Exploring Corporate Sustainability in the Insurance Sector: A Case Study of a Multinational Enterprise Engaging with UN SDGs in Malaysia

Abstract

:1. Introduction

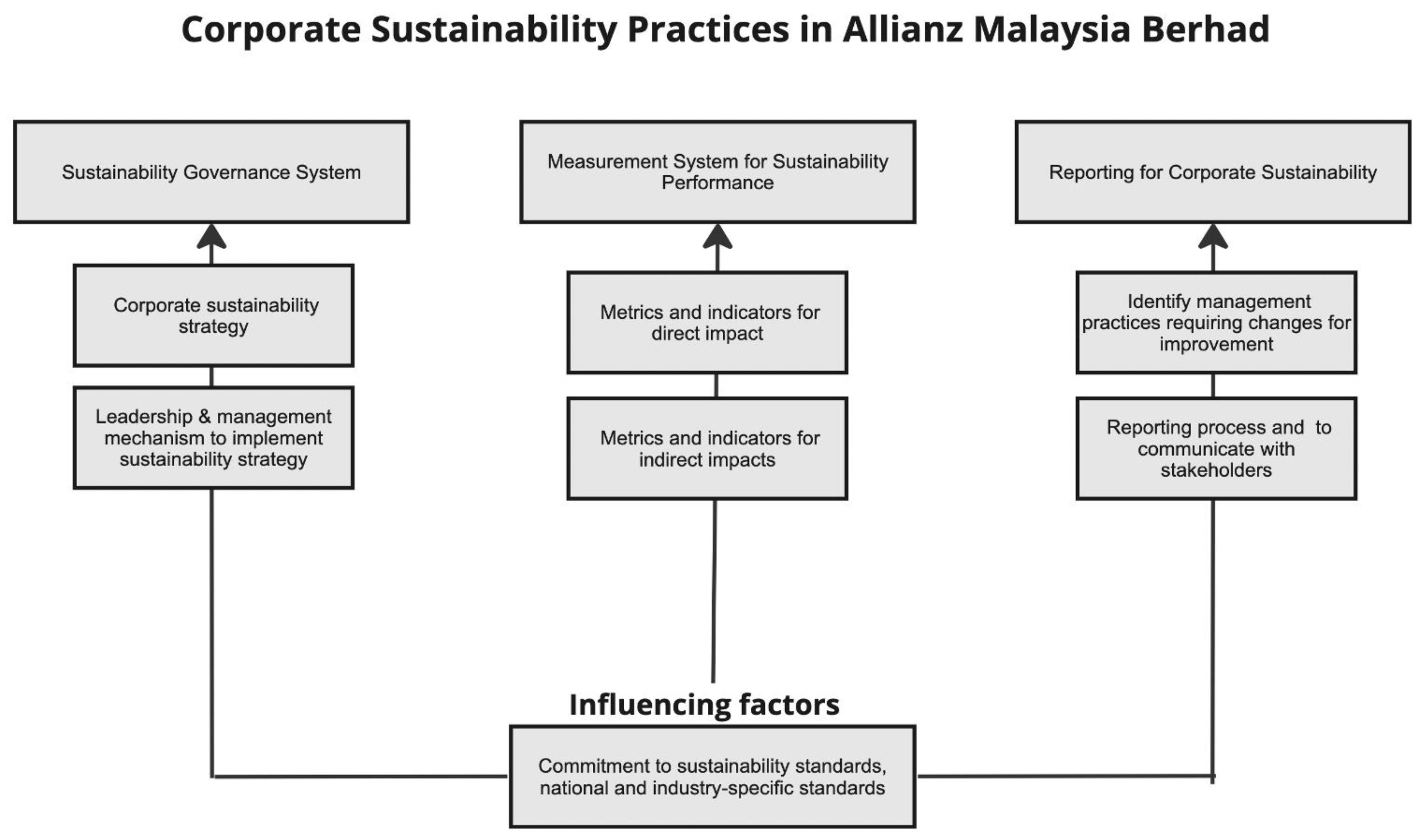

2. Literature Review: Understanding Corporate Sustainability Practices through Corporate Sustainability Assessment (CSA) Process Framework

2.1. Sustainability Governance System

2.2. Measurement for Corporate Sustainability Performance: Direct and Indirect Impact

2.3. Reporting for Corporate Sustainability

3. Methodology

3.1. Selection of Allianz Malaysia Berhad as the Case Study

3.2. Data Collection and Analysis

4. Result: Corporate Sustainability Practices in Allianz Malaysia Berhad

4.1. Sustainability Governance System in Allianz Malaysia Berhad

“Our sustainability strategy—exemplified by our roles as a responsible business, employer of choice and responsible corporate citizen—is driven across the organisation by the five dimensions of Allianz Group’s Renewal Agenda. In this sense, the Renewal Agenda is a mechanism for realising the group’s corporate sustainability strategy and not the other way round. As highlighted, though we are guided by the Allianz Group’s sustainability direction overall, there is a need for local contextualisation in order for initiatives to be effective and meaningful within our operating environment”.

4.2. Measurement System for Sustainability Performance in Allianz Malaysia Berhad

4.2.1. Metrics and Indicators to Assess Impact of Sustainability across Business Operation

4.2.2. Metrics and Indicators to Assess Indirect Impact of Sustainability in Core Business

“In Allianz, responsible investment refers to the incorporation of ESG related considerations, through assessment and screening, namely for our underwriting and investment standards for direct financing, as well as our risk management framework. This process is initiated on a local level and escalated on a case-by-case basis to a group-level when required. ESG screening is an integral part of due diligence by our underwriters and investment managers and reflects our organisational commitment to our long- term sustainability strategy.”

“ASRRIM is a group-wide standard which guides the group’s reputational risk assessment process and considerations. It is developed by the Allianz Group and is continually updated, and periodically updated. ASRRIM guides the company’s business considerations in relation to potential reputational and ESG-related risks. Each sector is provided with its own set of guidelines outlining key ESG considerations to be taken into consideration. This includes our group-wide commitment to divest from businesses that derive 30% of revenue from coal mining or 30% of energy through coal and will continue to be reduced in line with Allianz’s coal phase-out plan”.

4.3. Sustainability Reporting at Allianz

5. Discussion

5.1. Sustainability Governance System: Critical to Initiating Corporate Sustainability Practices in a Company

5.2. Measurement System for Corporate Sustainability: Guide Corporate Sustainability Strategy Implementation, Monitoring Performance and Measuring Impact

5.3. Reporting for Sustainability: Supports an Iterative Management Process in Addressing Sustainability through Improvement Loops

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- United Nation. The Sustainable Development Goals Report 2020; United Nation: New York, NY, USA, 2020; Available online: https://unstats.un.org/sdgs/report/2020/The-Sustainable-Development-Goals-Report-2020.pdf (accessed on 11 November 2022).

- United Nation. Financing for Sustainable Development Report 2020; United Nation: New York, NY, USA, 2020; Available online: https://developmentfinance.un.org/sites/developmentfinance.un.org/files/FSDR_2020.pdf (accessed on 11 November 2022).

- van Zanten, J.A.; van Tulder, R. Multinational enterprises and the Sustainable Development Goals: An institutional approach to corporate engagement. J. Int. Bus. Policy 2018, 1, 208–233. [Google Scholar] [CrossRef]

- Brammer, S.; Jackson, G.; Matten, D. Corporate social responsibility and institutional theory: New perspectives on private governance. Socio-Econ. Rev. 2012, 10, 3–28. [Google Scholar]

- Borgert, T.; Donovan, J.D.; Topple, C.; Masli, E.K. Initiating sustainability assessments: Insights from practice on a procedural perspective. Environ. Impact Assess. Rev. 2018, 72, 99–107. [Google Scholar] [CrossRef]

- Ike, M.; Donovan, J.D.; Topple, C.; Masli, E.K. A holistic perspective on corporate sustainability from a management viewpoint: Evidence from Japanese manufacturing multinational enterprises. J. Clean. Prod. 2019, 216, 139–151. [Google Scholar] [CrossRef]

- Burritt, R.L.; Christ, K.L.; Rammal, H.G.; Schaltegger, S. Multinational Enterprise Strategies for Addressing Sustainability: The Need for Consolidation. J. Bus. Ethics 2020, 164, 389–410. [Google Scholar] [CrossRef]

- Shapiro, D.; Hobdari, B.; Oh, C.H. Natural Resources, Multinational Enterprises and Sustainable Development; Elsevier: Amsterdam, The Netherlands, 2018; pp. 1–14. [Google Scholar]

- Thien, G.T.K. CSR for Clients’ Social/Environmental Impacts? Corp. Soc. Responsib. Environ. Manag. 2015, 22, 83–94. [Google Scholar] [CrossRef]

- United Nation Environment Programme Financial Initiative. UNEP FI Annual Overview 2019–2020; United Nation: New York, NY, USA, 2020. [Google Scholar]

- BlackRock. BlackRock Investment Funds; BlackRock: New York, NY, USA, 2020. [Google Scholar]

- Nogueira, F.G.; Lucena, A.F.; Nogueira, R. Sustainable insurance assessment: Towards an integrative model. Geneva Pap. Risk Insur.-Issues Pract. 2018, 43, 275–299. [Google Scholar] [CrossRef]

- Dong, S.; Xu, L.; McIver, R. China’s financial sector sustainability and “green finance” disclosures. Sustain. Account. Manag. Policy J. 2020, 12, 353–384. [Google Scholar]

- Pranugrahaning, A.; Donovan, J.D.; Topple, C.; Masli, E.K. Corporate sustainability assessments: A systematic literature review and conceptual framework. J. Clean. Prod. 2021, 295, 126385. [Google Scholar] [CrossRef]

- Borgert, T.; Donovan, J.D.; Topple, C.; Masli, E.K. Impact analysis in the assessment of corporate sustainability by foreign multinationals operating in emerging markets: Evidence from manufacturing in Indonesia. J. Clean. Prod. 2020, 260, 120714. [Google Scholar] [CrossRef]

- Pranugrahaning, A.; Denis Donovan, J.; Topple, C.; Kordi Masli, E. Corporate Sustainability Assessments in the Information Communication Technology Sector in Malaysia. Sustainability 2020, 12, 9271. [Google Scholar] [CrossRef]

- Donovan, J.D.; Topple, C.; Masli, E.K.; Vanichseni, T. Corporate Sustainability Assessments: Sustainability Practices of Multinational Enterprises in Thailand; Taylor & Francis: Abingdon, UK, 2016. [Google Scholar]

- Moldavska, A. Defining Organizational Context for Corporate Sustainability Assessment: Cross-Disciplinary Approach. Sustainability 2017, 9, 2365. [Google Scholar] [CrossRef]

- Topple, C.; Donovan, J.D.; Masli, E.K.; Borgert, T. Corporate sustainability assessments: MNE engagement with sustainable development and the SDGs. Transnatl. Corp. 2017, 24, 61–71. [Google Scholar] [CrossRef]

- Lion, H.; Donovan, J.D.; Topple, C.; Bedggood, R.; Masli, E.K. Sustainability Assessments: Insights from Multinational Enterprises Operating in the Philippines; Routledge: Oxfordshire, UK, 2020. [Google Scholar]

- Borgert, T.; Donovan, J.D.; Topple, C.; Masli, E.K. Determining what is important for sustainability: Scoping processes of sustainability assessments. Impact Assess. Proj. Apprais. 2019, 37, 33–47. [Google Scholar] [CrossRef]

- Moldavska, A.; Welo, T. A Holistic approach to corporate sustainability assessment: Incorporating sustainable development goals into sustainable manufacturing performance evaluation. J. Manuf. Syst. 2019, 50, 53–68. [Google Scholar] [CrossRef]

- Roca, L.C.; Searcy, C. An analysis of indicators disclosed in corporate sustainability reports. J. Clean. Prod. 2012, 20, 103–118. [Google Scholar] [CrossRef]

- Jones, P.; Hillier, D.; Comfort, D. Materiality and external assurance in corporate sustainability reporting: An exploratory study of Europe’s leading commercial property companies. J. Eur. Real Estate Res. 2016, 9, 147–170. [Google Scholar] [CrossRef]

- Lodhia, S.; Martin, N. Corporate Sustainability Indicators: An Australian Mining Case Study. J. Clean. Prod. 2014, 84, 107–115. [Google Scholar] [CrossRef]

- Pranugrahaning, A.; Donovan, J.D.; Topple, C.; Masli, E.K. Corporate sustainability assessments as a tool for integrating SDGs into MNE practices: An investigation into the financial sector in Malaysia. In The Role of Multinational Enterprises in Supporting the United Nations’ SDGs; Edward Elgar Publishing: Cheltenham, UK, 2022; pp. 295–316. [Google Scholar]

- Schneider, A.; Meins, E. Two dimensions of corporate sustainability assessment: Towards a comprehensive framework. Bus. Strategy Environ. 2012, 21, 211–222. [Google Scholar] [CrossRef]

- Maas, K.; Schaltegger, S.; Crutzen, N. Integrating corporate sustainability assessment, management accounting, control, and reporting. J. Clean. Prod. 2016, 136, 237–248. [Google Scholar] [CrossRef]

- Garcia, S.; Cintra, Y.; Rita de Cássia, S.; Lima, F.G. Corporate sustainability management: A proposed multi-criteria model to support balanced decision-making. J. Clean. Prod. 2016, 136, 181–196. [Google Scholar] [CrossRef]

- Nawaz, W.; Koç, M. Exploring Organizational Sustainability: Themes, Functional Areas, and Best Practices. Sustainability 2019, 11, 4307. [Google Scholar] [CrossRef]

- Abdul-Rashid, S.H.; Sakundarini, N.; Ghazilla, R.A.R.; Thurasamy, R. The impact of sustainable manufacturing practices on sustainability performance: Empirical evidence from Malaysia. Int. J. Oper. Prod. Manag. 2017, 37, 182–204. [Google Scholar] [CrossRef]

- Klettner, A.; Clarke, T.; Boersma, M. The Governance of Corporate Sustainability: Empirical Insights into the Development, Leadership and Implementation of Responsible Business Strategy. J. Bus. Ethics 2014, 122, 145–165. [Google Scholar] [CrossRef]

- Metclaf, L.; Benn, S. Sustainability leadership: An evolution of leadership ability. J. Bus. Ethics 2013, 112, 369–384. [Google Scholar] [CrossRef]

- Engert, S.; Baumgartner, R.J. Corporate sustainability strategy–bridging the gap between formulation and implementation. J. Clean. Prod. 2016, 113, 822–834. [Google Scholar] [CrossRef]

- Amidjaya, P.G.; Widagdo, A.K. Sustainability reporting in Indonesian listed banks: Do corporate governance, ownership structure and digital banking matter? J. Appl. Account. Res. 2020, 21, 231–247. [Google Scholar] [CrossRef]

- Orazalin, N. Do board sustainability committees contribute to corporate environmental and social performance? The mediating role of corporate social responsibility strategy. Bus. Strategy Environ. 2020, 29, 140–153. [Google Scholar] [CrossRef]

- Peters, G.F.; Romi, A.M.; Sanchez, J.M. The influence of corporate sustainability officers on performance. J. Bus. Ethics 2019, 159, 1065–1087. [Google Scholar] [CrossRef]

- Kumar, K.; Prakash, A. Examination of sustainability reporting practices in Indian banking sector. Asian J. Sustain. Soc. Responsib. 2019, 4, 2. [Google Scholar] [CrossRef]

- Lee, K.-H.; Farzipoor Saen, R. Measuring corporate sustainability management: A data envelopment analysis approach. Int. J. Prod. Econ. 2012, 140, 219–226. [Google Scholar] [CrossRef]

- Wijethilake, C. Proactive sustainability strategy and corporate sustainability performance: The mediating effect of sustainability control systems. J. Environ. Manag. 2017, 196, 569–582. [Google Scholar] [CrossRef] [PubMed]

- Searcy, C. Corporate Sustainability Performance Measurement Systems: A Review and Research Agenda. J. Bus. Ethics 2012, 107, 239–253. [Google Scholar] [CrossRef]

- Truant, E.; Corazza, L.; Scagnelli, S.D. Sustainability and risk disclosure: An exploratory study on sustainability reports. Sustainability 2017, 9, 636. [Google Scholar] [CrossRef]

- Khatib, S.F.A.; Hendrawaty, E.; Bazhair, A.H.; Rahma, I.A.A.; Al Amosh, H. Financial Inclusion and the Performance of Banking Sector in Palestine. Economies 2022, 10, 247. [Google Scholar] [CrossRef]

- Khatib, A.E. The post war performance of the Lebanese banks using the balanced scorecard: A case study. Int. J. Manag. Sustain. 2020, 9, 54–75. [Google Scholar] [CrossRef]

- Leksono, E.B.; Suparno, S.; Vanany, I. Integration of a balanced scorecard, DEMATEL, and ANP for measuring the performance of a sustainable healthcare supply chain. Sustainability 2019, 11, 3626. [Google Scholar] [CrossRef]

- Busch, D. Sustainability Disclosure in the EU Financial Sector. In Sustainable Finance in Europe: Corporate Governance, Financial Stability and Financial Markets; Busch, D., Ferrarini, G., Grünewald, S., Eds.; Springer International Publishing: Cham, Switzerlands, 2021; pp. 397–443. [Google Scholar]

- Sofian, I.; Dumitru, M. The compliance of the integrated reports issued by European financial companies with the international integrated reporting framework. Sustainability 2017, 9, 1319. [Google Scholar] [CrossRef]

- Pillay, S. Evaluation of integrated reporting adoption in the financial sector of Kenya. Afr. J. Bus. Econ. Res. 2019, 14, 53. [Google Scholar] [CrossRef]

- Vitolla, F.; Raimo, N.; Rubino, M. Appreciations, criticisms, determinants, and effects of integrated reporting: A systematic literature review. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 518–528. [Google Scholar] [CrossRef]

- Kane, E.; O’Reilly-de Brún, M. Doing Your Own Research; Marion Boyars: London, UK, 2001. [Google Scholar]

- Yin, R.K. Case Study Research: Design and Methods (Applied Social Research Methods); Sage Publications: Thousand Oaks, CA, USA, 2014. [Google Scholar]

- Ridder, H.G. Case Study Research: Approaches, Methods, Contribution to Theory; Rainer Hampp Verlag: Mering, Germany, 2016. [Google Scholar]

- Creswell, J.W. Qualitative Inquiry and Research Design: Choosing among Five Approaches; SAGE Publications: Thousand Oaks, CA, USA, 2007. [Google Scholar]

- Eisenhardt, K.M.; Graebner, M.E. Theory Building From Cases: Opportunities And Challenges. Acad. Manag. J. 2007, 50, 25–32. [Google Scholar] [CrossRef]

- Hacking, T. The SDGs and the sustainability assessment of private-sector projects: Theoretical conceptualisation and comparison with current practice using the case study of the Asian Development Bank. Impact Assess. Proj. Apprais. 2019, 37, 2–16. [Google Scholar] [CrossRef]

- Gehrke, C. CEO Succession Planning in Small Community Banks: A Qualitative Case Study of “PNW” Bank. J. Account. Financ. 2019, 19, 254–282. [Google Scholar]

- Yin, R.K. How to do better case studies. In The SAGE Handbook of Applied Social Research Method; SAGE: Newcastle upon Tyne, UK, 2009; Volume 2, pp. 254–282. [Google Scholar]

- Girschik, V. Shared Responsibility for Societal Problems: The Role of Internal Activists in Reframing Corporate Responsibility. Bus. Soc. 2020, 59, 34–66. [Google Scholar] [CrossRef]

- Gaya, H.; Smith, E. Developing a qualitative single case study in the strategic management realm: An appropriate research design. Int. J. Bus. Manag. Econ. Res. 2016, 7, 529–538. [Google Scholar]

- AMB. Allianz Malaysia Berhad Annual Report 2021; Allianz Malaysia Berhad: Kuala Lumpur, Malaysia, 2021; Available online: https://www.allianz.com.my/content/dam/onemarketing/azmb/wwwallianzcommy/pdf/investor-updates/2022/AnnualReport2021.pdf (accessed on 12 December 2022).

- Allianz Group. Allianz Sustainability Report 2016; Allianz Group: Munich, Germany, 2016; Available online: https://www.allianz.com/content/dam/onemarketing/azcom/Allianz_com/investor-relations/en/results/2016-fy/2016-Sustainability-Report-Embracing-the-Future.pdf (accessed on 17 April 2018).

- AMB. Allianz Malaysia Berhad Sustainability Report 2017; Allianz Malaysia Berhad: Kuala Lumpur, Malaysia, 2017; Available online: https://www.allianz.com.my/content/dam/onemarketing/azmb/wwwallianzcommy/pdf/sustainability-report/AllianzMalaysiaSustainabilityReport2017.pdf (accessed on 22 September 2020).

- AMB. Allianz Malaysia Berhad Sustaianbility Report 2018; Allianz Malaysia Berhad: Kuala Lumpur, Malaysia, 2018; Available online: https://www.allianz.com.my/content/dam/onemarketing/azmb/wwwallianzcommy/pdf/sustainability-report/AMBSustainabilityReport2018.pdf (accessed on 22 September 2020).

- AMB. Aliianz Malaysia Berhad Sustainbility Report 2019; Allianz Malaysia Berhad: Kuala Lumpur, Malaysia, 2019; Available online: https://www.allianz.com.my/content/dam/onemarketing/azmb/wwwallianzcommy/pdf/sustainability-report/AllianzMalaysiaSustainabilityReport2019.pdf (accessed on 11 November 2021).

- Allianz Group. Allianz Group Sustainability Report 2017; Allianz Group: Munich, Germany, 2017; Available online: https://www.allianz.com/content/dam/onemarketing/azcom/Allianz_com/responsibility/documents/Allianz_Group_Sustainability_Report_2017-web.pdf (accessed on 22 September 2020).

- Allianz Group. Allianz Group Sustainability Report 2018; Allianz Group: Munich, Germany, 2018; Available online: https://www.allianz.com/en/sustainability/sustainability-report-and-other-publications.html#TabVerticalNegative21694789100 (accessed on 11 November 2021).

- Allianz Group. Allianz Group Sustainability Report 2019; Allianz Group: Munich, Germany, 2019; Available online: https://www.allianz.com/content/dam/onemarketing/azcom/Allianz_com/sustainability/documents/Allianz_Group_Sustainability_Report_2019-web.pdf (accessed on 11 November 2021).

- Allianz Group. Allianz Group Sustainbility Report 2020; Allianz Group: Munich, Germany, 2020; Available online: https://www.allianz.com/content/dam/onemarketing/azcom/Allianz_com/sustainability/documents/Allianz_Group_Sustainability_Report_2020-web.pdf (accessed on 22 October 2022).

- AMB. Allianz Malaysia Berhad Annual Report 2020; Allianz Malaysia Berhad: Kuala Lumpur, Malaysia, 2020; Available online: https://www.allianz.com.my/content/dam/onemarketing/azmb/wwwallianzcommy/pdf/investor-updates/2021/AnnualReport2020.pdf (accessed on 22 October 2022).

- del Mar Alonso-Almeida, M.; Llach, J.; Marimon, F. A Closer Look at the ‘Global Reporting Initiative’ Sustainability Reporting as a Tool to Implement Environmental and Social Policies: A Worldwide Sector Analysis. Corp. Soc. Responsib. Environ. Manag. 2014, 21, 318–335. [Google Scholar] [CrossRef]

- Pérez-López, D.; Moreno-Romero, A.; Barkemeyer, R. Exploring the Relationship between Sustainability Reporting and Sustainability Management Practices. Bus. Strategy Environ. 2015, 24, 720–734. [Google Scholar] [CrossRef]

- Silva, S.; Schaltegger, S. Social assessment and management of conflict minerals: A systematic literature review. Sustain. Account. Manag. Policy J. 2019, 10, 157–182. [Google Scholar] [CrossRef]

| Implementation in Core Business | Implementation in Operation | |

|---|---|---|

| Responsible Business Adopted sustainability standards, principle, guideline:

| Develop business innovation; new product and services development to tap new segments/markets. For example: Insurance for Speedhome customers (one-stop platform for homeowners, from advertising properties to selecting tenants, generating paperless agreements and even managing rental payments). | Digitalisation to support waste management. Committed to addressing Cyber risk. Incorporate relevant recommendations from Allianz Global into Malaysian operational strategy to manage the financial risks from climate change. |

| Employer of Choice Adopted sustainability standards, principle, guideline:

| Implemented in operation | Provide employee learning and development. Having fair employment practices, fostering diversity and equal opportunities |

| Responsible Corporate Citizen Adopted sustainability standards, principle, guideline:

| Developing Sustainable Solutions. Providing appropriate/needs-based services, including insurance and investment. For example: SolarPro All Risk PV Insurance (“SolarPro”) is Malaysia’s first comprehensive insurance protection scheme that is catered for home, commercial and industrial solar photovoltaic (“PV”) systems Taking environmental, social and governance matters into consideration in business and investment decision-making. | Reduce societal risks and equalise opportunities of underserved communities through community development initiatives Adopt Environmental Management directed by Allianz Global |

| Material Aspect | Prioritised Issues | Target | Indicator |

|---|---|---|---|

| Environmental Management | Managing carbon footprint | Reduce energy consumption by 34% |

|

| Reduce paper consumption by 40% |

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pranugrahaning, A.; Donovan, J.D.; Topple, C.; Masli, E.K. Exploring Corporate Sustainability in the Insurance Sector: A Case Study of a Multinational Enterprise Engaging with UN SDGs in Malaysia. Sustainability 2023, 15, 8609. https://doi.org/10.3390/su15118609

Pranugrahaning A, Donovan JD, Topple C, Masli EK. Exploring Corporate Sustainability in the Insurance Sector: A Case Study of a Multinational Enterprise Engaging with UN SDGs in Malaysia. Sustainability. 2023; 15(11):8609. https://doi.org/10.3390/su15118609

Chicago/Turabian StylePranugrahaning, Agnes, Jerome Denis Donovan, Cheree Topple, and Eryadi Kordi Masli. 2023. "Exploring Corporate Sustainability in the Insurance Sector: A Case Study of a Multinational Enterprise Engaging with UN SDGs in Malaysia" Sustainability 15, no. 11: 8609. https://doi.org/10.3390/su15118609