Abstract

This paper examines the effect of new urbanization on high-quality economic development in Northeast China, focusing on three aspects: urban factor aggregation, internal division of labor, and scale effect. A panel mediated and moderated effects model is used to analyze data from 34 cities between 2000 and 2020. The results show that new urbanization promotes high-quality economic development through the mediating variables of innovation, consumption, and investment, with a strong mediating effect observed for innovation and consumption and a relatively weaker effect for investment. Furthermore, the study finds that public services, ecological environment, and industrial structure upgrading have significant positive moderating effects on innovation and consumption mediation but a negative effect on investment. In promoting new urbanization, Northeast China should prioritize investment in innovative factors, expand domestic demand, upgrade consumption patterns, improve people’s livelihoods, enhance urban investment in social service functions, optimize investment to promote industrial upgrading and improve urban public services, ecological environment, and management efficiency.

1. Introduction

The Northeast region played a significant role as an industrial base and economic center during the early years of China’s establishment [1]. However, in the 21st century, many cities in the region have faced challenges such as resource and energy depletion, difficulties in transforming and upgrading traditional industries, and population loss, resulting in an obvious economic recession. This has earned the region the nickname of the “rust belt” of China [2]. Based on the data from the 6th and 7th national census, the population in Northeast China has decreased by over 11 million, with Heilongjiang Province alone experiencing a decrease of more than 6.4 million. The number of medium-sized cities, defined as urban areas with a resident population of 500,000 to 1 million, has decreased from 20 to 17. In contrast, megacities and large cities in the region have experienced a net population increase of more than 3.4 million. The four core cities of Harbin, Changchun, Shenyang, and Dalian collectively contribute more than 30% to their respective province’s total economy and secondary and tertiary industries. Additionally, Changchun, as the capital of Jilin province, accounts for 50% of the province’s economy. These observations indicate that the spatial distribution of urban economic activities and factors in the Northeast region is undergoing significant adjustment, and the region’s urbanization is exhibiting new characteristics. China has been actively implementing the strategy of coordinated regional development and the new urbanization strategy [3], with a focus on the construction of urban clusters and metropolitan areas nationwide [4]. From a practical standpoint, whether the Northeast region can achieve high-quality economic development through the new urbanization strategy is a question that requires exploration.

Development practice and research have demonstrated that there is a strong correlation between urbanization and economic development. Urban development is thought to follow the Northam “S” curve and the Chinnery correspondence theory [5]. On the basis of these theories, scholars have extensively studied the relationship between urbanization and economic development. Some scholars argue that urbanization and economic development can be negatively impacted if the cost of urbanization exceeds the level of capital and resources that the country can afford [6]. The impact of urbanization on productivity is not significant on its own, and optimal urban concentration is necessary to promote maximum productivity growth [7]. During different periods of industrialization, there is typically a strong correlation between the level of urbanization and the level of economic development in a country. Specifically, the share of the urban population tends to be roughly proportional to the logarithm of gross per capita value [8]. The process of urbanization has been recognized as a technology-oriented process that involves the structural transfer of production, which is a vital aspect of industrialization and economic development [9]. The correlation between urbanization and economic development has prompted extensive scholarly investigation into the mechanisms underlying their effects. The current literature suggests that the primary mechanisms include the development of productivity through human capital investment [10], the enhancement of innovation levels via urban agglomeration effects [11], urban investment in infrastructure and R&D [12], urban consumption patterns [13,14], industrial development [15,16], the distribution of income between urban and rural areas [17], and the provision of basic public services [18]. Although these factors partially explain the role of urbanization in economic development, existing studies tend to adopt a macroscopic perspective. Moreover, some literature that takes a microscopic perspective may not be applicable to the unique geographical location and development status of Northeast China. Therefore, it is necessary to explore the specific paths and mechanisms through which urbanization construction can facilitate high-quality economic development in this region, both from a theoretical and empirical standpoint.

To achieve this objective, this study employs a sample of 34 cities in Northeast China from 2000 to 2020. Firstly, this study presents a theoretical analysis of the potential path mechanisms between urbanization and high-quality economic development. Secondly, a comprehensive indicator system is established in this study to scientifically measure the level of new urbanization and high-quality economic development in Northeast China. Finally, a panel mediation and moderation effect model is constructed to empirically analyze the mechanisms and pathways between new urbanization and high-quality economic development in Northeast China. The findings suggest that new urbanization has the potential to promote the regional economic development of high quality in the region, which can be achieved through three mediating variables, namely innovation, consumption, and investment. Meanwhile, the study finds that public services, ecological environment, and industrial structure upgrading have significant positive moderating effects on innovation and consumption mediators but negative effects on investment. Compared with previous studies, this paper offers possible marginal contributions in two aspects: first, it establishes a more scientific evaluation system for new urbanization and high-quality economic development. Second, it provides a new perspective for achieving high-quality economic development in Northeast China.

2. Theory and Mechanism Analysis

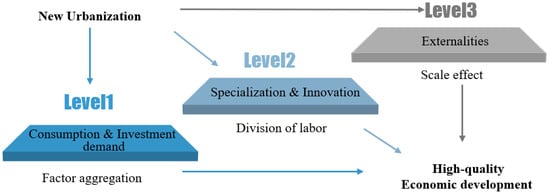

Urbanization is a multidimensional process of social change that results from the aggregation of material elements in geographic space [19,20]. However, from the perspective of the internal causes of urbanization formation and development, its impact on high-quality economic development can be explored at least at three levels: factor aggregation, internal division of labor, and scale effect, as shown in Figure 1.

Figure 1.

Theoretical Mechanism of New Urbanization Impact on High-quality Economic Development.

In general, the process of industrialization leads to the establishment of cities. Subsequently, the joint development of industrialization and urbanization results in the geographic concentration of industries, population, and other factors. Population migration and agglomeration are always at the core of urbanization. The migration of the population is influenced by various factors such as the quality of life, business environments, educational attainment, employment opportunities, foreign direct investment, and globalization. In the context of regional economic and social development, the inflow of population can drive the gathering of related factors, and the formation of scale effect can promote urbanization and sustainable economic development. Conversely, population outflow can trigger a continuous depletion of production factors and cause the regional economy to lose its vitality, which can immensely impact urbanization and high-quality economic development. The concentration of industries and population in urban areas creates a demand for consumption and investment, representing the first level at which urbanization influences economic development. This gathering of factors enables specialization and division of labor, which in turn promote higher levels of urban innovation, representing the second level of urbanization’s impact on economic development. Furthermore, as cities continue to expand, scale effects and externalities are formed, constituting the third level of urbanization’s influence on economic development. The aforementioned process can be described as follows.

The initial stage of urbanization involves the gathering of material, human knowledge, modern services, and other factors. This process is considered by scholars to have an indirect impact on economic development, which is primarily achieved through the conduction effect [21,22]. This effect improves economic growth efficiency [23], optimizes industrial structure, enhances green development, and improves social welfare [24,25]. Moreover, factor aggregation significantly enhances the total factor productivity of regional core cities [26,27], generating growth poles and promoting high-quality economic development.

At the factor aggregation level, urbanization has a mediating effect on economic development through two mechanisms. Firstly, the formation of large-scale consumer demand due to population aggregation [28], and secondly, investment due to increased demand. The gathering of the population in cities results in an increase in demand that is satisfied by consumption. The new urbanization has a great promotion effect on consumption, which is manifested as the income effect and wealth effect [29].

The income effect is derived from a huge labor productivity difference between urban and rural areas, which indicates that the efficiency and frequency of production factors used in urban areas are much higher than those in rural areas [30]. This leads to higher income levels for urban residents compared to rural residents [31]. This difference in income generates a suction force for factors, such as labor and other resources, to move to cities to obtain higher income. For urban laborers, the most direct result of urbanization is the increase in residents’ wage income. The wealth effect is the second mechanism through which urbanization affects consumption. Modern consumption theory suggests that income and wealth jointly influence residents’ consumption behavior. Both the life cycle theory and permanent income hypothesis consider the proportion and level of wealth holdings as the key factors affecting consumption [32]. The initial wealth holdings and immediate income jointly constrain consumption behavior [33]. Compared with the rural sector, urban residents have greater access to assets and are more likely to accumulate wealth [30,31]. Moreover, urban residents have better financial management concepts and pay more attention to asset appreciation. Both physical and financial assets bring residents higher income expectations, leading to an increase in consumption.

Additionally, the promotion effect of new urbanization on consumption is also evidenced through the demonstration effect of former urban residents on the consumption behavior of new citizens, who tend to adopt the urban lifestyle and develop new consumption patterns as they spend more time in the city [34,35].

The aggregation determines that urbanization is a typical dual-source domestic demand of consumption and investment, which is concentrated and intensified in newly developed urban areas. Investment in urban infrastructure, goods, and services creates favorable conditions for both residents and the production of consumer goods. New urbanization enhances investment by facilitating the transformation of income from savings to investment through the financial system. Academics generally agree that urbanization has a positive impact on the economy through its effects on consumption and investment. For example, some studies show that population urbanization mainly promotes economic growth through consumption and investment effects, while the investment effect of land urbanization shows a decreasing trend [36]. Urbanization is a crucial means of expanding investment space [37]. At a micro level, urbanization has a significant effect on the common wealth level of Chinese households. It has a dynamic effect on consumption and affects consumption through the government’s fiscal expenditure, with a short-term “crowding out” effect. In the long run, it can effectively increase the consumption level of the population [38]. Some scholars estimated that for every 1% increase in urbanization, consumption rates increase by 0.04% [39]. In particular, the cumulative effect on the consumption growth of rural residents is greater than that on urban residents, and the positive pull effect lasts longer and is more stable [40]. Macroscopically, urbanization has regional characteristics that vary in consumption and investment effects. Higher urbanization levels drive urban consumption rates, but urbanization varies across regions at different rates. Central cities are more likely to increase urban production capacity and consumption rate by expanding population size than Eastern cities, while eastern cities can only promote consumption rate growth by improving welfare benefits for migrant workers [41]. In particular, some scholars point out that the development of urbanization in the Northeast has not yet reached the inflection point [42], and economic growth is mainly dependent on investment expansion brought by urbanization [43]. Overall, the literature suggests that new urbanization has a positive impact on economic development through consumption and investment, with the mechanism of action differing across regions.

Second, the internal division of labor is another important factor in urban formation and development, according to classical division of labor theory [44]. According to classical writers such as Marx, the separation between urban and rural areas can be attributed to the social division of labor. It is believed that the emergence of industrial modes of production in rural territories led to the industrialization of a significant portion of the agricultural labor force. As a result, the industrial sector, which included handicrafts and other manufacturing processes, began to separate from the agricultural sector and grew in aggregation. This led to growing antagonism between urban and rural areas, ultimately resulting in the emergence of cities [45]. The establishment of cities is based on the principles of division of labor, specialization, and commodity exchange. Furthermore, large cities have the ability to reinforce the division of labor and specialization, create conditions for urban technological innovation, and increase urban technological and productive efficiency. The role of urbanization in fostering innovation is widely recognized within academic circles. For example, in the 1990s, 92% of patents were generated in urban areas, despite the fact that urban areas comprised only 20% of the United States’ total area. Furthermore, a twofold increase in regional economic density is associated with a 20 to 30 percent higher rate of patenting [46]. In a study conducted by Pred (1966), the correlation between population and the number of patents in 35 large cities in the United States from 1860 to 1910 was measured, revealing that the number of patents per capita was 4.1 times higher than the national level [47]. Additionally, a strong correlation between the level of urbanization and the number of patent applications has been established [48]. Thus, it can be inferred that enhancing the technical and productive efficiency of cities’ urbanization plays a crucial role. Generally speaking, urban human capital tends to be highly educated and trained, resulting in significant positive externalities in terms of knowledge and skills. Furthermore, the frequent interactions that occur within urban areas foster a culture of innovation among urban workers [49]. Urban lifestyles effectively increase the frequency of linkages between inventions and technological needs [50]. The convergence of people from diverse backgrounds, enterprises, and research institutes in urban areas continuously refines the division of labor, promotes specialization, and fosters technological innovation. Additionally, cities play a vital role as agents for R&D investment, and their highly centralized organizational structure also facilitates the diffusion of innovations established channels. Based on the above theoretical analysis and literature argumentation, Hypothesis 1 (H1) of this paper is proposed:

H1.

The construction of new urbanization in Northeast China can promote high-quality economic development by facilitating consumption, investment, and innovation as the three key mediating mechanisms.

Third, the scale effect. As cities grow and develop to a certain scale, they generate externalities that can have a substantial impact on regional economic development [51]. Generally speaking, public service supply, industrial structure upgrading, and ecological environment optimization are closely related to the city scale effect. This effect mediates urban innovation, consumption, and investment, which in turn have a profound influence on economic development.

Firstly, the provision of public services is an essential institutional arrangement that accompanies the process of urbanization and is closely linked to its continuous improvement [52]. Urbanization provides the economic conditions and material carrier to promote the development of fundamental public services. The role of income growth in urbanization determines the quantity and quality of public goods supply, providing a stable economic source for the expansion of fundamental public services. The social security attributes of public services also help stabilize residents’ expectations and promote consumption to a certain extent [53]. Public services play a crucial role in promoting the urbanization process by enhancing the innovation capacity, soft power, and competitiveness of cities. Some studies have shown that public services exhibit a nonlinear characteristic of increasing marginal effect on the enhancement of urban innovation capacity [54]. Additionally, public service efficiency has a positive lagging effect on regional innovation capacity [55]. It can form a diverse grouping of driving urban innovation performance improvement through government efficiency, innovation environment, human capital, and other factors. However, there is also a significant difference in the improvement path of urban innovation performance between eastern, central, and western regions [56]. Some scholars have found that urban infrastructure can positively influence innovation, and there are regional variability and threshold effects [57]. Furthermore, public services are closely linked to investment. Studies have shown that public services have a significant impact on entrepreneurial investment in China’s service sector [58] and are also closely related to mobility and social investment [59]. Public services reconfigure the support network of urban society and, as such, have a considerable impact on economic growth and development. Based on the literature analysis, Hypothesis 2 (H2) of this paper is proposed:

H2.

Public services have a moderating effect on the innovation, consumption, and investment intermediation of new urbanization for economic development.

Second, industrial structure upgrading. Generally speaking, it refers to the regular transformation of the industry across the primary, secondary, and tertiary industries in response to the evolving economic landscape [60]. The process reflects the dynamic and evolutionary nature of industrial structures and their development trends across various levels of economic growth. It is closely linked to new urbanization and high-quality economic development. It not only facilitates the upgrading of consumption patterns but also enhances industrial innovation capacity and innovation levels. In general, innovation plays a critical role in industrial structure upgrading [61,62]. However, some scholars contend that the continuous upgrading of industrial structure also serves as a driving force for innovation, creating a synergistic relationship between the two that yields positive effects on economic efficiency [63]. From a micro perspective, the transformation and upgrading of industrial structures are outcomes of resource allocation optimization among enterprises, and the process positively impacts enterprise innovation [64]. From a macro perspective, the advancement and rationalization of industrial structures synergize with technological innovation to enhance urban economic resilience [65]. The study concludes that a dynamic linkage effect exists between industrial structure upgrading and urban–rural residents’ consumption, which has a greater influence and determining effect on the urban-rural consumption gap, during the new urbanization development stage [66]. Industrial structure upgrading can improve the level of household consumption and increase consumption structure upgrading, which is especially evident in eastern and central regions of China [67]. Furthermore, many scholars propose a two-way relationship between industrial structure upgrading and consumption and investment [68,69], with apparent regional differences [70]. Based on the above theoretical analysis and literature argumentation, Hypothesis 3 (H3) of this paper is proposed:

H3.

Industrial structure upgrading has a moderating effect on the innovation, consumption, and investment intermediation of new urbanization for economic development.

Thirdly, the interaction between ecology and the environment is a crucial aspect of new urbanization. New urbanization is a carrier and development background for ecological civilization, whereas ecological civilization is a guarantee and endogenous driving force for new urbanization and an important part of high-quality economic development. The relationship between environmental ecology, urbanization, and economic development is closely intertwined [71,72]. On the one hand, the improvement of urbanization levels must be supported by a healthy ecological environment [73]. The development degree and scale of regional urbanization are determined by the ecological conditions and resource endowment. On the other hand, compared with rural areas, urban systems require more manual management and regulation. Urban population aggregation and industrial changes require resources from the ecological environment, and the material energy must be continuously absorbed and released to maintain the stable development of urban systems. Several studies have highlighted the importance of recognizing the ecological and economic values of nature. The sustainability of economic development is heavily influenced by the level of the ecological environment [74]. Furthermore, the ecological environment plays a vital role in the formation of a green industrial chain, regional innovation synergy, and the improvement of consumption levels [75]. Based on the theoretical analysis and literature argumentation mentioned above, Hypothesis 4 (H4) of this paper is proposed:

H4.

The ecological environment has a moderating effect on the innovation, consumption, and investment intermediation of new urbanization for economic development.

In general, factor agglomeration is the source of town formation in geographic space. The division of labor and specialization is the driving force for further urban development, and the scale spillover enables cities to generate externalities to space. To achieve economic development, urbanization works through various theoretical endogenous factors such as aggregation, division of labor, and scale effects. In this paper, the theoretical mechanism is divided into two aspects: the intermediary mechanism and moderating mechanism. The intermediary mechanism comprises the direct factor of urbanization for economic growth, including consumption growth, investment increase, and innovation level increase. The moderating mechanism, on the other hand, focuses on the role of upgrading industrial structure, public service supply, and ecological environment optimization on the intermediary mechanism. These factors serve as essential moderators that enhance and optimize the economic benefits of urbanization.

3. Construction Indicator, Evaluation Methodology, and Characteristics Analysis

3.1. Indicator System Construction

3.1.1. New Urbanization

The measurement of new urbanization lacks standard indicators and methods in the literature. Some scholars criticize the population share method for being too simplistic and failing to fully capture the economic development, social structure, and lifestyle changes that occur during urbanization [76]. Current mainstream indicators for urbanization measurement include population size and density, the density of commercial and residential areas, urban land [77], and commuting time [78]. Other scholars have used multiple indicator assignment methods to measure the development characteristics of new urbanization from the perspectives of efficiency and quality [79,80]. However, new urbanization has a rich theoretical foundation and practical requirements for social development. In accordance with the theoretical concept of new urbanization, which emphasizes the “people-oriented” approach, and with the aim of addressing the unsustainable issues encountered in traditional urbanization, this paper proposes constructing new urbanization (Urban) indicators from five dimensions, namely urbanization of the population, social development, living services, ecological environment, and living standards (as presented in Table 1). The index system comprises five subsystems with 18 basic indicators. The proposed index system highlights a “people-oriented” approach, with an emphasis on the comprehensive development of individuals during the process of urbanization.

Table 1.

New urbanization index system.

3.1.2. High-Quality Economic Development

Traditional approaches to economic growth and development have typically focused on indicators such as the growth rate of the economy, increases in gross product, and per capita gross product. However, these approaches often neglect the importance of resilience and sustainability in achieving long-term economic development. A high-quality economic development strategy prioritizes both economic growth and meeting the needs of the population for a better standard of living [81,82]. Achieving high-quality economic development requires a comprehensive transformation of the modern economic system [83,84], which reflects the new development concept by emphasizing the construction of a modernized economic system that is efficient, equitable, and environmentally sustainable [85]. From a micro perspective, high-quality economic development refers to the provision of superior products and services. From a macro perspective, it encompasses the efficient upgrading of industries, regional coordination, and the smooth operation of the national economy [86]. This article defines high-quality economic development (HQED) as encompassing three key aspects. Firstly, achieving a higher efficiency of economic growth is identified as a fundamental prerequisite for attaining high quality, which entails maintaining a certain rate of economic growth. Secondly, the smooth operation of the economy, reflected in its resilience and adaptability, is deemed critical. Thirdly, the attainment of environmental sustainability, as measured by the ecological efficiency per unit of output, is considered of paramount importance. The index system for HQED is presented in Table 2.

Table 2.

Level of high-quality economic development index.

3.1.3. Intermediaries, Moderating and Controlling Variables

Drawing on the theoretical and mechanistic analysis presented above, the intermediaries, moderating variables, and control variables used in this study are detailed in Table 3, taking into account both the availability of variables and covariance issues.

Table 3.

Summary of Intermediaries, moderate, and control variables.

Table 3 presents the index of advanced industrial structure, which is expressed as the ratio of tertiary to secondary industry with reference to Gan, C. H. (2011) [88]. The industrial structure level coefficient and the change coefficient serve as indicators of the rationalization level of the industrial structure, where the industrial structure level coefficient is calculated as the proportion of the three industries Wi multiplied by the corresponding weight q. The calculation formula is as follows:

The industrial structure change coefficient is calculated by summing the absolute values of the differences between the beginning and end of the period for each of the three industries, and the formula for this calculation is as follows:

3.2. Evaluation Methodology

In this paper, the index is calculated using the entropy method, as described by Zhang, D. C. (2021) [89]. This method involves determining the discrete degree of each indicator by calculating its information entropy value, which reflects the degree of contribution of each indicator to the system while also avoiding information overlap and subjective bias. This approach allows for the substitution of single variables with multivariate indicators, thereby enhancing the prediction and explanatory power of historical data related to economic phenomena. Additionally, positive and negative indicators are standardized separately to eliminate the influence of magnitude when synthesizing indicators. The general steps of this method are as follows:

Suppose there are n research subjects and m indicators; the initial data are set to:

where zij is the value of the jth indicator of the ith object, i = 1, 2, 3,⋯n; j = 1, 2, 3,⋯m.

Indicators are normalized:

Equation (4) is primarily used for measuring positive indicators, with a larger value indicating a greater probability of high-quality economic development or new urbanization. On the other hand, Equation (5) is mostly utilized to assess negative indicators, with a smaller value indicating superior outcomes. minzij represents the minimum value, and maxzij represents the maximum value of the selected relevant indicators,

3.3. Characteristics Analysis

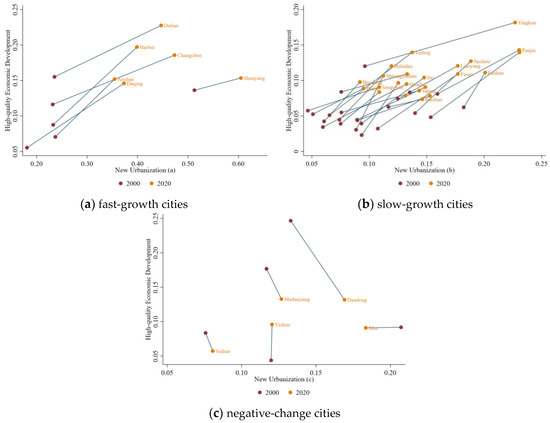

First, the study utilizes the entropy method to measure the two indicators of new urbanization and the level of high-quality economic development to depict the change characteristics from 2000 to 2020. The 34 sample cities are then classified into three categories: fast-growth (Figure 2a), slow-growth (Figure 2b), and negative-change (Figure 2c). Figure 2a displays the fast-growth cities of new urbanization and high-quality economic development in Northeast China, mainly comprising Harbin, Daqing, Changchun, Shenyang, Dalian, and Anshan. During the period from 2000 to 2020, the level of new urbanization and economic development of six cities improved by more than 0.2 points, exhibiting significant growth in comparison to other prefecture-level cities that function as regional core cities. As shown in Figure 2b, among the 23 slow-growing cities, except for Yingkou, Panjin, Benxi, and Fuxin, the score growth was less than 0.1 from 2000 to 2020, with most cities having low levels of new urbanization and economic development. In 2000, Heihe, Shuangyashan, Hegang, and Qitaihe in Heilongjiang Province, and Baicheng, Songyuan, and Siping in Jilin Province had very low levels of high-quality economic development, which still generally lag behind most cities in Liaoning province by 2020. Cities with faster growth rates are mostly concentrated in Liaoning Province. Figure 2c presents the five cities with negative changes. Notably, among the cities with negative change, Mudanjiang, Dandong, and Suihua exhibit an increase in the level of new urbanization but a decrease in the level of high-quality economic development. In contrast, Yichun in Heilongjiang Province displays a relatively stable level of new urbanization while experiencing an improvement in high-quality economic development. Meanwhile, Jilin in Jilin Province maintains a constant level of high-quality economic development while observing a decline in the level of new urbanization.

Figure 2.

Characteristics of new urbanization and high-quality economic development changes in Northeast China.

The analysis reveals that the core cities in the Northeast region exhibit high initial levels and growth rates of new urbanization and high-quality economic development. These cities possess strong factor-absorbing capacity, which enables them to attract investment, promote consumption upgrading, drive technological innovation, and achieve social transformation with the aid of high-quality factors and policy support. Conversely, slow-growth and negative-change cities are predominantly energy and resource-based cities that have been classified by the State Council of China. These cities face challenges due to continuous factor outflows and relatively backward industries, which makes it difficult to cultivate new growth momentum. Further investigation is required to determine the specific impact relationship between new urbanization and high-quality economic development.

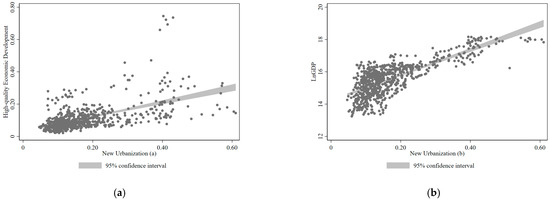

To examine the correlation between new urbanization and high-quality economic development, a scatterplot is plotted (Figure 3a). In order to verify the stability of the correlation, we replace the variable of high-quality economic development with LnGDP and plot the changes of new urbanization and LnGDP (Figure 3b). As seen in Figure 3, new urbanization and economic development exhibit a strong positive correlation, which serves as the premise and basis for the empirical evidence presented in this paper.

Figure 3.

Development trend of new urbanization and high-quality economic development in Northeast China. (a) Correlation between new urbanization and high- quality economic development; (b) Correla-tion between new urbanization and lnGDP.

3.4. The Setting of the Model and Data Sources

This paper aims to investigate the impact of new urbanization on high-quality economic development while scrutinizing the mediating role played by innovation, consumption, and investment. Additionally, the moderating influence of public service level, industrial structure upgrading, and ecological environment on the mediating variables will also be explored. First, referring to Baron and Kenny (1986) [90], Wen, Z.L. et al. (2004) [91], Zhou, G.Y. et al. (2022) [92], the following panel mediated effects model is set up:

The above structural equation represents a mediating effect model, where HQED denotes high-quality economic development, Urban denotes new urbanization, M denotes the mediating variable innovation, consumption, and investment, i denotes city, t denotes year, C represents the control variable, and ε represents the random disturbance term of the model. Equation (11) represents the total effect, and the total effect holds true if the coefficient α1 is significant. β1 is the effect of Urban on the mediating variable, while θ2 is the direct effect of Urban on HQED after the introduction of the mediating variable. The indirect effect of Urban on HQED is represented by θ1×β1. If the model mediating effect holds true, the value of the specific effect of a mediating variable is M = θ1×β1, and the share of this mediating effect in the total effect is R = M/(α1) [91,93]. Second, the moderating effect model is as follows.

Ti.t is the moderating variables including the level of public services, industrial upgrading, and ecological environment; Urbani.t*Ti.t is the interaction term between new urbanization and each moderating variable to verify the moderating effect; Furthermore, the model includes the urban fixed effect, λi, the year time effect, ηt, and the random error term, εit.

The aforementioned model includes the dependent variable HQED, the independent variable Urban, and the moderating variables (T) industrial structure upgrading and ecological environment are obtained by using the basic indicators in Table 1, Table 2 and Table 3, calculated through the entropy method. The intermediate variables (M) innovation, consumption, and investment were extracted from the Statistical Yearbook. This paper employs balanced panel data, which comprises cross-sectional and time series data. Therefore, the generalized least squares (GLS) model is utilized to estimate models (11)–(14) through Stata15 software. In fact, the GLS model proficiently addresses the problems of autocorrelation and heteroskedasticity, thereby ensuring the analysis’s quality.

This study takes a sample of 34 cities in the northeast region from 2000 to 2020, with a time span of 20 years. The researchers obtain the data from the China Statistical Yearbook, China City Statistical Yearbook, and China Science and Technology Statistical Yearbook published by the National Bureau of Statistics of China to ensure the objectivity and authenticity of the selected data. Table 4 presents the results of the descriptive statistics for the main variables.

Table 4.

The descriptive statistics of variables.

4. Analysis of Empirical Results

This paper analyzes the data using Stata15 software. Firstly, the correlation and multiple cointegration tests reveal that the variables have significant correlation coefficients above 0.5 at various statistical levels. Furthermore, the multicollinearity test results indicate that the VIF of each variable ranges from 1.49 to 5.80, much lower than the critical value of 10, demonstrating that the variables were chosen scientifically and there was no issue of multicollinearity. To ensure data stationarity, a unit root test is conducted prior to regression modeling. The results of the LLC and IPS tests confirm data stationarity, while the Hausman test supports the use of a fixed effects model for regression.

4.1. Intermediation Effect Test

The regression results of the intermediary effects are shown in Table 5. Firstly, the regression coefficients of model 1 indicate that both new urbanization (Urban) and high-quality economic development (HQED) are significantly positive (α = 0.17, p < 0.01), indicating the existence of a total effect of new urbanization on high-quality economic development, which is consistent with the findings of characterization analysis. Secondly, models 2 to 4 demonstrate that the regression coefficients of new urbanization and the three mediating variables are significantly positive. Particularly, the positive coefficient of new urbanization and consumption (Consume:β = 1.04, p < 0.01) is higher than that of innovation (Innovation:β = 0.60, p < 0.01) and investment (Invest:β = 0.30, p < 0.01), indicating that new urbanization has a greater impact on promoting consumption. This suggests that new urbanization concentrates the demand for consumption growth due to population aggregation. Furthermore, it is evident that new urbanization has a positive impact on innovation. In contrast, the positive coefficient of new urbanization on investment is lower than those of consumption and innovation, indicating that new urbanization places more emphasis on the adjustment of urban functions and structures and avoids disorderly urban expansion caused by reckless investment. Finally, models 5 to 8 present the complete mediating effect transmission mechanism and the empirical results confirm the role of new urbanization in promoting high-quality economic development through the mediating variables of innovation, consumption, and investment. The contribution of new urbanization to HQED remains significant even after the inclusion of mediating variables. Notably, the mediating effect of new urbanization on promoting high-quality economic development through innovation is found to be 0.19 greater than that of consumption (0.062) and significantly higher than that of investment (0.027).

Table 5.

Mediation effects of new urbanization for high-quality economic development.

To further test the intermediation mechanism, this study employs the Sobel, M.E. (1990) method [94] to analyze the intermediation effect of innovation, consumption, and investment. The results are presented in Table 6.

Table 6.

The test of Mediation effect based on Sobel method.

The regression results for models 1–3 in Table 6 are all significantly positive, and the p-values of the Sobel test are all less than 0.05, indicating that the mediating effect remains. Through the intermediary effect test, it is observed that the effect in this paper is partial, i.e., urbanization can impact economic quality development through intermediary variables, while there is also a direct effect of urbanization on economic quality development.

The regression analysis reveals that the construction of new urbanization in Northeast China has a profound positive effect on the levels of consumption, investment, and innovation. However, the impact on consumption and innovation is more pronounced, which indicates a distinction between new urbanization and traditional urbanization. Elevating consumption levels and fostering consumption and innovation are central to new urbanization for achieving high-quality economic development. The mediation mechanism of new urbanization for promoting high-quality economic development through consumption, investment, and innovation is present in Northeast China, and the mediating effect of consumption and innovation is more prominent. Hence, hypothesis 1 in this paper is validated.

4.2. Moderating Effect Test

The regression findings for the moderating effects are presented in Table 7. Overall, the model’s goodness of fit is high, as demonstrated by both the R2 and Wald chi2 statistics. This reflects a well-structured model and an appropriate selection of variables. Furthermore, the regression coefficients for all variables are significant at varying levels of statistical significance, even when controlling for sample years and regions. These findings provide evidence that the variables are interrelated and influence each other, as shown by the analysis.

Table 7.

Test of moderating effect of new urbanization for high-quality economic development.

4.2.1. The Moderating Influence of Public Services on High-Quality Economic Development through Innovation, Consumption, and Investment in New Urbanization

Models 1, 4, and 7 are regressions of new urbanization (Urban) and public service interaction terms (Urban*Insurance) on the mediating variables. The coefficient of each interaction term is significant, which means that the moderating effect holds. Specifically, in Model 1, the coefficient of the interaction term between Urbanization and public service (Urban*Insurance) on Innovation is significantly positive (α = 0.71, p < 0.01). This result suggests that an improvement in the level of public services during the construction of new urbanization can promote urban innovation. In model 4, the coefficient of the interaction term between new urbanization and public service (Urban*Insurance) on consumption (Consume) is significantly positive (α = 1.03, p < 0.01). This finding is consistent with the theoretical analysis presented in the previous section, which suggests that an improvement in public service supply can enhance the stable income expectation of urban residents, thereby increasing their demand to expand consumption. In Model 7, the regression coefficient of the interaction term between new urbanization construction and public services (Urban*Insurance) on investment (Invest) is significantly negative (α = −1.05, p < 0.05). This result indicates that the improvement of new urbanization construction and public services in Northeast China may have a negative impact on investment. Overall, these findings demonstrate that public services play a significant moderating role in the relationship between new urbanization and economic development, particularly in terms of innovation, consumption, and investment intermediation. Therefore, the results of the regression analyses provide support for Hypothesis 2.

4.2.2. The Moderating Effect of Ecological Environment on New Urbanization for High-Quality Economic Development through Innovation and Consumption, with a Negligible Moderating Effect on Investment

Models 2, 5, and 8 are regressions of the new urbanization (Urban) and ecological environment interaction term (Urban*Environment) on the mediating variables. The results demonstrate that the moderating effect partially holds. In Model 2, the regression coefficient of the Urban*Environment interaction term on innovation (Innovation) is significantly positive (α = 1.76, p < 0.01), indicating that the combination of new urbanization and ecological environment can promote the improvement of urban innovation level. The ecological environment, as the goal of sustainable economic development, has received attention from the state and academia in recent years. Furthermore, in Model 5, the coefficient of the Urban*Environment interaction term on consumption (Consume) is significantly positive (α = 0.66, p < 0.01), indicating that urbanization and ecological co-build are beneficial to consumption. The urban ecological environment is a symbol of the harmonious development of humans and nature, and the improvement of urban ecology is conducive to the happiness and sense of acquisition of urban residents. Suitable living conditions are the prerequisite for urban residents to participate in other economic activities. However, in Model 8, the coefficient of the Urban*Environment interaction term on investment (Invest) is positive (α = 0.18), indicating a positive effect on the increase in urban investment, but the result is not statistically significant. Therefore, the regression results show that the moderating effect of the ecological environment on new urbanization for high-quality economic development through innovation and consumption holds, but the moderating effect on investment is not significant. As a result, hypothesis 4 is partially verified.

4.2.3. The Moderating Effect of Industrial Structure Upgrading on New Urbanization for High-Quality Economic Development through Innovation, Consumption, and Investment

Models 3, 6, and 9 are regressions of the interaction term between new urbanization (Urban) and industrial structure upgrading (Urban*Industry) on the mediating variables. The analysis reveals that the coefficient of each interaction term is statistically significant, which provides evidence that the moderating effect exists. Specifically, in model 3, the regression coefficient of the interaction term between new urbanization and industrial upgrading (Urban* Industry) is significantly positive (α = 0.93, p < 0.01). This finding suggests that the synergistic promotion of new urbanization and industrial upgrading in Northeast China will contribute to the improvement of innovation levels. The development of cities is dependent on the concentration of industries, and the combination of industrial structure upgrading and new urbanization construction can effectively increase the degree and level of urban innovation. The development of industries compatible with the city’s resource endowment can significantly enhance the city’s innovation capacity and achieve high-quality urban economic development. In model 6, the (Urban* Industry) coefficient is significantly positive (α = 3.27, p < 0.01), indicating that the coordinated development of industrial structure upgrading and new urbanization construction can promote consumption. Industrial upgrading is a prerequisite for producing quality products and a driving force for continuous upgrading of consumption. This can effectively resolve social conflicts and promote high-quality urban economic development. In model 9, the interaction term between new urbanization construction and industrial structure upgrading (Urban*Industry) has a significantly negative coefficient on investment (Invest) (α = −0.91, p < 0.01). This finding suggests that when new urbanization construction is introduced, industrial upgrading negatively affects the level of investment. This reflects that new urbanization construction in Northeast China will have some impact on investment when industrial upgrading impacts. Overall, the regression results demonstrate that the moderating effect of industrial structure upgrading on new urbanization for high-quality economic development through innovation, consumption, and investment holds. Therefore, Hypothesis 3 is verified.

4.3. Robustness Tests

In this paper, we make reference to the works of Preacher and Haye (2008) [95] and Roodman (2019) [96]. We employ the non-parametric percentile Bootstrap method to test the robustness of the mediating effect (as presented in Table 8), indicating that the values of the direct and indirect effects of the three mediating variables do not encompass the value of 0 within the 95% confidence interval, thus providing evidence for the persistence of the mediating effect.

Table 8.

Robustness tests for intermediate effects (Bootstrap method).

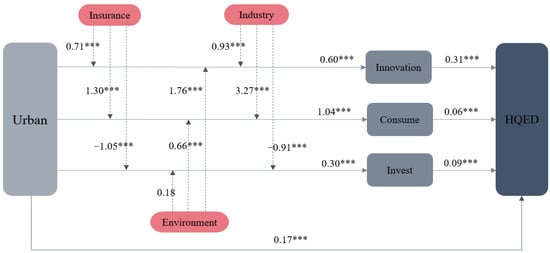

The present study focuses on the mediating and moderating effects of new urbanization on high-quality economic development. The primary regression results have been systematically organized, and the mediating and moderating mechanisms are illustrated in Figure 4 in accordance with the theoretical framework of this paper.

Figure 4.

Mediation Mechanism and Moderating Effect of New Urbanization for High-Quality Economic Development in Northeast China. Note: *** indicates that the variables regression coefficient is significant at 1% level.

The figure presented in this paper shows solid lines that represent the main and mediating effects, with the mediating effect being partial due to the significant main effect. The dashed lines, on the other hand, indicate the moderating effects, with the regression coefficients labeled numerically. The study finds that all variables, except for the moderating effect of the environment on investment, have significant main, mediating, and moderating effects. These results confirm the path mechanism of new urbanization for high-quality economic development, providing an important reference for achieving such development in northeastern cities.

5. Conclusions and Suggestions

Based on the three effects of urbanization-factor aggregation, internal division of labor, and scale spillover-this paper has selected 34 cities in Northeast China as samples to construct an index system of new urbanization and high-quality economic development. Through empirical analysis, the paper has measured the development level of these cities and analyzed the relationship between new urbanization and high-quality economic development. The study has found that the new urbanization construction promotes high-quality regional economic development through three intermediary mechanisms: technological innovation, consumption upgrade, and investment growth. Factor aggregation is the basis for the spatial formation and scale expansion of cities, while the division of labor and specialization can promote knowledge innovation and technological progress. In addition, consumption and investment growth can contribute to high-quality economic development. The existence of this path has been confirmed through theoretical analysis and intermediary effect tests. Moreover, the paper suggests that the industrial structure, public services, and ecological environment can moderate the effect of new urbanization on high-quality economic development through relevant mediating variables. Factor agglomeration is expected to bring positive externalities, prompting industrial structure upgrading, public service supply, and ecological environment optimization and promoting urban innovation and consumption levels through new urbanization construction. However, it may have a negative impact on investment.

After conducting an analysis, it has been found that there are fundamental reasons for the low level of high-quality economic development in Northeast China. The first reason is insufficient innovation capacity. The region’s industrial structure and resource endowment determine that regional cities rely on resources more than on technology, and the demand for basic elements is much higher than for innovative elements. As a result, urban development lacks innovative elements, and it is difficult to achieve high-quality economic development through technological innovation. The second reason is a low consumption level. From both a total and structural perspective, the consumption level in Northeast China is significantly lower than that of Central and Eastern China. The economic growth model led by the domestic demand system has not yet been formed. The third reason is an unreasonable investment structure. The urbanization process in Northeast China started earlier, and the infrastructure related to people’s livelihood is in urgent need of renewal. In terms of intermediary mechanisms, to encourage the development of new urbanization and address these issues, several intermediary mechanisms need to be considered. Firstly, investment in regional innovation factors should be increased to enhance the attractiveness of the region to talents. Secondly, expanding domestic demand and leading consumption upgrades should be a priority. It is also important to quickly break down barriers between urban and rural areas to promote the formation of a unified large market in the Northeast. To promote the upgrading of consumption and industrial structure, it is important to focus on supply-side and demand-side matching, driven by demand and innovation. This can help to realize the virtuous cycle of material factors in cities. To lead investment optimization with new urbanization, more attention should be paid to improving people’s livelihood and enhancing urban investment in social service functions. The focus of investment should be on consumption upgrading, industrial transformation, benefiting people’s livelihood, and restructuring while avoiding investing in ineffective and inefficient areas that may cause overcapacity.

In terms of moderate mechanisms, a new generation of information technology makes modern urban development ideas and intelligent concepts possible, which highlights the need to increase investment in smart cities in the Northeast. The integration of emerging technologies with traditional industries should be explored to empower industries with technology and achieve industrial upgrading. Furthermore, improving the quality of urban public services and the ecological environment can have a moderating effect on urban innovation, consumption, and investment. This can help optimize the consumption and investment structure, improve the urban production and living environment, and enhance the efficiency of urban management and operation. This paper identifies some of the problems faced by urbanization and high-quality economic development in Northeast China and clarifies the mechanisms of action between the two. However, one of the mechanisms can still be refined and discussed specifically. For example, investment, as a mediating variable, has a differential impact on quality economic development when a squared term is used. This implies that there may be threshold effects or nonlinear characteristics of this impact mechanism, which can be taken as a topic for further research.

Author Contributions

Conceptualization, D.Z.—data collection, data analysis, writing draft and final manuscript; F.J.—concept, writing draft manuscript; X.Z.—writing final manuscript, commentary and revision; J.P.—writing final manuscript. All authors have read and agreed to the published version of the manuscript.

Funding

This research was supported by the National Natural Science Foundation of China, grant number 72172042; The Philosophy and Social Sciences Research and Planning Project of Heilongjiang Province, grant number 20JYC150; The Graduate Innovation and Scientific Research Program of Heilongjiang University, grant number YJSCX2021-005HLJU.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The sample data are sourced from the corresponding years of “China Statistical Yearbook”, “China City Statistical Yearbook” and “Technology Statistical Yearbook”.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Ma, X.Y.; Li, H.B. An Empirical Study on the Effect of Market Divisions on the Coordinated Economic Development of Northeast China. In Proceedings of the International Institute of Applied Statistics Studies, Yantai, China, 1 January 2008. [Google Scholar]

- Pottie-Sherman, Y. Rust and reinvention: Im/migration and urban change in the American Rust Belt. Geogr. Compass. 2020, 14, e12482. [Google Scholar] [CrossRef]

- Li, Y.R.; Wang, J.; Liu, Y.S.; Long, H.L. Problem regions and regional problems of socioeconomic development in China: A perspective from the coordinated development of industrialization, informatization, urbanization and agricultural modernization. J. Geogr. Sci. 2014, 24, 1115–1130. [Google Scholar] [CrossRef]

- Ding, M.C. Quantitative contrast of urban agglomeration colors based on image clustering algorithm: Case study of the Xia-Zhang-Quan metropolitan area. Front. Archit. Res. 2021, 10, 692–700. [Google Scholar] [CrossRef]

- Zhao, X.B. Urban performance and the control of urban size in China. Urban Stud. 1995, 32, 813–846. [Google Scholar] [CrossRef]

- Richardson, H.W. The Costs of Urbanization: A Four-country comparison. Econ. Dev. Cult. Chang. 1987, 35, 561–580. [Google Scholar] [CrossRef]

- Henderson, J.V. The urbanization process and economic growth: The so-what question. J. Econ. Growth. 2003, 8, 47–71. [Google Scholar] [CrossRef]

- Bertinelli, L.; Strobl, E. Urbanization, Urban Concentration and Economic Development. Urban Stud. 2007, 44, 2499–2510. [Google Scholar] [CrossRef]

- Tahsin, B.; Ahmet, G.A. The Relationship between Energy Consumption, Urbanization, and Economic Growth in New Emerging-Market Countries. Energy 2018, 147, 321–349. [Google Scholar]

- Bertinelli, L.; Black, D. Urbanization and growth. J. Urban Econ. 2004, 56, 80–96. [Google Scholar] [CrossRef]

- Sedgley, N.; Elmslie, B. Do We Still Need Cities? Evidence on Rates of Innovation from Count Data Models of Metropolitan Statistical Area Patents. Am. J. Econ. Social. 2011, 70, 86–108. [Google Scholar] [CrossRef]

- Rudra, P. Investigating the Causal Relationship Between Transportation Infrastructure, Financial Penetration and Economic Growth in G-20 countries. Res. Transp. Econ. 2019, 78, 100766. [Google Scholar]

- Waldfogel, J. Preference Externalities: An Empirical Study of Who Benefits Whom in Differentiated Product Markets. J. Econ. 2003, 34, 557–568. [Google Scholar] [CrossRef]

- Gleaser, E.L.; Kolko, J.; Saiz, A. Consumer City. J. Econ. Geogr. 2001, 1, 27–50. [Google Scholar] [CrossRef]

- Oosterhaven, J.; Broersma, L. Sector structure and cluster economies: A decomposition of regional labour productivity. Reg. Stud. 2007, 41, 639–659. [Google Scholar] [CrossRef]

- Mahmood, H.; Alkhateeb, T.T.Y.; Furqan, M. Industrialization, urbanization and CO2 emissions in Saudi Arabia: Asymmetry analysis. Energy Rep. 2020, 6, 1553–1560. [Google Scholar] [CrossRef]

- Hein, E.; Vogel, L. Distribution and growth reconsidered-empirical results for six OECD countries. Camb. J. Econ. 2008, 32, 479–511. [Google Scholar] [CrossRef]

- Wang, E.C.; Alvi, E. Relative efficacy of government spending and its determinants: Evidence from east Asian countries. Eurasian. Econ. Rev. 2011, 1, 3–28. [Google Scholar]

- Chen, M.X.; Liu, W.D.; Lu, D.D. Challenges and the way forward in China’s new-type urbanization. Land Use Policy 2016, 55, 334–339. [Google Scholar] [CrossRef]

- Liang, W.; Yang, M. Urbanization, economic growth and environmental pollution: Evidence from China. Sutain. Comput.-Infor. 2019, 21, 1–9. [Google Scholar] [CrossRef]

- Moomaw, R.L.; Shatter, A.M. Shatter, Urbanization and economic development: A bias toward large cities? J. Urban Econ. 1996, 40, 13–37. [Google Scholar] [CrossRef]

- Lin, X.Q.; Wang, D.; Ren, W.B.; Liu, Y.F. Research on the mechanism of urbanization to economic increase in China. Geogr. Res. 2013, 32, 691–700. [Google Scholar]

- He, X.B. Investigating Environmental Regulation and Income Inequality of Urban Residents-The Perspective of Idiosyncratic Regulatory Tools. Collect. Essays Financ. Econ. 2019, 6, 104–112. [Google Scholar]

- Wang, G.M.; Salman, M. The driving influence of multidimensional urbanization on green total factor productivity in China: Evidence from spatiotemporal analysis. Environ. Sci. Pollut. R. 2023, 30, 52026–52048. [Google Scholar] [CrossRef] [PubMed]

- Zhang, J.X.; Lu, G.Y.; Skitmore, M.; Ballesteros-Perez, P. A critical review of the current research mainstreams and the influencing factors of green total factor productivity. Environ. Sci. Pollut. R. 2021, 28, 35392–35405. [Google Scholar] [CrossRef]

- Yuan, Q.; Wu, L.H.; Zhang, P. Informatization Construction and Urban Total Factor Productivity: Empirical Analysis Based on China’s Smart City Pilot Policy. Eurasian Stud. Bus. Econ. 2021, 16, 437–456. [Google Scholar]

- Jiang, A.Y.; Chen, W.Q. Measurement of Chinese Residents’ Quality Life From the Perspective of High-quality Development. Stat. Deci. 2020, 36, 5–9. [Google Scholar]

- Vajjala, V.A.H.; Jewell, W. Demand Response Potential in Aggregated Residential Houses Using GridLAB-D. In Proceedings of the 2015 IEEE Conference on Technologies for Sustainability (SusTech), Ogden, UT, USA, 30 July 2015–1 August 2015; pp. 27–34. [Google Scholar]

- Li, L.; Zhu, Y.L. The Impact of China’s Urbanization Level on Household Consumption. Rev. Cercet. Interv. So. 2021, 72, 378–397. [Google Scholar] [CrossRef]

- Zhao, H.B.; Zheng, X.; Yang, L. Does Digital Inclusive Finance Narrow the Urban-Rural Income Gap through Primary Distribution and Redistribution? Sustainability 2022, 14, 2120. [Google Scholar] [CrossRef]

- Shi, X.J. Heterogeneous effects of rural-urban migration on agricultural productivity: Evidence from China. China Agric. Econ. Rev. 2018, 10, 482–497. [Google Scholar] [CrossRef]

- Duesenberry, J.S. Income, Saving, and the Theory of Consumer Behavior; Harvard University Press: Cambridge, MA, USA, 1949. [Google Scholar]

- Geiger, S.M.; Fischer, D.; Schrader, U. Measuring What Matters in Sustainable Consumption: An Integrative Framework for the Selection of Relevant Behaviors. Sustain. Dev. 2019, 26, 18–33. [Google Scholar] [CrossRef]

- Liao, Z.D. Time Length of Migrating into City, Demonstration Effect and Consumption Structure of Rural-Urban Migrant Households. J. Finance Econ. Theor. 2014, 21, 21–28. [Google Scholar]

- Southerton, D. Habits, routines and temporalities of consumption: From individual behaviours to the reproduction of everyday practices. Time Soc. 2013, 22, 335–355. [Google Scholar] [CrossRef]

- Su, C.W.; Liu, T.Y.; Chang, H.L. Is urbanization narrowing the urban-rural income gap? A cross-regional study of China. Habitat. Int. 2015, 48, 79–86. [Google Scholar] [CrossRef]

- Davis, J.C.; Henderson, J.V. Evidence on the political economy of the urbanization process. J. Urban. Econ. 2004, 53, 98–125. [Google Scholar] [CrossRef]

- Bouakez, H.; Rebei, N. Why does private consumption rise after a government spending shock? Can. J. Econ. 2007, 40, 954–979. [Google Scholar] [CrossRef]

- Fu, B.H.; Fang, Q.Y.; Song, D.Y. Urbanization, Population Age Composition and Resident Consumption: Empirical Research Based on Provincial Dynamic Panel Data. China Popul. Resour. Environ. 2013, 23, 108–114. [Google Scholar]

- Xiong, X.; Yu, X.H.; Wang, Y.X. The impact of basic public services on residents’ consumption in China. Hum. Soc. Sci. Commun. 2022, 9, 389. [Google Scholar] [CrossRef]

- Cao, Y.N.; Wu, T.; Kon, L.Q.; Wang, X.Z.; Zhang, L.F.; Ouyang, Z.Y. The drivers and spatial distribution of economic efficiency in China’s cities. J. Georg. Sci. 2022, 8, 1427–1450. [Google Scholar] [CrossRef]

- Zhao, Z.; Peng, P.Y.; Zhang, F.; Wang, J.Y.; Li, H.X. The Impact of the Urbanization Process on Agricultural Technical Efficiency in Northeast China. Sustainability 2022, 14, 12144. [Google Scholar] [CrossRef]

- Yang, K.; Zhang, S.H.; Luo, Y.; Quan, L.; Li, Q. The widening urbanization gap between the Three Northeast Provinces and the Yangtze River Delta under China’s economic reform from 1984 to 2014. Int. J. Sust. Dev. World. 2018, 25, 262–275. [Google Scholar] [CrossRef]

- Rauh, M.T. Incentives, wages, employment, and the division of labor in teams. RAND J. Econ. 2014, 45, 533–552. [Google Scholar] [CrossRef]

- Marx, E. Selected Works of Marx and Engels; People’s Publishing House: Beijing, China, 1995; Volume 3, p. 640. [Google Scholar]

- Maryann, P.; Feldman; David, B. Audretsch. Innovation in cities: Science-based diversity, specialization and localized competition. Eur. Econ. Rev. 1999, 43, 409–429. [Google Scholar]

- Pred, A.R. The Spatial Dynamics of U.S. Urban-Industrial Growth, 1800–1914: Interpretive and Theoretical Essays; MIT Press: Cambridge, MA, USA, 1966; pp. 10–19. [Google Scholar]

- Higgs, R. American Inventiveness:1870–1920. J. Polit. Econ. 1971, 79, 661–667. [Google Scholar] [CrossRef]

- Glaeser, E.L.; Kallal, H.D.; Scheinkman, J.A. Growth in Cities. J. Polit. Econ. 1992, 100, 98–125. [Google Scholar] [CrossRef]

- Jaffea, A.; Trajtenberg, M.; Herderson, R. Geographic Localization of Knowledge spillovers as Evidenced by Patent citations. Q. J. Econ. 1993, 108, 577–598. [Google Scholar] [CrossRef]

- Glaeser, E.L.; Xiong, W.T. Urban productivity in the developing world. Oxford. Rev. Econ. Pol. 2017, 33, 373–404. [Google Scholar]

- Ouyang, W.; Wang, B.Y.; Tian, L.; Niu, X.Y. Spatial deprivation of urban public services in migrant enclaves under the context of a rapidly urbanizing China: An evaluation based on suburban Shanghai. Cities 2017, 60, 436–445. [Google Scholar] [CrossRef]

- Fiorito, R.; Kollintzas, T. Public goods, merit goods, and the relation between private and government consumption. Eur. Econ. Rev. 2004, 48, 1367–1398. [Google Scholar] [CrossRef]

- Yang, H.C.; Xu, X.Z.; Zhang, F.M. Industrial co-agglomeration, green technological innovation, and total factor energy efficiency. Environ. Sci. Pollut. R. 2021, 65, 848–877. [Google Scholar]

- Hanneke, G.; Michael, D.; Arwin, V.B. Ambidextrous practices in public service organizations: Innovation and optimization tensions in Dutch water authorities. Public. Manag. Rev. 2019, 22, 341–363. [Google Scholar]

- Fernandes, C.; Farinha, L.; Ferreira, J.J. Regional innovation systems: What can we learn from 25 years of scientific achievements? Reg. Stud. 2020, 55, 377–389. [Google Scholar] [CrossRef]

- Furman, J.L.; Porter, M.E.; Stern, S. The determinants of national innovative capacity. Res. Policy 2000, 31, 899–933. [Google Scholar] [CrossRef]

- Chen, W.Y.; Hu, F.Z.Y.; Li, X.; Hua, L. Strategic interaction in municipal governments’ provision of public green spaces: A dynamic spatial panel data analysis in transitional China. Cities 2017, 71, 1–10. [Google Scholar] [CrossRef]

- Chan, K.S.; Dang, V.Q.T.; Lai, J.T.; Ikmy, B. Regional capital mobility in China: 1978–2006. J. Int. Money Financ. 2011, 30, 1506–1515. [Google Scholar] [CrossRef]

- Eggers, A.; Ioannides, Y.M. The role of output composition in the stabilization of US output growth. J. Macroecon. 2006, 28, 585–595. [Google Scholar] [CrossRef]

- Christoffersen, J.; Plenborg, T.; Robson, M.J. Measures of strategic alliance performance, classified and assessed. Int. Bus. Rev. 2014, 23, 479–489. [Google Scholar] [CrossRef]

- Feldman, M.P.; Kelley, M.R. The ex ante assessment of knowledge spillovers: Government R&D policy, economic incentives and private firm behavior. Res. Policy 2006, 35, 1509–1521. [Google Scholar]

- Lach, S. Do R&D subsidies stimulate or displace private R&D? Evidence from Israel. J. Ind. Econ. 2002, 50, 369–390. [Google Scholar]

- Lo, S.F.; Lu, W.M. An integrated performance evaluation of financial holding companies in Taiwan. Eur. J. Oper. Res. 2009, 198, 341–350. [Google Scholar] [CrossRef]

- Castaldi, C.; Frenken, K.; Los, B. Related Variety, Unrelated Variety and Technological Breakthroughs: An Analysis of US State-level Patenting. Reg. Stud. 2015, 49, 767–781. [Google Scholar] [CrossRef]

- Chang, H.H. Consumption inequality between farm and nonfarm households in Taiwan: A decomposition analysis of differences in distribution. Agric. Econ-Blackwell 2012, 43, 487–498. [Google Scholar] [CrossRef]

- Yu, J.; Shi, X.; Cheong, T.S. Distribution Dynamics of China’s Household Consumption Upgrading. Struct. Chang. Econ. D 2021, 58, 193–203. [Google Scholar] [CrossRef]

- Kiminori, M. The Rise of Mass Consumption Societies. J. Polit. Econ. 2002, 110, 1035–1070. [Google Scholar]

- Zhang, D.; Ma, X.; Zhang, J. Can consumption drive industrial upgrades? evidence from Chinese household and firm matching data. Emerg. Mark. Financ. Tr. 2020, 56, 409–416. [Google Scholar] [CrossRef]

- Gao, Y.D.; Zhang, W.G.; Yang, Q. The Factors Influencing of Industrial Structure Upgrade in China. Econ. Geogr. 2015, 6, 96–102. [Google Scholar]

- Pearce, D.W.; Tumer, R.K. Economics of Natural Resources and the Environment; Johns Hopkins University Press: Baltimore, MA, USA, 1990; pp. 215–289. [Google Scholar]

- Grossman, G.; Krueger, A. Economic Growth and the Environment. Q. J. Econ. 1995, 110, 353–377. [Google Scholar] [CrossRef]

- Liu, Y.B.; Li, R.D.; Zhang, S.Z. Study on the coordinative criteria and coordination Degree Model Between Regional Urbanization and Eco-environment. China Soft Sci. 2005, 20, 140–148. [Google Scholar]

- Jawadi, F.; Mallick, S.K.; Sousa, R.M. Fiscal and monetary policies in the BRICs: A panel VAR approach. Econ. Model. 2016, 58, 535–542. [Google Scholar] [CrossRef]

- Fodha, M.; Zaghdoud, O. Economic growth and pollutant emissions in Tunisia: An empirical analysis of the environmental Kuznets curve. Energy Policy 2010, 38, 1150–1156. [Google Scholar] [CrossRef]

- Wang, Y.; Fang, C.L.; Wang, Z.B. The study on comprehensive evaluation and urbanization division at county level in China. Geogr. Res. 2012, 31, 1305–1316. [Google Scholar]

- David, L.B.; John, B.C. Metropolitan Areas The Measurement of American Urbanization. Popul. Res. Policy Rev. 2004, 23, 399–418. [Google Scholar]

- Hirotsugu, U.; Andrew, N. Agglomeration Index: Towards a New Measure of Urban Concentration; The Word Bank: Washington, DC, USA, 2010; pp. 1–16. [Google Scholar]

- Zhang, Y.; Yang, Q.Y.; Li, C.; Yang, M.Y. The Quality evaluation and Comparative Analysis of New Urbainzation Development in Chongqing. China. Econ. Geogr. 2015, 35, 79–86. [Google Scholar]

- Yu, J.; Ye, L. Evaluation Index System of New-Pattern Urbanization in China: Construction, Measure and Comparison. Wuhan Univ. J. (Philos. Soc. Sci.) 2018, 71, 145–156. [Google Scholar]

- Ma, R.; Luo, H.; Wang, H.W.; Wang, T.C. Study of evaluating high-quality economic development in Chinese regions. China Soft Sci. 2019, 34, 60–67. [Google Scholar]

- Guo, Z.M.; Zhang, X.L. The connotation and key tasks of high-quality open economic development. Reform 2019, 35, 43–53. [Google Scholar]

- Pang, J.J.; Lin, G.; Yang, R.L.; Huang, T.Y. Stetches and note on promoting high-quality development of the economy. Econ. Perspect. 2019, 60, 3–19. [Google Scholar]

- Gao, P.Y.; Du, C.; Liu, X.H.; Yuan, F.H.; Tang, D.D. The Construction of a Modern Economic System in the Context of High-quality Development: A New Framework. Econ. Res. J. 2019, 54, 4–17. [Google Scholar]

- Zhang, K.J.; Hou, Y.Z.; Liu, P.L.; He, J.W.; Zhuo, X. The target requirements and strategic path of high quality development. J. Manag. World 2019, 35, 1–7. [Google Scholar]

- Ren, B.P.; Li, Y.M. On the construction of Chinese High-quality Development Evaluation system and path of its transformation in the new ear. J. Shaanxi Norm. Univ. 2018, 47, 105–113. [Google Scholar]

- Nie, C.F.; Jian, X.H. Measurement of China’s high-quality developoment and analysis of provincial status. J. Quant. Technol. Econ. 2020, 37, 26–47. [Google Scholar]

- Gan, C.H.; Zheng, R.G.; Yu, D.F. An empirical study on the effects of industrial structure on economic growth and fluctuations in China. Econ. Res. J. 2011, 46, 4–16. [Google Scholar]

- Zhang, D.C.; Jiao, F.Y.; Zheng, X.Y. Analysis of the spatial and temporal evolution of economic growth dynamics of major cities in Northeast China. Stat. Decis. 2021, 37, 121–125. [Google Scholar]

- Baron, R.M.; Kenny, D.A. The Moderator-mediat or Variable Distinction in Social Psychological Research: Conceptual, Strategic, and Statistical Considerations. J. Pers. Soc. Psychol. 1989, 51, 1173–1182. [Google Scholar] [CrossRef] [PubMed]

- Wen, Z.L.; Chang, L.; Hau, K.T.; Liu, H.Y. Testing and Application of the Mediating Effects. Acta Psychol. Sin. 2004, 36, 614–620. [Google Scholar]

- Zhou, G.Y.; Liu, L.; Luo, S.M. Sustainable development, ESG performance and company market value: Mediating effect of financial performance. Bus. Strateg. Environ. 2022, 31, 3371–3387. [Google Scholar] [CrossRef]

- Jiang, T. Mediating Effects and Moderating Effects in Causal Inference. China Ind. Econ. 2022, 5, 100–120. [Google Scholar]

- Sobel, M.E. Direct and Indirect Effects in Linear Structural Equation Models. Psychometrika 1990, 55, 495–515. [Google Scholar] [CrossRef]

- Preacher, K.J.; Hayes, A.F. Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behav. Res. Methods 2008, 40, 879–891. [Google Scholar] [CrossRef]

- Roodman, D.; MacKinnon, J.G.; Nielsen, M.O.; Webb, M.D. Fast and wild: Bootstrap inference in Stata using boot test. Stata. J. 2019, 19, 4–60. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).