Research on the Impact of Global Economic Policy Uncertainty on Manufacturing: Evidence from China, the United States, and the European Union

Abstract

:1. Introduction

2. Literature Review and Hypothesis

2.1. Literature Review

2.2. Hypotheses

3. Materials and Methods

3.1. Time-Varying Parameter Vector Autoregressive

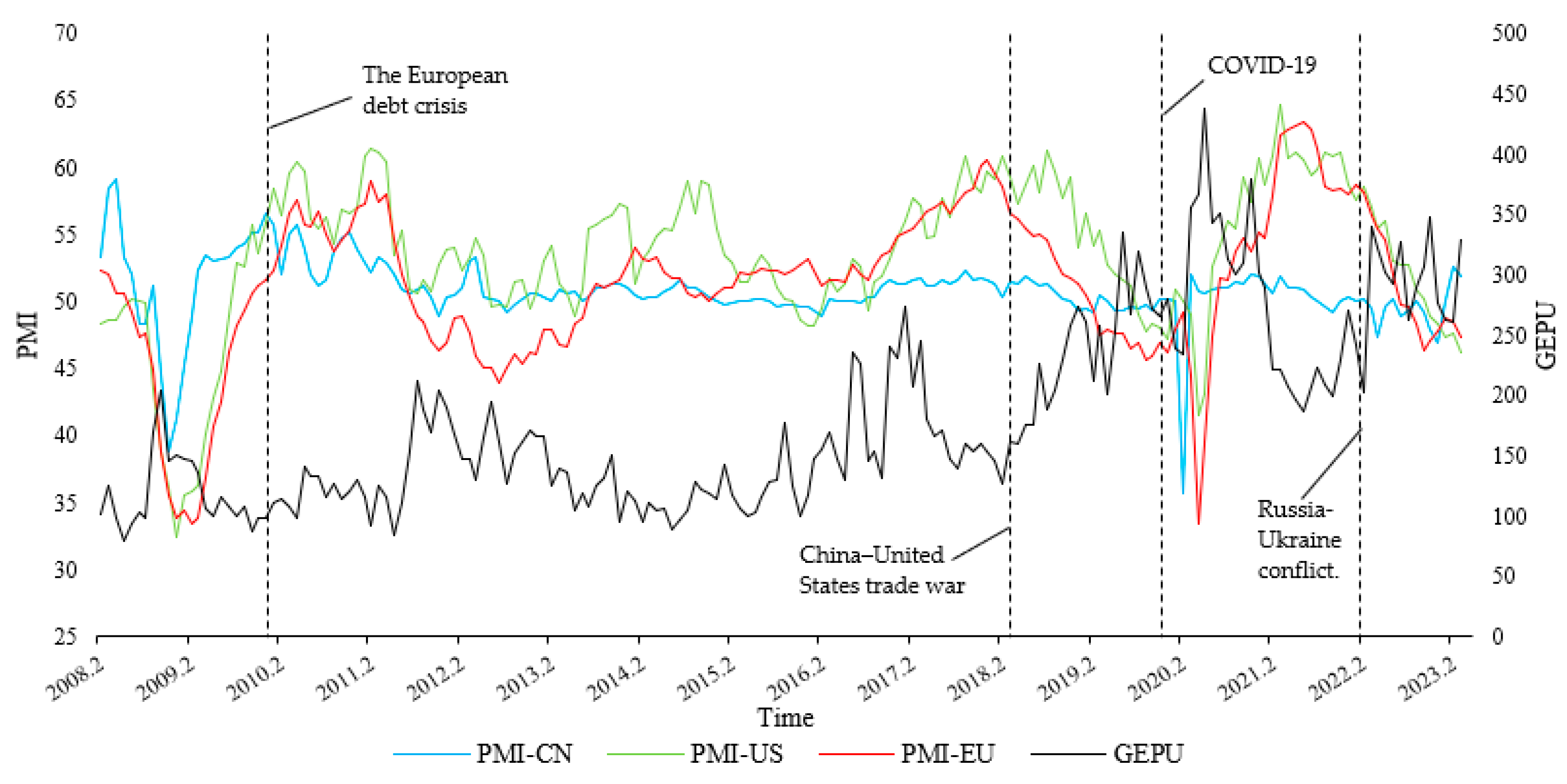

3.2. Data Source and Description

4. Results

4.1. Empirical Testing

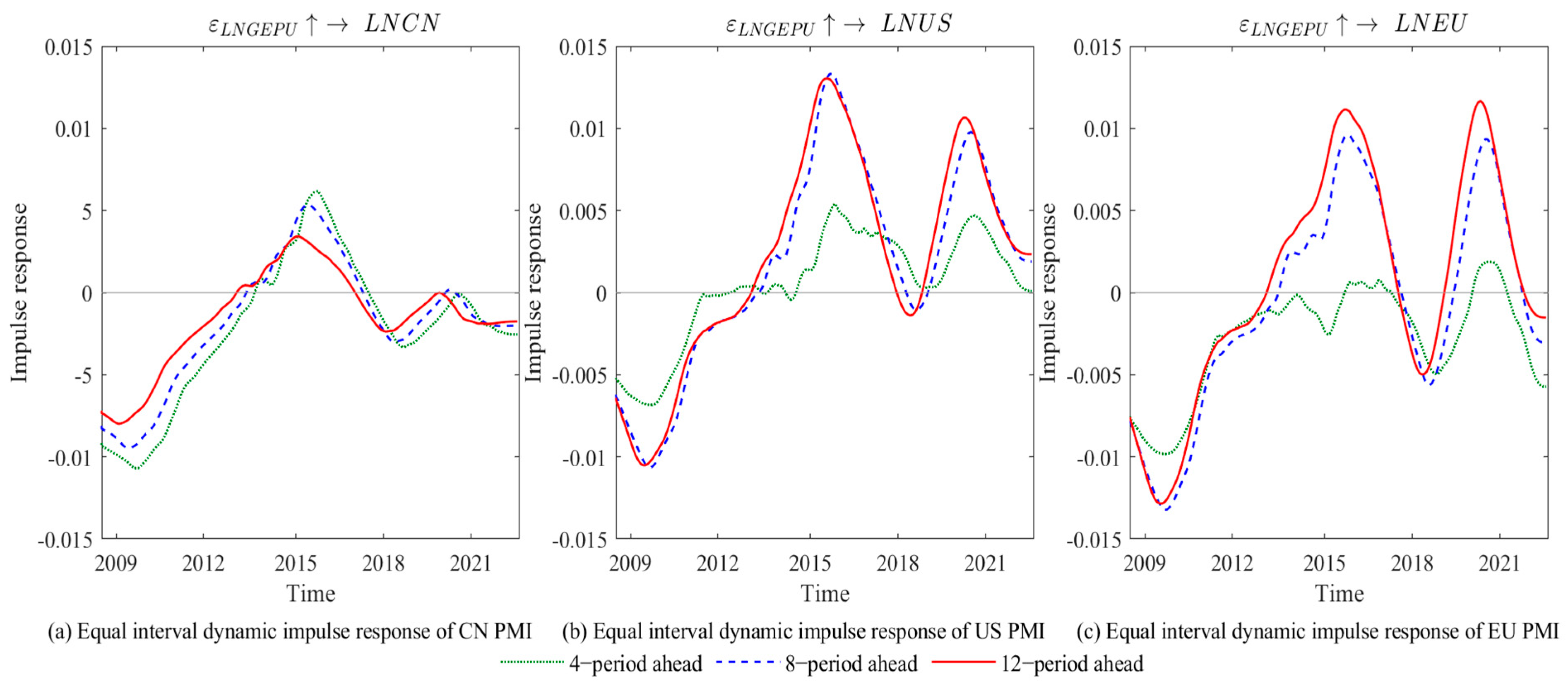

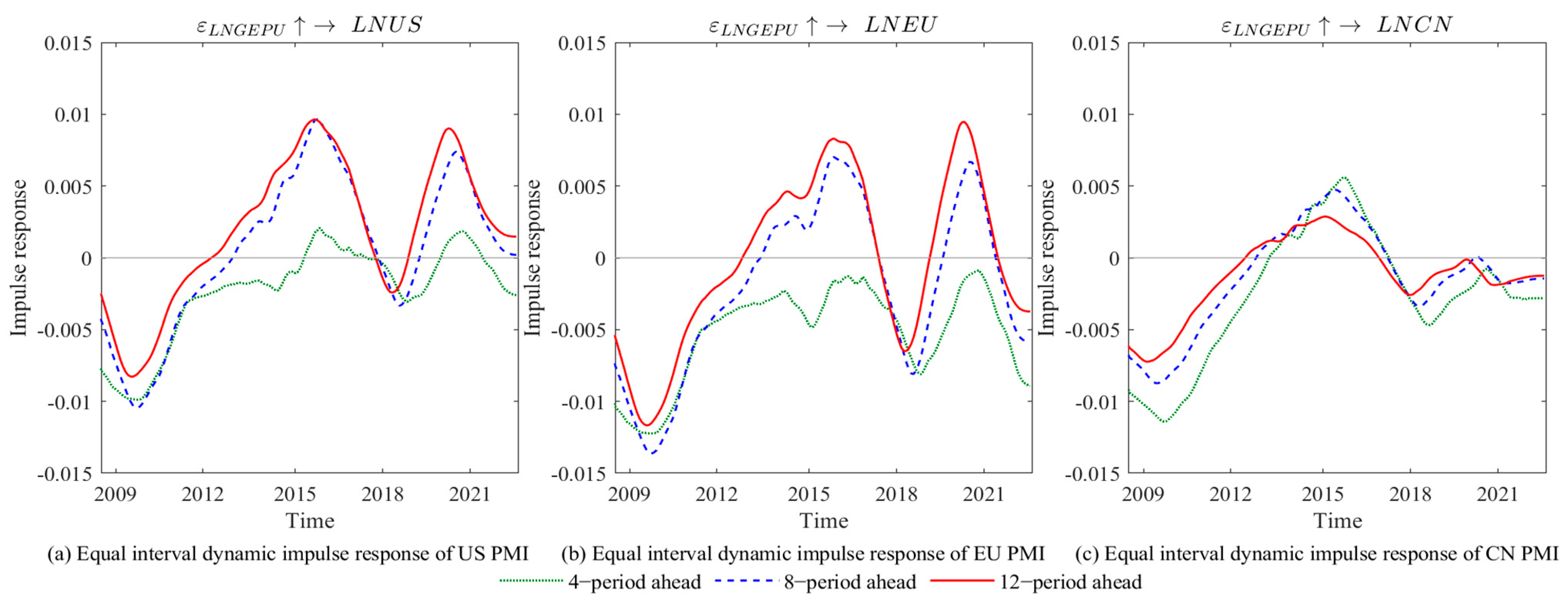

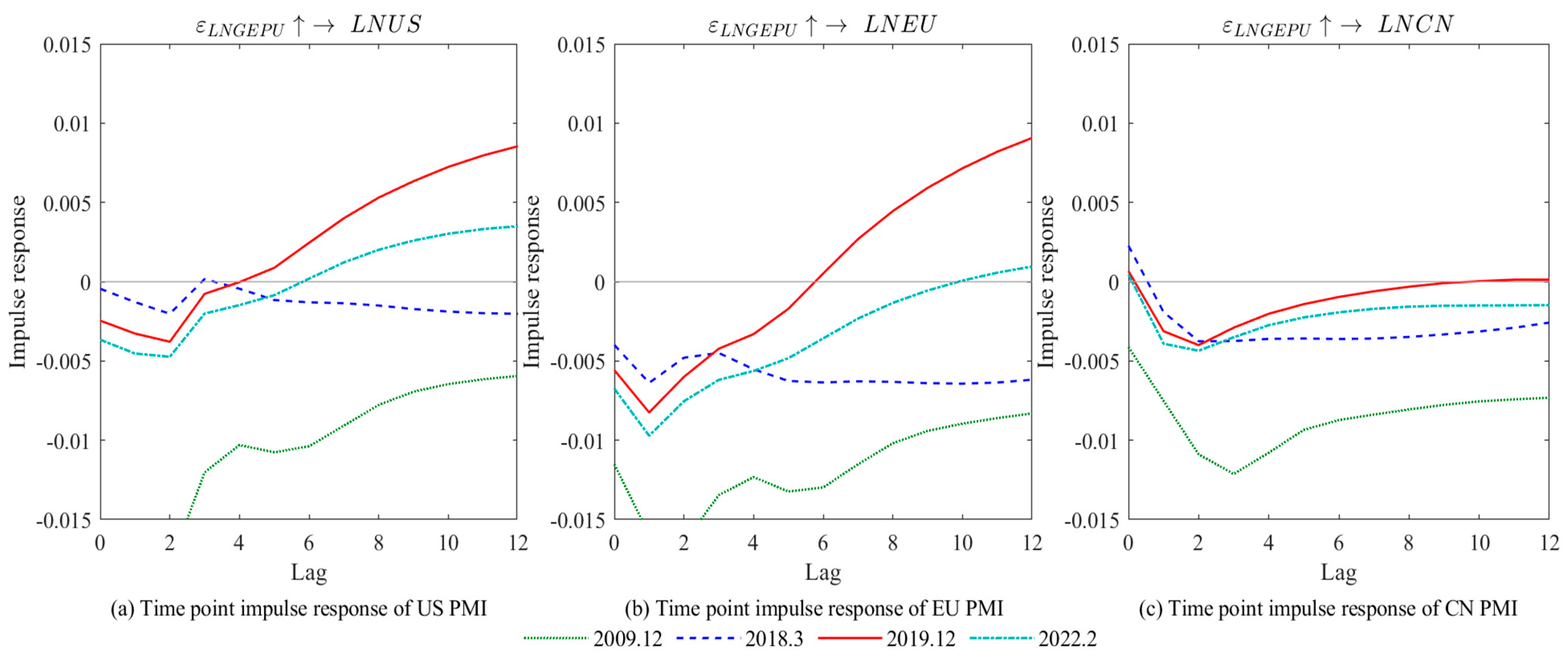

4.2. Empirical Results

5. Robust Test

6. Discussion and Conclusions

6.1. Discussion

6.2. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Marconi, N.; de Borja Reis, C.F.; de Araújo, E.C. Manufacturing and Economic Development: The Actuality of Kaldor’s First and Second Laws. Struct. Chang. Econ. Dyn. 2016, 37, 75–89. [Google Scholar] [CrossRef]

- Liu, F.; Ding, Y.; Gao, J.; Gong, P. Effects of Cost Factors on National Manufacturing Based on Global Perspectives. Economies 2017, 5, 45. [Google Scholar] [CrossRef] [Green Version]

- McCausland, W.D.; Theodossiou, I. Is Manufacturing Still the Engine of Growth? J. Post Keynes. Econ. 2012, 35, 79–92. [Google Scholar] [CrossRef]

- Su, D.; Yao, Y. Manufacturing as the Key Engine of Economic Growth for Middle-Income Economies. J. Asia Pac. Econ. 2017, 22, 47–70. [Google Scholar] [CrossRef] [Green Version]

- Cantore, N.; Clara, M.; Lavopa, A.; Soare, C. Manufacturing as an Engine of Growth: Which Is the Best Fuel? Struct. Chang. Econ. Dyn. 2017, 42, 56–66. [Google Scholar] [CrossRef]

- Haraguchi, N.; Cheng, C.F.C.; Smeets, E. The Importance of Manufacturing in Economic Development: Has This Changed? World Dev. 2017, 93, 293–315. [Google Scholar] [CrossRef]

- de Bondt, G.J. A PMI-Based Real GDP Tracker for the Euro Area. J. Bus. Cycle Res. 2019, 15, 147–170. [Google Scholar] [CrossRef]

- Zhang, D.; Xiao, M.; Yang, X.; He, Y. The Analysis of Manufacturing PMI Potential Trends of the US, EU, Japan and China. Procedia Comput. Sci. 2015, 55, 43–51. [Google Scholar] [CrossRef]

- He, Y.; Zhang, Y.; Tian, P. The Study of Warning Threshold of Chinese Manufacturing PMI for Important Macroeconomic Indicators. Procedia Comput. Sci. 2015, 55, 1374–1380. [Google Scholar] [CrossRef] [Green Version]

- Meyer, D.F.; Habanabakize, T. An assessment of the value of PMI and manufacturing sector growth in predicting overall economic output (GDP) in South Africa. Int. J. EBusiness EGovernment Stud. 2019, 11, 191–206. [Google Scholar] [CrossRef]

- Wei, Y.; Bai, L.; Yang, K.; Wei, G. Are Industry-Level Indicators More Helpful to Forecast Industrial Stock Volatility? Evidence from Chinese Manufacturing Purchasing Managers Index. J. Forecast. 2021, 40, 17–39. [Google Scholar] [CrossRef]

- Cziráky, D.; Sambt, J.; Rovan, J.; Puljiz, J. Regional Development Assessment: A Structural Equation Approach. Eur. J. Oper. Res. 2006, 174, 427–442. [Google Scholar] [CrossRef]

- Raiser, M.; Di Tommaso, M. The Measurements and Determinants of Institutional Change: Evidence from Transition Economies; 2001. Available online: https://www.ebrd.com/downloads/research/economics/workingpapers/wp0060.pdf (accessed on 16 May 2023).

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring Economic Policy Uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Gulen, H.; Ion, M. Policy Uncertainty and Corporate Investment. Rev. Financ. Stud. 2016, 29, 523–564. [Google Scholar] [CrossRef] [Green Version]

- Davis, S.J. An Index of Global Economic Policy Uncertainty; National Bureau of Economic Research: Cambridge, MA, USA, 2016. [Google Scholar]

- Baker, S.R.; Bloom, N.; Davis, S.J. Has Economic Policy Uncertainty Hampered the Recovery? In Government Policies and the Delayed Economic Recovery; Hoover Institution: Stanford, CA, USA, 2012. [Google Scholar]

- Stock, J.H.; Watson, M.W. Disentangling the Channels of the 2007–2009 Recession; National Bureau of Economic Research: Cambridge, MA, USA, 2012. [Google Scholar]

- Collins, A.; Florin, M.-V.; Renn, O. COVID-19 Risk Governance: Drivers, Responses and Lessons to Be Learned. J. Risk Res. 2020, 23, 1073–1082. [Google Scholar] [CrossRef]

- Zhang, J. The changing trend and internal law of the proportion of China’s manufacturing added value in GDP. J. Explor. Controv. 2021, 379, 57–72+181+178. [Google Scholar]

- Zhou, R.; Tang, D.; Da, D.; Chen, W.; Kong, L.; Boamah, V. Research on China’s Manufacturing Industry Moving towards the Middle and High-End of the GVC Driven by Digital Economy. Sustainability 2022, 14, 7717. [Google Scholar] [CrossRef]

- Wang, L.; Wei, L. Low-End Locking or Crowding-out Effects-An Empirical Analysis of China’s Manufacturing Industry Embedded in GVCS. J. Trans Bus. Econ. 2018, 17, 216–236. [Google Scholar]

- Kimble, C.; Wang, H. China’s New Energy Vehicles: Value and Innovation. J. Bus. Strategy 2013, 34, 13–20. [Google Scholar] [CrossRef] [Green Version]

- Wang, S. Exploring the Sustainability of China’s New Energy Vehicle Development: Fresh Evidence from Population Symbiosis. Sustainability 2022, 14, 10796. [Google Scholar] [CrossRef]

- Xu, B.; Lin, B. Assessing the Development of China’s New Energy Industry. Energy Econ. 2018, 70, 116–131. [Google Scholar] [CrossRef]

- Council, N.R. Rising to the Challenge: U.S. Innovation Policy for the Global Economy; National Academies Press: Washington, DC, USA, 2012; ISBN 978-0-309-25551-6. [Google Scholar]

- Appelbaum, E. Manufacturing Advantage: Why High-Performance Work Systems Pay Off; Cornell University Press: Ithaca, NY, USA, 2000; ISBN 978-0-8014-3765-6. [Google Scholar]

- Behun, M.; Gavurová, B.; Tkáčová, A.; Kotaskova, A. The impact of the manufacturing industry on the economic cycle of European Union countries. J. Compet. 2018, 10, 23–39. [Google Scholar] [CrossRef] [Green Version]

- Fasanya, I.O.; Oyewole, O.J.; Agbatogun, T. How Does Economic Policy Uncertainty Connect with the Volatility Spillovers in Asia-Pacific Markets? Asian Econ. Lett. 2021, 2. [Google Scholar] [CrossRef]

- Masona, C.; Sakarombe, U.; Nyawo, T.; Dube, B. Role of COVID-19 pandemic and global economic policy uncertainty on firms’ participation in innovation: An empirical study in sub-Saharan Africa SMES. Gap iNterdisciplinarities 2022, 5, 123–129. [Google Scholar]

- Istiak, K.; Serletis, A. Economic Policy Uncertainty and Real Output: Evidence from the G7 Countries. Appl. Econ. 2018, 50, 4222–4233. [Google Scholar] [CrossRef]

- Arouri, M.; Estay, C.; Rault, C.; Roubaud, D. Economic Policy Uncertainty and Stock Markets: Long-Run Evidence from the US. Financ. Res. Lett. 2016, 18, 136–141. [Google Scholar] [CrossRef]

- Nilavongse, R.; Michal, R.; Uddin, G.S. Economic Policy Uncertainty Shocks, Economic Activity, and Exchange Rate Adjustments. Econ. Lett. 2020, 186, 108765. [Google Scholar] [CrossRef]

- Chen, L.; Du, Z.; Hu, Z. Impact of Economic Policy Uncertainty on Exchange Rate Volatility of China. Financ. Res. Lett. 2020, 32, 101266. [Google Scholar] [CrossRef]

- Nguyen, C.P.; Le, T.-H.; Su, T.D. Economic Policy Uncertainty and Credit Growth: Evidence from a Global Sample. Res. Int. Bus. Financ. 2020, 51, 101118. [Google Scholar] [CrossRef]

- Phan, D.H.B.; Iyke, B.N.; Sharma, S.S.; Affandi, Y. Economic Policy Uncertainty and Financial Stability—Is There a Relation? Econ. Model. 2021, 94, 1018–1029. [Google Scholar] [CrossRef]

- Sahinoz, S.; Erdogan Cosar, E. Economic Policy Uncertainty and Economic Activity in Turkey. Appl. Econ. Lett. 2018, 25, 1517–1520. [Google Scholar] [CrossRef]

- Demir, E.; Gozgor, G.; Lau, C.K.M.; Vigne, S.A. Does Economic Policy Uncertainty Predict the Bitcoin Returns? An Empirical Investigation. Financ. Res. Lett. 2018, 26, 145–149. [Google Scholar] [CrossRef] [Green Version]

- Fang, L.; Bouri, E.; Gupta, R.; Roubaud, D. Does Global Economic Uncertainty Matter for the Volatility and Hedging Effectiveness of Bitcoin? Int. Rev. Financ. Anal. 2019, 61, 29–36. [Google Scholar] [CrossRef]

- Pirgaip, B.; Dinçergök, B. Economic Policy Uncertainty, Energy Consumption and Carbon Emissions in G7 Countries: Evidence from a Panel Granger Causality Analysis. Environ. Sci. Pollut. Res. 2020, 27, 30050–30066. [Google Scholar] [CrossRef] [PubMed]

- Huang, H.; Ali, S.; Solangi, Y.A. Analysis of the Impact of Economic Policy Uncertainty on Environmental Sustainability in Developed and Developing Economies. Sustainability 2023, 15, 5860. [Google Scholar] [CrossRef]

- Adams, S.; Adedoyin, F.; Olaniran, E.; Bekun, F.V. Energy Consumption, Economic Policy Uncertainty and Carbon Emissions; Causality Evidence from Resource Rich Economies. Econ. Anal. Policy 2020, 68, 179–190. [Google Scholar] [CrossRef]

- Nakhli, M.S.; Shahbaz, M.; Jebli, M.B.; Wang, S. Nexus between Economic Policy Uncertainty, Renewable & Non-Renewable Energy and Carbon Emissions: Contextual Evidence in Carbon Neutrality Dream of USA. Renew. Energy 2022, 185, 75–85. [Google Scholar]

- Yu, J.; Shi, X.; Guo, D.; Yang, L. Economic Policy Uncertainty (EPU) and Firm Carbon Emissions: Evidence Using a China Provincial EPU Index. Energy Econ. 2021, 94, 105071. [Google Scholar] [CrossRef]

- Luo, X.; Yu, M.; Jin, Y. The Impact of Economic Policy Uncertainty on Enterprise Green Innovation: A Study on the Moderating Effect of Carbon Information Disclosure. Sustainability 2023, 15, 4915. [Google Scholar] [CrossRef]

- Khan, Y.; Hassan, T.; Kirikkaleli, D.; Xiuqin, Z.; Shukai, C. The Impact of Economic Policy Uncertainty on Carbon Emissions: Evaluating the Role of Foreign Capital Investment and Renewable Energy in East Asian Economies. Environ. Sci. Pollut. Res. 2022, 29, 18527–18545. [Google Scholar] [CrossRef]

- Yu, H.; Fang, L.; Sun, W. Forecasting Performance of Global Economic Policy Uncertainty for Volatility of Chinese Stock Market. Phys. Stat. Mech. Appl. 2018, 505, 931–940. [Google Scholar] [CrossRef]

- Yu, M.; Song, J. Volatility Forecasting: Global Economic Policy Uncertainty and Regime Switching. Phys. Stat. Mech. Appl. 2018, 511, 316–323. [Google Scholar] [CrossRef]

- Qin, M.; Su, C.-W.; Xiao, Y.-D.; Zhang, S. Should Gold Be Held under Global Economic Policy Uncertainty? J. Bus. Econ. Manag. 2020, 21, 725–742. [Google Scholar] [CrossRef] [Green Version]

- Long, S.; Li, J.; Luo, T. The Asymmetric Impact of Global Economic Policy Uncertainty on International Grain Prices. J. Commod. Mark. 2022, 30, 100273. [Google Scholar]

- Yu, Z.; Qian, L. Research on the dynamic correlation between U.S. manufacturing PMI and GDP growth rate. J. Times Financ. 2012, 499, 278. [Google Scholar]

- Yanik, R.; Osman, A.B.; Ozturk, O. Impact of Manufacturing PMI on Stock Market Index: A Study on Turkey. SSRN. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3743277 (accessed on 5 July 2023).

- Shaikh, I. On the Relation between Purchasing Manager’s Index and Trade Policy Uncertainty: Evidence from China, Japan and the USA. J. Chin. Econ. Foreign Trade Stud. 2021, 14, 202–223. [Google Scholar] [CrossRef]

- Zhang, H.; Jiang, Z.; Gao, W.; Yang, C. Time-Varying Impact of Economic Policy Uncertainty and Geopolitical Risk on Tourist Arrivals: Evidence from a Developing Country. Tour. Manag. Perspect. 2022, 41, 100928. [Google Scholar] [CrossRef]

- Gu, X.; Zhu, Z.; Yu, M. The Macro Effects of GPR and EPU Indexes over the Global Oil Market—Are the Two Types of Uncertainty Shock Alike? Energy Econ. 2021, 100, 105394. [Google Scholar] [CrossRef]

- Zhang, B.; Ma, J.; Khan, M.A.; Repnikova, V.; Shidlovskaya, K.; Barykin, S.; Ahmad, M.S. The Effect of Economic Policy Uncertainty on Foreign Direct Investment in the Era of Global Value Chain: Evidence from the Asian Countries. Sustainability 2023, 15, 6131. [Google Scholar] [CrossRef]

- Feng, Z.; Xiyuan, L.; Lidong, W.; Xile, Y. Product Innovation or Service Transformation: Economic Policy Uncertainty and Manufacturing Innovation Choice. J. Chin. Ind. Econ. 2019, 7, 101–118. [Google Scholar]

- Xia, G.; Yong, C.; Shi, P. Economic Policy Uncertainty and Innovation—Based on the Empirical Analysis of my country’s Listed Companies. J. Econ. Res. 2018, 53, 109–123. [Google Scholar]

- He, F.; Ma, Y.; Zhang, X. How Does Economic Policy Uncertainty Affect Corporate Innovation?—Evidence from China Listed Companies. Int. Rev. Econ. Financ. 2020, 67, 225–239. [Google Scholar] [CrossRef]

- Gächter, M.; Geiger, M.; Stöckl, S. Credit Intermediation and the Transmission of Macro-Financial Uncertainty: International Evidence. J. Int. Money Financ. 2020, 108, 102152. [Google Scholar] [CrossRef] [Green Version]

- Caggiano, G.; Castelnuovo, E.; Figueres, J.M. Economic Policy Uncertainty Spillovers in Booms and Busts. Oxf. Bull. Econ. Stat. 2020, 82, 125–155. [Google Scholar] [CrossRef]

- Li, H.; Li, Q.; Huang, X.; Guo, L. Do Green Bonds and Economic Policy Uncertainty Matter for Carbon Price? New Insights from a TVP-VAR Framework. Int. Rev. Financ. Anal. 2023, 86, 102502. [Google Scholar] [CrossRef]

- Gao, H.W. Chinese-style modernization and industrial chain resilience: Historical logic, theoretical basis and countermeasures. J. Contemp. Econ. Manag. 2023, 45, 11–19. [Google Scholar]

- Li, L.S.; Shi, X.A.; Liu, J. 40 years of China’s manufacturing industry: The process and prospect of intelligentization. J. China Soft Sci. 2019, 1–9+30. [Google Scholar]

- Li, X.H. The Supporting Basis of Industrial Chain Resilience: Based on the Perspective of Industrial Embeddedness. J. Gansu Soc. Sci. 2022, 180–189. [Google Scholar]

- Deng, Z.L. Sino-US trade friction from the perspective of Sino-US trade structure. J. China Circ. Econ. 2018, 32, 80–92. [Google Scholar] [CrossRef]

- Ding, C.; Chen, T.H. China-U.S.-EU manufacturing competition: Status quo, policy responses and prospects. J. Eur. Stud. 2021, 39, 5–35. [Google Scholar]

- Lv, J.; Xiang, L. Empirical Analysis of Bilateral Trade Complementarity between China and the USA. In Proceedings of the 2010 International Conference on Management and Service Science, Wuhan, China, 24–26 August 2010; IEEE: Piscataway, NJ, USA, 2010; pp. 1–6. [Google Scholar]

- Sims, C.A. Macroeconomics and Reality. Econometrica 1980, 48, 1–48. [Google Scholar] [CrossRef] [Green Version]

- Primiceri, G.E. Time Varying Structural Vector Autoregressions and Monetary Policy. Rev. Econ. Stud. 2005, 72, 821–852. [Google Scholar] [CrossRef] [Green Version]

- Nakajima, J. Time-Varying Parameter VAR Model with Stochastic Volatility: An Overview of Methodology and Empirical Applications. Monet. Econ. Stud. 2011, 29, 107–142. [Google Scholar]

- Bai, Y.; Wang, C.; Zhang, L. Impact of Imported Dairy Products on China’s Raw Milk Production. J. Intell. Fuzzy Syst. 2022, 43, 7511–7524. [Google Scholar] [CrossRef]

| Variable | N | Mean | Std | Min | Max | Skewness | Kurtosis |

|---|---|---|---|---|---|---|---|

| GEPU | 175 | 175.985 | 5397.808 | 79.854 | 437.238 | 0.911 | 2.990 |

| CN | 175 | 50.873 | 6.180 | 35.7 | 59.2 | −1.678 | 14.59 |

| US | 175 | 53.638 | 30.708 | 32.4 | 64.7 | −1.050 | 4.866 |

| EU | 175 | 51.415 | 33.290 | 33.4 | 63.4 | −0.729 | 4.350 |

| Variable | ADF Test Statistic | Prob. * | PP Test Statistic | Prob. * |

|---|---|---|---|---|

| LNCN | −5.690536 | 0.0000 | −6.913705 | 0.0000 |

| ΔLNCN | −10.051150 | 0.0000 | −22.548040 | 0.0000 |

| LNEU | −2.719834 | 0.0727 | −2.861398 | 0.0521 |

| ΔLNEU | −9.276044 | 0.0000 | −9.279564 | 0.0000 |

| LNUS | −2.749221 | 0.0679 | −3.053498 | 0.0321 |

| ΔLNUS | −12.331430 | 0.0000 | −12.340520 | 0.0000 |

| LNGEPU | −4.965404 | 0.0004 | −4.842320 | 0.0006 |

| ΔLNGEPU | −16.295340 | 0.0000 | −19.865730 | 0.0000 |

| Lag | LogL | LR | FPE | AIC | SC | HQ |

|---|---|---|---|---|---|---|

| 1 | 986.3979 | NA | 1.29 × 10−10 | −11.41645 | −11.12131 | −11.29668 |

| 2 | 1028.416 | 80.08187 | 9.53 × 10−11 | −11.72254 | −11.13228 | −11.48302 |

| 3 | 1074.669 | 85.97497 | 6.68 × 10−11 * | −12.07845 * | −11.19305 * | −11.71917 * |

| 4 | 1088.187 | 24.49297 | 6.89 × 10−11 | −12.04926 | −10.86873 | −11.57022 |

| 5 | 1103.391 | 26.83033 * | 6.97 × 10−11 | −12.0399 | −10.56423 | −11.44109 |

| Hypothesized No. of CE (s) | Eigenvalue | Trace Statistic | 0.05 Critical Value | Prob. ** |

|---|---|---|---|---|

| None * | 0.310988 | 95.77258 | 47.85613 | 0 |

| At most 1 * | 0.098185 | 31.7032 | 29.79707 | 0.0298 |

| At most 2 | 0.06295 | 13.9277 | 15.49471 | 0.0849 |

| At most 3 | 0.015829 | 2.744419 | 3.841466 | 0.0976 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, Y.; Bai, Y. Research on the Impact of Global Economic Policy Uncertainty on Manufacturing: Evidence from China, the United States, and the European Union. Sustainability 2023, 15, 11217. https://doi.org/10.3390/su151411217

Li Y, Bai Y. Research on the Impact of Global Economic Policy Uncertainty on Manufacturing: Evidence from China, the United States, and the European Union. Sustainability. 2023; 15(14):11217. https://doi.org/10.3390/su151411217

Chicago/Turabian StyleLi, Yifei, and Yuhang Bai. 2023. "Research on the Impact of Global Economic Policy Uncertainty on Manufacturing: Evidence from China, the United States, and the European Union" Sustainability 15, no. 14: 11217. https://doi.org/10.3390/su151411217