The Sustainability of Market Orientation from a Dynamic Perspective: The Mediation of Dynamic Capability and the Moderation of Error Management Climate

Abstract

:1. Introduction

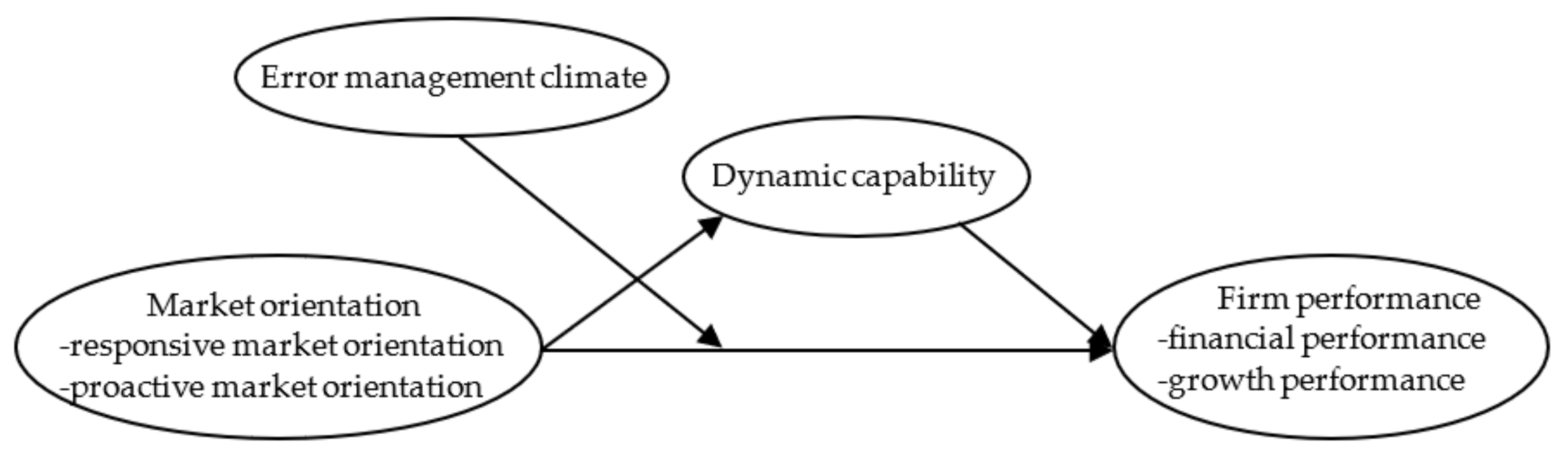

2. Theoretical Basis and Hypotheses

2.1. Market Orientation and Firm Performance

2.2. The Mediating Role of Dynamic Capability

2.3. The Moderating Effect of Error Management Climate

3. Research Design

3.1. Samples and Procedures

3.2. Variable Measures

3.3. Common Method Bias

4. Results

4.1. Descriptive Statistics and Correlations

4.2. Direct Effect and Mediating Effect Test

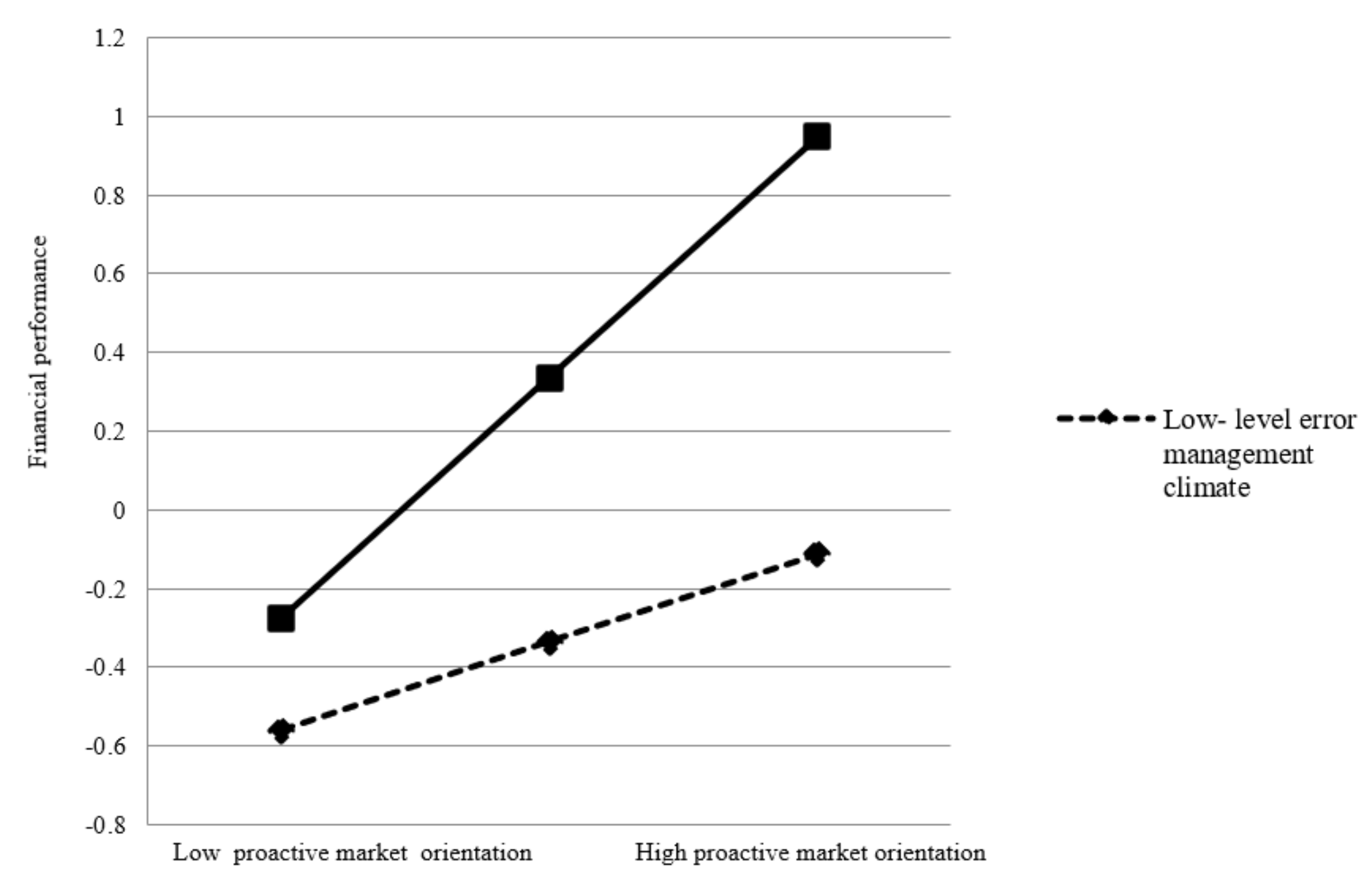

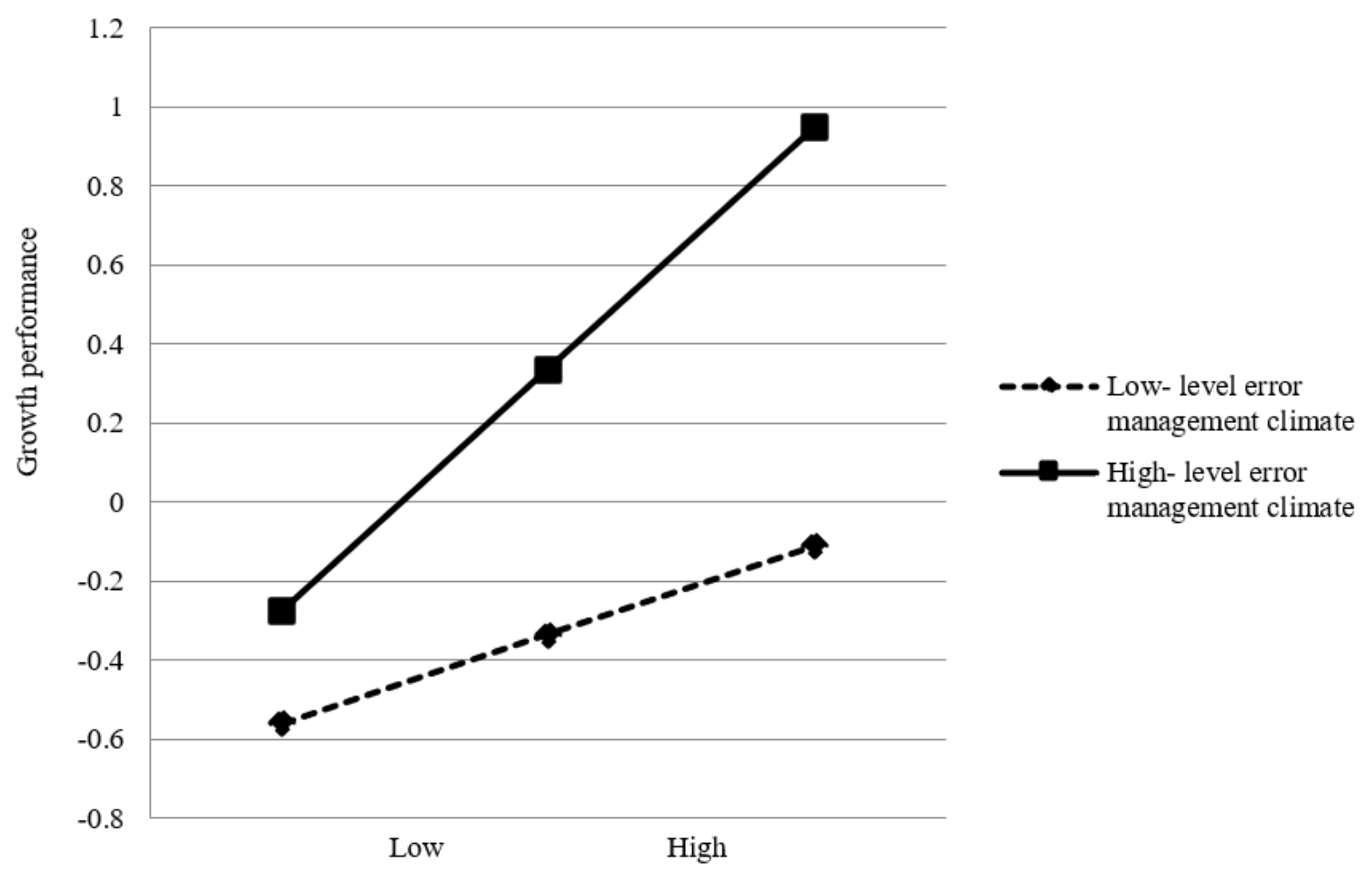

4.3. Moderating Effect Test

5. Conclusions and Discussion

5.1. Research Findings

5.2. Discussion and Theory Contributions

5.3. Practical Contribution

5.4. Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Questionnaire

Appendix A.1. Responsive Market Orientation

- We constantly monitor our level of commitment and orientation to serving customer needs.

- We measure customer satisfaction systematically and frequently.

- Our strategy for competitive advantage is based on our understanding of customers’ needs.

- Data on customer satisfaction are disseminated at all levels in this business unit on a regular basis.

Appendix A.2. Responsive Market Orientation

- We help our customers anticipate developments in their markets.

- We continuously try to discover additional needs of our customers of which they are unaware.

- We incorporate solutions to unarticulated customer needs in our new products and services.

- We search for opportunities in areas where customers have a difficult time expressing their needs.

Appendix A.3. Dynamic Capability

- We understand new information and knowledge very quickly.

- We can quickly identify the changes that new information and new knowledge may bring to our company.

- We can quickly incorporate new technologies that have been digested into other technologies.

- We can quickly develop products or services using digested new technologies.

- The coordination between different departments in our company is good.

- We can quickly integrate and share new information and knowledge within our company.

- We can quickly integrate new information and new knowledge to apply new products or new market development.

- We can successfully adjust or change their strategies as the situation changes.

- Our company has a culture that encourages innovation and a management system in place.

- The managers of our enterprise have a deep insight into the future development of our company.

- We can apply knowledge from different sources to new product or service development quickly and effectively.

- Our company are quick to incorporate market changes into new products or services.

- We can seek new profit growth in products or services.

Appendix A.4. Error Management Climate

- We think mistakes help us improve our work process.

- We think our mistakes point to areas where we can improve.

- When it comes to mastering a task, we can learn a lot from their mistakes.

- When we can’t correct our mistakes, we turn to our colleagues for help.

- If our colleagues have made mistakes that have prevented them from completing their work, they can turn to others for help.

- When colleagues made a mistake, they can turn to others for advices.

- When I made a mistake, I will tell others so they don’t make the same mistake.

- After the error occurs, we conduct a full analysis of the error.

- If there is an error, we try to analyze the cause of the error.

- In our organization, we think a lot about how to avoid same mistakes.

- In our organization, we are thinking more about how to avoid mistakes.

Appendix A.5. Financial Performance

- Compared with other companies in the industry, our company has a high net profit margin.

- Compared with other companies in the industry, our company has a good market position.

- Compared with other companies in the industry, our company has a good return on investment.

- Compared with other companies in the industry, our company has a good return on sales.

Appendix A.6. Growth Performance

- Compared with other companies in the industry, our company’s sales are growing faster.

- Compared with other companies in the industry, our company’s net income is growing at a faster rate.

- Compared with other companies in the industry, our company’s market share is growing faster.

- Compared with other companies in the industry, the growth rate of the number of employees in our company is faster.

References

- Taghvaee, S.; Talebi, K.; Mauer, R. Market orientation in uncertain environments: The enabling role of effectuation orientation in new product development. Eur. Manag. J. 2022; in press. [Google Scholar] [CrossRef]

- Kumar, V.; Jones, E.; Venkatesan, R.; Leone, R.P. Is Market Orientation a Source of Sustainable Competitive Advantage or Simply the Cost of Competing. J. Mark. 2011, 75, 16–30. [Google Scholar] [CrossRef]

- Tinoco, F.F.O.; Hernández-Espallardo, M.; Rodriguez-Orejuela, A. Nonlinear and complementary effects of responsive and proactive market orientation on firms’ competitive advantage. Asia Pac. J. Market. Logist. 2019, 32, 841–859. [Google Scholar] [CrossRef]

- Na, Y.K.; Kang, S.; Jeong, H.Y. The Effect of Market Orientation on Performance of Sharing Economy Business: Focusing on Marketing Innovation and Sustainable Competitive Advantage. Sustainability 2019, 11, 729. [Google Scholar] [CrossRef] [Green Version]

- Länsiluoto, A.; Joensuu-Salo, S.; Varamäki, E.; Viljamaa, A.; Sorama, K. Market Orientation and Performance Measurement System Adoption Impact on Performance in SMEs. J. Small Bus. Manag. 2019, 57, 1027–1043. [Google Scholar] [CrossRef]

- Hernandez-Linares, R.; Kellermanns, F.W.; Lopez-Fernandez, M.C. Dynamic capabilities and SME performance: The moderating effect of market orientation. J. Small Bus. Manag. 2021, 59, 162–195. [Google Scholar] [CrossRef]

- Abbu, H.R.; Gopalakrishna, P. Synergistic effects of market orientation implementation and internalization on firm performance: Direct marketing service provider industry. J. Bus. Res. 2021, 125, 851–863. [Google Scholar] [CrossRef]

- Aydin, H. Market orientation and product innovation: The mediating role of technological capability. Eur. J. Innov. Manag. 2020, 24, 1233–1267. [Google Scholar] [CrossRef]

- Murray, J.Y.; Gao, G.Y.; Kotabe, M. Market orientation and performance of export ventures: The process through marketing capabilities and competitive advantages. J. Acad. Mark. Sci. 2011, 39, 252–269. [Google Scholar] [CrossRef]

- Narver, J.C.; Slater, S.F.; Maclachlan, D.L. Responsive and Proactive Market Orientation and New-Product Success. J. Prod. Innov. Manag. 2004, 21, 334–347. [Google Scholar] [CrossRef]

- Jaeger, N.A.; Zacharias, N.A.; Brettel, M. Nonlinear and dynamic effects of responsive and proactive market orientation: A longitudinal investigation. Int. J. Res. Mark. 2016, 33, 767–779. [Google Scholar] [CrossRef]

- Bodlaj, M.; Cater, B. Responsive and proactive market orientation in relation to SMEs’ export venture performance: The mediating role of marketing capabilities. J. Bus. Res. 2022, 138, 256–265. [Google Scholar] [CrossRef]

- Kohli, A.K.; Jaworski, B.J. Market Orientation: The Construct, Research Propositions, and Managerial Implications. J. Mark. 1990, 54, 1–18. [Google Scholar] [CrossRef] [Green Version]

- Narver, J.C.; Slater, S.F. The effect of a market orientation on business profitability. J. Mark. 1990, 54, 20–35. [Google Scholar] [CrossRef]

- Van Raaij, E.M.; Stoelhorst, J.W. The implementation of a market orientation A review and integration of the contributions to date. Eur. J. Market. 2008, 42, 1265–1293. [Google Scholar] [CrossRef]

- Gupta, V.K.; Atav, G.; Dutta, D.K. Market orientation research: A qualitative synthesis and future research agenda. Rev. Manag. Sci. 2019, 13, 649–670. [Google Scholar] [CrossRef]

- Slater, S.F.; Narver, J.C. Market Orientation and the Learning Organization. J. Mark. 1995, 59, 63–74. [Google Scholar] [CrossRef]

- Kasim, A.; Ekinci, Y.; Altinay, L. Impact of market orientation, organizational learning and market conditions on small and medium-size hospitality enterprises. J. Hosp. Market. Manag. 2018, 27, 855–875. [Google Scholar] [CrossRef] [Green Version]

- Cho, Y.H.; Lee, J.H. A Study on the Effects of Entrepreneurial Orientation and Learning Orientation on Financial Performance: Focusing on Mediating Effects of Market Orientation. Sustainability 2020, 12, 4594. [Google Scholar] [CrossRef]

- Yang, D.; Wei, Z.; Shi, H.; Zhao, J. Market orientation, strategic flexibility and business model innovation. J. Bus. Ind. Mark. 2020, 35, 771–784. [Google Scholar] [CrossRef]

- Ho, K.L.P.; Nguyen, C.N.; Adhikari, R.; Miles, M.P.; Bonney, L. Exploring market orientation, innovation, and financial performance in agricultural value chains in emerging economies. J. Innov. Knowl. 2018, 3, 154–163. [Google Scholar] [CrossRef]

- Najafi-Tavani, S.; Sharifi, H.; Najafi-Tavani, Z. Market orientation, marketing capability, and new product performance: The moderating role of absorptive capacity. J. Bus. Res. 2016, 69, 5059–5064. [Google Scholar] [CrossRef] [Green Version]

- Ferreira, J.; Coelho, A.; Moutinho, L. Dynamic capabilities, creativity and innovation capability and their impact on competitive advantage and firm performance: The moderating role of entrepreneurial orientation. Technovation 2020, 92–93, 102061. [Google Scholar] [CrossRef]

- Teece, D. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef] [Green Version]

- Narver, J.C.; Slater, S.F. Additional Thoughts on the Measurement of Market Orientation: A Comment on Deshpande and Farley. J. Mark. -Focused Manag. 1998, 2, 233–236. [Google Scholar]

- Wang, Y.; Zeng, D.; Benedetto, C.A.; Song, M. Environmental determinants of responsive and proactive market orientations. J. Bus. Ind. Mark. 2013, 28, 565–576. [Google Scholar] [CrossRef]

- Hobfoll, S.E.; Halbesleben, J.; Neveu, J.P.; Westman, M. Conservation of Resources in the Organizational Context: The Reality of Resources and Their Consequences. Annu. Rev. Organ. Psychol. Organ. Behav. 2018, 5, 103–128. [Google Scholar] [CrossRef] [Green Version]

- Wilden, R.; Gudergan, S.; Lings, I. The interplay and growth implications of dynamic capabilities and market orientation. Ind. Mark. Manag. 2018, 83, 21–30. [Google Scholar] [CrossRef]

- Barney, J.B. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 3–10. [Google Scholar] [CrossRef]

- Voola, R.; O’Cass, A. Implementing competitive strategies: The role of responsive and proactive market orientations. Eur. J. Market. 2010, 8, 245–266. [Google Scholar] [CrossRef]

- Hult, G.T.M.; Ketchen, D.J.; Slater, S.F. Market orientation and performance: An integration of disparate approaches. Strateg. Manag. J. 2005, 26, 1173–1181. [Google Scholar] [CrossRef]

- Nangpiire, C.; Bangniyel, P. Entrepreneurial Leadership, Market Orientation, and Firm Performance. Manag. Stud. 2019, 3, 202–213. [Google Scholar]

- Sampaio, C.A.F.; Hernandez-Mogollon, J.M.; Rodrigues, R.G. Assessing the relationship between market orientation and business performance in the hotel industry—the mediating role of service quality. J. Knowl. Manag. 2019, 23, 644–663. [Google Scholar] [CrossRef]

- O’Reilly, C.A.; Tushman, M.L. Ambidexterity as a Dynamic Capability: Resolving the Innovator’s Dilemma. Res. Organ. Beh. 2008, 28, 185–206. [Google Scholar] [CrossRef]

- Li, F.; Zhu, Z.D. An Empirical Research on the Entrepreneurial Bricolage and Its Functions: The Mediating Role of Dynamic Capabilities. Chin. J. Manag. 2014, 11, 562–568. (In Chinese) [Google Scholar]

- Durand, R.; Vergne, J.P. The Path of Most Persistence: An Evolutionary Perspective on Path Dependence and Dynamic Capabilities. Organ. Stud. 2011, 32, 365–382. [Google Scholar]

- Fosfuri, A.; Tribo, J.A. Exploring the antecedents of potential absorptive capacity and its impact on innovative performance. Omega-Int. J. Manag. Sci. 2007, 19, 257–289. [Google Scholar]

- Pavlou, P.A.; El Sawy, O.A. Understanding the Elusive Black Box of Dynamic Capabilities. Decis. Sci. 2011, 42, 239–273. [Google Scholar] [CrossRef]

- Ambrosini, V.; Bowman, C.; Collier, N. Dynamic capabilities: An exploration of how firms renew their resource base. Brit. J. Manag. 2010, 20, S9–S24. [Google Scholar] [CrossRef] [Green Version]

- Tsai, W.P. Knowledge transfer in intraorganizational networks: Effects of network position and absorptive capacity on business unit innovation and performance. Acad. Manag. J. 2001, 44, 996–1004. [Google Scholar]

- Artz, K.W.; Norman, P.M.; Hatfield, D.E.; Cardinal, L.B. A Longitudinal Study of the Impact of R&D, Patents, and Product Innovation on Firm Performance. J. Prod. Innov. Manag. 2010, 27, 725–740. [Google Scholar]

- Wilden, R.; Gudergan, S.P. The impact of dynamic capabilities on operational marketing and technological capabilities: Investigating the role of environmental turbulence. J. Acad. Mark. Sci. 2015, 43, 181–199. [Google Scholar] [CrossRef]

- Helfat, C.E.; Peteraf, M.A. Managerial cognitive capabilities and the microfoundations of dynamic capabilities. Strateg. Manag. J. 2015, 36, 831–850. [Google Scholar] [CrossRef]

- Wang, Z.M.; Hong, Z.Q. Linking error management climate to organizational effectiveness: An empirical evidence. J. Zhejiang Univ. Humanit. Soc. Sci. 2000, 30, 111–116. (In Chinese) [Google Scholar]

- Van Dyck, C.; Frese, M.; Baer, M.; Sonnentag, S. Organizational Error Management Culture and Its Impact on Performance: A Two-Study Replication. J. Appl. Psychol. 2005, 90, 1228–1240. [Google Scholar] [CrossRef] [PubMed]

- Guchait, P.; Pasamehmetoglu, A.; Madera, J. Error management culture: Impact on cohesion, stress, and turnover intentions. Serv. Ind. J. 2016, 36, 124–141. [Google Scholar] [CrossRef]

- Gronewold, U.; Gold, A.; Salterio, S.E. Reporting Self-Made Errors: The Impact of Organizational Error-Management Climate and Error Type. J. Bus. Ethics 2013, 117, 189–208. [Google Scholar] [CrossRef]

- Zhang, J.; Duan, Y.L. An empirical study on the impact of market orientation equilibrium on product innovation performance of manufacturing firms. Manag. World 2010, 12, 119–130. (In Chinese) [Google Scholar]

- Hou, J.J. Toward a research model of market orientation and dynamic capabilities. Soc. Behav. Pers. 2008, 36, 1251–1268. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; MacKenzie, S.B.; Podsakoff, N.P. Sources of method bias in social science research and recommendations on how to control it. Annu. Rev. Psychol. 2012, 63, 539–569. [Google Scholar] [CrossRef] [Green Version]

- Podsakoff, P.M.; Organ, D.W. Self-reports in organizational research: Problems and prospects. J. Manag. 1986, 12, 531–544. [Google Scholar] [CrossRef]

- MacKinnon, D.P.; Krull, J.L.; Lockwood, C.M. Equivalence of the mediation, confounding, and suppression effect. Prev. Sci. 2000, 1, 173–181. [Google Scholar] [CrossRef]

- MacKinnon, D.P.; Lockwood, C.M.; Hoffman, J.M.; West, S.G.; Sheets, V. A comparison of methods to test mediation and other intervening variable effects. Psychol. Methods 2002, 7, 83–104. [Google Scholar] [CrossRef]

- Shrout, P.E.; Bolger, N. Mediation in experimental and nonexperimental studies: New procedures and recommendations. Psychol. Methods 2002, 7, 422–445. [Google Scholar] [CrossRef]

- Acosta, A.S.; Crespo, A.H.; Agudo, J.C. Effect of market orientation, network capability and entrepreneurial orientation on international performance of small and medium enterprises (SMEs). Int. Bus. Rev. 2018, 27, 1128–1140. [Google Scholar] [CrossRef]

- Gligor, D.; Gligor, N.; Maloni, M. The impact of the supplier’s market orientation on the customer market orientation-performance relationship. Int. J. Prod. Econ. 2019, 216, 81–93. [Google Scholar] [CrossRef]

- Chuang, S.H. Facilitating the chain of market orientation to value co-creation: The mediating role of e-marketing adoption. J. Destin. Mark. Manag. 2018, 7, 39–49. [Google Scholar] [CrossRef]

- Morgan, N.A.; Vorhies, D.W.; Mason, C.H. Market orientation, marketing capabilities, and firm performance. Strateg. Manag. J. 2009, 30, 909–920. [Google Scholar] [CrossRef]

- Barreto, I. Dynamic Capabilities: A Review of Past Research and an Agenda for the Future. J. Manag. 2010, 36, 256–280. [Google Scholar] [CrossRef] [Green Version]

- Fainshmidt, S.; Wenger, L.; Pezeshkan, A.; Mallon, M.R. When do Dynamic Capabilities Lead to Competitive Advantage? The Importance of Strategic Fit. J. Manag. Stud. 2019, 55, 758–787. [Google Scholar] [CrossRef]

| Variables | M | SD | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|---|---|

| 1 RMO | 4.160 | 0.567 | 0.675 | |||||

| 2 PMO | 3.960 | 0.553 | 0.524 ** | 0.647 | ||||

| 3 DC | 4.060 | 0.489 | 0.684 ** | 0.655 ** | 0.637 | |||

| 4 EMC | 4.054 | 0.486 | 0.542 ** | 0.497 ** | 0.656 ** | 0.653 | ||

| 5 FP | 3.813 | 0.686 | 0.355 ** | 0.424 ** | 0.501 ** | 0.396 ** | 0.746 | |

| 6 GP | 3.641 | 0.715 | 0.293 ** | 0.410 ** | 0.507 ** | 0.380 ** | 0.717 ** | 0.674 |

| Variables | Firm Performance | |||||

|---|---|---|---|---|---|---|

| Financial Performance | Growth Performance | |||||

| M1 | M2 | M3 | M4 | M5 | M6 | |

| Firm ages | −0.106 | −0.065 | −0.104 | −0.165 | −0.126 * | −0.163 * |

| Firm size | 0.242 ** | 0.253 ** | 0.268 ** | 0.224 * | 0.226 ** | 0.283 ** |

| RMO | 0.315 ** | 0.265 ** | ||||

| PMO | 0.400 ** | 0.388 ** | ||||

| DC | 0.482 ** | 0.493 ** | ||||

| R2 | 0.164 | 0.228 | 0.301 | 0.120 | 0.202 | 0.295 |

| Adjust R2 | 0.157 | 0.221 | 0.295 | 0.122 | 0.195 | 0.285 |

| F-value | 21.772 ** | 32.738 ** | 47.637 ** | 15.126 ** | 28.031 ** | 46.355 ** |

| Variables | Dynamic Capability | Firm Performance | ||||

|---|---|---|---|---|---|---|

| Financial Performance | Growth Performance | |||||

| M7 | M8 | M9 | M10 | M11 | M12 | |

| Firm ages | −0.004 | 0.063 | −0.104 | −0.090 | −0.163 * | −0.152 * |

| Firm size | −0.064 | −0.005 | 0.274 ** | 0.255 ** | 0.262 ** | 0.228 ** |

| RMO | 0.699 ** | −0.042 | −0.151 * | |||

| PMO | 0.656 ** | 0.147 * | 0.112 | |||

| DC | 0.510 ** | 0.386 ** | 0.594 ** | 0.420 ** | ||

| R2 | 0.472 | 0.432 | 0.302 | 0.313 | 0.307 | 0.302 |

| Adjust R2 | 0.462 | 0.427 | 0.293 | 0.305 | 0.298 | 0.294 |

| F-value | 98.914 ** | 84.245 ** | 35.770 ** | 37.714 ** | 36.605 ** | 35.859 ** |

| Variables | Firm Performance | |||||||

|---|---|---|---|---|---|---|---|---|

| Financial Performance | Growth Performance | |||||||

| M13 | M14 | M15 | M16 | M17 | M18 | M19 | M20 | |

| Firm ages | −0.118 * | −0.119 * | −0.085 | −0.081 | −0.180 ** | −0.180 ** | −0.146 * | −0.142 * |

| Firm size | 0.237 ** | 0.238 ** | 0.239 ** | 0.236 ** | 0.220 ** | 0.220 ** | 0.212 ** | 0.209 ** |

| RMO | 0.163 ** | −0.209 | 0.097 | −0.308 | ||||

| PMO | 0.290 ** | −0.288 | 0.277 ** | −0.285 | ||||

| EMC | 0.285 ** | −0.081 | 0.225 ** | −0.310 | 0.314** | −0.085 | 0.226 ** | −0.294 |

| Int_1: RMO × EMC | 0.120 | |||||||

| Int_2: PMO × EMC | 0.187 * | 0.136 | 0.190 * | |||||

| R2 | 0.221 | 0.225 | 0.265 | 0.276 | 0.189 | 0.193 | 0.240 | 0.249 |

| Adjust R2 | 0.212 | 0.213 | 0.257 | 0.265 | 0.180 | 0.181 | 0.231 | 0.238 |

| F−value | 23.521 ** | 19.109 ** | 29.905 ** | 25.128 ** | 19.334 ** | 15.804 ** | 26.091 ** | 21.936 ** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, Y.; Xue, X.; Guo, H. The Sustainability of Market Orientation from a Dynamic Perspective: The Mediation of Dynamic Capability and the Moderation of Error Management Climate. Sustainability 2022, 14, 3763. https://doi.org/10.3390/su14073763

Wang Y, Xue X, Guo H. The Sustainability of Market Orientation from a Dynamic Perspective: The Mediation of Dynamic Capability and the Moderation of Error Management Climate. Sustainability. 2022; 14(7):3763. https://doi.org/10.3390/su14073763

Chicago/Turabian StyleWang, Yi, Xianfang Xue, and Han Guo. 2022. "The Sustainability of Market Orientation from a Dynamic Perspective: The Mediation of Dynamic Capability and the Moderation of Error Management Climate" Sustainability 14, no. 7: 3763. https://doi.org/10.3390/su14073763

APA StyleWang, Y., Xue, X., & Guo, H. (2022). The Sustainability of Market Orientation from a Dynamic Perspective: The Mediation of Dynamic Capability and the Moderation of Error Management Climate. Sustainability, 14(7), 3763. https://doi.org/10.3390/su14073763