1. Introduction

In the 14th Five-Year Plan for National Economic and Social Development and Outline of Vision 2035, the Chinese Government continues to emphasize the Carbon Neutral Route of the Digital Economy, with Digital Infrastructure, New Energy, Innovation, and Industrial Digitization as key pillars to achieve the goal of carbon neutrality. Industrial structure optimization and low-carbon technology research and development are crucial for facilitating the low-carbon development of enterprises and the nation as a whole. Moreover, improving energy utilization efficiency and promoting the combined development of low-carbon economy and digitization are encouraged. In line with these goals, the Chinese Government actively promotes the digital transformation and upgrading of enterprises though policy support, aiming to facilitate industrial decarbonization through digitalization. For corporate entities, digital transformation is not only a strategic choice aligned with national development but also a necessary path for their long-term growth and sustainability. Not only does it lead to corporate carbon neutrality [

1] but also enhances productivity [

2]. Thus, from both a social responsibility perspective and a business economic efficiency standpoint, digital transformation is an essential development trend for all enterprises.

Enterprise digital transformation encompasses a systematic improvement and innovation process involving the implementation of digital intelligence technologies to enhance a company’s production system, R&D innovation, business processes, and commercial relationships. It can boost productivity, improving both internal processes and the external environment, thereby yielding economic and non-economic effects for the enterprise [

3,

4]. The digital transformation strategy encompasses various substrategies such as digital technology intervention and technology innovation, which heavily rely on the decision logic, risk appetite, and management style of the executive team. The Upper echelons theory suggests that the traits of the executive team can have a profound influence on an enterprise’s strategic decisions [

5].

Managerial myopia, a concept rooted in the Upper Echelons Theory, encompasses the personal traits, perceptions, and characteristics of managers, which subsequently shape managerial behavior and strategic choices, thereby influencing organizational outcomes [

5]. It is widely acknowledged that managerial myopia significantly impacts firm behavior. Specifically, myopic managers tend to have a limited time horizon for decision-making and prioritize current performance and stock performance considerations. Previous research on managerial myopia has primarily focused on corporate investment behavior, revealing that myopic managers are more inclined to select projects with short-term maturity and high returns when making investment decisions [

6,

7,

8]. Consequently, this preference leads to reduced corporate capital expenditures and research and development (R&D) expenditures. While the existing literature has explored the implications of managerial myopia on corporate investment decisions, limited attention has been given to the sustainability of enterprise decarbonization. It remains unclear whether myopic managers, driven by their resource allocation authority, would exert influence on the role of enterprise digitalization in the decarbonization process. Further investigation is warranted to understand how the traits and tendencies associated with managerial myopia may shape the utilization of resources and decision-making in the context of enterprise decarbonization.

Our study not only investigates the impact of digital transformation on enterprise carbon intensity but also explores the specific impact paths from a management perspective by constructing management myopic features. Previous studies have explored factors that reduce carbon emissions, mostly at the macro level, such as examining low-carbon pilot policies, carbon trading markets [

9,

10], the impact of innovation [

11], industrial restructuring [

12], and the effect of green finance on carbon emissions [

13,

14,

15,

16]. Research conducted at the enterprise level from a management perspective has primarily focused on the effect of management structure on enterprise carbon emissions [

17], with limited relevant research concerning the internal factors associated with management traits. Some studies have introduced management ambivalence in the process of digitally promoting decarbonization [

18] yet lack an analysis of the specific mechanisms of the effect.

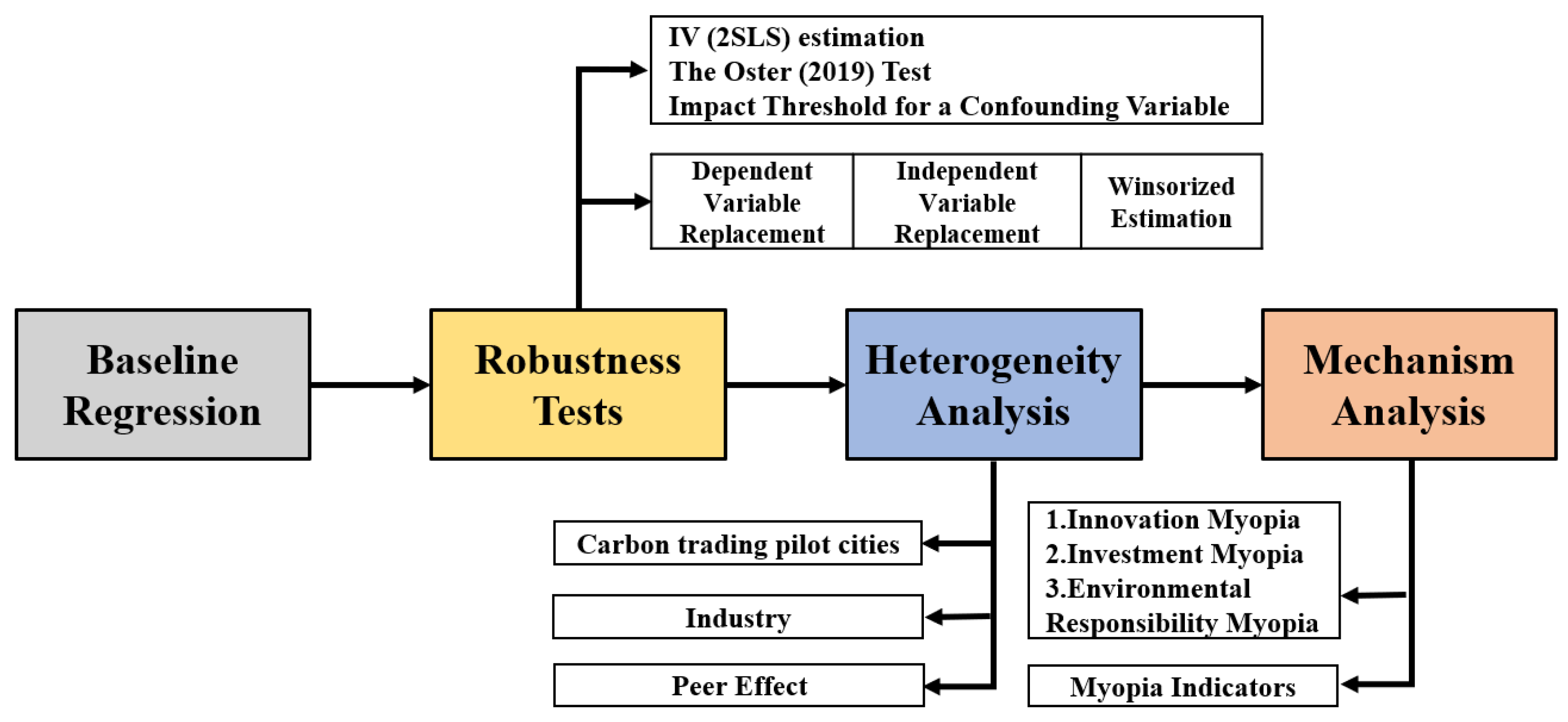

In this study, we utilize Text Mining and IPCC methods to measure the level of digital transformation and enterprise carbon emission intensity of A-share listed enterprises from 2008 to 2015. We first explore the impact of digitization on carbon intensity, followed by robustness tests and heterogeneity analysis. Furthermore, we construct Management Myopia as a framework to test and analyze the underlying mechanisms. This study makes four significant contributions. Firstly, it enhances the rationality and scientific rigor of indicators measurement. Previous studies have explored the effect of digital economy on regional carbon emission intensity at the provincial and city levels. However, some of these studies measured the carbon emission using absolute values, leading to a lack of comparability in carbon emissions among enterprises [

18,

19]. To address this limitation, our research adopts the IPCC method to calculate carbon emissions. We further divide these emissions by the enterprises’ production value added, constructing carbon emission intensity indicators that capture both environmental benefits and production efficiency. Secondly, our study is innovative, as evidenced by the fact that we adopt a unique research entry point, using text analysis to measure the degree of digital transformation and examining the influence of management myopic factors in this process. Thirdly, we construct a mechanism innovation by analyzing management myopia based on the Upper Echelons Theory and categorize myopia into three dimensions: innovation myopia, investment myopia, and environmental responsibility myopia. This framework sheds light on how different aspects of management myopia shape the relationship between digital transformation and decarbonization, thereby enriching our understanding of this complex phenomenon. Lastly, our study features perspective innovation by examining the effects of internal management characteristics on enterprise digital transformation-driven decarbonization. By considering the role of management traits and tendencies, we extend the scope and depth of research on this process, providing valuable insights for both academia and practice. The research framework is shown in

Figure 1.

2. Literature Review and Theoretical Background

2.1. Digital Transformation and Carbon Emission Intensity of Enterprises

Studies examining the impact of digitalization on carbon emissions have yielded several key findings. Firstly, the digital economy helps to reduce regional carbon emissions [

21] and drives decreases in the carbon emissions of surrounding regions with spatial spillover effects [

2], indicating the positive externalities of the digital economy. In addition to the direct effect of carbon emission reduction, the application of digital instruments also promotes the development of digital finance, reduces financing constraints, and increases sustainable investment, resulting in a reduction in overall regional carbon emissions [

14,

15]. At the industry level, digital transformation has proven effective in promoting sustainable development in the manufacturing sector. The development of digital technologies has reduced energy consumption intensity in China’s industrial system [

22], leading to a reduction in carbon emissions. Digitization has also been associated with increased productivity, driving total factor productivity [

23,

24], and contributing to energy intensity reduction and lower renewable energy costs [

25]. These gains in manufacturing efficiency and industrial upgrading further contribute to reductions in total carbon emissions [

12].

However, studies examining whether data factor inputs or digital technology applications contribute to a reduction in industrial carbon emissions have produced conflicting results. A second group of studies argues that digitization may actually exacerbate carbon emissions. The process of digitization itself, including the widespread usage of digital products and the operation of data centers, generates a substantial carbon footprint [

26]. A third group of studies suggests an uncertain relationship between digitization and carbon emissions, possibly exhibiting an inverted U-shape pattern [

27]. Chen et al. (2020) conclude that the environmental impacts of manufacturing digitization are both positive and negative, with the positive effect arising from resource efficiency gains through digital technology applications, while the negative effect stems from emissions during the manufacturing, use, and disposal of digital hardware [

28].

Despite the existing literature on the impact of digitalization on carbon emissions, most studies have focused on analyzing overall carbon emissions at city- and industry-level, with fewer studies conducted at the enterprise level to explore the factors and mechanisms influencing carbon emissions. In the era of coordinated digitalization and greenization, digital transformation has become imperative for micro, small, and medium-sized enterprises (MSMEs) in helping them to achieve high-quality and sustainable development. On one hand, digitalization assists enterprises in improving their production systems, R&D innovations, business processes, and relationships, thus reducing the carbon footprint associated with these processes. Through the utilization of big data technologies, enterprises can forecast and intervene in their energy demand more scientifically, thereby preventing and reducing pollutant generation and resource waste at the source [

29]. Xu et al. (2022) further confirm that digitization reduces energy intensity and optimizes the energy structure by promoting technological innovation, accelerating human capital accumulation, and mitigating structural distortions as mediating paths [

30]. On the other hand, digitalization and decarbonization have become focal prints in central and local government reports and related documents. Enterprises actively explore digitalization and decarbonization practices to enhance their business legitimacy and stability [

31,

32]. Moreover, competitors within the same industry may make strategic adjustments according to the behaviors of each other or follow the strategic alternatives of the leading companies, i.e., digital transformation has a cohort effect of mutual incentives [

33]. These influences of peer pressure create higher expectations for digital transformation, which is more conducive to its implementation, thus providing a basis for promoting decarbonization through digitalization. Therefore, we propose Hypothesis H1.

H1. Digital transformation leads to a decrease in enterprise carbon emission intensity, thereby promoting enterprise decarbonization.

2.2. The Impact of Management Myopia on an Enterprise’s Development

In practice scenarios, enterprises often encounter challenges in achieving substantial progress in digital transformation. The Accenture China Digital Transformation Index Study 2021 revealed that nearly 84% of enterprises have struggled to successfully undergo transformation, resulting in a predicament where they are torn between “waiting to die if they do not transform, but looking to die if they do.” This reality underscores the gap between strategic goals and strategy implementation, and scholars have analyzed the reasons in terms of resource base and the dynamic capabilities of enterprises [

34,

35]. However, it is essential to recognize that strategic decision-making in digital transformation relies on management for overall planning and driving implementation during practical execution. According to the Upper Echelon Theory, executive team traits influence strategy implementation [

5]. Just as management traits impact the concrete implementation of digital strategy, we examine the influence of management myopia, which involves prioritizing immediate satisfaction of current interests over making decisions aligned with the long-term interests of the company [

7,

36]. Given the significant impact of managerial behavior on company decisions, the prevalence of managerial myopia in practice is quite high. It has been observed that myopic managers tend to favor projects with short maturities and high returns when making investment decisions [

6,

7,

8].

Although digitalization is an industry megatrend, the decision to implement digital transformation can be risky, with uncertain prospects for different companies at various stages of development. Digitalization may lead to successful decarbonization, transformation failures, or fail to achieve decarbonization altogether. Regardless of the outcome, enterprises are required to make substantial investments in the current period, with potentially long-term returns. Due to myopic management, there may be a reluctance to sacrifice significant investments in the present for the uncertainties of the future. Alternatively, managers with limited cognitive abilities may be hindered when tasked with taking appropriate measures during digital transformation and ultimately fail to promote decarbonization through digitization. However, managers with strategic foresight will pay attention to national policies and observe the behavior of their peers, enabling them to adjust the direction of corporate development in a timely manner. Such enterprises are more likely to successfully implement digital transformation and promote decarbonization. Therefore, we hypothesize that:

H2. Management myopia plays a negative moderating role in the process of digitalization driving decarbonization.

2.3. Specific Impact Paths of Management Myopia

We have categorized management myopia into innovation myopia, investment myopia, and environmental awareness myopia, aiming to further investigate their moderating roles in driving decarbonization through digitalization.

Innovation myopia poses a significant challenge for enterprises. For businesses, adopting a low-carbon technology pathway is crucial for promoting low-carbonization. Digital transformation provides the appropriate conditions for enterprises to innovate in a green manner. This primarily manifests itself in two ways: Firstly, digital transformation utilizes emerging technologies, such as big data and artificial intelligence, to optimize the original operation mode [

25]. Secondly, it facilitates information sharing and collaboration among enterprises, strengthens interconnections within the industrial and supply chains, enhances overall efficiency, and creates an environment conducive to enterprise innovation.

Given the above context, promoting low-carbon technology innovation within enterprises, enhancing resource utilization efficiency, and reducing carbon dioxide emissions are not only beneficial to the long-term development of enterprises but also aligned with the aforementioned national policy objectives. However, compared to conventional technology innovation, green technology innovation necessitates substantial initial capital investment, features a prolonged profit cycle, and entails unpredictable risks. From the perspective of myopic management, implementing green innovation usually does not align with the immediate interests of enterprises, potentially leading to a neglect of low-carbon technology innovation during the process of digital transformation. Consequently, this obstacle hinders the process of digitization-driven decarbonization. Hence, we propose the following hypothesis:

H3. Innovation myopia hinders the process of digitization-driven decarbonization.

Decarbonizing enterprises requires sustainable investments, which, unfortunately, do not bring significant short-term benefits. Additionally, digital transformation itself represents a substantial investment for enterprises. In this context, myopic managers who prioritize stable short-term performance and are averse to taking risks are less inclined to allocate their limited resources towards long-term decarbonization initiatives [

37]. Instead, they are more motivated to invest in “short, flat, and fast” projects to avoid a decline in short-term performance, thereby impeding the progress of decarbonization. Based on this observation, we propose the following hypothesis:

H4. Investment myopia impedes the digitalization-driven decarbonization process.

Digitalization-driven decarbonization could yield long-term benefits for enterprise development; however, it may not yield immediate results and may lack motivational incentives for management. The willingness and attitude of performers towards implementing actual behavior have been found to have a strong positive relationship, as identified by psychologists and sociologists [

38]. Behavioral attitude serves as a crucial motivating factor that inspires individuals or organizations to overcome challenges associated with a specific behavior [

39]. Within the context of driving decarbonization, a key motivating factor for management is a sense of environmental responsibility, which significantly influences their strategic choices. The theory of strategic choice emphasizes the influence of values and cognitive abilities on an enterprise’s strategic decisions, with human resources being the core resource of an organization [

40]. Consequently, executives, who bear the responsibility for an enterprise’s future development, are more likely to prioritize decarbonization during the implementation of their strategies. Conversely, myopic managers lacking environmental responsibility find it harder to implement digitalization to promote decarbonization. We hypothesize as follows:

H5. Myopic environmental awareness is detrimental to the digitalization-driven decarbonization process.

5. Conclusions

This study investigates the impact of digital transformation on carbon emission intensity from a myopic management perspective. Our regression analysis reveals that digital transformation has a positive effect on reducing enterprise carbon emission intensity, and the results hold up under robustness tests. We performed the following rigorous endogeneity tests to ensure the credibility of the results: the Oster (2019) [

20] test and impact threshold for a confounding variable test—also applying the instrumental variables method. In our analysis of heterogeneity, we found that the carbon-emission-reduction effect of digitalization is weakened in carbon trading pilot cities, where enterprises prioritize low-carbon development due to policy influence. Conversely, in heavy industries, digitalization has a more significant impact on reducing carbon emissions. We also conducted a heterogeneity test to examine peer effects within the same industry, and our findings demonstrate that the carbon reduction effect of digitalization is more pronounced in enterprises with a peer effect.

In the mechanism research section, we analyzed the impact of management myopia, an internal factor that affects the promotion of decarbonization through digitalization. We explored the role played by managerial characteristics in the digital transformation process, enriching the study of the antecedent variables of enterprise digital transformation. We employed direct indicators, measuring management myopia and select mechanism variables (such as green innovation, sustainable investment, and environmental responsibility) to analyze the mechanisms involved in the digitalization-driven decarbonization process from a management perspective. Our results reveal that management myopia hinders the effectiveness of digital transformation in driving decarbonization, and we identify specific myopic tendencies in the following areas:

Innovation myopia: Insufficient emphasis on green innovation, failure to fully leverage the green innovation environment created by digitalization, and a lack of further mobilization of green innovation to support enterprise decarbonization efforts.

Investment myopia: The ability of digitalization to promote decarbonization relies on support from sustainable investment, but due to myopia among managers with respect to investment, they neglect sustainable investment with long return cycles, hampering decarbonization progress.

Myopic environmental responsibility: While digitalization promotes long-term enterprise development, its short-term effects may appear insignificant, and the decarbonization process may encounter challenges and transformations. Behavioral incentives are needed for management to sustain progress. Management teams that consider their environmental responsibility are more likely to persevere, while myopic management teams are not.

Table 10 provides a summary of the research hypotheses and their corresponding validation status.

Practice implications: As more traditional manufacturing enterprises opt for digital transformation to promote low-carbon development, based on our findings, we offer the following suggestions to managers: Actively embrace digital transformation as an inevitable long-term development trend to drive low-carbonization. Adjust strategies to align with the changing times and adopt a longer-term perspective on corporate transformation and development. Avoid innovation myopia by adapting to the evolving environment, cultivating core competencies, and emphasizing innovation in digitalization practices. Overcome investment myopia by making corresponding green and sustainable investments. Avoid environmental responsibility myopia and embrace the concept of environmental protection to help achieve low-carbonization.

Study limitations and future prospects: This study utilized linear regression to examine the relationship between digitalization and carbon emissions. Future research could consider incorporating non-linear relationships or gate-effects models to enhance their analysis. Additionally, the data used in this study were derived from The Chinese National Tax Survey Database, with the latest available data being from 2015. It would be worthwhile for future studies to explore other databases to extend the study period and examine potential changes in recent years.