Environmental, Social and Governance (ESG) Disclosure and the Small and Medium Enterprises (SMEs) Sustainability Performance

Abstract

1. Introduction

- Which of the three ESG dimensions is performed more by SMEs in Saudi Arabia?

- What are the challenges and opportunities of ESG disclosure in SMEs?

- How far are the SMEs in Saudi Arabia aware of the concept of sustainability?

- Are SMEs in Saudi Arabia ready for ESG disclosure practices?

2. Literature Review and the Theoretical Framework

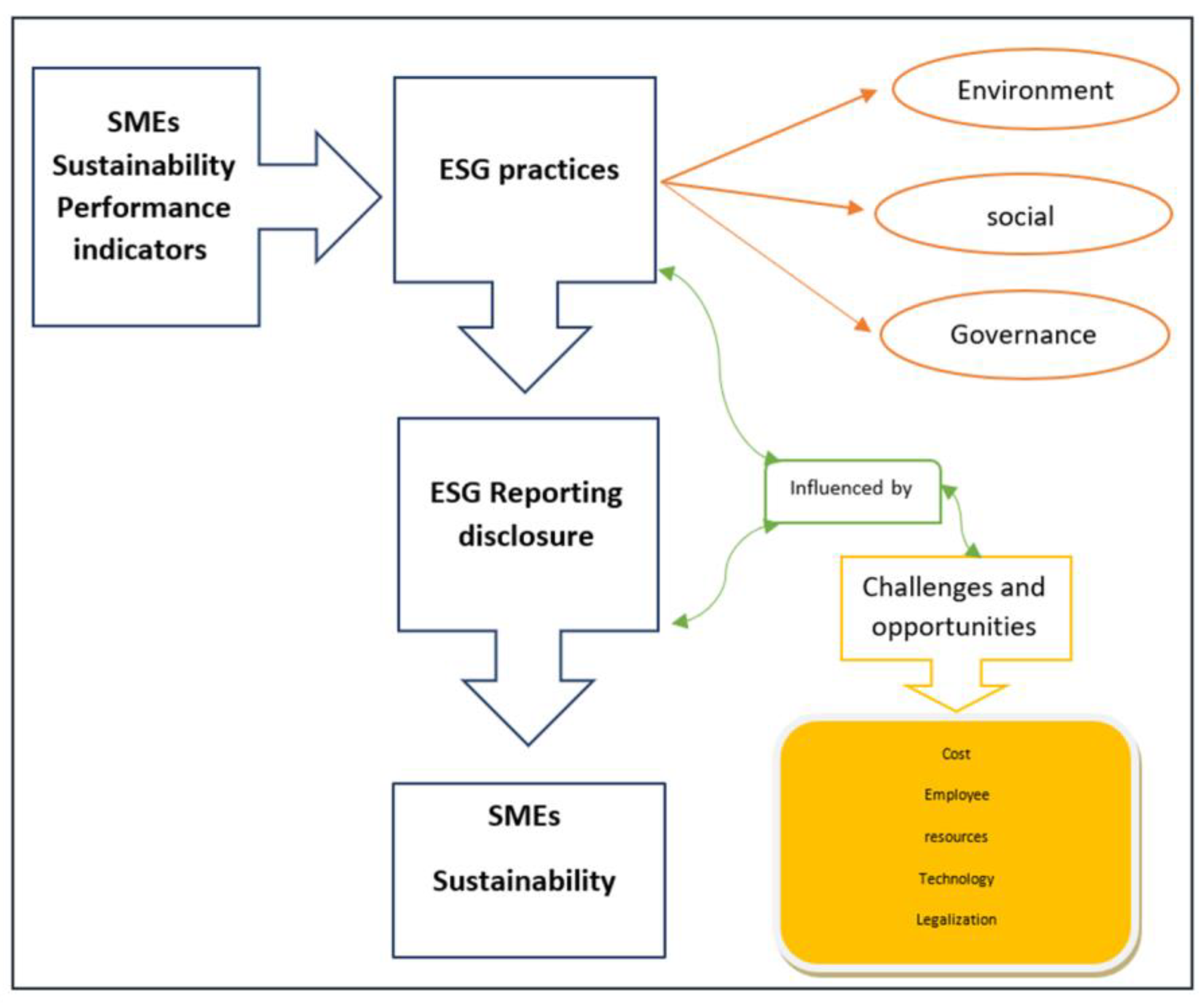

3. Conceptual Framework of the Relationship between ESG Disclosures on SMEs Sustainability

The Opportunities and Challenges of ESG Practices for SMEs

4. Research Methodology

5. Data Analysis

6. Results and Discussion

6.1. ESG Practices by SMEs

6.2. Factors Influencing the Practices of ESG

6.3. Awareness of Sustainability

6.4. ESG practices Disclosures

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Interview Participants’ Information

| Participants | Sector | Date | Duration | Formation |

| SME 1 | Housing and food services | 5 July 2022 | 30 min | Face-to-face |

| SME 2 | Housing and food services | 14 July 2022 | 45 min | Face-to-face |

| SME 3 | Housing and food services | 22 July 2022 | 47 min | Face-to-face |

| SME 4 | Housing and food services | 24 July 2022 | 35 min | Face-to-face |

| SME 5 | Housing and food services | 6 July 2022 | 36 min | Video communication |

| SME 6 | Housing and food services | 3 August 2022 | 45 min | Face-to-face |

| SME 7 | Housing and food services | 5 August 2022 | 45 min | Video communication |

| SME 8 | Wholesale and retail | 4 July 2022 | 40 min | Face-to-face |

| SME 9 | Wholesale and retail | 24 July 2022 | 45 min | Video communication |

| SME 10 | Wholesale and retail | 25 July 2022 | 53 min | Face-to-face |

| SME 11 | Fashion and Beauty | 10 July 2022 | 30 min | Video communication |

| SME 12 | Fashion and Beauty | 13 July 2022 | 40 min | Video communication |

| SME 13 | Fashion and Beauty | 24 July 2022 | 49 min | Video communication |

| SME 14 | Real estate activities | 25 July 2022 | 45 min | Video communication |

| SME 15 | Real estate activities | 3 August 2022 | 45 min | Face-to-face |

| SME 16 | Construction | 4 July 2022 | 40 min | Face-to-face |

| SME 17 | Construction | 10 August 2022 | 55 min | Face-to-face |

| SME 18 | Accounting and financial services | 4 July 2022 | 45 min | Video communication |

| SME 19 | Accounting and financial services | 6 August 2022 | 30 min | Video communication |

| SME 20 | Transport and storage | 24 July 2022 | 45 min | Video communication |

| SME 21 | Transport and storage | 5 August 2022 | 45 min | Video communication |

| SME 22 | Entertainment | 6 July 2022 | 45 min | Face-to-face |

| SME 23 | Entertainment | 5 August 2022 | 50 min | Face-to-face |

| SME 24 | Infrastructure | 5 July 2022 | 40 min | Face-to-face |

| SME 25 | Human health | 4 July 2022 | 45 min | Face-to-face |

| SME 26 | ICT | 5 July 2022 | 45 min | Video communication |

| SME 27 | Education | 5 August 2022 | 45 min | Video communication |

| SME 28 | Manufacturing | 12 July 2022 | 50 min | Video communication |

| SME 29 | Administrative and consulting services | 5 July 2022 | 58 min | Video communication |

| SME 30 | Marketing and consulting services | 10 July 2022 | 20 min | Face-to-face |

Appendix B. Lists of the Interview Questions

- General questions about the SME and its activities:

- ◦

- Q1: What is the company’s activity (In which sector)?

- ◦

- Q2: Is it a small or medium-sized business?

- ◦

- Q3: Does the company have a website, social media accounts? Please specify if any?

- ◦

- Q4: Does the company keep books of account?

- ◦

- Q5: Does the company have an accountant?

- ◦

- Q6: Does the company use one of the accounting programs (software), please specify if any?

- ◦

- Q7: Does the company disclose its Financial Statements /where if the answer is yes?

- Questions to identify the ESG practices applied by the SMEs:

- ◦

- Q8: Which practices related to the environment responsibility are practiced by your company?

- ◦

- Q9: Which practices related to the social development are practiced by your company?

- ◦

- Q10: Are you aware of the meaning of corporate governance?

- ◦

- Q11: Which practices related to corporate governance are practiced by your company?

- Factors influence the practices of the SMEs:

- ◦

- Q12: In your opinion, what are the factors affecting the implementation of the practices discussed previously with you, whether internal factors (strengths and weaknesses) or external factors (challenges and opportunities)?

- Measuring the awareness level of SMEs about the concept of sustainability in the Saudi Arabia:

- ◦

- Q13: Have you ever heard of the concept of sustainability? Please explain it if you do?

- ◦

- Q14: Do you know what sustainability reports are / and how important they are to the company?

- Knowing the extent to which SMEs in Saudi Arabia are prepared to disclose ESG reports:

- ◦

- Q15: Have you ever heard of what environmental, social and corporate governance practices are? please clarify?

- ◦

- Q16: Do you disclose such practices? If the answer is yes, is it done independently or within the company’s financial reports?

- ◦

- Q17: Where are such practices disclosed? (Website, social media)

- ◦

- Q18: Does the corporate legislation help or limit the application of such practices and why?

- ◦

- Q19: Do you think you maintain a good level of sustainability and good performance?

- ◦

- Q20: Would you like to add anything else?

Appendix C. ESG Practices by Interviewed SMEs

| Criteria | Practices |

| Environmental |

|

| Social |

|

| Corporate Governance |

|

References

- Gholami, A.; Sands, J.; Shams, S. Corporates’ sustainability disclosures impact on cost of capital and idiosyncratic risk. Meditari Account. Res. 2022. [Google Scholar] [CrossRef]

- Steyn, M. Organisational benefits and implementation challenges of mandatory integrated reporting: Perspectives of senior executives at South African listed companies. Sustain. Account. Manag. Policy J. 2014, 5, 476–503. [Google Scholar] [CrossRef]

- Ghoul, S.E.; Guedhami, O.; Kim, Y. Country-level institutions, firm value, and the role of corporate social responsibility initiatives. J. Int. Bus. Stud. 2017, 48, 360–385. [Google Scholar] [CrossRef]

- Buallay, A. Between cost and value: Investigating the effects of sustainability reporting on a firm’s performance. J. Appl. Account. Res. 2019, 20, 481–496. [Google Scholar] [CrossRef]

- Becker, M.G.; Martin, F.; Walter, A. The power of ESG transparency: The effect of the new SFDR sustainability labels on mutual funds and individual investors. Financ. Res. Lett. 2022, 47, 102708. [Google Scholar] [CrossRef]

- Kumar, P.; Firoz, M. Does Accounting-based Financial Performance Value Environmental, Social and Governance (ESG) Disclosures? A detailed note on a corporate sustainability perspective. Australas. Account. Bus. Financ. J. 2022, 16, 41–72. [Google Scholar] [CrossRef]

- Atan, R.; Alam, M.M.; Said, J.; Zamri, M. The impacts of environmental, social, & governance factors on firm performance: Panel study of Malaysian companies. Manag. Environ.Qual. Int. J. 2018, 29, 182–194. [Google Scholar] [CrossRef]

- Bansal, P.; Hoffman, A.J. The Oxford Handbook of Business and the Natural Environment; Oxford University Press: Oxford, UK, 2012. [Google Scholar] [CrossRef]

- Johnson, M.P. Sustainability management and small and mediumsized enterprises: Managers’ awareness and implementation of innovative tools. Corp. Soc. Responsib. Environ. Manag. 2015, 22, 271–285. [Google Scholar] [CrossRef]

- Saudi Exchange. ESG Disclosure Guidelines. 2021. Available online: https://sseinitiative.org/wp-content/uploads/2021/11/Tadawul-ESG-Disclosure-Guidelines-EN.pdf (accessed on 10 March 2022).

- Alhusaini, M. More Than Just Oil: Saudi Arabia’s Improved Credit Rating; Ehata Financial Company: Riyadh, Saudi Arabia, 2022; Available online: https://ehata.com.sa/saudi-arabias-journey-to-sustainable-sovereign-debt-2/ (accessed on 5 November 2022).

- Monshaat Quarterly Report. SME Monitor Q1 2022; Monshaat: Riyadh, Saudi Arabia, 2022. Available online: https://www.monshaat.gov.sa/sites/default/files/2022-06/Monshaat%20Quarterly%20Report%20Q1%202022%20-%20EN%20%281%29.pdf (accessed on 13 March 2022).

- Boffo, R.; Patalano, R. ESG Investing: Practices, Progress, and Challenges; OECD: Paris, France, 2020; Available online: https://www.oecd.org/finance/ESG-Investing-Practices-ProgressChallenges.pdf (accessed on 7 March 2022).

- World Economic Forum. Stakeholder Capitalism: Over 70 Companies Implement the ESG Reporting Metrics 2022. Available online: https://www.weforum.org/impact/stakeholder-capitalism-esg-reporting-metrics/ (accessed on 10 March 2022).

- Howard-Grenville, J. ESG Impact is Hard to Measure—But it’s Not Impossible. Harvard Business Review. 2021. Available online: https://hbr.org/2021/01/esg-impact-is-hard-to-measure-but-its-not-impossible (accessed on 7 March 2022).

- Orlitzky, M.; Siegel, D.; Waldman, D. Strategic corporate social responsibility and environmental sustainability. Bus. Soc. 2011, 50, 6–27. [Google Scholar] [CrossRef]

- Freeman, R. The politics of stakeholder theory: Some future directions. Bus. Ethics Q. 1994, 4, 409–421. [Google Scholar] [CrossRef]

- Jo, H.; Harjoto, M.A. The causal effect of corporate governance on corporate social responsibility. J. Bus. Ethics 2012, 106, 53–72. [Google Scholar] [CrossRef]

- Velte, P. Women on management board and ESG performance. J. Glob. Responsib. 2016, 7, 53–72. [Google Scholar] [CrossRef]

- Dakhli, A. The impact of ownership structure on corporate social responsibility: The moderating role of financial performance. Soc. Bus. Rev. 2021, 14, 12445. [Google Scholar] [CrossRef]

- Govindan, K.; Kilic, M.; Uyar, A.; Karaman, A.S. Drivers and value-relevance of CSR performance in the logistics sector: A cross-country firm-level investigation. Int. J. Prod. Econ. 2021, 231, 107835. [Google Scholar] [CrossRef]

- Mohammadi, S.; Saeidi, H.; Naghshbandi, N. The impact of board and audit committee characteristics on corporate social responsibility: Evidence from the Iranian stock exchange. Int. J. Product. Perform. Manag. 2020, 70, 2207–2236. [Google Scholar] [CrossRef]

- Deegan, C.; Blomquist, C. Stakeholder influence on corporate reporting: An exploration of the interaction between WWF-Australia and the Australian minerals industry. Account. Organ. Soc. 2006, 31, 343–372. [Google Scholar] [CrossRef]

- Katmon, N.; Mohamad, Z.Z.; Norwani, N.M.; Farooque, O.A. Comprehensive board diversity and quality of corporate social responsibility disclosure: Evidence from an emerging market. J. Bus. Ethics 2019, 157, 447–481. [Google Scholar] [CrossRef]

- Johnson, M.P.; Schaltegger, S. Two decades of sustainability management tools for SMEs: How far have we come? J. Small Bus. Manag. 2016, 54, 481–505. [Google Scholar] [CrossRef]

- Ma, X.; Qing, L.; Ock, Y.S.; Wu, J.; Zhou, Y. The Effect of Customer Involvement on Green Innovation and the Intermediary Role of Boundary Spanning Capability. Sustainability 2022, 14, 8016. [Google Scholar] [CrossRef]

- Galleli, B.; Semprebon, E.; Santos, J.A.R.D.; Teles, N.E.B.; Freitas-Martins, M.S.D.; Onevetch, R.T.D.S. Institutional Pressures, Sustainable Development Goals and COVID-19: How Are Organisations Engaging? Sustainability 2021, 13, 12330. [Google Scholar] [CrossRef]

- May, A.Y.C.; Hao, G.S.; Carter, S. Intertwining corporate social responsibility, employee green behavior, and environmental sustainability: The mediation effect of organizational trust and organizational identity. Econ. Manag. Financ. Mark. 2021, 16, 32–61. [Google Scholar]

- Fraj, E.; Matute, J.; Melero, I. Environmental strategies and organizational competitiveness in the hotel industry: The role of learning and innovation as determinants of environmental success. Tour. Manag. 2015, 46, 30. [Google Scholar] [CrossRef]

- Baron, R. The Evolution of Corporate Reporting for Integrated Performance; OECD: Paris, France, 2014; pp. 1–30. [Google Scholar]

- Raimo, N.; Caragnano, A.; Zito, M.; Vitolla, F.; Mariani, M. Extending the Benefits of ESG Disclosure: The Effect on the Cost of Debt Financing. Corporate Social Responsibility and Environment Management. 2021. Available online: https://onlinelibrary.wiley.com/doi/10.1002/csr.2134?af=R (accessed on 8 March 2022).

- Akhter, S.; Dey, P.K. Sustainability reporting practices: Evidence from Bangladesh. Int. J. Account. Financ. Report. 2017, 7, 61–78. [Google Scholar] [CrossRef]

- Kocmanova, A.; Docekalova, M.; Nemecek, P.; Simberova, I. Sustainability, Environmental, Social and Corporate Governance Performance in Czech SMEs. 2012. Available online: https://www.researchgate.net/publication/265186811 (accessed on 8 March 2022).

- Gannon, G.; Hieker, C. Employee Engagement and a Company‟ s Sustainability Values: A Case Study of a FinTech SME. Management 2022, 10, 201–210. [Google Scholar]

- Crane, A.; Matten, D.; Spence, L.J. Corporate social responsibility in a global context. In Corporate Social Responsibility: Readings and Cases in a Global Context; Routledge: Abingdon, UK, 2014; Volume 3, p. 26. Available online: https://core.ac.uk/download/pdf/28903705.pdf (accessed on 15 March 2022).

- Gillan, S.L.; Koch, A.; Starks, L.T. Firms and social responsibility: A review of ESG and CSR research in corporate finance. J. Corp. Financ. 2021, 66, 101889. [Google Scholar] [CrossRef]

- Bailey, R.; Ferguson, A. ESG as a Workforce Strategy. Marshmclennan.com. 2021. Available online: https://www.marshmclennan.com/insights/publications/2020/may/esg-as-a-workforce-strategy.html (accessed on 5 April 2022).

- Fenwick, M.; Joubert, T.; Van Wyk, S.; Vermeulen, E.P. ESG as a Business Model for SMEs. Available SSRN 2022, 642. [Google Scholar] [CrossRef]

- Tkalac, V.A.; Sincic, C.D. The relationship between reputation, employer branding and corporate social responsibility. Public Relat. Rev. 2018, 44, 444–452. [Google Scholar] [CrossRef]

- Aggerholm, H.K.; Andersen, S.E.; Thomsen, C. Conceptualising employer branding in sustainable organizations. Corp.Commun. Int. J. 2011, 16, 105–123. [Google Scholar] [CrossRef]

- Kotsantonis, S.; Pinney, C.; Serafeim, G. ESG integration in investment management: Myths and realities. J. Appl. Corp. Financ. 2016, 28, 10–16. [Google Scholar]

- Jensen, J.C.; Berg, N. Determinants of traditional sustainability reporting versus integrated reporting: An institutionalist approach. Bus. Strategy Environ. 2012, 21, 299–316. [Google Scholar] [CrossRef]

- Doug, M.; Yow, M. Measuring Sustainability Disclosure: Ranking the World’s Stock Exchanges; Corporate Knights Capital: Toronto, ON, Canada; Aviva, ACCA, Standard & Poor’s Ratings Services: New York, NY, USA, 2014; p. 45. [Google Scholar]

- Vannoni, V.; Ciotti, E. Esg or Not Esg? A Benchmarking Analysis. Int. J. Bus. Manag. 2020, 15, 152–161. Available online: https://pdfs.semanticscholar.org/e66f/1ed0d677e150bd83451741af9fd4e7fb6442.pdf (accessed on 9 April 2022). [CrossRef]

- Lydenberg, S. Emerging Trends in Environmental, Social, and Governance Data and Disclosure: Opportunities and Challenges. Priv. Sect. Opin. 2014, 32, 16–29. [Google Scholar]

- Adams, C. Understanding Integrated Reporting: The Concise Guide to Integrated Thinking and the Future of Corporate Reporting; Routledge: Abingdon, UK, 2017. [Google Scholar]

- Lee Brown, D.; Guidry, R.P.; Patten, D.M. Sustainability reporting and perceptions of corporate reputation: An analysis using fortune. In Sustainability, Environmental Performance and Disclosures; Emerald Group Publishing Limited: Bingley, UK, 2009; Volume 4, pp. 83–104. [Google Scholar]

- Clementino, E.; Perkins, R. How Do Companies Respond to Environmental, Social and Governance (ESG) ratings? Evidence from Italy. J. Bus. Ethics 2021, 171, 379–397. [Google Scholar] [CrossRef]

- Irfan, M.; Ahmad, M. Relating consumers’ information and willingness to buy electric vehicles: Does personality matter? Transp. Res. Part D Transp. Environ. 2021, 100, 103049. [Google Scholar] [CrossRef]

- Friede, G.; Busch, T.; Bassen, A. ESG and financial performance: Aggregate edevidence from more than 2000 empirical studies. J. Sustain. Financ. Invest. 2015, 5, 210–233. [Google Scholar] [CrossRef]

- Rabaya, A.J.; Saleh, N.M. The moderating effect of IR framework adoption on the relationship between environmental, social, and governance (ESG) disclosure and a firm’s competitive advantage. Environ. Dev. Sustain. 2022, 24, 2037–2055. [Google Scholar] [CrossRef]

- Mohammad, W.M.W.; Wasiuzzaman, S. Environmental, social and governance (ESG) disclosure, competitive advantage and performance of firms in Malaysia. Clean. Environ. Syst. 2021, 2, 100015. [Google Scholar] [CrossRef]

- Al Hawaj, A.Y.; Buallay, A.M. A worldwide sectorial analysis of sustainability reporting and its impact on firm performance. J. Sustain. Financ. Invest. 2022, 12, 62–68. [Google Scholar] [CrossRef]

- Popa, D.N.; Bogdan, V.; Sabau Popa, C.D.; Belenesi, M.; Badulescu, A. Performance mapping in two-step cluster analysis through ESEG disclosures and EPS. Kybernetes 2022, 51, 98–118. [Google Scholar] [CrossRef]

- Abdi, Y.; Li, X.; Càmara-Turull, X. Exploring the impact of sustainability (ESG) disclosure on firm value and financial performance (FP) in airline industry: The moderating role of size and age. Environ. Dev. Sustain. 2022, 24, 5052–5079. [Google Scholar] [CrossRef]

- Khalid, F.; Razzaq, A.; Ming, J.; Razi, U. Firm characteristics, governance mechanisms, and ESG disclosure: How caring about sustainable concerns? Environ. Sci. Pollut. Res. 2022, 29, 1–14. [Google Scholar] [CrossRef] [PubMed]

- Wright, P.; Ferris, S.P. Agency conflict and corporate strategy: The effect of divestment on corporate value. Strategy. Manag. J. 1997, 18, 77–83. [Google Scholar] [CrossRef]

- Kim, E.-H.; Lyon, T.P. Greenwash vs brownwash: Exaggeration and undue modesty in corporate sustainability disclosure. Organ Sci. 2015, 26, 705–723. [Google Scholar] [CrossRef]

- Duque-Grisales, E.; Aguilera-Caracuel, J. Environmental, Social and Governance (ESG) Scores and Financial Performance of Multilatinas: Moderating Effects of Geographic International Diversification and Financial Slack. J. Bus. Ethics 2021, 168, 315–334. [Google Scholar] [CrossRef]

- Russo, A.; Perrini, F. Investigating stakeholder theory and social capital: CSR in large firms and SMEs. J. Bus. Ethics 2010, 91, 207–221. [Google Scholar] [CrossRef]

- Chen, L.; Yuan, T.; Cebula, R.J.; Shuangjin, W.; Foley, M. Fulfillment of ESG Responsibilities and Firm Performance: A Zero-Sum Game or Mutually Beneficial. Sustainability 2021, 13, 10954. [Google Scholar] [CrossRef]

- Ren, S.; Wei, W.; Sun, H.; Xu, Q.; Hu, Y.; Chen, X. Can mandatory environmental information disclosure achieve a win-win for a firm’s environmental and economic performance? J. Clean. Prod. 2020, 250, 119530. [Google Scholar] [CrossRef]

- Barbagila, M.; Buttice, V.; Giudici, G.; Mendy, J.; Sarker, T.; Sharma, G.D.; Zutshi, A. Supporting SMEs in Sustainable Strategy Development Post-COVID-19: Challenges and Policy Agenda for the G20. Ph.D. Diss, Institute of Management Studies Ambika Zutshi Department of Management, Faculty of Business and Law, Deakin University. 2021. Available online: https://www.researchgate.net/profile/JohnMendy/publication/354809956_Policy_brief_Task_Force_5_2030_Agenda_and_Development_Cooperation_SUPPORTING_SMES_IN_SUSTAINABLE_STRATEGY_DEVELOPMENT_POST-COVID-19_CHALLENGES_AND_POLICY_AGENDA_FOR_THE_G20/links/614d9c59a3df59440ba94cdb/Policy-brief-Task-Force-5-2030-Agenda-and-Development-Cooperation-SUPPORTING-SMES-IN-SUSTAINABLE-STRATEGY-DEVELOPMENT-POST-COVID-19-CHALLENGES-AND-POLICY-AGENDA-FOR-THE-G20.pdf (accessed on 2 November 2022).

- Gjergji, R.; Vena, L.; Sciascia, S.; Cortesi, A. The effects of environmental, social and governance disclosure on the cost of capital in small and medium enterprises: The role of family business status. Bus. Strategy Environ. 2020, 30, 683–693. [Google Scholar] [CrossRef]

- Hu, M.K.; Kee, D.M.H. Global institutions and ESG integration to accelerate SME development and sustainability. In Handbook of Research on Global Institutional Roles for Inclusive Development; IGI Global: Hershey, PA, USA, 2022; pp. 139–156. [Google Scholar]

- Westman, L.; McKenzie, J.; Burch, S.L. Political participation of businesses: A framework to understand contributions of SMEs to urban sustainability politics. Earth Syst. Gov. 2020, 3, 100044. [Google Scholar] [CrossRef]

- Jo, D.; Kwon, C. Structure of Green Supply Chain Management for Sustainability of Small and Medium Enterprises. Sustainability 2021, 14, 50. [Google Scholar] [CrossRef]

- Zawya. Nearly Two-Thirds of Businesses in the UAE and Saudi Arabia Lack an ESG Framework: ASDA’A BCW Survey. 2022. Available online: https://www.zawya.com/en/press-release/research-and-studies/nearly-two-thirds-of-businesses-in-the-uae-and-saudi-arabia-lack-an-esg-framework-asdaa-bcw-survey-y4gmmu7h (accessed on 9 April 2022).

- Bamahros, H.M.; Alquhaif, A.; Qasem, A.; Wan-Hussin, W.N.; Thomran, M.; Al-Duais, S.D.; Shukeri, S.N.; Khojally, H.M. Corporate governance mechanisms and ESG reporting: Evidence from the Saudi Stock Market. Sustainability 2022, 14, 6202. [Google Scholar] [CrossRef]

- Al-Alqam, M.S.; Rehman, A.U.; Alsultan, M. Study of Saudi Arabian manufacturing and service organization sustainability and future research directions. In IOP Conference Series: Earth and Environmental Science; IOP Publishing: Bristol, UK, 2022; Volume 1026, p. 012004. [Google Scholar]

- Alharbi, R.K. Saudi Arabia’s small and medium enterprises (SMES) sector post-COVID-19 recovery: Stakeholders’ perception on investment sustainability. Int. J. Organ. Anal. 2022. [Google Scholar] [CrossRef]

- Cronan, J. ESG for Small Business—A Risk or an Opportunity Post COVID-19. Xchainge. 2022. Available online: https://xchainge.com.au/esg-for-small-business-a-risk-or-an-opportunity-post-covid-19/ (accessed on 15 November 2022).

- Kramer, M.R.; Porter, M. Creating Shared Value; FSG: Boston, MA, USA, 2011; Volume 17. [Google Scholar]

- Morsing, M.; Perrini, F. CSR in SMEs: Do SMEs matter for the CSR agenda? Bus. Ethics A Eur. Rev. 2009, 18, 1–6. [Google Scholar] [CrossRef]

- Porter, M.; Serafeim, G.; Kramer, M. Where ESG fails. Inst. Invest. 2019, 18, 1–6. [Google Scholar] [CrossRef]

- Ioannou, I.; Serafeim, G. The consequences of mandatory corporate sustainability reporting. Harv. Bus. Sch. Res. Work. Pap. 2017, 11–100. Available online: https://ssrn.com/abstract=1799589 (accessed on 16 April 2022). [CrossRef]

- Eliwa, Y.; Aboud, A.; Saleh, A. ESG practices and the cost of debt: Evidence from EU countries. Crit. Perspect. Account. 2021, 79, 102097. [Google Scholar] [CrossRef]

- Reber, B.; Gold, A.; Gold, S. ESG disclosure and idiosyncratic risk in initial public offerings. J. Bus. Ethics 2022, 179, 867–886. [Google Scholar] [CrossRef]

- Serafeim, G. Social-impact efforts that create real value. Harv. Bus. Rev. 2020, 98, 38–48. [Google Scholar]

- Steinhöfel, E.; Galeitzke, M.; Kohl, H.; Orth, R. Sustainability reporting in German manufacturing SMEs. Procedia Manuf. 2019, 33, 610–617. [Google Scholar] [CrossRef]

- Girin, J. Empirical Analysis of Management Situations: Elements of Theory and Method 1. Eur. Manag. Rev. 2011, 8, 197–212. [Google Scholar] [CrossRef]

- Alshaikh, L.; Hamas, Y.M.; Khan, M. Implementation of CSR programs in saudi SMES. PalArch’s J. Archaeol. Egypt/Egyptol. 2021, 18, 857–865. [Google Scholar]

- Meafinance. How ESG is Rapidly Taking Over the Financial Services Industry Saudi Arabia. 2021. Available online: https://issuu.com/meafinance/docs/mea-finance-apr-2021/s/12033529 (accessed on 22 April 2022).

- Ali, A.J.; Al-Aali, A. Corporate Social Responsibility in Saudi Arabia. Middle East Policy 2012, 19, 40–53. [Google Scholar] [CrossRef]

- Painter-Morland, M.; Dobie, K. Ethics and sustainability within SME’s in Sub-Saharan Africa; enabling, constraining and contaminating relationships. Afr. Bus. Ethics 2009, 14, 7–19. Available online: https://www.researchgate.net/publication/274899061_Corporate_Social_Responsibility_in_SMEs_A_Shift_from_Philanthropy_to_Institutional_Works (accessed on 25 April 2022).

- Turyakira, P.; Venter, E.; Smith, E. The impact of corporate social responsibility factors on the competitiveness of small and medium-sized enterprises. South Afr. J. Econ. Manag. Sci. 2014, 17, 157–172. [Google Scholar] [CrossRef]

- Brammer, S.; Hoejmose, S.; Marchant, K. Environmental management in SMEs in the UK: Practices, Pressures and Perceived Benefits. Bus. Strategy Environ. 2012, 21, 423–434. [Google Scholar] [CrossRef]

- Humphreys, J. Weakness or opportunity. MIT Sloan Manag. Rev. 2007, 48, 96. [Google Scholar]

- Caldera, H.; Desha, C.; Dawes, L. Evaluating the enablers and barriers for successful implementation of sustainable business practice in ‘lean’ S83MEs. J. Clean. Prod. 2019, 218, 575–590. [Google Scholar] [CrossRef]

| Strengths Strong Brand with Clear Visions Good Local Market Knowledge Able To Charge a Price Premium Customer-Centric Strategy Quality And Efficiency Increase Productivity Profit Improvement Good Corporate Culture Clear Value Proposition Close To the Customer Great Value Products High-Quality Stuff New Business | Weaknesses Lack Of Resources Number Of Employees High Costs Risk Management Difficult To Access Capital and Funding Tight Profit Margins Limited Product Range Marketing Cost Weak Bargaining Power with Suppliers |

| Opportunities Broaden Product Range to Target New Segments Increase The Number of Customers Growing Environmental Awareness Broaden Our Geographic Reach Competitive Advantage Market Growth Get Financing Technology Reputation Suitability | Challenges Or Threats Systematic Complexity of Disclosure Standards Consumers Becoming More Price Sensitive Conditions And Corruption Due to Rapid Weakening Supplier Relationships Losing Key/Valuable Customers Declining Economic Conditions Potential Loss of Employees Rising Fixed Costs Price Fluctuates Competitors Legislation Credit Risk |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shalhoob, H.; Hussainey, K. Environmental, Social and Governance (ESG) Disclosure and the Small and Medium Enterprises (SMEs) Sustainability Performance. Sustainability 2023, 15, 200. https://doi.org/10.3390/su15010200

Shalhoob H, Hussainey K. Environmental, Social and Governance (ESG) Disclosure and the Small and Medium Enterprises (SMEs) Sustainability Performance. Sustainability. 2023; 15(1):200. https://doi.org/10.3390/su15010200

Chicago/Turabian StyleShalhoob, Hebah, and Khaled Hussainey. 2023. "Environmental, Social and Governance (ESG) Disclosure and the Small and Medium Enterprises (SMEs) Sustainability Performance" Sustainability 15, no. 1: 200. https://doi.org/10.3390/su15010200

APA StyleShalhoob, H., & Hussainey, K. (2023). Environmental, Social and Governance (ESG) Disclosure and the Small and Medium Enterprises (SMEs) Sustainability Performance. Sustainability, 15(1), 200. https://doi.org/10.3390/su15010200