1. Introduction

The need for energy storage systems has increased as countries are begining to utilize more renewable energy technologies. Energy storage eliminates the need for synchronizing generation and demand. It becomes essential at high penetration of renewable energy resources. Moreover, the ability to store energy for later use is imperative in a society that relies heavily on energy for several daily activities. Batteries, in particular, are a very disruptive technology, enabling higher renewable energy penetration in the grid, increasing the resiliency of the grid, and allowing demand response in terms of finding a load to take excess energy. The addition of energy storage, batteries or not, will help smooth the duck curve (a curve that visualizes the difference in electricity demand and the amount of available solar energy throughout the day) and dragon curves (a curve similar to the duck curve but describes the effect that electric vehicle charging patterns might have on electricity use). However, large energy storage and placement of additional storage can be extremely expensive, leading to a challenge of balance between cost and overall benefit of performance.

Finding the proper balance between cost and overall benefit of performance is what stakeholders are most concerned about. While the most obvious solution would be to place energy storage technology everywhere, this relatively new technology comes at a cost encompassing real-estate-related expenses and additional charges that go toward regulation compliance, among other factors. Several publications have been made regarding the financial and regulatory aspects of energy storage. For instance, the Electric Power Research Institute (EPRI) published a white paper, “Electricity Energy Storage Technology Options,” on the applications, costs, and benefits of energy storage, even going as far as doing market analysis on the potential of energy storage deployment [

1]. However, the EPRI paper fails to address the hurdles of policy and regulation to energy storage deployment in New York City, which increase the costs when it comes to compliance. Another paper published by Florida State University’s (FSU) Law Review, “Reconsidering Regulatory Uncertainty: Making a Case for Energy Storage,” briefly discusses the costs while focusing primarily on the regulatory uncertainties that deter energy storage penetration and also providing an overview of how states such as California are able to provide more certainty through Energy Storage Law (AB 2541), requiring targets to be determined [

2]. Similar to California, New York City is a place that also has policies and regulations that are being made or modified to remove such uncertainties but is still lagging behind in the amount of storage deployed. FSU’s paper does not address other factors that play a major role in the barrier to ESSs such as extremely tight building regulations or a limiting environment which forces the developers and owners to spend more for extra modification. In terms of a limiting environment, New York City is densely urbanized in comparison to Arizona and California, leading to stricter zoning and deployment requirements for ESSs, which will be discussed further in the paper. These publications, as well as the study this paper will build off of, focus on either costs or policy and regulation, but do not focus on both at the same time. These studies also seem to address only national and other state-specific examples, specifically forward states. They lack framework for New York City, which this paper is geared toward highlighting, especially since New York State set aggressive energy storage goals and passed legislation to set up financial structures, such as incentives and investment tax credit, to support such goals.

In the United States, costs for energy storage projects can differ tremendously based on the location, policies, regulations, etc., across each state. These highly variable expenses are an important factor in the penetration of energy storage. Costs can slow down or even discourage stakeholders from investing in such technologies. New York, although one of the most aggressive states in the push for renewable integration and energy storage, is still behind other states, such as Arizona and California. Furthermore, with the recent gubernatorial doubling of the energy storage target in New York State to 6000 MW by 2030, intervention from the federal government via infrastructure bill and investment tax credits are crucial to the economic viability and increased deployment to meet climate change objectives. Using the “Levelized Cost of Storage” analysis by Lazard as a basis, this paper gives an insight into determining other “cost adders,” which are additional factors that would increase cost, as well as highlighting policy and regulation points that may also be slowing down New York State from achieving its energy storage goals.

This paper will discuss policy, regulations, costs, and even environmental factors within the context of New York City in addition to the information provided by other works that will be mentioned and credited in the various sections. These topics will also be compared among New York, California, and Arizona as a means of figuring out an approach that New York as whole can take in comparison to those states.

The main contributions of this paper can be categorized as: (1) Critique of the LCOS study that aims to carve out the cost “adders” associated with practical approach to deployment in NYC; (2) Highlight gaps in regulation and risk associated with in-city storage; (3) Offer recommendations to resolving the barriers to deployment based on national best practices, standards, and testimony from industry experts in developing projects in this geographic area.

The rest of the paper is organized as follows: In

Section 2, the LCOS study will be introduced. In

Section 3, the cost adders considered in the context of New York City will be presented along with cost adders that were determined in California and Arizona that are likely to have relevance in New York City. In

Section 4, regulations and policies that were enacted in California and Arizona involving ESS penetration will be analyzed to help provide ideas and comparisons for development of current and future policies and regulations in New York City. In

Section 5, fire code regulations on ownership and safety testing from California and Arizona will be looked at with respect to the current New York City regulations. In

Section 6, the environmental assessment and the added costs for the balance of plant in New York City will be introduced. In

Section 7, provisions made to encourage non-lithium battery technology deployment in California and Arizona will be compared to New York City.

Section 8 will then discuss the current structure of zoning and accommodation for ESSs in New York City. Lastly, the summary of the main conclusions as well as any recommendations for New York City’s approach will be presented in

Section 9.

2. Background of Lazard’s LCOS

The Levelized Cost of Storage (LCOS) analysis conducted by Lazard, a financial advisory company, assesses the costs of a specific selection of energy storage systems across several use cases and their associated operational parameters. The latest iteration, version 6.0, was published in October 2020 [

3]. The key findings of these LCOS analysis reports cover the trend of declining costs of energy storage systems (ESSs) particularly in shorter-duration application, an overview of annually improving project economics, their conclusion on the viability of solar PV, wind and storage, and the trends of battery ESS technology. On the trend of BESS technology, lithium-ion technology costs have continued to decline faster than alternate storage technologies, which is great for higher lithium-ion BESS penetration. However, New York City also seeks to increase the diversity of its ESS profile by including a large variety of non-lithium technologies as well.

This paper seeks to build upon the LCOS analysis’s key findings in the context of New York City and develop an analysis of possible cost adders that is not only unique to New York City but considers additional cost challenges in the form of policies and regulations with respect to the two states that are currently leading in the push for renewable energy and energy storage in the United States, California and Arizona. New York State in recent times has started several initiatives for creating a “greener community,” starting with New York City.

The Climate Leadership and Protection Act (CLCPA) is the overarching law enacted in 2019 for New York State to reduce its contribution to climate change by reducing emissions and using zero-emission electrical power sources [

4]. The primary targets listed by the CLCPA are as follows: an 85% reduction in greenhouse gas (GHG) emissions by 2050, 100% zero-emission electricity by 2040, 70% renewable energy by 2030, 9000 MW of offshore wind by 2035, and 6000 MW of solar by 2025. Acknowledging the grid challenges posed by high renewable energy penetration, the State has also recently doubled its initial goal to deploy 3000 MW of energy storage systems (ESS) to 6000 MW by 2030 [

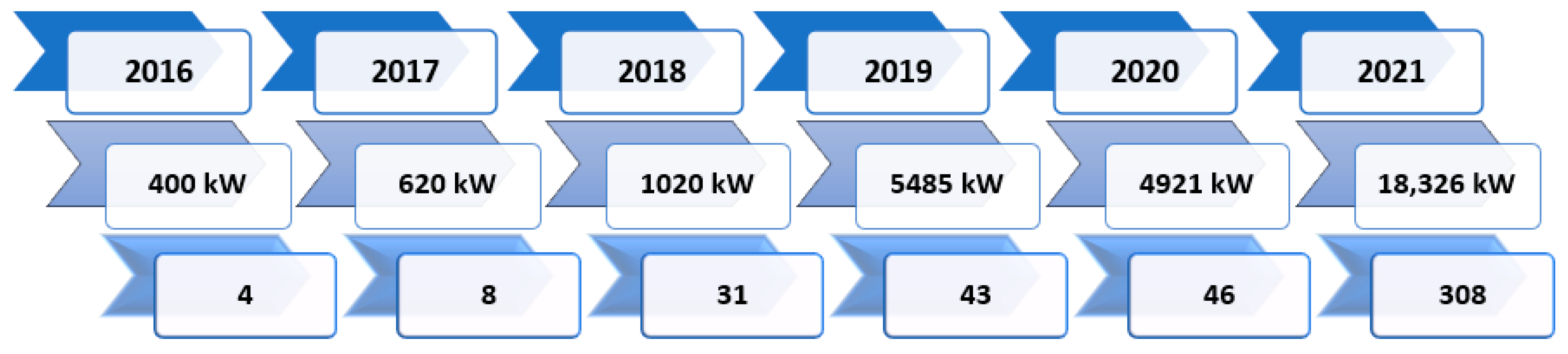

4]. Consolidated Edison data (

Figure 1) show that undecided regulations led to the lack of ESS penetration, and the trend can be seen where over a period of six years (2016–2021), there was an uptick in installed ESS projects as the Department of Buildings and the FDNY relaxed restrictions on ESS deployment [

5]. It is also important to note that the total capacity of installed projects up to and through 2021 was 30,772 kW, all of which were projects less than or equal to 5 MW in size and included a mix of front-of-the-meter (FTM) and behind-the-meter (BTM) installation [

6]. The notable uptick in projects during 2021 is directly correlated to the reprieve from COVID-19 lockdown and incentives received through the state entity NYSERDA and local utility (Con Edison) via their Non-Wires Solutions Solicitations (NWS), thereby lowering the capital cost associated with execution. With such aggressive goals set for New York, it is important to consider the major factors of costs, regulations, and other challenges that stand in the way of ESS penetration in the state, both unique and non-unique to New York.

While the LCOS study is generally useful at the national level, New York requires its own study unique to the state itself to inform stakeholders about the true values and costs. The LCOS study contains an overview of the operational parameters and use cases of commonly deployed ESSs, a summary of the levelized costs of storage based on capacity and energy, a list of revenue potential of use cases, an overview of international case studies, an overview of long-duration storage technologies, and comparisons of the international case studies in each of the previous topics relative to the United States. However, there are characteristics and other important factors that the LCOS does not specifically cover, but will be discussed in the following sections in this paper, that are unique to the city of New York which create uncertainty about ESS deployment. By addressing these uncertainties, stakeholders can feel more confident in investing in and creating policy for higher ESS penetration in New York.

3. Cost Adders to Consider for NYC

Looking at the “forward states,” California and Arizona, gives insight into some of the most important costs to consider for ESS penetration. California is particularly aggressive with a previously set target of 1325 MW energy storage capacity and an approved procurement of 1533 MW as of February 2021, 506 MW of which is already operational [

7]. California had a renewable generation capacity of approximately 26,500 MW installed, as of the latest CEC report published in 2018 [

8]. Arizona has set a target of 15% of retail electricity to be produced through renewable generation, with no exact capacity determined [

9]. However, as of March 2020, Arizona is third among the top solar energy producing states, behind North Carolina (second) and California (first), with a total installed capacity of 3285 MW [

10]. For reasons that will be discussed later in this paper, several Arizona utilities intend to install large capacities of energy storage to accompany the State’s large solar portfolio, one of which intends to install about 850 MW of energy storage capacity by 2025 [

11]. Lessons learned from the project costs in different sectors of these forward states can set the very foundations for a much easier and more understandable approach to ESS penetration in New York City and Westchester, especially considering that more owners are installing PV and ESS hybrid systems. Costs, misinformation and lack of precedence become significant barriers next to policies when introducing new technology. The higher these costs and the uncertainty about where they originate and what the long-term benefits are, the less likely it is for stakeholders to provide the investment and motivation to ensure ESS technology’s prominence in New York City. California and Arizona consist of a mix of urban, suburban, and rural areas with a number of ESS projects across these areas. Although New York City is exclusively a mix of urban and suburban areas, the zoning requirements add another layer of complexity as each lot in NYC is heavily regulated. This paper studies the urban and suburban areas of both the forward states for a comparison with respect to types of locations and lessons learned for ESS deployment. Places such as San Francisco and Los Angeles in California, or Phoenix in Arizona, are similar in structure and location types to New York City when looking past population density and environmental factors. These cities in particular hold great value in our considerations for possessing suburban, urban, and metropolitan equivalents to New York City that already have ESS projects developed within them.

Unique factors that incur additional costs are not necessarily mentioned in the LCOS study despite levelized costs of storage being considered. While these generalizations are great for New York State to make considerations for energy storage, the state government will have to analyze costs that arise from unique issues from within the state such as local regulation compliance or deciding on deployment strategies.

3.1. Lessons Learned from California

One important expense to consider when looking at California’s numerous ESS projects in urban and suburban areas is the cost associated with retrofitting existing buildings in an urban area. The California Energy Commission (CEC) set a mandate for all newly constructed residential and commercial buildings to be zero net energy (ZNE) by 2020 and 2030, respectively [

12]. Even if buildings were to be torn down and rebuilt from the ground up just as in California, this would only incur higher costs. An example in California provided by the CEC’s 2018 “Microgrid Analysis and Case Studies Report” is the 2500 R Midtown Development Project in Sacramento, which is an USD 850,000 affordable housing project consisting of 34 single-family homes built from the ground up with built-in distributed energy resources (DERs) and ESSs along with modifications that increase their efficiency [

13].

Other important costs to consider are ones which arise from compliance with differing local regulations. Across the United States, it should be recalled that all states are typically divided into several municipalities just as the states themselves are divided under the federal government. Local regulations differ between most municipalities regardless of the state, meaning ESSs that would be typically uniformly built must have additional changes made to them to comply with the local regulations that are present in the area which they are to be deployed. These changes, no matter how small, would mean additional costs. California has taken several initiatives to streamline regulations for ESSs, but very few seem to touch on these types of cost adders. They become prominent when placing energy storage across several municipalities.

3.2. Lessons Learned from Arizona

In Arizona, ESS penetration seems to be driven from a bottom-up need, as projects are built first while the policies and regulations follow suit. This is due to the utility companies taking initiatives ahead of the policymakers in Arizona’s government [

14]. Arizona Public Service (APS) and other Arizona utilities currently suffer from overgeneration during oversupply times. This causes DER owners to have to pay utilities to take the excess energy [

15]. The additional cost arises from the high penetration of PV resources with insufficient amounts of available storage on the customer end. As a result, Arizona utilities have proposed a reverse demand response strategy in which end users turn up demand to help relieve the grid of excess energy through non-essential loads and smooth the duck curve at peak production times [

15]. Energy storage is a long-term solution in smoothing the curve as the energy must go somewhere and may defer the addition of upgrades which would be another cost adder, as the suggestion of the reverse demand response strategy is that non-essential functions offtake energy at peak production times [

15]. However, this implies that upgrades which can automatically account for this must be made to the existing systems which can be avoided with the use of ESSs. This is another reason to encourage higher penetration of energy storage in New York City since the use of ESSs allows the city to circumvent the higher costs of installing these upgrades.

4. Adoption of Regulations and Policies for ESSs in the Forward States

The LCOS study lacks any mention or discussion of regulations and policies that have been taken by the forward states. This is a topic of significance to cover since the development of New York City’s regulations and policies is important to ensure the high penetration of energy storage and renewable energy resources. This paper’s intention is to get stakeholders and New York State’s government to consider revamping regulations and policies while taking into account any additional costs as a means to ensure confidence in increased ESS penetration.

4.1. Regulations and Policies in California

Overall, California regulations and policies are streamlined for energy storage as part of their ZNE plan. Most significantly, California’s Assembly Bill (AB) 546 was approved to streamline the actual process for permitting ESSs in 2017 [

16]. However, what is interesting about this bill is that it does not in any way uniformly set the actual regulations between the state government and the municipalities. Instead, it focuses exclusively on enhancing the accessibility of ESS permits by making all documents and forms available electronically, allowing for e-signatures and e-submissions and for the Office of Planning and Research to provide direct guidance on ESS permitting for the municipalities [

17]. Ultimately, the AB 546 seems to only affect the logistical process. This bill does not address the obstacles and costs present with the risk of choice. Without standardized regulations across the state, battery owners will have to spend additional time and funding to comply with differing regulations between each jurisdiction a battery is to be located in. Standardizing ESS regulations across municipalities in New York could potentially save on time and costs by giving the battery owners a defined set of batteries that can be used across all jurisdictions in the state. Of course, New York may also include the use of a bill similar to AB 546 for the logistical side just as California does. Making the process virtual can allow NYC to facilitate an estimated timeline for the approval of certain permits associated with ESS projects.

4.1.1. Fire Codes and Authority Having Jurisdictions on ESSs in California

The California Fire Code (CFC) was updated in 2019 to allow larger capacity sizes and new battery types to help increase the variety and prominence of ESSs in California [

18]. This, along with the previously mentioned AB 546, enables a much clearer and more streamlined process for obtaining an ESS permit. It should also be noted that the CFC 2019’s Chapter 12 Section 1206 on ESSs borrows directly from the International Fire Code (IFC) [

19]. The CFC 2019 uses other codes such as the ANSI standards and NFPA codes which can be found in CFC Chapter 80. It lists all the referenced codes but does not use all sections of those codes, an example being the lack of reference to the NFPA 855 installation of battery ESSs section, where the CFC 2019 instead opts to use the IFC’s installation rules for batteries [

18,

20]. It was not until late 2021 that New York City’s FDNY adopted the approach that California uses, using a national/international fire code as a foundation while forming its own fire code around the unique characteristics of the city. Unique to the new 2021 fire code law are the distinctions between the highly urbanized areas and the suburbs as well as the difference in topography among the five boroughs and Westchester County.

4.1.2. Municipalities versus Central Government of California

Looking further into the ESS regulations and policies of California, it was noticed that municipalities have a choice in what fire code is adopted, unlike the mandated statewide policy of streamlining the permitting process presented as part of AB 546. In AB 546, it is explicitly stated that all municipalities must maintain consistent statewide standards for a quick and cost-effective implementation of ESSs [

21]. Comparing some municipalities’ fire codes shows differences between them and the CFC. Santa Clara County had adopted the IFC as opposed to the city of Palo Alto, which adopted not only the CFC but several other codes unique to California [

22,

23]. The California Public Utilities Commission (CPUC) showcases Santa Clara County on its website for the municipality’s unique, advanced guidelines of safety practices for ESS installation while also encouraging the usage of several other codes such as UL 1973, UL 9540, NEC 480, NEC 705, NFPA 70, etc. [

24]. Knowing that fire code regulations can differ between each municipality, it is expected that there are cases where battery owners incur additional costs to make changes to a BESS in specific jurisdictions when that change would not have been necessary in another municipality. Addressing this pitfall and determining whether or not it is currently a major issue will only help reduce the costs in the long term in New York.

4.2. Regulations and Policis in Arizona

Arizona is in a special position with reference to the factors that drive ESS and DER penetration, most specifically, regulations and policies versus the initiatives. While Arizona is very proactive in its goal, very few policies and initiatives were put in place by the government itself. Instead, utility initiatives played the biggest role in furthering the development of the energy storage market in the state [

15]. Unlike California, it cannot be said that Arizona has regulations and policies streamlined for energy storage. Rather, policymakers are falling behind on the development of these functions. Meanwhile, the APS, Tucson Electric Power (TEP), and Salt River Project (SRP), all utilities, have begun initiatives in the development and usage of energy storage and renewable energy technologies on their own [

15]. While policy is not a concern in New York City, utility-driven initiatives could potentially be a gamechanger seeing that Arizona has made a large amount of progress in the approval of energy storage installation despite the lack of policy and regulation. Consolidated Edison (Con Edison), one of the largest investor-owned utilities in the United States and the main provider of energy for New York City, is already in the development of utility-driven initiatives such as non-wire solutions (NWS), tier-approach demand response compensation, or the EV Make-Ready Program [

25,

26,

27]. The Con Edison programs aim to ease the burden of costs and barriers for both the ratepayers and the utilities. In Arizona, many of the utility-driven initiatives fund the direct development and installation of technologies. Regardless, both approaches fundamentally achieve the same goal of furthering energy storage and renewable energy penetration.

4.2.1. Fire Codes and Authority Having Jurisdictions on ESSs in Arizona

In line with Arizona’s current stance on ESS penetration, fire code and AHJ regulations are still unclear despite the state being considered one of the forward states for ESS deployment, and they have yet to be fully adopted. In fact, several policies and regulations are being looked into following a battery explosion that occurred at the McMicken BESS project at Surprise, Arizona in April 2019 using the IFC as the baseline and asking for assistance from NYC’s fire department (FDNY) [

28]. Surprisingly, there were no local regulations for battery energy storage in Arizona prior to this accident, despite national organizations such as the NFPA having federal standards available as a reference [

28]. As of now, the new regulations are still being looked at and reformed according to the uniqueness of the region [

28]. Being that New York City is primarily an urbanized city, several safety regulations should address any potential dangers in addition to the deficiencies Arizona believed their fire codes had. Setting regulations in stone will not only ensure safety compliance for all the future deployments of ESSs but give stakeholders and investors of the deployments clearer guidelines.

4.2.2. Municipalities versus Central Government of Arizona

Arizona is similar to California in that fire code regulations vary from one municipality to the other, but overall, each jurisdiction follows statewide policies. Following the McMicken battery explosion, the Phoenix Fire Department Marshall gave insight into some of the fire code differences and similarities between districts, mentioning that while regulations somewhat differ from one municipality to the other, homeowners are not allowed to store batteries directly inside their houses [

28]. Only a few sectors, such as Surprise and Peoria, allow batteries to be stored inside utility closets, while most require batteries to be stored externally or in a garage [

28]. However, Marshall suggested more regulations be uniform across the state to help the fire department complete its job more efficiently. In the case of other battery-related emergencies, he suggested a battery owner permit requirement across the state as a whole [

28]. This detail should be noted, since New York City’s FDNY already possesses a requirement for all energy storage owners to have a “certificate of fitness.” Another important consideration to make is that the cities of Phoenix, Peoria, and Surprise finally passed laws that address the requirements for giant battery storage in these urban and suburban areas [

28]. Next to the residential regulations, there is the topic of the utility-side of battery regulation compliance. There seems to be a lack of clarity on which entities have the responsibility to make the final decision on rules and regulations for utilities. First, the Arizona Corporation Commission (ACC) does not have a clear understanding of the limit of its jurisdiction as it is stated to be responsible for regulating public utilities, public health laws, and the safety of ESSs, yet Arizona’s constitution defines the ACC explicitly as an entity separate from the legislative and executive branches [

15,

28]. They are implicitly given the responsibility to regulate public utilities, but the constitution does not explicitly give them the power to do so. Second, the local laws and regulations for utility-owned battery storage are ultimately determined by the municipalities of which the ESS is to be placed in, leading even Marshall Scholl to be confused on whether the ACC or the municipality’s authority takes precedence on a utility [

28]. Phoenix, Peoria, and Surprise now have regulations for public utilities that set up BESSs along the power grid in response to the Surprise explosion, requiring notification to the city, permits, inspections, and inclusion of certain safety features [

28].

New York City can learn by paying attention to the approach that Arizona has taken so far and the approach it will take in the coming years as policymakers continue to address safety concerns and the more intricate regulations involving utility and residential owners. Although New York City currently possesses an additional requirement for a certificate of fitness for ESSs, Arizona is still considering the addition of such a requirement. What Arizona has done so far and will do serves as a template for the five boroughs and Westchester, which would help in forming regulations to ensure safety and fairness between the municipalities.

5. Fire Code ESS Ownership and Safety Testing Comparisons

Safety testing and operational licenses have become a hot topic following the events of the McMicken BESS explosion in Arizona. The LCOS study did not address any of these topics (as it is outside the scope of the study), which have become a source of concern in New York City when it comes to ESS deployment. The FDNY has the major task of covering all of the boroughs of New York City, such that it is likely that no compromise will be made on safety. With such a heavily urbanized and suburbanized city, additional measures have been and will be taken by the FDNY, thus adding another set of costs/complexity when it comes to ESS ownership and deployment.

5.1. Certificate of Fitness License

In New York City, the FDNY requires that all battery owners in its jurisdiction hold a certificate of fitness (CoF) license for each energy storage system. This is due to the risks associated with the operation and handling of such technology in a metropolitan area, but this requirement adds to the complexity of deployment which can increase time and cost of commissioning of the project. Furthermore, consideration should be given to the distinction between owners, operators, and whoever else is more appropriate to be the CoF license holder. For the special case of owning a portfolio of ESS project, provision should be made to increase CoF license holder responsibility and control. This could foster a quicker deployment schedule and cost savings, and safety concerns can be mitigated with a localized emergency response plan and annual drill exercises to practice response.

5.1.1. Certificate of Fitness License in California

In line with the separation and flexibility of municipality and central government fire codes, holding a certificate of fitness license for ownership of a BESS does not seem to be standard across the state of California. Similar to the FDNY, San Francisco’s fire department code is an example of the few municipal fire codes in California that include a requirement for a BESS operational permit [

29]. Nevertheless, the details of this permit are not publicly available as of yet despite being shown as a requirement on the San Francisco Fire Department website.

5.1.2. Certificate of Fitness License in Arizona

None of Arizona’s municipalities make any mention of an operational permit or certificate of fitness license for battery owners. However, Arizona’s municipal governments, specifically Phoenix, Peoria, and Surprise, intend to make it so that utility and residential battery owners have an installation permit for all new systems which local fire departments can refer to during emergency responses in response to the April 2019 McMicken BESS explosion [

28].

5.2. Battery Safety Testing Requirements

In New York City, the FDNY requires that all BESSs pass UL 9540 A testing at the container level to be eligible for TM-2 deployment [

30]. As such, it is important to look at the available details of test regulations in the forward states.

5.2.1. Testing Requirements in California

No details specify whether batteries are tested at the cell or module level, but the CEC has a requirement for passing both the UL 1973 and UL 9540 testing methods in its Appendix JA12 Qualification Requirements for Battery Storage Systems document [

31].

5.2.2. Testing Requirements in Arizona

Phoenix, Arizona uses a modified version of the 2018 IFC for its fire code as of July 2020, which also includes passing the UL 9540/9540 A and UL 1973 testing methods [

32]. These requirements apply to all battery systems and types, with the exception that lead-acid batteries are not required to be listed, which may lead to a bigger prominence in their usage [

32]. On the other hand, the APS published a technical paper following the McMicken BESS explosion. As of July 2020, the paper discusses the APS’s concerns of possible shortcomings in the UL 9540/9540 A and UL 1973 when it comes to preventing thermal runaway as well as a lack of fire suppression capabilities [

32]. It is likely that Arizona will look into possible amendments to these testing methods when incorporating them into their fire codes in the future, especially for lithium batteries.

6. Environmental Assessments and Added Costs for Compliance in the Balance of Plant

The LCOS study seems to only exclusively mention nations or states that have ideal locations for energy storage penetration. Examples of this include countries such as Australia and Germany and states such as Hawaii and California. There is no mention of the need for environmental assessment and the additional costs for compliance in the balance of plant. Energy storage system installations in NYC are not simple, easygoing processes. Besides seeking the necessary permits, stakeholders have to dedicate time and effort into making sure all environmental and location-specific factors that add on to their project costs are accounted for. In such a populous city such as New York, there are several elements that stakeholders in suburban and rural areas would not even have to consider.

As the utility scale battery industry is continuously evolving, there has been a shift from air to liquid cooling. Cooling systems are essential to energy storage systems because batteries generate heat. An unfavorable external environment is one of the leading causes of overheating. Liquid cooling provides many more advantages than traditional air cooling besides removal of heat, such as less clutter, more space, and noise-free operation [

33]. Other equipment could be installed in place of the bulky fans, creating more compact systems that perform the same function. Fans generate noise that becomes more audible when the system is overworked. One of the advantages of a liquid cooling system is that it does not generate the same noise [

33]. All these factors make this type of cooling system highly desirable in a city such as New York, where real estate and less noise pollution are highly valued among the population.

Liquid coolants have higher heat capacity, density, and thermal conductivity than air, making them more effective. The higher efficiency of liquid cooling is necessary for complex systems such as ESSs and DERs. However, the usage of liquid coolant has several disadvantages. It poses several environmental hazards which have had to be regulated. These are mostly due to the potential leakages of hazardous chemicals, such as ethylene glycol, into the environment that lead to contamination of water systems. Companies that deploy the cooling system have to mitigate the risk of leakage as much as possible. These precautions, along with the complexity of the system, is what makes liquid cooling so costly to set up [

33]. Therefore, while the manufacturing cost for batteries has decreased thanks to the recent technological advancement in this technology, the balance of plant cost for deployment has increased. The LCOS studies from the past few years have not fully captured this issue.

Besides the added costs due to the transition to liquid coolants, there are other location-specific environmental cost drivers that stakeholders have to consider when planning to install an energy storage system at a location. Remediation of contaminated land is an important factor that is highly relevant to NYC. There is a shortage of uncontaminated brownfield properties in NYC due to its high density of people and buildings. Several empty lots have remained unoccupied for extended periods of time because the land is contaminated and needs to be remediated in order to comply with NYS environmental standards before new installations or buildings can be erected on it [

34]. Remediation is an expensive and time-consuming process that most companies avoid because it takes up time from their schedule and money from their budgets. Irrespective of where in NYC or Westchester an ESS project is deployed, stakeholders still need to consider proper handling and disposal of top-grade soil. Removing contaminated soil and properly disposing of it is rather expensive since disposal needs to happen at approved facilities, and there is quite a bit of soil that needs to be removed since the storage systems require piles and foundations to handle the massive weight of the battery containers. Companies would rather invest in other projects than to allocate funds for a process that will not yield them the revenue they seek right away. The topography of the locations also impacts the project budget. For example, Westchester and Staten Island contain wetlands that stakeholders need to consider before initiating a project. Storage systems in those areas will need different protections and even methods of installation from systems in dry vicinities.

If an energy storage system project is deployed in an NYC flood zone, installation companies need to take into consideration low-frequency, high-impact events such as hurricanes/Nor’easter/superstorms which are becoming more common due to the effects of climate change. In these special zones, there will be extra costs related to elevating and waterproofing all equipment to FEMA standards in order to avoid damage should the facility flood during a natural disaster. As we saw with Con Edison substations during Hurricane Sandy, several were flooded due to the 14+ foot water surge and could no longer provide customers with electricity. Similarly, in the event an ESS facility is flooded, the goal would be to continue storing the electricity, and once the facility is de-flooded, to be able to use the equipment. These extra costs are location specific. Besides this, spill containment and other maintenance costs are factors that stakeholders will need to take into consideration during the construction phases and throughout the life of the project.

7. Provisions to Permit and Deploy Non-Lithium Battery Technologies

The LCOS study seems to focus almost entirely on lithium-ion battery technologies, longer duration storage including flow batteries and hydrogen. This is despite the current energy storage landscape that was recently visualized by EPRI in a 2018 study as seen in

Figure 2 above [

35]. As various states move to decarbonize their economies, many have resorted to battery storage in order to store excess energy when solar panels and wind farms are producing electricity and feeding it back to the grid when they are not. Most energy storage systems employ the lithium-ion battery because of the economic feasibility and the gradual advancements of this mainstream technology. Power capacity has expanded rapidly, and batteries can store and discharge energy over longer periods of time. However, because of the aggressive push by many municipalities toward a greener power grid and the potential hazards and risks that come with the usage of lithium-ion batteries, several entities are researching other battery technologies that can be used for storage systems. On the state level, California and Arizona have taken several provisions to permit and deploy non-lithium battery technology. New York City can learn from the provisions made by both states to enhance regulation and policies to help diversify its energy storage portfolio, which will only make it easier to achieve its energy storage goals.

7.1. California Case

7.1.1. Policies Enacted

California is the global leader in the effort to balance the intermittency of renewable energy in electric grids with high-capacity batteries [

36]. It currently has a packed pipeline of storage projects with several involving non-lithium battery technologies. The Golden State has taken several actions to make non-lithium battery usage more widespread. An amendment was made to the California Fire Code in 2019 that increased capacity sizing and approved the use of additional types of battery technologies. This included all types of lead acid batteries, lithium-ion batteries, nickel cadmium batteries, and flow batteries (vanadium, zinc-bromine, polysulfide-bromide, and other flowing electrolyte-type technologies) [

18]. Since 2019, the California Energy Commission (CEC), the energy policy and planning governmental agency, has offered a grant explicitly soliciting the development of non-lithium-ion batteries. Called “GFO-19-305,” its purpose is to fund the research and development of other energy storage technologies [

37]. New York State may benefit from funding for research and development as this could potentially result in more cost-efficient technologies in the long run other than increasing the diversity of New York’s battery technology profile.

7.1.2. Policies in Action

For instance, The CEC has selected UK-based Invinity Energy Systems for funding as part of an initiative for long-duration, non-lithium energy storage with the use of its vanadium flow batteries (VFB). It also awarded modular microgrid energy solution company, BoxPower, a USD 1.2 million grant to further develop its software and hardware solution at 15 microgrid sites in California. The project sites in California are comprised of 7.8 MWh of Invinity VFBs [

38]. All these initiatives, along with incentives offered by utility companies, are proof of California’s commitment and open-mindedness to resiliency and renewable energy within its bounds.

Currently, there are several non-lithium battery storage projects connected to the power grid of California. Each is unique in the contributions it makes to the surrounding area and provides stakeholders with insight on things they can do differently in future projects. The Mission Produce Facility Project in Oxnard, California is a 1.5 MW total capacity project that consists of 1 MW of solar energy and 0.5 MW from an advanced vanadium redox flow battery system [

13]. Its purpose is to create a microgrid in a frequent demand response area and make the facility energy efficient. The project costs about USD 1 million and uses an innovative, cloud-based demand management software platform [

13]. The Alpha Omega Winery in Rutherford Bench, Napa Valley, California is a 500 kW total capacity project consisting of 400 kW solar PV and 100 kW saltwater energy storage batteries. The microgrid reduces the average monthly electric bill while powering nearly 100% of its needs. However, it is also meant to supply several EV charging stations in the future [

13]. The total cost is USD 1.1 million and the project uses 100 kW bi-directional inverters with capabilities such as peak shaving, demand response, and islanding mode. The Stone Edge Farm project in Sonoma, California is a 1.185 MW total capacity project that uses 324 kW of battery storage which includes Aquion sodium ion, iron flow cell, reflow zinc, and several other non-lithium batteries [

13]. This project is part of a bigger project to turn Stone Edge Farm into a self-sustaining island that is capable of exporting several resources. Stone Edge has a microgrid management system with grid interactive ability. EnerSmart, a renewable energy company based in San Diego and Boulder, Colorado, signed a USD 20 million order with EOS Energy to install 10 facilities of 3 MW each that will employ zinc battery storage technology. Seven of the ten storage sites will be located in San Diego county, and EnerSmart plans to have each one up and running by the end of 2021. Each of the facilities will supply enough energy to power about 2000 homes [

39].

California state has taken several provisions toward the permitting and deployment of non-lithium batteries. Knowing that many of these provisions now enable California to deploy non-lithium batteries in metropolitan areas, as shown by the previously mentioned cases, New York City can base its own provisions on the already-proven methodologies of California.

7.2. Arizona Case

In Arizona, there has been a local push toward abandoning the use of the lithium-ion battery for energy storage projects. In response to two battery fires that were caused when lithium battery cells failed at Arizona Public Service locations, local officials have promoted several alternatives to this type of technology [

40]. The explosive nature of lithium runaway fires has been well known by other parts of the business for a long time, but according to a commentator, the industry has been following a lithium-only bandwagon rather than thinking of suitability [

40]. In late 2020, the battery technology development company TEXEL and Arizona State University signed a cooperation agreement with the purpose of bringing a new battery technology toward commercialization in the US [

41]. The new battery technology, originally developed by Savannah River National Laboratory, is potentially much more cost effective than lithium-ion batteries on a large scale and is 100% circular. It is a new battery technology based on thermochemical metal hydrides [

41]. Arizona State University will analyze the TEXEL technology and evaluate the technology’s competitiveness to other energy storage technologies in different market applications across the US. Research, evaluations, and comparisons of emerging technologies to ones that currently dominate the industry are definitely an important part of making these new technologies more popular and widespread. New York City should follow Arizona’s example and set forth grants and research funds to study alternative types of batteries and how they can be applied to different types of storage projects the city has commissioned.

As mentioned before, Phoenix’s fire code allows increased flexibility of lead-acid batteries by not requiring them to be listed for UL 9540/9540 A and UL 1973 testing [

32]. Although this was not necessarily a provision to directly permit and deploy non-lithium battery technologies, it effectively encourages the use of such battery technology by providing an alternative battery type that is significantly easier to deploy relative to the regulations. Seeing as New York’s goals for energy storage are also very hefty, doing similar actions for proven battery technologies would make achieving these goals significantly easier and could potentially save time and costs.

7.3. Non-Lithium Ion Battery Deployment in NYC

At the present time, only lithium-ion battery technology is popular in New York City. The recent rules and regulations (or the lack thereof) for alternative battery technologies act as a barrier to their deployment. Battery storage companies are unclear about what is allowed by the city, so they have resorted to utilizing the widely accepted lithium-ion chemistry. Current rules for siting, permitting, and overall commissioning of non-lithium non-outdoor systems lack prescriptive requirements for successful deployment. Rather, it is written vaguely to transfer the risk to developers/integrators by requiring specific detail design before the AHJs can comment, which is seldomly a cost-effective approach. As such, the LCOS cost for non-lithium technology is therefore not applicable to the city. It is important for city officials to realize that other urban areas throughout the country, which are comparable to NYC, have passed meaningful legislation. This has allowed non-lithium battery technology deployment to thrive within the respective vicinities. If the city of New York were to pass similar ordinances, it would diversify the storage industry and help drive it forward, leading to a stronger and more resilient power grid.

Los Angeles, a densely populated city analogous to NYC, has its own fire code that explicitly deals with different types of battery technologies. Section 1206 of the Los Angeles fire code can serve as a template for NYC’s future fire code policies. It possesses a table of battery requirements that is detailed and includes different types of battery chemistries and the safety compliance requirements for each [

42]. Exhaust ventilation, spill control, neutralization, explosion control, safety caps, and thermal runaway are some of the issues that Section 1206 addresses. These specifications clarify many concerns that battery storage companies should have when they are in the design phase of different projects. Section 1206 of LA’s fire code also possesses a variety of requirements that deal with common concerns that a metropolitan area can have such as spacing, placement, clearance, countermeasures, and more [

42]. The section addresses open parking garage installations and clearance to exposure in metropolitan areas. It also includes a hazard mitigation analysis. This analysis evaluates consequences of specified failure modes. It is crucial to have this in a fire code because in densely packed cities, there is very little room for error. Understanding the consequences can help develop a methodology to mitigate consequences if accidents cannot be prevented and dealt with in a timely manner.

Learning about different use cases in the battery storage industry is necessary because it builds confidence in the technology and helps municipalities learn about the pros and cons that others faced while undertaking similar projects. However, differing location and environmental conditions should be two factors taken into consideration when a company is thinking about the approach it should take for a battery storage project. For example, San Francisco, California has a customized fire code that accounts for the San Andreas fault, which means in their projects they have to account for seismic protection [

43]. When NYC companies analyze potential technologies, they should take into account the city’s susceptibility to storm surges and flooding, which means incorporating flood protection to battery storage projects. These factors would not be considered in areas where the risk of a hurricane or tropical storm is low.

8. Zoning and Accommodation of ESSs in NYC

Market conditions are trending positively for energy storage in NYC. In 2021, The NYC Fire Department of standards and requirements approved the siting of outdoor energy storage systems. There are potential opportunities in the pipeline of additional market acceleration bridge incentives and federal ITC that can help close the gap between the calculated value of energy storage and the money it can earn in the market today. Con Edison has released several requests for proposals for bulk storage resources since 2019. Currently, the natural grid constraints of such a densely populated area are reaching their limit [

44]. There is also a need for demand charge management along with relatively high electricity prices that improve the economics under the State’s value of Distributed Energy Resources tariff. However, the recent zoning regulation moved in a direction favoring the deployment energy storage projects. While the city’s agencies are starting to redirect their efforts to zoning as they relate to energy storage systems, there need to be more aggressive changes in the residential zoning resolution and further considerations around accessory definition for greenfield projects to facilitate ESS penetration.

Under the NYC Zoning Resolution, which is a work in progress, there are a few instances of ESS regulation. However, there is a lot of work being performed around the creation of explicit rules and regulations for ESSs. New York City has a highly dense population across limited space in an urban area with very little room for newly constructed residential buildings. Thus, it would be more likely for existing buildings to be outfitted with new modifications to increase efficient use of ESSs. The NYC Planning Commission has confirmed that energy storage falls under Use Group 6D or 17C. Energy storage projects are permitted in some residential districts by special permit and as-of-right within some commercial and manufacturing districts [

44]. Developers are limited to sites within these districts unless they obtain a use variance from the Board of Standards and Appeals. A use variance is an approval to use a piece of land in a manner not permitted by the Zoning Resolution. Most of the time, developers are discouraged from pursuing a project at a specific location if a use variance is required because of the time and money that they lose in applying for one, providing supporting evidence, and making a case if rejected. When considering a use variance application, the zoning board is required to engage in a balancing test where it weighs the benefit of the applicant against the detriment to the health, safety, and welfare of the community if the variance is granted [

44]. However, the zoning board is not required to justify its determination with supporting evidence as long as its ultimate determination balancing the relevant consideration was rational. The zoning board use variance approval process is therefore very complex in NYC due to the high density of infrastructure and inhabitants it has. Compared to the balancing test used by the rest of the state, NYC’s five-factor test is significantly more burdensome. In order for the NYC Board of Standards and Appeals to grant a variance, there are five conditions that must be met:

There are unique physical conditions, including irregularity, narrowness, or shallowness of lot size or shape, or exceptional topographical or other physical conditions peculiar to and inherent in the particular zoning lot, and that as a result of such unique and physical conditions, practical difficulties or unnecessary hardship arise in complying strictly with the use of bulk provisions of the Resolution.

Because of such physical conditions, there is no reasonable possibility that the development of the zoning lot in strict conformity with the provisions of this Resolution will bring a reasonable return, and that the grant of a variance is therefore necessary to enable the owner to realize a reasonable return from such a zoning lot.

That the variance, if granted, will not alter the essential character of the neighborhood or district in which the zoning lot is located and will not substantially impair the appropriate use or development of adjacent property and will not be detrimental to the public welfare.

That the practical difficulties or unnecessary hardship claimed as a ground for a variance have not been created by the owner or by a predecessor in title; however, where all other required findings are made, the purchase of a zoning lot subject to the restrictions sought to be varied shall not itself constitute a self-created hardship.

That within the intent and purposes of this Resolution, the variance, if granted, is the minimum variance necessary to afford relief, and to this end, the board may permit a lesser variance than applied for.

It is particularly difficult for an energy storage applicant to meet the first prong of the balancing test, demonstrating the unique physical conditions, “peculiar to and inherent in the particular zoning lot” [

44]. Successful applicants have focused on physical conditions such as small, shallow, or irregularly shaped lots; subsurface soil conditions, such as rock, soft soil, contamination, or a high water table; or the inability to reuse obsolete buildings. Given the unique properties that are being scouted for energy storage installations, these physical characteristics may very well exist and should be used to strengthen an application for a use variance [

44].

As of now, developers have been mostly focusing on outdoor rather than indoor installations. The FDNY adopted rules for the outdoor installation of stationary lithium-ion batteries. These rules have slightly sped up the siting process for energy storage as compared to the process in the early days [

44]. The FDNY is taking a more cautious approach to indoor projects due to all associated risks and hazards. NYC officials should look into policy in California as a step toward moving more installations indoors. These types of projects would be much more convenient to the city since New York lacks expansive real estate. Developers have mostly focused on rooftops and empty lots for the siting of an energy storage project within the city. As mentioned before, they are finding success with creative approaches such as the demolition of old buildings to create open space for energy storage development. Once an area is cleared, a developer can pack in multiple battery systems with a larger number of megawatts that maximize revenue streams [

44]. ESS penetration to NYC’s power grid will not be successful if developers are discouraged due to the related expenses and time uncertainty of a use variance, then (if approved) demolishing an old building, clearing the area, possibly remediating contaminated land and then proceeding to install the battery systems. Only very few well-established companies will be able to endure these costs and risks and make revenue.

In order to make progress in the future, ESS stakeholders in NYC should realize that use and bulk area variances are not as simple to obtain in the city as in the rest of the state and design a site plan so that this approval is not required. If a determination is made that a bulk area variance is required, then the approval should be sought for early in the development process. The board associated with granting these use variances should allow developers to have an informal consultation before submitting an application in order to understand where approval is likely and whether any alternatives exist at all. This would help by potentially saving them time in submitting an application that will never get approved due to the nature of the project or the location chosen. Lastly, they should stay in touch with New York’s rapidly evolving policies and laws for the deployment of energy storage. This market is moving quickly with continued progress toward streamlining approvals so that these projects can get in the ground and online in time to meet the 2025 State and City goals of 1500 MW and 500 MW, respectively.

9. Conclusions

Various financial, environmental, and regulatory factors have been discussed in the paper with detailed breakdowns and discussions of how New York City can learn from California and Arizona to develop solutions unique to itself. While physical and environmental limitations are important, hurdles such as spacing, available real estate, financial incentives, and regulatory approval seem to be the biggest barriers to energy storage deployment in New York City. Although New York State seems to already have the policy in place for the energy storage market to flourish, it is imperative that both the city and state ramp up their efforts in addressing in-city deployment strategies. Our recommendations are as follows:

Ease restrictions and shorten approval timeline to continue the trend of increasing annual completed project capacity totals.

Using the lessons learned by the forward states and their solutions as templates, continue to improve on safety and zoning regulations while fine-tuning them for New York City to allow for projects to begin promptly and be completed quickly.

Produce more specific regulations on non-Li batteries to create more variety in New York City’s energy storage systems portfolio.

Since safety is a major concern in urban New York City, consider making a uniform foundational fire code across all the boroughs (including Westchester) that allows for each municipality to make unique changes to them just like Arizona and California.

Reassess the requirements for property tax abatement associated with the installation of energy storage equipment.

Consider minimum statewide battery testing requirements, certificates of fitness regulations, and other restrictions to eliminate the risk of choice on the developer’s end to potentially save time and money.

Author Contributions

Conceptualization, A.A.A.M., M.K.K., F.B., and Z.I.; methodology, A.A.A.M., M.K.K., F.B., and Z.I.; formal analysis, A.A.A.M., M.K.K., F.B., and Z.I.; investigation, A.A.A.M., M.K.K., F.B., and Z.I.; resources, A.A.A.M., M.K.K., F.B., and Z.I.; data curation, A.A.A.M., M.K.K., F.B., and Z.I.; writing—original draft preparation, A.A.A.M., F.B., and Z.I.; writing—review and editing, M.K.K., A.A.A.M., F.B., and Z.I.; supervision, A.A.A.M.; project administration, A.A.A.M., and M.K.K.; funding acquisition, A.A.A.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Science Foundation, grant number 1846940.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Rastler, D. Electricity Energy Storage Technology Options: A White Paper Primer on Applications, Costs, and Benefits; Electric Power Research Institute: Palo Alto, CA, USA, 2010; Available online: http://large.stanford.edu/courses/2012/ph240/doshay1/docs/EPRI.pdf (accessed on 2 May 2021).

- Stein, A.L. Reconsidering Regulatory Uncertainty: Making a Case for Energy Storage. FSU Law Rev. 2014, 41, 756–757. [Google Scholar]

- Lazard. Lazard’s Levelized Cost of Storage Analysis V6.0; Lazard Ltd.: New York, NY, USA, 2020; Available online: https://www.lazard.com/media/451418/lazards-levelized-cost-of-storage-version-60.pdf (accessed on 2 May 2021).

- Government of NYS. The Climate Leadership and Community Protection Act. Available online: https://climate.ny.gov/ (accessed on 18 July 2019).

- Kamaludeen, M. Discussion on ConEd’s Progress in Energy Storage Deployment in NYC. unpublished.

- Kamaludeen, M. Private Communication, May 2021. California Public Utilities Commission, “Energy Storage”; CPUC: San Francisco, CA, USA, 2021. Available online: https://www.cpuc.ca.gov/energystorage/ (accessed on 2 May 2021).

- Nyberg, M. 2018 Total System Electric Generation; California Energy Commission: Sacramento, CA, USA, 2018. Available online: https://www.energy.ca.gov/data-reports/energy-almanac/california-electricity-data/2019-total-system-electric-generation/2018#:~:text=California%20has%20approximately%2080%2C000%20MW,and%206%2C000%20MW%20from%20wind (accessed on 2 May 2021).

- U.S. Energy Information Administration. Arizona State Profile and Energy Estimates; EIA: Washington, DC, USA, 2021. Available online: https://www.eia.gov/state/analysis.php?sid=AZ#61 (accessed on 2 May 2021).

- Harding, R.; Levin, A. These States Are Winning on Clean Energy; Natural Resources Defense Council, Inc.: New York, NY, USA, 2020; Available online: https://www.nrdc.org/experts/robert-harding/these-states-are-winning-clean-energy#:~:text=Three%20states%20now%20get%20over,solar%20in%20the%20United%20States (accessed on 2 May 2021).

- Pyper, J. APS Plans to Add Nearly 1GW of New Battery Storage and Solar Resources by 2025; Greentech Media: Boston, MA, USA, 2019; Available online: https://www.greentechmedia.com/articles/read/aps-battery-storage-solar-2025 (accessed on 2 May 2021).

- California Public Utilities Commission. Zero Net Energy; CPUC: San Francisco, CA, USA, 2016. Available online: https://www.cpuc.ca.gov/zne/ (accessed on 2 May 2021).

- Asmus, P.; Forni, A.; Vogel, L. Microgrid Analysis and Case Studies Report; California Energy Commission: Sacramento, CA, USA, 2018. Available online: https://ww2.energy.ca.gov/2018publications/CEC-500-2018-022/CEC-500-2018-022.pdf (accessed on 2 May 2021).

- Sandia National Laboratories. Energy Storage Policy Summaries for the Global Energy Storage Database; SNL: Albuquerque, NM, USA, 2019. Available online: https://www.sandia.gov/ess-ssl/wp-content/uploads/2020/06/Sandia_StatePolicies_Book_v5.pdf (accessed on 2 May 2021).

- EnergyWatch. Reverse Demand Response? EnergyWatch Inc.: New York, NY, USA, 2021; Available online: https://energywatch-inc.com/reverse-demand-response/ (accessed on 2 May 2021).

- Taylor, M.; Fujita, K.S.; Zhang, J.; Harb, M.; Tamerius, J.; Jones, M.; Price, S. Explaining Jurisdictional Compliance with California’s Top-Down Streamlined Solar Permitting Law (AB 2188); Lawrence Berkeley National Laboratory: Berkeley, CA, USA, 2019; Available online: https://escholarship.org/content/qt7n5169cj/qt7n5169cj_noSplash_fce5c149c5e8be698f87a953ce9d4ead.pdf?t=q0g1zd (accessed on 2 May 2021).

- California Governor’s Office of Planning and Research. Renewable Energy: Energy Storage Systems; CA OPR: Sacramento, CA, USA, 2018. Available online: https://opr.ca.gov/planning/land-use/renewable-energy/ (accessed on 2 May 2021).

- 2019 California Fire Code: Chapter 12 Energy Systems; UpCodes: Walnut, CA, USA, 2018; Available online: https://up.codes/viewer/california/ca-fire-code-2019/chapter/12/energy-systems#1206 (accessed on 2 May 2021).

- 2018 International Fire Code: Chapter 12 Energy Systems; International Code Council: Washington, DC, USA, 2017; Available online: https://codes.iccsafe.org/content/IFC2018/chapter-12-energy-systems#IFC2018_Pt03_Ch12_Sec1206 (accessed on 2 May 2021).

- 2019 California Fire Code: Chapter 80 Referenced Standards; UpCodes: Walnut, CA, USA, 2018; Available online: https://up.codes/viewer/california/ca-fire-code-2019/chapter/80/referenced-standards#80 (accessed on 2 May 2021).

- California Legislature. Assembly Bill No. 546; Chapter 380; California Legislature: San Francisco, CA, USA, 2017. Available online: https://leginfo.legislature.ca.gov/faces/billTextClient.xhtml?bill_id=201720180AB546 (accessed on 30 September 2017).

- Pathway to Sustainability; Government of the City of Palo Alto: Palo Alto, CA, USA, 2020; Available online: https://www.cityofpaloalto.org/gov/depts/utl/pathway_to_sustainability/solar/residential/new/permitting.asp (accessed on 2 May 2021).

- Energy Storage Systems (ESS) Submittal Guidelines for Systems Exceeding Values in CFC Table 608.1; Government of the City of Palo Alto: Palo Alto, CA, USA, 2019; Available online: https://www.cityofpaloalto.org/files/assets/public/development-services/building-division/electrical-guidelines/submittals/ess-submittal_with-fire-requirements_2019-05-03.pdf (accessed on 2 May 2021).

- California Public Utilities Commission. Safety Best Practices for the Installation of Energy Storage; CPUC: San Francisco, CA, USA, 2016. Available online: https://www.cpuc.ca.gov/General.aspx?id=8353 (accessed on 2 May 2021).

- ConEdison. Non-Wires Solutions; Consolidated Edison Inc.: New York, NY, USA, 2018; Available online: https://www.coned.com/en/business-partners/business-opportunities/non-wires-solutions (accessed on 2 May 2021).

- ConEdison. Smart Usage Rewards; Consolidated Edison Inc.: New York, NY, USA, 2018; Available online: https://www.coned.com/en/save-money/rebates-incentives-tax-credits/rebates-incentives-tax-credits-for-commercial-industrial-buildings-customers/smart-usage-rewards (accessed on 2 May 2021).

- Joint Utilities of New York. EV Make-Ready Program; Joint Utilities of NY: New York, NY, USA, 2020; Available online: https://jointutilitiesofny.org/ev/make-ready (accessed on 2 May 2021).

- Fifield, J. After APS Explosion Injures 4 Firefighters, Arizona Cities Enact Battery Storage Laws for Utilities, Homeowners; The Arizona Republic: Phoenix, AZ, USA, 2019; Available online: https://www.azcentral.com/story/news/local/surprise/2019/09/30/phoenix-peoria-and-surprise-enact-battery-storage-laws/2305933001/ (accessed on 2 May 2021).

- San Francisco Fire Department. Operational Permits; SFFD: San Francisco, CA, USA, 2017; Available online: https://sf-fire.org/permits (accessed on 2 May 2021).

- New York City Fire Department. Outdoor Stationary Storage Battery Systems; FDNY: New York, NY, USA, 2019. Available online: https://www1.nyc.gov/assets/fdny/downloads/pdf/codes/3-rcny-608-01.pdf (accessed on 2 May 2021).

- California Energy Commission. Appendix JA12—Qualification Requirements for Battery Storage System; CEC: Sacramento, CA, USA, 2019. Available online: https://www.energy.ca.gov/sites/default/files/2019-09/JA12-Qualification_Requirements_for_Battery_Storage_System.pdf (accessed on 2 May 2021).

- 2018 International Fire Code as Amended by the City of Phoenix: Chapter 12 Energy Systems; International Code Council: Phoenix, AZ, USA, 2017; Available online: https://codes.iccsafe.org/content/PHXFC2018P1/chapter-12-energy-systems#PHXFC2018P1_Pt03_Ch12_Sec1206 (accessed on 2 May 2021).

- Bonheur, K. Advantages and Disadvantages of Liquid Cooling; Profolus (Esploro Company): Des Plaines, IL, USA, 2021; Available online: https://www.profolus.com/topics/advantages-and-disadvantages-of-liquid-cooling/#:~:text=Susceptibility%20to%20leaks,the%20liquid%20resulting%20in%20leaks. (accessed on 2 May 2021).

- New York City Office of Environmental Remediation. About the OER; NYC OER: New York, NY, USA, 2019. Available online: https://www1.nyc.gov/site/oer/about/about.page (accessed on 2 May 2021).

- Electric Power Research Institute. 2018 Energy Storage Technology Landscape; EPRI: Palo Alto, CA, USA, 2018; Available online: https://www.epri.com/research/products/000000003002013047 (accessed on 2 May 2021).

- Katz, C. In Boost for Renewables, Grid-Scale Battery Storage Is on the Rise; Yale School of The Environment: New Haven, CT, USA, 2020; Available online: https://e360.yale.edu/features/in-boost-for-renewables-grid-scale-battery-storage-is-on-the-rise (accessed on 2 May 2021).

- California Energy Commission. GFO-19-305 Developing Non-Lithium Ion Energy Storage Technologies to Support California’s Clean Energy Goals; CEC: Sacramento, CA, USA, 2019. Available online: https://www.energy.ca.gov/solicitations/2019-12/gfo-19-305-developing-non-lithium-ion-energy-storage-technologies-support (accessed on 2 May 2021).

- Energy Content Directors. California Energy Commission Funding Energy Storage, Microgrid Firms; Power-Eng.com: Sacramento, CA, USA, 2020; Available online: https://www.power-eng.com/energy-storage/cec-taps-lnvinity-boxpower-to-bring-energy-solutions-to-california/#gref (accessed on 2 May 2021).

- Sit, J. California Zinc-Ion Energy Storage Development and Validation Project; California Governor’s Office of Planning and Research: Sacramento, CA, USA, 2020. Available online: https://ceqanet.opr.ca.gov/2020080142/2 (accessed on 2 May 2021).

- Batteries International. Arizona Regulator Warns of ‘Unacceptable Hazards’ of Lithium Batteries. In Batteries International Magazine; Mustard Seed Publishing Ltd.: West Sussex, UK, 2019; Available online: https://www.batteriesinternational.com/2019/08/28/arizona-regulator-warns-of-unacceptable-hazards-of-lithium-batteries/ (accessed on 2 May 2021).

- Texel Signs an Agreement with Arizona State University to Move New Battery Technology towards Commercialization in The US; Cision PR Newswire: New York, NY, USA, 2020; Available online: https://www.prnewswire.com/news-releases/texel-signs-an-agreement-with-arizona-state-university-to-move-new-battery-technology-towards-commercialization-in-the-us-301179758.html (accessed on 2 May 2021).

- County of Los Angeles. 1206.2.10—Storage Batteries and Equipment; Code of Ordinances: Los Angeles, CA, USA, 2021; Available online: https://library.municode.com/ca/los_angeles_county/codes/code_of_ordinances?nodeId=TIT32FICO_1206.2.10STBAEQ (accessed on 2 May 2021).

- Government of California. Contractors State License Board: Licensing Committee Meeting Handouts; CA Government: Sacramento, CA, USA, 2018. Available online: https://www.cslb.ca.gov/Resources/BoardPackets/2-23-18_licensing_committee_mtg_handouts.pdf (accessed on 2 May 2021).

- Hodgson Russ, LLP. Zoning Nuances for Energy Storage Development in New York City that Every Developer Should Know; JD Supra, LLC.: Buffalo, NY, USA, 2020; Available online: https://www.jdsupra.com/legalnews/zoning-nuances-for-energy-storage-39648/ (accessed on 2 May 2021).

- NY Solar Map. New York City Energy Storage Systems Zoning Guide; Sustainable CUNY: New York, NY, USA, 2021; Available online: https://nysolarmap.com/resources/reports-and-guides/solarplusstorage/storage-permitting/ (accessed on 30 December 2021).

| Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).