Abstract

The purpose of the study was to determine if the diversity of gender, nationality, and age has a positive and significant effect on adopting corporate governance practices. The study considered 1106 corporate social responsibility and corporate governance reports from 2015 to 2020. The research was of the descriptive–correlational type, with a longitudinal temporality, considering in the first instance an analysis of the disaggregated descriptive statistics to later determine if the diversity of gender, nationality, and age of the board affects the adoption of corporate governance practices. The results show a low degree of diversity and stagnation in the analyzed period. Regarding the adoption of corporate governance practices, these are in an incipient stage, and the most liquid companies in the Chilean stock market are the ones that have advanced the most during the period. It is concluded that gender diversity has a positive and significant impact on the degree of adoption of corporate governance practices, operation, and composition of the board of directors, and protection of shareholders, while the diversity of nationality has a positive and significant impact on the adoption of related practices to risk management. Finally, the study confirms the heterogeneity of results by linking board diversity variables versus non-financial variables.

1. Introduction

During the last decades, different fraud scenarios have set alarms about how corporate governance bodies manage their companies [1]. Inclusively, various questions have arisen related to the composition of the board and its impact on both financial and non-financial variables [2,3,4]. In this sense, from risk control and management, the heterogeneity of the board plays a key role because it promotes the reduction of errors and fraud within organizations [5].

In this regard, the Organization for Economic Cooperation and Development (OECD) has promoted good corporate governance practices for its member countries, intending to help legislators evaluate and improve their legislative and institutional frameworks [6]. On the other hand, companies’ introduction of gender quotas on boards of directors and the adoption of voluntary gender diversity policies have made it possible to diversify the director prototype in listed companies [7,8].

In Chile, the regulation around corporate governance is of the utmost importance because the Commission for the Financial Market enacted, in 2013, its first attempt at regulation, repealing the regulations three years later due to the lack of progress in the matter [9]. Along these lines, in its second attempt at regulation, the Financial Market Commission enacted 2015 General Character Regulation No. 385 (NCG No. 385 by its acronym in Spanish), which, for six years, had an average adoption of close to 34% and did not reflect significant progress in terms of the operation and composition of the board, shareholder protection, and risk management [10,11].

Additionally, in Chile, the degree of diversity of the boards is low [11,12], and the composition of the upper management levels of the companies is a relevant topic and much promoted by international organizations [13,14]. From the diversity of the board, they show the generation of a critical mass [14], which is a wake-up call regarding the effectiveness of political proposals in terms of corporate governance [15].

Consequently, and based on the concepts and evidence described, the importance of this research lies in studying the composition of the board and the degree of adoption of corporate governance practices of Chilean companies, from a general analysis and another disaggregated through the Selective Stock Price Index (IPSA by its acronym in Spanish). This index classifies the largest and most liquid companies in the Chilean stock market and the incidence of both variables. In addition, this study addresses the Chilean problem regarding the low degree of diversity of boards and the low degree of adoption of corporate governance practices, identifying factors that could influence the adoption of good corporate practices, contributing significantly to the academic discussion and business on whether board diversity encourages the adoption of good corporate practices for an emerging market. Given the above, the main objective of this research was to determine if the diversity of gender, nationality, and age of the members of the board has a positive and significant impact on the adoption of corporate governance practices of companies listed in the market of Chilean securities during the period 2015–2020.

2. Literature Review and Hypothesis Development

This section presents a summary of the dimensions of corporate governance and diversity. The regulatory evolution of corporate governance in Chile over the last 40 years is reflected in the first case. In the second section, the fundamentals of diversity in the board’s composition are addressed from an international perspective and the different effects on the composition of a diverse board.

2.1. The Evolution of Corporate Governance in Chile

The Chilean regulatory framework related to corporate governance is structured according to the agencies or institutions that have regulated its operation [16]. In the first instance, the international standards are promoted by the Organization for Economic Cooperation and Development (OECD) and the Development Bank of Latin America (CAF). The second group corresponds to the laws enacted by Congress, the highest Chilean legislative body. Finally, the third group of regulations corresponds to the regulations issued by the Commission for the Financial Market, an institution in charge of regulating the local stock market.

Regarding international standards, intending to facilitate legislators the promotion of good business practices, the OECD 2015 issued the G20/OECD Principles of Corporate Governance, in which the new trends of the business sectors are collected, including lessons learned from financial crises, cross-border business activities, and the growing complexity of retirement systems, allowing the corporate governance principles enacted in 1999 to be updated [6]. Additionally, due to the low level of development, low financial deepening, and incipient market capitalization of the markets in Latin America, CAF issued specific guidelines which seek, through good corporate governance, to increase the region’s competitiveness at an international level [17].

Regarding the legislation promulgated by the Chilean National Congress, the Securities Market Law (Law 18045) and the Corporations Law (Law 18046) are both considered the basis of the pillar of the Chilean financial market. Both laws have had modifications, being the regulation of the public offer of acquisition of shares and the most relevant legislation on corporate governance. In this context, both legislations improve the regulations that regulate the relationships and asymmetries of information that could be generated between the different corporate governance bodies [16].

Regarding the regulations issued by the Commission for the Financial Market in 2012, the General Character Regulation No. 341 was promulgated, which within its requirements, considered the clear and explicit issuance on the adoption by companies of various corporate governance practices proposed by the regulator. The regulation was in force in 2012, 2013, and 2014. It was promptly repealed [1] because the information contained in the responses was scarce and highly standardized, which the regulator understood as formal and not necessarily natural to the regulations [9]. The spirit of the mentioned rule was not fulfilled, which accelerated its repeal.

The second attempt at regulation by the Commission for the Financial Market corresponds to the issuance in mid-2015 of the General Character Regulation No. 385 (NCG No. 385 by its acronym in Spanish) was to provide more information to shareholders and stakeholders [18]. In the specialists’ opinion, this new regulation was more exhaustive and demanding than the previous one, both due to the number of practices to be evaluated and the objectives to be achieved [10]. The NCG No. 385 was in force for six periods and considered the reports between 2015 and 2020. However, this regulation was also repealed due to its low level of adoption and marginal progress in its validity period [19].

Finally, in November 2021, the Financial Market Commission promulgated the General Character Regulation No. 461 (NCG No. 461), modifying the sections on corporate governance, social responsibility, and sustainable development. This new regulation incorporates the obligation to report on Environmental, Social, and Governance (ESG) factors in companies’ annual reports to provide better information to investors for decision-making. In this regard, NCG No. 461 is expected to allow companies to generate competitive advantages that lead to sustainable performance and material impacts on their governance models [15].

2.2. The Diversity of the Board

In recent years, diversity in the composition of decision-making boards has been of global concern due to the insufficient degree of diversity in public and private companies [20]. In this sense, through quota laws and codes of good corporate governance, different countries have increased the presence of women in the strategic councils of companies, with quota laws being more effective due to the mandatory nature of their application [12,21,22].

At an international level, the rate of female representation on the boards of directors of international companies amounts to an average of 10.3%, with Norway (42.0%), Sweden (28.0%), and Finland (27.2%) being the countries with the highest degree of diversity, versus Morocco (0.0%), Japan (0.9%), and Chile (2.4%) [12]. Concerning Latin America, although several countries have adopted codes of good corporate governance, no country has regulated gender quotas in the private sector. Particularly in Chile, the low representation of women on the board seems not to be a corporate concern [23].

On the other hand, the heterogeneity of the board should not be limited only to gender [24] but should incorporate multi-diversity characteristics, such as the nationality, occupation, age, and ethnicity of the directors [25]. Even Abdullah (2014) [26] points out that diversity contributes to reducing the risk of groupthink in the different decision-making levels, generating over time better control in managerial actions, corporate transparency, and better financial performance [27].

The effects of the diversity of decision-making on what to do entrepreneurial vary depending on each type of diversity to be investigated and the applied study methodology [3,4,5,6,7,8,9,10,11,12,13,14,15,16,17,18,19,20,21,22,23,24,25,26,27,28]. For example, different investigations have linked diversity and business performance variables, using univariate, dynamic, regression models, robustness tests, and hypothesis tests [29,30,31,32]. On the other hand, bibliometric analyses indicate that diversity could have positive, negative, or neutral effects, according to the particular characteristics of the study population [4,11,20,33].

Regarding the types of diversity, one of the most important at the corporate level corresponds to gender diversity. In this area, applied research in Europe, North America, and Africa indicates that the higher degree of female representation on boards, the better the financial or corporate performance of companies that adopt this type of policy [7,34,35,36]. In contrast, sectoral studies, both at the country, size, or economic sector level, indicate that the effects on the financial performance of the firms are highly dissimilar and few comparable, and other factors of incidence can be identified apart from financial performance, as well as a relationship. Inversely, that is, the better the financial performance, the greater the social responsibility, and the promotion of diversity in corporate governance bodies [2,3,37,38].

Other types of diversity in the board’s composition correspond to the diversity of nationality and age, and its effects and incidences are highly heterogeneous. On the one hand, studies indicate that these types of diversity have a positive and significant impact on firms’ financial and organizational performance [27,39,40]. While another stream of results concludes that these types of diversity inhibit any increase in financial performance, this is not the case in reputational, risk, or corporate governance variables [34,41].

Finally, the degrees of diversity in the composition of the boards of directors and the Chilean regulation related to corporate governance have presented a stagnation at the level of adoption of good corporate practices [11,12]. In this regard, the relevance of this research consists of reflecting the degree of progress in the adoption of different diversity practices and corporate governance during the 2015–2020 period and evaluating the effectiveness of this new regulation attempt. In this sense, the study hypothesis was the following:

Hypothesis 1 (H1).

The diversity of gender, nationality, and age positively and significantly impact the adoption of corporate governance practices of open corporations in the Chilean stock market.

3. Methods

This research was of descriptive–correlational type, with a longitudinal temporality [42]. The study variables were analyzed descriptively, reflecting their degree of progress during the 2015–2020 period. Subsequently, using multiple linear regressions, the incidence coefficients of the variables gender diversity, nationality, and age in the different dimensions of corporate governance considered in this study were determined [2,3,4,7,20,24,25,28,33,36,39,40,41,43,44,45,46].

Concerning the study population, this was 1271 reports, of which, through the application of a non-probabilistic sampling by conviction, a sample of 1106 reports corresponding to a total of 206 companies was reached, which reported their degree of adoption of the General Character Standard No. 385 on Corporate Governance and General Character Standard No. 386 on Social Responsibility, both regulations were enacted in 2015 and require open corporations to annually report their degree of adoption to the different corporate governance practices, as well as the level of diversity they have on their boards of directors.

Concerning the degree of adoption of corporate governance practices, this was determined from the quotient between the number of practices adopted by each of the dimensions evaluated and the total number of practices proposed by the regulations. The NCG No. 385 groups 99 corporate governance practices and each of its four categories. In this sense, “Cat.1” considers 51 practices related to the operation and composition of the board of directors, “Cat.2” considers 22 practices related to the protection of minority shareholders, “Cat.3” considers 22 practices related to control and risk management, and “Cat.4” considers 4 practices related to evaluation by an independent third party. Regarding the level of diversity in the board, the calculation was determined from the quotient between the number of directors of the gender, nationality, and age classifications and the total number of directors belonging to that board.

Table 1 describes the research variables used, differentiating dependent, independent, and control variables. The operationalization of the variables and the bibliography consulted are also presented, supporting the structure of the model.

Table 1.

Definition and operationalization of variables used in the study.

Finally, the regression model that considers the variables explained in Table 1 is presented below.

H1: G° Adop. CGxi = ß0 + ß1 Gender diversityit + ß2 Nationality diversityit + ß3 Age diversityit + ß4 Economis sectorit + ß5 IPSAit + ß6 Sizeit + €it

G° Adopt. CGxi = Corresponds to the degree of adoption of NCG No. 385, or adoption of Cat. 1, or adoption of Cat. 2, or adoption of Cat. 3, or adoption of Cat.4.

4. Results

This section presents the descriptive statistics related to the adoption of corporate governance practices and the diversity of the board of directors during the 2015–2020 period. Additionally, the executed regression model results are presented, considering the effects of diversity in adopting corporate governance practices, measured through NCG No. 385 and each of its categories.

4.1. Evolution of the 2015–2020 Period, Diversity and Corporate Governance Variables

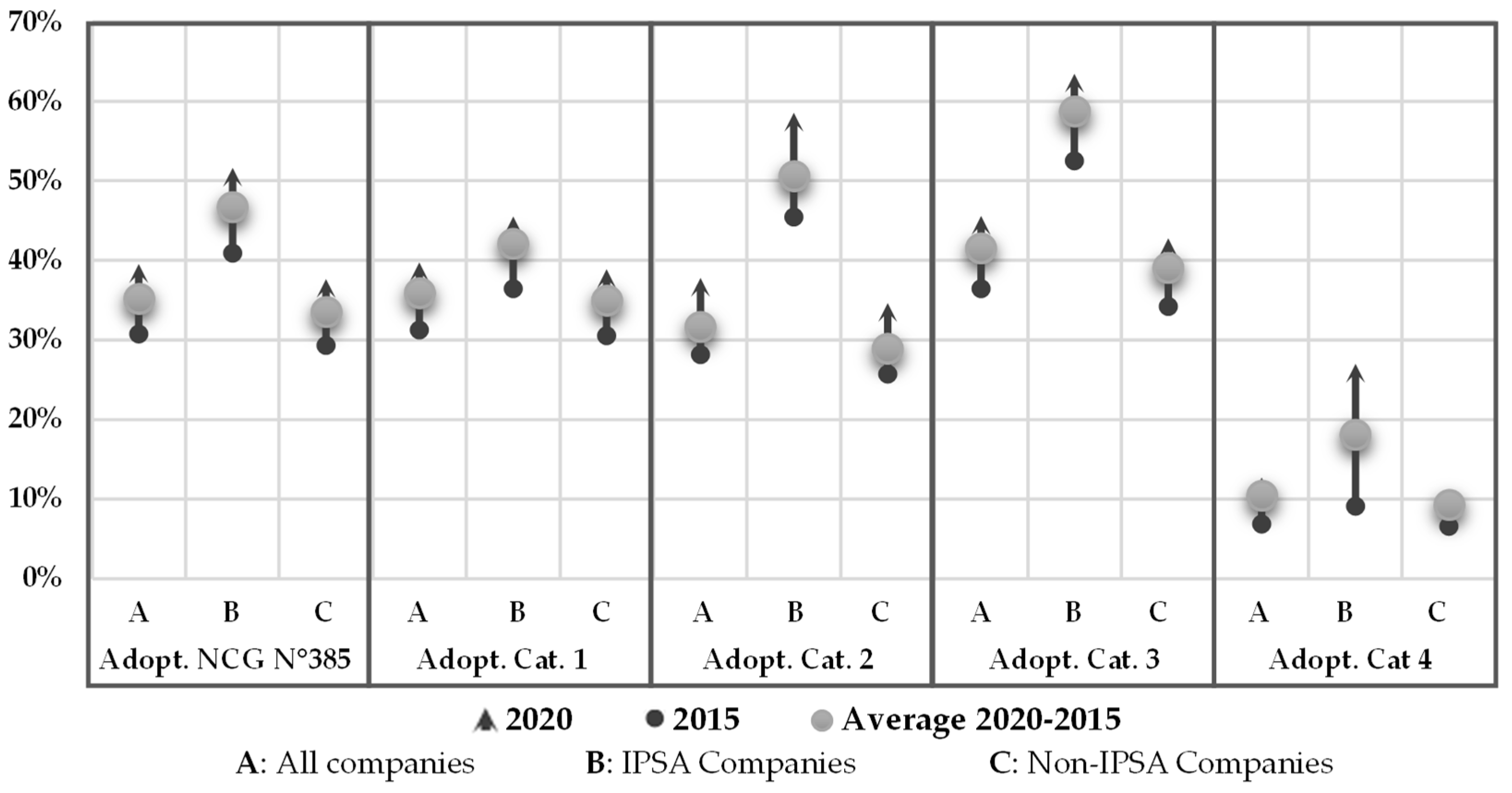

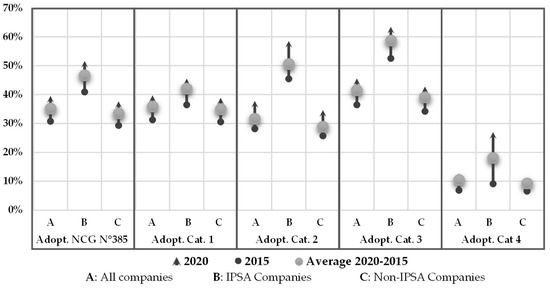

As specified in the previous sections, the study sample considered 1106 reports from 202 companies. Figure 1 shows the evolution in the degree of adoption of corporate governance practices during the period 2015–2020, considering the total study sample (A), IPSA companies (B), and non-IPSA companies (C). It is observed that adherence to NCG No. 385 at the all-companies (A) level in 2015 was close to 30%, increasing almost 10% six years later. Additionally, in all the quadrants, a higher degree of adoption and progress can be seen in the period analyzed by the IPSA companies (B) versus the non-IPSA companies (C). On the other hand, advances of more than 15% are observed by the IPSA (B) companies in the categories “Cat. 2”, relationship with shareholders, and “Cat. 4”, evaluation by a third party.

Figure 1.

Degree of adoption of corporate governance practices for the 2015–2020 period.

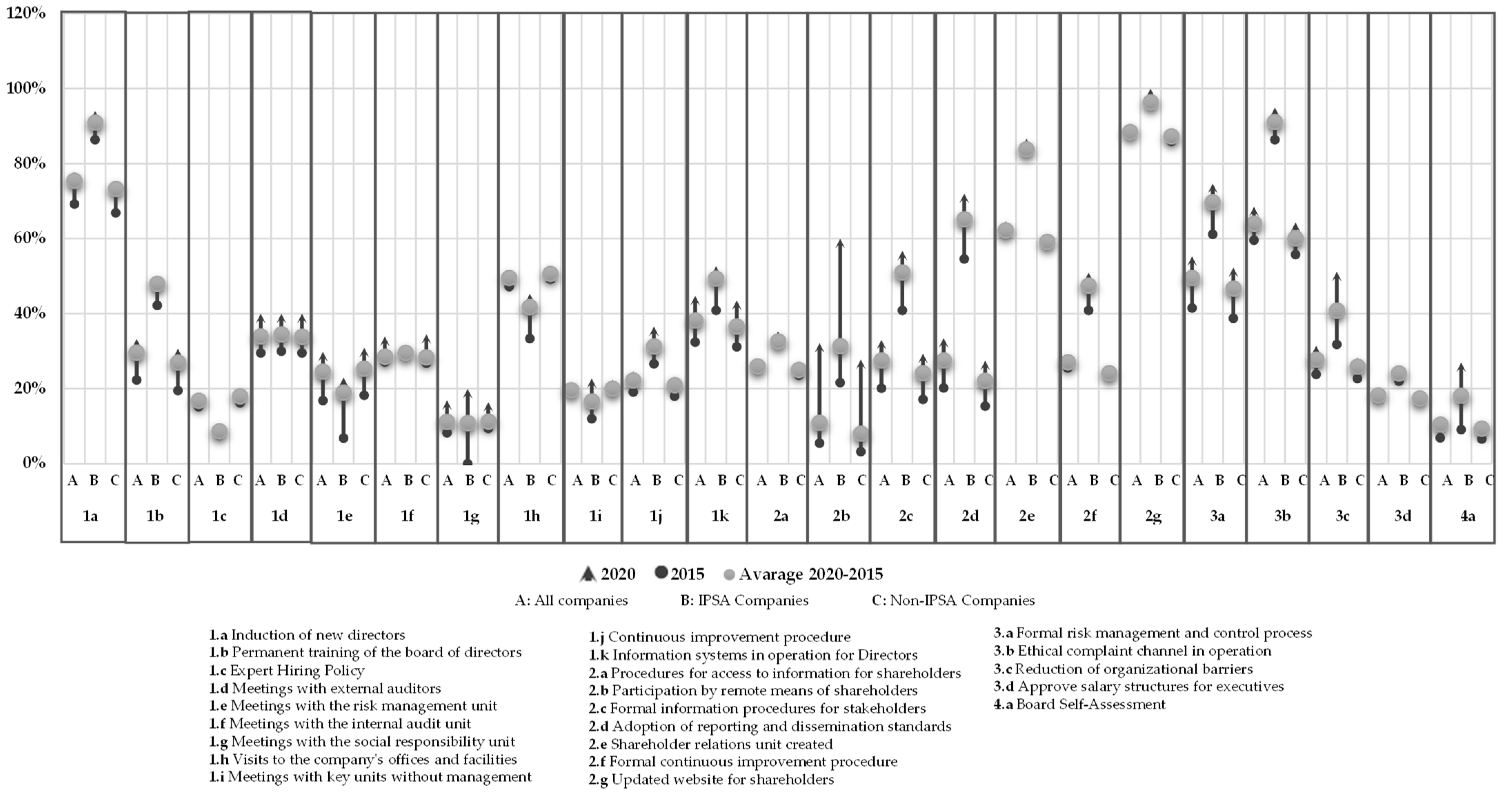

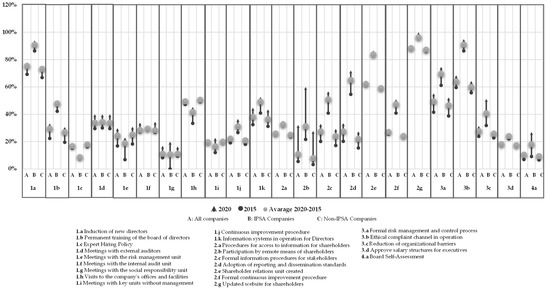

Figure 2 shows the adoption results for each corporate governance principle considered in Chilean regulation. It is observed that principles 1c, 1g, and 4a are the lowest, reflecting that most Chilean companies do not have a policy of hiring experts, maintain low communication with social responsibility units, and almost never submit to review by an independent expert its corporate governance structures. On the contrary, principles related to the induction of new directors (1a), communication and information with shareholders (2e and 2g), and the implementation of an ethical complaints channel (3b), are in an advanced implementation stage. Significant progress can also be observed, especially when considering the IPSA companies, for example, in principles 2b, 2d, and 3c, in which advances of more than 15% are reflected in progress in the participation of shareholders by remote means, formalization of reporting and dissemination standards, as well as the reduction of organizational barriers.

Figure 2.

Degree of adoption by corporate governance principle for the 2015–2020 period.

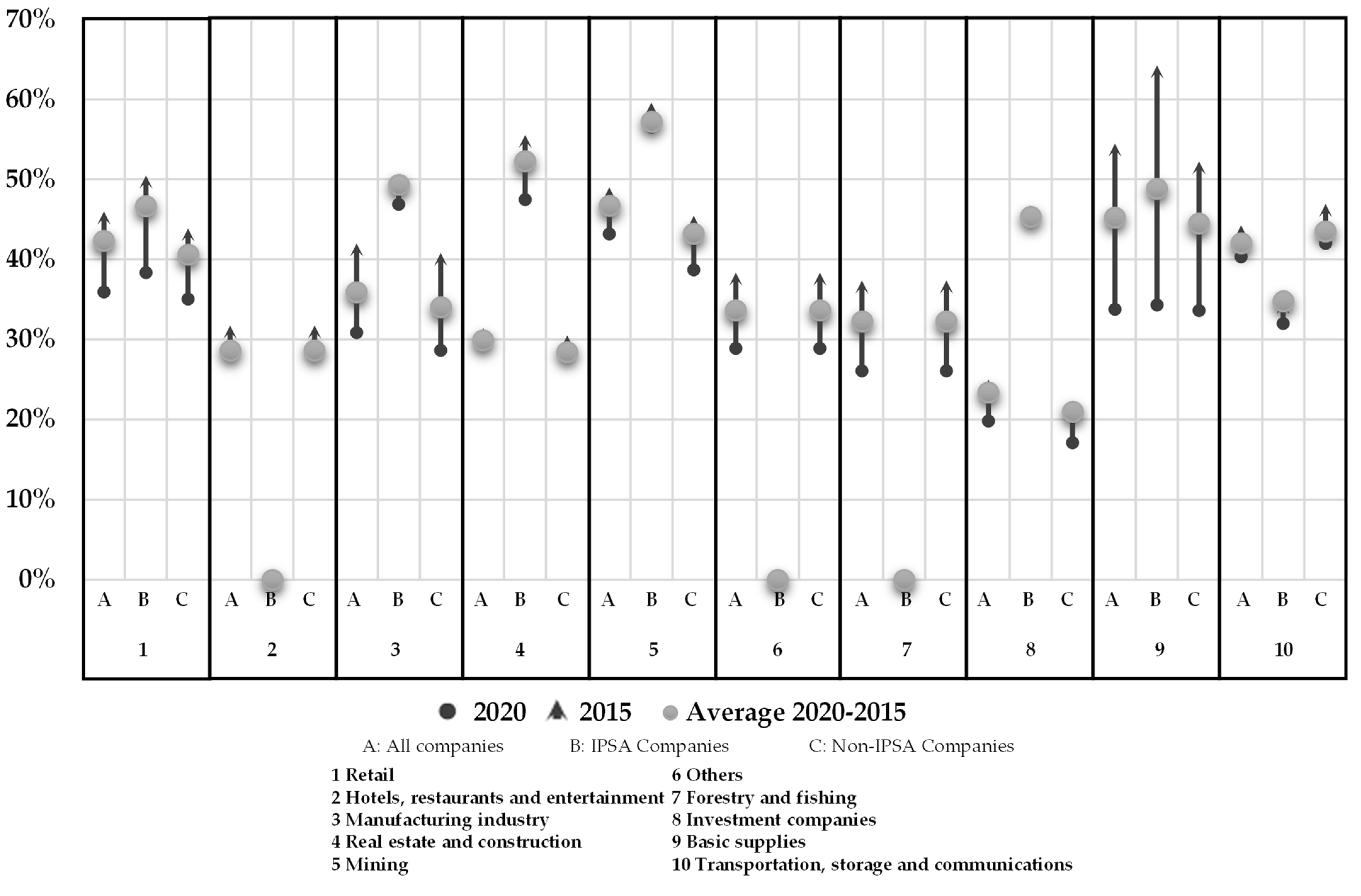

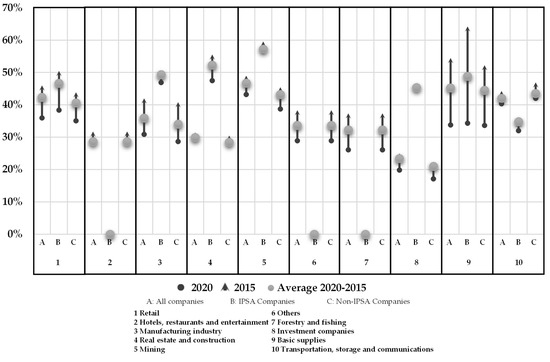

Figure 3 shows the degrees of adoption by economic sectors. In the first instance, two large groups can be observed. The first is made up of sectors 1, 3, 6, 7, and 9, which show progress of more than 10% during the analyzed period, including the primary supply sector, which increased its adherence level by around 20% and obtained in 2020 an adoption of more than 50% in its three items. On the other hand, there is the second group, made up of economic sectors 2, 4, 5, 8, and 10, which in six years had marginal advances. Additionally, the sector related to investment companies (8) presents the lowest degree of adoption and marginal progress during the analyzed period, leaving doubts about whether or not its subsidiaries and associates adhere to these corporate governance practices beyond a legal figure of the parent company subject to regulation.

Figure 3.

Degree of adoption by economic sectors for the 2020–2015 period.

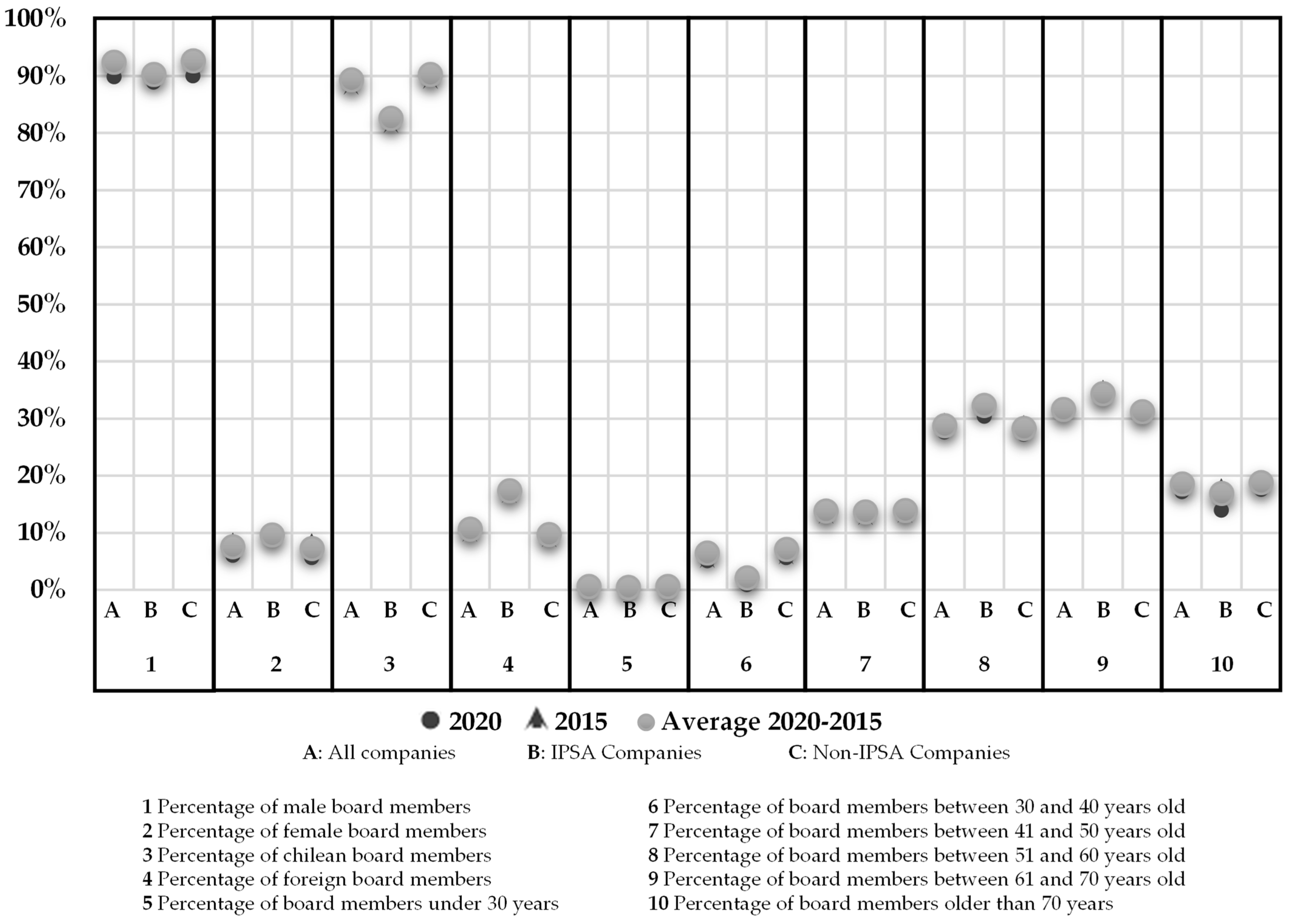

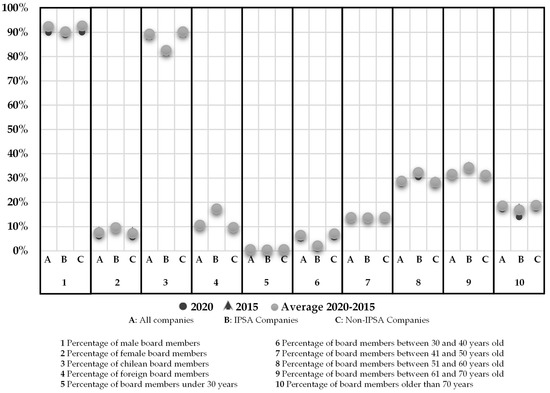

Finally, Figure 4 shows the composition of the Chilean boards regarding the variables gender, nationality, and age. On average, the percentage of male directors will reach 90% in 2020, while directors with Chilean nationality represent 89%. Regarding age diversity, the range of 51 to 70 years concentrates 60% of the evaluated variable. Additionally, there were no significant variations in the diversity variables during the analyzed period, both at the level of IPSA companies and non-IPSA companies.

Figure 4.

Degree of the diversity of the board for the period 2020–2015.

4.2. Result of the Multivariate Regressions

Table 2 presents the results of the multivariate regressions. It is observed that the adjusted R2 for models 1, 2, 3, 4, and 5 are low. Therefore, the reliability of the regressions is limited to each of the resulting coefficients of the equation. Additionally, it is observed that the adjusted R2 related to models 1, 3, and 4 explain 21.5% (0.215), 27.0% (0.270), and 29.8% (0.298), respectively, of the adoption of previously defined governance practices. Along the same lines, when applying Fisher’s “F” statistical test, with a ρ ≤ 0.050, all models have global statistical significance, at 0.000, validating the variables included in the model.

Table 2.

Results of the regressions related to the study Hypothesis H1.

Regarding the control variables used, it is observed that in most axes the variables were significant at a level of ρ ≤ 0.050. In this sense, only in the axes of the economic sector (model 2), economic sector (model 5), and size (model 3), there is no statistical significance in the variables. Additionally, in all the regression models, the control variable IPSA was significant, allowing us to differentiate those companies with low exposure to the stock market (non-IPSA) from those with a high level of transactions in the Chilean stock market (IPSA).

The coefficients of regressions were analyzed through the T-Student test [48], considering that any parameter βt, with H0: βi = 0 and H1: βi ≠ 0, rejecting H1 for any coefficient with a ρ ≥ 0.05. In this sense, H1 is accepted only for the coefficients related to the gender of models 1, 2, and 3 and the nationality coefficient of model 4. For the rest of the coefficients, H1 is wholly rejected as it is not statistically significant.

Regarding the incidence coefficients, it is observed that gender diversity has a positive and significant effect on adherence to corporate governance practices with a coefficient of 0.091 * (NCG No. 385), on the composition and operation of the board with a coefficient of 0.113 * (Cat. 1), and adoption of practices related to the protection of shareholders with a coefficient of 0.130 ** (Cat. 2), accepting H1 for these three cases. Regarding the incidence of nationality diversity in the adoption of corporate practices, only in the risk management category (Cat. 3) has a positive and significant incidence generated, obtaining a coefficient of 0.087 *, also accepting H1. On the other hand, regarding the incidence of age diversity in adopting corporate practices, a significant incidence is generated in none of the coefficients, rejecting the study hypothesis for this type of diversity.

Finally, it is observed that the constants of models 1 (28.529 **), 2 (30.291 **), 3 (23.708 **), 4 (33.454 **), and 5 (5.483 **) are statistically significant. However, in all cases, significant gaps are reflected between the optimal level and the starting point of each of the executed models, which do not reach a third of the total points considered by the measurement.

5. Discussion

In general, when considering the average degree of adoption of NCG No. 385 as of 2020, this was 40%, with an advance of almost ten percentage points in the analyzed period. Additionally, the IPSA companies, compared with the rest of the companies analyzed, are the ones that presented the most significant progress during the six years that the regulations were in force. In this regard, the authors Moraga and Ropero (2018) [1], Moraga and Ropero (2019) [10], and Arenas, Bustamante, and Campos (2021) [19] conclude that adherence to NCG No. 385 is insufficient, and its progress during six years of validity has been marginal. Additionally, Godoy, Walker, and Zegers (2018) [9] point out that there is a stagnation in corporate governance in the Chilean case due to the low level of adoption and the scarce and standardized information contained in the responses to the proposed practices. In this context, researchers Li (2018) [49] and Ghuslan, Jaffar, Saleh, and Yaacob (2021) [15] point out that the regulator’s attention should be on adopting implementing the proposed corporate governance practices.

Regarding gender diversity (10%), nationality diversity (11%), and age diversity (41%), the results indicated that in the period 2015–2020, there were no significant advances and the diversity variables fluctuations did not appear, there are also no relevant differences between IPSA and non-IPSA companies. In this regard, different studies indicate that in Chile the diversity in the composition of the boards of directors is low and that the integration of women in managerial positions is an essential weakness of the Chilean stock market [23,50,51]. Similarly, the authors Terjesen, Aguilera, and Lorenz (2015) [12] point out that Chile is one of the OECD countries with the least gender diversity in corporate governance. When analyzing the variables diversity of nationality and gender, there are no studies relevant to the Chilean market. However, the international average of foreign directors of listed companies is close to 16% [52]. In this area, Reguera, De Fuentes, and Laffarga (2017) [22] suggest a regulatory framework that efficiently promotes the incorporation of diversity variables in the composition of the boards to strengthen the corporate governance structures of the different listed companies.

Concerning the effects of diversity in adopting good corporate practices, the results depend on the type of diversity, and the category of corporate governance analyzed. In this line, H1 is accepted for the four axes of convergence with significant incidences at a level of ρ ≤ 0.05. These four incidences were positive and correspond to the incidences of gender diversity in the adoption of corporate governance practices (NCG No. 385 with a coefficient of 0.091 *), operation and composition of the board (Cat. 1 with a coefficient of 0.113 *), shareholder protection (Cat. 2 with a coefficient of 0.130 **), and the incidence of the diversity of nationality in risk management (Cat. 3 with a coefficient of 0.087 *) of companies listed on the market of Chilean securities.

Regarding the types of incidence, Rhode and Packel (2014) [20] and Conyon and He (2017) [53] explain that the impact of maintaining a diverse board is not comparable between countries, quite the contrary, the impacts could be variable, depending on the particular characteristics of the study population. Quite the contrary, the impacts could be variable, depending on the characteristics of the study population. In this sense, Cuadrado, Rubio, and Martínez (2015) [52], when studying 1043 international companies, conclude that incorporating foreign and female directors on the boards of directors would positively impact the socially responsible behavior of the organization, as well as in its operation. Along the same lines, Beji, Yousfi, Loukil, and Omri (2020) [47] point out that gender diversity improves the corporate governance structure of societies. However, Zaid, Wang, Adib, and Sahyouni (2020) [45] and Arenas, Bustamante, and Campos (2021) [46] mention in their research that although there is a positive and statistically significant incidence, it is minimal.

Additionally, and within the heterogeneity of possible effects, multiple investigations indicate that the diversity of the board would encourage the adoption of good corporate practices and have a positive impact on monetary variables such as financial performance, return on assets, and profitability on equity [7,36,54,55]. In this regard, there are also international investigations that have addressed the issue and concluded that the diversity of the board is negatively related to financial variables as well as governance and corporate social responsibility [2,3,44].

Regarding the effects of the diversity of the board of directors on non-financial variables, the findings of this study show that diversity has a positive and significant impact on the axes of gender and corporate governance, gender, and the functioning of the board of directors, and nationality and management of risks. In this sense, different studies indicate that the diversity of the board of directors has a positive effect on the corporate environmental performance of companies that adopt this type of policy [56,57,58]. Additionally, diversity positively affects the number of patents and innovative efficiency registered by companies [59] and their corporate social disclosure [60]. In this regard, these results confirm the theory that promotes the diversity of the board of directors as a measure that allows contributing to the sustainable development of communities and their environments [61]. Therefore, although these types of study results are heterogeneous, there is sufficient evidence of the positive effects on the organization of adopting this type of corporate practice.

Finally, the results of this research contribute to the heterogeneity of possible results due to the economic, cultural, social, and regulatory particularities of the Chilean market, identifying positive and significant incidences in some axes of convergence, confirming what was indicated by Rhode and Packel (2014) [20], regarding that the results are conditioned to the methodology and study population used.

6. Conclusions

The study concludes that the companies listed in the Chilean stock market have experienced insufficient progress during the 2015–2020 period regarding adopting corporate governance practices. However, in the disaggregated analysis, the companies with IPSA classification are the ones that present a higher degree of adoption and progress during the period. In this sense, the effectiveness of the regulation, its adoption principles of “comply and explain”, and the revision of the incentives for its adoption by companies are questioned.

Regarding the diversity in the board, it is concluded that during the analyzed period, the Chilean boards are concentrated in a male profile of Chilean nationality and an age range between 50 and 70 years. Additionally, during 2015–2020 there was a stagnation in the levels of diversity, which would merit a review by the regulator regarding policies related to gender quotas or suggestion of good practices in the formation of the board for the market of values.

Regarding the incidence of diversity on the board in adopting good corporate practices, the results are heterogeneous, both by type of diversity and the dimension of governance analyzed. However, H1 is accepted for the axes of gender diversity and adoption of corporate governance practices (NCG No. 385), gender diversity and board operations (Cat. 1), gender diversity and shareholder protection (Cat. 2), and nationality diversity and risk management (Cat. 3). There are no positive and significant incidences at a level lower than ρ ≤ 0.05 for the rest of the axes.

Finally, this research contributes significantly to the academic literature regarding the heterogeneity of results in these types of studies, depending on the study population’s methodology and economic, political, cultural, social, and temporal characteristics. While for the Chilean case, the research allows identifying two regulatory opportunities, which the Commission for the Financial Market must work on, taking into account that the diversity of the board would have a positive and significant impact on the adoption of good corporate practices.

Author Contributions

Conceptualization, F.A.-T., M.B.-U., V.S.-R. and P.S.-G.; methodology, F.A.-T., M.B.-U., V.S.-R. and P.S.-G.; software, F.A.-T.; validation, F.A.-T., M.B.-U., V.S.-R. and P.S.-G.; formal analysis, F.A.-T. and M.B.-U.; investigation, F.A.-T. and M.B.-U.; data curation, F.A.-T.; writing—original draft preparation, F.A.-T. and M.B.-U.; writing—review and editing, F.A.-T., M.B.-U., V.S.-R. and P.S.-G.; visualization, F.A.-T.; supervision, M.B.-U. and V.S.-R. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Moraga, H.; Ropero, E. Corporate Governance and Financial Performance of the most important companies in the Chilean Stock Market. Rev. Venez. Gerencia 2018, 23, 145–162. [Google Scholar] [CrossRef][Green Version]

- Adusei, M.; Akomea, S.Y.; Poku, K. Board and management gender diversity and financial performance of microfinance institutions. Cogent Bus. Manag. 2017, 4, 1360030. [Google Scholar] [CrossRef]

- Hassan, R.; Marimuthu, M. Contextualizing comprehensive board diversity and firm financial performance: Integrating market, management and shareholder’s perspective. J. Manag. Organ. 2018, 24, 634–678. [Google Scholar] [CrossRef]

- Reddy, S.; Jadhav, A.M. Gender diversity in boardrooms—A literature review. Cogent Econ. Financ. 2019, 7, 1644703. [Google Scholar] [CrossRef]

- Sijamic, A. The Effects and the Mechanisms of Board Gender Diversity: Evidence from Financial Manipulation. J. Bus. Ethics 2019, 159, 705–725. [Google Scholar] [CrossRef]

- Organization for Economic Cooperation and Development. G20/OECD Principles of Corporate Governance; OECD: Paris, France, 2015; pp. 1–60. Available online: https://www.oecd.org/daf/ca/Corporate-Governance-Principles-ENG.pdf (accessed on 30 November 2021).

- Isidro, H.; Sobral, M.A.A. The Effects of Women on Corporate Boards on Firm Value, Financial Performance, and Ethical and Social Compliance. J. Bus. Ethics 2015, 132, 1–19. [Google Scholar] [CrossRef]

- Pucheta-Martínez, M.C.; Bel-Oms, I.; Olcina-Sempere, G. The association between board gender diversity and financial reporting quality, corporate performance and corporate social responsibility disclosure: A literature review. Acad.-Rev. Latinoam. Adm. 2018, 31, 177–194. [Google Scholar] [CrossRef]

- Godoy, M.; Walker, E.; Zegers, M. Analysis of the first attempt at imposing self regulation on corporate governance in Chile: Results of an oxymoron. Rev. Chil. Derecho 2018, 45, 179–210. [Google Scholar] [CrossRef]

- Moraga, H.; Rossi, M. Corporate governance and bankruptcy risk in the chilean companies. J. Glob. Compet. Gov. 2019, 13, 112–125. [Google Scholar] [CrossRef]

- Arenas, F.; Bustamante, U.; Campos, R. Diversity of the Board of Directors and Financial Performance of the Firms. Sustainability 2021, 13, 11687. [Google Scholar] [CrossRef]

- Terjesen, S.; Aguilera, R.V.; Lorenz, R. Legislating a Woman’s Seat on the Board: Institutional Factors Driving Gender Quotas for Boards of Directors. J. Bus. Ethics 2015, 128, 233–251. [Google Scholar] [CrossRef]

- Wang, Q.; Dou, J.; Jia, S. A Meta-Analytic Review of Corporate Social Responsibility and Corporate Financial Performance: The Moderating Effect of Contextual Factors. Bus. Soc. 2016, 55, 1083–1121. [Google Scholar] [CrossRef]

- Ben-Amar, W.; Chang, M.; McIlkenny, P. Board Gender Diversity and Corporate Response to Sustainability Initiatives: Evidence from the Carbon Disclosure Project. J. Bus. Ethics 2017, 142, 369–383. [Google Scholar] [CrossRef]

- Ghuslan, M.; Jaffar, R.; Saleh, N.; Yaacob, M. Corporate governance and corporate reputation: The role of environmental and social reporting quality. Sustainability 2021, 13, 10452. [Google Scholar] [CrossRef]

- Arenas, F.; Campos, R.; Santander, V. Adoption of Corporate Governance practices of the chilean market in triennium 2015–2017. Visión Futuro 2019, 23, 37–55. [Google Scholar]

- CAF Development Bank of Latin America. Lineamientos Para un Código Latinoamericano de Gobierno Corporativo; CAF Development Bank of Latin America: Caracas, Venezuela, 2013; Available online: https://scioteca.caf.com/bitstream/handle/123456789/555/lineamientos_codigo_latinoamericano.pdf?sequence=1&isAllowed=y (accessed on 20 September 2021).

- Chilean Commission for the Financial Market. Informe Final: Fortalecimiento de Estándares de Gobierno Corporativo de las Sociedades Anónimas Abiertas; Chilean Commission for the Financial Market: Santiago, Chile, 2015; Available online: https://www.cmfchile.cl/sitio/aplic/serdoc/ver_sgd.php?s567=368a3c2505c87dfb861e1c7890281dacVFdwQmVFOUVRVEZOUkVFMFRXcEpkMDVuUFQwPQ==&secuencia=-1&t=1604908986 (accessed on 25 October 2021).

- Arenas, F.; Bustamante, M.; Campos, T. The incidence of the adoption of corporate governance practices in the returns of chilean corporations. Glob. Compet. Gov. 2021, 15, 79–93. [Google Scholar] [CrossRef]

- Rhode, D.; Packel, A. Diversity on Corporate Boards: How Much Difference Does Difference Make? Del. J. Corp. Law 2014, 39, 377–426. [Google Scholar] [CrossRef]

- Pucheta-Martínez, M.C. The role of the Board of Directors in the creation of value for the company. Span. Account. Rev. 2015, 18, 148–161. [Google Scholar] [CrossRef]

- Reguera-Alvarado, N.; De Fuentes, P.; Laffarga, J. Does Board Gender Diversity Influence Financial Performance? Evidence from Spain. J. Bus. Ethics 2017, 141, 337–350. [Google Scholar] [CrossRef]

- Arenas-Torres, F.; Bustamante-Ubilla, M.; Campos-Troncoso, R. The Incidence of Social Responsibility in the Adoption of Business Practices. Sustainability 2021, 13, 2794. [Google Scholar] [CrossRef]

- Nisiyama, E.K.; Nakamura, W.T. Diversity of the board and capital structure. RAE Rev. Adm. Empresas 2018, 58, 551–563. [Google Scholar] [CrossRef]

- Hillman, A.J. Board Diversity: Beginning to Unpeel the Onion. Corp. Gov. Int. Rev. 2014, 23, 104–107. [Google Scholar] [CrossRef]

- Abdullah, S.N. The causes of gender diversity in Malaysian large firms. J. Manag. Gov. 2014, 18, 1137–1159. [Google Scholar] [CrossRef]

- Bernile, G.; Bhagwat, V.; Yonker, S. Board diversity, firm risk, and corporate policies. J. Financ. Econ. 2018, 127, 588–612. [Google Scholar] [CrossRef]

- Jaén, M.H.; Auletta, N.; Celli, J.F.B.; Pocaterra, M. Análisis bibliométrico de investigación indexada sobre responsabilidad social de las empresas de América Latina. Acad. Rev. Latinoam. Adm. 2018, 31, 105–135. [Google Scholar] [CrossRef]

- Liao, L.; Luo, L.; Tang, Q. Gender diversity, board independence, environmental committee and greenhouse gas disclosure. Br. Account. Rev. 2015, 47, 409–424. [Google Scholar] [CrossRef]

- Cumming, D.; Leung, T.; Rui, O. Gender Diversity and Securities Fraud. Acad. Manag. J. 2015, 58, 1572–1593. [Google Scholar] [CrossRef]

- Sila, V.; Gonzalez, A.; Hagendorff, J. Women on board: Does boardroom gender diversity affect firm risk? J. Corp. Financ. 2016, 36, 26–53. [Google Scholar] [CrossRef]

- Terjesen, S.; Couto, E.B.; Francisco, P.M. Does the presence of independent and female directors impact firm performance? A multi-country study of board diversity. J. Manag. Gov. 2015, 20, 447–483. [Google Scholar] [CrossRef]

- Sun, W.; Yao, S.; Govind, R. Reexamining Corporate Social Responsibility and Shareholder Value: The Inverted-U-Shaped Relationship and the Moderation of Marketing Capability. J. Bus. Ethics 2019, 160, 1001–1017. [Google Scholar] [CrossRef]

- García-Meca, E.; Garcia-Sanchez, I.-M.; Martinez-Ferrero, J. Board diversity and its effects on bank performance: An international analysis. J. Bank. Financ. 2015, 53, 202–214. [Google Scholar] [CrossRef]

- Bennouri, M.; Chtioui, T.; Nagati, H.; Nekhili, M. Female board directorship and firm performance: What really matters? J. Bank. Financ. 2018, 88, 267–291. [Google Scholar] [CrossRef]

- Chijoke-Mgbame, A.M.; Boateng, A.; Mgbame, C.O. Board gender diversity, audit committee and financial performance: Evidence from Nigeria. Account. Forum 2020, 44, 262–286. [Google Scholar] [CrossRef]

- Pletzer, J.L.; Nikolova, R.; Kedzior, K.K.; Voelpel, S. Does Gender Matter? Female Representation on Corporate Boards and Firm Financial Performance—A Meta-Analysis. PLoS ONE 2015, 10, e0130005. [Google Scholar] [CrossRef]

- Marinova, J.; Plantenga, J.; Remery, C. Gender diversity and firm performance: Evidence from Dutch and Danish boardrooms. Int. J. Hum. Resour. Manag. 2015, 27, 1777–1790. [Google Scholar] [CrossRef]

- Sarhan, A.A.; Ntim, C.; Al-Najjar, B. Board diversity, corporate governance, corporate performance, and executive pay. Int. J. Financ. Econ. 2018, 24, 761–786. [Google Scholar] [CrossRef]

- Fernández-Temprano, M.A.; Tejerina-Gaite, F. Types of director, board diversity and firm performance. Corp. Gov. Int. J. Bus. Soc. 2020, 20, 324–342. [Google Scholar] [CrossRef]

- Halcro, K.; Ben Noamene, T.; Chaher, D.; Talib, A. Is there a business case for board diversity? An investigation of UK’s FTSE 100 companies. Hum. Syst. Manag. 2021, 40, 421–434. [Google Scholar] [CrossRef]

- Hernández, R.; Fernández, C.; Baptista, M. Metodología de la Investigación, 6th ed.; McGraw-Hill Interamericana: New York, NY, USA, 2014. [Google Scholar]

- Garay, U.; Gonzalez, M. Corporate governance and firm value: The case of Venezuela. Corp. Gov. Int. Rev. 2008, 16, 194–209. [Google Scholar] [CrossRef]

- Cucari, N.; De Falco, S.; Orlando, B. Diversity of Board of Directors and Environmental Social Governance: Evidence from Italian Listed Companies. Corp. Soc. Responsib. Environ. Manag. 2018, 25, 250–266. [Google Scholar] [CrossRef]

- Zaid, M.; Wang, M.; Adib, M.; Sahyouni, A. Boardroom nationality and gender diversity: Implications for corporate sustainability performance. J. Clean. Prod. 2020, 251, 119652. [Google Scholar] [CrossRef]

- Arenas, F.; Bustamante, M.; Campos, R. The influence of board diversity on the adoption of corporate governance practices. Inf. Tecnológica 2021, 32, 181–190. [Google Scholar] [CrossRef]

- Beji, R.; Yousfi, O.; Loukil, N.; Omri, A. Board Diversity and Corporate Social Responsibility: Empirical Evidence from France. J. Bus. Ethics 2020, 173, 133–155. [Google Scholar] [CrossRef]

- Anderson, D.; Sweeney, D.; Williams, T. Estadística para Administración y Economía, 10th ed.; Cengage Learning: Boston, MA, USA, 2008. [Google Scholar]

- Li, W. Corporate governance evaluation of Chinese listed companies. Nankai Bus. Rev. Int. 2018, 9, 437–456. [Google Scholar] [CrossRef]

- Gladman, K.; Lamb, M. GMI Ratings’ 2013 Women on Boards Survey; GMI Ratings: New York, NY, USA, 2013. [Google Scholar]

- Barrientos, F.; Hess, A. La Diversidad de Género en los Directorios Chilenos; Centro de Gobierno Corporativo UC: Santiago, Chile, 2016. [Google Scholar]

- Cuadrado-Ballesteros, B.; Rubio, R.G.; Martinez-Ferrero, J. Effect of the composition of the board of directors on corporate social responsibility. Span. Account. Rev. 2015, 18, 20–31. [Google Scholar] [CrossRef]

- Conyon, M.J.; He, L. Firm performance and boardroom gender diversity: A quantile regression approach. J. Bus. Res. 2017, 79, 198–211. [Google Scholar] [CrossRef]

- Platonova, E.; Asutay, M.; Dixon, R.; Mohammad, S. The Impact of Corporate Social Responsibility Disclosure on Financial Performance: Evidence from the GCC Islamic Banking Sector. J. Bus. Ethics 2016, 151, 451–471. [Google Scholar] [CrossRef]

- Opstrup, N.; Villadsen, A.R. The Right Mix? Gender Diversity in Top Management Teams and Financial Performance. Public Adm. Rev. 2014, 75, 291–301. [Google Scholar] [CrossRef]

- Elmagrhi, M.; Ntim, C. A study of environmental policies and regulations, governance structures, and environmental performance: The role of female directors. Strategy Environ. 2019, 28, 206–220. [Google Scholar] [CrossRef]

- Naciti, V. Corporate governance and board of directors: The effect of a board composition on firm sustainability performance. J. Clean. Prod. 2019, 237, 117727. [Google Scholar] [CrossRef]

- Disli, M.; Yilmaz, M.; Mohamed, F. Board characteristics and sustainability performance: Empirical evidence from emerging markets. Sustain. Account. Manag. Policy J. 2022; in press. [Google Scholar] [CrossRef]

- Griffin, D.; Li, K.; Xu, T. Board Gender Diversity and Corporate Innovation: International Evidence. J. Financ. Quant. Anal. 2021, 56, 123–154. [Google Scholar] [CrossRef]

- Hoang, T.; Abeysekera, I.; Ma, S. Board Diversity and Corporate Social Disclosure: Evidence from Vietnam. J. Bus. Ethics 2018, 151, 833–852. [Google Scholar] [CrossRef]

- Orazalin, N.; Baydauletov, M. Corporate social responsibility strategy and corporate environmental and social performance: The moderating role of board gender diversity. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 1664–1676. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).