Strategies of Participants in the Carbon Trading Market—An Analysis Based on the Evolutionary Game

Abstract

:1. Introduction

2. Literature Review

2.1. Literature on the Carbon Trading Mechanism

2.2. Literature on Carbon Trading Behavior

2.3. Literature on Evolutionary Game Theory and Its Applications

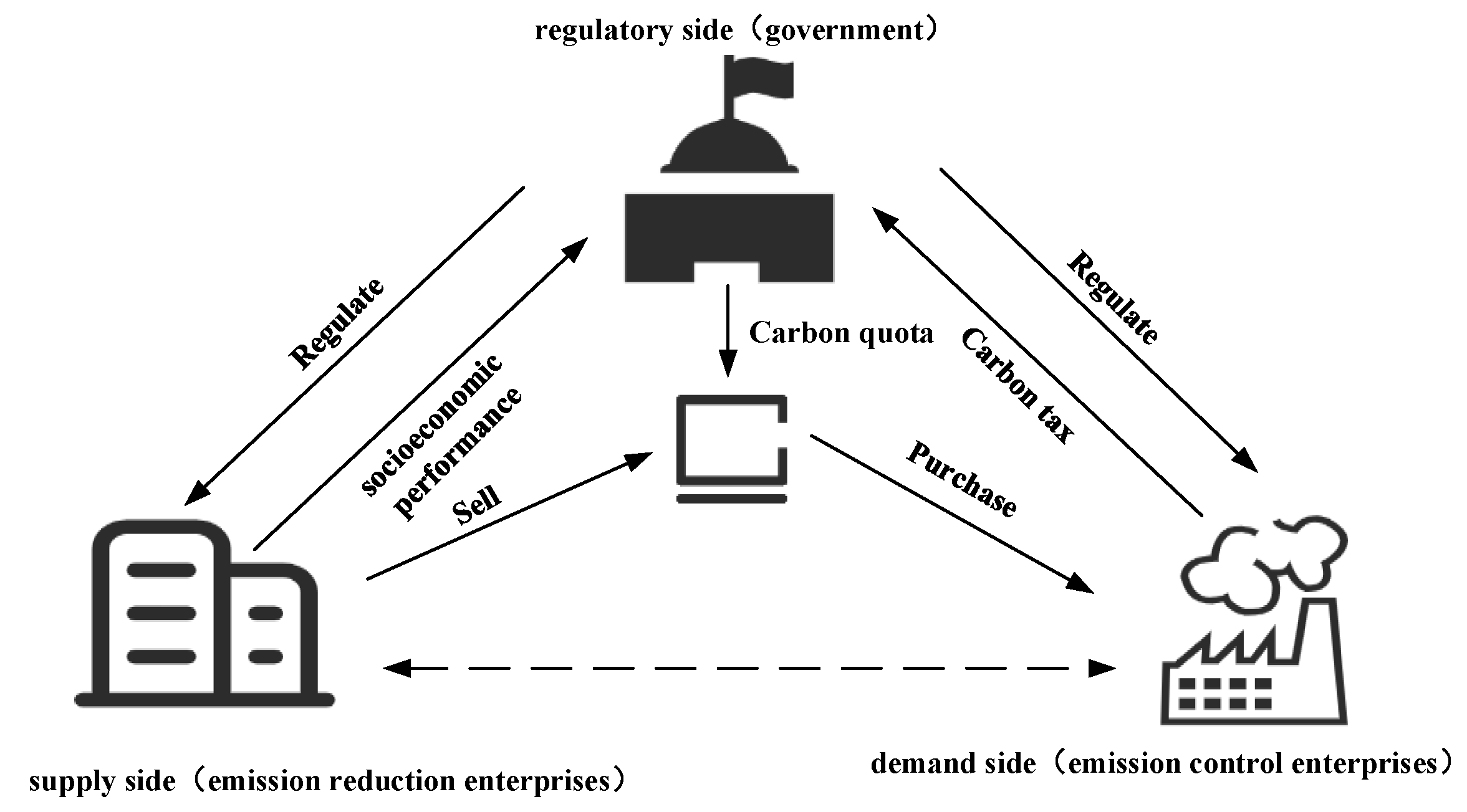

3. Establishment of the Evolutionary Game Process and Related Assumptions

3.1. Behavioral Preferences of Game Subjects

3.2. Basic Assumptions of the Model

3.3. Construction of Payoff Matrix

4. Model Solving and Stability Strategy Analysis

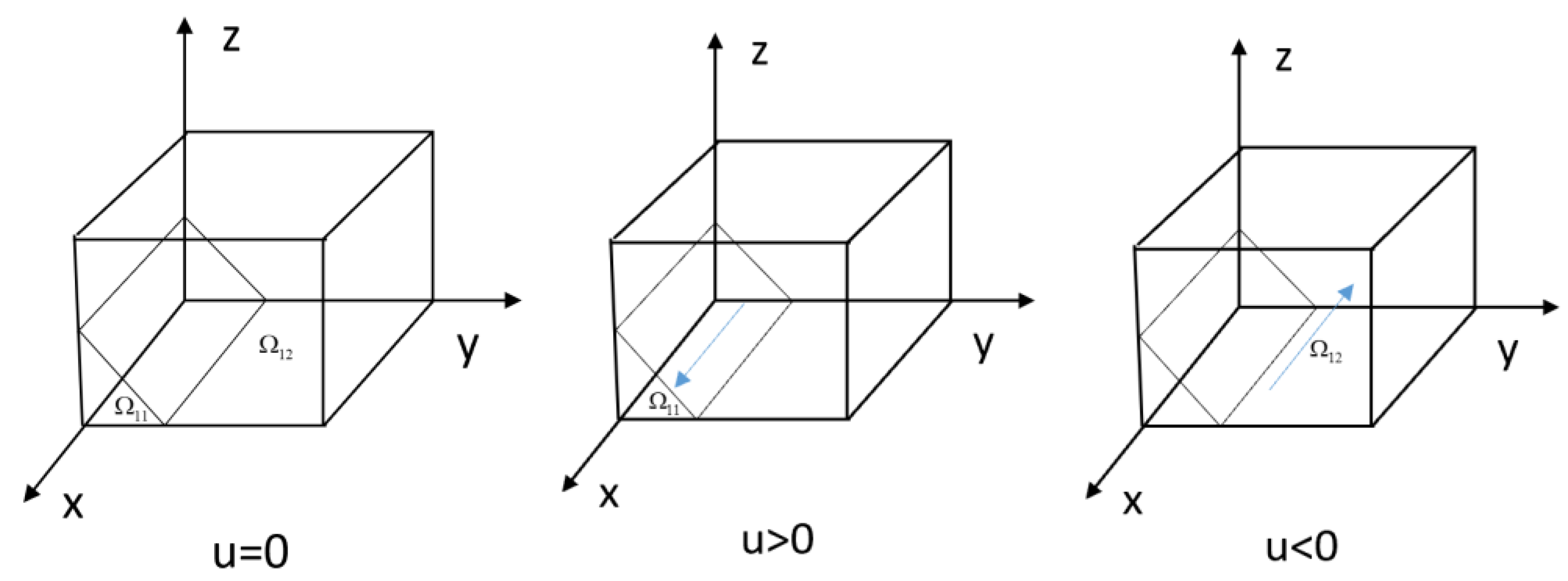

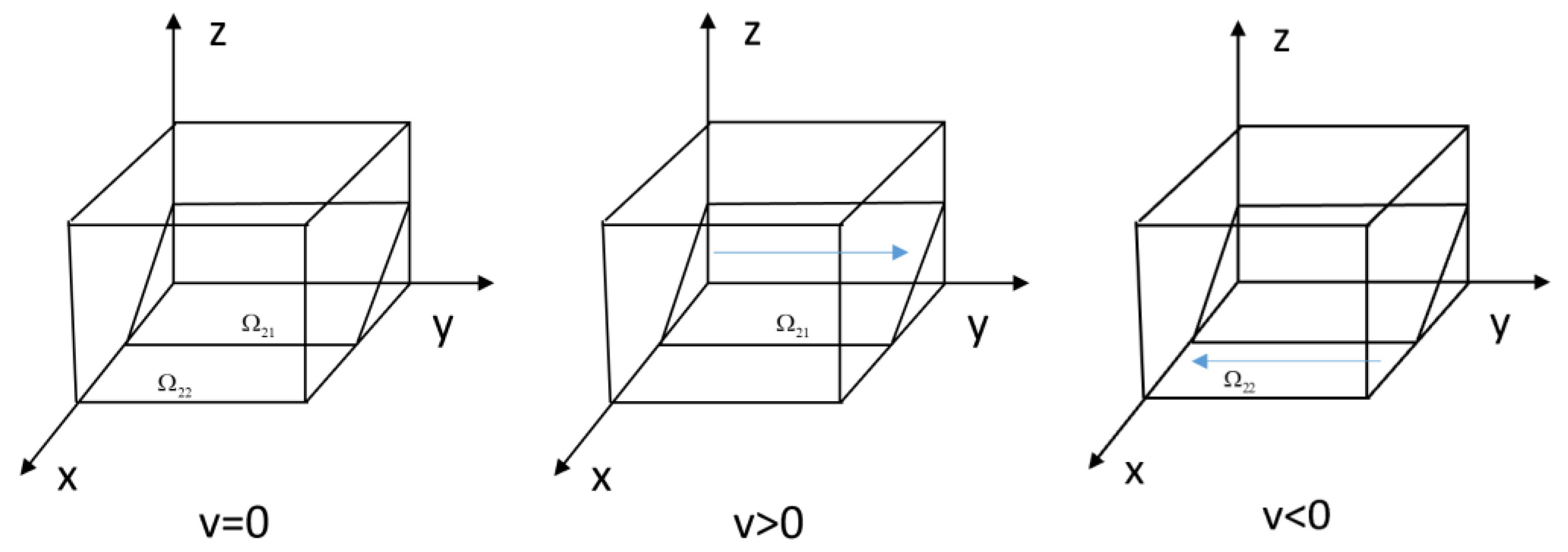

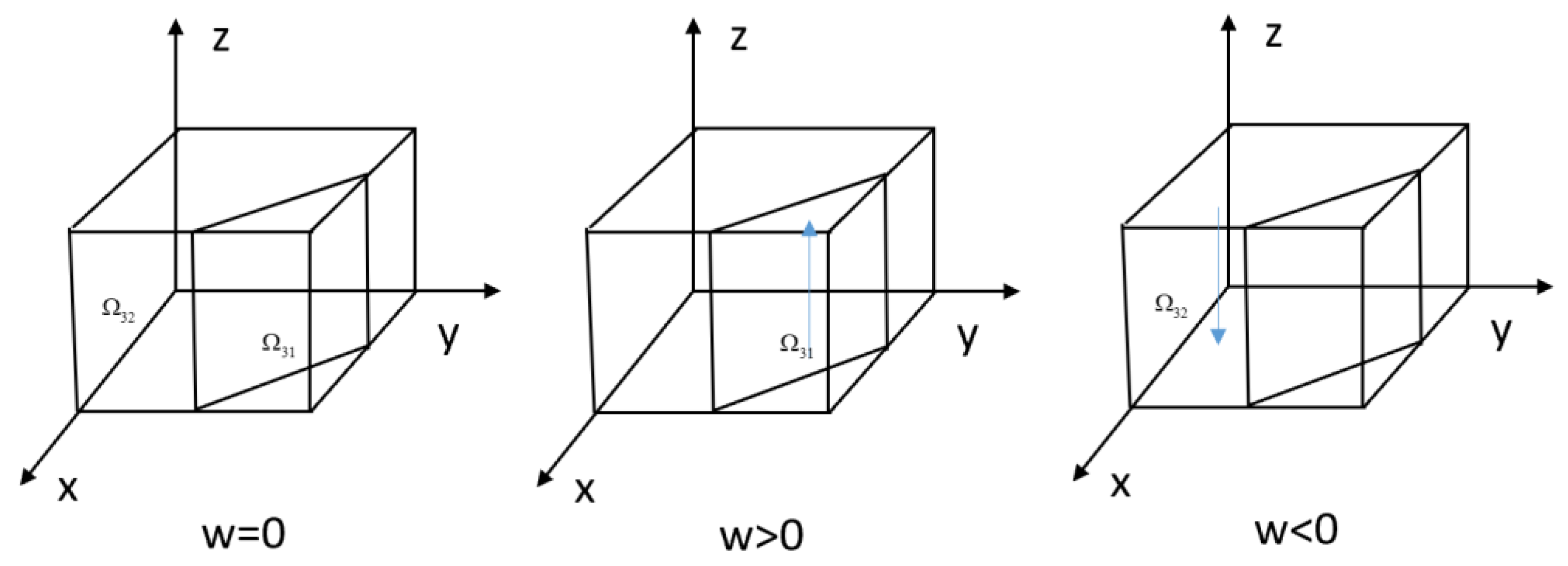

4.1. Replication Dynamic Equation Analysis

- (1)

- When , , , then is the stability point;

- (2)

- When , , , then is the stability point.

- (1)

- When , , , then is the stability point;

- (2)

- When , , , then is the stability point.

- (1)

- When , , , then is the stability point;

- (2)

- When , , , then is the stability point.

4.2. Stability Strategy Analysis

5. Simulation and Sensitivity Analysis

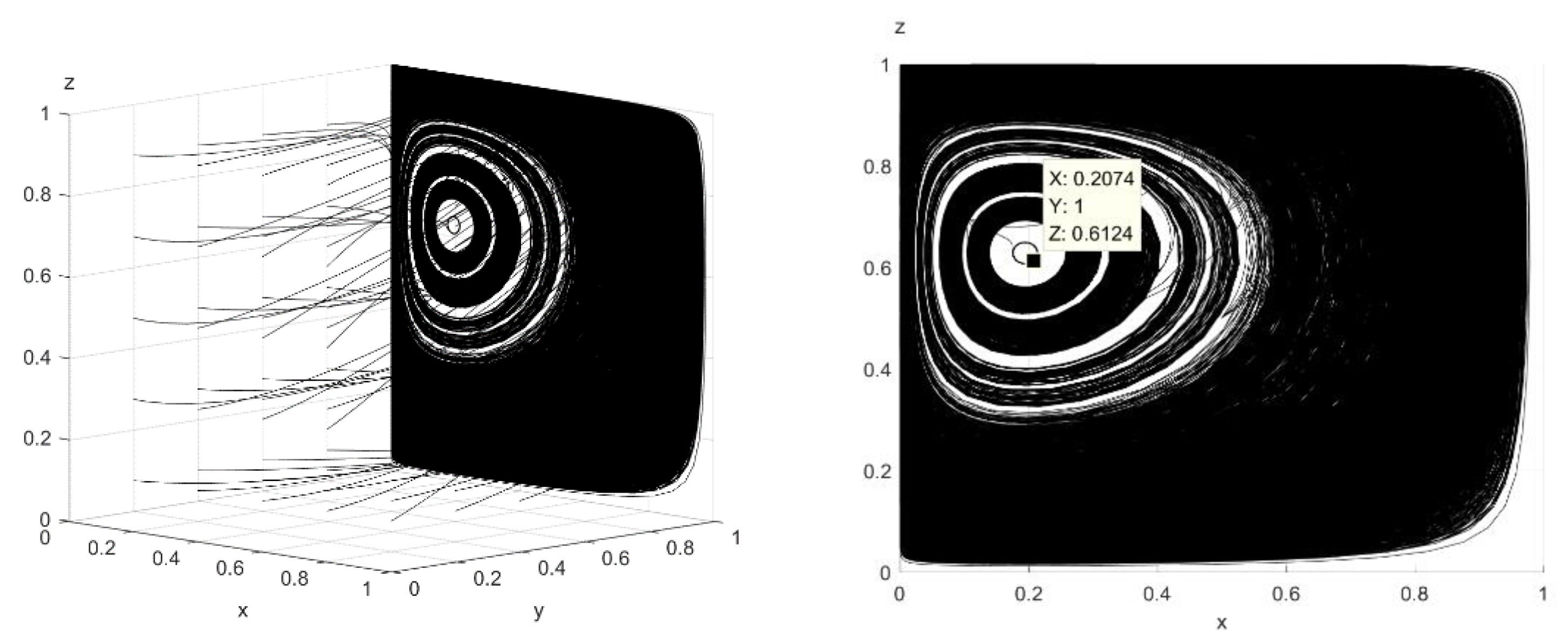

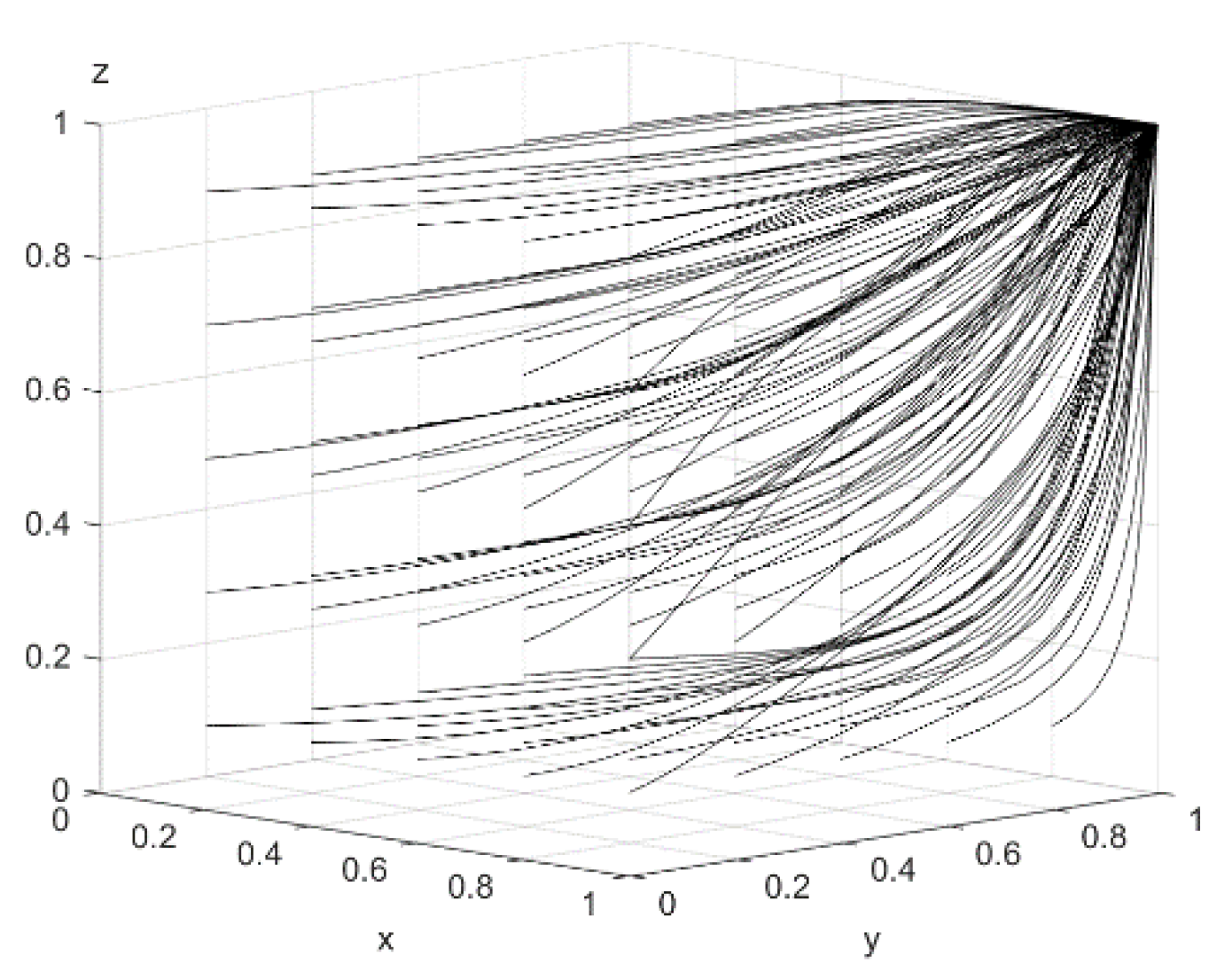

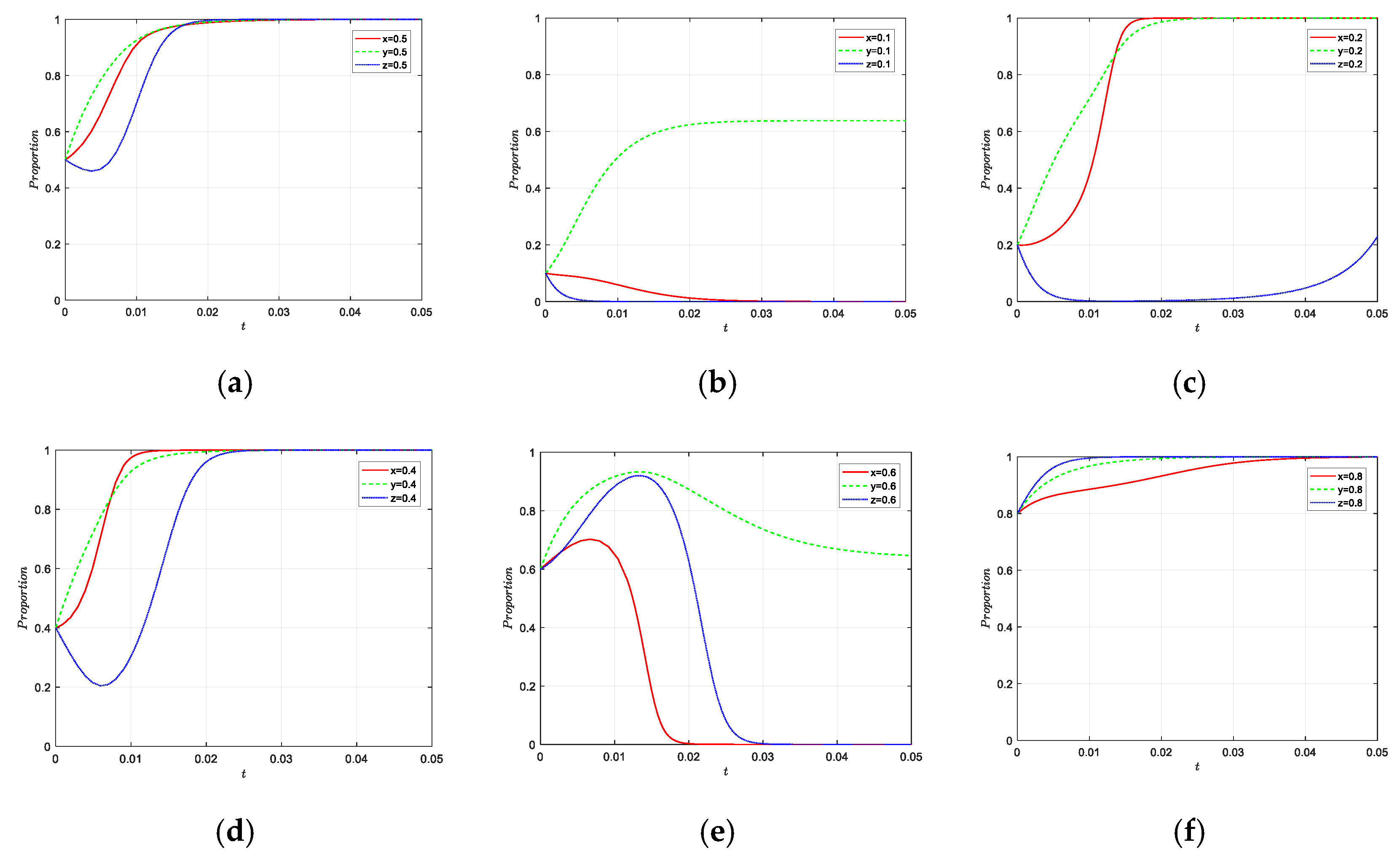

5.1. Effect of Different Initial Situations of the Principal Strategy on the Evolutionary Path

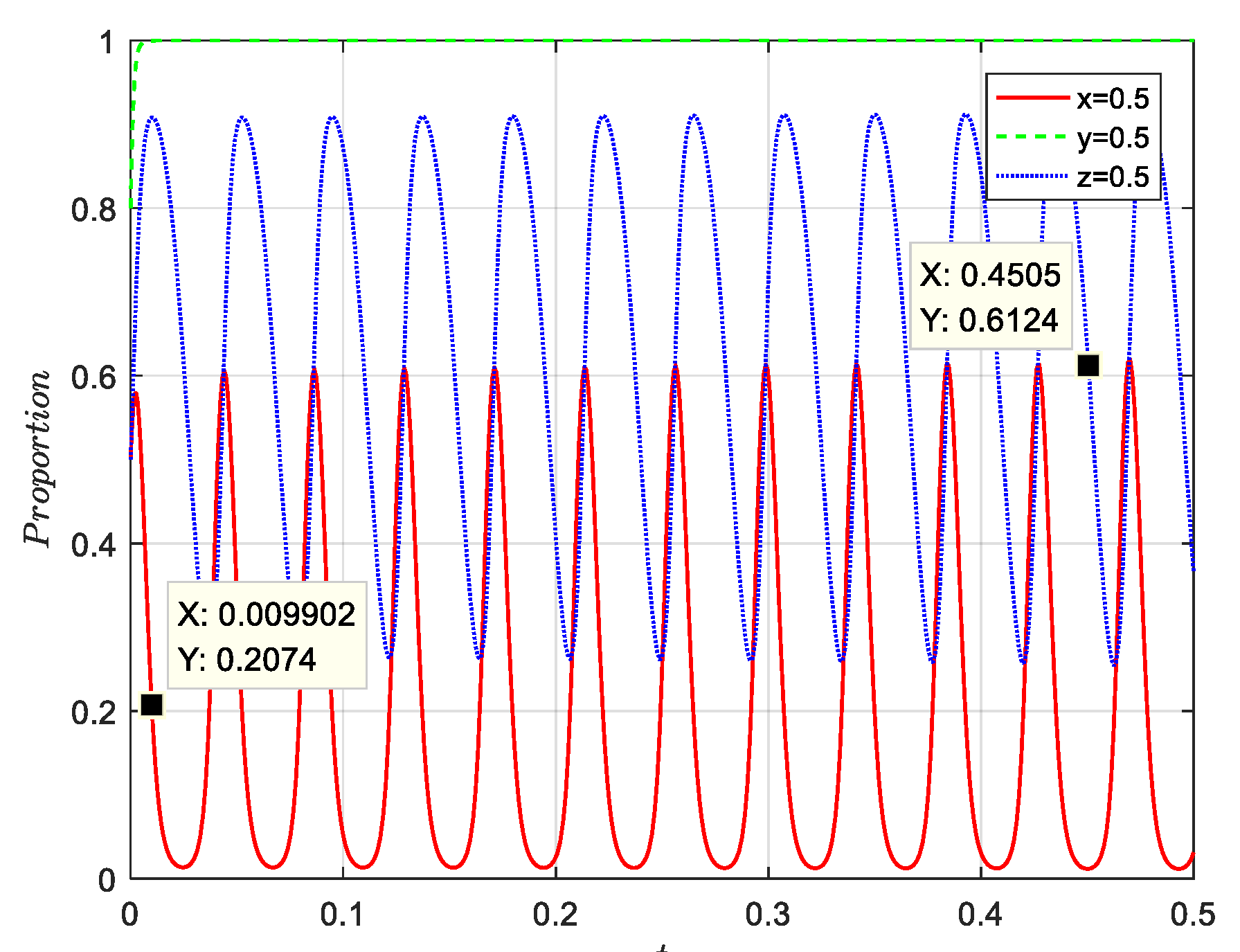

5.1.1. Effect of Input Cost on the Evolutionary Outcome of the Game

5.1.2. Effect of Reward and Punishment Mechanism on Game Evolution Results

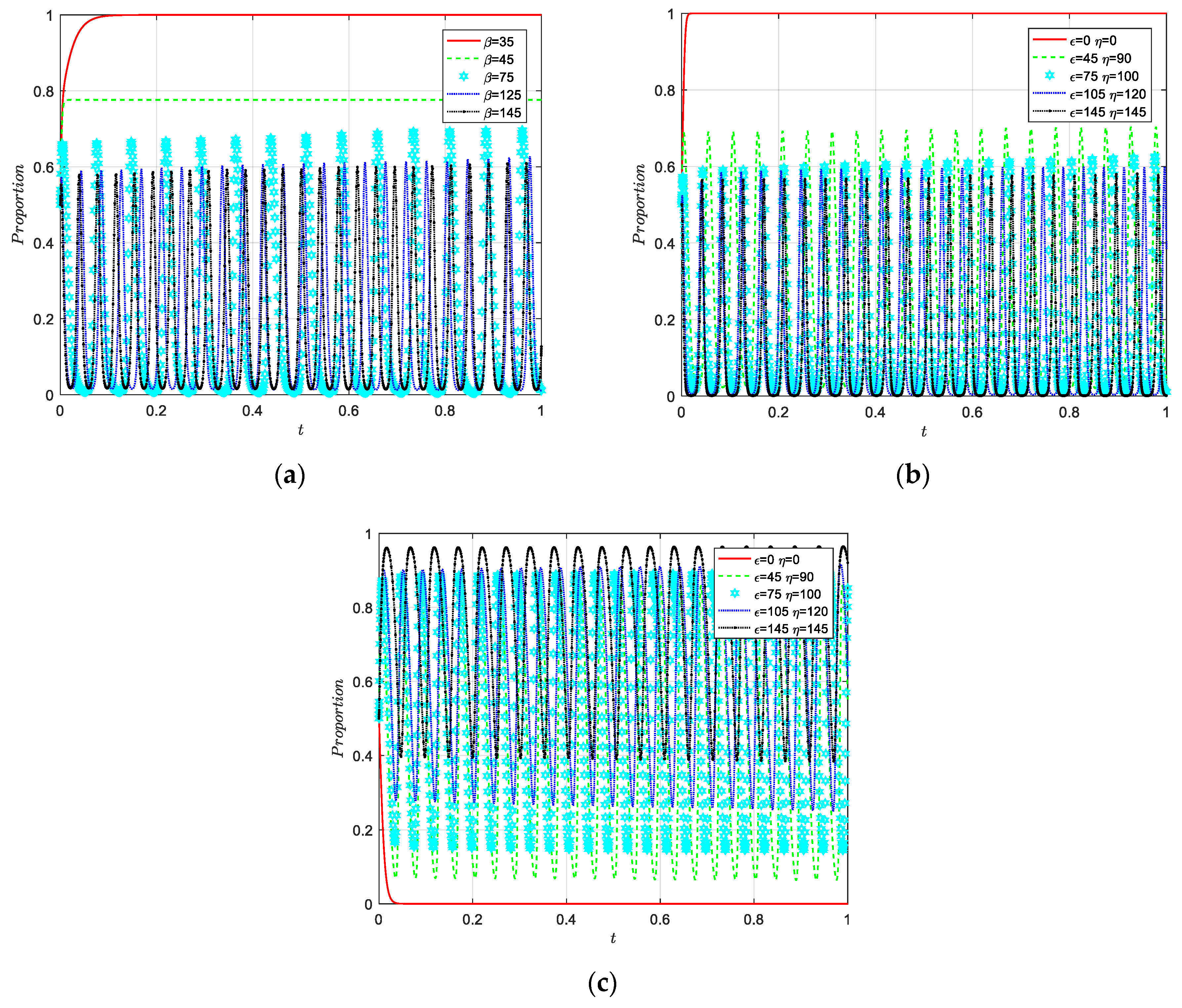

5.1.3. Effect of the Carbon Price and Initial Carbon Quota on the Evolutionary Outcome of the Game

5.1.4. Parameter Optimization

6. Model Optimization under Prospect Theory

6.1. The Evolutionary Game Model under Prospect Theory

6.2. Simulation Analysis after Optimization

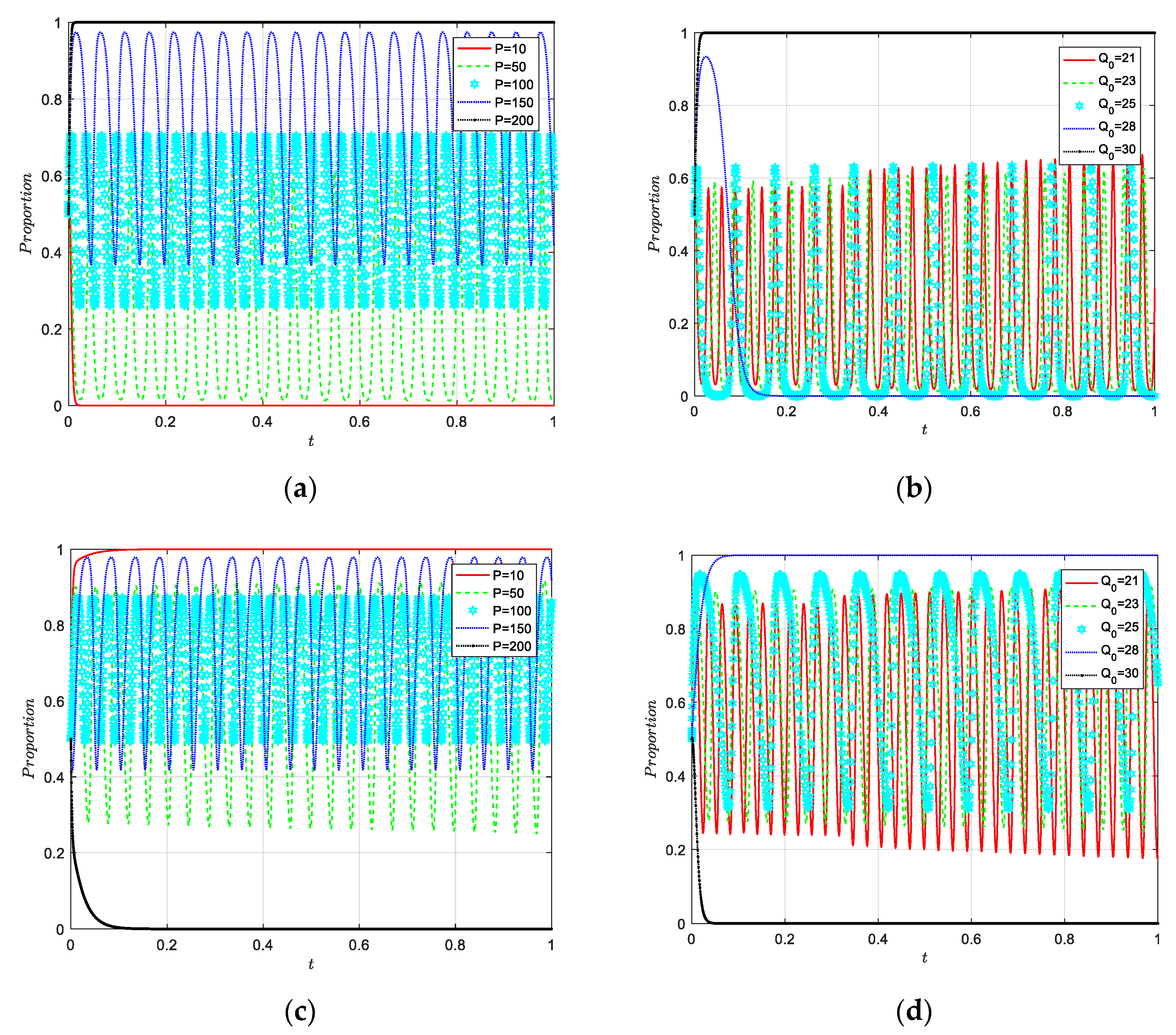

6.2.1. Effect of Initial Willingness on the Evolutionary Outcome of Optimal ESS

6.2.2. Effect of Risk Sensitivity Coefficients on the Evolutionary Results of Optimal ESS

6.2.3. Effect of Loss Avoidance Coefficients on the Evolutionary Results of Optimal ESS

7. Conclusions and Recommendations

7.1. Conclusions

- (1)

- Under the basic parameters, the game process of the three decision-makers shows a periodic behavior pattern and does not reach the optimal equilibrium. However, when the basic conditions are met, the three parties in the game can reach the optimal stable state (1,1,1); that is, {regulate, sell, purchase}, which is conducive to the steady development of the carbon trading market.

- (2)

- Input costs, rewards, and punishment mechanisms, carbon prices, and carbon quotas all have a significant impact on the evolutionary outcomes of the tripartite game model, and there is a threshold effect of the corresponding parameters. The higher the input cost, the lower the participation of government and enterprises in carbon trading; the higher the subsidy, the lower the penalty and the lower the participation of government in carbon trading, but the participation of emission control enterprises increases; the higher the carbon price, the government will tend to choose the “regulate” strategy, while emission control enterprises will tend to choose the “non-purchase” strategy; and the higher the initial carbon quota, the government will tend to choose the “non-regulate” strategy, and the role of emission control enterprises will change accordingly.

- (3)

- Following the introduction of prospect theory to optimize the tripartite game model, previous research on prospect theory indicates that incorporating risk sensitivity and loss avoidance coefficients at the outset does not alter the optimal and stable outcomes of the tripartite game system. However, as the initial willingness size changes, the results of carbon trading within the tripartite game change and emerge unstable strategies. During the carbon trading process, higher risk sensitivity coefficients among decision-makers facing gains can lead to more rational behavior towards gaining, ultimately promoting carbon trading behavior. Additionally, higher loss-sensitive coefficients among decision-makers, reflecting the effects of losses, facilitate the overall evolution of the tripartite game system toward an optimal state.

7.2. Recommendations

- (1)

- Give more institutional protection to carbon trading. Simplify the carbon trading process and reduce transaction fees to reduce the transaction costs of enterprises and increase their enthusiasm to participate in carbon trading. Establish a reward and punishment mechanism to stimulate the vitality of the carbon market, such as giving a set of tax incentives to enterprises that actively implement carbon emission reduction, to reduce the pressure of decreasing productivity caused by the environmental cost of carbon emissions in the short term; on the contrary, enterprises that do not meet the requirements of environmental protection and energy consumption standards should be included in the list of strict control, and carbon tax should be increased to regulate the emission behavior of heavy polluters to avoid the phenomenon of “bad money expelling good money”. The carbon trading market should be regulated from a macroscopic point of view by implementing phased subsidies according to the actual situation of the carbon trading market, and the operation of the trading platform should be checked regularly.

- (2)

- Stabilize the price of carbon emission rights trading in the carbon market and rational optimization of carbon quotas. Set the upper limit of the carbon price to control the cost of emission reduction of enterprises, and set the lower limit of the carbon price to promote the technical emission reduction of enterprises. To cope with the impact of different tax standards and carbon prices on enterprises’ strategic choices, adjust the gap between carbon subsidies and carbon taxes and carbon prices to promote the construction of carbon markets in each stage. Optimize the initial carbon quota allocation method. Allow some flexibility in the design of the quota allocation method for the national carbon trading market. A special working group can be set up to scientifically account for carbon emission quotas according to the characteristics of industries, regions, and even enterprises. By enriching the trading subjects of the carbon trading market, more enterprises in carbon emission-intensive industries can be included in the construction of the carbon market to stimulate the vitality of the carbon market, expand the supply and demand of carbon quotas, and achieve a larger scale of carbon emission reduction to achieve the “double carbon” goal.

- (3)

- Enterprises should proactively participate in carbon trading market activities. For emission reduction enterprises, active participation in carbon trading can not only reduce the cost pressure brought by low-carbon production, but also improve their visibility and lead the corresponding low-carbon industries toward stable and sustainable development. For emission control enterprises, in the short term, active participation in carbon trading can alleviate the pressure of excess emissions brought about by production targets. In the long run, active participation in carbon trading can maintain a good corporate environmental image and increase goodwill. Moreover, to respond to the national call for emission reduction, they need to actively adopt low-carbon production technologies, reduce carbon emissions, rationally analyze the evolution trend of carbon prices in the carbon trading market, enhance risk sensitivity and loss avoidance awareness, timely adjust low-carbon investments, seize the opportunity of green transformation, and meet the challenges of carbon trading policy.

7.3. Outlook

- (1)

- The carbon trading market involves multiple participating parties, including third-party monitoring organizations, carbon trading platforms, the public, and so on; future research could take more subjects into account.

- (2)

- The carbon market consists of various supply and demand sides, but this paper only focuses on emission reduction enterprises and emission control enterprises as representatives. Future research may consider incorporating additional types of carbon trading participants into the model to explore more influential factors, combined with actual case studies to improve the practical application of the model.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Nomenclature

| Parameters | |

| Government basic income when choosing “regulate” strategies; | |

| Government costs to regulate, such as supervision costs; | |

| The profit distribution coefficient of government participation in carbon trading; | |

| Administrative incentives from the central government; | |

| Penalties to emission control enterprises when both choose not to cooperate; | |

| Penalties to emission reduction enterprises when both choose not to cooperate; | |

| Government basic income when choosing “non-regulate” strategies; | |

| Government costs to non-regulate, such as ecological compensation costs; | |

| Emission reduction enterprises’ basic income when choosing “sell” strategies; | |

| The cost to sell for emission reduction enterprises, such as investment cost; | |

| The cost to sell for emission reduction enterprises, such as transaction cost; | |

| Subsidies for each unit of carbon credits sold by emission reduction enterprises; | |

| Carbon price; | |

| Selling the total amount of carbon allowances; | |

| Emission reduction enterprises’ basic income when choosing “non-sell” strategies; | |

| The cost to non-sell for emission reduction enterprises, such as opportunity cost; | |

| Actual carbon emissions of emission control enterprises; | |

| Government-allocated carbon quotas; | |

| Subsidies for each unit of carbon credits purchased by emission control enterprises; | |

| Emission control enterprises’ basic income when choosing “purchase” strategies; | |

| The cost to purchase for emission reduction enterprises, such as upfront cost; | |

| The cost to purchase for emission reduction enterprises, such as transaction cost; | |

| External benefits of emission control enterprise, such as benefits from a positive environmental image; | |

| Emission control enterprises’ basic income when choosing “non-purchase” strategies; | |

| The cost to non-purchase for emission reduction enterprises, such as penalties from the government. | |

| Variables | |

| The probability that governments choose “ regulate” strategies; | |

| The probability that emission reduction enterprises choose “sell” strategies; | |

| The probability that emission control enterprises choose “purchase” strategies. | |

| Acronyms | |

| ESS | Evolutionarily stable strategy; |

| Jacobian matrix. | |

Appendix A

References

- Hu, Z.-H.; Wang, S.-W. An Evolutionary Game Model between Governments and Manufacturers Considering Carbon Taxes, Subsidies, and Consumers’ Low-Carbon Preference. Dyn. Games Appl. 2022, 12, 513–551. [Google Scholar] [CrossRef]

- Tong, W.; Du, J.; Zhao, F.; Mu, D.; Sutherland, J.W. Optimal Joint Production and Emissions Reduction Strategies Considering Consumers’ Environmental Preferences: A Manufacturer’s Perspective. Sustainability 2019, 11, 474. [Google Scholar] [CrossRef] [Green Version]

- Wang, J.; Song, Y.; Li, M.; Yuan, C.; Guo, F. Study on Low-Carbon Technology Innovation Strategies through Government–University–Enterprise Cooperation under Carbon Trading Policy. Sustainability 2022, 14, 9381. [Google Scholar] [CrossRef]

- Zhu, B.; Zhang, M.; Huang, L.; Wang, P.; Su, B.; Wei, Y.-M. Exploring the Effect of Carbon Trading Mechanism on China’s Green Development Efficiency: A Novel Integrated Approach. Energy Econ. 2020, 85, 104601. [Google Scholar] [CrossRef]

- Yu, N.; Chen, J.; Cheng, L. Evolutionary Game Analysis of Carbon Emission Reduction between Government and Enterprises under Carbon Quota Trading Policy. Int. J. Environ. Res. Public Health 2022, 19, 8565. [Google Scholar] [CrossRef]

- Qi, X.; Han, Y. The Design of the Intertemporal Trading Ratio of Carbon Quotas. J. Clean. Prod. 2022, 370, 133481. [Google Scholar] [CrossRef]

- Zhang, Y.-J.; Sun, Y.-F.; Huo, B.-F. The Optimal Product Pricing and Carbon Emissions Reduction Profit Allocation of CET-Covered Enterprises in the Cooperative Supply Chain. Ann. Oper. Res. 2021, 1–29. [Google Scholar] [CrossRef]

- Xu, J.; Gao, Y.; Bai, Q.; Hu, T. Robust emission reduction strategy under different quota allocation methods of carbon trading policy. J. Ind. Eng. Eng. Manag. 2023, 37, 1–10. [Google Scholar] [CrossRef]

- Chen, X.; Wang, J.; Hu, D. Study on the effect of rent-seeking on carbon emission trading market performance under free carbon emission allowances. Syst. Eng.-Theory Pract. 2018, 38, 93–101. [Google Scholar]

- Lin, B.; Xu, B. A Non-Parametric Analysis of the Driving Factors of China’s Carbon Prices. Energy Econ. 2021, 104, 105684. [Google Scholar] [CrossRef]

- Xie, J.; Dou, X. Carbon Cap-and-trade Pricing Mechanism Based on Cooperative Game Theory. Manag. Rev. 2016, 28, 15–24. [Google Scholar] [CrossRef]

- Lv, J.; Fan, X.; Wu, H. Sensitivity Analysis of Factors Influencing Carbon Prices in China. Soft Sci. 2021, 35, 123–130. [Google Scholar] [CrossRef]

- Guo, J.; Gu, F.; Liu, Y.; Liang, X.; Mo, J.; Fan, Y. Assessing the Impact of ETS Trading Profit on Emission Abatements Based on Firm-Level Transactions. Nat. Commun. 2020, 11, 2078. [Google Scholar] [CrossRef]

- Shi, B.; Li, N.; Gao, Q.; Li, G. Market Incentives, Carbon Quota Allocation and Carbon Emission Reduction: Evidence from China’s Carbon Trading Pilot Policy. J. Environ. Manag. 2022, 319, 115650. [Google Scholar] [CrossRef]

- Cao, J.; Ho, M.S.; Ma, R.; Teng, F. When Carbon Emission Trading Meets a Regulated Industry: Evidence from the Electricity Sector of China. J. Public Econ. 2021, 200, 104470. [Google Scholar] [CrossRef]

- Pan, M.; Wang, C. Research on the Corporate Emission Reduction Effect of the Carbon Emission Trading Pilot. Econ. Rev. J. 2022, 10, 73–81. [Google Scholar] [CrossRef]

- Hu, Y.; Ren, S.; Wang, Y.; Chen, X. Can Carbon Emission Trading Scheme Achieve Energy Conservation and Emission Reduction? Evidence from the Industrial Sector in China. Energy Econ. 2020, 85, 104590. [Google Scholar] [CrossRef]

- Wen, Y.; Hu, P.; Li, J.; Liu, Q.; Shi, L.; Ewing, J.; Ma, Z. Does China’s Carbon Emissions Trading Scheme Really Work? A Case Study of the Hubei Pilot. J. Clean. Prod. 2020, 277, 124151. [Google Scholar] [CrossRef]

- Lyu, J.; Cao, M.; Wu, K.; Li, H.; Mohi-ud-din, G. Price Volatility in the Carbon Market in China. J. Clean. Prod. 2020, 255, 120171. [Google Scholar] [CrossRef]

- Zhang, Y.; Zhang, J. Estimating the Impacts of Emissions Trading Scheme on Low-Carbon Development. J. Clean. Prod. 2019, 238, 117913. [Google Scholar] [CrossRef]

- Lin, B.; Huang, C. Analysis of Emission Reduction Effects of Carbon Trading: Market Mechanism or Government Intervention? Sustain. Prod. Consum. 2022, 33, 28–37. [Google Scholar] [CrossRef]

- Lin, B.; Jia, Z. Does the Different Sectoral Coverage Matter? An Analysis of China’s Carbon Trading Market. Energy Policy 2020, 137, 111164. [Google Scholar] [CrossRef]

- Perera, R.S. An Evolutionary Game Theory Strategy for Carbon Emission Reduction in the Electricity Market. Int. Game Theory Rev. 2018, 20, 1850008. [Google Scholar] [CrossRef]

- Feichtinger, G.; Lambertini, L.; Leitmann, G.; Wrzaczek, S. R&D for Green Technologies in a Dynamic Oligopoly: Schumpeter, Arrow and Inverted-U’s. Eur. J. Oper. Res. 2016, 249, 1131–1138. [Google Scholar] [CrossRef] [Green Version]

- Lu, M.; Fang, X. Game Analysison Carbon Market form Allocation of Allowance. Chin. J. Manag. Sci. 2015, 23, 807–811. [Google Scholar]

- Zhu, Q.; Wang, Y.; Tian, Y. Analysis of an Evolutionary Game between Local Governments and Manufacturing Enterprises under Carbon Reduction Policies Based on System Dynamics. Oper. Res. Manag. Sci. 2014, 23, 71–82. [Google Scholar]

- Huang, X.; Ling, N. A Differential Game Model of Government and Enterprise Emission Reduction Based on Emission Permits Trading and Subsidy for Emission Abatement. J. Syst. Manag. 2020, 29, 1150–1160. [Google Scholar]

- Jiao, J.; Chen, J.; Li, L.; Li, F. A Study of Local Governments’ and Enterprises’ Actions in the Carbon Emission Mechanism of Subsidy or Punishment Based on the Evolutionary Game. Chin. J. Manag. Sci. 2017, 25, 140–150. [Google Scholar] [CrossRef]

- Calel, R.; Dechezleprêtre, A. Environmental Policy and Directed Technological Change: Evidence from the European Carbon Market. Rev. Econ. Stat. 2016, 98, 173–191. [Google Scholar] [CrossRef] [Green Version]

- Zhu, Q. A Perspective of Evolution for Carbon Emissions Trading Market: The Dilemma between Market Scale and Government Regulation. Discret. Dyn. Nat. Soc. 2017, 2017, e1432052. [Google Scholar] [CrossRef] [Green Version]

- Liu, Y.; Zhang, X. Carbon Emissions Trading System and Corporate R&D Innovation—An Empirical Study Based on Triple Difference Model. Econ. Sci. 2017, 3, 102–114. [Google Scholar] [CrossRef]

- Yu, P.; Liu, J. Researchon the Effects of Carbon Trading Market Size on Environment and Economic Growth. China Soft Sci. 2020, 4, 46–55. [Google Scholar]

- Maynard Smith, J. The Theory of Games and the Evolution of Animal Conflicts. J. Theor. Biol. 1974, 47, 209–221. [Google Scholar] [CrossRef] [Green Version]

- Cui, N.; Li, J.; Tu, J.; Zhou, M. Evolutionary Game Analysis of Non-Governmental Organizations Participating in Garbage Management under the Background of Internet of Things. Sustainability 2022, 14, 13008. [Google Scholar] [CrossRef]

- Gao, Y.; Jia, R.; Yao, Y.; Xu, J. Evolutionary Game Theory and the Simulation of Green Building Development Based on Dynamic Government Subsidies. Sustainability 2022, 14, 7294. [Google Scholar] [CrossRef]

- Zhao, D.; Hao, J.; Cao, C.; Han, H. Evolutionary Game Analysis of Three-Player for Low-Carbon Production Capacity Sharing. Sustainability 2019, 11, 2996. [Google Scholar] [CrossRef] [Green Version]

- Liu, L.; Wang, Z.; Li, X.; Liu, Y.; Zhang, Z. An Evolutionary Analysis of Low-Carbon Technology Investment Strategies Based on the Manufacturer-Supplier Matching Game under Government Regulations. Environ. Sci. Pollut. Res. 2022, 29, 44597–44617. [Google Scholar] [CrossRef]

- Zhao, X.; Zhang, Y. The System Dynamics (SD) Analysis of the Government and Power Producers’ Evolutionary Game Strategies Based on Carbon Trading (CT) Mechanism: A Case of China. Sustainability 2018, 10, 1150. [Google Scholar] [CrossRef] [Green Version]

- Chen, Z.; Wang, T. Photovoltaic Subsidy Withdrawal: An Evolutionary Game Analysis of the Impact on Chinese Stakeholders’ Strategic Choices. Sol. Energy 2022, 241, 302–314. [Google Scholar] [CrossRef]

- Zhang, J.; Wen, S.; Li, H.; Lü, X. Evolutionary Game Analysis of Supply Chain Operations Decision under the Background of Low-carbon Economy—Based on the Perspective of Government-Enterprise-Consumer Synergy. Oper. Res. Manag. Sci. 2022, 1–9. Available online: https://lib.swust.edu.cn/asset/detail/0/2031145452865 (accessed on 27 April 2023).

- Fan, R.; Wu, T.; Fan, W. Research on Tripartite Governance Evolutionary Game Model and Environmental Governance Strategy Under Environment Tax and Regulation Capture. Soft Sci. 2022, 36, 122–130. [Google Scholar] [CrossRef]

- Chen, L.; Wang, C.; Li, S.; Li, X.; Cao, D. Research on Multi-agent Evolution Game of Construction Safety Management Based on Prospect Theory. J. Saf. Environ. 2022, 1–11. [Google Scholar] [CrossRef]

- Shen, J.; Gao, X.; He, W.; Sun, F.; Zhang, Z.; Kong, Y.; Wan, Z.; Zhang, X.; Li, Z.; Wang, J.; et al. Prospect Theory in an Evolutionary Game: Construction of Watershed Ecological Compensation System in Taihu Lake Basin. J. Clean. Prod. 2021, 291, 125929. [Google Scholar] [CrossRef]

- Sun, H.; Gao, G.; Li, Z. Evolutionary Game Analysis of Enterprise Carbon Emission Regulation Based on Prospect Theory. Soft Comput. 2022, 26, 13357–13368. [Google Scholar] [CrossRef]

- Uchida, S.; Yamamoto, H.; Okada, I.; Sasaki, T. Evolution of Cooperation with Peer Punishment under Prospect Theory. Games 2019, 10, 11. [Google Scholar] [CrossRef] [Green Version]

- Yang, G.; Chen, J. Research on Enterprise Radical Technology Innovation Behavior—Evolutionary Game Analysis Based on Prospect Theory. J. Ind. Technol. Econ. 2020, 39, 57–64. [Google Scholar]

- Liu, M.; Li, Z.; Zhang, J. Evolutionary Game Analysis on Low-carbon Strategies of Government and Business Based on the View of Prospect Theory. Sci. Technol. Manag. Res. 2017, 37, 245–253. [Google Scholar]

- Fang, G.; He, Y.; Tian, L. Evolutionary game analysis of government and enterprises carbon-reduction under the driven of carbon trading. Chin. J. Manag. Sci. 2021, 1–12. [Google Scholar] [CrossRef]

- Cao, Y.; Kang, Z.; Bai, J.; Cui, Y.; Chang, I.-S.; Wu, J. How to Build an Efficient Blue Carbon Trading Market in China?—A Study Based on Evolutionary Game Theory. J. Clean. Prod. 2022, 367, 132867. [Google Scholar] [CrossRef]

- Wang, Y.; Guo, T.; Cheng, T.C.E.; Wang, N. Evolution of Blue Carbon Trading of China’s Marine Ranching under the Blue Carbon Special Subsidy Mechanism. Ocean Coast. Manag. 2022, 222, 106123. [Google Scholar] [CrossRef]

- Ritzberger, K.; Weibull, J. Evolutionary Selection in Normal-Form Games on JSTOR. Available online: https://www.jstor.org/stable/2171774 (accessed on 27 April 2023).

- Shen, M.; He, Z. The Experience of Foreign Fiscal Policy on Low-Carbon Economy. Ecol. Econ. 2011, 3, 83–89. [Google Scholar]

- Li, S.; Cai, J.; Feng, Z.; Xu, Y.; Cai, H. Government Contracting with Monopoly in Infrastructure Provision: Regulation or Deregulation? Transp. Res. Part E Logist. Transp. Rev. 2019, 122, 506–523. [Google Scholar] [CrossRef]

- Tversky, A.; Kahneman, D. Advances in Prospect Theory: Cumulative Representation of Uncertainty. J. Risk Uncertain. 1992, 5, 297–323. [Google Scholar] [CrossRef]

- Zhang, Y.; Fan, R.; Luo, M.; Sun, J. The Evolution of Short-sighted Behavior of Enterprise Technological Innovation: Analysis based on Prospect Theory. J. Tech. Econ. Manag. 2022, 6, 58–63. [Google Scholar]

| Strategy Matrix | Government | ||||

|---|---|---|---|---|---|

| Regulate | Non-Regulate | ||||

| emission reduction enterprises | sell | purchase | emission control enterprises | ||

| Non-purchase | |||||

| Non-sell | purchase | ||||

| Non-purchase | |||||

| Equilibrium Point | |||

|---|---|---|---|

| Parameters | Values | Parameters | Values | Parameters | Values |

|---|---|---|---|---|---|

| 1600 | 1250 | 23 | |||

| 1000 | 20 | 75 | |||

| 0.2 | 125 | 2000 | |||

| 200 | 50 | 1000 | |||

| 150 | 5 | 20 | |||

| 100 | 1000 | 100 | |||

| 800 | 400 | 1000 | |||

| 500 | 100 | ||||

| 2000 | 28 |

| Parameters | Values | Parameters | Values | Parameters | Values |

|---|---|---|---|---|---|

| 1600 | 1250 | 23 | |||

| 800 | 20 | 70 | |||

| 0.2 | 80 | 2000 | |||

| 200 | 50 | 900 | |||

| 150 | 5 | 20 | |||

| 100 | 1000 | 100 | |||

| 800 | 400 | 1000 | |||

| 500 | 100 | ||||

| 2000 | 28 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hu, J.; Wang, T. Strategies of Participants in the Carbon Trading Market—An Analysis Based on the Evolutionary Game. Sustainability 2023, 15, 10807. https://doi.org/10.3390/su151410807

Hu J, Wang T. Strategies of Participants in the Carbon Trading Market—An Analysis Based on the Evolutionary Game. Sustainability. 2023; 15(14):10807. https://doi.org/10.3390/su151410807

Chicago/Turabian StyleHu, Jieli, and Tieli Wang. 2023. "Strategies of Participants in the Carbon Trading Market—An Analysis Based on the Evolutionary Game" Sustainability 15, no. 14: 10807. https://doi.org/10.3390/su151410807