Dynamic Transition and Convergence Trend of the Innovation Efficiency among Companies Listed on the Growth Enterprise Market in the Yangtze River Economic Belt—Empirical Analysis Based on DEA—Malmquist Model

Abstract

1. Introduction

2. Materials and Methods

2.1. Data Sources

2.2. Model Approach

2.2.1. Dense Score Kernel Densitometry Method

2.2.2. DEA-BCC Model

2.2.3. Malmquist Index

2.2.4. σ-Convergence

2.2.5. β-Convergence

2.2.6. Tobit Regression Model

3. Basic Information of GEM Listed Companies in the YREB

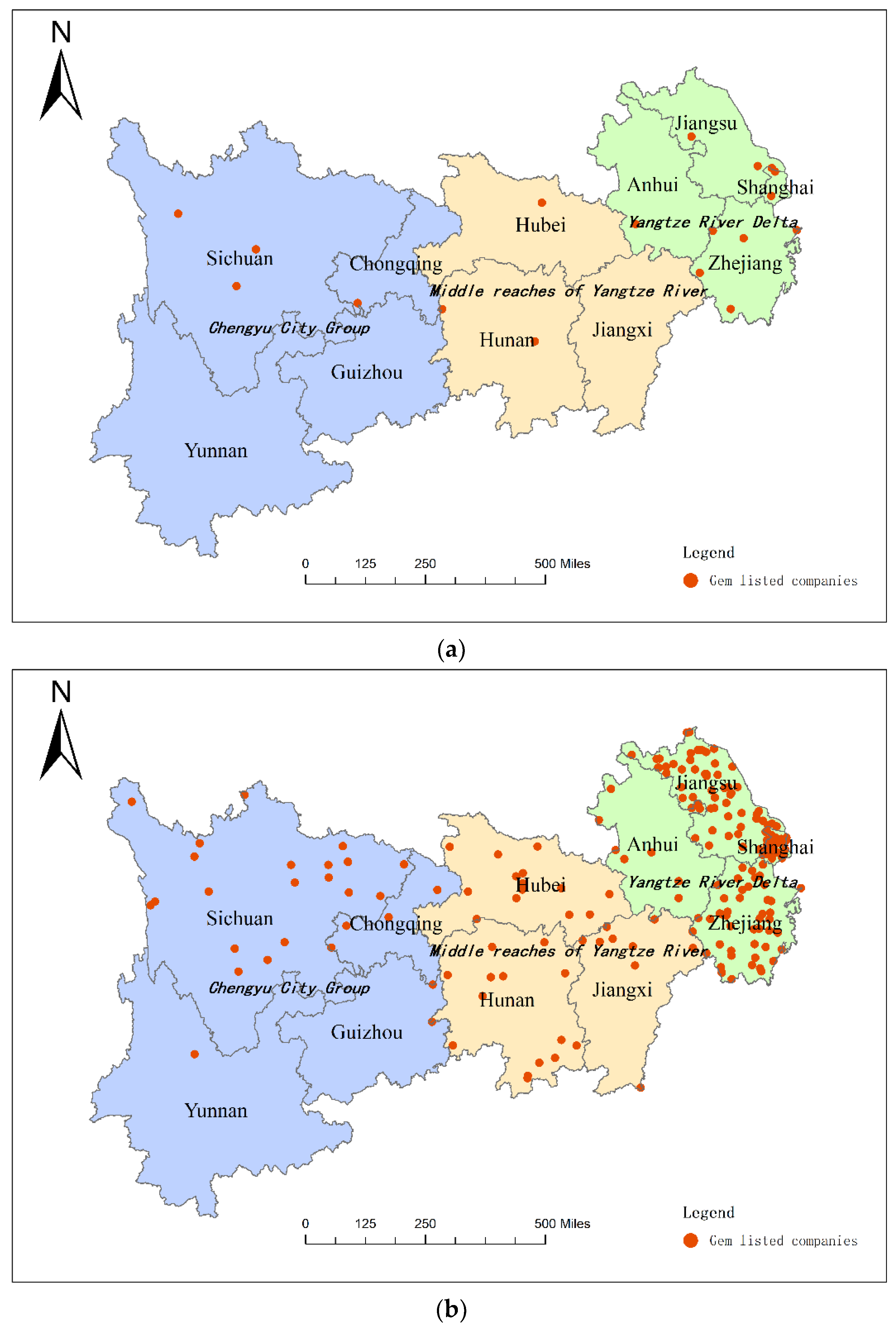

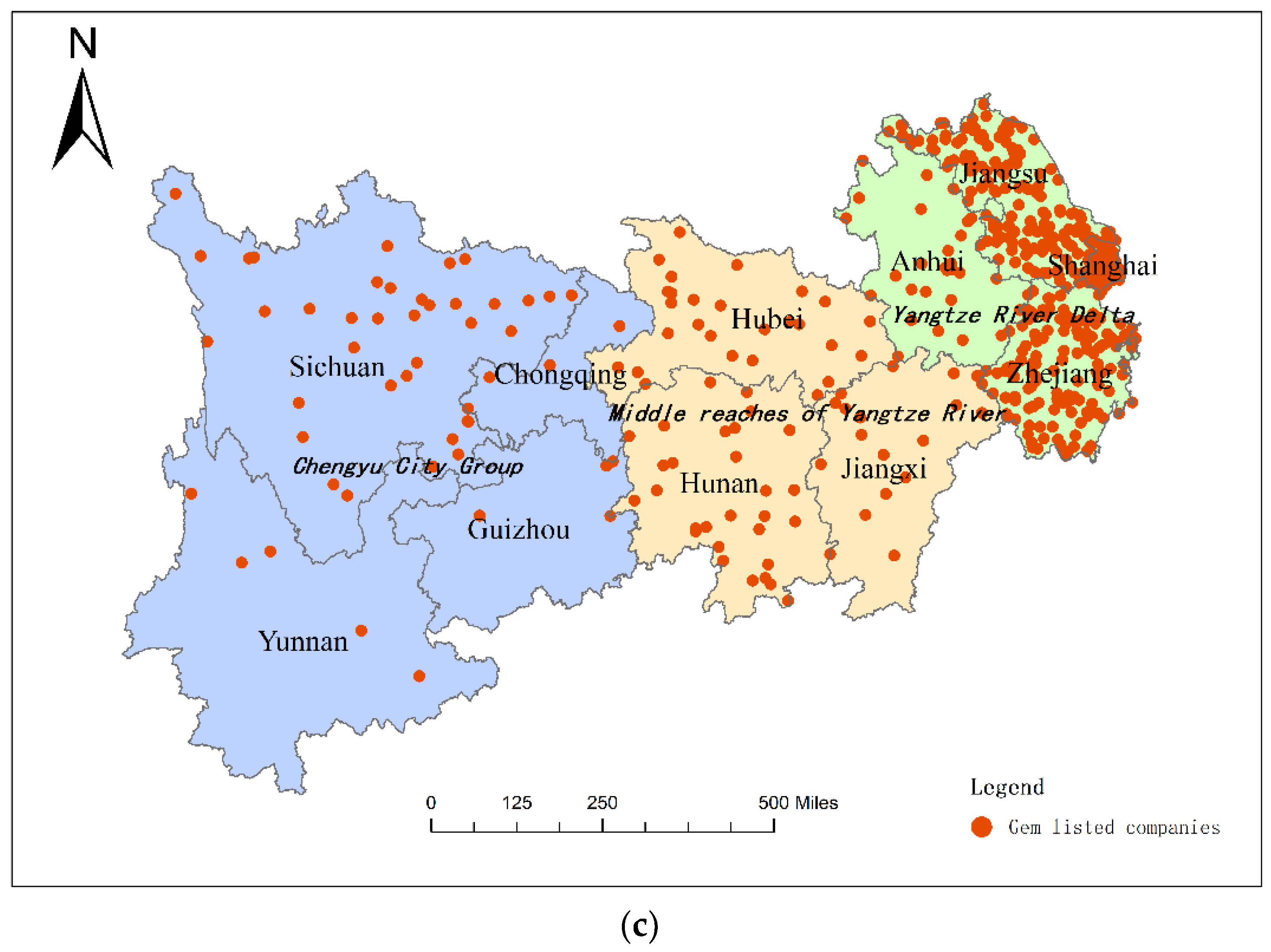

3.1. Classified Statistics of GEM-Listed Companies in the YREB

3.2. The Spatiotemporal Evolution of GEM-Listed Companies in the YREB

4. Results

4.1. Data Processing

- Irrational missing data processing. To ensure data integrity, this study first deleted company samples with a large amount of missing input-output index data. For patent application data, this study used the corresponding data in the CNRDS database to match. The rest of the input-output index data were obtained from the CSMAR database.

- Dimensionless processing. On the one hand, because the DEA model can only identify non-negative data in the calculation process, there are a few negative numbers in the original net profit and operating income data. On the other hand, there is a significant difference between the values of different indicators in the original data of this study. If the calculation is performed directly, the effect of small values can be ignored, resulting in inaccurate calculation results. Considering these two factors, we normalized the original data; the processing formula is as follows:

4.2. Index Selection

4.3. Spatiotemporal Transition of the Innovation Efficiency of GEM-Listed Companies in the YREB

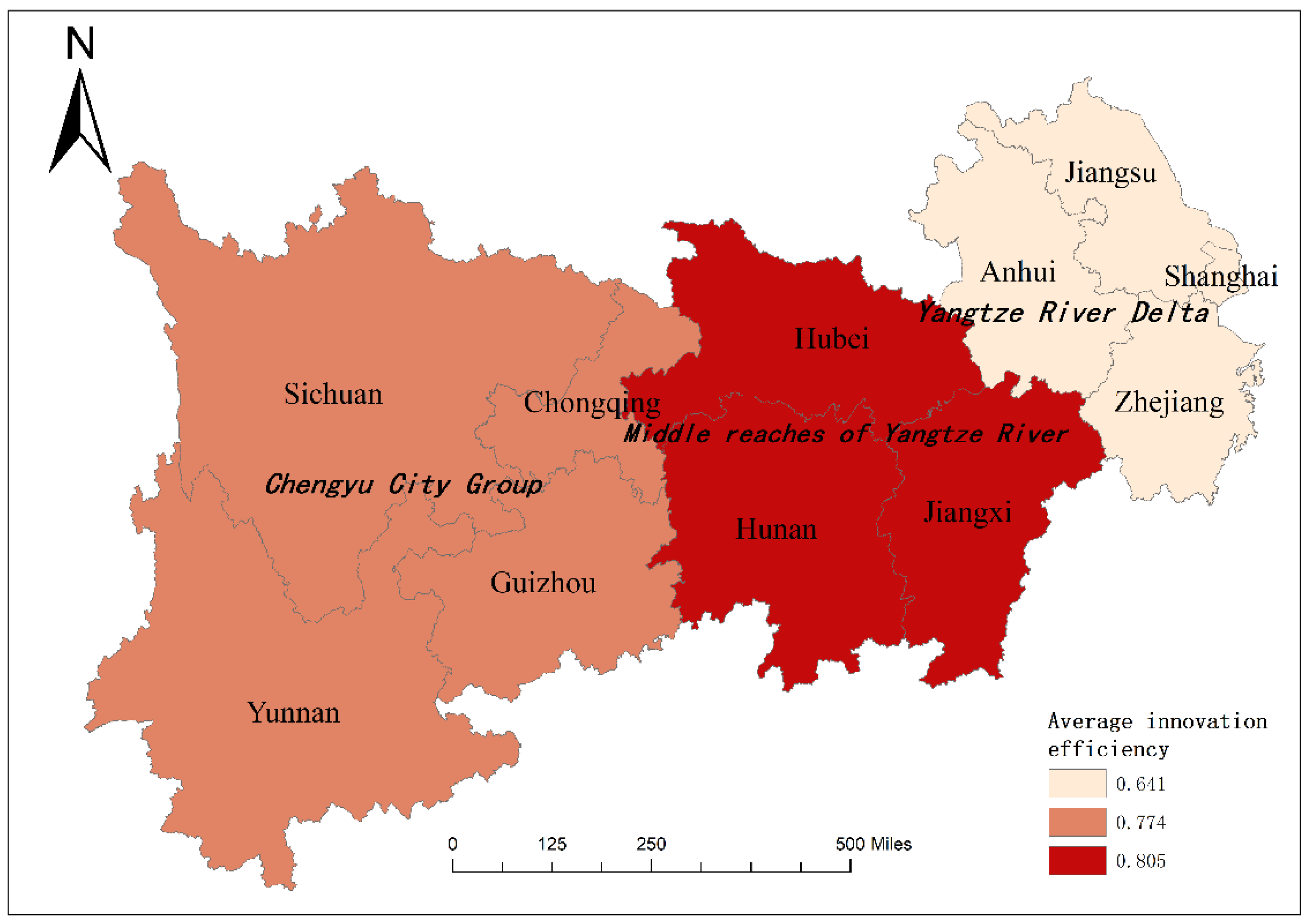

4.3.1. Static Analysis of Innovation Efficiency

4.3.2. Dynamic Analysis of Innovation Efficiency

4.4. Industry Heterogeneity Analysis of Innovation Efficiency

4.5. Convergence Test Results

4.6. Analysis of Factors Influencing Innovation Efficiency

5. Conclusions and Discussion

5.1. Discussion

5.2. Conclusions

5.3. Policy Advice

Author Contributions

Funding

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Company Code | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|

| 300006 | 0.872 | 1 | 0.634 | 1 | 1 |

| 300194 | 0.615 | 0.674 | 0.517 | 1 | 0.742 |

| 300275 | 1 | 1 | 0.844 | 0.694 | 0.796 |

| 300363 | 0.861 | 0.902 | 0.496 | 0.661 | 0.509 |

| 300019 | 0.922 | 0.672 | 0.805 | 0.946 | 0.882 |

| 300028 | 1 | 0.996 | 1 | 1 | 1 |

| 300092 | 1 | 0.827 | 1 | 0.987 | 0.955 |

| 300101 | 0.451 | 0.37 | 0.539 | 0.387 | 0.392 |

| 300249 | 0.76 | 0.689 | 0.732 | 0.764 | 0.68 |

| 300297 | 0.533 | 0.52 | 0.267 | 0.471 | 0.337 |

| 300366 | 0.848 | 0.633 | 0.513 | 0.577 | 0.49 |

| 300414 | 1 | 0.93 | 0.866 | 0.831 | 0.64 |

| 300425 | 0.993 | 0.962 | 1 | 1 | 1 |

| 300432 | 1 | 1 | 0.72 | 0.84 | 1 |

| 300434 | 1 | 1 | 0.937 | 1 | 1 |

| 300440 | 0.7 | 0.654 | 0.611 | 0.508 | 0.438 |

| 300463 | 0.879 | 0.845 | 0.555 | 1 | 0.663 |

| 300470 | 0.863 | 1 | 0.979 | 0.845 | 0.857 |

| 300471 | 0.795 | 1 | 1 | 0.832 | 0.78 |

| 300142 | 0.441 | 0.307 | 0.277 | 0.549 | 0.318 |

| 300288 | 0.624 | 0.672 | 0.842 | 1 | 0.93 |

| 300018 | 0.729 | 0.689 | 0.587 | 0.358 | 0.752 |

| 300041 | 0.862 | 0.923 | 0.632 | 0.724 | 0.756 |

| 300046 | 0.924 | 0.939 | 1 | 1.000- | 0.814 |

| 300054 | 0.93 | 0.897 | 0.764 | 0.749 | 0.852 |

| 300161 | 0.395 | 0.54 | 0.556 | 0.555 | 0.519 |

| 300184 | 1 | 1 | 1 | 1 | 1 |

| 300205 | 0.581 | 0.527 | 0.315 | 0.416 | 0.497 |

| 300220 | 0.845 | 0.964 | 1 | 1 | 1 |

| 300323 | 0.56 | 1 | 1 | 1 | 0.614 |

| 300387 | 0.906 | 1 | 0.994 | 0.952 | 1 |

| 300395 | 1 | 0.879 | 0.647 | 0.765 | 0.891 |

| 300035 | 1 | 1 | 0.966 | 0.927 | 0.889 |

| 300123 | 0.76 | 0.729 | 0.58 | 0.825 | 0.77 |

| 300187 | 0.955 | 0.969 | 0.704 | 0.497 | 0.948 |

| 300209 | 0.572 | 0.65 | 0.501 | 0.542 | 0.86 |

| 300298 | 0.972 | 0.78 | 0.761 | 0.636 | 0.647 |

| 300338 | 0.833 | 1 | 0.851 | 0.889 | 0.385 |

| 300345 | 0.906 | 0.94 | 1 | 1 | 1 |

| 300358 | 1 | 1 | 1 | 0.976 | 1 |

| 300433 | 0.691 | 0.677 | 0.586 | 0.542 | 0.366 |

| 300490 | 0.782 | 0.721 | 0.578 | 0.61 | 0.773 |

| 300066 | 1 | 0.912 | 0.643 | 0.886 | 0.99 |

| 300095 | 0.812 | 0.758 | 0.629 | 0.623 | 0.905 |

| 300294 | 1 | 1 | 1 | 1 | 0.827 |

| 300453 | 0.848 | 0.712 | 0.581 | 0.702 | 0.948 |

| 300472 | 0.824 | 1 | 0.558 | 1 | 0.921 |

| 300497 | 0.923 | 0.934 | 0.701 | 0.746 | 0.933 |

| 300013 | 0.66 | 0.623 | 0.499 | 0.584 | 0.585 |

| 300031 | 0.817 | 0.907 | 0.696 | 0.998 | 0.931 |

| 300091 | 0.55 | 0.617 | 0.663 | 0.729 | 0.69 |

| 300128 | 0.68 | 0.629 | 0.687 | 0.81 | 0.821 |

| 300141 | 0.863 | 0.666 | 0.594 | 0.788 | 0.852 |

| 300160 | 0.521 | 0.604 | 0.485 | 0.712 | 0.795 |

| 300165 | 0.424 | 0.571 | 0.578 | 0.547 | 0.598 |

| 300169 | 0.585 | 0.671 | 1 | 1 | 1 |

| 300172 | 0.915 | 0.73 | 0.656 | 0.801 | 0.729 |

| 300190 | 0.486 | 0.509 | 0.454 | 0.69 | 0.763 |

| 300196 | 0.479 | 0.57 | 0.566 | 0.636 | 0.675 |

| 300201 | 0.478 | 0.453 | 0.471 | 0.685 | 0.719 |

| 300215 | 0.514 | 0.514 | 0.417 | 0.574 | 0.542 |

| 300217 | 0.533 | 0.574 | 0.396 | 0.639 | 0.705 |

| 300228 | 0.46 | 0.555 | 0.715 | 0.776 | 0.622 |

| 300260 | 0.638 | 0.755 | 0.632 | 0.716 | 0.709 |

| 300261 | 0.331 | 0.375 | 0.297 | 0.494 | 0.553 |

| 300265 | 0.462 | 0.489 | 0.471 | 0.67 | 0.707 |

| 300279 | 0.615 | 0.554 | 0.493 | 0.534 | 0.717 |

| 300280 | 0.869 | 1 | 0.99 | 1 | 1 |

| 300284 | 0.632 | 0.498 | 0.523 | 0.551 | 0.63 |

| 300292 | 0.63 | 0.428 | 0.369 | 0.399 | 0.7 |

| 300304 | 0.656 | 0.658 | 0.506 | 0.654 | 0.57 |

| 300305 | 0.745 | 0.868 | 0.917 | 1 | 0.806 |

| 300320 | 0.596 | 0.684 | 0.499 | 0.646 | 0.686 |

| 300331 | 0.348 | 0.5 | 0.509 | 0.501 | 0.596 |

| 300337 | 0.479 | 0.765 | 0.882 | 0.837 | 0.791 |

| 300339 | 0.248 | 0.24 | 0.179 | 0.203 | 0.263 |

| 300342 | 0.724 | 0.723 | 0.537 | 0.587 | 0.517 |

| 300346 | 0.576 | 0.83 | 0.677 | 0.707 | 0.605 |

| 300382 | 0.772 | 0.815 | 0.75 | 0.833 | 0.795 |

| 300385 | 0.816 | 0.779 | 0.579 | 0.828 | 0.748 |

| 300390 | 0.831 | 0.685 | 0.564 | 0.807 | 0.783 |

| 300393 | 0.783 | 0.679 | 0.491 | 0.548 | 0.696 |

| 300394 | 0.856 | 0.716 | 0.632 | 0.7 | 0.662 |

| 300402 | 0.657 | 0.627 | 0.65 | 0.844 | 0.775 |

| 300416 | 0.654 | 0.743 | 0.539 | 0.666 | 0.72 |

| 300420 | 0.888 | 0.65 | 0.484 | 0.587 | 0.629 |

| 300421 | 0.769 | 0.846 | 0.838 | 0.758 | 0.77 |

| 300429 | 0.664 | 0.742 | 0.504 | 0.645 | 0.617 |

| 300447 | 0.7 | 0.535 | 0.47 | 0.5 | 0.562 |

| 300450 | 0.607 | 0.693 | 0.718 | 0.457 | 0.714 |

| 300466 | 0.867 | 0.755 | 0.501 | 0.574 | 0.631 |

| 300020 | 0.311 | 0.507 | 0.324 | 0.539 | 0.559 |

| 300025 | 0.407 | 0.392 | 0.299 | 0.623 | 0.699 |

| 300027 | 0.8 | 0.845 | 1 | 1 | 1 |

| 300032 | 0.515 | 0.677 | 0.366 | 0.391 | 0.744 |

| 300068 | 0.494 | 0.605 | 0.744 | 0.98 | 0.845 |

| 300076 | 0.813 | 0.681 | 0.688 | 1 | 1 |

| 300078 | 0.578 | 0.38 | 0.605 | 0.403 | 0.434 |

| 300100 | 0.644 | 0.593 | 0.508 | 0.551 | 0.58 |

| 300113 | 0.217 | 0.293 | 0.247 | 0.273 | 0.316 |

| 300118 | 0.472 | 0.562 | 0.542 | 0.503 | 0.529 |

| 300145 | 0.777 | 0.495 | 0.378 | 0.483 | 0.606 |

| 300203 | 0.284 | 0.291 | 0.238 | 0.292 | 0.336 |

| 300234 | 0.616 | 0.635 | 0.601 | 0.915 | 0.849 |

| 300244 | 0.406 | 0.566 | 0.48 | 0.654 | 0.92 |

| 300250 | 0.45 | 0.386 | 0.283 | 0.372 | 0.486 |

| 300266 | 0.575 | 0.538 | 0.486 | 0.505 | 0.677 |

| 300270 | 0.434 | 0.505 | 0.455 | 0.617 | 0.711 |

| 300283 | 0.527 | 0.62 | 0.567 | 0.754 | 0.844 |

| 300306 | 0.588 | 0.709 | 0.379 | 0.412 | 0.589 |

| 300307 | 0.444 | 0.388 | 0.423 | 0.737 | 0.603 |

| 300314 | 0.896 | 0.879 | 0.739 | 0.772 | 0.755 |

| 300316 | 0.401 | 0.429 | 0.492 | 0.428 | 0.532 |

| 300349 | 0.478 | 0.432 | 0.533 | 0.591 | 0.494 |

| 300351 | 0.751 | 0.574 | 0.504 | 0.6 | 0.501 |

| 300360 | 0.511 | 0.565 | 0.432 | 0.641 | 0.637 |

| 300411 | 0.944 | 0.954 | 0.669 | 0.388 | 0.651 |

| 300412 | 1 | 0.866 | 0.841 | 1 | 0.748 |

| 300435 | 0.848 | 0.899 | 0.915 | 0.858 | 0.871 |

| 300439 | 0.582 | 0.526 | 0.478 | 0.812 | 0.656 |

| 300441 | 0.91 | 0.787 | 0.667 | 0.774 | 0.745 |

| 300461 | 1 | 0.861 | 0.805 | 0.721 | 0.737 |

| 300008 | 1 | 1 | 0.702 | 0.581 | 0.714 |

| 300074 | 0.242 | 0.482 | 0.432 | 0.679 | 0.746 |

| 300129 | 0.462 | 0.632 | 0.798 | 0.842 | 0.781 |

| 300153 | 0.53 | 0.58 | 0.978 | 0.968 | 0.877 |

| 300171 | 0.494 | 0.425 | 0.452 | 0.655 | 0.588 |

| 300222 | 0.348 | 0.356 | 0.257 | 0.395 | 0.411 |

| 300230 | 0.6 | 0.464 | 0.364 | 0.62 | 0.732 |

| 300272 | 0.659 | 0.599 | 0.367 | 0.861 | 0.776 |

| 300326 | 0.516 | 0.693 | 0.68 | 1 | 0.715 |

| 300483 | 0.987 | 1 | 0.959 | 0.975 | 0.802 |

| 300009 | 0.468 | 0.404 | 0.276 | 0.336 | 0.309 |

| 300087 | 0.582 | 0.632 | 0.482 | 0.559 | 0.69 |

| 300088 | 1 | 1 | 1 | 1 | 0.835 |

| 300134 | 0.353 | 0.307 | 0.219 | 0.435 | 0.917 |

| 300218 | 0.448 | 0.434 | 0.488 | 0.591 | 0.639 |

| 300247 | 0.684 | 0.786 | 1 | 1 | 0.701 |

| 300274 | 0.656 | 0.472 | 0.452 | 0.461 | 0.573 |

| 300388 | 0.719 | 0.634 | 0.781 | 1 | 1 |

| 300452 | 1 | 1 | 0.873 | 0.994 | 0.908 |

| 300475 | 1 | 1 | 1 | 1 | 0.94 |

Appendix B

| Company Code | Technical Efficiency | Technical Progress | Pure Technical Efficiency | Scale Efficiency | Malmquist Index |

|---|---|---|---|---|---|

| 300006 | 1.035 | 0.902 | 1 | 1.035 | 0.934 |

| 300194 | 1.048 | 0.769 | 1.036 | 1.012 | 0.806 |

| 300275 | 0.945 | 0.801 | 0.981 | 0.963 | 0.756 |

| 300363 | 0.877 | 0.883 | 0.945 | 0.927 | 0.774 |

| 300019 | 0.989 | 0.85 | 1.011 | 0.978 | 0.841 |

| 300028 | 1 | 1.27 | 1 | 1 | 1.27 |

| 300092 | 0.989 | 0.815 | 0.994 | 0.995 | 0.805 |

| 300101 | 0.966 | 0.868 | 0.952 | 1.014 | 0.838 |

| 300249 | 0.973 | 0.914 | 0.98 | 0.993 | 0.889 |

| 300297 | 0.892 | 0.892 | 0.947 | 0.942 | 0.796 |

| 300366 | 0.872 | 0.823 | 0.956 | 0.912 | 0.718 |

| 300414 | 0.895 | 0.789 | 0.968 | 0.924 | 0.706 |

| 300425 | 1.002 | 0.802 | 1.001 | 1.001 | 0.803 |

| 300432 | 1 | 0.903 | 1 | 1 | 0.903 |

| 300434 | 1 | 0.687 | 1 | 1 | 0.687 |

| 300440 | 0.889 | 0.833 | 0.956 | 0.931 | 0.741 |

| 300463 | 0.932 | 0.948 | 1 | 0.932 | 0.883 |

| 300470 | 0.998 | 0.803 | 1.005 | 0.993 | 0.801 |

| 300471 | 0.995 | 1.043 | 0.973 | 1.022 | 1.038 |

| 300142 | 0.921 | 1.159 | 1.01 | 0.913 | 1.068 |

| 300288 | 1.105 | 0.791 | 1.003 | 1.102 | 0.874 |

| 300018 | 1.008 | 1.071 | 1.017 | 0.991 | 1.08 |

| 300041 | 0.968 | 1.017 | 0.973 | 0.994 | 0.984 |

| 300046 | 0.969 | 1.123 | 0.971 | 0.998 | 1.088 |

| 300054 | 0.978 | 1.152 | 0.973 | 1.005 | 1.127 |

| 300161 | 1.071 | 1.051 | 1.047 | 1.023 | 1.125 |

| 300184 | 1 | 1.189 | 1 | 1 | 1.189 |

| 300205 | 0.962 | 1.203 | 1.033 | 0.931 | 1.157 |

| 300220 | 1.043 | 1.024 | 1 | 1.043 | 1.068 |

| 300323 | 1.023 | 1.078 | 0.946 | 1.081 | 1.104 |

| 300387 | 1.025 | 0.994 | 1.025 | 1 | 1.019 |

| 300395 | 0.971 | 1.107 | 0.99 | 0.982 | 1.076 |

| 300035 | 0.971 | 0.938 | 0.99 | 0.981 | 0.911 |

| 300123 | 1.003 | 1.148 | 1.036 | 0.968 | 1.152 |

| 300187 | 0.998 | 1.157 | 0.998 | 1 | 1.155 |

| 300209 | 1.107 | 1.131 | 1.089 | 1.017 | 1.253 |

| 300298 | 0.903 | 1.143 | 0.974 | 0.927 | 1.032 |

| 300338 | 0.825 | 1.006 | 0.856 | 0.964 | 0.83 |

| 300345 | 1.025 | 1.061 | 1.011 | 1.014 | 1.088 |

| 300358 | 1 | 1.051 | 1 | 1 | 1.051 |

| 300433 | 0.853 | 1.099 | 1 | 0.853 | 0.937 |

| 300490 | 0.997 | 1.098 | 1.018 | 0.979 | 1.095 |

| 300066 | 0.998 | 1.086 | 1 | 0.998 | 1.083 |

| 300095 | 1.028 | 1.066 | 1.027 | 1 | 1.096 |

| 300294 | 0.954 | 1.11 | 1 | 0.954 | 1.058 |

| 300453 | 1.028 | 1.187 | 1.009 | 1.019 | 1.221 |

| 300472 | 1.028 | 1.008 | 1.032 | 0.997 | 1.037 |

| 300497 | 1.003 | 1.13 | 1.019 | 0.984 | 1.133 |

| 300013 | 0.97 | 1.258 | 1.045 | 0.928 | 1.22 |

| 300031 | 1.033 | 1.162 | 1.034 | 0.999 | 1.2 |

| 300091 | 1.058 | 1.104 | 1.122 | 0.943 | 1.168 |

| 300128 | 1.048 | 1.045 | 0.997 | 1.052 | 1.095 |

| 300141 | 0.997 | 1.223 | 1.02 | 0.977 | 1.219 |

| 300160 | 1.111 | 1.128 | 1.127 | 0.986 | 1.253 |

| 300165 | 1.089 | 1.259 | 1.117 | 0.975 | 1.371 |

| 300169 | 1.144 | 1.073 | 1.072 | 1.067 | 1.227 |

| 300172 | 0.945 | 1.216 | 0.992 | 0.952 | 1.148 |

| 300190 | 1.119 | 1.125 | 1.131 | 0.989 | 1.26 |

| 300196 | 1.089 | 1.051 | 1.076 | 1.013 | 1.145 |

| 300201 | 1.108 | 1.198 | 1.122 | 0.987 | 1.327 |

| 300215 | 1.014 | 1.303 | 1.093 | 0.928 | 1.32 |

| 300217 | 1.072 | 1.132 | 1.098 | 0.977 | 1.214 |

| 300228 | 1.079 | 1.024 | 1.023 | 1.054 | 1.104 |

| 300260 | 1.027 | 1.187 | 1.087 | 0.945 | 1.219 |

| 300261 | 1.137 | 1.148 | 1.16 | 0.981 | 1.305 |

| 300265 | 1.112 | 1.072 | 1.113 | 1 | 1.193 |

| 300279 | 1.039 | 1.036 | 1.081 | 0.961 | 1.076 |

| 300280 | 1.036 | 1.256 | 1.035 | 1.001 | 1.301 |

| 300284 | 0.999 | 1.085 | 0.995 | 1.004 | 1.085 |

| 300292 | 1.027 | 1.012 | 1.031 | 0.996 | 1.039 |

| 300304 | 0.966 | 1.3 | 1.03 | 0.937 | 1.255 |

| 300305 | 1.02 | 1.182 | 1.04 | 0.981 | 1.206 |

| 300320 | 1.036 | 1.102 | 1.092 | 0.948 | 1.141 |

| 300331 | 1.144 | 1.152 | 1.221 | 0.937 | 1.318 |

| 300337 | 1.134 | 0.842 | 1.056 | 1.074 | 0.954 |

| 300339 | 1.015 | 1.175 | 1.095 | 0.926 | 1.192 |

| 300342 | 0.919 | 1.313 | 1.035 | 0.888 | 1.207 |

| 300346 | 1.012 | 1.193 | 1.06 | 0.955 | 1.208 |

| 300382 | 1.007 | 1.325 | 1.026 | 0.982 | 1.335 |

| 300385 | 0.978 | 1.238 | 1.022 | 0.957 | 1.211 |

| 300390 | 0.985 | 1.271 | 1.022 | 0.964 | 1.252 |

| 300393 | 0.971 | 0.976 | 1.005 | 0.966 | 0.948 |

| 300394 | 0.938 | 1.327 | 1.005 | 0.933 | 1.245 |

| 300402 | 1.042 | 1.259 | 1.077 | 0.968 | 1.312 |

| 300416 | 1.025 | 1.318 | 1.076 | 0.952 | 1.351 |

| 300420 | 0.918 | 1.212 | 1.014 | 0.905 | 1.112 |

| 300421 | 1 | 1.201 | 1.031 | 0.97 | 1.201 |

| 300429 | 0.982 | 1.283 | 1.058 | 0.928 | 1.26 |

| 300447 | 0.946 | 1.262 | 1.052 | 0.9 | 1.194 |

| 300450 | 1.041 | 1.176 | 1.085 | 0.96 | 1.225 |

| 300466 | 0.924 | 1.324 | 0.994 | 0.929 | 1.223 |

| 300020 | 1.158 | 1.059 | 1.114 | 1.04 | 1.226 |

| 300025 | 1.145 | 1.162 | 1.166 | 0.982 | 1.33 |

| 300027 | 1.057 | 1.544 | 1 | 1.057 | 1.633 |

| 300032 | 1.096 | 0.996 | 1.02 | 1.075 | 1.092 |

| 300068 | 1.144 | 0.913 | 1 | 1.144 | 1.044 |

| 300076 | 1.053 | 1.372 | 1.05 | 1.003 | 1.445 |

| 300078 | 0.931 | 1.22 | 1.03 | 0.904 | 1.135 |

| 300100 | 0.974 | 1.019 | 0.942 | 1.035 | 0.992 |

| 300113 | 1.099 | 1.254 | 1.19 | 0.924 | 1.379 |

| 300118 | 1.029 | 0.914 | 1 | 1.029 | 0.941 |

| 300145 | 0.94 | 1.08 | 0.973 | 0.966 | 1.015 |

| 300203 | 1.043 | 1.002 | 1.047 | 0.996 | 1.046 |

| 300234 | 1.083 | 1.276 | 1.075 | 1.008 | 1.382 |

| 300244 | 1.227 | 0.975 | 1.138 | 1.078 | 1.196 |

| 300250 | 1.019 | 1.333 | 1.132 | 0.901 | 1.359 |

| 300266 | 1.042 | 1.105 | 1.071 | 0.973 | 1.152 |

| 300270 | 1.131 | 1.342 | 1.122 | 1.008 | 1.518 |

| 300283 | 1.125 | 1.162 | 1.126 | 0.999 | 1.307 |

| 300306 | 1 | 1.3 | 1.084 | 0.923 | 1.301 |

| 300307 | 1.079 | 1.169 | 1.036 | 1.042 | 1.261 |

| 300314 | 0.958 | 1.308 | 1.013 | 0.946 | 1.253 |

| 300316 | 1.074 | 1.144 | 1.19 | 0.903 | 1.229 |

| 300349 | 1.009 | 1.284 | 1.143 | 0.882 | 1.295 |

| 300351 | 0.904 | 1.326 | 0.968 | 0.933 | 1.198 |

| 300360 | 1.056 | 1.264 | 1.096 | 0.964 | 1.336 |

| 300411 | 0.911 | 1.147 | 0.996 | 0.915 | 1.045 |

| 300412 | 0.93 | 1.377 | 1 | 0.93 | 1.28 |

| 300435 | 1.007 | 1.265 | 1.012 | 0.994 | 1.273 |

| 300439 | 1.03 | 1.102 | 0.976 | 1.055 | 1.135 |

| 300441 | 0.951 | 1.284 | 1.016 | 0.936 | 1.221 |

| 300461 | 0.927 | 1.309 | 0.973 | 0.953 | 1.213 |

| 300008 | 0.919 | 0.939 | 0.967 | 0.951 | 0.863 |

| 300074 | 1.325 | 1.319 | 1.277 | 1.038 | 1.747 |

| 300129 | 1.14 | 0.949 | 1.017 | 1.121 | 1.082 |

| 300153 | 1.134 | 1.073 | 1.13 | 1.004 | 1.217 |

| 300171 | 1.044 | 1.184 | 1.031 | 1.013 | 1.237 |

| 300222 | 1.043 | 1.191 | 0.994 | 1.049 | 1.242 |

| 300230 | 1.051 | 1.125 | 1.09 | 0.964 | 1.182 |

| 300272 | 1.042 | 1.3 | 1.076 | 0.968 | 1.355 |

| 300326 | 1.085 | 1.194 | 1.035 | 1.048 | 1.295 |

| 300483 | 0.949 | 1.29 | 1 | 0.949 | 1.225 |

| 300009 | 0.901 | 1.251 | 1.098 | 0.821 | 1.128 |

| 300087 | 1.043 | 1.173 | 1.087 | 0.96 | 1.223 |

| 300088 | 0.956 | 1.001 | 1 | 0.956 | 0.957 |

| 300134 | 1.27 | 1.145 | 1.142 | 1.112 | 1.453 |

| 300218 | 1.093 | 1.136 | 1.112 | 0.982 | 1.242 |

| 300247 | 1.006 | 1.274 | 1.01 | 0.996 | 1.282 |

| 300274 | 0.967 | 1.018 | 1 | 0.967 | 0.984 |

| 300388 | 1.086 | 0.985 | 1.056 | 1.029 | 1.07 |

| 300452 | 0.976 | 1.295 | 0.99 | 0.986 | 1.264 |

| 300475 | 0.985 | 1.084 | 0.996 | 0.989 | 1.068 |

References

- Outline of the Development Plan of the Yangtze River Economic Belt. 2016. Available online: http://dpc.wuxi.gov.cn/doc/2016/09/13/1138086.shtml (accessed on 21 December 2021).

- Yi, J.; Zhang, L. Measurement of Innovation Efficiency of Innovative Countries Based on Three-stage DEA Model. Stat. Decis. 2021, 37, 81–85. [Google Scholar] [CrossRef]

- Yifei, L.; Panjia, X.; Liting, Y.; Xinrui, M. Research on Evaluation and Influencing Factors of Regional Science and Technology Innovation Efficiency in China—Based on Super-efficiency SBM-Malmquist-Tobit Model. Sci. Technol. Prog. Policy 2021, 38, 37–45. [Google Scholar]

- Wang, Y.; Pan, J.F.; Pei, R.M.; Yi, B.W.; Yang, G.L. Assessing the technological innovation efficiency of China’s high-tech industries with a two-stage network DEA approach. Socio-Econ. Plan. Sci. 2020, 71, 100810. [Google Scholar] [CrossRef]

- Qu, G.; Song, L.; Guo, Y. Research on Technological Innovation Efficiency of Listed Companies in China—Based on Three-stage DEA Method. Macroeconomics 2018, 6, 97–106. [Google Scholar] [CrossRef]

- Lin, S.; Lin, R.; Sun, J.; Wang, F.; Wu, W. Dynamically evaluating technological innovation efficiency of high-tech industry in China: Provincial, regional and industrial perspective. Socio-Econ. Plan. Sci. 2021, 74, 100939. [Google Scholar] [CrossRef]

- Han, D.; Xu, X.; Chen, X. Evaluation of technological innovation efficiency of “Made in China 2025” listed companies. Sci. Technol. Prog. Policy 2016, 33, 113–119. [Google Scholar]

- Wadud, A.; White, B. Farm Household Efficiency in Bangladesh: A Comparison of Stochastic Frontier and DEA Methods. Appl. Econ. 2000, 32, 1665–1673. [Google Scholar] [CrossRef]

- Lee, J.Y. Comparing SFA and DEA Methods on Measuring Production Efficiency for Forest and Paper Companies. For. Prod. J. 2005, 55, 51–56. [Google Scholar]

- Bin, Z. Modeling and Evaluation of Industrial Enterprises’ Technological Competitiveness Based on SFA-DEA-Malmquist. Sci. Technol. Manag. Res. 2015, 35, 55–61+67. [Google Scholar] [CrossRef]

- Yong, Q.; Yi, G. Evaluation of Market Allocation Efficiency of Science and Technology Resources Based on SFA Method. Sci. Res. Manag. 2015, 36, 84–91. [Google Scholar]

- Wu, F. Measurement of Technical Efficiency of Family Farms Based on SFA and Analysis of Influencing Factors. J. Huazhong Agric. Univ. (Soc. Sci. Ed.) 2020, 6, 48–56. [Google Scholar] [CrossRef]

- Yi, M.; Peng, J.; Wu, C. Research on Innovation Efficiency of China’s High-Tech Industry Based on SFA Method. Sci. Res. Manag. 2019, 40, 22–31. [Google Scholar] [CrossRef]

- Iglesias, G.; Castellanos, P.; Seijas, A. Measurement of Productive Efficiency with Frontier Methods: A Case Study for Wind Farms. Energy Econ. 2010, 32, 1199–1208. [Google Scholar] [CrossRef]

- Qian, Y.; Xinpeng, L.; Shuhui, S. Time-Space Pattern and Convergence Test of China’s Scientific and Technological Innovation Efficiency. J. Quant. Tech. Econ. 2021, 38, 105–123. [Google Scholar]

- Li, H.; Yang, W.; Zhou, Z.; Huang, C. Resource Allocation Models’ Construction for the Reduction of Undesirable Outputs Based on DEA Methods. Math. Comput. Modell. 2013, 58, 913–926. [Google Scholar] [CrossRef]

- Kádárová, J.; Durkáčová, M.; Teplická, K.; Kádár, G. The Proposal of an Innovative Integrated BSC—DEA Model. Procedia Econ. Fin. 2015, 23, 1503–1508. [Google Scholar] [CrossRef]

- Zhang, G.; Zhang, W.; Wang, X. Study on the Three-Stage Window-DEA Model Considering the Front of External Environment and Heterogeneity. Stat. Decis. 2017, 18, 29–33. [Google Scholar] [CrossRef]

- Liang, N.; Yao, C.; Gao, Y. Evaluation of Innovation Efficiency of Listed Enterprises in Environmental Protection Industry Based on DEA Method. Sci. Technol. Manag. Res. 2019, 39, 45–50. [Google Scholar] [CrossRef]

- Tachega, M.A.; Yao, X.; Liu, Y.; Ahmed, D.; Li, H.; Mintah, C. Energy Efficiency Evaluation of Oil Producing Economies in Africa: DEA, Malmquist and Multiple Regression Approaches. Clean. Environ. Syst. 2021, 2, 100025. [Google Scholar] [CrossRef]

- Yuwen, J.; Ma, L.H.; Li, H. Research on Innovation Efficiency and Influencing Factors of Regional High-Tech Industries Based on Two-Stage Series DEA. R D Manag. 2015, 27, 137–146. [Google Scholar] [CrossRef]

- Wu, J.S.; Zhang, J.; Quan, Y. Technological Innovation Efficiency and Influencing Factors of Industrial Enterprises Based on Two-Stage Series DEA Model. Sci. Technol. Manag. Res. 2018, 4, 181–189. [Google Scholar] [CrossRef]

- Pishgar-Komleh, S.H.; Zylowski, T.; Rozakis, S.; Kozyra, J. Efficiency Under Different Methods for Incorporating Undesirable Outputs in an LCA+DEA Framework: A Case Study of Winter Wheat Production in Poland. J. Environ. Manag. 2020, 260, 110138. [Google Scholar] [CrossRef]

- Huangbao, G. Spatial Econometric Analysis of Innovation Efficiency of China’s High-Tech Industry and Its Influencing Factors. Econ. Geogr. 2014, 34, 100–107. [Google Scholar]

- Li, J.; Tan, Q.; Bai, J. On the Convergence of China’s Regional Innovation Efficiency. In Proceedings of the 2009 IEEE International Conference on Grey Systems and Intelligent Services (GSIS 2009), Nanjing, China, 10–12 November 2009. [Google Scholar] [CrossRef]

- Xiongfeng, P.; Fengchao, L. Research on the Change and Convergence of Technological Innovation Efficiency of Regional Industrial Enterprises in China. Manag. Rev. 2010, 22, 59–64. [Google Scholar]

- Zhang, W.; Pan, X.; Yan, Y.; Pan, X. Convergence Analysis of Regional Energy Efficiency in China Based on Large-Dimensional Panel Data Model. J. Clean. Prod. 2017, 142, 801–808. [Google Scholar] [CrossRef]

- Ma, D.; Chen, Z.; Wang, L. Research on the Convergence of China’s Regional Innovation Efficiency. Based on the Perspective of Spatial Economics. J. Ind. Eng. Eng. Manag. 2017, 31, 71–78. [Google Scholar] [CrossRef]

- Xianfeng, H.; Boxin, L.; Mingfang, D. Does “Internet Plus” Help Accelerate the Convergence of Regional Innovation Efficiency? Sci. Res. Manag. 2021, 42, 167–174. [Google Scholar]

- Xiao, Z.-L.; Du, X.; Fan, F. Convergence in China’s High-Tech Industry Development Performance: A Spatial Panel Model. Appl. Econ. 2017, 49, 5296–5308. [Google Scholar] [CrossRef]

- Han, Z.; Xiaoxin, Y. Research on Regional Innovation Efficiency and Convergence of High-Tech Industries Under the Constraint of Innovation Environment. Sci. Technol. Prog. Policy 2018, 35, 43–51. [Google Scholar] [CrossRef]

- Wan, Q.; Yang, X.; Deng, F. Research on the Convergence of Innovation Efficiency of Provincial High-Tech Industries in China and Its Influencing Factors-Based on the Perspective of Spatial Economics. Sci. Technol. Manag. Res. 2018, 38, 80–86. [Google Scholar] [CrossRef]

- Xu, Y.; Zhang, Y.; Lu, Y.; Chen, J. The Evolution Rule of Green Innovation Efficiency and Its Convergence of Industrial Enterprises in China. Environ. Sci. Pollut. Res. Int. 2022, 29, 2894–2910. [Google Scholar] [CrossRef] [PubMed]

- Cheng, Y.; Liu, W.; Lu, J. Financing innovation in the Yangtze River Economic Belt: Rationale and impact on firm growth and foreign trade. Can. Public Policy 2017, 43, S122–S135. [Google Scholar] [CrossRef]

- Liu, Y.; Zhang, X.; Pan, X.; Ma, X.; Tang, M. The spatial integration and coordinated industrial development of urban agglomerations in the Yangtze River Economic Belt, China. Cities 2020, 104, 102801. [Google Scholar] [CrossRef]

- Zou, L.; Cao, X.; Zhu, Y. Research on regional high-tech innovation efficiency and influence factors: Evidence from Yangtze river economic belt in China. Complexity 2021, 2021, 9946098. [Google Scholar] [CrossRef]

- Meng, D.; Wei, G.; Sun, P. Analyzing the Characteristics and Causes of Location Spatial Agglomeration of Listed Companies: An Empirical Study of China’s Yangtze River Economic Belt. Complexity 2020, 2020, 8859706. [Google Scholar] [CrossRef]

- Yi, M.; Wang, Y.; Yan, M.; Fu, L.; Zhang, Y. Government R&D subsidies, environmental regulations, and their effect on green innovation efficiency of manufacturing industry: Evidence from the Yangtze River economic belt of China. Int. J. Environ. Res. Public Health 2020, 17, 1330. [Google Scholar]

- Li, X.; Lu, Y.; Huang, R. Whether foreign direct investment can promote high-quality economic development under environmental regulation: Evidence from the Yangtze River Economic Belt, China. Environ. Sci. Poll. Res. 2021, 28, 21674–21683. [Google Scholar] [CrossRef] [PubMed]

- Yu, W.; Tinghua, A.; Yang, M.; Jiping, L. Using Nuclear Density and Spatial Autocorrelation to Detect Hot Spots of Interest Distribution in Urban Facilities. Geom. Inf. Sci. Wuhan Univ. 2016, 41, 221–227. [Google Scholar] [CrossRef]

- Wang, H.; Yang, X. China’s PV Industry Innovation Efficiency Evaluation and Promotion Path Research. Sci. Manag. Res. 2021, 39, 49–57. [Google Scholar] [CrossRef]

- Malmquist, S. Index numbers and indifference surfaces. Trab. Estad. 1953, 4, 209–242. [Google Scholar] [CrossRef]

- Fare, R.; Grosskopf, S.; Norris, M.; Zhang, Z. Productivity growth, technical progress and efficiency change in industrialized countries. Am. Econ. Rev. 1997, 87, 1033–1039. [Google Scholar]

- Yanwei, L.; Yanxiang, X.; Xianjun, L. Research on the Convergence of Regional Green Innovation Efficiency in China. Sci. Technol. Prog. Policy 2019, 36, 37–42. [Google Scholar] [CrossRef]

- Barro, R.J.; Sala-i-Martin, X. Technological Diffusion, Convergence and Growth. J. Econ. Growth. 1997, 39, 1–26. [Google Scholar] [CrossRef]

- Ma, W.; Li, C.; Song, X. Analysis of Innovation Efficiency of China’s High-Tech Industry by Stages-Based on Three-Stage DEA Model. Macroeconomics 2019, 2, 78–91. [Google Scholar]

- Fan, D.; Gu, X. Analysis of Key Influencing Factors of Technological Innovation Efficiency in High-Tech Industries-An Empirical Study Based on DEA-Malmquist and BMA Methods. Sci. Res. Manag. 2022, 43, 70–78. [Google Scholar]

- Giacalone, M.; Nissi, E.; Cusatelli, C. Dynamic efficiency evaluation of Italian judicial system using DEA based Malmquist productivity indexes. Socio-Econ. Plan. Sci. 2020, 72, 100952. [Google Scholar] [CrossRef]

- Ding, L.; Lei, L.; Wang, L.; Zhang, L.F. Assessing industrial circular economy performance and its dynamic evolution: An extended Malmquist index based on cooperative game network DEA. Sci. Total Environ. 2020, 731, 139001. [Google Scholar] [CrossRef] [PubMed]

- Li, G.; Zhou, Y.; Liu, F.; Tian, A. Regional Difference and Convergence Analysis of Marine Science and Technology Innovation Efficiency in China—ScienceDirect. Ocean. Coast. Manag. 2021, 205, 105581. [Google Scholar] [CrossRef]

- Xi, Z.; Shufen, G. Research on the Convergence of China’s Provincial Industrial Technology Innovation Efficiency from the Perspective of Spatial Effect. World Surv. Res. 2022, 1, 48–57. [Google Scholar]

- Guangbin, C.; Jiaqing, W.; Xueying, S. Research on the Efficiency and Influencing Factors of Scientific and Technological Innovation in the Yangtze River Economic Belt. Sci. Technol. Manag. Res. 2022, 42, 57–65. [Google Scholar]

- Chao, Z.; Xiaohua, S.; Yanan, S. Difference Measurement, Source Decomposition and Formation Mechanism of Scientific and Technological Innovation Efficiency in the Yellow River Basin. Rev. Econ. Manag. 2021, 37, 38–50. [Google Scholar]

| Chengyu City Cluster | Middle Reaches of the Yangtze River | Yangtze River Delta |

|---|---|---|

| Yunnan 5 | Hubei 28 | Anhui 27 |

| Guizhou 2 | Hunan 31 | Zhejiang 135 |

| Chongqing 5 | Jiangxi 16 | Jiangsu 152 |

| Sichuan 37 | Shanghai 66 | |

| Total 49 | Total 75 | Total 380 |

| Sum 504 | ||

| Indicators | The Variable Name | Indicator Description |

|---|---|---|

| Input indicators | A1 | Number of R&D personnel (persons) |

| A2 | R&D Investment (YUAN) | |

| Output indicators | B1 | Net profit (YUAN) |

| B2 | Operating income (YUAN) | |

| B3 | Number of patent Applications (pieces) |

| Regions | 2015 | 2016 | 2017 | 2018 | 2019 | Mean |

| Chengyu city cluster | 0.817 | 0.793 | 0.721 | 0.804 | 0.734 | 0.774 |

| the middle reaches of the Yangtze River | 0.837 | 0.857 | 0.746 | 0.775 | 0.810 | 0.805 |

| the Yangtze River Delta | 0.626 | 0.629 | 0.577 | 0.678 | 0.695 | 0.641 |

| Mean | 0.760 | 0.759 | 0.681 | 0.752 | 0.746 | 0.740 |

| Years | Technical Efficiency | Advances in Technology | Pure Technical Efficiency | The Scale Efficiency | Malmquist Index |

|---|---|---|---|---|---|

| 2015–2016 | 0.955 | 0.706 | 0.886 | 1.078 | 0.674 |

| 2016–2017 | 0.894 | 1.575 | 1.100 | 0.812 | 1.407 |

| 2017–2018 | 1.146 | 0.548 | 1.013 | 1.131 | 0.628 |

| 2018–2019 | 0.890 | 0.960 | 0.959 | 0.929 | 0.855 |

| Mean | 0.966 | 0.874 | 0.986 | 0.979 | 0.844 |

| Years | Technical Efficiency | Advances in Technology | Pure Technical Efficiency | The Scale Efficiency | Malmquist Index |

|---|---|---|---|---|---|

| 2015–2016 | 1.028 | 0.971 | 1.008 | 1.020 | 0.999 |

| 2016–2017 | 0.852 | 1.136 | 0.859 | 0.991 | 0.967 |

| 2017–2018 | 1.039 | 1.773 | 1.037 | 1.002 | 1.841 |

| 2018–2019 | 1.050 | 0.717 | 1.115 | 0.941 | 0.753 |

| Mean | 0.989 | 1.088 | 1.000 | 0.988 | 1.076 |

| Years | Technical Efficiency | Advances in Technology | Pure Technical Efficiency | The Scale Efficiency | Malmquist Index |

|---|---|---|---|---|---|

| 2015–2016 | 1.017 | 1.183 | 1.020 | 0.997 | 1.203 |

| 2016–2017 | 0.897 | 1.201 | 0.874 | 1.027 | 1.077 |

| 2017–2018 | 1.194 | 1.251 | 1.336 | 0.894 | 1.493 |

| 2018–2019 | 1.046 | 1.048 | 1.046 | 1.000 | 1.097 |

| Mean | 1.033 | 1.168 | 1.056 | 0.978 | 1.207 |

| Industry Name | Number of Industries | 2015 | 2016 | 2017 | 2018 | 2019 | Mean |

|---|---|---|---|---|---|---|---|

| Special equipment manufacturing | 21 | 0.752 | 0.738 | 0.707 | 0.785 | 0.772 | 0.751 |

| Nonferrous metal smelting and rolling processing industry | 1 | 0.479 | 0.765 | 0.882 | 0.837 | 0.791 | 0.751 |

| Pharmaceutical manufacturing | 11 | 0.786 | 0.781 | 0.613 | 0.827 | 0.715 | 0.744 |

| General equipment manufacturing | 9 | 0.748 | 0.738 | 0.652 | 0.648 | 0.686 | 0.695 |

| Automobile industry | 3 | 0.767 | 0.750 | 0.578 | 0.682 | 0.717 | 0.699 |

| Manufacturing of computers, communications, and other electronic equipment | 20 | 0.703 | 0.694 | 0.667 | 0.665 | 0.694 | 0.685 |

| Chemical raw materials and chemical products manufacturing | 6 | 0.769 | 0.768 | 0.666 | 0.752 | 0.777 | 0.746 |

| Instrument manufacturing | 6 | 0.612 | 0.634 | 0.462 | 0.559 | 0.630 | 0.579 |

| Manufacturing of railway, ship, aerospace, and other transportation equipment | 1 | 0.760 | 0.729 | 0.580 | 0.825 | 0.770 | 0.733 |

| Metal products industry | 1 | 0.906 | 0.940 | 1.000 | 1.000 | 1.000 | 0.969 |

| Nonmetallic mineral products industry | 4 | 0.654 | 0.672 | 0.574 | 0.757 | 0.803 | 0.692 |

| Electrical machinery and equipment manufacturing | 19 | 0.619 | 0.623 | 0.588 | 0.672 | 0.713 | 0.643 |

| Rubber and plastic products industry | 5 | 0.595 | 0.6242 | 0.654 | 0.771 | 0.773 | 0.683 |

| Gas production and supply industry | 1 | 0.848 | 0.899 | 0.915 | 0.858 | 0.871 | 0.878 |

| Oil and gas extraction industry | 1 | 0.987 | 1.000 | 0.959 | 0.975 | 0.802 | 0.945 |

| Agriculture | 1 | 0.582 | 0.632 | 0.482 | 0.559 | 0.690 | 0.589 |

| Software and information technology services | 12 | 0.551 | 0.530 | 0.449 | 0.535 | 0.557 | 0.524 |

| Telecommunications, radio and television, and satellite transmission services | 1 | 0.624 | 0.672 | 0.842 | 1.000 | 0.930 | 0.814 |

| Ecological protection and environmental governance | 5 | 0.730 | 0.676 | 0.616 | 0.699 | 0.823 | 0.709 |

| Professional and technical services | 3 | 0.600 | 0.585 | 0.493 | 0.597 | 0.631 | 0.581 |

| Hygiene | 1 | 0.406 | 0.566 | 0.48 | 0.654 | 0.920 | 0.605 |

| Business services | 1 | 0.869 | 1.000 | 0.99 | 1.000 | 1.000 | 0.972 |

| Internet and related services | 2 | 0.517 | 0.600 | 0.472 | 0.636 | 0.624 | 0.569 |

| Radio, television, film, and television recording production industry | 1 | 0.800 | 0.845 | 1.000 | 1.000 | 1.000 | 0.929 |

| Storage industry | 1 | 0.660 | 0.623 | 0.499 | 0.584 | 0.585 | 0.590 |

| Wholesale industry | 2 | 1.000 | 1.000 | 1.000 | 1.000 | 0.970 | 0.994 |

| Retail | 1 | 0.572 | 0.650 | 0.501 | 0.542 | 0.860 | 0.625 |

| Public utility | 1 | 0.833 | 1.000 | 0.851 | 0.889 | 0.385 | 0.792 |

| Civil engineering and construction | 1 | 1.000 | 1.000 | 0.702 | 0.581 | 0.714 | 0.799 |

| Years | Yangtze River Economic Belt | Chengyu City Cluster | Yangtze River delta | Middle Reaches of the Yangtze River |

|---|---|---|---|---|

| 2015 | 0.3064 | 0.2300 | 0.3181 | 0.1926 |

| 2016 | 0.2951 | 0.2749 | 0.2899 | 0.1774 |

| 2017 | 0.3509 | 0.3257 | 0.3562 | 0.2727 |

| 2018 | 0.2925 | 0.2563 | 0.2994 | 0.2647 |

| 2019 | 0.2502 | 0.3263 | 0.2233 | 0.2348 |

| Regression Coefficient | Yangtze River Economic Belt | Chengdu Chongqing Region | Yangtze River Delta | Middle Reaches of the Yangtze River |

|---|---|---|---|---|

| −0.1772 *** (0.000) | −0.0978 *** (0.001) | −0.2042 *** (0.000) | −0.1857 *** (0.000) | |

| −0.4343 *** (0.000) | −0.2178 ** (0.049) | −0.4731 *** (0.000) | −0.6117 *** (0.000) | |

| 0.1139 | 0.0491 | 0.1281 | 0.1892 | |

| 6.0835 | 14.1087 | 5.4089 | 3.6637 | |

| 0.2491 | 0.0787 | 0.2732 | 0.2686 | |

| 69.83 | 4.00 | 47.50 | 24.91 |

| Variable | Yangtze River Economic Belt | Chengyu City Cluster | Yangtze River Delta | Middle Reaches of the Yangtze River |

|---|---|---|---|---|

| −1.5531 *** (0.004) | −1.8812 *** (0.008) | −9.9408 *** (0.000) | 13.4329 (0.557) | |

| −0.3871 *** (0.000) | −0.2123 ** (0.028) | −0.4281 *** (0.000) | −0.4860 *** (0.001) | |

| 0.1708 *** (0.001) | 0.0876 (0.191) | 0.8190 *** (0.000) | −0.7925 (0.613) | |

| −0.1354 (0.106) | −0.0460 (0.560) | −0.6597 ** (0.047) | 4.2828 * (0.063) | |

| 0.0137 (0.891) | −0.1758 ** (0.011) | 0.3749 (0.356) | −1.3378 (0.379) | |

| 0.1903 *** (0.000) | 0.0028 (0.960) | 0.2248 *** (0.000) | 0.1866 (0.631) | |

| −0.0196 (0.731) | 0.1074 * (0.058) | −0.1309 (0.426) | −0.2808 (0.229) | |

| 0.0979 | 0.0477 | 0.1118 | 0.1331 | |

| 7.0794 | 14.5230 | 6.2022 | 5.2075 | |

| 0.3638 | 0.2051 | 0.4507 | 0.3985 | |

| 24.19 | 3.17 | 21.81 | 12.62 |

| Y | Indicator Meaning | Coef. | Std. Err. | t | p > |t| |

|---|---|---|---|---|---|

| X1 | Regional GDP | 0.000387 | 8.08 × 10−5 | 4.79 | 0 |

| X2 | R&D funding intensity | 0.02524 | 0.005416 | −4.66 | 0 |

| X3 | Foreign direct investment | 0.000423 | 0.000314 | 1.35 | 0.178 |

| X4 | The number of listed companies | −0.00044 | 0.00013 | −3.41 | 0.001 |

| _cons | 0.808451 | 0.025519 | 31.68 | 0 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Han, Y.; Hua, M.; Huang, M.; Li, J.; Wang, S. Dynamic Transition and Convergence Trend of the Innovation Efficiency among Companies Listed on the Growth Enterprise Market in the Yangtze River Economic Belt—Empirical Analysis Based on DEA—Malmquist Model. Sustainability 2022, 14, 5269. https://doi.org/10.3390/su14095269

Han Y, Hua M, Huang M, Li J, Wang S. Dynamic Transition and Convergence Trend of the Innovation Efficiency among Companies Listed on the Growth Enterprise Market in the Yangtze River Economic Belt—Empirical Analysis Based on DEA—Malmquist Model. Sustainability. 2022; 14(9):5269. https://doi.org/10.3390/su14095269

Chicago/Turabian StyleHan, Yanqi, Minghui Hua, Malan Huang, Jin Li, and Shirui Wang. 2022. "Dynamic Transition and Convergence Trend of the Innovation Efficiency among Companies Listed on the Growth Enterprise Market in the Yangtze River Economic Belt—Empirical Analysis Based on DEA—Malmquist Model" Sustainability 14, no. 9: 5269. https://doi.org/10.3390/su14095269

APA StyleHan, Y., Hua, M., Huang, M., Li, J., & Wang, S. (2022). Dynamic Transition and Convergence Trend of the Innovation Efficiency among Companies Listed on the Growth Enterprise Market in the Yangtze River Economic Belt—Empirical Analysis Based on DEA—Malmquist Model. Sustainability, 14(9), 5269. https://doi.org/10.3390/su14095269