Can Local Government Debt Decrease the Pollution Emission of Enterprises?—Evidence from China’s Industrial Enterprises

Abstract

1. Introduction

2. Theoretical Analysis and Research Hypothesis

2.1. Theoretical Analysis

2.2. Research Hypothesis

3. Methodology and Data

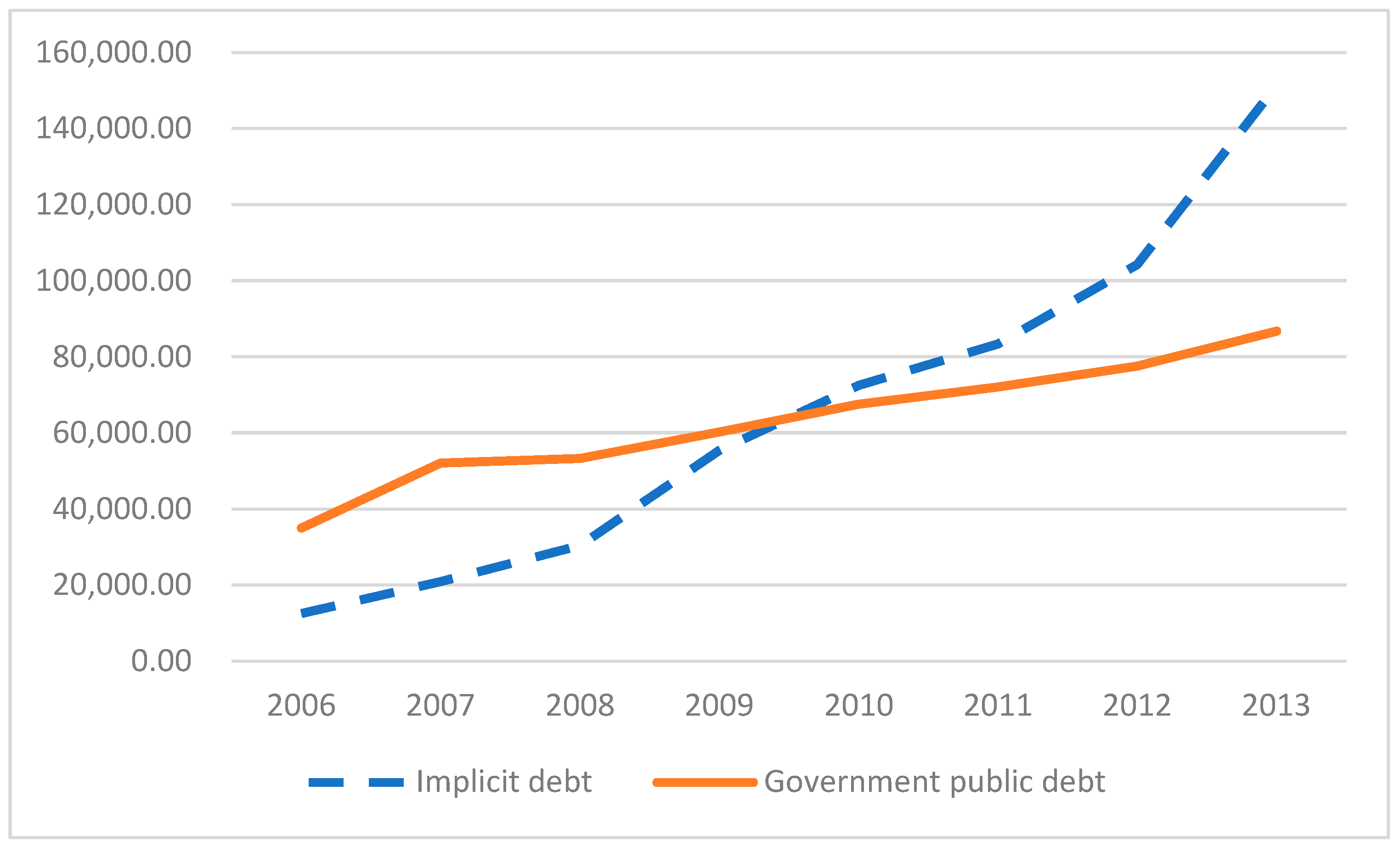

3.1. Data Processing

3.2. Model Specification

3.2.1. Basic Regression Model (Two-Way Fixed Effects Model)

3.2.2. Causal Variable Model (Difference in Differences Model with Exogenous Shocks)

4. Analysis of Empirical Results

4.1. Analysis of Basic Regression Results

4.2. Robustness Test

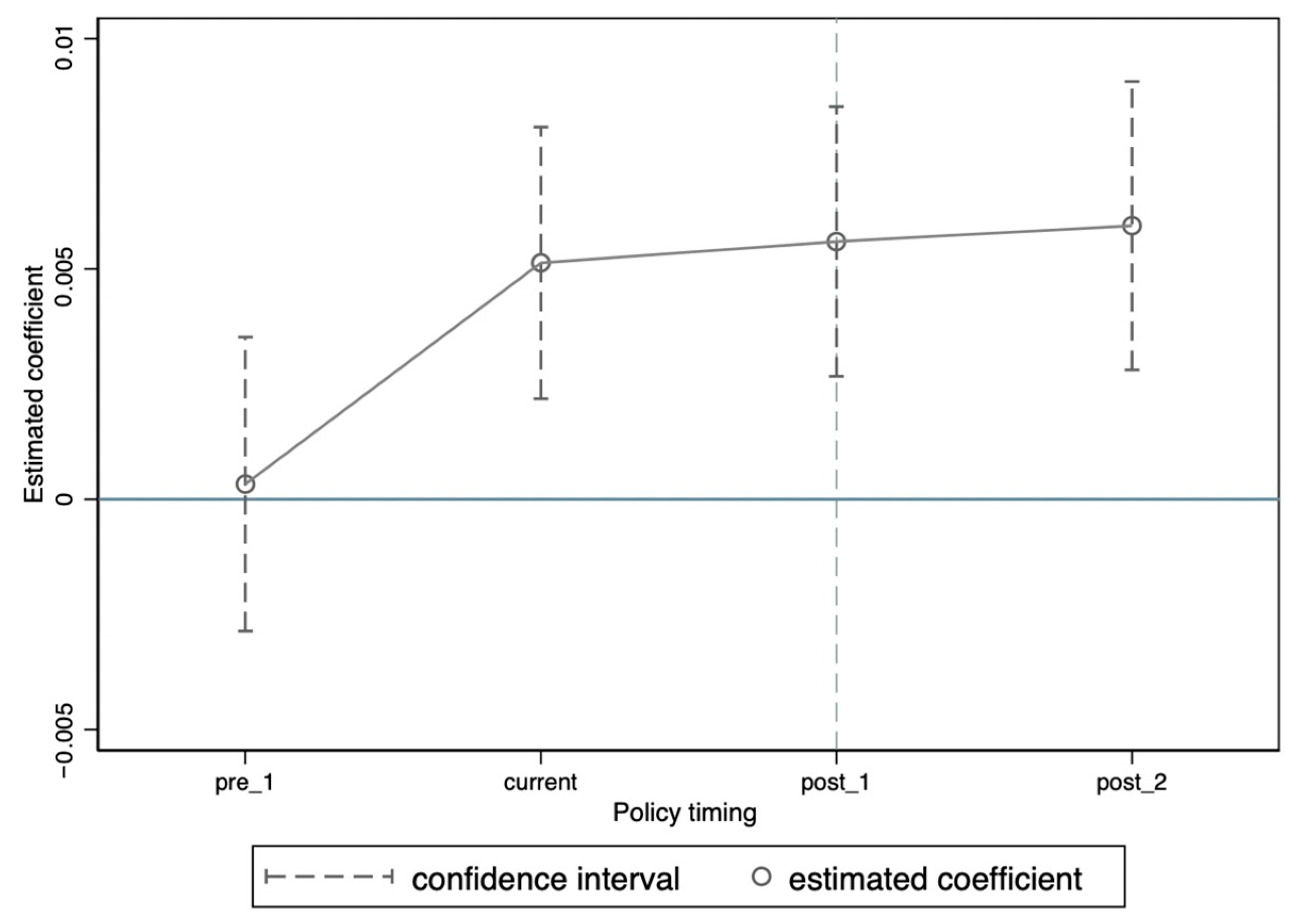

4.2.1. Parallel Trend Test

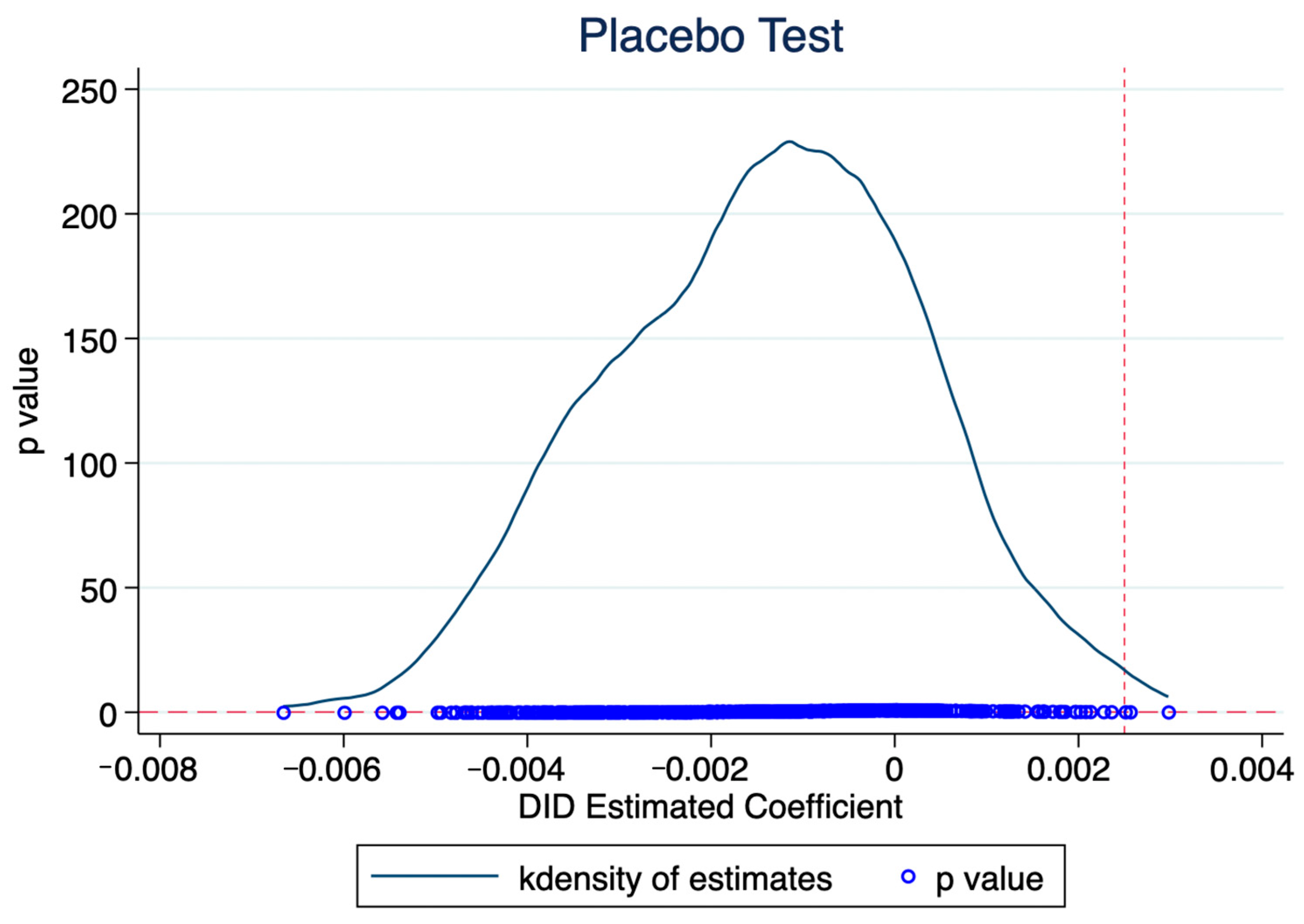

4.2.2. Placebo Test

4.2.3. Variable Regrouping

5. Heterogeneity Analysis

5.1. Heterogeneity of Geographical Location

5.2. The Heterogeneity of Enterprise Ownership

5.3. Industry Heterogeneity

6. Mechanism Test

6.1. Increase the Fixed Assets Investment

6.2. Squeeze Out “Innovation”: Decrease Research and Development Investment

7. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Tang, Z.F. Local Government Debt, Financial Circle, and Sustainable Economic Development. Sustainability 2022, 14, 11967. [Google Scholar] [CrossRef]

- Bednar, J.; Obersteiner, M.; Baklanov, A.; Thomson, M.; Wagner, F.; Geden, O.; Allen, M.; Hall, J.W. Operationalizing the net-negative carbon economy. Nature 2021, 596, 7872. [Google Scholar] [CrossRef]

- He, Z.; Jia, G. Rethinking China’s local government debts in the frame of modern money theory. J. Post Keynes. Econ. 2020, 43, 210–230. [Google Scholar] [CrossRef]

- Wu, J.; Wu, Y.; Wang, B. Local Government Debt, Factor Misallocation and Regional Economic Performance in China. China World Econ. 2018, 26, 82–105. [Google Scholar] [CrossRef]

- Zhang, J.; Wang, L.; Wang, S. Financial development and economic growth: Recent evidence from China. J. Comp. Econ. 2012, 40, 393–412. [Google Scholar] [CrossRef]

- Zhao, R.; Tian, Y.; Lei, A.; Boadu, F.; Ren, Z. The Effect of Local Government Debt on Regional Economic Growth in China: A Nonlinear Relationship Approach. Sustainability 2019, 11, 3065. [Google Scholar] [CrossRef]

- Yang, W.; Zhang, Z.; Wang, Y.; Deng, P.; Guo, L. Impact of China’s Provincial Government Debt on Economic Growth and Sustainable Development. Sustainability 2022, 14, 1474. [Google Scholar] [CrossRef]

- Liang, Y.; Shi, K.; Wang, L.; Xu, J. Local Government Debt and Firm Leverage: Evidence from China. Asian Econ. Policy Rev. 2017, 12, 210–232. [Google Scholar] [CrossRef]

- Zhu, J.; Xu, H.; Zhang, Y. Local government debt and firm productivity: Evidence from China. Res. Int. Bus. Financ. 2022, 63, 101798. [Google Scholar] [CrossRef]

- Gao, G.; Dong, J.; Li, X. Local Government Debt, Real Estate Investment and Corporate Investment: Evidence from China. Sustainability 2022, 14, 12353. [Google Scholar] [CrossRef]

- Wang, E. Fiscal Decentralization and Revenue/Expenditure Disparities in China. Eurasian Geogr. Econ. 2010, 51, 744–766. [Google Scholar] [CrossRef]

- Hou, S.Y.; Song, L.R. Fiscal Decentralization, Local Government Actions and High-quality Economic Development. Inq. Econ. Issues 2020, 9, 33–44. (In Chinese) [Google Scholar]

- Li, H.; Guan, S.; Liu, Y. Analysis on the Steady Growth Effect of China’s Fiscal Policy from a Dynamic Perspective. Sustainability 2022, 14, 7648. [Google Scholar] [CrossRef]

- Yuan, H.; Zhang, T.; Hu, K.; Feng, Y.; Feng, C.; Jia, P. Influences and transmission mechanisms of financial agglomeration on environmental pollution. J. Environ. Manag. 2022, 303, 114136. [Google Scholar] [CrossRef] [PubMed]

- Özmen, I.; Özcan, G.; Özcan, C.C.; Bekun, F.V. Does fiscal policy spur environmental issues? New evidence from selected developed countries. Int. J. Environ. Sci. Technol. 2022, 19, 10831–10844. [Google Scholar] [CrossRef]

- Guo, Y.; Xue, J. Non-linear Environmental Effects of Local Government Debt. Stat. Res. 2021, 38, 105–117. (In Chinese) [Google Scholar]

- Mao, J.; Guo, Y.Q.; Cao, J.; Xu, J.W. Local Government Financing Vehicle Debt and Environmental Pollution Control. J. Manag. World 2022, 10, 96. (In Chinese) [Google Scholar]

- Li, F.; Huang, J.; Du, M. Spatial and nonlinear effects of local government debt on environmental pollution: Evidence from China. Front. Environ. Sci. 2022, 10, 1691. [Google Scholar] [CrossRef]

- Qi, Z.; Yang, S.; Feng, D.; Wang, W. The impact of local government debt on urban environmental pollution and its mechanism: Evidence from China. PLoS ONE 2022, 17, e0263796. [Google Scholar] [CrossRef]

- Chen, Z.; He, Z.; Liu, C. The financing of local government in China: Stimulus loan wanes and shadow banking waxes. J. Financial Econ. 2020, 137, 42–71. [Google Scholar] [CrossRef]

- Bo, L.; Yao, H.; Mear, F. New development: Is China’s local government debt problem getting better or worse? Public Money Manag. 2021, 41, 663–667. [Google Scholar] [CrossRef]

- Guo, Y.; Li, Y.; Qian, Y. Local government debt risk assessment: A deep learning-based perspective. Inf. Process. Manag. 2022, 59, 102948. [Google Scholar] [CrossRef]

- Ouyang, T.; Lu, X. Clustering Analysis of Risk Divergence of China Government’s Debts. Sci. Program. 2021, 2021, 7033597. [Google Scholar] [CrossRef]

- Asian Development Bank. China Environmental Analysis; Asian Development Bank: Mandaluyong, Philippines, 2013. [Google Scholar]

- Gao, G.; Li, X.; Liu, X.; Dong, J. Does Air Pollution Impact Fiscal Sustainability? Evidence from Chinese Cities. Energies 2021, 14, 7247. [Google Scholar] [CrossRef]

- Halkos, G.E.; Papageorgiou, G.J. Pollution, environmental taxes and public debt: A game theory setup. Econ. Anal. Policy 2018, 58, 111–120. [Google Scholar] [CrossRef]

- Arrow, K.; Kurz, M. Public Investment, the Rate of Return and Optimal Fiscal Policy; The John Hopkins Press: Baltimore, MD, USA, 1970. [Google Scholar]

- Qu, X.; Xu, Z.; Yu, J.; Zhu, J. Understanding local government debt in China: A regional competition perspective. Reg. Sci. Urban Econ. 2023, 98, 103859. [Google Scholar] [CrossRef]

- Li, X.; Ge, X.; Fan, W.; Zheng, H. Research on Spatial Correlation Characteristics and Their Spatial Spillover Effect of Local Government Debt Risks in China. Sustainability 2021, 13, 2687. [Google Scholar] [CrossRef]

- Huo, X.; Bi, S.; Yin, Y. The impact of fiscal decentralization and intergovernmental competition on the local government debt risk: Evidence from China. Front. Environ. Sci. 2023, 11, 76. [Google Scholar] [CrossRef]

- Han, L.; Kung, J.K.-S. Fiscal incentives and policy choices of local governments: Evidence from China. J. Dev. Econ. 2015, 116, 89–104. [Google Scholar] [CrossRef]

- Giovanis, E.; Ozdamar, O. The impact of climate change on budget balances and debt in the Middle East and North Africa (MENA) region. Clim. Change 2022, 172, 34. [Google Scholar] [CrossRef]

- Kellner, M. Strategic effects of stock pollution: The positive theory of fiscal deficits revisited. Public Choice 2023, 194, 157–179. [Google Scholar] [CrossRef]

- Tsui, K.Y. China’s Infrastructure Investment Boom and Local Debt Crisis. Eurasian Geogr. Econ. 2011, 52, 686–711. [Google Scholar] [CrossRef]

- Zheng, S.Q.; Sun, W.Z.; Wu, J.; Wu, Y. To Make Money with Land, and to Support Land with Money’ Research on the In-vestment and Financing Model of Urban Construction with Chinese Characteristics. Econ. Res. J. 2014, 49, 14–27. (In Chinese) [Google Scholar]

- Fan, Z.Y. The Root of Land Finance: Fiscal Pressure or Investment Impulse. China Ind. Econ. 2015, 6, 18–31. [Google Scholar]

- Mo, J. Land financing and economic growth: Evidence from Chinese counties. China Econ. Rev. 2018, 50, 218–239. [Google Scholar] [CrossRef]

- Fu, L.; Sun, H.; Meng, Y.; Li, J. The Role of Public–Private Partnerships in Local Government Debt Is a Potential Threat to Sustainable Cities: A Case from China. Sustainability 2022, 14, 13972. [Google Scholar] [CrossRef]

- Hou, W.F.; Tian, X.M. Local Debt Expenditure, Investment Real Estate Demand and Macroeconomic Fluctuations. Stat. Decis. 2021, 37, 33–44. (In Chinese) [Google Scholar]

- Cheng, Y.D.; Jia, S.H.; Meng, H. Fiscal Policy Choices of Local Governments in China: Land Finance or Local Government Debt? Int. Rev. Econ. Financ. 2022, 80, 294–308. [Google Scholar] [CrossRef]

- Ji, Y.; Guo, X.; Zhong, S.; Wu, L. Land Financialization, Uncoordinated Development of Population Urbanization and Land Urbanization, and Economic Growth: Evidence from China. Land 2020, 9, 481. [Google Scholar] [CrossRef]

- Xu, J. Is there causality from investment for real estate to carbon emission in China: A cointegration empirical study. Procedia Environ. Sci. 2011, 5, 96–104. [Google Scholar] [CrossRef]

- Ma, S.C.; Hua, X.; Han, Y.H. How does Local Government Debt Squeeze out the Credit Financing of Entity Enterprises?—Microevidence from Chinese Industrial Enterprises. Stud. Int. Financ. 2020, 5, 3–13. (In Chinese) [Google Scholar]

- Zhang, M.; Brookins, O.T.; Huang, X. The crowding out effect of central versus local government debt: Evidence from China. Pac.-Basin Financ. J. 2022, 72, 101707. [Google Scholar] [CrossRef]

- Liu, R.; Li, N. Research on the Multiplier and Double Crowding Effect of the Rising Local Debt Intensity. Manag. World 2021, 37, 51–66, 160, 165. (In Chinese) [Google Scholar]

- National Bureau of Statistics. China Urban Statistical Yearbook; National Bureau of Statistics: Beijing, China, 2013.

- Lee, N.; Lee, J. External Financing, R&D Intensity, and Firm Value in Biotechnology Companies. Sustainability 2019, 11, 4141. [Google Scholar] [CrossRef]

- Fan, J.; Liu, Y.; Zhang, Q.; Zhao, P. Does government debt impede firm innovation? Evidence from the rise of LGFVs in China. J. Bank. Financ. 2022, 138, 106475. [Google Scholar] [CrossRef]

- Chen, W.; Zhu, Y.; He, Z.; Yang, Y. The effect of local government debt on green innovation: Evidence from Chinese listed companies. Pac. Basin Financ. J. 2022, 73, 101760. [Google Scholar] [CrossRef]

| Variables | Definition/Measurement | Total Observations | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|---|

| poll | Weighted pollution emissions to construct overall pollution indicators. | 93,941 | −0.028 | 0.16 | −0.078 | 1.165 |

| lndebt | Implicit debt logarithm. | 85,180 | 5.138 | 1.802 | −4.605 | 9.131 |

| treat | Grouped according to the median of implicit debt, if greater than or equal to the median, it is marked as 1, otherwise, it is 0. | 93,941 | 0.546 | 0.498 | 0 | 1 |

| post | Time dummy variable, greater than or equal to 2008, denoted as 1, otherwise 0. | 93,941 | 0.773 | 0.419 | 0 | 1 |

| gdp | Regional GDP. | 90,102 | 79,588.61 | 81,830.85 | 3943.344 | 466,996.2 |

| ind_ratio | The proportion of secondary industry output value to GDP. | 93,767 | 51.938 | 7.01 | 15.93 | 89.75 |

| fisspt | Fiscal expenditure/Fiscal revenue. | 92,993 | 1.543 | 0.823 | 0.649 | 18.025 |

| fiscal | Fiscal expenditure/GDP. | 89,166 | 0.111 | 0.042 | 0.043 | 0.688 |

| fdi | Foreign investment/GDP. | 87,733 | 0.272 | 0.308 | 0 | 1.443 |

| size | The logarithm of total assets. | 93,920 | 11.849 | 1.597 | 0 | 19.455 |

| lnL | The logarithm of the number of employees. | 65,591 | 5.994 | 1.16 | 0 | 12.316 |

| lev | Total liabilities/total assets of the enterprise. | 83,216 | 0.551 | 0.28 | −0.581 | 18.385 |

| age | Current year minus year of business opening. | 93,920 | 12.309 | 12.319 | 0 | 100 |

| lnwage | ln(Total payroll payable/number of employees). | 54,817 | 3.339 | 0.968 | −6.526 | 11.036 |

| lnkl | ln(Total fixed assets/number of employees) | 54,496 | 4.598 | 1.481 | −6.436 | 13.576 |

| profit | Total profit/total assets of the enterprise. | 83,200 | 0.087 | 0.264 | −41.092 | 20.046 |

| kc | Fixed assets/total industrial output value. | 82,721 | 2.49 | 604.934 | 0 | 173,987 |

| fi | Local government per capita fiscal income/Central government per capita fiscal income | 92,985 | 2.129 | 2.586 | 0.046 | 16.352 |

| fe | Local government per capita financial expenditure/Central government per capita financial expenditure | 92,985 | 6.779 | 7.352 | 0.779 | 48.466 |

| finance | Interest expense/Fixed assets | 80,211 | 0.108 | 5.556 | −2.992 | 1259.143 |

| (1) | (2) | (3) | |

|---|---|---|---|

| a1 | a2 | a3 | |

| Variables | new_poll | new_poll | new_poll |

| lndebt | 0.002 *** | 0.002 *** | 0.002 ** |

| (0.001) | (0.001) | (0.001) | |

| gdp | −0.000 | −0.000 | |

| (0.000) | (0.000) | ||

| ind_ratio | −0.000 | −0.001 ** | |

| (0.000) | (0.000) | ||

| fisspt | 0.002 | 0.003 | |

| (0.003) | (0.005) | ||

| fiscal | 0.001 | −0.044 | |

| (0.058) | (0.062) | ||

| fdi | 0.001 | −0.009 * | |

| (0.003) | (0.005) | ||

| size | 0.007 *** | ||

| (0.002) | |||

| lnL | 0.005 *** | ||

| (0.002) | |||

| lev | 0.001 | ||

| (0.002) | |||

| age | 0.000 | ||

| (0.000) | |||

| lnwage | 0.002 * | ||

| (0.001) | |||

| lnkl | 0.002 *** | ||

| (0.001) | |||

| profit | 0.003 | ||

| (0.002) | |||

| kc | −0.003 ** | ||

| (0.001) | |||

| Constant | −0.039 *** | −0.035 ** | −0.113 *** |

| (0.003) | (0.016) | (0.028) | |

| Observations | 76,083 | 70,228 | 40,402 |

| R-squared | 0.903 | 0.903 | 0.942 |

| (1) | (2) | (3) | |

|---|---|---|---|

| b1 | b2 | b3 | |

| Variables | new_poll | new_poll | new_poll |

| did | 0.003 ** | 0.003 *** | 0.002 ** |

| (0.001) | (0.001) | (0.001) | |

| ind_ratio | 0.000 | −0.000 | |

| (0.000) | (0.000) | ||

| fisspt | −0.002 | −0.002 | |

| (0.002) | (0.002) | ||

| fi | −0.003 ** | −0.004 *** | |

| (0.001) | (0.001) | ||

| fe | −0.000 | −0.000 | |

| (0.000) | (0.000) | ||

| size | 0.010 *** | ||

| (0.001) | |||

| lev | −0.000 | ||

| (0.002) | |||

| finance | −0.000 | ||

| (0.000) | |||

| age | −0.000 | ||

| (0.000) | |||

| profit | 0.005 *** | ||

| (0.002) | |||

| kc | −0.002 *** | ||

| (0.001) | |||

| Constant | −0.028 *** | −0.023 ** | −0.125 *** |

| (0.001) | (0.011) | (0.018) | |

| Observations | 83,498 | 82,740 | 68,871 |

| R-squared | 0.899 | 0.900 | 0.907 |

| (1) | (2) | (3) | |

|---|---|---|---|

| c1 | c2 | c3 | |

| Variables | new_poll | new_poll | new_poll |

| did1 | 0.002 ** | 0.003 ** | 0.002 * |

| (0.001) | (0.001) | (0.001) | |

| ind_ratio | 0.000 | −0.000 | |

| (0.000) | (0.000) | ||

| fisspt | −0.002 | −0.002 | |

| (0.002) | (0.002) | ||

| fi | −0.003 ** | −0.004 *** | |

| (0.001) | (0.001) | ||

| fe | −0.000 | −0.000 | |

| (0.000) | (0.000) | ||

| size | 0.010 *** | ||

| (0.001) | |||

| lev | −0.000 | ||

| (0.002) | |||

| finance | −0.000 | ||

| (0.000) | |||

| age | −0.000 | ||

| (0.000) | |||

| profit | 0.005 *** | ||

| (0.002) | |||

| kc | −0.002 *** | ||

| (0.001) | |||

| Constant | −0.028 *** | −0.023 ** | −0.125 *** |

| (0.001) | (0.011) | (0.018) | |

| Observations | 83,498 | 82,740 | 68,871 |

| R-squared | 0.899 | 0.900 | 0.907 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| d1 Inland Areas | d2 Inland Areas | d3 Coastal Areas | d4 Coastal Areas | |

| Variables | new_poll | new_poll | new_poll | new_poll |

| did | 0.000 | 0.000 | 0.005 *** | 0.004 *** |

| (0.002) | (0.002) | (0.001) | (0.002) | |

| ind_ratio | −0.000 | 0.000 | ||

| (0.000) | (0.000) | |||

| fisspt | −0.003 | 0.016 * | ||

| (0.003) | (0.009) | |||

| fi | −0.002 | −0.003 ** | ||

| (0.006) | (0.001) | |||

| fe | −0.002 | −0.000 | ||

| (0.002) | (0.000) | |||

| size | 0.011 *** | 0.008 *** | ||

| (0.002) | (0.002) | |||

| lev | −0.001 | 0.000 | ||

| (0.005) | (0.002) | |||

| finance | −0.001 *** | 0.000 *** | ||

| (0.000) | (0.000) | |||

| age | −0.000 | 0.000 | ||

| (0.000) | (0.000) | |||

| profit | 0.005 * | 0.005 ** | ||

| (0.003) | (0.002) | |||

| kc | −0.002 *** | −0.001 * | ||

| (0.001) | (0.001) | |||

| Constant | −0.012 *** | −0.112 *** | −0.044 *** | −0.160 *** |

| (0.001) | (0.029) | (0.001) | (0.027) | |

| Observations | 39,816 | 32,597 | 43,682 | 36,274 |

| R-squared | 0.904 | 0.911 | 0.889 | 0.898 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| e1 Non-State-Owned Enterprises | e2 Non-State-Owned Enterprises | e3 State-Owned Enterprises | e4 State-Owned Enterprises | |

| Variables | new_poll | new_poll | new_poll | new_poll |

| did | 0.003 ** | 0.003 ** | 0.006 | 0.006 |

| (0.001) | (0.001) | (0.006) | (0.007) | |

| ind_ratio | −0.000 | 0.002 | ||

| (0.000) | (0.001) | |||

| fisspt | −0.002 | −0.007 | ||

| (0.003) | (0.005) | |||

| fi | −0.002 * | −0.019 * | ||

| (0.001) | (0.012) | |||

| fe | −0.000 | 0.002 | ||

| (0.000) | (0.002) | |||

| size | 0.009 *** | 0.013 * | ||

| (0.001) | (0.008) | |||

| lev | 0.001 | −0.015 | ||

| (0.002) | (0.012) | |||

| finance | −0.000 | 0.001 | ||

| (0.000) | (0.001) | |||

| age | −0.000 *** | 0.001 * | ||

| (0.000) | (0.000) | |||

| profit | 0.005 *** | 0.002 | ||

| (0.002) | (0.009) | |||

| kc | −0.001 ** | −0.004 ** | ||

| (0.001) | (0.002) | |||

| Constant | −0.038 *** | −0.126 *** | 0.062 *** | −0.176 |

| (0.001) | (0.017) | (0.002) | (0.110) | |

| Observations | 75,166 | 61,889 | 7693 | 6400 |

| R-squared | 0.881 | 0.890 | 0.934 | 0.939 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| f1 Non-High-Tech | f2 Non-High-Tech | f3 High-Tech | f4 High-Tech | |

| Variables | new_poll | new_poll | new_poll | new_poll |

| did | 0.003 ** | 0.003 ** | −0.001 | 0.000 |

| (0.001) | (0.001) | (0.003) | (0.003) | |

| ind_ratio | −0.000 | 0.000 | ||

| (0.000) | (0.000) | |||

| fisspt | −0.002 | −0.001 | ||

| (0.002) | (0.003) | |||

| fi | −0.005 *** | −0.004 | ||

| (0.002) | (0.003) | |||

| fe | −0.000 | 0.000 | ||

| (0.000) | (0.001) | |||

| size | 0.010 *** | 0.008 ** | ||

| (0.001) | (0.003) | |||

| lev | −0.001 | 0.001 | ||

| (0.003) | (0.005) | |||

| finance | −0.000 | 0.000 | ||

| (0.000) | (0.001) | |||

| age | −0.000 | 0.000 | ||

| (0.000) | (0.000) | |||

| profit | 0.006 *** | −0.007 | ||

| (0.002) | (0.006) | |||

| kc | −0.003 *** | −0.001 | ||

| (0.001) | (0.001) | |||

| Constant | −0.023 *** | −0.116 *** | −0.056 *** | −0.169 *** |

| (0.001) | (0.020) | (0.001) | (0.049) | |

| Observations | 70,653 | 58,182 | 10,260 | 8235 |

| R-squared | 0.902 | 0.909 | 0.828 | 0.827 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| g1 | g2 | g3 | g4 | |

| Variables | inv | inv | lnyf | lnyf |

| did | 0.367 *** | 0.285 *** | −0.096 *** | −0.140 *** |

| (0.011) | (0.011) | (0.025) | (0.027) | |

| ind_ratio | −0.037 *** | −0.019 *** | ||

| (0.002) | (0.005) | |||

| fisspt | −0.039 *** | −0.116 *** | ||

| (0.012) | (0.036) | |||

| fi | 0.559 *** | −0.003 | ||

| (0.012) | (0.048) | |||

| fe | 0.190 *** | 0.028 *** | ||

| (0.005) | (0.005) | |||

| size | −0.067 *** | −0.111 *** | ||

| (0.012) | (0.026) | |||

| lev | −0.057 ** | 0.132 *** | ||

| (0.024) | (0.051) | |||

| finance | 0.000 | 0.000 | ||

| (0.000) | (0.000) | |||

| age | 0.000 | 0.003 | ||

| (0.000) | (0.002) | |||

| profit | −0.032 | 0.224 *** | ||

| (0.022) | (0.058) | |||

| kc | −0.008 * | −0.011 | ||

| (0.005) | (0.008) | |||

| Constant | 3.396 *** | 3.723 *** | 0.394*** | 2.631 *** |

| (0.005) | (0.172) | (0.011) | (0.405) | |

| Observations | 79,343 | 65,148 | 83,485 | 68,858 |

| R-squared | 0.961 | 0.972 | 0.522 | 0.545 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xie, H.; Zhang, W.; Liang, H. Can Local Government Debt Decrease the Pollution Emission of Enterprises?—Evidence from China’s Industrial Enterprises. Sustainability 2023, 15, 9108. https://doi.org/10.3390/su15119108

Xie H, Zhang W, Liang H. Can Local Government Debt Decrease the Pollution Emission of Enterprises?—Evidence from China’s Industrial Enterprises. Sustainability. 2023; 15(11):9108. https://doi.org/10.3390/su15119108

Chicago/Turabian StyleXie, Hai, Weikun Zhang, and Hanyuan Liang. 2023. "Can Local Government Debt Decrease the Pollution Emission of Enterprises?—Evidence from China’s Industrial Enterprises" Sustainability 15, no. 11: 9108. https://doi.org/10.3390/su15119108

APA StyleXie, H., Zhang, W., & Liang, H. (2023). Can Local Government Debt Decrease the Pollution Emission of Enterprises?—Evidence from China’s Industrial Enterprises. Sustainability, 15(11), 9108. https://doi.org/10.3390/su15119108