1. Introduction

In recent years, social entrepreneurship (SE) has received a great reception in the academic world, with several studies providing evidence of its contribution in relevant aspects, such as the economy and politics, to a country [

1]. In addition, research confirms that SE is a powerful tool to address social and environmental challenges in Ecuador [

2]. These ventures, driven by individuals and organizations committed to social change, seek to generate a positive impact on society through the implementation of innovative and sustainable solutions [

3].

However, despite their transformative potential, many of these ventures face significant barriers to their development and growth, mainly due to a lack of adequate financing [

4,

5]. In this sense, financing is essential for the success and sustainability of social ventures [

6]. Traditionally, social entrepreneurs have faced challenges in accessing traditional sources of funding as their business models and focus on generating a social impact do not easily fit the criteria of traditional financial institutions [

7]. This funding gap has led to a search for new forms of financing that fit the goals and principles of social enterprises.

In this context, the fundamental question is as follows: What is the role of impact investment in financing Ecuadorian social enterprises? Impact investment, also known as socially responsible investment or triple impact investment, is characterized by its focus on generating both social and financial benefits as it goes beyond simple economic return and seeks to promote positive changes in society and the environment [

8]. In the case of social enterprises, impact investment can play a critical role in providing the necessary financial resources for their long-term development and sustainability [

9].

However, there is a knowledge gap because there is little research on impact investing in Latin America and in Ecuador in particular; the literature is very scarce, despite the fact that there are active and growing communities of influential investors in many countries of the region [

10]. Therefore, understanding how this form of financing is implemented in the Ecuadorian context and its effectiveness in promoting social entrepreneurship is fundamental; thus, the objective of this research article is to analyze some cases of social entrepreneurship, conducting in-depth interviews and a taxonomy that will enable the research questions to be answered.

In this way, this research seeks to provide valuable information for social entrepreneurs, investors, government agencies and other actors interested in promoting social entrepreneurship in Ecuador. By understanding the role of impact investment in the financing of social entrepreneurship, it will be possible to develop strategies to improve the capacity of Ecuadorian social entrepreneurs to generate financing relationships and a favorable environment for the development of social entrepreneurship.

Therefore, the purpose of the study is to explore and analyze the role of impact investing in the financing of social enterprises in Ecuador. It is expected that the results of this study will contribute to the generation of knowledge about financial practices and challenges in the field of social enterprises in Ecuador and will serve as a basis for the development of policies and strategies that promote the development and sustainability of these enterprises and activities for the benefit of society and the environment.

Finally, this article is structured first through the theoretical framework and review of the bibliography, where the main themes for the subsequent development of the study are conceptualized and the literature to be treated is analyzed. Later, the methodological model is explained to give way to its development and the presentation of the results. Finally, a discussion and the conclusions drawn from the analysis of Ecuadorian social enterprises are presented.

2. Literature Review

In recent years, innovative financing mechanisms such as guarantees, impact investing, crowdfunding and complementary currencies have emerged to address these challenges and enable organizations to thrive. Despite this, according to the GIIN report, which collected information from nearly 1300 impact investors, only 4% of them are based in Latin America and the Caribbean, including Mexico, with the largest share in the United States and Canada [

11].

The Inter-American Development Bank [

12] emphasizes that it must be taken into account that social enterprises generate opportunities that contribute social value to a country, city or nation, thus fulfilling a fundamental role within societies; however, a lack of funding has caused many social enterprises to remain an unconsolidated idea, despite the importance they have in the economic and social sphere of a country [

3].

On the other hand, research on social entrepreneurship and its financing is limited in Latin America [

13]. As mentioned by Martínez and Dutrenit [

14] in their report based on the UAM-Ashoka survey focused on Mexico, Latin America and the Caribbean, there are barriers or capabilities for social entrepreneurship to consolidate and maintain over time, where the main sources of financing come either from the contributions of partners or donations from third parties and, as a result, economic conditions are one of the main barriers to accessing financing, as well as the lack of public programs for social entrepreneurship.

In addition, De la Pedrosa [

15] explained that the financing of social entrepreneurship is not easy; despite this, there is currently a slow but steady growth of financial instruments such as impact investments that allow the development of these companies, which are usually born as a venture and generate a great social impact, without neglecting that social entrepreneurship is the main asset of impact investments and, therefore, it is the only responsible investment strategy that seeks profitability accompanied by social and environmental impact.

In some cases, a lack of knowledge on the subject leads to a wrong choice of medium; thus, it is important to treat impact investment as a healthy financing alternative, taking into account the lack of resources that this type of investment has and how crucial they are currently for the construction of social ventures [

16].

Chile is developing its impact investment market; the country already has some key players in the public and private sectors as well as a well-developed entrepreneurial ecosystem. Currently, there are several programs, funds and contracts with institutions to support social entrepreneurs [

17].

However, Romero [

18] argued that the Bolivian state is depriving the country of attracting impact investment mechanisms and partnerships with public and private institutions. He stated that it should implement laws or any type of regulation that supports and encourages this type of investment so that the country can become a destination for thousands of economic resources that are channeled through this type of investment and relationships with different organizations. On the other hand, in an analysis carried out in Peru on impact investment and social entrepreneurship, a lack of financing for this type of venture was demonstrated, especially when businesses are in their early stages [

19].

In Ecuador, financing for social entrepreneurship is a problem. The Alliance for Entrepreneurship and Innovation (AEI) states that a mechanism is being sought in entrepreneurship law to create a financing base for entrepreneurs; it is also important to highlight the existence of the simplified corporation, which is a mechanism to formalize the creation of a business quickly and at a lower cost [

20].

Below is a summary of impact investor cases developed in recent years, all of which include projects and ventures that have benefited from these investments (

Table 1).

Thus, impact investment is increasingly present in Latin America, with cases implemented as mentioned above; therefore, it is important to analyze the role that this type of financing has in social enterprises.

The Role of Impact Investing in Social Enterprises

The emergence of impact investing in several countries has been slow. According to Maestre [

30], most Latin American countries have implemented impact investing in social ventures but, despite this, the role that this type of financing has played is almost zero. According to Podcamisky [

31], this situation could be mainly due to a lack of specific knowledge about impact investment, leading to a refusal to seek investors of this type.

In addition, Gölz [

32] claimed that a country’s industry must develop in such a way that impact investments achieve and have the possibility to generate significant benefits for its economy and can be used by entrepreneurs as an accepted instrument and, therefore, play a significant role in development.

For I-Ping, Ormiston and Findlay [

33], impact investing fulfills different roles in social ventures because there is more and more information on the topic and, therefore, the search for and use of these healthy investments is greater.

Below,

Table 2 presents the main roles that impact investing has in social ventures, according to several studies.

Despite the multiple roles of this type of investment, in several countries, the situation of social entrepreneurs is difficult because they are aware of impact investment but are reluctant to use this type of financing [

41]. The factors for social entrepreneurs not to use impact investment may be due to the situations presented in

Table 3.

Based on the findings, the following research questions were posed: Is impact investment known by the Ecuadorian social enterprises studied? What role does impact investment play in the social enterprises studied? These questions were addressed to analyze the presence of impact investment and whether knowledge of this topic is a determining factor for its development.

3. Materials and Methods

The research is developed through an interpretative, qualitative research methodology since it seeks to study observations with a specific quality, identifying the reality of their nature, behavior and characteristics [

44], which will allow for the study of their natural environment, seeking to understand and interpret phenomena based on the information that the subjects of study provide to the researcher [

45], thus helping to identify the role of impact investment in the Ecuadorian social enterprises under study.

The process carried out in the research is inductive since, as Abreu [

46] mentioned, this process involves non-linear stages of observation and the study and knowledge of characteristics that contain the realities under study to later conclude in a logical result, taking into account that this methodology helps to gain a deep, wide exploration and, therefore, an interpretative richness [

47]. It involves for its development a few subjects of study since it does not seek to generalize the results obtained [

48] (pp. 34–47).

From this point of view, three actions are conducted for the implementation of the qualitative methodology: observe, ask and process [

49] (p. 302); therefore, the study concludes with an interpretation of certain facts, applying in-depth interviews to the object of analysis so that as Murillo [

47] stated, it is possible to analyze and draw conclusions from the deepening of different realities of some social enterprises related to the sources of financing.

Within the observation, social entrepreneurs around Ecuador were identified; however, being a specific study, to build the information, a total of 15 social entrepreneurs were taken from a non-probabilistic sampling by convenience since, being a new topic under study, there is no established database (

Table 4).

In addition, we will begin with a summary of the overall results for the 15 ventures and later, as mentioned, the analysis will be carried out specifically for each social venture to identify the role of impact investment on each of these SEs. All this will be done through interviews with social entrepreneurs to process and achieve synthesis in the results summary tables, and descriptive and graphic taxonomy will be used.

It is important to mention that no methodology has been previously proposed for the topic under study; thus, the development of the questions used in the interview was done according to the factors to be considered in the research (

Table 5).

In addition, in the context of the research, impact investors are to be considered those people, institutions or organizations that have the following characteristics or variables proposed by the Global Impact Investing Network in its 2019 report (

Table 6).

Finally, a flow chart illustrates each of the stages of research that must be followed in order to properly gather information and then present the results (

Figure 1).

4. Results

In order to provide a more in-depth analysis of the results, the following is a summary of the key findings from the research, broken down and grouped by question and response category.

Table 7 shows that all of the social enterprises in the study were financed through other types of financing than impact investment, meaning that 100% of the SEs in the study did not use impact investment as a source of financing to start their business but rather opted for more common types of financing such as loans or self-financing.

Regarding the knowledge of the social entrepreneurs studied about impact investments,

Table 8 shows that 80% of them had heard of impact investments such as green credits, environmental microcredits, biocredits, credits for women, etc., in Ecuador, and only 20%, corresponding to three of the social entrepreneurs studied, did not know about impact investments.

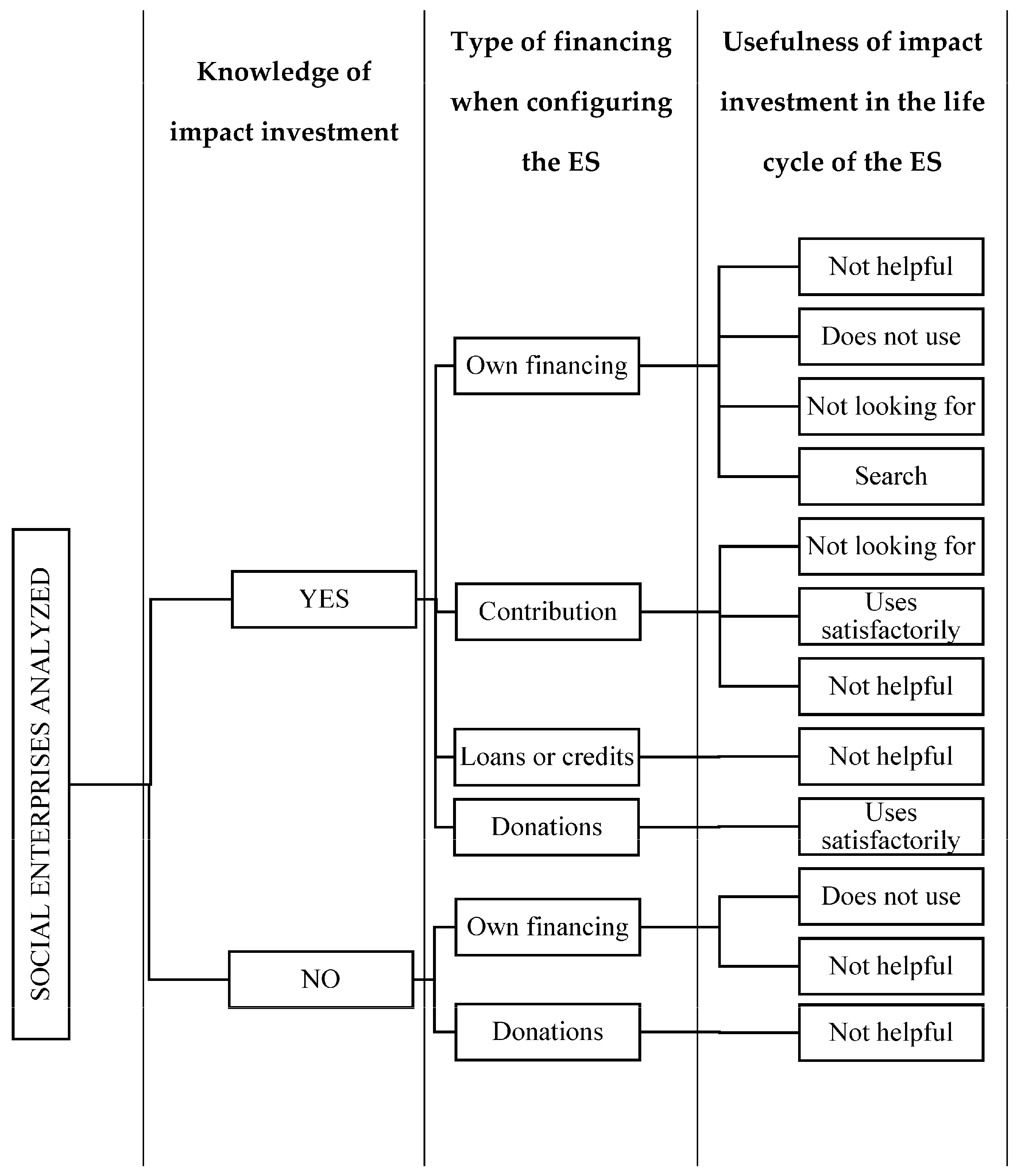

Table 9 below shows all the information obtained from the study instrument, classified according to the answers of the social entrepreneurs and grouped according to the research intentions. The table is divided into three main taxa: type of financing, knowledge of impact investment and usefulness of impact invesment.

As presented in

Table 10 and later graphically in

Figure 2, the results obtained for the first taxon show that most SE use their own financing, which includes responses such as the liquidation of previous jobs, savings and family support, and the lowest proportion of responses correspond to loans or credits (without a purpose related to impact investing). Regarding the taxon called knowledge of impact investment, 11 out of 15 respondents knew about impact investment. Finally, regarding the last taxon (utility of impact investments in the life cycle of the SE), regardless of their knowledge or ignorance of impact investments, five of the respondents indicated that they did not use this type of investment in their social enterprises, while another five indicated that this type of investment had not been helpful.

Next,

Table 11 provides a brief corroboration of the responses of the social enterprises surveyed who were aware of impact investment in order to determine if there is a true recognition of what an impact investment is and, in particular, if there is any confusion about the term.

Regarding the recognition that these social entrepreneurs have of impact investment, it should be noted that in the responses provided, the SEs studied gave examples of impact investors they knew, which helped to categorize the responses, and it was found that three of the social enterprises confused the term with banks and cooperatives that only provide loans to small and medium enterprises or producers; on the contrary, 80% of them knew institutions or investors that were dedicated to impact investment or had lines of credit related to it. Thus, they identified the term well. This shows that most of the SEs studied knew the term and correctly distinguished it from other types of financing.

Table 12 below shows the role played by impact investment in each of the social enterprises studied, for which purpose a classification was made of the answers given.

According to what is presented in

Table 13, impact investment played different roles in the Ecuadorian social enterprises studied. In Ecuador, a Latin American and underdeveloped country, it would be expected, according to the literature review, that the role of this type of financing is null, which is corroborated by the results of this study since most of the interviewees gave answers that suggested that impact investment played a null role within their social enterprises due to situations that will be detailed later. However, within the answers, another role that impact investments had was as a promoter of social entrepreneurship since it enabled a satisfactory use of impact investments in the development of SEs. In some Ecuadorian social enterprises under study, these investments worked as an expander of their SE.

Despite what has been described above, impact investments also had a limiting role for one of the social enterprises studied since access to these investments is difficult, as mentioned by some interviewees. Likewise, according to the research carried out on the role of impact investments, the financial health meter, meter and generator of impact, and driver of sustainable development did not coincide with any response of the interviewees because impact investors in Ecuador did not fulfill this role for the social entrepreneurs studied.

The results obtained so far, compared to the previous taxonomy, show the following (

Table 14).

The results of this study show that for most of the social enterprises studied, the role of impact investment was null; thus, some points can be taken into consideration. On the other hand, most of these enterprises were aware of impact investment; thus, this null role for nine of the social enterprises was not mainly due to a lack of knowledge of the subject but because most of them did not use it, did not seek it or had not been helped by it. Thus, this type of financing did not play a role in these social enterprises.

5. Discussion

According to a letter from the president of the Chilean Association of Investment Fund Administrators, Luis Alberto Letelier Herrera, in recent years, the world has gone through a series of changes in the financial sector as investors are now not only looking for financial returns but also for their funds to help and contribute to environmental and/or social practices that can have a measurable return in the long term.

From this point of view, there have been several studies carried out around the world on impact investment and the relevance of it when creating a social enterprise. In this study, it was proven that most ESs knew about impact investment but it was not present at the time of their creation since, in some cases, they did not seek it or had not received support. This is because all the social enterprises studied were built on the basis of own capital and family help; thus, they were born as an ES and also as a family business. All this led to a null role of impact investment in most of the social enterprises studied.

As argued by Gölz [

32], in order for an impact investment to bring significant benefits to the economy of a country and be used by entrepreneurs, the industry must be developed in such a way that impact investments reach and have the opportunity to contribute as an accepted instrument to the support and development of social entrepreneurs and thus play a significant role within their businesses.

Likewise, Ormiston and Seymour [

51] mentioned that the emergence of impact investment has been slow in several countries but, in the case of Australia, there is an attractive scenario to explore impact investment because the federal government of the country has promoted some reforms and strategies for impact investing to grow; therefore, social enterprises seek and use this type of financing. In the case of Ecuador, something similar has happened because there are institutions such as IMPAQTO and NEXUS that have established strategies for the development of impact investment; however, in the analysis, impact investment had not had a greater scope; thus, it is logical that there is the result of zero development.

Similarly, Maestre [

30] suggested that most Latin American countries have implemented impact investment in social enterprises; despite this, the role that this type of financing has had has been almost null. According to the author, this could be mainly due to a lack of specific knowledge regarding impact investing, leading to a rejection of investors of this type. On the other hand, he mentioned that a null role could not be due to a lack of knowledge of the terminology because entrepreneurs already have access to sufficient information on the subject [

52]. In another sense, I-Ping, Ormiston and Findlay [

33] argued that impact investment fulfills different roles in social enterprises as there is more and more information on the subject; they also mentioned that conventional investments are becoming less used over time, while impact investors are increasingly influencing the daily actions of entrepreneurs; therefore, it is important for the authors to defend the role it has played in SEs.

Furthermore, the results presented here are consistent with the research conducted by Glänzel and Scheuerle [

53], who conducted in-depth interviews with social entrepreneurs as beneficiaries of investments in Germany and social impact investment funds and investment advisors, from which it can be concluded that impact investment certainly faces obstacles and challenges. Investors face a lack of information and transparency about impact investment opportunities, as well as difficulties in properly assessing these opportunities and their associated risks. The lack of clear metrics and indicators to measure and evaluate social impact is also an obstacle. In addition, the lack of adequate tax and public sector investment incentives reduces investor interest.

On the other hand, as mentioned before, one of the main characteristics of impact investment is its ability to be measurable; thus, in several investigations and after an exhaustive search was found one of the most used methodologies in social enterprises, the SROI (social re-turn on investment), which has been used to demonstrate the important role that impact investment has in ES and is already used in some research and analysis, especially in Australia, demonstrating benefits such as better communication between investor and stakeholders, efficient management of social entrepreneurship, and better strategies and resources [

54]. On the other hand, Gordon [

39] argued that impact investment fulfills the role of limitation for social entrepreneurs who are looking for other types of financing beyond the usual ones since impact investors expect quite low and somewhat risky returns; thus, when entrepreneurs look for this type of investment, they usually run into a series of requirements that they have to meet and, therefore, opt for easier alternatives such as financing or family loans.

However, this research is specific to each of the 15 social enterprises analyzed; thus, the results are not generalized for all of Ecuador. Therefore, the null role that impact investment has had in most of the social enterprises studied is due to different factors for each case, but many of them are due to some characteristic mentioned by authors previously, as in what was presented by Maestre [

30] since, according to the results, the null role of impact investment for most of the ESs studied was not due to a lack of knowledge, which is quite similar to what the author mentioned.

6. Conclusions

This article sought to contribute to and expand the research on impact investment in Ecuador as there is little research on this topic in the country. Specifically, the issue of financing Ecuadorian social enterprises and the role of impact investment has been analyzed.

This study showed that impact investment plays a null role for most of the Ecuadorian social enterprises analyzed due to several factors. The first factor was the type of financing used by social entrepreneurs when starting their businesses since none of them mentioned impact investment; rather, they emphasized the use of funds from their family or own resources, which can be attributed to the fact that the 15 social enterprises analyzed were family businesses; thus, they opted for other types of financing mentioned above. The second factor was the usefulness of impact investments in the life cycle of an SE; it was concluded that most ESs do not use or seek this type of financing because many of the social enterprises mentioned that they had not seen the need to use this financing, but it is important to mention that most of the social entrepreneurs studied knew about impact investment, and most of them recognized the term and were able to give suitable examples regarding the characteristics analyzed for an impact investment according to the information of GIIN. Therefore, this did not influence the null role it fulfilled within SEs since it would be expected that this result is a consequence of the ignorance of the subject by social enterprises.

During the development of this study, some significant limitations were encountered. The first one is related to data collection. Although it was possible to identify some social enterprises in the country, access to a representative sample was limited, which affected the depth and breadth of the analysis. In addition, the lack of a consolidated database of Ecuadorian social enterprises made it necessary to collect information from scratch, which resulted in the limited availability of objects of analysis. As a result of these limitations, the results obtained cannot be generalized in a broad and representative manner.

With the research carried out, some future lines of research are established that can be addressed, such as determining the most appropriate type of financing for SEs, understanding the many requirements that must be met by social entrepreneurs, understanding the real benefits of using impact investments in a social enterprise as financing, analyzing the remuneration received by the investor for financing a social enterprise with impact investments, analyzing why social enterprises that know about impact investment in Ecuador do not use it, and determining the perception of impact investors of the role of their investment in social enterprises.

Author Contributions

Conceptualization, E.B. and J.M.; methodology, E.B and J.M.; software, J.M.; validation, J.A., K.C.-P. and P.M.; formal analysis, K.C.-P.; investigation, E.B. and PM.; resources, P.M.; data curation, E.B. and P.M.; writing—original draft preparation, K.C.-P.; writing—review and editing, E.B., P.M. and J.A; supervision, J.A.; project administration, P.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Elanet.

Institutional Review Board Statement

It has not been applied because the institution has not seen the need to include the statement.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data of the study can be obtained from the corresponding author.

Acknowledgments

This article is the result of the ELANET project, funded by the European Union through the Erasmus Call. It has also been supported by the Vice Rectorate for Research of the University of Cuenca, Ecuador.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Garzozi, R.; Messina, M.; Moncada, C.; Ochoa, J.; Ilabel, G.; Zambrano, R. Business Plans for Entrepreneurs, 1st ed.; Latin American Open Textbook Initiative, 2014; pp. 1–148. Available online: http://www.emprenur.edu.uy/sites/default/files/publicaciones/small_plan_de_negocios_para_emprendedores_cc_by-sa_3.0.pdf (accessed on 2 April 2022).

- Santocildes, M.; Gómez, L.; Aitziber, U.; Elorriaga, M. The Community initiative in favour of social entrepreneurship and its link with the social economy: An approach to its conceptual delimitation. J. Pub. Soc. Coop. Econ. 2012, 54, 54–80. Available online: https://www.redalyc.org/pdf/174/17425798004.pdf (accessed on 3 June 2022).

- Guzmán, A.; Trujillo, M. Social entrepreneurship-literature review. Manag. Stud. 2008, 24, 105–125. [Google Scholar] [CrossRef] [Green Version]

- Solano, S.; Martínez–Losa, N.; Plaza, P. Social entrepreneurship. J. Youth Stud. 2017, 118, 69–81. Available online: https://dialnet.unirioja.es/servlet/articulo?codigo=6504120 (accessed on 8 June 2022).

- Arízaga, F.; Zambrano, R.; Luna, G. Microprojects, social enterprises and their limitations in access to financing during the last triennium. Publicando Mag. 2017, 4, 931–943. Available online: https://revistapublicando.org/revista/index.php/crv/article/view/1169 (accessed on 21 June 2022).

- Kickul, J.; Lyons, T.S. Financing social enterprises. J. Bus. Res. 2015, 5, 83–85. [Google Scholar] [CrossRef]

- Vera, F.E.A.; Sánchez, R.M.Z.; Yerovi, G.A.L. Microprojects, social enterprises and their limitations in access to financing during the last three years. Publicando Mag. 2017, 4, 931–943. [Google Scholar]

- Agrawal, A.; Hockerts, K. Impact investing: Review and research agenda. J. Small Bus. Entrep. 2021, 33, 153–181. [Google Scholar] [CrossRef]

- Urban, B.; Lehasa, O.M.-E. Investing in a Social Venture to Generate Social Impact or Financial Return. Bus. Perspect. Res. 2022, 1–14. [Google Scholar] [CrossRef]

- Dumont, K.; Edens, G.; de Mariz, F.; Rocha, R.; Roman, E. Latin America Impact Investing Landscape: Trends 2014 & 2015; Special focus on Brazil, Colombia and Mexico. 2016. Available online: http://hdl.handle.net/10625/55731 (accessed on 9 June 2022).

- Mudaliar, A.; Dithrich, H. Sizing the Impact Investing Market Acknowledgments. 2019. Available online: https://thegiin.org/assets/Sizing the Impact Investing Market_webfile.pdf (accessed on 8 July 2022).

- Inter-American Development Bank. Effective Management of Social Enterprises. Lessons Learned from Companies and Civil Society Organizations in Ibero-America. A Collective Research Project of the Social Enterprise Knowledge Network; Editorial Planeta: Barcelona, Spain, 2006. [Google Scholar]

- Prado, A. Social Entrepreneurship in Latin America: Good Practices to Bring Products and Services to Rural Populations with Limited Resources. 2021. Available online: https://cnnespanol.cnn.com/wp-content/uploads/2021/06/Reporte-Emprendimiento-Social-en-América-Latina_Andrea-Prado-INCAE_VF.pdf (accessed on 9 October 2022).

- Martínez, N.; Dutrenit, G. Innovative Social Entrepreneurship in Mexico. 2017. Available online: https://www.researchgate.net/publication/328382508_EL_EMPRENDIMIENTO_SOCIAL_INNOVADOR_EN_MEXICO_AMERICA_LATINA_Y_EL_CARIBE (accessed on 21 June 2022).

- De la Pedrosa, B. Are Social Enterprises Profitable? Impact Investing and Measuring the Value of Social Impact. 2019. Available online: https://biblioteca.cunef.edu/gestion/catalogo/index.php?lvl=notice_display&id=46170 (accessed on 25 June 2022).

- Magomedova, N.; Roig, C.; Bastida-Vialcanet, R. Innovation Applied to the Financing of Social Economy Enterprises. The Case for Impact Investing. CIRIEC-Spain. J. Publicando Soc. Coop. Econ. 2020, 98, 127–151. [Google Scholar] [CrossRef] [Green Version]

- Tinelli, M.; Tinelli, F.; Delogne, M. Impact Investing in Chile: Opportunities and Challenges in a Powerful Market. 2020. Available online: http://www.acruxpartners.com/assets/publicaciones/5.Inversi%C3%B3n%20de%20Impacto%20en%20Chile%20-%20Un%20mercado%20con%20gran%20potencial%20-%202021.pdf (accessed on 24 June 2022).

- Romero, H. The evolution of private investment and its possible scenarios in Bolivia. Econ. Finanz. 2019, 1–26. Available online: https://library.fes.de/pdf-files/bueros/bolivien/19198.pdf (accessed on 13 November 2022).

- Black, C. Financing for Social Entrepreneurship in Peru. 2020. Available online: https://apfcanada-msme.ca/sites/default/files/2020-10/Peru_Deetken_ES.PDF (accessed on 29 August 2022).

- Jumbo, B. Lack of Financing Limits Entrepreneurship. Leaders Magazine. 11 August 2022. Available online: https://www.revistalideres.ec/lideres/financiamiento-entrevista-limita-emprendimientos-ley.html (accessed on 26 August 2022).

- Our Investment Policies. Available online: https://creasecuador.com/#investment (accessed on 14 September 2022).

- IMPAQTO Capital. Available online: https://www.impaqtocapital.com/ (accessed on 12 May 2022).

- Biocredits SMEs—Microenterprises. Available online: https://www.pichincha.com/portal/principal/pymes/creditos/ecologicos/biocredito-productivo (accessed on 23 September 2022).

- Green Credit. Available online: https://www.bolivariano.com/personas/creditos/credimax-verde (accessed on 15 August 2022).

- Green Lines. Available online: https://www.produbanco.com.ec/banca-minorista/banca-pyme/líneas-verdes/ (accessed on 18 September 2022).

- Green Finance. Available online: https://www.bancoprocredit.com.ec/gestion-ambiental/ (accessed on 18 September 2022).

- Personal Loans and Credits. Available online: https://www.bbva.es/personas/productos/prestamos.html#cuanto-dinero-puedo-solicitar-con-mi-prestamo-o-credito (accessed on 18 September 2022).

- Impact Investing with the IDB Group. Resources for Companies—IDB. Available online: https://www.iadb.org/es/recursos-para-empresas/inversion-de-impacto-en-el-desarrollo-en-america-latina-y-el-caribe%2C5752.html (accessed on 18 August 2022).

- Impact Funds and Investments. CAF Development Bank of Latin America. Available online: https://www.caf.com/es/temas/f/fondos-e-inversiones-de-impacto/ (accessed on 18 September 2022).

- Maestre, C. Analysis of Impact Investing. Final Degree Work, Comillas Pontifical University, Madrid, Spain, 2019. Available online: https://repositorio.comillas.edu/jspui/bitstream/11531/27879/1/TFG-Maestre%20Martinez%2C%20Maria%20Cristina.pdf (accessed on 13 May 2022).

- Podcamisky, M. The role from a linking perspective. Reflect 2006, 85, 179–187. Available online: https://www.redalyc.org/articulo.oa?id=72920817012 (accessed on 8 June 2022).

- Gölz, J. Impact Investments—An Analysis of the Concept Can They Contribute Significantly to Development Aid? Final Degree Thesis, Comillas Pontifical University, Madrid, Spain, 2015. Available online: https://repositorio.comillas.edu/xmlui/bitstream/handle/11531/4449/TFG001239.pdf?sequence=1 (accessed on 15 June 2022).

- I-Ping, E.; Ormiston, J.; Findlay, S. Financing social entrepreneurship: The role of impact investment in shaping social enterprise in Australia. Soc. Enterp. J. 2018, 14, 130–155. [Google Scholar] [CrossRef]

- Terraetica. Impact Measurement Guide for Impact Investing, 1st ed.; Toolbox: Ciudad de Mexico, Mexico, 2020; pp. 1–69. Available online: https://terraetica.com/wp-content/uploads/2021/02/Guia-de-Medicion-de-Impacto-para-la-Inversion-de-Impacto.pdf (accessed on 3 September 2022).

- Martín-Gil, M. Can There Be Shareholder Activism in Impact Investing? Final thesis in Business Administration and Management and in International Relations, Comillas Pontifical University, Madrid, Spain, 2020. Available online: http://hdl.handle.net/11531/37010 (accessed on 13 September 2022).

- Rivera, M. Financing Social Enterprises: Impact Investing. Final Thesis in Business Administration and Management, Comillas Pontifical University, Madrid, Spain, 2019. Available online: https://repositorio.comillas.edu/xmlui/handle/11531/27745 (accessed on 25 September 2022).

- Contreras-Pacheco, O.; Pedraza-Avella, A.; Martínez-Pérez, M. Impact investment as a way to boost sustainable development: A multi-case company-level approach in Colombia. Manag. Stud. 2017, 33, 13–23. [Google Scholar] [CrossRef]

- Álvarez, D. Open Innovation as a Lever for the Introduction of Companies in Impact Investing: BBVA, Repsol, Ikea, Starbucks. Thesis for a Bachelor’s Degree in Business Administration and Management and a Bachelor’s Degree in International Relations, Comillas Pontifical University, Madrid, Spain, 2022. Available online: https://repositorio.comillas.edu/xmlui/bitstream/handle/11531/63279/TFG%20Diego%20Alvarez%20Escudero.pdf?sequence=2&isAllowed=y (accessed on 18 August 2022).

- Gordon, L. General Review of the Status of Impact Investing in Ecuador. Master’s Thesis, Jaume I University, Castellon, Spain, 2019. Available online: http://repositori.uji.es/xmlui/bitstream/handle/10234/187204/TFM_Gord%c3%b3n_Pazmi%c3%b1o%2c_Liliana.pdf?sequence=1&isAllowed=y (accessed on 24 September 2022).

- López-Henares, E. Impact Investing as a Tool for Creating Shared Value. Final thesis in Business Administration and Management with a major in International Business Administration, Comillas Pontifical University, Madrid, Spain, 2022. Available online: https://repositorio.comillas.edu/xmlui/bitstream/handle/11531/57197/TFG%20-%20Manrique%20Lopez-Henares%2c%20Elena.pdf?sequence=2&isAllowed=y (accessed on 13 October 2022).

- Martino, S.; Figueroa, F.; Peirano, L. Impact Investment in Argentina 2013–2022. 2022. Available online: http://gsgii.org/wp-content/uploads/2018/12/Market-Size-Argentina.pdf (accessed on 28 November 2022).

- Galarza, E.; Ruiz, J. Report on the State of Impact Investing in Peru. 2020. Available online: https://www.bosquesandinos.org/wp-content/uploads/2021/04/Reporte-InversionImpacto.pdf (accessed on 12 July 2022).

- Center of Global Development. More than Money: Impact Investing for Development. (Independent Research and Practical Ideas for Global Prosperity); Simon, J., Barmeier, J., Eds.; Center of Global Development: Washington, DC, USA, 2010. [Google Scholar]

- Martinez, M. Qualitative research (conceptual synthesis). IIPSI Mag. 2006, 9, 123–146. Available online: https://sisbib.unmsm.edu.pe/bvrevistas/investigacion_psicologia/v09_n1/pdf/a09v9n1.pdf (accessed on 17 October 2022).

- Álvarez-Gayou, J.; Camacho, S.M.; López, S.; Maldonado, G.; Trejo, C.; Olguín, A.; Pérez, M. Qualitative research. Qual. Res. 2014, 2. Available online: https://www.uaeh.edu.mx/scige/boletin/tlahuelilpan/n3/e2.html (accessed on 2 June 2022).

- Abreu, J. The Research Method. Daena Int. J. Good Conscienc. 2014, 9, 195–204. Available online: http://www.spentamexico.org/v9-N3/A17.9(3)195-204.pdf (accessed on 3 June 2022).

- Murillo, Y. Sources of Financing for Social Enterprises: Key Factors for Financial Sustainability. Final Degree Work, University of EAFIT, Medellín, Colombia, 2021. Available online: https://repository.eafit.edu.co/bitstream/handle/10784/29900/yanireiza_murillolopez_2021.pdf?sequence=2&isallowed=y (accessed on 8 September 2022).

- Hernández, R.; Fernández, C.; Baptista, P. Research Methodology, 5th ed.; McGRAW-HILL Interamericana De España, S.A. DCV: Madrid, Spain, 2010. [Google Scholar]

- Corbetta, P. Methodology and Techniques of Social Research, 1st ed.; McGraw-Hill Interamericana de España S.A.U.: Madrid, Spain, 2007. (In Spanish) [Google Scholar]

- Global Impact Investing Network. What You Need to Know about Impact Investing. Available online: https://thegiin.org/impact-investing/need-to-know/#what-is-impact-investing (accessed on 22 May 2022).

- Ormiston, J.; Seymour, R. The emergence of social investment as a moral system of exchange: The Australian experience. In Social Entrepreneurship and Enterprise: Concepts in Context; Douglas, H., Grant, S., Eds.; Tilde University Press: Melbourne, Australia, 2013; pp. 301–323. Available online: https://www.researchgate.net/publication/290284020_The_Emergence_of_Social_Investment_as_a_Moral_System_of_Exchange_The_Australian_Experience (accessed on 3 May 2022).

- Kowszyk, Y.; Peace, J. Impact Investing in Latin America a Look at the Role of Companies. 2013. Available online: http://www.innovacional.com/wp-content/uploads/2017/07/la_inversion_de_impacto_en_america_latina.pdf (accessed on 18 October 2022).

- Glänzel, G.; Scheuerle, T. Social impact investing in Germany: Current impediments from investors and social entrepreneurs’ perspectives. VOLUNTAS Int. J. Volunt. Nonprofit Organ. 2016, 27, 1638–1668. [Google Scholar] [CrossRef]

- Valdes, F.; Saavedra, M. Critical analysis on the use of SROI in social impact assessment in social entrepreneurship initiatives: Case Mexico. AD-Minister 2019, 35, 53–76. [Google Scholar] [CrossRef]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).