Research on the Effect of Knowledge Stock on Technological Advance and Economic Growth in Republic of Korea

Abstract

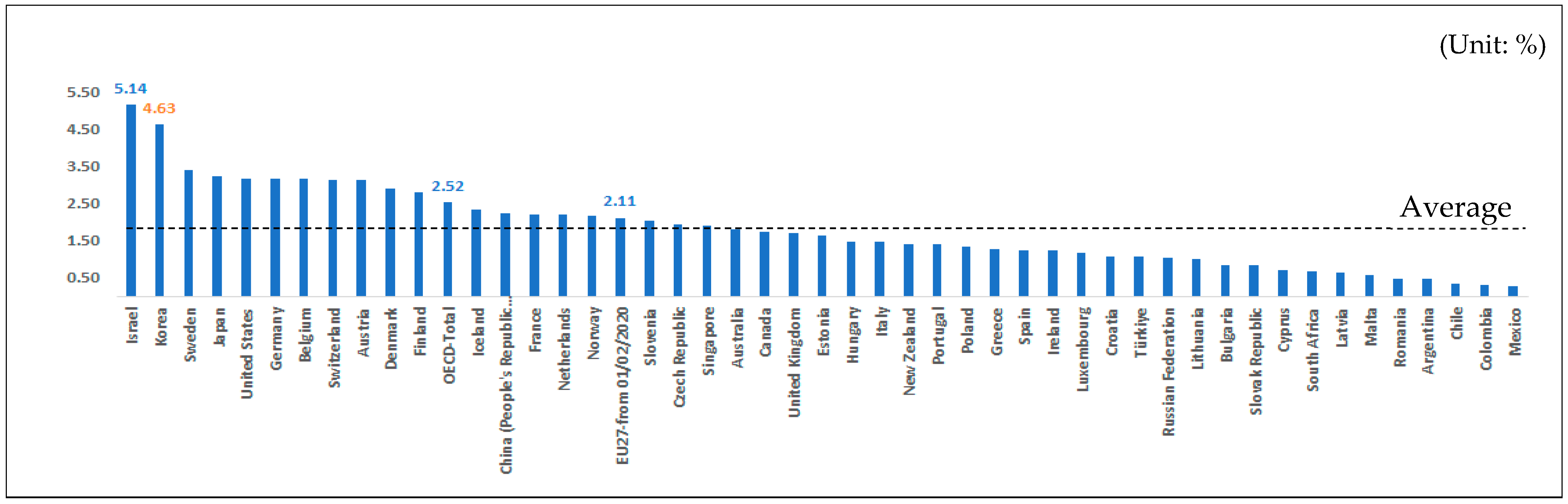

:1. Introduction

| Sort | Period | Range | Contribution to R&D (%) |

|---|---|---|---|

| STEPI (2004) [8] | 1981~2002 | Nation (Total Industry) | 28.1 |

| Ha (2005) [9] | 1991~2000 | 10.9 | |

| Shin et al. (1996) [10] | 1981~1994 | 34.9 | |

| Moon and Lee (2004) [11] | 1991~2002 | 23.3 | |

| Kim (2006) [12] | 1983~2004 | Nation (Total and Manufacturing Industry) | 45.7/17.5 |

| Baek(2014) [13] | 2004~2008 | Nation (Total Industry) | 41.3 |

| Park et al. (2016) [14] | 1997~2013 | ICT Industry | 48.2 |

2. Materials and Methods

2.1. Theoretical Background

2.1.1. Concepts and Estimates of Knowledge Stocks

2.1.2. Technological Innovation and Sustainable Economic Growth

2.2. Literature Reviews

| Sort | Author | Methodology | Main Contents |

|---|---|---|---|

| Knowledge Stock | Bosworth (2005) [22] | Empirical Analysis (Klette Model) | Estimation of R&D Knowledge Obsolescence Ratio |

| OECD (2015) [23] | Conceptual and Empirical Analysis | Concept and Estimation of R&D flows and stocks | |

| Lee & Kim (2004) [20] | Empirical Analysis (Obsolescence of a patent) | Estimation of Productivity Spillover Effect of R&D Investment | |

| Seo (2004) [21] | Empirical Analysis (Klette model) | Established panel data and estimated the obsolescence rate of knowledge stocks | |

| TFP Estimation | Krugman (1994) [1] | Case Study | TFP Discussion in East Asian Countries |

| Young (1992) [2] | Empirical Analysis | Estimating factors for economic growth in Hong Kong and Singapore by growth accounting formula | |

| Kim (2017) [24] | Empirical Analysis | Methodology of TFP by industry and Firm | |

| A causal relationship of R&D, TFP and Economic Growth | Kafouros (2005) [29] | Empirical Analysis (Constant returns to scale) | Comparison of TFP in the United Kingdom, the United States, France, Germany, and Japan |

| OECD (2015) [23] | Conceptual and Empirical Analysis | Estimating R&D returns in the production function framework | |

| Cherif and Hasanov (2019) [6] | Case Study and Empirical Analysis | Characteristics of Technology and Innovation Policy as a True Industrial Policy (TIP) | |

| Kim (2020) [28] | Empirical Analysis (Analysis of OECD Panel by Cobb–Douglas production function) | Panel Analysis by Technology in the Republic of Korea | |

| Hhang et al. (2020) [7] | Empirical Analysis (Estimation to Economic Growth by Cobb–Douglas production function) | Estimating the Effect of R&D Investment on Economic Growth |

2.3. Design, Methodology, and Approach

| Process | Methodology | Data Source |

|---|---|---|

| 1. Data processing and Time series trend analysis |

| |

| 2. Time series characteristic analysis | ||

| 3. OLS |

|

3. Results

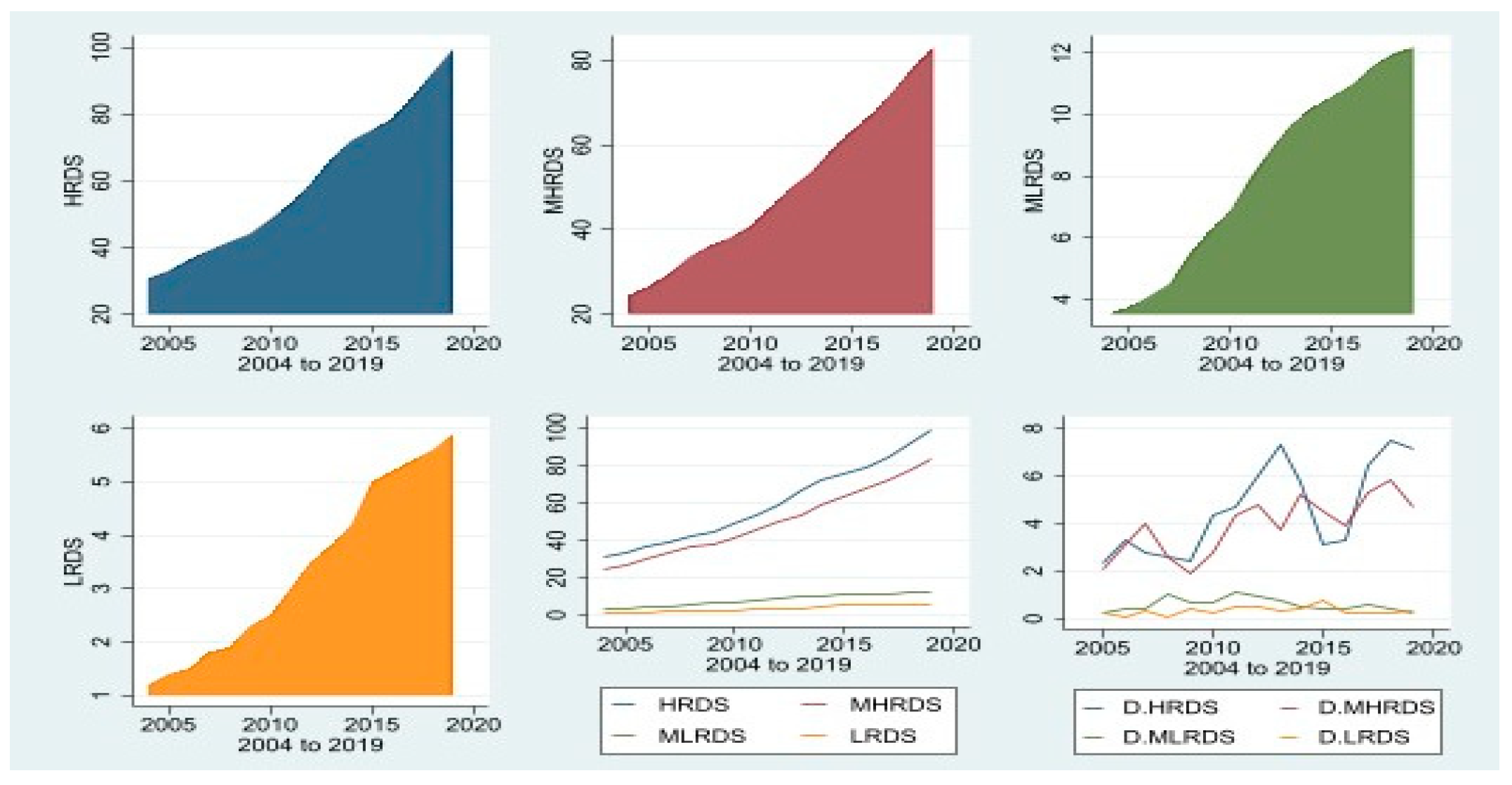

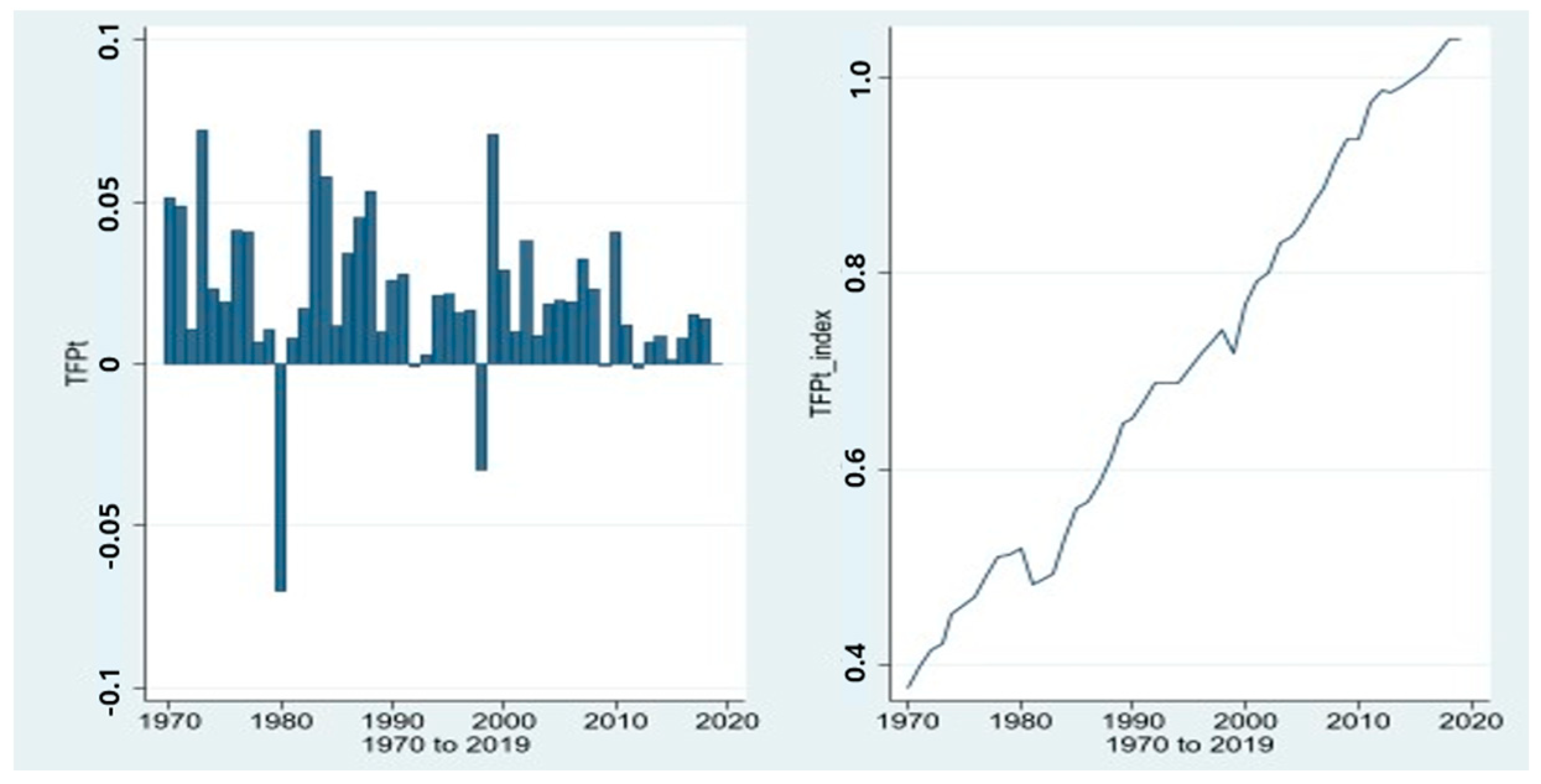

3.1. Time Series Trend Analysis

3.2. Analysis of Knowledge Stock, Technology Advances, and Economic Growth

3.2.1. The Impact of Knowledge Stock on Economic Growth

3.2.2. The Effect of Knowledge Stock on Total Factor Productivity

3.2.3. The Effects of Total Factor Productivity on Economic Growth

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Analysis Process of ECM (Error-Correction Model) by Engle and Granger

| Variable | Level Variable | 1st Difference | 2nd Difference | Test | |

|---|---|---|---|---|---|

| ln_RDSt | ADF | −3.057 (0.0299) ** | - | - | I(0) |

| PP | −2.299 (0.1724) | −2.065 (0.2589) | −6.856 (0.0000) *** | I(2) | |

| ln_RDSGt | ADF | −2.166 (0.2189) | −0.880 (0.7946) | −3.714 (0.0039) *** | I(2) |

| PP | −4.815 (0.0007) *** | - | - | I(0) | |

| ln_RDSPt | ADF | −2.507 (0.1138) | −3.556 (0.0067) *** | - | I(1) |

| PP | −10.02 (0.0000) *** | - | - | I(0) | |

| ln_Lt | ADF | −3.384 (0.0115) ** | - | - | I(0) |

| PP | −6.895 (0.0000) *** | - | - | I(0) | |

| ln_Kt | ADF | −3.384 (0.0128) ** | - | - | I(0) |

| PP | −3.685 (0.0043) *** | - | - | I(0) | |

| TFP | ADF | −1.275 (0.06405) | −2.845 (0.0521) ** | - | I(1) |

| PP | −1.903 (0.3309) | −6.322 (0.0000) *** | - | I(1) | |

| TFPM | ADF | −2.662 (0.0809) * | - | - | I(0) |

| PP | −2.443 (0.1300) | −5.580 (0.0000) | - | I(1) | |

| ln_GDPt | ADF | −2.537 (0.1067) | −0.802 (0.8184) | −4.047 (0.0012) *** | I(2) |

| PP | −5.725 (0.0000) *** | - | - | I(0) | |

| ln_GDPMt | ADF | −1.704 (0.4290) | −4.466 (0.0002) *** | - | I(1) |

| PP | −1.720 (0.4208) | −4.463 (0.0002) *** | - | I(1) | |

| ln_VAt | ADF | −1.099 (0.7153) | −1.613 (0.4763) | −3.366 (0.0122) ** | I(2) |

| PP | −2.045 (0.2670) | −5.080 (0.0000) | - | I(1) | |

| ln_VAMt | ADF | −1.026 (0.7438) | −1.577 (0.4953) | −3.214 (0.0192) ** | I(2) |

| PP | −1.999 (0.2869) | −4.991 (0.0000) ** | - | I(1) | |

| Sort | Relationship | Result | Test |

|---|---|---|---|

| Knowledge Stock → Economic Growth | ln_RDSt → GDPt | −3.514 (0.0076) *** | Exist |

| ln_RDSGt → GDPt | −3.309 (0.0145) ** | Exist | |

| ln_RDSGt → GDPt | −3.860 (0.0024) *** | Exist | |

| ln_RDSt → GDPMt | −2.181 (0.2129) | Non-exist | |

| ln_RDSPt → GDPMt | −2.041 (0.2689) | Non-exist | |

| ln_RDSPt → GDPMt | −2.238 (0.1929) | Non-exist | |

| ln_RDSt → VAt | −3.315 (0.0241) ** | Exist | |

| ln_RDSGt → VAt | −3.031 (0.0321) ** | Exist | |

| ln_RDSPt → VAt | −3.163 (0.0222) ** | Exist | |

| ln_RDSt → VAMt | −3.057 (0.0299) ** | Exist | |

| ln_RDSPt → VAMt | −2.941 (0.0408) * | Exist | |

| ln_RDSPt → VAMt | −3.066 (0.0291) ** | Exist | |

| ln_RDSHt → GDPt | −3.951 (0.0017) *** | Exist | |

| ln_RDSMHt → GDPt | −2.690 (0.0758) * | Exist | |

| ln_RDSMLt → GDPt | −3.096 (0.0268) ** | Exist | |

| ln_RDSLt → GDPt | −2.897 (0.0456) ** | Exist | |

| ln_RDSHt → GDPMt | −4.005 (0.0014) *** | Exist | |

| ln_RDSMHt → GDPMt | −3.471 (0.0088) *** | Exist | |

| ln_RDSMLt → GDPMt | −4.255 (0.0005) *** | Exist | |

| ln_RDSLt → GDPMt | −4.375 (0.0001) *** | Exist | |

| ln_RDSHt → VAt | −4.280 (0.0005) *** | Exist | |

| ln_RDSMHt → VAt | −4.270 (0.0005) *** | Exist | |

| ln_RDSMLt → VAt | −4.377 (0.0003) *** | Exist | |

| ln_RDSLt → VAt | −5.718 (0.0000) *** | Exist | |

| ln_RDSHt → VAt | −4.368 (0.0003) *** | Exist | |

| ln_RDSMHt → VAMt | −4.162 (0.0008) *** | Exist | |

| ln_RDSMLt → VAMt | −5.129 (0.0000) *** | Exist | |

| ln_RDSLt → VAMt | −6.141 (0.0000) *** | Exist | |

| Knowledge Stock → Technology Advance | ln_RDSt → TFPt | −3.544 (0.0069) *** | Exist |

| ln_RDSGt → TFPt | −2.966 (0.0382) ** | Exist | |

| ln_RDSPt → TFPt | −4.017 (0.0013) *** | Exist | |

| ln_RDSHt → TFPMt | −3.900 (0.0020) *** | Exist | |

| ln_RDSMHt → TFPMt | −5.034 (0.0000) *** | Exist | |

| ln_RDSMLt → TFPMt | −4.444 (0.0002) *** | Exist | |

| ln_RDSLt → TFPMt | −4.132 (0.0009) *** | Exist | |

| Technology Advance → Economic Growth | TFPt → GDPt | −2.501 (0.1153) | Non-exist |

| TFPt → GDPMt | −2.187 (0.2111) | Non-exist | |

| TFPt → VAt | −2.808 (0.0571) ** | Exist | |

| TFPt → VAMt | −2.767 (0.0697) ** | Exist |

References

- Krugman, P. The Myth of Asia’s Miracle. Foreign Aff. 1994, 73, 62–78. [Google Scholar] [CrossRef]

- Young, A. A Tale of Two Cities: Factor Accumulation and Technical Change in Hong Kong and Singapore. NBER Macroecon. Annu. 1992, 7, 13–54. [Google Scholar] [CrossRef]

- Jeong, J.H. The Current Research Trends and Challenges on Technological Innovation and Economic Growth: A Focus of Korean Cases. J. Technol. Innov. 2017, 25, 47–77. [Google Scholar] [CrossRef]

- OECD Science, Technology and Innovation Scoreboard. Available online: https://www.oecd.org/sti/scoreboard.htm (accessed on 10 April 2023).

- Jorgenson, D.W.; Zvi, G. The Explanation of Productivity Change. Rev. Econ. Stud. 1967, 34, 249–283. [Google Scholar] [CrossRef]

- Reda, C.; Hasanov, F. The Return of the Policy That Shall Not Be Named: Principles of Industrial Policy; IMF Working Paper; IMF: Washington, DC, USA, 2019; pp. 7–50. [Google Scholar]

- Hwang, J.H.; Pakr, S.I.; Park, J.L.; Kim, S.J.; Ahn, G.S.; Kim, Y.J.; Lee, J.S.; Kim, Y.J.; Lee, J.G.; Kim, Y.J.; et al. A Study on the Improvement of the Survey System to Improve the Consistency of the Preliminary Feasibility Study for R&D Projects in 2020; KISTEP (Korea Institute of S&T Evaluation and Planning): Eumseong, Republic of Korea, 2020. [Google Scholar]

- STEPI. Contribution of R&D Investment to Economic Growth; STEPI (Science and Technology Policy Institute): Sejong, Republic of Korea, 2004. [Google Scholar]

- Ha, J. Analysis of Economic Growth Effects of R&D. In Economic Analysis; BOK (Bank of Korea): Seoul, Republic of Korea, 2005; Volume 11, pp. 73–107. [Google Scholar]

- Shin, T.Y. Economic Effects of R&D Budget; STEPI (Science and Technology Policy Institute): Sejong, Republic of Korea, 1996. [Google Scholar]

- Moon, S.S.; Lee, J.G. Dynamic Analysis of Growth Potential Variation Factors; BOK (Bank of Korea): Seoul, Republic of Korea, 2004. [Google Scholar]

- Kim, S.H. Productivity Contribution of R&D Investment by Industry; STEPI (Science and Technology Policy Institute): Sejong, Republic of Korea, 2006. [Google Scholar]

- Beak, C.W.; Um, I.C.; Lee, S.B. A Comparative Study of Korea and Japan on the Contribution of R&D investments to Total Factor Productivity at the Firm Level. J. Asian Study. 2014, 17, 37–56. [Google Scholar]

- Park, C.M.; Han, J.M.; Goo, B.C. A Exploratory Study on the Differential Application of the R&D Contribution Rate: Focusing on the ICT R&D Project. J. Korea Technol. Innov. Soc. 2016, 19, 29–47. [Google Scholar]

- Chang, J.G.; Jung, S.C.; Kim, G.C. Economic Effects of R&D Investment; STEPI (Science and Technology Policy Institute): Sejong, Republic of Korea, 1994. [Google Scholar]

- STEPI. International Comparison of R&D Investment and Knowledge Storage; STEPI (Science and Technology Policy Institute): Sejong, Republic of Korea, 2002. [Google Scholar]

- Solow, R.M. Technical Change and the Aggregate Production Functio. Rev. Econ. Stat. 1957, 39, 312–320. [Google Scholar] [CrossRef] [Green Version]

- Romer, P.M. SEndogenous Technological Change. J. Political Econ. 1990, 98, 71–102. [Google Scholar] [CrossRef] [Green Version]

- Lucas, R.E. On the mechanics of Economic Development. J. Monet. Econ. 1988, 22, 3–42. [Google Scholar] [CrossRef]

- Lee, W.K.; Kim, B.K. Analysis of Productivity Ripple Effect of R&D Investment; STEPI (Science and Technology Policy Institute): Sejong, Republic of Korea, 2004. [Google Scholar]

- Seo, J.H. Characteristics and Economic Effects of Korean Firms’ R&D Investment. KDI J. Econ. Policy 2004, 27, 83–122. [Google Scholar]

- Bosworth, D.L. The Rate of Obsolescence of Technical Knowledge—A Note. J. Ind. Econ. 1978, 26, 273–279. [Google Scholar] [CrossRef]

- OECD. The Impact of R&D Investment on Economic Performance: A Review of the Econometric Evidence; OECD: Paris, France, 2015. [Google Scholar]

- Kim, W.G. Productivity Analysis and Policy Implications of the Korean Economy; KIET (Korea Institute for Industrial Economic & Trade): Sejong, Republic of Korea, 2017. [Google Scholar]

- Kwark, N.S. The Change in Potential Growth After the Currency Crisis in Korea Based on Growth Accounting Analysis. In Economic Research; The Korean Economic Association: Seoul, Republic of Korea, 2007; Volume 55, pp. 549–588. [Google Scholar]

- Caves, D.; Christensen, L.; Diewert, E. Multilateral Comparisons of Output, Input and Productivity Using Superlative Index Numbers. Econ. J. 1982, 92, 73–86. [Google Scholar] [CrossRef]

- Griffith, R.; Redding, S.; Van Reenen, J. Mapping the Two Faces of R&D: Productivity Growth in a Panel of OECD Industries. Rev. Econ. Stat. 2004, 86, 883–895. [Google Scholar]

- Kim, J.H. A Study on the Impact of R&D Investment and Education Support on Total Factor Productivity; Korea University: Seoul, Republic of Korea, 2020. [Google Scholar]

- Kafouros, M.I. R&D and productivity growth: Evidence from the UK. Econ. Innov. New Technol. 2005, 14, 479–497. [Google Scholar]

- OECD. OECD Taxonomy of Economic Activities Based on R&D Intensit; OECD: Paris, France, 2016. [Google Scholar]

- Dickey, D.A.; Fuller, W.A. Distribution of the Estimators for Autoregressive Time Series with a Unit Root. J. Am. Stat. Assoc. 1976, 74, 427–431. [Google Scholar]

- Granger, C.W.J. Some properties of time series data and their use in econometric model specification. J. Econ. 1981, 16, 121–130. [Google Scholar] [CrossRef]

- Engle, R.F.; Granger, C.W.J. Co-Integration and Error Correction: Representation, Estimation, and Testing. Econ. Soc. 1987, 55, 251–276. [Google Scholar] [CrossRef]

- KIET. Analysis and Policy Implications of Industrial Innovation Policy; KIET (Korea Institute for Industrial Economic & Trade): Sejong, Republic of Korea, 2020. [Google Scholar]

- BOK. Available online: https://ecos.bok.or.kr/ (accessed on 14 January 2023).

- ISTANS. Available online: https://istans.or.kr/ (accessed on 7 January 2023).

- KPC. Available online: https://www.kpc.or.kr/Productivity/StatisticDB.asp (accessed on 14 January 2023).

- NTIS. Available online: https://www.ntis.go.kr (accessed on 7 January 2023).

- PWT 10.0. Available online: https://www.rug.nl/ggdc/productivity/pwt/ (accessed on 21 January 2023).

- Kim, J.W. The Economic Growth Effect of R&D Activity in Korea. Korea World Econ. 2011, 12, 25–44. [Google Scholar]

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Variables | ln_GDPt | ln_GDPt | ln_GDPt | ln_GDPMt | ln_GDPMt | ln_GDPMt |

| ln_Lt | 0.602 *** | 0.419 *** | 0.327 * | −0.909 | −0.512 | −0.784 |

| (0.125) | (0.146) | (0.180) | (0.589) | (0.600) | (0.657) | |

| ln_Kt | 0.213 ** | 0.347 *** | 0.446 *** | −0.358 | −0.237 | −0.776 |

| (0.103) | (0.107) | (0.106) | (0.551) | (0.494) | (1.073) | |

| ln_RDSt | 0.144 ** | 1.636 ** | ||||

| (0.0700) | (0.634) | |||||

| ln_RDSGt | 0.0809 | 1.197 ** | ||||

| (0.122) | (0.442) | |||||

| ln_RDSPt | −0.0112 | 1.909 | ||||

| (0.0514) | (1.223) | |||||

| Constant | 0.0160 *** | 0.0167 *** | 0.0175 *** | −0.0631 | 0.0122 | −0.0143 |

| (0.00531) | (0.00608) | (0.00598) | (0.0372) | (0.0227) | (0.0267) | |

| Observations | 147 | 129 | 129 | 84 | 84 | 84 |

| R-squared | 0.856 | 0.852 | 0.856 | 0.730 | 0.720 | 0.705 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Variables | ln_VAt | ln_Vat | ln_VAt | ln_VAMt | ln_VAMt | ln_VAMt |

| ln_Lt | −0.0173 | 0.192 | 0.0563 | −0.0852 | 0.143 | 0.00376 |

| (0.310) | (0.314) | (0.353) | (0.313) | (0.321) | (0.364) | |

| ln_Kt | 0.171 | −0.000610 | −0.0274 | 0.143 | −0.0161 | −0.0148 |

| (0.453) | (0.401) | (0.759) | (0.448) | (0.407) | (0.775) | |

| ln_RDSt | 0.761 | 0.827 * | ||||

| (0.484) | (0.475) | |||||

| ln_RDSGt | 0.795 ** | 0.838 ** | ||||

| (0.357) | (0.362) | |||||

| ln_RDSPt | 0.901 | 0.912 | ||||

| (0.822) | (0.846) | |||||

| Constant | −0.0317 | 0.00367 | −0.000122 | −0.0343 | 0.00391 | 6.38 × 10−5 |

| (0.0278) | (0.0136) | (0.0184) | (0.0277) | (0.0138) | (0.0187) | |

| Observations | 84 | 84 | 84 | 84 | 84 | 84 |

| R-squared | 0.811 | 0.832 | 0.811 | 0.813 | 0.835 | 0.810 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variables | ln_GDPt | ln_GDPt | ln_GDPt | ln_GDPt |

| ln_Lt | 0.359 | −0.0113 | 0.166 | −0.311 |

| (0.212) | (0.220) | (0.200) | (0.321) | |

| ln_Kt | 1.521 *** | 0.827 | 0.921 * | 0.645 |

| (0.399) | (0.489) | (0.424) | (0.480) | |

| ln_RDSHt | 0.155 | |||

| (0.107) | ||||

| ln_RDSMHt | 0.243 * | |||

| (0.118) | ||||

| ln_RDSMLt | 0.0926 * | |||

| (0.0439) | ||||

| ln_RDSLt | 0.118 * | |||

| (0.0522) | ||||

| Constant | −0.0353 * | −0.0140 | −0.00643 | 0.00337 |

| (0.0158) | (0.0126) | (0.0151) | (0.0173) | |

| Observations | 60 | 60 | 60 | 60 |

| R-squared | 0.890 | 0.900 | 0.922 | 0.902 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variables | ln_GDPMt | ln_GDPMt | ln_GDPMt | ln_GDPMt |

| D.ln_Lt | −2.570 ** | −2.714 * | −0.967 | −3.471 ** |

| (0.931) | (1.392) | (0.917) | (1.387) | |

| D.ln_Kt | 3.630 ** | 0.563 | −0.498 | 1.069 |

| (1.401) | (3.198) | (1.839) | (1.476) | |

| D.ln_RDSHt | 1.456 ** | |||

| (0.513) | ||||

| D.ln_RDSMHt | 1.523 | |||

| (1.081) | ||||

| D.ln_RDSMLt | 1.129 *** | |||

| (0.200) | ||||

| D.ln_RDSLt | 0.644 * | |||

| (0.332) | ||||

| Constant | −0.190 *** | −0.0883 | −0.0309 | −0.0388 |

| (0.0526) | (0.0666) | (0.0681) | (0.0557) | |

| Observations | 60 | 60 | 60 | 60 |

| R-squared | 0.827 | 0.703 | 0.906 | 0.718 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variables | ln_Vat | ln_VAt | Dn_VAt | ln_VAt |

| D.ln_Lt | −1.269 ** | −1.021 | 0.0521 | −1.111 |

| (0.450) | (0.767) | (0.662) | (0.638) | |

| D.ln_Kt | 1.457 | 0.121 | −0.157 | 0.514 |

| (0.999) | (2.084) | (0.705) | (1.006) | |

| ln_RDSHt | 0.837 ** | |||

| (0.317) | ||||

| ln_RDSMHt | 0.629 | |||

| (0.652) | ||||

| ln_RDSMLt | 0.529 *** | |||

| (0.111) | ||||

| ln_RDSLt | 0.280 | |||

| (0.200) | ||||

| Constant | −0.0785 * | −0.0197 | −0.00890 | −0.00895 |

| (0.0383) | (0.0535) | (0.0358) | (0.0398) | |

| Observations | 60 | 60 | 60 | 60 |

| R-squared | 0.834 | 0.732 | 0.871 | 0.747 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variables | ln_VAMt | ln_VAMt | ln_VAMt | ln_VAMt |

| ln_Lt | −1.264 ** | −1.102 | −0.161 | −1.283 |

| (0.490) | (0.804) | (0.752) | (0.806) | |

| ln_Kt | 1.813 | 0.125 | 0.0396 | 0.755 |

| (1.024) | (2.157) | (1.127) | (1.193) | |

| ln_RDSHt | 0.800 ** | |||

| (0.323) | ||||

| ln_RDSMHt | 0.787 | |||

| (0.646) | ||||

| ln_RDSMLt | 0.554 *** | |||

| (0.112) | ||||

| ln_RDSLt | 0.304 | |||

| (0.214) | ||||

| Constant | −0.0874 * | −0.0314 | −0.0143 | −0.0170 |

| (0.0391) | (0.0498) | (0.0466) | (0.0445) | |

| Observations | 60 | 60 | 60 | 60 |

| R-squared | 0.830 | 0.756 | 0.873 | 0.756 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Variables | TFPt | TFPt | TFPt |

| ln_Lt | −0.530 *** | −0.457 *** | −0.838 *** |

| (0.113) | (0.116) | (0.0861) | |

| ln_Kt | 0.204 ** | 0.211 *** | 0.396 *** |

| (0.0971) | (0.0658) | (0.0365) | |

| ln_RDSt | 0.122 ** | ||

| (0.0526) | |||

| ln_RDSGt | 0.104 *** | ||

| (0.0267) | |||

| ln_RDSPt | 0.0406 * | ||

| (0.0213) | |||

| Constant | 2.472 *** | 1.585 ** | 4.055 *** |

| (0.881) | (0.720) | (0.958) | |

| Observations | 147 | 129 | 129 |

| R-squared | 0.984 | 0.984 | 0.971 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variables | TFPt | TFPt | TFPt | TFPt |

| ln_Lt | −0.176 *** | −0.295 *** | 0.104 *** | −0.140 *** |

| (0.0423) | (0.0149) | (0.0225) | (0.0167) | |

| ln_Kt | 0.374 *** | −0.238 *** | 0.260 *** | 0.278 *** |

| (0.0472) | (0.0412) | (0.0226) | (0.0259) | |

| ln_RDSHt | 0.0575 * | |||

| (0.0336) | ||||

| ln_RDSMHt | 0.299 *** | |||

| (0.0170) | ||||

| ln_RDSMLt | 0.0826 *** | |||

| (0.00676) | ||||

| ln_RDSLt | 0.0745 *** | |||

| (0.00762) | ||||

| Observations | 56 | 56 | 56 | 56 |

| R-squared | 0.995 | 0.998 | 0.998 | 0.997 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variables | ln_GDPt | ln_GDPMt | ln_VAt | ln_VAMt |

| TFPt | 0.955 *** | 2.145 *** | 1.446 *** | 1.526 *** |

| (0.0145) | (0.750) | (0.410) | (0.405) | |

| ln_Lt | 0.507 *** | −0.376 | 0.226 | 0.190 |

| (0.00781) | (0.617) | (0.319) | (0.323) | |

| ln_Kt | 0.413 *** | 0.669 ** | 0.636 *** | 0.651 *** |

| (0.00691) | (0.292) | (0.215) | (0.216) | |

| Constant | 0.00333 *** | −0.0140 | −0.0155 | −0.0162 |

| (0.000456) | (0.0224) | (0.0138) | (0.0139) | |

| Observations | 49 | 28 | 28 | 28 |

| R-squared | 0.999 | 0.722 | 0.840 | 0.846 |

| Sort | Result | Main Points | |

|---|---|---|---|

| Model 1. Knowledge Stock → Economic Growth | Knowledge Stock → Economic Growth | Significant (+) | Estimate that manufacturing industry is more resilient than total industry |

| Knowledge Stock by Financial Resource → Economic Growth | Significant (+) | Most private sector estimates statistically insignificant | |

| Knowledge Stock by Industry → Economic Growth | Significant (+) | High and high to med industrial groups are highly resilient | |

| Model 2. Knowledge Stock → Technology Advance | Knowledge Stock → Technology Advance | Significant (+) | All knowledge stocks have a positive (+) impact on technology advance |

| Knowledge Stock by Financial Resource → Technology Advance | Significant (+) | ||

| Knowledge Stock by Industry → Technology Advance | Significant (+) | ||

| Model 3. Technology Advance → Economic Growth | Significant (+) | Statistically significant estimates of all, especially manufacturing are more highly elastic than all industries | |

| Sort | Period | Range | R&D Elasticity |

|---|---|---|---|

| This study | 1976~2019 | Total industry (GDP) | 0.144 |

| 1991~2019 | Total industry (Value added) | 0.761 | |

| 2005~2019 | Industries based on R&D intensity (GDP) |

| |

| 2005~2019 | Industries based on R&D intensity (Value added) |

| |

| Hwang et al. (2020) [7] | 1995~2017 | Total industry | 0.132 |

| Beak et al. (2016) [13] | 1997~2013 | ICT industry | 0.344 |

| Kim (2011) [40] | 1976~2019 | Total industry | 0.166 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jung, J.; Choi, S. Research on the Effect of Knowledge Stock on Technological Advance and Economic Growth in Republic of Korea. Sustainability 2023, 15, 9639. https://doi.org/10.3390/su15129639

Jung J, Choi S. Research on the Effect of Knowledge Stock on Technological Advance and Economic Growth in Republic of Korea. Sustainability. 2023; 15(12):9639. https://doi.org/10.3390/su15129639

Chicago/Turabian StyleJung, Jaeho, and Sangok Choi. 2023. "Research on the Effect of Knowledge Stock on Technological Advance and Economic Growth in Republic of Korea" Sustainability 15, no. 12: 9639. https://doi.org/10.3390/su15129639