Exploring the Influence of Environmental Investment on Multinational Enterprises’ Performance from the Sustainability and Marketability Efficiency Perspectives

Abstract

1. Introduction

2. Literature Review

2.1. Environmental Management and ESG

2.2. Firm Performance—Sustainability Efficiency and Marketability Efficiency

2.3. Environmental Investment and Firm Performance

3. Research Method

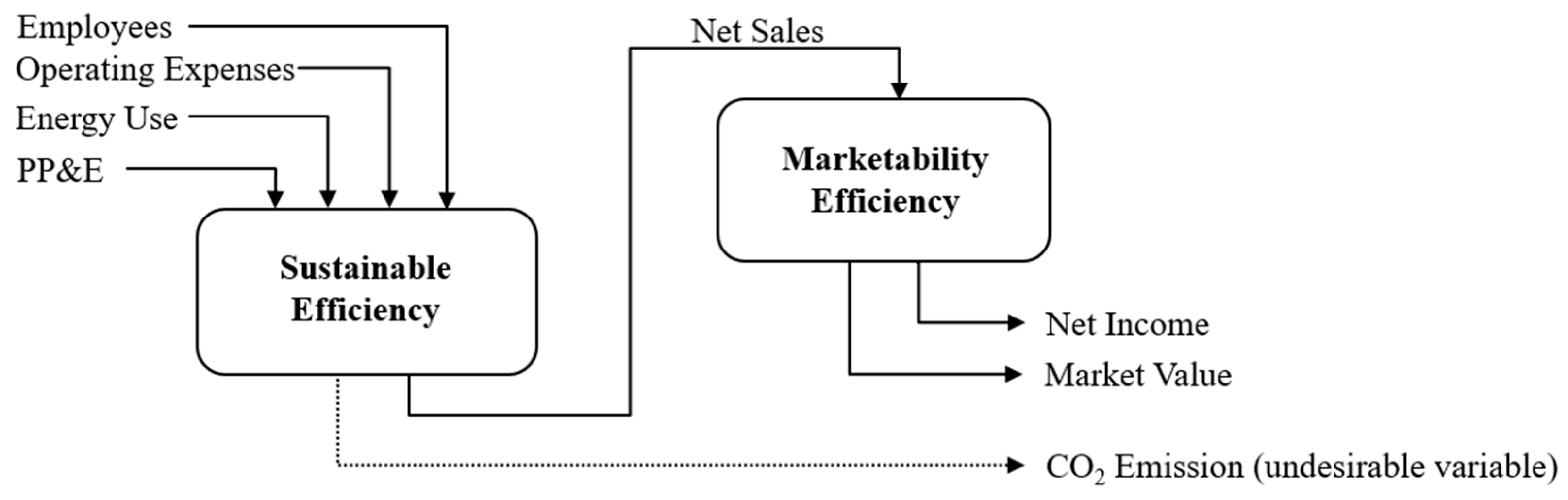

3.1. Two-Stage Production Process of Multinational Enterprises

3.2. Measuring Efficiency Using a Two-Stage Network DEA Model

3.3. Measurement of Firm Performance

3.4. Truncated Regression

4. Empirical Results

4.1. Data Collection and Descriptive Statistics

4.2. Analysis of Environmental Pillar Score

4.3. Analysis of Sustainability Efficiency and Marketability Efficiency

4.4. Influence of Environmental Investment on Firm Performance—Truncated Regression

5. Conclusions

5.1. Implications

5.2. Limitation and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Maliszewska, M.; Mattoo, A.; Van Der Mensbrugghe, D. The Potential Impact of COVID-19 on GDP and Trade: A Preliminary Assessment; World Bank Policy Research Working Paper; World Bank: Washington, DC, USA, 2020. [Google Scholar]

- Fernández-Gago, R.; Cabeza-García, L.; Nieto, M. Independent directors’ background and CSR disclosure. Corp. Soc. Responsib. Environ. Manag. 2018, 25, 991–1001. [Google Scholar] [CrossRef]

- Lee, K.-H.; Saen, R.F. Measuring corporate sustainability management: A data envelopment analysis approach. Int. J. Prod. Econ. 2012, 140, 219–226. [Google Scholar] [CrossRef]

- Fisher, D.R.; Freudenburg, W.R. Postindustrialization and environmental quality: An empirical analysis of the environmental state. Soc. Forces 2004, 83, 157–188. [Google Scholar] [CrossRef]

- Shrivastava, P. The role of corporations in achieving ecological sustainability. Acad. Manag. Rev. 1995, 20, 936–960. [Google Scholar] [CrossRef]

- Tracey, S.; Anne, B. OECD Insights Sustainable Development Linking Economy, Society, Environment: Linking Economy, Society, Environment; OECD Publishing: Paris, France, 2008. [Google Scholar]

- Li, T.-T.; Wang, K.; Sueyoshi, T.; Wang, D.D. ESG: Research progress and future prospects. Sustainability 2021, 13, 11663. [Google Scholar] [CrossRef]

- Alshehhi, A.; Nobanee, H.; Khare, N. The impact of sustainability practices on corporate financial performance: Literature trends and future research potential. Sustainability 2018, 10, 494. [Google Scholar] [CrossRef]

- Hariem Brundtland, G. World Commission on environment and development. Environ. Policy Law 1985, 14, 26–30. [Google Scholar] [CrossRef]

- Sharma, S.; Henriques, I. Stakeholder influences on sustainability practices in the Canadian forest products industry. Strateg. Manag. J. 2005, 26, 159–180. [Google Scholar] [CrossRef]

- Dyllick, T.; Hockerts, K. Beyond the business case for corporate sustainability. Bus. Strategy Environ. 2002, 11, 130–141. [Google Scholar] [CrossRef]

- Perrini, F.; Tencati, A. Sustainability and stakeholder management: The need for new corporate performance evaluation and reporting systems. Bus. Strategy Environ. 2006, 15, 296–308. [Google Scholar] [CrossRef]

- Gadenne, D.L.; Kennedy, J.; McKeiver, C. An Empirical Study of Environmental Awareness and Practices in SMEs. J. Bus. Ethics 2009, 84, 45–63. [Google Scholar] [CrossRef]

- Andersson, L.; Shivarajan, S.; Blau, G. Enacting Ecological Sustainability in the MNC: A Test of an Adapted Value-Belief-Norm Framework. J. Bus. Ethics 2005, 59, 295–305. [Google Scholar] [CrossRef]

- Cruz, J.M. Dynamics of supply chain networks with corporate social responsibility through integrated environmental decision-making. Eur. J. Oper. Res. 2008, 184, 1005–1031. [Google Scholar] [CrossRef]

- Gillan, S.L.; Koch, A.; Starks, L.T. Firms and social responsibility: A review of ESG and CSR research in corporate finance. J. Corp. Financ. 2021, 66, 101889. [Google Scholar] [CrossRef]

- EBA. Annual Report 2021; European Banking Authority, Publications Office of the European Union: Luxembourg, 2022; Available online: https://www.eba.europa.eu/sites/default/documents/files/document_library/About%20Us/Annual%20Reports/2021/1035237/EBA%202021%20Annual%20Report.pdf (accessed on 16 October 2022).

- Meng, Y.; Yang, Y.; Chung, H.; Lee, P.-H.; Shao, C. Enhancing Sustainability and Energy Efficiency in Smart Factories: A Review. Sustainability 2018, 10, 4779. [Google Scholar] [CrossRef]

- President, USDoSatUSEOot. The Long-Term Strategy of the United States: Pathways to Net-Zero Greenhouse Gas Emissions by 2050. Available online: https://www.whitehouse.gov/ (accessed on 23 March 2023).

- Farrell, M.J. The Measurement of Productive Efficiency. J. R. Stat. Soc. Ser. A 1957, 120, 253–290. [Google Scholar] [CrossRef]

- Cook, W.D.; Zhu, J. Classifying inputs and outputs in data envelopment analysis. Eur. J. Oper. Res. 2007, 180, 692–699. [Google Scholar] [CrossRef]

- Golany, B.; Roll, Y. An application procedure for DEA. Omega 1989, 17, 237–250. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Wang, D. Sustainability development for supply chain management in US petroleum industry by DEA environmental assessment. Energy Econ. 2014, 46, 360–374. [Google Scholar] [CrossRef]

- Seiford, L.M.; Zhu, J. Profitability and marketability of the top 55 US commercial banks. Manag. Sci. 1999, 45, 1270–1288. [Google Scholar] [CrossRef]

- O’Donnell, C.J.; Rao, D.S.; Battese, G.E. Metafrontier frameworks for the study of firm-level efficiencies and technology ratios. Empir. Econ. 2008, 34, 231–255. [Google Scholar] [CrossRef]

- Seiford, L.M.; Zhu, J. Modeling undesirable factors in efficiency evaluation. Eur. J. Oper. Res. 2002, 142, 16–20. [Google Scholar] [CrossRef]

- Artiach, T.; Lee, D.; Nelson, D.; Walker, J. The determinants of corporate sustainability performance. Account. Financ. 2010, 50, 31–51. [Google Scholar] [CrossRef]

- Trumpp, C.; Endrikat, J.; Zopf, C.; Guenther, E. Definition, conceptualization, and measurement of corporate environmental performance: A critical examination of a multidimensional construct. J. Bus. Ethics 2015, 126, 185–204. [Google Scholar] [CrossRef]

- Schaltegger, S.; Lüdeke-Freund, F.; Hansen, E.G. Business cases for sustainability: The role of business model innovation for corporate sustainability. Int. J. Innov. Sustain. Dev. 2012, 6, 95–119. [Google Scholar] [CrossRef]

- Russo, M.V.; Fouts, P.A. A Resource-Based Perspective On Corporate Environmental Performance And Profitability. Acad. Manag. J. 1997, 40, 534–559. [Google Scholar] [CrossRef]

- Suh, Y.; Seol, H.; Bae, H.; Park, Y. Eco-efficiency Based on Social Performance and its Relationship with Financial Performance. J. Ind. Ecol. 2014, 18, 909–919. [Google Scholar] [CrossRef]

- Zhou, P.; Ang, B.W.; Poh, K.L. Measuring environmental performance under different environmental DEA technologies. Energy Econ. 2008, 30, 1–14. [Google Scholar] [CrossRef]

- Le, M.-H.; Lu, W.-M. An integrated multiple objective decision making approach for exploring the competitiveness of pharmaceutical multinational enterprises. Ann. Oper. Res. 2022, 1–26. [Google Scholar] [CrossRef]

- Le, M.-H.; Lu, W.-M.; Kweh, Q.L. The moderating effects of power distance on corporate social responsibility and multinational enterprises performance. Rev. Manag. Sci. 2022, 1–31. [Google Scholar] [CrossRef]

- Pham, T.N.; Tran, P.P.; Le, M.-H.; Vo, H.N.; Pham, C.D.; Nguyen, H.-D. The Effects of ESG Combined Score on Business Performance of Enterprises in the Transportation Industry. Sustainability 2022, 14, 8354. [Google Scholar] [CrossRef]

- Eccles, R.G.; Ioannou, I.; Serafeim, G. The Impact of Corporate Sustainability on Organizational Processes and Performance. Manag. Sci. 2014, 60, 2835–2857. [Google Scholar] [CrossRef]

- Alsayegh, M.F.; Abdul Rahman, R.; Homayoun, S. Corporate Economic, Environmental, and Social Sustainability Performance Transformation through ESG Disclosure. Sustainability 2020, 12, 3910. [Google Scholar] [CrossRef]

- Bostian, M.; Färe, R.; Grosskopf, S.; Lundgren, T. Environmental investment and firm performance: A network approach. Energy Econ. 2016, 57, 243–255. [Google Scholar] [CrossRef]

- Chen, Y.; Ma, Y. Does green investment improve energy firm performance? Energy Policy 2021, 153, 112252. [Google Scholar] [CrossRef]

- Shabbir, M.S.; Wisdom, O. The relationship between corporate social responsibility, environmental investments and financial performance: Evidence from manufacturing companies. Environ. Sci. Pollut. Res. 2020, 27, 39946–39957. [Google Scholar] [CrossRef]

- Harjoto, M.; Laksmana, I. The Impact of Corporate Social Responsibility on Risk Taking and Firm Value. J. Bus. Ethics 2018, 151, 353–373. [Google Scholar] [CrossRef]

- Ersoy, E.; Swiecka, B.; Grima, S.; Özen, E.; Romanova, I. The Impact of ESG Scores on Bank Market Value? Evidence from the U.S. Banking Industry. Sustainability 2022, 14, 9527. [Google Scholar] [CrossRef]

- Albertini, E. Does Environmental Management Improve Financial Performance? A Meta-Analytical Review. Organ. Environ. 2013, 26, 431–457. [Google Scholar] [CrossRef]

- Gholami, A.; Sands, J.; Rahman, H.U. Environmental, Social and Governance Disclosure and Value Generation: Is the Financial Industry Different? Sustainability 2022, 14, 2647. [Google Scholar] [CrossRef]

- Lima Crisóstomo, V.; de Souza Freire, F.; Cortes de Vasconcellos, F. Corporate social responsibility, firm value and financial performance in Brazil. Soc. Responsib. J. 2011, 7, 295–309. [Google Scholar] [CrossRef]

- Jacobs, B.W.; Singhal, V.R.; Subramanian, R. An empirical investigation of environmental performance and the market value of the firm. J. Oper. Manag. 2010, 28, 430–441. [Google Scholar] [CrossRef]

- Reinecke, J.; Manning, S.; von Hagen, O. The Emergence of a Standards Market: Multiplicity of Sustainability Standards in the Global Coffee Industry. Organ. Stud. 2012, 33, 791–814. [Google Scholar] [CrossRef]

- Valente, M. Theorizing Firm Adoption of Sustaincentrism. Organ. Stud. 2012, 33, 563–591. [Google Scholar] [CrossRef]

- Montiel, I.; Delgado-Ceballos, J. Defining and Measuring Corporate Sustainability: Are We There Yet? Organ. Environ. 2014, 27, 113–139. [Google Scholar] [CrossRef]

- Hussain, N.; Rigoni, U.; Cavezzali, E. Does it pay to be sustainable? Looking inside the black box of the relationship between sustainability performance and financial performance. Corp. Soc. Responsib. Environ. Manag. 2018, 25, 1198–1211. [Google Scholar] [CrossRef]

- Kao, F.C.; Le, M.-H. Effects of corporate social responsibility on pharmaceutical multinational enterprises performance: Research and development and business efficiency perspectives. Manag. Decis. Econ. 2022, 43, 3419–3434. [Google Scholar] [CrossRef]

- Kuo, K.-C.; Lu, W.-M.; Kweh, Q.L.; Le, M.-H. Determinants of cargo and eco-efficiencies of global container shipping companies. Int. J. Logist. Manag. 2020, 31, 753–775. [Google Scholar] [CrossRef]

- Faere, R.; Grosskopf, S.; Lovell, C.A.K.; Pasurka, C. Multilateral Productivity Comparisons When Some Outputs are Undesirable: A Nonparametric Approach. Rev. Econ. Stat. 1989, 71, 90–98. [Google Scholar] [CrossRef]

- Wang, D.; Li, S.; Sueyoshi, T. DEA environmental assessment on US Industrial sectors: Investment for improvement in operational and environmental performance to attain corporate sustainability. Energy Econ. 2014, 45, 254–267. [Google Scholar] [CrossRef]

- Wang, M.; Feng, C. Regional total-factor productivity and environmental governance efficiency of China’s industrial sectors: A two-stage network-based super DEA approach. J. Clean. Prod. 2020, 273, 123110. [Google Scholar] [CrossRef]

- Belu, C. Ranking corporations based on sustainable and socially responsible practices. Sustain. Dev. 2009, 17, 257–268. [Google Scholar] [CrossRef]

- Chen, X.; Liu, Z.; Zhu, Q. Performance evaluation of China’s high-tech innovation process: Analysis based on the innovation value chain. Technovation 2018, 74, 42–53. [Google Scholar] [CrossRef]

- Yang, A.S.; Okada, H. Corporate innovations as institutional anomie: Patent activities and financial performance of the international aerospace industry. Financ. Res. Lett. 2019, 28, 328–336. [Google Scholar] [CrossRef]

- Wang, W.-K.; Lu, W.-M.; Kweh, Q.L.; Liu, Y.-L. Decentralized and concentrated investments in China and the performance of Taiwanese listed electronic companies. Appl. Econ. 2017, 49, 2443–2455. [Google Scholar] [CrossRef]

- Lim, S.; Oh, K.W.; Zhu, J. Use of DEA cross-efficiency evaluation in portfolio selection: An application to Korean stock market. Eur. J. Oper. Res. 2014, 236, 361–368. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Banker, R.D.; Charnes, A.; Cooper, W.W. Some Models for Estimating Technical and Scale Inefficiencies in Data Envelopment Analysis. Manag. Sci. 1984, 30, 1078–1092. [Google Scholar] [CrossRef]

- Kao, C.; Hwang, S.-N. Efficiency decomposition in two-stage data envelopment analysis: An application to non-life insurance companies in Taiwan. Eur. J. Oper. Res. 2008, 185, 418–429. [Google Scholar] [CrossRef]

- Premachandra, I.; Zhu, J.; Watson, J.; Galagedera, D.U. Best-performing US mutual fund families from 1993 to 2008: Evidence from a novel two-stage DEA model for efficiency decomposition. J. Bank. Financ. 2012, 36, 3302–3317. [Google Scholar] [CrossRef]

- Galagedera, D.U.; Watson, J.; Premachandra, I.; Chen, Y. Modeling leakage in two-stage DEA models: An application to US mutual fund families. Omega 2016, 61, 62–77. [Google Scholar] [CrossRef]

- Färe, R.; Grosskopf, S. Network dea. Socio-Econ. Plan. Sci. 2000, 34, 35–49. [Google Scholar] [CrossRef]

- Liu, J.S.; Lu, W.M. Network-based method for ranking of efficient units in two-stage DEA models. J. Oper. Res. Soc. 2012, 63, 1153–1164. [Google Scholar] [CrossRef]

- Kao, C. Efficiency decomposition in network data envelopment analysis: A relational model. Eur. J. Oper. Res. 2009, 192, 949–962. [Google Scholar] [CrossRef]

- Tone, K.; Tsutsui, M. Network DEA: A slacks-based measure approach. Eur. J. Oper. Res. 2009, 197, 243–252. [Google Scholar] [CrossRef]

- Chen, Y.; Cook, W.D.; Li, N.; Zhu, J. Additive efficiency decomposition in two-stage DEA. Eur. J. Oper. Res. 2009, 196, 1170–1176. [Google Scholar] [CrossRef]

- Cook, W.D.; Zhu, J.; Bi, G.; Yang, F. Network DEA: Additive efficiency decomposition. Eur. J. Oper. Res. 2010, 207, 1122–1129. [Google Scholar] [CrossRef]

- Sahoo, B.K.; Zhu, J.; Tone, K.; Klemen, B.M. Decomposing technical efficiency and scale elasticity in two-stage network DEA. Eur. J. Oper. Res. 2014, 233, 584–594. [Google Scholar] [CrossRef]

- Liang, L.; Cook, W.D.; Zhu, J. DEA models for two-stage processes: Game approach and efficiency decomposition. Nav. Res. Logist. 2008, 55, 643–653. [Google Scholar] [CrossRef]

- Baumol, W.J. Applied fairness theory and rationing policy. Am. Econ. Rev. 1982, 72, 639–651. [Google Scholar]

- Battese, G.E.; Rao, D.P. Technology gap, efficiency, and a stochastic metafrontier function. Int. J. Bus. Econ. 2002, 1, 87. [Google Scholar]

- Battese, G.E.; Rao, D.S.; O’donnell, C.J. A metafrontier production function for estimation of technical efficiencies and technology gaps for firms operating under different technologies. J. Product. Anal. 2004, 21, 91–103. [Google Scholar] [CrossRef]

- Simar, L.; Wilson, P.W. Estimation and inference in two-stage, semi-parametric models of production processes. J. Econom. 2007, 136, 31–64. [Google Scholar] [CrossRef]

- Refinitiv. Environmental, Social and Governance (esg) Scores from Refinitiv. Refinitiv. 2020. Available online: https://www.refinitiv.com/content/dam/marketing/en_us/documents/methodology/refinitiv-esg-scores-methodology.pdf (accessed on 3 December 2022).

- Kwon, H.-B.; Lee, J. Exploring the differential impact of environmental sustainability, operational efficiency, and corporate reputation on market valuation in high-tech-oriented firms. Int. J. Prod. Econ. 2019, 211, 1–14. [Google Scholar] [CrossRef]

- Landi, G.C.; Iandolo, F.; Renzi, A.; Rey, A. Embedding sustainability in risk management: The impact of environmental, social, and governance ratings on corporate financial risk. Corp. Soc. Responsib. Environ. Manag. 2022, 29, 1096–1107. [Google Scholar] [CrossRef]

- Capelle-Blancard, G.; Petit, A. Every Little Helps? ESG News and Stock Market Reaction. J. Bus. Ethics 2019, 157, 543–565. [Google Scholar] [CrossRef]

- Datamarancom. Global Insights Report (GIR) 2018: The Rise of ESG Regulations. 2018. Available online: https://pages.datamaran.com/hubfs/Ebooks/GIR%20report%20-%20Updated%20Jan%202020.pdf (accessed on 9 January 2023).

- Dangelico, R.M.; Pontrandolfo, P. Being ‘Green and Competitive’: The Impact of Environmental Actions and Collaborations on Firm Performance. Bus. Strategy Environ. 2015, 24, 413–430. [Google Scholar] [CrossRef]

| Variable | Description | Unit | References |

|---|---|---|---|

| 1st Stage Input | |||

| Employees | Total number of people employed by the company including full time and part time workers. | Number of people | Sueyoshi and Wang [23], Wang and Feng [55], Belu [56] |

| Operating Expenses | The expense that incurs in a business through its daily operations. | USD | Wang and Feng [55] |

| Energy Use | The total direct and indirect energy that has been consumed within the boundaries of the company’s operations. | Thousands of Tons | Sueyoshi and Wang [23]; |

| Carry Over | |||

| Property, Plant, and Equipment | The tangible assets, which are also called fixed assets, that are long-term and vital to business operations and not easily converted into cash. | USD | Wang and Feng [55], Chen, Liu [57] |

| 1st Stage Output | |||

| Link Net Sales | The sum of a company’s gross sales deducting its returns, allowances, and discounts. | USD | Sueyoshi and Wang [23] |

| CO2 Emission | Total carbon dioxide and CO2 equivalent emission released annually by the company. | Thousands of Tons | Sueyoshi and Wang [23], Wang, Li [54], Wang and Feng [55] |

| 2nd Stage Output | |||

| Market Value | The price or the value that the investment community gives to a particular equity or business, which is calculated by multiplying a company’s outstanding shares by its current market price. | USD | Yang and Okada [58], Wang, Lu [59] |

| Net Income | The entity’s sales income, deducting the cost of goods sold, administrative and operating expenses, and other expenses, including tax expenses and depreciation interest. | USD | Sueyoshi and Wang [23], Belu [56] |

| Environmental Pillar Score Category | Measurement Definition |

|---|---|

| Resource Use | The resource use score measures a firm’s capacity to minimize the usage of energy, water, or materials and to find ecofriendly solutions by improving supply chain management, which reflects the firm’s performance. |

| Emissions | The emission score measures a firm’s environmental emissions in its production and operations, which reflects its commitment and effectiveness. |

| Environmental Innovation | The environmental innovation score measures a firm’s capacity to create new market opportunities through innovative processes, technologies, and ecofriendly products that reduces environmental costs and burdens towards its customers. |

| Sector | Initial Sample | After Deleting Missing Data | Total Assets Percentage |

|---|---|---|---|

| Industrials (IN) | 86 | 55 | 79.87% |

| Consumer Discretionary (CD) | 70 | 46 | 75.91% |

| Information Technology (IT) | 66 | 42 | 75.17% |

| Health Care (HC) | 66 | 32 | 73.35% |

| Financials (FI) | 66 | 31 | 63.42% |

| Real Estate (RE) | 32 | 21 | 78.09% |

| Energy (EN) | 22 | 17 | 85.56% |

| Materials (MA) | 23 | 17 | 81.92% |

| Utilities (UT) | 34 | 17 | 44.10% |

| Consumer Staples (CT) | 24 | 15 | 34.69% |

| Communication Services (CS) | 21 | 13 | 60.06% |

| Total | 510 | 306 | 70.72% |

| Variables | Valid (N) | Mean | Median | Std. Dev. | Skewness | K-S Test |

|---|---|---|---|---|---|---|

| Employees | 306 | 64,231 | 24,150 | 161,766 | 10.900 | p < 0.01 |

| Operating Expenses | 306 | 24,231,496 | 10,094,731 | 40,431,944 | 3.456 | p < 0.01 |

| Property, Plant, and Equip. | 306 | 13,648,924 | 4,468,500 | 24,568,103 | 4.356 | p < 0.01 |

| Energy Use Total | 306 | 36,507,946 | 4,431,631 | 124,806,728 | 7.186 | p < 0.01 |

| CO2 Emission | 306 | 3,634,933 | 398,038 | 10,112,797 | 5.496 | p < 0.01 |

| Net Sales | 306 | 29,126,665 | 12,732,103 | 47,449,442 | 3.553 | p < 0.01 |

| Net Income | 306 | 3,877,359 | 1,467,256 | 9,226,225 | 6.185 | p < 0.01 |

| Market Capitalization | 306 | 92,344,583 | 37,269,581 | 254,807,941 | 8.695 | p < 0.01 |

| Industrials (IN) | ||||||

| Employees | 55 | 65,732 | 45,000 | 83,521 | 3.812 | |

| Operating Expenses | 55 | 19,271,457 | 11,708,600 | 24,246,996 | 2.640 | |

| Property, Plant, and Equip. | 55 | 8,867,286 | 3,506,000 | 12,807,357 | 2.663 | |

| Energy Use Total | 55 | 25,791,868 | 5,945,576 | 54,378,234 | 3.811 | |

| CO2 Emission | 55 | 2,299,678 | 580,100 | 4,288,631 | 2.729 | |

| Net Sales or Revenues | 55 | 21,925,779 | 13,750,000 | 26,015,483 | 2.619 | |

| Net Income | 55 | 2,063,123 | 1,356,000 | 3,362,134 | 2.332 | |

| Market Capitalization | 55 | 51,348,546 | 44,233,540 | 39,573,709 | 1.216 | |

| Consumer Discretionary (CD) | ||||||

| Employees | 46 | 131,125 | 39,000 | 362,096 | 6.010 | |

| Operating Expenses | 46 | 33,459,426 | 9,945,677 | 55,932,468 | 2.932 | |

| Property, Plant, and Equip. | 46 | 14,273,209 | 5,667,363 | 20,079,721 | 2.700 | |

| Energy Use Total | 46 | 43,489,227 | 10,904,419 | 89,546,261 | 3.164 | |

| CO2 Emission | 46 | 3,201,019 | 985,694 | 5,954,247 | 3.005 | |

| Net Sales | 46 | 35,721,059 | 12,034,595 | 58,425,140 | 2.890 | |

| Net Income | 46 | 1,556,643 | 1,338,138 | 3,417,321 | −0.095 | |

| Market Capitalization | 46 | 52,336,938 | 33,627,109 | 62,538,320 | 2.399 | |

| Information Technology (IT) | ||||||

| Employees | 42 | 57,350 | 18,191 | 108,811 | 4.043 | |

| Operating Expenses | 42 | 21,114,868 | 8,243,144 | 41,876,713 | 4.725 | |

| Property, Plant, and Equip. | 42 | 7,025,893 | 1,572,482 | 16,290,163 | 3.151 | |

| Energy Use Total | 42 | 5,126,194 | 1,221,300 | 10,996,470 | 3.149 | |

| CO2 Emission | 42 | 692,016 | 141,128 | 1,476,101 | 3.248 | |

| Net Sales | 42 | 28,756,359 | 12,640,898 | 60,702,375 | 4.680 | |

| Net Income | 42 | 6,599,683 | 1,389,000 | 17,030,419 | 4.375 | |

| Market Capitalization | 42 | 227,186,335 | 52,924,800 | 580,812,069 | 4.129 | |

| Health Care (HC) | ||||||

| Employees | 32 | 44,896 | 28,250 | 39,329 | 0.948 | |

| Operating Expenses | 32 | 27,674,963 | 7,927,050 | 44,093,202 | 2.368 | |

| Property, Plant, and Equip. | 32 | 4,661,437 | 2,647,500 | 5,307,405 | 1.957 | |

| Energy Use Total | 32 | 4,178,324 | 1,564,011 | 5,131,108 | 1.339 | |

| CO2 Emission | 32 | 325,384 | 113,800 | 360,247 | 1.095 | |

| Net Sales | 32 | 32,914,122 | 10,884,850 | 47,203,673 | 2.014 | |

| Net Income | 32 | 4,103,396 | 1,713,800 | 5,596,644 | 2.148 | |

| Market Capitalization | 32 | 98,290,306 | 51,947,498 | 109,217,369 | 1.680 | |

| Financials (FI) | ||||||

| Employees | 31 | 52,651 | 19,112 | 74,769 | 2.171 | |

| Operating Expenses | 31 | 20,218,673 | 10,199,000 | 21,443,516 | 1.239 | |

| Property, Plant, and Equip. | 31 | 4,039,876 | 1,411,000 | 6,716,950 | 2.525 | |

| Energy Use Total | 31 | 1,437,894 | 616,439 | 2,292,423 | 2.311 | |

| CO2 Emission | 31 | 133,151 | 50,480 | 217,256 | 2.308 | |

| Net Sales | 31 | 29,619,851 | 14,262,700 | 32,610,047 | 1.542 | |

| Net Income | 31 | 7,527,387 | 2,760,000 | 10,769,049 | 2.466 | |

| Market Capitalization | 31 | 88,974,875 | 34,036,402 | 124,961,400 | 2.217 | |

| Real Estate (RE) | ||||||

| Employees | 21 | 7611 | 2053 | 22,510 | 4.456 | |

| Operating Expenses | 21 | 3,852,851 | 2,124,780 | 5,392,507 | 3.874 | |

| Property, Plant, and Equip. | 21 | 17,951,591 | 16,728,193 | 9,929,762 | 1.091 | |

| Energy Use Total | 21 | 8,059,360 | 2,640,247 | 11,925,509 | 1.673 | |

| CO2 Emission | 21 | 395,179 | 113,525 | 673,342 | 2.234 | |

| Net Sales | 21 | 4,954,734 | 2,890,000 | 5,878,671 | 3.183 | |

| Net Income | 21 | 1,049,918 | 563,399 | 913,177 | 0.873 | |

| Market Capitalization | 21 | 41,904,363 | 33,985,211 | 35,854,964 | 1.558 | |

| Energy (EN) | ||||||

| Employees | 17 | 21,276 | 9900 | 27,199 | 1.474 | |

| Operating Expenses | 17 | 46,087,427 | 13,483,000 | 68,956,421 | 2.110 | |

| Property, Plant, and Equip. | 17 | 41,863,689 | 23,485,000 | 58,000,653 | 2.519 | |

| Energy Use Total | 17 | 225,809,668 | 26,409,809 | 405,215,273 | 2.321 | |

| CO2 Emission | 17 | 18,825,388 | 6,340,000 | 26,338,591 | 2.158 | |

| Net Sales | 17 | 51,686,736 | 17,870,000 | 73,806,805 | 2.179 | |

| Net Income | 17 | 4,256,908 | 1,517,000 | 6,468,980 | 2.032 | |

| Market Capitalization | 17 | 56,717,249 | 31,755,920 | 73,233,179 | 2.290 | |

| Materials (MA) | ||||||

| Employees | 17 | 27,163 | 20,875 | 19,819 | 0.954 | |

| Operating Expenses | 17 | 13,939,366 | 10,233,000 | 11,658,370 | 1.786 | |

| Property, Plant, and Equip. | 17 | 11,824,162 | 6,238,200 | 11,968,261 | 1.710 | |

| Energy Use Total | 17 | 150,582,893 | 44,887,896 | 184,967,157 | 1.117 | |

| CO2 Emission | 17 | 9,983,596 | 3,392,110 | 12,391,969 | 1.181 | |

| Net Sales | 17 | 17,049,148 | 11,656,000 | 14,296,112 | 1.677 | |

| Net Income | 17 | 1,931,127 | 1,129,900 | 1,867,781 | 1.331 | |

| Market Capitalization | 17 | 45,227,357 | 30,373,223 | 41,041,140 | 2.249 | |

| Utilities (UT) | ||||||

| Employees | 17 | 10,357 | 9116 | 7593 | 1.139 | |

| Operating Expenses | 17 | 7,064,017 | 6,183,000 | 5,218,699 | 1.307 | |

| Property, Plant, and Equip. | 17 | 30,722,744 | 23,506,000 | 29,013,159 | 1.585 | |

| Energy Use Total | 17 | 25,655,405 | 5,077,246 | 56,826,007 | 3.386 | |

| CO2 Emission | 17 | 15,492,051 | 8,205,060 | 19,798,286 | 2.181 | |

| Net Sales | 17 | 8,782,478 | 7,329,000 | 6,452,269 | 1.327 | |

| Net Income | 17 | 1,197,192 | 1,220,527 | 1,025,792 | 1.581 | |

| Market Capitalization | 17 | 29,484,926 | 24,102,382 | 18,763,484 | 1.617 | |

| Consumer Staples (CT) | ||||||

| Employees | 15 | 157,724 | 100,000 | 166704 | 1.034 | |

| Operating Expenses | 15 | 35,369,789 | 18,214,000 | 38167288 | 1.488 | |

| Property, Plant, and Equip. | 15 | 9,869,718 | 5,925,799 | 10375204 | 1.328 | |

| Energy Use Total | 15 | 7,887,535 | 5,875,683 | 7647813 | 1.216 | |

| CO2 Emission | 15 | 684,120 | 373,039 | 755759 | 1.168 | |

| Net Sales | 15 | 41,435,625 | 21,111,000 | 43164922 | 1.599 | |

| Net Income | 15 | 4,716,951 | 2,454,000 | 5052738 | 1.335 | |

| Market Capitalization | 15 | 86,986,759 | 40,194,562 | 106546924 | 2.675 | |

| Communication Services (CS) | ||||||

| Employees | 13 | 77,289 | 55,600 | 68,565 | 0.846 | |

| Operating Expenses | 13 | 51,120,879 | 23,503,335 | 56,985,031 | 1.313 | |

| Property, Plant, and Equip. | 13 | 38,677,181 | 3,770,026 | 54,057,120 | 1.317 | |

| Energy Use Total | 13 | 18,186,004 | 2,283,350 | 24,095,115 | 1.200 | |

| CO2 Emission | 13 | 1,790,589 | 246,466 | 2,399,859 | 1.246 | |

| Net Sales | 13 | 64,695,594 | 28,586,000 | 77,530,395 | 1.621 | |

| Net Income | 13 | 10,861,440 | 2,699,000 | 20,841,736 | 2.961 | |

| Market Capitalization | 13 | 243,180,099 | 51,830,406 | 513,366,859 | 3.365 | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

|---|---|---|---|---|---|---|---|---|

| 1st Stage Input | ||||||||

| (1) Employees | 1 | |||||||

| (2) Operating Expenses | 0.2541 *** | 1 | ||||||

| (3) Property, Plant, and Equip. | 0.0938 | 0.5502 *** | 1 | |||||

| (4) Energy Use | 0.0135 | 0.3982 *** | 0.5764 *** | 1 | ||||

| (5) CO2 Emission | −0.0102 | 0.3159 *** | 0.6527 *** | 0.8120 *** | 1 | |||

| 1st Stage Output | ||||||||

| (6) Net Sales (Link) | 0.2513 *** | 0.9839 *** | 0.5651 *** | 0.3617 *** | 0.2877 *** | 1 | ||

| 2st Stage Output | ||||||||

| (7) Net Income | 0.1901 *** | 0.5790 *** | 0.4283 *** | 0.1296 ** | 0.1050 * | 0.7109 *** | 1 | |

| (8) Market Capitalization | 0.1244 ** | 0.4691 *** | 0.3102 *** | 0.0337 | 0.0264 | 0.5936 *** | 0.8832 *** | 1 |

| Sector | Employees | Operating Expenses | Property, Plant, and Equip. | Energy Use | CO2 Emission | Net Sales | Net Income | Market Capitalization |

|---|---|---|---|---|---|---|---|---|

| IN | 65,732 | 19,271,457 | 8,867,286 | 25,791,868 | 2,299,678 | 21,925,779 | 2,063,123 | 51,348,546 |

| CD | 131,125 | 33,459,426 | 14,273,209 | 43,489,227 | 3,201,019 | 35,721,059 | 1,556,643 | 52,336,938 |

| IT | 57,350 | 21,114,868 | 7,025,893 | 5,126,194 | 692,016 | 28,756,359 | 6,599,683 | 227,186,335 |

| HC | 44,896 | 27,674,963 | 4,661,437 | 4,178,324 | 325,384 | 32,914,122 | 4,103,396 | 98,290,306 |

| FI | 52,651 | 20,218,673 | 4,039,876 | 1,437,894 | 133,151 | 29,619,851 | 7,527,387 | 88,974,875 |

| RE | 7611 | 3,852,851 | 17,951,591 | 8,059,360 | 395,179 | 4,954,734 | 1,049,918 | 41,904,363 |

| EN | 21,276 | 46,087,427 | 41,863,689 | 225,809,668 | 18,825,388 | 51,686,736 | 4,256,908 | 56,717,249 |

| MA | 27,163 | 13,939,366 | 11,824,162 | 150,582,893 | 9,983,596 | 17,049,148 | 1,931,127 | 45,227,357 |

| UT | 10,357 | 7,064,017 | 30,722,744 | 25,655,405 | 15,492,051 | 8,782,478 | 1,197,192 | 29,484,926 |

| CT | 157,724 | 35,369,789 | 9,869,718 | 7,887,535 | 684,120 | 41,435,625 | 4,716,951 | 86,986,759 |

| CS | 77,289 | 51,120,879 | 38,677,181 | 18,186,004 | 1,790,589 | 64,695,594 | 10,861,440 | 243,180,099 |

| K-W Test (p-Value) | 0.0000 *** | 0.0000 *** | 0.0000 *** | 0.0000 *** | 0.0000 *** | 0.0000 *** | 0.0001 *** | 0.0274 ** |

| Environmental Dimension | ||||

|---|---|---|---|---|

| Sector | Environment Pillar Score | Environmental Innovation | Resource Use | Emissions |

| IN | 69.63 | 52.21 | 81.62 | 75.90 |

| CD | 72.79 | 42.98 | 79.78 | 76.29 |

| IT | 63.40 | 41.39 | 82.27 | 79.69 |

| HC | 69.60 | 26.34 | 85.96 | 80.25 |

| FI | 59.79 | 43.79 | 80.67 | 82.08 |

| RE | 76.55 | 54.30 | 77.01 | 81.70 |

| EN | 69.86 | 38.43 | 82.00 | 79.08 |

| MA | 75.78 | 56.26 | 79.46 | 84.43 |

| UT | 65.12 | 44.99 | 74.44 | 74.02 |

| CT | 69.02 | 41.44 | 77.06 | 77.98 |

| CS | 62.99 | 34.48 | 79.42 | 76.96 |

| K-W Test (p-Value) | 0.0321 ** | 0.0386 ** | 0.6356 | 0.6267 |

| Overall Efficiency | Sustainability Efficiency | Marketability Efficiency | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Sector | MTE | GTE | TGR | MTE | GTE | TGR | MTE | GTE | TGR |

| Mean | |||||||||

| IN | 0.252 | 0.499 | 0.567 | 0.583 | 0.880 | 0.661 | 0.187 | 0.534 | 0.342 |

| CD | 0.201 | 0.387 | 0.548 | 0.535 | 0.826 | 0.632 | 0.204 | 0.413 | 0.491 |

| IT | 0.499 | 0.671 | 0.717 | 0.719 | 0.870 | 0.815 | 0.378 | 0.555 | 0.670 |

| HC | 0.386 | 0.797 | 0.468 | 0.678 | 0.902 | 0.745 | 0.302 | 0.625 | 0.472 |

| FI | 0.616 | 0.718 | 0.831 | 0.830 | 0.854 | 0.971 | 0.330 | 0.572 | 0.578 |

| RE | 0.705 | 0.947 | 0.750 | 0.783 | 0.935 | 0.837 | 0.356 | 0.767 | 0.474 |

| EN | 0.435 | 0.956 | 0.446 | 0.814 | 0.975 | 0.832 | 0.151 | 0.744 | 0.194 |

| MA | 0.208 | 0.916 | 0.229 | 0.550 | 0.950 | 0.577 | 0.169 | 0.766 | 0.220 |

| UT | 0.357 | 0.848 | 0.438 | 0.620 | 0.991 | 0.625 | 0.184 | 0.689 | 0.254 |

| CT | 0.261 | 0.466 | 0.505 | 0.623 | 0.917 | 0.670 | 0.236 | 0.466 | 0.475 |

| CS | 0.350 | 0.574 | 0.517 | 0.705 | 0.871 | 0.809 | 0.276 | 0.568 | 0.472 |

| K-W Test (p-Value) | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** |

| Std. Dev. | |||||||||

| IN | 0.269 | 0.356 | 0.291 | 0.156 | 0.126 | 0.134 | 0.138 | 0.284 | 0.099 |

| CD | 0.206 | 0.309 | 0.194 | 0.195 | 0.183 | 0.127 | 0.209 | 0.310 | 0.182 |

| IT | 0.310 | 0.299 | 0.202 | 0.189 | 0.134 | 0.112 | 0.250 | 0.275 | 0.212 |

| HC | 0.265 | 0.283 | 0.221 | 0.182 | 0.109 | 0.138 | 0.176 | 0.320 | 0.089 |

| FI | 0.293 | 0.254 | 0.163 | 0.157 | 0.148 | 0.041 | 0.245 | 0.248 | 0.249 |

| RE | 0.262 | 0.113 | 0.264 | 0.159 | 0.094 | 0.136 | 0.155 | 0.242 | 0.147 |

| EN | 0.298 | 0.099 | 0.290 | 0.229 | 0.060 | 0.218 | 0.094 | 0.285 | 0.075 |

| MA | 0.101 | 0.187 | 0.098 | 0.111 | 0.067 | 0.095 | 0.072 | 0.248 | 0.045 |

| UT | 0.286 | 0.250 | 0.296 | 0.156 | 0.022 | 0.154 | 0.109 | 0.225 | 0.090 |

| CT | 0.339 | 0.398 | 0.268 | 0.195 | 0.086 | 0.159 | 0.241 | 0.311 | 0.164 |

| CS | 0.336 | 0.331 | 0.237 | 0.182 | 0.147 | 0.145 | 0.247 | 0.320 | 0.237 |

| Minimum Value | |||||||||

| IN | 0.033 | 0.087 | 0.055 | 0.319 | 0.586 | 0.523 | 0.044 | 0.133 | 0.164 |

| CD | 0.011 | 0.019 | 0.145 | 0.115 | 0.225 | 0.435 | 0.022 | 0.094 | 0.200 |

| IT | 0.053 | 0.055 | 0.351 | 0.410 | 0.608 | 0.674 | 0.017 | 0.021 | 0.263 |

| HC | 0.052 | 0.174 | 0.194 | 0.435 | 0.681 | 0.567 | 0.010 | 0.033 | 0.178 |

| FI | 0.186 | 0.334 | 0.499 | 0.544 | 0.559 | 0.856 | 0.086 | 0.148 | 0.161 |

| RE | 0.118 | 0.599 | 0.118 | 0.504 | 0.733 | 0.638 | 0.102 | 0.218 | 0.163 |

| EN | 0.056 | 0.690 | 0.056 | 0.424 | 0.817 | 0.424 | 0.025 | 0.183 | 0.095 |

| MA | 0.094 | 0.485 | 0.118 | 0.416 | 0.801 | 0.419 | 0.072 | 0.301 | 0.102 |

| UT | 0.062 | 0.085 | 0.144 | 0.498 | 0.931 | 0.498 | 0.042 | 0.326 | 0.129 |

| CT | 0.044 | 0.096 | 0.155 | 0.418 | 0.747 | 0.484 | 0.060 | 0.145 | 0.293 |

| CS | 0.068 | 0.183 | 0.223 | 0.482 | 0.569 | 0.543 | 0.061 | 0.171 | 0.202 |

| Number of Efficient Firms | |||||||||

| IN | 4 | 15 | 3 | 20 | 0 | 7 | |||

| CD | 1 | 7 | 2 | 10 | 2 | 4 | |||

| IT | 7 | 12 | 8 | 16 | 3 | 6 | |||

| HC | 2 | 15 | 3 | 14 | 0 | 8 | |||

| FI | 9 | 12 | 10 | 12 | 0 | 3 | |||

| RE | 7 | 16 | 6 | 13 | 0 | 5 | |||

| EN | 2 | 13 | 8 | 14 | 0 | 7 | |||

| MA | 0 | 13 | 0 | 9 | 0 | 6 | |||

| UT | 2 | 8 | 2 | 14 | 0 | 4 | |||

| CT | 2 | 5 | 2 | 5 | 1 | 2 | |||

| CS | 0 | 4 | 1 | 6 | 0 | 4 | |||

| Total | 36 | 120 | 45 | 133 | 6 | 56 | |||

| Overall Efficiency | Sustainability Efficiency | Marketability Efficiency | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Sector | CRS | DRS | IRS | CRS | DRS | IRS | CRS | DRS | IRS |

| IN | 4 | 11 | 40 | 2 | 14 | 39 | 0 | 55 | 0 |

| CD | 1 | 2 | 43 | 1 | 17 | 28 | 1 | 44 | 1 |

| IT | 4 | 14 | 24 | 3 | 13 | 26 | 0 | 42 | 0 |

| HC | 2 | 9 | 20 | 6 | 11 | 14 | 0 | 31 | 0 |

| FI | 1 | 10 | 21 | 3 | 9 | 20 | 0 | 32 | 0 |

| RE | 4 | 0 | 17 | 3 | 1 | 17 | 0 | 21 | 0 |

| EN | 1 | 4 | 12 | 3 | 5 | 9 | 0 | 17 | 0 |

| MA | 0 | 3 | 14 | 0 | 4 | 13 | 0 | 17 | 0 |

| UT | 1 | 0 | 16 | 1 | 2 | 14 | 0 | 17 | 0 |

| CT | 1 | 2 | 12 | 1 | 7 | 7 | 0 | 15 | 0 |

| CS | 0 | 4 | 9 | 0 | 7 | 6 | 0 | 13 | 0 |

| Total | 19 | 59 | 228 | 23 | 90 | 193 | 1 | 304 | 1 |

| Item | MTE | MTES1 | MTES2 | |||

|---|---|---|---|---|---|---|

| Environmental Innovation Score (EIS) | −0.003656 | *** | −0.000939 | −0.000266 | ||

| Resource Use Score (RUS) | −0.006789 | *** | −0.001130 | −0.001582 | ||

| Emissions Score (ES) | 0.003012 | 0.005343 | ** | 0.003903 | ** | |

| ROA | 0.017618 | *** | 0.017379 | *** | 0.013102 | *** |

| ROE | −0.000041 | −0.000219 | −0.000121 | |||

| Debt Ratio | −0.004864 | ** | 0.000429 | −0.000489 | ||

| _cons | 0.623627 | *** | −0.426119 | ** | −0.141300 | |

| /sigma | 0.329686 | *** | 0.302446 | *** | 0.2416755 | *** |

| Log Likelihood | 92.1760 | 130.3373 | 150.3907 | |||

| Wald chi2(6) | 16.9 | 37.09 | 21.33 | |||

| Prob > chi2 | 0.0096 | 0.0000 | 0.0016 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mao, H.-Y.; Lu, W.-M.; Shieh, H.-Y. Exploring the Influence of Environmental Investment on Multinational Enterprises’ Performance from the Sustainability and Marketability Efficiency Perspectives. Sustainability 2023, 15, 7779. https://doi.org/10.3390/su15107779

Mao H-Y, Lu W-M, Shieh H-Y. Exploring the Influence of Environmental Investment on Multinational Enterprises’ Performance from the Sustainability and Marketability Efficiency Perspectives. Sustainability. 2023; 15(10):7779. https://doi.org/10.3390/su15107779

Chicago/Turabian StyleMao, Hsiao-Yen, Wen-Min Lu, and Hsin-Yen Shieh. 2023. "Exploring the Influence of Environmental Investment on Multinational Enterprises’ Performance from the Sustainability and Marketability Efficiency Perspectives" Sustainability 15, no. 10: 7779. https://doi.org/10.3390/su15107779

APA StyleMao, H.-Y., Lu, W.-M., & Shieh, H.-Y. (2023). Exploring the Influence of Environmental Investment on Multinational Enterprises’ Performance from the Sustainability and Marketability Efficiency Perspectives. Sustainability, 15(10), 7779. https://doi.org/10.3390/su15107779