COVID-19, Digital Transformation of Banks, and Operational Capabilities of Commercial Banks

Abstract

1. Introduction

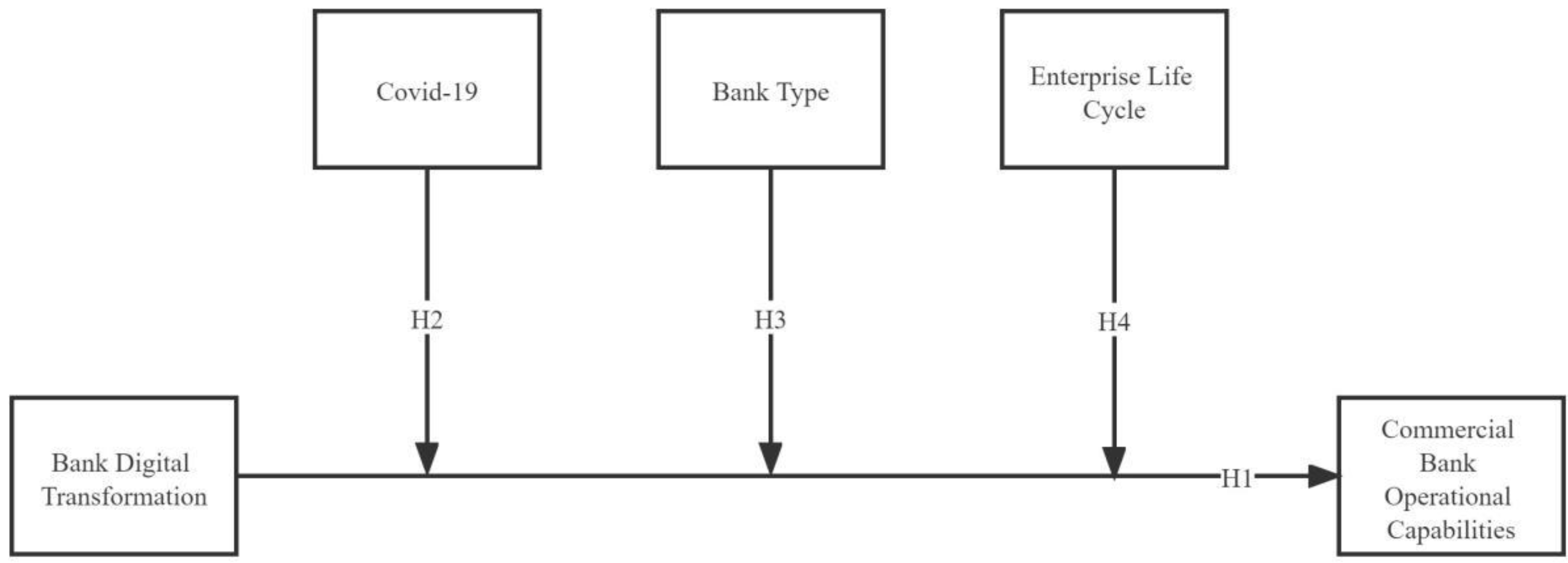

2. Literature Review and Theoretical Hypotheses

3. Research Design

3.1. Sample Selection and Data Sources

3.2. Variable Definition

- (1)

- Dependent variable

- (2)

- Independent variable

- (3)

- Modulating variable

- (4)

- Control variables

3.3. Model Design

- (1)

- Benchmark regression model

- (2)

- Moderating effect model

4. Research Results

4.1. Descriptive Statistics

4.2. Related Analysis

4.3. Empirical Analysis Results

- (1)

- Benchmark regression

- (2)

- Moderator effect analysis

5. Robustness Check

6. Discussion and Conclusions

6.1. Discussion

6.2. Conclusions

6.3. Implications

6.4. Limitations and Future Prospects

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Li, K.; Kim, D.J.; Lang, K.R.; Kauffman, R.J.; Naldi, M. How should we understand the digital economy in Asia? Critical assessment and research agenda. Electron. Commer. Res. Appl. 2020, 44, 101004. [Google Scholar] [CrossRef] [PubMed]

- Yang, C.; Zhang, Y.; Wang, S. The impact of the Internet on household consumption expenditure: An empirical study based on China Family Panel Studies data. Econ. Res. Ekon. Istraživanja 2022, 36, 3. [Google Scholar]

- Kan, D.; Lyu, L.; Huang, W.; Yao, W. Digital Economy and the Upgrading of the Global Value Chain of China’s Service Industry. J. Theor. Appl. Electron. Commer. Res. 2022, 17, 1279–1296. [Google Scholar] [CrossRef]

- Li, G.; Zhang, R.; Feng, S.; Wang, Y. Digital finance and sustainable development: Evidence from environmental inequality in China. Bus. Strategy Environ. 2022, 31, 3574–3594. [Google Scholar] [CrossRef]

- Su, C.; Yuan, X.; Umar, M.; Lobonţ, O.-R. Does technological innovation bring destruction or creation to the labor market? Technol. Soc. 2022, 68, 101905. [Google Scholar] [CrossRef]

- Wang, L.; Wang, Y. Supply chain financial service management system based on block chain IoT data sharing and edge computing. Alex. Eng. J. 2022, 61, 147–158. [Google Scholar] [CrossRef]

- Khattak, A.; Yousaf, Z. Digital Social Responsibility towards Corporate Social Responsibility and Strategic Performance of Hi-Tech SMEs: Customer Engagement as a Mediator. Sustainability 2021, 14, 131. [Google Scholar] [CrossRef]

- Tian, X.; Zhang, Y.; Qu, G. The Impact of Digital Economy on the Efficiency of Green Financial Investment in China’s Provinces. Int. J. Environ. Res. Public Health 2022, 19, 8884. [Google Scholar] [CrossRef]

- Naimi-Sadigh, A.; Asgari, T.; Rabiei, M. Digital Transformation in the Value Chain Disruption of Banking Services. J. Knowl. Econ. 2021, 13, 1212–1242. [Google Scholar] [CrossRef]

- Alam, N.; Gupta, L.; Zameni, A. Fintech and Islamic Finance; Springer: Berlin/Heidelberg, Germany, 2019. [Google Scholar]

- Bian, W.-L.; Wang, X.-N.; Sun, Q.-X. Non-interest Income, Profit, and Risk Efficiencies: Evidence from Commercial Banks in China. Asia-Pac. J. Financ. Stud. 2015, 44, 762–782. [Google Scholar] [CrossRef]

- Zhou, Z.; Li, Z. Corporate digital transformation and trade credit financing. J. Bus. Res. 2023, 160, 113793. [Google Scholar] [CrossRef]

- Jameaba, M.S. Digitization Revolution, FinTech Disruption, and Financial Stability: Using the Case of Indonesian Banking Ecosystem to Highlight Wide-Ranging Digitization Opportunities and Major Challenges. 2020, pp. 1–44. Available online: https://ssrn.com/abstract=3529924 (accessed on 24 May 2023).

- Chen, X.; You, X.; Chang, V. FinTech and commercial banks’ performance in China: A leap forward or survival of the fittest? Technol. Forecast. Soc. Chang. 2021, 166, 120645. [Google Scholar] [CrossRef]

- Pramanik, H.S.; Kirtania, M.; Pani, A.K. Essence of digital transformation—Manifestations at large financial institutions from North America. Future Gener. Comput. Syst. 2019, 95, 323–343. [Google Scholar] [CrossRef]

- Zhu, Y.; Jin, S. The Effect of the QR Code Commission Rate on Commercial Banks in China. J. Digit. Converg. 2022, 20, 99–105. [Google Scholar]

- Tang, W.; Yang, S. Digital Transformation and Firm Performance in the Context of Sustainability: Mediating Effects Based on Behavioral Integration. J. Environ. Public Health 2022, 2022, 8220940. [Google Scholar] [CrossRef]

- Donnellan, J.; Rutledge, W.L. A case for resource-based view and competitive advantage in banking. Manag. Decis. Econ. 2019, 40, 728–737. [Google Scholar] [CrossRef]

- Song, H.; Yang, X.; Yu, K. How do supply chain network and SMEs’ operational capabilities enhance working capital financing? An integrative signaling view. Int. J. Prod. Econ. 2020, 220, 107447. [Google Scholar] [CrossRef]

- Chen, C.; Geng, L.; Zhou, S. RETRACTED ARTICLE: Design and implementation of bank CRM system based on decision tree algorithm. Neural Comput. Appl. 2020, 33, 8237–8247. [Google Scholar] [CrossRef]

- Königstorfer, F.; Thalmann, S. Applications of Artificial Intelligence in commercial banks—A research agenda for behavioral finance. J. Behav. Exp. Financ. 2020, 27, 100352. [Google Scholar] [CrossRef]

- Kwan, A.; Lin, C.; Pursiainen, V.; Tai, M. Stress Testing Banks’ Digital Capabilities: Evidence from the COVID-19 Pandemic. SSRN Electron. J. 2020. [Google Scholar] [CrossRef]

- Khalifaturofi‘ah, S.O.; Listyarti, I.; Poerwanti, R. COVID-19 and the performance of islamic banks in indonesia. Int. J. Islam. Bus. Manag. 2022, 6, 19–30. [Google Scholar]

- Jin, S.; Gao, Y.; Xiao, S. Corporate Governance Structure and Performance in the Tourism Industry in the COVID-19 Pandemic: An Empirical Study of Chinese Listed Companies in China. Sustainability 2021, 13, 11722. [Google Scholar] [CrossRef]

- Sohibien, G.P.D.; Laome, L.; Choiruddin, A.; Kuswanto, H. COVID-19 Pandemic’s Impact on Return on Asset and Financing of Islamic Commercial Banks: Evidence from Indonesia. Sustainability 2022, 14, 1128. [Google Scholar] [CrossRef]

- Flogel, F.; Gartner, S. The COVID-19 Pandemic and Relationship Banking in Germany: Will Regional Banks Cushion an Economic Decline or is A Banking Crisis Looming? Tijdschr. Econ. Soc. Geogr. 2020, 111, 416–433. [Google Scholar] [CrossRef]

- Phan Thi Hang, N. Policy recommendations for controlling credit risks in commercial banks after the Covid-19 pandemic in Vietnam. Cogent Econ. Financ. 2022, 11, 2160044. [Google Scholar] [CrossRef]

- Benmelech, E.; Tzur-Ilan, N. The Determinants of Fiscal and Monetary Policies During the COVID-19 Crisis; National Bureau of Economic Research: Cambridge, MA, USA, 2020. [Google Scholar]

- Cortes, G.S.; Gao, G.P.; Silva, F.B.G.; Song, Z. Unconventional monetary policy and disaster risk: Evidence from the subprime and COVID-19 crises. J. Int. Money Financ. 2022, 122, 102543. [Google Scholar] [CrossRef]

- Rebucci, A.; Hartley, J.S.; Jiménez, D. An Event Study of COVID-19 Central Bank Quantitative Easing in Advanced and Emerging Economies. In Essays in Honor of M. Hashem Pesaran: Prediction and Macro Modeling; Emerald Publishing Limited: Bingley, UK, 2022; Volume 43, pp. 291–322. [Google Scholar]

- Dantas, M.M.; Merkley, K.J.; Silva, F.B.G. Government Guarantees and Banks’ Income Smoothing. J. Financ. Serv. Res. 2023, 63, 123–173. [Google Scholar] [CrossRef]

- Silva, F.B.G. Fiscal Deficits, Bank Credit Risk, and Loan-Loss Provisions. J. Financ. Quant. Anal. 2020, 56, 1537–1589. [Google Scholar] [CrossRef]

- Wang, C.; Dong, Y.; Ge, R. Bank branching deregulation and the credit risk of the regional banking sector: Evidence from city commercial banks in China. Emerg. Mark. Rev. 2022, 2022, 100969. [Google Scholar] [CrossRef]

- Opoku-Kwanowaa, Y.; Jianmin, C.; Attipoe, S.G. Evaluating the Impact of Rural Finance on Cocoa Farmers Productivity: A Case Study of Bodi District in Ghana. Asian J. Adv. Agric. Res. 2020, 12, 36–45. [Google Scholar]

- Akter, S.; Michael, K.; Uddin, M.R.; McCarthy, G.; Rahman, M. Transforming business using digital innovations: The application of AI, blockchain, cloud and data analytics. Ann. Oper. Res. 2020, 308, 7–39. [Google Scholar] [CrossRef]

- Wang, X.; Zhao, H.; Bi, K. The measurement of green finance index and the development forecast of green finance in China. Environ. Ecol. Stat. 2021, 28, 263–285. [Google Scholar] [CrossRef]

- Gao, Y.; Jin, S. Corporate Nature, Financial Technology, and Corporate Innovation in China. Sustainability 2022, 14, 7162. [Google Scholar] [CrossRef]

- Binsaddig, R.; Ali, A.; Al-Alkawi, T.; Ali, B.J. Inventory Turnover, Accounts Receivable Turnover, and Manufacturing Profitability: An Empirical Study. Int. J. Econ. Financ. Stud. 2023, 15, 1. [Google Scholar]

- Zhu, Y. Enterprise life cycle, financial technology and digital transformation of banks—Evidence from China. Aust. Econ. Pap. 2023, 62, 1–15. [Google Scholar]

- Guo, L.; Xu, L. The Effects of Digital Transformation on Firm Performance: Evidence from China’s Manufacturing Sector. Sustainability 2021, 13, 12844. [Google Scholar] [CrossRef]

- Xie, X.; Wang, S. Digital transformation of commercial banks in China: Measurement, progress and impact. China Econ. Q. Int. 2023, 3, 35–45. [Google Scholar] [CrossRef]

- Liu, L.; Liu, X.; Guo, Z.; Fan, S.; Li, Y. An Examination of Impact of the Board of Directors’ Capital on Enterprises’ Low-Carbon Sustainable Development. J. Sens. 2022, 2022, 7740946. [Google Scholar] [CrossRef]

- Zuo, L.; Strauss, J.; Zuo, L. The Digitalization Transformation of Commercial Banks and Its Impact on Sustainable Efficiency Improvements through Investment in Science and Technology. Sustainability 2021, 13, 11028. [Google Scholar] [CrossRef]

- Soesilo, R.; Tampubolon, L.R.R.U. Analysis Transformation and Digitalization of MSMes (Literature Review). J. Multidiscip. Res. 2023, 2, 649–658. [Google Scholar]

- Soesilo, R.; Tampubolon, L.R.R.U. Transformation and Digitalization of MSMEs to Increase Productivity, Added Value and Downstreaming of Strategic Food and Industry. J. Multidiscip. Res. 2023, 2, 757–766. [Google Scholar]

- Fakher, H.A.; Ahmed, Z.; Alvarado, R.; Murshed, M. Exploring renewable energy, financial development, environmental quality, and economic growth nexus: New evidence from composite indices for environmental quality and financial development. Environ. Sci. Pollut. Res. 2022, 29, 70305–70322. [Google Scholar] [CrossRef]

- Chang, V.; Baudier, P.; Zhang, H.; Xu, Q.; Zhang, J.; Arami, M. How Blockchain can impact financial services—The overview, challenges and recommendations from expert interviewees. Technol. Soc. Chang. 2020, 158, 120166. [Google Scholar] [CrossRef] [PubMed]

- Venturelli, A.; Cosma, S.; Leopizzi, R. Stakeholder Engagement: An Evaluation of European Banks. Corp. Soc. Responsib. Environ. Manag. 2018, 25, 690–703. [Google Scholar] [CrossRef]

- Zhang, W.; Zhao, S.; Wan, X.; Yao, Y. Study on the effect of digital economy on high-quality economic development in China. PLoS ONE 2021, 16, e0257365. [Google Scholar] [CrossRef] [PubMed]

- Loonam, J.; Eaves, S.; Kumar, V.; Parry, G. Towards digital transformation: Lessons learned from traditional organizations. Strateg. Chang. 2018, 27, 101–109. [Google Scholar] [CrossRef]

| Year | Number of Banks | Number of Listed Banks |

|---|---|---|

| 2011 | 180 | 16 |

| 2012 | 216 | 16 |

| 2013 | 255 | 16 |

| 2014 | 291 | 16 |

| 2015 | 301 | 16 |

| 2016 | 312 | 25 |

| 2017 | 334 | 26 |

| 2018 | 332 | 32 |

| 2019 | 350 | 36 |

| 2020 | 349 | 38 |

| 2021 | 306 | 42 |

| Total | 3226 | 279 |

| Variable | Variable Name | Variable Code | Variable Definitions |

|---|---|---|---|

| Dependent Variable | Commercial Bank Operating Capacity | BC | Operating income/total assets × 100% |

| Independent Variable | Bank Digital Transformation | BDT | Peking University Digital Finance Research Center |

| Moderator | COVID-19 | COVID19 | Dummy variable, 1 for 2020–2021, 0 for others |

| Bank Type | BT | Dummy variable, 1 for rural commercial banks and 0 for others | |

| Enterprise Life Cycle | ELC | The dummy variable, calculated according to cash flow, takes 1 when the commercial bank is in the growth and maturity stages, and 0 otherwise | |

| Control Variable | Bank Size | SIZE | The natural logarithm of the total assets at the end of the year |

| Solvency | LEV | Total liabilities at the end of the year/total assets at the end of the year | |

| Growth | GRO | Operating income growth rate | |

| Bank Age | AGE | Ln (observation year—bank establishment year + 1) | |

| Concentration of Ownership | TOP1 | The shareholding ratio of the largest shareholder | |

| Bank Nature | SOE | Dummy variable, 1 for state-owned holdings, 0 otherwise | |

| Individual Effect | COMPANY | Commercial bank individual dummy variables | |

| Annual Effect | YEAR | Year dummy variable |

| Variables | N | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| BC | 1419 | 2.197 | 0.616 | 0.540 | 3.800 |

| BDT | 1419 | 58.50 | 37.06 | 0 | 159.1 |

| COVID19 | 1419 | 0.188 | 0.391 | 0 | 1 |

| BT | 1419 | 0.232 | 0.422 | 0 | 1 |

| ELC | 1419 | 0.600 | 0.490 | 0 | 1 |

| SIZE | 1419 | 25.93 | 1.572 | 23.08 | 30.78 |

| LEV | 1419 | 91.91 | 3.145 | 73.88 | 95.74 |

| GRO | 1419 | 12.86 | 22.45 | −54.42 | 110.7 |

| TOP1 | 1419 | 27.31 | 28.10 | 4.860 | 100 |

| SOE | 1419 | 0.0359 | 0.186 | 0 | 1 |

| AGE | 1419 | 2.709 | 0.534 | 1.099 | 4.159 |

| Variables | BC | BDT | COVID-19 | BT | ELC | SIZE | LEV | GRO | TOP1 | SOE | AGE |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BC | 1 | ||||||||||

| BDT | 0.103 *** | 1 | |||||||||

| COVID19 | −0.144 *** | 0.408 *** | 1 | ||||||||

| BT | 0.152 *** | −0.077 *** | 0.0390 | 1 | |||||||

| ELC | 0.089 *** | −0.076 *** | −0.0300 | −0.0250 | 1 | ||||||

| SIZE | 0.128 *** | 0.653 *** | 0.123 *** | −0.219 *** | 0.0230 | 1 | |||||

| LEV | 0.058 ** | 0.207 *** | −0.065 ** | −0.0230 | 0.135 *** | 0.362 *** | 1 | ||||

| GRO | 0.133 *** | −0.137 *** | −0.139 *** | −0.091 *** | 0.0300 | −0.0190 | 0.0160 | 1 | |||

| TOP1 | −0.180 *** | −0.099 *** | 0.0370 | −0.342 *** | −0.077 *** | −0.052 ** | −0.521 *** | 0.00800 | 1 | ||

| SOE | 0.147 *** | 0.241 *** | 0.00400 | −0.106 *** | 0.104 *** | 0.548 *** | 0.044 * | −0.0410 | 0.134 *** | 1 | |

| AGE | −0.115 *** | 0.495 *** | 0.234 *** | −0.362 *** | −0.0310 | 0.507 *** | 0.205 *** | −0.102 *** | −0.069 *** | 0.329 *** | 1 |

| (1) | (2) | |

|---|---|---|

| Variables | BC | BC |

| BDT | 0.006 *** | 0.005 *** |

| (7.21) | (6.95) | |

| SIZE | −0.169 ** | |

| (−2.45) | ||

| LEV | −0.032 *** | |

| (−3.94) | ||

| GRO | 0.001 *** | |

| (2.61) | ||

| TOP1 | −0.008 *** | |

| (−3.04) | ||

| AGE | −0.095 | |

| (−0.92) | ||

| CONSTANT | 2.412 *** | 9.959 *** |

| (48.49) | (5.84) | |

| COMPANY FE | YES | YES |

| YEAR FE | YES | YES |

| OBSERVATIONS | 1419 | 1419 |

| R-SQUARED | 0.270 | 0.296 |

| NUMBER OF IDS | 202 | 202 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variables | BC | BC | BC | BC |

| BDT | 0.005 *** | 0.006 *** | 0.006 *** | 0.004 *** |

| (6.95) | (7.32) | (7.37) | (5.16) | |

| COVID19 | −0.452 ** | |||

| (−2.58) | ||||

| BDT × COVID19 | −0.002 ** | |||

| (−2.26) | ||||

| BT | −0.771 ** | |||

| (−2.47) | ||||

| BDT × BT | −0.002 ** | |||

| (−2.09) | ||||

| ELC | −0.158 *** | |||

| (−3.53) | ||||

| BDT × ELC | 0.002 *** | |||

| (2.63) | ||||

| SIZE | −0.169 ** | −0.166 ** | −0.184 *** | −0.173 ** |

| (−2.45) | (−2.41) | (−2.68) | (−2.52) | |

| LEV | −0.032 *** | −0.034 *** | −0.032 *** | −0.030 *** |

| (−3.94) | (−4.17) | (−3.93) | (−3.69) | |

| GRO | 0.001 *** | 0.001 *** | 0.002 *** | 0.001 ** |

| (2.61) | (2.64) | (2.78) | (2.47) | |

| TOP1 | −0.008 *** | −0.008*** | −0.007 *** | −0.007 *** |

| (−3.04) | (−3.03) | (−2.93) | (−2.91) | |

| AGE | −0.095 | −0.129 | −0.003 | −0.105 |

| (−0.92) | (−1.23) | (−0.02) | (−1.02) | |

| CONSTANT | 9.959 *** | 10.134 *** | 10.283 *** | 10.005 *** |

| (5.84) | (5.95) | (6.05) | (5.87) | |

| COMPANY FE | YES | YES | YES | YES |

| YEAR FE | YES | YES | YES | YES |

| OBSERVATIONS | 1419 | 1419 | 1419 | 1419 |

| R-SQUARED | 0.296 | 0.299 | 0.303 | 0.303 |

| NUMBER OF IDS | 202 | 202 | 202 | 202 |

| (1) | (2) | |

|---|---|---|

| First-Stage | Second-Stage | |

| Variables | BDT | BC |

| LBDT | 0.357 *** | |

| (12.12) | ||

| BDT | 0.014 *** | |

| (5.76) | ||

| SIZE | 2.283 | −0.291 *** |

| (0.73) | (−3.11) | |

| LEV | −0.058 | −0.018 * |

| (−0.16) | (−1.66) | |

| GRO | −0.021 | 0.004 *** |

| (−0.82) | (4.84) | |

| TOP1 | −0.086 | −0.011 *** |

| (−0.82) | (−3.51) | |

| AGE | −19.435 *** | 0.286 * |

| (−4.37) | (1.90) | |

| COMPANY FE | YES | YES |

| YEAR FE | YES | YES |

| OBSERVATIONS | 1117 | 1117 |

| R-SQUARED | 0.157 | |

| NUMBER OF IDS | 186 | 186 |

| UNDER-IDENTIFICATION TEST (KLEIBERGEN–PAAP RK LM STATISTIC) | 244.309 (CHI-SQ(1) P-VAL = 0.0000) | |

| WEAK IDENTIFICATION TEST (CRAGG–DONALD WALD F STATISTIC) | 1493.585 | |

| (KLEIBERGEN–PAAP RK WALD F STATISTIC) | 1035.078 | |

| 10% MAXIMAL IV SIZE | 16.38 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhu, Y.; Jin, S. COVID-19, Digital Transformation of Banks, and Operational Capabilities of Commercial Banks. Sustainability 2023, 15, 8783. https://doi.org/10.3390/su15118783

Zhu Y, Jin S. COVID-19, Digital Transformation of Banks, and Operational Capabilities of Commercial Banks. Sustainability. 2023; 15(11):8783. https://doi.org/10.3390/su15118783

Chicago/Turabian StyleZhu, Yongjie, and Shanyue Jin. 2023. "COVID-19, Digital Transformation of Banks, and Operational Capabilities of Commercial Banks" Sustainability 15, no. 11: 8783. https://doi.org/10.3390/su15118783

APA StyleZhu, Y., & Jin, S. (2023). COVID-19, Digital Transformation of Banks, and Operational Capabilities of Commercial Banks. Sustainability, 15(11), 8783. https://doi.org/10.3390/su15118783