A Rental Platform Service Supply Chain Network Equilibrium Model Considering Digital Detection Technology Investment and Big Data Marketing

Abstract

:1. Introduction

2. Literature Review

2.1. Manufacturing Rental Service Model

2.2. Research on Supply Chain Digital Technologies

2.3. Supply Chain Network Equilibrium Model

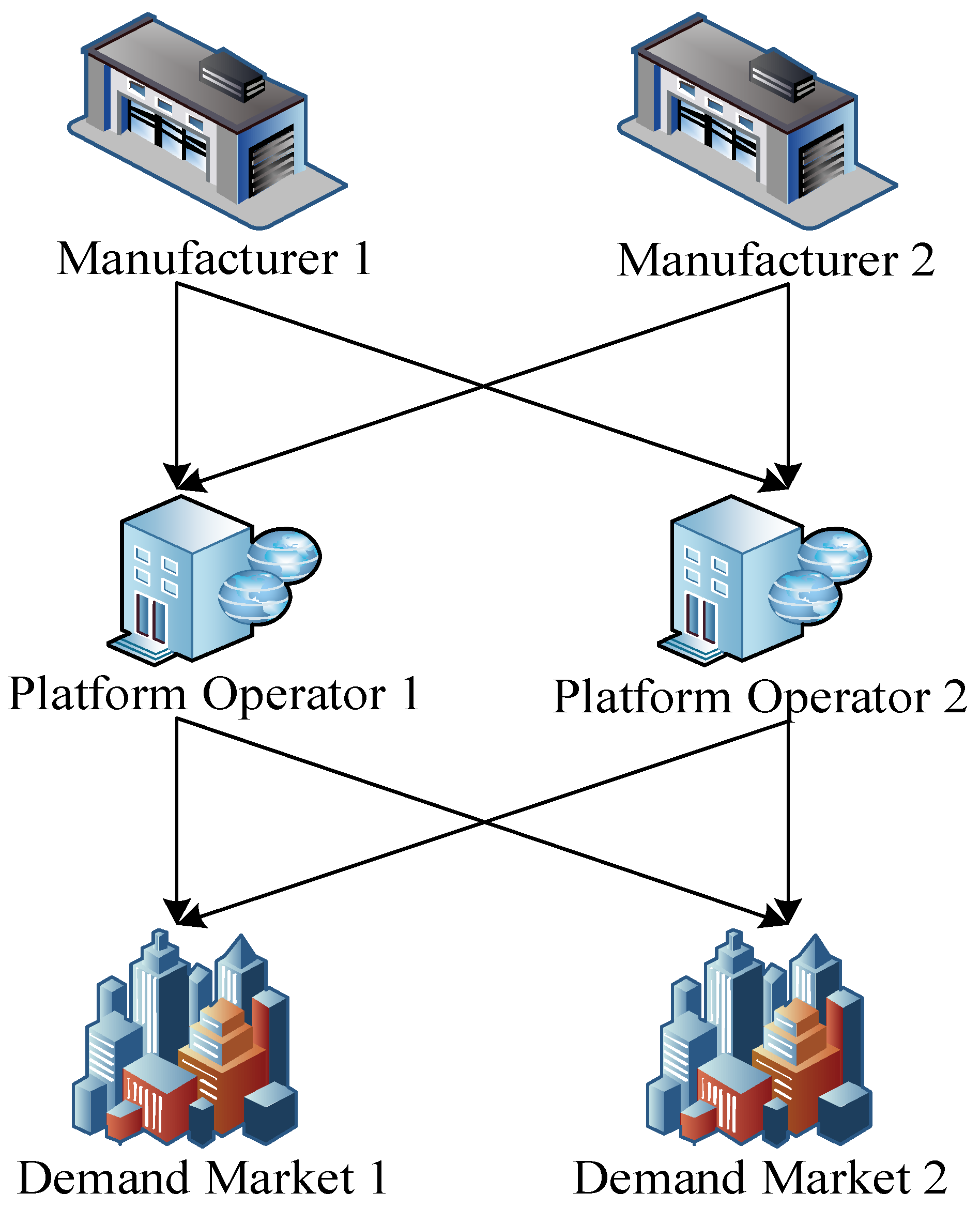

3. Problem Statement and Formulation

3.1. Problem Statement

3.2. Notation Description

3.3. Model Assumptions

4. Model Building

4.1. Analysis of the Decision Making Behavior and Equilibrium Requirements of the Manufacturers

4.2. Analysis of Decision Making Behavior and Equilibrium Conditions of the Layer of the Rental Platform Operators

4.3. Analysis of Decision Making Behavior and Equilibrium Conditions of the Layer of the Demand Markets

4.4. Analysis of Equilibrium Conditions of the Entire Rental Platform Service Supply Chain Network

5. Numerical Analysis

6. Discussion

6.1. Discussion of Theoretical Significance

6.2. Realistic Management Discussion

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Martinelli, E.M.; Farioli, M.C.; Tunisini, A. New companies’ DNA: The heritage of the past industrial revolutions in digital transformation. J. Manag. Gov. 2021, 25, 1079–1106. [Google Scholar] [CrossRef]

- Etemadi, N.; Borbon-Galvez, Y.; Strozzi, F.; Etemadi, T. Supply chain disruption risk management with blockchain: A dynamic literature review. Information 2021, 12, 70. [Google Scholar] [CrossRef]

- Ma, J.Y.; Shi, L.; Kang, T.W. The Effect of Digital Transformation on the Pharmaceutical Sustainable Supply Chain Performance: The Mediating Role of Information Sharing and Traceability Using Structural Equation Modeling. Sustainability 2023, 15, 649. [Google Scholar] [CrossRef]

- Liu, W.; Yan, X.; Li, X.; Wei, W. The impacts of market size and data-driven marketing on the sales mode selection in an Internet platform based supply chain. Transp. Res. Part E Logist. Transp. Rev. 2020, 136, 101914. [Google Scholar] [CrossRef]

- Li, K.; Dai, G.; Xia, Y.; Mu, Z.; Zhang, G.; Shi, Y. Green Technology Investment with Data-Driven Marketing and Government Subsidy in a Platform Supply Chain. Sustainability 2022, 14, 3992. [Google Scholar] [CrossRef]

- Jankovic-Zugic, A.; Medic, N.; Pavlovic, M.; Todorovic, T.; Rakic, S. Servitization 4.0 as a Trigger for Sustainable Business: Evidence from Automotive Digital Supply Chain. Sustainability 2023, 15, 2217. [Google Scholar] [CrossRef]

- Balakrishnan, A.S.; Usha, R. The role of digital technologies in supply chain resilience for emerging markets’ automotive sector. Supply Chain. Manag. 2021, 26, 654–671. [Google Scholar]

- Xu, Q.; He, Y. Optimal information disclosure strategies for a retail platform in the blockchain technology era. Int. J. Prod. Res. 2021, 61, 3781–3792. [Google Scholar] [CrossRef]

- Chong, A.Y.L.; Ch’ng, E.; Liu, M.J.; Li, B. Predicting consumer product demands via Big Data: The roles of online promotional marketing and online reviews. Int. J. Prod. Res. 2017, 55, 5142–5156. [Google Scholar] [CrossRef] [Green Version]

- Sweetwood, A. The Analytical Marketer: How to Transform Your Marketing Organization; Harvard Business Review Press: Boston, MA, USA, 2016. [Google Scholar]

- Khan, S.A.R.; Godil, D.I.; Jabbour, C.J.C.; Shujaat, S.; Razzaq, A.; Yu, Z. Green data analytics, blockchain technology for sustainable development, and sustainable supply chain practices: Evidence from small and medium enterprises. Ann. Oper. Res. 2021, 1–25. [Google Scholar] [CrossRef]

- Nagurney, A.; Toyasaki, F. Reverse supply chain management and electronic waste recycling: A multitiered network equilibrium framework for e-cycling. Transp. Res. Part E Logist. Transp. Rev. 2005, 41, 1–28. [Google Scholar] [CrossRef]

- Xiao, Y.X.; Zhang, R.Q. Supply chain network equilibrium considering coordination between after-sale service and product quality. Comput. Ind. Eng. 2023, 175, 108848. [Google Scholar] [CrossRef]

- Tan, X.; Yuan, Z.; Wang, Y. Financial leasing, factor circulation and supply chain competitiveness: Taking equipment manufacturing enterprises as an example. Int. J. Logist. Res. Appl. 2022, 1–26. [Google Scholar] [CrossRef]

- Ren, X.; Herty, M.; Zhao, L. Optimal price and service decisions for sharing platform and coordination between manufacturer and platform with recycling. Comput. Ind. Eng. 2020, 147, 106586. [Google Scholar] [CrossRef]

- Cai, Y.J.; Choi, T.M.; Zhang, J. Platform supported supply chain operations in the blockchain era: Supply contracting and moral hazards. Decis. Sci. 2021, 52, 866–892. [Google Scholar] [CrossRef]

- Qu, S.J.; Shu, L.L.; Yao, J.Y. Optimal pricing and service level in supply chain considering misreport behavior and fairness concern. Comput. Ind. Eng. 2023, 174, 108759. [Google Scholar] [CrossRef]

- Choi, T.M.; Feng, L.; Li, R. Information disclosure structure in supply chains with rental service platforms in the blockchain technology era. Int. J. Prod. Econ. 2020, 221, 107473. [Google Scholar] [CrossRef]

- Auer, S.; Nagler, S.; Mazumdar, S.; Mukkamala, R.R. Towards blockchain-IoT based shared mobility: Car-sharing and leasing as a case study. J. Netw. Comput. Appl. 2022, 200, 103316. [Google Scholar] [CrossRef]

- Yang, M.; Fu, M.; Zhang, Z. The adoption of digital technologies in supply chains: Drivers, process and impact. Technol. Forecast. Soc. Chang. 2021, 169, 120795. [Google Scholar] [CrossRef]

- Liang, L.; Han, Z.; Xie, J.; Wang, J.; Shi, N.; Zhu, W. S&T Innovation Platform Sharing Service Contract Mechanism to Achieve Supply Chain Resilience. Sustainability 2022, 14, 14124. [Google Scholar]

- Peng, Y.; Chen, B.; Veglianti, E. Platform Service Supply Chain Network Equilibrium Model with Data Empowerment. Sustainability 2022, 14, 5419. [Google Scholar] [CrossRef]

- De Giovanni, P. Blockchain and smart contracts in supply chain management: A game theoretic model. Int. J. Prod. Econ. 2020, 228, 107855. [Google Scholar] [CrossRef]

- Peng, Y.; Chen, B.; Lee, C.C. Equilibrium in platform service supply chain network with quality and innovation considering digital economy. Ann. Oper. Res. 2023, 1–30. [Google Scholar] [CrossRef]

- Kim, J.B.; Albuquerque, P.; Bronnenberg, B.J. Mapping online consumer search. J. Mark. Res. 2011, 48, 13–27. [Google Scholar] [CrossRef] [Green Version]

- Wang, L.; Li, Q.; Lam, J.; Wang, Z.; Zhang, Z. Intent inference in shared-control teleoperation system in consideration of user behavior. Complex Intell. Syst. 2021, 8, 2971–2981. [Google Scholar] [CrossRef]

- Ma, D.; Hu, J. Research on collaborative management strategies of closed-loop supply chain under the influence of big-data marketing and reference price effect. Sustainability 2020, 12, 1685. [Google Scholar] [CrossRef] [Green Version]

- Li, X. Reducing channel costs by investing in smart supply chain technologies. Transp. Res. Part E Logist. Transp. Rev. 2020, 137, 101927. [Google Scholar] [CrossRef]

- Figueiredo, F.; Gonçalves, M.J.A.; Teixeira, S. Information Technology Adoption on Digital Marketing: A Literature Review. Informatics 2021, 8, 74. [Google Scholar] [CrossRef]

- Dafermos, S. Isomorphic multiclass spatial price and multimodal traffic network equilibrium models. Reg. Sci. Urban Econ. 1986, 16, 197–209. [Google Scholar] [CrossRef]

- Nagurney, A.; Dong, J.; Zhang, D. A supply chain network equilibrium model. Transp. Res. Part E Logist. Transp. Rev. 2002, 38, 281–303. [Google Scholar] [CrossRef]

- Zhang, G.; Cheng, P.; Sun, H.; Shi, Y.; Zhang, G.; Kadiane, A. Carbon reduction decisions under progressive carbon tax regulations: A new dual-channel supply chain network equilibrium model. Sustain. Prod. Consum. 2021, 27, 1077–1092. [Google Scholar] [CrossRef]

- Hsueh, C.F.; Chang, M.S. Equilibrium analysis and corporate social responsibility for supply chain integration. Eur. J. Oper. Res. 2008, 190, 116–129. [Google Scholar] [CrossRef]

- Cheng, P.; Ji, G.; Zhang, G.; Shi, Y. A closed-loop supply chain network considering consumer’s low carbon preference and carbon tax under the cap-and-trade regulation. Sustain. Prod. Consum. 2022, 29, 614–635. [Google Scholar] [CrossRef]

- Li, D.; Cruz, J.M. Multiperiod supply chain network dynamics under investment in sustainability, externality cost, and consumers’ willingness to pay. Int. J. Prod. Econ. 2022, 247, 108441. [Google Scholar] [CrossRef]

- Duan, C.; Yao, F.; Li, Z.; Yu, H. Multi-period closed-loop supply chain network equilibrium considering CSR investment and sharing mechanism. Manag. Decis. Econ. 2022, 43, 1579–1595. [Google Scholar] [CrossRef]

- Dong, J.; Zhang, D.; Nagurney, A. A supply chain network equilibrium model with random demands. Eur. J. Oper. Res. 2004, 156, 194–212. [Google Scholar] [CrossRef]

- Chan, C.K.; Zhou, Y.; Wong, K.H. An equilibrium model of the supply chain network under multi-attribute behaviors analysis. Eur. J. Oper. Res. 2019, 275, 514–535. [Google Scholar] [CrossRef]

- Wan, X.; Jiang, B.; Li, Q.; Hou, X. Dual-channel environmental hotel supply chain network equilibrium decision under altruism preference and demand uncertainty. J. Clean. Prod. 2020, 271, 122595. [Google Scholar] [CrossRef]

- Peng, Y.; Xu, D.; Li, Y.; Wang, K. A product service supply chain network equilibrium model considering capacity constraints. Math. Probl. Eng. 2020, 2020, 1295072. [Google Scholar] [CrossRef]

- Peng, Y.; Xu, D.; Veglianti, E.; Magnaghi, E. A product service supply chain network equilibrium considering risk management in the context of COVID-19 pandemic. J. Ind. Manag. Optim. 2023, 19, 3459–3482. [Google Scholar] [CrossRef]

- Daultani, Y.; Kumar, S.; Vaidya, O.S.; Tiwari, M.K. A supply chain network equilibrium model for operational and opportunism risk mitigation. Int. J. Prod. Res. 2015, 53, 5685–5715. [Google Scholar] [CrossRef]

- Nagurney, A.; Daniele, P.; Shukla, S. A supply chain network game theory model of cybersecurity investments with nonlinear budget constraints. Ann. Oper. Res. 2017, 248, 405–427. [Google Scholar] [CrossRef]

- Nagurney, A.; Wolf, T. A Cournot–Nash–Bertrand game theory model of a service-oriented Internet with price and quality competition among network transport providers. Comput. Manag. Sci. 2014, 11, 475–502. [Google Scholar] [CrossRef]

- Chen, H.; Song, L.; Liu, S.; Fang, Z.; He, L. An optimal cost-sharing incentive model of main manufacturer-suppliers for complex equipment under grey information. J. Grey Syst. 2013, 25, 41. [Google Scholar]

- Xiang, Z.; Xu, M. Dynamic cooperation strategies of the closed-loop supply chain involving the internet service platform. J. Clean. Prod. 2019, 220, 1180–1193. [Google Scholar] [CrossRef]

| Notation | Definition |

|---|---|

| A typical manufacturer; there is a total of m manufacturers | |

| A typical rental platform operator; there are n rental platform operators | |

| A typical demand market; there is a total of o demand markets | |

| The number of rental services | |

| The price of rental services | |

| The digital detection technology investment level of manufacturer i | |

| Rental platform operator j’s unit rental service commission received from manufacturer i | |

| The proportion of risk loss cost undertaken by the manufacturer | |

| The big data marketing level of rental platform operator j | |

| θ | The allocation ratio of big data marketing cost |

| The rental service provision cost | |

| The transaction cost of manufacturer i | |

| The opportunity cost of platform operator j | |

| The digital detection technology investment cost of manufacturer i | |

| The risk loss cost | |

| The transaction cost of rental platform operator j | |

| The big data marketing cost of rental platform operator j |

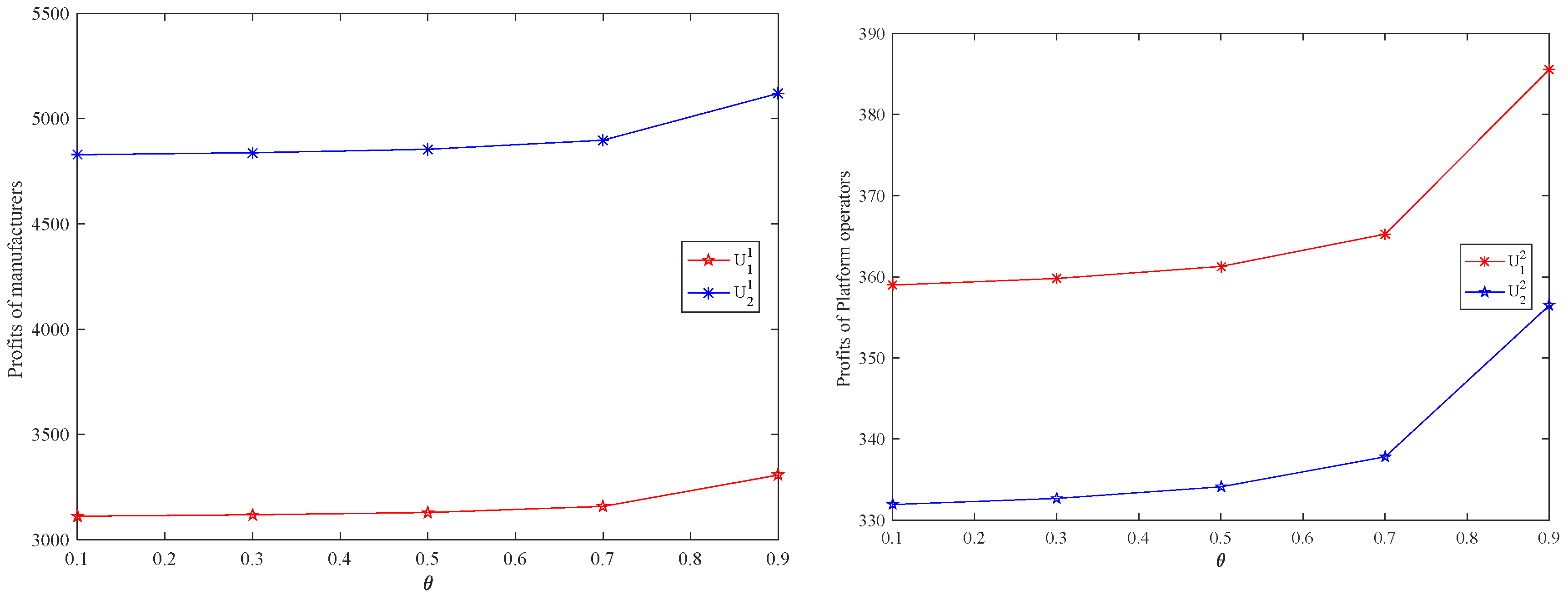

| 0.1 | 0.3 | 0.5 | 0.7 | 0.9 | ||

|---|---|---|---|---|---|---|

| Q1jk | 37.4381 | 37.4978 | 37.557 | 37.6156 | 37.6738 | |

| Q2jk | 68.6536 | 68.7648 | 68.8749 | 68.9841 | 69.0921 | |

| 13.4033 | 13.4139 | 13.4243 | 13.4346 | 13.4447 | ||

| 18.1068 | 18.1573 | 18.2074 | 18.2571 | 18.3065 | ||

| 16.1342 | 16.1492 | 16.1640 | 16.1786 | 16.1931 | ||

| 6.5050 | 6.5207 | 6.5362 | 6.5516 | 6.5669 | ||

| 50.9974 | 51.0583 | 51.1186 | 51.1782 | 51.2371 | ||

| 18.5054 | 18.5461 | 18.5865 | 18.6265 | 18.6663 | ||

| 26.5356 | 26.5676 | 26.5992 | 26.6305 | 26.6614 | ||

| 10.6990 | 10.7218 | 10.7444 | 10.7668 | 10.7890 | ||

| 0.4861 | 0.4861 | 0.4861 | 0.4861 | 0.4861 | ||

| 0.4861 | 0.4861 | 0.4861 | 0.4861 | 0.4861 | ||

| 180.3552 | 180.6254 | 180.8971 | 181.1702 | 181.4449 | ||

| 175.2124 | 175.5024 | 175.7937 | 176.0865 | 176.3807 | ||

| 0.1 | 0.3 | 0.5 | 0.7 | 0.9 | ||

|---|---|---|---|---|---|---|

| Q1jk | 37.4381 | 37.4434 | 37.4434 | 37.4434 | 37.4434 | |

| Q2jk | 68.6536 | 68.6639 | 68.6639 | 68.6639 | 68.6639 | |

| 13.4033 | 13.4069 | 13.4069 | 13.4069 | 13.4069 | ||

| 18.1068 | 18.1068 | 18.1068 | 18.1065 | 18.1065 | ||

| 16.1342 | 16.1379 | 16.1380 | 16.1378 | 16.1378 | ||

| 6.5050 | 6.5057 | 6.5057 | 6.5057 | 6.5057 | ||

| 50.9974 | 51.0074 | 51.0078 | 51.0069 | 51.0069 | ||

| 18.5054 | 18.5078 | 18.5079 | 18.5079 | 18.5079 | ||

| 26.5356 | 26.5410 | 26.5411 | 26.5408 | 26.5408 | ||

| 10.6990 | 10.7005 | 10.7005 | 10.7005 | 10.7005 | ||

| 0.4861 | 0.5000 | 0.5000 | 0.5000 | 0.5000 | ||

| 0.4861 | 0.5000 | 0.5000 | 0.5000 | 0.5000 | ||

| 180.3552 | 180.3812 | 180.3813 | 180.3813 | 180.3813 | ||

| 175.2124 | 175.2360 | 175.2361 | 175.2361 | 175.2361 | ||

| 3109.9121 | 3110.8155 | 3110.8184 | 3110.8227 | 3110.8227 | ||

| 4825.2261 | 4826.5398 | 4826.5333 | 4826.5603 | 4826.5603 | ||

| 358.6209 | 358.7222 | 358.6972 | 358.6722 | 358.6472 | ||

| 331.6001 | 331.6955 | 331.6718 | 331.6434 | 331.6184 | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Peng, Y.; Li, H. A Rental Platform Service Supply Chain Network Equilibrium Model Considering Digital Detection Technology Investment and Big Data Marketing. Sustainability 2023, 15, 9955. https://doi.org/10.3390/su15139955

Peng Y, Li H. A Rental Platform Service Supply Chain Network Equilibrium Model Considering Digital Detection Technology Investment and Big Data Marketing. Sustainability. 2023; 15(13):9955. https://doi.org/10.3390/su15139955

Chicago/Turabian StylePeng, Yongtao, and Hang Li. 2023. "A Rental Platform Service Supply Chain Network Equilibrium Model Considering Digital Detection Technology Investment and Big Data Marketing" Sustainability 15, no. 13: 9955. https://doi.org/10.3390/su15139955