Banking Industry Sustainable Growth Rate under Risk: Empirical Study of the Banking Industry in ASEAN Countries

Abstract

1. Introduction

2. Literature Review

2.1. Sustainable Growth Rate Model

2.2. SGR and Banking Risk Variability

3. Research Design

3.1. Sample

3.2. Model Specification

4. Results and Discussion

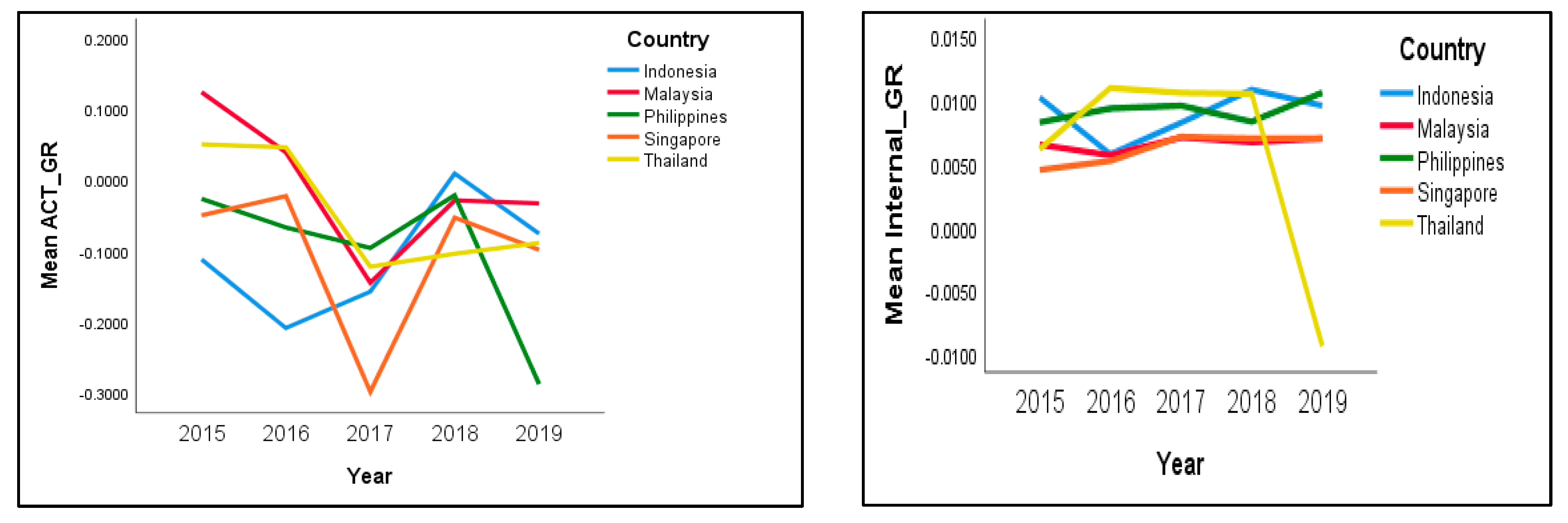

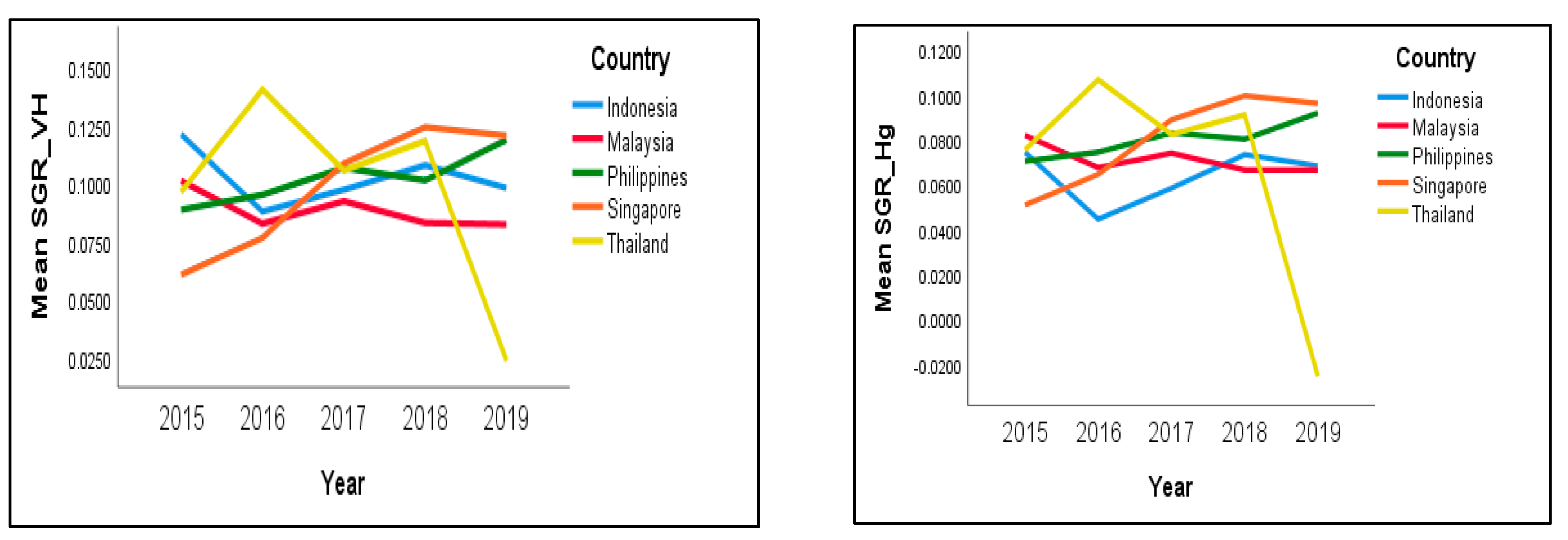

4.1. Descriptive of SGR and AGR in Various ASEAN Countries

4.2. Test Differences between SGR and AGR among ASEAN Countries

4.3. Descriptive of Risk Variability in Various ASEAN Countries

4.4. Effect of Risk on Sustainable Growth Rate (SGR) and Actual Growth (ACT_GR)

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Yamanaka, T. Integration of the ASEAN Banking Sector. Inst. Int. Monet. Aff. 2014, 18, 1–21. [Google Scholar]

- Ha, D.; Gillet, P.; Le, P.; Vo, D.T. Banking integration in ASEAN-6: An empirical investigation. Econ. Model. 2020, 91, 705–719. [Google Scholar] [CrossRef]

- Rillo, A.D. ASEAN Financial Integration: Opportunities, Risks, and Challenges. Public Policy Rev. 2018, 14, 901–924. [Google Scholar]

- Van Anh, D. Does better capitalization enhance bank efficiency and limit risk taking? Evidence from ASEAN commercial banks. Glob. Financ. J. 2022, 53, 100617. [Google Scholar] [CrossRef]

- Muchtar, S.; Manurung, A.H.; Margaretha, F. Determinant of Bank Risk with Bank Scale as Moderating Variable in ASEAN. Int. J. Sci. Soc. 2021, 3, 150–169. [Google Scholar] [CrossRef]

- Khan, A.B.; Fareed, M.; Salameh, A.A.; Hussain, H. Financial Innovation, Sustainable Economic Growth, and Credit Risk: A Case of the ASEAN Banking Sector. Front. Environ. Sci. 2021, 9, 397. [Google Scholar] [CrossRef]

- Guzmán, I. Measuring efficiency and sustainable growth in Spanish football teams. Eur. Sport Manag. Q. 2006, 6, 267–287. [Google Scholar] [CrossRef][Green Version]

- Ross, S.A.; Westerfield, R.W.; Jaffe, J.F. Corporate Finance, 10th ed.; McGraw-Hill: Irwin, NY, USA, 2013. [Google Scholar]

- Chen, Y.C.; Chiu, Y.H.; Huang, C.W.; Tu, C.H. The analysis of bank business performance and market risk-Applying Fuzzy DEA. Econ. Model. 2013, 32, 225–232. [Google Scholar] [CrossRef]

- Patel, P.C.; Guedes, M.J.; Pagano, M.S.; Olson, G.T. Industry Profitability Matters: The value of Sustainable Growth Rate and Distance from Bankruptcy as Enablers of Venture Survival. J. Bus. Res. 2020, 114, 80–92. [Google Scholar] [CrossRef]

- Utami, D.; Muthia, F.S.; Husni Thamrin, K.M. Sustainable Growth: Grow and Broke Empirical Study on Manufacturing Sector Companies Listed on the Indonesia Stock Exchange. KnE Soc. Sci. 2018, 3, 820–834. [Google Scholar] [CrossRef]

- Van Horne, J.C. Financial Management and Policy. In The Journal of Finance, 12th ed.; Riopelle, M., Boarman, P., Eds.; Prentice Hall: Englewood Cliffs, NJ, USA, 2002. [Google Scholar]

- Babcock, G.C. The concept of sustainable growth. Financ. Anal. J. 1970, 26, 108–114. [Google Scholar] [CrossRef]

- Kisor, M., Jr. The Financial Aspects of Growth. Financ. Anal. J. 1964, 20, 46–51. [Google Scholar] [CrossRef]

- Higgins, R.C. Sustainable Growth under Inflation. Financ. Manag. 1981, 10, 36–40. [Google Scholar] [CrossRef]

- Platt, H.D.; Platt, M.B.; Chen, G. Sustainable Growth Rate of Firms in Financial Distress. J. Econ. Financ. 1995, 19, 147–151. [Google Scholar] [CrossRef]

- Van Horne, J.C. Sustainable Growth Modeling. J. Corp. Financ. 1988, 1, 19–25. [Google Scholar]

- Amouzesh, N.; Moeinfar, Z.; Mousavi, Z. Sustainable growth rate and firm performance: Evidence from Iran Stock Exchange. Int. J. Bus. Soc. Sci. 2011, 2, 249–255. [Google Scholar]

- Chen, H.Y.; Gupta, M.C.; Lee, A.C.; Lee, C.F. Sustainable Growth Rate, Optimal Growth Rate, and Optimal Payout Ratio: A Joint Optimization Approach. J. Bank. Financ. 2013, 37, 1205–1222. [Google Scholar] [CrossRef]

- Johnsen, G. Risk Taking at the Corporate Level: The Search for Sustainable Growth. Ph.D. Thesis, Université Paris Sciences et Lettres, Paris, France, 2019. [Google Scholar]

- Harkleroad, D. Sustainable Growth Rate Analysis: Evaluating Worldwide Competitors’ Ability to Grow Profitably. Compet. Intell. Rev. 1993, 4, 36–45. [Google Scholar] [CrossRef]

- Junaidi, S.; Sulastri; Isnurhadi; Adam, M. Liquidity, asset quality, and efficiency to sustainable growth rate for banking at Indonesia Stock Exchange. J. Keuang. Dan Perbank. 2019, 23, 308–319. [Google Scholar] [CrossRef][Green Version]

- Kumar, P.; Kumar, A. Corporate Social Responsibility Disclosure and Financial Performance: Further Evidence from NIFTY 50 Firms. Int. J. Bus. Insights Transform. 2018, 11, 62–69. [Google Scholar]

- Phillips, M.; Anderson, S.; Volker, J. Understanding small private retail firm growth using the sustainable growth model. J. Financ. Account. 2010, 3, 1–11. [Google Scholar]

- Zheng, M.; Escalante, C.L. Banks’ Sustainable Growth Challenge Under Economic Recessionary Pressure. Agric. Financ. Rev. 2020, 80, 437–451. [Google Scholar] [CrossRef]

- Laskar, N.; Gopal Maji, S. Disclosure of Corporate Sustainability Performance and Firm Performance in Asia. Asian Rev. Account. 2018, 26. [Google Scholar] [CrossRef]

- Priyadi, U.; Utami, K.D.S.; Muhammad, R.; Nugraheni, P. Determinants of the credit risk of Indonesian Sharīʿah rural banks. ISRA Int. J. Islam. Financ. 2021, 13, 284–301. [Google Scholar] [CrossRef]

- Ozili, P.K. Bank earnings smoothing, audit quality and procyclicality in Africa: The case of loan loss provisions. Rev. Account. Financ. 2017, 16, 142–161. [Google Scholar] [CrossRef]

- Altaf, K.; Ayub, H.; Shabbir, M.S.; Usman, M. Do operational risk and corporate governance affect the banking industry of Pakistan? Rev. Econ. Political Sci. 2021, 7, 108–123. [Google Scholar] [CrossRef]

- Eckert, C.; Gatzert, N. The impact of spillover effects from operational risk events: A model from a portfolio perspective. J. Risk Financ. 2019, 20, 176–200. [Google Scholar] [CrossRef]

- Ko, C.; Lee, P.; Anandarajan, A. The impact of operational risk incidents and moderating influence of corporate governance on credit risk and firm performance. Int. J. Account. Inf. Manag. 2019, 27, 96–110. [Google Scholar] [CrossRef]

- Abou-El-Sood, H. Corporate governance structure and capital adequacy: Implications to bank risk taking. Int. J. Manag. Financ. 2017, 13, 165–185. [Google Scholar] [CrossRef]

- Ma, Y. Financial Sustainable Growth of SUNING Based on the Network Economy Service Platform. In Application of Intelligent Systems in Multi-Modal Information Analytics; Springer: Cham, Switzerland, 2020; pp. 169–174. [Google Scholar]

- Mamilla, R. A study on the sustainable growth rate for firm survival. Strateg. Chang. 2019, 28, 273–277. [Google Scholar] [CrossRef]

- Pandit, N.; Tejani, R. The sustainable growth rate of the textile and apparel segment of the Indian retail sector. Glob. J. Manag. Bus. Res. 2011, 11. Available online: http://library.ediindia.ac.in:8181/jspui/handle/123456789/6025 (accessed on 4 November 2022).

- Vuković, B. Sustainable Growth Rate Analysis in Eastern European Companies. Sustainability 2022, 14, 10731. [Google Scholar] [CrossRef]

- Nastiti, P.K.Y.; Atahau, A.D.R.; Supramono, S. Working capital management and its influence on profitability and sustainable growth. Bus. Theory Pract. 2019, 20, 61–68. [Google Scholar] [CrossRef]

- Cheng, Y.; Awan, U.; Ahmad, S.; Tan, Z. How do technological innovation and fiscal decentralization affect the environment? A story of the fourth industrial revolution and sustainable growth. Technol. Forecast. Soc. Chang. 2021, 162, 120398. [Google Scholar] [CrossRef]

- Ocak, M.; Fındık, D. The impact of intangible assets and sub-components of intangible assets on sustainable growth and firm value: Evidence from Turkish listed firms. Sustainability 2019, 11, 5359. [Google Scholar] [CrossRef]

- Nazir, A.; Azam, M.; Khalid, M.U. Debt Financing and Firm Performance: Empirical Evidence from the Pakistan Stock Exchange. Asian J. Account. Res. 2021, 6, 324–334. [Google Scholar] [CrossRef]

- Mahmutaj, L.R.; Krasniqi, B. Innovation Types and Sales Growth in Small Firms Evidence from Kosovo. South East Eur. J. Econ. Bus. 2020, 15, 27–43. [Google Scholar] [CrossRef]

- Pratama, I.G.A.P.T.; Rahyuda, H. Effect of Capital Structure and Sales Growth on Firm Value with Profitability as Mediation. Int. Res. J. Manag. IT Soc. Sci. 2020, 7, 145–155. [Google Scholar]

- Singh, J.; Flaherty, K.; Sohi, R.S.; Deeter-Schmelz, D.; Habel, J.; Le Meunier-FitzHugh, K.; Onyemah, V. Sales Profession and Professionals in the Age of Digitization and Artificial Intelligence Technologies: Concepts, Priorities, and Questions. J. Pers. Sell. Sales Manag. 2019, 39, 2–22. [Google Scholar] [CrossRef]

- Al-Slehat, Z.A.F.; Altameemi, A.F. The Relationship Between Non-Interest Revenue and Sustainable Growth Rate: A Case Study of Commercial Banks in Jordan. J. Asian Financ. Econ. Bus. 2021, 8, 99–108. [Google Scholar] [CrossRef]

- Chen, C.R.; Huang, Y.S.; Zhang, T. Non-interest Income, Trading, and Bank Risk, Journal of Financial Services Research. West. Financ. Assoc. 2017, 51, 19–53. [Google Scholar] [CrossRef]

- Jiang, H.; Han, L. Does Income Diversification Benefit the Sustainable Development of Chinese Listed Banks? Analysis Based on Entropy and the Herfindahl-Hirschman Index. Entropy 2018, 20, 255. [Google Scholar] [CrossRef] [PubMed]

- Pham, H. How Does Internal Control Affect Bank Credit Risk in Vietnam? A Bayesian Analysis. J. Asian Financ. Econ. Bus. 2021, 8, 873–880. [Google Scholar] [CrossRef]

- Isnurhadi, I.; Adam, M.; Sulastri, S.; Andriana, I.; Muizzuddin, M. Modal Bank, Efisiensi dan Risiko: Bukti dari Bank Syariah. J. Asian Financ. Econ. Bus. 2021, 8, 841–850. [Google Scholar] [CrossRef]

- Hoque, H.; Liu, H. The capital structure of Islamic banks: How different are they from conventional banks? Glob. Financ. J. 2021, 54, 100634. [Google Scholar] [CrossRef]

- Pak, O. Bank profitability in the Eurasian Economic Union: Do funding liquidity and systemic importance matter? N. Am. J. Econ. Financ. 2020, 54, 101265. [Google Scholar] [CrossRef]

- Marwick, A.; Hasan, M.M.; Luo, T. Organization capital and corporate cash holdings. Int. Rev. Financ. Anal. 2020, 68, 101458. [Google Scholar] [CrossRef]

- Nguyen, T.G. Stock liquidity and dividend policy: Evidence from an imputation tax environment. Int. Rev. Financ. Anal. 2020, 72, 101559. [Google Scholar] [CrossRef]

- Su, Z.; Fung, H.G.; Huang, D.; Shen, C.H. Cash dividends, expropriation, and political connections: Evidence from China. Int. Rev. Econ. Financ. 2014, 29, 260–272. [Google Scholar] [CrossRef]

- Rahim, N. Sustainable Growth Rate and Firm Performance: A Case Study in Malaysia. Int. J. Manag. Innov. Entrep. Res. 2017, 3, 48–60. [Google Scholar] [CrossRef]

- Isnurhadi, S.; Widiyanti, M.; Rossi, D. Sustainable Growth and Corporate Risk as Navigation for Shareholders: Study on Manufacturing Companies Listed on the Indonesia Stock Exchange. TEST Eng. Manag. 2020, 82, 13676–13688. Available online: http://www.testmagzine.biz/index.php/testmagzine/article/view/3022 (accessed on 4 November 2022).

- Arora, L.; Kumar, S.; Verma, P. The Anatomy of Sustainable Growth Rate of Indian Manufacturing Firms. Glob. Bus. Rev. 2018, 19, 1050–1071. [Google Scholar] [CrossRef]

- Huy, D.T.N.; Thach, N.N.; Chuyen, B.M.; Nhung, P.T.H.; Tran, D.T.; Tran, T.A. Enhancing risk management culture for sustainable growth of Asia commercial bank-ACB in Vietnam under mixed effects of macro factors. Entrep. Sustain. Issues 2021, 8, 291. [Google Scholar]

- Nor, F.M.; Shaharuddin, A.; Nawai, N. Risk Management of Full-Fledged Islamic Banks versus Islamic Subsidiaries of Conventional Banks in Malaysia: The Sustainable Growth within Restricted Minimum Requirements. J. Muamalat Islam. Financ. Res. 2017, 14, 1–37. [Google Scholar] [CrossRef]

- Olson, G. A new application of sustainable growth: A multi-dimensional framework for evaluating the long-run performance of bank mergers. J. Bus. Financ. Account. 2005, 32, 1995–2036. [Google Scholar] [CrossRef]

- Altahtamouni, F. Sustainable Growth Rate and ROE Analysis: An Applied Study on Saudi Banks Using the PRAT Model. Economies 2022, 10, 70. [Google Scholar] [CrossRef]

- Vasiliou, D. The sustainable growth model in banking: An application to the national bank of Greece. Manag. Financ. 2002, 28, 20–26. [Google Scholar] [CrossRef]

- Kessy, E.R.; Mbembela, N.; Amembah, M.; Taya, L. Assessment of Assets Quality and Liquidity on Sustainable Growth Rate of Small and Medium Banks in Kilimanjaro, Tanzania. Int. J. Contemp. Appl. Res. 2021, 8, 72–86. [Google Scholar]

- Mai, J. A Brief Analysis of Sustainable Growth of Bank Assets under Capital Restraint. J. East China Norm. Univ. (Philos. Soc. Sci.) 2006, 38, 92–96. [Google Scholar]

- Higgins, R. How Much Growth Can a Firm Afford? Financ. Manag. 1977, 6, 7–16. [Google Scholar] [CrossRef]

- Ashta, A. Sustainable Growth Rates: Refining a Measure. Strat. Chang. 2008, 17, 207–214. [Google Scholar] [CrossRef]

- Johnson, D.J. The Behavior of Financial Structure and Sustainable Growth in an Inflationary Environment. Financ. Manag. 1981, 10, 30–35. [Google Scholar] [CrossRef]

- Radasanu, A.C. Cash-flow Sustainable Growth Rate Models. J. Public Adm. Financ. Law 2015, 7, 62–70. [Google Scholar]

- Agyapong, D. Analyzing financial risks in small and medium enterprises: Evidence from the food processing firms in selected cities in Ghana. Int. J. Entrep. Behav. Res. 2021, 27, 45–77. [Google Scholar] [CrossRef]

- Perera, B.A.K.S.; Samarakkody, A.L.; Nandasena, S.R. Managing financial and economic risks associated with high-rise apartment building construction in Sri Lanka. J. Financ. Manag. Prop. Constr. 2020, 25, 143–162. [Google Scholar] [CrossRef]

- Trussel, J.M.; Patrick, P.A. Assessing and ranking the financial risk of municipal governments: The case of Pennsylvania. J. Appl. Account. Res. 2018, 19, 81–101. [Google Scholar] [CrossRef]

- Bhowmik, P.K.; Sarker, N. Loan growth and bank risk: Empirical evidence from SAARC countries. Heliyon 2021, 7, e07036. [Google Scholar] [CrossRef]

- Wang, C.; Lin, Y. Income diversification and bank risk in Asia Pacific. N. Am. J. Econ. Financ. 2021, 57, 101448. [Google Scholar] [CrossRef]

- Zhang, X.; Li, F.; Ortiz, J. Internal risk governance and external capital regulation affecting bank risk-taking and performance: Evidence from PR China. Int. Rev. Econ. Financ. 2021, 74, 276–292. [Google Scholar] [CrossRef]

- Neifar, S.; Jarboui, A. Corporate governance and operational risk voluntary disclosure: Evidence from Islamic banks. Res. Int. Bus. Financ. 2018, 46, 43–54. [Google Scholar] [CrossRef]

- Izzeldin, M.; Johnes, J.; Ongena, S.; Pappas, V.; Tsionas, M. Efficiency convergence in Islamic and conventional banks. J. Int. Financ. Mark. Inst. Money 2021, 70, 101279. [Google Scholar] [CrossRef]

- Safiullah, M. Financial stability efficiency of Islamic and conventional banks. Pac. Basin Financ. J. 2021, 6, 101587. [Google Scholar] [CrossRef]

- Chaffai, M.; Dietsch, M. Modeling and measuring business risk and the resiliency of retail banks. J. Financ. Stab. 2015, 16, 173–182. [Google Scholar] [CrossRef]

- Marcucci, J.; Quagliariello, M. Asymmetric effects of the business cycle on bank credit risk. J. Bank. Financ. 2009, 33, 1624–1635. [Google Scholar] [CrossRef]

- Ovi, N.; Bose, S.; Gunasekarage, A.; Shams, S. Do the business cycle and revenue diversification matter for banks’ capital buffer and credit risk: Evidence from ASEAN banks. J. Contemp. Account. Econ. 2020, 16, 100186. [Google Scholar] [CrossRef]

- Davydov, D.; Vähämaa, S.; Yasar, S. Bank liquidity creation and systemic risk. J. Bank. Financ. 2021, 123, 106031. [Google Scholar] [CrossRef]

- Paul, G.; Xu, X. Robust portfolio control with stochastic factor dynamics. Oper. Res. 2013, 61, 874–893. [Google Scholar]

- Djebali, N.; Zaghdoudi, K. Threshold effects of liquidity risk and credit risk on bank stability in the MENA region. J. Policy Model. 2020, 42, 1049–1063. [Google Scholar] [CrossRef]

- Mohammad, S.; Asutay, M.; Dixon, R.; Platonova, E. Liquidity risk exposure and its determinants in the banking sector: A comparative analysis between Islamic, conventional and hybrid banks. J. Int. Financ. Mark. Inst. Money 2020, 66, 101196. [Google Scholar] [CrossRef]

- Madugu, A.H.; Ibrahim, M.; Amoah, J.O. Differential effects of credit risk and capital adequacy ratio on the profitability of the domestic banking sector in Ghana. Transnatl. Corp. Rev. 2020, 12, 37–52. [Google Scholar] [CrossRef]

- King, P.; Tarbert, H. Basel III: An overview. Bank. Financ. Serv. Policy Rep. 2011, 30, 1–18. [Google Scholar]

- Stebbins, J. The Law of Diminishing Returns. Science 1944, 99, 267–271. [Google Scholar] [CrossRef] [PubMed]

- Hill, C.W.; Jones, T.M. Stakeholder-agency theory. J. Manag. Stud. 1992, 29, 131–154. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the Firm: Managerial Behavior, Agency Costs, and Ownership Structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Shapiro, S.P. Agency theory. Annu. Rev. Sociol. 2005, 31, 263–284. [Google Scholar] [CrossRef]

- Nastiti, P.K.Y.; Atahau, A.D.R.; Supramono, S. Does Working Capital Management Able Increase Sustainable Growth Through Asset Utilization? Eur. J. Appl. Econ. 2020, 17, 136–146. [Google Scholar] [CrossRef]

- Chang, Y.C. Strategy formulation implications from using a sustainable growth model. J. Air Transp. Manag. 2012, 20, 1–3. [Google Scholar] [CrossRef]

- Chen, C.J.P.; Du, J.; Su, X. A game of accounting numbers in asset pricing: Evidence from the privatization of state-owned enterprises. J. Contemp. Account. Econ. 2014, 10, 115–129. [Google Scholar] [CrossRef]

- Varadarajan, P. The sustainable growth model: A tool for evaluating the financial feasibility of market share strategies. Strateg. Manag. J. 1983, 4, 353–367. [Google Scholar] [CrossRef]

- Fidrmuc, J.; Lind, R. Macroeconomic impact of Basel III: Evidence from a meta-analysis. J. Bank. Financ. 2020, 112, 105359. [Google Scholar] [CrossRef]

- Naceur, S.B.; Marton, K.; Roulet, C. Basel III and bank-lending: Evidence from the United States and Europe. J. Financ. Stab. 2018, 39, 1–27. [Google Scholar] [CrossRef]

- Roulet, C. Basel III: Effects of capital and liquidity regulations on European bank lending. J. Econ. Bus. 2018, 95, 26–46. [Google Scholar] [CrossRef]

- Jorion, P. Financial Risk Manager Handbook; John Wiley & Sons: Hoboken, NJ, USA, 2007; Volume 406. [Google Scholar]

- Jorion, P.; Khoury, S. Financial Risk Management; Financial Risk Management: Cambridge, MA, USA, 1996. [Google Scholar]

- Altman, E.I.; Hotchkiss, E.; Wang, W. Corporate Financial Distress, Restructuring, and Bankruptcy: Analyze Leveraged Finance, Distressed Debt, and Bankruptcy; John Wiley & Sons: Hoboken, NJ, USA, 2019. [Google Scholar]

| No | Variable | Proxy | Definition | Indicator |

|---|---|---|---|---|

| 1. | Higgins’ SGR Model (1991) HG’S_SGR | Higgins’ SGR model consists of four accounting ratios, namely: dividend payments, profit margins, asset turnover, and capital structure | Higgins proposes the SGR model as a revenue/sales target by using internal funding sources as the impact of asset turnover and profit margin on a fixed leverage financial condition | |

| 2. | Ross’s SGR Model ROS’S_SGR | Using a simpler model consisting of the variable retained earnings as the plowback ratio and ROE | A model that explains SGR targets with internal funding sources through dividend policy and value for shareholders through Return to Equity | |

| 3. | This Research’s SGR Model VH’S_SGRB | Consists of Retention ratio, Net Operating Income, Operating Revenue, Ratio of Total Liability to Equity, and Ratio of Total Assets to Operating Revenue. | This model uses the Van Horne SGR model, which is implemented in banking accounts (in this study), namely the target for banking operating income growth that can be achieved with relatively fixed external sources of funds. | |

| 4. | Internal Growth I_GR | Internal growth rate According to Ross, it includes Return On Assets and Retention Ratio variables | Is an indicator of company growth that guarantees the company’s operations and income through the rate of return on assets | |

| 5. | Actual Growth ACT_GR | Growth of banking operating revenue. | Revenue growth is the increase, or decrease, in a company’s operating revenue between two periods. | |

| 6. | REV_RISK | Business Risk | Business risk is the exposure a company or organization has to factor that will lower its profits or operating revenue (OpRev) or lead it to fail. Anything that threatens a company’s ability to achieve its financial goals is considered a business risk. In this case, it is measured by the standard deviation of the volatility of operating revenue within a period of 5 years | X = operating revenue |

| 7. | COSTINCRATIO | Operational Risk Operating Cost To Operating Income Ratio | The cost to operating income ratio is one of the efficiency ratios used to gauge an organization’s efficiency. It is used to compare the operating expenses of a bank vis-à-vis its income. The lower the cost to income ratio the better the company’s performance. It depicts the efficiency at which the bank is being run. | |

| 8. | COASSRATIO | Cost To Asset Ratio | Cost to Assets Ratio (%) is an efficiency ratio that measures the operating expenses, i.e., non-interest expenses, of a bank about its size or the asset base | |

| 9. | LDR | Liquidity Risk is the risk that occurs if the company is unable to fulfill its obligations immediately in the short term which can be proxied by Loan To Deposit Ratio (LDR) and Non- Performing Loan (NPL) | The loan-to-deposit ratio is used to assess a bank’s liquidity by comparing a bank’s total loans to its total deposits for the same period. To calculate the loan to-deposit-ratio, divide a bank’s total amount of loans by the total amount of deposits for the same period. | |

| 10. | NPL | Liquidity Risk | A non-performing loan (NPL) is a loan in which the borrower defaults and does not make scheduled principal or interest payments for some time | The total NPL is divided by the total number of loans in the bank’s portfolio. The ratio can also be expressed as a percentage of the bank’s non-performing loans. |

| 11. | Eq to RWA | Financial Risk | The equity-to-risk weighted assets ratio (WRA) will help determine whether or not a bank has enough equity to take on any losses before becoming insolvent and losing depositor funds. It’s important for a bank to monitor this ratio and adhere to regulatory requirements to avoid going insolvent and to protect its clients and the larger economy as a whole. | |

| 12. | RWAI | Financial Risk | Risk weighted asset intensity (RWA / Total Assets). Weighted assets, or RWA, are used to link the minimum amount of capital that banks must have, with the risk profile of the bank’s lending activities (and other assets). The more risk a bank is taking, the more capital is needed to protect depositors | |

| 13. | GASSETS | Growth assets | Growth assets are assets that generate a return both from capital growth and from the distribution of profits through retention ratio and external funding |

| Country | N | Minimum | Maximum | Mean | Std. Deviation | |

|---|---|---|---|---|---|---|

| Indonesia | HG’S_SGR | 180 | −0.6390 | 0.2810 | 0.063933 | 0.1258829 |

| ROS’S_SGR | 180 | −0.7230 | 0.3310 | 0.075556 | 0.1455922 | |

| VH’S_SGRB | 180 | −0.4200 | 0.4950 | 0.102494 | 0.1386616 | |

| I_GR | 180 | −0.1050 | 0.0455 | 0.008889 | 0.0166827 | |

| ACT_GR | 180 | −2.6377 | 0.7152 | −0.108549 | 0.2942697 | |

| Malaysia | HG’S_SGR | 60 | 0.0000 | 0.1440 | 0.071383 | 0.0308007 |

| ROS’S_SGR | 60 | 0.0000 | 0.1560 | 0.080000 | 0.0324695 | |

| VH’S_SGRB | 60 | 0.0000 | 0.1850 | 0.088300 | 0.0380937 | |

| I_GR | 60 | 0.0000 | 0.0118 | 0.006562 | 0.0023930 | |

| ACT_GR | 60 | −0.3126 | 0.2882 | −0.008435 | 0.1171124 | |

| Philippines | HG’S_SGR | 45 | 0.0320 | 0.1520 | 0.080111 | 0.0290002 |

| ROS’S_SGR | 45 | 0.0380 | 0.1730 | 0.091511 | 0.0320650 | |

| VH’S_SGRB | 45 | 0.0400 | 0.2100 | 0.102178 | 0.0399080 | |

| I_GR | 45 | 0.0027 | 0.0164 | 0.009191 | 0.0031024 | |

| ACT_GR | 45 | −0.4826 | 0.0949 | −0.099329 | 0.1394821 | |

| Singapore | HG’S_SGR | 15 | 0.0150 | 0.1650 | 0.080133 | 0.0404031 |

| ROS’S_SGR | 15 | 0.0170 | 0.1760 | 0.087467 | 0.0422947 | |

| VH’S_SGRB | 15 | 0.0170 | 0.2130 | 0.098200 | 0.0535300 | |

| I_GR | 15 | 0.0011 | 0.0091 | 0.006147 | 0.0019504 | |

| ACT_GR | 15 | −0.4608 | 0.0504 | −0.104107 | 0.1331989 | |

| Thailand | HG’S_SGR | 28 | −0.5210 | 0.1570 | 0.069107 | 0.1224979 |

| ROS’S_SGR | 28 | −0.6450 | 0.1770 | 0.076393 | 0.1484489 | |

| VH’S_SGRB | 28 | −0.3920 | 0.2150 | 0.099536 | 0.1106414 | |

| I_GR | 28 | −0.0906 | 0.0166 | 0.006271 | 0.0195608 | |

| ACT_GR | 28 | −0.3023 | 0.5287 | −0.045150 | 0.1544876 | |

| Country | Paired Differences | T | Sig. (2-tailed) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Mean | Std. Deviation | Std. Error Mean | 95% Confidence Interval of the Difference | ||||||

| Lower | Upper | ||||||||

| Indonesia | Pair 1 | I_GR-ACT_GR | 0.11743 | 0.29530 | 0.02201 | 0.07400 | 0.16087 | 5.335 | 0.000 |

| Pair 2 | VH’S_SGRB-ACT_GR | 0.21104 | 0.32895 | 0.02451 | 0.16266 | 0.25942 | 8.607 | 0.000 | |

| Pair 3 | I_GR-VH’S_SGRB | −0.09360 | 0.12374 | 0.00922 | −0.11180 | −0.07540 | −10.148 | 0.000 | |

| Malaysia | Pair 1 | I_GR-ACT_GR | 0.01499 | 0.11699 | 0.01510 | −0.01522 | 0.04522 | 0.993 | 0.325 |

| Pair 2 | VH’S_SGRB-ACT_GR | 0.09673 | 0.12435 | 0.01605 | 0.06461 | 0.12885 | 6.026 | 0.000 | |

| Pair 3 | I_GR-VH’S_SGRB | −0.08173 | 0.03685 | 0.00475 | −0.09125 | −0.07221 | −17.179 | 0.000 | |

| Philippines | Pair 1 | I_GR-ACT_GR | 0.10852 | 0.14059 | 0.02095 | 0.06628 | 0.15075 | 5.178 | 0.000 |

| Pair 2 | VH’S_SGRB-ACT_GR | 0.20150 | 0.15743 | 0.02346 | 0.15420 | 0.24880 | 8.586 | 0.000 | |

| Pair 3 | I_GR-VH’S_SGRB | −0.09298 | 0.03736 | 0.00557 | −0.10421 | −0.08176 | −16.693 | 0.000 | |

| Singapore | Pair 1 | I_GR-ACT_GR | 0.11025 | 0.13365 | 0.03450 | 0.03623 | 0.18426 | 3.195 | 0.006 |

| Pair 2 | VH’S_SGRB-ACT_GR | 0.20230 | 0.15614 | 0.04031 | 0.11583 | 0.28877 | 5.018 | 0.000 | |

| Pair 3 | I_GR-VH’S_SGRB | −0.09205 | 0.05181 | 0.01337 | −0.12074 | −0.06335 | −6.881 | 0.000 | |

| Thailand | Pair 1 | I_GR-ACT_GR | 0.05142 | 0.16013 | 0.03026 | −0.01067 | 0.11351 | 1.699 | 0.101 |

| Pair 2 | VH’S_SGRB-ACT_GR | 0.14468 | 0.21187 | 0.04004 | 0.06252 | 0.22684 | 3.613 | 0.001 | |

| Pair 3 | I_GR-VH’S_SGRB | −0.09326 | 0.09232 | 0.01744 | −0.12906 | −0.05746 | −5.345 | 0.000 | |

| Country | N | Minimum | Maximum | Mean | Std. Deviation | |

|---|---|---|---|---|---|---|

| Indonesia | REV_RISK | 180 | 0.0367 | 1.7096 | 0.159716 | 0.1566431 |

| COSTINCRATIO | 180 | 32.2400 | 442.4600 | 64.090833 | 36.7747682 | |

| COASSRATIO | 180 | 1.2400 | 6.4800 | 3.360833 | 1.0730445 | |

| LDR | 180 | 0.2119 | 0.6481 | 0.439227 | 0.0666696 | |

| NPL | 180 | 0.0500 | 23.9100 | 4.379056 | 3.8455255 | |

| EQRWA | 180 | 10.3300 | 49.0700 | 21.864722 | 6.7151925 | |

| RWAI | 180 | 41.8200 | 90.0400 | 71.163611 | 11.3619166 | |

| CAR | 180 | 12.5800 | 45.8500 | 21.438444 | 5.6695979 | |

| GASSETS | 180 | −29.2600 | 280.7400 | 12.703611 | 27.6811875 | |

| Malaysia | REV_RISK | 60 | 0.0297 | 0.4350 | 0.117872 | 0.0822158 |

| COSTINCRATIO | 60 | 30.5400 | 63.9900 | 46.436833 | 7.0330444 | |

| COASSRATIO | 60 | 0.7400 | 2.6800 | 1.394167 | 0.4323264 | |

| LDR | 60 | 0.3432 | 1.7138 | 0.484962 | 0.2460794 | |

| NPL | 60 | 0.4800 | 11.3100 | 2.251667 | 1.9705365 | |

| EQRWA | 60 | 12.4600 | 86.4200 | 19.897667 | 12.8547205 | |

| RWAI | 60 | 45.5900 | 79.7300 | 61.133833 | 8.5147746 | |

| CAR | 60 | 14.7200 | 86.7300 | 21.014167 | 12.5477603 | |

| GASSETS | 60 | −34.4100 | 16.3200 | 1.938667 | 8.9689163 | |

| Philippines | REV_RISK | 45 | 0.0275 | 0.2136 | 0.112082 | 0.0455703 |

| COSTINCRATIO | 45 | 45.5400 | 77.0300 | 62.385333 | 7.9186422 | |

| COASSRATIO | 45 | 1.7000 | 5.0000 | 2.970444 | 0.9004240 | |

| LDR | 45 | 0.2548 | 0.5388 | 0.371433 | 0.0694828 | |

| NPL | 45 | 0.4100 | 6.0500 | 2.780889 | 1.5011962 | |

| EQRWA | 45 | 12.8900 | 24.4900 | 16.840222 | 2.8241004 | |

| RWAI | 45 | 65.6500 | 91.7600 | 77.049556 | 6.9288832 | |

| CAR | 45 | 12.2100 | 24.3100 | 15.895333 | 2.5656220 | |

| GASSETS | 45 | −0.9700 | 34.8400 | 13.506444 | 8.4006180 | |

| Singapore | REV_RISK | 15 | 0.0304 | 0.2366 | 0.131647 | 0.0639605 |

| COSTINCRATIO | 15 | 42.9200 | 71.6600 | 51.659333 | 10.9255680 | |

| COASSRATIO | 15 | 0.9200 | 1.9300 | 1.278000 | 0.3699073 | |

| LDR | 15 | 0.3388 | 0.4279 | 0.399733 | 0.0221359 | |

| NPL | 15 | 0.0200 | 1.7800 | 0.974333 | 0.6872067 | |

| EQRWA | 15 | 15.0000 | 26.9700 | 19.598000 | 3.1763483 | |

| RWAI | 15 | 26.5300 | 63.5000 | 45.630000 | 12.3257495 | |

| CAR | 15 | 15.6000 | 22.5000 | 17.320000 | 1.6410798 | |

| GASSETS | 15 | −2.7500 | 54.3300 | 9.439333 | 13.2043340 | |

| Thailand | REV_RISK | 28 | 0.0426 | 0.8552 | 0.177132 | 0.2177855 |

| COSTINCRATIO | 28 | 35.6000 | 66.1600 | 49.193929 | 8.7420581 | |

| COASSRATIO | 28 | 1.4300 | 2.5400 | 2.032857 | 0.2433540 | |

| LDR | 28 | 0.1534 | 0.4812 | 0.410889 | 0.0885771 | |

| NPL | 28 | 2.1800 | 16.9200 | 4.478214 | 2.7813081 | |

| EQRWA | 28 | 12.1900 | 47.2900 | 20.048929 | 8.0630820 | |

| RWAI | 28 | 54.2700 | 75.3200 | 66.805714 | 5.8319017 | |

| CAR | 28 | 14.8500 | 43.6900 | 20.778214 | 6.6480084 | |

| GASSETS | 28 | −18.5500 | 14.4600 | 1.759286 | 7.2854105 | |

| Cross-Section Fixed (Dummy Variables) | Variable | |

|---|---|---|

| VH’S_SGRB | ACT_GR | |

| Weighted Statistics | ||

| R-squared | 0.646174 | 0.625470 |

| Adjusted R-squared | 0.542856 | 0.516107 |

| S.E. of regression | 0.072336 | 0.165748 |

| F-statistic | 6.254264 | 5.719214 |

| Prob(F-statistic) | 0.000000 | 0.000000 |

| Mean dependent var | 0.102265 | −0.085289 |

| S.D. dependent var | 0.106987 | 0.238272 |

| Sum squared resid | 1.308135 | 6.868103 |

| Durbin-Watson stat | 2.077502 | 2.333971 |

| Variable | Dependent Variable | ||||||

|---|---|---|---|---|---|---|---|

| VH’S_SGRB | ACT_GR | ||||||

| Proxy | Coefficient | Std. Error | Prob. | Coefficient | Std. Error | Prob. | |

| C | 0.358978 | 0.052247 | 0.0000 | −0.060437 | 0.119716 | 0.6141 | |

| COSTINCRATIO | Operational Risk | −0.001565 | 0.000277 | 0.0000 | 0.002464 | 0.000634 | 0.0001 |

| COASSRATIO | Operational Risk | 0.020388 | 0.006805 | 0.0030 | −0.036263 | 0.015593 | 0.0208 |

| REV_RISK | Business Risk | 0.208373 | 0.055755 | 0.0002 | −0.336504 | 0.127753 | 0.0090 |

| LDR | Liquidity Risk | 0.094102 | 0.046384 | 0.0435 | 0.058926 | 0.106283 | 0.5798 |

| NPL | Liquidity Risk | −0.009763 | 0.001868 | 0.0000 | 0.001188 | 0.004280 | 0.7817 |

| CAR | Financial Risk | 0.000541 | 0.002557 | 0.8327 | 0.001650 | 0.005860 | 0.7785 |

| EQRWA | Financial Risk | −0.002385 | 0.002376 | 0.3163 | −0.001856 | 0.005444 | 0.7334 |

| RWAI | Financial Risk | −0.003189 | 0.000584 | 0.0000 | 0.000291 | 0.001339 | 0.8280 |

| GASSETS | Growth Assets | −0.000032 | 0.000234 | 0.8909 | −0.006747 | 0.000537 | 0.0000 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Isnurhadi; Sulastri; Saftiana, Y.; Jie, F. Banking Industry Sustainable Growth Rate under Risk: Empirical Study of the Banking Industry in ASEAN Countries. Sustainability 2023, 15, 564. https://doi.org/10.3390/su15010564

Isnurhadi, Sulastri, Saftiana Y, Jie F. Banking Industry Sustainable Growth Rate under Risk: Empirical Study of the Banking Industry in ASEAN Countries. Sustainability. 2023; 15(1):564. https://doi.org/10.3390/su15010564

Chicago/Turabian StyleIsnurhadi, Sulastri, Yulia Saftiana, and Ferry Jie. 2023. "Banking Industry Sustainable Growth Rate under Risk: Empirical Study of the Banking Industry in ASEAN Countries" Sustainability 15, no. 1: 564. https://doi.org/10.3390/su15010564

APA StyleIsnurhadi, Sulastri, Saftiana, Y., & Jie, F. (2023). Banking Industry Sustainable Growth Rate under Risk: Empirical Study of the Banking Industry in ASEAN Countries. Sustainability, 15(1), 564. https://doi.org/10.3390/su15010564