1. Introduction

As an essential determining factor in the yield of crops, the weather may bring agricultural growers yield uncertainty [

1], incurring economic losses [

2]. For example, maize is one of China’s most important grain crops, and rainfall is indispensable to supporting maize growth [

3,

4]. Over the past few decades, climate change has led to the more frequent fluctuation of weather factors, resulting in drought and flood being the principal restrictions on maize yield stability [

5]. Yield uncertainty due to uncontrollable weather factors may also affect the retailers downstream an agricultural supply chain, which is up to the contract design between the supplier and retailer. For example, contract farming is a prevalent transaction mode for agricultural products in China, in which a retailer buys agricultural products from a supplier at a predetermined quantity, price, and quality [

6]. Therefore, the retailer will assume part or all of the yield risk transferred from the supplier, depending on how much realized output they agreed to buy. Meanwhile, retailers are faced with demand uncertainty all the time. As a result, both the yield and demand uncertainties negatively affect the agricultural supply chain’s performance and then the contractual relationship’s sustainability [

7]. Supply chain coordination in the presence of single or multiple uncertainties has been studied in the classical newsvendor model. For the former, previous research primarily pays attention to the effect of demand uncertainty on the optimal order [

8] or the impact of yield uncertainty on the optimal input or production decision [

1]. For the latter, the existing literature focuses on multiple yield and demand uncertainties faced by the same one [

9,

10] or different decision makers [

2,

11,

12,

13]. This paper will consider both the weather-related yield uncertainty and market demand uncertainty and study how an agricultural supply chain can achieve coordination in the presence of multiple uncertainties under a revenue-sharing contract.

The yield uncertainty can be depicted by a multiplicative or additive model [

14]. The multiplicative yield (also known as the stochastically proportional yield, SPY) is modeled as a random variable multiplied by the planned input or output quantity, which has been widely used in previous work [

1,

12]. However, these previous studies mainly focus on the output uncertainties originating from industrial production and transportation. These output uncertainties are endogenous and dependent on the planned input or output quantity while controllable to some extent; in contrast, the weather-related yield uncertainties that suffer from the fluctuation of weather factors (such as rainfall or temperature) are uncontrollable and exogenous to the supply chain. Their influences on the output are independent of the planned input or output quantity. An additive yield model adds a random variable to the planned production quantity, assuming that the two variables are independent. For the impact of weather factors on crop yield, the existing literature indicates that the crop’s actual or observed yield is the sum of its potential and detrended yield [

15]. Potential yield designates the crop yield associated with technological advances (e.g., improved agro-management) and socio-economic factors (e.g., the effect of market price on nutrient application) with perfect environmental conditions [

16]. Detrended yield is affected by seasonal and climate variability and unfavorable weather conditions [

17]. This paper considers the relationship between a weather factor (e.g., the effect of rainfall on crops) and its resulting uncertain yield. The order quantity or planned production corresponds to the potential yield, and the detrended yield is affected by the randomness of the weather factor. Moreover, the detrended yield is a random variable independent of the potential yield. Although the multiplicative model is more generally used, the additive form is more applicable for specific and detailed analysis of the effect of weather-related yield uncertainty on the revenue and risk sharing of the agricultural supply chain. Therefore, this paper will take an additive form to depict uncertain yield. It may also be conducive to extending the research on the effect of weather-related factors on uncertain yield.

A classic revenue-sharing contract is widely used in the existing literature for supply chain coordination, in which a retailer pays a wholesale price to a supplier for each unit purchased while sharing a portion of his/her sales revenue [

18]. Some existing literature [

6,

19] points out that a traditional revenue-sharing contract can coordinate a supply chain with random demand if the supplier and retailer bear yield and demand risks, respectively. However, it cannot coordinate a supply chain in the presence of uncertain yield due to failing to redistribute yield risk. Therefore, they propose combined contracts, including a traditional revenue-sharing contract, to achieve coordination. However, this paper aims to rearrange the contract structure and parameters to share the yield risk and show that a revenue-sharing contract still has the coordination ability to face yield randomness.

For the above discussion, we constructed a two-echelon agricultural supply chain motivated by contract farming practices in China. A retailer buys crops from a supplier who plants crops and sells them to the market. Due to uncontrollable weather, the supplier may suffer a loss of profit, thus being unwilling to join the contract; accordingly, the retailer may share the yield risk to induce the supplier to sustainable supply. Then, we take as an example maize planting in Heilongjiang Province, one of the main maize producing areas in China, to analyze how the fluctuation of rainfall index affects the maize yield and thus the performance of the agricultural supply chain. This study contributes as follows. (1) The exogenous weather factor is a primary driver behind the agricultural yield uncertainty and is independent of the production process. This study takes an additive form in modeling uncertain yield to deeply link it with the random variation in weather index, i.e., rainfall, and further explores its influence on supply chain coordination. (2) How much a retailer buys crops from a supplier influences the extent to which he assumes yield risk. We discuss the contract structure design concerning yield risk-sharing and find that while the retailer purchases all the realized yield of the supplier instead of an order quantity, the revenue-sharing contract can coordinate the agricultural supply chain with uncertain yield and demand. In addition, it can improve the performance of the whole agricultural supply chain as well as the profitability of the participants.

The rest of this paper is organized as follows. In

Section 2, we review the related literature. We introduce the preliminaries of the model and provide the benchmark model of the integrated supply chain in

Section 3. In

Section 4, we study the decentralized supply chain under a wholesale price contract.

Section 5 discusses the influence of different contract structures on yield risk-sharing and how to rearrange the structure and parameters of a traditional revenue-sharing contract to achieve supply chain coordination. In

Section 6, we make a numerical analysis.

Section 7 presents concluding remarks.

2. Literature Review

The related literature is reviewed on two topics: (1) uncertain yield and the form to model it, and (2) supply chain coordination mechanism in the presence of uncertain yield and demand.

2.1. Supply Chain Yield Uncertainty

Most existing literature takes a multiplicative form of uncertain yield. He and Zhao [

11] and Adhikari [

2] describe the realized production yield as a stochastic proportion of the planned production quantity to depict the supply randomness in the production process. Giri and Bardhan [

13] assume that the supplier and manufacturers’ actual produced quantities are random proportions of the planned production quantity and order quantity, respectively. Güler and Keski [

14] assume that the retailer can use a stochastic proportion to the delivered quantity from the supplier due to the supply uncertainty resulting from quality, transportation, or theft issues. Anderson [

1] expresses the actual yield as the random proportion of nitrogen fertilizer input and studies its influence on yield. These studies focus on yield randomness in the production and transportation process. They assume that the available yield depends on the planned production amount or input quantity, but they have the same underlying structure.

A few previous works involve an additive model of uncertain yield. Keren [

20] explores a two-echelon supply chain coordination with both multiplicative and additive stochastic yield. It is demonstrated that the member’s profit is affected by whether the standard deviation of the realized delivery is independent of the order quantity. Wang et al. [

21] find that the yield uncertainties in the process industry are independent of the target quantity. Thus, they constructed an additive model of random yield to study periodic review lot-sizing problems. A weather factor is a crucial driver of yield randomness in crop farming that may positively or negatively impact crop yield. It is not affected by crop planting, thus being exogenous and independent of planned production or order quantity, which may differ from yield uncertainty in the manufacturing industry, usually arising in the production and transportation process and thus depending on target input or output. Furthermore, previous studies indicate that the influence of a weather factor on crop yield can be separated from the gap between potential yield and detrended yield [

15,

17]. It means that the real output is not proportional to the target quantity. In this paper, our problem may align with the additive form of random yield.

2.2. The Supply Chain Coordination Mechanism with Uncertain Yield and Demand

A critical issue resulting from yield uncertainty involves the contract mechanism to achieve supply chain coordination. The existing literature shows that it is impossible for a single classic contract mechanism (e.g., wholesale price contract, buyback contract, and revenue-sharing contract [

22]) to achieve supply chain coordination in the presence of simultaneous yield and demand uncertainty. In addition to a wholesale price contract, other contracts can coordinate supply chains where only random demand exists. Inderfurth and Clemens [

8] point out that a wholesale price contract cannot coordinate a supply chain with uncertain yield. They show how the contract design compensates for overproduction or penalizes shortages can coordinate this supply chain. Luo and Chen [

19] take into account the overproduction and shortage case in a two-echelon supply chain with uncertain yield and demand. Their research shows that revenue-sharing contracts fail to redistribute yield risk and combine a surplus subsidy contract to achieve supply chain coordination. He and Zhao [

12] indicate that wholesale price contract, buyback, or revenue-sharing contract fails to coordinate the supply chain facing uncertain yield and demand. Instead, they propose two combined contract mechanisms to achieve perfect coordination. Fu et al. [

23] designed a revenue-sharing contract coupled with a weather-related yield risk transfer mechanism to explore a two-echelon supply chain coordination. Tang and Kouvelis [

9] construct a payback–revenue-sharing contract to resolve supply chain coordination. Likewise, Xie et al. [

10] design a buyback–revenue-sharing mechanism to address supply chain coordination with random yield and demand with a similar contract portfolio form. He and Zhao [

11] construct a three-echelon supply chain consisting of a supplier facing random yield, a manufacturer, and a retailer facing stochastic demand. It assumes that a supplier replenishes the gap between the realized output and ordered quantity from a spot market. In this case, they propose a wholesale price contract with a return policy to coordinate the upstream and downstream pairwise members. For this situation, the under-production risk stops passing downstream. Similarly, Giri and Bardhan [

24] assume that a buyer has backup sourcing to resolve an under-production issue of the supplier. Unlike the above studies that combine a new contract with a classical one, Güler and Keski [

14] analyze several existing well-known contracts, including wholesale price, buyback, revenue-sharing, quantity flexibility, and quantity discounts. With the assumption of voluntary compliance (refer to [

22]), they show that the yield randomness will only influence the contract structure and parameters but not the coordination ability of the contracts.

To the best of our knowledge, our study is most relevant to the work by Luo and Chen [

19], Xie et al. [

10], and Güler and Keski [

14], but it differs in several ways. Luo and Chen [

19] assume that yield and demand uncertainties are faced by different players and propose to combine a surplus subsidy with a revenue-sharing contract to share yield and demand risk, respectively. The surplus subsidy contract guarantees that the retailer partly shares an overproduction risk, which means that all the supplier’s realized yield can be paid without determining order quantity. Likewise, Güler and Keski [

14] take the assumption of voluntary compliance that the supplier decides the amount delivered to maximize his/her profit, not exceeding the retailer’s order quantity. It denotes that the retailer shares the yield uncertainty by purchasing all the actual output of the supplier. Xie et al. [

10] assume that the buyer simultaneously takes on yield and demand uncertainties; thus, there is no need to determine order quantity. Therefore, the above three studies have the same underlying contract structure to deal with yield risk in coordinating the supply chain. It indicates that the retailer must share the supplier’s yield risk to achieve coordination, which is expressed as quantitatively buying all the actual yield.

Inspired by Güler and Keski [

14], our study focuses on rearranging the contract structure and parameters of a revenue-sharing contract to redistribute the yield risk instead of designing a combined contract like Luo and Chen [

19] and Xie et al. [

10]. This paper aims not only to coordinate a supply chain with uncertain yield and demand like Güler and Keski [

14] but also to explore the impact of weather-related yield risk on supply chain coordination rather than yield uncertainty in the production and transportation process. Different from their premises, we consider the cases in which a retailer promises to buy the amount ordered or all the realized yield from the supplier. This arrangement means that the retailer only takes demand risk or simultaneously shares yield risk. Furthermore, in contrast to the above three studies, we adopt an additive form to depict uncertain yield instead of SPY, considering that the weather index is a random variable independent of the target input or output.

3. Preliminaries and Benchmark Model

We consider an agricultural supply chain consisting of a supplier and a retailer. Weather-related uncertain yield and random demand threaten the supplier and retailer, respectively. As discussed above, we take an additive form to model the actual yield, i.e., units. It is the sum of the meteorological output and the planned production quantity . The meteorological output is a linear function of the weather factor , i.e., rainfall, taken as an example in our study. In this paper, we only consider the occurrence of rainfall deficiency as representative of unfavorable weather. Let be a nonnegative random variable, having a mean and variance , with cumulative distribution function (CDF), , and probability density function (PDF) . Assume that rainfall distributes between and (), thus having . We assume that the retailer faces stochastic demand , characterized by CDF and PDF , with a mean and variance . The retailer orders units of crops at the wholesale price set by the supplier. Then, the supplier plans to grow crops of units at a cost . The retailer sells at a price between the delivered amount and the realized market demand. To avoid trivial cases, we also assume . In addition, the profit of the supply chain members should be greater than zero; otherwise, they are not willing to participate.

We first consider a centralized supply chain to establish a benchmark model for evaluating the performance of the subsequent contracts. In the centralized supply chain, we can achieve an optimal solution and the maximum expected profit of the integrated supply chain. The expected profit in the centralized supply chain is

The expected profit in the centralized supply chain is the total sales revenue minus the production costs. As the second-order condition on is , we can obtain the optimal planned production quantity from the first-order derivative .

Proposition 1. In the centralized supply chain, the integrated expected profit is concave in , and the optimal planned yield is uniquely decided by

Proposition 1 demonstrates the optimal production decision in the centralized supply chain. Equation (2) indicates that the optimal yield is affected by both the yield and demand uncertainty. It is also evident that increases with and decreases with .

4. The Decentralized Supply Chain under a Wholesale Price Contract

In the decentralized supply chain, we assume that the retailer only pays the order quantity for the supplier. So, the supplier assumes yield risk while the retailer bears demand risk. The supplier and retailer each pursue maximizing their own expected profit, which leads to the sum of their expected profits being less than that in the centralized model. The supplier’s expected profit is

As shown in Equation (3), the first term is the supplier’s revenue from providing the retailer’s order in the first line. The second term is the production cost for the planned yield. Then, we deal with the retailer’s order decision on maximizing his/her profit. The retailer’s expected profit function is

As shown in Equation (4), in the first line, the first term is the retailer’s sales revenue, and the second term is the purchased cost that the retailer pays to the supplier. Being aware of the pre-agreed wholesale price , the retailer can decide on his/her optimal order quantity. The first and second derivatives are and ; then, we can straightforwardly obtain the following proposition.

Proposition 2. In the decentralized model, the retailer’s optimal order quantity is uniquely solved by

As shown in Proposition 2 because the supplier bears yield risk alone in the decentralized model, the randomness of yield does not influence the retailer’s optimal order quantity, which is related to wholesale price and retail price and affected by the distribution of random demand. Substituting Equation (5) into Equations (3) and (4), we can obtain the profit of the integrated supply chain in the decentralized model, i.e.,

. Referring to the proof of Luo and Chen [

19], when the order quantity

is the minimum one among the order quantity

, planned output

, and demand

,

is less than the integrated supply chain profit in the centralized model

. It suggests that the wholesale price contract cannot coordinate the agricultural supply chain, consistent with previous research results. We further demonstrate this in numerical analysis.

5. Supply Chain Coordination Using a Revenue-Sharing Contract

The decentralized model assumes that the retailer makes decisions on order quantity without sharing the yield risk. In this case, we rearrange the contract structure to coordinate the agricultural supply chain. Assume that the retailer buys all the realized yield rather than the order quantity from the supplier. It signifies that the retailer shares the yield risk with the supplier. With a similar contract structure, Güler and Keski [

14] indicate that a wholesale price contract cannot coordinate a supply chain in the presence of random yield and demand. Our problem faces the same case, where the wholesale price contract can make the sum of supplier and retailer profits equal to that in the centralized supply chain. However, the supplier cannot improve her revenue, while the retailer accounts for most of the increased revenue compared to that in the decentralized model. Accordingly, based on redesigning the contract structure, we propose a revenue-sharing contract to reallocate the risk and profit between the retailer and the supplier, assuring that both the supplier and retailer can benefit from the coordination. The above contract arrangement naturally lies in contract farming practice, especially in the rural villages of China [

25]. A buyer pays the crop yield from farmers at a wholesale price. When the farmers suffer low output from unfavorable weather, they are unwilling to sustain the cooperation. In this case, the buyer is willing to share his revenue with the farmer.

We now consider how a revenue-sharing contract coordinates the supply chain with uncertain yield and demand. The retailer promises to buy all the actual output to share the yield risk with the supplier. Except for paying the supplier a wholesale price for the delivered quantity, the retailer shares a portion

(

) of his sales revenue with the supplier. The expected profit function of the retailer is

In the case that the retailer purchases all the output from the supplier, the retailer’s optimal decision is determined by the planned production quantity instead of the order quantity. The first and second conditions are

and

. Hence, the retailer’s profit

is strictly concave in the planned output

, and the optimal

satisfies the following condition:

Under a revenue-sharing contract, the supplier’s expected profit is

From Equations (6) and (7), we can infer that the sum of the supplier and retailers’ profits equals that in the centralized supply chain, which manifests that the resigned revenue-sharing contract can coordinate the chain facing uncertain yield and demand. Still, a specific condition needs to allocate the profits between the supplier and retailer arbitrarily. Comparing Equation (7) with (2), to induce the supplier to design the same amount of the planned production quantity, the retailer needs to make the supplier agree with the wholesale price set by

Therefore, we have the following proposition.

Proposition 3. Revenue-sharing contracts can coordinate the supply chain under uncertain yield and demand if , and the optimal profit of the supply chain can be arbitrarily allocated by varying and .

From Proposition 3, the wholesale price must be set below the production cost. The wholesale price decreases as the revenue-sharing portion increase. Thus, the risk and profit can reallocate between the supplier and the retailer while the supply chain remains in coordination. In addition, the distribution of the random yield and demand also impacts the coordinating contract, and we discuss this and compare the results with the decentralized case in the numerical analysis section.

6. Numerical Analysis

To further explore the effect of weather-related uncertain yield and random demand on coordinating contracts, in this section, we conduct a numerical analysis to illustrate the performance of the supply chain with and without coordination and the effect of weather-related yield and demand uncertainties on the profitability of the supply chain. Heilongjiang Province is one of the main maize-producing areas in China. Fluctuations in rainfall, especially rainfall deficiency, are the most typical unfavorable weather risk that threatens maize growers with yield uncertainty, which will negatively affect the profitability and performance of the agricultural supply chain by a contract mechanism. We make use of the annual average of rainfall, unit maize yield, and unit maize cost or price from 1998 to 2017 in Heilongjiang Province (the data come from the National Agricultural Product Cost Income Data Compilation from 1999 to 2018) to explain the main results of this study. Assume that both the rainfall

and demand

follow a uniform distribution that is extensively used in the previous literature (refer to Rekik [

26]); the default values of the parameters are

CNY and

CNY. The detrended or meteorological yield function is

. The rain has a mean

mm and standard deviation

mm. The mean value and standard deviation of the demand are

kg/hectare and

kg/hectare, respectively. Referring to He and Zhao [

11], we compare the efficiency of the supply chain with and without coordination, measured by the ratio between the profit increase under a coordinated revenue-sharing contract and the profit under a wholesale price contract without coordination.

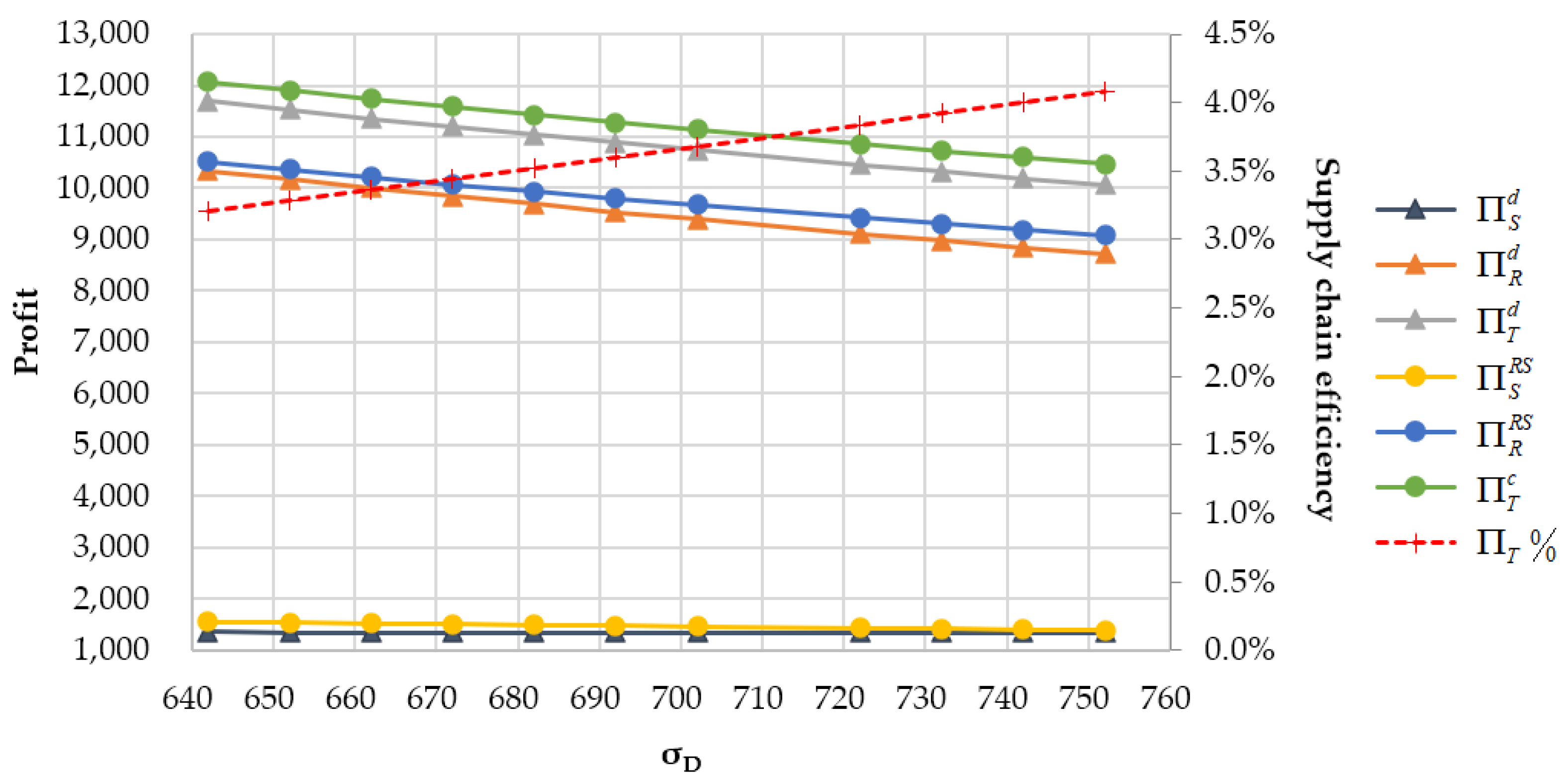

In

Figure 1,

is the total supply chain profit without coordination, comprising the supplier and retailer’s profits in the decentralized situation.

designates the profit of the integrated supply chain with coordination, consisting of the supplier and retailer’s profit under a modified revenue-sharing contract. As shown in

Figure 1, the profits of the supplier and the entire supply chain under coordination are always higher than those under incoordination. Referring to He and Zhao [

11],

defines the supply chain efficiency that illustrates a supply chain’s profit increase with coordination compared to that without coordination.

Figure 1 indicates that both the supplier and retailer suffer from increased demand uncertainty with and without coordination. As

increases, representing that the demand uncertainty becomes more severe, the profits of the supplier and retailer decrease in the central axis while the supply chain efficiency increases in the secondary ordinate axis. This implies that the entire supply chain benefits from the coordination, and all the supply chain members achieve profit improvement.

Figure 2 illustrates the impact of yield uncertainty on the performance of the supply chain. The increasing standard deviation of rainfall

signifies that the yield uncertainty becomes more severe, thus reducing more profits of the members and the entire supply chain. It is worth noting that as the standard deviation

rises, the profit-increasing portion

and the supply chain efficiency decrease. This result is inconsistent with those of Luo and Chen [

19] and He and Zhao [

11] while being consistent with those of Xie et al. [

10] and He and Zhao [

12], mainly due to the different contract structures and assumptions that the retailer bears yield risk under the revised revenue-sharing contract but not under the wholesale price contract. Although supply chain efficiency declines with increasing yield uncertainty, it remains above 3.5%, which demonstrates that the profits of the coordinated supply chain are always higher than those of the uncoordinated chain. Still, as the yield risk increases, contrary to the retailer’s situation, the supplier’s profit grows, indicating that the retailer shares more of the yield risk. In this case, like Xie et al. [

10], we want to explore whether the rainfall’s mean

limits the performance of the supply chain and the extent to which the revised revenue-sharing contract still works to improve the profits of the supplier, retailer, and entire chain.

Most of the previous studies use a standard deviation to illustrate the impact of demand and yield uncertainties on the profitability of the supply chain. However, Xie et al. [

10] find that the mean of random yield affects the yield uncertainty under a uniform distribution. Referring to their study, we further explore the influence of the rainfall’s mean

on the profit improvement of the supply chain. Without considering the excessive rainfall scenario, in our analysis, the rise in the mean rainfall

represents that the probability of unfavorable and adverse weather (e.g., rainfall deficiency and even drought) declines; in contrast, the possibility of favorable weather (e.g., rainfall sufficiency) increases. The increase in the rainfall’s mean value signifies that the yield uncertainty weakens, thus improving productivity.

Figure 3 and

Figure 4 illustrate the profit improvement of the supplier and retailer, respectively, considering the influences of the rainfall’s mean and standard deviation simultaneously. As the average rainfall

decreases, the profit-increasing portions of the supplier (

) and retailer (

) decrease, respectively. However, as long as the average rainfall

remains high enough, the profit-increasing amounts of the supplier and retailer are greater than zero. This is related to the range of rainfall we consider. If the mean

keeps falling, the increase in profit may be less than zero, which can be observed in reality. For example, when the output is too low due to drought, the supply chain members can no longer share the yield risk and must rely on external government subsidies or insurance to transfer it. As a result, the revised revenue-sharing contract can improve the supplier and retailers’ profit if the mean rainfall

remains sufficiently high.

7. Conclusions

An agricultural supply chain naturally faces weather-related uncertain yield and market-linked random demand. In this context, we investigated the issue of how to arrange the contract structure and parameters to perfectly coordinate a two-echelon supply chain with uncertain yield and demand. The uncertain yield takes an additive form to depict the influence of a critical weather factor (i.e., rainfall) on crop output, relating to the gaps between the planned production quantity and the realized harvest. First, we present the equilibrium decision of the retailer’s order and the optimal planned production quantity for the entire supply chain. The results indicate that the wholesale price contract cannot achieve supply chain coordination. Second, to tackle this issue, we propose a new contract arrangement under a revenue-sharing contract that the retailer promises to purchase all the realized output from the supplier. Then, we look into how to coordinate the supply chain with the retailer’s multiple uncertainties and achieve a win-win situation. The results indicate that the redevised revenue-sharing contract can fulfill our purpose. We further explore the effect of random yield on the members’ profit and the performance of the entire supply chain and find that the increasing mean and standard deviation of rainfall have favorable and unfavorable effects, respectively. Although the rising standard deviation reduces the supply chain efficiency, the revised coordination mechanism can still improve all the members’ benefits while keeping the mean rainfall sufficiently high. Accordingly, managerial implications can be obtained: (1) weather-related risks usually harm the crop yield, followed by the growers’ revenue reduction. The retailer shares the yield risk and sales revenue with the supplier, improving the supplier’s profit and thus making the supplier willing to continue participating in the supply chain. It implies that the contract structure and arrangement are significant for coordinating the agricultural supply chain facing multiple yield and demand uncertainties. A profitable contract mechanism is beneficial to maintaining the sustainability of the supply chain. (2) Furthermore, the fluctuation of weather factors is inevitable and more frequent, primarily due to climate change in recent years. However, effective countermeasures can alleviate the weather-related yield uncertainty; e.g., irrigation of crops may mitigate the adverse impact of insufficient rainfall, thereby facilitating the realization of profitability for all supply chain members.

In this paper, we proposed a linear additive random yield function to depict the influence of unfavorable weather on crop yield, and then conducted a numerical analysis in the case that maize yield uncertainty comes from insufficient rainfall. First, in the rainfall case, future research can extend the numerical analysis to account for both inadequate and excessive rainfall in the same random yield function. Second, to raise a more precise simulation of the weather-related yield uncertainty in the agricultural context, a non-linear additive random yield function needs to attract more attention. Furthermore, we explored a two-echelon supply chain coordination under a traditional revenue-sharing contract by redesigning the contract structure. Yet, in the development of contract farming, cooperatives and other intermediary organizations are developed to link smallholders and agricultural companies. In addition to that, future research can be extended to the multi-echelon supply chain as well as other contract structures and formats to deal with multiple uncertainties. In summary, keeping pace with practice brings more managerial insights and feedback to contract design practice in an agricultural supply chain facing multiple uncertainties.