Abstract

The excessive use of fossil energy has led to a yearly increase in carbon dioxide and atmospheric pollutant emissions, and climate change has become increasingly prominent, seriously affecting people’s daily lives and physical and mental health. According to statistics, rising temperatures and extreme weather phenomena due to climate change have led to a 68% increase in heat-related deaths today compared to the period between 2000 and 2004, and a 61% increase in the number of days humans face high fire risks in the same period. Currently, in order to achieve synergistic economic and environmental development and enhance the health co-benefits of carbon emission reduction, it is urgent for high-energy-consuming enterprises to make sound low-carbon technology investment decisions. Therefore, in this paper, under the carbon quota and trading policy and carbon tax policy, and considering the existence of low-carbon preferences of consumers, the financial constraints of upstream high energy-consuming enterprises and sufficient funds of downstream retailers, a low-carbon technology investment decision model under intra-supply chain financing is constructed using Stackelberg game theory. Moreover, by applying the inverse induction method, we solve the optimal decision of low-carbon technology investment with three different subsidy methods: no subsidy, cost subsidy and product subsidy. Finally, the validity of the model is verified by numerical simulation, and the effects of different influencing factors on low-carbon technology investment are analyzed. The results show that: (1) the reasonable formulation of carbon trading price, carbon tax rate, cost subsidy ratio and product subsidy coefficient are important factors to promote enterprises’ low-carbon technology investment; (2) the improvement of consumers’ low-carbon preference level and the reduction in repayment interest rate can promote enterprises’ investment; (3) compared with no subsidy, cost subsidy and product subsidy can effectively improve enterprises’ low-carbon technology investment enthusiasm, and the effect of product subsidy is better than that of cost subsidy. The effect of product subsidies is better than that of cost subsidies. This paper aims to provide suggestions for the government to refine low-carbon technology investment incentive policies and for enterprises to optimize low-carbon technology investment decisions, so as to enhance the healthy co-benefits of carbon emission reduction and achieve green and sustainable economic development.

1. Introduction

After the Industrial Revolution, the consumption of fossil energy increased significantly, and the excessive use of energy led to the annual rise of carbon dioxide and atmospheric pollutant emissions, climate change and other problems became increasingly prominent, seriously affecting human daily life and physical and mental health. According to statistics, rising temperatures and extreme weather phenomena due to climate change have led to a 68% increase in heat-related deaths today compared to the period between 2000 and 2004, and a 61% increase in the number of days humans are at high fire risk over the same period [1]. Climate change will not only directly affect people’s health by increasing the frequency and intensity of high temperatures, drought and rainstorms, but also indirectly affect people’s health by aggravating air pollution, accelerating the spread of disease vectors, and affecting food security and mental health [2]. At present, the international medical community has reached a consensus that there may be a causal relationship between air pollution and the number of severe cases and deaths after the outbreak of the novel coronavirus. Carbon dioxide and air pollutants have the same root and origin, both mainly from the burning and utilization of fossil fuels. Therefore, carbon emission reduction policies committed to mitigating climate change will also promote the emission reduction in atmospheric pollutants, thus bringing air quality improvement and population health benefits, namely the “health co-benefits of carbon emission reduction” [3].

In recent years, China has made great achievements in economic development; however, the relationship between economic development and environmental protection has not been well balanced due to the inefficient use of resources [4]. As a major energy consumer, China’s carbon emissions reached 11.48 billion tons in 2022, with the highest emissions coming from energy-intensive industries. Energy-intensive industries are characterized by “high energy consumption”, “high emission” and “high pollution”. Although energy-intensive industries have developed rapidly, they have also caused great damage to the ecological environment. At present, the development of energy-intensive industries is still in the expansion stage. While driving economic growth, the consumption of highly polluting fossil energy is huge, the ecological environment is increasingly damaged, and the physical and mental health of the human body is seriously threatened. Severe environmental conditions, climate change and health threats force energy-intensive enterprises to invest in low-carbon technologies, so as to promote the transformation of energy-saving and carbon-reducing technologies and reduce carbon dioxide emissions [5]. Carbon emission reduction measures invested in low-carbon science and technology can effectively reduce the adverse impact of climate change and improve people’s health benefits. However, at present, low-carbon science and technology still have problems such as imperfect system mechanisms, construction ideas, innovation paths and development theory. Moreover, due to the uncertainty of market and technological progress, it brings many obstacles to enterprises’ choice of transformation path. In addition, low-carbon technology investment projects have a long cycle span, a large amount of investment capital, a long return cycle and irreversibility. These characteristics make project investment relatively risky, which requires enterprises to take income maximization as the goal when investing and master the mechanism of policy to play a role, so as to obtain the maximum economic and environmental benefits.

Therefore, in the context of a low-carbon economy, it is necessary to transform the production mode and crack the environmental constraint problem by developing and utilizing low-carbon technologies. By examining the investment strategies of high energy-consuming enterprises in low-carbon technologies under different subsidy strategies, this paper constructs an investment decision model under financial constraints and provides an in-depth analysis of the influencing factors of low-carbon technology investment in high energy-consuming enterprises. Through the research of this paper, we aim to provide an optimization method for the government to refine the low-carbon technology investment incentive policy and for the managers of high energy-consuming enterprises to formulate a scientific and reasonable low-carbon technology investment and financing strategy, which is important to enhance the healthy synergistic benefits of carbon emission reduction and achieve green and sustainable economic development.

2. Literature Review

In recent years, the research on government low-carbon subsidies mainly focuses on the supply chain and provides subsidies to retailers, suppliers, consumers and other subjects. From the perspective of subsidy objects, Liu et al. [6] considered the effects of low-carbon consumption preferences and government subsidies on firms’ low-carbon production decisions, and apply optimality theory to study optimal pricing strategies and optimal carbon reduction strategies. Lu et al. [7] also considered subsidies for recyclers and consumers and studied the production and pricing strategies of enterprises. From the perspective of subsidy methods, Ma et al. [8], respectively, discussed the effects of government consumption subsidies and information asymmetry on participants’ performance and analyzed four situations: no subsidies and information asymmetry under complete information, subsidies under complete information and subsidies under asymmetric information. Yang et al. [9] used the real option method to compare the effects of different subsidy schemes such as the initial investment subsidy, electricity price subsidy and CO2 utilization subsidy on the investment benefit of CCUS projects at different price levels. From the perspective of the subsidy effect, Aryanpur et al. [10] proposed the mechanism of energy subsidy reform at different stages of carbon emissions. Abrell et al. [11] used the heterogeneity of weather conditions to assess changes in carbon emissions and costs caused by subsidies for renewable energy (wind and solar). Adekunle et al. [12] used a nonlinear autoregressive distributed lag estimation program to measure the concurrent impact of fuel subsidies on carbon intensity in Nigeria.

Low carbon investment decision-making behavior is to reduce carbon dioxide emissions as the goal through the introduction of low carbon technology means and achieve the enterprise’s low carbon development investment decision-making behavior. Existing research on low-carbon investment mainly focuses on investment efficiency, incentive mechanism and investment timing. From the perspective of green investment efficiency, Pan et al. [13] evaluated the efficiency of green investment through the relaxation model (SBM) and “super efficiency” (DEA) model using panel data of iron and steel enterprises and studied the impact of public environmental concerns on the efficiency of green investment. Liu et al. [14] made a comprehensive evaluation of the efficiency of green investment in China’s energy industry by using the data of 113 relevant listed enterprises from 2010 to 2018. Yu et al. [15] adopted data envelopment analysis (DEA) and simulation technology to accurately evaluate the efficiency of green portfolios from the perspective of investors’ subjective risk. From the perspective of incentive mechanisms, most scholars start with government policies to discuss the role of government carbon regulation on low-carbon investment. Liu et al. [16] developed a game model to study the impact of carbon tax policies on low-carbon investment decisions in agricultural supply chains. Ohlendorf et al. [17] believed that adding the carbon price floor level index into the carbon trading system can stabilize the expectation of future carbon prices, thus promoting low-carbon investment. Meng et al. [18] took renewable energy enterprises as research objects and studied the impact of carbon subsidies and carbon taxes on enterprise investment efficiency from the perspective of property heterogeneity. From the perspective of low-carbon investment timing, Najafi et al. [19] established a real option valuation framework based on Monte Carlo simulation and adaptive backward dynamic least squares programming and studied the influence of volatility and drift rate of electricity market price on the optimal investment timing and exercise value of extended options. Liu et al. [20] developed a differential game model to investigate the impact of the relationship between fresh food suppliers and retailers on R&D investments in pre-cooling and carbon reduction technologies. Bakker et al. [21] studied the optimal time to invest in mature oil and gas fields under the condition of price uncertainty. Ofori et al. [22] combined a binary tree model with a Monte Carlo simulation to evaluate the optimal investment timing in the first cycle of a renewable energy project master plan.

Under the high cost of low-carbon technology research and development, enterprises need to raise funds for carbon emission reduction through financing. At present, the research on low-carbon financing mainly focuses on the financing model, financing risk, financing effect and other aspects. From the perspective of the financing model, Owen et al. [23] discussed the role of public sector support for high and low-income countries in grants, equity, debt and new forms of crowdfunding. Xia et al. [24] took the capital-constrained closed-loop supply chain as the research object and studied the optimal production and financing strategies under the four financing strategies of sufficient capital, limited capital without financing, debt financing and prepayment financing. Chaudhari et al. [25] proposed an inventory model in the context of carbon tax policies and investigate how down payment cash credits affect business strategies for perishable items. From the perspective of risk, Wu et al. [26] constructed an asymmetric duopoly model of two competitive supply chains with different carbon emission technologies and studied the influence of financing risk of investment in carbon emission technologies in supply chains on pricing. Spasenic et al. [27] adopted the qualitative analysis method to conduct a credit risk assessment on the financing of small hydropower station projects in Serbia to identify and describe risk events that may lead to loan default. From the perspective of the financing effect, Gu et al. [28] established a climate-economic-technology comprehensive assessment model and studied the implementation effect of low-carbon technology financing on climate mitigation, technology extension and economic development in the context of climate change cooperation. Bhadoriya et al. [29] studied the combined effects of carbon emissions, exchange programs, trade credit and advertising effort in the buyer’s inventory decision to seek the buyer’s optimal total profit in terms of cycle time, selling price and advertising cost. Yu et al. [30] introduced financing constraints into the partial equilibrium analysis framework of heterogeneous enterprises and revealed the influence mechanism of financing constraints on pollutant emission of enterprises. The results showed that financing constraints could significantly improve the emission intensity of enterprises. Al Mamun et al. [31] found through a large sample survey of 46 countries that green finance can significantly reduce carbon emissions in both the short and long term, and this effect is more obvious in developed credit markets and economies with high success rates of innovation and high risk of climate change.

Throughout the above literature, there are relatively few studies from the perspective of enterprises’ low carbon investment strategies, and most of the literature focuses on whether to make investments based on macro analysis of data performance, ignoring the influence of government policies as well as market changes. In addition, in the study of carbon emission reduction investment, most of the literature studied the subsidy mode and financing mode of enterprises separately, but less literature combined different subsidy modes and financing modes into different combination strategies and conducted a comparative analysis of different combination strategies. In summary, this paper analyzes the impact of each factor on corporate investment in low-carbon technology from the perspective of the government, market and enterprises themselves, and uses the Stackelberg game approach to study the problem of low-carbon technology investment decisions. Compared with the existing studies, the innovations of this paper are as follows: (1) Differently from the macro emission reduction studies on the regional economy and industry performance, this paper focuses on micro subjects and explores how enterprises can achieve technological progress and the linkage development of carbon subsidy-carbon trading mechanism-carbon tax through government policy innovation. (2) Combining carbon quotas and trading mechanisms, the paper integrates low-carbon technology investment decisions under multiple uncertainties such as carbon tax, consumers’ low carbon preferences, and carbon emission reduction subsidies. (3) Considering the possible financial constraints of high energy-consuming enterprises with sufficient retailer funds, the retailer financing approach is introduced, and the low-carbon technology investment and financing strategies of high energy-consuming enterprises under financial constraints are studied.

3. Problem Description and Basic Assumptions

Because investment in low-carbon technology is expensive, companies can raise money by borrowing from well-capitalized companies up and down the supply chain. The upstream and downstream enterprises in the supply chain can obtain certain interest income by lending funds. Therefore, enterprises with sufficient capital are willing to provide funds to enterprises with capital constraints. In addition to the extra interest, the profits of downstream retailers will also increase as enterprises invest in low-carbon technology for carbon emission reduction.

In this paper, we construct a supply chain consisting of upstream energy-consuming enterprises and downstream retailers with the energy-consuming enterprises occupying a dominant position as the executors of low-carbon technology investment. The energy-consuming enterprises have their own funds to meet their normal production and operation activities but they have no surplus funds to invest in low-carbon technology, while the downstream retailers have sufficient funds, and the retailers provide low-carbon technology investment funds to the energy-consuming enterprises at interest rate . There is no impact on productivity and the investment is irreversible, and the risk attitude of energy-consuming enterprises is neutral. Under the carbon quota and trading policy, the government issues carbon quotas to energy-intensive enterprises as . The enterprises invest in low-carbon technologies and then put their excess carbon credits on the carbon market for sale at a price of ; before investing in low-carbon technology, the carbon emission of high energy-consuming enterprises producing unit products is . After investing in low-carbon technology, the carbon emission of high energy-consuming enterprises producing unit products is and the emission reduction rate of low-carbon technology is ; in addition, drawing on the study of Luo et al. [32], the cost of carbon abatement technology for high energy-consuming enterprises is correlated with carbon emission reduction, and the two are positively correlated. It is assumed that the one-time investment cost of low carbon technology is , where is the cost coefficient of adopting low carbon technology in high energy-consuming enterprises, which represents the cost level of low carbon technology.

Enterprises with high energy consumption need to pay a certain amount of carbon tax, which is calculated according to the total amount of carbon emissions produced by enterprises in a year. The carbon tax payable by enterprises after investing in low-carbon technology is as follows: , is the carbon tax rate. Assume that the market demand function is:

where is the potential market demand, meet ; represents the consumer price elasticity coefficient; represents the sensitivity coefficient of consumers to the unit emission reduction in low-carbon products. The higher the level of carbon emission reduction of a product, the higher the demand for the product.

The specific parameter Settings are shown in Table 1:

Table 1.

Parameter setting and meaning description.

4. Model Construction and Solution

4.1. The Construction and Solution of Investment Strategy Model of No Carbon Emission Reduction Subsidy

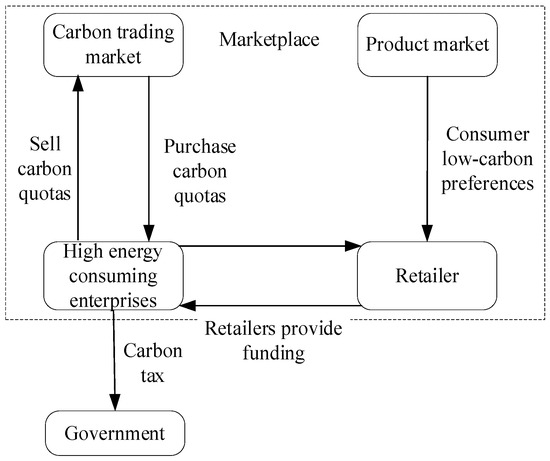

In order to compare and analyze the investment effect of government subsidies and supply chain upstream and downstream enterprises, the model and results under the condition of non-government subsidies are given as the lower limit of the comparison of the effect of government subsidy policies, and the profits of both parties after the government provides subsidies should be higher than that without subsidies. The research framework is shown in Figure 1.

Figure 1.

Scenario 1 research framework.

As the dominant player in the supply chain, high energy-consuming enterprises take profit maximization as the goal and first determine the carbon emission reduction level and product wholesale price. Retailers then determine the selling price of products according to the decisions of high energy-consuming enterprises. Meanwhile, from the perspective of the market demand function, the decisions of high energy-consuming enterprises will also affect the demand of consumers, thus affecting the profits of retailers. According to scenario 1 research framework in Figure 1, the investment optimization models of high energy-consuming enterprises and retailers are as follows:

The backward induction method is used to solve the investment optimization model of high energy-consuming enterprises and retailers.

Calculate the first partial derivative of the retail price of the retailer in Equation (3), and the first derivative is , and the second derivative is , there is an optimal retail price to maximize the retailer’s profit. Let the first derivative be 0, and get the optimal retail price:

Equation (4) is substituted into the profit model of high energy-consuming enterprises, and we can obtain:

The second partial derivative of and in Equation (5) is obtained to obtain the Hessian Matrix:

According to the judgment principle:

When , there is an optimal wholesale price and carbon emission reduction rate that make the profits of energy-intensive enterprises reach the maximum, take the derivative of and in Equation (5) and set them as 0 to obtain the optimal wholesale price and the optimal carbon emission reduction rate:

By substituting Equations (6) and (7) into Equation (4), the optimal retail price can be obtained:

By substituting Equations (7) and (8) into Equation (1), the market demand is:

Therefore, the profit model of high energy-consuming enterprises and downstream retailers can be written as follows:

Corollary 1.

In the distributed decision-making without carbon emission reduction subsidy, when is satisfied, as the price of carbon emission rights increases, the unit carbon emission reduction shows an upward trend, and the profit of high energy-consuming enterprises increases with the increase of the price of carbon emission rights.

Proof.

Equations (7) and (10) calculate the first-order partial derivative of carbon emission right price , and obtain:

, , the function is monotonically increasing, in other words, the larger is, the larger and are, indicating that the price of carbon emission right can promote high energy-consuming enterprises to invest in low-carbon science and technology. Thus, inference 1 is proved. □

Corollary 2.

In the distributed decision without carbon emission reduction subsidy, when is satisfied, with the increase of the carbon tax rate, the unit carbon emission reduction showed an upward trend, and the profits of energy-intensive enterprises decreased with the increase of the carbon tax rate.

Proof.

Equations (7) and (10) obtain the first-order partial derivative of the carbon tax rate , and obtain:

According to , , the larger is, the larger is, and the smaller is indicating that carbon tax can promote energy-intensive enterprises to reduce carbon emissions. However, the imposition of a carbon tax will increase the cost of enterprises, so the profits of enterprises will decline, which can be proved by inference 2. □

Corollary 3.

In the distributed decision without carbon emission reduction subsidy, when is satisfied, with the increase of consumers’ sensitivity coefficient of low carbon level, unit carbon emission reduction presents an upward trend, and the profits of high energy-consuming enterprises increase accordingly.

Proof.

Equations (7) and (10) calculate the first-order partial derivative of the sensitivity coefficient of low carbon level to consumers, and obtain:

According to , , the function is monotonically increasing, in other words, the larger the is, the larger the and are, which indicates that the low carbon level sensitivity coefficient of consumers can promote the high energy-consuming enterprises to invest in low carbon technology. Therefore, conclusion 3 can be proven. □

Corollary 4.

In the distributed decision without carbon emission reduction subsidies, when

is satisfied, unit carbon emission reduction shows a downward trend with the increase of repayment interest rate, and the profit of high energy-consuming enterprises decreases with the increase of repayment interest rate.

Proof.

Equations (7) and (10) obtain the first-order partial derivative of repayment interest rate , and obtain:

According to , , in other words, the larger is, the smaller and are, indicating that the increase in the repayment interest rate increases the investment cost of enterprises, which is not conducive to enterprises’ investment in low-carbon technology, so inference 4 can be proved. □

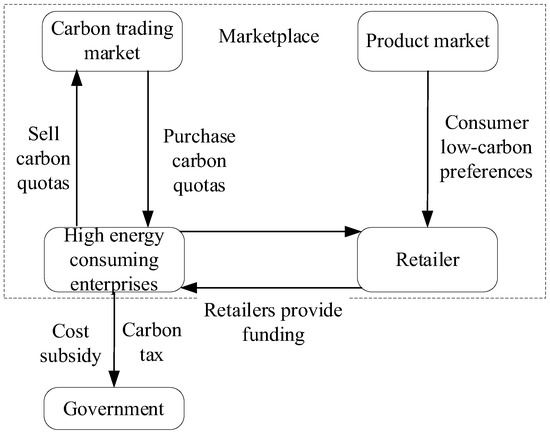

4.2. Construction and Solution of Investment Strategy Model under Cost Subsidy

This section presents a decentralized decision-making model for low-carbon technology investment of high energy-consuming enterprises considering government cost subsidies under internal financing. The cost subsidy ratio is set as (0 < < 1), and the subsidy limit is set as . The research framework is shown in Figure 2.

Figure 2.

Scenario 2 research framework.

According to scenario 2 research framework in Figure 2, the investment optimization models of high energy-consuming enterprises and retailers are as follows:

Similarly, calculate the first partial derivative of the retail price of the retailer in Equation (13), the first derivative is and the second derivative is , then there is an optimal retail price to maximize the profit of the retailer. Let the first derivative be 0, and obtain the optimal retail price:

Equation (14) is substituted into the profit model of high energy-consuming enterprises:

The second partial derivative of and in Equation (15) is obtained to obtain the Hessian Matrix:

According to the decision principle:

When , there is an optimal wholesale price and carbon emission reduction rate that maximizes the profits of high energy-consuming enterprises, by taking the derivative of and in Equation (15) and setting them to 0, the optimal wholesale price and carbon emission reduction rate can be obtained as follows:

By substituting Equations (16) and (17) into Equation (14), the optimal retail price can be obtained as:

By substituting Equations (17) and (18) into Equation (1), the market demand is:

Therefore, the profit model of high energy-consuming enterprises and downstream retailers can be written as follows:

Corollary 5.

In the decentralized decision making under cost subsidies, when

is satisfied, the unit carbon emission reduction rate shows an upward trend with the increase of carbon emission right price, and the profit of high energy-consuming enterprises increases with the increase of carbon emission right price.

Proof.

Equations (17) and (20) calculate the first-order partial derivative of carbon emission right price , and obtain:

According to , , the function presents monotonically increasing property, that is, the larger is, the larger and are, which indicates that the price of carbon emission right can promote the investment in low-carbon science and technology by high energy-consuming enterprises. Thus, inference 5 can be proved. □

Corollary 6.

In the decentralized decision making under cost subsidies, when

is satisfied, the unit carbon emission reduction rate will rise with the increase of carbon tax rate, and the profits of energy-intensive enterprises will decrease with the increase of carbon tax rate.

Proof.

Equations (17) and (20) obtain the first-order partial derivative of the carbon tax rate , and obtain:

If , , indicates that the larger is, the larger is, and the smaller is, which indicates that carbon tax can promote high energy-consuming enterprises to reduce carbon emissions. However, since the imposition of carbon tax increases enterprise costs, the profits of enterprises will decline. Therefore, deduction 6 can be proved. □

Corollary 7.

In the distributed decision-making under cost subsidies, when

, the unit carbon emission reduction rate presents an upward trend, and the profits of high energy-consuming enterprises will increase accordingly.

Proof.

Equations (17) and (20) calculate the first-order partial derivative of the sensitivity coefficient of low carbon level of consumers, and obtain:

, , it can be seen that the function presents a monotonically increasing property, that is, the larger is, the larger and are, indicating that the low carbon level sensitivity coefficient of consumers can promote high energy-consuming enterprises to invest in low carbon science and technology, so inference 7 can be proved. □

Corollary 8.

In the distributed decision-making under cost subsidies, when

is satisfied, unit carbon emission reduction shows a downward trend with the increase of repayment interest rate, and the profit of energy-consuming enterprises decreases with the increase of repayment interest rate.

Proof.

Equations (17) and (20) calculate the first-order partial derivative of repayment interest rate , and obtain:

If , , it can be seen that the larger is, the smaller and are, indicating that the increase in repayment interest rate increases enterprise investment cost, which is not conducive to enterprise investment in low-carbon science and technology. Therefore, deduction 8 can be proved. □

Corollary 9.

In the distributed decision making under cost subsidies, when

, the unit carbon emission reduction level will rise with the increase of the cost subsidy coefficient of low-carbon science and technology investment, and the profits of high energy-consuming enterprises will rise accordingly.

Proof.

Equations (17) and (20) obtain the first-order partial derivative of the cost subsidy coefficient , and obtain:

If , , it can be seen that the function presents a monotonically increasing property, that is, the larger is, the larger and are, which indicates that the government subsidies the investment cost of low-carbon science and technology can promote high energy consumption enterprises to invest in low-carbon science and technology, so inference 9 can be proved. □

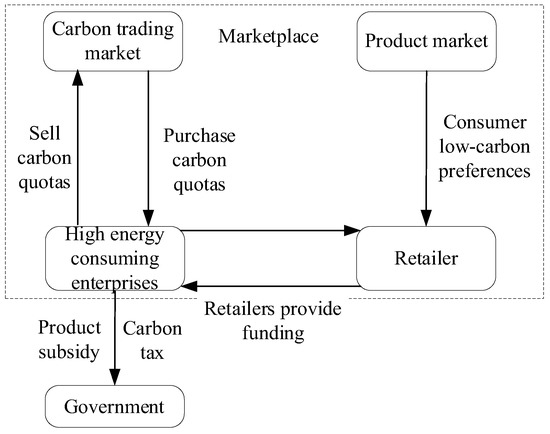

4.3. Construction and Solution of Investment Strategy Model under Product Subsidy

On the basis of the above assumptions, this section constructs a decentralized decision-making model for low-carbon technology investment of high energy-consuming enterprises considering government product subsidies under internal financing. Compared with the results of other models in this paper, we set the cost subsidy ratio as ( > 0) and the subsidy limit as . The research framework is shown in Figure 3.

Figure 3.

Scenario 3 research framework.

According to scenario 3 research framework in Figure 3, the investment optimization models of high energy-consuming enterprises and retailers are as follows:

Similarly, calculate the first partial derivative of the retail price of the retailer in Equation (23). The first derivative is , and the second derivative is , then there is an optimal retail price that maximizes the profit of the retailer. Let us set the first derivative to 0 and get the optimal retail price:

Equation (24) is substituted into the profit model of high energy-consuming enterprises:

The second partial derivative of and in Equation (25) is obtained to obtain the Hessian Matrix:

According to the decision principle:

When is met, there exists an optimal wholesale price and carbon emission reduction rate that maximizes the profits of high energy-consuming enterprises. By taking the derivative of and in Equation (25) and setting them to 0, the optimal wholesale price and carbon emission reduction rate can be obtained as follows:

By substituting Equations (26) and (27) into Equation (24), the optimal retail price is:

By substituting Equations (27) and (28) into Equation (1), the market demand can be written as:

Thus, the profit model of high energy-consuming enterprises and downstream retailers can be written as:

Corollary 10.

In the distributed decision-making under product subsidies, when

is met, unit carbon emission reduction shows an upward trend with the increase of carbon emission right price, and the profits of high energy-consuming enterprises increase with the increase of carbon emission right price.

Proof.

Equations (27) and (30) obtain the first-order partial derivative of carbon emission right price , and obtain:

If , , the function presents a monotonically increasing property, that is, the larger is, the larger and are, which indicates that the price of carbon emission right can promote high energy consumption enterprises to invest in low carbon science and technology, so inference 10 can be proved. □

Corollary 11.

In distributed decision-making under product subsidies, when

is satisfied, unit carbon emission reduction shows an upward trend with the increase of carbon tax rate, and profits of energy-intensive enterprises decrease with the increase of carbon tax rate.

Proof.

Equations (27) and (30) obtain the first-order partial derivative of the carbon tax rate , and obtain:

If , , it can be seen that the larger is, the larger is, and the smaller is, which means that carbon tax can promote high energy-consuming enterprises to reduce carbon emissions. However, the imposition of a carbon tax will increase the cost of enterprises, so the profits of enterprises will decline. Therefore, inference 11 can be proved. □

Corollary 12.

In the distributed decision-making under product subsidies, when

is satisfied, the unit carbon emission reduction shows an upward trend with the increase of the low carbon level sensitivity coefficient of consumers, and the profits of high energy-consuming enterprises will increase accordingly.

Proof.

Equations (27) and (30) calculate the first partial derivative of the sensitivity coefficient of the low carbon level of consumers, and obtain:

If , , it can be seen that the function presents a monotonically increasing property, that is, the larger is, the larger and are, indicating that the low carbon level sensitivity coefficient of consumers can promote high energy-consuming enterprises to invest in low carbon science and technology, which can be proven by inference 12. □

Corollary 13.

In distributed decision-making under product subsidies, when

is satisfied, unit carbon emission reduction shows a downward trend with the increase of repayment interest rate, and profits of high energy-consuming enterprises decrease with the increase of repayment interest rate.

Proof.

Equations (17) and (20) obtain the first-order partial derivative of repayment interest rate , and obtain:

If , , it can be seen that the larger is, the smaller and are, indicating that the increase in the repayment interest rate increases enterprise investment costs, which is not conducive to enterprise investment in low-carbon science and technology. Therefore, deduction 13 can be proved. □

Corollary 14.

In the distributed decision-making under product subsidies, when

is satisfied, the unit carbon emission reduction level shows an upward trend with the increase of the subsidy coefficient of low-carbon technology investment products, and the profit of high energy-consuming enterprises increases with the increase of the subsidy coefficient.

Proof.

Formulas (27) and (30) calculate the first-order partial derivative of the product subsidy coefficient , and obtain:

If , , it can be seen that the function presents a monotonically increasing property, that is, the larger is, the and are, which indicates that government subsidies for low-carbon technology investment products can promote high energy-consuming enterprises to invest in low-carbon technology. Therefore, inference 14 can be proved. □

5. Numerical Algorithms and Simulations

In order to verify the above inference and analyze the influence of each variable on the carbon reduction rate and profit, the paper sets the values of each variable, brings them into the above equation for solving and draws the relationship between the independent and dependent variables. Due to the large amount of investment in low-carbon technology and its early stage of development, limited by the current level of technological development, it is difficult to obtain complete data. Therefore, in terms of data selection, some data are selected from the “China Steel Yearbook 2022” [33] and the “Baoshan Iron and Steel Co., Ltd. (Shanghai, China) 2022 Sustainable Development Report” [34], while others refer to existing literature [35]. The parameter values are set as follows:

| Parameter | β | Q0 | α | C | A | |

|---|---|---|---|---|---|---|

| Value | 10 (t) | 100,000 (104 CNY/pcs) | 20,000 (pcs) | 30 (104 CNY/pcs) | 0.8 (104 CNY/pcs) | 150,000 (t) |

5.1. The Impact of Carbon Emission Right Price

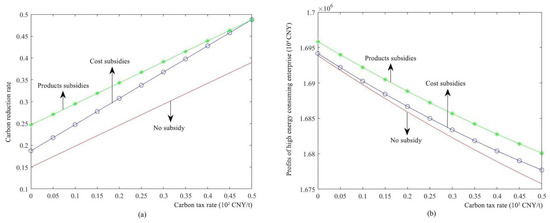

As can be seen from Figure 4a, under the three subsidy modes of no subsidy, cost subsidy and product subsidy, the carbon emission reduction rate increases with the increase in carbon emission right price. With the increase in carbon emission permit price, enterprises will gain higher income from selling the surplus carbon quota in the carbon trading market. At the same time, the increase in carbon emission reduction, product market demand and product sales revenue will increase. The increase in product sales revenue will exceed the sum of low-carbon technology investment and loan interest to retailers of high energy-consuming enterprises, and the profits of high energy-consuming enterprises will show an upward trend (Figure 4b).

Figure 4.

The impact of carbon emission right price. (a) The impact of carbon emission right price on carbon reduction rate; (b) The impact of carbon emission right price on profit.

As can be seen from Figure 4, carbon trading prices without subsidies, product subsidies and cost subsidies have the same influence trend on carbon emission reduction rate and profits of high energy-consuming enterprises. Carbon emission reduction rate and the profits of high energy-consuming enterprises under product subsidies and cost subsidies are all higher than those under no subsidies, indicating that the subsidy strategy can effectively motivate enterprises to carry out carbon emission reduction work. Compared with cost subsidies, the carbon emission reduction rate and profit of high energy-consuming enterprises are higher than that of cost subsidies. However, with the increase in carbon emission right price, the sensitivity of product subsidies to carbon emissions decreases gradually. Therefore, the government should flexibly formulate subsidy strategies according to the change in carbon price.

5.2. The Impact of Carbon Tax Rate

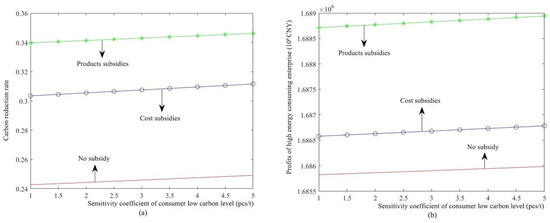

As can be seen from Figure 5a, under the three subsidy modes of no subsidy, cost subsidy and product subsidy, the carbon emission reduction rate increases with the increase in the carbon tax rate. The higher the carbon tax rate is, the higher the carbon tax rate enterprises need to pay, which brings higher costs to enterprises. Therefore, in order to reduce the cost, enterprises will actively carry out carbon emission reduction work and encourage enterprises to invest in low-carbon technology, thus increasing the carbon emission reduction rate of enterprises. On the other hand, it can be seen from Figure 5b that the profits of high energy-consuming enterprises all show a downward trend. This is because when the carbon tax rate is high, the carbon emission reduction rate of enterprises is at a high level, and the cost of investing in low-carbon technology is also high. The increase in sales revenue of high energy-consuming enterprises is less than the sum of the cost and interest of investing in low-carbon technology, so their profits decline.

Figure 5.

The impact of carbon tax rate. (a) The impact of carbon tax rate on carbon reduction rate; (b) The impact of carbon tax rate on profit.

As can be seen from Figure 5, the carbon tax rate without subsidies, product subsidies and cost subsidies have the same influence trend on the carbon emission reduction rate and the profits of high energy-consuming enterprises. The carbon emission reduction rate and the profits of high energy-consuming enterprises under product subsidies and cost subsidies are all higher than those without subsidies, indicating that the subsidy strategy can effectively motivate enterprises to carry out carbon emission reduction work. Compared with cost subsidies, the carbon emission reduction rate and profit of high energy-consuming enterprises are higher than that of cost subsidies, and the incentive effect of product subsidies is more obvious than that of cost subsidies.

5.3. The Impact of Sensitivity Coefficient of Consumer Low Carbon Level

As can be seen from Figure 6a, under the three subsidy modes of no subsidy, cost subsidy and product subsidy, the carbon emission reduction rate increases with the increase in the sensitivity coefficient of consumers’ low carbon level. The higher the sensitivity coefficient of consumers’ low carbon level, the higher the price and market demand of consumers’ low carbon products will increase. In order to sell more products and seize more market shares, enterprises will increase the carbon emission reduction rate of the products. As a result, high energy-consuming enterprises and retailers will gain more income from product sales. The increased income from product sales exceeds the cost of enterprises’ investment in low-carbon technology. Therefore, enterprises with high energy consumption tend to increase gradually (as shown in Figure 6b).

Figure 6.

The impact of sensitivity coefficient of consumer low carbon level. (a) The impact of sensitivity coefficient of consumer low carbon level on carbon reduction rate; (b) The impact of sensitivity coefficient of consumer low carbon level on profit.

As can be seen from Figure 6, the low carbon level sensitivity coefficient of consumers without subsidies, product subsidies and cost subsidies have the same influence trend on carbon emission reduction rate and profits of high energy-consuming enterprises. Carbon emission reduction rate and profits of high energy-consuming enterprises under product subsidies and cost subsidies are all higher than those under no subsidies, indicating that the subsidy strategy can effectively motivate enterprises to carry out carbon emission reduction work. Compared with cost subsidies, the carbon emission reduction rate and profit of high energy-consuming enterprises are higher than that of cost subsidies. With the increase in the consumers’ sensitivity coefficient of low carbon levels, the influence of product subsidies on carbon emissions is gradually reduced, but it is still greater than that of product subsidies. Moreover, under the strategy of product subsidies, enterprises’ profits increase and change their name obviously. Government product subsidies give companies a greater incentive to invest in low-carbon technologies.

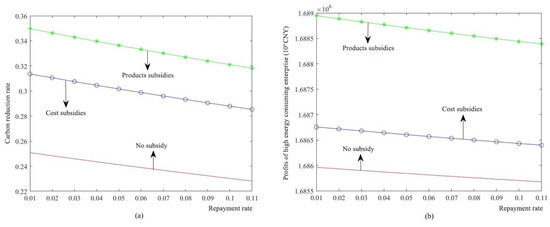

5.4. The Impact of Repayment Rate

As can be seen from Figure 7a, under the three subsidy modes of no subsidy, cost subsidy and product subsidy, the carbon emission reduction rate and the profits of energy-intensive enterprises decrease with the increase in repayment interest rate. The higher the repayment interest rate, the higher the interest enterprises need to pay, and the more cost enterprises have to pay to invest in low-carbon technology. At this time, enterprises are reluctant to invest in high-level low-carbon technology, and the carbon emission reduction rate shows a downward trend. As costs rise, the profits of energy-intensive enterprises tend to decline. In order to ensure a certain income, enterprises will limit the amount of loans and will not borrow unlimited money from retailers.

Figure 7.

The impact of repayment rate. (a) The impact of repayment rate on carbon reduction rate; (b) The impact of repayment rate on profit.

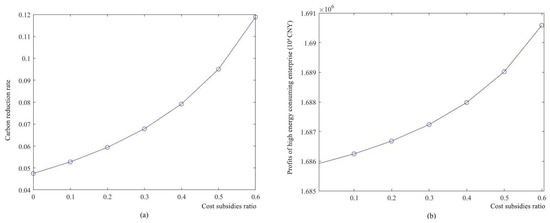

5.5. The Impact of Cost Subsidies Ratio

As can be seen from Figure 8a, the carbon emission reduction rate increases with the increase in the proportion of cost subsidies. The higher the proportion of cost subsidies, the less funds needed for investment in low-carbon technology, the less interest paid due to financing, the less cost enterprises have to pay to invest in low-carbon technology, and the more willing enterprises are to invest in low-carbon technology. In addition, after investing in low-carbon technology, the carbon emissions of products are significantly reduced, and consumers have low-carbon preferences for products, which increases the market demand for products. Moreover, compared with ordinary products, the cost of producing low-carbon products is higher. Therefore, energy-intensive enterprises will increase the wholesale price of products, and downstream retailers will increase the sales price of low-carbon products. Therefore, the profits of high energy-consuming enterprises and retailers increase with the increase in the proportion of cost subsidies, and the increase in income further strengthens the enthusiasm of enterprises to invest in low-carbon technology.

Figure 8.

The impact of cost subsidies ratio. (a) The impact of cost subsidies ratio on carbon reduction rate; (b) The impact of cost subsidies ratio on profit.

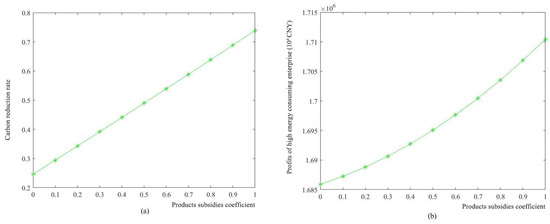

5.6. The Impact of Products Subsidies Coefficient

As can be seen from Figure 9a, the carbon emission reduction rate increases with the increase in the product subsidies coefficient. The government subsidizes the product carbon emission reduction, which makes up part of the cost of enterprises’ investment in low-carbon science and technology, thus reducing the cost. In addition, after enterprises invest in low-carbon technology, the higher the level of low-carbon technology input, the bigger the carbon emission reduction, the more product subsidies they get, the higher the market demand of products, the higher the wholesale price and sales price of products, and the higher the sales income of enterprises. For high energy-consuming enterprises, after the government subsidizes their products, they will get higher sales income by investing in low-carbon technology. Compared with without subsidies, they need to pay less cost. Therefore, enterprises are more active in investing in low-carbon technology.

Figure 9.

The impact of products subsidies coefficient. (a) The impact of products subsidies coefficient on carbon reduction rate; (b) The impact of products subsidies coefficient on profit.

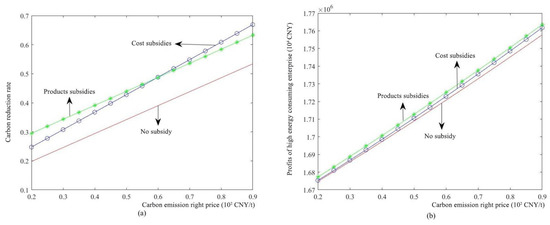

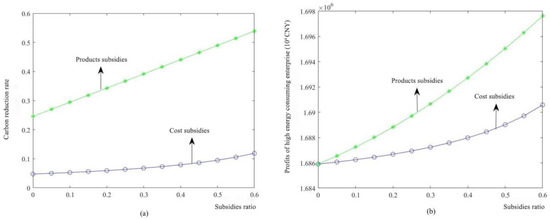

5.7. The Impact of Different Subsidies Ratio

Figure 10 depicts the trends of carbon emission reduction rate and profits of high energy-consuming enterprises when the cost subsidy ratio and product subsidy ratio are the same under internal financing. From Figure 10a, it can be seen that the carbon emission reduction level of high energy-consuming enterprises is higher when product subsidy is adopted under the same subsidy ratio, and the sensitivity of product subsidy gradually increases with the increase in the subsidy ratio, and the gap with cost subsidy gradually increases. From Figure 10b, it can be seen that under the same subsidy ratio, the profits of high energy-consuming enterprises are greater when adopting product subsidies, and with the increase in the subsidy ratio, the profits of high energy-consuming enterprises grow faster and the advantages are more obvious when adopting product subsidies; therefore, the incentive effect of adopting product subsidies is better when there are sufficient funds.

Figure 10.

The impact of different subsidies ratio. (a) The impact of different subsidies ratio on carbon reduction rate; (b) The impact of different subsidies ratio on profit.

6. Conclusions

This paper takes the supply chain composed of high energy-consuming enterprises and retailers as the research object, constructs a low-carbon technology investment decision model, analyzes the low-carbon technology investment strategies under no subsidy, cost subsidy and product subsidy when high energy-consuming enterprises are financed internally, and analyzes the effects of each influencing factor on carbon emission reduction rate, profits of high energy-consuming enterprises and profits of retailers through numerical simulation. It is found that: (1) the carbon emission reduction rate and profits of high energy-consuming enterprises under cost subsidy and product subsidy are higher than those under no subsidy policy, and the carbon emission reduction rate and profits of high energy-consuming enterprises under product subsidy are higher than those under cost subsidy. (2) The increase in consumers’ low carbon preference level, cost subsidy ratio and product subsidy coefficient have the same effect, and all of them are conducive to the increase in the carbon emission reduction rate and profit of enterprises. (3) The price of carbon credits is also an important incentive for enterprises to invest. As the price of carbon credits increases, the rate of carbon emission reduction and the profit of energy-consuming enterprises both show an increasing trend. (4) Carbon tax and repayment interest rate show negative effects, carbon tax shows positive correlation with carbon emission reduction rate and negative correlation with profits of high energy-consuming enterprises, and repayment interest rate shows negative correlation with both carbon emission reduction rate and profits of high energy-consuming enterprises.

Based on the above research results, we have drawn corresponding management insights: (1) The government should accelerate the formulation of a reasonable carbon quota allocation system and subsidy policy, effectively play the role of carbon price in regulating low carbon technology investment, and enhance the enthusiasm of high energy-consuming enterprises to invest in low carbon technology. (2) High energy-consuming enterprises should make scientific and reasonable investment plans in conjunction with national policies, increase low-carbon technology innovation, and should actively take responsibility for carbon emission reduction, so as to enhance the health benefits for consumers. (3) High energy-consuming enterprises should strengthen cooperation with other supply chain members, enhance the mobility of capital, information and technology in the supply chain and other elements, and reduce the risk of low-carbon technology investment. (4) High energy-consuming enterprises should flexibly use one-time subsidies, tax incentives and other policies to improve the efficiency of their capital use, thus alleviating the difficulties of their capital constraints and accelerating the investment in low-carbon technology research and development.

In addition, due to many uncertain factors in the operation process of low-carbon science and technology projects, the research of this paper still has shortcomings: This paper only considers the low-carbon supply chain system composed of a single high energy-consuming enterprise and a single retailer. In the actual operation process, there is a more complex supply chain system composed of multiple energy-consuming enterprises and multiple retailers. Therefore, realizing the balance of a low-carbon supply chain under multi-agents is the next research direction.

Author Contributions

Methodology, W.S.; Software, W.S.; Formal analysis, Z.L.; Investigation, W.S.; Data curation, Z.L.; writing—original draft, Z.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Social Science Fund of China (Grant No. 22BGL203).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The simulation experiment data used to support the findings of this study are available from the corresponding author upon request.

Conflicts of Interest

The authors declare that there is no conflict of interest regarding the publication of this paper.

References

- Romanello, M.; Di Napoli, C.; Drummond, P.; Green, C.; Kennard, H.; Lampard, P.; Costello, A. The 2022 report of the Lancet Countdown on health and climate change: Health at the mercy of fossil fuels. Lancet 2022, 400, 1619–1654. [Google Scholar] [CrossRef] [PubMed]

- Jiang, B.; Li, Y.; Yang, W. Evaluation and treatment analysis of air quality including particulate pollutants: A case study of Shandong province, China. Int. J. Environ. Res. Public Health 2020, 17, 9476. [Google Scholar] [CrossRef] [PubMed]

- Tong, D.; Geng, G.; Zhang, Q.; Cheng, J.; Qin, X.; Hong, C.; He, K.; Davis, S.J. Health co-benefits of climate change mitigation depend on strategic power plant retirements and pollution controls. Nat. Clim. Chang. 2021, 11, 1077–1083. [Google Scholar] [CrossRef]

- Yang, W.; Hu, Y.; Ding, Q.; Gao, H.; Li, L. Comprehensive Evaluation and Comparative Analysis of the Green Development Level of Provinces in Eastern and Western China. Sustainability 2023, 15, 3965. [Google Scholar] [CrossRef]

- Liu, Q.; Zhu, Y.; Yang, W.; Wang, X. Research on the impact of environmental regulation on green technology innovation from the perspective of regional differences: A quasi-natural experiment based on China’s new environmental protection law. Sustainability 2022, 14, 1714. [Google Scholar] [CrossRef]

- Liu, Z.; Sun, W.; Hu, B.; Han, C.; Ieromonachou, P.; Zhao, Y.; Zheng, J. Research on supply chain optimization considering consumer subsidy mechanism in the context of carbon neutrality. Energies 2023, 16, 3147. [Google Scholar] [CrossRef]

- Lv, B.; Zhang, G.; Liu, Y. Nash game equilibrium model of the closed-loop supply chain network considering carbon tax mechanism and product green degree. China Popul. Resour. Environ. 2019, 29, 59–69. [Google Scholar]

- Ma, C.; Yang, H.; Zhang, W.; Huang, S. Low-carbon consumption with government subsidy under asymmetric carbon emission information. J. Clean. Prod. 2021, 318, 128423. [Google Scholar] [CrossRef]

- Yang, L.; Xu, M.; Yang, Y.; Zhang, X. Comparison of subsidy schemes for carbon capture utilization and storage (CCUS) investment based on real option approach: Evidence from China. Appl. Energy 2019, 255, 113828. [Google Scholar] [CrossRef]

- Aryanpur, V.; Fattahi, M.; Mamipour, S.; Ghahremani, M.; Gallachóir, B.Ó.; Bazilian, M.D.; Glynn, J. How energy subsidy reform can drive the Iranian power sector towards a low-carbon future. Energy Policy 2022, 169, 113190. [Google Scholar] [CrossRef]

- Abrell, J.; Kosch, M.; Rausch, S. Carbon abatement with renewables: Evaluating wind and solar subsidies in Germany and Spain. J. Public Econ. 2019, 169, 172–202. [Google Scholar] [CrossRef]

- Adekunle, I.A.; Oseni, I.O. Fuel subsidies and carbon emission: Evidence from asymmetric modelling. Environ. Sci. Pollut. Res. 2021, 28, 22729–22741. [Google Scholar] [CrossRef] [PubMed]

- Pan, K.; He, F. Does Public Environmental Attention Improve Green Investment Efficiency?—Based on the Perspective of Environmental Regulation and Environmental Responsibility. Sustainability 2022, 14, 12861. [Google Scholar] [CrossRef]

- Liu, L.; Zhao, Z.; Zhang, M.; Zhou, D. Green investment efficiency in the Chinese energy sector: Overinvestment or underinvestment? Energy Policy 2022, 160, 112694. [Google Scholar] [CrossRef]

- Yu, W.; Liu, S.; Ding, L. Efficiency Evaluation and Selection Strategies for Green Portfolios under Different Risk Appetites. Sustainability 2021, 13, 1933. [Google Scholar] [CrossRef]

- Liu, Z.; Lang, L.; Hu, B.; Shi, L.; Huang, B.; Zhao, Y. Emission reduction decision of agricultural supply chain considering carbon tax and investment cooperation. J. Clean. Prod. 2021, 294, 126305. [Google Scholar] [CrossRef]

- Ohlendorf, N.; Flachsland, C.; Nemet, G.F.; Steckel, J.C. Carbon price floors and low-carbon investment: A survey of German firms. Energy Policy 2022, 169, 113187. [Google Scholar] [CrossRef]

- Meng, Z.; Sun, H.; Liu, X. Impact of green fiscal policy on the investment efficiency of renewable energy enterprises in China. Environ. Sci. Pollut. Res. 2022, 29, 76216–76234. [Google Scholar] [CrossRef]

- Najafi, P.; Talebi, S. Using real options model based on Monte-Carlo Least-Squares for economic appraisal of flexibility for electricity generation with VVER-1000 in developing countries. Sustain. Energy Technol. Assess. 2021, 47, 101508. [Google Scholar] [CrossRef]

- Liu, Z.; Huang, Y.; Shang, W.; Zhao, Y.; Yang, L.; Zhao, Z. Precooling Energy and Carbon Emission Reduction Technology Investment Model in a Fresh Food Cold Chain based on a Differential Game. Appl. Energy 2022, 10, 119945. [Google Scholar] [CrossRef]

- Bakker, S.J.; Kleiven, A.; Fleten, S.E.; Tomasgard, A. Mature offshore oil field development: Solving a real options problem using stochastic dual dynamic integer programming. Comput. Oper. Res. 2021, 136, 105480. [Google Scholar] [CrossRef]

- Ofori, C.G.; Bokpin, G.A.; Aboagye, A.Q.; Afful-Dadzie, A. A real options approach to investment timing decisions in utility-scale renewable energy in Ghana. Energy 2021, 235, 121366. [Google Scholar] [CrossRef]

- Owen, R.; Brennan, G.; Lyon, F. Enabling investment for the transition to a low carbon economy: Government policy to finance early stage green innovation. Curr. Opin. Environ. Sustain. 2018, 31, 137–145. [Google Scholar] [CrossRef]

- Xia, X.; Chen, W.; Liu, B. Optimal production decision and financing strategy for a capital-constrained closed loop supply chain under fairness concern. J. Clean. Prod. 2022, 376, 134256. [Google Scholar] [CrossRef]

- Chaudhari, U.; Bhadoriya, A.; Jani, M.Y.; Sarkar, B. A generalized payment policy for deteriorating items when demand depends on price, stock, and advertisement under carbon tax regulations. Math. Comput. Simul. 2023, 207, 556–574. [Google Scholar] [CrossRef]

- Wu, T.; Kung, C.C. Carbon emissions, technology upgradation and financing risk of the green supply chain competition. Technol. Forecast. Soc. Chang. 2020, 152, 119884. [Google Scholar] [CrossRef]

- Spasenic, Z.; Makajic-nikolic, D.; Benkovic, S. Risk assessment of financing renewable energy projects: A case study of financing a small hydropower plant project in Serbia. Energy Rep. 2022, 8, 8437–8450. [Google Scholar] [CrossRef]

- Gu, G.; Zhang, W.; Cheng, C. Mitigation effects of global low carbon technology financing and its technological and economic impacts in the context of climate cooperation. J. Clean. Prod. 2022, 381, 135182. [Google Scholar] [CrossRef]

- Bhadoriya, A.; Jani, M.Y.; Chaudhari, U. Combined Effect of Carbon Emission, Exchange Scheme, Trade Credit, and Advertisement Efforts in a Buyer’s Inventory Decision. Process Integr. Optim. Sustain. 2022, 6, 1043–1061. [Google Scholar] [CrossRef]

- Yu, L.; Zhang, B.; Yan, Z.; Cao, L. How do financing constraints enhance pollutant emissions intensity at enterprises? Evidence from microscopic data at the enterprise level in China. Environ. Impact Assess. Rev. 2022, 96, 106811. [Google Scholar] [CrossRef]

- Al Mamun, M.; Boubaker, S.; Nguyen, D.K. Green finance and decarbonization: Evidence from around the world. Financ. Res. Lett. 2022, 46, 102807. [Google Scholar] [CrossRef]

- Luo, R.; Fan, T.; Xia, H. The game analysis of carbon reduction technology investment on supply Chain under carbon cap-and-trade rules. Chin. J. Manag. Sci. 2014, 22, 44–53. [Google Scholar]

- National Bureau of Statistics of China. China Steel Yearbook 2022; National Bureau of Statistics of China: Beijing, China, 2022.

- Baoshan Iron and Steel Co., Ltd. 2022 Sustainable Development Report. Available online: http://www.sse.com.cn/disclosure/listedinfo/announcement/c/new/2023-04-28/600019_20230428_FG11.pdf (accessed on 25 May 2023).

- Lin, Y.; Yang, H.; Ma, L.; Li, Z.; Ni, W. Low-carbon development for the iron and steel industry in China and the world: Status quo, future vision, and key actions. Sustainability 2021, 13, 12548. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).