Trade Openness and Environmental Policy Stringency: Quantile Evidence

Abstract

:1. Introduction

2. A Brief Review of Literature

3. Data and Methodology

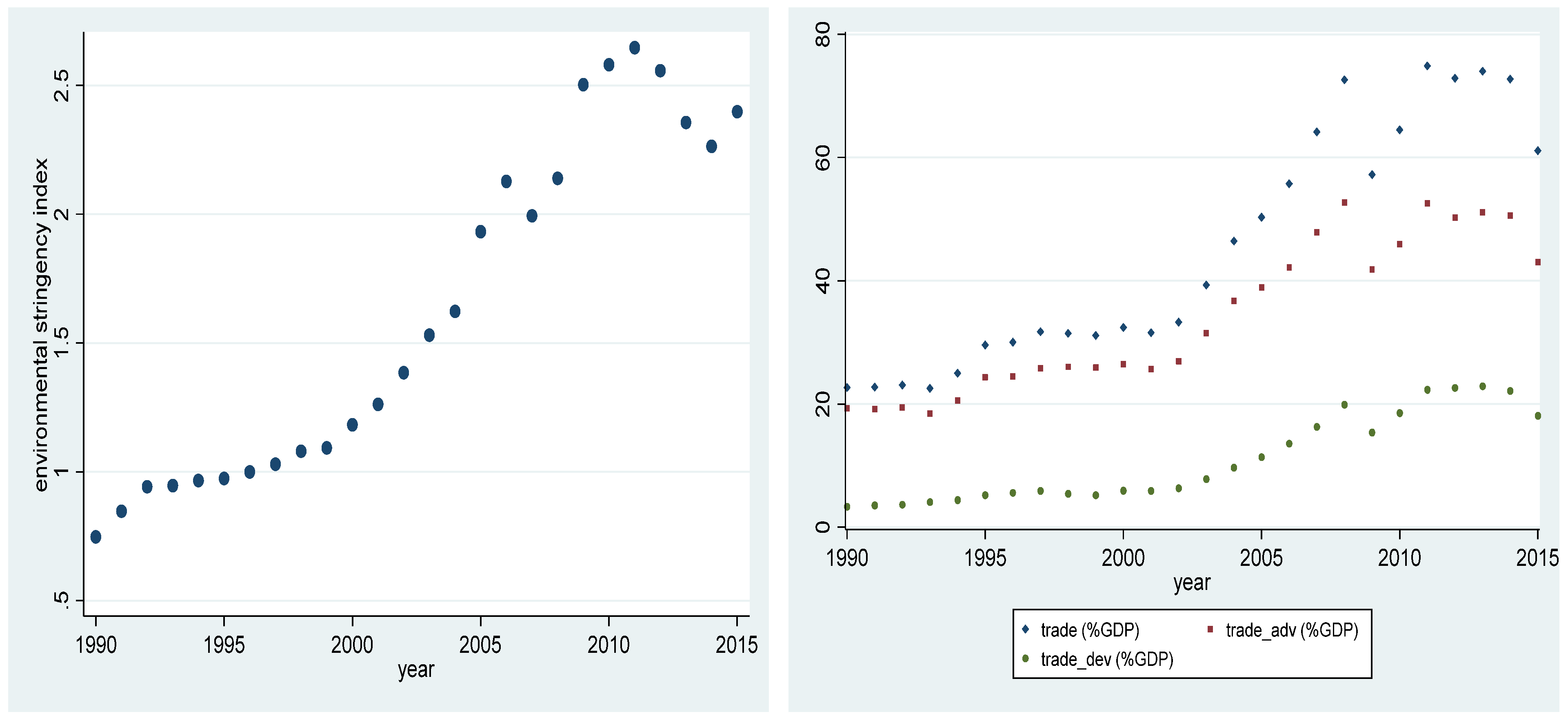

3.1. Data

3.2. Model Specifications

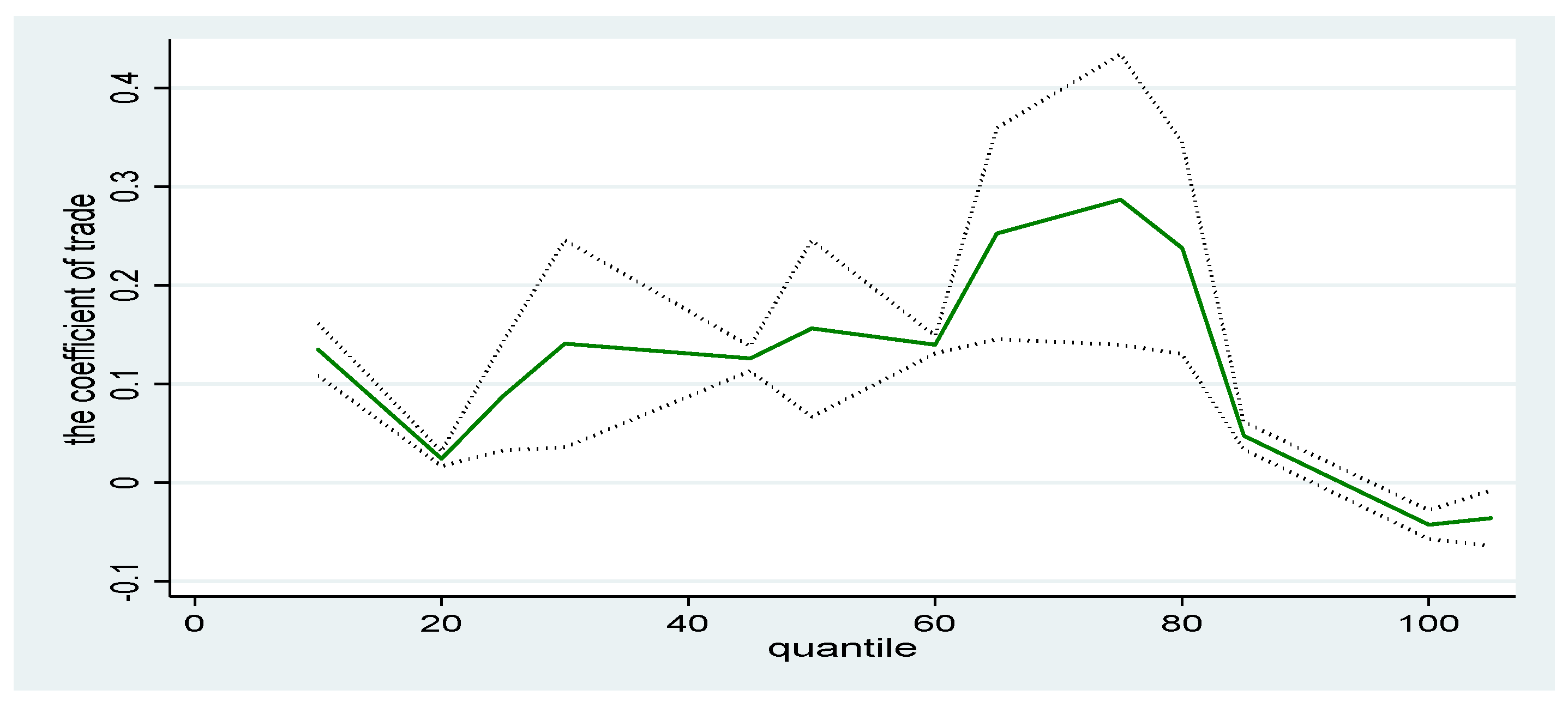

4. Empirical Results

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Grossman, G.; Krueger, A.B. Economic environment and the economic growth. Q. J. Econ. 1995, 110, 353–377. [Google Scholar] [CrossRef] [Green Version]

- Botta, E.; Kozluk, T. Measuring Environmental Policy Stringency in OECD Countries: A Composite Index Approach; OECD Economics Department Working Papers: Paris, France, 2014; No. 1177. [Google Scholar]

- Ederington, J.; Minier, J. Is environmental policy a secondary trade barrier? An empirical analysis. Can. J. Econ. 2003, 36, 137–154. [Google Scholar]

- Aklin, M. Re-exploring the trade and environment nexus through the diffusion of pollution. Environ. Resour. Econ. 2016, 64, 663–682. [Google Scholar] [CrossRef]

- Kim, D.H.; Suen, Y.B.; Lin, S.C. Carbon dioxide emissions and trade: Evidence from disaggregate trade data. Energy Econ. 2019, 78, 13–28. [Google Scholar] [CrossRef]

- Porter, G. Trade Competition and Pollution Standards: “Race to the Bottom” or “Stuck at the Bottom”. J. Environ. Dev. 1999, 8, 133–151. [Google Scholar] [CrossRef]

- Copeland, B.R.; Taylor, M.S. Trade, growth and the environment. J. Econ. Lit. 2004, 42, 7–71. [Google Scholar] [CrossRef]

- Copeland, B.R.; Taylor, M.S. Trade and the Environment: Theory and Evidence; Princeton University Press: Princeton, NJ, USA, 2013. [Google Scholar]

- Esty, D. Revitalizing environmental federalism. Mich. Law Rev. 1996, 95, 570–653. [Google Scholar] [CrossRef]

- Esty, D.C.; Geradin, D. Market access, competitiveness, and harmonization: Environ-mental protection in regional trade agreements. Harv. Environ. Law Rev. 1997, 21, 265–336. [Google Scholar]

- Porter, M.E.; van der Linde, C. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef] [Green Version]

- Bommer, R.; Schulze, G.G. Environmental improvement with trade liberalization. Eur. J. Political Econ. 1999, 15, 639–661. [Google Scholar] [CrossRef]

- Fredriksson, P.G. The political economy of trade liberalization and environmental policy. South Econ. J. 1999, 65, 513–525. [Google Scholar]

- Damania, R.; Fredriksson, P.G. Trade policy reform, endogenous lobby group formation, and environmental policy. J. Econ. Behav. Organ. 2003, 52, 47–69. [Google Scholar] [CrossRef]

- McAusland, C. Voting for pollution policy: The importance of income inequality and openness to trade. J. Int. Econ. 2003, 61, 425–451. [Google Scholar] [CrossRef]

- McAusland, C. Trade, politics, and the environment: Tailpipe vs. smokestack. J. Environ. Econ. Manag. 2008, 55, 52–71. [Google Scholar] [CrossRef] [Green Version]

- Cao, X.; Prakash, A. Trade competition and environmental regulations: Domestic political constraints and issue visibility. J. Politics 2012, 74, 66–82. [Google Scholar] [CrossRef] [Green Version]

- Damania, R.; Fredriksson, P.G.; List, J.A. Trade liberalization, corruption, and environmental policy formation: Theory and evidence. J. Environ. Econ. Manag. 2003, 46, 490–512. [Google Scholar] [CrossRef]

- Frediksson, P.G.; Matschke, X. Trade liberalization and environmental taxation in Federal systems. Scand. J. Econ. 2016, 118, 150–167. [Google Scholar] [CrossRef] [Green Version]

- Saikawa, E. Policy diffusion of emission standards: Is there a race to the top? World Politics 2013, 65, 1–33. [Google Scholar] [CrossRef]

- Prakash, A.; Potoski, M. Racing to the bottom? Trade, environmental governance, and ISO 14001. Am. J. Political Sci. 2006, 50, 350–364. [Google Scholar] [CrossRef]

- Busse, M.; Silberberger, M. Trade in pollutive industries and the stringency of environ-mental regulations. Appl. Econ. Lett. 2013, 20, 320–323. [Google Scholar] [CrossRef]

- Aisbett, E.; Silberberger, M. Tariff liberalization and product standards: Regulatory chill and race to the bottom? Regul. Gov. 2021, 15, 987–1006. [Google Scholar] [CrossRef] [Green Version]

- Eliste, P.; Fredriksson, P.G. Environmental regulations, transfers, and trade: Theory and evidence. J. Environ. Econ. Manag. 2002, 43, 234–250. [Google Scholar] [CrossRef]

- Lisciandra, M.; Migliardo, C. An empirical study of the impact of corruption on environmental performance: Evidence from panel data. Environ. Resour. Econ. 2017, 68, 297–318. [Google Scholar] [CrossRef]

- Dincer, O.C.; Fredriksso, P.G. Corruption and environmental regulatory policy in the United States: Does trust matter? Resour. Energy Econ. 2018, 54, 212–225. [Google Scholar] [CrossRef]

- Cole, M.A.; Elliott, R.J.R.; Fredriksson, P.G. Endogenous pollution havens: Does FDI influence environmental regulations? Scand. J. Econ. 2006, 108, 157–178. [Google Scholar] [CrossRef]

- Cole, M.A.; Fredriksson, P.G. Institutionalized pollution havens. Ecol. Econ. 2009, 68, 1239–1256. [Google Scholar] [CrossRef] [Green Version]

- Dasgupta, S.; Laplante, B.; Wang, H.; Wheeler, D. Confronting the environmental Kuznets curve. J. Econ. Perspect. 2002, 16, 147–168. [Google Scholar] [CrossRef] [Green Version]

- Pellegrini, L.; Gerlagh, R. Corruption, democracy, and environmental policy: An empirical contribution to the debate. J. Environ. Dev. 2006, 15, 332–354. [Google Scholar] [CrossRef]

- Arellano, M.; Bover, O. Another look at the instrumental variable estimation of error-component models. J. Econom. 1995, 68, 29–52. [Google Scholar] [CrossRef] [Green Version]

- Blundell, R.; Bond, S. Initial conditions and moment restrictions in dynamic panel data models. J. Econom. 1998, 87, 115–143. [Google Scholar] [CrossRef] [Green Version]

- Roodman, D. A note on the theme of too many instruments. Oxf. Bull. Econ. Stat. 2009, 71, 135–158. [Google Scholar] [CrossRef]

- Windmeijer, F. A finite sample correction for the variance of linear efficient two-step GMM estimators. J. Econom. 2005, 126, 25–51. [Google Scholar] [CrossRef]

- Powell, D.; Wagner, J. The exporter productivity premium along the productivity distribution: Evidence from quantile regression with nonadditive firm fixed effects. Rev. World Econ. 2014, 150, 763–785. [Google Scholar] [CrossRef]

- Powell, D. Quantile Regression with Nonadditive Fixed Effects. Empir.Econ. 2022, 1–17. [Google Scholar] [CrossRef]

- Cole, M.A. Corruption, income and the environment: An empirical analysis. Ecol. Econ. 2007, 62, 63–647. [Google Scholar] [CrossRef]

| EPS | trade | trade_N | trade_S | export_N | export_S | import_N | import_S | FDI | GDP Per Capita | Internet Use | Control of Corruption | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Panel A: Summary statistics | ||||||||||||

| obs. | 258 | 260 | 260 | 260 | 260 | 260 | 260 | 260 | 263 | 264 | 262 | 231 |

| mean | 1.649 | 3.574 | 3.265 | 2.088 | 2.568 | 1.302 | 2.543 | 1.442 | 1.179 | 9.935 | 2.314 | 1.022 |

| std.dev. | 0.96 | 0.695 | 0.752 | 0.771 | 0.799 | 0.809 | 0.767 | 0.794 | 0.993 | 1.05 | 2.447 | 0.969 |

| min | 0.333 | 1.6 | 1.166 | 0.556 | 0.643 | −0.271 | −0.033 | −0.214 | −2.34 | 6.381 | −8.711 | −1.176 |

| max | 4.028 | 5.164 | 4.998 | 3.915 | 4.338 | 3.283 | 4.27 | 3.216 | 4.062 | 11.416 | 4.561 | 2.436 |

| Panel B: Pairwise correlations | ||||||||||||

| EPS | 1 | |||||||||||

| trade | 0.621 * | 1 | ||||||||||

| trade_N | 0.577 * | 0.577 * | 1 | |||||||||

| trade_S | 0.573 * | 0.573 * | 0.573 * | 1 | ||||||||

| export_N | 0.540 * | 0.540 * | 0.540 * | 0.581 * | 1 | |||||||

| export_S | 0.529 * | 0.529 * | 0.529 * | 0.960 * | 0.960 * | 1 | ||||||

| import_N | 0.582 * | 0.582 * | 0.582 * | 0.599 * | 0.599 * | 0.599 * | 1 | |||||

| import_S | 0.570 * | 0.570 * | 0.570 * | 0.972 * | 0.972 * | 0.972 * | 0.588 * | 1 | ||||

| FDI | 0.244 * | 0.244 * | 0.244 * | 0.182 * | 0.182 * | 0.182 * | 0.511 * | 0.511 * | 1 | |||

| GDP per capita | 0.572 * | 0.572 * | 0.572 * | 0.075 | 0.075 | 0.075 | 0.413 * | 0.413 * | 0.413 * | 1 | ||

| internet use | 0.549 * | 0.549 * | 0.549 * | 0.403 * | 0.403 * | 0.403 * | 0.343 * | 0.343 * | 0.343 * | 0.343 * | 1 | |

| control of corruption | 0.505 * | 0.505 * | 0.505 * | −0.124 | −0.124 | −0.124 | 0.382 * | 0.382 * | 0.382 * | 0.382 * | 0.382 * | 1 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| environmental policy stringency t−1 | 0.166 *** | 0.113 *** | 0.156 *** | 0.271 *** | 0.630 *** |

| (0.040) | (0.038) | (0.051) | (0.044) | (0.070) | |

| trade | 1.642 *** | 1.652 *** | 1.698 *** | 1.451 *** | 0.360 *** |

| (0.118) | (0.107) | (0.121) | (0.116) | (0.122) | |

| GDP per capita t−1 | −2.521 | −2.571 | −2.916 * | −0.529 | −1.476 |

| (1.644) | (1.633) | (1.617) | (1.159) | (1.178) | |

| squared GDP per capita t−1 | 0.145 * | 0.152 * | 0.169 ** | 0.061 | 0.080 |

| (0.082) | (0.080) | (0.079) | (0.058) | (0.060) | |

| FDI t−1 | −0.103 *** | −0.092 *** | −0.066 *** | −0.090 *** | |

| (0.016) | (0.028) | (0.022) | (0.031) | ||

| internet use t−1 | −0.024 | −0.049 | −0.025 | ||

| (0.015) | (0.031) | (0.022) | |||

| control of corruption t−1 | −0.161 | −0.005 | |||

| (0.133) | (0.054) | ||||

| period dummies | yes | ||||

| constant | 6.006 | 5.999 | 7.514 | −4.588 | 4.511 |

| (8.215) | (8.327) | (8.195) | (5.687) | (5.607) | |

| instrument count | 21 | 22 | 22 | 23 | 23 |

| AR(1) | −1.76 * | −1.74 * | −1.74 * | −2.42 ** | −2.91 *** |

| [0.078] | [0.081] | [0.081] | [0.016] | [0.004] | |

| AR(2) | −1.58 | −1.39 | −1.45 | −1.42 | −1.19 |

| [0.115] | [0.166] | [0.148] | [0.155] | [0.234] | |

| Hansen J | 21.33 | 20.98 | 0.154 | 9.59 | 15.37 |

| [0.166] | [0.179] | [20.50] | [0.188] | [0.285] | |

| obs.: N × T (N) | 207 (27) | 207 (27) | 207 (27) | 182 (27) | 182 (27) |

| Quantile | ||||||

|---|---|---|---|---|---|---|

| GMM | 10th | 25th | 50th | 75th | 90th | |

| environmental policy stringency t−1 | 0.630 *** | 0.795 *** | 0.688 *** | 0.690 *** | 0.525 *** | 0.515 *** |

| (0.070) | (0.022) | (0.004) | (0.022) | (0.017) | (0.004) | |

| trade | 0.360 ** | 0.135 *** | 0.088 *** | 0.156 *** | 0.287 *** | −0.042 *** |

| (0.152) | (0.013) | (0.028) | (0.046) | (0.075) | (0.007) | |

| GDP per capita t−1 | −1.476 | −0.668 *** | 0.656 *** | −1.271 *** | −1.313 *** | 0.801 *** |

| (1.178) | (0.207) | (0.055) | (0.393) | (0.212) | (0.041) | |

| squared GDP per capita t−1 | 0.080 | 0.039 *** | −0.034 *** | 0.067 *** | 0.055 *** | −0.040 *** |

| (0.061) | (0.010) | (0.003) | (0.019) | (0.013) | (0.002) | |

| FDI t−1 | −0.090 ** | 0.015 * | 0.006 ** | 0.070 *** | 0.045 *** | 0.003 |

| (0.038) | (0.008) | (0.003) | (0.009) | (0.004) | (0.004) | |

| internet use t−1 | −0.025 | −0.242 *** | −0.079 *** | −0.032 *** | 0.234 *** | 0.072 *** |

| (0.022) | (0.060) | (0.002) | (0.004) | (0.012) | (0.003) | |

| control of corruption t−1 | −0.005 | 0.119 *** | 0.160 *** | 0.030 ** | 0.108 ** | 0.101 *** |

| (0.054) | (0.014) | (0.004) | 0.690 *** | (0.047) | (0.007) | |

| constant | 4.511 | |||||

| (5.607) | ||||||

| instrument count | 23 | |||||

| AR(1) | −2.91 *** | |||||

| [0.004] | ||||||

| AR(2) | −1.19 | |||||

| [0.234] | ||||||

| Hansen J test statistic | 15.37 | |||||

| [0.285] | ||||||

| Obs.: N × T (N) | 182 (27) | 182 (27) | 182 (27) | 182 (27) | 182 (27) | 182 (27) |

| Quantile | ||||||

|---|---|---|---|---|---|---|

| GMM | 10th | 25th | 50th | 75th | 90th | |

| environmental policy stringency t−1 | 0.233 *** | 0.770 *** | 0.693 *** | 0.661 *** | 0.633 *** | 0.544 *** |

| (0.053) | (0.014) | (0.007) | (0.005) | (0.004) | (0.003) | |

| trade with advanced countries | −0.193 ** | 0.165 *** | −0.048 *** | −0.146 *** | −0.042 *** | 0.017 *** |

| (0.091) | (0.003) | (0.013) | (0.005) | (0.005) | (0.003) | |

| trade with developing countries | 1.245 *** | −0.092 *** | 0.098 *** | 0.194 *** | 0.083 *** | −0.059 *** |

| (0.086) | (0.008) | (0.008) | (0.005) | (0.007) | (0.003) | |

| GDP per capita t−1 | −4.978 *** | −0.942 ** | −0.520 *** | −1.911 *** | −0.659 *** | 0.749 *** |

| (1.561) | (0.384) | (0.106) | (0.117) | (0.062) | (0.024) | |

| squared GDP per capita t−1 | 0.262 *** | 0.050 *** | 0.025 *** | 0.096 *** | 0.026 *** | −0.036 *** |

| (0.080) | (0.019) | (0.006) | (0.006) | (0.003) | (0.001) | |

| FDI t−1 | 0.069 ** | 0.032 *** | 0.051 *** | 0.081 *** | 0.049 *** | 0.020 *** |

| (0.029) | (0.012) | (0.002) | (0.005) | (0.003) | (0.003) | |

| internet use t−1 | −0.071 *** | −0.141 *** | −0.098 *** | −0.024 *** | 0.061 *** | 0.086 *** |

| (0.022) | (0.015) | (0.002) | (0.002) | (0.003) | (0.003) | |

| control of corruption t−1 | 0.199 ** | 0.070 *** | 0.086 *** | 0.090 *** | 0.053 *** | 0.059 *** |

| (0.086) | (0.014) | (0.005) | (0.015) | (0.012) | (0.003) | |

| constant | 22.725 *** | |||||

| (7.719) | ||||||

| instrument count | 25 | |||||

| AR(1) | −2.33 ** | |||||

| [0.020] | ||||||

| AR(2) | −0.91 | |||||

| [0.363] | ||||||

| Hansen J test statistic | 18.11 | |||||

| [0.317] | ||||||

| Obs.: N × T (N) | 182 (27) | 182 (27) | 182 (27) | 182 (27) | 182 (27) | 182 (27) |

| Quantile | ||||||

|---|---|---|---|---|---|---|

| GMM | 10th | 25th | 50th | 75th | 90th | |

| Panel A: Exports | ||||||

| environmental policy stringency t−1 | 0.603 *** | 0.811 *** | 0.664 *** | 0.679 *** | 0.471 *** | 0.518 *** |

| (0.075) | (0.007) | (0.035) | (0.029) | (0.012) | (0.009) | |

| exports to advanced countries | −0.346 *** | 0.150 *** | −0.055 ** | −0.273 *** | −0.077 *** | 0.020 *** |

| (0.118) | (0.030) | (0.026) | (0.094) | (0.008) | (0.003) | |

| exports to developing countries | 0.587 *** | −0.056 ** | 0.064 *** | 0.243 *** | 0.235 *** | −0.133 *** |

| (0.112) | (0.025) | (0.024) | (0.060) | (0.012) | (0.003) | |

| instrument count | 24 | |||||

| AR(1) | −3.17 | |||||

| [0.002] | ||||||

| AR(2) | −1.45 | |||||

| [0.148] | ||||||

| Hansen J test statistic | 20.15 | |||||

| [0.166] | ||||||

| Obs.: N × T (N) | 182 (27) | 182 (27) | 182 (27) | 182 (27) | 182 (27) | 182 (27) |

| Panel B: Imports | ||||||

| environmental policy stringency t−1 | 0.666 *** | 0.769 *** | 0.710 *** | 0.756 *** | 0.416 *** | 0.469 *** |

| (0.175) | (0.001) | (0.002) | (0.007) | (0.037) | (0.015) | |

| imports from advanced countries | −0.333 ** | 0.129 *** | −0.040 *** | −0.132 *** | −0.063 *** | 0.022 ** |

| (0.129) | (0.001) | (0.009) | (0.007) | (0.016) | (0.011) | |

| imports from developing countries | 0.736 *** | −0.029 *** | 0.017 *** | 0.200 *** | 0.092 * | −0.071 *** |

| (0.156) | (0.001) | (0.005) | (0.016) | (0.049) | (0.014) | |

| instrument count | 24 | |||||

| AR(1) | −2.13 ** | |||||

| [0.033] | ||||||

| AR(2) | −1.20 | |||||

| [0.230] | ||||||

| Hansen J test statistic | 17.78 | |||||

| [0.166] | ||||||

| Obs.: N × T (N) | 182 (27) | 182 (27) | 182 (27) | 182 (27) | 182 (27) | 182 (27) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, D.-H.; Lin, S.-C. Trade Openness and Environmental Policy Stringency: Quantile Evidence. Sustainability 2022, 14, 3590. https://doi.org/10.3390/su14063590

Kim D-H, Lin S-C. Trade Openness and Environmental Policy Stringency: Quantile Evidence. Sustainability. 2022; 14(6):3590. https://doi.org/10.3390/su14063590

Chicago/Turabian StyleKim, Dong-Hyeon, and Shu-Chin Lin. 2022. "Trade Openness and Environmental Policy Stringency: Quantile Evidence" Sustainability 14, no. 6: 3590. https://doi.org/10.3390/su14063590