Fairness Concern in Remanufacturing Supply Chain—A Comparative Analysis of Channel Members’ Fairness Preferences

Abstract

:1. Introduction

- How does channel members’ (channel members refer to the manufacturer and the retailer in the proposed model of this paper) fairness preference affect operational strategies regarding wholesale and sales prices of new and remanufactured products, and collection rate of the EOL product?

- In the short term, which scenario of channel members’ fairness concerns is the most favorable for sustainable progress of the RSC?

- In the long term, how does fairness preference of channel members evolve in the game between the manufacturer and the retailer? And what is the influencing element for the channel to achieve evolutionary stable state?

2. Literature Review

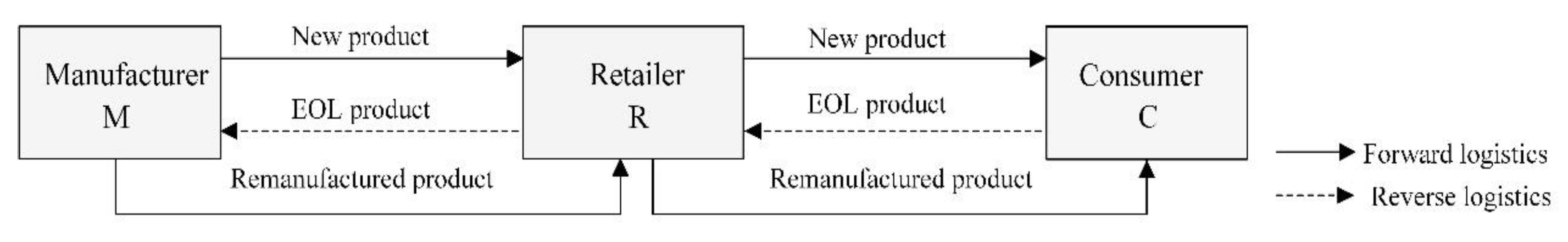

3. Problem Characteristics and Assumptions

3.1. Notations and Definitions

3.2. Complementary Descriptions and Assumptions

4. RSC Strategies Considering Distinct Fairness Preferences of Channel Members

4.1. RSC Strategies and Utilities in Distinct Scenarios

4.2. Comparative Analysis of Distinct Scenarios

4.3. RSC Performance Considering Channel Members’ Fairness Concerns in a Single Period

5. Evolvements and Stable Strategy of Fairness Concern in Multi Periods

5.1. Pay-Off Matrix and Evolutionary Game Model of Channel Members with Fairness Concerns

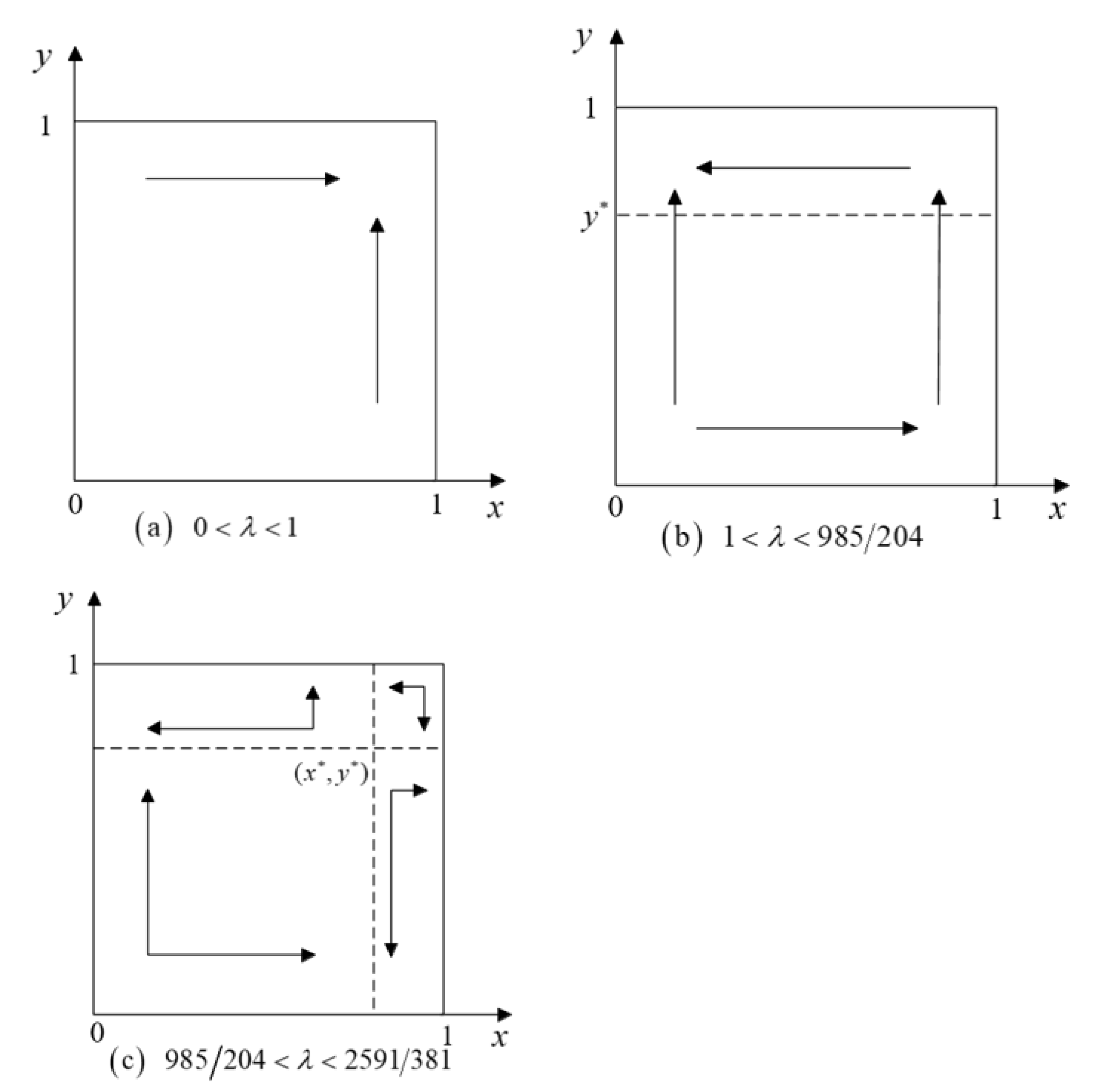

5.2. Evolutionary Stable Strategy of Channel Members’ Fairness Concerns

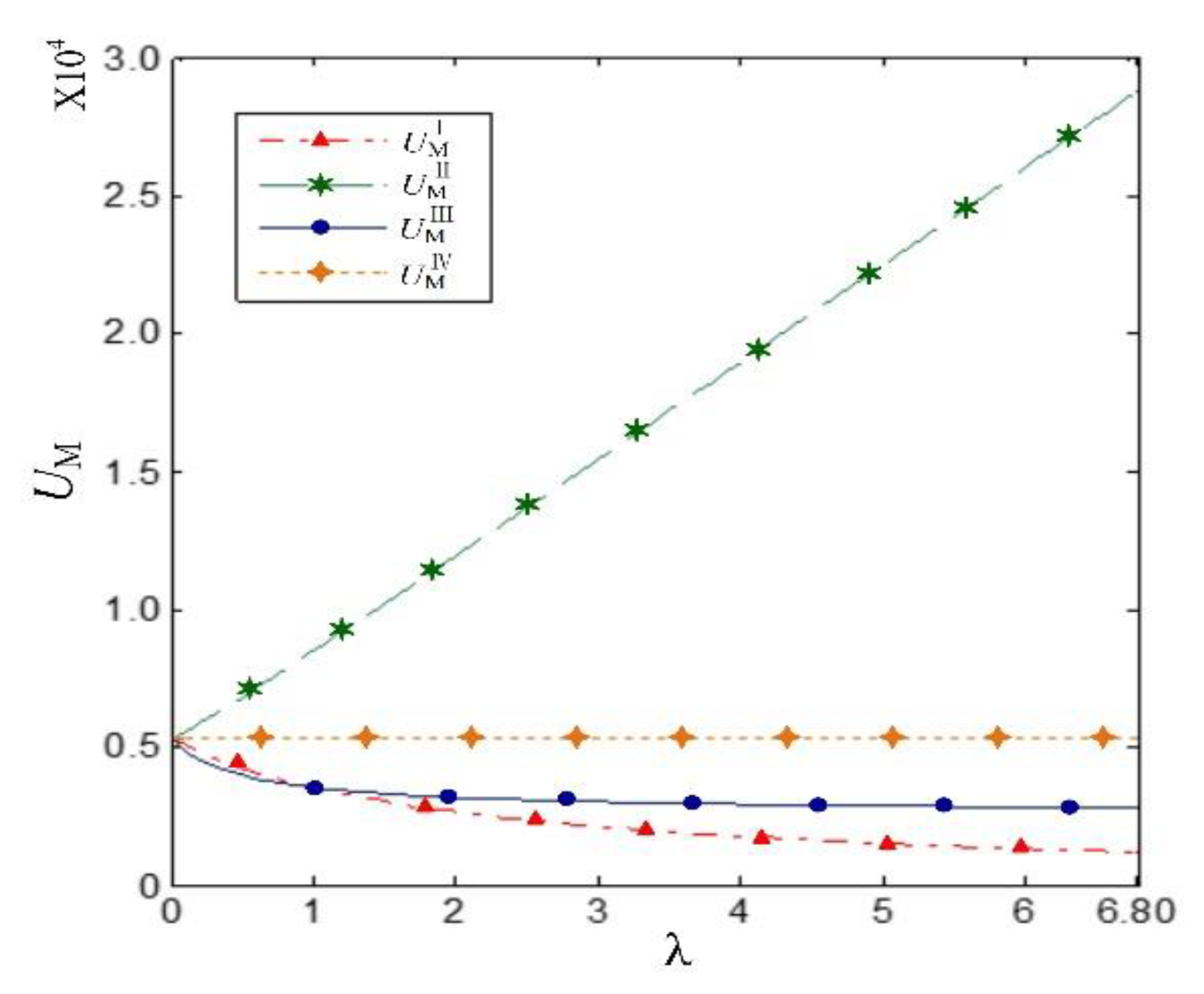

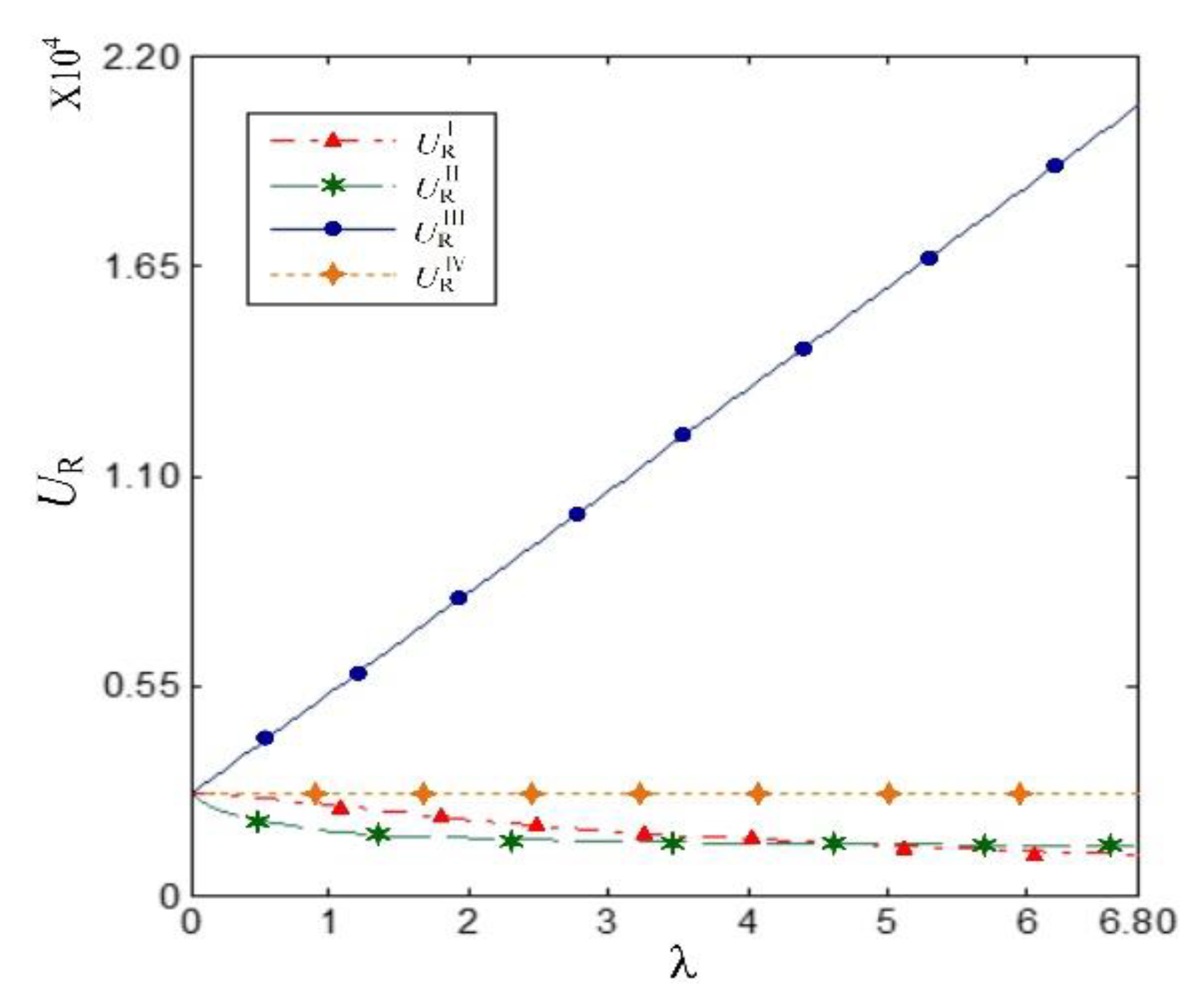

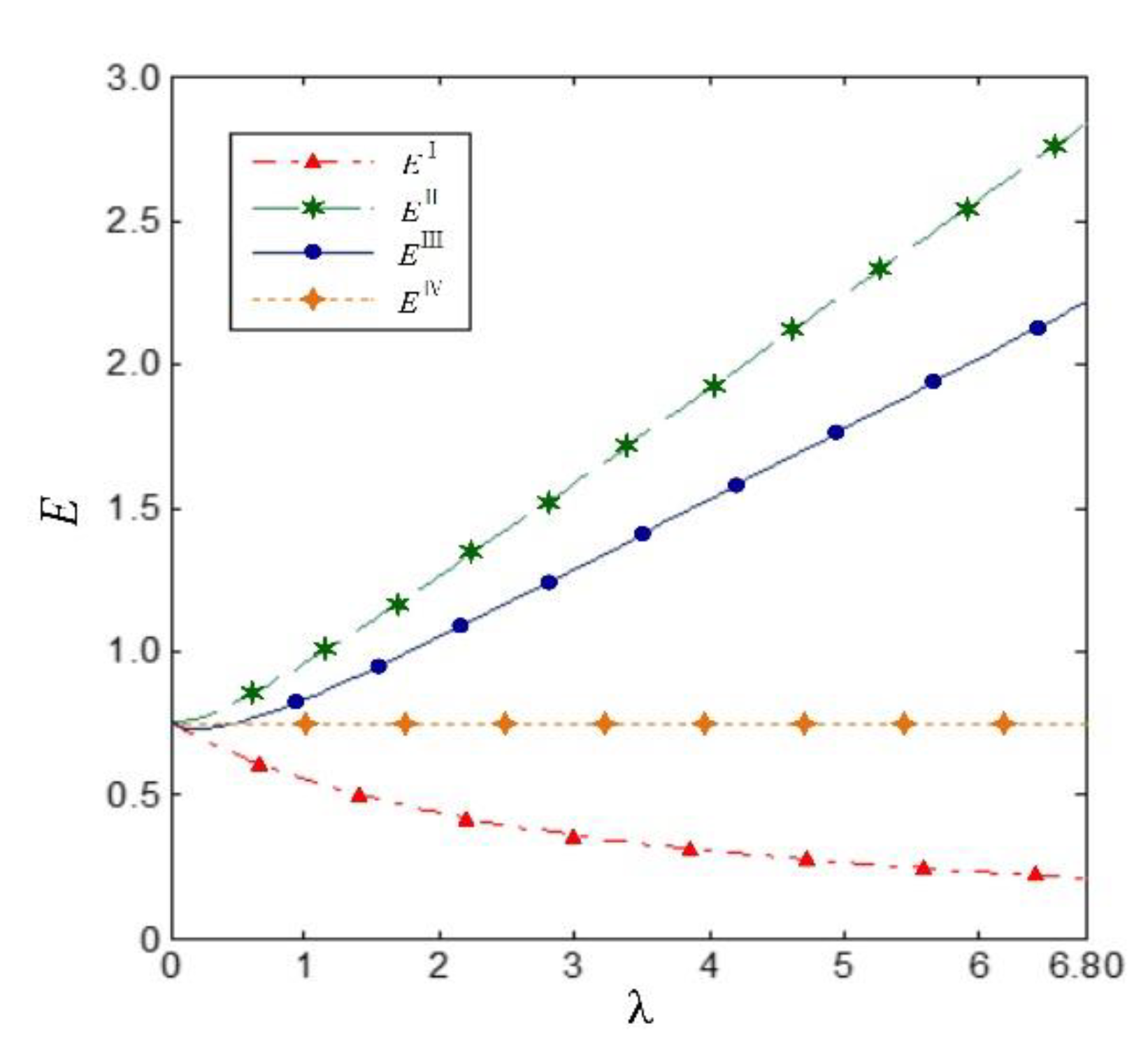

6. Numerical Analysis

- Impacts of fairness concerns on RSC utility

- 2.

- Impacts of fairness concerns on RSC performance and environmental benefit in a single period

- 3.

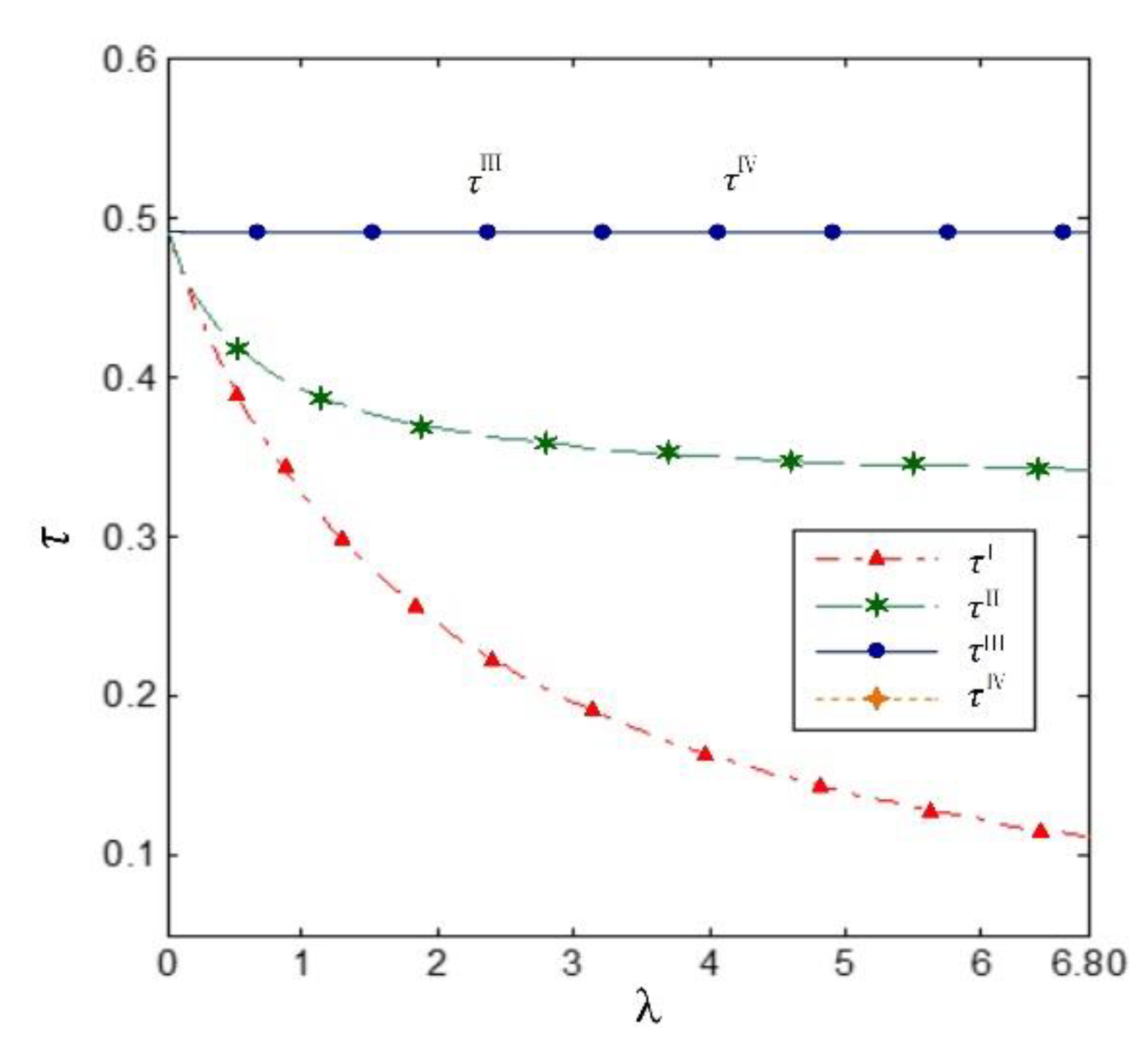

- Evolutionary process and stable strategy of channel members’ fairness concerns

7. Conclusions

7.1. Theoretic Results

- For the impacts of fairness preferences on operational strategies and resulting utilities

- 2.

- For the favorable scenarios to accomplish desired objectives in the short term

- 3.

- For the evolutionary process and stability of fairness preferences in the long term

7.2. Managerial Implications

7.3. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

Appendix A. Proof of Proposition 1

Appendix B. Proof of Corollary 1

- Scenario I (Both the manufacturer and retailer are fairness concerned)

- 2.

- Scenario II (The manufacturer is fairness concerned and retailer is fair neutral)

- 3.

- Scenario III (The manufacturer is fair neutral and retailer is fairness concerned)

Appendix C. Proof of Proposition 3

- The sales price.

- 2.

- The wholesale price.

- 3.

- The collection rate.

Appendix D. Proof of Propositions 4 and 5

Appendix E. Proof of Proposition 6

Appendix F. Stability Analysis of Equilibrium Solutions

- The equilibrium point (0,0)

- 2.

- The equilibrium point (1,0)

- 3.

- The equilibrium point (0,1)

- 4.

- The equilibrium point (1,1)

- 5.

- The equilibrium point (x*, y*)

| Equilibrium Solutions | Conditions and Results | |||||

|---|---|---|---|---|---|---|

| det (J) | tr (J) | Results | ||||

| (0,0) | none | + | + | + | + | |

| (1,0) | 0 | 0 | 0 | 0 | Saddle point | |

| − | + | − | − | |||

| − | 0 | − | − | |||

| − | − | + | − | ESS | ||

| (0,1) | 0 | 0 | 0 | 0 | Saddle point | |

| + | − | − | − | |||

| 0 | − | − | − | |||

| − | − | + | − | ESS | ||

| (1,1) | 0 | 0 | 0 | 0 | Saddle point | |

| − | − | + | − | ESS | ||

| 0 | − | 0 | − | |||

| + | − | − | − | |||

| + | − | − | 0 | Saddle point | ||

| + | − | − | + | |||

| + | 0 | 0 | + | |||

| + | bbb+ | + | + | |||

| ) | none | 0 | 0 | − | 0 | Saddle point |

References

- Jena, S.K.; Sarmah, S.P. Price and service coopetition under uncertain demand and condition of used items in a remanufacturing system. Int. J. Prod. Econ. 2016, 173, 1–21. [Google Scholar] [CrossRef]

- Nobrega, J.H.C.; Pio, P.G.C.; Fernandes, G.L.; Botelho, S.T.; Araujo, T.C.; Anholon, R.; Ordonea, R.E.C.; Rampasso, I.S.; Leal Filho, W.; Quelhas, O.L.G. Sustainability in manufacturing processes: Practices performed in mental forming, casting, heat treatment, welding and electrostatic painting. Int. J. Sustain. Dev. World Ecol. 2019, 26, 684–697. [Google Scholar] [CrossRef]

- Cheng, J.; Li, B.; Gong, B.; Cheng, M.; Xu, L. The optimal power structure of environmental protection responsibilities transfer in remanufacturing supply chain. J. Clean. Prod. 2017, 153, 558–569. [Google Scholar] [CrossRef]

- Perkins. You’re as Good as New with Remanufactured Parts. 2019. Available online: https://www.perkins.com/en_GB/products/sectors/agriculture/youre-as-good-as-new-with-remanufactured-parts.html (accessed on 13 June 2021).

- Liu, B.; Papier, F. Remanufacturing of Multi-Component Systems with Product Substitution. Eur. J. Oper. Res. 2021, in press. [Google Scholar] [CrossRef]

- Cao, J.; Zhang, X.; Hu, L.; Xu, J.; Zhao, Y.; Zhou, G.; Schnoor, J.L. EPR regulation and reverse supply chain strategy on re-manufacturing. Comput. Ind. Eng. 2018, 125, 279–297. [Google Scholar] [CrossRef]

- Cao, J.; Chen, X.; Zhang, X.; Gao, Y.; Zhang, X.; Zhao, Y.; Yang, X.; Xu, J.; Zhou, G.; Schnoor, J.L. Public awareness of reman-ufactured products in Yangtze River Delta of China: Present status, problems and recommendation. Int. J. Environ. Res. Public Health 2018, 15, 1199. [Google Scholar] [CrossRef] [Green Version]

- Chen, Y.; Chen, F. On the Competition between Two Modes of Product Recovery: Remanufacturing and Refurbishing. Prod. Oper. Manag. 2019, 28, 2983–3001. [Google Scholar] [CrossRef]

- Duberg, J.V.; Johansson, G.; Sundin, E.; Kurilova-Palisaitiene, J. Prerequisite factors for original equipment manufacturer remanufacturing. J. Clean. Prod. 2020, 270, 122309. [Google Scholar] [CrossRef]

- Zou, Z.-B.; Wang, J.-J.; Deng, G.-S.; Chen, H. Third-party remanufacturing mode selection: Outsourcing or authorization? Transp. Res. Part E Logist. Transp. Rev. 2016, 87, 1–19. [Google Scholar] [CrossRef]

- Yang, L.; Wang, G.; Ke, C. Remanufacturing and promotion in dual-channel supply chains under cap-and-trade regulation. J. Clean. Prod. 2018, 204, 939–957. [Google Scholar] [CrossRef]

- Mitra, S. Models to explore remanufacturing as a competitive strategy under duopoly. Omega 2016, 59, 215–227. [Google Scholar] [CrossRef]

- Bulmuş, S.C.; Zhu, S.X.; Teunter, R. Capacity and production decisions under a remanufacturing strategy. Int. J. Prod. Econ. 2013, 145, 359–370. [Google Scholar] [CrossRef]

- Ho, T.-H.; Su, X.; Wu, Y. Distributional and Peer-Induced Fairness in Supply Chain Contract Design. Prod. Oper. Manag. 2014, 23, 161–175. [Google Scholar] [CrossRef] [Green Version]

- Liu, G.; Yang, T.; Wei, Y.; Zhang, X. Decisions of Green Supply Chain under Fairness Concerns and Different Power Structures. Int. J. Enterp. Inf. Syst. 2018, 14, 28–53. [Google Scholar] [CrossRef] [Green Version]

- Cui, T.H.; Mallucci, P. Fairness and channel coordination. Manag. Sci. 2007, 53, 1303–1314. [Google Scholar]

- Li, Q.; Xiao, T.; Qiu, Y. Price and carbon emission reduction decisions and revenue-sharing contract considering fairness concerns. J. Clean. Prod. 2018, 190, 303–314. [Google Scholar] [CrossRef]

- Nie, P.; He, B.; Du, S. Supply chain operations considering fairness concerns with bargaining disagreement point. J. Manag. Sci. China 2017, 20, 97–107. (In Chinese) [Google Scholar]

- Scheer, L.K.; Kumar, N.; Jan-Benedict, E.M. Similar and divergent reactions to inequity in U.S. and Dutch interorganizational relationships. Acad. Manag. J. 2003, 46, 303–316. [Google Scholar]

- Times, J. Behind the Scenes of 24/7 Service: The Realities of ‘Owning’ a Japanese Convenience Store. Jpn. Times 2019. Available online: https://www.japantimes.co.jp/news/2019/05/27/national/behind-scenes-24-7-service-realities-owning-japanese-convenience-store/ (accessed on 1 September 2021).

- Yuan, X.; Zhang, X. Remanufacturers’ mixed recycling channel strategy considering fairness concerns. Control Eng. China 2020, in press. [Google Scholar]

- Maiti, T.; Giri, B.C. A closed loop supply chain under retail price and product quality dependent demand. J. Manuf. Syst. 2015, 37, 624–637. [Google Scholar] [CrossRef]

- Sun, H.; Zheng, H.; Sun, X.; Li, W. Customized Investment Decisions for New and Remanufactured Products Supply Chain Based on 3D Printing Technology. Sustainability 2022, 14, 2502. [Google Scholar] [CrossRef]

- Xia, X.; Zhang, C. The Impact of Authorized Remanufacturing on Sustainable Remanufacturing. Processes 2019, 7, 663. [Google Scholar] [CrossRef] [Green Version]

- Ji, G.; Huang, W. Effective implementation of WEEE take-back directive. J. Manag. Sci. China 2012, 15, 1–9. (In Chinese) [Google Scholar]

- Peralta, M.E.; Luna, P.; Soltero, V.M. Towards standards-based of circular economy: Knowledge available and sufficient for transition? Int. J. Sustain. Dev. World Ecol. 2020, 27, 369–386. [Google Scholar] [CrossRef]

- He, P.; He, Y.; Xu, H. Channel structure and pricing in a dual-channel closed-loop supply chain with government subsidy. Int. J. Prod. Econ. 2019, 213, 108–123. [Google Scholar] [CrossRef]

- Singhal, D.; Jena, S.K.; Aich, S.; Tripathy, S.; Kim, H.-C. Remanufacturing for Circular Economy: Understanding the Impact of Manufacturer’s Incentive under Price Competition. Sustainability 2021, 13, 11839. [Google Scholar] [CrossRef]

- Pazoki, M.; Zaccour, G. A mechanism to promote product recovery and environmental performance. Eur. J. Oper. Res. 2019, 274, 601–614. [Google Scholar] [CrossRef]

- Huang, Y.; Wang, Z. Demand disruptions, pricing and production decisions in a closed-loop supply chain with technology licensing. J. Clean. Prod. 2018, 191, 248–260. [Google Scholar] [CrossRef]

- Chen, X.; Wang, J.; Wang, F. Decision research for dual-channel closed-loop supply chain under the consumer’s preferences and government subsidies. Syst. Eng. Theory Pract. 2016, 36, 3111–3122. (In Chinese) [Google Scholar]

- Zhou, Y.; Xiong, Y.; Jin, M. Less is more: Consumer education in a closed-loop supply chain with remanufacturing. Omega 2021, 101, 102259. [Google Scholar] [CrossRef]

- Wang, Z.; Duan, Y.; Huo, J. Impact of Trade-in Remanufacturing Policy and Consumer Behavior on Remanufacturer Decisions. Sustainability 2020, 12, 5980. [Google Scholar] [CrossRef]

- Zhang, F.; Ma, J. Research on the complex features about a dual-channel supply chain with a fair caring retailer. Commun. Nonlinear Sci. Numer. Simul. 2016, 30, 151–167. [Google Scholar] [CrossRef]

- Zhang, T.; Wang, X. The impact of fairness concern on the three-party supply chain coordination. Ind. Mark. Manag. 2018, 73, 99–115. [Google Scholar] [CrossRef]

- Wang, Y.; Li, J. Research on dominant models of E-CLSC based on network sale and recycle considering fairness concerns. Chin. J. Manag. Sci. 2018, 26, 139–151. (In Chinese) [Google Scholar]

- Xiao, Q.; Chen, L.; Xie, M.; Wang, C. Optimal contract design in sustainable supply chain: Interactive impacts of fairness concern and overconfidence. J. Oper. Res. Soc. 2021, 72, 1505–1524. [Google Scholar] [CrossRef]

- Li, Q.-H.; Li, B. Dual-channel supply chain equilibrium problems regarding retail services and fairness concerns. Appl. Math. Model. 2016, 40, 7349–7367. [Google Scholar] [CrossRef]

- Liu, Z.; Li, B.; Gong, B.; Cheng, J. Product design decision and coordination of closed-loop supply chain considering reman-ufacturer’s fairness concern. Control Decis. 2016, 31, 1615–1622. (In Chinese) [Google Scholar]

- Wang, W.; Zhang, M.; Zhao, L.; Zhou, Z. Decision-making model of closed-loop supply chain based on third-party collector’s fairness concern. J. Syst. Eng. 2019, 34, 409–421. [Google Scholar]

- Zhang, L.; Zhou, H.; Liu, Y.; Lu, R. Optimal environmental quality and price with consumer environmental awareness and retailer’s fairness concerns in supply chain. J. Clean. Prod. 2019, 213, 1063–1079. [Google Scholar] [CrossRef]

- Nie, T.; Du, S. Dual-fairness supply chain with quantity discount contracts. Eur. J. Oper. Res. 2017, 258, 491–500. [Google Scholar] [CrossRef]

- Tang, J.; Li, B.; Liu, Z.; Gong, B.; Chen, Y. Decisions of remanufacturing cooperation mode and coordination in supply chain considering relative fairness concern and product design. Control Decis. 2018, 33, 2234–2242. [Google Scholar]

- Adhikari, A.; Bisi, A. Collaboration, bargaining, and fairness concern for a greed apparel supply chain: An emerging economy perspective. Transp. Res. Part E Logist. Transp. Rev. 2020, 135, 101863. [Google Scholar] [CrossRef]

- Yoshihara, R.; Matsubayashi, N. Channel coordination between manufacturers and competing retailers with fairness concerns. Eur. J. Oper. Res. 2020, 290, 546–555. [Google Scholar] [CrossRef]

- Gao, W.; Feng, Y. Dynamic evolution of CLSCR based on third-party collecting with double fairness concerns. Math. Pract. Theory 2020, 50, 10–21. [Google Scholar]

- Esenduran, G.; Kemahlıoğlu-Ziya, E.; Swaminathan, J.M. Take-Back Legislation: Consequences for Remanufacturing and Environment. Decis. Sci. 2016, 47, 219–256. [Google Scholar] [CrossRef]

- Xu, J.; Liu, N. Research on closed loop supply chain with reference price effect. J. Intell. Manuf. 2017, 28, 51–54. [Google Scholar] [CrossRef]

- Du, S.; Du, C.; Liang, L.; Liu, T. Supply chain contract and coordination considering fairness concerns. J. Manag. Sci. China 2010, 13, 41–48. [Google Scholar]

- Pan, K.; Cui, Z.; Xing, A.; Lu, Q. Impact of fairness concern on retailer-dominated supply chain. Comput. Ind. Eng. 2020, 139, 106209. [Google Scholar] [CrossRef]

- Chen, Z. Dominant Retailers and the Countervailing-Power Hypothesis. RAND J. Econ. 2003, 34, 612. [Google Scholar] [CrossRef]

- Xie, S. Economic Game Theory; Fudan University Press: Shanghai, China, 2014; pp. 104–136. [Google Scholar]

- Zhang, X.; Zhou, G.; Cao, J.; Wu, A. Evolving strategies of e-commerce and express delivery enterprises with public super-vision. Res. Transp. Econ. 2020, 5, 100810. [Google Scholar] [CrossRef]

- Yu, T.; Liu, C. The analysis of evolution game model and simulation between governments and the third-party in product quality regulation. Chin. J. Manag. Sci. 2016, 24, 90–96. [Google Scholar]

- Cao, J.; Zhao, Y.; Xu, J.; Wu, S. Dynamic optimization of closed-loop supply chain with retailer’s fairness concerns. Comput. Integr. Manuf. Syst. 2020, 26, 3142–3155. (In Chinese) [Google Scholar]

| Notations | Definitions |

|---|---|

| Parameters | |

| i = M, R, S respectively represents the manufacturer, the retailer, and the RSC. | |

| j = I, II, III, IV, C represent respective scenarios. | |

| The manufacturer’s fairness concern coefficient, . The manufacturer is fair neutral if . | |

| The retailer’s fairness concern coefficient, . The manufacturer is fair neutral if . | |

| Production cost of unit new product. | |

| Production cost of unit remanufactured product. | |

| A cost-saving of a unit of remanufactured product compared to new product, . | |

| The market size of the products (new and remanufactured). | |

| The price sensitive coefficient of consumers, . | |

| The market demand of new and remanufactured products, . | |

| Transfer price of unit EOL product charged by the retailer. | |

| Acquisition price of unit EOL product from consumers. | |

| The cost investment of EOL product collection. | |

| The collection scale coefficient, i.e., the available collection quantity of the EOL product. | |

| Decision variables, profits, and utilities | |

| Sales price of unit product (new and remanufactured). | |

| Collection rate of the EOL product. | |

| Wholesale price of unit product (new and remanufactured). | |

| Profits of channel members and the entire RSC (i = M, R, S). | |

| Utilities of channel members and the entire RSC (i = M, R, S). | |

| RSC performance under distinct scenarios (j = I, II, III, IV). | |

| Scenario II | Scenario III | Scenario IV | Scenario C | |

|---|---|---|---|---|

| / | ||||

| Scenario I | Scenario II | Scenario III | ||||||

|---|---|---|---|---|---|---|---|---|

| + | + | + | + | + | + | + | / | |

| + | − | + | − | + | − | + | − | |

| − | − | − | − | − | − | − | / | |

| ± | − | + | − | + | − | + | − | |

| − | + | − | + | − | ± | − | + | |

| − | ± | − | − | ± | − | + | ± | |

| Retailer | |||

|---|---|---|---|

| Fairness Concerned | Fair Neutral | ||

| Manufacturer | Fairness concerned | ||

| Fair neutral | |||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, X.; Cao, J.; Zhao, Y.; Lu, J. Fairness Concern in Remanufacturing Supply Chain—A Comparative Analysis of Channel Members’ Fairness Preferences. Sustainability 2022, 14, 3813. https://doi.org/10.3390/su14073813

Zhang X, Cao J, Zhao Y, Lu J. Fairness Concern in Remanufacturing Supply Chain—A Comparative Analysis of Channel Members’ Fairness Preferences. Sustainability. 2022; 14(7):3813. https://doi.org/10.3390/su14073813

Chicago/Turabian StyleZhang, Xuemei, Jian Cao, Yang Zhao, and Jiansha Lu. 2022. "Fairness Concern in Remanufacturing Supply Chain—A Comparative Analysis of Channel Members’ Fairness Preferences" Sustainability 14, no. 7: 3813. https://doi.org/10.3390/su14073813

APA StyleZhang, X., Cao, J., Zhao, Y., & Lu, J. (2022). Fairness Concern in Remanufacturing Supply Chain—A Comparative Analysis of Channel Members’ Fairness Preferences. Sustainability, 14(7), 3813. https://doi.org/10.3390/su14073813