Outward Foreign Direct Investment and Industrial Structure Upgrading: The Mediating Role of Reverse Green Technology Innovation, the Moderating Role of R&D Investment and Environmental Regulation

Abstract

1. Introduction

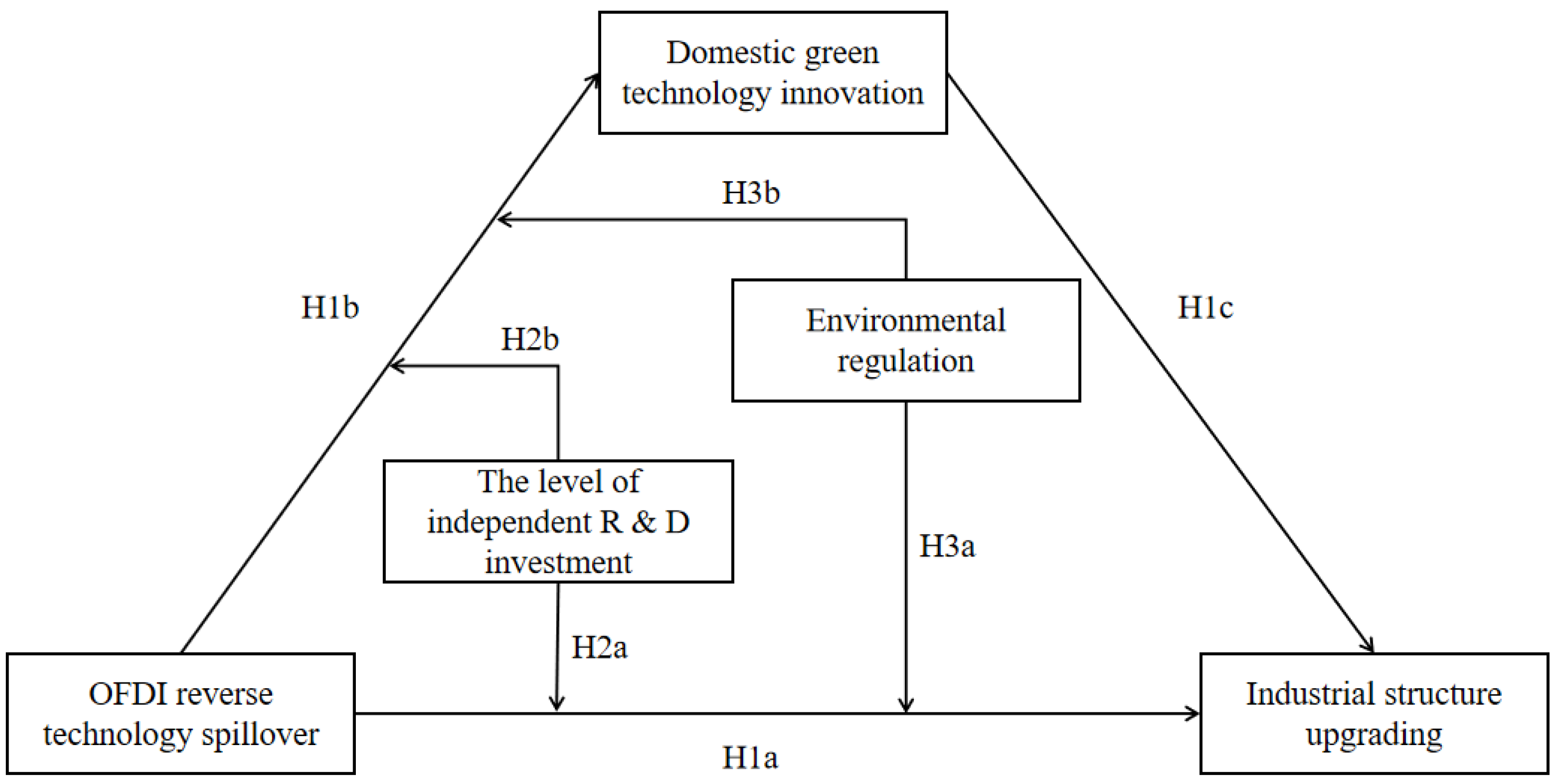

2. Theoretical Background and Hypotheses Development

2.1. OFDI, Reverse Green Technology Innovation, and Industrial Structure Upgrading

2.2. The Moderating Effect of Independent R&D Level

2.3. The Moderating Effect of Environmental Regulation

3. Research and Data Methodology

3.1. Data Sources and Descriptive Statistics

3.2. Model

3.3. Measures

4. Result

4.1. Mediating Effect Analysis

4.2. Moderated Mediation Effect Analysis

4.3. Robustness Test

5. Discussion

6. Conclusions

7. Limitations and Future Research Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Liu, L.; Zhou, H.; Xie, J. Dynamic Evolutionary Analysis of the Impact of Outward Foreign Direct Investment on Green Innovation Heterogeneity—From the Perspective of Binary Innovation. Sustainability 2023, 15, 7341. [Google Scholar] [CrossRef]

- Wu, W.-B.; Ma, J.; Meadows, M.E.; Banzhaf, E.; Huang, T.-Y.; Liu, Y.-F.; Zhao, B. Spatio-Temporal Changes in Urban Green Space in 107 Chinese Cities (1990–2019): The Role of Economic Drivers and Policy. Int. J. Appl. Earth Obs. Geoinf. 2021, 103, 102525. [Google Scholar] [CrossRef]

- Li, X.; Lu, Y.; Huang, R. Whether Foreign Direct Investment Can Promote High-Quality Economic Development under Environmental Regulation: Evidence from the Yangtze River Economic Belt, China. Environ. Sci. Pollut. Res. 2021, 28, 21674–21683. [Google Scholar] [CrossRef] [PubMed]

- Yu, X.; Li, Y. Effect of Environmental Regulation Policy Tools on the Quality of Foreign Direct Investment: An Empirical Study of China. J. Clean. Prod. 2020, 270, 122346. [Google Scholar] [CrossRef]

- He, L.; Sun, Y.; Xia, Y.; Zhong, Z. Construction of a Green Development Performance Index of Industrial Enterprises: Based on the Empirical Study of 458 Listed Industrial Enterprises in China. Ecol. Indic. 2021, 132, 108239. [Google Scholar] [CrossRef]

- Xin-gang, Z.; Jin, Z. Impacts of Two-Way Foreign Direct Investment on Carbon Emissions: From the Perspective of Environmental Regulation. Environ. Sci. Pollut. Res. 2022, 29, 52705–52723. [Google Scholar] [CrossRef]

- Cheng, Y.; Awan, U.; Ahmad, S.; Tan, Z. How Do Technological Innovation and Fiscal Decentralization Affect the Environment? A Story of the Fourth Industrial Revolution and Sustainable Growth. Technol. Forecast. Soc. Chang. 2021, 162, 120398. [Google Scholar] [CrossRef]

- Awan, U.; Arnold, M.G.; Gölgeci, I. Enhancing Green Product and Process Innovation: Towards an Integrative Framework of Knowledge Acquisition and Environmental Investment. Bus. Strategy Environ. 2021, 30, 1283–1295. [Google Scholar] [CrossRef]

- Wang, H.; Li, J. Untangling the Effects of Overexploration and Overexploitation on Organizational Performance: The Moderating Role of Environmental Dynamism. J. Manag. 2008, 34, 925–951. [Google Scholar] [CrossRef]

- Iqbal, S.; Moleiro Martins, J.; Nuno Mata, M.; Naz, S.; Akhtar, S.; Abreu, A. Linking Entrepreneurial Orientation with Innovation Performance in SMEs; the Role of Organizational Commitment and Transformational Leadership Using Smart PLS-SEM. Sustainability 2021, 13, 4361. [Google Scholar] [CrossRef]

- Guo, Y.; Xia, X.; Zhang, S.; Zhang, D. Environmental Regulation, Government R&D Funding and Green Technology Innovation: Evidence from China Provincial Data. Sustainability 2018, 10, 940. [Google Scholar] [CrossRef]

- Dong, T.; Yin, S.; Zhang, N. The Interaction Mechanism and Dynamic Evolution of Digital Green Innovation in the Integrated Green Building Supply Chain. Systems 2023, 11, 122. [Google Scholar] [CrossRef]

- Wicki, S.; Hansen, E.G. Green Technology Innovation: Anatomy of Exploration Processes from a Learning Perspective. Bus. Strategy Environ. 2019, 28, 970–988. [Google Scholar] [CrossRef] [PubMed]

- Huan, Q.; Chen, Y.; Huan, X. A Frugal Eco-Innovation Policy? Ecological Poverty Alleviation in Contemporary China from a Perspective of Eco-Civilization Progress. Sustainability 2022, 14, 4570. [Google Scholar] [CrossRef]

- Yin, S.; Yu, Y. An Adoption-Implementation Framework of Digital Green Knowledge to Improve the Performance of Digital Green Innovation Practices for Industry 5.0. J. Clean. Prod. 2022, 363, 132608. [Google Scholar] [CrossRef]

- Jin, W.; Zhang, H.; Liu, S.; Zhang, H. Technological Innovation, Environmental Regulation, and Green Total Factor Efficiency of Industrial Water Resources. J. Clean. Prod. 2019, 211, 61–69. [Google Scholar] [CrossRef]

- Eskeland, G.S.; Harrison, A.E. Moving to Greener Pastures? Multinationals and the Pollution Haven Hypothesis. J. Dev. Econ. 2003, 70, 1–23. [Google Scholar] [CrossRef]

- Lai, M.; Peng, S.; Bao, Q. Technology Spillovers, Absorptive Capacity and Economic Growth. China Econ. Rev. 2006, 17, 300–320. [Google Scholar] [CrossRef]

- Li, X. Sources of External Technology, Absorptive Capacity, and Innovation Capability in Chinese State-Owned High-Tech Enterprises. World Dev. 2011, 39, 1240–1248. [Google Scholar] [CrossRef]

- Parrado, R.; De Cian, E. Technology Spillovers Embodied in International Trade: Intertemporal, Regional and Sectoral Effects in a Global CGE Framework. Energy Econ. 2014, 41, 76–89. [Google Scholar] [CrossRef]

- Qiu, L.D.; Zhou, M.; Wei, X. Regulation, Innovation, and Firm Selection: The Porter Hypothesis under Monopolistic Competition. J. Environ. Econ. Manag. 2018, 92, 638–658. [Google Scholar] [CrossRef]

- Luo, Y.; Salman, M.; Lu, Z. Heterogeneous Impacts of Environmental Regulations and Foreign Direct Investment on Green Innovation across Different Regions in China. Sci. Total Environ. 2021, 759, 143744. [Google Scholar] [CrossRef] [PubMed]

- He, W.; Lyles, M.A. China’s Outward Foreign Direct Investment. Bus. Horiz. 2008, 51, 485–491. [Google Scholar] [CrossRef]

- Cheng, Z.; Li, L.; Liu, J. Industrial Structure, Technical Progress and Carbon Intensity in China’s Provinces. Renew. Sustain. Energy Rev. 2018, 81, 2935–2946. [Google Scholar] [CrossRef]

- Eiadat, Y.; Kelly, A.; Roche, F.; Eyadat, H. Green and Competitive? An Empirical Test of the Mediating Role of Environmental Innovation Strategy. J. World Bus. 2008, 43, 131–145. [Google Scholar] [CrossRef]

- Wu, J.; Ma, Z.; Liu, Z. The Moderated Mediating Effect of International Diversification, Technological Capability, and Market Orientation on Emerging Market Firms’ New Product Performance. J. Bus. Res. 2019, 99, 524–533. [Google Scholar] [CrossRef]

- Zhou, X.; Zhang, J.; Li, J. Industrial Structural Transformation and Carbon Dioxide Emissions in China. Energy Policy 2013, 57, 43–51. [Google Scholar] [CrossRef]

- Han, S.-Z.; Pan, W.-T.; Zhou, Y.-Y.; Liu, Z.-L. Construct the Prediction Model for China Agricultural Output Value Based on the Optimization Neural Network of Fruit Fly Optimization Algorithm. Future Gener. Comput. Syst. 2018, 86, 663–669. [Google Scholar] [CrossRef]

- Falvey, R.; Foster, N.; Greenaway, D. Imports, Exports, Knowledge Spillovers and Growth. Econ. Lett. 2004, 85, 209–213. [Google Scholar] [CrossRef]

- Chen, F.; Zhong, F.; Chen, Y. Outward Foreign Direct Investment and Sovereign Risks in Developing Host Country. Econ. Model. 2014, 41, 166–172. [Google Scholar] [CrossRef]

- Dong, Z.; Miao, Z.; Zhang, Y. The Impact of China’s Outward Foreign Direct Investment on Domestic Innovation. J. Asian Econ. 2021, 75, 101307. [Google Scholar] [CrossRef]

- Hu, J.; Wang, Z.; Lian, Y.; Huang, Q. Environmental Regulation, Foreign Direct Investment and Green Technological Progress—Evidence from Chinese Manufacturing Industries. Int. J. Environ. Res. Public Health 2018, 15, 221. [Google Scholar] [CrossRef] [PubMed]

- Wakelin, K. Productivity Growth and R&D Expenditure in UK Manufacturing Firms. Res. Policy 2001, 30, 1079–1090. [Google Scholar] [CrossRef]

- Zhang, A.; Zhang, Y.; Zhao, R. A Study of the R&D Efficiency and Productivity of Chinese Firms. J. Comp. Econ. 2003, 31, 444–464. [Google Scholar] [CrossRef]

- York, R. Residualization Is Not the Answer: Rethinking How to Address Multicollinearity. Soc. Sci. Res. 2012, 41, 1379–1386. [Google Scholar] [CrossRef]

- Jiang, M.; Luo, S.; Zhou, G. Financial Development, OFDI Spillovers and Upgrading of Industrial Structure. Technol. Forecast. Soc. Change 2020, 155, 119974. [Google Scholar] [CrossRef]

- Zhang, D.; Rong, Z.; Ji, Q. Green Innovation and Firm Performance: Evidence from Listed Companies in China. Resour. Conserv. Recycl. 2019, 144, 48–55. [Google Scholar] [CrossRef]

- Stoian, C. Extending Dunning’s Investment Development Path: The Role of Home Country Institutional Determinants in Explaining Outward Foreign Direct Investment. Int. Bus. Rev. 2013, 22, 615–637. [Google Scholar] [CrossRef]

- Zhang, W.; Li, J.; Sun, C. The Impact of OFDI Reverse Technology Spillovers on China’s Energy Intensity: Analysis of Provincial Panel Data. Energy Econ. 2022, 116, 106400. [Google Scholar] [CrossRef]

- Wang, C.; Zhang, X.; Vilela, A.L.M.; Liu, C.; Stanley, H.E. Industrial Structure Upgrading and the Impact of the Capital Market from 1998 to 2015: A Spatial Econometric Analysis in Chinese Regions. Phys. A Stat. Mech. Its Appl. 2019, 513, 189–201. [Google Scholar] [CrossRef]

- Gupeng, Z.; Xiangdong, C. The Value of Invention Patents in China: Country Origin and Technology Field Differences. China Econ. Rev. 2012, 23, 357–370. [Google Scholar] [CrossRef]

- Dadashpoor, H.; Yousefi, Z. Centralization or Decentralization? A Review on the Effects of Information and Communication Technology on Urban Spatial Structure. Cities 2018, 78, 194–205. [Google Scholar] [CrossRef]

- Cherry, T.L.; McEvoy, D.M.; Westskog, H. Cultural Worldviews, Institutional Rules and the Willingness to Participate in Green Energy Programs. Resour. Energy Econ. 2019, 56, 28–38. [Google Scholar] [CrossRef]

- Zhang, G.; Zhao, S.; Xi, Y.; Liu, N.; Xu, X. Relating Science and Technology Resources Integration and Polarization Effect to Innovation Ability in Emerging Economies: An Empirical Study of Chinese Enterprises. Technol. Forecast. Soc. Chang. 2018, 135, 188–198. [Google Scholar] [CrossRef]

- Feng, C.; Wang, M.; Liu, G.-C.; Huang, J.-B. Green Development Performance and Its Influencing Factors: A Global Perspective. J. Clean. Prod. 2017, 144, 323–333. [Google Scholar] [CrossRef]

- Barrios, S.; Görg, H.; Strobl, E. Foreign Direct Investment, Competition and Industrial Development in the Host Country. Eur. Econ. Rev. 2005, 49, 1761–1784. [Google Scholar] [CrossRef]

| Variable | Mean | Std. Dev | Min | Max |

|---|---|---|---|---|

| lnInd | 1.892 | 0.325 | 0.986 | 2.715 |

| lnSf | 2.246 | 2.292 | −4.717 | 7.096 |

| lnofdi | 13.618 | 2.272 | 6.738 | 18.703 |

| lnginnov | 6.640 | 1.691 | 1.098 | 10.363 |

| lnrd | −4.443 | 0.647 | −6.329 | −2.602 |

| lner | 2.549 | 1.038 | −1.649 | 4.953 |

| lnfdi | −4.166 | 1.054 | −7.859 | −2.502 |

| lnpeduc | 2.164 | 0.113 | 1.852 | 2.548 |

| lngov | −1.598 | 0.408 | −2.566 | −0.464 |

| lnlroad | −0.435 | 0.809 | −3.248 | 0.750 |

| lngdpr | 0.113 | 0.078 | −0.327 | 0.474 |

| Variable | Model (1) | Model (2) | Model (3) | Model (2) | Model (3) | Model (2) | Model (3) |

|---|---|---|---|---|---|---|---|

| lnInd | lnginnov1 | lnInd | lnginnov2 | lnInd | lnginnov3 | lnInd | |

| lnSf | 0.093 *** | 0.355 *** | 0.052 *** | 0.312 *** | 0.064 *** | 0.367 *** | 0.056 *** |

| (8.70) | (9.70) | (5.05) | (8.77) | (7.27) | (8.98) | (5.46) | |

| lnginnov1 | - | - | 0.114 *** | - | - | - | - |

| (6.57) | |||||||

| lnginnov2 | - | - | - | - | 0.093 *** | - | - |

| (5.69) | |||||||

| lnginnov3 | - | - | - | - | - | - | 0.099 *** |

| (6.48) | |||||||

| lnfdi | −0.126 | −0.152 ** | 0.004 | −0.085 | −0.004 | −0.160 ** | 0.003 |

| (−0.81) | (−2.37) | (0.33) | (−1.13) | (−0.33) | (−2.66) | (0.23) | |

| lnpeduc | 0.970 | 4.756 *** | 0.424 ** | 6.060 *** | 0.403 ** | 4.577 *** | 0.515 ** |

| (4.56) | (5.47) | (2.25) | (6.49) | (2.31) | (4.70) | (2.54) | |

| lngov | −0.090 | 0.726 *** | −0.173 ** | 0.726 *** | −0.158 ** | 0.711 *** | −0.160 ** |

| (−1.32) | (3.36) | (−2.55) | (3.25) | (−2.31) | (3.08) | (−2.36) | |

| lnlroad | 0.151 *** | 0.193 | 0.129 *** | 0.116 | 0.140 *** | 0.203 | 0.131 *** |

| (4.46) | (1.69) | (4.41) | (0.83) | (4.99) | (1.68) | (4.20) | |

| lngdpr | 0.013 | −0.397 | 0.059 | −0.724 * | 0.081 | −0.309 | 0.044 |

| (0.16) | (−1.58) | (0.75) | (−2.04) | (1.06) | (−1.18) | (0.54) | |

| Cons | −0.550 | −3.794 * | −0.114 | −7.71 *** | 0.171 | −3.785 * | −0.174 |

| (−1.19) | (−1.95) | (−0.29) | (−3.80) | (0.47) | (−1.73) | (−0.42) | |

| R2 | 0.913 | 0.935 | 0.930 | 0.914 | 0.928 | 0.928 | 0.928 |

| N | 480 | 480 | 480 | 480 | 480 | 480 | 480 |

| Variable | First Half Path | Direct Path | ||||

|---|---|---|---|---|---|---|

| Model (4) | Model (5) | Model (6) | Model (4) | Model (5) | Model (6) | |

| lnInd | lnginnov | lnInd | lnInd | lnginnov | lnInd | |

| lnSf | 0.143 *** | 0.588 *** | 0.072 *** | 0.089 *** | 0.313 *** | 0.054 *** |

| (5.70) | (8.28) | (2.95) | (7.63) | (9.43) | (4.79) | |

| lnginnov | - | - | 0.119 *** | - | - | 0.111 *** |

| (5.45) | (5.99) | |||||

| lnrd | 0.014 | 0.643 *** | −0.062 | - | - | - |

| (0.30) | (3.97) | (−1.13) | ||||

| lnSf × lnrd | 0.011 ** | 0.060 *** | 0.004 | - | - | - |

| (2.26) | (4.57) | (0.95) | ||||

| lner | - | - | - | −0.026 *** | −0.092 ** | −0.016 ** |

| (−4.01) | (−2.08) | (−2.49) | ||||

| lnSf × lner | - | - | - | 0.003 * | 0.023 *** | 0.001 |

| (1.73) | (2.82) | (0.40) | ||||

| Control variable | Yes | Yes | Yes | Yes | Yes | Yes |

| Cons | −0.266 | 0.122 | −0.281 | −0.390 | −3.057 | −0.050 |

| (−0.57) | (0.07) | (−0.68) | (−0.83) | (−1.59) | (−0.13) | |

| R2 | 0.917 | 0.947 | 0.932 | 0.916 | 0.938 | 0.931 |

| N | 480 | 480 | 480 | 480 | 480 | 480 |

| Variable | First Half Path | Direct Path | |||

|---|---|---|---|---|---|

| Model (4) | Model (5) | Model (6) | Model (5) | Model (6) | |

| lnInd | lnginnov2 | lnInd | lnginnov3 | lnInd | |

| lnginnov2 | - | - | 0.094 *** | - | - |

| (4.76) | |||||

| lnginnov3 | - | - | - | - | 0.099 *** |

| (5.28) | |||||

| lnSf × lnrd | 0.011 ** | 0.062 *** | 0.005 | 0.061 *** | 0.005 |

| (2.26) | (3.10) | (1.35) | (4.43) | (1.13) | |

| Control variable | Yes | Yes | Yes | Yes | Yes |

| Cons | −0.266 | −3.514 * | 0.066 | 0.072 | −0.273 |

| (−0.57) | (−1.96) | (0.18) | (0.04) | (−0.62) | |

| R2 | 0.917 | 0.928 | 0.929 | 0.940 | 0.929 |

| N | 480 | 480 | 480 | 480 | 480 |

| Variable | First Half Path | Direct Path | |||

|---|---|---|---|---|---|

| Model (4) | Model (5) | Model (6) | Model (5) | Model (6) | |

| lnInd | lnginnov2 | lnInd | lnginnov3 | lnInd | |

| lnginnov2 | - | - | 0.093 *** | - | - |

| (5.22) | |||||

| lnginnov3 | - | - | - | - | 0.094 *** |

| (5.04) | |||||

| lnSf × lner | 0.089 *** | 0.028 *** | 0.001 | 0.023 ** | 0.001 |

| (7.63) | (3.01) | (0.34) | (2.70) | (0.66) | |

| Control variable | Yes | Yes | Yes | Yes | Yes |

| Cons | −0.390 | −7.112 *** | 0.273 | −2.930 | −0.112 |

| (−0.83) | (−3.40) | (0.79) | (−1.35) | (−0.27) | |

| R2 | 0.916 | 0.918 | 0.930 | 0.932 | 0.929 |

| N | 480 | 480 | 480 | 480 | 480 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xing, G.; Dong, H. Outward Foreign Direct Investment and Industrial Structure Upgrading: The Mediating Role of Reverse Green Technology Innovation, the Moderating Role of R&D Investment and Environmental Regulation. Sustainability 2023, 15, 9062. https://doi.org/10.3390/su15119062

Xing G, Dong H. Outward Foreign Direct Investment and Industrial Structure Upgrading: The Mediating Role of Reverse Green Technology Innovation, the Moderating Role of R&D Investment and Environmental Regulation. Sustainability. 2023; 15(11):9062. https://doi.org/10.3390/su15119062

Chicago/Turabian StyleXing, Guangyuan, and Hao Dong. 2023. "Outward Foreign Direct Investment and Industrial Structure Upgrading: The Mediating Role of Reverse Green Technology Innovation, the Moderating Role of R&D Investment and Environmental Regulation" Sustainability 15, no. 11: 9062. https://doi.org/10.3390/su15119062

APA StyleXing, G., & Dong, H. (2023). Outward Foreign Direct Investment and Industrial Structure Upgrading: The Mediating Role of Reverse Green Technology Innovation, the Moderating Role of R&D Investment and Environmental Regulation. Sustainability, 15(11), 9062. https://doi.org/10.3390/su15119062