: Evidence from the CFA franc zones. Afr. J. Econ. Manag. Stud. 2016, 7, 164–204. [Google Scholar] [CrossRef] [Green Version]

- Famoroti, J.O.; Tipoy, C.K. Macroeconomic Effects of External Monetary Policy Shocks to Economic Growth in West Africa; Stellenbosch University: Cape Town, Western Cape, South Africa, 2019; Available online: https://www.ekon.sun.ac.za/phdconference2019/famoroti-o.-jonathan.pdf (accessed on 5 March 2020).

- Omojolaibi, J.A.; Egwaikhide, F.O. A Panel Analysis of Oil Price Dynamics Fiscal Stance and Macroeconomic Effects: The Case of Some Selected African Countries. Cent. Bank Niger. Econ. Financ. Rev. 2013, 51, 61–91. [Google Scholar]

- Etornam, D.K. The Impact of Oil Price Shocks on the Macroeconomy of Ghana. J. Poverty Investig. Dev. 2015, 9, 37–54. [Google Scholar]

- Chiweza, J.T.; Aye, G.C. The effects of oil price uncertainty on economic activities in South Africa. Gen. Appl. Econ. 2018, 6, 1518117. [Google Scholar] [CrossRef] [Green Version]

- Odhiambo, S.A. Money, Inflation and Output: Understanding the cornerstones of a monetary union in East Africa Community. Eur. Sci. J. 2017, 13, 503–520. [Google Scholar] [CrossRef]

- Buigut, S. Monetary Policy Transmission Mechanism: Implications for the Proposed East African Community (EAC) Monetary Union. 2009. Available online: http://www.csae.ox.ac.uk/conferences/2009-EdiA/paperlist.html (accessed on 10 September 2021).

- Abuka, C.; Alinda, R.K.; Minoiu, C.; Peydró, J.-L.; Presbitero, A.F. Monetary policy and bank lending in developing countries: Loan applications, rates, and real effects. J. Dev. Econ. 2019, 139, 185–202. [Google Scholar] [CrossRef]

- Nyorekwa, E.T.; Nicholas, M.; Odhiambo, N.M. Monetary policy and economic growth dynamics in Uganda. Banks Bank Syst. 2014, 9, 18–28. [Google Scholar]

- Kamaan, C.K. Effect of Economic Growth in Kenya. Int. J. Bus. Commer. 2014, 3, 11–24. Available online: www.ijbcnet.com (accessed on 5 March 2020).

- Ayubu, V.S. Monetary Policy and Inflation Dynamics: An Empirical Case Study of Tanzania Economy. Unpublished Master’s Thesis in Economics, Umea, Sweden. 2013. [Google Scholar]

- Wetite, T.B. The Relative Effectiveness of Monetary and Fiscal Policies on Industrial Growth of Ethiopia. 2021, Volume 8. Available online: www.ijrar.org (accessed on 10 September 2021).

- Beyene, S.D.; Kotosc, B. Is Fiscal or Monetary Policy More Effective on Economic Growth? an Empirical Evidence in The Case of Ethiopia. J. Afr. Res. Bus.Technol. 2020, 2020, 124855. [Google Scholar] [CrossRef]

- Davoodi, H.; Dixit, S.; Pinter, G. Monetary Transmission Mechanism in the East African Community: An Empirical Investigation; IMF Working paper; International Monetary Fund: Washington, DC, USA, 2013; Volume 2013, No. 39. [Google Scholar]

- Berg, A.; Charry, L.; Portillo, R.; Vlcek, J. The Monetary Transmission Mechanism in the Tropics: A Narrative Approach; IMF Working Paper; IMF: Washington, DC, USA, 2013; p. 197. [Google Scholar]

- Twinoburyo, E.N.; Odhiambo, N.M. Monetary Policy and Economic Growth in Kenya: The Role of Money Supply and Interest Rates. UNISA Economic Research Working Paper Series 11/2016. 2016. Available online: http://hdl.handle.net/10500/20712 (accessed on 5 March 2020).

- Caporale, G.M.; Gil-Alana, L. Prospects for a Monetary Union in the East Africa Community: Some Empirical Evidence. S. Afr. J. Econ. 2020, 88, 174–185. [Google Scholar] [CrossRef] [Green Version]

- Omolade, A.; Ngalawa, H. Monetary policy transmission mechanism and growth of the manufacturing sectors in Libya and Nigeria: Does exchange rate regime matter? J. Entrep. Bus. Econ. 2017, 5, 67–107. [Google Scholar]

- Olamide, E.G.; Maredza, A. A dynamic regression panel approach to the determinants of monetary policy and economic growth: The SADC experience. Afr. J. Econ. Manag. Stud. 2019, 10, 385–399. [Google Scholar] [CrossRef]

- Olamide, E.G.; Maredza, A. The Short and Long Run Dynamics of Monetary Policy, Oil Price Volatility and Economic Growth in the CEMAC Region. Asian Econ. Financ. Rev. 2021, 11, 78–89. [Google Scholar] [CrossRef]

- Chudik, A.; Pesaran, M.H. Large Panel Data Models with Cross-Sectional Dependence. A Survey, Federal Reserve Bank of Dallas Globalisation and Monetary Policy Institute Working Paper. 2013, p. 153. Available online: http://www.dallasfed.org/assets/documents/institute/wpapers/2013/0153.pdf (accessed on 10 September 2021).

- Pesaran, M.H.; Im, K.S.; Shin, Y. Testing for unit roots in heterogeneous panels. J. Econom. 2003, 115, 53–74. [Google Scholar] [CrossRef]

- Moon, H.R.; Perron, B. Testing for a Unit Root in Panels with Dynamic Factors. J. Econom. 2004, 122, 81–126. [Google Scholar] [CrossRef] [Green Version]

- Bai, J.; Ng, S. A PANIC Attack on Unit Roots and Cointegration. Econometrica 2004, 72, 1127–1177. [Google Scholar] [CrossRef] [Green Version]

- Breitung, I.; Das, S. Testing for Unit Root in Panels with a Factor Structure. Econom. Theory 2008, 24, 88–108. [Google Scholar] [CrossRef]

- Svensson, E. Regional Effects of Monetary Policy in Sweden; Working Paper 9; Department of Economics, School of Economics and Management, Lund University: Lund, Sweden, 2013. [Google Scholar]

- Dritsakis, N. Demand for Money in Hungary: An ARDL Approach. Rev. Econ. Financ. 2011, 1, 1–16. [Google Scholar]

- Trade Performance and Commodity Dependence, Economic Development in Africa. In Proceedings of the United Nations Conference on Trade and Development, Geneva, Switzerland, 26 February 2004.

- McMillin, W.D. The Effects of Monetary Policy Shocks: Comparing Contemporaneous versus Long-Run Identifying Restrictions. South. Econ. J. 2001, 67, 618–636. [Google Scholar]

- Paramanik, R.N.; Kamaiah, B. A Structural Vector Autoregression Model for Monetary Policy Analysis in India. Margin—J. Appl. Econ. Res. 2014, 8, 401–429. [Google Scholar] [CrossRef]

- Rotimi, M.E.; Ngalawa, H. Oil Price Shocks and Economic Performance in Africa’s Oil Exporting Countries. Acta Univ. Danub. 2017, 13, 169–188. [Google Scholar]

- Arias, J.E.; Rubio-Ramirez, J.F.; Waggoner, D.F. Inference Based on SVARs Identified with Sign and Zero Restrictions: Theory and Applications. Econometrica 2018, 86, 685–720. [Google Scholar] [CrossRef]

- Elbourne, A. The UK housing market and the monetary policy transmission mechanism: An SVAR approach. J. Hous. Econ. 2008, 17, 65–87. [Google Scholar] [CrossRef]

- Demachi, K. The Effect of Crude Oil Price Change and Volatility on Nigerian Economy; MPRA Paper 41413; Munich Personal RePEc Archive-MPRA; University Library of Munich: Munich, Germany, 2012. [Google Scholar]

- Tevdovski, D.; Petrevski, G.; Bogoev, J. The effects of macroeconomic policies under fixed exchange rates: A Bayesian VAR analysis. Econ. Res -Ekon. Istraživanja 2019, 32, 2138–2160. [Google Scholar] [CrossRef] [Green Version]

- Phetole, S.; Ogujiuba, K. Is there a Nexus between Inflation, Exchange Rate and Unemployment in South Africa: An Econometric Analysis. Montenegrin J. Econ. 2021, 17, 45–58. [Google Scholar]

- Ogujiuba, K.; Mbangata, T. A Comparative Analysis of Macroeconomic Outcomes amongst the BRICS Countries (2000–2015). J. Int. Econ. 2020, 11, 49–63. [Google Scholar]

| Variable | Description | Measurement | Sources of Data |

|---|---|---|---|

| Real GDP growth rate | This is the growth rate value of total annual output of goods and services produced in the economy in a particular period of time usually a year. It is used as proxy for Economic Growth (see Nogueira 2009) | It is measured in percentage and as the value of all productive resources that nations used in a year after correcting for inflation. This implies that real GDP is the value of nominal GDP that has been corrected for inflation in the SSA countries used in this study. | World Development Indicator |

| Exchange Rate | It is the price of a country currency expressed in terms of one unit of another country’s currency. | It is measured as the exchange rate of one currency to the dollar. It is measured as nominal and real exchange rate. The nominal exchange rate is measured by how much one currency is necessary to acquire one unit of another. The real exchange rate is measured as the purchasing power of a currency relative to another at current exchange rates and prices. | World Development Indicators |

| Interest rate | This is the lending rate by banks on borrowed money by their customers. | Interest rate can be measured in terms of nominal and real interest rates. Nominal interest rates are the rates quoted in loan and deposit agreement. It is measured as real interest rate plus inflation. Real interest rate is measured by deflating the nominal interest rates. i.e., nominal interest rates minus inflation. | World Development Indicators |

| Inflation rate | The inflation rate is the percentage rate of change in consumer prices. | It is measured by the annual percentage change in consumer prices. There are two measures, the Retail Price Index (RPI) and the Consumer Price Index (CPI). For this study, CPI measure was be used. | World Development Indicators |

| Money Supply | The money supply is the total quantity of money in the economy at any given time. | This is measured by M2 known as broad money or money plus quasi money. The M2 measure includes the money in circulation as well as bank deposits. The M2 is being divided by GDP to get the rate of money supply | World Development Indicators |

| Oil Prices | This is the oil revenue accruable to the oil producing Sub Saharan Africa Countries. It comprises of the Premium Motor Spirit (PMS), Dual Purpose Kerosene (DPK) and the Automotive Gas Oil (AGO). | It is measured by the value of fuel exports (% of merchandise exports) | International Financial Statistics. |

| Variable | IPS Unit Root Test | ADF-Fisher Chi2 Unit Root Test | ||||

|---|---|---|---|---|---|---|

| t * Statistics | p Value | Order of Integration | t * Statistics | p Value | Order of Integration | |

| Mpr | −4.6844 | 0.000 *** | I(1) | 57.6671 | 0.000 *** | I(1) |

| Gdpgr | −3.1492 | 0.000 *** | I(0) | 23.4964 | 0.000 *** | I(0) |

| Exr | −3.9023 | 0.000 *** | I(1) | 40.4313 | 0.000 *** | I(1) |

| Inf | −6.1259 | 0.006 *** | I(0) | 98.7155 | 0.000 *** | I(0) |

| Msgr | −3.1744 | 0.000 ** | I(0) | 25.4526 | 0.000 *** | I(0) |

| Ndc | −5.1601 | 0.000 *** | I(1) | 69.5453 | 0.000 *** | I(1) |

| Dum | −5.8310 | 0.000 *** | I(1) | 294.7543 | 0.000 *** | I(1) |

| Oilpvol | −3.9879 | 0.000 *** | I(0) | 104.3020 | 0.000 *** | I(0) |

| Compvol | −3.6001 | 0.000 *** | I(0) | 82.5095 | 0.000 *** | I(0) |

| –e1 | –e2 | –e3 | |

|---|---|---|---|

| –e1 | 1.0000 | ||

| –e2 | 0.1277 | 1.0000 | |

| –e3 | 0.1224 | 0.1209 | 1.0000 |

| Lag | LogL | LR | FPE | AIC | SC | HQ |

|---|---|---|---|---|---|---|

| 0 | −4506.430 | NA | 2.03 × 1076 | 239.6004 | 214.8114 * | 232.6771 |

| 1 | −4519.89 | 59.82016 | 1.21 × 1096 | 239.0445 | 216.3397 | 232.6704 |

| 2 | −4492.248 | 54.05899 * | 6.64 × 1083 * | 234.3601 * | 216.3405 | 232.5986 * |

| Root | Modulus |

|---|---|

| −0.163002 − 0.841894i | 0.857529 |

| −0.163002 + 0.841894i | 0.857529 |

| 0.81897 | 0.81897 |

| 0.222459 − 0781098i | 0.812159 |

| 0.222459 + 0.781098i | 0.812159 |

| 0.470677 − 0.452707i | 0.653055 |

| 0.470677 + 0.452707i | 0.653055 |

| −0.56571 | 0.56571 |

| −0.468747 − 0.270802i | 0.541347 |

| −0.468747 − 0.270802i | 0.541347 |

| Period | S.E. | OPV | CPV | NDC | GDPgr | INF | EXR | MSgr | MPR |

|---|---|---|---|---|---|---|---|---|---|

| 3 | 4.475124 | 4.36 × 10−6 | 10.17958 | 5.66 × 10−5 | 0.335233 | 9.996381 | 17.43934 | 0.143394 | 61.90601 |

| 6 | 5.956191 | 3.23 × 10−6 | 9.319766 | 3.71 × 10−5 | 1.280981 | 9.764982 | 30.99097 | 1.827320 | 46.81594 |

| 9 | 7.026602 | 7.73 × 10−6 | 7.669539 | 2.68 × 10−5 | 1.856150 | 7.693765 | 31.86595 | 14.40582 | 36.50874 |

| 12 | 9.596733 | 3.81 × 10−5 | 4.337483 | 1.54 × 10−5 | 1.784839 | 4.611530 | 19.38965 | 49.99995 | 19.87649 |

| Period | S.E. | OPV | CPV | NDC | GDPgr | INF | EXR | MSgr | MPR |

|---|---|---|---|---|---|---|---|---|---|

| 3 | 166.1394 | 10.01 × 10−6 | 4.307193 | 0.000538 | 0.658041 | 0.985044 | 93.63537 | 0.013494 | 0.400321 |

| 6 | 275.6775 | 6.95 × 10−6 | 3.240690 | 0.000485 | 1.539355 | 3.140111 | 91.67701 | 0.013452 | 0.388893 |

| 9 | 430.5304 | 3.03 × 10−5 | 21.76515 | 0.000356 | 2.317943 | 4.858448 | 70.82463 | 0.012107 | 0.221338 |

| 12 | 816.8864 | 6.62 × 10−5 | 58.94114 | 0.000177 | 2.208229 | 3.414434 | 35.29079 | 0.024161 | 0.121004 |

| Period | S.E. | OPV | CPV | NDC | GDPGR | INF | EXR | MSGR | MPR |

|---|---|---|---|---|---|---|---|---|---|

| 3 | 6.228362 | 4.93 × 10−6 | 0.000141 | 0.841456 | 96.49658 | 0.074595 | 0.014869 | 0.118110 | 2.454247 |

| 6 | 6.281070 | 4.88 × 10−6 | 0.000141 | 0.835408 | 94.90033 | 0.488358 | 0.435774 | 0.281881 | 3.058101 |

| 9 | 6.331746 | 4.92 × 10−6 | 0.000140 | 1.118283 | 93.44318 | 1.080032 | 0.799203 | 0.347002 | 3.212151 |

| 12 | 6.445082 | 6.75 × 10−6 | 0.000136 | 3.619285 | 90.28285 | 1.470141 | 1.109168 | 0.364309 | 3.154106 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Olamide, E.; Maredza, A.; Ogujiuba, K. Monetary Policy, External Shocks and Economic Growth Dynamics in East Africa: An S-VAR Model. Sustainability 2022, 14, 3490. https://doi.org/10.3390/su14063490

Olamide E, Maredza A, Ogujiuba K. Monetary Policy, External Shocks and Economic Growth Dynamics in East Africa: An S-VAR Model. Sustainability. 2022; 14(6):3490. https://doi.org/10.3390/su14063490

Chicago/Turabian StyleOlamide, Ebenezer, Andrew Maredza, and Kanayo Ogujiuba. 2022. "Monetary Policy, External Shocks and Economic Growth Dynamics in East Africa: An S-VAR Model" Sustainability 14, no. 6: 3490. https://doi.org/10.3390/su14063490