Study on Emission Control of Berthing Vessels-Based on Non-Cooperative Game Theory

Abstract

1. Introduction

2. Materials and Methods

2.1. Non-Cooperative Game Models for Air Pollution Control Considering Low-Sulfur Fuel Subsidies

2.2. A Simultaneous Game Model for Two Ports

2.3. A Sequential Game Model for Two Ports

3. Results

3.1. Analysis of the Factors Affecting the Optimal Service Prices of Two Ports

3.2. Comparative Analysis of Simultaneous and Sequential Game Models

4. Discussion and Case Analysis

4.1. Data Source

4.1.1. AIS Data of Container Ships in Shanghai Port and Ningbo-Zhoushan Port

4.1.2. Price of Marine Fuel

4.1.3. Parameter Values

4.2. A Case Study of Non-Cooperative Games Considering Low-Sulfur Fuel Oil Subsidies

4.2.1. Discussion of the Case Analysis

- 1.

- Simultaneous competition between two ports.

- 2.

- Sequential competition between two ports

- 3.

- Comparative analysis of two non-cooperative game models

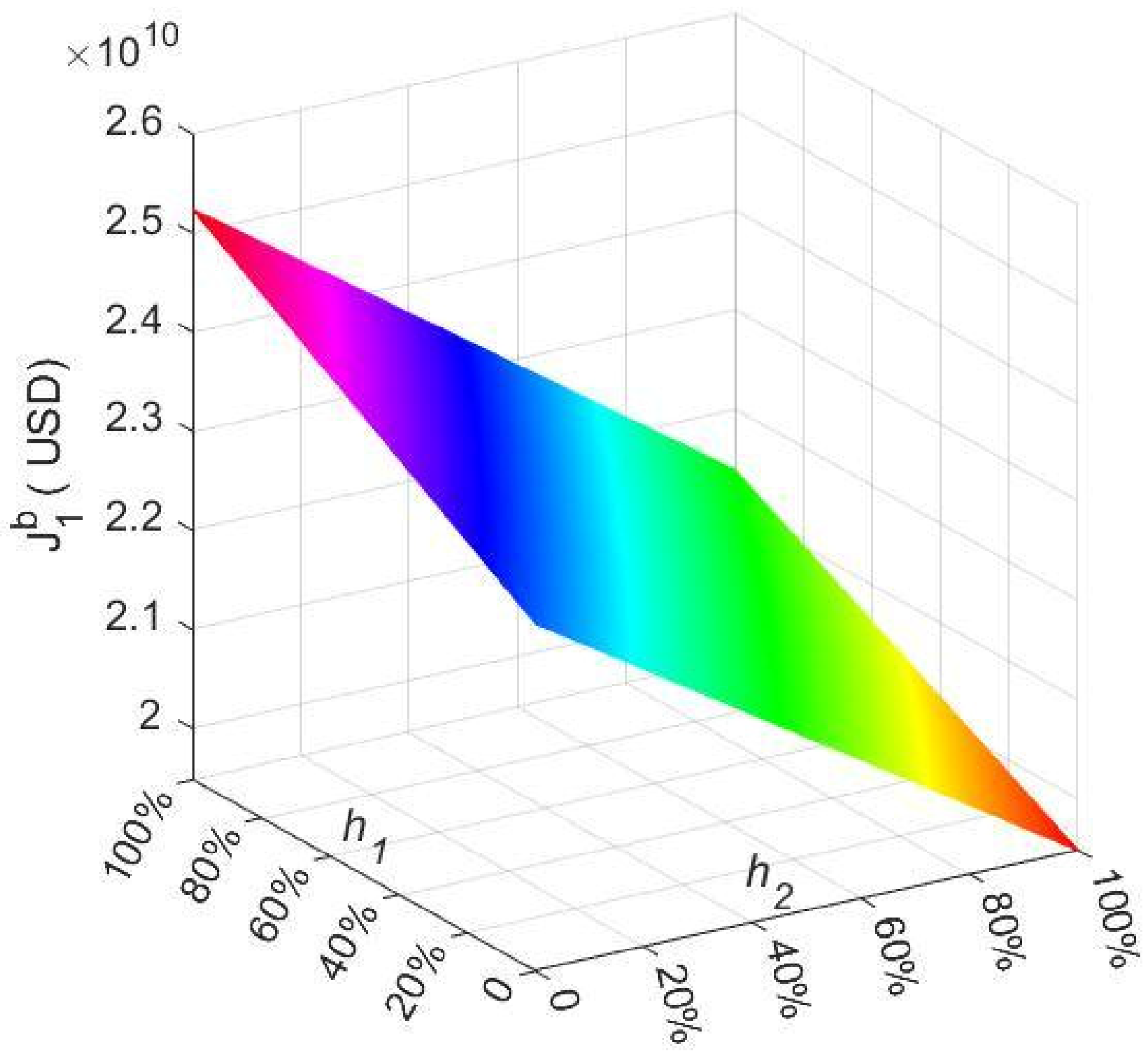

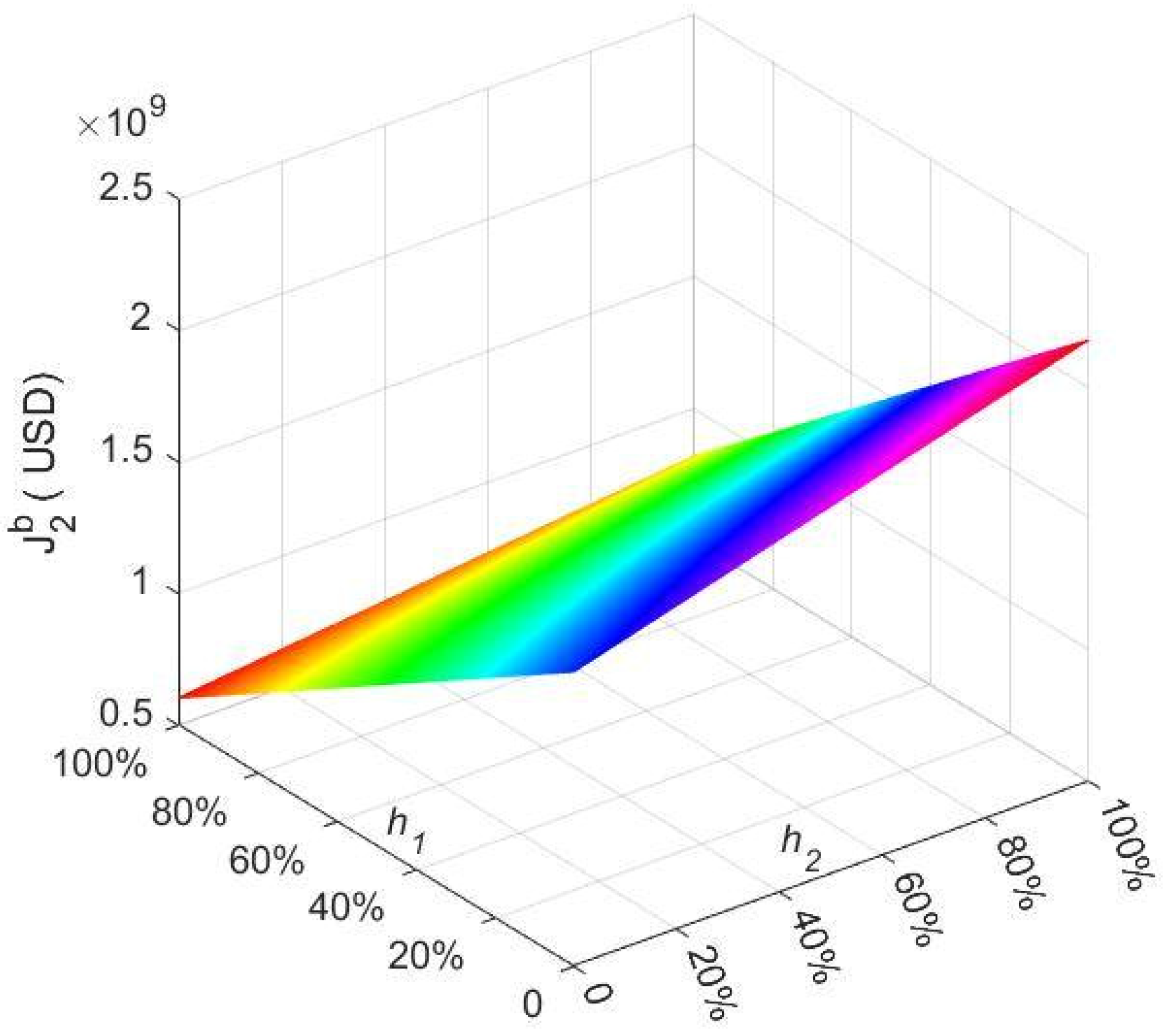

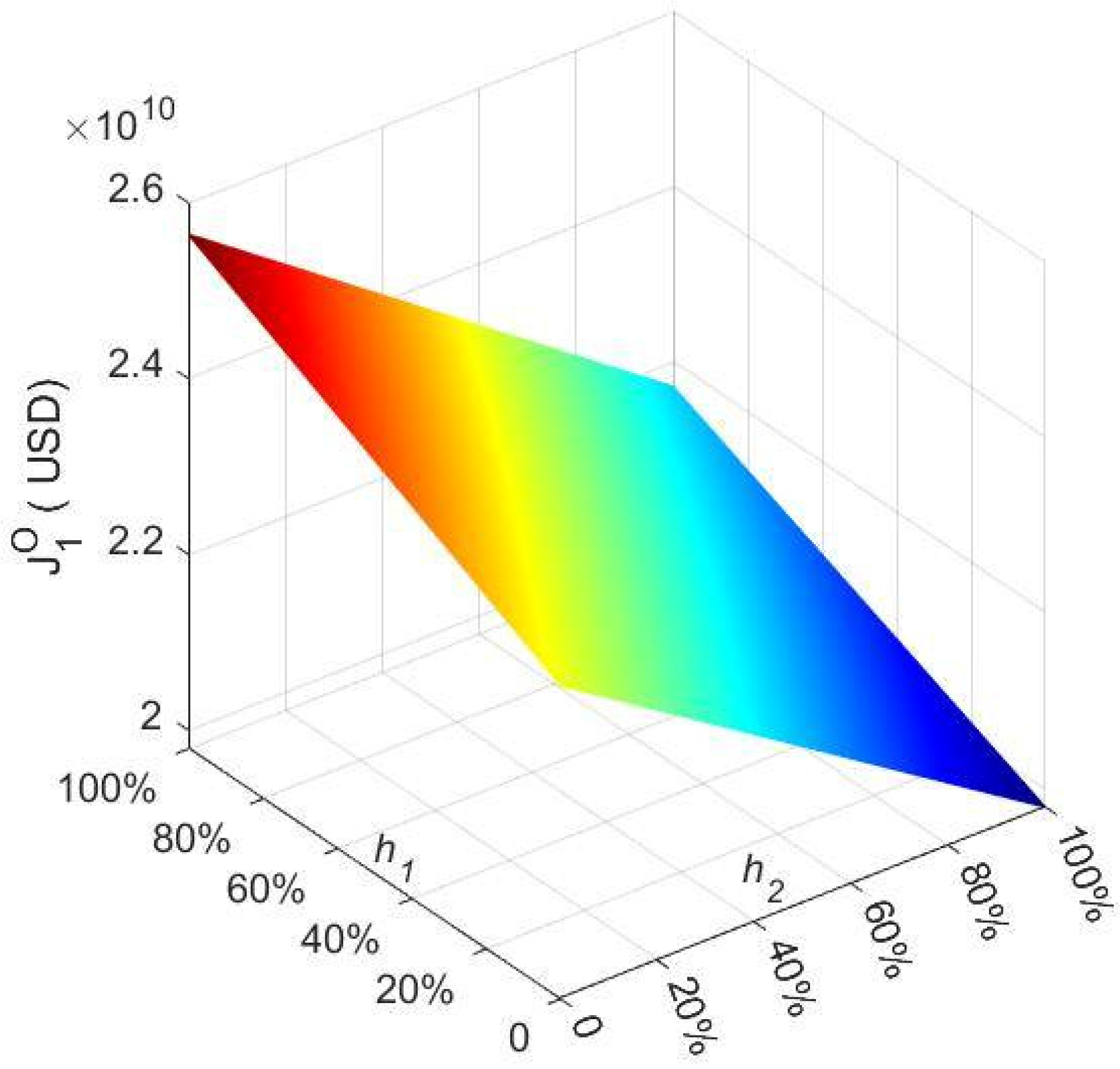

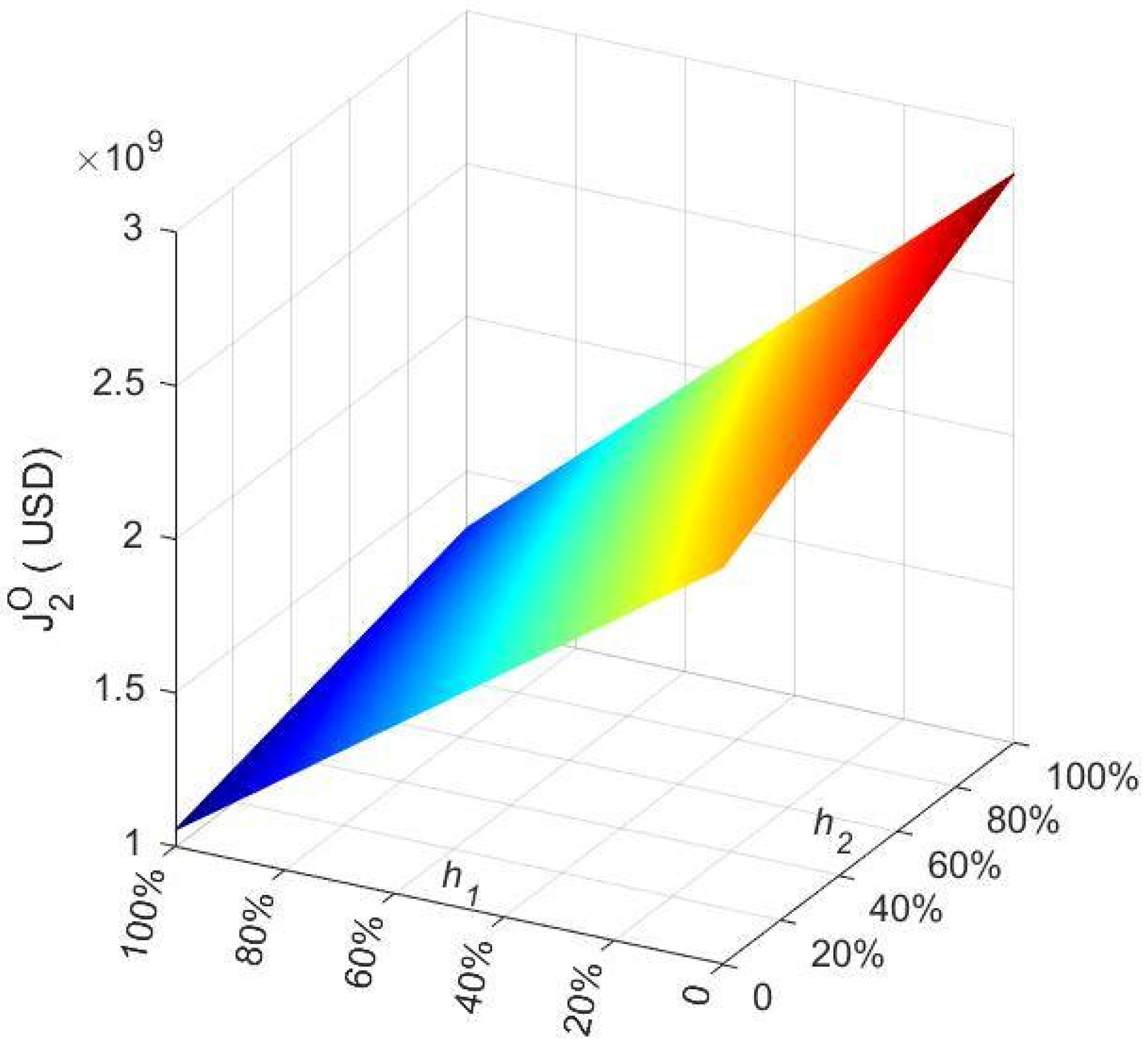

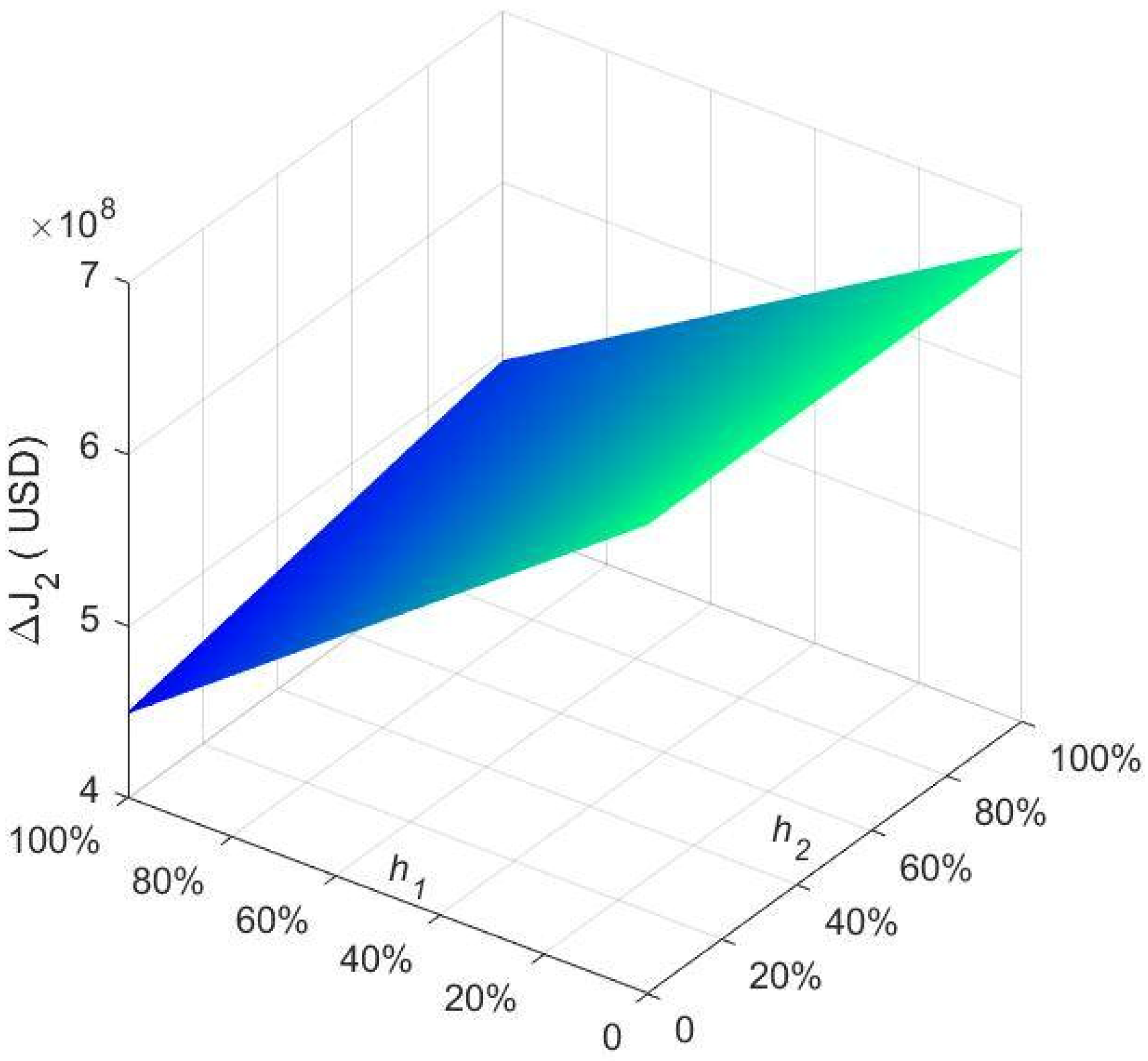

4.2.2. The Impact of the Subsidy Rates on the Profit of Two Ports

4.3. Conclusions and Policy Recommendations

- (1)

- In both sequential and simultaneous games, the gross tonnage of a ship has a significant impact on the optimal service price, throughput and profit of the port. When formulating subsidy policies for air pollution prevention in port waters, it is recommended that port authorities could consider implementing different subsidy criteria depending on the gross or net tonnage of the ship.

- (2)

- The low-sulfur fuel oil subsidy rate has a positive impact on the profitability of the port itself, to the detriment of competitor ports. When a port authority implements a low-sulfur fuel oil subsidy policy, it can attract more ships to call at that port, making it more profitable. The greater the subsidy rate of the port, the greater the difference in profits between the two games, which means that in this case, sequential competition is more favorable to both ports, making both ports more profitable.

- (3)

- The low-sulfur fuel oil subsidy policy can help alleviate the plight of port compliance fuel shortages and excessive pressure on shipping companies to reduce emissions and can lead to a soft landing for IMO’s emissions reduction policy, which plays a positive and important role in improving air quality in port waters. In designing an effective subsidy policy, government departments need to consider the impact of incentive policy on the service price, throughput and competitiveness of ports.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Mirabelli, M.C.; Boehmer, T.K.; Damon, S.A.; Sircar, K.D.; Wall, H.K.; Yip, F.Y.; Zahran, H.S.; Garbe, P.L. Air quality awareness among US adults with respiratory and heart disease. Am. J. Prev. Med. 2018, 54, 679–687. [Google Scholar] [CrossRef] [PubMed]

- Huang, D.Z.; Wang, Y.; Yin, C.Z. Selection of CO2 emission reduction measures affecting the maximum annual income of a container ship. J. Mar. Sci. Eng. 2023, 11, 534. [Google Scholar] [CrossRef]

- Oloruntobi, O.; Mokhtar, K.; Gohari, A.; Asif, S.; Chuah, L.F. Sustainable transition towards greener and cleaner seaborne shipping industry: Challenges and opportunities. Clean. Eng. Technol. 2023, 13, 100628. [Google Scholar] [CrossRef]

- IMO. Initial IMO GHG Strategy, International Maritime Organization. 2018. Available online: https://www.imo.org/en/MediaCentre/HotTopics/Pages/Reducing-greenhouse-gas-emissions-from-ships.aspx (accessed on 2 July 2023).

- Chuah, L.F.; Mokhtar, K.; Ruslan, S.M.; Bakar, A.A.; Abdullah, M.A.; Osman, N.H.; Bokhari, A.; Mubashir, M.; Show, P.L. Implementation of the energy efficiency existing ship index and carbon intensity indicator on domestic ship for marine environmental protection. Environ. Res. 2023, 222, 115348. [Google Scholar] [CrossRef]

- Chen, D.; Zhao, N.; Lang, J.; Zhou, Y.; Wang, X.; Li, Y.; Zhao, Y.; Guo, X. Contribution of ship emissions to the concentration of PM2.5: A comprehensive study using AIS data and WRF/Chem model in Bohai Rim Region. China Sci. Total Environ. 2018, 610–611, 1476–1486. [Google Scholar] [CrossRef]

- Peng, Y.; Dong, M.; Li, X.D.; Liu, H.K.; Wang, W.Y. Cooperative optimization of shore power allocation and berth allocation: A balance between cost and environmental benefit. J. Clean. Prod. 2020, 279, 123816. [Google Scholar] [CrossRef]

- Durmaz, M.; Kalender, S.S.; Ergin, S. Experimental study on the effects of ultra-Low sulfur diesel fuel to the exhaust emissions of a ferry. Fresen. Environ. Bull. 2017, 26, 5833–5840. [Google Scholar]

- Gysel, N.R.; Welch, W.A.; Johnson, K.; Miller, W.; Cocker, D.R. Detailed analysis of criteria and particle emissions from a very large crude carrier using a novel ECA fuel. Environ. Sci. Technol. 2017, 51, 1868–1875. [Google Scholar] [CrossRef]

- Ministry of Transport of the People’s Republic of China. Implementation Scheme of the Domestic Emission Control Areas for Atmospheric Pollution from Vessels. 2018. Available online: https://en.msa.gov.cn/html/newsList/20181219/2843.html (accessed on 2 July 2023).

- Shi, K.; Weng, J. Impacts of the COVID-19 epidemic on merchant ship activity and pollution emissions in Shanghai port waters. Sci. Total Environ. 2021, 790, 148198. [Google Scholar] [CrossRef]

- Weng, J.; Shi, K.; Gan, X.; Li, G.; Huang, Z. Ship emission estimation with high spatial-temporal resolution in the Yangtze River estuary using AIS data. J. Clean. Prod. 2020, 248, 119297. [Google Scholar] [CrossRef]

- Wan, Z.; Zhang, Q.; Xu, Z.; Chen, J.; Wang, Q. Impact of emission control areas on atmospheric pollutant emissions from major ocean-going ships entering the Shanghai Port. China Mar. Pollut. Bull. 2019, 142, 525–532. [Google Scholar] [CrossRef]

- Wan, Z.; Ji, S.; Liu, Y.; Zhang, Q.; Chen, J.; Wang, Q. Shipping emission inventories in China’s Bohai Bay, Yangtze River Delta, and Pearl River Delta in 2018. Mar. Pollut. Bull. 2020, 151, 110882. [Google Scholar] [CrossRef]

- Schwarzkopf, D.A.; Petrik, R.; Matthias, V.; Quante, M.; Majamäki, E.; Jalkanen, J.P. A ship emission modeling system with scenario capabilities. Atmos. Environ.-X 2021, 12, 100132. [Google Scholar] [CrossRef]

- Toscano, D.; Murena, F.; Quaranta, F.; Mocerino, L. Assessment of the impact of ship emissions on air quality based on a complete annual emission inventory using AIS data for the port of Naples. Ocean. Eng. 2021, 232, 109166. [Google Scholar] [CrossRef]

- Yang, L.; Zhang, Q.; Zhang, Y.; Lv, Z.Y.; Wang, Y.N.; Wu, L.; Feng, X.; Mao, H.J. An AIS-based emission inventory and the impact on air quality in Tianjin port based on localized emission factors. Sci. Total Environ. 2021, 783, 146869. [Google Scholar] [CrossRef]

- Murenaa, F.; Mocerinob, L.; Quarantab, F.; Toscanoa, D. Impact on air quality of cruise ship emissions in Naples, Italy. Atmos. Environ. 2018, 187, 70–83. [Google Scholar] [CrossRef]

- López-Aparicio, S.; Tønnesen, D.; Thanh, T.N.; Neilson, H. Shipping emissions in a Nordic port: Assessment of mitigation strategies. Transport. Res. D 2017, 53, 205–216. [Google Scholar] [CrossRef]

- Zhang, Y.; Fung, J.C.H.; Chan, J.W.M.; Lau, A.K.H. The significance of incorporating unidentified vessels into AIS-based ship emission inventory. Atmos. Environ. 2019, 203, 102–113. [Google Scholar] [CrossRef]

- Tichavska, M.; Tovara, B.; Gritsenkob, D.; Johansson, L.; Jalkanen, J.P. Air emissions from ships in port: Does regulation make a difference? Transp. Policy 2017, 75, 128–140. [Google Scholar] [CrossRef]

- Kwona, Y.; Limb, H.; Limc, Y.; Lee, H. Implication of activity-based vessel emission to improve regional air inventory in a port area. Atmos. Environ. 2019, 203, 262–270. [Google Scholar] [CrossRef]

- Ekmekçioğlu, A.; Levent Kuzu, S.; Ünlügençoğlu, K.; Çelebi, U.B. Assessment of shipping emission factors through monitoring and modelling studies. Sci. Total Environ. 2020, 743, 140742. [Google Scholar] [CrossRef] [PubMed]

- Monteiro, A.; Russo, M.; Gama, C.; Borrego, C. How important are maritime emissions for the air quality: At European and national scale. Environ. Pollut. 2018, 242, 565–575. [Google Scholar] [CrossRef] [PubMed]

- Chen, D.; Wang, X.; Nelson, P.; Li, Y.; Guo, X. Ship emission inventory and its impact on the PM2.5 air pollution in Qingdao PortNorth China. Atmos. Environ. 2017, 166, 351–361. [Google Scholar] [CrossRef]

- Jiang, B.; Wang, X.Q.; Xue, H.L.; Li, J.; Gong, Y. An evolutionary game model analysis on emission control areas in China. Mar. Policy 2020, 118, 104010. [Google Scholar] [CrossRef]

- Meng, L.; Liu, K.; He, J.L.; Han, C.F.; Liu, P.H. Carbon emission reduction behavior strategies in the shipping industry under government regulation: A tripartite evolutionary game analysis. J. Clean Prod. 2022, 378, 134556. [Google Scholar] [CrossRef]

- Zhou, Q.; Yuen, K.F. Low-sulfur fuel consumption: Marine policy implications based on game theory. Mar. Policy 2021, 124, 104304. [Google Scholar] [CrossRef]

- Carr, E.W.; Corbett, J.J. Ship compliance in emission control areas: Technology costs and policy instruments. Environ. Sci. Technol. 2015, 49, 9584–9591. [Google Scholar] [CrossRef]

- Shi, K.; Weng, J.; Li, G. Exploring the effectiveness of ECA policies in reducing pollutant emissions from merchant ships in Shanghai port waters. Mar. Pollut. Bull. 2020, 155, 111164. [Google Scholar] [CrossRef]

- Qiao, B.; He, W.J.; Tian, Y.J.; Liu, Y.C.; Cai, O.C.; Li, Y. Ship emission reduction effect evaluation of air pollution control countermeasures. Transp. Res. Procedia 2017, 25, 3606–3618. [Google Scholar] [CrossRef]

- Chen, W.; Yang, R. Evolving temporal–spatial trends, spatial association, and influencing factors of carbon emissions in mainland China: Empirical analysis based on provincial panel data from 2006 to 2015. Sustainability 2018, 10, 2809. [Google Scholar] [CrossRef]

- Yu, L.; Zheng, S.; Gao, Q. Independent or collaborative management? Regional management strategy for ocean carbon sink trading based on game theory. Ocean Coast. Manag. 2023, 235, 106484. [Google Scholar] [CrossRef]

- Dragovic, B.; Tzannatos, E.; Tselentis, V.; Meštrovic, R.; Škuric, M. Ship emissions and their externalities in cruise ports. Transp. Res. D 2015, 61, 289–300. [Google Scholar] [CrossRef]

- Progiou, A.G.; Bakeas, E.; Evangelidou, E.; Kontogiorgi, C.; Lagkadinou, E.; Sebos, I. Air pollutant emissions from Piraeus port: External costs and air quality levels. Transp. Res. D 2021, 91, 102586. [Google Scholar] [CrossRef]

- Jiao, Y.; Wang, C.X. Shore power vs low sulfur fuel oil: Pricing strategies of carriers and port in a transport chain. Int. J. Low-Carbon Technol. 2021, 16, 715–724. [Google Scholar] [CrossRef]

- Dong, G.; Zhong, D. Tacit collusion of pricing strategy game between regional ports: The case of Yangtze River economic belt. Sustainability 2019, 11, 365. [Google Scholar] [CrossRef]

- Zheng, S.Y.; Negenborn, R.R. Centralization or decentralization: A comparative analysis of port regulation modes. Transport. Res. E 2014, 69, 21–40. [Google Scholar] [CrossRef]

- Luo, M.F.; Liu, L.M.; Gao, F. Post-entry container port capacity expansion. Transp. Res. B 2012, 46, 120–138. [Google Scholar] [CrossRef]

- Dong, G.; Lee, T.W. Environmental effects of emission control areas and reduced speed zones on container ship operation. J. Clean. Prod. 2020, 274, 122582. [Google Scholar] [CrossRef]

- Cui, H.; Notteboom, T. A game theoretical approach to the effects of port objective orientation and service differentiation on port authorities’ willingness to cooperate. Res. Transp. Bus. Manag. 2018, 26, 76–86. [Google Scholar] [CrossRef]

- EPA. Current Methodologies in Preparing Mobile Source Port-Related Emission Inventories Final Report April 2009. Available online: https://www.epa.gov/moves/current-methodologies-preparing-mobile-source-port-related-emission-inventories-final-report (accessed on 2 July 2023).

| Parameters | Explanation |

| Monthly throughput of regional ports | |

| The impact factor of service price on the throughput | |

| The impact factor of competitors’ service price on the throughput | |

| Service cost per TEU for port | |

| The average fuel consumption of auxiliary engines per hour per ship calling at port during berthing period | |

| Handling efficiency of a crane per hour in port | |

| Subsidy rate of low-sulfur fuel at port | |

| Price of MGO with a sulfur content of 0.1% m/m | |

| Price of VLSFO with a sulfur content of 0.5% m/m | |

| The price difference between the two types of low-sulfur fuel oil | |

| Variables and functions | Explanation |

| Service price per TEU at port | |

| Monthly throughput of port | |

| Total fuel consumption of vessels calling at port during berthing | |

| Subsidies from ports for switching to ultra-low marine fuel when the supply of compliant fuel at port is insufficient | |

| Profit function of port |

| Callsign | IMO | MMSI | Gross Tonnage | Net Tonnage | DWT | Berth | Building Year | Distance (nm) |

|---|---|---|---|---|---|---|---|---|

| BLBX | 8,901,755 | 416,260,000 | 17,123 | 7336 | 23,692 | Waigaoqiao | 1990 | 121.30 |

| BIBP7 | 9,159,878 | 413,378,250 | 16,705 | 9118 | 24,336 | Wusong | 1997 | 164.18 |

| D5IR9 | 9,189,500 | 636,016,980 | 66,526 | 29,460 | 67,712 | Yangshan | 2000 | 139.74 |

| 3EB09 | 9,320,403 | 371,860,000 | 50,963 | 30,224 | 59,587 | Changxing | 2006 | 125.34 |

| 9LU2532 | 9,258,210 | 667,001,729 | 1510 | 705 | 2212 | Baoshan | 2001 | 147.41 |

| GT | ||||

|---|---|---|---|---|

| Container Ships | ||||

| Number of ship calls | 221 | 315 | 315 | |

| Percentage | 26% | 37% | 37% | |

| The average power of auxiliary engines (kW) | 1728.73 | 4744.68 | 12,392.47 | |

| (ton/h) | 0.19 | 0.52 | 1.37 | |

| GT | ||||

|---|---|---|---|---|

| Container Ships | ||||

| Number of ship calls | 13 | 64 | 215 | |

| Percentage | 4% | 22% | 74% | |

| The average power of auxiliary engines (kW) | 1725.98 | 5022.15 | 11,684.20 | |

| (ton/h) | 0.19 | 0.55 | 1.29 | |

| Parameters | Explanation | Value |

|---|---|---|

| Monthly throughput of regional ports | TEUs | |

| The impact factor of service price on the throughput | TEUs/$ | |

| The impact factor of competitors’ service price on throughput | TEUs/$ | |

| Handling efficiency in Shanghai port | TEUs/h | |

| Handling efficiency in Ningbo-Zhoushan port | TEUs/h | |

| Service cost per TEU in Shanghai port | USD/TEU | |

| Service cost per TEU in Ningbo-Zhoushan port | USD/TEU | |

| Fuel subsidy rate at Shanghai port | 00% | |

| Fuel subsidy rate at Ningbo-Zhoushan port | 75% | |

| Price of MGO | USD/ton | |

| Price of VLSFO | USD/ton | |

| The price difference between the two types of low-sulfur fuel oil | 141 USD/ton |

| GT | Unit | ||||

|---|---|---|---|---|---|

| Parameters | |||||

| USD | 87.11 | 87.97 | 90.06 | ||

| USD | 92.37 | 93.29 | 95.30 | ||

| TEUs | 1.87 | 1.83 | 1.72 | ||

| TEUs | 0.56 | 0.50 | 0.41 | ||

| USD | 23.33 | 22.42 | 19.72 | ||

| USD | 2.06 | 1.69 | 1.13 | ||

| GT | Unit | ||||

|---|---|---|---|---|---|

| Parameters | |||||

| USD | 88.89 | 89.72 | 91.70 | ||

| USD | 92.97 | 93.88 | 95.84 | ||

| TEUs | 1.66 | 1.63 | 1.53 | ||

| TEUs | 0.64 | 0.59 | 0.49 | ||

| USD | 23.70 | 22.77 | 20.03 | ||

| USD | 2.77 | 2.32 | 1.63 | ||

| GT | Unit | |||||

|---|---|---|---|---|---|---|

| Parameters | ||||||

| USD | 1.78 | 1.75 | 1.64 | |||

| USD | 0.59 | 0.58 | 0.55 | |||

| / | 3 | 3 | 3 | |||

| TEUs | −0.21 | −0.20 | −0.19 | |||

| TEUs | 0.09 | 0.09 | 0.08 | |||

| / | −2.33 | −2.33 | −2.33 | |||

| USD | 0.37 | 0.36 | 0.31 | |||

| USD | 0.71 | 0.64 | 0.49 | |||

| / | 0.52 | 0.56 | 0.63 | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, Q.; Jiang, M. Study on Emission Control of Berthing Vessels-Based on Non-Cooperative Game Theory. Sustainability 2023, 15, 10572. https://doi.org/10.3390/su151310572

Wang Q, Jiang M. Study on Emission Control of Berthing Vessels-Based on Non-Cooperative Game Theory. Sustainability. 2023; 15(13):10572. https://doi.org/10.3390/su151310572

Chicago/Turabian StyleWang, Qin, and Minhang Jiang. 2023. "Study on Emission Control of Berthing Vessels-Based on Non-Cooperative Game Theory" Sustainability 15, no. 13: 10572. https://doi.org/10.3390/su151310572

APA StyleWang, Q., & Jiang, M. (2023). Study on Emission Control of Berthing Vessels-Based on Non-Cooperative Game Theory. Sustainability, 15(13), 10572. https://doi.org/10.3390/su151310572